UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

EDGAR ONLINE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

May 24, 2007

Dear Stockholder:

On behalf of the Board of Directors of EDGAR Online, Inc., I cordially invite you to attend our Annual Meeting of Stockholders, which will be held on June 27, 2007 at 10:00 A.M. (local time) at our offices at 50 Washington Street, Norwalk, Connecticut 06854.

At this year’s meeting, you will vote: (i) to elect seven (7) directors to serve on the Board of Directors of the Company until the Company’s 2008 Annual Meeting of Stockholders and until their successors are duly elected and qualified or until their earlier resignation or removal; (ii) to approve and ratify the appointment of BDO Seidman, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2007; and (iii) to transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

We have attached a notice of meeting and a proxy statement that contains more information about these proposals.

You will also find enclosed a proxy card appointing proxies to vote your shares at the Annual Meeting. Please sign, date and return your proxy card as soon as possible so that your shares can be represented and voted in accordance with your instructions, even if you cannot attend the Annual Meeting in person.

Sincerely,

Marc Strausberg

Chairman of the Board of Directors

EDGAR ONLINE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 27, 2007

TO THE STOCKHOLDERS OF EDGAR ONLINE, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of EDGAR Online, Inc., a Delaware corporation (“EDGAR Online” or the “Company”), will be held at the Company’s offices, 50 Washington Street, Norwalk, Connecticut 06854, on June 27, 2007 at 10:00 A.M. (local time) for the following purposes:

(1) ELECTION OF DIRECTORS: To elect seven (7) members of the Company’s Board of Directors (the “Board of Directors”) to serve until the Company’s 2008 Annual Meeting of Stockholders and until their successors are duly elected and qualified or until their earlier resignation or removal;

(2) RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM: To ratify the appointment of BDO Seidman, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2007; and

(3) OTHER BUSINESS: To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement that is attached to and made a part of this Notice. The Board of Directors has fixed May 11, 2007 as the record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. Whether or not you plan to attend the Annual Meeting, your vote is important. To assure your representation at the Annual Meeting, please sign and date the enclosed proxy card and return it promptly in the enclosed envelope, which requires no additional postage if mailed in the United States or Canada. Should you receive more than one proxy card because your shares are registered in different names and addresses, each proxy card should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the Annual Meeting in the manner set forth in the Proxy Statement. If you attend the Annual Meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the Annual Meeting will be counted.

The Proxy Statement and the accompanying proxy card are being mailed beginning on or about May 24, 2007 to stockholders entitled to vote.

By Order of the Board of Directors

Susan Strausberg

Chief Executive Officer

and Secretary

Norwalk, Connecticut

May 24, 2007

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY, COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED ENVELOPE.

EDGAR ONLINE, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 27, 2007

GENERAL

The enclosed proxy is solicited by the Board of Directors (the “Board of Directors”) of EDGAR Online, Inc., a Delaware corporation (“EDGAR Online” or “the Company,” “we,” “our” or “us”), for use at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at 10:00 A.M. (local time) on June 27, 2007, at the Company’s offices, 50 Washington Street, Norwalk, Connecticut 06854, and any adjournment or postponement thereof. This Proxy Statement, the accompanying proxy card and the Company’s Annual Report on Form 10-K for the fiscal year ending December 31, 2006 are being mailed on or about May 24, 2007 to stockholders entitled to vote at the Annual Meeting.

RECORD DATE AND VOTING SHARES

Only holders of record of the Company’s common stock, par value $0.01 per share (the “Common Stock”), at the close of business on May 11, 2007 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting. At the close of business on the Record Date, the Company had 26,013,048 shares of Common Stock outstanding. No shares of the Company’s preferred stock, par value $0.01, were outstanding. Each stockholder is entitled to one vote for each share of Common Stock held by such stockholder on the Record Date. Cumulative voting is not permitted.

Directors are elected by a plurality of votes, which means the seven (7) nominees who receive the largest number of properly executed votes will be elected as directors. Shares that are represented by proxies that are marked “withhold authority” for the election of one or more director nominees will not be counted in determining the number of votes cast for those persons. The affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting (in person or by proxy) is required to ratify the appointment of the auditors. Abstentions will have the effect of a vote against these proposals. Broker non-votes will be deemed shares not present to vote on such matters and will not count as votes for or against such proposals and will not be included in calculating the number of votes necessary for approval of such matters. Any other matters properly considered at the Annual Meeting will be determined by a majority of the votes cast.

VOTING OF PROXIES

If the enclosed form of proxy is properly signed and returned, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon. If the proxy does not specify how the shares represented thereby are to be voted: the proxy will be voted “FOR” the election of the directors proposed by the Board of Directors, unless the authority to vote for the election of such directors is withheld; the proxy will be voted “FOR” the approval to ratify the appointment of BDO Seidman, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2007; and, in accordance with the discretion of the proxy holders, as to all other matters that may properly come before the Annual Meeting. If a broker indicates on the enclosed proxy or its substitute that it does not have discretionary authority as to certain shares to vote on a particular matter (“broker non-votes”), those shares will not be considered as voting with respect to that matter and will not be counted for purposes of determining whether a quorum is present at the Annual Meeting. The Company believes that the tabulation procedures to be followed by the Inspector of Elections are consistent with the general requirements of Delaware law concerning voting of shares and determination of a quorum.

The manner in which your shares may be voted depends on how your shares are held. If you own shares of record, meaning that your shares of Common Stock are represented by certificates or book entries in your name

1

so that you appear as a stockholder on the records of the Company’s stock transfer agent, American Stock Transfer & Trust Company, a proxy card for voting those shares will be included with this Proxy Statement. You may vote those shares by completing, signing and returning the proxy card in the enclosed envelope. If you own shares in street name, meaning that your shares of Common Stock are held by a bank or brokerage firm, you may instead receive a voting instruction form with this Proxy Statement that you may use to instruct your bank or brokerage firm how to vote your shares. As with a proxy card, you may vote your shares by completing, signing and returning the voting instruction form in the envelope provided.

ATTENDANCE AND VOTING AT THE ANNUAL MEETING

If you own Common Stock of record, you may attend the Annual Meeting and vote in person, regardless of whether you have previously voted by proxy card. If you own Common Stock in street name, you may attend the Annual Meeting but in order to vote your shares at the Annual Meeting you must obtain a “legal proxy” from the bank or brokerage firm that holds your shares. You should contact your bank or brokerage account representative to learn how to obtain a legal proxy. We encourage you to vote your shares in advance of the Annual Meeting, even if you plan on attending the Annual Meeting. If you have already voted prior to the Annual Meeting, you may nevertheless change or revoke your vote at the Annual Meeting in the manner described below.

REVOCATION

If you own Common Stock of record you may revoke a previously granted proxy at any time before it is voted by (i) delivering to the Secretary of the Company a written notice of revocation or a duly executed proxy bearing a later date or (ii) attending the Annual Meeting and voting in person. Any stockholder owning Common Stock in street name may change or revoke previously given voting instructions by (i) contacting the bank or brokerage firm holding the shares or (ii) obtaining a legal proxy from such bank or brokerage firm and voting in person at the Annual Meeting.

TABULATION OF VOTES; QUORUM

Votes cast in person or by proxy at the Annual Meeting will be tabulated by the Inspector of Elections appointed for the Annual Meeting and will determine whether or not a quorum is present. The holders of a majority of the shares of Common Stock entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business. Broker non-votes will not be counted for purposes of determining whether a quorum is present.

SOLICITATION

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy and any additional solicitation materials furnished to the stockholders. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, the Company may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone, telegram or other means by directors, officers or employees of the Company. No additional compensation will be paid to these individuals for any such services. Except as described above, the Company does not presently intend to solicit proxies other than by mail.

