FI N° 25.660UK

Serapis N° 20090544

CE Electric UK El. Distribution - A

Finance Contract

between the

European Investment Bank

and

Northern Electric Distribution Limited

Newcastle upon Tyne, 1 July 2010

and Luxembourg, 2 July 2010

CONTENTS

| | |

| ARTICLE 1 Credit and disbursement | 14 | |

| 1.01 Amount of Credit | 14 | |

| 1.02 Disbursement procedure | 14 | |

| 1.03 Currency of disbursement | 15 | |

| 1.04 Conditions of disbursement | 15 | |

| 1.05 Deferment of disbursement | 16 | |

| 1.06 Cancella tion and suspension | 17 | |

| 1.07 Cancellation after expiry of the Credit | 18 | |

| 1.08 Up-front fee | 18 | |

| 1.09 Sums due under Article 1 | 19 | |

| ARTICLE 2 The Loan | 19 | |

| 2.01 Amount of Loan | 19 | |

| 2.02 Currency of repayment, interest and other charges | 19 | |

| 2.03 Confirmation by the Bank | 19 | |

| ARTICLE 3 Interest | 19 | |

| 3.01 Rate of interest | 19 | |

| 3.02 Interest on overdue sums | 20 | |

| ARTICLE 4 Repayment | 20 | |

| 4.01 Normal repayment | 20 | |

| 4.02 Voluntary prepayment | 21 | |

| 4.03 Compulsory prepayment | 21 | |

| 4.04 Application of partial prepayments | 23 | |

| ARTICLE 5 Payments | 23 | |

| 5.01 Day count convention | 23 | |

| 5.02 Time and place of payment | 23 | |

| 5.03 Set-off | 24 | |

| ARTICLE 6 Borrower undertakings and representations | 24 | |

| 6.01 Use of Loan and availability of other funds | 24 | |

| 6.02 Completion of Project | 24 | |

| 6.03 Increased cost of Project | 24 | |

| 6.04 Procurement procedure | 24 | |

| 6.05 Continuing Project undertakings | 24 | |

| 6.06 Environmental Impact Assessments, EU Habitats and Birds Directives | 25 | |

| 6.07 Disposal of assets | 25 | |

| 6.08 Compliance with laws | 26 | |

| 6.09 Change in business | 26 | |

| 6.10 Merger | 26 | |

| 6.11 Arms' length dealings | 26 | |

| 6.12 Cross Default | 26 | |

| 6.13 Restrictions on incurring Financial Indebtedness | 26 | |

| 6.14 Financial covenants | 27 | |

| 6.15 General Representations and Warranties | 29 | |

| | |

| ARTICLE 7 Security | 30 | |

| 7.01 Security | 31 | |

| 7.02 Negative pledge | 31 | |

| 7.03 Pari passu ranking | 32 | |

| 7.04 Most favoured lender | 32 | |

| ARTICLE 8 Information and visits | 32 | |

| 8.01 Information concerning the Project | 33 | |

| 8.02 Information concerning the Borrower | 34 | |

| 8.03 Visits by the Bank | 34 | |

| ARTICLE 9 Charges and expenses | 34 | |

| 9.01 Taxes, duties and fees | 34 | |

| 9.02 Other charges | 35 | |

| 9.03 Currency indemnity | 35 | |

| ARTICLE 10 Events of default | 35 | |

| 10.01 Right to demand repayment | 38 | |

| 10.02 Other rights at law | 38 | |

| 10.03 Indemnity | 38 | |

| 10.04 Non-Waiver | 38 | |

| 10.05 Application of sums received | 38 | |

| ARTICLE 11 Law and jurisdiction | 38 | |

| 11.01 Governing Law | 38 | |

| 11.02 Jurisdiction | 38 | |

| 11.03 Evidence of sums due | 38 | |

| ARTICLE 12 Final clauses | 39 | |

| 12.01 Notices to either party | 39 | |

| 12.02 Form of notice | 39 | |

| 12.03 Changes to parties | 39 | |

| 12.04 Contracts (Rights of Third Parties) Act 1999 | 39 | |

| 12.05 European Monetary Union, GBP obligations and IFRS | 40 | |

| 12.06 Recitals, Schedules and Annexes | 40 | |

| 12.07 Counterparts | 41 | |

| Schedule A | 42 | |

| Technical Description and Reporting | 42 | |

| Schedule B | 47 | |

| Definitions of EURIBOR and LIBOR | 47 | |

| Schedule C | 49 | |

| Forms for the Borrower | 49 | |

| Schedule D | 53 | |

| Interest Rate Revision and Conversion | 53 | |

THIS CONTRACT IS MADE BETWEEN:

| |

| The European Investment Bank having its seat at 100 blvd Konrad Adenauer, Luxembourg, L-2950 Luxembourg, represented by Mr Laurent de Mautort, Director and Mr Pierre Albouze, Head of Division | (the "Bank") |

of the first part, and

| |

| Northern Electric Distribution Limited (company number 02906593), a limited company incorporated in England and having its registered office at Lloyds Court, 78 Grey Street, Newcastle upon Tyne, NE1 6AF, represented by Mr John France, Director | (the "Borrower") |

of the second part.

WHEREAS:

(1)

