UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

|

| | | | | |

| VALUECLICK, INC. |

| (Name of Registrant as Specified In Its Charter) |

| | | | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1 | ) | | Title of each class of securities to which transaction applies: |

| | | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | | (5 | ) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1 | ) | | Amount Previously Paid: |

| | | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | | (3 | ) | | Filing Party: |

| | | (4 | ) | | Date Filed: |

ValueClick, Inc.

30699 Russell Ranch Road, Suite 250

Westlake Village, CA 91362

(818) 575-4500

March 27, 2013

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the "Annual Meeting") of ValueClick, Inc., a Delaware corporation (the "Company" or "ValueClick" or, in the first person, "we", "us" and "our"), to be held on Tuesday, May 7, 2013, at 9:00 a.m. Pacific Time at the Company's corporate offices located at 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91362.

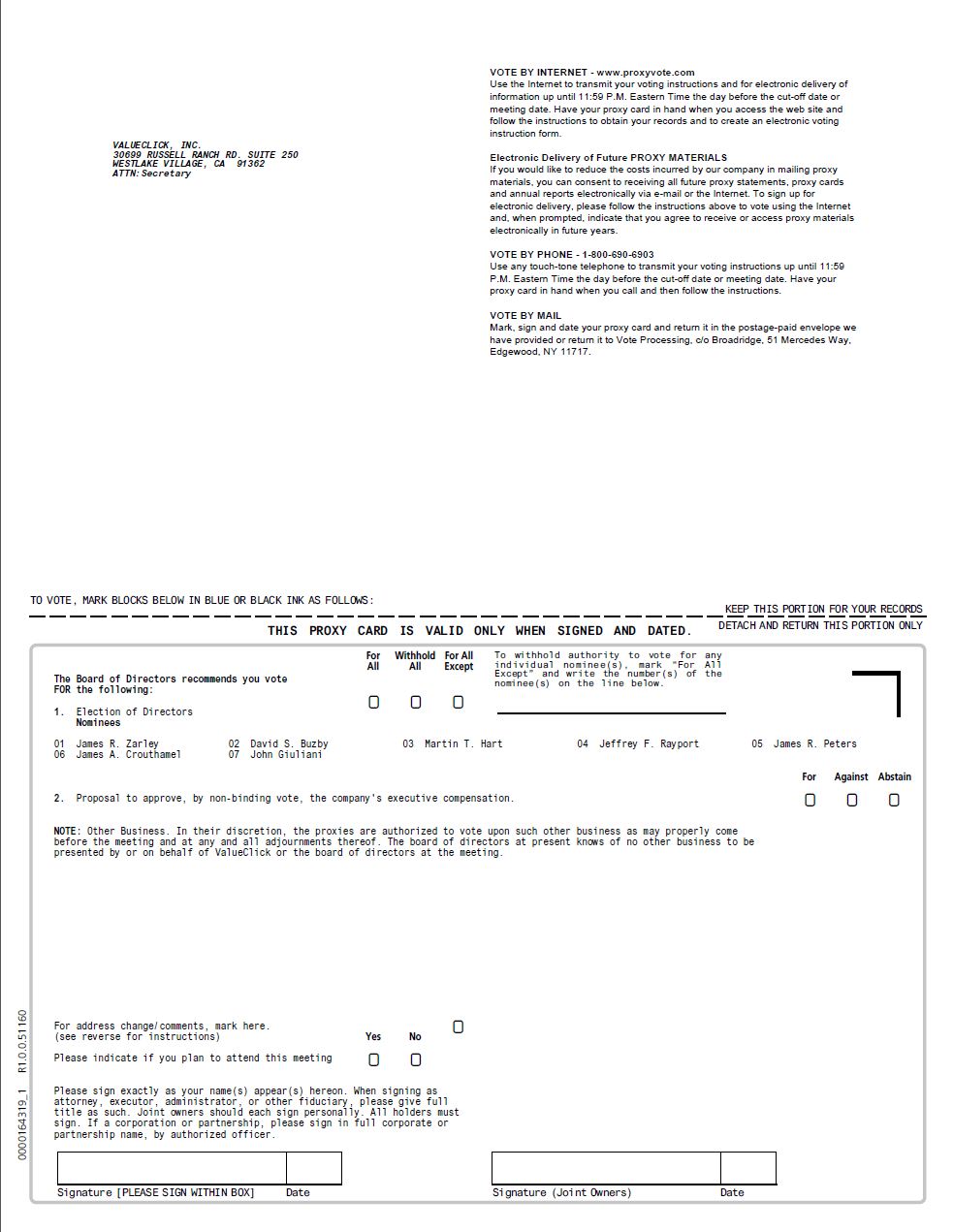

The Annual Meeting has been called for the purposes of: (i) considering and voting upon the election of the seven nominees named in the Proxy Statement to the Board of Directors of ValueClick to serve until the next annual meeting of ValueClick stockholders and until their successors have been elected and qualified; (ii) holding an advisory (non-binding) vote on executive compensation (a "say-on-pay" vote); and, (iii) transacting such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the "SEC"), we now furnish to our stockholders proxy materials, including our Annual Report to Stockholders, on the Internet. Accordingly, on or about March 27, 2013, our stockholders will receive a notice containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K and how to vote online. If you receive a notice, you will not receive a paper copy of the Annual Meeting materials, including the Notice of Annual Meeting, Proxy Statement and proxy card, unless you request one. The notice also includes instructions on how to request a paper or e-mail copy of the Annual Meeting materials. Stockholders who request paper copies of the Annual Meeting materials will not receive a notice and will receive the Annual Meeting materials in the format requested.

The Board of Directors of the Company has fixed the close of business on March 11, 2013 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

The Board of Directors of the Company recommends that you vote:

| |

| • | "FOR" the election of the seven nominees named in the Proxy Statement as Directors of the Company; and |

| |

| • | "FOR" approval, on an advisory basis, of the Company's executive compensation. |

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE YOUR PROXY TODAY. YOU CAN VOTE BY INTERNET, BY TELEPHONE OR BY MAIL USING THE INSTRUCTIONS INCLUDED ON THE NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS OR PROXY CARD. |

| | |

| | | Sincerely, |

| | | |

| | | John Giuliani Chief Executive Officer |

|

| |

| | NOTICE: Brokers are not permitted to vote without instructions from the beneficial owner on any of the proposals included in the Proxy Statement, as discussed in more detail in the Proxy Statement. Therefore, if your shares are held through a brokerage firm, bank or other nominee, they will not be voted on a particular proposal unless you affirmatively vote your shares in one of the ways described in the Proxy Statement. |

| |

| |

| |

ValueClick, Inc.

30699 Russell Ranch Road, Suite 250

Westlake Village, CA 91362

(818) 575-4500

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Tuesday, May 7, 2013

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of ValueClick, Inc. (the “Company” or “ValueClick” or, in the first person, “we”, “us” and “our”) will be held on Tuesday, May 7, 2013, at 9:00 a.m. Pacific Time at the Company's corporate offices located at 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91362. The Annual Meeting is being called for the purposes of:

| |

| 1. | Considering and voting upon the election of the seven nominees named in the Proxy Statement to the Board of Directors of ValueClick to serve until the next annual meeting of ValueClick stockholders and until their successors have been elected and qualified; |

| |

| 2. | Holding an advisory (non-binding) vote on the Company's executive compensation (a “say-on-pay” vote); and |

| |

| 3. | Transacting such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

The Board of Directors has fixed the close of business on March 11, 2013 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Only holders of record of the Company's common stock, par value $.001 per share, at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

In the event there are not sufficient shares to be voted in favor of any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies.

Directions to the Annual Meeting can be obtained by contacting the Company at (818) 575-4500.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE VOTE YOUR PROXY TODAY. YOU CAN VOTE BY INTERNET, BY TELEPHONE OR BY MAIL USING THE INSTRUCTIONS INCLUDED ON THE NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS OR PROXY CARD. |

| |

| | By Order of the Board of Directors |

| | |

| | Scott P. Barlow Secretary |

Westlake Village, California

March 27, 2013

ValueClick, Inc.

