- SQFT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Presidio Property Trust (SQFT) DEF 14ADefinitive proxy

Filed: 7 Oct 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x | Filed by a party other than the Registrant o |

Check the appropriate box:

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional materials |

o | Soliciting Material Under Rule14a-12 |

NetREIT, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x | No fee required. |

o | No fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

NetREIT, Inc.

Dear Stockholder,

You are cordially invited to attend the Special Meeting of Stockholders of NetREIT, Inc., a Maryland corporation, to be held at 8:30 a.m., P.S.T., Monday, November 21, 2016 at the Company’s headquarters, 1282 Pacific Oaks Place, Escondido, California, 92029. The attached notice of special meeting describes the business we will conduct and provides information about how to access the proxy materials that you should consider when you vote your shares.

At this special meeting, we will ask stockholders to consider and vote upon, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission. The Board of Directors recommends the approval of this proposal. We urge you to carefully review the Proxy Statement.

Whether you own a few or many shares, we hope you will be able to attend the special meeting. Whether you plan to attend the special meeting or not, it is important that you cast your vote either in person or by proxy. None of our stockholders own more than 10% of our outstanding shares so every vote is important to us. Therefore, when you have finished reading the Proxy Statement, you are urged to vote in accordance with the instructions set forth in the Proxy Statement. We encourage you to authorize your vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend. In order to make it easy to vote your shares, in addition to your proxy card we have added the ability for you to authorize your proxy by telephone or through the Internet.

YOUR VOTE MATTERS. We urge you to review the 2015 Annual Report to Stockholders and this Proxy Statement and authorize your vote via phone or Internet at www.proxypush.com/NetREIT or mark, sign, date, and return your enclosed proxy card in the postage paid envelope so your shares will be represented at the meeting.

Thank you for your ongoing support of NetREIT, Inc. We look forward to seeing you at our special meeting.

Jack K. Heilbron |

Chairman of the Board |

Chief Executive Officer |

October 7, 2016 |

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TIME: 8:30 a.m., P.S.T.

DATE: November 21, 2016

PLACE: 1282 Pacific Oaks Place, Escondido, California, 92029

PURPOSE:

Proposal 1: | To consider and vote upon, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in the Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission. |

The foregoing item of business is more fully described in the attached Proxy Statement, which forms a part of this notice and is incorporated herein by reference.

WHO MAY VOTE:

Our Board of Directors has fixed the close of business on September 23, 2016 as the record date for the determination of stockholders entitled to notice of, and to vote at, the special meeting or any adjournment or postponement thereof.

Pursuant to the rules of the Securities and Exchange Commission, we have elected to furnish proxy materials to our stockholders over the Internet. Alternatively, we are sending full set proxy materials to some of our stockholders and to any stockholder who has elected to receive proxy materials by mail. We believe that this combination of the e-proxy process and the full set mailing will ensure our stockholders’ receipt of proxy materials, lower the cost of the proxy and mailing, reduce the environmental impact of our special meeting, and help ensure that we can meet quorum. Accordingly, we will send either a Notice of Internet Availability of Proxy Materials or a full set of proxy materials on or about October 11, 2016, and provide access to our proxy materials over the Internet beginning on October 7, 2016 for the beneficial owners of our common stock as of the close of business on the record date. If you receive a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice of Internet Availability of Proxy Materials instructs you on how to access and review this Proxy Statement and our annual report, how to authorize your proxy online or by telephone, and how to receive a printed copy of our proxy materials.

Your proxy is important. Whether or not you plan to attend the special meeting, please authorize your proxy by Internet or telephone, or, if you received a paper copy of the materials by mail, by marking, signing, dating and returning your proxy card, so that your shares will be represented at the special meeting. If you plan to attend the special meeting and wish to vote your shares personally, you may do so at any time before the proxy is voted.

All stockholders are cordially invited to attend the meeting.

BY ORDER OF THE BOARD OF DIRECTORS | |

|

|

By: | /s/ Kathryn Richman |

Name: Kathryn Richman | |

Title: Corporate Secretary | |

October 7, 2016 | |

NetREIT, Inc.

1282 Pacific Oaks Place

Escondido, California 92029

PROXY STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS

To Be Held on November 21, 2016 at 8:30 a.m. P.S.T.

This Proxy Statement is furnished to the stockholders of NetREIT, Inc. a Maryland corporation, in connection with the solicitation by the Board of Directors of the Company (the “Board” or “Board of Directors”) of your proxy to be voted at the special meeting of the stockholders of the Company (the “Special Meeting”) to be held on Monday, November 21, 2016 at 8:30 a.m., P.S.T., at our corporate headquarters, 1282 Pacific Oaks Place, Escondido, California, 92029 and at any postponement or adjournment thereof. References in this Proxy Statement to “the Company,” “NetREIT,” “we,” “us,” “our” or like terms also refer to NetREIT, Inc. The mailing address of our corporate office is 1282 Pacific Oaks Place, Escondido, California 92029. As described in detail in this Proxy Statement, in addition to mailing copies of our proxy materials to our stockholders, we have chosen to also deliver this Proxy Statement, its accompanying proxy materials, and our 2015 Annual Report (the “Annual Report”) electronically by posting them on our website and mailing either Notices of Internet Availability of Proxy Materials or full set proxy materials to stockholders on or about October 11, 2016. This Proxy Statement and the accompanying proxy materials (together with our Annual Report) are also posted on our website at www.netreit.com.

At the Company’s 2013 Annual Meeting of Stockholders, the stockholders approved holding a say-on-pay advisory vote once every three years. In accordance with such vote, the Company is submitting the say-on-pay resolution set forth in this Proxy Statement to a stockholder vote at the Special Meeting, as the say-on-pay proposal was not included in the proxy statement for the Company’s 2016 Annual Meeting of Stockholders. The Compensation Narrative set forth in this Proxy Statement is identical in all material respects to the compensation disclosure included in the proxy statement for the Company’s 2016 Annual Meeting of Stockholders.

Important Information Regarding Delivery of Proxy Materials

What is “Notice and Access”?

“Notice and access” generally refers to rules governing how companies must provide proxy materials. Under the notice and access model, a company may select either of the following two options for making proxy materials available to stockholders:

| · | the full set delivery option; or |

| · | the notice only option. |

A company may use a single method for all its stockholders, or use full set delivery for some while adopting the notice only option for others.

