Washington, D.C. 20549

This Schedule 14A filing consists of communications from Arena Pharmaceuticals, Inc., a Delaware corporation (the “Company” or “Arena”), to the Company’s employees, customers, partners and analysts relating to the Agreement and Plan of Merger, dated December 12, 2021, by and among the Company, Pfizer Inc., a Delaware corporation (“Pfizer”) and Antioch Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Pfizer (the “Merger Agreement”).

The following letter was sent to the Company’s employees on December 13, 2021:

To: | All Employees |

From: | Amit |

Subject: | Today’s Announcement |

I am pleased to announce that we have entered into a merger agreement with Pfizer under which Pfizer will acquire Arena Pharmaceuticals. We are targeting the first half of 2022 for close of the transaction, subject to regulatory approvals and other customary closing conditions. You can read our joint press release here.

I am exceptionally proud of the work we have done over the past several years to advance our clinical research across multiple therapeutic areas. As one of the world's largest and most innovative biopharmaceutical companies, Pfizer provides the global reach and broad technical capabilities to accelerate the significant progress we have made in advancing Arena’s therapeutic pipeline and delivering important medicines to patients. As we approach critical milestones in 2022 and begin planning for Etrasimod commercialization, Pfizer is uniquely positioned to advance this work through their major presence across global markets and exceptional commercial capabilities.

We know that you will have questions, and we will schedule several meetings today and over the next week to provide you with more information. Please join us for an all company meeting at 9:00am PST today; you will receive an Outlook invitation with details shortly. We will also stand up a new SharePoint site to house FAQs and other resources as they are available. As with most transactions of this nature, it will take time to resolve many of the open questions you may have. With that said, we are committed to providing you with up-to-date information as it becomes available to us. In the meantime, if you have any questions, please feel free to send them to ***@***.

