- ARNA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Arena Pharmaceuticals (ARNA) DEF 14ADefinitive proxy

Filed: 23 Apr 04, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

Arena Pharmaceuticals, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

| Jack Lief President, Chief Executive Officer and Director | 6166 Nancy Ridge Drive San Diego, CA 92121 |

April 23, 2004

Dear Arena Stockholder:

You are cordially invited to attend the 2004 Annual Meeting of the Stockholders of Arena Pharmaceuticals, Inc., a Delaware corporation. The Annual Meeting will be held on Friday, June 11, 2004, at 10:00 a.m. San Diego local time, at our offices located at 6150 Nancy Ridge Drive, San Diego, California 92121. I look forward to meeting with as many of our stockholders as possible.

At the Annual Meeting, we will elect eight directors and act upon a proposal to ratify the appointment of our independent auditors for the year ending December 31, 2004. There will also be a report on our business, and you will have an opportunity to ask questions about your company.

If you would like directions to our offices, please visit our website atwww.arenapharm.com, where you will find a "Directions" section under "About Us" that has an easy to use map locator program.

On behalf of the employees and the Board of Directors, I would like to express our appreciation for your continued interest in Arena.

Sincerely,

Jack Lief

President, Chief Executive Officer & Director

For further information about the Annual Meeting, please call (858) 453-7200, ext. 1315

Notice of Annual Meeting of Stockholders

To be held on June 11, 2004

ARENA PHARMACEUTICALS, INC.

6150 Nancy Ridge Drive

San Diego, California 92121

April 23, 2004

To the Stockholders of Arena Pharmaceuticals, Inc.:

The Annual Meeting of Stockholders of Arena Pharmaceuticals, Inc., a Delaware corporation, will be held on Friday, June 11, 2004, at 10:00 a.m. San Diego local time, at our offices, located at 6150 Nancy Ridge Drive, San Diego, California 92121, for the following purposes:

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

Only stockholders of record at the close of business on April 15, 2004, are entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof.

Whether or not you expect to attend in person, we urge you to sign, date and return the enclosed proxy card at your earliest convenience. This will ensure the presence of a quorum at the meeting.Promptly signing, dating and returning the proxy card will save us the expense and extra work of additional solicitation. You may return your proxy card in the enclosed envelope (no postage is required if mailed in the United States). You may also vote by telephone or the Internet pursuant to the instructions that accompanied your proxy card. Sending in your proxy card or voting by telephone or the Internet will not prevent you from voting your stock at the Annual Meeting if you desire to do so, as your proxy may be cancelled at your option. Please note, however, that if your shares are held of record by a bank, broker or other agent and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

By Order of the Board of Directors

![]()

Steven W. Spector

Vice President, General Counsel & Secretary

TABLE OF CONTENTS TO PROXY STATEMENT

| Information Concerning Solicitation and Voting | 1 | |||

| General | 1 | |||

| Questions and Answers About this Proxy Material and Voting | 1 | |||

| Proposal 1—Election of Directors | 4 | |||

| Nominees | 5 | |||

| Business Experience of Directors | 5 | |||

| Information About the Board of Directors and its Committees | 7 | |||

| Audit Committee | 7 | |||

| Compensation Committee | 8 | |||

| Corporate Governance and Nominating Committee | 8 | |||

| Stockholder Director Recommendations | 9 | |||

| Stockholder Communications with the Board of Directors | 9 | |||

| Proposal 2—Ratification of Independent Auditors | 10 | |||

| Compensation and Other Information Concerning Officers, Directors and Certain Stockholders | 10 | |||

| Executive Officers | 10 | |||

| Director Compensation | 12 | |||

| Executive Compensation | 13 | |||

| Restricted Stock Grants | 15 | |||

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values | 16 | |||

| Employment Agreements | 16 | |||

| Compensation Committee Report on Executive Compensation | 16 | |||

| General Executive Compensation Policy and its Implementation | 17 | |||

| Chief Executive Officer Compensation | 18 | |||

| Internal Revenue Code Section 162(m) | 18 | |||

| Performance Graph | 18 | |||

| Security Ownership of Certain Beneficial Owners and Management | 20 | |||

| Section 16(a) Beneficial Ownership Reporting Compliance | 22 | |||

| Compensation Committee Interlocks and Insider Participation | 22 | |||

| Certain Relationships and Related Transactions | 23 | |||

| Audit Committee Report | 24 | |||

| Independent Auditors' Fees | 25 | |||

| Pre-Approval Policies and Procedures | 25 | |||

| Code of Ethics | 25 | |||

| Stockholder Proposals for the 2005 Annual Meeting | 25 | |||

| Annual Report | 26 | |||

| Annual Report on Form 10-K | 26 | |||

| Householding of Proxy Materials | 26 | |||

| Other Matters | 26 | |||

| Charter of the Audit Committee | Appendix A | |||

| Charter of the Compensation Committee | Appendix B | |||

| Charter of the Corporate Governance and Nominating Committee | Appendix C | |||

ARENA PHARMACEUTICALS, INC.

6166 Nancy Ridge Drive

San Diego, CA 92121

PROXY STATEMENT FOR ANNUAL MEETING

OF STOCKHOLDERS

To Be Held on June 11, 2004, at 10:00 a.m. San Diego Local Time

Information Concerning Solicitation and Voting

In this proxy statement, "Arena Pharmaceuticals," "Arena," "we," "us" and "our" refer to Arena Pharmaceuticals, Inc. and our wholly owned subsidiary, BRL Screening, Inc., unless the context otherwise provides.

General

The enclosed proxy is solicited on behalf of the Board of Directors of Arena Pharmaceuticals, Inc., a Delaware corporation, for use at the 2004 Annual Meeting of Stockholders to be held on Friday, June 11, 2004, at 10:00 a.m. San Diego local time, or at any adjournments or postponements thereof, for the purposes set forth in this proxy statement and the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at our offices, located at 6150 Nancy Ridge Drive, San Diego, California.

This proxy statement, together with the Notice of Annual Meeting of Stockholders, the form of proxy and our Annual Report to Stockholders, are first being mailed on or about April 23, 2004, to all stockholders of record at the close of business on the record date, which is April 15, 2004 (the "Record Date").

Questions and Answers About this Proxy Material and Voting

Q: Why am I receiving these materials?

Q: Who can vote at the annual meeting?

Stockholder of Record: Shares Registered in Your Name

If on the Record Date your shares were registered directly in your name with our transfer agent, Computershare Trust Company, Inc., then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy.

1

Beneficial Owner: Shares Registered in the Name of a Bank, Broker or Other Agent

If on the Record Date your shares were held in an account by a bank, broker or other agent, then you are the beneficial owner of shares held in "street name" and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your bank, broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a legal proxy from your bank, broker or other agent.

Q: What is the proxy card?

Q: What am I voting on?

Q: How do I vote?

BY MAIL: Please complete and sign your proxy card and mail it in the enclosed pre-addressed envelope (no postage is required if mailed in the United States). If you mark your voting instructions on the proxy card, your shares will be voted as you instruct or in the best judgment of Mr. Lief or Mr. Spector if a proposal comes up for a vote at the meeting that is not on the proxy card.

If you do not mark your voting instructions on the proxy card, your shares will be voted as follows:

BY TELEPHONE: Please follow the vote by telephone instructions that accompanied your proxy card. If you vote by telephone, you do not have to mail in your proxy card.

BY INTERNET: Please follow the vote by Internet instructions that accompanied your proxy card. If you vote by Internet, you do not have to mail in your proxy card.

IN PERSON: We will pass out written ballots to anyone who wants to vote in person at the meeting. However, if you hold your shares in street name, you must request a legal proxy from your bank, broker or other agent in order to vote at the meeting. Holding shares in "street name" means

2

that you hold them through a bank, broker or other agent, and, therefore, the shares are not held in your individual name.

