EXHIBIT 5

November 21, 2018

Berkshire Hathaway Energy Company

666 Grand Avenue, Suite 500

Des Moines, Iowa 50309-2580

Ladies and Gentlemen:

We have acted as special Iowa counsel to Berkshire Hathaway Energy Company, formerly known as MidAmerican Energy Holdings Company, a corporation organized under the laws of the State of Iowa (the “Company”), with respect to the Company's Registration Statement on Form S-8 (the “Registration Statement”) to be filed by the Company with the Securities and Exchange Commission on or about November 21, 2018, in connection with the registration under the Securities Act of 1933, as amended (the “Act”), by the Company of an aggregate of $40,000,000 of the Company’s Deferred Compensation Obligations (the “Obligations”), issuable under the Berkshire Hathaway Energy Company Long-Term Incentive Partnership Plan, formerly known as the MidAmerican Energy Holdings Company Long-Term Incentive Partnership Plan, as amended and restated January 1, 2014 (the “LTIP Plan”), and the Berkshire Hathaway Energy Company Executive Voluntary Deferred Compensation Plan, formerly known as the MidAmerican Energy Holdings Company Executive Voluntary Deferred Compensation Plan, restated effective as of January 1, 2007 (the “Executive Plan”) (the LTIP Plan and Executive Plan collectively referred to herein as the “Plans”).

We have examined, among other things, originals and/or copies (certified or otherwise identified to our satisfaction) of such documents, papers, statutes and authorities as we have deemed necessary to form a basis for the opinion hereinafter expressed. In our examination, we have assumed the genuineness of all signatures and the conformity to original documents of all copies submitted to us, without independent investigation. As to various questions of fact material to our opinion, we have relied on statements and certificates of officers and representatives of the Company.

Based on the foregoing, we are of the opinion that the Obligations have been duly authorized for issuance and, when issued in accordance with the terms of the Plans, will be legal, valid and binding obligations of the Company, except that the enforceability of the Obligations may be limited by bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other similar laws relating to or affecting creditors' rights generally, regardless of whether that enforceability is considered in a proceeding in equity or at law.

This opinion is limited to the general business corporation law of the State of Iowa.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

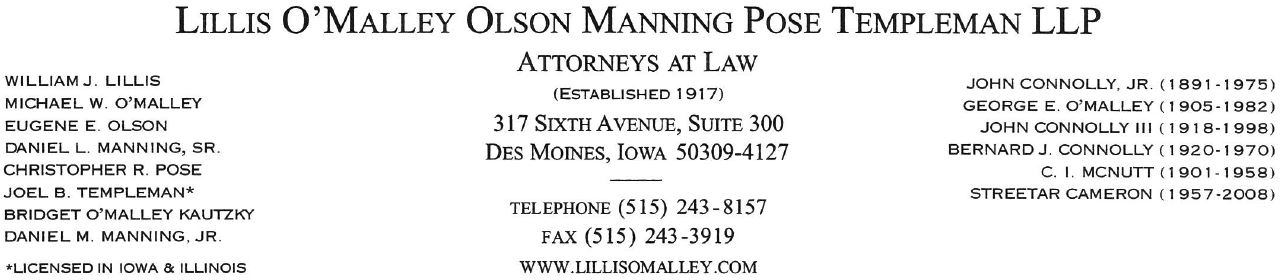

Very truly yours,

/s/ Joel B. Templeman

Joel B. Templeman

For the Firm