What is the Full Set Delivery Option?

Under the full set delivery option, a company delivers all proxy materials to its stockholders. This delivery can be by mail or, if a stockholder has previously agreed, by e-mail. In addition to delivering proxy materials to stockholders, the company must also post all proxy materials on a publicly accessible website and provide information to stockholders about how to access that website.

What is the Notice Only Option?

Under the notice only option, a company must post all its proxy materials on a publicly accessible website and deliver a Notice of Internet Availability of Proxy Materials. The notice includes, among other matters:

| · | information regarding the date and time of the meeting of stockholders as well as the items to be considered at the meeting; |

| · | information regarding the website where the proxy materials are posted; and |

| · | the means by which a stockholder can request paper or e-mail copies of the proxy materials. |

If a stockholder requests paper copies of the proxy materials, we will send these materials to the stockholder within three business days via first class mail.

In connection with its Special Meeting, NetREIT has elected to use both the Notice Only option and the Full Set option. Accordingly, you should have received either the NetREIT Notice of Internet Availability of Proxy Materials by mail which included instructions on how to access and view the materials and vote online or by telephone, or a full set paper copy of the Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2015.

You may view your proxy materials, including our Annual Report and proxy card online by going to www.proxydocs.com/NetREIT. If you received Notice Only and prefer a paper copy of the proxy materials, you may request one by calling 1-866-648-8133, by email at paper@investorelections.com, or via the internet at www.investorelections.com/NetREIT. You will also have the opportunity to make a request to receive paper copies for all future meetings or only for the Special Meeting.

PURPOSE OF THE MEETING

At the Special Meeting, the stockholders of the Company will be asked:

Proposal 1: | To consider and vote upon, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission. |

|

|

QUORUM

The presence, in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast on a matter will constitute a quorum at the Special Meeting. Votes “for” and “against,” “abstentions”, and “broker non-votes” will all be counted as present to determine whether a quorum has been established. If a quorum is not present, the chairman of the meeting or the stockholders entitled to vote at the Special Meeting, present in person or by proxy, may adjourn the Special Meeting to a date not more than sixty (60) days after the original record date without notice other than announcement at the meeting. The persons named as proxies will vote in favor of any such adjournment.

VOTING RIGHTS

Only holders of record of outstanding shares of our common stock at the close of business on September 23, 2016 are entitled to receive notice of and to vote at the Special Meeting or any postponement or adjournment of the meeting. As of the record date, there were issued and outstanding 17,374,767.749 shares of common stock. Each share of common stock entitles the holder thereof to one vote on each matter properly brought before the Special Meeting.

VOTING PROCEDURES

Abstentions from voting on the proposal and broker non-votes, if any, are considered present for the purpose of determining the presence of a quorum. A “broker non-vote” occurs when a bank, broker, or other holder of record holding shares for a beneficial owner does not vote because that holder does not have discretionary voting power and has not received voting instructions from the beneficial owner. Brokers do not have the discretion to vote your shares at the Special Meeting without receiving voting instructions from you. As a result, if you don’t complete the voting instructions, your votes will not be cast for the proposal to approve, on a non-binding, advisory basis, the compensation of our named executive officers.

Telephone and Internet voting for all stockholders of record will be available 24-hours a day, and will close at 11:59 p.m., P.S.T., on Sunday, November 20, 2016. Attendance at the Special Meeting will not revoke a previously submitted proxy unless you actually vote in person at the meeting. For shares you hold beneficially in street name, you may change your vote by submitting a new voting instruction to your broker or other nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker or other nominee giving you the right to vote your shares, by attending the Special Meeting and voting in person.

VOTE REQUIRED

Approval of Proposal 1 requires the affirmative vote of a majority of the shares of common stock represented in person or by proxy at the Special Meeting and entitled to vote thereon. Abstentions and broker non-votes, if any, will be considered present for the purpose of determining the presence of a quorum and, therefore, will have the same effect as a vote against the proposal.

SOLICITATION OF PROXIES

If you cannot attend the meeting, the accompanying proxy card should be used to instruct the persons named as proxies to vote your shares in accordance with your directions. The persons named in the accompanying proxy card will vote shares represented by all valid proxies in accordance with the instructions contained therein. In the absence of instructions, shares represented by properly executed proxies will be voted FOR the approval of the compensation of our named executive officers. As to any other business which may properly come before the Special Meeting and be submitted to a vote of the stockholders, proxies received by the Board of Directors will be voted in the discretion of the named proxy holders.

Attendance at the Special Meeting will not revoke a previously submitted proxy unless you actually vote in person at the meeting. For shares you hold beneficially in street name, you may change your vote by submitting a new voting instruction to your broker or other nominee following the instructions they provided, or, if you have obtained a legal proxy from your broker or other nominee giving you the right to vote your shares, by attending the Special Meeting and voting in person.

If you are a stockholder of record, you may revoke a proxy at any time before it is voted at the Special Meeting by:

(a) | delivering a proxy revocation or another duly executed proxy bearing a later date to the Secretary of the Company at 1282 Pacific Oaks Place, Escondido, CA 92029; or |

(b) | attending the Special Meeting and voting in person; or |

(c) | authorizing a proxy to vote via the Internet or by telephone with new voting instructions. |

The expense of soliciting proxies, including the cost of preparing and mailing the Notice of Internet Availability of Proxy Materials for the Stockholders Meeting, the Annual Report, and the cost of Internet and telephone posting and voting will be paid by the Company. In addition to solicitation by mail, our directors, officers and employees and representatives from RR Donnelly, P.O. Box 932721, Cleveland, OH 44193 and Mediant Communications, 3 Columbus Circle, Suite 2110, New York, NY 10019, may solicit proxies by telephone, Internet or otherwise. Our

directors, officers and employees will not be additionally compensated for the solicitation, but may be reimbursed for their out-of-pocket expenses. The Company will pay RR Donnelly and Mediant Communications a fee to maintain the Internet and telephone voting services and, if necessary, perform the solicitation of proxies. Brokerage firms, fiduciaries and other custodians who forward soliciting material to the beneficial owners of shares held of record by them will be reimbursed for their reasonable expenses incurred in forwarding such materials.

