such date less the sum of (a) the consolidated current liabilities of MEHC determined in accordance with GAAP and (b) assets properly classified as Intangible Assets.

"Currency Protection Agreement" means, with respect to any person, any foreign exchange contract, currency swap agreement or other similar agreement or arrangement intended to protect such person against fluctuations in currency values to or under which such person is a party or a beneficiary on the date of the indenture or becomes a party or a beneficiary thereafter.

"Debt" means, with respect to any person, at any date of determination (without duplication):

For purposes of determining any particular amount of Debt that is or would be outstanding, Guarantees of, or obligations with respect to letters of credit or similar instruments supporting (to the extent the foregoing constitutes Debt), Debt otherwise included in the determination of such particular amount will not be included. For purposes of determining compliance with the indenture, in the event that an item of Debt meets the criteria of more than one of the types of Debt described in the above clauses, MEHC, in its sole discretion, will classify such item of Debt and only be required to include the amount and type of such Debt in one of such clauses.

"Guarantee" means any obligation, contingent or otherwise, of any person directly or indirectly guaranteeing any Debt of any other person and, without limiting the generality of the foregoing, any Debt obligation, direct or indirect, contingent or otherwise, of such person (1) to purchase or pay (or advance or supply funds for the purchase or payment of) such Debt of such other person (whether arising by virtue of partnership arrangements (other than solely by reason of being a general partner of a partnership), or by agreement to keep-well, to purchase assets, goods, securities or services or to take-or-pay, or to maintain financial statement conditions or otherwise) or (2) entered into for purposes of assuring in any other manner the obligee of such Debt of the payment thereof or to protect such obligee against loss in respect thereof (in whole or in part), provided that the term "Guarantee" will not include endorsements for collection or deposit in the ordinary course of business or the grant of a lien in connection with any Non-Recourse Debt. The term "Guarantee" used as a verb has a corresponding meaning.

"Independent Investment Banker" means an independent investment banking institution of international standing appointed by MEHC.

"Intangible Assets" means, as of the date of determination thereof, all assets of MEHC properly classified as intangible assets determined on a consolidated basis in accordance with GAAP. "Interest Rate Protection Agreement" means, with respect to any person, any interest rate protection agreement, interest rate future agreement, interest rate option agreement, interest rate swap agreement, interest rate cap agreement, interest rate collar agreement, interest rate hedge agreement or other similar agreement or arrangement intended to protect such person against fluctuations in interest rates to or under which such person or any of its Subsidiaries is a party or a beneficiary on the date of the indenture or becomes a party or a beneficiary thereafter.

"Investment Grade" means with respect to the notes, (1) in the case of S&P, a rating of at least BBB–, (2) in the case of Moody's, a rating of at least Baa3, and (3) in the case of a Rating Agency other than S&P or Moody's, the equivalent rating, or in each case, any successor, replacement or equivalent definition as promulgated by S&P, Moody's or other Rating Agency as the case may be.

"Joint Venture" means a joint venture, partnership or other similar arrangement, whether in corporate, partnership or other legal form.

"Lien" means, with respect to any Property, any mortgage, lien, pledge, charge, security interest or encumbrance of any kind in respect of such Property, but will not include any partnership, joint venture, shareholder, voting trust or similar governance agreement with respect to Capital Stock in a Subsidiary or Joint Venture. For purposes of the indenture, MEHC will be deemed to own subject to a Lien any Property that it has acquired or holds subject to the interest of a vendor or lessor under any conditional sale agreement, capital lease or other title retention agreement relating to such Property.

"Non-Recourse" means any Debt or other obligation (or that portion of such Debt or other obligation) that is without recourse to MEHC or any property or assets directly owned by MEHC (other than a pledge of the equity interests in any Subsidiary of MEHC, to the extent recourse to MEHC under such pledge is limited to such equity interests).

"Property" of any person means all types of real, personal, tangible or mixed property owned by such person whether or not included in the most recent consolidated balance sheet of such person under GAAP.

"Rating Agencies" means (1) S&P and (2) Moody's or (3) if S&P or Moody's or both do not make a rating of the notes publicly available, a nationally recognized securities rating agency or agencies, as the case may be, selected by MEHC, which will be substituted for S&P, Moody's or both, as the case may be.

"Rating Category" means (1) with respect to S&P, any of the following categories: BB, B, CCC, CC, C and D (or equivalent successor categories), (2) with respect to Moody's, any of the following categories: Ba, B, Caa, Ca, C and D (or equivalent successor categories) and (3) the equivalent of any such category of S&P or Moody's used by another Rating Agency. In determining whether the rating of the notes has decreased by one or more gradations, gradations within Rating Categories (+ and – for S&P, 1, 2 and 3 for Moody's or the equivalent gradations for another Rating Agency) will be taken into account (e.g., with respect to S&P, a decline in a rating from BB+ to BB, as well as from BB– to B+, will constitute a decrease of one gradation).

"Rating Decline" means the occurrence of the following on, or within 90 days after, the earlier of (1) the occurrence of a Change of Control and (2) the date of public notice of the occurrence of a Change of Control or of the public notice of the intention of MEHC to effect a Change of Control (the "Rating Date"), which period will be extended so long as the rating of the notes is under publicly announced consideration for possible downgrading by any of the Rating Agencies: (a) in the event that any series of the notes are rated by either Rating Agency on the Rating Date as Investment Grade, the rating of such notes by both such Rating Agencies is reduced below Investment Grade, or (b) in the event the notes are rated below Investment Grade by both such Rating Agencies on the

106

Rating Date, the rating of such notes by either Rating Agency is decreased by one or more gradations (including gradations within Rating Categories as well as between Rating Categories).

"Redeemable Stock" means any class or series of Capital Stock of any person that by its terms or otherwise is (1) required to be redeemed prior to the stated maturity of any series of the notes, (2) redeemable at the option of the holder of such class or series of Capital Stock at any time prior to the stated maturity of any series of the notes or (3) convertible into or exchangeable for Capital Stock referred to in clause (1) or (2) above or Debt having a scheduled maturity prior to the stated maturity of any series of the notes, provided that any Capital Stock that would not constitute Redeemable Stock but for provisions thereof giving holders thereof the right to require MEHC to purchase or redeem such Capital Stock upon the occurrence of a "change of control" occurring prior to the stated maturity of any series of the notes will not constitute Redeemable Stock if the "change of control" provisions applicable to such Capital Stock are no more favorable to the holders of such Capital Stock than the provisions contained in the covenants described under "Purchase of Notes Upon a Change of Control" above.

"Redemption Date" means any date on which MEHC redeems all or any portion of the notes in accordance with the terms of the indenture.

"Reference Treasury Dealer" means a primary U.S. government securities dealer in New York City appointed by MEHC.

"Reference Treasury Dealer Quotation" means, with respect to the Reference Treasury Dealer and any Redemption Date, the average, as determined by MEHC, of the bid and asked prices for the Comparable Treasury Issue (expressed in each case as a percentage of its principal amount and quoted in writing to MEHC by such Reference Treasury Dealer at 5:00 p.m. on the third business day preceding such Redemption Date).

"Significant Subsidiary" means a "significant subsidiary" as defined in Rule 1-02(w) of Regulation S-X under the Securities Act and the Exchange Act, substituting 20 percent for 10 percent each place it appears therein. Unless the context otherwise clearly requires, any reference to a "Significant Subsidiary" is a reference to a Significant Subsidiary of MEHC.

"Subsidiary" means, with respect to any person including, without limitation, MEHC and its Subsidiaries, any corporation or other entity of which such person owns, directly or indirectly, a majority of the Capital Stock or other ownership interests and has ordinary voting power to elect a majority of the board of directors or other persons performing similar functions.

"Trade Payables" means, with respect to any person, any accounts payable or any other indebtedness or monetary obligation to trade creditors incurred, created, assumed or Guaranteed by such person or any of its Subsidiaries or Joint Ventures arising in the ordinary course of business.

"Treasury Yield" means, with respect to any Redemption Date, the rate per annum equal to the semiannual equivalent yield to maturity of the Comparable Treasury Issue, assuming a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price for such Redemption Date.

