China Valves Technology, Inc.

21F Kineer Plaza

226 Jinshui Road

Zhengzhou, Henan Province

People’s Republic of China 450008

People’s Republic of China

August 4, 2011

By EDGAR Transmission and by Hand Delivery

Lisa Etheredge, Esq.

Division of Corporate Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

| Re: | China Valves Technology, Inc.

Form 10-K for the Fiscal Year Ended December 31, 2010

Form 10-Q for the Period Ended March 31, 2011

Form 8-K/A filed November 8, 2010

File No. 1-34542 |

Dear Ms. Etheredge:

On behalf of China Valves Technology, Inc. (“China Valves” or the “Company”), we hereby submit the Company’s responses to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) set forth in the Staff’s letter, dated July 15, 2011 providing the Staff’s comments with respect to the above referenced filings.

For the convenience of the Staff, each of the Staff’s comments is included and is followed by the corresponding response of the Company. Unless the context indicates otherwise, references in this letter to “we”, “us” and “our” refer to the Company on a consolidated basis.

Form 10-K for the Year Ended December 31, 2010

General

| 1. | Where a comment below requests additional disclosures or other revisions to be made, please show us in your supplemental response what the revisions will look like. These revisions should be included in your future filings, including your interim filings. |

China Valves Response: We acknowledge the Staff’s comments and have provided the Staff with such revisions in our supplemental response, and will include such revisions in future filings.

Consolidated Financial Statements, page F-1

Note 11-Commitments and Contingencies, page F-18

| 2. | We note your response to comment seven from our letter dated June 22, 2011. Please confirm that you will revise your future filings to convey to investors (in a manner similar to the way you describe in your response letter) that you would not have been able to meet the targets for net income and fully diluted earnings per share if you had not acquired Changsha Valve and Hanwei Valve. |

| | |

| China Valves Response:We acknowledge the Staff’s comments and will provide disclosures similar to the following in future filings: |

Net income target required by the Make Good Escrow Agreement for fiscal year ended December 31, 2010 was $34,000,000, and the target for fully diluted earnings per share was $1.082. If we had not acquired Changsha Valve, the consolidated net income in 2010 would be $34,303,537, which was slightly higher than the net income target, the fully diluted earnings per share would be $0.99, $0.092 less than the target. If we had not acquired Hanwei Valve, the consolidated net income in 2010 would be $34,034,935, which was also slightly higher than the net income target, and fully diluted earnings per share would be $0.98, $0.102 less than the target. If we had not acquired Changsha Valve and Hanwei Valve, we would not be able to meet the targets for net income and fully diluted earnings per share.

Note 15 – Geographic and Product Lines, page F-24

| 3. | We note your response to comment nine from our letter dated June 22, 2011.It appears that each of your six operating subsidiaries meet the definition of an operating segment. You indicate that each of these subsidiaries has similar assets, customers, distribution methods and economic characteristics; however, they are managed separately because of trademark management and industry focus. Based upon the management reports you provided, we note that gross profit for each of your subsidiaries ranged from 24.7% to 27%. It is unclear how you determined that all of these subsidiaries had similar economic characteristics and therefore it was appropriate to aggregate them into a single operating segment. Furthermore, since you provide services to customers in a variety of industries ranging from water supply to nuclear power, it is unclear how you determined that all of your operating subsidiaries have a similar customer base. Please provide us with a comprehensive analysis (with quantification) explaining how you determined that it was appropriate to aggregate all of your operating subsidiaries into a single operating segment as of December 31, 2010. Please refer to ASC 280-10-50-11. |

China Valves Response: TheASC 280-10-50-11 states the following:

Two or more operating segments may be aggregated into a single operating segment if aggregation is consistent with the objective and basic principles of this Subtopic, if the segments have similar economic characteristics, and if the segments are similar in all of the following areas:

| | a. | The nature of the products and services |

| | b. | The nature of the production processes |

| | c. | The type or class of customer for their products and services |

| | d. | The methods used to distribute their products or provide their services |

| | e. | If applicable, the nature of the regulatory environment, for example, banking, insurance, or public utilities.