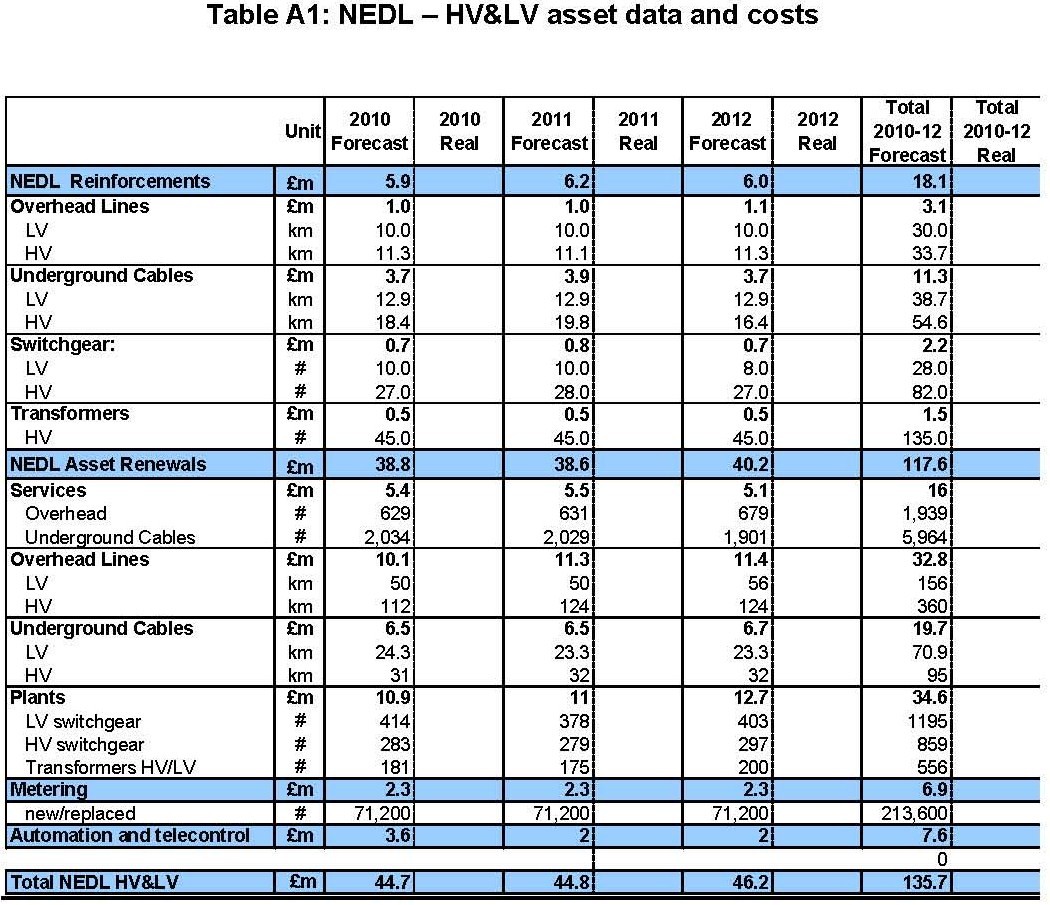

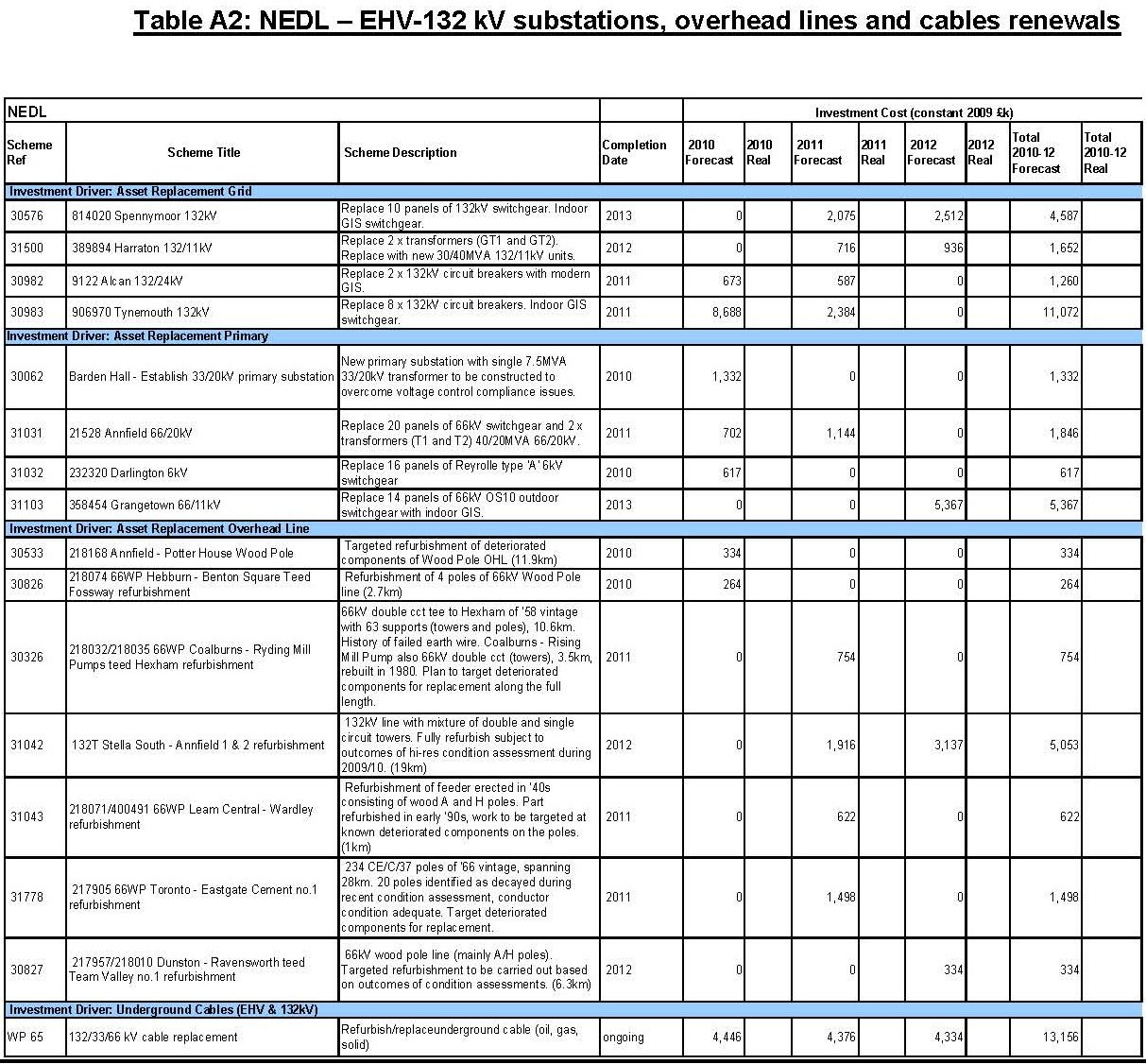

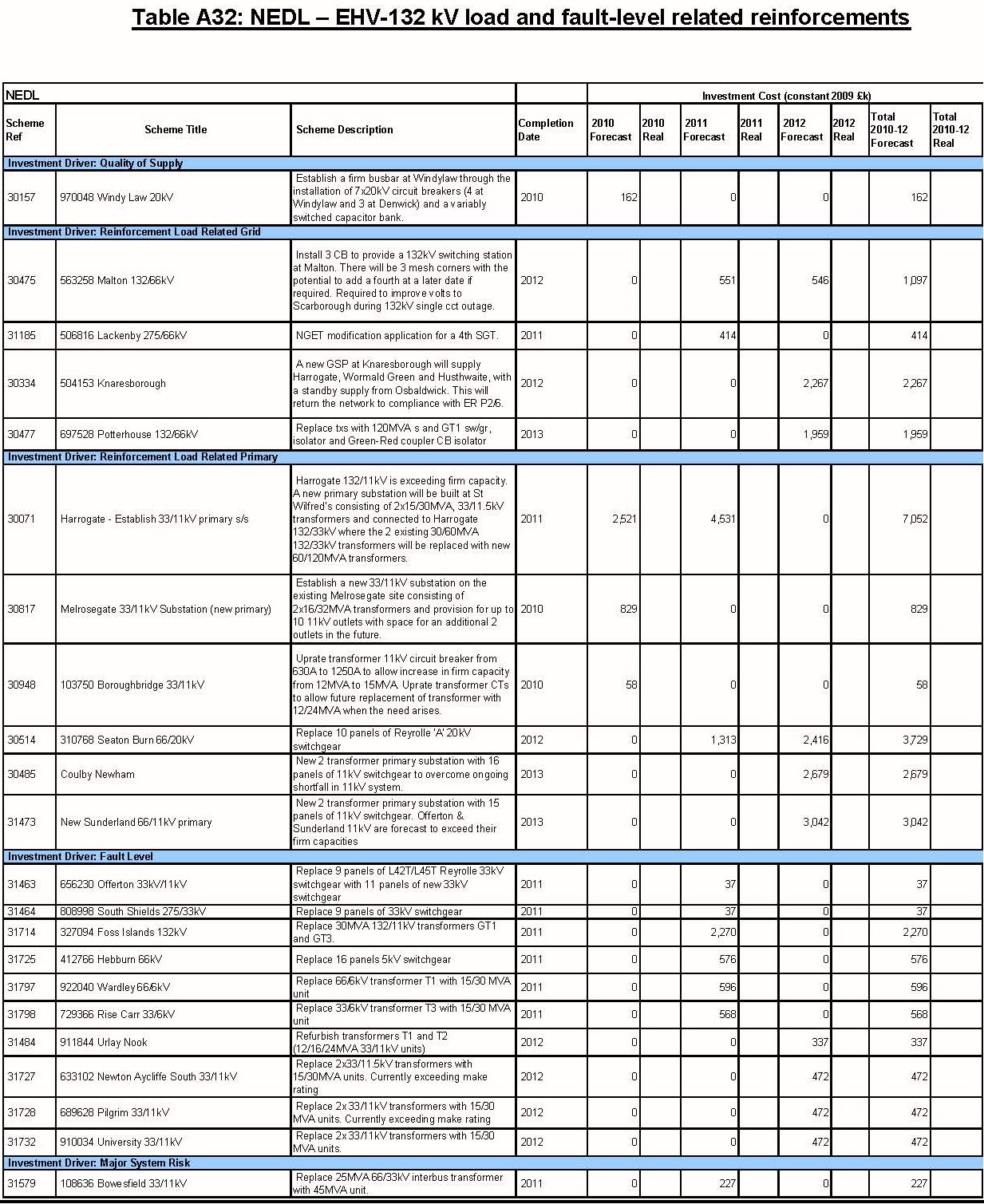

The Borrower has stated that it is undertaking a project during the period January 2010 to December 2012 consisting of certain schemes aimed at renovating and reinforcing the distribution electricity network of the Borrower, as more particularly described in the technical description (the "Technical Description") set out in Schedule A (collectively, the "Project").

(2)

The total cost of the Project is estimated by the Bank to be GBP 241,000,000 (two hundred and forty-one million pounds sterling) and the Borrower has stated that it intends to finance the Project as follows:

| | |

| Source | Amount (M GBP) |

| Own funds | 122 | |

| Credit from the Bank | 119 | |

| TOTAL | 241 | |

(3)

In order to fulfil the financing plan set out in Recital (2), the Borrower has requested from the Bank a credit of GBP 119,000,000 (one hundred and nineteen million pounds sterling).

(4)

The Bank, considering that th e financing of the Project falls within the scope of its functions, and having regard to the statements and facts cited in these Recitals, has decided to give effect to the Borrower's request by providing to it a credit in an amount of GBP 119,000,000 (one hundred and nineteen million pounds sterling) under this Finance Contract (the "Contract"); provided that the amount of the Bank loan shall not, in any case, exceed 50% (fifty per cent) of the total cost of the Project set out in Recital (2).

(5)

The Board of Directors of the Borrower has authorised the borrowing of the sum of GBP 119,000,000 (one hundred and nineteen million pounds sterling) represented by this credit on the terms and conditions set out in this Contract by a resolution in the terms set out in Annex I and it has been duly certified in the form set out in Annex II that such borrowing is within the corporate powers of the Borrower and does not exceed any borrowing or similar limit binding upon the Borrower.

(6)

The financial obligations of the Borrower under this Contract are from the date of this Contract to be guaranteed by CE Electric UK Funding Company (the "Guarantor") under a guarantee and indemnity (the "Guarantee") by execution of a guarantee and indemnity agreement dated on or about the date hereof in form and substance satisfactory to the Bank (the "Guarantee Agreement"). The Guarantee Agreement may be replaced by alternative security from time to time in accordance with the terms of this Contract.

(7)

The Statute of the Bank provides that the Bank shall ensure that its funds are used as rationally as possible in the interests of the European Union; and, accordingly, the terms and conditions of the Bank's loan operations mus t be consistent with relevant EU policies.

(8)

The Bank has entered on or about the date of this Contract into a finance contract (the "Yorkshire Finance Contract") with Yorkshire Electricity Distribution plc, a Subsidiary of the Guarantor.

"Acceptable Security" means security for the Loan in the form of:

(a) the Guarantee from the Guarantor;

(b) a guarantee on terms and from a bank acceptable to the Bank;

(c) cash collateral; or

(d) other security acceptable to the Bank.

