SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(c) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No.)

Check the Appropriate Box:

[ ] Preliminary Information Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

[X] Definitive Information Statement

Wells Fargo Funds Trust

(Name of Registrant as Specified in Its Charter)

Payment of filing fee (check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

(a) Title of each class of securities to which transaction applies: N/A

(b) Aggregate number of securities to which transaction applies: N/A

(c) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A

(d) Proposed maximum aggregate value of transaction: N/A

(e) Total fee paid: $0

[ ] Fee paid previously with preliminary material: N/A

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(a) Amount Previously Paid: N/A

(b) Form, Schedule or Registration Statement No.: N/A

(c) Filing Party: N/A

(d) Date Filed: N/A

[INSERT NOTICE]

[INSERT INFORMATION STATEMENT]

WELLS FARGO FUNDS TRUST ("Funds Trust"), on behalf of the following series:

Wells Fargo Asset Allocation Fund

(the "Fund")

200 Berkeley Street, Boston, Massachusetts 02116

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF INFORMATION STATEMENT

March 19, 2018

As a shareholder of the Fund, you are receiving this notice regarding the availability of an information statement (the "Information Statement") relating to the change of the sub-adviser for the Fund. This notice presents an overview of the Information Statement that is available to you on the Internet or, upon request, by mail or email. We encourage you to access and review all of the important information contained in the Information Statement. As described below, the Information Statement is for informational purposes only and, as a shareholder of the Fund, you do not need to take any action.

At a meeting held on February 27-28, 2018, Funds Trust's Board of Trustees (the "Board") unanimously approved a new sub-advisory agreement (the "Sub-Advisory Agreement") among Funds Trust, on behalf of the Fund, Wells Fargo Funds Management, LLC ("Funds Management" or the "Manager"), as investment manager, and Wells Capital Management Incorporated ("Wells Capital Management"), as investment sub-adviser, with respect to the Fund, effective June 15, 2018. In connection with Wells Capital Management becoming the Fund's sub-advisor, the Fund will have new portfolio managers responsible for implementing the Fund's new investment strategy, among other changes. For a complete description of the changes made to the Fund's investment strategy and related risks, portfolio management, expense caps, transaction costs and tax implications, please consult the Information Statement for additional details.

Funds Trust and Funds Management have received an exemptive order (the "Manager of Managers Order") from the U.S. Securities and Exchange Commission that permits the Manager, subject to certain conditions, such as approval by the Board, to enter into new sub-advisory agreements with certain sub-advisers or to change the terms of existing sub-advisory agreements with certain sub-advisers. Approval of the Sub-Advisory Agreement by the Fund's shareholders is not required, but the Manager of Managers Order requires that the Information Statement be made available to the Fund's shareholders.

By sending you this notice, the Fund is notifying you that it is making the Information Statement available to you via the Internet in lieu of mailing you a paper copy. You may print and view the Information Statement on the Funds' website at wellsfargofunds.com. The Information Statement will be available on the Funds' website until at least June 19, 2018. You may request a paper copy or email copy of the Information Statement free of charge by calling 1-800-222-8222 or writing to Wells Fargo Funds, P.O. Box 8266, Boston, MA 02266-8266.

Only one copy of this notice will be delivered to shareholders of the Fund who reside at the same address, unless the Fund has received instructions to the contrary. If you would like to receive an additional copy, please write to the Wells Fargo Funds at P.O. Box 8266, Boston, MA 02266-8266 or call 1-800-222-8222. Shareholders wishing to receive separate copies of notices in the future, and shareholders sharing an address who wish to receive a single copy if they are receiving multiple copies, should also contact the Wells Fargo Funds as indicated above.

If you want to receive a paper or email copy of the Information Statement, you must request one. There is no charge to you to obtain a copy.

NOT038

WELLS FARGO FUNDS TRUST ("Funds Trust"), on behalf of the following series:

Wells Fargo Asset Allocation Fund

(the "Fund")

200 Berkeley Street, Boston, Massachusetts 02116

INFORMATION STATEMENT

March 19, 2018

This Information Statement is for informational purposes only and no action is requested on your part. We are not asking you for a proxy and you are requested not to send us a proxy.

This Information Statement is being made available to shareholders of the Fund, a series of the Trust, in lieu of a proxy statement, pursuant to the terms of an exemptive order (the "Manager of Managers Order") that the Trust and Wells Fargo Funds Management, LLC ("Funds Management" or the "Manager") have received from the U.S. Securities and Exchange Commission (the "SEC"). The Manager of Managers Order permits the Manager, subject to certain conditions, such as approval by the Trust's Board of Trustees (the "Board"), to enter into a new sub-advisory agreement with a sub-adviser, including one that is a wholly-owned subsidiary of the Manager or of a company that wholly-owns the Manager, without shareholder approval.

Appointment of Wells Capital Management Incorporated as Sub-Adviser to the Fund

At a meeting held on Feberuary 27-28, 2018 (the "Meeting"), the Board, all the members of which have no direct or indirect interest in the investment management and sub-advisory agreements and are not "interested persons" of Funds Trust, as defined in the Investment Company Act of 1940 (the "1940 Act") (the "Independent Trustees"), unanimously approved a new investment sub-advisory agreement (the "New Sub-Advisory Agreement") for the Fund among Funds Trust, on behalf of the Fund, the Manager, as investment manager, and Wells Capital Management Incorporated ("Wells Capital Management"), as investment sub-adviser, effective June 15, 2018.

Terms of the New Sub-Advisory Agreement

At the Meeting, the Board of Funds Trust, of which the Fund is a series, approved the New Sub-Advisory Agreement with Wells Capital Management on behalf of the Fund.