STOCKHOLDER PROPOSALS

Our By-laws establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of stockholders. In general, stockholder proposals and director nominations intended to be presented at our 2008 Annual Meeting of Stockholders must be received by us at our corporate headquarters between

2

March 28, 2008 and April 28, 2008 in order to be considered at that meeting. This notice requirement does not apply to (i) any stockholder holding at least twenty-five percent (25%) of our outstanding Common Stock or (ii) any stockholder who has an agreement with us for the nomination of a person or persons for election to the Board of Directors. A copy of the full text of the By-law provisions discussed above may be obtained by writing to our Secretary at our corporate headquarters.

In addition to our By-law provisions, stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, and intended to be presented at the 2008 Annual Meeting of Stockholders must be received by our Secretary at our corporate headquarters no later than December 25, 2007 in order to be considered for inclusion in our proxy materials for that meeting.

If the stockholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Securities Exchange Act of 1934, we may exercise discretionary voting under proxies that we solicit to vote in accordance with our best judgment on any such stockholder proposal or nomination.

DISSENTERS’ RIGHT OF APPRAISAL

Under Delaware law, stockholders are not entitled to dissenters’ rights on any proposal referred to herein.

3

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL ONE

ELECTION OF DIRECTORS

The Company’s By-laws provide that the initial number of directors constituting the Board of Directors shall be seven (7), or such other number as fixed by the Board of Directors from time to time. The Board of Directors reserves the right to increase the size of the Board of Directors as provided in the Company’s By-laws.

At the Annual Meeting, the stockholders will elect seven (7) directors, who have been recommended by the Nominating Committee of the Board of Directors and who will serve a one-year term until the 2008 Annual Meeting of Stockholders or until a successor is elected or appointed and qualified or until such director’s earlier resignation or removal. If any nominee is unable or unwilling to serve as a director, proxies may be voted for a substitute nominee designated by the present Board of Directors. The Board of Directors has no reason to believe that the persons named below will be unable or unwilling to serve as nominees or as directors if elected. Proxies received will be voted “FOR” the election of all nominees unless otherwise directed. Pursuant to applicable Delaware corporation law, assuming the presence of a quorum, seven (7) directors will be elected from among those persons duly nominated for such positions by a plurality of the votes actually cast by stockholders entitled to vote at the Annual Meeting who are present in person or by proxy.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE

NOMINEES NAMED BELOW.

INFORMATION CONCERNING NOMINEES

Certain information about each of the seven (7) nominees is set forth below. Except for Messrs. Mutch and O’Neill, each director has served continuously with the Company since his or her first election as indicated below.

| | | | | | |

Name | | Age | | Position | | Director Since |

Susan Strausberg (1) | | 68 | | Chief Executive Officer, Secretary and Director and Chairman designee | | 1995 |

Elisabeth DeMarse (2)(3)(4) | | 51 | | Director | | 2004 |

Richard L. Feinstein (3)(4) | | 62 | | Director | | 2003 |

Mark Maged (2)(3)(4) | | 74 | | Director | | 1999 |

Douglas K. Mellinger (2) | | 41 | | Director | | 2006 |

John Mutch (5) | | 50 | | Director | | (5) |

William J. O’Neill, Jr. (5) | | 65 | | Director | | (5) |

| (1) | Member of the Outside Directors Compensation Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating Committee. |

| (4) | Member of the Audit Committee. |

Susan Strausberg, one of our co-founders, has served as a member of the Board of Directors, Chief Executive Officer and Secretary since our formation in November 1995. Ms. Strausberg served as President from January 2003 through April 2007 when she relinquished her role as President due to the appointment of Philip D. Moyer as the Company’s new President. Ms. Strausberg served on the Board of Directors of RKO Pictures from December 1998 to May 2001. Ms. Strausberg is a member of the Sarah Lawrence Planning Committee. Ms. Strausberg is the wife of Marc Strausberg, our other co-founder and Chairman emeritus. Ms. Strausberg received a B.A. from Sarah Lawrence College.

4

Elisabeth DeMarsehas been a member of the Board of Directors since November 2004. Ms DeMarse is Chief Executive Officer and President of Creditcards.com, an internet based provider of consumer credit card offerings. Ms. DeMarse is a director at ZipRealty, Inc., an internet real estate brokerage firm since 2005. Ms. DeMarse was a member of the Board of Directors of Heska Corporation from October 2004 until May 2007. Ms. DeMarse served as President and Chief Executive Officer of Bankrate Inc., an internet based consumer banking marketplace. From January 1999 to April 2000, Ms. DeMarse served as Executive Vice President of International Operations at Hoover’s, Inc., which operates Hoover’s Online. Prior to her focus in the Internet sector, Ms. DeMarse spent ten years at Bloomberg L.P. in various leadership positions, and over four years at Western Union marketing telecommunications services. Ms. DeMarse holds an A.B. cum laude from Wellesley College, and an M.B.A. from Harvard with an emphasis on marketing. Ms. DeMarse is a member of The Committee of 200.

Richard L. Feinsteinhas been a member of the Board of Directors since April 2003. From October 2002 to present, Mr. Feinstein has been a private consultant providing management and financial advice to clients in a variety of industries. From December 1997 to October 2002, Mr. Feinstein was a Senior Vice President and Chief Financial Officer for The Major Automotive Companies, Inc. (MJRC.PK), formerly a diversified holding company, but now engaged solely in retail automotive dealership operations. Mr. Feinstein, a Certified Public Accountant, received a B.B.A. from Pace University.

Mark Magedhas been a member of the Board of Directors since March 1999. Since 1992, Mr. Maged, either individually or as Chairman of MJM Associates, LLC, has engaged in various private investment banking activities in the U.S. and internationally. From September 1995 through May 2000, Mr. Maged was chairman of Internet Tradeline, Inc. Mr. Maged received a B.S.S. from the College of the City of New York and an M.A. and L.L.B. from Harvard University.

Douglas K. Mellingerjoined the Board of Directors in February 2006. Since August 2001, Mr. Mellinger has been Vice-chairman and co-founder of Foundation Source, a provider of support services for private foundations. Prior to assuming his full-time responsibilities with Foundation Source, from July 2000 to August 2001, Mr. Mellinger was a partner with Interactive Capital Partners, an investor and investment banker for early-stage technology companies. Mr. Mellinger is also the founder of Enherent Corp. (Nasdaq: ENHT), a global software development and services company, where he served as Chief Executive Officer from August 1989 to June 1999, Chairman of the Board from July 1999 to October 2000, and is currently a director. Mr. Mellinger has served as both the national and international director of the Association of Collegiate Entrepreneurs. In addition, Mr. Mellinger helped found the Young Entrepreneurs’ Organization, and served as its international president in 1997 and 1998. Mr. Mellinger is a graduate of Syracuse University.

John Mutch is currently the managing partner of MV Advisors, LLC, a strategic block investment firm he founded in June 2006. MV Advisors provides focused investment and strategic guidance to small and mid-cap technology companies. Prior to founding MV Advisors, Mr. Mutch was the President and CEO of Peregrine Systems. In March 2003, Mr. Mutch was appointed to the Peregrine Board of Directors by the U.S. Bankruptcy Court and assisted the company in its bankruptcy work out. Mr. Mutch became President and CEO in August 2003 and successfully restructured the company, culminating in the sale of Peregrine to Hewlett Packard in December of 2005. Prior to that, Mr. Mutch served as President and CEO of HNC Software Inc., an enterprise analytics software provider. Mr. Mutch also spent seven years at Microsoft in a variety of executive sales and marketing positions. Mr. Mutch is currently a director at Phoenix Technologies Ltd. and is an honorary member of the Classroom of the Future Foundation’s Board of Director as well as active in numerous civic and charitable causes. He earned a M.B.A. from the University of Chicago Graduate School of Business and a B.S. from Cornell University where he serves on the advisory board for the undergraduate school of business.