"Acceptable Security Event" means any of the following events, circumstances or occurrences:

(a)

an Acceptable Security Provider fails to pay any amount payable under the relevant Acceptable Security Document on or before its due date unless the non-payment is due to a technical or administrative error or disruption to a payment system and is cured within 3 (three) Business Days;

(b)

any representation or statement made or deemed to be made by an Acceptable Security Provider in an Acceptable Security Document is or proves to have been incorrect or misleading in any respect;

(c)

any representation or statement made or deemed to be made by an Acceptable Security Provider in connection with the negotiation of an Acceptable Security Document or any other information or document given to the Bank by or on behalf of an Acceptable Security Provider is or proves to have been incorrect or misleading in any material respect;

(d)

following any default in relation thereto, an Acceptable Security Provider is required or is capable of being required or will, following expiry of any applicable contractual grace period, be required or be capable of being required to prepay, discharge, close out or terminate ahead of maturity any other Financial Indebtedness or any commitment for any other Financial Indebtedness is cancelled or suspended, provided that no Acceptable Security Event shall occur under this paragraph (d) if the aggregate amount of such Financial Indebtedness or commitment for Financial Indebtedness is less than GBP 10,000,000 (ten million pounds sterling) or its equivalent in any other currency or currencies;

(e)

an Acceptable Security Provider is unable to pay its debts as they fall due or is deemed unable to pay its debts within the meaning of Section 123(1) or 123(2) of the Insolvency Act 1986 or any statutory modification or re-enactment thereof (whether or not a court of justice has so determined), or admits its inability to pay its debts as they fall due, or suspends its debts, or makes or, without the prior written agreement of the Bank, seeks to make a composition with its creditors or by reason of actual or anticipated financial difficulties commences negotiations with one or more of its creditors with a view to rescheduling any of its indebtedness or a moratorium is declared in respect of any indebtedness of an Acceptable Security Provider;

(f)

any corporate action, legal proceedings or other procedure or step is taken in relation to or an order is made or an effective resolution is passed for:

(i)

the winding up of an Acceptable Security Provider;

(ii)

the suspension of payments, a moratorium of any indebtedness, winding-up, dissolution, ad ministration or reorganisation (by way of voluntary arrangement, scheme of arrangement or otherwise) of an Acceptable Security Provider;

(iii)

a composition, compromise, assignment or arrangement with any creditor of an Acceptable Security Provider;

(iv)

the appointment of a liquidator, receiver, administrative receiver, administrator, compulsory manager or other similar officer in respect of an Acceptable Security Provider or of any of its assets; or

(v)

the enforcement of any Security over assets of an Acceptable Security Provider,

or any analogous procedure or step is taken in any jurisdiction, provided that no Acceptable Security Event shall occur under this paragraph (f) in respect of any frivolous or vexatious winding-up petition brought by a third party (other than the Guarantor or any of its Subsidiaries) which is discharged within 14 (fourteen) days of commencement or, if earlier, the date on which it is advertised;

(g)

an Acceptable Security Provider takes steps towards a substantial reduction in its capital, is declared insolvent or ceases or resolves to cease to carry on (or threatens to suspend or cease to carry on) the whole or any substantial part of its business or activities;

(h)

an encumbrancer takes possession of, or a receiver, liquidator, administrator, compulsory manager, administrative receiver or similar officer is appointed, whether by a court of competent jurisdiction or by any competent administrative authority or by any person, of or over, any part of the business or assets of an Acceptable Security Provider having an aggregate value in excess of GBP 10,000,000 (ten million pounds sterling) or its equivalent in any other currency or currencies and, in the case of any of the foregoing, the same is not discharged within 14 (fourteen) days or if the Acceptable Security Provider petitions for the appointment of such an officer;

(i)

any step is taken by any person with a view to the seizure, attachment, sequestration, distress, compulsory acquisition, expropriation, execution or nationalisation of all or any of the shares, or all or any material part of the assets of an Acceptable Security Provider having an aggregate value in excess of GBP 10,000,000 (ten million pounds sterling) or its equivalent in any other currency or currencies;

(j)

by or under the authority of any Governmental Authority, the management of an Acceptable Security Provider is wholly or substantially displaced or the authority of an Acceptable Security Provider in the conduct of its business is wholly or substantially curtailed;

(k)

an Acceptable Security Provider defaults in the performance of any obligation in respect of any other loan or financial instrument granted by the Bank or to the Bank;

(l)

any distress, attachment, execution, sequestration or other process is levied or enforced upon the property of an Acceptable Security Provider having an aggregate value in excess of GBP 10,000,000 (ten million pounds sterling) or its equivalent in any other currency or currencies and is not discharged within 14 (fourteen) days;

(m)

any material Authorisation issued to an Acceptable Security Provider is subject to notice of revocation by the competent Governmental Authority or an Acceptable Security Provider agrees to any revocation or surrender of such material Authorisation;

(n)

it is or becomes unlawful for an Acceptable Security Provider to perform any of its obligations under an Acceptable Security Document or an Acceptable Security Document is not effective in accordance with its terms or is alleged by an Acceptable Security Provider to be ineffective in accordance with its terms or an Acceptable Security Provider evidences an intention to repudiate an Acceptable Security Document;

(o)

an Acceptable Security Provider fails to comply with any obligation under an Acceptable Security Document (not being an obligation otherwise referred to in any other paragraph of this definition of Acceptable Security Event) unless the non-compliance or circumstance giving rise to the non-compliance is capable of remedy and is remedied within 15 (fifteen) days of the earlier of (i) the Bank giving notice to the Acceptable Security Provider or (ii) the Acceptable Security Provider or the Borrower becoming aware of the non-compliance; or

(p)

CalEnergy Investments C.V. fails to comply with any provision of the Subordination Letter.

"Acceptable Security Document" means the Guarantee Agreement or any other document evidencing Acceptable Security.

"Acceptable S ecurity Provider" means the Guarantor or any other provider of Acceptable Security.

"Acceptance Deadline" for a notice means:

(a) 16h00 Luxembourg time on the day of delivery, if the notice is delivered by 14h00 Luxembourg time on a Business Day; or

(b) 11h00 Luxembourg time on the next following day which is a Business Day, if the notice is delivered after 14h00 Luxembourg time on any such day or is delivered on a day which is not a Business Day.

"Authorisation" means any authorisation, consent, registration, filing, agreement, notarisation, certificate, licence, approval, permit, resolution, authority or exemption and any corporate, creditors' and shareholders' approval or consent.

"Authority" means the Gas and Electricity Markets Authority, operating through OFGEM, and any successors thereto.

"Bonds" means the GBP 150,000,000 5.125% per cent. Guaranteed Bonds due 2035 issued by Northern Electric Finance plc.

"Borrower Material Adverse Change" means, in relation to the Borrower or any other member of the Group, any event or change of condition, as compared with the condition as at the date of this Contract, affecting the Borrower or its Group as a whole, which: (1) materially impairs the ability of the Borrower to perform its financial obligations under this Contract or to comply with any of the financial ratios set out in Article 6.13 or 6.14 of this Contract; or (2) materially impairs the business or financial condition of the Borrower or its Group as a whole.

"Business Day" means a day (other than a Saturday or Sunday) on which the Bank and commercial banks are open for general business in Luxembourg.

"Calculation Date" has the meaning given to it in Article 6.14C.

"Cash Equivalents" has the meaning given to it in Article 6.14C.

"Change-of-Control Event" has the meaning given to it in Article 4.03A(3).

"Change-of-Law Event" has the meaning given to it in Article 4.03A(4).

"Competition Act" means the Competition Act 1998.

"Compliance Certificate" means a certificate substantially in the form set out in Schedule C.3.

" Compulsory Prepayment Event" means any circumstance, event or occurrence which constitutes or which, with the giving of notice, the passage of time or the making of any determination, or any combination thereof, would constitute a prepayment event under Article 4.03A.

"Consent Letter" means the letter dated 6 August 2004 from the Gas and Electricity Markets Authority to the Borrower.

"Consolidated EBIT" has the meaning given to it in Article 6.14C.

"Consolidated Net Finance Charges" has the meaning given to it in Article 6.14C.

"Consolidated Senior Total Net Debt" has the meaning given to it in Article 6.14C.

"Contract" has the meaning given to it in Recital (4).

"Credit" has the meaning given to it in Article 1.01.

"Credit Facility" has the meaning given to it in Article 7.04(a).

"Cross Default Obligation" means a term of any agreement or arrangement under which the Borrower's liability to pay or repay any debt or other sum arises or is increased or accelerated or is capable of arising or of increasing or of being accelerated, because of a default (however it may be described or defined) by any person other than the Borrower, unless:

(a)

that liability can arise only as the result of a default by a Subsidiary of the Borrower;

(b)

the Borrower holds a majority of the voting shares in that Subsidiary and has the right to appoint or remove a majority of its board of directors; and

(c)

that Subsidiary carries on business only for a purpose within sub-paragraph (a) or (b) of the definition of "Permitted Purpose" set out in Standard Condition 1 of the Licence.

"Default" means any Event of Default or any event, circumstance or occurrence which, with the giving of notice, the passage of time or the making of any determination, or any combination thereof, would become an Event of Default.

"Disbursement Notice" means a notice from the Bank to the Borrower pursuant to and in accordance with Article 1.02C.

"Disbursement Request" means a notice substantially in the form set out in Schedule C.1.

"Electricity Act" means the Electricity Act 1989, as amended by the Utilities Act 2000, the Enterprise Act 2002 and the Energy Act 2004 or otherwi se from time to time.

"Energy Act" means the United Kingdom Energy Act 2004.

"Energy Administration Order" means an order made pursuant to Chapter 3 of Part 3 of the Energy Act.

"Enterprise Act" means the United Kingdom Enterprise Act 2002.

"Environment" means the following, in so far as they affect human well-being: (a) fauna and flora; (b) soil, water, air, climate and the landscape; and (c) cultural heritage and the built environment.

"Environmental Claim" means any claim or proceeding by any person in respect of any Environmental Law.

"Environmental Impact Assessment" has the meaning given to it in the relevant Environmental Law.

"Environmental Law" means EU law and national laws and regulations applicable in the United Kingdom, as well as applicable international treaties, of which a principal object ive is the preservation, protection or improvement of the Environment.