CONFIDENTIALITY

The Company will keep all the proxies, ballots and voting tabulations private, except as necessary to meet applicable legal requirements. We will permit the Inspector of Elections and our outside legal counsel to examine these documents. The Company will, however, disclose the total votes received for and against each proposal in a Form 8-K filing following the Special Meeting as required by law.

ELECTRONIC DELIVERY OF COMPANY STOCKHOLDER COMMUNICATIONS

Company stockholders will be able to view the Proxy Statement and Annual Report over the Internet at www.proxydocs.com/NetREIT in addition to receiving paper copies in the mail. Please follow the instructions provided in your Proxy Materials and on your proxy card or the instructions provided when you authorize your vote over the Internet by going to the website www.proxypush.com/NetREIT.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to Be Held on November 21, 2016. The Proxy Statement and Annual Report to stockholders are available at www.proxydocs.com/NetREIT.

ANNUAL REPORT AND FINANCIAL STATEMENTS OF THE COMPANY

The annual report of the Company, containing financial statements for the fiscal year ended December 31, 2015, is included with this Proxy Statement and is available at www.proxydocs.com/NetREIT.

PROPOSALS ON WHICH YOU MAY VOTE

WHETHER YOU PLAN TO ATTEND THE SPECIAL MEETING AND VOTE IN PERSON OR NOT, WE URGE YOU TO HAVE YOUR VOTE RECORDED. STOCKHOLDERS MAY SUBMIT THEIR PROXIES VIA THE INTERNET AT WWW.PROXYPUSH.COM/NETREIT OR VIA TELEPHONE AT 1-866-249-5360.

PROPOSAL 1

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) provides our stockholders with the opportunity to consider and vote upon, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission.

As described in detail under the heading “Compensation Narrative,” we seek to closely align the interests of our named executive officers with the interests of our stockholders. Our compensation programs are designed to reward the achievement of specific annual, long-term and strategic goals by the Company and to align executives’ interests with those of the stockholders by rewarding performance above established goals with the ultimate objective of improving stockholder value.

We encourage you to carefully review the section of this Proxy Statement titled “Compensation Narrative” for additional details on our executive compensation program as well as the reasons and processes for how our Compensation Committee determined the structure and amounts of the 2015 compensation of our named executive officers.

We are asking our stockholders to indicate their support for the compensation of our named executive officers as set forth in this Proxy Statement. Accordingly, we are asking our stockholders to vote “FOR” the following resolution at the Special Meeting.

“RESOLVED, that the stockholders of NetREIT, Inc. approve, on an advisory basis, the compensation of NetREIT’s named executive officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K, including the compensation tables and any related disclosure set forth in this Proxy Statement.”

The vote on this resolution is not intended to address any specific element of compensation; rather, the vote relates to the compensation of our named executive officers, as described in this Proxy Statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission. The vote is advisory, which means that the vote is not binding on the Company, our Board of Directors or our Compensation Committee. Nevertheless, the views expressed by our stockholders, whether through this vote or otherwise, are important to us and, accordingly, the Board of Directors and the Compensation Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

COMPENSATION NARRATIVE

Overview of Compensation Program

The Compensation Committee is responsible for establishing, implementing and continually monitoring adherence with our compensation philosophy. The Compensation Committee ensures that the total compensation paid to our executive leadership team is fair, reasonable, and competitive. Generally, the types of compensation and benefits provided to members of our executive leadership team, including the named executive officers, are similar to those provided to other executive officers of other real estate investment trusts (“REITs”). The following Compensation Narrative explains our compensation philosophy, objectives, policies, and practices with respect to our named executive officers to whom we refer to collectively as our “Executive Officers”, as determined in accordance with applicable SEC rules.

Compensation Objectives and Philosophy

The Compensation Committee believes that the most effective executive compensation program is one that is designed to reward the achievement of specific annual, long-term and strategic goals by the Company and that aligns executives’ interests with those of the stockholders by rewarding performance above established goals with the ultimate objective of improving stockholder value. The Compensation Committee evaluates both performance and compensation to ensure that we maintain our ability to attract and retain employees in key positions with superior ability, experience and leadership capability and that compensation provided to key employees remains competitive relative to the compensation paid to similarly situated executives of our peer companies. To that end, the Compensation Committee believes that executive compensation packages provided by us to our executives, including our Executive Officers, should include both cash and share-based compensation that rewards performance measured against established goals.

The Compensation Committee believes that measures such as growth in assets and number of properties, rental income, and funds from operations (“FFO”)1 play an important part in setting compensation; however, the

|

1 | FFO is widely used as a key measure of financial performance by REITs. The National Association of Real Estate Investment Trusts (“NAREIT”) defines FFO as net income (loss) (computed in accordance with generally accepted accounting principles), excluding gains (or losses) from extraordinary items and sales of depreciated operating properties, plus real estate related depreciation and amortization, impairment write-downs of real estate and write-downs of investments in an affiliate where the write-downs have been driven by a decrease in value of real estate held by the affiliate and after adjustments for unconsolidated joint ventures. For a reconciliation of FFO to net income, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Supplemental Financial Measure: Funds From Operations (“FFO”)” in our Annual Report on Form 10-K for the year ended December 31, 2015. |

Compensation Committee also recognizes that often outside forces beyond the control of management, such as economic conditions, capital market conditions, changing retail and real estate markets, and other factors, may contribute to less favorable near-term results. The Compensation Committee also strives to assess whether management is making appropriate strategic decisions that will allow us to succeed over the long term and build long-term stockholder value. These may include ensuring that we have the appropriate leasing and acquisition pipelines to ensure a future stream of recurring and increasing revenues, assessing our risks associated with real estate markets and tenant credit, managing our debt maturities, and determining whether our staffing and general and administrative expense is appropriate given our projected operating requirements.

Role of Executive Officers in Compensation Decisions

The Compensation Committee makes compensation decisions with respect to the compensation of Mr. Jack K. Heilbron, our Chairman, President and Chief Executive Officer, Mr. Kenneth W. Elsberry, our Chief Financial Officer, and Mr. Larry Dubose, CFO & Treasurer of NetREIT Dubose Model Home REIT, Inc., and Chief Executive Officer of NetREIT Advisors LLC, and establishes the general parameters within which it establishes the compensation for our other Executive Officers and senior management team. The Compensation Committee also approves recommendations regarding equity awards to all of our other officers and employees.

