daily statistical release (or any successor release) published by the Federal Reserve Bank of New York and designated "Composite 3:30 p.m. Quotations for U.S. Government Securities" or (2) if such release (or any successor release) is not published or does not contain such prices on such business day, the Reference Treasury Dealer Quotation for such Redemption Date.

"Consolidated Net Tangible Assets" means, as of the date of any determination thereof, the total amount of all assets of MEHC determined on a consolidated basis in accordance with GAAP as of such date less the sum of (a) the consolidated current liabilities of MEHC determined in accordance with GAAP and (b) assets properly classified as Intangible Assets.

"Currency Protection Agreement" means, with respect to any person, any foreign exchange contract, currency swap agreement or other similar agreement or arrangement intended to protect such person against fluctuations in currency values to or under which such person is a party or a beneficiary on the date of the indenture or becomes a party or a beneficiary thereafter.

"Debt" means, with respect to any person, at any date of determination (without duplication):

For purposes of determining any particular amount of Debt that is or would be outstanding, Guarantees of, or obligations with respect to letters of credit or similar instruments supporting (to the extent the foregoing constitutes Debt), Debt otherwise included in the determination of such particular amount will not be included. For purposes of determining compliance with the indenture, in the event that an item of Debt meets the criteria of more than one of the types of Debt described in the above clauses, MEHC, in its sole discretion, will classify such item of Debt and only be required to include the amount and type of such Debt in one of such clauses.

"Guarantee" means any obligation, contingent or otherwise, of any person directly or indirectly guaranteeing any Debt of any other person and, without limiting the generality of the foregoing, any Debt obligation, direct or indirect, contingent or otherwise, of such person (1) to purchase or pay (or advance or supply funds for the purchase or payment of) such Debt of such other person (whether arising by virtue of partnership arrangements (other than solely by reason of being a general partner of a partnership), or by agreement to keep-well, to purchase assets, goods, securities or services or to take-or-pay, or to maintain financial statement conditions or otherwise) or (2) entered into for

purposes of assuring in any other manner the obligee of such Debt of the payment thereof or to protect such obligee against loss in respect thereof (in whole or in part), provided that the term "Guarantee" will not include endorsements for collection or deposit in the ordinary course of business or the grant of a lien in connection with any Non-Recourse Debt. The term "Guarantee" used as a verb has a corresponding meaning.

"Independent Investment Banker" means an independent investment banking institution of international standing appointed by MEHC.

"Intangible Assets" means, as of the date of determination thereof, all assets of MEHC properly classified as intangible assets determined on a consolidated basis in accordance with GAAP. "Interest Rate Protection Agreement" means, with respect to any person, any interest rate protection agreement, interest rate future agreement, interest rate option agreement, interest rate swap agreement, interest rate cap agreement, interest rate collar agreement, interest rate hedge agreement or other similar agreement or arrangement intended to protect such person against fluctuations in interest rates to or under which such person or any of its Subsidiaries is a party or a beneficiary on the date of the indenture or becomes a party or a beneficiary thereafter.

"Investment Grade" means with respect to the notes, (1) in the case of S&P, a rating of at least BBB–, (2) in the case of Moody's, a rating of at least Baa3, and (3) in the case of a Rating Agency other than S&P or Moody's, the equivalent rating, or in each case, any successor, replacement or equivalent definition as promulgated by S&P, Moody's or other Rating Agency as the case may be.

"Joint Venture" means a joint venture, partnership or other similar arrangement, whether in corporate, partnership or other legal form.

"Lien" means, with respect to any Property, any mortgage, lien, pledge, charge, security interest or encumbrance of any kind in respect of such Property, but will not include any partnership, joint venture, shareholder, voting trust or similar governance agreement with respect to Capital Stock in a Subsidiary or Joint Venture. For purposes of the indenture, MEHC will be deemed to own subject to a Lien any Property that it has acquired or holds subject to the interest of a vendor or lessor under any conditional sale agreement, capital lease or other title retention agreement relating to such Property.

"Non-Recourse" means any Debt or other obligation (or that portion of such Debt or other obligation) that is without recourse to MEHC or any property or assets directly owned by MEHC (other than a pledge of the equity interests in any Subsidiary of MEHC, to the extent recourse to MEHC under such pledge is limited to such equity interests).

"Property" of any person means all types of real, personal, tangible or mixed property owned by such person whether or not included in the most recent consolidated balance sheet of such person under GAAP.

"Rating Agencies" means (1) S&P and (2) Moody's or (3) if S&P or Moody's or both do not make a rating of the notes publicly available, a nationally recognized securities rating agency or agencies, as the case may be, selected by MEHC, which will be substituted for S&P, Moody's or both, as the case may be.

"Rating Category" means (1) with respect to S&P, any of the following categories: BB, B, CCC, CC, C and D (or equivalent successor categories), (2) with respect to Moody's, any of the following categories: Ba, B, Caa, Ca, C and D (or equivalent successor categories) and (3) the equivalent of any such category of S&P or Moody's used by another Rating Agency. In determining whether the rating of the notes has decreased by one or more gradations, gradations within Rating Categories (+ and – for S&P, 1, 2 and 3 for Moody's or the equivalent gradations for another Rating Agency) will be taken into account (e.g., with respect to S&P, a decline in a rating from BB+ to BB, as well as from BB– to B+, will constitute a decrease of one gradation).

"Rating Decline" means the occurrence of the following on, or within 90 days after, the earlier of (1) the occurrence of a Change of Control and (2) the date of public notice of the occurrence of a Change of Control or of the public notice of the intention of MEHC to effect a Change of Control

104

(the "Rating Date"), which period will be extended so long as the rating of the notes is under publicly announced consideration for possible downgrading by any of the Rating Agencies: (a) in the event that any series of the notes are rated by either Rating Agency on the Rating Date as Investment Grade, the rating of such notes by both such Rating Agencies is reduced below Investment Grade, or (b) in the event the notes are rated below Investment Grade by both such Rating Agencies on the Rating Date, the rating of such notes by either Rating Agency is decreased by one or more gradations (including gradations within Rating Categories as well as between Rating Categories).

"Redeemable Stock" means any class or series of Capital Stock of any person that by its terms or otherwise is (1) required to be redeemed prior to the stated maturity of any series of the notes, (2) redeemable at the option of the holder of such class or series of Capital Stock at any time prior to the stated maturity of any series of the notes or (3) convertible into or exchangeable for Capital Stock referred to in clause (1) or (2) above or Debt having a scheduled maturity prior to the stated maturity of any series of the notes, provided that any Capital Stock that would not constitute Redeemable Stock but for provisions thereof giving holders thereof the right to require MEHC to purchase or redeem such Capital Stock upon the occurrence of a "change of control" occurring prior to the stated maturity of any series of the notes will not constitute Redeemable Stock if the "change of control" provisions applicable to such Capital Stock are no more favorable to the holders of such Capital Stock than the provisions contained in the covenants described under "Purchase of Notes Upon a Change of Control" above.

"Redemption Date" means any date on which MEHC redeems all or any portion of the notes in accordance with the terms of the indenture.

"Reference Treasury Dealer" means a primary U.S. government securities dealer in New York City appointed by MEHC.

"Reference Treasury Dealer Quotation" means, with respect to the Reference Treasury Dealer and any Redemption Date, the average, as determined by MEHC, of the bid and asked prices for the Comparable Treasury Issue (expressed in each case as a percentage of its principal amount and quoted in writing to MEHC by such Reference Treasury Dealer at 5:00 p.m. on the third business day preceding such Redemption Date).

"Significant Subsidiary" means a "significant subsidiary" as defined in Rule 1-02(w) of Regulation S-X under the Securities Act and the Exchange Act, substituting 20 percent for 10 percent each place it appears therein. Unless the context otherwise clearly requires, any reference to a "Significant Subsidiary" is a reference to a Significant Subsidiary of MEHC.

"Subsidiary" means, with respect to any person, including, without limitation, MEHC and its Subsidiaries, any corporation or other entity of which such person owns, directly or indirectly, a majority of the Capital Stock or other ownership interests and has ordinary voting power to elect a majority of the board of directors or other persons performing similar functions.