If you are a beneficial owner of shares registered in the name of your bank, broker or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply follow the instructions you received from that organization to ensure that your vote is counted. Please contact your bank, broker or other agent if you did not receive a proxy card or voting instructions.

To vote in person at the annual meeting, you must obtain a legal proxy from your bank, broker or other agent. Follow the instructions from your bank, broker or other agent included with these proxy materials, or contact such agent to request a proxy form.

Q: What does it mean if I receive more than one proxy card?

Q: Can I change my vote after submitting my proxy?

Q: How many shares must be present to hold the meeting?

Shares are counted as present at the meeting if the stockholder either:

Both abstentions and broker non-votes are counted as present for the purposes of determining the presence of a quorum. Broker non-votes occur when a broker who holds shares for a stockholder in street name submits a proxy for those shares but does not vote. In general, this occurs when the broker has not received voting instructions from the stockholder, and the broker lacks discretionary voting power under the rules of the NASD Inc. or otherwise to vote the shares.

3

Q: How many votes must the nominees receive to be elected as directors?

Q: How many votes must the ratification of Ernst & Young LLP as our independent auditors for the year ending December 31, 2004, receive to be approved?

Q: How may I vote and how are votes counted?

You may vote "FOR" or "AGAINST" or "ABSTAIN" from voting on the proposal to ratify the selection of Ernst & Young LLP as our independent auditors. If you abstain from voting on any of these proposals, it will have the same effect as a vote "AGAINST" the proposal.

Broker non-votes, if any, will not affect the outcome of the voting on any of the proposals described in this proxy statement.

Voting results are tabulated and certified by our transfer agent, Computershare Trust Company, Inc.

Q: Who will bear the cost of soliciting votes for the meeting?

Proposal 1

ELECTION OF DIRECTORS

The persons named below are nominees for director to serve until the next annual meeting of stockholders and until their successors have been elected and qualified or until their early resignation or removal. Our by-laws provide that the authorized number of directors shall be determined by a resolution of the Board of Directors. In 2003, the Board of Directors increased the authorized number of directors from six to eight and appointed additional directors to add more experience to the Board of Directors and to achieve a majority of independent directors.

It is our policy to encourage directors and nominees for director to attend the annual meetings of stockholders. All six of the nominees for election as a director at the 2003 annual meeting of stockholders attended that meeting.

Each nominee listed below other than Messrs. Belcher, Bice and Toms was elected at the 2003 annual meeting of stockholders. Messrs. Belcher and Toms were identified and recommended as nominees by our independent directors. As discussed below under the caption "Business Experience of Directors," the BVF Stockholders designated Mr. Bice to serve as their designee on the Board of

4

Directors. All of the nominees were recommended for election to the Board of Directors by the Corporate Governance and Nominating Committee. Directors are elected by a plurality of votes present in person or represented by proxy at the Annual Meeting and entitled to vote. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. In the event that any of these nominees is unavailable to serve as a director at the time of the Annual Meeting, the proxies will be voted for any substitute nominee who shall be designated by the Board of Directors. We have no reason to believe that any nominee will be unavailable to serve. The Board of Directors recommends a vote "FOR" each named nominee below.

Nominees

The following table sets forth information regarding the nominees as of April 23, 2004.

| Name | Positions and Offices Held | Year First Elected Director | Age | |||

|---|---|---|---|---|---|---|

| Jack Lief | President, CEO and Director | 1997 | 58 | |||

| Dominic P. Behan, Ph.D. | Vice President, Research and Director | 2000 | 40 | |||

| Donald D. Belcher(1) | Director | 2003 | 65 | |||

| Scott H. Bice, Esq.(1) | Director | 2003 | 61 | |||

| Duke K. Bristow, Ph.D.(1) | Director | 2002 | 47 | |||

| Derek T. Chalmers, Ph.D.(2) | Vice President, Research and Director | 2000 | 40 | |||

| J. Clayburn La Force, Jr., Ph.D.(1) | Director | 2002 | 75 | |||

| Robert L. Toms, Sr., Esq.(1) | Director | 2003 | 68 |

Business Experience of Directors

Jack Lief is one of our co-founders and has served as a director and our President and Chief Executive Officer since April 1997. Mr. Lief also serves as a director and President and Chief Executive Officer of BRL Screening, Inc. and as a director of TaiGen Biotechnology Co., Ltd. Mr. Lief served as a director and Chairman of ChemNavigator, Inc. until January 2004. We own 100% of the outstanding voting securities of BRL Screening, approximately 35% of the outstanding voting securities of ChemNavigator and approximately 14% of the outstanding voting securities of TaiGen. From 1995 to April 1997, Mr. Lief served as an advisor and consultant to numerous biopharmaceutical organizations. From 1989 to 1994, Mr. Lief served as Senior Vice President, Corporate Development and Secretary of Cephalon, Inc., a biopharmaceutical company. From 1983 to 1989, Mr. Lief served as Director of Business Development and Strategic Planning for Alpha Therapeutic Corporation, a manufacturer of biological products. Mr. Lief joined Abbott Laboratories, a pharmaceutical company, in 1972, where he served until 1983, most recently as the head of International Marketing Research. Mr. Lief holds a B.A. from Rutgers University and a M.S. in Psychology (Experimental and Neurobiology) from Lehigh University.

Dominic P. Behan, Ph.D. is one of our co-founders and has served as our Vice President, Research since April 1997 and as a director since April 2000. From 1993 to January 1997, Dr. Behan directed various research programs at Neurocrine Biosciences, Inc., a biopharmaceutical company. From 1990 to 1993, Dr. Behan was engaged in research at the Salk Institute. Dr. Behan holds a Ph.D. in Biochemistry from Reading University, England.

5

Donald D. Belcher has served as a director since December 2003. Since May 1995, Mr. Belcher has been the Chairman of the Board of Banta Corporation (NYSE: BN), a leading printing and supply-chain management company servicing the technology and other industries. Mr. Belcher was Banta's Chief Executive Officer from January 1995 to October 2002, and was Banta's President from September 1994 to January 2001. Mr. Belcher is retiring from the board of directors of Banta at the time of its annual meeting, which is scheduled to be held on April 27, 2004. Before joining Banta, Mr. Belcher held a number of executive positions with the Avery Dennison Corporation, including most recently Senior Group Vice President, Worldwide Office Products.

Scott H. Bice, Esq. has served as a director since December 2003. Mr. Bice is the Robert C. Packard Professor at the University of Southern California Law School, where he served as Dean from 1980 to 2000 and as a professor since 1969. Mr. Bice has experience on several corporate boards, including Imagine Films, Western and Residence Mutual Insurance Companies and Jenny Craig. Mr. Bice serves as the "BVF Designee" (as defined in the Stockholders Agreement) under the Stockholders Agreement, dated January 17, 2003 (the "Stockholders Agreement"), by and among BVF Inc., BVF Partners L.P., Biotechnology Value Fund, L.P., Biotechnology Value Fund II, L.P., BVF Investments, L.L.C., Investment 10, L.L.C. (collectively, the "BVF Stockholders") and Arena. Pursuant to the Stockholders Agreement, the Board of Directors is required to nominate the BVF Designee to stand for election as one of our directors, recommend such election and solicit proxies in respect thereof and vote the shares of our common stock represented by all proxies granted by stockholders in connection with the solicitation of proxies by the Board of Directors in connection with such meeting in favor of the BVF Designee, except for such proxies that specifically indicate a vote to withhold any authority with respect to the BVF Designee.

