UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For The Fiscal Year Ended December 31, 2006

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For The Transition Period From______ to ______

Commission File No. 0-25681

(exact name of registrant specified in its charter)

Florida | | 65-0423422 |

(State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | |

11760 U.S. Highway One, Suite 200

North Palm Beach, Florida 33408

(Address of principal executive offices) (zip code)

Registrant's telephone number, including area code: (561) 630-2400

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par Value | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. Large accelerated filer o Accelerated filer x Non-accelerated filer o

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) oYes x No

The aggregate market value of the voting common equity held by non-affiliates of the registrant, based on the average of the closing bid and ask quotations for the Common Stock on June 30, 2006 as reported by the Nasdaq National Market was approximately $311,862,000. As of February 28, 2007, the registrant had outstanding 18,269,924 shares of Common Stock.

Documents Incorporated By Reference

Portions of the registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held on June 20, 2007, are incorporated by reference in Part III.

TABLE OF CONTENTS

| | | | | PAGE |

Part I | | | | |

| | | | | |

Item 1. | | Business | | 5 |

| Item 1A. | | Risk Factors | | 11 |

| Item 1B. | | Unresolved Staff Comments | | 15 |

| Item 2. | | Properties | | 15 |

| Item 3. | | Legal Proceedings | | 16 |

| Item 4. | | Submission of Matters to a Vote of Security Holders | | 16 |

| | | | | |

Part II | | | | |

| | | | | |

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchase of | | |

| | | Equity Securities | | 16 |

| Item 6. | | Selected Financial Data | | 17 |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 34 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 35 |

| Item 8. | | Financial Statements and Supplementary Data | | 57 |

| Item 9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | | 57 |

| Item 9A. | | Controls and Procedures | | 57 |

| Item 9B. | | Other Information | | 59 |

| | | | | |

Part III | | | | |

| | | | | |

| Item 10. | | Directors, Executive Officers and Corporate Governance | | 59 |

| Item 11. | | Executive Compensation | | 59 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 59 |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 59 |

| Item 14. | | Principal Accounting Fees and Services | | 59 |

| | | | | |

Part IV | | | | |

| | | | | |

| Item 15. | | Exhibits, Financial Statement Schedules | | 59 |

| | | | | |

| Signatures | | | | 62 |

| Exhibits | | | | 63 |

Introductory Note

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements about our beliefs, plans, objectives, goals, expectations, estimates and intentions that are subject to significant risks and uncertainties and are subject to change based on various factors, many of which are beyond our control. The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,” “goal,” and similar expressions are intended to identify forward-looking statements. All forward-looking statements, by their nature, are subject to risks and uncertainties. Our actual future results may differ materially from those set forth in our forward-looking statements. Our ability to achieve our financial objectives could be adversely affected by the factors discussed in detail in Part I, Item 1A. “Risk Factors” and Part II, Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K, as well as:

· | the willingness of our advertisers to advertise on our web sites; |

| | |

· | interest rate volatility; |

| | |

· | our ability to establish and maintain distribution arrangements; |

| | |

· | our ability to integrate the business and operations of companies that we have acquired, and those we may acquire in the future; |

| | |

· | our ability to realize expected benefits, including synergies, of companies that we have acquired, and those that we may acquire in the future; |

| | |

| · | our ability to maintain the confidence of our advertisers by detecting click-through fraud and unscrupulous advertisers; |

| | |

· | our need and our ability to incur additional debt or equity financing; |

| | |

· | the effect of unexpected liabilities we assume from our acquisitions; |

| | |

· | the impact of resolution of lawsuits to which we are a party; |

| | |

· | the willingness of consumers to accept the Internet as a medium for obtaining financial product information; |

| | |

· | the ability of consumers to access our websites through non-PC devices; |

| | |

· | increased competition and its effect on our web site traffic, advertising rates, margins, and market share; |

| | |

· | our ability to manage traffic on our web sites and service interruptions; |

| | |

· | our ability to protect our intellectual property; |

| | |

· | the effects of facing liability for content on our web sites; |

| | |

· | legislative or regulatory changes; |

| | |

· | the concentration of ownership of our common stock; |

| | |

· | the fluctuations of our results of operations from period to period; |

| | |

· | the strength of the United States economy in general; |

| | |

· | the accuracy of our financial statement estimates and assumptions; |

| | |

· | effect of changes in the stock market and other capital markets; |

| | |

· | technological changes; |

| | |

· | changes in monetary and fiscal policies of the U.S. Government; |

| | |

· | changes in consumer spending and saving habits; |

| | |

· | changes in accounting principles, policies, practices or guidelines; |

| | |

· | the effect of provisions in our Articles of Incorporation, Bylaws, and certain laws on change-in-control transactions; |

| | |

· | other risks described from time to time in our filings with the Securities and Exchange Commission; and |

| | |

· | our ability to manage the risks involved in the foregoing. |

However, other factors besides those referenced could adversely affect our results, and you should not consider any such list of factors to be a complete set of all potential risks or uncertainties. Any forward-looking statements made by us herein speak as of the date of this Annual Report. We do not undertake to update any forward-looking statement, except as required by law.

PART I

Item 1. Business

Overview

Bankrate, Inc. and subsidiaries (the "Company", "Bankrate", "we", "us", "our") own and operate an Internet-based consumer banking marketplace. Our flagship web site, Bankrate.com, is one of the web's leading aggregators of information on more than 300 financial products and fees, including mortgages, credit cards, automobile loans, money market accounts, certificates of deposit, checking and ATM fees, home equity loans and online banking fees. We also own and operate Interest.com, a smaller, yet similar site, FastFind.com, an Internet-based lead aggregation firm, and Bankrate Print, which produces newspaper-based advertising and editorial products. Additionally, we provide financial applications and information to a network of distribution partners and national, regional, and local publications. We provide the tools and information that can help consumers make better financial decisions. We regularly survey more than 4,800 financial institutions in more than 575 markets in all 50 states in order to provide the most current objective, unbiased information. Hundreds of print and online partner publications depend on us as their trusted source for financial rates and information.

Bankrate was founded approximately 30 years ago as a print publisher of the newsletter Bank Rate Monitor. From 1976 through 1996, our principal business was the publication of print newsletters, the syndication of unbiased editorial bank and credit product research to newspapers and magazines and advertising sales of the Mortgage and Deposit Guide, a newspaper-advertising table consisting of product and rate information from local mortgage companies and financial institutions. The company that we operate today was incorporated in the State of Florida in 1993.

In 1996, we began our online operations by placing our editorially unbiased research on our web site, Bankrate.com. By offering our information online, we created new revenue opportunities through the sale of graphical and hyperlink advertising associated with our rate and yield tables. In fiscal 1997, we implemented a strategy to concentrate on building these online operations.