"Trade Payables" means, with respect to any person, any accounts payable or any other indebtedness or monetary obligation to trade creditors incurred, created, assumed or Guaranteed by such person or any of its Subsidiaries or Joint Ventures arising in the ordinary course of business.

"Treasury Yield" means, with respect to any Redemption Date, the rate per annum equal to the semiannual equivalent yield to maturity of the Comparable Treasury Issue, assuming a price for the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price for such Redemption Date.

"U.S. Government Obligations" means any securities that are (1) direct obligations of the United States for the payment of which its full faith and credit is pledged or (2) obligations of a person controlled or supervised by and acting as an agency or instrumentality of the United States, the payment of which is unconditionally guaranteed as a full faith and credit obligation by the United States, that, in either case are not callable or redeemable at the option of the issuer thereof, and will also include any depository receipt issued by a bank or trust company as custodian with respect to any such U.S. Government Obligations or a specific payment of interest on or principal of any such U.S.

105

Government Obligation held by such custodian for the account of the holder of a depository receipt, provided that (except as required by law) such custodian is not authorized to make any deduction from the amount payable to the holder of such depository receipt from any amount received by the custodian in respect of the U.S. Government Obligation or the specific payment of interest on or principal of the U.S. Government Obligation evidenced by such depository receipt.

"Voting Stock" means, with respect to any person, Capital Stock of any class or kind ordinarily having the power to vote for the election of directors (or persons fulfilling similar responsibilities) of such person.

Global Notes; Book-Entry System

The original series D notes were, and the series D exchange notes will be, issued under a book-entry system in the form of one or more global notes (each, a "Global Note"). Each Global Note with respect to the original series D notes was, and each Global Note with respect to the series D exchange notes will be, deposited with, or on behalf of, a depositary, which is The Depository Trust Company, New York, New York (the "Depositary"). The Global Notes with respect to the original series D notes were, and the Global Notes with respect to the series D exchange notes will be, registered in the name of the Depositary or its nominee.

The original series D notes were not issued in certificated form and, except under the limited circumstances described below, owners of beneficial interests in the Global Notes are not entitled to physical delivery of the series D notes in certificated form. The Global Notes may not be transferred except as a whole by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any nominee to a successor of the Depositary or a nominee of such successor.

The Depositary is a limited-purpose trust company organized under the New York Banking Law, a "banking organization" within the meaning of the New York Banking Law, a member of the Federal Reserve System, a "clearing corporation" within the meaning of the New York Uniform Commercial Code, and a "clearing agency" registered pursuant to the provisions of Section 17A of the Exchange Act. The Depositary holds securities that its participants ("Direct Participants") deposit with the Depositary. The Depositary also facilitates the post-trade settlement among Direct Participants of securities transactions, such as transfers and pledges, in deposited securities through electronic computerized book-entry changes in Direct Participants' accounts, thereby eliminating the need for physical movement of securities certificates. Direct Participants include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations, including Euroclear Bank S.A./N.V. as operator of the Euroclear System ("Euroclear") and Clearstream Banking, société anonyme ("Clearstream"). The Depositary is a wholly owned subsidiary of The Depository Trust & Clearing Corporation ("DTCC"). DTCC, in turn, is owned by a number of Direct Participants and Members of the National Securities Clearing Corporation, Government Securities Clearing Corporation, MBS Clearing Corporation and Emerging Markets Clearing Corporation, also subsidiaries of DTCC, as well as by the New York Stock Exchange, Inc., the American Stock Exchange LLC and the National Association of Securities Dealers, Inc. Access to the Depositary system is also available to others such as securities brokers and dealers, banks and trust companies that clear through or maintain a custodial relationship with a Direct Participant, either directly or indirectly ("Indirect Participants"). The rules applicable to the Depositary and its Direct and Indirect Participants are on file with the SEC.

Purchases of the notes under the Depositary system must be made by or through Direct Participants, which will receive a credit for the notes on the Depositary's records. The ownership interest of each actual purchaser of each note ("Beneficial Owner") is in turn to be recorded on the Direct and Indirect Participants' records. Beneficial Owners will not receive written confirmation from the Depositary of their purchase, but Beneficial Owners are expected to receive written confirmations providing details of the transaction, as well as periodic statements of their holdings, from the Direct or Indirect Participant through which the Beneficial Owner entered into the transaction. Transfers of ownership interests in the notes are to be accomplished by entries made on the books of Direct and

106

Indirect Participants acting on behalf of Beneficial Owners. Beneficial Owners will not receive certificates representing their ownership interests in notes, except in the event that use of the book-entry system for the notes is discontinued.

To facilitate subsequent transfers, all series D notes deposited by Direct Participants with the Depositary are registered in the name of the Depositary's partnership nominee, Cede & Co., or such other name as may be requested by an authorized representative of the Depositary. The deposit of series D notes with the Depositary and their registration in the name of Cede & Co. or such other nominee effect no change in beneficial ownership. The Depositary has no knowledge of the actual Beneficial Owners of the series D notes; the Depositary's records reflect only the identity of the Direct Participants to whose accounts such series D notes are credited, which may or may not be the Beneficial Owners. The Direct and Indirect Participants remain responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications by the Depositary to Direct Participants, by Direct Participants to Indirect Participants, and by Direct Participants and Indirect Participants to Beneficial Owners are governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

Neither the Depositary nor Cede & Co. (nor any other nominee of the Depositary) will consent or vote with respect to the series D notes unless authorized by a Direct Participant in accordance with the Depositary's procedures. Under its usual procedures, the Depositary mails an Omnibus Proxy to MEHC as soon as possible after the record date. The Omnibus Proxy assigns Cede & Co.'s consenting or voting rights to those Direct Participants to whose accounts the notes are credited on the record date (identified in a listing attached to the Omnibus Proxy).

Principal (and premium, if any) and interest payments on the series D notes and any redemption payments are made to Cede & Co. (or such other nominee as may be requested by an authorized representative of the Depositary). The Depositary's practice is to credit Direct Participants' accounts upon the Depositary's receipt of funds and corresponding detail information from MEHC or the trustee on the payable date in accordance with their respective holdings shown on the Depositary's records. Payments by Participants to Beneficial Owners will be governed by standing instructions and customary practices, as is the case with securities held for the accounts of customers in bearer form or registered in "street name," and will be the responsibility of such Participant and not of the Depositary, the trustee or MEHC, subject to any statutory or regulatory requirements as may be in effect from time to time. Payment of principal (and premium, if any), interest and any redemption proceeds to Cede & Co. (or such other nominee as may be requested by an authorized representative of the Depositary) is the responsibility of MEHC, disbursements of such payments to Direct Participants shall be the responsibility of the Depositary, and disbursement of such payments to the Beneficial Owners shall be the responsibility of Direct and Indirect Participants.

The Depositary may discontinue providing its services as securities depositary with respect to the series D notes at any time by giving reasonable notice to MEHC or the trustee. Under such circumstances, in the event that a successor securities depositary is not obtained, certificated series D notes are required to be printed and delivered. MEHC may decide to discontinue use of the system of book-entry transfers through the Depositary (or a successor securities depositary). In that event, certificated series D notes will be printed and delivered.

The information in this section concerning the Depositary and the Depositary's book-entry system has been obtained from sources that MEHC believes to be reliable, but MEHC, the initial purchasers and the trustee take no responsibility for the accuracy thereof.

A Global Note of any series may not be transferred except as a whole by the Depositary to a nominee or successor of the Depositary or by a nominee of the Depositary to another nominee of the Depositary. A Global Note representing series D notes is exchangeable, in whole but not in part, for series D notes in definitive form of like tenor and terms if (1) the Depositary notifies MEHC that it is unwilling or unable to continue as depositary for such Global Note or if at any time the Depositary is no longer eligible to be or in good standing as a "clearing agency" registered under the Exchange Act,

107

and in either case, a successor depositary is not appointed by MEHC within 120 days of receipt by MEHC of such notice or of MEHC becoming aware of such ineligibility, (2) while such Global Note is subject to the transfer restrictions described under "Transfer Restrictions," the book-entry interests in such Global Note cease to be eligible for Depositary services because such series D notes are neither (a) rated in one of the top four categories by a nationally recognized statistical rating organization nor (b) included within a Self-Regulatory Organization system approved by the SEC for the reporting of quotation and trade information of securities eligible for transfer pursuant to Rule 144A under the Securities Act, or (3) MEHC in its sole discretion at any time determines not to have such series D notes represented by a Global Note and notifies the trustee thereof. A Global Note exchangeable pursuant to the preceding sentence shall be exchangeable for series D notes registered in such names and in such authorized denominations as the Depositary shall direct.