Mr. William J. O’Neill, Jr. is currently the Dean of the Frank Sawyer School of Management at Suffolk University in Boston, Massachusetts. Prior to this appointment, Mr. O’Neill spent thirty years (1969-1999) with

5

the Polaroid Corporation where he held the positions of Executive Vice President of the Corporation, President of Corporate Business Development and Chief Financial Officer. Mr. O’Neill was also previously a Senior Financial Analyst at Ford Motor Company. Mr. O’Neill was a Trustee at the Dana Farber Cancer Institute and is currently a member of the Massachusetts Bar Association as well as a member of the Board of Directors of the Greater Boston Chamber of Commerce. Mr. O’Neill has been a director of CardioTech International, Inc. since May 2004 and was appointed Chairman on August 7, 2006. Since August 2001, Mr. O’Neill has also been a member of the Board of Directors of Concord Camera Corp. Mr. O’Neill earned a B.A. at Boston College in mathematics, an M.B.A. in finance from Wayne State University and a J.D. from Suffolk University Law School.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors held six (6) meetings and took one (1) action by written consent during the fiscal year ending December 31, 2006 (the “2006 Fiscal Year”). The Board of Directors has an Audit Committee, a Compensation Committee, an Outside Directors Compensation Committee and a Nominating Committee. Except for Ms. DeMarse each director attended or participated in 75% or more of the aggregate of: (i) the total number of meetings of the Board of Directors; and (ii) the total number of meetings held by all committees of the Board of Directors on which such director served during the 2006 Fiscal Year. Ms. DeMarse attended 4 of 6 of (i) the total number of meetings of the Board of Directors; and (ii) 3 of 4 of the total number of meetings held by all committees of the Board of Directors on which such director served during the 2006 Fiscal Year. Each director is expected to attend and participate in, either in person or by means of telephonic conference, all scheduled Board of Director meetings and meetings of committees on which such director is a member. Each of our directors then serving attended last year’s annual meeting of stockholders, and members of the Board of Directors are encouraged to attend the annual meeting each year. A majority of our Board of Directors, consisting of Ms. DeMarse and Messrs. Feinstein, Maged and Mellinger, qualify as “independent” within the meaning of the director independence standards of The Nasdaq Stock Market, Inc. (“Nasdaq”). Director nominees, Messrs. Mutch and O’Neill, also qualify as independent within the meaning of the director independence standards of the Nasdaq. Individuals may communicate directly with members of the Board of Directors or members of the Board of Director’s standing committees by writing to the following address:

EDGAR Online, Inc.

50 Washington Street

Norwalk, Connecticut 06854

Attention: Secretary

The Secretary will summarize all correspondence received and periodically forward summaries to the Board of Directors. Members of the Board of Directors may, at any time, request copies of any such correspondence. Communications may be addressed to the attention of the Board of Directors, a standing committee of the Board of Directors, or any individual member of the Board of Directors or a committee. Communication that is primarily commercial in nature, relates to an improper or irrelevant topic, or requires investigation to verify its content may not be forwarded.

Audit Committee

The Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including selecting the Company’s independent registered public accounting firm, the scope of the annual audits, fees to be paid to the accountants, the performance of the independent registered public accounting firm and the Company’s accounting practices. The members of the Audit Committee currently are Ms. DeMarse and Messrs. Feinstein and Maged, each of whom, as required by Nasdaq, qualifies as “independent” under special standards established by the U.S. Securities and Exchange Commission (the “SEC”) for members of audit committees. Director nominees, Messrs. Mutch and O’Neill, also qualify as independent within the meaning of the special standards of the SEC. The Audit Committee also includes at least one independent member who is determined by the Board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules, including that the person meets the relevant definition of an “independent director.”

6

Richard L. Feinstein, the Chairman of the Audit Committee, is the independent director who has been determined to be an audit committee financial expert. Stockholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Feinstein’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon Mr. Feinstein any duties, obligations or liability that are greater than are generally imposed on him as a member of the Audit Committee and the Board of Directors, and his designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board of Directors. The Board of Directors has also determined that each Audit Committee member has sufficient knowledge in reading and understanding the Company’s financial statements to serve on the Audit Committee. The Audit Committee held four (4) meetings during the 2006 fiscal year.

Compensation Committee

The primary purpose of our Compensation Committee is to discharge our Board’s responsibilities relating to compensation and benefits of our officers and directors. The Compensation Committee reviews and approves the compensation and benefits of the Company’s key executive officers, administers the Company’s employee benefit plans and makes recommendations to the Board of Directors regarding such matters. The current members of the Compensation Committee are Ms. DeMarse and Messrs. Maged and Mellinger, each of whom is an independent within the meaning of the director independence standards of Nasdaq. Mr. Maged serves as the Chairman of the Compensation Committee. The Compensation Committee held three (3) meetings and took one (1) action by written consent during the 2006 fiscal year.

The functions of our Compensation Committee include:

| | • | | Designing and implementing competitive compensation policies to attract and retain key personnel; |

| | • | | Reviewing and formulating policy and determining or making recommendations to our Board of Directors regarding compensation of our executive officers; |

| | • | | Administering our equity incentive plans and granting or recommending grants of equity awards to our executive officers and directors under these plans; and |

| | • | | Reviewing and establishing Company policies in the area of management perquisites. |

Our CEO does not participate in the determination of her own compensation or the compensation of employee directors. However, she makes recommendations to, and participates in deliberations with our Compensation Committee regarding the amount and composition of the compensation of our other officers and serves on the Outside Director Compensation Committee.

Outside Directors Compensation Committee

The Outside Directors Compensation Committee has the discretion of granting compensation and stock options to the outside directors under the terms of the 2005 Stock Award and Incentive Plan (the “2005 Plan”). The members of the Outside Directors Compensation Committee during the Fiscal Year ended December 31, 2006 are Messrs. Greg D. Adams and Marc Strausberg and Ms. Susan Strausberg. The Outside Directors Compensation Committee did not meet during the 2006 fiscal year. Neither Mr. Strausberg nor Mr. Adams is being nominated for election to the Board of Directors at the Annual Meeting.

Nominating Committee

The Nominating Committee reviews and assesses the composition of the Board of Directors, assists in identifying potential new candidates for director and nominates candidates for election to the Board of Directors. The Nominating Committee currently consists of Ms. DeMarse and Messrs. Feinstein and Maged, each of whom is independent within the meaning of the director independence standards of Nasdaq. The Nominating Committee held one (1) meeting during the 2006 fiscal year.

7

The Nominating Committee operates under a formal Nominating Committee Charter, which was attached as Exhibit A to the proxy statement filed on May 31, 2005 for the 2005 Annual Meeting of Stockholders of the Company, and contains a detailed description of such Committee’s duties and responsibilities. As more fully described in its charter, the functions of the Nominating Committee include identifying individuals qualified to become directors and making recommendations to the Board of Directors for the selection of such candidates for directorship, with the goal of assembling a Board of Directors that brings the Company a variety of perspectives and skills derived from business and professional experience.