Today, we operate in two reportable business segments: online publishing and print publishing and licensing. The online publishing segment generally includes the online operations of the Bankrate Network, which includes Bankrate.com, Interest.com, Mortgage-calc.com, and Bankrate Select, the new partnership involving our FastFind operations and Lending Tree. Our rate tables provide, at no cost to the consumer, a detailed list of lenders by market and include relevant details to help consumers compare loan products. We continue to enhance our offerings in order to provide Bankrate.com users with the most complete experience. Features such as financial calculators and e-mail newsletters allow users to interact with our site. Our Rate Trend Index is a weekly poll of industry insiders designed to help consumers forecast interest rate trends. In addition, our offerings include channels on investing, taxes, college finances, financial advice and insurance. Each channel offers a unique look at its particular topic. For example. Bankrate.com users can read advice and tips from the Tax channel, obtain business ideas from the Small Business channel and ask a financial expert a question in the Advice channel.

We operate a traditional media business on the Internet. We have a high quality, poised-to-transact audience that we educate and is ready to do business with our advertisers. Bankrate.com is one of the leading web sites for financial information and advice according to comScore Media Metrix.

Our print publishing and licensing segment includes our traditional print publications and syndicated editorial content in more than 150 newspapers and three national magazines. Today, the Mortgage and Deposit Guide. The Mortgage and Deposit Guide is a weekly newspaper-advertising table consisting of product and rate information from local mortgage companies and financial institutions. The Mortgage and Deposit Guide appears weekly in approximately 500 U.S. metropolitan newspapers with combined single day circulation in excess of 40 million copies, and a television version. In addition to serving as a revenue source, our print publications also increase our exposure, serve as branding opportunities for our web site, and absorb part of the costs of producing our research and original editorial content.

For further discussion of our two reportable business segments, see Management's Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations and Critical Accounting Policies, and Note 8 to the Financial Statements elsewhere in this Form 10-K.

We believe that the recognition of our research as a leading source of independent, objective information on banking and credit products is essential to our success. As a result, we have sought to maximize distribution of our research to gain brand recognition as a research authority. We are seeking to build greater brand awareness of our web site and to reach a greater number of online users.

Our efforts during the past several years have been focused on developing Bankrate.com into the leading destination site for consumer banking and personal finance information. The key drivers of our business are the number of advertisers on our online network, the number of "page views," and the number of consumers visiting our web sites. Since 2001 the number of advertisers on our web sites has grown from approximately 320 to over 390 and annual page views have grown from 237 million to 487 million.

Additionally, we have broadened the focus of our financial products research from 100 financial products in 155 markets in 2001 to more than 300 financial products in approximately 575 markets today. Our marketing efforts to generate traffic have evolved from primarily non-cash intensive programs such as sweepstakes and promotions into today's key word search engine advertising campaigns. In 2001 we syndicated our editorial content and research to 97 newspapers compared to today's 153 newspapers.

As a result of these efforts we were able to take advantage of several acquisition opportunities in 2005 and 2006. On November 30, 2005, we acquired Wescoco, LLC (“FastFind”) and on December 1, 2005, we acquired Mortgage Market Information Services, Inc. and Interest.com (collectively, “MMIS/Interest.com”). FastFind, an Internet lead aggregator based in San Francisco, California was purchased for $10.1 million in cash. MMIS/Interest.com, which publishes Mortgage and Deposit Guides in over 300 newspapers and operates Interest.com, a web site which publishes financial rates and information connecting consumers with lenders, was acquired for $30 million in cash, subject to post-closing adjustments.

In August 2006, we completed the acquisition of a group of assets that consists of three web sites (Mortgage-calc.com, Mortgagecalc.com, and Mortgagemath.com) owned and operated by East West Mortgage, Inc. for $4.4 million in cash. The operations of the three web sites were integrated into our online publishing segment.

In 2007, we are focusing on:

| · | Optimizing our cost per thousand impressions (“CPMs”) and cost per clicks (“CPCs”) on the Bankrate Network - Bankrate.com, Interest.com, Mortgage-calc.com, and FastFind. |

| · | Enhancing search engine marketing and keyword buying to drive targeted impressions into the Bankrate Network. |

| · | Re-launching FastFind with the new name “Bankrate Select” through a partnership with Lending Tree to gain access to a well-established lender network, which we anticipate will better monetize the leads we generate. |

| · | Expanding our co-brand and affiliate footprint. |

| · | Selling advertising for our Deposit rate tables to be placed in our 500+ newspaper network. |

Our Opportunity

We believe many financial services customers are relatively uninformed with respect to financial products and services and often rely upon personal relationships when choosing such products and services. It is our belief that many of these products and services are not well explained, and viable, equivalent alternatives typically are not presented when marketed to consumers through traditional media. As the sale of many of these products and services moves to the Internet, consumers seek new sources of independent objective information such as Bankrate.com to facilitate and support their buying decisions. The interactive nature of the Internet allows us to display extensive research on financial products and services that was previously unavailable to consumers.

According to a 2004 survey conducted by the Board of Governors of the U.S. Federal Reserve, the percentage of U.S. families that own certain financial instruments was as follows:

| | Transaction Accounts | | CDs | | Stocks | | Loan secured by primary residence | | Installment loans | | Credit card balances | | Any debt | |

| | | 91.3 | | | 12.7 | | | 20.7 | | | 47.9 | | | 46.0 | | | 46.2 | | | 76.4 | |

We believe the majority of financial information available on the Internet is oriented toward investment advice and providing business news and stock market information, rather than personal and consumer finance information, advice and interest rate data. Our efforts are targeted to fulfill the slightly less competitive, but equally important niches of consumer banking and personal finance information. As a result, we believe we can maintain a loyal base of users comprised of targeted audiences that are attractive to advertisers.

We have seen steady interest in our primary niches - mortgages, automobile loans, home equity loans and CD/savings products. Our ability to provide a platform for frictionless communication between consumers and businesses has not changed. We believe that we are well-positioned to benefit from growth in the Internet personal finance advertising market.

Strategy

We believe that the consumer banking and personal finance sectors hold significant opportunities for growth and expansion. As we grow, we are seeking to consolidate our position as the industry leader in the gathering of rate data and to expand our brand recognition with consumers and partners. Elements of our strategy include:

| · | Continuing to provide advertisers with high-quality, ready-to-transact consumers: By advertising on our online network, either through purchasing graphic ads or hyperlinks banks, brokers and other advertisers are tapping into our strongest resource, consumers on the verge of engaging in a high-value transaction. By allowing advertisers to efficiently access these “in-market” consumers, we are helping advertisers lower their own costs of acquiring new customers, and ultimately creating a transaction that is beneficial for the advertiser, the consumer and us. |

| · | Remaining the dominant brand in consumer personal finance data and content: We are continuing our strong push to remain the dominant player in our market. We believe that we are the leader in our market using based on a number of metrics, including revenue, the number of financial institutions surveyed, the number of pages viewed by consumers and the number of unique visitors each month. |

| · | Continuing growth through partnering with top web sites: Our partner network provides our online network with a steady stream of visitors, with little to no up-front payment risk to us. As the bulksubstantially all of these agreements are revenue-sharing, we only pay our partners a percentage of the revenue earned. We will also explore initiatives to expand the breadth and depth of our product offerings and services by partnering in the real estate, insurance, auto finance, sub-prime lending and college lending areas. |

Distribution Arrangements

Our distribution (or syndication) arrangements with other web site operators fall into two categories: (1) co-branding, in which we establish a "co-branded" site with another web site operator, and (2) licensing, in which we provide content to the other operator's web site together with a hyperlink to Bankrate.com. Historically, co-branding has been more effective in driving traffic to our online network than licensing

Co-branded sites are created pursuant to agreements with other web site operators. Generally, agreements relating to co-branded sites provide for us to host the co-branded web pages, sell and serve the graphic advertising, and collect advertising revenues, which are shared with the third party web site.