"EUR" or "euro" means the lawful currency for the time being of the Participating Member States.

"EURIBOR" has the meaning given to it in Schedule B.

"Event of Default" means any one of the circumstances, events or occurrences specified in Article 10.01.

"Final Availability Date" means the date which is 18 (eighteen) months after the date of this Contract.

"Final Proposals" has the meaning given to it in Article 6.14C.

"Financial Indebtedness" means, at any time, any obligation of such person, whether incurred as principal or surety and whether present, future, actual or contingent, for the payment or repayment of money in respect of:

(b)

any amount raised by acceptance under any acceptance credit facility or dematerialised equivalent;

(c)

any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument;

(d)

the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with IFRS, be treated as a finance or capital lease;

(e)

receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis) and any bill discounting or factoring facilities;

(f)

the acquisition cost of any asset to the extent payable before or after the time of acquisition or possession by the party liable where the advance or deferred payment is arranged primarily as a method of raising finance or financing the acquisition of that asset;

(g)

leases (whether in respect of land, machinery, equipment or otherwise) entered into primarily as a method of raising finance o r financing the acquisition of that asset;

(h)

any amount raised under any other transaction (including any forward sale or purchase agreement) having the commercial effect of a borrowing or raising money;

(i)

any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value shall be taken into account);

(j)

any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution;

(k)

any amount raised by the issue of redeemable shares which are by their terms capable of redemption before the 31 December 2032; and

(l)

(without double counting) the amount of any liability in respect of any guarantee or indemnity in respect of any of the items referred to in paragraphs (a) to (k) above.

"First Currency" has the meaning given to it in Article 9.03(a).

"Fixed Rate" means an annual interest rate determined by the Bank in accordance with the applicable principles from time to time laid down by the governing bodies of the Bank for loans made at a fixed rate of interest, denominated in the currency of the Tranche and bearing equivalent terms for the repayment of capital and the payment of interest.

"Fixed Rate Notified Tranche" means a Notified Tranche which is a Fixed Rate Tranche.

"Fixed Rate Tranche" means a Tranche disbursed on a Fixed Rate basis.

"Floating Rate" means a fixed-spread f loating interest rate, that is to say an annual interest rate equal to LIBOR plus or minus the Spread, determined by the Bank for each successive Floating Rate Reference Period.

"Floating Rate Notified Tranche" means a Notified Tranche which is a Floating Rate Tranche.

"Floating Rate Reference Period" means each period from one Payment Date to the next relevant Payment Date and the first Floating Rate Reference Period shall commence on the date of disbursement of the Tranche.

"Floating Rate Tranche" means a Tranche disbursed on a Floating Rate basis.

"GBP" means pounds sterling, the lawful currency for the time being of the United Kingdom.

"GIC" has the meaning given to it in Article 6.14C.

"Governmental Authority" means the government of any country, or of any political subdivision thereof, whether state, regional or local, and any ag ency, authority, branch, department, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government or any subdivision thereof (including any supra-national bodies and including, for the avoidance of doubt, the Authority), and all officials, agents and representatives of each of the foregoing.

"Group" means the Borrower and the Borrower's Subsidiaries (if any) from time to time.

"Guarantee" has the meaning given to it in Recital (6).

"Guarantee Agreement" has the meaning given to it in Recital (6).

"Guarantor" has the meaning given to it in Recital (6).

"Guarantor Group" means the Guarantor and the Guarantor's Subsidiaries from time to time.

"IFRS" means the international accounting standards within the meaning of IAS Regulation 1606/20 02.

"Incorporated Provision" has the meaning given to it in Article 7.04(a).

"Indemnifiable Prepayment Event" means a prepayment event under Article 4.03A other than paragraphs 4.03A(1) and 4.03A(2).

"Interest Cover" has the meaning given to it in Article 6.14C.

"Interest Revision/Conversion" means the determination of new financial conditions relative to the interest rate, specifically the same interest rate basis ("revision") or a different interest rate basis ("conversion") which can be offered for the remaining term of a Tranche or until a next Interest Revision/Conversion Date, if any.

"Interest Revision/Conversion Date" means the date, being a Payment Date, specified by the Bank pursuant to Article 1.02C in the Disbursement Notice or pursuant to Article 3 and Schedule D.

"Interest Revision/Conversion Proposal" means a proposal made by the Bank under Schedule D, for an amount which, at the proposed Interest Revision/Conversion Date, is not less than GBP 10,000,000 (ten million pounds sterling).

"Interest Revision/Conversion Request" means a written notice from the Borrower, delivered at least 75 (seventy-five) days before an Interest Revision/Conversion Date, requesting the Bank to submit to it an Interest Revision/Conversion Proposal. The Interest Revision/Conversion Request shall also specify:

(a) Payment Dates chosen in accordance with the provisions of Article 3.01;

(b) the prefe rred repayment schedule chosen in accordance with Article 4.01; and

(c) any further Interest Revision/Conversion Date chosen in accordance with Article 3.01.

"LIBOR" has the meaning given to it in Schedule B.

"Licence" means the distribution licence granted to the Borrower under Section 6(1)(c) of the Electricity Act with respect to the distribution of electricity in the distribution service area as such area is defined in such licence, as such licence may be amended or replaced from time to time.

"Loan" means the aggregate amount of Tranches disbursed from time to time by the Bank under this Contract.

"Margin" has the meaning given to it in Article 3.01.

"Market Disruption Event" has the meaning given to it in Article 1.06B.

"Material Adverse Change" means (a) in relation to the Borrower, a Borrower Material Adverse Change; and (b) in relation to the Guarantor or any other member of the Guaranto r Group, any event or change of condition, as compared with the condition as at the date of this Contract, affecting the Guarantor or the Guarantor Group, which: (1) materially impairs the ability of the Guarantor to perform its financial obligations under the Guarantee Agreement or to comply with any of the financial ratios set out in Article 6.01, 6.02 or 6.03 of the Guarantee Agreement; or (2) materially impairs the business or financial condition of the Guarantor or of the Guarantor Group as a whole.

"Maturity Date" means the last or sole repayment date of a Tranche specified pursuant to Article 4.01A(b)(iii) or Article 4.01B.

"Moody's" means Moody's Investors Service, Inc. or its successor.

"More Favourable Provision" has the meaning given to it in Article 7.04(a).

“Non-Technical Summary” has the meaning given to it in the relevant Environmental Law.

"Notified Tranche" means a Tranche in respect of which the Bank has issued a Disbursement Notice.

"OFGEM" means the Office of Gas and Electricity Markets.

"Original Financial Statements" means the audited financial statements of the Borrower for the financial year ended 31 December 2009.

"Participating Member States" means any member state of the European Union that adopts or has adopted the euro as its lawful currency in accordance with legislation of the European Union relating to Economic and Monetary Union.

"Payment Date" means the annual, semi-annual or quarterly dates specified in the Disbursement Notice until the Interest Revision/Conversion Date, if any, or the Maturity Date, save that, in case any such date is not a Relevant Business Day, it means:

(a) for a Fixed Rate Tranche, the following Relevant Business Day, without adjustment to the interest due under Article 3.01 except for those cases where repayment is made in a single instalment according to Article 4.01B, when the preceding Relevant Business Day shall apply instead to the single instalment and last interest payment and only in this case with adjustment to the interest due under Article 3.01; and

(b) for a Floating Rate Tranche, the next day, if any, of that calendar month that is a Relevant Business Day or, failing that, the nearest preceding day that is a Relevant Business Day, in all cases with corresponding adjustment to the interest due under Article 3.01.

"Permitted Financial Indebtedness" means:

(a) Financial Indebtedness of Northern Electric Finance plc under the Bonds in an amount of GBP 150,000,000 (one hundred and fifty million pounds sterling) and of the Borrower pursuant to a guarantee in an amount of GBP 150,000,000 (one hundred and fifty million pounds sterling) dated 5 May 2005 between, among others, the Borrower and Northern Electric Finance plc;

(b) Financial Indebtedness of Northern Electric Finance plc and the Borrower outstanding on 31 December 2009 and not otherwise referred to in the definition of "Permitted Financial Indebtedness";

(c) Financial Indebtedness of the Borrower pursuant to the Revolving Facility Agreement;

(d) Financial Indebtedness owed by one member of the Group to another member of the Group;

(e) Financial Indebtedness owed to the Bank;

(f) Financial Indebtedness which is subordinated to the Loan on terms satisfactory in form and substance to the Bank; and

(g) Financial Indebtedness of the Borrower from time to time which does not exceed an aggregate amount of GBP 10,000,000 (ten million pounds sterling) or its equivalent in any other currency or currencies.

"Prepayment Amount" means the amount of a Tranche to be prepaid by the Borrower in accordance with Article 4.02A.

"Prepayment Date" means the date, w hich shall be a Payment Date, on which the Borrower proposes to effect prepayment of a Prepayment Amount.

"Prepayment Notice" means a written notice from the Borrower specifying, amongst other things, the Prepayment Amount and the Prepayment Date in accordance with Article 4.02A.

"Project" has the meaning given to it in Recital (1).

"Project Completion Report" means the information that the Borrower is obliged to deliver to the Bank in accordance with paragraph 4 of Schedule A.2.

"Quasi-Security" has the meaning give n to it in Article 7.02(c).

"Rating Agency" has the meaning given to it in Article 6.14C.

"RAV" has the meaning given to it in Article 6.14C.