30699 Russell Ranch Road, Suite 250

Westlake Village, CA 91362

________________________

PROXY STATEMENT

________________________

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of ValueClick, Inc. (the “Company” or “ValueClick” or, in the first person, “we” “us” and “our”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) of the Company to be held on Tuesday, May 7, 2013 at 9:00 a.m. Pacific Time and any adjournments or postponements thereof. The Annual Meeting will be held at the Company's corporate offices located at 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91362.

At the Annual Meeting, the stockholders of the Company will be asked to:

| |

| 1. | Consider and vote upon the election of the seven nominees named in this Proxy Statement to the Board of Directors of ValueClick to serve until the next annual meeting of ValueClick stockholders and until their successors have been elected and qualified; |

| |

| 2. | Hold an advisory (non-binding) vote on the Company's executive compensation (a “say-on-pay” vote); and |

| |

| 3. | Transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

This Proxy Statement and the related proxy form are being distributed on or about March 27, 2013 in connection with the solicitation of proxies for the Annual Meeting. The Board has fixed the close of business on March 11, 2013 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting (the “Record Date”). Only holders of record of the Company's common stock, par value $.001 per share (the “Common Stock”), at the close of business on the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, there were 76,079,063 shares of Common Stock outstanding and entitled to vote at the Annual Meeting and 462 stockholders of record. Each holder of a share of Common Stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held of record with respect to each matter submitted at the Annual Meeting.

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions are counted as present for purposes of determining the presence of a quorum, while “broker non-votes” (i.e., shares held by brokers or other nominees that they do not vote because they have not received voting instructions from the beneficial owners and do not have discretionary voting power) are not counted as present for the purpose of determining the presence of a quorum.

With respect to the election of directors, ValueClick has adopted a majority voting standard in uncontested director elections. Under this voting standard, directors are elected at each annual meeting by a majority of votes cast, meaning that the number of votes “for” a director must exceed the number of votes “against” that director. In the event that a nominee who is currently serving as a director is not elected at the Annual Meeting, the Board shall give consideration to the director's resignation following a recommendation by the Nominating Committee. In contested director elections where the number of nominees exceeds the number of directors to be elected as of a date that is five business days in advance of the date the Company files its definitive proxy statement with the SEC, plurality voting will apply. Election by a plurality of the votes cast means that the nominees receiving the highest number of votes cast for the number of positions to be filled are elected. Abstentions and broker non-votes will have no effect on the outcome of the vote.

Approval of the advisory resolution on the Company's executive compensation requires the approval of a majority of the shares represented in person or by proxy and entitled to vote at the Annual Meeting. Abstentions are treated as shares represented in person or by proxy and entitled to vote at the Annual Meeting and, therefore, will have the same effect as a vote “Against” the proposal. Broker non-votes will have no effect on the outcome of the vote. However, because this is an advisory vote, the result will not be binding on the Company or the Board of Directors.

Other matters require the approval of at least a majority of the voting power of the shares present in person or represented by proxy at the Annual Meeting.

Stockholders of record of the Company are requested to vote by Internet, by telephone or by mail using the instructions included on the notice regarding the Internet availability of proxy materials or proxy card. If you are a beneficial owner (that is, your shares are held in the name of a bank, brokerage house or other holder of record), you will receive instructions from the holder of record that you must follow in order for your shares to be voted. Certain of these institutions offer Internet and telephone voting.

Common Stock represented by properly executed proxies received by the Company and not revoked will be voted at the Annual Meeting in accordance with the instructions contained therein. If instructions are not given therein, properly executed proxies will be voted in accordance with the recommendations of the Company's Board of Directors as described above. It is not anticipated that any other matters will be presented at the Annual Meeting. If other matters are presented, proxies will be voted in accordance with the discretion of the proxy holders.

Stockholders of record may revoke any properly completed proxy at any time before it is voted on any matter by giving written notice of such revocation to the Secretary of the Company, by signing and duly delivering a proxy bearing a later date via the mail, telephone or Internet, or by attending the Annual Meeting and voting in person. If you are a beneficial owner, you may revoke any prior voting instructions by contacting the bank, brokerage house or other holder of record that is the holder of record of your shares. Attendance at the Annual Meeting, by itself, will not revoke a proxy.

Except where otherwise incorporated by reference, the Annual Report on Form 10-K is not a part of the proxy solicitation material. Stockholders may obtain printed copies of the Annual Report on Form 10-K for the year ended December 31, 2012, as filed with the Securities and Exchange Commission, without charge by mailing a request to ValueClick, Inc., Attention: Investor Relations, 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91362.

CORPORATE GOVERNANCE

Independence of Directors

We follow the standards of independence set forth in the Marketplace Rules of NASDAQ. Under these standards of independence, an independent director is one who is not an officer or employee of the Company or any other individual who has a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and who otherwise:

| |

| • | is not, and has not within the past three years been, employed by the Company; |

| |

| • | has not accepted, and whose immediate family member has not accepted, any compensation from the Company in excess of $120,000 during any period of twelve consecutive months within the past three years preceding our determination of their independence, other than the following: |

| |

| (i) | compensation for service on the Board or any committee of the Board; |

| |

| (ii) | payments arising solely from investment in our securities that are non-compensatory in nature; |

| |

| (iii) | compensation paid to a member of the director's immediate family who is a non-executive employee of the Company; or |

| |

| (iv) | benefits under a tax-qualified retirement plan, or non-discretionary compensation. |

| |

| • | is not an immediate family member of an individual who is, or at any time during the past three years was, an executive officer of the Company; |

| |

| • | is not, and whose immediate family member is not, a partner in, or a controlling stockholder or an executive officer of, any organization to which we made, or from which we received, payments for property or services in 2012 or in any of the two prior fiscal years that exceed 5% of the recipient's consolidated gross revenues for that year, or $200,000, whichever is more, other than payments arising solely from investment in our securities or payments made under non-discretionary charitable contribution matching programs; |

| |

| • | is not, and whose immediate family member is not, an executive officer of another entity where at any time during the past three years any of our executive officers served on the compensation committee of such entity; and |

| |

| • | is not, and whose immediate family member is not, a current partner of our independent registered public accounting firm, or was a partner or employee of our independent registered public accounting firm who worked on our audit at any time during the past three years. |

The Board has affirmatively determined that David Buzby, James A. Crouthamel, Martin Hart, James Peters and Jeffrey Rayport are “independent directors” under the criteria for independence set forth in the listing standards of NASDAQ and that accordingly a majority of the Company's Board is independent. John Giuliani, Chief Executive Officer, is not an independent director due to his role as an executive officer of the Company, and James R. Zarley, Chairman, is not an independent director due to his recent role as an executive officer of the Company. There were no direct or indirect relationships between the Company and Messrs. Buzby, Crouthamel, Hart, Peters and Rayport other than their roles as Directors.

All members of the Audit Committee, Compensation Committee and Nominating Committee of the Board are independent directors. In accordance with NASDAQ listing standards, all of the members of the Audit Committee also meet additional, heightened independence criteria applicable to audit committee members, which provide that they must not accept, directly or indirectly, any fees from the Company other than directors' fees and must not be affiliated persons of the Company (other than by virtue of their directorship).

The Board's Role in Risk Oversight

It is management's responsibility to manage risk and bring to the Board's attention the most material risks to the Company. The Board has oversight responsibility of the processes established to report and monitor systems for material risks applicable to the Company. In this regard, the Board reviews and approves the Company's annual budget and meets at least quarterly to review our business developments, initiatives and financial results and regularly considers risk in connection with these reviews. The Board implements its risk oversight function both as a whole and through delegation to various committees. The Audit Committee regularly reviews financial and accounting risks, legal and compliance risks, treasury risks (insurance, investments, foreign exchange, etc.), and information technology security risks and has responsibility for overseeing other risk management functions. The Compensation Committee considers risks related to the attraction and retention of talent and risks relating to the design of compensation programs and arrangements. The full Board considers strategic risks and opportunities and is updated regularly by the Audit Committee and Compensation Committee regarding risk oversight in their areas of responsibility.