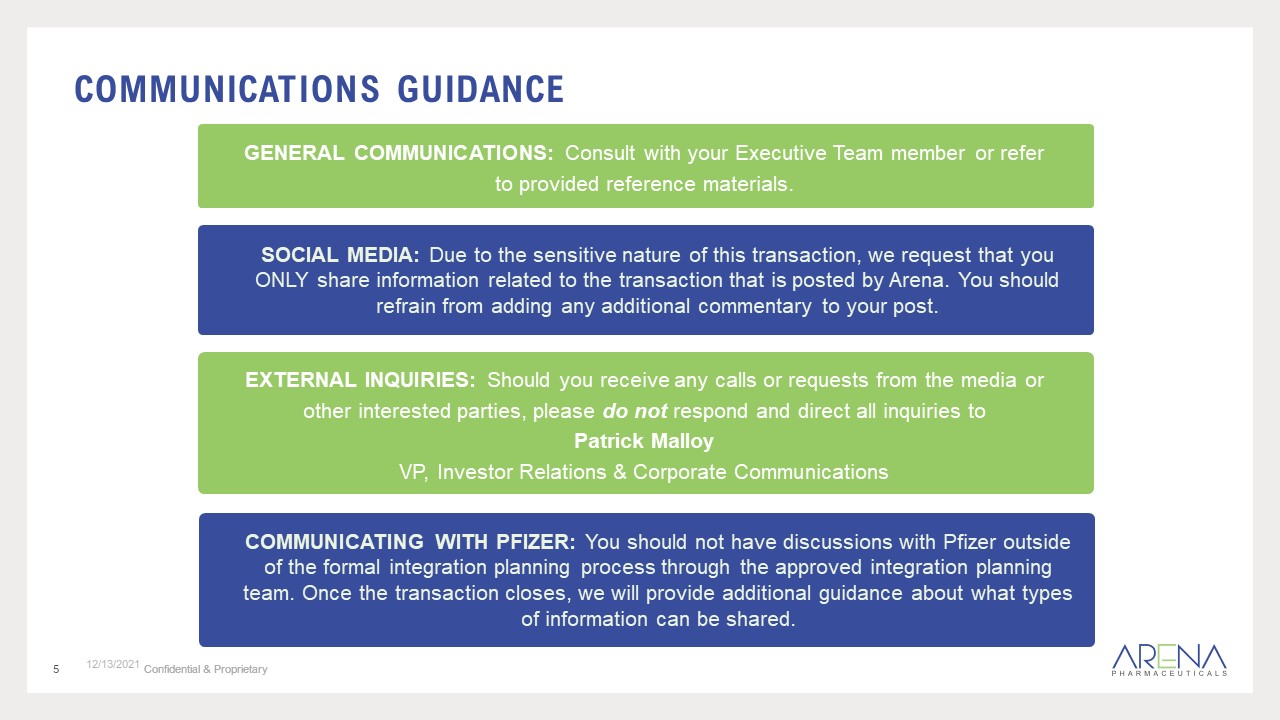

This is a critically important time for our company, and it is essential that we speak with one voice. Should you receive any calls or requests from the media or other interested parties, please do not respond and direct all inquiries to Patrick Malloy, VP Investor Relations & Corporate Communications.

The next few months will be a learning journey for all of us. Thank you for your continued commitment to Arena, to the critical work we are doing, and to the patients we serve. This merger is possible due in no small part to the hard work and dedication of this team, and I am incredibly proud of the company we’ve built together.

Sincerely,

Amit

Cautionary Statement Regarding Forward-Looking Statements

This communication and any documents referred to in this communication contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Pfizer and Arena, including, but not limited to, statements regarding the expected benefits of the proposed transaction and the anticipated timing of the proposed transaction, strategies, objectives and the products and markets of each company. These forward-looking statements generally are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Arena and the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (iv) the effect of the announcement or pendency of the proposed transaction on Arena’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of Arena or Pfizer and potential difficulties in Arena employee retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from Arena’s ongoing business operations, and (vii) the outcome of any legal proceedings that may be instituted against Pfizer or against Arena related to the Merger Agreement or the proposed transaction. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic (and related variants) impacts Arena’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Pfizer and Arena described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arena assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Arena gives no assurance that it will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, Arena will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Arena’s stockholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Arena with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Arena’s stockholder meeting to approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Arena’s proxy statement. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, on Arena’s website at https://invest.arenapharm.com or by contacting Arena Investor Relations at (858) 453-7200.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Arena and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Arena’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov and by going to Arena’s website at https://invest.arenapharm.com.

The following slides were used at an all employee meeting held on December 13, 2021:

Pfizer acquisition announcement December 13, 2021 1

Disclosure Cautionary Statement Regarding Forward-Looking StatementsThis communication and any documents referred to in this communication contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Pfizer and Arena, including, but not limited to, statements regarding the expected benefits of the proposed transaction and the anticipated timing of the proposed transaction, strategies, objectives and the products and markets of each company. These forward-looking statements generally are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Arena and the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (iv) the effect of the announcement or pendency of the proposed transaction on Arena’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of Arena or Pfizer and potential difficulties in Arena employee retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from Arena’s ongoing business operations, and (vii) the outcome of any legal proceedings that may be instituted against Pfizer or against Arena related to the Merger Agreement or the proposed transaction. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic (and related variants) impacts Arena’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Pfizer and Arena described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arena assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Arena gives no assurance that it will achieve its expectations.Additional Information and Where to Find ItIn connection with the proposed transaction, Arena will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Arena’s stockholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Arena with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Arena’s stockholder meeting to approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Arena’s proxy statement. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, on Arena’s website at https://invest.arenapharm.com or by contacting Arena Investor Relations at (858) 453-7200.No Offer or SolicitationThis communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.Participants in the SolicitationArena and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Arena’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov and by going to Arena’s website at https://invest.arenapharm.com. 12/12/2021 2

Today’s announcement Pfizer and Arena have entered into a definitive agreement under which Pfizer will acquire Arena.We are targeting the first half of 2022 for close of the transaction, subject to regulatory approvals and other conditions.Pfizer was interested in Arena in recognition of the promise and value of our robust therapeutic pipeline and the alignment of this pipeline with Pfizer’s areas of expertise.Pfizer’s global reach and scale will accelerate our mission to deliver our important medicines to patients. An integration team will be announced in the next few weeks that will include members from both Pfizer and Arena.There will be an integration planning period over the next several months, during which many decisions will be finalized. We will continue to operate business as usual during this time, and we will implement a regular cadence of communication to keep you informed.It is imperative that we continue to deliver on our commitments to patients and execute our clinical studies and trials flawlessly. 12/12/2021 3