Under licensing arrangements, we provide limited content to other web sites in exchange for a fee. The content identifies Bankrate.com as its source and typically includes a hyperlink to the Bankrate.com web site.

Our largest partners in terms of driving traffic to our online network, as of December 31, 2006, included America Online, Yahoo!, CNN, MSN, Internet Broadcasting System, Dollar Stretcher and USA Today. During 2006, approximately 12% of the traffic to Bankrate.com was attributable to the distribution partners compared to 14% in 2005 and 20% in 2004. The decline results primarily from the heightened consumer awareness of our site, resulting in more traffic coming directly to Bankrate.com. We expect traffic from distribution partners to continue to be approximately 10% to 15% of total site traffic in 2007.

Financial Product Research

Our research staff tracks comparative information on more than 300 financial products and services, including checking accounts, consumer loans, lines of credit, mortgages, certificates of deposit, savings accounts, credit cards, money market accounts and online accounts. We estimate that over 3,000,000 items of data are gathered each week for approximately 575 markets across the United States from over 4,800 financial institutions. The information obtained includes not only interest rates and yields, but also related data such as lock periods, fees, points, and loan sizes for mortgages, and grace periods, late penalties, cash advance fees, cash advance annual percentage rates, annual percentage yields, minimum payments, and terms and conditions of credit cards.

We adhere to a strict methodology in developing our markets and our institutional survey group. The market survey includes the 100 largest U.S. markets, as defined by the U.S. Census Bureau's Metropolitan Statistical Area categories and FDIC Market Report. Along with the largest markets, the surveys include secondary markets and other selected communities that represent areas of high growth.

In most instances, institutions in the survey group include the largest banks and thrifts within each market area based on total deposits. The number of institutions tracked within a given market is based on the types of financial products available and number of institutions in the market area. In each of the largest 25 markets, we track at least 10 institutions. In each of the smaller markets, we track three or more institutions. We verify and adjust, if necessary, the institutions included in the survey group on an annual basis using FDIC deposit data from year-end call reports. We do not include credit unions in the market survey group because product availability is based upon membership. However, we track the 50 largest U.S. credit unions as a separate survey group for comparison purposes.

All products included in our database have narrowly defined criteria so that information provided by institutions is comparable. The quality control process then includes several visual checks and proofing by different staff members to ensure that the data inputs are accurate. Our quality control staff reviews each listing in relation to regional and national trends and for overall accuracy and consistency fees and related information prior to disclosure of the information to consumers. The staff also reviews the comparability of products, institutional accuracy and survey accuracy. In addition, the quality control team performs anonymous shopping on a daily basis, whereby we place calls to institutions in order to validate the data in a consumer setting. Institutions providing invalid data are contacted by our quality control staff to ensure that future information will be accurate.

The criteria for product listings consist of specific attributes, such as loan size and term that are used to define each type of financial instrument in order to ensure uniformity in the products that are compared. Institutions listed in our Bankrate.com online tables that purchase hyperlinks to their own sites or purchase other advertising must comply with the same criteria for product listings that apply to other institutions or the advertisements will be removed.

We are aware of the potential conflict of interest resulting from the sale of advertising to financial institutions while providing independent and objective research. However, we believe that no potential conflicts of interest have ever compromised our ability to provide independent and objective research, and we are committed to continue to provide such research in the future.

Editorial Content

In addition to our research department, as of December 31, 2006, we maintained an editorial staff of 19 editors, writers, researchers, technical producers and designers who create original content, research studies and decision tools for our online network. We also have relationships with more than 30 freelance journalists. The reporters and editors of our online network have extensive combined media experience in newspaper, magazine, new media and or broadcast with a combined average of 18 years' experience in journalism. We believe the quality of our original content plays a critical role in attracting visitors to our Web siteonline network and to our co-branded partners’ web sites.

Most of the content within our online network is original and produced internally. There is a very limited amount of third-party content, acquired under advertising revenue-sharing agreements or licenses, which allows us to incorporate relevant information on our Bankrate Network that would otherwise require additional resources to produce. An example of this type of arrangement is the incorporation in Bankrate.com of currency conversion functionality from OANDA.com, a comprehensive provider of foreign exchange and currency trading information services.

Print Publications

We continue to produce traditional print publications to absorb part of the cost of producing research and original editorial content. Additionally, we believe that print publishing activities contribute to greater exposure and branding opportunities for our web site. Our print publications activities include the following:

| · | Mortgage Guide: We generate revenue through the sale of mortgage rate and product listings in over 500 newspapers across the United States with combined daily circulation of more than 40 million copies. We enter into agreements with the newspapers for blocks of print space, which is in turn sold to mortgage lenders and we share the revenue with the newspapers on a percentage basis. |

| · | Deposit Guide: We generate revenue through the sale of Deposit rate and product listings in 13 newspapers across the United States with combined daily circulation of more than 2 million copies. We enter into agreements with the newspapers for blocks of print space, which is in turn sold to financial institutions and we share the revenue with the newspapers on a percentage basis. |

| · | Syndication of Editorial Content and Research: We syndicate editorial research to 153 newspapers, which have a combined Sunday circulation of more than 29 million copies, and three national magazines with combined monthly circulation in excess of 3 million copies. |

| · | Newsletters: We publish three newsletters: 100 Highest Yields and Jumbo Flash Report, which target individual consumers, and Bank Rate Monitor, which targets an institutional audience. These newsletters provide bank deposit, loan and mortgage interest rate information with minimal editorial content. |

In 2006, we launched a new product, our Free Standing Insert program. We create a free standing publication with our original editorial content that is inserted into a newspaper. We then sell sponsorship of the free standing publication to an advertiser. Although this product is expensive to produce, we expect this product to increase net income slightly. We believe our Free Standing Insert program is beneficial to us because it further increases our visibility in the marketplace.

For the fiscal years ended December 31, 2006, 2005 and 2004, the percentage of total revenue generated by Mortgage and Deposit Guide advertising was 18%, 10% and 11%, respectively.

Consumer Marketing

Our primary marketing expenditures are for key word cost-per-click advertising campaigns on Internet search engines. Through the end of 2005, we also entered into barter transactions (our exchange of advertising space on our online network for reciprocal advertising space on other web sites) to promote our brand and generate traffic to our online network. We actively conduct earned media public relations campaigns to promote our editorial content and personnel to the consumer and trade media. Bankrate spokespersons are routinely featured in newspapers, magazines and in broadcast media, and are promoted to and are featured as expert commentators on, major broadcast and cable news programs and talk radio. In 2006, Bankrate experts were quoted or we were referenced in over 1,100 media exposures. Our spokespersons were featured in 112 television interviews, including The Today Show, CBS’ The Early Show, The Fox Cable Network, MSNBC, CNBC, and CNN; 772 print articles, including The New York Times, The Wall Street Journal and USA Today; and about 225 interviews on numerous talk radio broadcasts. Finally, we produce “The Bankrate.com Personal Finance Minute” which is distributed to XM radio and selected terrestrial radio stations throughout the U.S.