Under the terms of the New Sub-Advisory Agreement, Wells Capital Management will be responsible, subject to the direction and control of Funds Management and the Board, for investing and reinvesting the Fund's assets in a manner consistent with the Amended and Restated Declaration of Trust of Funds Trust, ( a "Declaration of Trust"), Funds Trust's registration statement, investment guidelines, policies and restrictions established by the Board, and applicable federal and state law. As such, Wells Capital Management will have full discretion within the scope of its delegated authority to place orders, issue instructions, and select brokerdealers for the purchase and sale of securities and other investment assets for the Fund.

For providing these services under the New Sub-Advisory Agreement, Wells Capital Management will be entitled to receive a sub-advisory fee based on the Fund's average daily net asset value, calculated and paid monthly by applying the annual rates indicated below to the average daily net assets of the Fund throughout the month:

Aggregate Average Daily Net Assets | Fee | |

Asset Allocation Fund

| | |

First $250 million | 0.10% | |

Over $250 million | 0.05% | |

A form of the New Sub-Advisory Agreement with Wells Capital Management is attached as Exhibit A to this Information Statement.

Under the New Sub-Advisory Agreement, Wells Capital Managment will be responsible for providing additional services related to the continuous investment program for the Fund, including recordkeeping services, and would be obligated to comply with all the applicable rules and regulations of the Securities and Exchange Commission (the "SEC"). The New Sub-Advisory Agreement requires Wells Capital Managment to report to the Board following the close of each calendar quarter regarding the investment performance of the Fund since the prior report, as well as important developments affecting Funds Trust, the Fund, or Wells Capital Management. On its own initiative, Wells Capital Management will also provide the Board from time to time with such other information as Wells Capital Management believes appropriate. In addition, the New Sub-Advisory Agreement requires that Wells Capital Management furnish the Board and Funds Management with statistical and analytical information regarding securities held by the Fund, on Wells Capital Management's own initiative or upon reasonable request by such Board or Funds Management.

Wells Capital Managment may from time to time employ or associate with such persons as it believes to be appropriate or necessary to assist in the execution of Wells Capital Management's duties. In addition, Wells Capital Management shall maintain records relating to portfolio transactions and allocations of brokerage orders as required by the 1940 Act.

Except for expenses incurred by Wells Capital Managment, the Fund is responsible for all of the ordinary business expenses incurred in its operations, including, but not limited to: brokerage commissions; taxes, legal, auditing or governmental fees; the cost of preparing share certificates; custodian, transfer agent and shareholder service agent costs; expense of issue, sale, redemption and repurchase of shares; expenses of registering and qualifying shares for sale; expenses relating to the Board and shareholder meetings; the cost of preparing and distributing reports and notices to shareholders or interest holders; the fees and other expenses incurred by the Fund in connection with membership in investment company organizations; and the cost of printing copies of prospectuses and statements of additional information distributed to shareholders or interest holders.

The New Sub-Advisory Agreement requires Wells Capital Management to comply with investment guidelines, policies and restrictions established by the Board that have been communicated in writing to Wells Capital Mangament; all applicable provisions of the 1940 Act and the Investment Advisers Act of 1940 and any rules and regulations adopted by the SEC thereunder; the registration statement of Funds Trust, as it may be amended and supplemented from time to time; the provisions of the Declaration of Trust as they may be amended from time to time; the applicable provisions of the Internal Revenue Code of 1986, as amended, and any rules or regulations adopted thereunder; and any other applicable provisions of state or federal law and any rules and regulations adopted thereunder, to the extent that such laws, rules or regulations impact the provision of services by Wells Capital Management as described herein.

The New Sub-Advisory Agreement provides that, when entering into a securities transaction, Wells Capital Management is prohibited from consulting with any other sub-adviser of a fund in the fund complex that is not an affiliated person (as that term is defined in the 1940 Act) of Wells Fargo, or an affiliated person of such sub-adviser concerning transactions in securities or other assets for the Fund. In addition, Wells Capital Management is not responsible for voting proxies or for participating in class actions or other legal proceedings on behalf of the Fund but will provide assistance as reasonably requested by Funds Management. The New Sub-Advisory Agreement provides that Wells Capital Management shall only be liable for losses resulting from willful misfeasance, bad faith, gross negligence, or reckless disregard of its duties and

obligations, and will be indemnified and held harmless by the Fund, and Funds Management for all other losses.

The New Sub-Advisory Agreement will continue in effect from year to year for the Fund, provided that the continuation of the New Sub-Advisory Agreement is approved at least annually in accordance with the 1940 Act. The New Sub-Advisory Agreement may be terminated at any time, without payment of any penalty, by vote of the Board or by vote of a majority of the Fund's outstanding securities, or by Funds Management or Wells Capital Managment, on 60 days' written notice to the other parties. Consistent with the federal securities laws, the New Sub-Advisory Agreement also will terminate automatically upon its "assignment" as defined in the 1940 Act.

Board Considerations of the New Agreements

Under the 1940 Act, the Board of Funds Trust and the Board of Trustees (together with the Funds Trust Board, the "Boards") of Asset Allocation Trust must determine whether to approve any new or amended investment management, advisory and sub-advisory agreements. At the Meeting, the Funds Trust Board, all the members of which all the members of which have no direct or indirect interest in the investment management or sub-advisory agreements and are Independent Trustees, reviewed and approved an amended investment management agreement (the "Amended Management Agreement" with Funds Management for the Fund, and the New Sub-Advisory Agreement with Wells Capital Management for the Fund. At the Meeting, the Asset Allocation Trust Board, all the members of which have no direct or indirect interest in the investment advisory agreement and are Independent Trustees, reviewed and approved an investment advisory agreement (the "Advisory Agreement") with Funds Management for the Asset Allocation Trust. The Fund and the Asset Allocation Trust are collectively referred to in this section as the "Funds" and individually as a "Fund." The Amended Management Agreement, New Sub-Advisory Agreement and the Advisory Agreement are collectively referred to as the "New Agreements."