108

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The exchange of original series D notes for series D exchange notes pursuant to the exchange offer will not constitute a taxable event for U.S. federal income tax purposes. The series D exchange notes received by a holder of original series D notes should be treated as a continuation of such holder's investment in the original series D notes; thus there should be no material U.S. federal income tax consequences to holders exchanging original series D notes for series D exchange notes. As a result:

|  |

| • | a holder of original series D notes will not recognize taxable gain or loss as a result of the exchange of original series D notes for series D exchange notes pursuant to the exchange offer; |

|  |

| • | the holding period of the series D exchange notes will include the holding period of the original series D notes surrendered in exchange therefor; and |

|  |

| • | a holder's adjusted tax basis in the series D exchange notes will be the same as such holder's adjusted tax basis in the original series D notes surrendered in exchange therefor. |

109

PLAN OF DISTRIBUTION

Based on existing interpretations of the Securities Act by the staff of the SEC set forth in several no-action letters to third parties, and subject to the immediately following sentence, we believe that the series D exchange notes that will be issued pursuant to the exchange offer may be offered for resale, resold and otherwise transferred by the holders thereof without further compliance with the registration and prospectus delivery provisions of the Securities Act. However, any purchaser of series D notes who is an "affiliate" (within the meaning of the Securities Act) of ours or who intends to participate in the exchange offer for the purpose of distributing the series D exchange notes or a broker-dealer (within the meaning of the Securities Act) that acquired original series D notes in a transaction other than as part of its market-making or other trading activities and who has arranged or has an understanding with any person to participate in the distribution of the series D exchange notes: (1) will not be able to rely on the interpretations by the staff of the SEC set forth in the above-mentioned no-action letters; (2) will not be able to tender its original series D notes in the exchange offer; and (3) must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any sale or transfer of the series D notes unless such sale or transfer is made pursuant to an exemption from such requirements.

Each broker-dealer that receives series D exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such series D exchange notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of series D exchange notes received in exchange for original series D notes where such original series D notes were acquired as a result of market-marketing activities or other trading activities. We have agreed that, for a period of 120 days after the expiration date, we will make this prospectus, as amended or supplemented, available to any broker-dealer for use in connection with any such resale. In addition, until April 15, 2004, all dealers effecting transactions in the series D exchange notes may be required to deliver a prospectus.

We will not receive any proceeds from any such sale of series D exchange notes by broker-dealers. Series D exchange notes received by broker-dealers for their own account pursuant to the exchange offer may be sold from time to time in one or more transactions in the over-the-counter market, in negotiated transactions, through the writing of options on the series D exchange notes or a combination of such methods of resale, at market prices prevailing at the time of resale, at prices related to such prevailing market prices or at negotiated prices. Any such resale may be made directly to purchasers or to or through brokers or dealers who may receive compensation in the form of commissions or concessions from any such broker/dealer and/or the purchasers of any such series D exchange notes. Any broker-dealer that resells series D exchange notes that were received by it for its own account pursuant to the exchange offer and any broker or dealer that participates in a distribution of such series D exchange notes may be deemed to be an "underwriter" within the meaning of the Securities Act and any profit on any such resale of series D exchange notes and any commissions or concessions received by any such persons may be deemed to be underwriting compensation under the Securities Act. The letters of transmittal states that by acknowledging that it will deliver and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act.

For a period of 120 days after the expiration date we will promptly send additional copies of this prospectus and any amendment or supplement to this prospectus to any broker-dealer that requests such documents in the letter of transmittal. We have agreed to pay all expenses incident to the exchange offer (including the expenses of one counsel for the holders of the series D notes) other than commissions or concessions of any brokers or dealers and will indemnify the holders of the series D notes (including any broker-dealers) against certain liabilities, including liabilities under the Securities Act.

110

NOTICE TO CANADIAN RESIDENTS

Any resale of the series D notes in Canada must be made under applicable securities laws which will vary depending on the relevant jurisdiction, and which may require resales to be made under available statutory exemptions or under a discretionary exemption granted by the applicable Canadian securities regulatory authority. Note holders resident in Canada are advised to seek legal advice prior to any resale of the series D notes.

LEGAL MATTERS

Certain legal matters with respect to the series D exchange notes will be passed upon for us by Willkie Farr & Gallagher LLP, New York, New York.

EXPERTS

The consolidated financial statements of MidAmerican Energy Holdings Company and subsidiaries, as of December 31, 2003 and 2002 and for each of the three years in the period ended December 31, 2003, included in this prospectus, and the related financial statement schedules included elsewhere in the registration statement, have been audited by Deloitte & Touche LLP, independent auditors, as stated in their report appearing herein (which report expresses an unqualified opinion and includes an explanatory paragraph referring to MidAmerican's changes in its accounting policy for asset retirement obligations and for variable interest entities in 2003, for goodwill and other intangible assets in 2002 and for major maintenance, overhaul and well workover costs in 2001), and have been so included in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file reports and information statements and other information with the SEC. Such reports, proxy and information statements and other information filed by us with the SEC can be inspected and copied at the Public Reference Section of the SEC at Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549, and at the regional offices of the SEC located at Woolworth Building, 233 Broadway, New York, New York 10279 and 500 West Madison Street, Suite 1400, Chicago, Illinois 60661. Copies of such material can be obtained from the Public Reference Section of the SEC at Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549 at prescribed rates. The SEC maintains a Web site that contains reports, proxy and information statements and other materials that are filed through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. This Web site can be accessed at http://www.sec.gov.

We make available free of charge through our internet website at http://www.midamerican.com our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file with, or furnish it to, the SEC. Any information available on or through our website is not part of this prospectus and our web address is included as an inactive textual reference only.

111

FINANCIAL STATEMENTS

Index to Financial Statements

|  |  |  |  |  |  |

| Independent Auditors' Report |  | | F-2 | |

| |  | | | |

| Consolidated Balance Sheets as of December 31, 2003 and 2002 |  | | F-3 | |

| |  | | | |

Consolidated Statements of Operations for the Years Ended December 31, 2003, 2002

and 2001 |  | | F-4 | |

| |  | | | |

| Consolidated Statements of Stockholders' Equity for the Years Ended December 31, 2003, 2002 and 2001 |  | | F-5 | |

| |  | | | |

Consolidated Statements of Cash Flows for the Years Ended December 31, 2003, 2002

and 2001 |  | | F-6 | |

| |  | | | |

| Notes to Consolidated Financial Statements |  | | F-7 | |

|

F-1

INDEPENDENT AUDITORS' REPORT

Board of Directors and Stockholders

MidAmerican Energy Holdings Company

Des Moines, Iowa

We have audited the accompanying consolidated balance sheets of MidAmerican Energy Holdings Company and subsidiaries (the "Company") as of December 31, 2003 and 2002, and the related consolidated statements of operations, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2003. Our audits also included the consolidated financial statement schedules listed in the Index at Item 15. These financial statements and financial statement schedules are the responsibility of the Company's management. Our responsibility is to express an opinion on the financial statements and financial statement schedules based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of MidAmerican Energy Holdings Company and subsidiaries as of December 31, 2003 and 2002, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2003, in conformity with accounting principles generally accepted in the United States of America. Also, in our opinion, such consolidated financial statement schedules, when considered in relation to the basic consolidated financial statements taken as a whole, present fairly in all material respects the information set forth therein.

As discussed in Note 2 to the consolidated financial statements, the Company changed its accounting policy for asset retirement obligations and for variable interest entities in 2003, for goodwill and other intangible assets in 2002, and for major maintenance, overhaul and well workover costs in 2001.