"Redeployment Rate" means the Fixed Rate in effect on the day of the indemnity calculation for fixed-rate loans denominated in the same currency and which shall have the same terms for the payment of interest and the same repayment profile to the Interest Revision/Conversion Date, if any, or the Maturity Date as the Prepayment Amount. For those cases where the period is shorter than the minimum intervals described under Article 3.01 the most closely corresponding money market rate equivalent will be used, that is LIBOR minus 0.125% (12.5 basis points) for periods of up to 12 (twelve) months. For periods falling between 13 and 36/48 months respectively, the bid point on the swap rates as published by Intercapital in Reuters for the related currency and observed by the Bank at the time of calculation will apply.

"Regulated Asset Value" has the meaning given to it in Article 6.14C.

"Relevant Business Day" means:

(a) for EUR, a day which is a TARGET Day; and

(b) for any other currency, a day on which banks are open for general business in the principal domestic financial centre of the relevant currency.

"Relevant Interbank Rate" means:

(a)&nbs p; EURIBOR for an amount denominated in EUR;

(b) LIBOR for an amount denominated in GBP or USD; and

(c) the market rate and its definition chosen by the Bank and separately communicated to the Borrower, for an amount denominated in any other currency.

"Relevant Period" has the meaning given to it in Article 6.14C.

"Revolving Facility Agreement" means the GBP 150,000,000 Multicurrency Revolving Facility Agreement dated 26 March 2010 entered into between the Guarantor, the Borrower, Yorkshire Electricity Distribution plc, Abbey National Treasury Services plc, Lloyds TSB Bank plc and The Royal Bank of Scotland plc.

"Scheduled Disbursement Date" means the date on which a Tranche is scheduled to be disbursed in accordance with Article 1.02C.

"Second Currency" has the meaning given to it in Article 9.03(a).

"Security" and "Security Interest" means any mortgage, pledge, lien, charge, assignment, hypothecation or security interest or any other agreement or arrangement having the effect of conferring security.

"Spread" means the fixed spread to LIBOR (being either plus or minus) determined by the Bank including the Margin and notified to the Borrower in the relevant Disbursement Notice or Interest Revision/Conversion Proposal.

"S&P" means Standard and Poor's Ratings Group or its successor.

"Subordinated Loan Agreement" means the loan agreement entered into between CalEnergy Investments C.V. and CE Electric UK Limited dated 31 January 2000 in an amount of GBP 300,000,000 (three hundred million pounds sterling).

“Subordination Letter&rd quo; means a letter between the Bank and CalEnergy Investments C.V. dated on or about the date of this Contract.

"Subsidiary":

(a) for the purposes of the definition of Cross Default Obligation, has the meaning given to such term in the Licence of the Borrower; and

(b) for all other purposes, means a subsidiary undertaking within the meaning of section 1162 of the Companies Act 2006 and in interpreting that provision for the purposes of this Contract, an undertaking is to be treated as a subsidiary undertaking even if its shares are registered in the name of (i) a nominee, or (ii) any party holding Security over those shares, or that secured party's nominee.

"Sum" has the meaning given to it in Article 9.03(a).

"TARGET Day" means any day on which TARGET2 is open for the settlement of payments in EUR.

"TARGET2" means the Tra ns-European Automated Real-time Gross Settlement Express Transfer payment system which utilises a single shared platform and which was launched on 19 November 2007.

"Tax" means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same).

"Technical Description" has the meaning given to it in Recital (1).

"Term Loan" has the meaning given to it in Article 4.03A(2).

"Tranche" means each disbursement made or to be made under this Contract.

"USD" means the lawful currency for the time being of the United States of America.

"Yorkshire Finance Contract" has the meaning given to it in Recital (8).

(a) references to Articles, Recitals, Schedules and Annexes are, save if explicitly stipulated otherwise, references respectively to articles of, and recitals, schedules and annexes to, this Contract;

(b) unless the context otherwise requires, words denoting the singular include the plural and vice versa;

(c) a reference (i) to an amendment or to an agreement being amended includes a supplement, variation, assignment, novation, restatement or re-enactment, and (ii) to an agreement shall be construed as a reference to such agreement as it may be amended, supplemented or restated from time to time;

(d) the headings and the Table of Contents are inserted for convenience of reference o nly and shall not affect the interpretation of this Contract;

(e) any reference to "law" means any law (including, any common or customary law) and any treaty, constitution, statute, legislation, decree, normative act, rule, regulation, judgement, order, writ, injunction, determination, award or other legislative or administrative measure or judicial or arbitral decision in any jurisdiction which has the force of law;

(f) any reference to a provision of law, is a reference to that provision as from time to time amende d or re-enacted;

(g) a reference to a "person" includes any person, natural or juridical entity, firm, company, corporation, government, state or agency of a state or any association, trust or partnership (whether or not having separate legal personality) or two or more of the foregoing and references to a "person" include its successors in title, permitted transferees and permitted assigns;

(h) "including" and "include" shall be deemed to be followed by "without limitation" where not so followed;

(i) a Default is "continuing" if it has not been remedied or waived in writing by the Bank; and

(j) a reference to "indebtedness" includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent.

NOW THEREFORE it is hereby agreed as follows:

ARTICLE 1

Credit and disbursement

By this Contract the Bank establishes in favour of the Borrower, and the Borrower accepts, the credit in an amount of GBP 119,000,000 (one hundred and nineteen million pounds sterling) for the financing of the Project (the "Credit").

The Bank shall disburse the Credit in up to 12 (twelve) Tranches. The amount of each Tranche, if not being the undrawn balance of the Credit, shall be in a minimum amount of GBP 10,000,000 (ten million pounds sterlin g).

(a)

From time to time up to 15 (fifteen) days before the Final Availability Date, the Borrower may present to the Bank a Disbursement Request for the disbursement of a Tranche. The Disbursement Request shall specify:

(i)

the amount and currency (being GBP) of the Tranche;

(ii)

the preferred disbursement date for the Tranche, which shall be a Relevant Business Day falling at least 15 (fifteen) days after the date of the Disbursement Request and on or before the Final Availability Date, it being understood that the Bank may disburse the Tranche up to 4 (four) calendar months from the date of the Disbursemen t Request;

(iii)

whether the Tranche is a Fixed Rate Tranche or a Floating Rate Tranche, each pursuant to the relevant provisions of Article 3.01;

(iv)

the preferred interest payment periodicity for the Tranche, chosen in accordance with Article 3.01;

(v)

th e preferred terms for repayment of principal for the Tranche, chosen in accordance with Article 4.01;

(vi)

the preferred first and last dates for repayment of principal for the Tranche;

(vii)

the Borrower's choice of Interest Revision/Conversion Date, if any, for the Tranche; and

(viii)

the IBAN code (or appropriate format in line with local banking practice) and SWIFT BIC of the bank account to which disbursement of the Tranche should be made in accordance with Article 1.02D.

(b)

The Borrower may also at its discretion specify in the Disbursement Request the following respective elements, if any, as provided by the Bank on an indicative basis and without commitment, to be applicable to the Tranche, that is to say:

(i)

in the case of a Fixed Rate Tranche, the fixed interest rate; and

(ii)

in the case of a Floating Rate Tranche, the Spread,

applicable until the Maturity Date or until the Interest Revision/Conversion Date, if any.

(c)

Each Disbursement Request shall be accompanied by evidence of the authority of the person or persons authorised to sign it and the specimen signature of such person or persons.

(d)

Subject to Article 1.02C(b), each Disbursement Request is irrevocable.

(a)

Not less than 10 (ten) days before the proposed Scheduled Disbursement Date of a Tranche the Bank shall, if the Disbursement Request conforms to this Article 1.02, deliver to the Borrower a Disbursement Notice which shall specify:

(i)

the currency and amount of the Tranche;

(ii)

the Scheduled Disbursement Date;

(iii)

the interest rate basis for the Tranche;

(iv)

the first interest Payment Date and the periodicity for the payment of interest for the Tranche;

(v)

the terms for repayment of principal for the Tranche;

(vi)

the first and last dates for repayment of principal for the Tranche;

(vii)

the applicable Payment Dates for the Tranche;

(viii)

the Interest Revision/Conversion Date, if any, for the Tranche; and

(ix)

for a Fixed Rate Tranche the fixed interest rate and for a Floating Rate Tranche the Spread.

(b)

If one or more of the elements specified in the Disbursement Notice does not reflect the corresponding element, if any, in the Disbursement Request, the Borrower may following receipt of the Disbursement Notice revoke the Disbursement Request by written notice to the Bank to be received no later than 12h00 Luxembourg time on the next Business Day and thereupon the Disbursement Request and the Disbursement Notice shall be of no effect. If the Borrower has not revoked in writing the Disbursement Request within such period, the Borrower will be deemed to have accepted all elements specified in the Disbursement Notice.

(c)

If the Borrower has presented to the Bank a Disbursement Request in which the Borrower has not specified the elements referred to in Article 1.02B(b), the Borrower will be deemed to have agreed in advance to the corresponding element as subsequently specified in the Disbursement Notice.

Disbursement shall be made to the account of the Borrower as the Borrower shall notify in writing to the Bank not later than 15 (fifteen) days before the Scheduled Disbursement Date (with IBAN code or with the appropriate format in line with local banking practice).

Only one account may be specified for each Tranche.

The Bank shall disburse each Tranche in GBP.