"U.S. Government Obligations" means any securities that are (1) direct obligations of the United States for the payment of which its full faith and credit is pledged or (2) obligations of a person controlled or supervised by and acting as an agency or instrumentality of the United States, the payment of which is unconditionally guaranteed as a full faith and credit obligation by the United States, that, in either case are not callable or redeemable at the option of the issuer thereof, and will also include any depository receipt issued by a bank or trust company as custodian with respect to any such U.S. Government Obligations or a specific payment of interest on or principal of any such U.S. Government Obligation held by such custodian for the account of the holder of a depository receipt, provided that (except as required by law) such custodian is not authorized to make any deduction from the amount payable to the holder of such depository receipt from any amount received by the custodian in respect of the U.S. Government Obligation or the specific payment of interest on or principal of the U.S. Government Obligation evidenced by such depository receipt.

107

"Voting Stock" means, with respect to any person, Capital Stock of any class or kind ordinarily having the power to vote for the election of directors (or persons fulfilling similar responsibilities) of such person.

Global Notes; Book-Entry System

The original series C notes were, and the series C exchange notes will be, issued under a book-entry system in the form of one or more global notes (each, a "Global Note"). Each Global Note with respect to the original series C notes was, and each Global Note with respect to the series C exchange notes will be, deposited with, or on behalf of, a depositary, which is The Depository Trust Company, New York, New York (the "Depositary"). The Global Notes with respect to the original series C notes were, and the Global Notes with respect to the series C exchange notes will be, registered in the name of the Depositary or its nominee.

The original series C notes were not issued in certificated form and, except under the limited circumstances described below, owners of beneficial interests in the Global Notes are not entitled to physical delivery of the series C notes in certificated form. The Global Notes may not be transferred except as a whole by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any nominee to a successor of the Depositary or a nominee of such successor.

The Depositary is a limited-purpose trust company organized under the New York Banking Law, a "banking organization" within the meaning of the New York Banking Law, a member of the Federal Reserve System, a "clearing corporation" within the meaning of the New York Uniform Commercial Code, and a "clearing agency" registered pursuant to the provisions of Section 17A of the Exchange Act. The Depositary holds securities that its participants ("Direct Participants") deposit with the Depositary. The Depositary also facilitates the post-trade settlement among Direct Participants of securities transactions, such as transfers and pledges, in deposited securities through electronic computerized book-entry changes in Direct Participants' accounts, thereby eliminating the need for physical movement of securities certificates. Direct Participants include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations, including Euroclear Bank S.A./N.V. as operator of the Euroclear System ("Euroclear") and Clearstream Banking, societe anonyme ("Clearstream"). The Depositary is a wholly owned subsidiary of The Depository Trust & Clearing Corporation ("DTCC"). DTCC, in turn, is owned by a number of Direct Participants and Members of the National Securities Clearing Corporation, Government Securities Clearing Corporation, MBS Clearing Corporation and Emerging Markets Clearing Corporation, also subsidiaries of DTCC, as well as by the New York Stock Exchange, Inc., the American Stock Exchange LLC and the National Association of Securities Dealers, Inc. Access to the Depositary system is also available to others such as securities brokers and dealers, banks and trust companies that clear through or maintain a custodial relationship with a Direct Participant, either directly or indirectly ("Indirect Participants"). The rules applicable to the Depositary and its Direct and Indirect Participants are on file with the SEC.

Purchases of the notes under the Depositary system must be made by or through Direct Participants, which will receive a credit for the notes on the Depositary's records. The ownership interest of each actual purchaser of each note ("Beneficial Owner") is in turn to be recorded on the Direct and Indirect Participants' records. Beneficial Owners will not receive written confirmation from the Depositary of their purchase, but Beneficial Owners are expected to receive written confirmations providing details of the transaction, as well as periodic statements of their holdings, from the Direct or Indirect Participant through which the Beneficial Owner entered into the transaction. Transfers of ownership interests in the notes are to be accomplished by entries made on the books of Direct and Indirect Participants acting on behalf of Beneficial Owners. Beneficial Owners will not receive certificates representing their ownership interests in notes, except in the event that use of the book-entry system for the notes is discontinued.

To facilitate subsequent transfers, all series C notes deposited by Direct Participants with the Depositary are registered in the name of the Depositary's partnership nominee, Cede & Co., or such

108

other name as may be requested by an authorized representative of the Depositary. The deposit of series C notes with the Depositary and their registration in the name of Cede & Co. or such other nominee effect no change in beneficial ownership. The Depositary has no knowledge of the actual Beneficial Owners of the series C notes; the Depositary's records reflect only the identity of the Direct Participants to whose accounts such series C notes are credited, which may or may not be the Beneficial Owners. The Direct and Indirect Participants remain responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications by the Depositary to Direct Participants, by Direct Participants to Indirect Participants, and by Direct Participants and Indirect Participants to Beneficial Owners are governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

Neither the Depositary nor Cede & Co. (nor any other nominee of the Depositary) will consent or vote with respect to the series C notes unless authorized by a Direct Participant in accordance with the Depositary's procedures. Under its usual procedures, the Depositary mails an Omnibus Proxy to MEHC as soon as possible after the record date. The Omnibus Proxy assigns Cede & Co.'s consenting or voting rights to those Direct Participants to whose accounts the notes are credited on the record date (identified in a listing attached to the Omnibus Proxy).

Principal (and premium, if any) and interest payments on the series C notes and any redemption payments are made to Cede & Co. (or such other nominee as may be requested by an authorized representative of the Depositary). The Depositary's practice is to credit Direct Participants' accounts upon the Depositary's receipt of funds and corresponding detail information from MEHC or the trustee on the payable date in accordance with their respective holdings shown on the Depositary's records. Payments by Participants to Beneficial Owners will be governed by standing instructions and customary practices, as is the case with securities held for the accounts of customers in bearer form or registered in "street name," and will be the responsibility of such Participant and not of the Depositary, the trustee or MEHC, subject to any statutory or regulatory requirements as may be in effect from time to time. Payment of principal (and premium, if any), interest and any redemption proceeds to Cede & Co. (or such other nominee as may be requested by an authorized representative of the Depositary) is the responsibility of MEHC, disbursements of such payments to Direct Participants shall be the responsibility of the Depositary, and disbursement of such payments to the Beneficial Owners shall be the responsibility of Direct and Indirect Participants.

The Depositary may discontinue providing its services as securities depositary with respect to the series C notes at any time by giving reasonable notice to MEHC or the trustee. Under such circumstances, in the event that a successor securities depositary is not obtained, certificated series C notes are required to be printed and delivered. MEHC may decide to discontinue use of the system of book-entry transfers through the Depositary (or a successor securities depositary). In that event, certificated series C notes will be printed and delivered.

The information in this section concerning the Depositary and the Depositary's book-entry system has been obtained from sources that MEHC believes to be reliable, but MEHC, the initial purchasers and the trustee take no responsibility for the accuracy thereof.

A Global Note of any series may not be transferred except as a whole by the Depositary to a nominee or successor of the Depositary or by a nominee of the Depositary to another nominee of the Depositary. A Global Note representing series C notes is exchangeable, in whole but not in part, for series C notes in definitive form of like tenor and terms if (1) the Depositary notifies MEHC that it is unwilling or unable to continue as depositary for such Global Note or if at any time the Depositary is no longer eligible to be or in good standing as a "clearing agency" registered under the Exchange Act, and in either case, a successor depositary is not appointed by MEHC within 120 days of receipt by MEHC of such notice or of MEHC becoming aware of such ineligibility, (2) while such Global Note is subject to the transfer restrictions described under "Transfer Restrictions," the book-entry interests in such Global Note cease to be eligible for Depositary services because such series C notes are neither (a) rated in one of the top four categories by a nationally recognized statistical rating organization nor (b) included within a Self-Regulatory Organization system approved by the SEC for the reporting of

109

quotation and trade information of securities eligible for transfer pursuant to Rule 144A under the Securities Act, or (3) MEHC in its sole discretion at any time determines not to have such series C notes represented by a Global Note and notifies the trustee thereof. A Global Note exchangeable pursuant to the preceding sentence shall be exchangeable for series C notes registered in such names and in such authorized denominations as the Depositary shall direct.