/s/ Deloitte & Touche LLP

DELOITTE & TOUCHE LLP

Des Moines, Iowa

February 9, 2004

(March 1, 2004 as to Notes 2, 5 and 20)

F-2

MIDAMERICAN ENERGY HOLDINGS COMPANY

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

|  |  |  |  |  |  |  |  |  |  |

| |  | As of December 31, |

| |  | 2003 |  | 2002 |

| ASSETS |  |

| Current assets: |  |

| Cash and cash equivalents |  | $ | 660,213 | |  | $ | 844,430 | |

| Restricted cash and short-term investments |  | | 55,281 | |  | | 50,808 | |

| Accounts receivable, net of allowance for doubtful accounts of $26,004 and $39,742 |  | | 666,063 | |  | | 707,731 | |

| Inventories |  | | 123,301 | |  | | 126,938 | |

| Other current assets |  | | 371,855 | |  | | 246,731 | |

| Total current assets |  | | 1,876,713 | |  | | 1,976,638 | |

| Properties, plants and equipment, net |  | | 11,180,979 | |  | | 10,284,487 | |

| Goodwill |  | | 4,305,643 | |  | | 4,258,132 | |

| Regulatory assets |  | | 512,549 | |  | | 415,804 | |

| Other investments |  | | 228,896 | |  | | 446,732 | |

| Equity investments |  | | 234,370 | |  | | 273,707 | |

| Deferred charges and other assets |  | | 829,039 | |  | | 779,420 | |

| Total assets |  | $ | 19,168,189 | |  | $ | 18,434,920 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY |  |

| Current liabilities: |  |

| Accounts payable |  | $ | 345,237 | |  | $ | 462,960 | |

| Accrued interest |  | | 189,635 | |  | | 192,015 | |

| Accrued taxes |  | | 112,823 | |  | | 108,940 | |

| Other accrued liabilities |  | | 443,531 | |  | | 457,058 | |

| Short-term debt |  | | 48,036 | |  | | 79,782 | |

| Current portion of long-term debt |  | | 500,941 | |  | | 470,213 | |

| Current portion of parent company subordinated debt |  | | 100,000 | |  | | — | |

| Total current liabilities |  | | 1,740,203 | |  | | 1,770,968 | |

| Other long-term accrued liabilities |  | | 1,827,633 | |  | | 1,486,608 | |

| Parent company senior debt |  | | 2,777,878 | |  | | 2,323,387 | |

| Parent company subordinated debt |  | | 1,772,146 | |  | | — | |

| Subsidiary and project debt |  | | 6,674,640 | |  | | 7,077,087 | |

| Deferred income taxes |  | | 1,433,144 | |  | | 1,238,421 | |

| Total liabilities |  | | 16,225,644 | |  | | 13,896,471 | |

| Deferred income |  | | 69,201 | |  | | 80,078 | |

| Minority interest |  | | 9,754 | |  | | 7,351 | |

| Preferred securities of subsidiaries |  | | 92,145 | |  | | 93,325 | |

| Company-obligated mandatorily redeemable preferred securities of subsidiary trusts |  | | — | |  | | 2,063,412 | |

| Commitments and contingencies (Note 19) |  |

| Stockholders' equity: |  | | | |  | | | |  |

| Zero coupon convertible preferred stock — authorized 50,000 shares, no par value; 41,263 shares outstanding at December 31, 2003 and 2002 |  | | — | |  | | — | |

| Common stock — authorized 60,000 shares, no par value; 9,281 shares issued and outstanding at December 31, 2003 and 2002 |  | | — | |  | | — | |

| Additional paid-in capital |  | | 1,957,277 | |  | | 1,956,509 | |

| Retained earnings |  | | 999,627 | |  | | 584,009 | |

| Accumulated other comprehensive loss, net |  | | (185,459 | ) |  | | (246,235 | ) |

| Total stockholders' equity |  | | 2,771,445 | |  | | 2,294,283 | |

| Total liabilities and stockholders' equity |  | $ | 19,168,189 | |  | $ | 18,434,920 | |

|

The accompanying notes are an integral part of these financial statements.

F-3

MIDAMERICAN ENERGY HOLDINGS COMPANY

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Year Ended December 31, |

| |  | 2003 |  | 2002 |  | 2001 |

| Revenue: |  | | | |  | | | |  | | | |  |

| Operating revenue |  | $ | 5,948,224 | |  | $ | 4,794,010 | |  | $ | 4,696,781 | |

| Income on equity investments |  | | 38,224 | |  | | 40,520 | |  | | 39,565 | |

| Interest and dividend income |  | | 47,911 | |  | | 56,250 | |  | | 24,552 | |

| Other income |  | | 110,318 | |  | | 77,359 | |  | | 212,082 | |

| Total revenue |  | | 6,144,677 | |  | | 4,968,139 | |  | | 4,972,980 | |

| Costs and expenses: |  |

| Cost of sales |  | | 2,416,132 | |  | | 1,844,024 | |  | | 2,341,178 | |

| Operating expense |  | | 1,527,516 | |  | | 1,345,205 | |  | | 1,176,422 | |

| Depreciation and amortization |  | | 609,889 | |  | | 525,902 | |  | | 538,702 | |

| Interest expense |  | | 771,831 | |  | | 647,379 | |  | | 499,263 | |

| Less interest capitalized |  | | (30,483 | ) |  | | (37,469 | ) |  | | (86,469 | ) |

| Total costs and expenses |  | | 5,294,885 | |  | | 4,325,041 | |  | | 4,469,096 | |

| Income before provision for income taxes |  | | 849,792 | |  | | 643,098 | |  | | 503,884 | |

| Provision for income taxes |  | | 250,971 | |  | | 99,588 | |  | | 250,064 | |

| Income before minority interest and preferred dividends |  | | 598,821 | |  | | 543,510 | |  | | 253,820 | |

| Minority interest and preferred dividends |  | | 183,203 | |  | | 163,467 | |  | | 106,547 | |

| Income before cumulative effect of change in accounting principle |  | | 415,618 | |  | | 380,043 | |  | | 147,273 | |

| Cumulative effect of change in accounting principle, net of tax (Note 2) |  | | — | |  | | — | |  | | (4,604 | ) |

| Net income available to common and preferred stockholders |  | $ | 415,618 | |  | $ | 380,043 | |  | $ | 142,669 | |

|

The accompanying notes are an integral part of these financial statements.

F-4

MIDAMERICAN ENERGY HOLDINGS COMPANY

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(Amounts in thousands)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Outstanding

Common

Shares |  | Common

Stock |  | Additional

Paid-in

Capital |  | Retained

Earnings |  | Accumulated

Other

Comprehensive

Income (Loss) |  | Total |

| Balance, January 1, 2001 |  | | 9,281 | |  | $ | — | |  | $ | 1,553,073 | |  | $ | 81,257 | |  | $ | (57,929 | ) |  | $ | 1,576,401 | |

| Net income |  | | — | |  | | — | |  | | — | |  | | 142,669 | |  | | — | |  | | 142,669 | |

| Other comprehensive income: |  |

| Foreign currency translation adjustment |  | | — | |  | | — | |  | | — | |  | | — | |  | | (22,103 | ) |  | | (22,103 | ) |

| Fair value adjustment on cash flow hedges, net of tax of $8,143 |  | | — | |  | | — | |  | | — | |  | | — | |  | | 18,490 | |  | | 18,490 | |

| Minimum pension liability adjustment, net of tax of $(3,448) |  | | — | |  | | — | |  | | — | |  | | — | |  | | (4,847 | ) |  | | (4,847 | ) |

| Unrealized losses on securities, net of tax of $(1,315) |  | | — | |  | | — | |  | | — | |  | | — | |  | | (2,443 | ) |  | | (2,443 | ) |

| Total other comprehensive income |  | | | |  | | | |  | | | |  | | | |  | | | |  | | 131,766 | |

| Balance, December 31, 2001 |  | | 9,281 | |  | | — | |  | | 1,553,073 | |  | | 223,926 | |  | | (68,832 | ) |  | | 1,708,167 | |