At the Meeting, the Boards considered the factors and reached the conclusions described below relating to the selection of Funds Management and Wells Capital Management, as applicable, and the approval of the New Agreements. Prior to the Meeting, including at an in-person meeting held on November 9-10, 2017, the Trustees conferred extensively among themselves and with representatives of Funds Management about these matters. Also, the Boards have adopted a team-based approach, with each team consisting of a sub-set of Trustees, to assist the Boards in the discharge of their duties in reviewing performance and other matters throughout the year. Representatives of Funds Management met with a team of Trustees prior to proposing the New Agreements to the Boards at the Meeting. The Independent Trustees were also assisted in their evaluation of the New Agreements by independent legal counsel, from whom they received separate legal advice and with whom they met separately.

The Boards considered that the Fund has historically been structured as a gateway fund managed by Funds Management that invests substantially all of its assets in the Asset Allocation Trust, which in turn invests in underlying funds that are advised by Grantham, Mayo, Van Otterloo & Co. LLC ("GMO"). The Boards noted that Funds Management has historically provided investment advice to the Fund pursuant to an investment management agreement (the "Current Management Agreement"), and that GMO has historically provided investment advice to the Asset Allocation Trust pursuant to an investment advisory agreement (the "GMO Advisory Agreement", and together with the Current Amended Management Agreement, the "Current Agreements").

The Boards noted that Funds Management proposed the New Agreements in order to restructure this arrangement such that the Fund would be restructured as a Fund sub-advised by Wells Capital Management that would invest in underlying master portfolios and funds managed by Funds Management pursuant to a new investment strategy for the Fund, that GMO would be terminated as investment adviser to the Asset Allocation Trust, and that the Asset Allocation Trust would be liquidated (the "Restructuring"). The Boards considered the New Agreements in the context of considering the Restructuring, and noted that the Amended Management Agreement would replace the Current Management Agreement and that the Advisory Agreement would replace the GMO Advisory Agreement.

In providing information to the Boards, Funds Management and Wells Capital Management were guided by detailed sets of requests for information submitted to them by the Independent Trustees and the Independent Trustees' independent legal counsel. In considering and approving the New Agreements, the Trustees considered the information they believed relevant, including but not limited to, the information discussed below. The Boards considered not only the specific information presented in connection with the Meeting, but also the knowledge gained over time through interactions with Funds Management and Wells Capital Management about various topics. The Boards did not identify any particular information or consideration that was all-important or controlling, and each individual Trustee may have attributed different weights to various factors. The Boards evaluated information provided to them about both Funds together and each Fund separately as they considered appropriate.

The Funds Trust Board noted that the Fund and Funds Management would rely on an exemptive order which permits Funds Management, subject to Funds Trust Board approval, to enter into new sub-advisory agreements with sub-advisers that are wholly owned-subsidiaries of Funds Management or a company that wholly owns Funds Management, such as Wells Capital Management, without obtaining shareholder approval.

After its deliberations, the Funds Trust Board unanimously approved the Amended Management Agreement and New Sub-Advisory Agreement, and determined that the compensation payable to Funds Management, and by Funds Management to Wells Capital Management, respectively, was reasonable. After its deliberations, the Asset Allocation Trust Board approved the Advisory Agreement, and took into account the absence of any compensation payable to Funds Management thereunder. The following summarizes a number of important, but not necessarily all, factors considered by the Boards in support of their approvals.

Nature, Extent and Quality of Services

The Boards received and compared information regarding the nature, extent and quality of services provided by Funds Management and GMO under the Current Agreements, and the nature, extent and quality of services to be provided by Funds Management and Wells Capital Management under the New Agreements.

The Board noted that it received and considered information regarding the nature, quality and extent of services provided to the respective Funds by Funds Management and GMO under the Current Agreements in connection with the 2017 contract renewal process, as well as through regular quarterly updates on investment performance over the past year.

The Funds Trust Board noted that upon completion of the Restructuring, Funds Management would continue to serve as the investment manager to the Fund and Wells Capital Management would begin to serve as the sub-adviser to the Fund. As such, Funds Management and Wells Capital Management would provide services relating to the selection of underlying master portfolios and funds, and allocation of Fund's assets among those master portfolios and funds. The Funds Trust Board received and considered information about the investment management services and Fund-level administrative services covered by the Amended Management Agreement, and information about the qualifications, background, tenure and responsibilities of each of the portfolio managers of Wells Capital Management that would be primarily responsible for the day-to-day portfolio management of the Fund. The Funds Trust Board noted that Funds Management serves as investment manager and Wells Capital Management serves as sub-adviser to another Wells Fargo Fund that has the same investment strategy as the investment strategy being proposed for the Fund (the "Comparable Fund"). The Funds Trust Board also took into consideration alternative proposals to the Restructuring provided by GMO, and Funds Management's assessment of GMO's alternative proposals.

The Asset Allocation Trust Board noted that the Advisory Agreement would be in place only temporarily to facilitate the Restructuring and that it would terminate upon the Asset Allocation Trust's liquidation. The Asset Allocation Trust Board also noted that, as a result of the Restructuring, GMO would no longer be providing services relating to the selection of underlying funds and allocation of Asset Allocation Trust's assets among those funds.

The Boards evaluated the ability of Funds Management and Wells Capital Management to attract and retain qualified investment professionals, including research, advisory and supervisory personnel. The Boards further considered the compliance programs of Funds Management and Wells Capital Management. In addition, the Boards took into account the full range of services provided to the Wells Fargo Fund family by Funds Management and its affiliates.

The Boards took into account the information described above, in addition to other information they received and discussions they had with Funds Management and Wells Capital Management about the services that would be provided to the Funds, in deciding to approve the New Agreements.