Candidates for Nomination

Candidates for nomination as director come to the attention of our Nominating Committee from time to time through incumbent directors, management, stockholders or third parties. These candidates may be considered at meetings of our Nominating Committee at any point during the year. Such candidates are evaluated against the criteria set forth below. If our Nominating Committee believes at any time that it is desirable that our Board consider additional candidates for nomination, the Committee may poll directors and management for suggestions or conduct research to identify possible candidates and may, if our Nominating Committee believes it is appropriate, engage a third-party search firm to assist in identifying qualified candidates.

The Nominating Committee will evaluate director candidates recommended by stockholders in light of the Committee’s criteria for the selection of new directors. Such criteria include:

| | • | | the appropriate size of our Board and its committees; |

| | • | | the perceived needs of our Board for particular skills, background and business experience; |

| | • | | the skills, background, reputation, and business experience of nominees compared to the skills, background, reputation, and business experience already possessed by other Board members; |

| | • | | nominees’ independence from management; |

| | • | | applicable regulatory and listing requirements, including independence requirements and legal considerations, such as antitrust compliance; |

| | • | | the benefits of a constructive working relationship among directors; and |

| | • | | the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members. |

Any stockholder recommendation of a director candidate should include the name and address of the stockholder and the person nominated; a representation that the stockholder (1) is a holder of record of our common stock on the date of such notice and (2) intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; a description of all arrangements or understandings between the nominating stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the stockholder is making the nomination or nominations; such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the SEC, had the nominee been nominated, or intended to be nominated, by our Board; and the consent of each nominee to serve as a director, if elected.

All director nominees must also complete a customary form of directors’ questionnaire as part of the nomination process. The evaluation process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of our Nominating Committee. Any stockholder recommendation of a director candidate should be sent to EDGAR Online, Inc., 50 Washington Street, Norwalk, Connecticut, 06854, Attention: Secretary. Any stockholder recommendations must be submitted in sufficient time for an appropriate evaluation by the committee. In addition, any stockholder wishing to nominate a director for consideration at an annual meeting of stockholders must follow the procedures set forth in this Proxy Statement.

8

AUDIT COMMITTEE REPORT

On June 12, 2000, the Board of Directors adopted a charter for the Audit Committee. Subsequently, on March 23, 2004, the Board of Directors adopted an Amended and Restated Audit Committee Charter, a copy of which was attached as Exhibit B to the proxy statement filed on May 31, 2005 for the 2005 Annual Meeting of Stockholders of the Company. The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management is responsible for the Company’s internal controls, financial reporting process and compliance with laws and regulations and ethical business standards. The independent registered public accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the auditing standards of the Public Company Accounting Oversight Board and to issue a report thereon. The Audit Committee has the power and authority to engage the independent registered public accountants, reviews the preparations for and the scope of the audit of the Company’s annual financial statements, reviews drafts of the statements and monitors the functioning of the Company’s accounting and internal control systems through discussions with representatives of management, the independent registered public accountants and the accounting staff.

On March 12, 2007, the Audit Committee met to review the Company’s audited financial statements for fiscal 2006 as well as the process and results of the Company’s assessment of internal control over financial reporting. The Audit Committee has also met with management and BDO Seidman, LLP (“BDO Seidman”), the Company’s independent registered public accounting firm, to discuss the financial statements and internal control over financial reporting. Management has represented to the Audit Committee that the financial statements were prepared in accordance with accounting principles generally accepted in the United States, that internal control over financial reporting was effective and that no material weaknesses in those controls existed as of the fiscal year-end reporting date, December 31, 2006.

The Audit Committee has received from BDO Seidman the written disclosures and the letter required by Independence Standards Board Standard No. 1(Independence Discussions with Audit Committees)and discussed with BDO Seidman their independence from the Company and its management. The Audit Committee also received reports from BDO Seidman regarding all critical accounting policies and practices used by the Company, generally accepted accounting principles that have been discussed with management, and other material written communications between BDO Seidman and management. There were no differences of opinion reported between BDO Seidman and the Company regarding critical accounting policies and practices used by the Company. In addition, the Audit Committee discussed with BDO Seidman all matters required to be discussed by Statement on Auditing Standards No. 61, as amended(Communication with Audit Committees). Finally, the Audit Committee has received from, and reviewed with, BDO Seidman all communications and information concerning its audit of the Company’s assessment of internal control over financial reporting as required by the Public Company Accounting Oversight Board Auditing Standard No. 2. Based on these reviews, activities and discussions, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ending December 31, 2006, which was filed with the SEC on March 16, 2007.

The Audit Committee plans to meet with BDO during the current fiscal year to review the scope of the 2007 audit and other matters.

Submitted by the Audit Committee:

Richard L. Feinstein, Chairman

Elisabeth DeMarse

Mark Maged

9

CODE OF ETHICS

The Company adopted a Code of Ethics and a Code of Conduct that apply to its chief executive officer, chief financial officer, all other executive officers, senior financial officers, directors and employees. A copy of the code was filed as an exhibit to our Annual Report on Form 10-K for the year ending December 31, 2003 and is available on the Company’s website(www.edgar-online.com).

INFORMATION CONCERNING EXECUTIVE OFFICERS

The executive officers of the Company as of the date of this Proxy Statement, other than Ms. Strausberg, are identified below. Executive officers are elected annually by the Board of Directors and serve at the pleasure of the Board of Directors.

| | | | |

Name | | Age | | Position |

Marc Strausberg | | 72 | | Chairman of the Board of Directors |

Philip D. Moyer | | 41 | | President |

Greg D. Adams | | 45 | | Chief Financial Officer & Chief Operating Officer |

Stefan Chopin | | 47 | | Chief Technology Officer |

Marc Strausberg, one of our co-founders, has served as Chairman of the Board of Directors since our inception in November 1995. Mr. Strausberg serves on the advisory board of CARLAB, the Continuous Auditing Research Lab at Rutgers University and is a member of the Council on the future of the Courant Institute of Mathematical Sciences at New York University. Mr. Strausberg is the husband of Susan Strausberg, our Chief Executive Officer. Mr. Strausberg received a B.A. from Muhlenberg College. Mr. Strausberg’s term will expire at the Annual Meeting.

Philip D. Moyerbecame our President on April 16, 2007. Mr. Moyer has fifteen years of experience at Microsoft (NASDAQ: MSFT) directly managing large teams in sales, consulting, support, partner channels and technology. Mr. Moyer began his career at Microsoft as a systems engineer and account executive. Mr. Moyer then moved to Microsoft Consulting Services where he received multiple performance awards including the Top Managing Consultant Award, Mid Atlantic in 1997. Following that Mr. Moyer became General Manager of Microsoft Services, Partners & Technology where he was responsible for software sales and consulting services. In 2002, Mr. Moyer became General Manager for Global Customers focusing on Microsoft’s largest global customers such as Price Waterhouse Coopers and Deloitte Touche Tohmatsu. His last position at Microsoft was General Manager for the Professional Services Industry which he founded and managed. After leaving Microsoft in 2005, Mr. Moyer spent two years as an early stage investor, Entrepreneur in Residence and Advisory Board Member for Safeguard Scientifics, Inc. (NASDAQ: SFE).

Greg D. Adamsjoined us as our Chief Financial Officer in March 1999 and became Chief Operating Officer in January 2003. Mr. Adams was a member of the Board of Directors from February 2004 until June 2007. In February 2007, Mr. Adams announced that he will not stand for reelection to the Board of Directors. From May 1996 to March 1999, Mr. Adams served as Senior Vice President Finance and Administration of PRT Group Inc., a technology solutions and services company. Mr. Adams is a Certified Public Accountant. Mr. Adams is a member of the New York State Society of Certified Public Accountants and the American Institute of Certified Public Accountants. Mr. Adams received a B.B.A. in accounting from the College of William & Mary.