| Net income |  | | — | |  | | — | |  | | — | |  | | 380,043 | |  | | — | |  | | 380,043 | |

| Other comprehensive income: |  |

| Foreign currency translation adjustment |  | | — | |  | | — | |  | | — | |  | | — | |  | | 166,880 | |  | | 166,880 | |

| Fair value adjustment on cash flow hedges, net of tax of $(10,106) |  | | — | |  | | — | |  | | — | |  | | — | |  | | (27,623 | ) |  | | (27,623 | ) |

| Minimum pension liability adjustment, net of tax of $(135,707) |  | | — | |  | | — | |  | | — | |  | | — | |  | | (313,456 | ) |  | | (313,456 | ) |

| Unrealized losses on securities, net of tax of $(1,813) |  | | — | |  | | — | |  | | — | |  | | — | |  | | (3,204 | ) |  | | (3,204 | ) |

| Total other comprehensive income |  | | | |  | | | |  | | | |  | | | |  | | | |  | | 202,640 | |

| Issuance of zero-coupon convertible preferred stock |  | | — | |  | | — | |  | | 402,000 | |  | | — | |  | | — | |  | | 402,000 | |

| Retirement of stock options |  | | — | |  | | — | |  | | 815 | |  | | (19,960 | ) |  | | — | |  | | (19,145 | ) |

| Other equity transactions |  | | — | |  | | — | |  | | 621 | |  | | — | |  | | — | |  | | 621 | |

| Balance, December 31, 2002 |  | | 9,281 | |  | | — | |  | | 1,956,509 | |  | | 584,009 | |  | | (246,235 | ) |  | | 2,294,283 | |

| Net income |  | | — | |  | | — | |  | | — | |  | | 415,618 | |  | | — | |  | | 415,618 | |

| Other comprehensive income: |  |

| Foreign currency translation adjustment |  | | — | |  | | — | |  | | — | |  | | — | |  | | 58,148 | |  | | 58,148 | |

| Fair value adjustment on cash flow hedges, net of tax of $7,202 |  | | — | |  | | — | |  | | — | |  | | — | |  | | 16,769 | |  | | 16,769 | |

| Minimum pension liability adjustment, net of tax of $(6,425) |  | | — | |  | | — | |  | | — | |  | | — | |  | | (14,989 | ) |  | | (14,989 | ) |

| Unrealized losses on securities, net of tax of $566 |  | | — | |  | | — | |  | | — | |  | | — | |  | | 848 | |  | | 848 | |

| Total other comprehensive income |  | | | |  | | | |  | | | |  | | | |  | | | |  | | 476,394 | |

| Other equity transactions |  | | — | |  | | — | |  | | 768 | |  | | — | |  | | — | |  | | 768 | |

| Balance, December 31, 2003 |  | | 9,281 | |  | $ | — | |  | $ | 1,957,277 | |  | $ | 999,627 | |  | $ | (185,459 | ) |  | $ | 2,771,445 | |

|

The accompanying notes are an integral part of these financial statements.

F-5

MIDAMERICAN ENERGY HOLDINGS COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Year Ended December 31, |

| |  | 2003 |  | 2002 |  | 2001 |

| Cash flows from operating activities: |  |

| Net income |  | $ | 415,618 | |  | $ | 380,043 | |  | $ | 142,669 | |

| Adjustments to reconcile net cash flows from operating activities: |  |

| Distributions less income on equity investments |  | | 40,160 | |  | | (11,383 | ) |  | | (28,515 | ) |

| Gains on asset sales |  | | (24,321 | ) |  | | (25,329 | ) |  | | (179,493 | ) |

| Depreciation and amortization |  | | 609,889 | |  | | 525,902 | |  | | 442,284 | |

| Amortization of goodwill |  | | — | |  | | — | |  | | 96,418 | |

| Amortization of regulatory assets and liabilities and other |  | | (14,363 | ) |  | | 8,709 | |  | | 23,774 | |

| Amortization of deferred financing costs |  | | 28,046 | |  | | 28,615 | |  | | 20,737 | |

| Provision for deferred income taxes |  | | 237,322 | |  | | (16,228 | ) |  | | 152,920 | |

| Cumulative effect of change in accounting principle, net of tax |  | | — | |  | | — | |  | | 4,604 | |

| Changes in other items: |  |

| Accounts receivable and other current assets |  | | (27,447 | ) |  | | (201,147 | ) |  | | 571,910 | |

| Accounts payable and other accrued liabilities |  | | (46,138 | ) |  | | 64,759 | |  | | (420,434 | ) |

| Deferred income |  | | (9,344 | ) |  | | (4,839 | ) |  | | 6,428 | |

| Other |  | | 8,501 | |  | | 8,624 | |  | | 13,696 | |

| Net cash flows from operating activities |  | | 1,217,923 | |  | | 757,726 | |  | | 846,998 | |

| Cash flows from investing activities: |  |

| Acquisitions, net of cash acquired |  | | (54,263 | ) |  | | (1,416,937 | ) |  | | (81,934 | ) |

| Sale (purchase) of convertible preferred securities |  | | 288,750 | |  | | (275,000 | ) |  | | — | |

| Capital expenditures relating to operating projects |  | | (677,256 | ) |  | | (542,615 | ) |  | | (398,165 | ) |

| Construction and other development costs |  | | (513,771 | ) |  | | (965,470 | ) |  | | (178,587 | ) |

| Purchase of affiliates notes |  | | (35,029 | ) |  | | — | |  | | (13,247 | ) |

| Proceeds from sale of assets |  | | 13,113 | |  | | 214,070 | |  | | 377,396 | |

| Decrease in restricted cash and investments |  | | 7,415 | |  | | 16,351 | |  | | 24,540 | |

| Other |  | | (32,126 | ) |  | | 61,790 | |  | | 31,453 | |

| Net cash flows from investing activities |  | | (1,003,167 | ) |  | | (2,907,811 | ) |  | | (238,544 | ) |

| Cash flows from financing activities: |  |

| Proceeds from subsidiary and project debt |  | | 1,157,649 | |  | | 1,485,349 | |  | | 200,000 | |

| Proceeds from parent company senior debt |  | | 449,295 | |  | | 700,000 | |  | | — | |

| Repayments of subsidiary and project debt |  | | (1,490,986 | ) |  | | (395,370 | ) |  | | (437,372 | ) |

| Repayment of parent company senior debt |  | | (215,000 | ) |  | | — | |  | | — | |

| Repayment of parent company subordinated debt |  | | (198,958 | ) |  | | — | |  | | — | |

| Net proceeds from (repayment of) parent company revolving credit facility |  | | — | |  | | (153,500 | ) |  | | 68,500 | |

| Repayment of other obligations |  | | — | |  | | (94,297 | ) |  | | — | |

| Net repayment of subsidiary short-term debt |  | | (31,750 | ) |  | | (472,835 | ) |  | | (74,144 | ) |

| Proceeds from issuance of trust preferred securities |  | | — | |  | | 1,273,000 | |  | | — | |

| Proceeds from issuance of preferred stock |  | | — | |  | | 402,000 | |  | | — | |

| Redemption of preferred securities of subsidiaries |  | | (1,176 | ) |  | | (127,908 | ) |  | | (24,910 | ) |

| Other |  | | (95,411 | ) |  | | (61,205 | ) |  | | 9,459 | |

| Net cash flows from financing activities |  | | (426,337 | ) |  | | 2,555,234 | |  | | (258,467 | ) |

| Effect of exchange rate changes |  | | 27,364 | |  | | 52,536 | |  | | (1,394 | ) |

| Net change in cash and cash equivalents |  | | (184,217 | ) |  | | 457,685 | |  | | 348,593 | |

| Cash and cash equivalents at beginning of period |  | | 844,430 | |  | | 386,745 | |  | | 38,152 | |

| Cash and cash equivalents at end of period |  | $ | 660,213 | |  | $ | 844,430 | |  | $ | 386,745 | |

| Supplemental Disclosure: |  |

| Interest paid, net of interest capitalized |  | $ | 706,039 | |  | $ | 588,972 | |  | $ | 389,953 | |

| Income taxes paid |  | $ | 9,911 | |  | $ | 101,225 | |  | $ | 133,139 | |

| Non-cash transaction – ROP note received under NIA Arbitration Settlement |  | $ | 97,000 | |  | $ | — | |  | $ | — | |

|

The accompanying notes are an integral part of these financial statements.