1.04

Conditions of disbursement

The disbursement of the first Tranche under Article 1.02 is conditional upon receipt by the Bank in form and substance satisfactory to it, on or before the date falling 5 (five) Business Days before the Scheduled Disbursement Date, of the following documents or evidence:

(a)

a certified copy of the Borrower's constitutional documents and of the Licence;

(b)

evidence satisfactory to the Bank that the execution of this Contract by the Borrower has been duly authorised and that the person or persons signing t he Contract on behalf of the Borrower is/are duly authorised to do so together with the specimen signature of each such person or persons;

(c)

evidence that the Borrower has obtained all necessary Authorisations required in connection with entering into and delivering this Contract;

(d)

if required by the Bank, evidence that the Borrower has obtained all necessary Authorisations required in connection with the Project;

(e)

the duly executed Guarantee Agreement, in form and substance satisfactory to the Bank;

(f)

evidence satisfactory to the Bank that the execution of the Guarantee Agreement by the Guarantor has been duly authorised and that the person or persons signing the Guarantee Agreement on behal f of the Guarantor is/are duly authorised to do so together with the specimen signature of each such person or persons;

(g)

evidence that the Guarantor has obtained all necessary Authorisations required in connection with entering into and delivering the Guarantee Agreement;

(h)

evidence that the fees, costs and expenses then due from the Borrower have been paid, including those payable pursuant to Article 9 of this Contract (other than any fees to be invoiced by Norton Rose LLP in connection with the preparation and execution of this Contract and the Guarantee Agree ment and with the conditions precedent to be satisfied under this Article 1.04);

(i)

a due capacity, execution and enforceability opinion in relation to this Contract and the Guarantee Agreement of Norton Rose LLP, legal advisers to the Bank in England;

(j)

a certified copy of the Revolving Facility Agreement;

(k)

a certified copy of the Consent Letter; and

(l) a certified copy of the Subordinated Loan Agreement.

The disbursement of each Tranche under Article 1.02, including the first, is conditional upon:

(a)

receipt by the Bank in form and substance satisfactory to it, on or before the date falling 5 (five) Business Days before the Scheduled Disbursement Date for the proposed Tranche, of the following documents or evidence:

(i)

a certificate from the Borrower in the form of Schedule C.2, such certificate to be signed by two directors of the Borrower (or, failing that, by one director of the Borrower and the finance director or the treasurer or the investor reporting manager or the financial controller or the company secretary of the Borrower) and to be dated no earlier than the date falling 15 (fifteen) days before the Scheduled Disbursement Date; and

(ii)

a copy of any other Authorisation or other document, opinion or assurance which the Bank has notified the Borrower is necessary or desirable in connection with (1) the entry into and performance of, and the transa ctions contemplated by, this Contract or the Guarantee or the validity and enforceability of the same or (2) the Project; and

(b)

that on the Scheduled Disbursement Date for the proposed Tranche:

(i)

the representations and warranties which are repeated pursuant to Article 6.15 are correct in all respects; and

(ii)

no Default or Compulsory Prepayment Event has occurred and is continuing unremedied or unwaived or would result from the proposed Tranche.

On or before the date which is the later of (a) the date falling 10 Business Days after receipt of an invoice from Norton Rose LLP; and (b) 30 days from the date of this Contract, the Borrower shall provide to the Bank in form and substance satisfactory to the Bank, evidence that the fees, costs and expenses then due from the Borrower to Norton Rose LLP in connection with the preparation and execution of this Contract and the Guarantee Agreement and with the conditions precedent to be satisfied under Article 1.04A, have been paid.

1.05

Deferment of disbursement

Upon the written request of the Borrower, the Bank shall defer the disbursement of any Notified Tranche in whole or in part to a date specified by the Borrower being a date falling not later than 6 (six) months from its Scheduled Disbursement Date. In such case, the Borrower shall pay the deferment indemnity as determined pursuant to Article 1.05B below.

Any request for deferment shall have effect in respect of a Tranche only if it is made at least 5 (five) Business Days before its Scheduled Disbursement Date.

If any of the conditions referred to in Article 1.04 is not fulfilled as at the specified date and at the Scheduled Disbursement Date, and the Bank is of the opinion that it will not be satisfied, disbursement will be deferred to a date agreed between the Bank and the Borrower falling not earlier than 5 (five) Business Days following the fulfilment of all conditions of disbursement.

If the disbursement of any Notified Tranche is deferred, whether at the request of the Borrower or by reason of non-fulfilment of the conditions of disbursement, the Borrower shall, upon demand by the Bank, pay an indemnity on the amount of disbursement deferred. Such indemnity shall accrue from the Scheduled Disbursement Date to the actual disbursement date or, as the case may be, until the date of cancellation of the Notified Tranche in accordance with this Contract at a rate equal to R1 minus R2, where:

"R1" means the rate of interest less the Margin that would have applied from time to time pursuant to Article 3.01, if the Tranche had been disbursed on the Scheduled Disbursement Date; and

"R2" means LIBOR less 0.125% (12.5 basis points); provided that for the purpose of determining LIBOR in relation to this Article 1.05, the relevant periods provided for in Schedule B shall be successive periods of 1 (one) month commencing on the Scheduled Disbursement Date.

Furthermore, the indemnity:

(a)

if the deferment exceeds one (1) month in duration, shall accrue at the end of every month;

(b)

shall be calculated using the day count convention applicable to R1;

(c)

where R2 exceeds R1, shall be set at zero; and

(d)

shall be payable in accordance with Article 1.09.

1.05C

Cancellation of disbursement deferred by 6 (six) months

The Bank may, by notice in writing to the Borrower, cancel a disbursement which has been deferred under Article 1.05A by more than 6 (six) months in aggregate. The cancelled amount shall remain available for disbursement under Article 1.02.

1.06

Cancellation and suspension

1.06A

Borrower's right to cancel

The Borrower may at any time by notice in writing to the Bank cancel, in whole or in part and with immediate effect, the undisbursed portion of the Credit. However, the notice shall have no effect in respect of a Notified Tranche which has a Scheduled Disbursement Date falling within 5 (five) Business Days of the date of the notice.

1.06B

Bank's right to suspend and cancel

(a)

The Bank may, by notice in writing to the Borrower, suspend and/or cancel the undisbursed portion of the Credit in whole or in part at any time and with immediate effect:

(i)

if a Default has occurred and is continuing;

(ii)

if, in the opinion of the Bank, a Material Adverse Change has occurred and is continuing;

(iii)

if a Market Disruption Event has occurred and is continuing; or

(iv)

if the Credit (as such term is defined in the Yorkshire Finance Contract) or any part thereof is suspended and/or cancelled or if a Default or a Compulsory Prepayment Event (as such terms are defined in the Yorkshire Finance Contract) occurs under the Yorkshire Finance Contract.

(b)

Furthermore, to the extent that the Bank may cancel the Credit under Article 4.03A, the Bank may also suspend it. Any suspension shall continue until the Bank ends the suspension or cancels the suspended amount.

(c)

For the purposes of this Article, "Market Disruption Event" means:

(i)

the Bank determines that there are exceptional circumstances adversely affecting the Bank's access to its sources of funding;

(ii)

in the opinion of the Bank, the cost to the Bank of obtaining funds from its sources of funding would be in excess of the applicable LIBOR for th e relevant period of a Tranche;

(iii)

the Bank determines that by reason of circumstances affecting its sources of funding generally adequate and fair means do not exist for ascertaining the applicable LIBOR for the relevant period of a Tranche;

(iv)

in the opinion of the Bank, funds are not reasonably likely to be available to it in the ordinary course of business to fund a Tranche in GBP or for the relevant period, if applicable and appropriate to the specific lending operation; or

(v)

it is not possible for the Bank to obtain funding in sufficient amounts for it to fund a disbursement, if applicable and appropriate to the specific lending operation, or there is a material upheaval in the international debt, money or capital markets.

1.06C

Indemnity for suspension and cancellation of a Tranche

1.06C(1) SUSPENSION

If the Bank suspends a Notified Tranche, whether upon an Indemnifiable Prepayment Event or an event mentioned in Article 10.01, the Borrower shall indemnify the Bank under Article 1.05B.

1.06C(2) CANCELLATION

If, pursuant to Article 1.06A, the Borrower cancels:

(a)

a Fixed Rate Notified Tranche, it shall indemnify the Bank under Article 4.02B(1);

(b)

a Floating Rate Notified Tranche or any part of the Credit other than a Notified Tranche, no indemnity is payable.

If the Bank cancels a Fixed Rate Notified Tranche upon an Indemnifiable Prepayment Event or pursuant to Article 1.05C, the Borrower shall indemnify the Bank un der Article 4.02B(1). If the Bank cancels a Notified Tranche upon an event mentioned in Article 10.01, the Borrower shall indemnify the Bank under Article 10.03. Save in these cases, no indemnity is payable upon cancellation of a Tranche by the Bank.

An indemnity shall be calculated on the basis that the cancelled amount is deemed to have been disbursed and repaid on the Scheduled Disbursement Date or, to the extent that the disbursement of the Tranche is currently deferred or suspended, on the date of the cancellation notice.

1.07

Cancellation after expiry of the Credit

Any time on or after the Final Availability Date, the Bank may by notice to the Borrower and without liability arising on the part of either party, cancel any part of the Credit which has not yet been disbursed.

The Borrower shall pay to the Bank an up-front fee in an amount of GBP 119,000 (one hundred and nineteen thousand pounds sterling) for the establishment of the Credit under this Contract. Such up-front fee shall be payable as follows:

(a) upon separate request of the Borrower to be made together with the Disbursement Request, it shall be deducted by the Bank from the amount to be disbursed under the first Tranche;

(b) by the Borrower to the Bank on the Scheduled Disbursement Date of the first Tranche;

(c) if the Borrower communicates to the Bank that it wishes to cancel the Credit without a Disbursement Request having been submitted by the Borrower, within 30 (thirty) days of such notice of cancellation; or

(d) if the Borrower fails to make a valid Disbursement Request before or by the Final Availability Date, within 30 (thirty) days of the Final Availability Date.