Bankrate.com’s home page and other key pages of our online network routinely rank at or near the top of major search engines' natural (unpaid) listings for highly coveted key words and phrases related to banking products, and we generate significant traffic and revenue from such placements. The high rankings are largely a result of our success at creating highly relevant, widely read content, and because our personnel stay abreast of and use various search engine optimization techniques.

Bankrate Select

In early 2007 we will re-launch the FastFind lead generation business as Bankrate Select through a partnership with Lending Tree. We will gain access to a well established lender network, which we believe will better and more fully monetize the leads we generate. We believe visitors to our online network value and trust the Bankrate brand and we expect that the click and conversion rates should improve with the implementation of Bankrate Select.

Advertising Sales

The sales team focuses on selling online and offline advertising to national, regional and local advertisers. The sales staff focuses on three segments of the financial industry: lending (mortgage, home equity and auto loans), banking (CDs, MMAs and credit cards) and general personal finance (college loans, taxes and IRAs). We have three sales regions with offices in each region: East (New York City), Midwest (Chicago), and West (San Francisco and Orange County). Each salesperson is responsible for a designated geographic region of the United States. They are paid based on their individual performance within their territory.

The sales team is responsible for selling all of our products including graphic advertising on Bankrate.com, Mortgage-calc.com and Interest.com, hyperlink listings on the Bankrate rate tables, rate table listings in the Mortgage and Deposit Guides and mortgage leads from Bankrate Select. We believe this approach enhances the value for advertisers and direct marketers by (1) alleviating the need to purchase advertising from numerous vendors, (2) providing advertisers and direct marketers the opportunity to optimize their marketing dollars between four different products, (3) offering integrated marketing packages that meet the strategic needs of our customers, and (4) providing access to in-market consumers who are ready to act. Advertisers and direct marketers can enhance the effectiveness of their campaigns by customizing advertising delivery on our networks within a particular content channel, geographically or across an entire network.

For the fiscal years ended December 31, 2006, 2005 and 2004, the percentage of total revenue generated by graphic advertising was 47%, 56% and 50%, respectively. For the fiscal years ended December 31, 2006, 2005 and 2004, the percentage of total revenue generated by hyperlink advertising was 34%, 32% and 37%, respectively.

Our advertisers can target prospective customers using several different approaches:

| · | Focusing on consumers in specific situations, such as those who are first-time home buyers, or those actively shopping for home equity loans. |

| · | Targeting specific geographic and product areas; for example, CD shoppers in Georgia; or just one of these - all consumers interested in CDs, or all consumers from Georgia. |

| · | General rotation throughout our network. |

Graphic Advertising

Our most common graphic advertisement sizes are leader boards (728 x 90 pixels) and banners (486 x 60 pixels), which are prominently displayed at the top or bottom of a page, skyscrapers (160x600 or 120x600 pixels) posters (330 x 275 pixels), and islands (250 x 250 pixels). We offer these advertisements which can be targeted to specific areas of our network, or on a general rotation basis. Advertising rates may vary depending upon the product areas targeted (home equity has a higher CPM than auto), geo-targeting (a 15% premium for targeting advertisements to a specific state), the quantity of advertisements purchased by an advertiser, and the length of time an advertiser runs an advertisement on our network. Discounts may be available based upon the volume of advertisements purchased.

Posters are oversized advertisements that contain more information than traditional banner advertisements. We position posters on certain pages so that they dominate the page. In addition, we offer product special issues that are available for single sponsorships. Rates for product special issues are based on expected impression levels and additional content requirements.

Providing effective tools for managing advertising campaigns is essential to maintaining advertising relationships. We use a state-of-the-art program under license from a third-party that allows our advertisers to monitor their spending on our web sites in real-time for impressions received and click-through ratios generated. We also allow third-parties to serve our customers’ advertisements, such as DoubleClick.

Hyperlinks

Financial institutions that are listed in our rate tables have the opportunity to hyperlink their listings. By clicking on the hyperlink, users are taken to the institution's web site. Prior to October 1, 2005, hyperlinks were sold under a flat dollar fee per month contracts that ranged primarily between three and twelve months.

Our hyperlinks were converted to a “cost-per-click” or CPC pricing model on October 1, 2005. Under this arrangement, advertisers pay Bankrate a specific, pre-determined cost each time a consumer clicks on that advertiser’s hyperlink or phone icon (usually found under the advertiser’s name in the rate table listings). All clicks are screened for fraudulent characteristics by an independent thirdparty vendor and then charged to the advertiser’s account.

We also sell text links on our rate pages to advertisers on a CPC basis. Advertisers enter an auction bidding process on a thirdparty web site for placement of their text link based on the amount they are willing to pay for each click through to their web site. We recognize revenue monthly for each text link based on the number of clicks at the CPC contracted for during the auction bidding process.

Behavioral Targeting

In the fourth quarter of 2006, we launched a behavioral targeting initiative with two partners who manage two distinct advertising networks. Behavioral targeting allows us to identify consumers who come to the Bankrate Network, track them on an anonymous basis, and then serve them targeted ads when they are on websites on one of the two partner’s networks. We believe that this initiative can increase the number of advertisements that we serve, however, this initiative is too new to determine its impact on our operations.

Advertisers

We market to local advertisers targeting a specific audience in a city or state and also to national advertisers targeting the entire country. As of December 31, 2006, we had 61 graphic advertisers and 349 hyperlink advertisers, some of which are both graphic and hyperlink advertisers. Among our larger advertisers are E-Loan, Inc., Citibank, Amerisave Mortgage, ING Direct, Bank of America and HSBC. No sales to any one customer in either our online publishing or print publishing and licensing segment exceeded 10% of total revenue for the periods presented.

Competition

We compete for advertising revenues across the broad category of personal finance information, both in traditional media such as newspapers, magazines, radio, and television, and in the developing market for online financial information. There are many competitors that have substantially greater resources than we do. Our online and print competition includes the following:

| · | Personal finance sections of general interest web sites such as Yahoo! Finance, AOL Money & Finance and MSN Money; |

| · | Personal finance destination sites such as The Motley Fool, MarketWatch, SmartMoney.com, Kiplinger.com and CNNMoney.com; |

| · | E-commerce oriented sites that include banking and credit products such as LendingTree; |

| · | Lead aggregators such as LowerMyBills, iHomeowners and NexTag; |

| · | Print mortgage table sellers like National Financial News Service; |

| · | Rate listing web sites, such as Realtor.com/Move.com, Informa Research Services and Loans.com/CarsDirect; and |

| · | Key word CPC advertising sites/networks such as Google, Yahoo! Search Marketing, and Ask.com. |

Competition in the online publishing segment is generally directed at growing users and revenue using marketing and promotion to increase traffic to web sites. We believe that our original content, focus and objective product information differentiate us from our competitors. We believe that the market for our print publishing and licensing segment is highly concentrated, and following our acquisition of MMIS, we believe that we are the dominant player in this market.