110

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The exchange of original series C notes for series C exchange notes pursuant to the exchange offer will not constitute a taxable event for U.S. federal income tax purposes. The series C exchange notes received by a holder of original series C notes should be treated as a continuation of such holder's investment in the original series C notes; thus there should be no material U.S. federal income tax consequences to holders exchanging original series C notes for series C exchange notes. As a result:

| • | a holder of original series C notes will not recognize taxable gain or loss as a result of the exchange of original series C notes for series C exchange notes pursuant to the exchange offer; |

| • | the holding period of the series C exchange notes will include the holding period of the original series C notes surrendered in exchange therefor; and |

| • | a holder's adjusted tax basis in the series C exchange notes will be the same as such holder's adjusted tax basis in the original series C notes surrendered in exchange therefor. |

111

PLAN OF DISTRIBUTION

Based on existing interpretations of the Securities Act by the staff of the SEC set forth in several no-action letters to third parties, and subject to the immediately following sentence, we believe that the series C exchange notes that will be issued pursuant to the exchange offer may be offered for resale, resold and otherwise transferred by the holders thereof without further compliance with the registration and prospectus delivery provisions of the Securities Act. However, any purchaser of series C notes who is an "affiliate" (within the meaning of the Securities Act) of ours or who intends to participate in the exchange offer for the purpose of distributing the series C exchange notes or a broker-dealer (within the meaning of the Securities Act) that acquired original series C notes in a transaction other than as part of its market-making or other trading activities and who has arranged or has an understanding with any person to participate in the distribution of the series C exchange notes: (1) will not be able to rely on the interpretations by the staff of the SEC set forth in the above-mentioned no-action letters; (2) will not be able to tender its original series C notes in the exchange offer; and (3) must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any sale or transfer of the series C notes unless such sale or transfer is made pursuant to an exemption from such requirements.

Each broker-dealer that receives series C exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such series C exchange notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of series C exchange notes received in exchange for original series C notes where such original series C notes were acquired as a result of market-marketing activities or other trading activities. We have agreed that, for a period of 120 days after the expiration date, we will make this prospectus, as amended or supplemented, available to any broker-dealer for use in connection with any such resale. In addition, until July 22, 2003, all dealers effecting transactions in the series C exchange notes may be required to deliver a prospectus.

We will not receive any proceeds from any such sale of series C exchange notes by broker-dealers. Series C exchange notes received by broker-dealers for their own account pursuant to the exchange offer may be sold from time to time in one or more transactions in the over-the-counter market, in negotiated transactions, through the writing of options on the series C exchange notes or a combination of such methods of resale, at market prices prevailing at the time of resale, at prices related to such prevailing market prices or at negotiated prices. Any such resale may be made directly to purchasers or to or through brokers or dealers who may receive compensation in the form of commissions or concessions from any such broker/dealer and/or the purchasers of any such series C exchange notes. Any broker-dealer that resells series C exchange notes that were received by it for its own account pursuant to the exchange offer and any broker or dealer that participates in a distribution of such series C exchange notes may be deemed to be an "underwriter" within the meaning of the Securities Act and any profit on any such resale of series C exchange notes and any commissions or concessions received by any such persons may be deemed to be underwriting compensation under the Securities Act. The letters of transmittal states that by acknowledging that it will deliver and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act.

For a period of 120 days after the expiration date we will promptly send additional copies of this prospectus and any amendment or supplement to this prospectus to any broker-dealer that requests such documents in the letter of transmittal. We have agreed to pay all expenses incident to the exchange offer (including the expenses of one counsel for the holders of the series C notes) other than commissions or concessions of any brokers or dealers and will indemnify the holders of the series C notes (including any broker-dealers) against certain liabilities, including liabilities under the Securities Act.

NOTICE TO CANADIAN RESIDENTS

Any resale of the series C notes in Canada must be made under applicable securities laws which will vary depending on the relevant jurisdiction, and which may require resales to be made under

112

available statutory exemptions or under a discretionary exemption granted by the applicable Canadian securities regulatory authority. Note holders resident in Canada are advised to seek legal advice prior to any resale of the series C notes.

LEGAL MATTERS

Certain legal matters with respect to the series C exchange notes will be passed upon for us by Willkie Farr & Gallagher, New York, New York.

EXPERTS

The consolidated balance sheets of MidAmerican Energy Holdings Company (successor to MidAmerican Energy Holdings Company (Predecessor), or MEHC (Predecessor)), and its subsidiaries, which are herein collectively referred to as MEHC, as of December 31, 2002 and 2001 for MEHC, and the related consolidated statements of operations, stockholders' equity, and cash flows for the years ended December 31, 2002 and 2001 for MEHC, for the period January 1, 2000 to March 13, 2000 for MEHC (Predecessor) and for the period March 14, 2000 to December 31, 2000 for MEHC, included in this prospectus, and the related financial statement schedules included elsewhere in the registration statement, have been audited by Deloitte & Touche LLP, independent auditors, as stated in their report appearing herein (which report expresses an unqualified opinion and includes an explanatory paragraph referring to MEHC's change in its accounting policy for goodwill and other intangible assets in 2002 and for major maintenance, overhaul, and well workover costs in 2001), and have been so included in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

With respect to the unaudited interim financial information for the periods ended March 31, 2003 and 2002, which is included in this prospectus, Deloitte & Touche LLP have applied limited procedures in accordance with professional standards for a review of such information. However, as stated in their report included herein, they did not audit and they do not express an opinion on that interim financial information. Accordingly, the degree of reliance on their report on such information should be restricted in light of the limited nature of the review procedures applied. Deloitte & Touche LLP are not subject to the liability provisions of Section 11 of the Securities Act of 1933 for their report on the unaudited interim financial information because this report is not a "report" or a "part" of the registration statement prepared or certified by an accountant within the meaning of Sections 7 and 11 of the Act.

WHERE YOU CAN FIND MORE INFORMATION

We file reports and information statements and other information with the SEC. Such reports, proxy and information statements and other information filed by us with the SEC can be inspected and copied at the Public Reference Section of the SEC at Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549, and at the regional offices of the SEC located at Woolworth Building, 233 Broadway, New York, New York 10279 and 500 West Madison Street, Suite 1400, Chicago, Illinois 60661. Copies of such material can be obtained from the Public Reference Section of the SEC at Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549 at prescribed rates. The SEC maintains a Web site that contains reports, proxy and information statements and other materials that are filed through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. This Web site can be accessed athttp://www.sec.gov.

We make available free of charge through our internet website athttp://www.midamerican.com our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file with, or furnish it to, the SEC. Any information available on or through our website is not part of this prospectus and our web address is included as an inactive textual reference only.

113

FINANCIAL STATEMENTS

Index to Financial Statements

|  |  |  |  |  |  |

| |  | Page |

| Independent Accountant's Report |  | | F-2 | |

| Consolidated Balance Sheets as of March 31, 2003 (unaudited) and December 31, 2002 |  | | F-3 | |

| Consolidated Statements of Operations for the three-month periods ended March 31, 2003 and 2002 (unaudited) |  | | F-4 | |

| Consolidated Statements of Cash Flows for the three-month periods ended March 31, 2003 and 2002 (unaudited) |  | | F-5 | |

| Notes to Consolidated Financial Statements (unaudited) |  | | F-6 | |

| Independent Auditors' Report |  | | F-16 | |

| Consolidated Balance Sheets as of December 31, 2002 and 2001 |  | | F-17 | |

| Consolidated Statements of Operations for the years ended December 31, 2002 and 2001 and for the periods from March 14, 2000 through December 31, 2000 and January 1, 2000 through March 13, 2000 |  | | F-18 | |

| Consolidated Statements of Stockholders' Equity for the three years ended December 31, 2002, 2001 and 2000 |  | | F-19 | |

| Consolidated Statements of Cash Flows for the years ended December 31, 2002 and 2001 and for the periods from March 14, 2000 through December 31, 2000 and January 1, 2000 through March 13, 2000 |  | | F-20 | |

| Notes to Consolidated Financial Statements |  | | F-21 | |

|

F-1

INDEPENDENT ACCOUNTANTS' REPORT

Board of Directors and Stockholders

MidAmerican Energy Holdings Company

Des Moines, Iowa

We have reviewed the accompanying consolidated balance sheet of MidAmerican Energy Holdings Company and subsidiaries (the "Company") as of March 31, 2003, and the related consolidated statements of operations and cash flows for the three-month periods ended March 31, 2003 and 2002. These financial statements are the responsibility of the Company's management.