Mr. Heilbron reviews the performance of our Executive Officers and management team annually and makes recommendations to the Compensation Committee with respect to salary adjustments, bonuses and equity award amounts. The Compensation Committee can exercise its discretion in modifying any recommended adjustment or award. The Compensation Committee also reviews the performance of our Executive Officers.

Peer Groups for Executive Compensation Purposes

The Compensation Committee reviewed a comprehensive schedule of publicly-traded REITs based on information contained in their proxy statements on SEC Schedule 14A to assist it in considering the compensation for our Executive Officers and in determining an appropriate peer group of REITs in connection therewith. The peer group had total capitalization ranging from approximately $335.4 million to $785.5 million. There is no public market for NetREIT securities, therefore, total capitalization for NetREIT is not readily available but is less than the maximum of the initial peer group. The peer group average capitalization was $471.5 million dollars. The average total compensation for the refined peer group was approximately $2.6 million and $1.2 million for their Chief Executive Officer and Chief Financial Officer, respectively.

As some of our peer group still has a greater capitalization than NetREIT, we have further discounted our compensation metrics in order to more appropriately compare our compensation metrics to the peer group.

Comparison of Executive Compensation to Peer Group

|

| Jack Heilbron |

|

| Larry Dubose |

|

| Kenneth Elsberry |

| |||

Base Salary |

| $ | 308,711 |

|

| $ | 62,500 |

|

| $ | 205,962 |

|

Cash Bonus |

|

| 150,000 |

|

|

| 75,000 |

|

|

| 106,000 |

|

Stock |

|

| 145,000 |

|

|

| 75,000 |

|

|

| 104,000 |

|

Other |

|

| 85,049 |

|

|

| 23,974 |

|

|

| 21,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Compensation |

| $ | 688,760 |

|

| $ | 236,474 |

|

| $ | 437,847 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peer Group Average |

| $ | 2,579,000 |

|

| $ | 590,000 |

|

| $ | 1,175,000 |

|

As we are able to grow our capitalization in relation to the peer group, it is anticipated that this additional discount will be reduced and that, as our total capitalization becomes more comparable, we will not utilize the discount.

Total Compensation

In setting compensation for our Executive Officers and management team, the Compensation Committee focused on total annual compensation as well as the components of total annual compensation. For this purpose, total annual compensation consists of base salary, cash incentives at target levels of performance, and long-term equity incentive compensation in the form of restricted stock. In setting the total annual compensation for our Executive Officers, the Compensation Committee evaluates market data and information on the performance of each Executive Officer for the prior year as well as comparing salaries in the peer group. This evaluation is comprised of both quantitative assessment as well as qualitative assessment. The target levels for the total annual compensation of our Executive Officers and management team are less than the average of the peer group, primarily due to the size and the nature of being a nontraded REIT. We believe that this is an appropriate target that contemplates both the quantitative and qualitative elements of each position and rewards for performance. In addition, each Executive Officer has corporate level quantitative goals, qualitative strategic goals and team oriented goals. The Compensation Committee believes that this approach allows us to attract and retain skilled and talented executives to guide and lead our business and supports a “pay for performance” culture.

Annual Cash Compensation

Base Salary. Each of our Executive Officers receives a base salary to compensate him for services performed during the year. When determining the base salary for each of our Executive Officers, the Compensation Committee considers the market levels of similar positions, discounted for size, at the peer group companies, the performance of the Executive Officer, the experience of the Executive Officer in his position, and the other components of compensation and total compensation. The base salaries of our Executive Officers are established by the terms of their employment agreements. The Executive Officers are eligible for annual increases in their base salaries as determined by the Compensation Committee. Due to the slower than expected recovery of the capital needs of the residential home builder industry and the resulting effect on the growth of our model home business, Mr. Dubose volunteered to temporarily reduce his base salary in 2015 to $62,500 with the stipulation that his bonus in 2015, depending on the targets set, would be based on his previous salary base.

Annual Non-Equity Compensation. The Compensation Committee’s practice is to provide a significant portion of each Executive Officer’s compensation in the form of an annual cash bonus. These annual bonuses are primarily based upon quantifiable company performance objectives. This practice is consistent with our compensation objective of supporting a performance-based environment. The Compensation Committee makes an annual determination as to the appropriate split between company-wide and Executive specific goals based upon its

assessment of the appropriate balance. Each year, the Compensation Committee sets for the Executive Officers the threshold, target, and maximum bonus that may be awarded to those officers if the threshold goals are achieved.

For 2015, the Compensation Committee established the following goals for Mr. Heilbron and set a target cash bonus of 60% of base salary:

2015 Goal |

| 2015 Actual |

| % of Company Goal |

|

| Incentive paid, as Percentage of Base Salary |

| ||

Increase Modified Funds From Operations (MFFO) |

| MFFO increased by 26% |

|

| 85 | % |

|

| 7 | % |

Strategic initiatives and advancement toward IPO |

| Increased assets by $37 million/reduced diversification |

|

| 75 | % |

|

| 25 | % |

Increase size of portfolio |

| Increased by 36% |

|

| 100 | % |

|

| 18 | % |

For 2015, the Compensation Committee established the following goals for Mr. Kenneth Elsberry, Chief Financial Officer and set a target cash bonus of 60% of base salary:

2015 Goal |

| 2015 Actual |

| % of Company Goal |

|

| Incentive paid, as Percentage of Base Salary |

| ||

Increase MFFO |

| MFFO increased by 26% |

|

| 85 | % |

|

| 15 | % |

Increase Portfolio |

| Increased assets by $37 million/reduced diversification |

|

| 100 | % |

|

| 9 | % |

Prepare budgets on a timely and accurate basis |

| Achieved |

|

| 100 | % |

|

| 12 | % |

Strategic initiatives and advancement toward IPO |

| Increased assets by $37 million/reduced diversification |

|

| 75 | % |

|

| 11 | % |

Increase revenue per employee |

| 77% increase |

|

| 100 | % |

|

| 3.0 | % |

Financial Reporting |

| On time and more efficient |

|

| 100 | % |

|

| 3 | % |

For 2015, the Compensation Committee established the following goals for Mr. Larry Dubose, CFO & Treasurer of NetREIT Dubose Model Home REIT, Inc., and Chief Executive Officer of NetREIT Advisors LLC, and set a target cash bonus of 50% of his 2014 base salary:

2015 Goal |

| 2015 Actual |

| % of Company Goal |

|

| Incentive paid, as Percentage of Base Salary |

| ||

Execute and raise capital |

| Commenced formation of new limited partnerships |

|

| 25 | % |

|

| 3.8 | % |

Renew lines of credit and reduce interest rate. |

| Set up new line with new bank; renewed existing lines at 25% reduction in rate |

|

| 100 | % |

|

| 10.0 | % |

Increase builder pipeline. |

| Final negotiation with two new builders for acquisitions of 26 model homes |

|

| 50 | % |

|

| 12.5 | % |

Based upon performance, the Compensation Committee awarded Mr. Heilbron a bonus of $150,000, which was 81% of his target bonus, Mr. Elsberry a bonus of $106,000, which was 84% of his target bonus, and Mr. Dubose a bonus of $75,000, which was 23% of his target bonus.