Fund Performance and Expenses

The Funds Trust Board noted that it has reviewed the investment performance of the Fund as a result of its investment in the Asset Allocation Trust. The Funds Trust Board received and considered the Fund's performance over various time periods in comparison to the Fund's benchmark index, and in comparison to the investment performance of the Comparable Fund. The Funds Trust Board also considered hypothetical stress test comparisons with respect to both the Fund and the Comparable Fund under various market conditions.

The Funds Trust Board also considered the current net operating expense ratios of Fund, and noted that if the Funds Trust Board approves the Amended Management Agreement and New Sub-Advisory Agreement and if the Restructuring is completed, Funds Management would reduce the net operating expense ratio caps of Fund for each share class as part of the Restructuring and that the proposed caps, unlike the current caps, would limit the acquired fund fees and expenses incurred by the Fund through its investments in underlying master portfolios and funds managed by Funds Management. The Funds Trust Board received a comparison of the current net operating expense ratios and the planned net operating expense ratio caps for each share class of Fund, and a comparison of such net operating expense ratios and caps against the median ratios of funds in class-specific expense groups that were determined by Broadridge Inc. to be similar to the Fund. Taking into account the planned expense caps, the Funds Trust Board noted that the net operating expense ratios of the Fund would be lower than or equal to the median net operating expense ratio of the peer group for each share class.

The Funds Trust Board took into account the performance and expense information provided to it among the factors considered in deciding to approve the Amended Management Agreement and New Sub-Advisory Agreement. The Asset Allocation Trust Board received and reviewed the same information that the Funds Trust Board received with respect to the Fund's performance and expenses, and the Asset Allocation Trust Board considered information about the Restructuring generally in deciding to approve the Advisory Agreement.

Investment Management and Sub-Advisory Fee Rates

The Funds Trust Board reviewed and compared the contractual management fee rate that is payable by the Fund to Funds Management under the Current Management Agreement, and the contractual management fee rate that would be payable by the Fund to Funds Management under the Amended Management Agreement. The Funds Trust Board noted that the contractual management fee rate that would be payable under the Amended Management Agreement is lower than the contractual management fee rate currently payable under the Current Management Agreement even though Funds Management would begin providing the additional services described above that it is not currently providing. The Funds Trust Board also noted that, unlike the Current Management Agreement, the Amended Management Agreement would not include a dormant management fee to be paid by the Fund to Funds Management if the Fund invests in more than one underlying fund. The Funds Trust Board also reviewed and considered information about the contractual sub-advisory fee rate that would be payable by Funds Management to Wells Capital Management under the New Sub-Advisory Agreement.

The Asset Allocation Trust Board noted that the Asset Allocation Trust does not currently pay a fee to GMO for its advisory services under the GMO Advisory Agreement, and that the Asset Allocation Trust would not pay a fee to Funds Management under the Advisory Agreement.

Based on its consideration of the factors and information it deemed relevant, including those described here, each Board determined that the compensation payable by the Fund or by Funds Management under the applicable New Agreement, if any, was reasonable.

Profitability

The Boards requested and received information about the impact of the Restructuring on the profitability of Wells Fargo Asset Management, which includes both Funds Management and Wells Capital Management. Such information included Wells Fargo Asset Management's variable margin under various scenarios, including under the Current Agreements and under the New Agreements. The Board noted that Wells Fargo Asset Management's variable margin under the New Agreements may be higher than or lower than its variable margin under the Current Agreements, depending on the Fund's asset level after the Reorganization.

Economies of Scale

With respect to possible economies of scale, the Funds Trust Board noted the existence of breakpoints in the Fund's management fee structure, which operate generally to reduce the Fund's expense ratios as the Fund grows in size. The Funds Trust Board considered that, for a small fund or a fund that shrinks in size, breakpoints conversely can result in higher fee levels. The Funds Trust Board noted that the underlying master portfolios and funds in which the Fund would invest generally have breakpoints in their management fee schedules and are generally subject to expense caps, which may also result in sharing economies of scale through reductions in acquired fund fees and expenses. The Funds Trust Board also noted that the Fund's expense caps will limit the acquired fund fees and expenses incurred by the Fund through its investments in underlying master portfolios and funds managed by Funds Management. The Funds Trust Board also considered that in addition to management fee breakpoints, competitive management fee rates set at the outset without regard to breakpoints and fee waiver and expense reimbursement arrangements are means of sharing potential economies of scale with shareholders of the Fund. The Funds Trust Board considered Funds Management's view, which Funds Management has previously indicated to the Funds Trust Board was supported by independent third-party industry studies, that any analyses of potential economies of scale in managing a particular fund are inherently limited in light of the joint and common costs and investments that Funds Management incurs across the Wells Fargo Fund family as a whole.

The Board did not review specific information regarding possible economies of scale with respect to Wells Capital Management's proposed sub-advisory services, principally because the Board regards that information as less relevant at the sub-adviser level.

The Asset Allocation Trust Board noted that the Asset Allocation Trust would not pay fees to Funds Management for advisory services under the Advisory Agreement, and thus that any possible economies of scale were not a material factor in determining whether to approve the Advisory Agreement.

The Boards concluded that the Funds' fee and expense arrangements, including contractual breakpoints, under the New Agreements constituted a reasonable approach to sharing potential economies of scale with the Funds and the Fund shareholders.

Other Benefits to Funds Management and Wells Capital Management

The Boards considered potential "fall-out" or ancillary benefits to be received by Funds Management and its affiliates, including Wells Capital Management, as a result of their relationships with the Funds. Ancillary benefits could include, among others, benefits directly attributable to other relationships with the Funds, fees payable to them by the underlying master portfolios and funds in which the Fund would invest, which are reviewed annually by the Board, and benefits potentially derived from an increase in Funds Management's and Wells Capital Management's business as a result of their relationships with the Funds.