We conducted our review in accordance with standards established by the American Institute of Certified Public Accountants. A review of interim financial information consists principally of applying analytical procedures to financial data and of making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with auditing standards generally accepted in the United States of America, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to such financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

We have previously audited, in accordance with auditing standards generally accepted in the United States of America, the consolidated balance sheet of MidAmerican Energy Holdings Company and subsidiaries as of December 31, 2002, and the related consolidated statements of operations, stockholders' equity and cash flows for the year then ended (not presented herein); and in our report dated January 24, 2003, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying consolidated balance sheet as of December 31, 2002 is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

/s/ Deloitte & Touche LLP

DELOITTE & TOUCHE LLP

Des Moines, Iowa

May 8, 2003

F-2

MIDAMERICAN ENERGY HOLDINGS COMPANY

CONSOLIDATED BALANCE SHEETS

(In thousands)

|  |  |  |  |  |  |  |  |  |  |

| |  | As of |

| |  | March 31,

2003 |  | December 31,

2002 |

| |  | (Unaudited) |  |

| ASSETS |

| Current assets: |  |

| Cash and cash equivalents |  | $ | 852,868 | |  | $ | 844,430 | |

| Restricted cash and short-term investments |  | | 72,695 | |  | | 50,808 | |

| Accounts receivable, net |  | | 734,901 | |  | | 707,731 | |

| Inventories |  | | 62,326 | |  | | 126,938 | |

| Other current assets |  | | 238,454 | |  | | 212,888 | |

| Total current assets |  | | 1,961,244 | |  | | 1,942,795 | |

| Properties, plants and equipment, net |  | | 10,135,056 | |  | | 9,898,796 | |

| Excess of cost over fair value of net assets acquired |  | | 4,259,574 | |  | | 4,258,132 | |

| Regulatory assets, net |  | | 568,882 | |  | | 415,804 | |

| Other investments |  | | 444,679 | |  | | 446,732 | |

| Equity investments |  | | 278,755 | |  | | 273,707 | |

| Deferred charges and other assets |  | | 760,770 | |  | | 780,489 | |

| Total assets |  | $ | 18,408,960 | |  | $ | 18,016,455 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current liabilities: |  |

| Accounts payable |  | $ | 418,367 | |  | $ | 462,960 | |

| Accrued interest |  | | 182,348 | |  | | 192,015 | |

| Accrued taxes |  | | 93,622 | |  | | 75,097 | |

| Other accrued liabilities |  | | 518,838 | |  | | 457,058 | |

| Short-term debt |  | | 70,932 | |  | | 79,782 | |

| Current portion of long-term debt |  | | 364,358 | |  | | 470,213 | |

| Total current liabilities |  | | 1,648,465 | |  | | 1,737,125 | |

| Other long-term accrued liabilities |  | | 1,275,554 | |  | | 1,100,917 | |

| Parent company debt |  | | 2,325,756 | |  | | 2,324,456 | |

| Subsidiary and project debt |  | | 7,231,794 | |  | | 7,077,087 | |

| Deferred income taxes |  | | 1,284,195 | |  | | 1,238,421 | |

| Total liabilities |  | | 13,765,764 | |  | | 13,478,006 | |

| Deferred income |  | | 77,695 | |  | | 80,078 | |

| Minority interest |  | | 6,533 | |  | | 7,351 | |

| Company-obligated mandatorily redeemable preferred securities of subsidiary trusts |  | | 2,063,935 | |  | | 2,063,412 | |

| Preferred securities of subsidiaries |  | | 93,028 | |  | | 93,325 | |

| Commitments and contingencies (Note 6) |  |

| Stockholders' equity: |  |

| Zero-coupon convertible preferred stock — authorized 50,000 shares, no par value, 41,263 shares outstanding |  | | — | |  | | — | |

| Common stock — authorized 60,000 shares, no par value, 9,281 shares issued and outstanding |  | | — | |  | | — | |

| Additional paid-in capital |  | | 1,956,509 | |  | | 1,956,509 | |

| Retained earnings |  | | 714,645 | |  | | 584,009 | |

| Accumulated other comprehensive loss |  | | (269,149 | ) |  | | (246,235 | ) |

| Total stockholders' equity |  | | 2,402,005 | |  | | 2,294,283 | |

| Total liabilities and stockholders' equity |  | $ | 18,408,960 | |  | $ | 18,016,455 | |

|

The accompanying notes are an integral part of these financial statements.

F-3

MIDAMERICAN ENERGY HOLDINGS COMPANY

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands)

|  |  |  |  |  |  |  |  |  |  |

| |  | Three Months

Ended March 31, |

| |  | 2003 |  | 2002 |

| |  | (Unaudited) |

| Revenue: |  |

| Operating revenue |  | $ | 1,562,834 | |  | $ | 1,041,752 | |

| Income on equity investments |  | | 7,455 | |  | | 14,120 | |

| Interest and dividend income |  | | 13,871 | |  | | 8,355 | |

| Other income |  | | 19,794 | |  | | 5,350 | |

| Total revenue |  | | 1,603,954 | |  | | 1,069,577 | |

| Costs and expenses: |  |

| Cost of sales |  | | 672,750 | |  | | 409,283 | |

| Operating expense |  | | 356,493 | |  | | 279,667 | |

| Depreciation and amortization |  | | 141,849 | |  | | 126,244 | |

| Interest expense |  | | 186,845 | |  | | 141,300 | |

| Capitalized interest |  | | (15,532 | ) |  | | (6,647 | ) |

| Total costs and expenses |  | | 1,342,405 | |  | | 949,847 | |

| Income before provision for income taxes |  | | 261,549 | |  | | 119,730 | |

| Provision for income taxes |  | | 73,000 | |  | | 29,130 | |

| Income before minority interest and preferred dividends |  | | 188,549 | |  | | 90,600 | |

| Minority interest and preferred dividends |  | | 57,913 | |  | | 25,851 | |

| Net income available to common and preferred stockholders |  | $ | 130,636 | |  | $ | 64,749 | |

|

The accompanying notes are an integral part of these financial statements.

F-4

MIDAMERICAN ENERGY HOLDINGS COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

|  |  |  |  |  |  |  |  |  |  |

| |  | Three Months

Ended March 31, |

| |  | 2003 |  | 2002 |

| |  | (Unaudited) |

| Cash flows from operating activities: |  |

| Net income |  | $ | 130,636 | |  | $ | 64,749 | |

| Adjustments to reconcile net cash flows from operating activities: |  |

| Income in excess of distributions on equity investments |  | | (3,541 | ) |  | | (11,745 | ) |

| Depreciation and amortization |  | | 141,849 | |  | | 126,244 | |

| Amortization of deferred financing costs |  | | 9,555 | |  | | 9,005 | |

| Amortization of regulatory assets and liabilities and other |  | | (9,709 | ) |  | | (1,656 | ) |

| Provision for deferred income taxes |  | | 58,923 | |  | | 4,797 | |

| Changes in other items: |  |

| Accounts receivable, net |  | | (20,651 | ) |  | | (137,731 | ) |

| Other current assets |  | | 53,018 | |  | | 54,595 | |

| Accounts payable and other accrued liabilities |  | | 14,896 | |  | | 44,164 | |

| Accrued interest |  | | (9,357 | ) |  | | 28,551 | |

| Accrued taxes |  | | 15,291 | |  | | (15,560 | ) |

| Deferred income |  | | (2,214 | ) |  | | (492 | ) |

| Other |  | | 7,097 | |  | | 17,701 | |

| Net cash flows from operating activities |  | | 385,793 | |  | | 182,622 | |

| Cash flows from investing activities: |  |

| Acquisitions, net of cash acquired |  | | (36,575 | ) |  | | (493,696 | ) |

| Purchase of convertible preferred securities |  | | — | |  | | (275,000 | ) |

| Capital expenditures relating to operating projects |  | | (133,845 | ) |  | | (95,673 | ) |