Board Leadership Structure

We currently separate the functions of the Chairman of the Board and the Chief Executive Officer. Prior to December 2012, the Chairman of the Board position was held by Mr. Hart and the Chief Executive Officer position was held by Mr. Zarley. Effective in December 2012, Mr. Zarley became the Executive Chairman of the Board, with responsibility for overseeing Board-related matters, and Mr. Giuliani became President and Chief Executive Officer, overseeing the day-to-day operations of the Company. In March 2013, Mr. Zarley retired from his full-time position as Executive Chairman and assumed the role of non-executive Chairman of the Board.

The Board believes that having different individuals serve as Chairman and Chief Executive Officer is the most appropriate leadership structure for the Board at this time because it is valuable to have strong independent leadership to assist the Board in fulfilling its role of overseeing the management of ValueClick and its risk management practices, separate from the CEO. However, ValueClick does not have a policy against having the roles of the Chief Executive Officer and Chairman of the Board filled by the same person. This provides the Board with the flexibility to determine whether the two roles should be combined in the future based on ValueClick's needs and the Board's assessment of ValueClick's leadership from time to time.

Due to the fact that Mr. Zarley is not an independent Director, in January 2013, Mr. Crouthamel was elected to the role of Lead Outside Director.

Meetings of Independent Directors

The Board has determined that our independent directors will meet a minimum of two times per year in executive session to discuss any issues that might more properly be raised outside of the presence of management.

Code of Ethics and Business Conduct/Reporting of Concerns

We have adopted a Code of Ethics and Business Conduct (the “Code”) for our principal executive, financial and accounting, and other officers, and our directors, employees, agents, and consultants. The Code is publicly available on our website at www.valueclick.com in the “Investors” section under “Corporate Governance”. Among other things, the Code addresses such issues as conflicts of interest, corporate opportunities, confidentiality, fair dealing, protection and proper use of Company assets, compliance with applicable laws, and reporting of illegal or unethical behavior.

Within the Code, ValueClick has established an accounting ethics complaint procedure for all of its employees, directors, agents, and consultants of the Company. The complaint procedure is for any of these persons who may have concerns regarding accounting, internal accounting controls and auditing matters. The Company treats all complaints confidentially and with the utmost professionalism. If an employee desires, he or she may submit any concerns or complaints on an anonymous basis by calling a toll free hotline, and his or her concerns or complaints will be addressed in the same manner as any other complaints. The Company does not, and will not, condone any retaliation of any kind against an employee who comes forward with an ethical concern or complaint.

The Board also has established a process through which interested parties may communicate directly with Mr. Peters, the Audit Committee Chairman, or with the Company's outside compliance attorney, Stewart McDowell at Gibson, Dunn & Crutcher LLP, regarding any ethical concerns or complaints. Confidential communications may be sent directly to Mr. Peters, c/o the Secretary of the Company, at the Company's corporate offices, 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91362, or to Ms. McDowell at Gibson, Dunn & Crutcher LLP, 555 Mission Street, Suite 3000, San Francisco, CA 94105.

Communications with the Board of Directors

The Board has established a process for stockholders and other interested parties to communicate with the Board. Anyone wishing to communicate with the Board should send their communication to the Company's corporate offices, c/o the Secretary of the Company, at 30699 Russell Ranch Road, Suite 250, Westlake Village, CA 91362. Communications intended for a specific director or to a committee of the Board, should be addressed to their attention, c/o the Secretary of the Company, at this same address. The Secretary shall forward all such communications to the appropriate director or directors for consideration.

Nomination of Directors/Director Presence at Annual Meetings

General Criteria

The Nominating Committee views the breadth of the experience of the full Board as an important aspect of the director nominations process. Nominees for director are evaluated and approved by the Nominating Committee and recommended to the Board for consideration and approval.

The Company does not maintain a formal policy on board diversity and does not believe it is in the best interests of the Company to establish rigid criteria for the selection of director nominees. While diversity and having a variety of experiences and viewpoints represented on the Board should always be considered, a director nominee should not be chosen nor excluded solely or largely because of race, color, gender, national origin or sexual orientation or identity. Rather, the Nominating Committee recognizes that the challenges and needs of the Company will vary over time and, accordingly, believes that the selection of director nominees by the Nominating Committee should be based on skill sets most pertinent to the needs and issues facing or likely to face the Company at the time of nomination. At the same time, the Nominating Committee believes that the Company will benefit from a diversity of background and experience on the Board and, therefore, the Nominating Committee will consider and seek nominees who, in addition to general management experience and business knowledge, possess, among other attributes, an expertise in one or more of the following areas: finance, technology, international business, investment banking, business law, corporate governance, risk assessment, and investor relations. In addition, there are certain general attributes that the Nominating Committee believes all director candidates must possess, including:

| |

| • | A commitment to ethics and integrity; |

| |

| • | A commitment to personal and organizational accountability; |

| |

| • | A history of achievement that reflects superior standards for themselves and others; and |

| |

| • | A willingness to express alternative points of view while, at the same time, being respectful of the opinions of others and working collaboratively as a team player. |

The Nominating Committee periodically evaluates the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experience that the Board will find valuable in the future. This evaluation of the Board's composition enables the Board to update the skills and experience it seeks in the Board as a whole, and in individual directors, as the Company's needs evolve and change over time and to assess the effectiveness of efforts at pursuing diversity.

Stockholder Recommendations for Director Candidates

The Nominating Committee will consider nominees for directors recommended by stockholders. To recommend a candidate for the 2014 Annual Meeting of Stockholders, a stockholder must deliver the recommendation to the Secretary of the Company, at the Company's corporate offices, not later than the close of business on February 6, 2014. Each recommendation should include information as to the qualifications of the candidate and should be accompanied by a written statement (presented to the Secretary of the Company) from the suggested candidate to the effect that the candidate is willing to serve.

Selection and Evaluation of Director Candidates

In addition to considering director candidates recommended by stockholders, the Nominating Committee may consider candidates recommended by current directors, officers and employees of the Company and, from time to time, may utilize the services of a search firm to identify and approach potential candidates. In evaluating candidates for director, the Nominating Committee assesses the skills, experience and qualifications of the individual against the general criteria set forth above, including the particular needs of and issues facing or likely to face the Company at the time of nomination. In addition, with regard to the evaluation of current directors for renomination, the Nominating Committee takes into consideration each individual's past performance as a director of the Company. The Nominating Committee intends to evaluate any stockholder‑recommended candidates in the same manner as candidates recommended from all other sources.

Director Attendance at Annual Meetings

Members of the Board are encouraged, but not required, to attend the annual meeting of stockholders. One director attended the 2012 Annual Meeting.