Stefan Chopinwas a member of the Board of Directors from 1996 until February 2004, when he was appointed Chief Technology Officer. From 2001 to 2004, Mr. Chopin was the President of Pequot Group Inc., a technology development company for the financial services industry. From October 1998 to November 2001, Mr. Chopin was the Senior Vice President of Technology for iXL Enterprises, Inc., an e-business solutions provider.

10

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview of Compensation Program

Our Compensation Committee (for purposes of this analysis, the “Committee”) of the Board of Directors has responsibility for establishing, implementing and continually monitoring adherence with our compensation philosophy. The Committee ensures that the total compensation paid to the Named Executive Officers (as defined in the Summary Compensation Table below) is fair, reasonable and competitive.

Compensation Philosophy and Objectives

The Committee believes that the compensation programs for executive officers should reflect our performance and the value created for our stockholders. In addition, the Committee believes that the compensation program should support our short-term and long-term strategic goals and values and should reward individual contributions to our success. The Committee ensures that the executive compensation policies and plans provide the necessary total remuneration program to properly align our performance with the interests of our stockholders through the use of competitive and equitable executive compensation in a balanced and reasonable manner, for both the short and long-term.

Our overall compensation philosophy is to provide a total compensation package that is competitive and enables us to attract, motivate, reward and retain key executives and other employees who have the skills and experience necessary to promote our short and long-term financial performance and growth.

The Committee recognizes the critical role of its executive officers in the significant growth and success of the Company. Accordingly, our executive compensation policies are designed to: (1) align the interests of executive officers and stockholders by encouraging stock ownership by executive officers and by making a significant portion of executive compensation dependent upon our financial performance; (2) provide compensation that will attract and retain talented professionals; (3) reward individual results through base salary, annual cash bonuses, long-term incentive compensation in the form of stock options and various other benefits; and (4) manage compensation based on skill, knowledge, effort and responsibility needed to perform a particular job successfully.

In its review of salary, bonuses and long-term incentive compensation for its executive officers, the Committee takes into account both the position and expertise of a particular executive, as well as the Committee’s understanding of the competitive compensation for similarly situated executives in the Company’s industry.

Role of Executive Officers in Compensation Decisions

The Committee makes all compensation decisions for the Named Executive Officers. Decisions regarding the compensation of other officers and employees are made by our President and Chief Executive Officer, and our Chief Financial Officer and Chief Operating Officer.

Our President and Chief Executive Officer, and our Chief Financial Officer and Chief Operating Officer, annually review the performance of each member of the Named Executive Officers (other than their own respective reviews, and that of our President and Chief Executive Officer, whose performance is reviewed solely by the Committee). The conclusions reached and recommendations based on these reviews, including with respect to salary adjustments and annual award amounts, are presented to the Committee. The Committee can exercise its discretion in modifying any recommended adjustments or awards to executives.

11

Setting Executive Compensation

Based on the foregoing objectives, the Committee has structured our annual and long-term incentive-based cash and non-cash executive compensation to motivate executives to achieve the business goals set by us and reward the executives for achieving such goals.

A percentage of total compensation is allocated to incentives as a result of the philosophy mentioned above. There is no pre-established policy or target for the allocation between either cash and non-cash, or short-term and long-term incentive compensation. Rather, the Committee reviews all relevant information to determine the appropriate level and mix of incentive compensation. Income from such incentive compensation is realized as a result of the performance of the Company or the individual, depending on the type of award, compared to established goals.

2006 Executive Compensation Components

For the fiscal year ended December 31, 2006, the principal components of compensation for the Named Executive Officers were:

| | • | | performance-based incentive compensation; |

| | • | | long-term equity compensation; and |

| | • | | perquisites and other benefits. |

Base Salary

We provide the Named Executive Officers and other employees with base salary to compensate them for services rendered during the fiscal year. Base salary ranges for the Named Executive Officers are determined on an individual basis by evaluating each executive’s scope of responsibility, performance, prior experience and salary history, as well as the salaries for similar positions at comparable companies.

Salary levels are typically considered annually as part of the Company’s performance review process as well as upon a promotion or other change in job responsibility. Merit based increases to salaries of members of the Named Executive Officers are based on the Committee’s assessment of the individual’s performance.

Performance-Based Incentive Compensation

Performance-based incentive compensation is intended to encourage the Named Executive Officers to achieve short-term goals that we believe are integrally linked to long-term value creation. The incentive award ranges are established annually by the Committee for the Named Executive Officers and management employees. The business criteria used by the Committee in establishing performance goals applicable to performance awards to the Named Executive Officers are selected from among the following:

| | • | | Expenses or expense ratios; |

| | • | | Operating income, earnings from operations, earnings before or after taxes, earnings before or after interest, depreciation, amortization, or extraordinary or special items; |

| | • | | Net income or net income per common share (basic or diluted; including or excluding extraordinary items); |

| | • | | Return on assets, return on investment, return on capital, or return on equity; |

| | • | | Cash flow, free cash flow, cash flow return on investment, or net cash provided by operations; |

12

| | • | | Economic profit or value created; |

| | • | | Stock price or total stockholder return; and |

| | • | | Specific strategic or operational business criteria, including market penetration, geographic expansion, new concept development goals, new projects, new products, or new ventures; customer satisfaction; staffing, training and development, succession planning or employee satisfaction; goals relating to acquisitions, divestitures, affiliates or joint ventures. |

The overall assessment of the achievement of each named executive’s goals determines the percent of the target award that will be paid to the executive as an annual incentive award.

The Committee retains discretion to set the level of performance for a given business criteria that will result in the earning of a specified amount under a performance award. These goals may be set with fixed, quantitative targets, targets relative to past Company performance, or targets compared to the performance of other companies, such as a published or special index or a group of companies selected by the Committee for comparison. The Committee may specify that these performance measures will be determined before payment of bonuses, capital charges, non-recurring or extraordinary income or expense, or other financial and general and administrative expenses for the performance period, if so specified by the Committee.

There was no performance-based incentive compensation awarded to the Named Executive Officers for services rendered in 2006.

Long-Term Compensation

The Committee believes that equity-based compensation in the form of stock options links the interests of executives with the long-term interests of our stockholders, encourages executives to remain in our employ and maintains competitive levels of total compensation. We grant stock options in accordance with our 2005 Stock Award and Incentive Plan (the “2005 Plan”). The 2005 Plan authorizes a broad range of awards, including stock options, stock appreciation rights, restricted stock grants, and deferred stock grants. We have not granted any appreciation rights, restricted stock grants or deferred stock grants under the 2005 Plan.

Stock options are granted based on a number of factors, including the individual’s level of responsibility, the amount and term of options already held by the individual, the individual’s contributions to the achievement of performance goals, and industry practices and norms. Stock options are generally awarded on an annual basis and, from time to time, when employees are hired or promoted. All options granted to the Named Executive Officers and other employees are approved by the Committee.

Stock options are awarded at the Nasdaq’s closing price of our Common Stock on the date of the grant. The majority of the options granted by the Committee vest at a rate of 33 1 / 3 % per year over the first three years of the ten-year option term. Prior to the exercise of an option, the holder has no rights as a stockholder with respect to the shares subject to such option, including voting rights and the right to receive dividends or dividend equivalents.

Perquisites and Other Benefits

We provide the Named Executive Officers with limited perquisites and other personal benefits, such as a commutation allowance, that the Company and the Committee believe are reasonable and consistent with its overall compensation program to better enable us to attract and retain superior employees for key positions. All such perquisites are reflected in the All Other Compensation column of the Summary Compensation Table and the accompanying footnotes.

The Named Executive Officers participated in the same Company 401(k) program as provided to other employees. The Company did not provide any special 401(k) benefits to the Named Executive Officers, and their health care and insurance coverage is the same as that provided to other employees.