| Construction and other development costs |  | | (244,033 | ) |  | | (22,372 | ) |

| (Increase) decrease in restricted cash and investments |  | | (603 | ) |  | | 5,423 | |

| Other |  | | (28,944 | ) |  | | (5,372 | ) |

| Net cash flows from investing activities |  | | (444,000 | ) |  | | (886,690 | ) |

| Cash flows from financing activities: |  |

| Proceeds from subsidiary and project debt |  | | 287,572 | |  | | 395,428 | |

| Proceeds from parent company debt |  | | — | |  | | 120,500 | |

| Repayments of subsidiary and project debt |  | | (211,268 | ) |  | | (11,092 | ) |

| Net repayment of subsidiary short-term debt |  | | (8,850 | ) |  | | (46,195 | ) |

| Proceeds from issuance of trust preferred securities |  | | — | |  | | 323,000 | |

| Proceeds from issuance of common and preferred stock |  | | — | |  | | 402,000 | |

| Redemption of preferred securities of subsidiaries |  | | (294 | ) |  | | (100,320 | ) |

| Increase in restricted cash |  | | (21,887 | ) |  | | (23,012 | ) |

| Other |  | | 28,276 | |  | | (31,113 | ) |

| Net cash flows from financing activities |  | | 73,549 | |  | | 1,029,196 | |

| Effect of exchange rate changes |  | | (6,904 | ) |  | | (6,394 | ) |

| Net increase in cash and cash equivalents |  | | 8,438 | |  | | 318,734 | |

| Cash and cash equivalents at beginning of period |  | | 844,430 | |  | | 386,745 | |

| Cash and cash equivalents at end of period |  | $ | 852,868 | |  | $ | 705,479 | |

| Supplemental Disclosure: |  |

| Interest paid, net of interest capitalized |  | $ | 172,181 | |  | $ | 146,222 | |

| Income taxes paid |  | $ | 280 | |  | $ | 20,167 | |

|

The accompanying notes are an integral part of these financial statements.

F-5

MIDAMERICAN ENERGY HOLDINGS COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. General

In the opinion of management of MidAmerican Energy Holdings Company and subsidiaries ("MEHC" or the "Company"), the accompanying unaudited consolidated financial statements contain all adjustments (consisting of normal recurring accruals) necessary to present fairly the financial position as of March 31, 2003, and the results of operations and cash flows for the three-month periods ended March 31, 2003 and 2002. The results of operations for the three-month period ended March 31, 2003 are not necessarily indicative of the results to be expected for the full year.

The unaudited consolidated financial statements include the accounts of MidAmerican Energy Holdings Company and its wholly and majority owned subsidiaries. Other investments and corporate joint ventures, where the Company has the ability to exercise significant influence, are accounted for under the equity method. Investments where the Company's ability to influence is limited are accounted for under the cost method of accounting.

Certain amounts in the prior year financial statements and supporting note disclosures have been reclassified to conform to the current year presentation. Such reclassification did not impact previously reported net income or retained earnings.

The unaudited consolidated financial statements should be read in conjunction with the consolidated financial statements included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002.

2. New Accounting Pronouncements

Effective January 1, 2003 the Company adopted SFAS No. 143, "Accounting for Asset Retirement Obligations" ("SFAS 143"). This statement provides accounting and disclosure requirements for retirement obligations associated with long-lived assets. The cumulative effect of initially applying this statement was immaterial.

The Company's review of its regulated entities identified legal retirement obligations for nuclear decommissioning, wet and dry ash landfills and offshore and minor lateral pipeline facilities. On January 1, 2003, the Company recorded $289.3 million of asset retirement obligation ("ARO") liabilities; $13.9 million of ARO assets, net of accumulated depreciation; $114.6 million of regulatory assets; and reclassified $1.0 million of accumulated depreciation to the ARO liability. The initial ARO liability recognized includes $266.5 million that pertains to obligations associated with the decommissioning of the Quad Cities nuclear station. The $266.5 million includes a $159.8 million nuclear decommissioning liability that had been recorded at December 31, 2002. The adoption of this statement did not have a material impact on the operations of the regulated entities, as the effects were offset by the establishment of regulatory assets, totaling $114.6 million, pursuant to SFAS No. 71.

During the three-month period ended March 31, 2003, the Company recorded, as a regulatory asset, accretion related to the ARO liability of $4.2 million resulting in an ARO liability balance of $293.5 million at March 31, 2003.

On April 30, 2003, the Financial Accounting Standards Board issued Statement No. 149, "Amendment of Statement 133 on Derivative Instruments and Hedging Activities" ("SFAS 149"). SFAS 149 amends SFAS No. 133 for derivative instruments, including certain derivative instruments embedded in other contracts and for hedging activities. SFAS 149 also amends certain other existing pronouncements. It will require contracts with comparable characteristics to be accounted for similarly. In particular, SFAS 149 clarifies when a contract with an initial net investment meets the characteristic of a derivative and clarifies when a derivative that contains a financing component will require special reporting in the statement of cash flows. SFAS 149 is effective for the Company for contracts entered into or modified after June 30, 2003. The Company and its subsidiaries are evaluating the impact of adopting the requirements of SFAS 149.

F-6

3. Properties, Plants and Equipment, Net

Properties, plants and equipment, net comprise the following (in thousands):

|  |  |  |  |  |  |  |  |  |  |

| |  | March 31,

2003 |  | December 31,

2002 |

| Properties, plants and equipment, net: |  |

| Utility generation and distribution system |  | $ | 8,226,590 | |  | $ | 8,165,140 | |

| Interstate pipelines' assets |  | | 2,291,482 | |  | | 2,260,145 | |

| Independent power plants |  | | 1,415,538 | |  | | 1,410,170 | |

| Mineral and gas reserves and exploration assets |  | | 508,062 | |  | | 500,422 | |

| Utility non-operational assets |  | | 381,269 | |  | | 370,811 | |

| Other assets |  | | 136,343 | |  | | 131,577 | |

| Total operating assets |  | | 12,959,284 | |  | | 12,838,265 | |

| Accumulated depreciation and amortization |  | | (4,261,446 | ) |  | | (4,109,954 | ) |

| Net operating assets |  | | 8,697,838 | |  | | 8,728,311 | |

| Construction in progress |  | | 1,437,218 | |  | | 1,170,485 | |

| Properties, plants and equipment, net |  | $ | 10,135,056 | |  | $ | 9,898,796 | |

|

Construction in Progress

Kern River Gas Transmission Company ("Kern River") completed the construction of its 2003 Expansion Project at a total cost of approximately $1.2 billion. The expansion, which was placed into operation on May 1, 2003, increased the design capacity of the existing Kern River pipeline by 885,626 decatherms per day to 1,755,626 decatherms per day.

4. Investment in CE Generation

The equity investment in CE Generation LLC ("CE Generation") at March 31, 2003 and December 31, 2002 was approximately $247.4 million and $244.9 million, respectively. During the three-month period ended March 31, 2003 and 2002, the Company recorded income from its investment in CE Generation of $2.3 million and $7.2 million, respectively.

5. Debt Issuances and Redemptions

On January 14, 2003, MidAmerican Energy Company ("MidAmerican Energy") issued $275.0 million of 5.125% medium-term notes due in 2013. The proceeds were used to refinance existing debt and for other corporate purposes.

On May 1, 2003, Kern River Funding Corporation, a wholly owned subsidiary of Kern River, issued $836 million of its 4.893% Senior Notes with a final maturity on April 30, 2018. The proceeds were used to repay all of the approximately $815 million of outstanding borrowings under Kern River's $875 million credit facility. Kern River entered into this credit facility in 2002 to finance the construction of the 2003 Expansion Project. The credit facility was canceled and a completion guarantee issued by the Company in favor of the lenders as part of the credit facility terminated upon completion of the 2003 Expansion Project.

