AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON April 3, 2007

FILE NO.333 -136586

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Post-Effective Amendment No. 2 on

FORM S-3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

API Nanotronics Corp.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

3670

(Primary Standard Industrial Classification Code Number)

98-0200798

(I.R.S. Employer Identification Number)

505 University Avenue, Suite 1400, Toronto, Ontario Canada M5G 1X3

(416) 593-6543

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Phillip DeZwirek

Chief Executive Officer

505 University Avenue, Suite 1400

Toronto, Ontario, Canada M5G 1X3

(416) 593-6543

(Name, address, including zip code, and telephone number, including area code, of agent of service)

With copies to:

Leslie J. Weiss

Sugar, Friedberg & Felsenthal LLP

30 North LaSalle Street, Suite 3000

Chicago, Illinois 60602

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filled to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act regulation statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statements shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

We are filing this Post-Effective Amendment No. 2 to amend our registration statement to further reflect the effects of our acquisition of National Hybrid, Inc. and Pace Technology, Inc. on January 25, 2007 with the audited financial statements of such companies for the fiscal year ended December 31, 2006 and 2005 and related proforma information. Also, we have reduced the number of shares covered by this registration statement because API Nanotronics Corp. common stock had been previously issued for API Electronics Group Corp. common shares or with respect to the exchange of previous issued exchangeable shares, and therefore will not be issued upon the exchange of API Nanotronics Sub, Inc. exchangeable shares in the future. Only shares of API Nanotronics Corp. stock issued upon such an exchange in the future are covered by this amended registration statement.

Additionally, this Post-Effectiveness Amendment No. 2 on Form S-3 to Form S-1 Registration Statement is being filed to convert registrant’s Form S-1 (Registration No. 333-136586) into a registration statement on Form S-3.

Subject to Completion, Dated April , 2007

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Prospectus

API NANOTRONICS CORP.

12,290,330 SHARES

COMMON STOCK

We may issue from time to time up to 12,290,330 shares of our common stock in exchange for exchangeable shares of our special purpose subsidiary, API Nanotronics Sub, Inc., formerly known as RVI Sub, Inc., which we refer to in this prospectus as Nanotronics Sub. Nanotronics Sub issued exchangeable shares to certain shareholders of API Electronics Group Corp., which we refer to in this prospectus as API, in connection with a business combination transaction between API and us, which we refer to in this prospectus as the Business Combination. These shareholders may now exchange their exchangeable shares for our common stock at any time following the effectiveness of the Registration Statement of which this prospectus is a part. Nanotronics Sub will redeem any exchangeable shares that remain outstanding on a date established by Nanotronics Sub’s board of directors, which will be no earlier than November 6, 2016. Nanotronics Sub also will redeem the exchangeable shares before November 6, 2016 if certain events occur.

Prior to the Business Combination, we were called Rubincon Ventures Inc. However, as part of the Business Combination and to better capture the nature of the combined companies, we changed our name to “API Nanotronics Corp.” We refer to the combined company in this prospectus as API Nanotronics.

Because the shares of our common stock offered by this Prospectus will be issued only in exchange for, or to purchase the exchangeable shares, we will not receive any cash proceeds from this offering. We are paying all expenses of this offering.

Our common stock is currently traded on the over-the-counter bulletin board operated by NASDAQ (the “OTCBB”). Prior to November 7, 2006 it traded under the symbol RBCV. Effective as of November 7, 2006, the symbol under which our common stock traded became APIO. On April 2, 2007, the last reported sale price for our common stock as reported on the OTCBB was $3.165 per share.

Our executive offices are located at 505 University Avenue, Suite 1400, Toronto, Ontario, Canada M5G 1X3.

THE SECURITIES OFFERED IN THIS PROSPECTUS INVOLVE A HIGH DEGREE OF RISK.

YOU SHOULD CAREFULLY CONSIDER THERISK FACTORS BEGINNING ON PAGE 7.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This prospectus is datedApril , 2007.

TABLE OF CONTENTS

| | |

| |

SUMMARY | | 1 |

RISK FACTORS | | 7 |

FORWARD LOOKING STATEMENTS | | 21 |

USE OF PROCEEDS | | 21 |

PLAN OF DISTRIBUTION | | 22 |

DESCRIPTION OF OUR AND NANOTRONICS SUB’S SHARE CAPITAL | | 29 |

TAX CONSIDERATIONS | | 35 |

BUSINESS OF THE COMPANY | | 49 |

MARKET PRICE OF OUR STOCK | | 72 |

STOCKHOLDERS AND RELATED STOCKHOLDER MATTERS | | 73 |

| |

| CAPITALIZATION | | 78 |

SUMMARY FINANCIAL INFORMATION | | 79 |

MANAGEMENT DISCUSSION AND ANALYSIS | | 86 |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 119 |

MANAGEMENT | | 121 |

EXECUTIVE COMPENSATION | | 126 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 134 |

EXPERTS | | 135 |

LEGAL MATTERS | | 136 |

WHERE YOU CAN FIND MORE INFORMATION | | 136 |

| |

| INDEX TO FINANCIAL STATEMENTS | | F-1 |

| |

Report of Independent Registered Public Accounting Firm | | F-2 |

| |

Consolidated Financial Statements for API Electronics Group Corp. for the Fiscal Years Ended May 31, 2006, 2005 and 2004 | | F-3 |

| |

Consolidated Financial Statements for API Nanotronics Corp. for the Six Month Periods Ended November 30, 2006 and 2005 | | F-30 |

| |

Independent Auditor’s Report | | F-49 |

| |

Financial Statements for Keytronics, Inc. for the Fiscal Years Ended September 30, 2005 and 2004 | | F-50 |

| |

Financial Statements for Keytronics, Inc. for the Six Month Periods Ended March 31, 2006 and 2005 | | F-56 |

| |

Independent Auditors’ Report | | F-64 |

| |

Financial Statements for National Hybrid, Inc. and Pace Technology, Inc. for the Fiscal Years Ended December 31, 2006 and 2005 | | F-65 |

i

EXHIBITS

| | | | |

| EXHIBIT A | | – | | Support Agreement |

| EXHIBIT B | | – | | Voting and Exchange Trust Agreement |

| EXHIBIT C | | – | | Exchangeable Share Provisions |

WE HAVE NOT AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION NOT CONTAINED IN THIS PROSPECTUS IN CONNECTION WITH ANY OFFERING OF THESE SHARES OF COMMON STOCK. WE ARE NOT MAKING AN OFFER OF THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER IS NOT PERMITTED.

REPORTING CURRENCIES AND ACCOUNTING PRINCIPLES

The information regarding our company included in this document, including our audited financial statements are reported in U.S. dollars and have been prepared in accordance with U.S. generally accepted accounting principles.

iii

SUMMARY

The following summarizes the information contained elsewhere in this Prospectus. This summary is qualified in its entirety by and should be read in conjunction with the more detailed information contained in this Prospectus, including the risk factors, the financial statements and the exhibits.

Glossary

Unless the context requires otherwise,

“API” means API Electronics Group Corp. and its subsidiaries.

“API Nanotronics,” “we,” “us,” “our” or “the Company” means API Nanotronics Corp., formerly known as Rubincon Ventures Inc., a Delaware corporation

“Business Combination” means the business combination among API Nanotronics, Nanotronics Sub and API, that became effective on November 6, 2006. In the business combination, API became a wholly-owned subsidiary of our wholly-owned direct subsidiary, Nanotronics Sub. The combination occurred pursuant to a Plan of Arrangement approved by the Ontario Superior Court of Justice.