Long-Term Incentive Compensation

We award long-term equity incentive grants to our Executive Officers as part of our overall compensation package. These awards are consistent with our policies of fostering a performance-based environment and aligning the interests of our senior management with the financial interests of our stockholders. When determining the

amount of long-term equity incentive awards to be granted, the Compensation Committee considered, among other things, the following factors, based upon current year performance and three-year historical performance: our business performance, such as growth in FFO and performance of real estate assets (including, but not limited to, occupancy, same property net operating income growth and leasing spreads); the responsibilities and performance of the executive, such as how they performed relative to their delineated goals; value created for our stockholders, such as total stockholder return (defined as distributions plus capital appreciation for a given year or period) compared to sector average and net asset value; strategic accomplishment, such as identifying strategic direction for us, and market factors, such as navigating the current economic climate and the strength of the balance sheet and debt maturities.

We compensate our Executive Officers for long-term service to us and for sustained increases in our stock performance, through grants of restricted shares. In 2012 and prior years, these shares vested equally over three years for all officers. Beginning with stock grants in 2013, a larger number of restricted share were granted to all Executive Officers but the shares vest over a ten-year period, which the Compensation Committee believes appropriately aligns the interest of senior management with that of the stockholders. The aggregate value of the long-term incentive compensation granted is based upon established goals set by the Compensation Committee, including an assessment of FFO as compared to budgeted or targeted goals; FFO growth year over year as compared against the peer group; the identification of strategic initiatives, their execution and the anticipated long-term benefits to stockholders; and overall stockholder value and performance based upon the above metrics and in relation to the peer group performance.

The Compensation Committee determines the number of shares of restricted stock and the period and conditions for vesting. The Compensation Committee awarded equity compensation to our Executive Officers and senior management team based primarily on the strategic initiatives and decisions made during 2015. On January 2, 2016, the Chief Executive Officer was granted 16,279 shares of restricted stock that vest equally over ten years, the Chief Financial Officer was granted 11,628 shares of restricted stock that vest equally over ten years, and the CFO & Treasurer of NetREIT Dubose Model Home REIT, Inc., and Chief Executive Officer of NetREIT Advisors LLC was granted 8,720 shares of restricted stock that vest equally over ten years.

Perquisites and Other Personal Benefits

We provide our Executive Officers with perquisites and other personal benefits that we and the Compensation Committee believe are reasonable and consistent with our overall compensation program to better enable us to attract and retain superior employees for key positions. The Compensation Committee periodically reviews the levels of perquisites and other personal benefits provided to the Executive Officers.

We maintain a 401(k) retirement savings plan for all of our employees on the same basis, which provides matching contributions at the rate of 100% of the employee’s contributions up to 4% of their salary. Executive Officers are also eligible to participate in all of our employee benefit plans, such as medical, dental, group life, disability and accidental death and dismemberment insurance, in each case on the same basis as other employees.

EXECUTIVE OFFICERS OF THE COMPANY

Certain information about the current executive officers of the Company is set forth below, including their ages, their positions with the Company, their principal occupations or employment for at least the past five years, the length of their tenure as officers and the names of other public companies in which such persons hold or have held directorships during the past five years. Each executive officer of the Company may be removed from office at any time by a majority vote of the Board with or without cause.

Name of Officer (Age) | Position With The Company | Business Experience |

|

|

|

Jack K. Heilbron (65) | Chairman of the Board, President and Director | Mr. Heilbron has served as a director and officer of the Company since its inception. Mr. Heilbron also has served as Chairman of the Board of Directors and President and Chief Executive Officer of NetREIT Dubose Model Home REIT, Inc. since its inception, and has served as President of NetREIT Advisors, LLC and NTR Property Management, Inc. since their inceptions. Mr. Heilbron was a founding officer, director, and shareholder of the former CI Holding Group, Inc. and of its subsidiary corporations (Centurion Counsel, Inc., Bishop Crown Investment Research Inc., PIM Financial Securities Inc., Centurion Institutional Services Inc. and CHG Properties, Inc.) and currently serves as CEO and Chairman of Centurion Counsel, Inc., a licensed investment advisor. He also served as a director of the Centurion Counsel Funds, an investment company registered under the Investment Company Act of 1940, from March 10, 2001 until 2005. From 1994 until its dissolution in 1999, Mr. Heilbron served as the Chairman and/or Director of Clover Income and Growth REIT (“Clover REIT”). Mr. Heilbron graduated with a B.S. degree in Business Administration from California Polytechnic College, San Luis Obispo, California. |

|

|

|

Kenneth W. Elsberry (77) | Chief Financial Officer until April 1, 2016 and Director | Mr. Elsberry served as the Company’s Chief Financial Officer until April 1, 2016 and Treasurer since its inception and as a director until 2008 before he commenced serving as a director again in 2010. On April 1, 2016, Mr. Elsberry informed the Board that he was resigning from his current position as Chief Financial Officer but would remain a director of NetREIT, Inc. and continue the duties of Treasurer. Mr. Elsberry also had served as Vice President and Chief Financial Officer of NetREIT Advisors, LLC and NTR Property Management, Inc., the Company’s property management affiliate. He is a member of the California Society of Certified Public Accountants and American Institute of Certified Public Accountants. From December 2004 to October 2007, Mr. Elsberry served as chief financial officer of Trusonic, Inc., a startup technology company based in San Diego, California. Mr. Elsberry also served as a Director of the Centurion Counsel Funds, an investment company registered under the Investment Company Act of 1940, from March 10, 2001 until 2005 and was formerly the chief financial officer and a Director of Centurion Institutional Services. From 1994 until its dissolution in 1999, Mr. Elsberry served as chief financial officer of Clover REIT. Mr. Elsberry received his Bachelor of Science degree in accounting from Colorado State University. |