Executive Officers and Directors

Set forth below is information concerning ValueClick's executive officers and directors as of March 27, 2013: |

| | | | |

| Name | | Age | | Position(s) |

| John Giuliani | | 52 | | President and Chief Executive Officer |

| John Pitstick | | 39 | | Chief Financial Officer |

| James R. Zarley | | 68 | | Chairman of the Board |

| Peter Wolfert | | 49 | | Chief Technology Officer |

| Scott P. Barlow | | 44 | | Vice President, General Counsel and Secretary |

| Martin T. Hart(2)(3) | | 77 | | Director |

| David S. Buzby(1)(2)(3) | | 53 | | Director |

| James A. Crouthamel | | 48 | | Director |

| James R. Peters(1) | | 66 | | Director |

| Jeffrey F. Rayport(1)(3) | | 53 | | Director |

| |

| (1) | Member of the Audit Committee. |

| |

| (2) | Member of the Compensation Committee. |

| |

| (3) | Member of the Nominating Committee. |

JOHN GIULIANI is the President and Chief Executive Officer of ValueClick. Mr. Giuliani joined ValueClick as the President of the Company's Dotomi division and a director of the Company's Board in August 2011. Mr. Giuliani was promoted to Chief Operating Officer in April 2012 and was promoted to President and Chief Executive Officer in December 2012. From December 2005 to August 2011, Mr. Giuliani served as the Chairman of the Board and Chief Executive Officer of Dotomi prior to ValueClick's acquisition of Dotomi. In addition to ValueClick, Mr. Giuliani is currently a member of the Board of Directors for Bluestem Brands, Inc., formerly known as Fingerhut Direct Marketing, Inc. In the past, Mr. Giuliani has participated on Boards for Q Interactive, SuperMarkets Online, Affinova, Claria, Imagitas, and El Dorado Marketing. Mr. Giuliani has an M.B.A. from Northwestern University’s Kellogg Graduate School of Management, as well as a B.S. from the University of Illinois.

Mr. Giuliani is qualified to be a director of ValueClick due to, among other factors, his industry experience, general management experience in operational and leadership roles in various organizations, and his experience as a director on the boards of other companies.

JOHN PITSTICK is the Chief Financial Officer of ValueClick. Mr. Pitstick joined ValueClick in March 2005 and served as the Company's Executive Vice President of Finance prior to his promotion to Chief Financial Officer in September 2007. Prior to joining ValueClick, Mr. Pitstick was a senior manager in the audit practice of Ernst & Young, where he served both public and private companies in the high technology industry for nearly ten years. Mr. Pitstick is a Certified Public Accountant (inactive) with a bachelor's degree in accounting from the University of San Francisco.

JAMES R. ZARLEY is the Chairman of the Board. From his arrival in 1999 until May 2007, Mr. Zarley served as Chairman and Chief Executive Officer of ValueClick and shaped the Company into a global leader in online marketing solutions. During the period from May 2007 through May 2010, Mr. Zarley served as Executive Chairman of the Company. From May 2010 to December 2012, Mr. Zarley served as the Company's Chief Executive Officer. From December 2012 to March 2013, Mr. Zarley served as Executive Chairman of the Board and assumed the role of non-executive Chairman of the Board beginning in March 2013 in connection with his retirement from a full-time position with the Company. Prior to joining ValueClick, from April 1987 to December 1996, Mr. Zarley was Chief Executive Officer of Quantech Investments, an information services company. From December 1996 to May 1998, Mr. Zarley was the Chairman and Chief Executive Officer of Best Internet until its merger with Hiway Technologies, a Web hosting company, in May 1998. From May 1998 to January 1999, Mr. Zarley was the Chief Operating Officer of Hiway Technologies until its merger with Internet service provider, Verio, Inc. Mr. Zarley currently serves as a director of Texas Roadhouse, Inc., a restaurant chain.

Mr. Zarley has been a member of the Board of the Company for over ten years and is qualified to be a director of ValueClick due to, among other factors, his industry experience, extensive knowledge of the day-to-day operations of our business, general management experience in operational and leadership roles in various organizations, and his experience as a director on the boards of other companies.

PETER WOLFERT joined ValueClick as the Chief Technology Officer in June 2000. Previously, Mr. Wolfert was the Senior Vice President and Director of Information Technology for Mellon Capital Management, an investment management firm in San Francisco, from October 1998 until June 2000. Prior to that, he served as Senior Vice President of Information Technology at AIM Funds in San Francisco from October 1995 to October 1998. From January 1992 until October 1995, Mr. Wolfert was Senior Vice President of Information Technology at Trust Company of the West. Mr. Wolfert graduated with a B.S. from the University of California at Davis, and an M.B.A., with emphasis in Management Information Systems, from the University of California at Irvine.

SCOTT P. BARLOW joined ValueClick as the Vice President and General Counsel in October 2001 and has also served as the Secretary since February 2002. Prior to joining ValueClick, Mr. Barlow served as the General Counsel and Secretary for Mediaplex, Inc., a provider of technology‑based marketing products and services, from December 2000 to October 2001. From October 1999 to December 2000, Mr. Barlow served as Mediaplex, Inc.'s Assistant General Counsel. Prior to his employment with Mediaplex, Inc., Mr. Barlow was a senior associate with Raifman & Edwards LLP, a San Francisco‑based corporate law firm, from 1995 to 1999. Mr. Barlow graduated with a B.S. from the University of Florida and a J.D. from the University of Akron School of Law.

MARTIN T. HART has been a director of ValueClick since March 1999. Mr. Hart has been a private investor in the Denver area since 1969. Mr. Hart has owned and developed a number of companies into successful businesses, and has served on the board of directors for many public and private corporations. Presently, Mr. Hart is serving on the board of the following public companies: MassMutual Corporate Investors, an investment company; MassMutual Participation Investors, an investment company; and Texas Roadhouse, Inc., a restaurant chain. Within the past five years, Mr. Hart also served on the board of directors of Spectranetics Corporation, a medical device company. He also serves on the board of directors of several private companies. Mr. Hart graduated with a B.A. from Regis University and is a Certified Public Accountant.

In addition to the substantial knowledge of our company and industry that Mr. Hart has gained during his over ten years of service on our Board, Mr. Hart is qualified to be a director of ValueClick due to, among other factors, his background in public accounting, his deep capital markets and mergers and acquisition experience, and his experience as a director on the boards of other companies.

DAVID S. BUZBY has been a director of ValueClick since May 1999. Mr. Buzby is a San Francisco‑based investor and operator of entrepreneurial companies with experience in the internet and environmental industries. Mr. Buzby currently serves as the Chief Executive Officer of Bright Plain Renewable Energy, a solar finance company, since May 2011. Mr. Buzby has been an investor and director of several private companies, including currently: Stem, Inc., a power storage company, since April 2010. Previously, Mr. Buzby has been an investor and a Board member of SunRun, Inc., a residential solar service company, from July 2008 to July 2012; Eco2 Plastics, Inc., a plastic recycling company, from May 2007 to July 2010; an investor and Chairman of the Board of SunEdison, LLC, a solar integrator, from January 2005 to November 2009; and a Board member of Xunlight Corporation, a solar photovoltaic manufacturer, from August 2007 to September 2009. Mr. Buzby graduated with a B.A. from Middlebury College and an M.B.A. from Harvard Business School.

In addition to the substantial knowledge of our company and industry that Mr. Buzby has gained during his over ten years of service on our Board, Mr. Buzby is qualified to be a director of ValueClick due to, among other factors, his over fifteen years of experience managing companies in various operational and finance roles, his involvement as both an investor and executive in companies operating in high-growth industries such as the internet and clean energy, and his experience as a director on the boards of other companies.

JAMES A. CROUTHAMEL has been a director of ValueClick since July 2007. Mr. Crouthamel is the Principal of Old Town Capital, LLC where he has been an operating investor in early‑stage interactive marketing service and technology companies since March 2005. Mr. Crouthamel founded Performics, Inc. in 1998 and served as the company's Chief Executive Officer from inception through its acquisition by DoubleClick, Inc. in June 2004. From June 2004 to March 2005, Mr. Crouthamel served as the Senior Vice President and General Manager at DoubleClick, Inc., where he oversaw the operations of Performics. Mr. Crouthamel earned a Master of Business Administration degree from Northwestern University's J.L. Kellogg Graduate School of Management, a Master of Engineering Management from Northwestern University's McCormick School of Engineering and completed his Bachelor of Science in Mechanical Engineering at Drexel University. Mr. Crouthamel currently serves on the board of directors of privately-held AdGooroo LLC, an online marketing company.

Mr. Crouthamel is qualified to be a director of ValueClick primarily due to his extensive senior management and entrepreneurial experience in the online marketing industry. Mr. Crouthamel has started, operated and sold businesses that are similar in nature to, or in the same industry as, ValueClick.