“Exchangeable Shares” means the shares of Nanotronics Sub that were exchanged for certain common shares of API in the Business Combination. These shares are exchangeable into our common shares on a one-for-one basis as more fully described in this Prospectus.

“GAAP” means United States generally accepted accounting principles.

“Nanotronics Sub” means API Nanotronics Sub, Inc., formerly known as RVI Sub, Inc., an Ontario corporation, a wholly-owned subsidiary of API Nanotronics and the issuer of the Exchangeable Shares.

“Prospectus” means this prospectus.

“Rubincon” means Rubincon Ventures Inc., the name of API Nanotronics prior to the Business Combination. We use this term to refer to our company during the period prior to the Business Combination.

“Rubincon Holdings” means API Nanotronics Holding Corp., formerly known as Rubincon Holdings Corp., an Ontario corporation and our wholly-owned direct subsidiary.

The Company

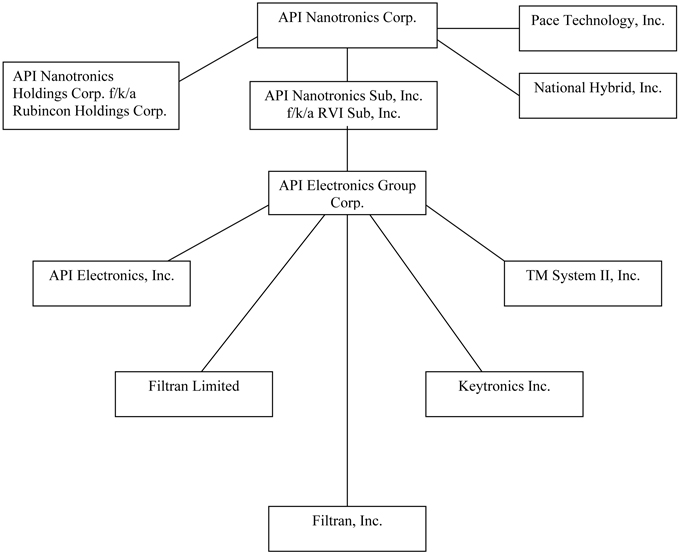

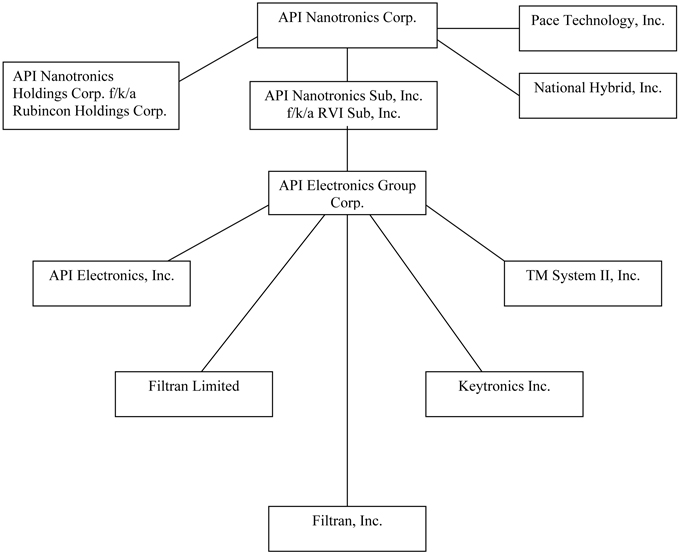

We are engaged in the manufacture of electronic components and systems for the defense and communications industries. Our operations are conducted through our subsidiaries. We have ten subsidiaries:

| | (1) | Nanotronics Sub, which holds the stock of API and issued the Exchangeable Shares; |

| | (2) | API, which is a holding company for our operating companies; |

| | (3) | API Nanotronics Holding Corp., formerly known as Rubincon Holdings Corp., which was incorporated to facilitate the exchange of Exchangeable Shares; |

| | (4) | API Electronics, Inc., which is a designer and manufacturer of critical elements for advanced military, industrial, commercial, automotive and medical applications; |

| | (5) | Filtran Group, which consists of Filtran Ltd., an Ontario corporation, and Filtran Inc., a New York corporation, and which is a designer and supplier of electronic components to major producers of communications equipment, military hardware, computer peripherals, process control equipment and instrumentation; |

| | (6) | TM Systems II Inc., which supplies the defense sector with naval landing and launching equipment, flight control and signaling systems, radar systems alteration, data communication and test equipment, as well as aircraft ground support equipment; |

| | (7) | Keytronics, Inc., which is a designer and manufacturer of electronic components of major producers of communications equipment, military hardware, computer peripherals, process control equipment and instrumentation; and |

| | (8) | National Hybrid Group, which consists of National Hybrid, Inc. and Pace Technology, Inc., and is a developer and manufacturer of 1553 data bus products, solid state power controllers, opto-controllers, high density multi-chip modules and custom hybrid micro-circuits for the military/aerospace market and the industrial process control market. |

We have operations in the U.S. in New York and Florida and in Canada in Ontario. After the Business Combination we moved our executive offices to the executive offices of API in Toronto, Ontario. Our operating subsidiaries are located in Endicott, New York, Hauppauge, New York, Ogdensburg, New York, Ronkonkoma, New York, Islip, New York, Largo, Florida and Ottawa, Ontario.

The mailing address and telephone number for our executive offices are: 505 University Avenue, Suite 1400, Toronto, Ontario, Canada M5G 1X3, (416) 593-6543.

2

3

On November 6, 2006, we completed the Business Combination with API. Prior to that, we were a shell company. We did not have an operating business and our assets consisted of cash and cash equivalents. We were seeking to acquire an operating company and accomplished that objective through the Business Combination. We continue to seek additional acquisitions in the nanotechnology industry as well as in industries that complement our existing subsidiaries.

The Source of the Exchangeable Shares

The Business Combination

The Business Combination was implemented through a Plan of Arrangement, which was approved by the Ontario Superior Court of Justice on November 3, 2006. Upon or immediately prior to completion of the Business Combination:

| | 1. | We changed our name to “API Nanotronics Corp.” from Rubincon Ventures Inc. and amended our Certificate of Incorporation and bylaws to implement the Business Combination. |

| | 2. | Nanotronics Sub became the sole owner of API. Except for the Exchangeable Shares held by former API shareholders, described below, Nanotronics Sub is our wholly-owned subsidiary. |

| | 3. | Holders of common shares of API ceased to be shareholders of API (other than dissenting shareholders) and received ten shares of our stock, or at the election of shareholders resident in Canada, ten Exchangeable Shares, for each common share of API. The Exchangeable Shares are exchangeable, at the option of the holder, on a one-for-one basis, for our common stock. Under certain other circumstances other than the election of the holder, the Exchangeable Shares may be exchanged for our common stock. |

| | 4. | Each Exchangeable Share has economic and voting rights, to the extent practical, equivalent to one share of our common stock. |

| | 5. | The stockholders of Rubincon prior to the Business Combination retained their shares of common stock, which remained outstanding as shares of API Nanotronics common stock. |