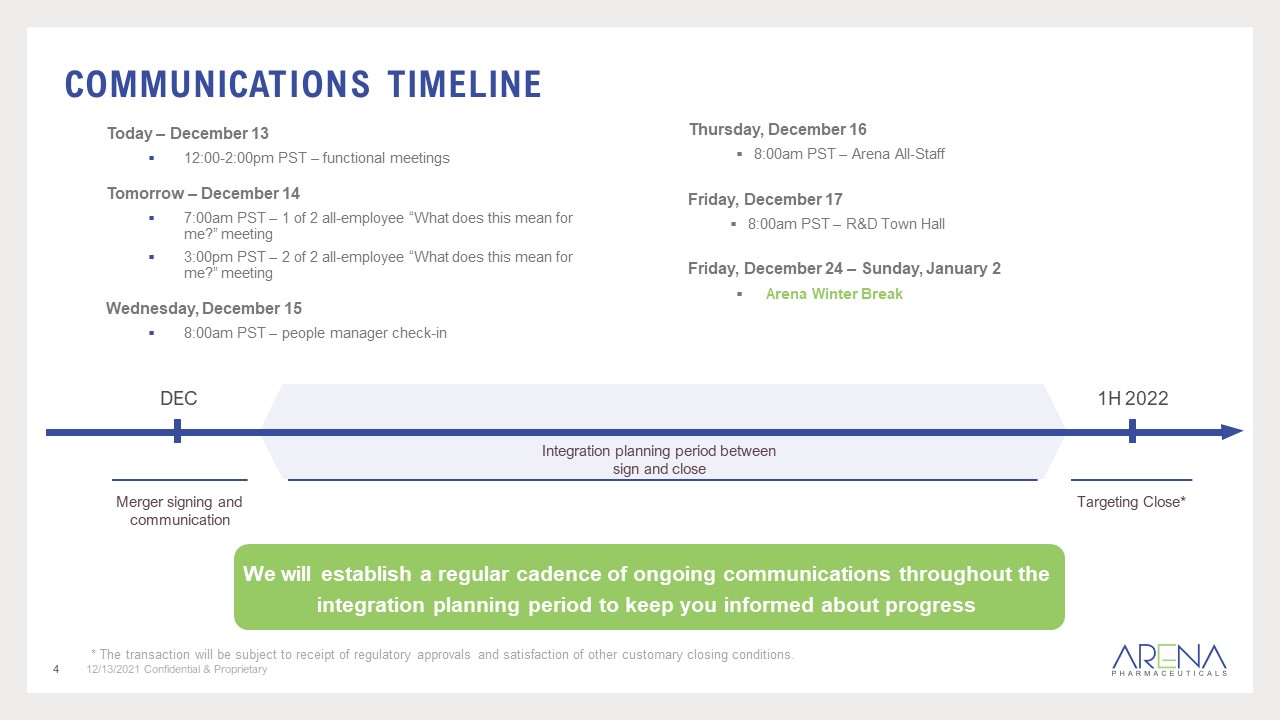

Communications timeline 12/12/2021 4 DEC 1H 2022 Targeting Close* Integration planning period between sign and close Merger signing and communication Today – December 1312:00-2:00pm PST – functional meetingsTomorrow – December 147:00am PST – 1 of 2 all-employee “What does this mean for me?” meeting3:00pm PST – 2 of 2 all-employee “What does this mean for me?” meetingWednesday, December 158:00am PST – people manager check-in Thursday, December 168:00am PST – Arena All-StaffFriday, December 178:00am PST – R&D Town HallFriday, December 24 – Sunday, January 2 Arena Winter Break We will establish a regular cadence of ongoing communications throughout the integration planning period to keep you informed about progress * The transaction will be subject to receipt of regulatory approvals and satisfaction of other customary closing conditions.