|

ASC 280 does not provide a bright line to help measure similar economic characteristics, but the Company believes that a major factor in determining if operating segments have similar economic characteristics is gross margins. The Company has provided the Staff the gross profit for each of its subsidiaries which ranged from 24.7% to 27%. There is less than 3% difference in gross margins and the Company believes that this difference is small enough to consider these subsidiaries to have similar economic characteristics and believed these product lines to be similar based on the following:

All of the operations revolve around the production and selling of valves under various trademarks. Mr. Siping Fang founded Zhengzhou ZD Valves, and acquired Kaifeng Valves in 2004. The Company acquired Taizhou Valves in 2008, Yangzhou Valves, Changsha Valve, and Hanwei Valves in 2010. Our six operating subsidiaries are producing and selling all types of valves and valve interlock under six trademarks.

The production process of manufacturing valves of each subsidiary is similar for each operation. The production process of the six operating subsidiaries is highly similar. Our manufacturing process is a five-step production process: (a) Raw materials. Our subsidiaries purchase raw materials such as casting, forging steel, and shape them into body or disc of steel. (b) Processing., Raw materials are manufactured into semi-finished products through turning, milling, grinding and trimming. (c) Assembling. Various parts are installed into different types of valves. (d) Painting. The next step is to paint the valves according to customers’ order. (e) Inspection and testing. Before placing finished productions into inventory warehouse, we conduct production inspection and testing, such as pressure testing and etc, in accordance with appropriate standards.

Each of the subsidiaries has similar types of customers. Valves produced by the six operating subsidiaries can be used in various industries, including but not limited to water supply, power supply, petrochemical and oil, and metallurgy. Each of the six operating subsidiaries has similar customer base with different industry focus. For instance, Kaifeng Valves sold 46%, 33%, 6% and 15% of their valves to customers in power supply industry, chemical industry, metallurgy industry and others respectively for the year ended December 31, 2011. ZD Valves sold 37%, 21%, 12%, 11% and 19% of their valves to customers in petroleum industry, power supply industry, chemical industry, water supply industry and others respectively in the same period. Other four operating subsidiaries have the similar but different proportion components in term of customer industry.

Each of the subsidiaries has similar distribution methods. Our six operating subsidiaries distribute their valves through two methods: (1) sell more than 80% of our valves directly to our customers through sales team of the Company after winning project contracts by public bids; (2) market our valves by around 50 external agents.

The regulatory environment in which all subsidiaries operate is similar. Our six operating subsidiaries are located in the PRC who are regulated by the national and local laws of the PRC. Our six operating subsidiaries operate under the same regulatory environment, such tax law, foreign currency regulation, business law, technology standards and etc.

The Company believes that it has appropriately aggregated its six subsidiaries into one segment in accordance with ASC 280-10-50-11 since all have similar economic characteristics and are similar in the five areas described above.

Note 16-Bussiness Combinations, page F-24

| 4. | We note your response to comment 12 from our letter dated June 22, 2011. However, it remains unclear why you agreed to pay $12.2 million (plus other expenditures related to the acquisition) for Changsha Valve when Able Delight Investment, Ltd. paid only $6 million for the same business one month earlier. Please provide us with a comprehensive analysis supporting the $12.2million purchase price. Furthermore, considering that you purchased Changsha Valve from a related party, please describe for us in detail how you determined that the $12.2 million purchase price is representative of the price that would have been paid by a third party in an arms’ length transaction. |

China Valves Response:The acquisition of Changsha Valve was a two step process. Because Watts (the owner of Changsha Valve) preferred not to sell Changsha Valve to a public company, Able Delight was set up as an intermediary to facilitate the transaction. Able Delight signed a loan agreement with the Company to acquire Changsha Valve from Watts. Then Able Delight acquired Changsha Valve on behalf of the Company, and then transferred its ownership to the Company on February 3, 2010. Pursuant to the purchase agreement between Able Delight and Watts, Able Delight paid $6 million to Watts. Pursuant to email communications, Able Delight, the Company and Watts agreed that as a post-closing condition to the agreement between Watts and Able Delight, the Company would pay $8.93 million to Watts in order to settle certain liabilities of Changsha Valve concurrently, including vendor payables, unpaid salaries and sales commissions, severance payments and etc, besides the cash consideration paid by the Company through Able Delight to Watts.