Duke K. Bristow, Ph.D. has served as a director since October 2002. Dr. Bristow is an economist and is responsible for a research program in entrepreneurship, corporate governance and corporate finance in the Harold Price Center for Entrepreneurial Studies at the Anderson Graduate School of Management at the University of California, Los Angeles. Prior to his arrival at UCLA in 1990, Dr. Bristow worked for ten years at Eli Lilly and Company, holding various management positions in the Pharmaceutical Division, Medical Device Division, Diagnostics Division and in Corporate Finance. Dr. Bristow received his Ph.D. in Financial Economics at UCLA, his M.B.A. from Indiana University and his B.S. in Chemical Engineering from Purdue. Dr. Bristow is presently a member of the board of directors or advisory boards of three privately held companies, including two in the life sciences industry.

Derek T. Chalmers, Ph.D. is one of our co-founders and served as our Vice President, Research since April 1997 and as a director since April 2000. Dr. Chalmers has decided to leave Arena as an employee effective May 1, 2004, to pursue another professional opportunity and to be geographically closer to his family, but is continuing to serve as one of our directors. From 1994 to January 1997, Dr. Chalmers directed various research programs at Neurocrine. From 1990 to 1994, Dr. Chalmers was engaged in research at the University of Michigan. Dr. Chalmers holds a Ph.D. in Neuroscience and Neuropharmacology from the University of Glasgow, Scotland.

J. Clayburn La Force, Jr., Ph.D. has served as a director since October 2002. Dr. La Force brings over 20 years of experience in corporate governance as an independent director in a variety of industries, including life sciences. Dr. La Force has previously served as Chairman of the UCLA Economics Department and Dean of the Anderson School at UCLA. Dr. La Force has also served on more than 19 for-profit company boards of directors, including The Timken Company (1994-2001), Rockwell International (1980-2000), Eli Lilly (1981-1999) and Getty Oil Company (1983 until the merger with Texaco in 1984). Dr. La Force received his M.A. and Ph.D. in Economics from UCLA, as well as an A.B. in Economics from San Diego State University. Dr. La Force is on several boards of directors, including CancerVax Corporation, BlackRock Closed-End Funds, Payden Funds, Metzler/Payden Funds, and Advisors Services Trust.

6

Robert L. Toms, Sr., Esq. has served as a director since December 2003. Mr. Toms has over 35 years of broad experience in business and law. He has been Counsel, General Counsel, Vice President, and Secretary to several major corporations and Senior Partner and Head of Corporate Business Groups in substantial law firms. Since 1998, Mr. Toms has practiced law in Pasadena, California, with a primary emphasis on business ventures, including being Of Counsel from 1998 to 2001 to Christie, Parker & Hale, a patent and trademark law firm. He is a former Commissioner of Corporations for the State of California.

Information About the Board of Directors and its Committees

The Board of Directors held a total of nine meetings during the fiscal year ended December 31, 2003. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which such director served, in each case during the periods in which he served. In addition to regularly scheduled meetings, the directors discharge their responsibilities through considerable telephone and other communications with each other and our executive officers, as well as with our independent auditors and external advisors such as legal counsel, scientific consultants and investment bankers. As required under The NASDAQ Stock Market listing standards, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present, in conjunction with regularly scheduled meetings of the Board of Directors and otherwise as needed.

The standing committees of the Board of Directors are the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. A majority of the members of a listed company's board of directors must qualify as "independent" under the applicable NASDAQ Stock Market listing standards. The board of directors must affirmatively make this determination. The Board of Directors has reviewed all relevant transactions and relationships between each non-employee director and Arena, our senior management and our independent auditors. After such evaluation, the Board of Directors affirmatively determined that our non-employee directors, namely Drs. Bristow and La Force and Messrs. Bice, Belcher and Toms, are independent directors under the applicable NASDAQ listing standards.

All of the standing committees of the Board of Directors are comprised entirely of independent directors, and all of our independent directors are on each of our standing committees. The chairmen of our standing committees are appointed by the Board of Directors and may change in the future.

Audit Committee

The Audit Committees' general responsibilities include:

The Board of Directors has determined that each of the Audit Committee members meets the independence and experience requirements contained in the applicable NASDAQ listing standards and

7

Rule 10A-3(b)(1) of the Securities Exchange Act of 1934. The Board of Directors has also determined that Dr. Bristow is an "audit committee financial expert" as defined in Item 401(h) of Regulation S-K. We have adopted a written charter for the Audit Committee, which is available on our website atwww.arenapharm.com and is attached hereto as Appendix A. Dr. Bristow is the Chairman of the Audit Committee. The Audit Committee held 11 meetings in 2003. All members of the Audit Committee attended all of the meetings.

Compensation Committee

The Compensation Committee's general responsibilities include:

Under our equity compensation plans, the Compensation Committee has broad discretion to set the exercise price of options and has the ability to grant restricted stock for no cash consideration. We have adopted a written charter for the Compensation Committee, which is available on our website atwww.arenapharm.com and is attached hereto as Appendix B. Dr. La Force is the Chairman of the Compensation Committee. The Compensation Committee held nine meetings in 2003. All members of the Compensation Committee attended all of the meetings.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee's responsibilities include:

The Corporate Governance and Nominating Committee uses many sources to identify potential director candidates, including the network of contacts among our directors, officers and other employees, and may engage outside consultants in this process. As set forth in the next section, the Corporate Governance and Nominating Committee will consider director candidates recommended by our stockholders. The Corporate Governance and Nominating Committee believes that candidates for director should have certain minimum qualifications, including being able to understand basic financial statements and having high personal integrity and ethics. In considering candidates for director, the Corporate Governance and Nominating Committee will consider all relevant factors, which may include among others the candidate's experience and accomplishments, the usefulness of such experience to our business, the availability of the candidate to devote sufficient time and attention to Arena, the candidate's reputation for personal integrity and ethics and the candidate's ability to exercise sound

8

business judgment. However, the Corporate Governance and Nominating Committee retains the right to modify these qualifications from time to time. Candidates for director are reviewed in the context of the composition of the then current Board of Directors, our requirements and the interests of our stockholders. To date, the Corporate Governance and Nominating Committee has not rejected a timely director nominee from a stockholder or stockholders holding more than 5% of our voting stock. The Corporate Governance and Nominating Committee recommended the nominations of each of the directors nominated for election at the Annual Meeting.

We have adopted a written charter for the Corporate Governance and Nominating Committee, which is available on our website atwww.arenapharm.com and is attached hereto as Appendix C. Dr. Bristow is the Chairman of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee held seven meetings in 2003. All members of the Corporate Governance and Nominating Committee attended all of the meetings.

Stockholder Director Recommendations

The Corporate Governance and Nominating Committee will consider director candidates recommended by our stockholders. A candidate must be highly qualified and be willing and expressly interested in serving on the Board of Directors. The Corporate Governance and Nominating Committee must receive all stockholder recommendations for director candidates for an annual meeting of stockholders by December 31 of the year before such annual meeting. A stockholder who wishes to recommend a candidate for the Corporate Governance and Nominating Committee's consideration should forward the candidate's name and information about the candidate's qualifications to Corporate Secretary, Arena Pharmaceuticals, Inc., 6166 Nancy Ridge Drive, San Diego, California 92121.Submissions must include a representation that the nominating stockholder is a beneficial or record owner of the Company's stock. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected. This procedure does not affect the deadline for submitting other stockholder proposals for inclusion in the proxy statement, nor does it apply to questions a stockholder may wish to ask at an annual meeting. Additional information regarding submitting stockholder proposals is set forth in our by-laws. Stockholders may request a copy of the by-law provisions relating to stockholder proposals from our Corporate Secretary.

Stockholder Communications with the Board of Directors

The Board of Directors has a formal process by which stockholders may communicate with the Board of Directors or any of our directors or officers. Stockholders who wish to communicate with the Board of Directors or any of our directors or officers may do so by sending written communications addressed to such person or persons in care of Arena Pharmaceuticals, Inc., 6166 Nancy Ridge Drive, San Diego, California, 92121. All such communications will be compiled by our Corporate Secretary and submitted to the addressees on a periodic basis. If the Board of Directors modifies this process, we will post the revised process on our website.