5 12/12/2021 SOCIAL MEDIA: Due to the sensitive nature of this transaction, we request that you ONLY share information related to the transaction that is posted by Arena. You should refrain from adding any additional commentary to your post. Communications GUIDANCE EXTERNAL INQUIRIES: Should you receive any calls or requests from the media or other interested parties, please do not respond and direct all inquiries to Patrick MalloyVP, Investor Relations & Corporate Communications GENERAL COMMUNICATIONS: Consult with your Executive Team member or refer to provided reference materials. COMMUNICATING WITH PFIZER: You should not have discussions with Pfizer outside of the formal integration planning process through the approved integration planning team. Once the transaction closes, we will provide additional guidance about what types of information can be shared.

6 12/12/2021 All questions regarding the merger can be sent to the email below. We will engage the appropriate individuals to provide you with an answer. questions@arenapharm.com

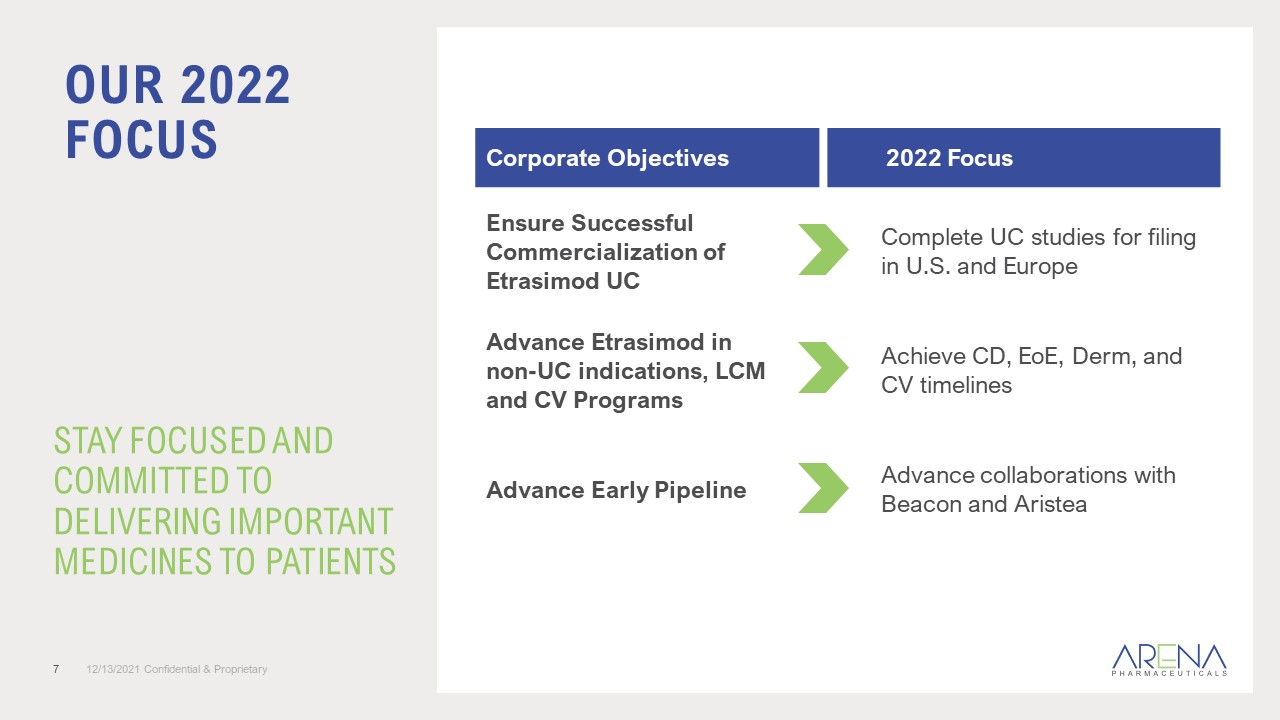

Our 2022 focus Stay focused and committed to delivering important medicines to patients 7 12/12/2021 Corporate Objectives 2022 Focus Ensure Successful Commercialization of Etrasimod UC Complete UC studies for filing in U.S. and Europe Advance Etrasimod in non-UC indications, LCM and CV Programs Achieve CD, EoE, Derm, and CV timelines Advance Early Pipeline Advance collaborations with Beacon and Aristea