Although the Company purchased Changsha Valve from a related party (Able Delight) the essence of the transaction was that the Company purchased Changsha Valve from Watts in an arm-length transaction. As mentioned above, the acquisition was a two step process to satisfy the seller requirement that Changsha Valve would not be sold to a publicly traded company.

The $14.9 million aggregate expenditure was comprised as following:

| Explanation of payment (amount in thousands) | | Amount | |

| Consideration paid by Abel Delight to Watts | $ | 6,070 | |

| Settlement of Changsha Valve's liabilities assumed | | | |

| Payment of accounts payable to Watts’ Shanghai subsidiary | | 1,170 | |

| Payment of accounts payable to Watts’ Tianjin subsidiary | | 1,170 | |

| Payment to Changsha Valves sales personnel for unpaid sales commission | | 2,195 | |

| Payment to employees of Changsha Valve for unpaid salaries and year-end bonuses | | 658 | |

| Payment to employees of Changsha Valves for severance payments | | 878 | |

| Total purchase price | $ | 12,141 | |

| Acquisition expenses | | | |

| Payment of accounts payable to unrelated third parties | | 2,274 | |

| Payment of legal fees for due diligence and documentation | | 542 | |

| Payment of compensation to Able Delight | | 40 | |

| TOTAL | $ | 14,997 | |

Form 10-Q for the period Ended March 31, 2011

General

| 5. | Please address the above comments in your interim filings as well. |

| | |

| China Valves Response:Please refer to our responses above as applicable to our interim filings. |

Consolidated Financial Statements, page 3

Note 2-Summary of Significant Accounting Policies, page 8

| 6. | We note your response to comment 15 from our letter dated June 22, 2011. Please provide us with a detailed analysis explaining how you determined that the considerable decline in your stock price since November 2010 did not represent a significant change in your business climate that represented a triggering event for an interim impairment evaluation as of March 31, 2011 or June 30, 2011. Your analysis should include a comparison of the changes in your stock price compared to stock prices of your competitors as well as the overall market. Your analysis should also provide specific details explaining why you believe the decrease in your stock price is temporary and is not expected to continue for the foreseeable future. |

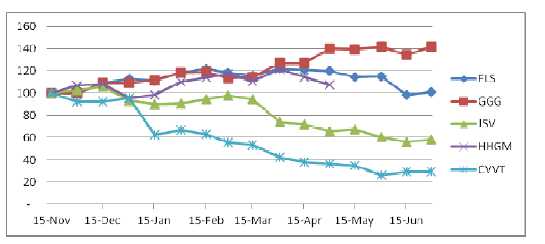

China Valves Response:Below is a chart showing stock prices (using the stock price at November 15, 2010 as the base index of 100) of the Company’s competitors: Flowserve Corporation (FLS); Graco, Inc. (GGG) Jiangsu Shentong Valves Co. Ltd (JSV); and Hubei Hongchen General Machinery Co. Ltd (HHGM)

Three of the four competitors’ stock price have remained at or above the November 15 level and the Company believes that the market continues to remain strong. The Company believes that the significant decline in its stock price is primarily due to the negative publicity about Chinese companies going public in the United States through reverse merger. The Company’s business continues to remain strong with the reporting net income of $43.2 million for the year ended December 31, 2010 and $7.6 million for the quarter ended March 31, 2011. In November 2010, the Company’s stock was trading at a P/E of approximately 9.2 whereas at June 30, 2011 the Company’s stock was trading at a P/E of approximately 2.7.

The Company believes that the decline in its stock price is temporary due to the negative publicity about Chinese companies going public in the United States through reverse merger transactions. The fundamentals of the Company’s business remain strong as evidenced by over $50 million of net income over the past 15 months. The Company does not believe impairing its goodwill is necessary at this time just because its stock price has temporarily dropped while the fundamental of the business remain strong.

If you would like to discuss any of the responses to the Staff’s comments or if you would like to discuss any other matters, please contact the undersigned at (011) 86 378-2925211 or Louis A. Bevilacqua of Pillsbury Winthrop Shaw Pittman LLP, our outside special securities counsel, at (202) 663-8158.

Sincerely,

China Valves Technology, Inc.

By:/s/ Jianbao Wang

Jianbao Wang

Chief Executive Officer