9

Proposal 2

RATIFICATION OF INDEPENDENT AUDITORS

The Audit Committee has appointed Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2004. Ernst & Young LLP has audited our financial statements since our inception in 1997. The Board of Directors is submitting the appointment of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. The affirmative vote of the holders of a majority of shares (determined as if all of our Preferred Stock was converted to common stock) represented and voting at the meeting will be required to ratify the appointment of Ernst & Young LLP.

In the event that the stockholders fail to ratify the appointment, the Audit Committee will reconsider its selection of audit firms, but may decide not to change its selection. Even if the appointment is ratified, the Audit Committee may appoint different independent auditors at any time if it determines that such a change would be in our stockholders' best interest.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

The Board of Directors recommends that stockholders vote "FOR" the ratification of the appointment of Ernst & Young LLP to serve as our independent auditors for the fiscal year ending December 31, 2004.

Compensation and Other Information Concerning Officers,

Directors and Certain Stockholders

Executive Officers

Our executive officers are appointed by the Board of Directors and serve at the discretion of the Board of Directors. Set forth below are the names and certain biographical information regarding our executive officers as of April 23, 2004.

| Name | Age | Position | ||

|---|---|---|---|---|

| Jack Lief | 58 | President and Chief Executive Officer | ||

| K.A. Ajit-Simh | 51 | Vice President, Quality Systems | ||

| Nigel R.A. Beeley, Ph.D. | 53 | Vice President, Chief Chemical Officer | ||

| Dominic P. Behan, Ph.D. | 40 | Vice President, Research | ||

| Derek T. Chalmers, Ph.D.(1) | 40 | Vice President, Research | ||

| Robert E. Hoffman, C.P.A. | 38 | Vice President, Finance and Chief Accounting Officer | ||

| Paul W. Maffuid, Ph.D. | 48 | Vice President, Pharmaceutical Development | ||

| Louis J. Scotti | 48 | Vice President, Marketing and Business Development | ||

| William R. Shanahan, Jr., M.D., J.D. | 55 | Vice President, Chief Medical Officer | ||

| Steven W. Spector, Esq. | 39 | Vice President, General Counsel and Secretary | ||

| Joyce H. Williams, R.A.C. | 58 | Vice President, Drug Development |

See "Proposal No. 1 Election of Directors" for biographical information regarding Mr. Lief, Dr. Chalmers and Dr. Behan, who are also directors.

10

K.A. Ajit-Simh has served as our Vice President, Quality Systems since January 1, 2004. Beginning in 1999, Mr. Ajit-Simh formed a consulting business and contracted his services in the areas of regulatory compliance and quality systems to several biologics and drug companies worldwide. From 1991 to 1999, he worked for Cytel Corporation, a biotechnology company, most recently as Senior Director, Quality Assurance and Regulatory Compliance. From 1989 to 1991, he served as Head of Biologics Manufacturing at Abbott BioTech., a medical products company. From 1986 to 1989, he worked as Senior Manager R&D at Baxter Healthcare, a global healthcare products company. From 1975 to 1985, he worked for Mallinckrodt Inc, a medical products company. He has been an instructor at the University of California, San Diego, and San Diego State University in regulatory compliance and quality control/systems since 1994. Mr. Ajit-Simh has a B.Sc. in Biology and Chemistry from Bangalore University, Bangalore, India and a M.S. degree in Cell Biology from St. Louis University.

Nigel R.A. Beeley, Ph.D. has served as our Vice President, Chief Chemical Officer since March 1999. From 1994 to 1998, Dr. Beeley was Senior Director of Chemistry at Amylin Pharmaceuticals, Inc., a biotechnology company, and, from 1988 to 1994, he served as Head of Oncology-Chemistry for Celltech, a biotechnology company. From 1980 to 1988, Dr. Beeley held positions of increasing seniority in the cardiovascular group at Synthelabo Research, a pharmaceutical company, and, from 1978 to 1980, he was a CNS medicinal chemist in the pharmaceutical division of Reckitt and Coleman, a conglomerate. From 1976 to 1978, Dr. Beeley held a Royal Society Overseas Research Fellowship at ETH, Zurich, Switzerland. Dr. Beeley has a B.Sc. Honours (Class 1) degree in Chemistry from the University of Liverpool, U.K. and a Ph.D. in Chemistry from the University of Manchester, U.K.

Robert E. Hoffman, C.P.A. has served as our Vice President, Finance since April 2000 and served as our Controller from August 1997 to April 2000. Mr. Hoffman also serves as our Chief Accounting Officer, Chief Financial Officer of ChemNavigator and as Vice President, Finance of BRL Screening. From 1994 to 1997, Mr. Hoffman served as Assistant Controller for Document Sciences Corporation, a software company. Mr. Hoffman is a member of the Association of Bioscience Financial Officers, and serves as a director for the San Diego County Credit Union. Mr. Hoffman holds a B.B.A. from St. Bonaventure University and is licensed as a C.P.A. in California.

Paul W. Maffuid, Ph.D. has served as our Vice President, Pharmaceutical Development since November 2002, and as our Director of Pharmaceutical Development from November 2001 to November 2002. From 1999 to 2001, Dr. Maffuid served as Executive Director in Pharmaceutical Development at Magellan Laboratories, Inc., a pharmaceutical development company. From 1994 to 1999, Dr. Maffuid served in various positions including as Senior Director Pharmaceutical Development at Amylin Pharmaceuticals, Inc., a biotechnology company. From 1990 to 1994, Dr. Maffuid served in various positions including as Group Leader in Analytical Chemistry at Glaxo Research Institute, a pharmaceutical company. Dr. Maffuid has over 17 years of experience in pharmaceutical development, and he holds a Ph.D. in Organic Chemistry from the University of California, San Diego.

Louis J. Scotti has served as our Vice President, Marketing and Business Development since September 2002 and as our Vice President, Business Development from August 1999 to September 2002. From June 1998 to July 1999, Mr. Scotti served as President and Chief Executive Officer for ProtoMed, Inc., a biopharmaceutical company. From April 1996 to June 1998, Mr. Scotti served as Executive Director of Licensing for Ligand Pharmaceuticals, Inc., a drug discovery company. From 1986 to 1995, Mr. Scotti served in various positions at Reed & Carnrick Pharmaceuticals, a pharmaceutical company, most recently as Vice President of Marketing and Business Development. Mr. Scotti holds a B.S.E. in Biomedical Engineering from the University of Pennsylvania.

William R. Shanahan, Jr., M.D., J.D. has served as our Vice President, Chief Medical Officer, since March 29, 2004. From August 2000 to March 2004, Dr. Shanahan served as Chief Medical Officer for Tanox, Inc., a biopharmaceutical company. From October 1994 to August 2000, Dr. Shanahan

11

worked for Isis Pharmaceuticals, a biopharmaceutical company, and since 1995 as Vice President, Drug Development. From 1990 to 1994, Dr. Shanahan served as Director, Clinical Research for Pfizer Central Research, a pharmaceutical company. From 1986 to 1990, Dr. Shanahan worked for Searle Research & Development, a former pharmaceutical company, most recently as Director, Clinical Research. Dr. Shanahan also has a substantial academic background, and he holds a M.D. from the University of California, San Francisco.

Steven W. Spector, Esq. has served as our Vice President, General Counsel since October 2001. Mr. Spector also serves as our Corporate Secretary and as a director of BRL Screening and ChemNavigator. Prior to joining us, Mr. Spector was a partner with the law firm of Morgan, Lewis & Bockius LLP, where he worked from 1991 to October 2001. Mr. Spector was also a member of Morgan Lewis' Technology Steering Committee. Mr. Spector was our outside corporate counsel from 1998 to October 2001. Mr. Spector holds a B.A. and a J.D. from the University of Pennsylvania.