Seasonality

We believe our online publishing segment in terms of page views is not generally susceptible to seasonality. As brand awareness continues to strengthen for the Bankrate Network, we believe our quarterly page views will become more consistent with a possible decline in the fourth quarter due to the holiday season. However, in 2006, page views in the fourth quarter were 120.6 million, 17.3 million, or 17%, higher than the third quarter in 2006, and 22.9 million, or 24%, higher than the fourth quarter of 2005. See Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations for a further discussion of our traffic and page views.

Operations

We currently operate our online network and supporting systems on servers at a secure third-party co-location facility in Atlanta, Georgia. This third-party facility is manned, and our infrastructure and network connectivity are monitored continuously, on a 24 hours a day, 365 days a year basis. In March 2006, we also added a presence at a similar data center in Denver, Colorado. The additional data center primarily operates systems related to our web sites other than Bankrate.com. The additional data center is also key to our business continuity strategy, providing additional recovery options if either data center should suffer a major outage. These facilities are powered continuously from multiple sources, including uninterruptible power supplies and emergency power generators. The facilities are connected to the Internet with redundant high-speed data lines. The systems at each data center are protected by a multi-layered security system including multiple firewalls at each data center. To provide maximum scalability, many of our high-traffic web pages are served from an independent content distribution network. Multi-node clusters or multiple load shared systems are used for most key functions, including web serving, ad serving, and SQL databases. The vast majority of the information presented on our web sites, including backend databases that provide the raw information, is stored and delivered via such multi-node or multi-system configurations from one of the co-location facilities.

All of our systems are controlled and updated remotely via encrypted virtual private network (“VPN”) links to our operating locations. The technical services team, based in North Palm Beach, Florida has established extensive monitoring of all key systems, originating from multiple locations and methodologies, to provide continuous real-time response capability should key systems or network connections fail. Much of the content on our various web sites is prepared on systems located in the secure server room in our North Palm Beach location, then transferred at scheduled intervals via the VPN to the systems at the co-location facilities. The North Palm Beach facility systems are also powered redundantly by uninterruptible power supply units. In the event that North Palm Beach or any other location is temporarily unavailable, temporary access is established from alternative locations to provide continuity for key operations and content updates.

Proprietary Rights

Our proprietary intellectual property includes our unique research and editorial content, our web sites, our URL’s, and our print publications. We rely primarily on a combination of copyrights, trademarks, trade secret laws, our user policy and restrictions on disclosure to protect this content. In addition, we license some of our data and content from other parties. Our copyrights, trademarks and licenses expire at various dates, and none is individually significant. Because of the nature of our business, we believe that both of our operating segments rely equally on our proprietary intellectual property.

Employees

As of December 31, 2006, we had 163 full-time employees. We have never had a work stoppage and none of our employees are represented under collective bargaining agreements. We consider our employee relations to be favorable.

Financial Information About Geographic Areas

The advertising customers that we contract with to generate our revenue are located within the United States.

Available Information

For further discussion concerning our business, see the information included in Items 7 (Management’s Discussion and Analysis of Financial Condition and results of Operations) and 8 (Financial Statements and Supplementary Data) of this report.

We make available, free of charge through our web site at www.bankrate.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports, if applicable, filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after the material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). The information posted on our web site is not incorporated into this Annual Report on Form 10-K.

Item 1A. Risk Factors

You should consider carefully the following risk factors before deciding whether to invest in our common stock. Our business, including our operating results and financial condition, could be harmed by any of these risks. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing these risks you should also refer to the other information contained in our filings with the SEC, including our financial statements and related notes.

Risks Related to Our Business

Our Success Depends on Internet Advertising Revenue

We expect to derive approximately 83% of our revenue in the foreseeable future through the sale of advertising space and hyperlinks on our Internet web pages. Any factors that limit the amount advertisers are willing to spend on advertising on our web sites could have a material adverse effect on our business. These factors may include:

| · | a lack of standards for measuring web site traffic or effectiveness of web site advertising; |

| · | a lack of established pricing models for Internet advertising; |

| · | the failure of traditional media advertisers to adopt Internet advertising; |

| · | the introduction of alternative advertising sources; and |

| · | a lack of significant growth in web site traffic. |

Continuing to demonstrate the effectiveness of advertising on our web sites is critical to our ability to generate advertising revenue. Currently, there are no widely accepted standards to measure the effectiveness of Internet advertising, and we cannot be certain that such standards will develop sufficiently to support our growth through Internet advertising.

A number of different pricing models are used to sell advertising on the Internet. Pricing models are typically either CPM-based (cost per thousand impressions) or performance-based. We utilize the CPM-based model, which is based upon the number of advertisement impressions, and the performance-based, or cost-per-click (“CPC”), model, which generates revenue based on each individual click on a particular advertisement. We cannot predict which pricing model, if any, will emerge as the industry standard. Therefore, it is difficult for us to project our future advertising rates and revenues. For instance, banner advertising, which is one of our primary sources of online revenue, may not be an effective advertising method in the future. If we are unable to adapt to new forms of Internet advertising and pricing models, our business could be adversely affected.

Financial services companies account for a majority of our advertising revenues. We will need to sell advertising to customers outside of the financial services industry in order to significantly increase our revenues. If we do not attract advertisers from other industries, revenue growth could be adversely affected.

Our Success Depends on Interest Rate Volatility

We provide interest rate information for mortgages and other loans, credit cards and savings accounts. Visitor traffic to our web sites tends to increase with interest rate movements and decrease with interest rate stability. Factors that have caused significant visitor fluctuations in the past have been Federal Reserve Board actions and general market conditions affecting home mortgage interest rates. Additionally, the level of traffic to our web sites can be dependent on interest rate levels as well as mortgage re-financing activity. Accordingly, a slowdown in mortgage production volumes could have a material adverse effect on our business.

We believe that as we continue to develop our web sites with broader personal finance topics, the percentage of overall traffic seeking mortgage information will remain stabilized at current levels. To accelerate the growth of traffic to our web sites, we are working with our syndication partners to program more intensively, and we are aggressively promoting products not related to mortgage activity. If we are otherwise unable to increase or maintain traffic to areas of our web sites other than mortgage information, we will be more dependant on interest rate levels and mortgage refinancing activity.

We May Expand our Operations Through Acquisitions, Which Could Divert Management’s Attention and Expose Us to Unanticipated Costs and Liabilities and We May Experience Difficulties Integrating the Acquired Operations, and We May Incur Costs Relating to Potential Acquisitions that are Never Consummated

Our business plan could include growth through future acquisitions. For example, in late 2005, we acquired FastFind and MMIS/Interest.com, and in 2006 we acquired Mortgagecalc.com. However, our ability to consummate any future acquisitions on terms that are favorable to us may be limited by the number of attractive acquisition targets, internal demands on our resources and our ability to obtain financing. Our success in integrating newly acquired businesses will depend upon our ability to retain key personnel, avoid diversion of management’s attention from operational matters, and integrate the technical operations and personnel of the acquired company. In addition, future acquisitions could result in the incurrence of additional debt, costs and contingent liabilities or the dilution of our stockholders’ ownership through issuance of additional stock. Integration of acquired operations may take longer, or be more costly or disruptive to our business, than originally anticipated. It is also possible that expected synergies from future acquisitions may not materialize. We may also incur costs and divert management attention as regards potential acquisitions that are never consummated.