The amount due to the Bank under paragraphs (b) to (d) above shall be payable in GBP and shall be paid to the account indicated by the Bank to the Borrower.

The amount due to the Bank and deducted from the first Tranche upon the request of the Borrower under paragraph (a) above shall be considered as having been duly paid by the Borrower to the Bank on the Scheduled Disbursement Date of the first Tranche. For the purposes of Article 2.01, such amount shall also be considered as having been disbursed by the Bank.

Sums due under Articles 1.05 and 1.06 shall be payable in GBP. They shall be payable within 7 (seven) days of the Borrower's receipt of the Bank's demand or within any longer period specified in the Bank's demand.

ARTICLE 2

The Loan

The Loan shall comprise the aggregate amount of Tranches disbursed by the Bank under the Credit, as confirmed by the Bank pursuant to Article 2.03.

2.02

Currency of repayment, interest and other charges

Interest, repayments and other charges payable in respect of each Tranche shall be made by the Borrower in the currency of the Tranche.

Any other payment shall be made in the currency specified by the Bank having regard to the currency of the expenditure to be reimbursed by means of that payment.

Within 10 (ten) days after disbursement of each Tranche, the Bank shall deliver to the Borrower the amortisation table referred to in Article 4.01, if appropriate, showing the disbursement date, currency, the amount disbursed, the repayment terms and the interest rate of and for that Tranche, which shall not contradict the relevant Disbursement Notice.

ARTICLE 3

Interest

For the purposes of this Contract "Margin" means sixteen basis points (0.16%) per annum.

Fixed Rates and Spreads are available for periods of not less than 4 (four) years or, where repayment is made in a single instalment according to Article 4.01B, not less than 5 (five) years.

The Borrower shall pay interest on the outstanding balance of each Fixed Rate Tranche at the Fixed Rate together with the Margin quarterly, semi-annually or annually in arrears on the relevant Payment Dates, as specified in the Disbursement Notice, commencing on the first such Payment Date following the date on which the disbursement of the Tranche was made. If the period from the date on which disbursement was made to the first Payment Date is 15 days or less then the payment of i nterest accrued during such period shall be postponed to the following Payment Date.

Interest shall be calculated on the basis of Article 5.01(a) at an annual rate that is the sum of the Margin and the Fixed Rate.

The Borrower shall pay interest on the outstanding balance of each Floating Rate Tranche at the Floating Rate quarterly, semi-annually or annually in arrears on the relevant Payment Dates, as specified in the Disbursement Notice commencing on the first such Payment Date following the date of disbursement of the Tranche. If the period from the date on which disbursement was made to the first Payment Date is 15 days or less then the payment of interest accrued during such period shall be postponed to the following Payment Date.

The Bank shall notify the Floating Rate to the Borrower within 10 (ten) days following the commencement of each Floating Rate Reference Period.

If pursuant to Articles 1.05 and 1.06 disbursement of any Floating Rate Tranche takes place after the Scheduled Disbursement Date the interest rate applicable to the first Floating Rate Reference Period shall be determined as though disbursement had taken place on the Scheduled Disbursement Date.

Interest shall be calculated in respect of each Floating Rate Reference Period on the basis of Article 5.01(b).

3.01C

Revision or Conversion of Tranches

Where the Borrower exe rcises an option to revise or convert the interest rate basis of a Tranche, it shall, from the effective Interest Revision/Conversion Date (in accordance with the procedure set out in Schedule D) pay interest at a rate determined in accordance with the provisions of Schedule D.

Without prejudice to Article 10 and by way of exception to Article 3.01, interest shall accrue on any overdue sum payable under the terms of this Contract from the due date to the date of payment at an annual rate equal to LIBOR plus 2% (200 basis points) and shall be payable in accordance with the demand of the Bank. For the purpose of determining LIBOR in relation to this Article 3.02, the relevant periods within the meaning of Schedule B shall be successive periods of one month commencing on the due date.

However, interest on a Fixed Rate Tranche shall be charged at the annual rate that is the sum of the rate defined in Article 3.01A plus 0.25% (25 basis points) if that annual rate exceeds, for any given relevant period, the rate specified in the preceding paragraph.

If the overdue sum is in a currency other than the currency of the Loan, the following rate per annum shall apply, namely the Relevant Interbank Rate that is generally retained by the Bank for transactions in that currency plus 2% (200 basis points), calculated in accordance with the market practice for such rate.

ARTICLE 4

Repayment

(a)

The Borrower shall repay each Tranche by instalments on the Payment Date s specified in the relevant Disbursement Notice in accordance with the terms of the amortisation table delivered pursuant to Article 2.03.

(b)

Each amortisation table shall be drawn up on the basis that:

(i)

in the case of a Fixed Rate Tranche without an Interest Revision/Conversion Date, repayment shall be made on a constant annuity basis or by equal annual, semi-annual or quarterly instalments of principal;

(ii)

in the case of a Fixed Rate Tranche with an Interest Revision/Conversion Date or a Floating Rate Tranche, repayment shall be made by equal annual, semi-annual or quarterly instalments of principal; and

(iii)

the first repayment date of each Tranche shall be a Payment Date fa lling not later than the first Payment Date immediately following the 4th (fourth) anniversary of the Scheduled Disbursement Date of the Tranche and the last repayment date shall be a Payment Date falling not earlier than 4 (four) years and not later than 20 (twenty) years from the Scheduled Disbursement Date.

Alternatively, the Borrower may repay the Tranche in a single instalment on a Payment Date specified in the Disbursement Notice, being a date falling not less than 5 (five) years or more than 12 (twelve) years from the Scheduled Disbursement Date.

Subject to Articles 4.02B, 4.02C and 4.04, the Borrower may prepay all or part of any Tranche, together with accrued interest and indemnities if any, upon giving a Prepayment Notice with at least 1 (one) month's prior notice specifying the Prepayment Amount and the Prepayment Date.

Subject to Article 4.02C the Prepayment Notice shall be binding and irrevocable.

4.02B(1) FIXED RATE TRANCHE

(a)

Subject to paragraph (b) below, if the Borrower prepays a Fixed Rate Tranche, the Borrower shall pay to the Bank on the Prepayment Date an indemnity equal to the present value (as of the Prepayment Date) of the excess, if any, of:

(i)

the interest calculated net of the Margin that would accrue thereafter on the Prepayment Amount over the period from the Prepayment Date to the Interest Revision/Conversion Date, if any, or the Maturity Date, if it were not prepaid; over

(ii)

the interest that would so accrue over that period, if it were calculated at the Redeployment Rate, less 0.15% (fifteen basis points).

The said present value shall be calculated at a discount rate equal to the Redeployment Rate, applied as of each relevant Payment Date.

(b)

The Borrower may prepay a Fixed Rate Tranche without indemnity on the Interest Revision/Conversion Date in the event of the no n-fulfilment of an Interest Revision/Conversion pursuant to Schedule D.

4.02B(2) FLOATING RATE TRANCHE

The Borrower may prepay a Floating Rate Tranche without indemnity on any relevant Payment Date. If the Borrower has accepted an Interest Revision/Conversion Proposal to convert a Floating Rate Tranche to a Fixed Rate Tranche pursuant to Schedule D Article 4.02B(1) applies.

The Bank shall notify the Borrower, not later than 15 (fifteen) days prior to the Prepayment Date, of the Prepayment Amount, of the accrued interest due thereon and of the indemnity payable under Article 4.02B or, as the case may be, that no indemnity is due.

Not later than the Acceptance Deadline, the Borrower shall notify the Bank either:

(a)

that it confirms the Prepayment Notice on the terms specified by the Bank; or

(b)

that it withdraws the Prepayment Notice.

If the Borrower gives the confirmation under paragraph (a) above, it shall effect the prepayment. If the Borrower withdraws the Prepayment Notice or fails to confirm it in due time, it may not effect the prepayment. Save as aforesaid, the Prepayment Notice shall be binding and irrevocable.

The Borrower shall accompany the prepayment by the payment of accrued interest and indemnity, if any, due on the Prepayment Amount.

4.03A(1)&nbs p; PROJECT COST REDUCTION

If the total cost of the Project should be reduced from the figure stated in Recital (2) to a level at which the aggregate of (i) the amount of the Credit remaining available for disbursement and (ii) the Loan exceeds 50% (fifty per cent) of such cost, the Bank may, by notice to the Borrower, cancel the Credit and/or demand prepayment of the Loan in an amount not exceeding the amount required to ensure that the aggregate of (i) the Credit remaining available for disbursement and (ii) the Loan does not exceed 50% (fifty per cent) of the total cost of the Project as so reduced.

4. 03A(2) PARI PASSU TO ANOTHER TERM LOAN

If the Borrower (or any other member of the Group) voluntarily prepays a part or the whole of any other loan originally granted to it for a term of more than 3 (three) years (a "Term Loan") otherwise than out of the proceeds of a loan having a term at least equal to the unexpired term of the Term Loan prepaid, the Bank may, by notice to the Borrower, cancel the Credit and demand prepayment of the Loan, in such proportion as the prepaid amount of the Term Loan bears to the aggregate outstanding amount of all Term Loans.

The Bank shall address its notice to the Borrower within 30 (thirty) days of receipt of the relevant notice under Article 8.02(c)(iii).

For the purposes of this Article:

(a)

"loan" includes any loan, bond or other form of financial indebtedness or any obligation for the payment or repayment of money; and

(b)

"Term Loan" excludes a loan from the Guarantor or any member of the Guarantor Group to the Borrower or to any member of the Group.