Joyce H. Williams, R.A.C. has served as our Vice President, Drug Development since February 1998. From January 1997 to February 1998, Ms. Williams served as regulatory consultant to various biotechnology and medical device companies. From 1995 to 1996, Ms. Williams served as Executive Director, Regulatory Affairs at Advanced Sterilization Products, a division of Johnson & Johnson, a pharmaceutical and health care product company. Ms. Williams has over 20 years of experience in regulatory affairs with pharmaceutical and medical technology firms. Ms. Williams holds a B.A. from Case Western Reserve University and an M.B.A. from Pepperdine University and is Regulatory Affairs Certified by the Regulatory Affairs Professional Society.

Director Compensation

Directors who are also employees do not receive additional compensation for serving as a director. The compensation of our non-employee directors is set forth below.

2003 Fiscal Year

For the fiscal year 2003, each of our non-employee directors (other than the directors appointed in December 2003 and Mark N. Lampert, the former designee of the BVF Stockholders to the Board of Directors), earned the following compensation for their participation on the Board of Directors and its committees:

In addition, the chairman of our Audit Committee earned an additional annual retainer of $9,000; the chairman of our Compensation Committee earned an additional annual retainer of $3,000; the chairman of our Corporate Governance and Nominating Committee earned an additional annual retainer of $3,000; and each member of our special committee relating to the BVF Stockholders received $10,000.

The Board of Directors appointed Messrs. Belcher and Toms as directors in December 2003, and we paid each of them $4,000 for participating in the meetings of the Board of Directors and its committees in December 2003. Also in December 2003, the BVF Stockholders designated Mr. Bice to serve as a director to replace Mr. Lampert as the BVF Designee on the Board of Directors. Neither Mr. Lampert nor Mr. Bice received any compensation from us in 2003.

12

2004 Fiscal Year

For the fiscal year 2004, each of our non-employee directors will earn the following compensation for their participation on the Board of Directors and its committees:

In addition, the chairman of our Audit Committee will receive an additional $2,000 for each Audit Committee meeting attended in person or $1,000 for each Audit Committee meeting attended by telephone; the chairman of our Compensation Committee will receive an additional $1,000 for each Compensation Committee meeting attended in person or $500 for each Compensation Committee meeting attended by telephone; and the chairman of our Corporate Governance and Nominating Committee will receive an additional $1,000 for each Corporate Governance and Nominating Committee meeting attended in person or $500 for each Corporate Governance and Nominating Committee meeting attended by telephone. Each outside director can elect to make an irrevocable election each year to receive 25%, 50%, 75% or 100% of his retainer and meeting attendance fees in (a) fully vested deferred stock units (DSUs) with a 15% discount to market, (b) fair market value options with grant value equal to three times the amount of cash retainer converted, or (c) a combination of cash, options and DSUs.

Also beginning in 2004, we grant directors 25,000 options for joining the Board of Directors, which vest in equal annual installments over two years, and intend to make annual grants to ongoing directors of 10,000 options that are fully vested at time of grant. Vested options have a three-year post-termination exercise period for involuntary termination or self-termination occurring with the permission of a majority of the board, as well as following death or disability. The exercise price for all director options is fair market value at the time of grant. The term of the options is ten years.

Each non-employee director is entitled to reimbursement for all of such director's reasonable out-of-pocket expenses incurred in connection with performing board business. While non-employee directors are eligible to receive direct stock issuances under our equity compensation plans, no non-employee director received any direct stock issuances during 2003.

We did not pay Mr. Lampert, the former designee of the BVF Stockholders, any compensation for service on the Board of Directors or any committee thereof. Mr. Lampert was, however, reimbursed for reasonable travel expenses and was covered under our directors' and officers' insurance policy to the same extent provided generally to our non-employee directors. We have determined that Mr. Bice is an independent director and are compensating him as we do other non-employee directors.

Executive Compensation

The following table sets forth certain information concerning the compensation we paid, or was accrued by the officers, for services rendered to us in all capacities for the fiscal years ended

13

December 31, 2003, 2002 and 2001 by our Chief Executive Officer and our four other most highly paid executive officers (collectively, the "Named Executive Officers"):

Summary Compensation Table

| | | Annual Compensation | Long Term Compensation Awards | | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary(1) | Bonus | Other Annual Compensation | Restricted Stock Awards | Securities Underlying Options | All Other Compensation | |||||||||||||

| Jack Lief President and Chief Executive Officer | 2003 2002 2001 | $ | 603,750 586,979 502,083 | $ | 32,000 — — | $ | — — — | $ | 1,286,000 — — | (3) | — 170,000 200,000 | (5) | $ | — — — | ||||||

Dominic P. Behan, Ph.D. Vice President, Research | 2003 2002 2001 | 315,000 306,250 262,083 | 16,000 — — | — — (55,000) | (2) | 643,000 — — | (3) | — 85,000 50,000 | — — — | |||||||||||

Derek T. Chalmers, Ph.D. Vice President, Research | 2003 2002 2001 | 315,000 306,250 262,083 | 16,000 — — | — — (55,000) | (2) | 643,000 — — | (3) | — 85,000 50,000 | 6,057 11,826 — | (6) (6) | ||||||||||

Steven W. Spector, Esq. Vice President, General Counsel and Secretary | 2003 2002 2001 | 300,000 259,375 46,875 | 30,000 — — | — — — | 257,200 — — | (4) | — 15,000 60,000 | — 50,000 — | (7) | |||||||||||

Nigel R.A. Beeley, Ph.D. Vice President, Chief Chemical Officer | 2003 2002 2001 | 220,000 216,667 195,833 | 5,000 — — | — — — | 192,900 — — | (4) | — 15,000 25,000 | 8,461 8,077 — | (6) (6) | |||||||||||

14

Restricted Stock Grants

We did not grant options to any of our executive officers in 2003. Subsequent to BVF increasing their ownership of our stock in October 2002, we (i) adopted a stockholders rights plan, also known as a "poison pill," (ii) amended our by-laws to include an advanced notice provision, (iii) adopted a change in control severance plan and entered into termination protection agreements with key employees and (iv) granted an aggregate of 750,500 shares of our restricted common stock to key employees, including the executive officers reported above. In the case of the executive officers, the restricted shares were issued in exchange for forfeiting certain out-of-the-money options and in lieu of receiving annual grants of stock options and salary increases in 2003. The restricted shares issued to our executive officers vest over a two or four-year period, subject to forfeiture in individual cases should an employee leave our employ or acceleration in the case of a change of control at Arena and their subsequent termination without cause or resignation for good reason within two years following a change of control. The executive officers received 570,000 of these restricted shares and forfeited to us stock options to purchase 565,000 shares of our common stock.

15

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

The following table provides information for options exercised by each of the Named Executive Officers during fiscal year ended December 31, 2003, and the value of the remaining options held by those executive officers at year-end.

| | | | Number of Securities Underlying Unexercised Options at December 31, 2003(1) | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | Value of Unexercised In-the-Money Options at December 31, 2003(2) | ||||||||||||

| Name | Number of Shares Acquired on Exercise | Value Realized ($) | |||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| Jack Lief | — | $ | — | 92,500 | 147,500 | $ | — | $ | — | ||||||

| Dominic P. Behan, Ph.D. | — | — | 158,750 | 88,750 | 490,000 | 140,000 | |||||||||

| Derek T. Chalmers, Ph.D. | — | — | 71,250 | 88,750 | — | 140,000 | |||||||||

| Steven W. Spector, Esq. | — | — | 29,476 | 5,524 | — | — | |||||||||

| Nigel R.A. Beeley, Ph.D. | — | — | 3,750 | 6,250 | — | — | |||||||||

Employment Agreements

Each Named Executive Officer serves at the discretion of the Board of Directors. However, each Named Executive Officer is a party to a termination protection agreement with us, which provides for, among other things, a payment equal to the executive's base salary and accelerated vesting of equity grants if the executive is terminated without cause or the executive officer resigns for good reason within two years following a change of control.