Based on its consideration of the factors and information it deemed relevant, including those described here, the Board did not find that any ancillary benefits that may be received by Funds Management and its affiliates, including Wells Capital Management, were unreasonable.

Conclusion

At the Meeting, after considering the above-described factors and based on its deliberations and evaluation of the information described above, the Funds Trust Board unanimously approved the Amended Management Agreement and New Sub-Advisory Agreement, and determined that the compensation payable to Funds Management, and by Funds Management to Wells Capital Management, respectively, was reasonable. In addition, at the Meeting, after considering the above-described factors and based on its deliberations and evaluation of the information described above, the Asset Allocation Trust Board approved the Advisory Agreement, and took into account the absence of any compensation payable to Funds Management thereunder.

Investment Strategy and Related Risk Changes, Portfolio Management, Expense Caps, Transition Costs and Tax Implications

In connection with the Restructuring, the Fund's principal investment strategies and principal risks will be changed. In addition, portfolio managers of Wells Capital Management will become responsible for the day-to-day management of the Fund's assets. Funds Management will also reduce the Fund's net operating expense ratio caps for all share classes, and the Restructuring will involve transition costs and have tax implications.

Changes to Principal Investment Strategy and Risks. The Fund's investment objective will remain the same, but the Fund's principal investment strategy and principal risks will be changed. Information about these changes is included in the table below:

Investment Objective |

Current | Revised |

The Fund seeks long-term total return, consisting of capital appreciation and current income. | The Fund seeks long-term total return, consisting of capital appreciation and current income. |

Principal Investment Strategy | |

Current | Revised |

The Fund's target allocation is as follows: ■ at least 15% of the Fund's assets in fixed income securities; and ■ at least 25% of the Fund's assets in equity securities. | The Fund's "neutral" allocation is as follows: ■ 65% of the Fund's assets in equity securities; and ■ 35% of the Fund's assets in fixed income securities. |

The Fund is a diversified investment, providing exposure to stock, bond and alternative investment strategy funds, with an emphasis on stock funds. The Fund invests all of its investable assets in AAT, an investment company managed by GMO. AAT, in turn, invests its assets in GMO-managed mutual funds and may be exposed to any asset class, including, for example, U.S. and foreign equities (including emerging country equities), U.S. and foreign fixed income securities (including emerging country debt securities), and, from time to time, other alternative asset classes. The underlying funds may gain their investment exposures directly or through investment in derivatives and/or other mutual funds. AAT is currently wholly owned by the Fund. | The Fund is a diversified investment, providing exposure to equity, fixed income and alternative investment strategies. The Fund is a fund-of-funds that invests in various affiliated mutual funds employing a multi-asset, multi-style investment approach designed to reduce the price and return volatility of the Fund and to provide more consistent returns. The Fund may invest in Wells Fargo Master Portfolios, in other Wells Fargo Funds, or directly in securities. |

GMO uses its multi-year forecasts of returns among asset classes, together with its assessment of the risk of such asset classes, to select the underlying funds in which AAT invests and to decide how much to invest in each. An important component of those forecasts is the expectation that market valuations ultimately revert to their historical means (averages). GMO shifts AAT's investments in the underlying funds in response to changes in GMO's investment outlook and market valuations and to accommodate cash flows, and intends to expose at least 15% of AAT's assets to fixed income investments and at least 25% of AAT's assets to equity investments. GMO regularly reviews the investments of AAT and may sell a holding of AAT when it has achieved its valuation target, there is deterioration in the underlying fundamentals of the business, or GMO has identified a more attractive investment opportunity. | The Fund may be exposed to any asset class, including, for example, U.S. and foreign equities (including emerging market equities), U.S. and foreign fixed income securities (including emerging markets fixed income securities), and alternative investments. The underlying funds or Portfolios may gain their investment exposures directly or through investment in derivatives. |

| The Fund will incorporate a Tactical Asset Allocation Overlay ("TAA Overlay") strategy which invests in long and/or short positions in exchange-traded futures contracts across a variety of asset classes, which include, but are not limited to, stocks, bonds, and currencies. The TAA Overlay strategy seeks to improve the Fund's risk/return profile through the tactical use of futures contracts. The TAA Overlay uses qualitative and quantitative inputs to guide equity and fixed income exposures in the Fund. Dependent upon market conditions, the TAA Overlay may increase or decrease exposures to a given asset class. As part of managing the Fund's level of risk, both in absolute terms and relative to its benchmark, we may make changes to the allocations among investment styles at any time. We may use cash flows or effect transactions to accomplish these changes. Portfolio Asset Allocation The following table provides the Fund's neutral allocation and target ranges. |

| Asset Class Neutral Allocation Target Allocation

Stock Funds 65% 55% to 75%

Bond Funds 35% 25% to 45%

TAA Overlay 0% -10% to 10% Negative values represent short positions in futures contracts that may be taken using the applicable overlay strategy. |

Principal Risks | |

Current | Revised |

■ Credit Risk ■ Derivatives Risk ■ Emerging Markets Risk ■ Focused Investment Risk ■ Foreign Currency Contracts Risk ■ Foreign Investment Risk ■ High Yield Securities Risk ■ Interest Rate Risk ■ Growth/Value Investing Risk ■ Large Shareholder Risk ■ Management Risk ■ Market Disruption and Geopolitical Risk ■ Market Risk ■ Mortgage- and Asset-Backed Securities Risk ■ Options Risk ■ Short Sales Risk ■ Small Company Securities Risk ■ Underlying Funds Risk | ■ Credit Risk ■ Derivatives Risk ■ Emerging Markets Risk ■ Foreign Currency Contracts Risk ■ Foreign Investment Risk ■ Futures Contracts Risk ■ High Yield Securities Risk ■ Interest Rate Risk ■ Growth/Value Investing Risk ■ Management Risk ■ Market Risk ■ Mortgage- and Asset-Backed Securities Risk ■ Options Risk ■ Short Sales Risk ■ Small Company Securities Risk ■ Swaps Risk ■ U.S. Government Obligations Risk |