Although we undertake a due diligence investigation of each business that we acquire, there may be liabilities of the acquired companies that we fail to or are unable to discover during the due diligence investigation and for which we, as a successor owner, may be responsible. In connection with acquisitions, we generally seek to minimize the impact of these types of potential liabilities through indemnities and warranties from the seller, which may in some instances be supported by deferring payment of a portion of the purchase price. However, these indemnities and warranties, if obtained, may not fully cover the liabilities due to limitations in scope, amount or duration, financial limitations of the indemnitor or warrantor or other reasons.

The Expected Benefits of Our Recent Acquisition of FastFind, Including Expected Synergies, May Not Be Realized

Our FastFind operations, which we acquired in November 2005, have not performed as originally expected and we have been unable to monetize the FastFind assets as we had planned. Although we have developed a strategy to develop FastFind into a successful lead generation business, there is no assurance that we will be able to realize the revenue opportunities available in the lead aggregator business. Furthermore, our strategy for FastFind requires us to continue to incur costs and expenses to, among other things, increase traffic for FastFind and develop more significant relationships with key financial institutions. However, there can be no assurance that sufficient revenue will ever be derived from FastFind to substantiate these costs or that we will ever receive an acceptable return on our investment in FastFind.

If We Fail to Detect Click-through Fraud or Unscrupulous Advertisers, We Could Lose the Confidence of our Advertisers, Thereby Causing our Business to Suffer

We are exposed to the risk of fraudulent clicks on our ads by persons seeking to increase the advertising fees paid to us. Clickthrough fraud occurs when a person clicks on an ad displayed on our Web site in order to generate revenue to us and to increase the cost for the advertiser. If we were unable to detect this fraudulent activity and find new evidence of past fraudulent clicks, we may have to issue refunds retroactively of amounts previously paid to us. In addition, if fraudulent clicks are not detected, the affected advertisers may experience a reduced return on their investment in our advertising programs because the fraudulent clicks would not lead to potential revenue for the advertisers.

We are also exposed to the risk that advertisers who advertise on our Web site will advertise interest rates on a variety of financial products that they do not intend to honor. Such “bait and switch” activity encourages consumers to contact fraudulent advertisers over legitimate advertisers because the fraudulent advertisers claim to offer a better interest rate.

Both “bait and switch” and click-through fraud would negatively affect our profitability, and could hurt our reputation and our brand. This could lead the advertisers to become dissatisfied with our advertising programs, which could lead to loss of advertisers and revenue.

More Individuals are Utilizing Non-PC Devices to Access the Internet, and our Online Network May Not be Accepted by Such Users.

The number of individuals who access the Internet through devices other than a personal computer, such as personal digital assistants and mobile telephones, has increased dramatically. Our online network was designed for rich, graphic environments such as those available on desktop and laptop computers. The lower resolution, functionality and memory associated with alternative devices currently available may make access of our online network through such devices difficult. If consumers find our online network difficult to access through alternative devices, we may fail to capture a sufficient share of an increasingly important portion of the market for online services and may fail to attract both advertisers and web traffic.

Adverse Resolution of Litigation May Harm Our Operating Results or Financial Condition

We are party to lawsuits in the normal course of business. Litigation can be expensive, lengthy and disruptive to normal business operations. Moreover, the results of complex legal proceedings are difficult to predict. An unfavorable resolution of a particular lawsuit could have a material adverse effect on our business, operating results, or financial condition. For additional information regarding certain of the lawsuits in which we are involved, see Item 3, "Legal Proceedings."

Our Success Depends on Establishing and Maintaining Distribution Arrangements

Our business strategy includes the distribution of our content through the establishment of co-branded web pages with hightraffic business and personal finance sections of online services and web sites. A co-branded site is typically a custom version of our web site with the graphical look, feel, and navigation, of the co-branded partner’s web site. Providing access to these co-branded web pages is a significant part of the value we offer to our advertisers. We compete with other Internet content providers to maintain our current relationships with other web site operators and establish new relationships. In addition, as we expand our personal finance content, some of these web site operators may perceive us as a competitor. As a result, they may be unwilling to promote distribution of our banking and credit content. If our distribution arrangements do not attract a sufficient number of users to support our current advertising model, or if we do not establish and maintain distribution arrangements on favorable economic terms, our business could be adversely affected.

Risks Related to Our Industry, the Internet and Our Technology Infrastructure

Our Future Success is Dependent Upon Increased Acceptance of the Internet by Consumers as a Medium for Obtaining Financial Product Information

Our success will depend in large part on continued and expanded widespread consumer acceptance of obtaining rate information regarding financial products such as mortgages, credit cards, money market accounts, certificates of deposit, checking and ATM fees, home equity loans, online banking fees and new and used auto loans online. The level of consumer use of the Internet to provide for their personal finance needs is subject to uncertainty. The development of an online market for obtaining rate information regarding the above listed financial products is rapidly evolving and likely will be characterized by an increasing number of market entrants. If consumer acceptance of the Internet as a source for such information does not increase, we may not be able to compete effectively with traditional methods of obtaining such rate information and our business, results of operations and financial condition will be adversely affected.

Our Markets Are Highly Competitive

We compete for Internet advertising revenues with the personal finance sections of general interest sites such as Yahoo! Finance, AOL Money & Finance, and MSN Money; personal finance destination sites such as The Motley Fool, MarketWatch, SmartMoney.com, Kiplinger.com and CNNMoney.com; e-commerce oriented sites that include banking and credit products such as LendingTree; lead aggregators such as LowerMyBills, iHomeowners and NexTag; print mortgage table sellers like National Financial News Service; rate listing sites such as Realtor.com/Move.com, Informa Research Services and Loan.com/CarsDirect; and key word cost-per-click advertising sites/networks such as Google, Yahoo! Search Marketing and Ask.com. In addition, new competitors may enter this market as there are few barriers to entry. Many of our existing competitors, as well as a number of potential new competitors, have longer operating histories, greater name recognition, larger customer bases and significantly greater financial, technical and marketing resources than us. Many competitors have complementary products or services that drive traffic to their web sites. Increased competition could result in lower web site traffic, advertising rate reductions, reduced margins or loss of market share, any of which would adversely affect our business. We cannot be certain that we will be able to compete successfully against current or future competitors.

Our Web Sites May Encounter Technical Problems and Service Interruptions

In the past, our web sites have experienced significant increases in traffic in response to interest rate movements and other business or financial news events. The number of our users has continued to increase over time, and we are seeking to further increase our user base. As a result, our Internet servers must accommodate spikes in demand for our web pages in addition to potential significant growth in traffic.

Our web sites have in the past, and may in the future, experience slower response times or interruptions as a result of increased traffic or other reasons. These delays and interruptions resulting from failure to maintain Internet service connections to our site could frustrate users and reduce our future web site traffic, which could have a material adverse effect on our business.