4.03A(3) CHANGE OF CONTROL

The Borrower shall promptly inform the Bank if a Change-of-Control Event has occurred or is reasonably likely to occur. In such case, or if the Bank has reasonable cause to believe that a Change-of-Control Event has occurred or is about to occur, the Bank may request that the Borrower consult with it. Such consultation shall take place within 30 (thirty) days from the date of the Bank's request. After the earlier of (a) the expiry of 30 (thirty) days from the date of such request for consultation; or (b) the occurrence of the anticipated Change-of-Control Event, the Bank may, by notice to the Borrower, cancel the Credit and demand prepayment of the Loan, together with accrued interest and all other amounts accrued and outstanding under this Contract. The Borrower shall effect payment of the amount demanded on the date specified by the Bank, such date being a date falling not less than 30 (thirty) days from the date of the demand.

For the purposes of this Article, a "Change-of-Control Event" occurs if:

(a) any of the Guarantor or MidAmerican Energy Holdings Company ceases to be the beneficial owner directly or indirectly through wholly owned subsidiaries of the entire issued share capital of the Borrower; or

(b) MidAmerican Energy Holdings Company ceases to be the beneficial owner directly or indirectly through wholly owned subsidiaries of the entire issued share capital of the Guarantor.

4.03A(4) CHANGE OF LAW

The Borrower shall promptly inform the Bank if a Change-of-Law Event has occurred or is reasonably likely to occur in respect to the Borrower. In such case, or if the Bank has reasonable cause to believe that a Change-of-Law Event has occurred or is about to occur, the Bank may request that the Borrower consult with it. Such consultation shall take place within 30 (thirty) days from the date of the Bank's request. After the earlier of (a) the lapse of 30 (thirty) days from the date of such request for consultation or (b) the occurrence of the anticipated Change-of-Law Event, the Bank may, by notice to the Borrower, cancel the Credit and demand prepayment of the Loan, together with accrued interest and all other amounts accrued and outstanding under this Contract. The Borrower shall effect payment of the amount demanded on the date speci fied by the Bank, such date being a date falling not less than 30 (thirty) days from the date of the demand.

For the purposes of this Article "Change-of-Law Event" means the enactment, promulgation, execution or ratification of or any change in or amendment to any law, rule or regulation (or in the application or official interpretation of any law, rule or regulation) that occurs after the date of this Contract which results or is reasonably likely to result in a Borrower Material Adverse Change.

4.03A(5) ACCEPTABLE SECURITY EVENT

(a)

If an Acceptable Security Event occurs, the Borrower shall provide alternative Accepta ble Security in replacement of the existing Acceptable Security.

(b)

If within a period of 30 (thirty) days alternative Acceptable Security has not been executed in a manner, form and substance acceptable to the Bank, the Bank may, by notice to the Borrower, forthwith cancel the Credit and demand prepayment of the Loan together with accrued interest and all other amounts accrued and outstanding under this Contract.

(c)

Notwithstanding the aforegoing, the Bank shall not have any right under this Article 4.03A(5) to the extent that such right would constitute a "Cross-Default Obligation" as defined in the Licence.

Any sum demanded by the Bank pursuant to Article 4.03A, together with any interest or other amounts accrued and outstanding and any indemnity due under Article 4.03C, shall be paid on the date indicated by the Bank which date shall fall not less than 30 (thirty) days from the date of the Bank's notice of demand and shall be applied in accordance with Article 10.05.

In the case of an Indemnifiable Prepayment Event, the indemnity, if any, shall be determined in accordance with Article 4.02B(1) for a Fixed Rate Tranche.

If, moreover, pursuant to any provision of Article 4.03A the Borrower prepays a Tranche on a date other than a relevant Payment Date, the Borrower shall indemnify the Bank in such amount as the Bank shall certify is required to compensate it for receipt of funds otherwise than on a relevant Payment Date.

4.04

Application of partial prepayments

If the Borrower partially prepays a Tranche, the Prepayment Amount shall be applied pro rata to each outstanding instalment.

A prepaid amount may not be reborrowed. This Article 4 shall not prejudice Article 10.

ARTICLE 5

Payments

Any amount due by way of interest, indemnity or fee from the Borrower under this Contract, and calculated in respect of a fraction of a year, shall be determined on the following respective conventions:

(a)

for a Fixed Rate Tranche, a year of 360 (three hundred and sixty) days and a month of 30 (thirty) days; and

(b)

for a Floating Rate Tranche, a year of 365 (three hundred and sixty five) days (invariable) and the number of days elapsed.

5.02

Time and place of payment

Unless otherwise specified, all sums other than sums of interest, indemnity and principal are payable within 7 (seven) days of the Borrower's receipt of the Bank's demand.

Each sum payable by the Borrower under this Contract shall be paid to the respective account notified by the Bank to the Borrower. The Bank shall indicate the account not less than 15 (fifteen) days before the due date for the first payment by the Borrower and shall notify any change of account not less than 15 (fifteen) days before the date of the first payment to which the change applies. This period of notice does not apply in the case of payment under Article 10.

A sum due from the Borrower shall be deemed paid when the Bank receives it.

The Bank may set off any matured obligation due from the Borrower under this Contract (to the extent beneficially owned by the Bank) against any obligation (whether or not matured) owed by the Bank to the Borrower regardless of the place of payment, booking branch or currency of either obligation. If the obligations are in different currencies, th e Bank may convert either obligation at a market rate of exchange in its usual course of business for the purpose of the set-off. If either obligation is unliquidated or unascertained, the Bank may set off in an amount estimated by it in good faith to be the amount of that obligation.

ARTICLE 6

Borrower undertakings and representations

The undertakings in this Article 6 remain in force from the date of this Contract for so long as any amount is outstanding under this Contract or the Credit is in force.

A. Project undertakings

6.01

Use of Loan and availability of other funds

The Borrower shall use the proceeds of the Loan exclusively for the execution of the Project.

The Borrower shall ensure that it has available to it the other funds listed in Recital (2) and that such funds are expended, to the extent required, on the financing of the Project.

The Borrower shall carry out the Project in accordance with the Technical Description as may be modified from time to time with the approval of the Bank, and complete it by the final date specified therein.

6.03

Increased cost of Project

If the total cost of the Project exceeds the estimated figure set out in Recital (2), the Borrower shall obtain the finance to fund the excess cost without recourse to the Bank, so as to enable the Project to be completed in accordance with the Technical Description. The plans for funding the excess cost shall be communicated to the Bank without delay.

The Borrower shall purc hase equipment, secure services and order works for the Project (a) in so far as they apply to it or to the Project, in accordance with EU law in general and in particular with the relevant EU Directives and (b) in so far as EU Directives do not apply, by procurement procedures which, to the satisfaction of the Bank, respect the criteria of economy and efficiency.

6.05

Continuing Proj ect undertakings

The Borrower shall:

(a)

Maintenance: maintain, repair, overhaul and renew all property forming part of the Project as required to keep it in good working order;

(b)

Project assets: unless the Bank shall have given its prior consent in writing, retain title to and possession of all or substantially all the assets comprising the Project or, as appropriate, replace and renew such assets and maintain the Project in substantially continuous operation in accordance with its original purpose; provided that the Bank may withhold its consent only where the proposed action would prejudice the Bank's interests as lender to the Borrower or would render the Project ineligible for financing by the Bank under its Statute or under Article 309 of the Treaty on the Functioning of the European Union;

(c)

Insurance: insure all works and property (including all works and property forming part of the Project) with reputable underwriters or insurance companies against those risks and to the extent as is consistent with sound business practice;

(d)

Rights and Permits: maintain in force all rights of way or use and all permits necessary for the execution and operation of the Project; and

(e)

Environment: implement and operate the Project in conformity with Environmental Law.

6.06

Environmental Impact Assessments, EU Habitats and Birds Directives

The Borrower shall not allocate any part of the Loan to any component of the Project that would require an Environmental Impact Assessment according to applicable EU or national law until the Environmental Impact Assessment with the integrated biodiversity assessment has been finalised and approved by the competent authority. The Borrower shall place an electronic copy of all Non-Technical Summaries and of the corresponding Authorisations on the website http://www.ce-electricuk.com/page/EIA.cfm (which shall not be password protected) when the Environmental Impact Assessment is made available to the public and when environmental authorisation is achieved, and shall maintain such copies on the relevant website until the Project Completion Report contemplated in Schedule A.2 is delivered to the Bank. The Bank will, without having any obligation towards the Borrower to do so, make available the Non-Technical Summaries via a web-link on the Bank's website.

The Borrower shall store and keep updated any documents as may be relevant for the Project supporting the compliance with the provisions of the EU Habitats and Birds Directives (Form A/B or equivalent declaration by the competent authority) and shall promptly upon request deliver such documents to the Bank.

B. General undertakings

(a)

The Borrower shall not, and shall proc ure that no other member of the Group will, without the prior written consent of the Bank, either in a single transaction or in a series of transactions whether related or not and whether voluntarily or involuntarily, dispose of all or any part of its business, undertaking or assets.

(b)

Paragraph (a) above does not apply to the disposal of assets, other than assets forming part of the Project and all shares in Subsidiaries holding assets forming part of the Project:

(i)

for fair market value and at arm's length, provided that, during the life of the Loan, the aggregate book value of the assets disposed of by each and every member of the Group shall not exceed 5% (five per cent) of the Group's consolidated fixed assets as reflected in the latest consolidated management accounts of the Group prior to the signature of this Contract;

(ii)

of assets in exchange for other assets comparable or superior as to type, value and quality; or

(iii)

made in good faith and in the ordinary course of business by way of dividend out of distributable profits and as permitted by applicable law.

(c)