Cautionary Statement Regarding Forward-Looking Statements

This communication and any documents referred to in this communication contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Parent and Arena, including, but not limited to, statements regarding the expected benefits of the proposed transaction and the anticipated timing of the proposed transaction, strategies, objectives and the products and markets of each company. These forward-looking statements generally are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Arena and the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (iv) the effect of the announcement or pendency of the proposed transaction on Arena’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of Arena or Parent and potential difficulties in Arena employee retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from Arena’s ongoing business operations, and (vii) the outcome of any legal proceedings that may be instituted against Parent or against Arena related to the Merger Agreement or the proposed transaction. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic (and related variants) impacts Arena’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Parent and Arena described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arena assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Arena gives no assurance that it will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, Arena will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Arena’s stockholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Arena with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Arena’s stockholder meeting to approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Arena’s proxy statement. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, on Arena’s website at https://invest.arenapharm.com or by contacting Arena Investor Relations at (858) 453-7200.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Arena and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Arena’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov and by going to Arena’s website at https://invest.arenapharm.com.

The following email was sent to the Company’s Investors on December 13, 2021:

From: Patrick Malloy

Sent: Monday, December 13, 2021 5:29 AM

To: Patrick Malloy (***@arenapharm.com) <***@arenapharm.com>

Cc: Sara Doran <***@arenapharm.com>

Subject: Arena Pharmaceuticals Announces Proposed Acquisition by Pfizer

Dear Investor Community,

Today we announced that Arena Pharmaceuticals, Inc. (Nasdaq: ARNA) has entered into an agreement to be acquired by Pfizer Inc. (NYSE: PFE) for $100 per share, which represents an equity value for the entire company of approximately $6.7 billion on a fully-diluted basis.

The proposed transaction is targeted to close in the first half of 2022, subject to receipt of regulatory approvals and satisfaction of other customary closing conditions. Arena will continue to enroll studies and drive forward on our stated timelines.

A press release with transaction information can be found here.

The proposed acquisition allows us to utilize Pfizer’s established infrastructure across global markets and expertise in Inflammation and Immunology, as well as Cardiology, to accelerate and advance Arena’s pipeline. We believe this transaction represents the best next step for the company and will potentially allow us to more rapidly address unmet need for a broader number of patients with inflammatory and cardiovascular diseases.

Thank you for your continued support towards delivering important medicines to patients.

Sincerely,

Pat

Cautionary Statement Regarding Forward-Looking Statements

This communication and any documents referred to in this communication contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Pfizer and Arena, including, but not limited to, statements regarding the expected benefits of the proposed transaction and the anticipated timing of the proposed transaction, strategies, objectives and the products and markets of each company. These forward-looking statements generally are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Arena and the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (iv) the effect of the announcement or pendency of the proposed transaction on Arena’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of Arena or Pfizer and potential difficulties in Arena employee retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from Arena’s ongoing business operations, and (vii) the outcome of any legal proceedings that may be instituted against Pfizer or against Arena related to the Merger Agreement or the proposed transaction. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic (and related variants) impacts Arena’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Pfizer and Arena described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arena assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Arena gives no assurance that it will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, Arena will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Arena’s stockholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Arena with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Arena’s stockholder meeting to approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Arena’s proxy statement. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, on Arena’s website at https://invest.arenapharm.com or by contacting Arena Investor Relations at (858) 453-7200.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Arena and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Arena’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov and by going to Arena’s website at https://invest.arenapharm.com.

| Patrick Malloy Vice President, Investor Relations & Corporate Communications 6154 Nancy Ridge Drive, San Diego, CA 92121 MOBILE: +1.***.***.**** ***@arenapharm.com |

The information contained in this message may be confidential, privileged, and protected from disclosure. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by email or telephone and destroy all copies of the original message. To learn more about how we collect and use personal information, please review our privacy statement and privacy notices for residents of EEA, UK, Switzerland, and California. Thank you.

The following FAQ was posted on the Company’s website on December 13, 2021:

Frequently Asked Questions

What role will your executive team have after the proposed acquisition closes?