The Exchangeable Shares

The Exchangeable Shares, which were issued by our subsidiary, Nanotronics Sub, in the Business Combination, have the following attributes:

| | 1. | holders of Exchangeable Shares are entitled to receive dividends, if any, on a per share basis, equivalent to the per share dividends that we may pay from time to time on our common stock, and to vote at our shareholders meetings indirectly through a voting trust arrangement; |

4

| | 2. | holders of Exchangeable Shares generally are not entitled to receive notice of or to attend or vote at any meeting of the shareholders of Nanotronics Sub; |

| | 3. | the Exchangeable Shares are entitled to a preference over the common shares of Nanotronics Sub, and any other shares ranking junior to the Exchangeable Shares, with respect to the payment of dividends and the distribution of assets in the event of the liquidation, dissolution or winding-up of Nanotronics Sub; and |

| | 4. | in the event of the liquidation, dissolution or winding-up of Nanotronics Sub, a holder of Exchangeable Shares is entitled to receive for each Exchangeable Share one share of our common stock, together with the amount of all dividends payable on our common stock which have not also been paid on the Exchangeable Shares. |

Tax Consequences of the Exchange of Exchangeable Shares

The receipt of Exchangeable Shares rather than our common stock in the Business Combination provided the opportunity for a tax deferral for most Canadian residents holding API common shares. To take advantage of this deferral, an appropriate tax election had to be made. This tax deferral continues as long as such holders continue to hold the Exchangeable Shares. The exchange of the Exchangeable Shares for our common stock may be required after ten years from the Business Combination or sooner under specified circumstances, which would end such holder’s tax deferral.

Accounting Treatment of the Exchange

For accounting purposes the acquisition of API by Rubincon was considered a reverse acquisition, an acquisition transaction where the acquired company, API, is considered the acquirer for accounting purposes, notwithstanding the form of the transaction. The primary reason the transaction was treated as a recapitalization by API rather than a purchase of API by Rubincon was because Rubincon was a shell company. As reported in its Form 10-QSB for the quarter ended October 31, 2006, (the final quarterly filing requirement for Rubincon under its prior year end of January 31, 2006), Rubincon had cash of approximately $4,200,000, other assets of approximately $117,000 and liabilities of approximately $187,000.

In conjunction with this reverse acquisition, Rubincon changed its year end from January 31 to May 31, the year-end of API. Assets, liabilities and equity of the Company continue to be that of the operating company, API, as adjusted for the cash, other assets and liabilities of Rubincon. No additional goodwill or intangible assets were recognized on completion of the transaction. The capital structure, including the number and type of shares issued, appearing in the consolidated balance sheet reflects that of the legal parent, Rubincon, now known as API Nanotronics, including the shares issued to affect the reverse acquisition for the period after the consummation of the Plan of Arrangement and the capital structure of API modified by the 10 for 1 exchange ratio in the Plan of Arrangement for the period prior to the consummation of the plan of arrangement.

5

The Offering

Securities Offered: We are offering shares of our common stock.

You are in receipt of this prospectus because you received Exchangeable Shares in the Business Combination. Exchangeable Shares have the right to convert into our common stock as described in this prospectus.

The Exchangeable Shares were designed to give you, to the extent practicable, rights equivalent to owning our common stock. These equivalent rights were created by agreements, and are not the same as directly owning our common stock. The Exchangeable Shares were not issued by us, but Nanotronics Sub, an Ontario corporation and our subsidiary. By exercising your exchange rights, you will receive our common stock for your Exchangeable Shares. Such an exchange may have tax consequences to you. See “Tax Considerations” on page 35.

Use of Proceeds: Because our common stock will be issued in exchange for Exchangeable Shares or to purchase the Exchangeable Shares, we will not receive any cash proceeds from this offering.

Trading: Our common stock is traded on the OTCBB under the symbol APIO.

Dividend Policy: We do not expect to pay dividends on our common stock in the foreseeable future.

Risk Factors: See “Risk Factors” on page 7 and the other information in this prospectus for a discussion of the factors you should carefully consider before electing to exchange your Exchangeable Shares for shares of our common stock being offered by us in this prospectus.

6

RISK FACTORS

The Exchange

The Exchange of Exchangeable Shares for Shares of Our Common Stock is Generally a Taxable Event in Canada (Under Current Law) and in The United States

The exchange of Exchangeable Shares for shares of our common stock is generally a taxable event in Canada (under current law) and in the United States. Your tax consequences can vary depending on a number of factors, including your residency, your tax cost, the length of time that the Exchangeable Shares were held by you prior to an exchange and, for Canadian tax consequences, the method of the exchange (redemption or purchase). See “Tax Considerations” on page 35 for information regarding potential tax liability. You should consult your own tax advisor as to the tax consequences to you of an exchange of Exchangeable Shares for shares of our common stock.

Holders May be Required to Make An Election to Avoid Future United States Taxes

While there can be no assurance with respect to the classification, for U.S. federal income tax purposes, of Nanotronics Sub as a passive foreign investment company, know as “PFIC”, Nanotronics Sub believes that it will not constitute a PFIC. At the present time, we intend to cause Nanotronics Sub to avoid PFIC status in the future, although there can be no assurance that they will be able to do so or that our intent will not change. A determination of a foreign corporation’s status as a PFIC cannot be made until the close of the taxable year. Nanotronics Sub intends to monitor its status regularly, and promptly following the end of each taxable year Nanotronics Sub will notify U.S. holders of record of its Exchangeable Shares if it believes that it was a PFIC that taxable year.

If Nanotronics Sub becomes a PFIC during a U.S. holder’s holding period for Exchangeable Shares, and the U.S. holder does not make an election to treat Nanotronics Sub as a “qualified electing fund” under Section 1295 of the U.S. Internal Revenue Code, then a U.S. holder may be subject to additional tax and penalties on excess dividend payments with respect to, and gains from the disposition of, the Exchangeable Shares.

Some of the Shares of our Common Stock May Be Withheld and Sold to Pay Any Withholding Tax That We Are Required To

The exchange or redemption of your Exchangeable Shares for our common stock is for most holders of Exchangeable Shares a taxable event. Under applicable tax laws, we may be required to withhold some of the consideration to be received by you in an exchange or purchase of your Exchangeable Shares. The documents governing the Exchangeable Shares allow us to withhold some of the shares of our common stock that you would otherwise receive and sell such shares to pay tax owed with respect to your sale or redemption of Exchangeable Shares.

7

You Will Experience a Delay In Receiving Shares of Our Common Stock From The Date That You Request An Exchange, Which May Affect The Value of The Shares You Receive In A Subsequent Sale of Our Common Stock

If you request to receive our common stock in exchange for your Exchangeable Shares, you will not receive our common stock for 10 business days or more after the applicable request is received. During this 10 or more business day period, the market price of our common stock may increase or decrease. Any such increase or decrease would affect the amount to be received by you on a subsequent sale if you were waiting to receive our common stock before selling it.

Trading and Corporate Matters

Future Trading In Our Stock May Be Restricted By the SEC’s Penny Stock Regulations, Which May Limit A Stockholder’s Ability To Buy And Sell Our Common Shares

The SEC has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our shares most likely will be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors.” The term “accredited investor” refers generally to entities with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income for the current and the past two years exceeding $200,000 or $300,000 jointly with their spouse.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for our stock. We believe that the penny stock rules may discourage investor interest in and limit the marketability of our common stock if the price remains below $5.00 after the Business Combination.

8

The Securities Of The Combined Entities May Not Be More Liquid Than The Securities Of Each Of The Company Individually.