|

|

|

Larry G. Dubose (66) | CFO & Treasurer of NetREIT Dubose Model Home REIT, Inc., and Chief Executive Officer of NetREIT Advisors LLC | Mr. Dubose has served as a director of the Company since June 2005 and was Chairman of the Audit Committee until March 2010. In connection with NetREIT entering into a management agreement with Dubose Model Homes, USA, Mr. Dubose became an employee of NetREIT on March 1, 2010 and has served as Chief Financial Officer, Treasurer, and a director of NetREIT Dubose Model Home REIT, Inc. since its organization. He has also served as Chief Executive Officer of NetREIT Advisors LLC, a wholly-owned subsidiary of the Company, since its inception. From 2008 to 2010, Mr. Dubose was President of Dubose Model Homes, USA, a residential real estate investment company headquartered in Houston, Texas that he founded in 1985, a position he also held until 2004. Prior to forming that company, Mr. Dubose served as Vice President and Chief Financial Officer of a full service real estate brokerage company in Houston for six years. From June 1973 to February 1976, he served as a staff accountant with PricewaterhouseCoopers f/k/a Price Waterhouse. Mr. Dubose graduated with a B.A. degree in Accounting from Lamar University in 1973. Although not active at present, Mr. Dubose is a Certified Public Accountant in the state of Texas. He also holds a real estate brokerage license. |

|

|

|

Grant Harbert (41) | Chief Financial Officer as of April 1, 2016. | Mr. Harbert, 41, has served as the VP of Finance since joining NetREIT, Inc., in October 2015. Prior to joining NetREIT, Inc., Mr. Harbert served as the Director of Financial Planning and Analysis for American Assets Trust, Inc., a position he held from April 2011 until August 2015. Mr. Harbert has a Bachelor of Science in Accounting from the University of Arizona and a Master of Science in Business Administration from San Diego State University. |

Our Compensation Committee has the authority to determine and approve the individual elements of total compensation paid to the Chief Executive Officer and other executives holding the title of senior vice president or higher. The Compensation Committee reviews the performance and compensation of the Chief Executive Officer, and all of the executive officers named in this Proxy Statement. Our Chief Executive Officer and President annually assists in the review of the compensation of the Company’s other executive officers. Our Chief Executive Officer and President also makes recommendations with respect to salary adjustments, annual bonus and nonvested stock awards to the Compensation Committee based on his review and market data.

EXECUTIVE COMPENSATION

The following table sets forth information concerning the compensation earned by the Company’s three most highly compensated executive officers for the fiscal years ended December 31, 2015 and 2014.

Name and Principal Position |

| Year |

| Salary |

|

| Bonus (1) |

|

| Stock Awards (2) |

|

| Options Awards |

| All Other Compensation (4) |

|

| Total |

| |||||

Larry G. Dubose |

| 2015 |

| $ | 62,500 |

|

| $ | 75,000 |

|

| $ | 75,000 |

|

|

|

| $ | 23,974 |

|

| $ | 236,474 |

|

CFO & Treasurer of NetREIT Dubose Model Home REIT, Inc., Chief Executive Officer of NetREIT Advisors LLC |

| 2014 |

|

| 266,863 |

|

|

| 10,000 |

|

|

| 60,000 |

|

|

|

| $ | 30,343 |

|

|

| 369,206 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth W. Elsberry |

| 2015 |

|

| 209,923 |

|

|

| 106,000 |

|

|

| 104,000 |

|

|

|

|

| 21,884 |

|

|

| 441,807 |

|

Chief Financial Officer |

| 2014 |

|

| 198,041 |

|

|

| 80,000 |

|

|

| 75,000 |

|

|

|

|

| 19,816 |

|

|

| 372,857 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jack K. Heilbron |

| 2015 |

|

| 308,711 |

|

|

| 150,000 |

|

|

| 145,000 |

|

|

|

|

| 85,049 |

|

|

| 688,760 |

|

Chairman of the Board, President and Chief Executive Officer |

| 2014 |

|

| 291,236 |

|

|

| 140,000 |

|

|

| 100,000 |

|

|

|

|

| 78,749 |

|

|

| 609,985 |

|

______________________

(1) | The bonuses shown were earned in the prior year and paid in January of the following year. |

(2) | The amounts shown represent the aggregate grant date value of awards granted during each fiscal year shown. This does not represent the compensation expense recognized for the fiscal years shown for financial statement reporting purposes. For a discussion of the valuation assumptions used to determine the grant date fair values for awards granted in 2014 and 2015, see Note 10 to the Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015. |

(3) | The following table sets forth the components of Other Compensation included above paid by the Company: |

Name and Principal Position |

| Year |

| Distributions Paid on Restricted Stock |

|

| Matching Contributions to 401K Plan |

|

| Group Term Life Insurance Payments |

|

| Auto Allowance |

|

| Country Club |

|

| Total of Other Compensation |

| ||||||

Larry G. Dubose |

| 2015 |

| $ | 6,303 |

|

| $ | 4,172 |

|

| $ | 1,499 |

|

| $ | 12,000 |

|

|

|

|

|

| $ | 23,974 |

|

Chief Financial Officer & Treasurer of NetREIT Dubose Model Home REIT, Inc., & CEO of NetREIT Advisors, LLC |