We will provide more details on matters such as this as we move through this process.

What is the status of your ongoing programs? Are they still on track?

Our ongoing programs remain on track, and we remain committed to executing on the timelines for each of our clinical and non-clinical programs.

What is the premium?

The $100 per share acquisition price represents an equity value for the entire company of approximately $6.7 billion on a fully-diluted basis.

Can you provide any color on the timing of the acquisition agreement? Why now?

Our proxy statement, which will be filed with the SEC, will include details on the Board’s considerations.

When and how did discussions between Pfizer and Arena begin? How long did this process take?

Please refer to our proxy statement, when available.

Was it a competitive process? How many bidders were involved?

Please refer to our proxy statement, when available.

What is the integration strategy?

In the lead up to the closing of the transaction, we will discuss the best working model going forward and ensure the smooth integration of our programs into Pfizer’s development portfolio following closing.

When will stockholder vote take place?

The stockholder vote is expected to take place as soon as practicable. The consummation of the proposed acquisition is subject to various conditions including but not limited to the receipt of regulatory approvals, and other customary closing conditions.

When will you file with the Federal Trade Commission for Hart-Scott-Rodino (HSR)? When do you expect clearance and do you anticipate any significant pushback on HSR?

Further details will be available in our proxy statement, which will be filed with the SEC. The proposed transaction is subject to customary closing conditions, including receipt of regulatory approvals and approval by Arena stockholders.

When do you expect to file the proxy statement forms?

Under the terms of the merger agreement, the proxy statement is required to be filed within ten business days following the signing of the agreement.

When do you expect the transaction to close?

The proposed transaction is subject to customary closing conditions, including receipt of regulatory approvals and approval by Arena stockholders.

Cautionary Statement Regarding Forward-Looking Statements

This communication and any documents referred to in this communication contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Pfizer and Arena, including, but not limited to, statements regarding the expected benefits of the proposed transaction and the anticipated timing of the proposed transaction, strategies, objectives and the products and markets of each company. These forward-looking

statements generally are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will

be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Arena and the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the

Merger Agreement, (iv) the effect of the announcement or pendency of the proposed transaction on Arena’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of Arena or Pfizer and potential difficulties in Arena employee retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from Arena’s ongoing business operations, and (vii) the outcome of any legal proceedings that may be instituted against Pfizer or against Arena related to the Merger Agreement or the proposed transaction. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic (and related variants) impacts Arena’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Pfizer and Arena described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arena assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Arena gives no assurance that it will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, Arena will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Arena’s stockholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Arena with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Arena’s stockholder meeting to approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Arena’s proxy statement. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, on Arena’s website at https://invest.arenapharm.com or by contacting Arena Investor Relations at (858) 453-7200.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Arena and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Arena’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov and by going to Arena’s website at https://invest.arenapharm.com.

The following post was posted on LinkedIn by the Company on December 13, 2021:

Today, Arena Pharmaceuticals, Inc. and Pfizer Inc. announced that we have entered into a definitive agreement under which Pfizer will acquire Arena. Learn more in our joint press release: https://lnkd.in/eycs3_g #ArenaPharm #ARNA https://lnkd.in/d4vFBZH4

The following post was posted on Twitter by the Company on December 13, 2021:

Today, Arena Pharmaceuticals, Inc. and Pfizer Inc. announced that we have entered into a definitive agreement under which Pfizer will acquire Arena. Learn more in our joint press release: https://invest.arenapharm.com/press-releases #ArenaPharm #ARNA https:// https://www.arenapharm.com/media/cozlwdba/legend.pdf

The following email was sent to the Company’s Partners & Vendors on December 13, 2021:

From: Notices

Sent: Monday, December 13, 2021 2:55 PM

To: ***@***

Subject: Arena Pharmaceuticals Announces Proposed Acquisition by Pfizer

Dear Arena Partners & Vendors,

As you are a valued and trusted partner of Arena Pharmaceuticals, we are providing you with an important update on our company. On Sunday, December 12, 2021, we entered an agreement to be acquired by Pfizer.