Although our common stock is quoted on the OTCBB, there was only one trade from November 2005 (when our stock qualified for trading on the OTCBB) through early March 2006. Since early March, the common stock has traded regularly.We believe that now that the Business Combination has been effected, our common stock will be more liquid that either the stock of API or of Rubincon. In particular, we believe that broker and investor interest will be greater than was previously the case with either company. However, there can be no assurance what such superior liquidity for our securities will actually develop.

Our Stock Market Price and Trading Volume May Be Volatile

The market for the common stock of API was volatile. API’s stock price was volatile for reasons both related to its performance or events pertaining to its industries, as well as factors unrelated to API or its industries. We expect that our common stock will be subject to similar volatility in both price and volume arising from market expectations, announcements and press releases regarding our business, and changes in estimates and evaluations by securities analysts or other events or factors.

Over the years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly small-capitalization companies like us, have experienced wide fluctuations which have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies. For these reasons, our shares of common stock also can be expected to be subject to significant volatility resulting from purely market forces over which we will have no control. Further, despite the existence of a market for API’s common stock in the United States, the market had limited liquidity. The market for our common stock has been very thin. As a result, our stockholders may be unable to sell significant quantities of common stock in the public trading markets without a significant reduction in the price of the stock.

We May Have Difficulty to Attract and Hold Outside Board Members and This May Affect the Quality of Our Management

The directors and management of publicly traded corporations are increasingly concerned with the extent of their personal exposure to lawsuits and shareholder claims, as well as governmental and creditor claims which may be made against them in connection with their positions with publicly-held companies. Outside directors are becoming increasingly concerned with the availability of directors and officers’ liability insurance to pay on a timely basis the costs incurred in defending shareholder claims. Directors and officers liability insurance has become much more expensive and difficult to obtain than it had been in the past. It has become increasingly more difficult for small companies like us to attract and retain qualified outside directors to serve on its Board.

9

We Do Not Expect to Pay Dividends

We intend to invest all available funds to finance our growth. Therefore our stockholders cannot expect to receive any dividends on our common stock in the foreseeable future. Even if we were to determine that a dividend could be declared, we could be precluded from paying dividends by restrictive provisions of loans, leases or other financing documents or by legal prohibitions under applicable corporate law.

Since Some of Our Directors and Assets Are Located Outside United States It May Be More Difficult to Enforce Judgments Against Us and Our Directors

Half of our directors are domiciled outside of the United States. As a result, it may not be possible to effect service of process upon such directors. Also, since all or a substantial portion of the assets of such directors are located outside the United States, it may be difficult to enforce judgments obtained in United States courts against such directors. Also, because a significant portion of our assets will be located outside the United States, it may be difficult to enforce judgments obtained in United States courts against us.

Some of Our Directors and Officers May be Subject to Conflicts of Interest

Some of our directors and officers are also directors and/or officers and/or shareholders of other companies. Such associations may give rise to conflicts of interest from time to time. Our directors are required by law to act honestly and in good faith with a view to our best interests and to disclose any interest, which they may have in any project or opportunity applicable to us. If a conflict of interest arises at a meeting of the board of directors, any director in a conflict must disclose his interest and abstain from voting on such matter. In determining whether or not we will participate in any project or opportunity, the directors will primarily consider the degree of risk to which we may be exposed and our financial position at the time.

Control of Us by Our Officers and Directors Could Adversely Affect the Company’s Stockholders Because of Their Control of Our Affairs and By Discouraging Our Potential Acquisition

Our officers and directors as a group beneficially own a large percentage of our stock, treating Exchangeable Shares as the equivalent of our common stock. Therefore, directors and officers, acting together may have a controlling influence on (i) matters submitted to our stockholders (and the trustee holding the special share of our stock issued in connection with the Business Combination which allows each holder of exchangeable shares, other than us and our affiliates, one vote at our meeting for each exchangeable share) for approval (including the election and removal of directors and any merger, consolidation or sale of all or substantially all of our assets) and (ii) our management and affairs. These persons, acting alone or together, do not have sufficient numbers of votes to approve matters submitted to stockholders. However, this concentration of ownership may have the effect of delaying, deferring or preventing a change in control, impeding a merger, consolidation, takeover or other business combination or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us. This in turn could materially adversely affect the market price of our stock.

10

We Are Dependent on Key Personnel

We are dependent upon a small number of key personnel, who were the key personnel for API prior to the Business Combination. Thomas W. Mills, who is our President and Chief Operating Officer, held similar positions with API since 1991 and has been employed by API’s subsidiary since 1981. He is extremely familiar with all aspects of our business, and has a proven track record of capable leadership. Mr. Phillip DeZwirek was the Chief Executive Officer of API prior to the Business Combination and was instrumental in directing the growth of API. We are depending upon Mr. DeZwirek to continue to act in such capacity. The loss of the services of such personnel could have a material adverse effect on our business. Our success will depend in large part on the efforts of these individuals. It is not currently proposed that there will be any long-term employment agreements or key-man insurance in respect of such key personnel. However, Mr. DeZwirek is a major stockholder of ours.

We May Require Additional Financing Which We May Not be Able to Obtain

We may require additional financing in order to support expansion, develop new or enhanced services or products, respond to competitive pressures, acquire complementary businesses or technologies, or take advantage of unanticipated opportunities. Our ability to arrange such financing in the future will depend in part upon the prevailing capital market conditions, as well as our business performance. There can be no assurance that we will be successful in our efforts to arrange additional financing under satisfactory terms. If additional financing is raised by the issuance of additional shares of our common stock, our shareholders may suffer dilution. If adequate funds are not available, or are not available on acceptable terms, we may not be able to take advantage of opportunities, or otherwise respond to competitive pressures and remain in business.

The Success of the Business Combination is Not Certain

The success of the Business Combination will depend upon our ability to continue to grow and expand the business operations of the former API and to add to that business with additional acquisitions in the nanotechnology industry or the industries in which API is presently engaged. In addition, we expect the transaction to result in greater liquidity for our stock. There can be no assurance that we can consummate any acquisitions in the nanotechnology industry and if we make an acquisition, that we can successfully integrate the operations of the acquired business into our own. Further, there can be no assurance that the market for our common stock will have greater liquidity or that the Business Combination will ultimately have a positive effect on our stock price.

We May Be Unable To Obtain The Increased Access To Capital Anticipated To Be Available After The Business Transaction

Before the Business Combination we were a shell corporation without any operations

11

making periodic filings with the SEC, and API was an operating company filing as a private foreign issuer with the SEC. We anticipated the combined companies will have increased access to the U.S. capital markets. However, there can be no assurance that such greater access will be available to the combined companies.

The Securities Of The Combined Companies May Not Be A Superior Tool For Use In The Acquisition Of Additional Operating Subsidiaries

We anticipate using our common stock to acquire additional operating companies. We believe that our common stock will be a superior tool for acquiring new operating companies than the common shares of API used in past acquisitions. However, owners of such operating companies may not find our common stock more attractive consideration than API common shares previously were.

Nanotechnology Opportunities May Not Occur or May Not be Profitable

We believe that we will benefit from the nanotechnology expertise of Prof. Martin Moskovitz, who we have engaged as a consultant, in identifying potential nanotechnology investments and acquisitions. There can be no assurances that such investments or acquisitions will be realized. Moreover, Prof. Moskovitz has only recently become associated with us and his agreement with us only has a term of one year. There can be no assurance that he will continue as a consultant of ours beyond such term. Moreover, we have no experience with nanotechnology investments or acquisitions, and there can be no assurance that any such investment, if undertaken, will be profitable.