On April 23, 2003, Yorkshire Power Group Limited, a wholly owned subsidiary of MEHC, reported that it had authorized the redemption in full of the outstanding shares of the Yorkshire Capital Trust I, 8.08% Trust Securities, due June 30, 2038. The Trust Securities will be redeemed on June 9, 2003, at a redemption price of 100% of the principal amount ($25 liquidation amount per each Trust Security) plus accrued distributions of $0.381555555 per Trust Security to the redemption date. The redemption price will be paid to holders of the Trust Security on the redemption date. At March 31, 2003 and December 31, 2002, $250.5 million and $249.7 million, respectively, of the Trust Securities are included in subsidiary and project debt.

F-7

6. Commitments and Contingencies

Manufactured Gas Plants

The United States Environmental Protection Agency ("EPA") and the state environmental agencies have determined that contaminated wastes remaining at decommissioned manufactured gas plant facilities may pose a threat to the public health or the environment if such contaminants are in sufficient quantities and at such concentrations as to warrant remedial action.

MidAmerican Energy has evaluated or is evaluating 27 properties that were, at one time, sites of gas manufacturing plants in which it may be a potentially responsible party. The purpose of these evaluations is to determine whether waste materials are present, whether the materials constitute an environmental or health risk, and whether MidAmerican Energy has any responsibility for remedial action. MidAmerican Energy is currently conducting field investigations at 21 sites, has conducted interim removal actions at 14 sites and has received regulatory closure on two sites. MidAmerican Energy is continuing to evaluate several of the sites to determine the future liability, if any, for conducting site investigations or other site activity.

MidAmerican Energy estimates the range of possible costs for investigation, remediation and monitoring for the sites discussed above to be $16 million to $54 million. As of March 31, 2003, MidAmerican Energy has recorded a $21 million liability for these sites and a corresponding regulatory asset for future recovery through the regulatory process. MidAmerican Energy projects that these amounts will be paid or incurred over the next four years.

The estimate of probable remediation costs is established on a site-specific basis. The costs are accumulated in a three-step process. First, a determination is made as to whether MidAmerican Energy has potential legal liability for the site and whether information exists to indicate that contaminated wastes remain at the site. If so, the costs of performing a preliminary investigation and the costs of removing known contaminated soil are accrued. As the investigation is performed and if it is determined remedial action is required, the best estimate of remedial costs is accrued. The estimated recorded liabilities for these properties include incremental direct costs of the remediation effort, costs for future monitoring at sites and costs of compensation to employees for time expected to be spent directly on the remediation effort. The estimated recorded liabilities for these properties are based upon preliminary data. Thus, actual costs could vary significantly from the estimates. The estimate could change materially based on facts and circumstances derived from site investigations, changes in required remedial action and changes in technology relating to remedial alternatives. Insurance recoveries have been received for some of the sites under investigation. Those recoveries are intended to be used principally for accelerated remediation, as specified by the Iowa Utilities Board ("IUB"), and are recorded as a regulatory liability.

Although the timing of potential incurred costs and recovery of such costs in rates may affect the results of operations in individual periods, management believes that the outcome of these issues will not have a material adverse effect on MidAmerican Energy's financial position or results of operations.

Air Quality

In July 1997, the EPA adopted revisions to the National Ambient Air Quality Standards for ozone and a new standard for fine particulate matter. Based on data to be obtained from monitors located throughout each state, the EPA will determine which states have areas that do not meet the air quality standards (i.e., areas that are classified as nonattainment). The standards were subjected to legal proceedings, and in February 2001, the United States Supreme Court upheld the constitutionality of the standards, though remanding the issue of implementation of the ozone standard to the EPA. As a result of a decision rendered by the United States Circuit Court of Appeals for the District of Columbia, the EPA is moving forward in implementation of the ozone and fine particulate standards and is analyzing existing monitored data to determine attainment status.

The impact of the new standards on MidAmerican Energy is currently unknown. MidAmerican Energy's generating stations may be subject to emission reductions if the stations are located in

F-8

nonattainment areas or contribute to nonattainment areas in other states. As part of state implementation plans to achieve attainment of the standards, MidAmerican Energy could be required to install control equipment on its generating stations or decrease the number of hours during which these stations operate.

The ozone and fine particulate matter standards could, in whole or in part, be superceded by one of a number of multi-pollutant emission reduction proposals currently under consideration at the federal level. In July 2002, legislation was introduced in Congress to implement the Administration's "Clear Skies Initiative," calling for reduction in emissions of sulfur dioxide, nitrogen oxides and mercury through a cap-and-trade system. Reductions would begin in 2008 with additional emission reductions being phased in through 2018.

While legislative action is necessary for the Clear Skies Initiative or other multi-pollutant emission reduction initiatives to become effective, MidAmerican Energy has implemented a planning process that forecasts the site-specific controls and actions required to meet emissions reductions of this nature. On April 1, 2002, in accordance with Iowa law passed in 2001, MidAmerican Energy filed with the IUB its first multi-year plan and budget for managing regulated emissions from its generating facilities in a cost-effective manner. MidAmerican Energy expects the IUB to rule on the prudence of the multi-year plan and budget in 2003.

In recent years, the EPA has requested from several utilities information and support regarding their capital projects for various generating plants. The requests were issued as part of an industry-wide investigation to assess compliance with the New Source Review and the New Source Performance Standards of the Clean Air Act. In December 2002, MidAmerican Energy received a request from the EPA to provide documentation related to its capital projects from January 1, 1980, to the present for its Neal, Council Bluffs, Louisa and Riverside Energy Centers. MidAmerican Energy has responded to this request and at this time cannot predict the outcome of this request.

Nuclear Decommissioning Costs

Each licensee of a nuclear facility is required to provide financial assurance for the cost of decommissioning its licensed nuclear facility. In general, decommissioning of a nuclear facility means to safely remove the facility from service and restore the property to a condition allowing unrestricted use by the operator.

Based on information presently available, MidAmerican Energy expects to contribute approximately $41 million during the period 2003 through 2007 to external trusts established for the investment of funds for decommissioning Quad Cities Station. Approximately 60% of the fair value of the trusts' funds is now invested in domestic corporate debt and common equity securities. The remainder is invested in investment grade municipal and U.S. Treasury bonds. Funding for Quad Cities Station nuclear decommissioning is reflected as depreciation expense in the Consolidated Statements of Income. Quad Cities Station decommissioning costs charged to Iowa customers are included in base rates, and recovery of increases in those amounts must be sought through the normal ratemaking process.

Pipeline Litigation

In 1998, the United States Department of Justice informed the then current owners of Kern River and Northern Natural Gas Company ("Northern Natural Gas") that Jack Grynberg, an individual, had filed claims in the United States District Court for the District of Colorado under the False Claims Act against such entities and certain of their subsidiaries including Kern River and Northern Natural Gas. Mr. Grynberg has also filed claims against numerous other energy companies and alleges that the defendants violated the False Claims Act in connection with the measurement and purchase of hydrocarbons. The relief sought is an unspecified amount of royalties allegedly not paid to the federal government, treble damages, civil penalties, attorneys' fees and costs. On April 9, 1999, the United States Department of Justice announced that it declined to intervene in any of the Grynberg qui tam cases, including the actions filed against Kern River and Northern Natural Gas in the United States District Court for the District of Colorado. On October 21, 1999, the Panel on Multi-District

F-9

Litigation transferred the Grynberg qui tam cases, including the ones filed against Kern River and Northern Natural Gas, to the United States District Court for the District of Wyoming for pre-trial purposes. Motions to dismiss the complaint, filed by various defendants including Northern Natural Gas and The Williams Companies, Inc. ("Williams") which was the former owner of Kern River, were denied on May 18, 2001. On October 9, 2002, the United States District Court for the District of Wyoming dismissed Grynberg's Royalty Valuation Claims. On November 19, 2002, the Court denied Grynberg's motion for clarification dismissing royalty valuation claims. Grynberg has appealed this dismissal to the United States Court of Appeals for the Tenth Circuit. In connection with the purchase of Kern River from Williams in March 2002, Williams agreed to indemnify the Company against any liability for this claim; however, no assurance can be given as to the ability of Williams to perform on this indemnity should it become necessary. No such indemnification was obtained in connection with the purchase of Northern Natural Gas in August 2002. The Company believes that the Grynberg cases filed against Kern River and Northern Natural Gas are without merit and Williams, on behalf of Kern River pursuant to its indemnification, and Northern Natural Gas, intend to defend these actions vigorously.