The proposed acquisition allows us to utilize Pfizer’s established infrastructure across global markets and expertise in Inflammation and Immunology, as well as Cardiology, to accelerate and advance Arena’s pipeline. We believe this transaction represents the best next step for the company and will potentially allow us to more rapidly address unmet need for a broader number of patients with inflammatory and cardiovascular diseases.

The proposed transaction is subject to customary closing conditions, including receipt of regulatory approvals and approval by Arena stockholders. We are committed to executing a smooth transition.

Between now and the closing date, operations at Arena will not change. We do not expect changes to your relationship with Arena and your contacts will remain the same. Arena will continue to enroll studies and drive forward on our stated timelines.

Thank you for your contributions to date, which have helped us reach this milestone. The combination of Arena and Pfizer gives us an exciting opportunity to advance our mission to deliver important medicines to patients, and we look forward to continuing our work together.

Feel free to share this information with your teams. Information can also be found on our webpage at www.arenapharm.com/acquisition.

Sincerely,

Laurie Stelzer

Executive Vice President and Chief Financial Officer

Arena Pharmaceuticals, Inc.

Cautionary Statement Regarding Forward-Looking Statements

This communication and any documents referred to in this communication contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Pfizer and Arena, including, but not limited to, statements regarding the expected benefits of the proposed transaction and the anticipated timing of the proposed transaction, strategies, objectives and the products and markets of each company. These forward-looking statements generally are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Arena and the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (iv) the effect of the announcement or pendency of the proposed transaction on Arena’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of Arena or Pfizer and potential difficulties in Arena employee retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from Arena’s ongoing business operations, and (vii) the outcome of any legal proceedings that may be instituted against Pfizer or against Arena related to the Merger Agreement or the proposed transaction. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic (and related variants) impacts Arena’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Pfizer and Arena described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arena assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Arena gives no assurance that it will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, Arena will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Arena’s stockholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Arena with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Arena’s stockholder meeting to approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Arena’s proxy statement. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, on Arena’s website at https://invest.arenapharm.com or by contacting Arena Investor Relations at (858) 453-7200.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Arena and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Arena’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov and by going to Arena’s website at https://invest.arenapharm.com.

The information contained in this message may be confidential, privileged, and protected from disclosure. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by email or telephone and destroy all copies of the original message. To learn more about how we collect and use personal information, please review our privacy statement and privacy notices for residents of EEA, UK, Switzerland, and California. Thank you.

The following email was sent to the Company’s Investigators on December 13, 2021:

From: Notices <***@arenapharm.com>

Sent: Monday, December 13, 2021 2:48 PM

To: ***@***

Subject: Arena Pharmaceuticals Announces Proposed Acquisition by Pfizer

***

***

Protocol Number: ***, ***

Dear Sir or Madam,

Arena Pharmaceuticals is focused on delivering important medicines to patients and we’re grateful that you have joined us on our journey to date. We are excited to share that Arena Pharmaceuticals has entered into an agreement to be acquired by Pfizer. A press release with transaction information can be found here.

The proposed acquisition allows us to utilize Pfizer’s established infrastructure across global markets and expertise in Inflammation and Immunology, as well as Cardiology, to accelerate and advance Arena’s pipeline. We believe this transaction represents the best next step for the company and will potentially allow us to more rapidly address unmet need for a broader number of patients with inflammatory and cardiovascular diseases.

The proposed transaction is subject to customary closing conditions, including receipt of regulatory approvals and approval by Arena stockholders. We are committed to executing a smooth transition. Between now and the closing date, operations at Arena will not change. We do not expect changes to your relationship with Arena and your contacts will remain the same. Arena will continue to enroll studies and drive forward on our stated timelines. Thank you for the strong partnership that we have with both you and your site as we make this transition with the highest professional standards.

Feel free to share this information with your teams. See our FAQ below and please contact your Arena Clinical Trial Manager if you have any additional questions. Information can also be found on our webpage at www.arenapharm.com/acquisition.

Sincerely,

Paul Streck

Senior Vice President, Clinical Development and Chief Medical Officer

Arena Pharmaceuticals, Inc.