Listing Our Stock on Markets Other than the OTCBB Could be Costly for Us

Our common stock is currently quoted and trades on the OTCBB in the United States. The OTCBB is operated by NASDAQ. In the future, we may file an application to be quoted on the NASDAQ small cap market or a national securities exchange (collectively, an “Exchange”). Unlike the OTCBB, every Exchange has corporate governance and other public interest standards, which we will have to meet. Such standards and regulations may restrict our capital raising or other activities by requiring stockholder approval for certain issuances of stock, for certain acquisitions, and for the adoption of stock option or stock purchase plans.

The Exchange will require that a majority of the members of our Board of Directors be independent directors as defined by the Exchange. The independent directors must have regularly scheduled meetings at which only independent directors are present. Compensation of our chief executive officer must be determined, or recommended to the Board of Directors for determination, either by (i) a majority of the independent directors, or (ii) a compensation committee comprised solely of independent directors, and the chief executive officer cannot be present during voting or deliberations. Compensation of our other executive officers must be determined, or recommended to the Board of Directors either by (i) a majority of the independent directors, or (ii) a compensation committee comprised solely of independent directors. Director nominees must either be selected, or recommended for selection by the Board of Directors either by (i) a majority of the independent directors, or (ii) a nominations committee comprised solely of independent directors. The nominations process must be set forth in a formal written charter or a Board of Directors’ resolution.

12

We will have to adopt a new written audit committee charter. In addition, the audit committee will have to be composed of at least three (3) members, all of whom are independent as defined by the Exchange and under SEC Rule 10A-3(c), and who have not participated in the preparation of the financial statements of us or any subsidiary of us during the past three (3) years. One member of the audit committee must have specified employment experience in finance or accounting. Accordingly, we would have to appoint three independent directors to serve on our audit committee and one of those audit committees members would need the required experience in finance and accounting. We do not currently meet these corporate governance requirements.

Some Exchanges have lesser requirements for small business issuers, but such requirements would still require us to make substantial changes in our Board structure and internal procedures. It is likely that after an acquisition we would continue to qualify as a small business issuer. The directors and management of publicly traded corporations are increasingly concerned with the extent of their personal liability. In order to attract independent directors, we anticipate that we will need to purchase directors and officers insurance, which is costly. Consequently, our compliance with the rules necessary to have our stock listed in any other market could be quite costly to us.

Shareholders May Experience Dilution Through Employee, Director and Consultant Options; Such Options May Also Negatively Impact Our Net Income

Because our success is highly dependent upon our employees, directors and consultants, we have and intend in the future to grant to some or all of our key employees, directors and consultants options or warrants to purchase shares of our common stock as non-cash incentives. We have adopted a stock option plan for this purpose. To the extent that significant numbers of such options may be granted and exercised when the exercise price is below the then current market price for our common stock, the interests of the other stockholders of the company may be diluted. As of the date of this prospectus, we have granted outstanding options to purchase 5,925,000 shares of common stock to employees, directors, and consultants (which number includes API options which were each converted into ten Rubincon options per API option as a result of the Business Combination).

As a result of the Business Combination, API is the successor entity for financial reporting purposes, and API’s historical financial statements have become our financial statements. Accordingly, the accounting policies discussed in this risk factor, were the policies adopted by API. We have accounted for employee stock-based compensation using the intrinsic value method prescribed in APB No. 25, Accounting Stock Issued to Employees, or APB 25, and related interpretations. We have recognized non-cash compensation expense for stock options by measuring the excess, if any, of the estimated fair value of our common stock at the date of grant over the amount an employee must pay to acquire the stock, and amortizing the excess on a straight-line basis over the vesting period of the applicable stock options. Options issued to non-employees have been accounted for in accordance with SFAS 123, “Accounting for Stock-Based Compensation”, and Emerging Issues Task Force (“EITF”) Issue No. 96-18, “Accounting for Equity Instruments That Are Issued to Other Than Employees for Acquiring, or in Conjunction with Selling, Goods and Services”, using a fair value approach.

Under APB 25, the full costs to us and our stockholders of granting stock options are not reflected on our statement of operations, because APB 25 assumes that an option with an exercise price equal to the market value of stock on the date of grant has no value.

13

We adopted SFAS No. 123R,Share-Based Payments (“ SFAS 123R”), on June 1, 2006. The impact on our financial statements of adopting SFAS 123R will depend on the level of stock-based payments we grant in the future and the value of the exercise price. However, had we adopted SFAS 123R in prior periods, the impact would have approximated the impact of SFAS 123R as described in Note 1 to our financial statements.

The Possibility of Goodwill Impairments Exist

The company evaluates the recoverability annually or more frequently if impairment indicators arise, as required under SFAS 142, “Goodwill and Other Intangible Assets” of the goodwill carried on our financial statements as an asset. Goodwill is reviewed for impairment by applying a fair-value to the reporting unit level, which is the same as the business segment level. A Goodwill impairment loss will be reported for any goodwill impaired. Consequently, a loss of goodwill could have a significant adverse effect on our financial results.

We may not be required to furnish a report on our internal control over financial reporting until August 2008.

We are not currently required to furnish a report on our internal control over financial reporting pursuant to the SEC’s rules under Section 404 of the Sarbanes-Oxley Act of 2002 as part of the Annual Reports that we file on Form 10-KSB. We expect that these rules will apply to us when we file our Annual Report on Form 10-K for our fiscal year ending in May 2008, which we are required to file in August 2008. As a result, we cannot assure you that our internal control over financial reporting is effective, and you will not have a report from us to that effect until August 2008, and our independent registered public accounting firm will not have to provide their attestation on our management’s report or their opinion as to the effectiveness of our internal control over financial reporting until August 2008.

If we are unable to complete our assessment of the adequacy of our internal control over financial reporting as required by Section 404 of the Sarbanes-Oxley Act of 2002, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in the value of our common stock.

Under the rules issued under Section 404 of the Sarbanes-Oxley Act of 2002, it is highly likely that we will be required to include in each of our future annual reports on Form 10-K, beginning with our annual report for the fiscal year ended May 31, 2008, a report containing our management’s assessment of the effectiveness of our internal control over financial reporting and a related attestation of our independent auditors. We have not yet taken any steps with respect to preparing such report with respect to our compliance with Section 404. Due to the number of controls to be examined, the complexity of the project, as well as the subjectivity involved in determining effectiveness of controls, we cannot be certain that all our controls will be considered effective once they are reviewed. Therefore, we can give no assurances that our internal control over financial reporting will satisfy the new regulatory requirements. If we are unable to successfully implement the requirements of Section 404, it will prevent our independent auditors from issuing an unqualified attestation report on a timely basis as required by Section 404. In that event, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in the value of our common stock.