| 2014 |

|

| 7,889 |

|

| $ |

|

|

|

| 10,454 |

|

| $ | 12,000 |

|

|

|

|

|

|

| 30,343 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth W. Elsberry, |

| 2015 |

|

| 10,581 |

|

|

| — |

|

|

| 4,103 |

|

|

| 7,200 |

|

|

|

|

|

|

| 21,884 |

|

Chief Financial Officer |

| 2014 |

|

| 8,708 |

|

|

| — |

|

|

| 3,908 |

|

|

| 7,200 |

|

|

|

|

|

|

| 19,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jack K. Heilbron, |

| 2015 |

|

| 14,419 |

|

|

| 24,000 |

|

|

| 26,455 |

|

|

| 11,235 |

|

|

| 8,940 |

|

|

| 85,049 |

|

Chairman of the Board, Chief Executive Officer and President |

| 2014 |

|

| 11,307 |

|

|

| 22,544 |

|

|

| 21,544 |

|

|

| 14,713 |

|

|

| 8,671 |

|

|

| 78,749 |

|

Employment and Severance Agreements

We employ Mr. Heilbron as President and Chief Executive Officer of the Company, Mr. Elsberry as Chief Financial Officer of the Company, and Mr. Dubose as Chief Financial Officer of NetREIT Dubose Model Home REIT, Inc., and CEO of NetREIT Advisors, LLC pursuant to employment agreements, each effective as of January 1, 2011 and filed in their entirety with the SEC as exhibits to the Company’s Current Report on Form 8-K filed on January 24, 2011. Under their respective employment agreement, Messrs. Heilbron, Elsberry, and Dubose are entitled to (a) a base annual salary, (b) an annual bonus compensation of up to 100% of base salary, (c) participation in the Company’s welfare benefit plans, practices, policies, and programs and (d) an automobile allowance. The bonus compensation is awarded upon achievement of targets and other objectives established by the Board or the Compensation Committee for each fiscal year.

As set by the January 1, 2011 agreements and as amended by the Board pursuant to those agreements, for 2016 the annual base salary rate for Mr. Heilbron is $321,059, Mr. Elsberry is $218,320 and Mr. Dubose is $100,000. The Compensation Committee recommended and the Board approved increasing the annual base salary rate for Messrs. Heilbron and Elsberry by four percent (4%) based on the accomplishments to target goals during 2015. Mr. Dubose’s base salary rate was increased to $100,000 based on the anticipated increase in the Model Home business. Messrs. Heilbron and Elsberry’s employment agreements each had an initial three-year term, while Mr. Dubose’s employment agreement had an initial one-year term. All terms are extended automatically for additional one-year periods unless either the Company or the employee notifies the other party in writing not less than three (3) months prior to the last day of the employment term. The agreements also provide that the executives will be entitled to certain compensation and benefits upon a qualifying termination of employment.

Long-Term Incentive Compensation Awards

Stock awards are issued to our executive officers under our 1999 Incentive Award Plan at the Compensation Committee meeting in December of each year. Such stock awards are effective as of January of the following year. The stock awards granted vest evenly over ten (10) years on December 31 of each year. Distributions are paid on the entirety of the grant from the grant date.

As of December 4, 2009, the Board adopted a 401(k) plan and discontinued the Simple IRA plan effective January 1, 2010. All employees including the executive officers are eligible to participate. The Company matches the employee’s elective deferral up to four percent (4%) of the employee’s compensation. In 2015, employees could contribute up to $18,000 of their salary, subject to annual limits under the Internal Revenue Code of 1986, as amended.

Outstanding Equity Awards at Fiscal Year End

The following table shows information regarding grants of stock options and grants of unvested stock awards outstanding on the last day of our fiscal year ended December 31, 2015 to each of the executive officers named in the Summary Compensation Table.

|

| Option Awards (1) |

|

| Stock Awards (2)(3)(4) |

| ||||||||||||||||||||||||||||||

Name |

| Number of Securities Underlying Unexercised Options (#) Exercisable |

|

| Number of Securities Underlying Unexercisable Options (#) Unexercisable |

|

| Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

|

| Option Exercise Price ($) |

|

| Option Expiration Date |

|

| Number of Shares Or Units That Have Not Vested (3) |

|

| Market Value of Shares or Units That Have Not Vested (4) |

|

| Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested |

|

| Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested |

| |||||||||

Larry G. Dubose |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 13,355 |

|

| $ | 114,856 |

|

|

| — |

|

|

| — |

|

Kenneth W. Elsberry |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 23,547 |

|

|

| 202,500 |

|

|

| — |

|

|

| — |

|

Jack K. Heilbron |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 32,093 |

|

|

| 276,001 |

|

|

| — |

|

|

| — |

|

______________________

(1) | No options have been granted since 2005. |

(2) | The amounts in this column represent the stock awards held at December 31, 2015 that were granted on January 2, 2013, January 2, 2014, and January 2, 2015. |

(3) | Restricted stock awards vest according to the following schedule; Mr. Dubose 2,403 shares in the first year, then 1,570 shares evenly for the next six years and 872 shares in the eighth and ninth year; Mr. Elsberry 2,906 shares evenly for the next seven years, 2,035 in the eighth year and 1,163 shares in the ninth year and; Mr. |

Heilbron 3,954 shares evenly for the next seven years, 2,791 in the eighth year and 1,628 shares in the ninth year. |

(4) | Since there is no public trading in the Company’s stock, the market value has been calculated using $8.60 per share, which represents the approximate amount of net proceeds per share received from the offering price of $10 in the Company’s private placement offering that terminated on December 31, 2011, multiplied by the number of outstanding restricted stock awards for each named executive officer. |

OTHER BUSINESS

Under Maryland law, the only matters that may be acted on at a special meeting of stockholders are those stated in the notice of the special meeting. Accordingly, other than procedural matters relating to Proposal 1, no other business may properly come before the Special Meeting. If any procedural matter requiring a vote of stockholders should arise, the persons named as proxies will vote on such procedural matter in accordance with their discretion.

Other Information Regarding the Company’s Proxy Solicitation

ANNUAL REPORT ON FORM 10-K

Company stockholders will receive full set copies in the mail or be able to view the Proxy Statement and Annual Report over the Internet at www.proxydocs.com/NetREIT. The annual report contains important information about the Company and its financial condition that is not included in the Proxy Statement. If you prefer a paper copy of the proxy materials, you may request one by calling 1-866-648-8133.