F-6

MIDAMERICAN ENERGY HOLDINGS COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Organization And Operations

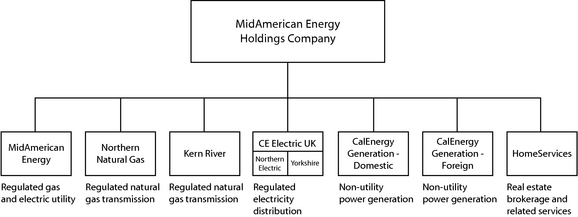

MidAmerican Energy Holdings Company ("MEHC") and its subsidiaries (together with MEHC, the "Company") is a United States-based privately owned global energy company. The Company's operations are organized and managed on seven distinct platforms: MidAmerican Energy Company ("MidAmerican Energy"), Kern River Gas Transmission Company ("Kern River"), Northern Natural Gas Company ("Northern Natural Gas"), CE Electric UK Funding ("CE Electric UK") (which includes Northern Electric plc ("Northern Electric") and Yorkshire Electricity Group plc ("Yorkshire")), CalEnergy Generation–Domestic (interests in independent power projects and related operations), CalEnergy Generation–Foreign (the subsidiaries owning the Upper Mahiao, Malitbog and Mahanagdong Projects (collectively the "Leyte Projects") and the Casecnan project) and HomeServices of America, Inc. (collectively with its subsidiaries, "HomeServices"). Through these platforms, the Company owns and operates a combined electric and natural gas utility company in the United States, two natural gas pipeline companies in the United States, two electricity distribution companies in the United Kingdom, a diversified portfolio of domestic and international independent power projects and the second largest residential real estate brokerage firm in the United States.

On March 14, 2000, MEHC and an investor group comprised of Berkshire Hathaway Inc. ("Berkshire Hathaway"), Walter Scott, Jr., a director of MEHC, David L. Sokol, Chairman and Chief Executive Officer of MEHC, and Gregory E. Abel, President and Chief Operating Officer of MEHC, closed on a definitive agreement and plan of merger whereby the investor group, together with certain of Mr. Scott's family members and family trusts and corporations, acquired all of the outstanding common stock of MEHC (the "Teton Transaction").

MEHC initially incorporated in 1971 under the laws of the State of Delaware and was reincorporated in 1999 in Iowa, at which time it changed its name from CalEnergy Company, Inc. to MidAmerican Energy Holdings Company.

In these notes to consolidated financial statements, references to "U.S. dollars," "dollars," "$" or "cents" are to the currency of the United States, references to "pounds sterling," " £," "sterling," "pence" or "p" are to the currency of the United Kingdom and references to "pesos" are to the currency of the Philippines. References to kW means kilowatts, MW means megawatts, GW means gigawatts, kWh means kilowatt hours, MWh means megawatt hours, GWh means gigawatts hours, kV means kilovolts, mmcf means million cubic feet, Bcf means billion cubic feet, Tcf means trillion cubic feet, MMBtus means million British thermal units and Dth means decatherms or MMBtus.

2. Summary of Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts of MEHC and its wholly owned subsidiaries excluding entities for which adoption of FASB Interpretation No. 46R, "Consolidation of Variable Interest Entities" ("FIN 46R") was required at December 31, 2003. Subsidiaries which are less than 100% owned but greater than 50% owned are consolidated with a minority interest. Subsidiaries that are 50% owned or less, but where the Company has the ability to exercise significant influence, are accounted for under the equity method of accounting. Investments where the Company's ability to influence is limited are accounted for under the cost method of accounting. All inter-enterprise transactions and accounts have been eliminated. The results of operations of the Company include the Company's proportionate share of results of operations of entities acquired from the date of each acquisition for purchase business combinations.

For the Company's foreign operations whose functional currency is not the U.S. dollar, the assets and liabilities are translated into U.S. dollars at current exchange rates. Resulting translation adjustments are reflected as accumulated other comprehensive income (loss) in stockholders' equity. Revenue and expenses are translated at average exchange rates for the period. Transaction gains and

F-7

losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Reclassifications

Certain amounts in the fiscal 2002 and 2001 consolidated financial statements and supporting note disclosures have been reclassified to conform to the fiscal 2003 presentation. Such reclassification did not impact previously reported net income or retained earnings.

The Company originally issued its 2003 consolidated financial statements on February 9, 2004. In accordance with accounting guidance issued subsequent to that date, the Company has adjusted the consolidated financial statements to reflect the reclassification of $385.7 million of 2002 regulatory liabilities and $367.9 million of 2001 regulatory liabilities for the cost of removal of utility plant previously recognized within accumulated depreciation as an other long-term accrued liability. Prior to this reclassification, 2002 properties, plants and equipment, net was $9.9 billion, total assets were $18.0 billion, other long-term accrued liabilities were $1.1 billion and total liabilities were $13.5 billion. Subsequent to this reclassification, 2002 properties, plants and equipment, net is $10.3 billion, total assets are $18.4 billion, other long-term accrued liabilities are $1.5 billion, and total liabilities are $13.9 billion.

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Accounting for the Effects of Certain Types of Regulation

MidAmerican Energy, Kern River and Northern Natural Gas prepare their financial statements in accordance with the provisions of Statement of Financial Accounting Standards ("SFAS") No. 71 ("SFAS 71"), which differs in certain respects from the application of generally accepted accounting principles by non-regulated businesses. In general, SFAS 71 recognizes that accounting for rate-regulated enterprises should reflect the economic effects of regulation. As a result, a regulated utility is required to defer the recognition of costs (a regulatory asset) or the recognition of obligations (a regulatory liability) if it is probable that, through the rate-making process, there will be a corresponding increase or decrease in future rates. Accordingly, MidAmerican Energy, Kern River and Northern Natural Gas have deferred certain costs, which will be amortized over various future periods. To the extent that collection of such costs or payment of such obligations is no longer probable as a result of changes in regulation, the associated regulatory asset or liability is charged or credited to income.

A possible consequence of deregulation of the regulated energy industry is that SFAS 71 may no longer apply. If portions of the Company's regulated energy operations no longer meet the criteria of SFAS 71, the Company could be required to write off the related regulatory assets and liabilities from its balance sheet, and thus a material adjustment to earnings in that period could result if regulatory assets or liabilities are not recovered in transition provisions of any deregulation legislation.

The Company continues to evaluate the applicability of SFAS 71 to its regulated energy operations and the recoverability of these assets and liabilities through rates as there are on-going changes in the regulatory and economic environment.

Cash and Cash Equivalents

The Company considers all investment instruments purchased with an original maturity of three months or less to be cash equivalents. Investments other than restricted cash are primarily commercial paper and money market securities. Restricted cash is not considered a cash equivalent.

Restricted Cash and Investments

The current restricted cash and short-term investments balance recorded separately in restricted cash and short term investments and in deferred charges and other assets, was $119.5 million and

F-8

$58.7 million at December 31, 2003 and 2002, respectively, and includes commercial paper and money market securities. The balance is mainly composed of amounts deposited in restricted accounts from which the Company will source its debt service reserve requirements relating to the projects and customer deposits held in escrow. The debt service funds are restricted by their respective project debt agreements to be used only for the related project.

The Company's nuclear decommissioning trust funds and other marketable securities are classified as available for sale and are accounted for at fair value.

Allowance for Doubtful Accounts

The allowance for doubtful accounts is based on the Company's assessment of the collectibility of payments from its customers. This assessment requires judgment regarding the outcome of pending disputes, arbitrations and the ability of customers to pay the amounts owed to the Company.

Fair Value of Financial Instruments

The fair value of a financial instrument is the amount at which the instrument could be exchanged in a current transaction between willing parties, other than in a forced sale or liquidation. Although management uses its best judgment in estimating the fair value of these financial instruments, there are inherent limitations in any estimation technique. Therefore, the fair value estimates presented herein are not necessarily indicative of the amounts that the Company could realize in a current transaction.