14

Post Business Combination Business Risks

Downturns in the Highly Cyclical Semiconductor Industry and/or the Electronic Component Industry Would Adversely Affect Our Operating Results and Our Value

The semiconductor and electronic component industries are highly cyclical, and our value business may decline during the “down” portion of these cycles. The markets for our products depend on continued demand in the aerospace, military defense systems, and commercial end-markets, and these end-markets may experience changes in demand that could adversely affect our operating results and financial condition. The markets for Filtran Group’s products depend upon continued demand in the military defense, telecommunications, computer, instrumentation and process control end-markets, and these end-markets may experience changes in demand that could adversely affect our operating results and financial condition. The markets for TM Systems’ products depend primarily upon continued demand within the military defense industry for its products, which include naval landing and launching equipment, flight control and signaling systems, radar systems alteration, data communication and test equipment, and aircraft ground control equipment.

The Semiconductor and Electronic Components Businesses Are Highly Competitive and Increased Competition Could Adversely Affect Our Operating Results

The areas of the semiconductor and electronic component industries in which we do business are highly competitive. We expect intensified competition from existing competitors and new entrants. Competition is based on price, product performance, product availability, quality, reliability and customer service. Even in strong markets, pricing pressures may emerge. For instance, competitors may attempt to gain a greater market share by lowering prices. The market for commercial products is characterized by declining selling prices. We anticipate that average selling prices for our products will continue to decrease in future periods, although the timing and amount of these decreases cannot be predicted with any certainty. We compete in various markets with companies of various sizes, many of which are larger and have greater financial and other resources than we have, and thus may be better able to pursue acquisition candidates and to withstand adverse economic or market conditions. In addition, companies not currently in direct competition with us may introduce competing products in the future. We or any of our subsidiaries may not be able to compete successfully in the future and competitive pressures may harm our financial condition and/or operating results.

We Are Highly Reliant on Defense Spending

We are dependent upon the US defense industry and its military subcontractors for the sale of many of our products. While the US government currently plans increases in defense spending, the actual timing and amount of such increases has been occurring at a rate that has been slower than expected. In addition, changes in appropriations and in the national defense

15

policy and decreases in ongoing defense programs could adversely affect our performance. Such occurrences are beyond our control. The effects of defense spending increases are difficult to estimate and subject to many sources of delay.

Our contracts with prime US Government contractors contain customary provisions permitting termination at any time, at the convenience of the US Government or the prime contractors upon payment to us for costs incurred plus a reasonable profit. If we experience significant reductions or delays in procurements of our products by the US Government, or terminations of government contracts or subcontracts, our operating results could be materially and adversely affected.

Because Some of Our Products are Adaptations of Existing Products, New Technologies Could Make Our Products Obsolete; Additionally, Because We Make Some of Our Products Based on Existing Technologies, Few Barriers Exist to Others Attempting to Sell to the Same Market

The products sold by our subsidiary, API Electronics, Inc., are typically adaptations of existing products formerly manufactured by others. Because these products are typically based on older technologies, the rapidly changing technologies and industry standards, along with frequent new product introductions, that characterize much of the semiconductor and electronic component industries, could render our products obsolete. Our financial performance depends on our ability to design, develop, manufacture, assemble, test, market and support new products (which for API Electronics, Inc. are typically adaptations of existing products formerly manufactured by others), and enhancements on a timely and cost-effective basis. Additionally, the lack of significant amounts of new technology in our products means that there are not significant barriers to the entry of competitors who might attempt to sell into the markets to which we presently cater.

We May Not be Able to Develop New Products to Satisfy Changes in Demand

The industries in which we operate are dynamic and constantly evolving. We cannot assure that we will successfully identify new product opportunities and develop and bring products to market in a timely and cost-effective manner, or those products or technologies developed by others will not render our products or technologies obsolete or noncompetitive. We may not be able to accomplish these goals.

The introduction of new products presents significant business challenges because product development commitments and expenditures must be made well in advance of product sales. The success of a new product depends on accurate forecasts of long-term market demand and future technological developments, as well as on a variety of specific implementation factors, including:

| | • | | timely and efficient completion of process design and development; |

16

| | • | | timely and efficient implementation of manufacturing and assembly processes; |

| | • | | the quality and reliability of the product; |

| | • | | effective marketing, sales and service; and |

| | • | | sufficient demand for the product. |

The failure of our products to achieve market acceptance due to these or other factors could harm our business.

Our Products May be Found to be Defective, Product Liability Claims May Be Asserted Against Us and We May Not Have Sufficient Liability Insurance

One or more of our products may be found to be defective after shipment, requiring a product replacement, recall or repair which would cure the defect but impede performance of the product. We may also be subject to product returns, which could impose substantial costs and harm to our business.

Product liability claims may be asserted with respect to our technology or products. Although we currently have insurance, there can be no assurance that we have obtained a sufficient amount of insurance coverage, that asserted claims will be within the scope of coverage of the insurance, or that we will have sufficient resources to satisfy any asserted claims.

Our Substantial Reliance on Products that Do Not Embody Proprietary Technology Make Us Particularly Vulnerable to Competition

We rely heavily on our skill in the manufacture of our products and not on any proprietary technologies that we develop or license on an exclusive basis. Such manufacturing know-how is primarily embodied in our drawings and specifications, and information about the manufacture of these products purchased from others. Our future success and competitive position may depend in part upon our ability to obtain licenses of certain proprietary technologies used in principal products from the original manufacturers of such products. Our reliance upon protection of some of our production technology as “trade secrets” will not necessarily protect us from the others independently obtaining the ability to manufacture our products. We cannot assure that we will be able to maintain the confidentiality of our production technology, dissemination of which could have a material adverse effect on our business.

We Must Commit Resources to Product Production Prior to Receipt of Purchase Commitments and Could Lose Some or All of the Associated Investment

We sell many of our products pursuant to purchase orders for current delivery, rather than pursuant to long-term supply contracts. This makes long-term planning difficult. Further, many of these purchase orders may be revised or canceled prior to shipment without penalty. As a result, we must commit resources to the production of products without advance purchase commitments from customers. The cancellation or deferral of product orders, the return of

17

previously sold products, or overproduction due to the failure of anticipated orders to materialize, could result in our holding excess or obsolete inventory. This could cause inventory write-downs. Our inability to sell products after we have devoted significant resources to them could have a material adverse effect on our business, financial condition and results of operations.

Variability of Our Manufacturing Yields May Affect Our Gross Margins

Our manufacturing yields vary significantly among products, depending on the complexity of a particular integrated circuit’s design and our experience in manufacturing that type of integrated circuit. From time to time, we have experienced difficulties in achieving planned yields, which have adversely affected our gross margins.

The fabrication of integrated circuits is a highly complex and precise process. Problems in the fabrication process can cause a substantial percentage of wafers to be rejected or numerous integrated circuits on each wafer to be nonfunctional, thereby reducing yields. These difficulties include:

| | • | | defects in masks, which are used to transfer circuit patterns onto our wafers; |

| | • | | impurities in the materials used; |

| | • | | contamination of the manufacturing environment; and |

The manufacture of filters and transformers is a multi-level process. Each component has dependency on the other. Each raw material must yield consistent results or productivity is adversely affected. The difficulties that may be experienced in this process include:

| | • | | impurities in the materials used; |

| | • | | bottlenecks (product cannot move to the next stage until the previous stage is completed). |

The manufacturing process for the stabilized Glide Slope Indicator (SGSI) is a unique process in that it is highly reliant on subcontractors. These units are comprised of four major units, three of which are manufactured by separate manufacturing companies.