JAMES R. PETERS has been a director of ValueClick since July 2007. Mr. Peters is a Certified Public Accountant (inactive) and a retired partner (2006) from the audit practice of the accounting firm Ernst & Young LLP, where he began his career in 1971. He has extensive experience with public and private companies in a number of industries, including retail, distribution, manufacturing, health sciences, technology, communications, and entertainment. Mr. Peters is a former faculty member of the Directors' Certification Program at the Anderson School of Business of the University of California, Los Angeles. He is also a former advisory board member for the Entrepreneurial Studies program of the University of Southern California. Mr. Peters is a member of the National Association of Corporate Directors and serves on the board of directors of privately-held FzioMed, Inc., a medical device company. Mr. Peters was previously a director of Natrol, Inc. prior to its acquisition by a private enterprise in December 2007.

Mr. Peters is the chairman of the Company's Audit Committee. Mr. Peters is qualified to be a director of ValueClick primarily due to his background in public accounting whereby he was an audit partner at the accounting firm of Ernst & Young LLP. Mr. Peters provides extensive audit and corporate governance knowledge and experience and qualifies as an audit committee financial expert as defined by the SEC. During his tenure as an audit partner, Mr. Peters advised numerous publicly‑traded and privately-held companies on accounting, internal controls, and capital markets activities. In additional to his extensive financial and accounting background, Mr. Peters has experience as a director on the boards of other companies.

JEFFREY F. RAYPORT has been a director of ValueClick since May 2002. Dr. Rayport was formerly a director of Be Free, Inc. (which merged with ValueClick in 2002). Dr. Rayport works as an operating partner at Castanea Partners, a private equity firm, since 2009 and currently serves as the non-executive Chairman of Marketspace, LLC, an e-commerce research and media unit of Monitor Group, a management consulting firm. From 1999 to 2009, Dr. Rayport served as the founder and Chief Executive Officer of Marketspace, LLC. From 1991 to 2000, he was a faculty member at Harvard Business School in the Service Management Unit. He currently serves as a director of Monster Worldwide. Dr. Rayport earned an A.B., A.M. and Ph.D. from Harvard University, and an M. Phil. from the University of Cambridge (U.K.).

In addition to the substantial knowledge of our company and industry that Dr. Rayport has gained during his service on our Board, Dr. Rayport is qualified to be a director of ValueClick due to, among other factors, his background as an educator at Harvard Business School, his active involvement in the online marketing sector as a consultant and advisor since 1994, and his experience as a director on the boards of other companies.

Committees

Audit Committee

Function. The Company has a standing Audit Committee, which acts under a written charter that was last revised in July 2010. Under its charter, the Audit Committee, among other things, appoints our independent registered public accounting firm each year and approves the compensation and terms of engagement of our independent registered public accounting firm, approves services proposed to be provided by our independent registered public accounting firm as well as all services proposed to be provided by other professional financial services providers, reviews and approves all related party transactions, and monitors and oversees the quality and integrity of our accounting process and system of internal controls. The Audit Committee reviews the annual audit reports of our independent registered public accounting firm and reports of examinations by any regulatory agencies, and it oversees our corporate governance program. The Audit Committee also performs certain risk oversight functions as noted above in “The Board's Role in Risk Oversight”. The Audit Committee charter is publicly available on our website at www.valueclick.com in the “Investors” section under “Corporate Governance”.

Members. The current members of the Audit Committee are Mr. Peters-Chairman, Mr. Buzby, and Dr. Rayport. Each member of the Audit Committee is an independent director under the listing standards of NASDAQ as set forth above. In addition, in accordance with NASDAQ listing standards, each member of the Audit Committee meets additional heightened independence criteria applicable to audit committee members. As determined by the Board, each Audit Committee member meets NASDAQ's financial literacy requirements, and the Board has determined that Mr. Peters qualifies as an “audit committee financial expert” as that term is defined by rules of the SEC.

Compensation Committee

The Company has a standing Compensation Committee, which consists of Mr. Hart-Chairman and Mr. Buzby, both of whom are independent directors under NASDAQ listing standards as set forth above. The Compensation Committee does not have a written charter.

The Compensation Committee, among other things, reviews and approves the compensation and incentive arrangements for the Company's Chief Executive Officer and Executive Chairman (without the presence of the Company's Chief Executive Officer or Executive Chairman during deliberations) and for all other executive officers, reviews general compensation levels for other employees as a group, approves awards to be granted to eligible persons under the Company's stock plans, and takes such other actions as may be required in connection with the Company's compensation and incentive plans. The Chief Executive Officer periodically reviews the performance of each executive officer, other than himself, whose performance is periodically reviewed by the Compensation Committee. The conclusions reached and recommendations based on these reviews, including with respect to compensation adjustments and equity award amounts, are presented to or developed by the Compensation Committee. The Compensation Committee can exercise its discretion in modifying any recommended cash compensation adjustments or equity awards to executive officers. The Compensation Committee has not delegated its authority to others and has not utilized outside compensation consultants in determining compensation and incentive arrangements for any of the Company's executive officers.

Compensation for non-management directors is overseen by the full Board. The Board's process for reviewing and determining compensation of the non-management directors is described on page 26.

Nominating Committee

The Company has a standing Nominating Committee, which consists of Dr. Rayport-Chairman, Mr. Buzby, and Mr. Hart, all of whom are independent directors under NASDAQ listing standards. The Nominating Committee oversees the director nominations process and evaluates and recommends director candidates to the Board for nomination and election by the Company's stockholders. In evaluating director candidates, the Nominating Committee follows the general criteria described above in “Nomination of Directors/Director Presence at Annual Meetings.” The Nominating Committee charter is publicly available on our website at www.valueclick.com in the “Investors” section under “Corporate Governance.”

Board and Committee Meetings

During 2012, the Board held five meetings, the Compensation Committee held four meetings, the Audit Committee held eight meetings, and the Nominating Committee held one meeting. In 2012, each director attended or participated in approximately 95% or more of the number of meetings held by the Board and each of the committees on which the director served.

During 2012, the members of the Compensation Committee were Martin Hart and David Buzby, neither of whom are, or were, employees of the Company, or had any relationships with the Company requiring disclosure under Item 404 of Regulation S-K during fiscal 2012. None of our executive officers served on the compensation committee or board of directors of another entity whose executive officer(s) served on our Compensation Committee or Board.

Risk and Compensation Programs

Upon review and evaluation of its compensation policies and practices, including the 2012 Executive Incentive Compensation Plan performance metrics, the mix of variable and non-variable cash compensation, and the use of equity awards that align the interests of the recipients of such awards with the long-term interests of the Company's stockholders, the Company has determined that the risks arising from the compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

Related Party Transactions

Our Board has adopted written policies and procedures regarding related party transactions, as described in the Audit Committee Charter. The policies and procedures apply to transactions with any related person, which SEC rules define to include directors, director nominees, executive officers, beneficial owners of in excess of 5% of the outstanding shares of the Company's common stock, and their respective immediate family members. The Audit Committee Charter requires that all related party transactions, regardless of size, be approved by the Audit Committee. The Audit Committee's decision as to whether or not to approve a related party transaction is to be made in light of the Audit Committee's determination that consummation of the transaction is not contrary to our best interests and is on terms no less favorable to us than we could obtain from non-related parties. Any related party transaction approved by the Audit Committee must be disclosed to the Board.

During 2012, other than as described below, the Company was not a party to any transactions in which a related party had a material direct or indirect interest. There are no family relationships between any of our directors or executive officers.

On August 7, 2012, Carl White, Chief Executive Officer - Europe, informed the Company of his intention to resign from the Company after a brief transition period. Around the time of Mr. White's notice of his pending resignation, the Company was holding discussions with a third party regarding a potential sale of the Company's Search123 business, a self-service paid search business in Europe. After discussing the terms of a potential transaction with this third party, Mr. White approached the Company regarding his interest in acquiring the Search 123 business. The terms proposed by Mr. White were determined to be more favorable to the Company and represented a higher certainty of closing than the terms being proposed with the third party. Accordingly, the Company entered into an agreement to sell Search123 to Mr. White effective on September 30, 2012 at which time Mr. White ceased his employment with the Company. The terms of the sale include a royalty equal to 10% of the gross revenue generated by Search123 during the four-year period following the sale to Mr. White. The full Board of Directors, in lieu of the Audit Committee, approved the terms of the transaction.