13

Trading Windows / Hedging

We restrict the ability of employees to freely trade in our Common Stock because of their periodic access to material non-public information regarding the Company. Under our Insider Trading Policy, all of our employees (including the Named Executive Officers) are restricted from purchasing or selling our Common Stock and exercise stock options during certain blackout periods. In addition, all employees, including our Named Executive Officers, are prohibited from hedging against or speculating in the potential changes in the value of our Common Stock.

Change in Control Protections

The Named Executive Officers are parties to written employment agreements. The value of the “change in control” benefits provided under agreements is summarized in the section below entitled Potential Payments Upon Termination or Change in Control. The Company does not gross-up any executive payments for potential taxes that may be incurred in connection with a “change in control”.

Policy with Respect to Section 162(m) Deduction Limit

Section 162(m) of the Internal Revenue Code, enacted in 1993, generally disallows a tax deduction to publicly held companies for compensation exceeding $1 million paid to certain of the Company’s executive officers. The limitation applies only to compensation that is not considered to be performance-based. The non-performance based compensation paid to our executive officers in 2006 did not exceed the $1 million limit per officer. Our stock option plan is structured so that any compensation deemed paid to an executive officer in connection with the exercise of option grants made under that plan will qualify as performance-based compensation which will not be subject to the $1 million limitation. The Compensation Committee currently intends to limit the dollar amount of all other compensation payable to the Company’s executive officers to no more than $1 million. The Compensation Committee is aware of the limitations imposed by Section 162(m), and the exemptions available therefrom, and will address the issue of deductibility when and if circumstances warrant.

Conclusion

We strive to ensure that each element of compensation delivered to the Named Executive Officers is reasonable and appropriate as compared to the type and levels of compensation and benefits provided to executives in the marketplace. We also believe that such compensation should properly reflect the performance and results achieved by each individual. Along with the Committee, we continually monitor trends in executive pay to ensure that recommendations and plan design reflect best practice.

Management of the Company has prepared the Compensation Discussion and Analysis of the compensation program for the Named Executive Officers. The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis for fiscal year 2006 (included in this proxy statement) with the Company’s management. Based on such review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

The Compensation Committee:

Mark Maged, Chairman

Elisabeth DeMarse

Douglas K. Mellinger

14

Summary Compensation Table

The following table sets forth certain information regarding compensation paid for all services rendered to us in all capacities during fiscal year 2006 by our President and Chief Executive Officer, our Chief Financial Officer and Chief Operating Officer and three other of our most highly compensated executive officers whose total annual salary and bonus exceeded $100,000, based on salary and bonuses earned during fiscal year 2006 (collectively, the “Named Executive Officers”).

| | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary ($) | | | Bonus

($)(1) | | Stock

Awards

($) | | Option

Awards

($)(2) | | Non-Equity

Incentive

Compensation

($) | | Change in

Pension Value and

Nonqualified

Deferred

Compensation

Earnings ($) | | All Other

Compensation

($)(3) | | Total ($) |

Susan Strausberg (4) President and Chief Executive Officer | | 2006 | | $ | 262,000 | | | $ | 30,000 | | — | | $ | 95,662 | | — | | — | | $ | 27,600 | | $ | 415,262 |

| | | | | | | | | |

Marc Strausberg Chairman | | 2006 | | $ | 100,000 | | | | — | | — | | | — | | — | | — | | $ | 24,000 | | $ | 124,000 |

| | | | | | | | | |

Greg D. Adams Chief Financial Officer and Chief Operating Officer | | 2006 | | $ | 239,333 | | | $ | 25,000 | | — | | $ | 95,662 | | — | | — | | $ | 24,600 | | $ | 384,595 |

| | | | | | | | | |

Stefan Chopin Chief Technology Officer | | 2006 | | $ | 240,167 | | | $ | 25,000 | | — | | $ | 95,662 | | — | | — | | $ | 24,600 | | $ | 385,429 |

| | | | | | | | | |

Morton Mackof (5) Executive Vice President, Sales | | 2006 | | $ | 276,948 | (6) | | $ | 25,000 | | — | | $ | 95,662 | | — | | — | | $ | 20,850 | | $ | 418,460 |

| (1) | The amounts shown represent amounts paid in 2006 related to bonuses earned in 2005. No bonuses were earned in 2006. |

| (2) | The amounts shown represent the 2006 expense related to the total FAS 123(R) grant date fair value of the options awarded to the Named Executive Officers. This expense is being recognized over the three year vesting terms of the options. See “Note 2(m), Stock-Based Compensation” to our audited financial statements for the year ended December 31, 2006 for the assumptions used in such calculations. |

| (3) | The amounts shown represent, for each Named Executive Officer: (i) a commutation allowance; and (ii) matching contributions made by the Company to each of the Named Executive Officers pursuant to the Company’s 401(k) Savings Plan. The amount attributable to each such perquisite or benefit for each Named Executive Officer does not exceed the greater of $25,000 or 10% of the total amount of perquisites received by such named executive officer. |

| (4) | Ms. Strausberg served as President from January 2003 through April 2007 when she resigned her role as President due to the appointment of Philip D. Moyer as the Company’s new President. |

| (5) | Mr. Mackof was Executive Vice President, Sales of the Company during the fiscal year ended December 31, 2006. Mr. Mackof left the Company effective May 21, 2007. |

| (6) | The amount shown includes commissions. |

Option Grants In Last Fiscal Year

The following table sets forth information regarding stock options granted to each of the executives named in the Summary Compensation Table above during the 2006 fiscal year. We have never granted any stock appreciation rights.

| | | | | | | | | | |

Name | | Grant

Date | | All Other Option Awards:

Number of Securities

Underlying Options (#) | | Exercise or Base Price of

Option Awards | | Grant

Date Fair

Value (1) |

Susan Strausberg | | 1/11/06 | | 75,000 | | $ | 1.92 | | $ | 120,728 |

| | 2/8/06 | | 75,000 | | $ | 3.01 | | $ | 189,270 |

Marc Strausberg | | — | | | | | | | | |

Greg D. Adams | | 1/11/06 | | 75,000 | | $ | 1.92 | | $ | 120,728 |

| | 2/8/06 | | 75,000 | | $ | 3.01 | | $ | 189,270 |

Stefan Chopin | | 1/11/06 | | 75,000 | | $ | 1.92 | | $ | 120,728 |

| | 2/8/06 | | 75,000 | | $ | 3.01 | | $ | 189,270 |

Morton Mackof (2) | | 1/11/06 | | 75,000 | | $ | 1.92 | | $ | 120,728 |

| | 2/8/06 | | 75,000 | | $ | 3.01 | | $ | 189,270 |

| (1) | The amounts shown represent the total FAS 123(R) grant date fair value of the options awarded to the Named Executive Officers. This expense is being recognized over the three year vesting terms of the options. See “Note 2(m), Stock-Based Compensation” to our audited financial statements for the year ended December 31, 2006 for the assumptions used in such calculations. |

| (2) | Mr. Mackof was Executive Vice President , Sales of the Company during the fiscal year ended December 31, 2006. Mr. Mackof has left the Company effective May 21, 2007. |

15

Outstanding Equity Awards at Fiscal Year-End

The following table provides information on the exercise and holdings of previously awarded equity grants outstanding as of December 31, 2006.

| | | | | | | | | | | | |

| | | Options Awards | | | | |

Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable (1) | | | Equity Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#) | | Option