BY ORDER OF THE BOARD OF DIRECTORS |

|

KATHRYN RICHMAN, |

Corporate Secretary |

Dated: October 7, 2016

|

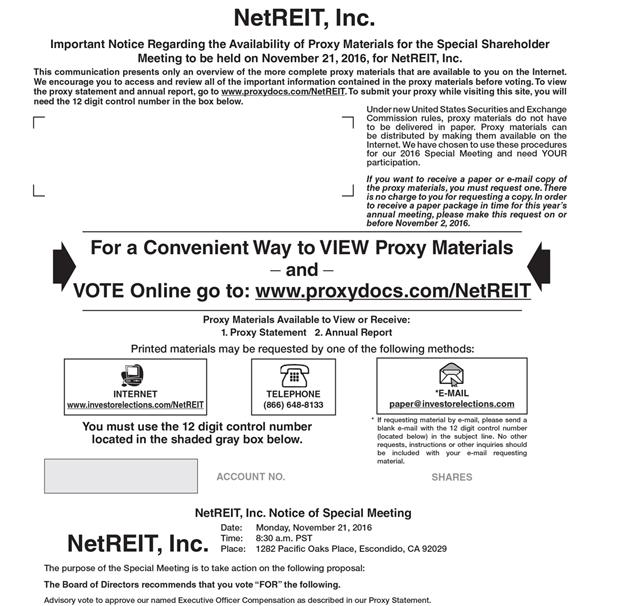

NetREIT, Inc. Important Notice Regarding the Availability of Proxy Materials for the Special Shareholder Meeting to be held on November 21, 2016, for NetREIT, Inc. This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review all of the important information contained in the proxy materials before voting. To view the proxy statement and annual report, go to www.proxydocs.com/NetREIT. To submit your proxy while visiting this site, you will need the 12 digit control number in the box below. Under new United States Securities and Exchange Commission rules, proxy materials do not have to be delivered in paper. Proxy materials can be distributed by making them available on the Internet. We have chosen to use these procedures for our 2016 Special Meeting and need YOUR participation. If you want to receive a paper or e-mail copy of the proxy materials, you must request one. There is no charge to you for requesting a copy. In order to receive a paper package in time for this year’s annual meeting, please make this request on or before November 2, 2016. For a Convenient Way to VIEW Proxy Materials and VOTE Online go to: www.proxydocs.com/NetREIT Proxy Materials Available to View or Receive: 1. Proxy Statement 2. Annual Report Printed materials may be requested by one of the following methods: INTERNET www.investorelections.com/NetREIT TELEPHONE (866) 648-8133 *E-MAIL paper@investorelections.com You must use the 12 digit control number located in the shaded gray box below. * If requesting material by e-mail, please send a blank e-mail with the 12 digit control number (located below) in the subject line. No other requests, instructions or other inquiries should be included with your e-mail requesting material. ACCOUNT NO. SHARES NetREIT, Inc. Notice of Special Meeting NetREIT, Inc. Date: Monday, November 21, 2016 Time: 8:30 a.m. PST Place: 1282 Pacific Oaks Place, Escondido, CA 92029 The purpose of the Special Meeting is to take action on the following proposal: The Board of Directors recommends that you vote “FOR” the following. Advisory vote to approve our named Executive Officer Compensation as described in our Proxy Statement.

SPECIAL MEETING OF NETREIT, INC. Date: November 21, 2016 Time: 8:30 A.M. PST Place: 1282 Pacific Oaks Place, Escondido, CA 92029 Please make your marks like this: Use dark black pencil or pen only Board of Directors Recommends a Vote FOR proposal 1. Advisory vote to approve our named Executive Officer Compensation as described in our Proxy Statement. Authorized Signatures - This section must be completed for your Instructions to be executed. Please Sign Here Please Date Above Please Sign Here Please Date Above Please sign exactly as your name(s) appears on your stock certificate. If held in joint tenancy, all persons should sign. Trustees, administrators, etc., should include title and authority. Corporations should provide full name of corporation and title of authorized officer signing the proxy. Please separate carefully at the perforation and return just this portion in the envelope provided. Special Meeting of NetREIT, Inc. to be held on Monday, November 21, 2016 for Holders as of September 23, 2016 This proxy is being solicited on behalf of the Board of Directors VOTE BY: INTERNET Call TELEPHONE 866-249-5360 www. Go To proxypush.com/NetREIT Cast your vote online. View Meeting Documents. OR Use any touch-tone telephone. Have your Proxy Card/Voting Instruction Form ready. Follow the simple recorded instructions. MAIL OR Mark, sign and date your Proxy Card/Voting Instruction Form. Detach your Proxy Card/Voting Instruction Form. Return your Proxy Card/Voting Instruction Form in the postage-paid envelope provided. The undersigned hereby appoints Jack K. Heilbron, as the true and lawful attorney of the undersigned, with full power of substitution and revocation, and authorizes him, to vote all the shares of capital stock of NetREIT, Inc. which the undersigned is entitled to vote at said meeting and any adjournment thereof upon the matters specified and upon such other matters as may be properly brought before the meeting or any adjournment thereof, conferring authority upon such true and lawful attorney to vote in his discretion on such other matters as may properly come before the meeting and revoking any proxy heretofore given. THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED OR, IF NO DIRECTION IS GIVEN, SHARES WILL BE VOTED FOR THE PROPOSAL 1. All votes must be received by 11:59 P.M., PST, November 20, 2016. PROXY TABULATOR FOR NETREIT, INC. P.O. BOX 8016 CARY, NC 27512-9903 EVENT # CLIENT #

Proxy — NetREIT, Inc. Special Meeting of Stockholders November 21, 2016 at 8:30 a.m. PST This Proxy is Solicited on Behalf of the Board of Directors The undersigned appoints Jack K. Heilbron (the “Named Proxy”) for the undersigned, with full power of substitution, to vote the shares of common stock of NetREIT, Inc., a Maryland corporation (“the Company”), the undersigned is entitled to vote at the Special Meeting of Stockholders of the Company to be held at the Company’s corporate office at 1282 Pacific Oaks Place, Escondido, CA 92029, on November 21, 2016 at 8:30 a.m. PST and all adjournments thereof. The purpose of the Special Meeting is to take action on the following: 1. Proposal 1; 2. Transact such other business as may properly come before the Special Meeting or any adjournment or postponement of the Special Meeting. The Board of Directors of the Company recommends a vote “FOR” proposal 1. This proxy, when properly executed, will be voted in the manner directed herein. If no direction is made, this proxy will be voted “FOR” proposal 1 in their discretion, the Proxy is authorized to vote upon such other matters that may properly come before the Special Meeting or any adjournment or postponement thereof. You are encouraged to specify your choice by marking the appropriate box (SEE REVERSE SIDE) but you need not mark any box if you wish to vote in accordance with the Board of Directors’ recommendation. The Named Proxies cannot vote your shares unless you sign and return this card. To attend the meeting and vote your shares in person, please mark this box. Please separate carefully at the perforation and return just this portion in the envelope provided.