Report of the Audit Committee of the Board of Directors

The Audit Committee of the Board of Directors has furnished the following report on Audit Committee matters:

Pursuant to its charter, the Audit Committee, consisting entirely of independent directors, is primarily responsible for overseeing and monitoring the accounting, financial reporting and internal controls practices of the Company. Its primary objective is to promote and preserve the integrity of the Company's consolidated financial statements and the independence and performance of the Company's independent registered public accounting firm. The Committee also oversees the performance of the Company's corporate governance function, the Company's compliance with legal and regulatory requirements, and the review and approval of any related party transactions.

It is important to note, however, that the role of the Audit Committee is one of oversight, and the Committee relies, without independent verification, on the information provided to it and the representations made by management, the Company's corporate governance personnel and the Company's independent registered public accounting firm. Management retains direct responsibility for the financial reporting process and the Company's system of internal controls.

In furtherance of its role, the Audit Committee has an annual agenda which includes periodic reviews of the Company's internal controls and of potential exposure for the Company such as litigation matters. The Audit Committee meets at least quarterly and reviews the Company's interim quarterly financial results and earnings releases prior to their publication.

The Audit Committee's policy, per its charter, is to pre-approve all audit and non-audit services provided by the Company's independent registered public accounting firm and other professional financial services providers. These services may include audit services, audit-related services, tax services, and other financial services. Pre-approval generally is provided for up to one year and any pre-approval is detailed as to the particular service or category of services and generally is subject to a specific budget. The Audit Committee has delegated pre-approval authority to its Chairman when expedition of services is necessary. The Company's independent registered public accounting firm and management report annually to the Audit Committee regarding the extent of services provided by the Company's independent registered public accounting firm in accordance with this pre-approval, and the related fees for the services performed. All of the audit, audit-related, tax, and other financial services provided by PricewaterhouseCoopers LLP in 2012 and related fees were approved in accordance with the Audit Committee's charter.

The Audit Committee has reviewed and discussed with management: (i) the audited consolidated financial statements of the Company for the year ended December 31, 2012; (ii) the Company's evaluation of the effectiveness of its internal control over financial reporting as of December 31, 2012; and (iii) the related opinions by the Company's independent registered public accounting firm. The Audit Committee has also discussed with PricewaterhouseCoopers LLP the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee also has received written disclosures and a letter from PricewaterhouseCoopers LLP as required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant's communications with the Audit Committee concerning independence, and has discussed with PricewaterhouseCoopers LLP the independence of that firm. Based upon these materials and discussions, the Audit Committee has recommended to the Board of Directors that the Company's audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2012.

Submitted by the Audit Committee of the Board of Directors

James R. Peters, Chairman

David S. Buzby

Jeffrey F. Rayport

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation Objectives

This Compensation Discussion and Analysis, or "CD&A," reports on the Company's compensation principles and practices for its named executive officers ("NEOs"), whose actual compensation for 2012 is set forth in the Summary Compensation Table following this CD&A.

The objectives of our executive compensation policies and practices are to:

| |

| • | Provide competitive compensation that supports the Company's business strategies; |

| |

| • | Attract, retain and motivate over the long-term, high-quality and productive individuals by maintaining competitive compensation relative to other companies in the marketplace; |

| |

| • | Focus our executives on achieving financial and operational goals that are tied to defined performance objectives, with the ultimate objective of improving stockholder value; and |

| |

| • | Align management and stockholder interests through grants of equity-based awards. |

2012 Executive Compensation Components

The compensation components for our NEOs include base salary, performance-based cash incentive compensation and grants of equity awards, as well as the standard benefits available to all full-time Company employees. Certain of our NEOs are also eligible for additional post-termination benefits in the event of a termination of employment in connection with a change in control of the Company under certain circumstances as described below.

The Compensation Committee has not established formal policies or guidelines with respect to the mix of base salary, performance-based cash incentive compensation and equity awards to be paid or awarded to our NEOs, nor has it established formal policies or guidelines with respect to the frequency of reviewing base salary and performance-based cash incentive compensation levels or the frequency of making grants of equity awards to our NEOs. The Compensation Committee has not utilized benchmarking or outside compensation consultants when making decisions regarding the base salary, cash incentive compensation and equity awards for the Company's NEOs. Accordingly, no particular percentile in comparison with peers has been established as a target level for any of these components or total compensation.

Instead, the Compensation Committee members use their general business knowledge, which includes their external business experience, when making compensation decisions. The Compensation Committee also solicits input from the Chief Executive Officer related to compensation decisions for NEOs (excluding decisions related to the Chief Executive Officer himself). In general, the Compensation Committee believes that the largest component of the compensation for our NEOs and other senior members of management should be based on corporate performance and seeks to link performance-based cash incentive compensation with measurable Company financial objectives to align the interests of our NEOs with our stockholders. Additionally, the Compensation Committee views equity awards as performance-based compensation as our NEOs receive greater value if the price of the Company's common stock appreciates.

Base Salary

The Company pays base salaries at levels believed to be necessary to attract and retain our NEOs. In setting and modifying base salary levels for our NEOs, the Compensation Committee takes into broad consideration job responsibilities, tenure with the Company and the Company's historical salary levels for that position.

The following summarizes the base salary levels of our NEOs during 2012: |

| | | | | | | | | | | |

| Name and Title | | | Beginning Base Salary | | Ending Base Salary | | Date of Salary Increase |

| John Giuliani, President and Chief Executive Officer | | $ | 400,000 |

| | $ | 400,000 |

| | Not applicable (1) |

| John Pitstick, Chief Financial Officer | | $ | 300,000 |

| | $ | 325,000 |

| | 2/1/2012 (2) |

| James R. Zarley, Chairman of the Board(3) | | $ | 450,000 |

| | $ | 450,000 |

| | Not applicable |

| Carl White, former Chief Executive Officer—Europe(4) | | $ | 316,000 |

| | $ | — |

| | Not applicable |

| Peter Wolfert, Chief Technology Officer | | $ | 325,000 |

| | $ | 325,000 |

| | Not applicable |

| Scott Barlow, Vice President and General Counsel | | $ | 325,000 |

| | $ | 325,000 |

| | Not applicable |

| |

| (1) | On January 29, 2013, the Compensation Committee approved an increase to the base salary level of Mr. Giuliani from $400,000 to $600,000, effective on February 1, 2013, in recognition of his recent promotion in December 2012 to the role of President and Chief Executive Officer and the associated increase in his responsibilities. |

| |

| (2) | On February 2, 2012, the Compensation Committee approved an increase to the base salary level of Mr. Pitstick from $300,000 to $325,000 effective February 1, 2012. The Compensation Committee determined that it was appropriate to adjust Mr. Pitstick's base salary to be consistent with other executives with similar levels of responsibility, namely Messrs. Wolfert and Barlow. |

| |

| (3) | In March 2013, Mr. Zarley retired from his full-time position as Executive Chairman of the Board and assumed the role of non-executive Chairman of the Board. Upon his retirement, he no longer receive a base salary or participates in an incentive compensation plan. Beginning April 1, 2013, Mr. Zarley will be paid director fees commensurate with other Directors as discussed on page 26. |

| |

| (4) | Salary amount for Mr. White was converted from British Pounds to U.S. Dollars using the average currency exchange rates in effect from January 1, 2012 to September 30, 2012 equal to £1 British Pound to $1.58 U.S. Dollars. Effective September 30, 2012, Mr. White resigned from his position with the Company. |

Performance-Based Cash Incentive Compensation

The 2012 Executive Incentive Compensation Plans ("2012 EIC Plans") for our NEOs required achievement by the Company of certain quarterly, or in the case of Mr. Giuliani annual, revenue and earnings targets. With the exception of Mr. Giuliani, payments associated with achieving revenue targets were equally weighted with payments associated with achieving earnings targets, and the achievement/non-achievement of either the revenue or earnings target did not impact the amounts earned related to the other target. Mr. Giuliani's 2012 EIC Plan provided for a payment associated with achieving both an annual revenue and annual earnings target for the Company's Dotomi division, and additional payments based solely upon increasing earnings targets for this division. The Compensation Committee utilized revenue and earnings targets in the 2012 EIC Plans because it believes that growth in these metrics are key factors in creating long-term stockholder value.