Exercise

Price ($) | | Option

Expiration

Date |

Susan Strausberg | | 14,000 | | — | | | — | | $ | 3.60 | | 1/28/07 |

| | 27,500 | | — | | | — | | $ | 1.10 | | 2/11/13 |

| | 5,000 | | 2,500 | | | — | | $ | 1.05 | | 6/17/14 |

| | 16,667 | | 33,333 | | | — | | $ | 1.45 | | 1/31/15 |

| | — | | 75,000 | (2) | | — | | $ | 1.92 | | 1/11/16 |

| | — | | 75,000 | (2) | | — | | $ | 3.01 | | 2/8/16 |

| | | | | |

Marc Strausberg | | 14,000 | | — | | | — | | $ | 3.60 | | 1/28/07 |

| | 5,000 | | 2,500 | | | — | | $ | 1.05 | | 6/17/14 |

| | | | | |

Greg D. Adams | | 109,000 | | — | | | — | | $ | 4.50 | | 3/25/09 |

| | 16,000 | | — | | | — | | $ | 9.50 | | 5/25/09 |

| | 40,000 | | — | | | — | | $ | 9.00 | | 1/26/10 |

| | 30,000 | | — | | | — | | $ | 3.06 | | 7/14/10 |

| | 25,000 | | — | | | — | | $ | 2.56 | | 1/25/11 |

| | 14,000 | | — | | | — | | $ | 3.27 | | 1/28/12 |

| | 100,000 | | — | | | — | | $ | 1.21 | | 6/18/13 |

| | 10,000 | | 10,000 | | | — | | $ | 0.95 | | 6/17/14 |

| | 100,000 | | 50,000 | | | — | | $ | 1.27 | | 12/27/14 |

| | — | | 75,000 | (2) | | — | | $ | 1.92 | | 1/11/16 |

| | — | | 75,000 | (2) | | — | | $ | 3.01 | | 2/8/16 |

| | | | | |

Stefan Chopin | | 10,000 | | — | | | — | | $ | 4.50 | | 3/25/09 |

| | — | | 33,333 | | | — | | $ | 1.72 | | 2/18/14 |

| | — | | 2,500 | | | — | | $ | 0.95 | | 6/17/14 |

| | — | | 33,333 | | | — | | $ | 1.32 | | 1/31/15 |

| | — | | 75,000 | (2) | | — | | $ | 1.92 | | 1/11/16 |

| | — | | 75,000 | (2) | | — | | $ | 3.01 | | 2/8/16 |

| | | | | |

Morton Mackof (3) | | 50,000 | | 25,000 | | | — | | $ | 1.30 | | 12/1/14 |

| | 8,334 | | 16,666 | | | — | | $ | 1.32 | | 1/31/15 |

| | — | | 75,000 | (2) | | — | | $ | 1.92 | | 1/11/16 |

| | — | | 75,000 | (2) | | — | | $ | 3.01 | | 2/8/16 |

(1) | All options listed above vest at a rate of 331 / 3 % per year over the first three years of the ten-year option term. |

| (2) | Amounts represent 2006 stock option grants included in the Summary Compensation Table and Grants of Plan Based Awards Table above. |

| (3) | Mr. Mackof was Executive Vice President , Sales of the Company during the fiscal year ended December 31, 2006. Mr. Mackof left the Company effective May 21, 2007. |

16

Option Exercises and Stock Vested

The following table shows information for 2006 regarding the exercise of stock options.

| | | | | |

| | | Option Awards |

Name | | Number of

Shares

Acquired on

Exercise (#) | | Value

Realized on

Exercise (1) |

Susan Strausberg | | 22,500 | | $ | 64,350 |

Marc Strausberg | | 37,500 | | $ | 108,900 |

Greg D. Adams | | 62,500 | | $ | 183,825 |

Stefan Chopin | | 105,834 | | $ | 258,385 |

Morton Mackof | | — | | | — |

| (1) | Amount represents the difference between the exercise price of the option and the market price of our common stock upon exercise of such option. |

Employment Agreements and Potential Payments upon Termination or Change of Control

This section discusses the terms and conditions of the employment agreements entered into with our Named Executive Officers and the tables below reflect the amount of compensation payable to each of the Named Executive Officers of the Company in the event of termination of such executive’s employment. The amount of compensation payable to each named executive officer upon termination for “cause,” termination in the event of death or disability, involuntary not-for-cause termination, termination for “good reason,” and termination following a “change of control” is shown below.

The Company has “cause” to terminate the agreement upon (i) the failure by the executive to substantially perform his/her duties under the agreement, (ii) the conviction by the executive in criminal misconduct (including embezzlement and criminal fraud) which is materially injurious to the Company, monetarily or otherwise, (iii) the conviction of the executive of a felony, or (iv) gross negligence on the part of the executive.

A “change of control” means the occurrence of (i) the acquisition by an individual, entity, or group of the beneficial ownership of 50% or more of (1) the outstanding common stock, or (2) the combined voting power of the Company’s voting securities;provided ,however , that the following acquisitions will not constitute a “change of control”: (x) any acquisition by any employee benefit plan of the Company or any affiliate or (y) any acquisition by any corporation if, immediately following such acquisition, more than 50% of the outstanding common stock and the outstanding voting securities of such corporation is beneficially owned by all or substantially all of those who, immediately prior to such acquisition, were the beneficial owners of the common stock and the Company’s voting securities (in substantially similar proportions as their ownership of such Company securities immediately prior thereto); or (ii) the approval by the Company’s stockholders of a reorganization, merger or consolidation, other than one with respect to which all or substantially all of those who were the beneficial owners, immediately prior to such reorganization, merger or consolidation, of the Common Stock and the Company’s voting securities beneficially own, immediately after such transaction, more than 50% of the outstanding common stock and voting securities of the corporation resulting from such transaction (in substantially the same proportions as their ownership, immediately prior thereto, of the Common Stock and the Company’s voting securities); or (iii) the approval by the Company’s stockholders of the sale or other disposition of all or substantially all of the assets of the Company, other than to a subsidiary of the Company.

17

Susan Strausberg

On April 26, 2004, we entered into a two-year employment agreement, as amended, with Susan Strausberg to serve as our President, Chief Executive Officer and Secretary. On April 26, 2006, the agreement automatically renewed for an additional one-year term. Thereafter, the agreement will continue to automatically renew for additional one-year terms on each anniversary of the agreement unless thirty day prior notice of termination is provided by either Ms. Strausberg or us. Ms. Strausberg will serve as Chief Executive Officer until such time as Mr. Moyer becomes Chief Executive Officer under the terms of his employment agreement with the Company. See below for a summary of Mr. Moyer’s employment agreement.