Portfolio Management. The following portfolio managers of Wells Capital Management will become responsible for the day-to-day management of the Fund's assets:

Kandarp R. Acharya, CFA, FRM Mr. Acharya joined Wells Capital Management in 2013, where he currently serves as a Senior Portfolio Manager. Prior to joining Wells Capital Management, Mr. Acharya led the Advanced Analytics and Quantitative Research Group at Wells Fargo Wealth Management, where he also led the development and implementation of quantitative tactical allocation models as a member of the firm's Asset Allocation Committee.

Petros Bocray, CFA, FRM Mr. Bocray joined Wells Capital Management in 2006, where he currently serves as a Portfolio Manager. Prior to joining the Multi-Asset Solutions team, he held a similar role with the Quantitative Strategies group at Wells Capital Management where he co-managed several of the team's portfolios.

Christian L. Chan, CFA Mr. Chan joined Wells Capital Management in 2013, where he currently serves as a Portfolio Manager. Prior to joining Wells Capital Management, Mr. Chan was a Portfolio Manager at Wells Fargo Funds Management, LLC where he managed several of the firm's asset allocation mutual funds, and also served as the firm's Head of Investments.

Expense Caps, Transition Costs and Tax Implications. Funds Management will reduce the Fund's net operating expense ratio ("NOER") caps for each share class as follows:

| Class A | Class C | Class R | Administrator Class | Institutional Class |

Planned NOER Cap1

| 1.13% | 1.88% | 1.38% | 0.95% | 0.80% |

| 1 | The planned NOER caps will be contractually committed through August 31, 2020. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses from funds in which the underlying master portfolios and funds invest and from money market funds, and extraordinary expenses are excluded from the expense cap. All other acquired fund fees and expenses from the affiliated master portfolios and funds are included in the expense cap. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. |

The transition to the new investment strategy and underlying investments will entail transition costs. While transition costs are difficult to estimate, Funds Management estimates that the transition costs, including trading costs, taxes, and redemption fees, will be approximately $11 million. Actual costs may vary based on market conditions and the actual, rather than projected, amount of portfolio securities that may be transferred to the new underlying master portfolios and fund. The transition may also entail realization of capital gains for shareholders. Based upon September 30, 2017 data, Funds Management estimates that the tax impact would be realization of approximately $248 million in capital gains.

While the proposed changes would entail immediate transition costs and tax implications for taxable shareholders, Funds Management believes that all shareholders would benefit long-term from ongoing expense reductions and the potential for improved performance.

Principal Executive Officers and Directors of Wells Capital Management

Wells Capital Management is a registered investment adviser located at 525 Market Street, San Francisco, CA 94105. Wells Capital Management, an affiliate of Funds Management and indirect wholly owned subsidiary of Wells Fargo & Company, is a multi-boutique asset management firm committed to delivering superior investment services to institutional clients, including mutual funds. Wells Capital Management is a part of Wells Fargo Asset Management, the trade name used by the asset management businesses of Wells Fargo & Company.

The name and principal occupation of Wells Capital Management's principal executive officers and directors as of the date of this Information Statement are set forth below. The business address of each such officer and/or director is 525 Market Street, San Francisco, CA 94105.

■

Kirk Hartman, President, Chief Investment Officer

■

Sallie Squire, Executive Vice President, Chief Administrative Officer

■

Karen Norton, Senior Vice President, Chief Operating Director

■

Francis Baranko, Senior Vice President, Chief Equity Officer

■

Siobhan Foy, Senior Vice President, Chief Compliance Officer

No Officer or Trustee of Funds Trust is an officer, employee, director, general partner or shareholder of Wells Capital Management. No Trustee of Funds Trust has any material direct or indirect interest in Wells Capital Management or any person controlling, controlled by or under common control with Wells Capital Management. Since the beginning of the Funds' most recently completed fiscal year, no Trustee of Funds Trust has had, directly or indirectly, any material interest in any material transactions or material proposed transactions to which Wells Capital Management, any of its parents or subsidiaries, or any subsidiaries of a parent of any such entities was or is to be a party.

Other Similar Funds Managed by Wells Capital Management

Wells Capital Management provides investment sub-advisory services for the following similar fund.

| Asset Allocation Fund (Current) | Growth Balanced Fund |

Investment Objective | The Fund seeks long-term total return, consisting of capital appreciation and current income. | The Fund seeks total return, consisting of capital appreciation and current income. |

Net Assets as of 12/31 | $3,271,559,904 | $244,970,038 |

Management Fee Rate | Assets Fee

First $1B 0.350%

Next $4B 0.325%

Next $3B 0.280%

Next $2B 0.255%

Over $10B 0.235% | Assets Fee

First $500M 0.30%

Next $500M 0.28%

Next $2B 0.26%

Next $2B 0.24%

Next $5B 0.23%

Over $10B 0.22% |

Sub-Advisory Fee Rate | N/A | Assets Fee

First $250M 0.10%

Over $250M 0.05% |

In addition, Wells Capital Management manages discretionary accounts with substantially similar investment objectives, policies and strategies as the Fund. Composite performance information about those accounts is included in Exhibit B to this Information Statement. |

Service Providers to Funds Trust

Investment Manager and Class-Level Administrator. Funds Management currently serves as the investment manager and class-level administrator for the Fund.