The 2012 EIC Plans had a tiered structure whereby increased levels of performance above the threshold target would result in greater payouts up to a specified maximum. The 2012 EIC Plans did not have a guaranteed minimum payment, so it was possible that performance could have resulted in no incentive payments being made to our NEOs.

Earnings targets under the 2012 EIC Plans for Messrs. Zarley, Pitstick, Wolfert, and Barlow were based on a measure of consolidated adjusted-EBITDA which, for purposes of the 2012 EIC Plans, is defined as net income before interest, income taxes, depreciation, amortization, and stock-based compensation. The revenue and earnings targets for Messrs. Zarley, Pitstick, Wolfert, and Barlow were based on the Company's consolidated results as these individuals had oversight responsibilities that covered the entire Company. The revenue and earnings targets for 2012 for Mr. Giuliani were based on the results of the Company's Dotomi division as this was the business that he oversaw when the 2012 EIC plans were put in place in early 2012.

Mr. White's 2012 EIC plan was weighted based upon the achievement of the following factors: 45% on European income from operations before corporate overhead; 45% on European total revenue; and 10% on consolidated revenue. Mr. White's targets were primarily based on European operations because he was the executive primarily responsible for the Company's European operations.

The Compensation Committee structured the 2012 EIC Plans such that the maximum potential payments under the plan for Mr. Giuliani was $800,000 or 200% of his base salary; the maximum potential payout for Mr. Zarley was $585,000 or 130% of his respective base salary; the maximum potential payments for Messrs. Pitstick, Wolfert and Barlow were $325,000, or 100% of their respective base salaries; and the maximum potential payment for Mr. White was £130,000, or 65% of his base salary. The Compensation Committee believes the significant percentage of performance-based cash compensation relative to base salaries is consistent with the objective of linking a significant portion of our NEOs' total compensation, including cash compensation, to Company performance. The employment agreements with our NEOs do not specify the minimum amount of incentive compensation that our NEOs are eligible to achieve. The higher relative percentage of incentive compensation to base salary for Mr. Giuliani is due to the Compensation Committee retaining the incentive compensation structure that Mr. Giuliani had in place prior to the Company's acquisition of Dotomi in 2011 and prior to Mr. Giuliani becoming an executive officer of the Company.

The following table summarizes the consolidated revenue and earnings targets, including the impact from Search123 (which was divested on September 30, 2012) in the first three quarters of 2012, and excluding the impact of this divestiture in the fourth quarter, followed by the related quarterly payout amounts under the 2012 EIC Plans for Messrs. Zarley, Pitstick, Wolfert, and Barlow at various achievement levels, including: the minimum threshold achievement level in order to qualify for any payment; the maximum achievement level; and the midpoint which represents the target achievement level.

Notwithstanding the targets and formulas contained in the EIC Plans, the Compensation Committee maintains the discretion to grant incentive compensation other than in connection with the attainment of certain targets. No such discretionary payments were approved for 2012 or 2011.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Minimum Threshold(1) | | Mid Point(1) | | Maximum Achievement(1) | | Actual Results(1) |

| | | Revenue | | Earnings | | Revenue | | Earnings | | Revenue | | Earnings | | Revenue | | Earnings |

Performance Targets by Tier (in millions) | | | | | | | | | | | | | | | | |

| First Quarter 2012 | | $ | 147.2 |

| | $ | 43.2 |

| | $ | 160.0 |

| | $ | 47.0 |

| | $ | 183.8 |

| | $ | 54.0 |

| | $ | 152.9 |

| | $ | 47.9 |

|

| Second Quarter 2012 | | $ | 158.2 |

| | $ | 45.1 |

| | $ | 172.0 |

| | $ | 49.0 |

| | $ | 197.6 |

| | $ | 56.3 |

| | $ | 161.0 |

| | $ | 49.5 |

|

| Third Quarter 2012 | | $ | 156.4 |

| | $ | 46.0 |

| | $ | 170.0 |

| | $ | 50.0 |

| | $ | 195.3 |

| | $ | 57.5 |

| | $ | 168.0 |

| | $ | 53.1 |

|

| Fourth Quarter 2012 | | $ | 186.8 |

| | $ | 63.0 |

| | $ | 203.0 |

| | $ | 68.5 |

| | $ | 233.2 |

| | $ | 78.7 |

| | $ | 199.6 |

| | $ | 77.1 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Minimum Threshold | | Mid Point | | Maximum Achievement | | Maximum Potential Annual Payout |

| | | Revenue | | Earnings | | Revenue | | Earnings | | Revenue | | Earnings | |

| Potential Quarterly Payout Amounts | | | | | | | | | | | | | | |

| James R. Zarley | | $ | 33,750 |

| | $ | 33,750 |

| | $ | 56,250 |

| | $ | 56,250 |

| | $ | 73,125 |

| | $ | 73,125 |

| | $ | 585,000 |

|

| John Pitstick | | $ | 18,750 |

| | $ | 18,750 |

| | $ | 31,250 |

| | $ | 31,250 |

| | $ | 40,625 |

| | $ | 40,625 |

| | $ | 325,000 |

|

| Peter Wolfert | | $ | 18,750 |

| | $ | 18,750 |

| | $ | 31,250 |

| | $ | 31,250 |

| | $ | 40,625 |

| | $ | 40,625 |

| | $ | 325,000 |

|

| Scott Barlow | | $ | 18,750 |

| | $ | 18,750 |

| | $ | 31,250 |

| | $ | 31,250 |

| | $ | 40,625 |

| | $ | 40,625 |

| | $ | 325,000 |

|

_____________________

| |

| (1) | Includes the impact of Search123 in the first, second and third quarters of 2012. Search123 was divested on September 30, 2012. |

The following table summarizes the revenue and earnings targets for the Company's European operations for the first, second and third quarters under the 2012 EIC Plan for Mr. White, followed by the related quarterly payout amounts under the 2012 EIC Plans for Mr. White at various achievement levels, including: the minimum threshold achievement level in order to qualify for any payment; the maximum achievement level; and the midpoint which represents the target achievement level. Mr. White resigned from the Company in September 2012.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Minimum Threshold | | Mid Point | | Full Achievement | | Actual Results |

| | | Revenue | | Earnings | | Revenue | | Earnings | | Revenue | | Earnings | | Revenue | | Earnings |

Performance Targets by Tier (in millions) | | | | | | | | | | | | | | | | |

| First Quarter 2012 | | $ | 23.1 |

| | $ | 4.7 |

| | $ | 24.9 |

| | $ | 5.0 |

| | $ | 28.6 |

| | $ | 5.8 |

| | $ | 26.5 |

| | $ | 4.9 |

|

| Second Quarter 2012 | | $ | 23.7 |

| | $ | 4.8 |

| | $ | 25.5 |

| | $ | 5.1 |

| | $ | 29.2 |

| | $ | 5.9 |

| | $ | 26.3 |

| | $ | 5.4 |

|

| Third Quarter 2012 | | $ | 24.4 |

| | $ | 5.2 |

| | $ | 26.2 |

| | $ | 5.6 |

| | $ | 30.1 |

| | $ | 6.4 |

| | $ | 25.2 |

| | $ | 5.5 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Minimum Threshold | | Mid Point | | Full Achievement | | Maximum Annual Payout |

| | | Revenue | | Earnings | | Revenue | | Earnings | | Revenue | | Earnings | |

| Quarterly Payout Amounts | | £ | 5,500 |

| | £ | 4,500 |

| | £ | 13,750 |

| | £ | 11,250 |

| | £ | 17,875 |

| | £ | 14,625 |

| | £ | 130,000 |

|

Actual payouts under the 2012 EIC Plans for the NEOs in 2012 are shown in the Summary Compensation Table appearing on page 19. The quarterly targets for Messrs. Zarley, Pitstick, White, Wolfert and Barlow were achieved, in general, between the minimum and mid-point achievement targets. The annual targets for Mr. Giuliani related to the Dotomi division were achieved at the maximum level.