The difficulties that may be experienced in this process include:

| | • | | defects in subcontractors components; |

| | • | | impurities in the materials used; |

| | • | | unreliability of a subcontractor. |

Because a large portion of our costs of manufacturing these products are relatively fixed, it is critical for us to improve the number of shippable integrated circuits per wafer and increase the production volume of wafers in order to maintain and improve our results of operations. Yield decreases can result in substantially higher unit costs, which could materially and

18

adversely affect our operating results and have done so in the past. Moreover, we cannot assure that we will be able to continue to improve yields in the future or that we will not suffer periodic yield problems, particularly during the early production of new products or introduction of new process technologies. In either case, our results of operations could be materially and adversely affected.

Our Inventories May Become Obsolete

The life cycles of some of our products depend heavily upon the life cycles of the end products into which these products are designed. Products with short life cycles require us to manage closely our production and inventory levels. Inventory may also become obsolete because of adverse changes in end-market demand. The life cycles for electronic components have been shortening over time at an accelerated pace. We may be adversely affected in the future by obsolete or excess inventories which may result from unanticipated changes in the estimated total demand for our products or the estimated life cycles of the end products into which our products are designed.

Interruptions, Delays or Cost Increases Affecting Our Materials, Parts, Equipment or Subcontractors May Impair Our Competitive Position

Some of the our products are assembled and tested by third-party subcontractors. We do not have any long-term agreements with these subcontractors. As a result, we may not have assured control over our product delivery schedules or product quality. Due to the amount of time typically required to qualify assemblers and testers, we could experience delays in the shipment of our products if we are forced to find alternative third parties to assemble or test them. Any product delivery delays in the future could have a material adverse effect on our operating results and financial condition. Our operations and ability to satisfy customer obligations could be adversely affected if our relationships with these subcontractors is disrupted or terminated.

Certain of Our Divisions Are Reliant One Key Customer

The Filtran Group and TM are each highly reliant on a single key customer. For Filtran, Harris Corporation accounted for 47%, 35% and 30.6%, respectively, of divisional sales, which translated to 24.9%, 16.7% and 16%, respectively of API’s total annual sales for the fiscal years ended May 31, 2006, 2005 and 2004. For TM Systems II, NASSCO accounted for 43%, 37% and 42%, respectively, of divisional sales, which translated into 6.6%, 8.5% and 11.7% respectively of API’s total annual sales for the fiscal years ended May 31, 2006, 2005 and 2004. If either customer should decide to purchase components from other suppliers, it could have an adverse impact on the applicable division and our revenues and net income.

Environmental Liabilities Could Adversely Impact Our Financial Position

United States federal, state and local laws and regulations and federal, provincial and local laws, rules and regulations in Canada, impose various restrictions and controls on the discharge of materials, chemicals and gases used in our manufacturing processes. In the conduct of our manufacturing operations, we have handled and continue to handle materials that are considered hazardous, toxic or volatile under US federal, state and local laws and Canadian,

19

federal, provincial and local laws, rules and regulations. The risk of accidental release of such materials cannot be completely eliminated. In addition, contaminants may migrate from or within, or through real property. These risks may give rise to substantial claims.

Fixed Costs May Reduce Operating Results If Our Sales Fall Below Expectations

Our expense levels are based, in part, on our expectations as to future sales. Many of our expenses, particularly those relating to capital equipment and manufacturing overhead, are relatively fixed. Decreases in lead times between orders and shipments and customers’ ordering practices could adversely affect our ability to project future sales. We might be unable to reduce spending quickly enough to compensate for reductions in sales. Accordingly, shortfalls in sales could materially and adversely affect our operating results.

Acquisitions

The Integration of Acquisitions May Be Difficult and May Not Yield the Expected Results

We recently completed the Business Combination. Prior to the Business Combination, API had recently expanded its operations through strategic acquisitions, specifically, the TM Systems acquisition and the Keytronics Inc. acquisition. We expect to continue to expand and diversify our operations with additional acquisitions and are currently the party to a non-binding letter of intent to acquire two affiliated companies. While we believe that TM Systems and Keytronics are adequately integrated into our operations, risks are involved with this process. Some of the risks that may continue to affect our ability to integrate acquired companies include those associated with:

| | • | | unexpected losses of key employees or customers of the acquired companies; |

| | • | | conforming the acquired company’s standards, processes, procedures and controls with our operations; |

| | • | | coordinating our new product and process development; |

| | • | | integrating administrative processes, accounting practices and technologies; |

| | • | | retaining management from the acquired companies, hiring additional management and other critical personnel; |

| | • | | increasing the scope, geographic diversity and complexity of our operations; and |

| | • | | the need to implement controls and procedures and policies appropriate for a public company and a company that prior to their acquisition lacked these controls, procedures and policies. |

For certain acquisitions, we have raised the capital required to make such acquisitions from the sale of stock, warrants and options, which has been dilutive to our stockholders.

Additionally, in the period following an acquisition, we are required to evaluate goodwill and acquisition-related intangible assets for impairment. When such assets are found to be impaired, they are written down to estimated fair value, with a charge against earnings.

Integrating acquired organizations and their products and services may be difficult, expensive, time-consuming and a strain on our resources and our relationships with employees and customers. Ultimately acquisitions may not be as profitable as expected or profitable at all.

The Integration of National Hybrid Group May be Difficult

National Hybrid, Inc. and Pace Technology, Inc. (collectively “National Hybrid Group”) were acquired by the Company on January 25, 2007. The stock purchase agreement used to purchase these companies had limited representations and warranties and limited indemnification provisions. Therefore, there may be more liabilities associated with these acquisitions than contemplated and the Company may not be fully reimbursed with respect to these liabilities.

National Hybrid Group created a significant increase in the size of the Company. National Hybrid Group had gross revenues of $12,771,293 for the fiscal year ended December 31, 2005 while the Company had net revenues of $15,634,093 for the fiscal year ended May 31, 2006. The National Hybrid Group acquisition increased the total number of employees at the Company from approximately 225 to approximately 345. The National Hybrid Group acquisition adds new product lines and new personnel to the Company. There can be no assurance that the National Hybrid Group can be successfully integrated into the Company either in terms of personnel, sales or product development and manufacture. The Company has never had to integrate an acquisition of this size.

The Financing of the National Hybrid Group Acquisition May be Detrimental to the Company’s Stockholders

The Company has borrowed $6 million at 12% interest and has sold shares of its common stock in Regulation S private

placements overseas to finance the acquisition of National Hybrid Group. The debt service may materially impact earnings. The common stock issued to fund the acquisition is at prices significantly below the current market price of the Company’s stock. Consequently, such sales of stock may have a dilutive effect on existing stockholders of the Company. There can be no assurance that the new acquisitions will have a positive impact on the Company’s profits or earnings per share.

20

FORWARD LOOKING STATEMENTS

This document and the documents incorporated in this document by reference contain forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact contained in this document and the materials accompanying this document are forward-looking statements.

The forward-looking statements are based on the beliefs of our management, as well as assumptions made by and information currently available to our management. Frequently, but not always, forward-looking statements are identified by the use of the future tense and by words such as “believes,” “expects,” “anticipates,” “intends,” “will,” “may,” “could,” “would,” “projects,” “continues,” “estimates” or similar expressions. Forward-looking statements are not guarantees of future performance and actual results could differ materially from those indicated by the forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements.

The forward-looking statements contained or incorporated by reference in this document are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (“Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (“Exchange Act”) and are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These statements include declarations regarding our plans, intentions, beliefs or current expectations.