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors has furnished this report on its policies with respect to the compensation of our executive officers. The report is not deemed to be "soliciting material" or to be "filed" with the SEC, or subject to the SEC's proxy rules or to the liabilities of Section 18 of the Exchange Act, and the report shall not be deemed incorporated by reference into any prior or subsequent filing by us under the Securities Act of 1933 or the Exchange Act, except to the extent that we specifically incorporate it by reference into any such filing.

The Compensation Committee is comprised of the directors Drs. Bristow and La Force and Messrs. Bice, Belcher and Toms, each of whom is "independent" under the applicable NASDAQ rules. In addition, each of these individuals is a "non-employee director" under Section 162(m) of the Internal Revenue Code and meets the independence requirements under Section 16 of the Exchange Act of 1934.

Decisions regarding compensation of our executive officers are made by, or subject to review and approval by, the Compensation Committee. The Compensation Committee is responsible for reviewing the executive salary and our benefits structure at least annually. The Compensation Committee also makes decisions regarding grants under our option plans.

16

General Executive Compensation Policy and its Implementation

Our executive compensation policy is designed to attract qualified individuals who have the potential to contribute to our growth and success and, thereby, enhance stockholder value, to motivate such executive officers to perform at the highest of professional levels so as to maximize their contribution to us and to retain such executive officers in our employ. Accordingly, our executive compensation policy is to offer our executive officers competitive compensation opportunities that are tied to their personal performance and their contribution to our growth and success. Beginning in January 2004, each executive officer's compensation package is comprised of three key elements: (i) salary, (ii) performance-based cash bonus, which reflects both corporate and individual performance, and (iii) equity grant, which is intended to align the interests of the executive officer and our stockholders. Our compensation packages are designed to be competitive with compensation levels at similar companies in our industry.

As a general matter, the salary for each executive officer initially is established through negotiation at the time the officer is hired, taking into account such officer's qualifications, experience, prior salary and competitive salary information. Year-to-year adjustments to each executive officer's salary are based on personal performance for the year, changes in the general level of salaries of persons in comparable positions within the industry, and the average merit salary increase for such year for all of our employees, as well as other factors judged to be pertinent during an assessment period. Our Chief Executive Officer recommends to the Compensation Committee new salary levels for our executive officers. In formulating such salary levels, our Chief Executive Officer considers industry, peer group and national surveys of compensation, the past and expected future contributions of the individual executive officers and the amount of equity granted to executive officers. Our Chief Executive Officer also meets with our executive officers to design individual performance goals for each executive officer. The Compensation Committee then reviews our Chief Executive Officer's recommendations in light of its assessment of each executive officer's past performance and its expectation as to future contributions. In making salary decisions, the Compensation Committee exercises its judgment to determine the appropriate weight to be given to each of these factors. The Compensation Committee may take into account additional factors, and may, in its discretion, apply entirely different factors, particularly different measures of performance, in setting executive compensation for future fiscal years, but it is expected that all compensation decisions will be designed to fall within the general executive compensation policy set forth above.

In 2003, the Compensation Committee did not raise the base salaries of any of our executive officers. In the fall of 2003, the Compensation Committee engaged an outside compensation consultant to advise the committee on the compensation of our executive officers. In January 2004, based on a review of individual performance and the compensation levels of a peer group of similar companies in our industry, the Compensation Committee granted cash bonuses to our executive officers and increased the base salary of two of our non-Named Executive Officers. The Compensation Committee also added a formal bonus structure to the executive officers' compensation and established company goals and individual goals for each executive officer. The Compensation Committee believes that performance-based compensation will help motivate management to achieve results that will enhance stockholder value over the long-term. The Compensation Committee will evaluate each executive officer's performance in 2004, including each executive officer's success in meeting his or her goals, and will determine the executive officer's bonus, if any, based on such evaluation.

The Compensation Committee also believes that equity grants provide our executive officers with the opportunity to share in the appreciation of the value of our common stock. The Compensation Committee believes that equity grants directly motivate an executive to maximize long-term stockholder value. The equity grants also utilize vesting periods that encourage executive officers to continue in our employ. As set forth above under "Restricted Stock Grants," due to the uncertainty caused by BVF increasing their ownership of our stock in October 2002 and in lieu of granting options and salary

17

increases, the Compensation Committee granted the executive officers restricted stock in 2003. These restricted stock grants were intended to help retain our key employees.

We also have an employee stock purchase plan to encourage employees to continue in our employ and to motivate employees through ownership interest. Under the employee stock purchase plan, executive officers and other employees may elect to have a portion of their cash compensation withheld for purchases of our common stock on certain dates set forth in the plan. The price of our common stock purchased under the employee stock purchase plan is equal to 85% of the lower of the fair market value of our common stock on the date of enrollment or the exercise date.

Chief Executive Officer Compensation

In setting the compensation payable to Mr. Lief, the Compensation Committee seeks to be competitive with other companies in the industry, while at the same time tying a significant portion of such compensation to company performance.

In 2003, in anticipation of the Compensation Committee engaging an outside compensation consultant to review Mr. Lief's compensation, the Compensation Committee did not raise Mr. Lief's base salary. In January 2003, Mr. Lief received the restricted stock grant discussed in footnote 3 to the Executive Compensation table and under the caption "Restricted Stock Grants" above. Taking into consideration the recommendations of the compensation consultant and based on the Compensation Committee's evaluation of our performance and Mr. Lief's personal performance in 2003, as well as on their review of Mr. Lief's historical compensation relative to industry comparables, the Compensation Committee awarded Mr. Lief a cash bonus of $32,000 in January 2004. In making this determination, the Compensation Committee also considered the continued performance and success of the executive officers reporting to Mr. Lief, our scientific progress, and the achievement of certain financing goals.

The Compensation Committee discussed and established Mr. Lief's compensation outside his presence.

Internal Revenue Code Section 162(m)

The Compensation Committee also considers the potential impact of Section 162(m) of the Internal Revenue Code of 1986, as amended ("Section 162(m)"). Section 162(m) disallows a Federal tax deduction for any publicly held corporation for individual compensation exceeding $1 million in any taxable year for the Chief Executive Officer and other senior executive officers. This limitation does not, however, apply to compensation that is performance-based under a plan that is approved by the stockholders and that meets other technical requirements. Based on these requirements, the Compensation Committee attempts to limit the impact Section 162(m) will have on our ability to deduct senior executive compensation, but in certain cases our tax deductions may be limited by Section 162(m).

The foregoing report is provided by the following directors, who constitute the Compensation Committee:

Donald D. Belcher

Scott H. Bice, Esq.

Duke K. Bristow, Ph.D.

J. Clayburn La Force, Jr., Ph.D.

Robert L. Toms, Sr., Esq.