The agreement provides for a minimum annual salary of $220,000, a discretionary annual bonus and a commutation allowance equal to $1,750 per month. In the event of termination for “cause” or termination in the event of death or disability, Ms. Strausberg will receive accrued salary, bonus and benefits through the date of termination of employment, and in the event of death or disability, all stock options held by the executive shall immediately vest and remain exercisable for the lesser of their original term or five years. In the event of a “change of control” (and Ms. Strausberg’s employment is terminated either by her or us within the employment term), Ms. Strausberg will receive, in addition to payment of accrued salary, bonus and benefits through the date of termination of employment, a severance payment equal to the sum of (i) her then applicable annual base salary and (ii) the average of her last two annual cash bonuses, which will be paid in equal monthly installments over a one year period, and all stock options held by the executive shall immediately vest and remain exercisable for the lesser of their original term or five years. In addition, we will maintain benefits for Ms. Strausberg through the severance period which is the greater of (a) the balance of the remaining term of the agreement or (b) one year from the date of termination. In the event of termination for any reason other than for “cause,” death or disability, or “change of control,” if we decide not to renew the agreement or Ms. Strausberg terminates the agreement for “good reason,” Ms. Strausberg will receive a one-year severance payment and all stock options held by the executive shall immediately vest and remain exercisable for the lesser of their original term or five years. “Good Reason” means (i) a material breach of the agreement by the Company, (ii) removal of the executive by the Company from the Board of Directors or the failure of the Company to nominate the executive as a member of the Board of Directors for any reason other than for “cause” or death or disability or due to executive’s request, (iii) a material reduction in the executive’s duties or the assignment of duties to the executive that are materially inconsistent with the duties and positions set forth in the agreement; or (iv) the relocation of the Company’s offices more than 45 miles from its current location.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Executive Benefits and Payments (1) | | Termination

for “cause” on

December 31,

2006 | | | Death on

December 31,

2006 | | | Disability on

December 31,

2006 (2) | | | Involuntary

not-for-cause

termination on

December 31,

2006 | | | Termination

for “good

reason” on

December 31,

2006 | | | “Change of

Control” on

December 31,

2006 | | | Non-Renewal on

December 31,

2006 | |

Stock Options | | $ | 112,442 | (3) | | $ | 342,163 | (4) | | $ | 342,163 | (4) | | $ | 342,163 | (4) | | $ | 342,163 | (4) | | $ | 342,163 | (4) | | $ | 342,163 | (4) |

Cash Severance | | | — | | | | — | | | | — | | | $ | 279,000 | (5) | | $ | 279,000 | (5) | | $ | 279,000 | (5) | | $ | 279,000 | (5) |

| (1) | Assumes no additional payments of accrued salary or discretionary bonus due to payments made in full to Ms. Strausberg prior to December 31, 2006 in accordance with normal payroll procedures. |

| (2) | Assumes disability occurred 181 days prior to December 31, 2006. |

| (3) | Assumes exercise of only vested options at $3.50 per share, the closing price of our Common Stock on December 31, 2006. |

| (4) | Assumes immediate vesting of all options as well as their exercise at $3.50 per share, the closing price of our Common Stock on December 31, 2006. |

| (5) | Amount payable in twelve equal monthly installments of $23,250, beginning January 1, 2007. |

Marc Strausberg

On April 26, 2004, we entered into a two-year employment agreement, as amended, with Marc Strausberg to serve as our Chairman of the Board of Directors. On April 26, 2007, the agreement automatically renewed for

18

an additional one-year term. Mr. Strausberg’s tenure as Chairman of the Board will terminate at the Annual Meeting.

Under the terms of Mr. Strausberg’s employment agreement, the Company’s decision not to nominate Mr. Strausberg for election as a director for any reason other than for “cause” or death or disability or due to executive’s request is treated as a termination of his employment agreement for “good reason.” Under the terms of the employment agreement Mr. Strausberg shall receive accrued salary, bonus and benefits through his last day as Chairman of the Board of Directors and severance pay totaling $100,000 which represents the sum of his annual salary and the average of his last two cash bonuses. In addition, all stock options held by Mr. Strausberg will immediately vest and remain exercisable for the lesser of their original term or five years from the termination date.

| | | | |

Executive Benefits and Payments (1) | | Termination for

“good reason” on

June 27, 2007 | |

Stock Options | | $ | 15,038 | (2) |

Cash Severance | | $ | 100,000 | (3) |

| (1) | Assumes no additional payments of accrued salary or discretionary bonus due to payments made in full to Mr. Strausberg prior to June 27, 2007 in accordance with normal payroll procedures. |

| (2) | Assumes immediate vesting of all options as well as their exercise at $3.05 per share, the closing price of our Common Stock on the Record Date. |

| (3) | Amount payable in twelve equal monthly installments of $8,333, beginning July 1, 2007. |

Greg D. Adams

On December 27, 2004, we entered into a two-year employment agreement, as amended, with Greg Adams to serve as our Chief Financial Officer and Chief Operating Officer. On December 27, 2006, the agreement automatically renewed for an additional one-year term. Thereafter, the agreement will continue to automatically renew for additional one-year terms on each anniversary of the agreement unless thirty day prior notice of termination is provided by either Mr. Adams or us.

The agreement provides for a minimum annual salary of $210,000, a discretionary annual bonus and a commutation allowance equal to $1,500 per month. In the event of termination for “cause” or termination in the event of death or disability, Mr. Adams will receive accrued salary, bonus and benefits through the date of termination of employment, and, in the event of death or disability, all stock options held by the executive shall immediately vest and remain exercisable for the lesser of their original term or five years. In the event of termination for “change of control” (and Mr. Adams employment is terminated either by him or us within the employment term), Mr. Adams terminates the agreement for “good reason” or termination for any reason other than for “cause,” death or disability, Mr. Adams will receive, in addition to payment of accrued salary, bonus and benefits through the date of termination of employment, the cost of outplacement counseling not to exceed $25,000, a severance payment equal to the sum of 1.5 times (i) his then applicable annual base salary and (ii) the average of his last two annual cash bonuses and all stock options held by the executive shall immediately vest and remain exercisable for the lesser or their original term or five years. The severance payment will be made in (i) one lump sum payment of up to 75% of the total amount due and the remainder in 18 equal monthly installments or (ii) 18 equal monthly installments, as determined by Mr. Adams. “good reason” means (i) a material breach of the agreement by the Company, (ii) removal of the executive by the Company from the Board of Directors or the failure of the Company to nominate the executive as a member of the Board of Directors for any reason other than for “cause” or death or disability or due to the executive’s request, (iii) a material reduction in the executive’s duties or the assignment of duties to the executive that are materially inconsistent with the duties and positions set forth in the agreement; or (iv) the relocation of the Company’s offices more than 45 miles from its current location. If we decide not to renew the agreement, Mr. Adams will receive a severance payment equal to the sum of (i) his then applicable annual base salary and (ii) the average of his last two annual

19

cash bonuses, paid in 12 monthly installments, and all stock options held by the executive shall immediately vest and remain exercisable for the lesser of their original term or five years. Mr. Adams has waived his right to invoke the good reason termination clause of his employment agreement as it relates to the Company’s failure to nominate him as a director at this year’s Annual Meeting.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Executive Benefits and

Payments (1) | | Termination

for “cause” on

December 31,

2006 | | | Death on

December 31,

2006 | | | Disability on

December 31,

2006 (2) | | | Involuntary

not-for-cause

termination on

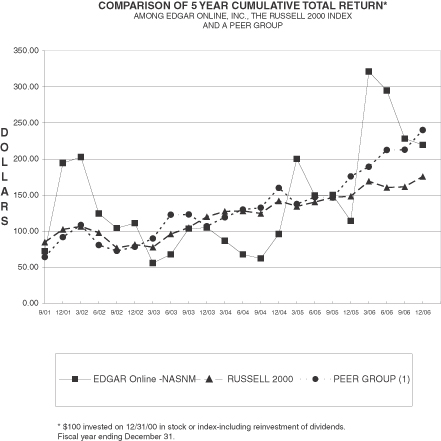

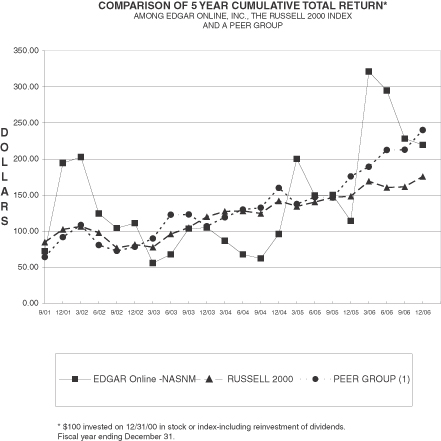

December 31,