On June 8, 2001, a number of interstate pipeline companies, including Kern River and Northern Natural Gas, were named as defendants in a nationwide class action lawsuit which had been pending in the 26th Judicial District, District Court, Stevens County Kansas, Civil Department against other defendants, generally pipeline and gathering companies, since May 20, 1999. The plaintiffs allege that the defendants have engaged in mismeasurement techniques that distort the heating content of natural gas, resulting in an alleged underpayment of royalties to the class of producer plaintiffs. In November 2001, Kern River and Northern Natural Gas, along with the coordinating defendants, filed a motion to dismiss under Rules 9B and 12B of the Kansas Rules of Civil Procedure. In January 2002, Kern River and most of the coordinating defendants filed a motion to dismiss for lack of personal jurisdiction. The court has yet to rule on these motions. The plaintiffs filed for certification of the plaintiff class on September 16, 2002. On January 13, 2003, oral arguments were heard on coordinating defendants' opposition to class certification. On April 10, 2003, the court entered an order denying the plaintiffs' motion for class certification. It is anticipated that the plaintiffs will appeal this decision. On April 10, 2003, the court entered an order denying the plaintiffs' motion for class certification. It is anticipated that the plaintiffs will appeal this decision. Williams has agreed to indemnify the Company against any liability associated with Kern River for this claim; however, no assurance can be given as to the ability of Williams to perform on this indemnity should it become necessary. Williams, on behalf of Kern River and other entities, anticipates joining with Northern Natural Gas and other defendants in contesting certification of the plaintiff class. Kern River and Northern Natural Gas believe that this claim is without merit and that Kern River's and Northern Natural Gas' gas measurement techniques have been in accordance with industry standards and its tariff.

Philippines

Casecnan Construction Contract

The CE Casecnan Water and Energy Company, Inc. ("CE Casecnan") Project (the "Casecnan Project") was initially constructed pursuant to a fixed-price, date-certain, turnkey construction contract (the "Hanbo Contract") on a joint and several basis by Hanbo Corporation ("Hanbo") and Hanbo Engineering and Construction Co., Ltd. ("HECC"), both of which are South Korean corporations. On May 7, 1997, CE Casecnan terminated the Hanbo Contract due to defaults by Hanbo and HECC including the insolvency of both companies. On the same date, CE Casecnan entered into a new fixed-price, date certain, turnkey engineering, procurement and construction contract to complete the construction of the Casecnan Project (the "Replacement Contract"). The work under the Replacement Contract was conducted by a consortium consisting of Cooperativa Muratori Cementisti CMC di Ravenna and Impresa Pizzarotti & C. Spa., (collectively, the "Contractor"), working together with Siemens A.G., Sulzer Hydro Ltd., Black & Veatch and Colenco Power Engineering Ltd.

On November 20, 1999, the Replacement Contract was amended to extend the Guaranteed Substantial Completion Date for the Casecnan Project to March 31, 2001. This amendment was approved by the lenders' independent engineer under the Trust Indenture.

F-10

On February 12, 2001, the Contractor filed a Request for Arbitration with the International Chamber of Commerce ("ICC") seeking schedule relief of up to 153 days through August 31, 2001 resulting from various alleged force majeure events. In its March 20, 2001 Supplement to Request for Arbitration, the Contractor also seeks compensation for alleged additional costs of approximately $4 million it incurred from the claimed force majeure events to the extent it is unable to recover from its insurer. On April 20, 2001, the Contractor filed a further supplement seeking an additional compensation for damages of approximately $62 million for the alleged force majeure event (and geologic conditions) related to the collapse of the surge shaft. The Contractor has alleged that the circumstances surrounding the placing of the Casecnan Project into commercial operation in December 2001 amounted to a repudiation of the Replacement Contract and has filed a claim for unspecified quantum meruit damages, and has further alleged that the delay liquidated damages clause which provides for payments of $125,000 per day for each day of delay in completion of the Casecnan Project for which the Contractor is responsible is unenforceable. The arbitration is being conducted applying New York law and pursuant to the rules of the ICC.

Hearings have been held in connection with this arbitration in July 2001, September 2001, January 2002, March 2002, November 2002 and January 2003. As part of those hearings, on June 25, 2001, the arbitration tribunal temporarily enjoined CE Casecnan from making calls on the demand guaranty posted by Banca di Roma in support of the Contractor's obligations to CE Casecnan for delay liquidated damages. As a result of the continuing nature of that injunction, on April 26, 2002, CE Casecnan and the Contractor mutually agreed that no demands would be made on the Banca di Roma demand guaranty except pursuant to an arbitration award. As of March 31, 2003, however, CE Casecnan has received approximately $6.0 million of liquidated damages from demands made on the demand guarantees posted by Commerzbank on behalf of the Contractor. On November 7, 2002, the ICC issued the arbitration tribunal's partial award with respect to the Contractor's force majeure and geologic conditions claims. The arbitration panel awarded the Contractor 18 days of schedule relief in the aggregate for all of the force majeure events and awarded the Contractor $3.8 million with respect to the cost of the collapsed surge shaft. The $3.8 million is shown as part of the accounts payable and accrued expenses balance at March 31, 2003 and December 31, 2002. All of the Contractor's other claims with respect to force majeure and geologic conditions were denied.

Further hearings on the Contractor's repudiation and quantum meruit claims, the alleged unenforceability of the delay liquidated damages clause and certain other matters had been scheduled for March 24 through March 28, 2003, but were postponed as a result of the commencement of military action in Iraq. The hearings have been rescheduled for June 30 through July 11, 2003.

If the Contractor were to prevail on its claim that the delay liquidated damages clause is unenforceable, CE Casecnan would not be entitled to collect such delay damages for the period from March 31, 2001 through December 11, 2001. If the Contractor were to prevail in its repudiation claim and prove quantum meruit damages in excess of amounts paid to the Contractor, CE Casecnan could be liable to make additional payments to the Contractor. CE Casecnan believes all of such allegations and claims are without merit and is vigorously contesting the Contractor's claims.

Casecnan NIA Arbitration

Under the terms of the Project Agreement, the Philippines National Irrigation Administration ("NIA") has the option of timely reimbursing CE Casecnan directly for certain taxes CE Casecnan has paid. If NIA does not so reimburse CE Casecnan, the taxes paid by CE Casecnan result in an increase in the Water Delivery Fee. The payment of certain other taxes by CE Casecnan results automatically in an increase in the Water Delivery Fee. As of March 31, 2003, CE Casecnan has paid approximately $58.1 million in taxes, which as a result of the foregoing provisions results in an increase in the Water Delivery Fee. NIA has failed to pay the portion of the Water Delivery Fee each month, related to the payment of these taxes by CE Casecnan. As a result of this non-payment, on August 19, 2002, CE Casecnan filed a Request for Arbitration against NIA, seeking payment of such portion of the Water Delivery Fee and enforcement of the relevant provision of the Project Agreement going forward. The arbitration will be conducted in accordance with the rules of the ICC.

F-11

NIA filed its Answer and Counterclaim on March 31, 2003. In its Answer, NIA asserts, among other things, that most of the taxes which CE Casecnan has factored into the Water Delivery Fee compensation formula do not fall within the scope of the relevant section of the Project Agreement, that the compensation mechanism itself is invalid and unenforceable under Philippine law and that the Project Agreement is inconsistent with the Philippine build-operate-transfer ("BOT") law. As such, NIA seeks dismissal of CE Casecnan's claims and a declaration from the arbitral tribunal that the taxes which have been taken into account in the Water Delivery Fee compensation mechanism are not recoverable thereunder and that, at most, certain taxes may be directly reimbursed (rather than compensated for through the Water Delivery Fee) by NIA. NIA also counterclaims for approximately $7 million which it alleges is due to it as a result of the delayed completion of the Casecnan Project. On April 23, 2003, NIA filed a Supplemental Counterclaim in which it asserts that the Project Agreement is contrary to Philippine law and public policy and by way of relief seeks a declaration that the Project Agreement is void from the beginning or should be cancelled, or alternatively, an order for reformation of the Project Agreement or any portions or sections thereof which may be determined to be contrary to such law and or public policy. CE Casecnan intends to vigorously contest all of NIA's assertions and counterclaims.