Among the important factors that could cause actual results to differ materially from those indicated by forward-looking statements are the risks and uncertainties described under “Risk Factors” and elsewhere in this document and in our other filings with the SEC.

Forward-looking statements are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and we do not undertake any obligation to update forward-looking statements to reflect new information, subsequent events or otherwise.

USE OF PROCEEDS

Because our common stock will be issued in exchange for or to purchase Exchangeable Shares, we will not receive any cash proceeds upon the issuance of our common stock registered in this prospectus. No broker, dealer or underwriter has been engaged with this offering. The Exchangeable Shares were issued to former shareholders of API in connection with the Business Combination.

21

PLAN OF DISTRIBUTION

Under the terms of a Plan of Arrangement approved by the Ontario Superior Court of Justice and in connection with the Business Combination among Rubincon, API and Nanotronics Sub, Nanotronics Sub has issued and may issue ten shares of our common stock, or at a Canadian shareholder’s option, ten Exchangeable Shares, for each existing common share of API (other than dissenting shares). The Exchangeable Shares have economic rights (including the right to equivalent dividends) and voting attributes substantially equivalent to those of our common stock. Holders of API common shares who properly exercised their rights of dissent were not issued any Exchangeable Shares or shares of our common stock and have been or will be paid fair value for their API common shares. Our common stock may be issued to holders of Exchangeable Shares through the holder’s election, upon Nanotronics Sub’s redemption or purchase, or upon Nanotronics Sub’s or our liquidation.

Although our common stock will be issued to you in exchange for your Exchangeable Shares, our stock may be issued to you using various legal mechanisms. For instance, you have the right to exchange or cause the redemption of your Exchangeable Shares. By exercising these rights, you may require an exchange by us or redemption by Nanotronics Sub, as the case may be, of your Exchangeable Shares for our common stock. Your rights to require us to exchange the Exchangeable Share for our common stock are called:

| | • | | exchange put rights; and |

Also, we may issue our common stock to you as a result of an automatic exchange or redemption. Upon the occurrence of specified triggering event, you will be required to exchange your Exchangeable Shares for our common stock. These rights arise automatically upon the occurrence of triggering events and are called:

| | • | | the automatic redemption right; |

| | • | | the optional exchange right; |

| | • | | the liquidation right; and |

| | • | | the automatic exchange right; |

Finally, we may exercise our rights to require you to sell your Exchangeable Shares for our common stock and receive the identical consideration that you would receive upon an exchange of your Exchangeable Shares. Our call rights permit us to require you to sell your Exchangeable Shares for our common stock if you exercise your retraction rights or in any circumstance where Nanotronics Sub would otherwise be required to redeem your Exchangeable Shares. We plan to exercise our call rights, when available, through our wholly-owned subsidiary Rubincon Holdings Corp., and currently foresee limited, if any, circumstances under

22

which we would not exercise our call rights rather than permit your Exchangeable Shares to be redeemed by Nanotronics Sub. Accordingly, we expect that you will receive our common stock only through an exchange with Rubincon Holdings Corp., as opposed to upon redemption by Nanotronics Sub, of your Exchangeable Shares for our common stock. While in either case you would receive the same consideration, the tax consequences resulting from an exchange with us will be substantially different from the tax consequences resulting from a redemption by Nanotronics Sub. We may, at our option, cause Rubincon Holdings Corp., another Canadian subsidiary of ours, to acquire your Exchangeable Shares in our place and deliver to you your shares of our common stock. Thus, for purposes of describing our call right below, references to our acquisition of your Exchangeable Shares and our delivery of our common stock for your Exchangeable Shares includes the acquisition and delivery by our Canadian subsidiary of our common stock for your Exchangeable Shares. Our call rights are called, depending on the circumstances under which they are exercised, our:

| | • | | retraction call rights; |

| | • | | liquidation call rights; and |

| | • | | redemption call rights. |

Your Rights to Exchange or Redeem Your Shares

Your right to receive our common stock. We have granted your exchange put right described below to Equity Transfer & Trust Company as trustee (the “Trustee”), for the benefit of the holders of the Exchangeable Shares. You also have the right to retract (i.e., require Nanotronics Sub to redeem, subject to our retraction call rights) any or all of your Exchangeable Shares.

Your exchange put right. You may require us to exchange all or any part of your Exchangeable Shares for an equivalent number of shares of our common stock, plus cash equal to the cash dividends declared on our common stock and not also paid to holders of the Exchangeable Shares between the closing of the Business Combination and the date of exchange (“the “Unpaid Dividends”), if any. You may exercise your exchange put right by presenting to the Trustee at its principal offices in Toronto, Ontario:

| | • | | a certificate or certificates for the Exchangeable Shares you want to exchange; and |

| | • | | other documents and instruments as may be required to effect a transfer of Exchangeable Shares as provided in the voting and exchange trust agreement among us, Nanotronics Sub and the Trustee. |

An exchange pursuant to this right will be completed not later than the close of business on the third business day following receipt by the trustee of the items listed above.

23

Your retraction rights. Subject to applicable law and our retraction call right, you are entitled at any time to retract (i.e., require Nanotronics Sub to redeem) any of your Exchangeable Shares and to receive an equal number of shares of our common stock plus the equivalent amount of Unpaid Dividends on the Exchangeable Shares, if any. You may cause a redemption by presenting certificates representing the number of Exchangeable Shares you wish to redeem to the Trustee or Nanotronics Sub, together with a duly executed retraction request:

| | • | | specifying the number of Exchangeable Shares you desire to have redeemed; |

| | • | | stating the retraction date on which you desire to have us redeem your Exchangeable Shares, which must be a business day between five and ten days from the date of delivery of the request; and |

| | • | | acknowledging our retraction call right to purchase all but not less than all of the retracted Exchangeable Shares directly from you and that the retraction request will be deemed to be a revocable offer by you to sell the retracted shares to us in accordance with our retraction call right on the terms and conditions described below. |

Upon receipt of a retraction request, Nanotronics Sub will promptly notify us upon receipt of a retraction request.

Your retraction rights are subject to our retraction call rights. In order to exercise our retraction call right, we must notify Nanotronics Sub of our determination to do so within two business days of our receipt of notification. If we deliver the call notice within two business days, and you have not revoked your retraction request in the manner described below, Nanotronics Sub will not redeem the retracted shares and we (or Nanotronics Holdings) will purchase from you the retracted shares on the retraction date. If we do not deliver the call notice within the two business day period, and you have not revoked your retraction request, Nanotronics Sub will redeem the retracted shares on the retraction date.

You may withdraw you retraction request by giving notice in writing to Nanotronics Sub before the close of business on the business day immediately preceding the date specified as the retraction date. If you withdraw your retraction request, your offer to sell the retracted Exchangeable Shares to us will be deemed to have been revoked.

If, as a result of liquidity or solvency requirements or other provisions of applicable law, Nanotronics Sub is not permitted to redeem all those Exchangeable Shares you desire to retract, Nanotronics Sub will redeem only those Exchangeable Shares you have tendered as would be permitted by applicable law.

If any of your Exchangeable Shares are not redeemed by Nanotronics Sub as a consequence of applicable law or purchased by us, you will be deemed to have required us to purchase your unretracted shares in exchange for an equal number of shares of our common stock, plus the amount of all of our dividends then payable and unpaid, if any, on the retraction date pursuant to your exchange put right as provided for in the voting and exchange trust agreement described below.

24