Performance Graph

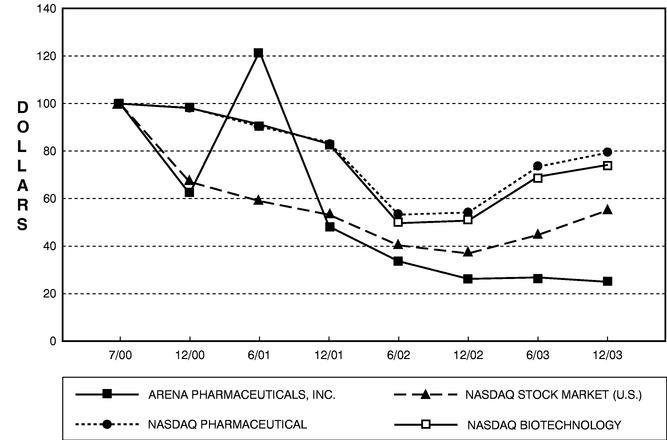

The following is a line graph comparing the cumulative total return to stockholders (change in stock price plus reinvested dividends) of our common stock from July 28, 2000 (the date of our initial

18

public offering) through December 31, 2003, to (i) the cumulative total return over such period to the Total Return Index for the NASDAQ Stock Market (U.S. Companies); (ii) the Total Return Index for the NASDAQ Pharmaceutical Stocks (the "NASDAQ Pharmaceutical Index"); and (iii) the Total Return Index for the NASDAQ Biotechnology Index, in each case as provided by Research Data Group, Inc. We are providing information on the NASDAQ Pharmaceutical Index because it was included in our proxy statement for our annual meeting in 2003. However, we intend for future years to substitute the NASDAQ Biotechnology Index for the NASDAQ Pharmaceutical Index because we believe it is a better representation of our performance against companies in our industry than the NASDAQ Pharmaceutical Index, which includes many pharmaceutical companies that are not biotechnology companies. In establishing the starting point on the line graph, we used the closing price of our common stock on July 28, 2000, of $25.00 as required by SEC guidelines.

The graph assumes the investment of $100 and the reinvestment of dividends, although dividends have not been declared on our common stock, and is based on the returns of the component companies weighted according to their market capitalizations as of the end of each monthly period for which returns are indicated. We caution that the stock price performance shown in the graph may not be indicative of future stock price performance. The information contained in the Performance Graph is not deemed to be "soliciting material" or to be "filed" with the SEC, or subject to the SEC's proxy rules or to the liabilities of Section 18 of the Exchange Act, and shall not be deemed incorporated by reference into any prior or subsequent filing by us under the Securities Act of 1933 or the Exchange Act, except to the extent that we specifically incorporate it by reference into any such filing.

Comparison of Cumulative Return on Investment

ARENA PHARMACEUTICALS, INC.

| | Cumulative Total Return | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 7/00 | 12/00 | 6/01 | 12/01 | 6/02 | 12/02 | 6/03 | 12/03 | ||||||||

| ARENA PHARMACEUTICALS, INC. | 100.00 | 62.00 | 121.96 | 48.12 | 33.60 | 26.04 | 26.68 | 24.80 | ||||||||

| NASDAQ STOCK MARKET (U.S.) | 100.00 | 67.03 | 58.99 | 53.21 | 40.19 | 36.79 | 44.62 | 55.00 | ||||||||

| NASDAQ PHARMACEUTICAL | 100.00 | 98.26 | 90.39 | 83.74 | 53.12 | 54.11 | 73.47 | 79.31 | ||||||||

| NASDAQ BIOTECHNOLOGY | 100.00 | 98.11 | 91.27 | 82.98 | 49.61 | 50.76 | 69.27 | 74.21 | ||||||||

19

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information we know with respect to the beneficial ownership of our common stock as of March 31, 2004, by:

Unless otherwise indicated in the footnotes below, the address for the beneficial owners listed in this table is in care of Arena Pharmaceuticals, Inc., 6166 Nancy Ridge Drive, San Diego, CA 92121. This table is based on information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that the stockholders named in this table have sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 25,590,829 shares of common stock outstanding on March 31, 2004, adjusted as required by the rules promulgated by the SEC. This table includes shares issuable pursuant to options and other rights to purchase shares of our common stock exercisable within 60 days of March 31, 2004.

| Name and Address of Beneficial Owner | Shares Beneficially Owned | Percentage of Total | |||

|---|---|---|---|---|---|

| BVF Inc.(1) | 3,130,912 | 12.2 | % | ||

| Perry Capital, L.L.C.(2) | 2,806,154 | 11.0 | % | ||

| Mainfield Enterprises, Inc.(3)(5) | 2,695,754 | 9.5 | % | ||

| Smithfield Fiduciary LLC(4)(5) | 2,021,816 | 7.3 | % | ||

| Dimensional Fund Advisors Inc.(6) | 1,741,786 | 6.8 | % | ||

| Jack Lief(7) | 909,883 | 3.5 | % | ||

| Dominic P. Behan, Ph.D.(8) | 626,250 | 2.4 | % | ||

| Derek T. Chalmers, Ph.D.(9) | 626,500 | 2.4 | % | ||

| Steven W. Spector, Esq.(10) | 128,200 | * | |||

| Nigel R.A. Beeley, Ph.D.(11) | 145,907 | * | |||

| Duke K. Bristow, Ph.D.(12) | 80,000 | * | |||

| J. Clayburn La Force, Jr., Ph.D.(13) | 80,000 | * | |||

| Donald D. Belcher(14) | 35,000 | * | |||

| Scott H. Bice, Esq.(15) | 25,000 | * | |||

| Robert L. Toms, Esq.(16) | 25,000 | * | |||

| All directors and executive officers as a group (15 persons)(17) | 3,078,350 | 11.4 | % |

20

Partners is authorized to invest the funds of Ziff Asset Management, L.P., the majority member of Investments, in shares of our common stock and to vote, exercise or convert and dispose of such shares and is entitled to receive fees based on assets under management and allocations based on realized and unrealized gains on such assets. Pursuant to an investment management agreement with Investment 10, L.L.C. ("ILL10"), Partners and BVF Inc. have authority to invest funds of ILL10 in shares of our common stock and to vote, exercise or convert and dispose of such shares. Pursuant to such investment management agreement, Partners and BVF Inc. receive fees based on assets under management and realized and unrealized gains thereon. BVF Inc. is the general partner of Partners and may be deemed to beneficially own securities over which Partners exercises voting and dispositive power. The principal business office of BVF Inc. and related entities specified hereinabove is located at 227 West Monroe Street, Suite 4800, Chicago, Illinois 60606.

This table excludes the shares of our common stock that the holder may acquire by exercising warrants and unit warrants that were issued in the Series B Convertible Preferred Stock financing transaction. The warrants provide that the number of shares of our common stock that may be acquired by the holder upon any exercise of the warrant is limited to the extent necessary to ensure that, following such exercise, the total number of shares of our common stock then beneficially owned by such holder and its affiliates and any other persons whose beneficial ownership of our common stock would be aggregated with the holders for purposes of Section 13(d) of the Securities Exchange of 1934 does not exceed 4.999% of our common stock (including shares of our common stock issuable upon such exercise). The holder can waive this limitation on exercise or increase or decrease the 4.999% by giving us written notice, but (i) any

21

such waiver or increase will not be effective until the 61st day after such notice is delivered to us and (ii) any such waiver or increase or decrease will apply only to such holder and not to any other holder of warrants.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires our directors, executive officers and our ten percent or greater stockholders to file reports of ownership of our equity securities and changes in such ownership with the SEC and the NASDAQ and to furnish copies of such reports to us.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, all Section 16(a) filing requirements applicable to our directors, executive officers and our ten percent or greater stockholders were complied with during the fiscal year ended December 31, 2003.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of the outside directors Drs. Bristow and La Force and Messrs. Belcher, Bice and Toms. None of our executive officers serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as members of the Board of Directors or Compensation Committee.

22

Certain Relationships and Related Transactions

Biotechnology Value Fund

On October 17, 2003, the BVF Stockholders accepted our offer to purchase 3.0 million shares of our common stock from us at a cash price per share of $7.69. We made the offer on October 7, 2003, pursuant to the Stockholders Agreement. Mark N. Lampert, the President of BVF Inc. and the BVF Designee under the Stockholders Agreement, was a director on the Board of Directors and on its Corporate Governance and Nominating Committee and Audit Committee when we made the offer to purchase such shares. The BVF Stockholders replaced Mr. Lampert with Mr. Bice as the BVF Designee in December 2003.