Investigator Frequently Asked Questions:

Q: Will the study contact(s) for my trial change?

A: No. For the current time, all contacts will remain the same. If these change in the future, we will provide notification.

Q: May I share any information or documents related to Arena clinical trials with Pfizer or their CROs?

A: All documents should not be shared with anyone outside of Arena or our current designated CRO until further notice, which will occur following the closing of the transaction.

Q: Should I respond to any direct communications received from Pfizer about Arena or Arena’s clinical trials?

A: If you receive any questions or requests from Pfizer, their CROs or other representatives, do not respond and please notify Arena immediately.

Q: Will the clinical trial agreement between my site and Arena be amended or assigned to Pfizer?

A: Not at this time.

Q: Should I continue to maintain my record keeping and investigational drug retention responsibilities for this study?

A: Yes, nothing changes in terms of current trial conduct.

Q: If I have a pertinent financial disclosure update to make (e.g., equity interest, etc.) due to this announcement, should I inform Arena?

A: At this time, you should not change any processes you’re currently using to report financial disclosures with respect to Arena.

Q: Will my CRO change?

A: No, the current CRO that is running your trial will remain during the transition of Sponsorship.

Q: Will I be paid for the work performed?

A: Yes, all contracts will remain in effect and follow the same payment schedules.

Q: Will the sponsor of my study be changing from Arena to Pfizer?

A: The current relationship that Arena has with FDA or any other Health Authority is not impacted by this announcement. Specific details related to regulatory operations will be further informed following the closing of the transaction with Pfizer.

Q: As an investigator in an Arena-sponsored study, will I have to change the way I report safety-related events observed in the study?

A: No. You should not change any processes you’re currently using to report safety-related events.

Q: Do I need to inform my local Ethics Committee of this announcement?

A: Until the closing of the transaction, it is not necessary to inform your local EC. We will update you on appropriate communication when the transition occurs.

Cautionary Statement Regarding Forward-Looking Statements

This communication and any documents referred to in this communication contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Pfizer and Arena, including, but not limited to, statements regarding the expected benefits of the proposed transaction and the anticipated timing of the proposed transaction, strategies, objectives and the products and markets of each company. These forward-looking statements generally are identified by the words “believe,” “predict,” “target,” “contemplate,” “potential,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “could,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, (ii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Arena and the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (iv) the effect of the announcement or pendency of the proposed transaction on Arena’s business relationships, operating results, and business generally, (v) risks that the proposed transaction disrupts current plans and operations of Arena or Pfizer and potential difficulties in Arena employee retention as a result of the proposed transaction, (vi) risks related to diverting management’s attention from Arena’s ongoing business operations, and (vii) the outcome of any legal proceedings that may be instituted against Pfizer or against Arena related to the Merger Agreement or the proposed transaction. The risks and uncertainties may be amplified by the COVID-19 pandemic (and related variants), which has caused significant economic uncertainty. The extent to which the COVID-19 pandemic (and related variants) impacts Arena’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, which are unpredictable, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Pfizer and Arena described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Arena assumes no obligation to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law. Arena gives no assurance that it will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, Arena will be filing documents with the SEC, including preliminary and definitive proxy statements relating to the proposed transaction. The definitive proxy statement will be mailed to Arena’s stockholders in connection with the proposed transaction. This communication is not a substitute for the proxy statement or any other document that may be filed by Arena with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any vote in respect of resolutions to be proposed at Arena’s stockholder meeting to approve the proposed transaction or other responses in relation to the proposed transaction should be made only on the basis of the information contained in Arena’s proxy statement. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, on Arena’s website at https://invest.arenapharm.com or by contacting Arena Investor Relations at (858) 453-7200.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

Arena and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Arena’s directors and executive officers in the proposed transaction will be included in the proxy statement described above. These documents are available free of charge at the SEC’s web site at www.sec.gov and by going to Arena’s website at https://invest.arenapharm.com.

The information contained in this message may be confidential, privileged, and protected from disclosure. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by email or telephone and destroy all copies of the original message. To learn more about how we collect and use personal information, please review our privacy statement and privacy notices for residents of EEA, UK, Switzerland, and California. Thank you.