The methods and assumptions used to estimate fair value are as follows:

Short-term debt — Due to the short-term nature of the short-term debt, the fair value approximates the carrying value.

Debt instruments — The fair value of all debt instruments has been estimated based upon quoted market prices as supplied by third-party broker dealers, where available, or at the present value of future cash flows discounted at rates consistent with comparable maturities with similar credit risks. The Company is unable to estimate a fair value for the Leyte debt as there are no quoted market prices available.

Other financial instruments — All other financial instruments of a material nature are short-term and the fair value approximates the carrying amount.

Properties, Plants and Equipment, Net

Properties, plants and equipment are recorded at historical cost. The cost of major additions and betterments are capitalized, while replacements, maintenance, and repairs that do not improve or extend the lives of the respective assets are expensed.

Capitalized costs for gas reserves, other than costs of unevaluated exploration projects and projects awaiting development consent, are depleted using the units of production method. Depletion is calculated based on hydrocarbon reserves of properties in the evaluated pool estimated to be commercially recoverable and include anticipated future development costs in respect of those reserves.

Impairment of Long-Lived Assets

The Company's long-lived assets consist primarily of properties, plants and equipment. Depreciation is computed using the straight-line method based on economic lives or regulatorily mandated recovery periods. The Company believes the useful lives assigned to the depreciable assets, which generally range from 3 to 87 years, are reasonable.

The Company periodically evaluates long-lived assets, including properties, plants and equipment, when events or changes in circumstances indicate that the carrying value of these assets may not be recoverable. Upon the occurrence of a triggering event, the carrying amount of a long-lived asset is reviewed to assess whether the recoverable amount has declined below its carrying amount. The recoverable amount is the estimated net future cash flows that the Company expects to recover from

F-9

the future use of the asset, undiscounted and without interest, plus the asset's residual value on disposal. Where the recoverable amount of the long-lived asset is less than the carrying value, an impairment loss would be recognized to write down the asset to its fair value that is based on discounted estimated cash flows from the future use of the asset.

Goodwill

On January 1, 2002, the Company adopted SFAS No. 142, "Goodwill and Other Intangible Assets" ("SFAS 142"), which establishes the accounting for acquired goodwill and other intangible assets, and provides that goodwill and indefinite-lived intangible assets will not be amortized, but will be tested for impairment on an annual basis. The Company's related amortization consisted primarily of goodwill amortization. Following is a reconciliation of net income available to common and preferred stockholders as originally reported for the years ended December 31, 2003, 2002 and 2001 to adjusted net income available to common and preferred stockholders (in thousands):

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Year Ended December |

| |  | 2003 |  | 2002 |  | 2001 |

| Reported net income available to common and preferred stockholders |  | $ | 415,618 | |  | $ | 380,043 | |  | $ | 142,669 | |

| Amortization of goodwill |  | | — | |  | | — | |  | | 96,418 | |

| Tax effect of amortization |  | | — | |  | | — | |  | | (2,018 | ) |

| Adjusted net income available to common and preferred stockholders |  | $ | 415,618 | |  | $ | 380,043 | |  | $ | 237,069 | |

|

The Company completed its annual review pursuant to SFAS 142 for its reporting units during the fourth quarter of 2003 primarily using a discounted cash flow methodology. No impairment was indicated as a result of these assessments.

Capitalization of Interest and Allowance for Funds Used During Construction

Allowance for funds used during construction ("AFUDC") represents the approximate net composite interest cost of borrowed funds and a reasonable return on the equity funds used for construction. Although AFUDC increases both utility plant and earnings, it is realized in cash through depreciation provisions included in rates for subsidiaries that apply SFAS 71. Interest and AFUDC for subsidiaries that apply SFAS 71 are capitalized as a component of projects under construction and will be amortized over the assets' estimated useful lives.

Deferred Financing Cost

The Company capitalizes costs associated with financings, as deferred financing costs, and amortizes the amounts over the term of the related financing using the effective interest method.

Contingent Liabilities

The Company establishes reserves for estimated loss contingencies, such as environmental, legal and income taxes, when it is management's assessment that a loss is probable and the amount of the loss can be reasonably estimated.

Deferred Income Taxes

The Company recognizes deferred tax assets and liabilities based on the difference between the financial statement and tax basis of assets and liabilities using estimated tax rates in effect for the year in which the differences are expected to reverse. The Company does not intend to repatriate earnings of foreign subsidiaries in the foreseeable future. As a result, deferred United States income taxes are not provided for currency translation adjustments, retained earnings of international subsidiaries or corporate joint ventures unless the earnings are intended to be remitted.

Revenue Recognition

Revenue is recorded based upon services rendered and electricity, gas and steam delivered, distributed or supplied to the end of the period. The Company records unbilled revenue representing

F-10

the estimated amounts customers will be billed for services rendered between the meter reading dates in a particular month and the end of that month. The unbilled revenue estimate is reversed in the following month.

Where billings result in an overrecovery of United Kingdom distribution business revenue against the maximum regulated amount, revenue is deferred in an amount equivalent to the over recovered amount. The deferred amount is deducted from revenue and included in other accrued liabilities. Where there is an under recovery, no anticipation of any potential future recovery is made.

Revenue from the transportation and storage of gas are recognized based on contractual terms and the related volumes. Kern River and Northern Natural Gas are subject to the Federal Energy Regulatory Commission's ("FERC") regulations and, accordingly, certain revenue collected may be subject to possible refunds upon final orders in pending rate cases. Kern River and Northern Natural Gas record rate refund liabilities, which are included in other accrued liabilities, considering their regulatory proceedings and other third party regulatory proceedings, advice of counsel and estimated total exposure, as well as collection and other risks.

Revenue from water delivery is recorded on the basis of the contractual minimum guaranteed water delivery threshold for the respective contract year. If and when cumulative deliveries within a contract year exceed the minimum threshold, additional revenue is recognized. Revenue from long-term electricity contracts is recorded at the lower of the amount billed or the average of the contract, subject to contractual provisions at each project.

Commission revenue from real estate brokerage transactions and related amounts due to agents are recognized when title has transferred from seller to buyer. Title fee revenue from real estate transactions and related amounts due to the title insurer are recognized at the closing, which is when consideration is received. Fees related to loan originations are recognized at the closing, which is when services have been provided and consideration is received.

Financial Instruments

The Company currently utilizes swap agreements and forward purchase agreements to manage market risks and reduce its exposure resulting from fluctuation in interest rates, foreign currency exchange rates and electric and gas prices. For interest rate swap agreements, the net cash amounts paid or received on the agreements are accrued and recognized as an adjustment to interest expense. Gains and losses related to gas forward contracts are deferred and included in the measurement of the related gas purchases. These instruments are either exchange traded or with counterparties of high credit quality; therefore, the risk of nonperformance by the counterparties is considered to be negligible.

Accounting Principle Change

Effective January 1, 2001, the Company changed its accounting policy regarding major maintenance and repairs for non-regulated gas projects, non-regulated plant overhaul costs and geothermal well rework costs to the direct expense method from the former policy of accruals based on long-term scheduled maintenance plans for the gas projects and deferral and amortization of plant overhaul costs and geothermal well rework costs over the estimated useful lives. The cumulative effect of the change in accounting principle was $4.6 million, net of taxes of $0.7 million.

New Accounting Pronouncements

On January 1, 2003, the Company adopted SFAS No. 143, "Accounting for Asset Retirement Obligations". This statement provides accounting and disclosure requirements for retirement obligations associated with long-lived assets. The cumulative effect of initially applying this statement by the Company was immaterial.

The Company identified legal retirement obligations for nuclear decommissioning, wet and dry ash landfills and offshore and minor lateral pipeline facilities. On January 1, 2003, the Company recorded $289.3 million of asset retirement obligation ("ARO") liabilities; $13.9 million of ARO assets, net of accumulated depreciation; $114.6 million of regulatory assets; and reclassified $1.0

F-11

million of accumulated depreciation to the ARO liability. The initial ARO liability recognized includes $266.5 million that pertains to obligations associated with the decommissioning of the Quad Cities nuclear station. The $266.5 million includes a $159.8 million nuclear decommissioning liability that had been recorded at December 31, 2002. The adoption of this statement did not have a material impact on the operations of the regulated entities, as the effects were offset by the establishment of regulatory assets, totaling $114.6 million, pursuant to SFAS 71, "Accounting for the Effects of Certain Types of Regulation".