All of our communications and network equipment is located at our corporate headquarters in North Palm Beach, Florida and/or at secure third-party co-locations facilities in Atlanta, Georgia and Denver, Colorado. Multiple system failures involving these locations could lead to interruptions or delays in service for our web sites, which could have a material adverse effect on our business. Our operations are dependent upon our ability to protect our systems against damage from fires, hurricanes, earthquakes, power losses, telecommunications failures, break-ins, computer viruses, hacker attacks and other events beyond our control.

We Rely on the Protection of Our Intellectual Property

Our intellectual property includes our unique research and editorial content of our web sites, our URL's, and print publications. We rely on a combination of copyrights, trademarks, trade secret laws and our user policy and restrictions on disclosure to protect our intellectual property. We also enter into confidentiality agreements with our employees and consultants and seek to control access to and distribution of our proprietary information. Despite these precautions, it may be possible for other parties to copy or otherwise obtain and use the content of our web sites or print publications without authorization. A failure to protect our intellectual property in a meaningful manner could have a material adverse effect on our business.

Because we license some of our data and content from other parties, we may be exposed to infringement actions, if such parties do not possess the necessary proprietary rights. Generally, we obtain representations as to the origin and ownership of licensed content and obtain indemnification to cover any breach of any these representations. However, these representations may not be accurate and the indemnification may not be sufficient to provide adequate compensation for any breach of these representations.

Any future infringement or other claims or prosecutions related to our intellectual property could have a material adverse effect on our business. Defending against any of these claims, with or without merit, could be time-consuming, result in costly litigation and diversion of technical and management personnel or require us to introduce new content or trademarks, develop new technology or enter into royalty or licensing agreements. These royalty or licensing agreements, if required, may not be available on acceptable terms, if at all.

We May Face Liability for Information on Our Web Sites

Much of the information published on our web sites relates to the competitiveness of financial institutions’ rates, products and services. We may be subjected to claims for defamation, negligence, copyright or trademark infringement or other theories relating to the information we publish on our web sites. These types of claims have been brought, sometimes successfully, against providers of online services as well as print publications. Our insurance may not adequately protect us against these types of claims.

We May Face Liability for, and may be Subject to Claims Related to, Inaccurate Advertising Content Provided to Us

Much of the information on our web sites that is provided by advertisers and collected from third parties relates to the rates, costs and features for various loan, depositary, personal credit and investment products offered by financial institutions, mortgage companies, investment companies, insurance companies and others participating in the consumer financial marketplace. We are exposed to the risk that some advertisers may provide us, or directly post on our web sites, (i) inaccurate information about their product rates, costs and features, or (ii) rates, costs and features that are not available to all consumers. This could cause consumers to lose confidence in the information provided by advertisers on our web sites, cause certain advertisers to become dissatisfied with our web sites, and result in lawsuits being filed against us. Our insurance may not adequately protect us against these types of lawsuits.

Future Government Regulation of the Internet is Uncertain and Subject to Change

As Internet commerce continues to evolve, increasing regulation by federal or state agencies or foreign governments may occur. Such regulation is likely in the areas of user privacy, pricing, content and quality of products and services. Additionally, taxation of Internet use or electronic commerce transactions may be imposed. Any regulation imposing fees for Internet use or electronic commerce transactions could result in a decline in the use of the Internet and the viability of Internet commerce, which could have a material adverse effect on our business.

We May Be Limited or Restricted in the Way We Establish and Maintain Our Online Relationships by Laws Generally Applicable to Our Business, or We may be Required to Obtain Certain Licenses

State and federal lending laws and regulations generally require the accurate disclosure of the critical components of credit costs so that consumers can readily compare credit terms from various lenders. In addition, these laws and regulations impose certain restrictions on the advertisement of these credit terms. Because we are an aggregator of rate and other information regarding many financial products online, we may be subject to some of these laws and regulations. We believe that we have structured our web sites to comply with these laws and regulations. However, if these laws and regulations are changed, or if new laws or regulations are enacted, these events could prohibit or substantially alter the content we provide on our web sites. Moreover, such events could materially and adversely affect our business, results of operations and financial condition.

We are also required to obtain licenses from various states to conduct parts of our business. In the case of FastFind, many states require licenses to solicit, broker or make loans secured by residential mortgages and other consumer loans to residents of those states. No assurances can be given that any of the licenses or rights currently held by us will not be revoked prior to, or will be renewed upon, their expiration. In addition, no assurances can be given that we will be granted new licenses or rights for which we may be required to apply from time to time in the future. Furthermore, because the licensing laws of each state change frequently and are difficult to determine their applicability, we may unknowingly operate FastFind without a required license.

Risks Related to Corporate Control and Our Stock Price

Our Ownership is Heavily Concentrated

At December 31, 2006, approximately 30% of our outstanding common stock was beneficially owned by our officers and directors, including Peter C. Morse, a director and our largest shareholder, who beneficially owned approximately 26% of our outstanding common stock. As a result, our officers and directors, if acting together, may be able to exercise significant influence over matters requiring shareholder approval, including the election of our directors significant corporate transactions. This influence could be used to prevent or significantly delay another company or person from acquiring or merging with us, and could inhibit our liquidity and affect trading in our common stock.

Our Articles Of Incorporation, Bylaws, and Certain Laws And Regulations May Prevent or Delay Transactions You Might Favor, Including a Sale or Merger of Us.

Provisions of our Articles of Incorporation, Bylaws, certain laws and regulations and various other factors may make it more difficult and expensive for companies or persons to acquire control of us without the consent of our Board of Directors. It is possible, however, that you would want a takeover attempt to succeed because, for example, a potential buyer could offer a premium over the then prevailing price of our common stock.

For example, our Articles of Incorporation permit our Board of Directors to issue preferred stock without stockholder action. The ability to issue preferred stock could discourage a company from attempting to obtain control of us by means of a tender offer, merger, proxy contest or otherwise. Additionally, our Articles of Incorporation and Bylaws divide our Board of Directors into three classes, as nearly equal in size as possible, with staggered three-year terms. One class is elected each year. The classification of our Board of Directors could make it more difficult for a company to acquire control of us. We are also subject to certain provisions of the Florida Business Corporation Act and our Articles of Incorporation that relate to business combinations with interested stockholders. Other provisions in our Articles of Incorporation or Bylaws that may discourage takeover attempts or make them more difficult include:

| § | Supermajority voting requirements to remove a director from office; |

| § | Provisions regarding the timing and content of stockholder proposals and nominations; |

| § | Supermajority voting requirements to amend Articles of Incorporation; and |

| § | Absence of cumulative voting. |

Our Results of Operations May Fluctuate Significantly

Our results of operations are difficult to predict and may fluctuate significantly in the future as a result of several factors, many of which are beyond our control. These factors include:

| · | changes in fees paid by advertisers; |

| · | traffic levels on our web sites, which can fluctuate significantly; |

| · | changes in the demand for Internet products and services; |

| · | changes in fee or revenue-sharing arrangements with our distribution partners; |

| · | our ability to enter into or renew key distribution agreements; |

| · | the introduction of new Internet advertising services by us or our competitors; |

| · | changes in our capital or operating expenses; |

| · | changes in interest rates; |

| · | general economic conditions; and |

| · | changes in banking or other laws that could limit or eliminate content on our web sites. |

Our future revenue and results of operations are difficult to forecast due to these factors. As a result, we believe that period-to-period comparisons of our results of operations may not be meaningful, and you should not rely on past periods as indicators of future performance.