Below are the aggregate management fees paid by the Fund and the aggregate management fees waived by Funds Management for the most recent fiscal year.

| Management Fees Paid | | Management Fees Waived | |

Asset Allocation Fund | $12,109,885 | | $321,537 | |

Below are the aggregate class-level administration fees paid by the Fund and the aggregate class-level administration fees waived by Funds Management for the most recent fiscal year.

| Administrative Service Fees Paid | | Administrative Service Fees Waived | |

Asset Allocation Fund | $7,203,507 | | $0 | |

Under the Fund's current structure of investing 100% of its assets in Asset Allocation Trust, the Fund does not have a sub-adviser. Therefore, for the fiscal year ended April 30, 2017, Funds Management did not pay any fees related to sub-advisory services for the Fund.

Brokerage Commissions to Affiliates. For the latest fiscal year, the Fund did not pay any brokerage commissions to affiliates.

Principal Underwriter/Distributor. Wells Fargo Funds Distributor, LLC ("Funds Distributor") serves as the distributor and principal underwriter of the Fund.

Below are the underwriting commissions received by Funds Distributor from sales charges on the sale of Fund shares and the amounts retained by Funds Distributor after the payment of any dealer allowance for the most recent fiscal year:

| Aggregate Total Underwriting Commissions | | Underwriting Commissions Retained | |

Asset Allocation Fund | $104,353 | | $104,353 | |

Below are the distribution fees paid by the Fund for the most recent fiscal year. Class A, Administrator class, and Institutional class shares do not pay 12b-1 fees.

Fund | Class C | Class R |

Asset Allocation Fund | | |

Total | $10,397,323 | $52,874 |

Compensation to Underwriters | $328,869 | $(66) |

Compensation to Broker/Dealers | $10,068,454 | $64,940 |

Share Ownership

Please see Exhibit B for a list of persons reflected on the books and records of the Fund as owning of record 5% or more of the outstanding shares of any class of the Fund as of February 26, 2018. Additionally, as of February 26, 2018, the Trustees and Officers of the Fund, as a group, beneficially owned in the aggregate less than 1% of the outstanding shares of a Fund and each class of the Fund.

Outstanding Shares

As of February 26, 2018, the Fund had the following number of shares issued and outstanding:

Fund / Share Class | | | Number of

Shares |

Asset Allocation Fund

|

Class A | | | 98,369,904.857 |

Class C | | | 70,407,669.367 |

Class R | | | 1,118,688.209 |

Administrator Class | | | 5,229,767.556 |

Institutional Class | | | 47,417,258.917 |

Financial Information

The Fund's annual and semi-annual reports contain additional performance information about the Fund and are available upon request, without charge, by writing to Wells Fargo Funds, P.O. Box 8266, Boston, MA 02266-8266, by calling 1.800.222.8222 or by visiting the Wells Fargo Funds website at www.wellsfargofunds.com.

Shareholder Proposals

The Trust is not required, nor does it intend, to hold annual meetings of shareholders for the election of Trustees and other business. Instead, meetings will be held only when and if required (for example, whenever less than a majority of the Board has been elected by shareholders). Any shareholder desiring to present a proposal for consideration at the next shareholder meeting must submit the proposal in writing so that it is received within a reasonable time before any meeting. A proposal should be sent to the Trust at 525 Market Street, 12th Floor, San Francisco, CA 94105.

Exhibit A

FORM OF NEW SUB-ADVISORY AGREEMENT

FORM OF SUB-ADVISORY AGREEMENT AMONG WELLS FARGO FUNDS TRUST, WELLS FARGO FUNDS MANAGEMENT, LLC AND WELLS CAPITAL MANAGEMENT INCORPORATED

AMENDED AND RESTATED

INVESTMENT SUB-ADVISORY AGREEMENT

AMONG WELLS FARGO FUNDS TRUST,

WELLS FARGO FUNDS MANAGEMENT, LLC AND

WELLS CAPITAL MANAGEMENT INCORPORATED

This AMENDED AND RESTATED AGREEMENT is made as of this 1st day of March 2001, as amended and restated as of November 7, 2012, between Wells Fargo Funds Trust (the "Trust"), a business trust organized under the laws of the State of Delaware with its principal place of business at 525 Market Street, 12th Floor, San Francisco, California 94163, Wells Fargo Funds Management, LLC (the "Adviser"), a limited liability company organized under the laws of the State of Delaware with its principal place of business at 525 Market Street, 12th Floor, San Francisco, California 94163, and Wells Capital Management Incorporated, a corporation organized under the laws of the State of California, with its principal place of business at 525 Market Street, 12th Floor, San Francisco, California 94163 (the "Sub-Adviser").

WHEREAS, the Trust is registered under the Investment Company Act of 1940, as amended, (the "1940 Act") as an open-end, series management investment company; and

WHEREAS, the Trust and the Adviser desire that the Sub-Adviser perform investment advisory services for each of the series of the Trust listed in Appendix A hereto as it may be amended from time to time (each a "Fund" and collectively the "Funds"), and the Sub-Adviser is willing to perform those services on the terms and conditions set forth in this Agreement;

NOW THEREFORE, the Trust, the Adviser and Sub-Adviser agrees as follows:

Section 1. The Trust; Delivery of Documents. The Trust is engaged in the business of investing and reinvesting its assets in securities of the type and in accordance with the limitations specified in its Declaration of Trust, as amended or supplemented from time to time, By-Laws (if any) and Registration Statement filed with the Securities and Exchange Commission (the "Commission") under the 1940 Act and the Securities Act of 1933 (the "Securities Act"), including any representations made in the prospectus and statement of additional information relating to the Funds contained therein and as may be supplemented from time to time, all in such manner and to such extent as may from time to time be authorized by the Trust's Board of Trustees (the "Board"). The Board is authorized to issue any unissued shares in any number of additional classes or series. The Trust has delivered copies of the documents listed in this Section to the Sub-Adviser and will from time to time furnish the Sub-Adviser with any amendments thereof.