During the year ended December 31, 2003, the Company recorded, as a regulatory asset and as accretion expense, accretion related to the ARO liability of $16.5 million and $0.1 million, respectively. In addition, as the result of a decommissioning study, the Company reduced its ARO liability associated with the decommissioning of the Quad Cities nuclear station by $21.9 million. As a result, the ARO liability balance is $284.0 million at December 31, 2003.

On April 30, 2003, the FASB issued SFAS No. 149, "Amendment of Statement 133 on Derivative Instruments and Hedging Activities" ("SFAS 149"). SFAS 149 amends SFAS No. 133 for derivative instruments, including certain derivative instruments embedded in other contracts and for hedging activities. SFAS 149 requires contracts with comparable characteristics to be accounted for similarly. In particular, SFAS 149 clarifies when a contract with an initial net investment meets the characteristic of a derivative and clarifies when a derivative that contains a financing component will require special reporting in the statement of cash flows. SFAS 149 is effective for the Company for contracts entered into or modified after June 30, 2003. The adoption of SFAS 149 did not have a material effect on the Company's financial position, results of operations or cash flows.

In May 2003, the FASB issued SFAS No. 150, "Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity" ("SFAS 150"). SFAS 150 established standards for how an issuer classifies and measures certain financial instruments with characteristics of both liabilities and equity. It requires that an issuer classify a financial instrument that is within its scope as a liability (or an asset in some circumstances). The standard is effective for the Company for fiscal periods beginning after December 15, 2003. The adoption of SFAS 150 is not expected to have a material effect on the Company's financial position, results of operations or cash flows.

In December 2003, the FASB issued FASB Interpretation No. 46R which served to clarify guidance in Financial Interpretation No. 46 ("FIN 46"), and provided additional guidance surrounding the application of FIN 46. The Company adopted and applied the provisions of FIN 46R, related to certain finance subsidiaries, as of October 1, 2003. The adoption required the deconsolidation of certain finance subsidiaries, which resulted in the amounts previously classified as mandatorily redeemable preferred securities of subsidiary trusts, in the amount of $1.9 billion, being reclassified to parent company subordinated debt in the accompanying consolidated balance sheet as of December 31, 2003. In addition, the associated amounts previously recorded in minority interest and preferred dividends are now recorded as interest expense in the accompanying consolidated statement of operations. For the period from October 1, 2003 to December 31, 2003 the Company has recorded $49.8 million of interest expense related to these securities. In accordance with the requirements of FIN 46R, no amounts prior to adoption on October 1, 2003 have been reclassified. The Company will adopt the provisions of FIN 46R related to non-special purpose entities in the first quarter of 2004, in accordance with the provisions of FIN 46R. The Company is currently evaluating the impact of FIN 46R on several operating joint ventures that the Company currently does not consolidate.

3. Acquisitions

Kern River

On March 27, 2002, the Company acquired Kern River. At the date of acquisition, Kern River owned a 926-mile interstate pipeline transporting Rocky Mountain and Canadian natural gas to markets in California, Nevada and Utah.

The Company paid $419.7 million, net of cash acquired and a working capital adjustment, for Kern River's gas pipeline business. The acquisition has been accounted for as a purchase business

F-12

combination. The Company completed the allocation of the purchase price to the assets and liabilities acquired during the first quarter of 2003. The results of operations for Kern River are included in the Company's results beginning March 27, 2002.

The recognition of goodwill resulted from various attributes of Kern River's operations and business in general. These attributes include, but are not limited to:

|  |

| • | Opportunities for expansion; |

|  |

| • | Generally high credit quality shippers contracting with Kern River; |

|  |

| • | Kern River's strong competitive position; |

|  |

| • | Exceptional operating track record and state-of-the-art technology; |

|  |

| • | Strong demand for gas in the Western markets; and |

|  |

| • | An ample supply of low-cost gas. |

There is no assurance that these attributes will continue to exist to the same degree as believed at the time of the acquisition.

In connection with the acquisition of Kern River, MEHC issued $323.0 million of 11% Company-obligated mandatorily redeemable preferred securities of a subsidiary trust due March 12, 2012 with scheduled principal payments beginning in 2005 and $127.0 million of no par, zero coupon convertible preferred stock to Berkshire Hathaway. Each share of preferred stock is convertible at the option of the holder into one share of the Company's common stock subject to certain adjustments as described in the MEHC's Amended and Restated Articles of Incorporation.

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition (in millions):

|  |  |  |  |  |  |

| Cash |  | $ | 7.7 | |

| Properties, plants and equipment |  | | 796.8 | |

| Goodwill |  | | 33.9 | |

| Other assets |  | | 171.7 | |

| Total assets acquired |  | | 1,010.1 | |

| Current liabilities |  | | (104.3 | ) |

| Long-term debt |  | | (482.0 | ) |

| Other liabilities |  | | (1.5 | ) |

| Total liabilities assumed |  | | (587.8 | ) |

| Net assets acquired |  | $ | 422.3 | |

|

Northern Natural Gas Company

On August 16, 2002, the Company acquired Northern Natural Gas from Dynegy Inc. Northern Natural Gas is a 16,500-mile interstate pipeline extending from southwest Texas to the upper Midwest region of the United States.

The Company paid $882.7 million for Northern Natural Gas, net of cash acquired and a working capital adjustment. The acquisition has been accounted for as a purchase business combination. The Company completed the allocation of the purchase price to the assets and liabilities acquired during the third quarter of 2003. The results of operations for Northern Natural Gas are included in the Company's results beginning August 16, 2002.

The recognition of goodwill resulted from various attributes of Northern Natural Gas' operations and business in general. These attributes include, but are not limited to:

|  |

| • | Generally high credit quality shippers contracting with Northern Natural Gas; |

F-13

|  |

| • | Northern Natural Gas' strong competitive position; |

|  |

| • | Strategic location in the high demand Upper Midwest markets; |

|  |

| • | Flexible access to an ample supply of low-cost gas; |

|  |

| • | Exceptional operating track record; and |

|  |

| • | Opportunities for expansion. |

There is no assurance that these attributes will continue to exist to the same degree as believed at the time of the acquisition.

In connection with the acquisition of Northern Natural Gas, MEHC issued $950.0 million of 11% Company-obligated mandatorily redeemable preferred securities of a subsidiary trust due August 31, 2011, with scheduled principal payments beginning in 2003, to Berkshire Hathaway.

The following table summarizes the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition (in millions):

|  |  |  |  |  |  |

| Cash |  | $ | 1.4 | |

| Properties, plants and equipment |  | | 1,294.3 | |

| Goodwill |  | | 416.3 | |

| Other assets |  | | 340.4 | |

| Total assets acquired |  | | 2,052.4 | |

| Current portion of long-term debt |  | | (450.0 | ) |

| Other current liabilities |  | | (195.3 | ) |

| Long-term debt |  | | (499.8 | ) |

| Other liabilities |  | | (28.2 | ) |

| Total liabilities assumed |  | | (1,173.3 | ) |

| Net assets acquired |  | $ | 879.1 | |

|

The following pro forma financial information of the Company represents the unaudited pro forma results of operations as if the Kern River and Northern Natural Gas acquisitions, and the related financings, had occurred at the beginning of each period. These pro forma results have been prepared for comparative purposes only and do not profess to be indicative of the results of operations which would have been achieved had these transactions been completed at the beginning of each year, nor are the results indicative of the Company's future results of operations (in millions):

|  |  |  |  |  |  |  |  |  |  |

| |  | Year Ended December 31, |

| |  | 2002 |  | 2001 |

| Revenue |  | $ | 5,299.4 | |  | $ | 5,688.5 | |

Income before cumulative effect of change in

accounting principle |  | | 285.5 | |  | | 36.9 | |