The three member arbitration panel has been confirmed by the ICC and an initial organizational hearing was held on April 28, 2003. Hearings on this matter are scheduled for July 2004.

Included in revenue, for the three months ended March 31, 2003 and 2002, were $5.5 million and $5.8 million, respectively, of tax compensation for Water Delivery Fees under the Project Agreement, none of which has been paid. As of March 31, 2003 and December 31, 2002, the net receivable for the tax compensation piece of the Water Delivery Fees invoiced since the start of commercial operations totaled $29.8 million and $24.3 million, respectively.

Casecnan Stockholder Litigation

Pursuant to the share ownership adjustment mechanism in the CE Casecnan stockholder agreement, which is based upon pro forma financial projections of the Casecnan Project prepared following commencement of commercial operations, in February 2002, MEHC, through its indirect wholly owned subsidiary CE Casecnan Ltd., advised the minority stockholder LaPrairie Group Contractors (International) Ltd., ("LPG"), that MEHC's indirect ownership interest in CE Casecnan had increased to 100% effective from commencement of commercial operations. On July 8, 2002, LPG filed a complaint in the Superior Court of the State of California, City and County of San Francisco against, inter alia, CE Casecnan Ltd. and MEHC. In the complaint, LPG seeks compensatory and punitive damages for alleged breaches of the stockholder agreement and alleged breaches of fiduciary duties allegedly owed by CE Casecnan Ltd. and MEHC to LPG. The complaint also seeks injunctive relief against all defendants and a declaratory judgment that LPG is entitled to maintain its 15% interest in CE Casecnan. The impact, if any, of this litigation on CE Casecnan cannot be determined at this time.

In February 2003, San Lorenzo Ruiz Builders and Developers Group, Inc. ("San Lorenzo"), an original shareholder substantially all of whose shares in CE Casecnan MEHC purchased in 1998, threatened to initiate legal action in the Philippines in connection with certain aspects of its option to repurchase such shares on or prior to commercial operation of the Casecnan Project. CE Casecnan believes that San Lorenzo has no valid basis for any claim and, if named as a defendant in any action that may be commenced by San Lorenzo, will vigorously defend any such action.

Philippine Political Risks

In connection with an interagency review of approximately 40 independent power project contracts in the Philippines, the Casecnan Project (together with four other unrelated projects) has reportedly been identified as raising legal and financial questions and, with those projects, has been prioritized for renegotiation. The Company's subsidiaries' Upper Mahiao, Malitbog, and Mahanagdong projects have also reportedly been identified as raising financial questions. No written report has yet been issued with respect to the interagency review, and the timing and nature of steps, if any that the

F-12

Philippine Government may take in this regard are not known. Accordingly, it is not known what, if any, impact the government's review will have on the operations of the Company's Philippine Projects. CE Casecnan representatives, together with certain current and former government officials, also have been requested to appear, and have appeared during 2002, before a Philippine Senate committee which has raised questions and made allegations with respect to the Casecnan Project's tariff structure and implementation.

On May 5, 2003, the Philippine Supreme Court issued its ruling in a case involving an unsolicited BOT project for the development, construction and operation of the new Manila International Airport. Various members of Congress and labor unions initiated the action in the Philippine Supreme Court on September 17, 2002 seeking to enjoin the enforcement of the BOT agreement with an international consortium known as PIATCO (the "PIATCO Agreement"). The PIATCO Consortium is unrelated to CE Casecnan or the Company. On March 4, 2003, PIATCO separately initiated an ICC arbitration pursuant to the terms of the PIATCO Agreement. The Supreme Court, in its ruling, stated that there were no unresolved factual issues and therefore it had original jurisdiction and concluded that the pendency of the arbitration did not preclude the court from ruling on a case brought by non-parties to the PIATCO Agreement, such as members of the Philippine Congress or non-governmental organizations. In a public speech on November 29, 2002 prior to the December 10, 2002 oral arguments before the Philippine Supreme Court, Philippine President Arroyo stated that she would not honor the PIATCO Agreement because the executive branch's legal department had concluded it was "null and void". In light of that announcement, the project owners stopped work on the project, which is approximately 90% complete and accordingly has not been placed into commercial operation. In its 10 to 3 ruling (with one abstention) issued on May 5, 2003, the Philippine Supreme Court ruled that the PIATCO Agreement was contrary to Philippine law and public policy and was "null and void". CE Casecnan is assessing the impact of the PIATCO ruling on the Casecnan Project.

On April 24, 2003 Standard & Poor's Ratings Services ("S&P") lowered its rating of CE Casecnan to 'BB' from 'BB+' as a result of S&P's downgrade of the Republic of the Philippines. The downgrade of the Philippines by S&P reflected the Country's growing debt burden and fiscal rigidity.

On May 8, 2003, Moody's Investors Service ("Moody's") placed the Ba2 senior secured notes rating of CE Casecnan on review for possible downgrade, noting NIA's supplemental counterclaim seeking to have the Project Agreement declared void. Moody's noted that actions by government related agencies and the resulting instability of contractual arrangements was becoming inconsistent with their rating approach that attaches significant benefit to offtake arrangements with those government supported entities.

F-13

7. Comprehensive Income

The differences from net income to total comprehensive income for the Company are due to minimum pension liability adjustments, foreign currency translation adjustments, unrealized holding gains and losses of marketable securities during the periods, and the effective portion of net gains and losses of derivative instruments classified as cash flow hedges. Total comprehensive income for the Company is shown in the table below (in thousands).

|  |  |  |  |  |  |  |  |  |  |

| |  | Three Months

Ended March 31, |

| |  | 2003 |  | 2002 |

| Net income |  | $ | 130,636 | |  | $ | 64,749 | |

| Other comprehensive income: |  |

| Minimum pension liability adjustment, net of tax of $927 |  | | 2,164 | |  | | — | |

| Foreign currency translation |  | | (30,171 | ) |  | | (28,515 | ) |

| Marketable securities, net of tax of $(83) and $(1,116), respectively |  | | (133 | ) |  | | (2,158 | ) |

| Cash flow hedges, net of tax of $2,442 and $3,803, respectively |  | | 5,226 | |  | | 9,819 | |

| Total comprehensive income |  | $ | 107,722 | |  | $ | 43,895 | |

|

8. Segment Information

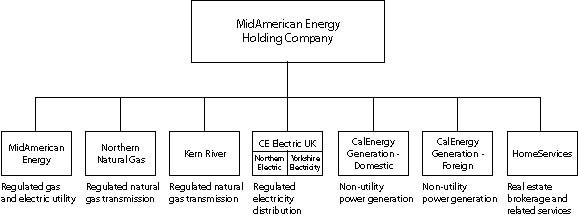

The Company has identified seven reportable operating segments based on management structure: MidAmerican Energy, Kern River, Northern Natural Gas, CE Electric UK Funding, Inc. ("CE Electric UK"), CalEnergy Generation-Domestic, CalEnergy Generation-Foreign, and HomeServices of America, Inc. ("HomeServices"). Information related to the Company's reportable operating segments is shown below (in thousands).

|  |  |  |  |  |  |  |  |  |  |

| |  | Three Months

Ended March 31, |

| |  | 2003 |  | 2002 |

| Operating revenue: |  |

| MidAmerican Energy |  | $ | 815,916 | |  | $ | 575,035 | |

| Kern River |  | | 39,030 | |  | | 2,198 | |

| Northern Natural Gas |  | | 170,002 | |  | | — | |

| CE Electric UK |  | | 225,532 | |  | | 213,957 | |

| CalEnergy Generation – Domestic |  | | 11,233 | |  | | 5,105 | |

| CalEnergy Generation – Foreign |  | | 76,729 | |  | | 74,085 | |