We filed the Stockholders Agreement as Exhibit 10 to our report on Form 8-K filed with the SEC on January 21, 2003.

ChemNavigator

In January 1999, we began development of an Internet-based search engine to allow scientists to search for compounds based primarily on the similarity of chemical structures. In May 1999, ChemNavigator was incorporated and in June 1999, we licensed to ChemNavigator a website, the trademark "ChemNavigator" and associated goodwill, intellectual property related to the search engine, as well as technology needed to perform chemical similarity searches. In return, we received shares of preferred stock in ChemNavigator. As of both December 31, 2003, and 2002, our equity ownership represented approximately 35% of the outstanding voting securities of ChemNavigator.

In March 2002, we entered into a license agreement with ChemNavigator for the use of their cheminformatic software program and in September 2003 we amended this license agreement to include additional development work to be performed by ChemNavigator. In 2002, we paid ChemNavigator $165,000 under this agreement. In 2003, we renewed our license under this agreement for $50,000 and have an option to renew the license in subsequent years for $50,000 per year. We expect to renew our license in 2004. In 2003, we paid ChemNavigator $68,000 for development work. We expect to pay ChemNavigator approximately $100,000 for additional development work through mid 2004.

We sublease office space to ChemNavigator at current market rates. Lease payments increase annually by 2% in April. In 2003 and 2002, we recorded approximately $98,000 and $88,000, respectively, in other income for this sublease.

Mr. Lief, our President and Chief Executive Officer, was the Chairman of the Board of ChemNavigator until January 9, 2004. Mr. Lief no longer serves as a director of ChemNavigator. As compensation for his services he has received 200,000 shares of common stock of ChemNavigator, which vested over a period of four years. Robert E. Hoffman, our Vice President, Finance and Chief Accounting Officer, is also the Chief Financial Officer of ChemNavigator. Mr. Hoffman entered into a four-year service agreement with ChemNavigator in May of 1999, in which he agreed to provide up to 200 hours of service per year. As compensation for his services he has received 100,000 shares of common stock of ChemNavigator, which vested over a period of four years. Mr. Hoffman continues to work for ChemNavigator, but for no additional compensation. Mr. Spector, our Vice President and General Counsel, is a director of ChemNavigator. Mr. Spector does not receive any compensation from ChemNavigator. Dr. Beeley, our Vice President, Chief Chemical Officer has provided consulting services to ChemNavigator and has received 3,200 options to purchase shares of common stock of ChemNavigator as compensation for services rendered. The options vest over a period of four years.

23

Audit Committee Report

The Audit Committee of the Board of Directors has furnished the following report on its activities with respect to its responsibilities during the year 2003. The report is not deemed to be "soliciting material," or to be "filed" with the SEC or subject to the SEC's proxy rules or to the liabilities of Section 18 of the Exchange Act, and the report shall not be deemed incorporated by reference into any prior or subsequent filing by us under the Securities Act of 1933 or the Exchange Act, except to the extent that we specifically incorporate it by reference into any such filing.

Our management has the primary responsibility for our financial reporting process, principles and internal controls as well as preparation of our financial statements. The Audit Committee oversees our financial reporting process on behalf of the Board of Directors. The Audit Committee is comprised of Drs. Bristow and La Force and Messrs. Bice, Belcher and Toms, each of whom is an "independent" director as defined in the applicable NASDAQ and SEC rules. The Audit Committee held 11 meetings during 2003.

The Board of Directors has adopted a written charter for the Audit Committee, which is attached hereto as Appendix A. The Audit Committee reviews and assesses the adequacy of its charter, and recommends any proposed changes to the Board of Directors for its consideration.

In fulfilling its responsibilities, the Audit Committee appointed our independent auditors, Ernst & Young LLP, for the fiscal year ended 2003. The Audit Committee reviewed and discussed with the independent auditors the overall scope and specific plans for their audit. The Audit Committee also reviewed and discussed with the independent auditors and with management our financial statements and the adequacy of our internal controls. During its meetings, the Audit Committee met with the independent auditors, without management present, to discuss the results of the independent auditors' audits, their evaluations of our internal controls and the overall quality of our financial reporting. The meetings also were designed to facilitate any desired private communication between the Audit Committee and the independent auditors.

The Audit Committee monitored the independence and performance of the independent auditors. The Audit Committee discussed with the independent auditors the matters required to be discussed by Statements on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed with the independent auditors the independent auditors' independence. The Audit Committee concluded that the provision of non-audit professional services, as discussed below, is compatible with maintaining the independent auditors' independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in our annual report on Form 10-K for the fiscal year ended December 31, 2003, for filing with the SEC. The Audit Committee has also appointed Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2004.

The foregoing report is provided by the following directors, who constitute the Audit Committee:

Donald D. Belcher

Scott H. Bice, Esq.

Duke K. Bristow, Ph.D.

J. Clayburn La Force, Jr., Ph.D.

Robert L. Toms, Sr., Esq.

24

Independent Auditors' Fees

The following presents aggregate fees billed to us for the fiscal years ended December 31, 2003, and December 31, 2002, by Ernst & Young LLP, our independent auditors and principal outside accountants.

Audit Fees. Audit fees were $138,250 and $96,100 for the years ended December 31, 2003, and December 31, 2002, respectively. The fees were for professional services rendered for audits of our consolidated financial statements and consultations on matters and reviews of the financial statements included in our quarterly reports.

Audit-Related Fees. Audit-related fees were $19,000 for the year ended December 31, 2003 and related to the audit of our 401(k) employee benefit plan. There were no audit-related fees for the year ended December 31, 2002.

Tax Fees. Tax fees were $9,450 and $11,620 for the years ended December 31, 2003, and December 31, 2002, respectively. The tax fees were for preparation of tax returns.

All Other Fees. There were no fees billed in either of the years ended December 31, 2003, or December 31, 2002, for products or services provided by our principal accountant other than the ones disclosed above in this section.

Pre-Approval Polices and Procedures

The Audit Committee has adopted a policy and procedure for pre-approving all audit and non-audit services to be performed by our independent auditors. The policy requires pre-approval of all services rendered by our independent auditors either as part of the Audit Committee's approval of the scope of the engagement of the independent auditors or on a case-by-case basis. The Audit Committee has authorized its chairman to pre-approve individual expenditures of audit and non-audit services. Any pre-approval decision must be reported to the Audit Committee at the next regularly scheduled Audit Committee meeting. The Audit Committee approved all audit fees, audit-related fees and tax fees for 2003.

For the services approved above for 2002, 89% were audit fees, 0% were audit-related fees, and 11% were tax fees. For the services approved above for 2003, 83% were audit fees, 11% were audit-related fees and 6% were tax fees.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics Policy that applies to our directors and employees (including our principal executive officer, principal financial officer, principal accounting officer and controller), and have posted the text of the policy on our website (www.arenapharm.com) in connection with "Investor" materials. In addition, we intend to promptly disclose (i) the nature of any amendment to the policy that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and (ii) the nature of any waiver, including an implicit waiver, from a provision of the policy that is granted to one of these specified individuals, the name of such person who is granted the waiver and the date of the waiver on our website and, as applicable, in filings on Form 8-K in the future.

Stockholder Proposals for the 2005 Annual Meeting

To be considered for inclusion in next year's proxy statement, stockholder proposals must be in writing, addressed to our Corporate Secretary, and be received at our executive offices at 6166 Nancy Ridge Drive, San Diego, California 92121, no later than the close of business on December 24, 2004. In addition, notice of any stockholder proposal to be presented at next year's Annual Meeting must be

25

received at our Headquarters no later than the close of business on February 12, 2005, and no earlier than January 23, 2004. The above dates in this section may change under circumstances set forth in our by-laws. Stockholders may request a copy of the by-law provisions relating to stockholder proposals from our Corporate Secretary.