In future periods, our results of operations may fall below the expectations of securities analysts and investors, which could adversely affect the trading price of our common stock.

Our Stock Price May Continue to be Volatile

Our common stock has experienced substantial price volatility, particularly as a result of variations between our actual financial results and the published expectations of analysts. Furthermore, speculation in the press or investment community about our strategic position, financial condition, results of operations, business, or significant transactions can cause changes in our stock price. These factors, as well as general economic and political conditions, may materially adversely affect the market price of our common stock in the future.

Item 1B. Unresolved Staff Comments

We have received no written comments regarding our periodic or current reports from the staff of the Securities and Exchange Commission that were issued 180 days or more preceding the end of our 2006 fiscal year and that remain unresolved.

Item 2. Properties

Our principal administrative, sales, web operations, marketing and research functions are located in one leased facility in North Palm Beach, Florida. The lease is for approximately 20,935 square feet of office and expires on December 31, 2016. We entered into this lease on November 3, 2005. The initial lease term is for 10 years with an option to renew for one additional 5-year term.

We lease approximately 8,800 square feet in New York, New York, that is principally used for administration, sales and business development. The New York office lease expires on September 30, 2016. We also lease approximately 6,000 square feet in San Francisco, California, that is also used for administration, sales and business development. The San Francisco lease expires on February 28, 2009. We also lease approximately 4,872 square feet in Chicago, Illinois that is used for sales and business development, and a small facility in Sherman Oaks, California that is used as a sales office. The Chicago lease expires on November 30, 2008 and the Sherman Oaks lease is on a month-to month basis.

We believe that all of our facilities are adequate and suitable for operations in the foreseeable future. However, we may undertake the expansion of certain facilities from time to time in the ordinary course of business.

See Note 7 to the financial statements in Item 8 below for more information about our leased facilities.

Item 3. Legal Proceedings

On October 9, 2006, we entered into a Confidential Final Settlement Agreement and Mutual Release with American Interbanc Mortgage, LLC (“AI”) in settlement of the claims pending against us in the lawsuit filed in the Superior Court of California in March 2002. AI had originally filed suit against several of its competitors (but not us) who advertised on Bankrate.com alleging false advertising under the Lanham Act, common law unfair competition, and violations of certain sections of the California Business and Professional Code. AI later amended its complaint to include us as a defendant, alleging, in short, that we conspired with the co-defendants to allow the co-defendants to engage in false advertising on Bankrate.com while prohibiting AI to advertise on Bankrate.com. AI sought damages of at least $16.5 million, to have those damages tripled, and “reasonable attorneys fees pursuant to 15 U.S.C. Section 1117(b) and California Business and Professional Code Section 16750(a),” and costs.

Under the terms of the Settlement Agreement, we agreed to make a one-time cash payment of $3.0 million to AI and AI agreed to dismiss the lawsuit with no ability to reassert its claims against us. We have also agreed to certain terms and conditions that permit AI to advertise on Bankrate.com. We believe that all of AI’s claims against us were factually and legally without merit and did not admit to any wrongdoing as part of the settlement. The $3.0 million cash payment is included in the accompanying consolidated statement of income as legal settlement.

Item 4. Submission of Matters to a Vote of Security Holders

None.

PART II

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the NASDAQ Global Select Market under the stock symbol “RATE”.

The prices per share reflected in the table below represent, for the periods indicated, the range of highest and lowest closing prices for our common stock on the NASDAQ Global Select Market.

| | | HIGH | | LOW | |

| Year ended December 31, 2005 | | | | | | | |

| First quarter | | $ | 20.16 | | $ | 13.10 | |

| Second quarter | | | 20.14 | | | 12.41 | |

| Third quarter | | | 28.56 | | | 20.17 | |

| Fourth quarter | | | 34.01 | | | 23.95 | |

| Year ended December 31, 2006 | | | | | | | |

| First quarter | | $ | 43.56 | | $ | 28.91 | |

| Second quarter | | | 51.87 | | | 31.82 | |

| Third quarter | | | 38.39 | | | 26.45 | |

| Fourth quarter | | | 41.36 | | | 25.60 | |

The closing sale price of our common stock as reported by the NASDAQ Global Select Market on February 28, 2007 was $40.59 per share.

The number of shareholders of record of our common stock as of February 28, 2007, was 4,801.

We have never paid cash dividends on our capital stock. We currently intend to retain any earnings for use in our business and do not anticipate paying any cash dividends in the foreseeable future.

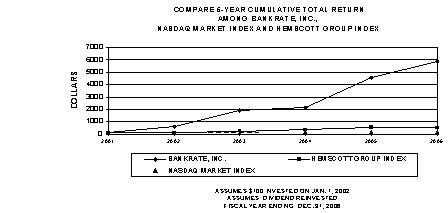

Stock Performance Graph

The following graph provides a comparison of the cumulative total stockholder return on our Common Stock for the period from December 31, 2001 through December 31, 2006, against the cumulative stockholder return during such period achieved by the NASDAQ Global Select Market Index for U.S. Companies (“Nasdaq Market Index”) and the Hemscott Internet Information Providers Index (“Hemscott Group Index”). The graph assumes that $100 was invested on December 31, 2001 in our Common Stock and in each of the comparison indices, and assumes reinvestment of dividends.

| | December 31, | | Bankrate, Inc. | | NASDAQ Market Index | | Hemscott Group Index | |

| | 2001 | | $ | 100 | | $ | 100 | | $ | 100 | |

| | 2002 | | | 592 | | | 70 | | | 84 | |

| | 2003 | | | 1,905 | | | 105 | | | 233 | |

| | 2004 | | | 2,131 | | | 114 | | | 340 | |

| | 2005 | | | 4,542 | | | 116 | | | 517 | |

| | 2006 | | | 5,838 | | | 128 | | | 505 | |

Item 6. Selected Financial Data

The selected financial data set forth below should be read in conjunction with the financial statements and notes thereto, and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this Form 10-K. The statement of income data for the years ended December 31, 2006, 2005 and 2004, and the balance sheet data as of December 31, 2006 and 2005, are derived from, and are qualified by reference to, the financial statements of Bankrate, Inc. included elsewhere in this Form 10-K, which financial statements have been audited by KPMG LLP, independent registered public accounting firm. The audit report is included elsewhere in this Form 10-K. The statement of income data for years ended December 31, 2003 and 2002, and the balance sheet data as of December 31, 2004, 2003 and 2002, have been derived from audited financial statements not included in this Form 10-K. Historical results are not necessarily indicative of results to be expected in the future.

| | | Year Ended December 31, | |

| | | 2006 | | 2005 (A) | | 2004 | | 2003 | | 2002 | |

| Statement of Income Data: | | | | | | | | | | | | | | | | |

| (In thousands, except share and per share data) | | | | | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | | | | | |

| Online publishing | | $ | 63,971 | | $ | 43,296 | | $ | 33,942 | | $ | 31,368 | | $ | 22,651 | |