Equity Awards

Restricted Stock Awards

The Company utilizes stock plans to provide our NEOs with incentives to maximize long-term stockholder value. Prior to 2008, awards under these plans took the form of stock option grants. Since 2008, the Company has utilized restricted stock awards. In 2012, the Company granted 50,000 restricted stock awards to each of the Company's NEOs. In addition, Mr. Giuliani was granted an additional 500,000 restricted stock awards shortly after his promotion to Chief Operating Officer. All restricted stock awards granted in 2011 and prior, including those granted to non-executive employees, vest over a four-year period from the date of grant and vest immediately upon the occurrence of a change in control. Effective February 2012, the change in control provision for newly issued restricted stock grants was amended so that 50 percent of the unvested shares shall immediately become vested shares upon the consummation of a change in control transaction with the remaining 50 percent to vest upon the earlier of (a) the original vesting schedule of the shares or (b) the twelve month anniversary of the date of consummation of the change in control transaction.

As noted above, the Compensation Committee has not utilized benchmarking when making decisions regarding the levels of stock awards granted to the Company's NEOs. In addition, when determining the number of shares subject to stock awards for NEOs, the Compensation Committee does not determine the number of shares to be awarded based upon a specific dollar value thereof, nor has it utilized other financial models. Rather, the Compensation Committee takes into broad consideration job responsibilities, tenure with the Company, the Company's historical levels of stock awards for that position, and the number and exercise price of prior stock awards for each NEO. The Compensation Committee also considers the amount of shares available under the 2002 Stock Plan as well as the financial statement impact of stock awards. Equity awards are generally granted at the regularly scheduled quarterly meetings of the Compensation Committee. These meetings are generally scheduled well in advance of the actual meeting dates and prior to the public disclosure of the Company's quarterly results. The grants made are at the discretion of the Compensation Committee using the factors noted above.

Employee Stock Purchase Plan

In order to foster increased stock ownership by employees generally, the Company established its Employee Stock Purchase Plan ("ESPP") in September 2007. The ESPP allows all employees and officers to purchase shares of the Company's common stock through payroll deductions of up to 20 percent of their annual, eligible compensation up to a maximum of $15,000 per year. The price of common stock purchased under the ESPP is equal to 85 percent of the lower of the fair market value of the common stock on the commencement date of each twelve-month offering period or the specified purchase date. During 2012, all of the NEOs participated in the ESPP.

Benefits

We provide various employee benefit programs to our NEOs, including medical, dental, life, and disability insurance benefits, which are generally available to all full-time employees of the Company. We also sponsor a tax-qualified 401(k) savings plan pursuant to which eligible employees paying U.S. taxes on a non-discriminatory basis are able to contribute a portion of their base salaries up to the limit prescribed by the Internal Revenue Service. We provide for discretionary matching contributions equal to 50% of the first 4% of base salary contributed. All employee contributions to the 401(k) savings plan are fully vested upon contribution. Our matching contributions are vested based on the employee's years of service.

Perquisites

Other than a car allowance for Mr. White, which is customary practice in Europe, we do not provide any additional perquisites or executive-level benefit programs to our NEOs.

Compensation Arrangements Relating to Termination of Employment

The only contractual severance benefits to which the named executive officers are entitled are severance benefits upon a termination in connection with a change in control. We view change in control provisions for our NEOs as an important tool to align their interests with the interests of our stockholders insofar as it allows our NEOs to focus on stockholder interests when considering strategic alternatives. The change in control benefits provided to our NEOs do not affect our decisions regarding other compensation elements; rather they are one tool we use to ensure we can attract and retain our NEOs. The structure of the change in control provisions for our NEOs as described below has evolved over time and is based upon the Compensation Committee's determination of what is appropriate (based upon their external business experience) for a publicly-traded company of our size and complexity.

The employment agreements with Messrs. Zarley, Pitstick, Wolfert and Barlow provide certain compensation if their employment is terminated without cause in connection with the occurrence of a change in control of the Company or upon an occurrence of a constructive termination following a change in control (hereafter referred to as "a double-trigger event"). Other than the acceleration of vesting of a portion of an NEOs restricted stock awards, which is provided to all holders of the Company's restricted stock, no severance or other benefits are provided under these employment agreements solely upon the occurrence of a change in control. These employment agreements were last amended on February 7, 2008 and provide for the following benefits upon a double-trigger event:

| |

| (a) | the payment of one year's base salary; |

| |

| (b) | the vesting of 100% of all outstanding equity awards; and |

| |

| (c) | a tax gross-up payment to reimburse the NEO for any golden parachute excise taxes that may be imposed by the Internal Revenue Service ("IRS") as a result of (a) and (b). |

We do not provide for contractual severance benefits upon termination of employment other than in connection with a change in control and double-trigger event as we favor an "at will" employment approach that gives flexibility to the Company should we determine that termination of an NEO's employment is in the best interests of the Company.

Deductibility of Executive Compensation

The Compensation Committee has considered the impact of Section 162(m) of the Internal Revenue Code, which disallows a Federal income tax deduction for any publicly-held corporation for individual compensation exceeding $1 million in any taxable year for the chief executive officer and the other NEOs (excluding the chief financial officer), respectively, unless such compensation meets the requirements for the "performance-based" exception to Section 162(m).

In 2012, four of our NEOs' compensation exceeded the $1 million limitation on deductible compensation as a result of certain compensation structures that were deemed non-performance-based under Section 162(m). The 2012 EIC Plans were not submitted for stockholder approval, and all compensation paid under the 2012 EIC Plans was accordingly subject to the $1 million limitation. The Compensation Committee has decided not to submit the 2013 EIC Plans for stockholder approval at the Annual Meeting or to take any other action to limit or restructure the elements of cash compensation payable to our NEOs. In addition, the deductibility of any compensation in connection with restricted stock awards will also be subject to the $1 million limitation per covered NEO. For the year ended December 31, 2012, the total amount of compensation that will not be deductible pursuant to Section 162(m) of the Internal Revenue Code is set forth in the table below.

|

| | | |

| | Total Amount of Compensation Not Deductible |

| John Giuliani | $ | 2,831,107 |

|

| James R. Zarley | $ | 1,003,875 |

|

| Peter Wolfert | $ | 660,670 |

|

| Scott Barlow | $ | 676,052 |

|

The Compensation Committee believes that in establishing the cash and equity incentive compensation programs for our NEOs, the potential deductibility of the compensation payable under those programs should be only one of several factors taken into consideration and not the sole governing factor. For that reason, the Compensation Committee may deem it appropriate to continue to provide one or more executive officers with the opportunity to earn incentive compensation, whether through cash or equity incentive programs, which may be in excess of the amount deductible pursuant to Section 162(m) or other provisions of the Internal Revenue Code.

Advisory Vote on Executive Compensation for 2011

In connection with the proxy statement for the 2012 Annual Meeting of Stockholders, 90% of the shares voted at the Annual Meeting approved, on an advisory basis, the compensation of the NEOs as described in the prior year proxy statement. Due to the high approval level, the Compensation Committee did not believe that significant changes were required to the Company's compensation principles and practices for its NEOs.