Section 2. Appointment of Sub-Adviser. Subject to the direction and control of the Board, the Adviser manages the investment and reinvestment of the assets of the Funds and provides for certain management and services as specified in the Investment Advisory Agreement between the Trust and the Adviser with respect to the Funds.

Subject to the direction and control of the Board, the Sub-Adviser shall manage the investment and reinvestment of the assets of the Funds, and without limiting the generality of the foregoing, shall provide the management and other services specified below, all in such manner and to such extent as may be directed from time to time by the Adviser.

The Sub-Adviser acknowledges that the Fund and other mutual funds advised by the Adviser (collectively, the "fund complex") may engage in transactions with certain sub-advisers in the fund complex (and their affiliated persons) in reliance on exemptions under Rule 10f-3, Rule 12d3-1, Rule 17a-10 and Rule 17e-1 under the 1940 Act. Accordingly, the Sub-Adviser hereby agrees that it will not consult with any other sub-adviser of a fund in the fund complex that is not an affiliated person (as that term is defined in the 1940 Act) of Wells Fargo & Company ("Wells Fargo"), or an affiliated person of such a sub-adviser, concerning transactions for a fund in securities or other fund assets. With respect to a multi-managed Fund, the Sub-Adviser shall be limited to managing only the discrete portion of the Fund's portfolio as may be determined from time-to-time by the Board or the Adviser, and shall not consult with the any Sub-adviser that is not an affiliated person of Wells Fargo as to any other portion of the Fund's portfolio concerning transactions for the Fund in securities or other Fund assets.

Section 3. Duties of the Sub-Adviser.

(a) The Sub-Adviser shall make decisions with respect to all purchases and sales of securities and other investment assets for the Funds. To carry out such decisions, the Sub-Adviser is hereby authorized, as agent and attorney-in-fact for the Trust, for the account of, at the risk of and in the name of the Trust, to place orders and issue instructions with respect to those transactions of the Funds. In all purchases, sales and other transactions in securities for the Funds, the Sub-Adviser is authorized to exercise full discretion and act for the Trust in the same manner and with the same force and effect as the Trust might or could do with respect to such purchases, sales or other transactions, as well as with respect to all other things necessary or incidental to the furtherance or conduct of such purchases, sales or other transactions.

(b) The Sub-Adviser will report to the Board at each regular meeting thereof all material changes in the Funds since the prior report, and will also keep the Board informed of important developments affecting the Trust, the Funds and the Sub-Adviser, and on its own initiative will furnish the Board from time to time with such information as the Sub-Adviser may believe appropriate, whether concerning the individual companies whose securities are held by a Fund, the industries in which they engage, or the economic, social or political conditions prevailing in each country in which the Fund maintains investments. The Sub-Adviser will also furnish the Board with such statistical and analytical information with respect to securities in the Funds as the Sub-Adviser may believe appropriate or as the Board reasonably may request. In making purchases and sales of securities for the Funds, the Sub-Adviser will comply with the policies set from time to time by the Board as well as the limitations imposed by the Trust's Declaration of Trust, as amended from time to time, By-Laws (if any), Registration Statement under the Act and the Securities Act, the limitations in the Act and in the Internal Revenue Code of 1986, as amended applicable to the Trust and the investment objectives, policies and restrictions of the Funds.

(c) The Sub-Adviser may from time to time employ or associate with such persons as the Sub-Adviser believes to be appropriate or necessary to assist in the execution of the Sub-Adviser's duties hereunder, the cost of performance of such duties to be borne and paid by the Sub-Adviser. No obligation may be imposed on the Trust in any such respect.

(d) The Sub-Adviser shall maintain records relating to portfolio transactions and the placing and allocation of brokerage orders as are required to be maintained by the Trust under the Act. The Sub-Adviser shall prepare and maintain, or cause to be prepared and maintained, in such form, for such periods and in such locations as may be required by applicable law, all documents and records relating to the services provided by the Sub-Adviser pursuant to this Agreement required to be prepared and maintained by the Trust pursuant to the rules and regulations of any national, state, or local government entity with jurisdiction over the Trust, including the Securities and Exchange Commission and the Internal Revenue Service. The books and records pertaining to the Trust which are in possession of the Sub-Adviser shall be the property of the Trust. The Trust, or the Trust's authorized representatives (including the Adviser), shall have access to such books and records at all times during the Sub-Adviser's normal business hours. Upon the reasonable request of the Trust, copies of any such books and records shall be provided promptly by the Sub-Adviser to the Trust or the Trust's authorized representatives.

Section 4. Control by Board. As is the case with respect to the Adviser under the Investment Advisory Agreement, any investment activities undertaken by the Sub-Adviser pursuant to this Agreement, as well as any other activities undertaken by the Sub-Adviser on behalf of the Funds, shall at all times be subject to the direction and control the Trust's Board.

Section 5. Compliance with Applicable Requirements. In carrying out its obligations under this Agreement, the Sub-Adviser shall at all times comply with:

(a) all applicable provisions of the 1940 Act, and any rules and regulations adopted thereunder;

(b) the provisions of the registration statement of the Trust, as it may be amended or supplemented from time to time, under the Securities Act and the 1940 Act;

(c) the provisions of the Declaration of Trust of the Trust, as it may be amended or supplemented from time to time;

(d) the provisions of any By-laws of the Trust, if adopted and as it may be amended from time to time, or resolutions of the Board as may be adopted from time to time;

(e) the provisions of the Internal Revenue Code of 1986, as amended, applicable to the Trust or the Funds;

(f) any other applicable provisions of state or federal law; and

In addition, any code of ethics adopted by the Sub-Adviser must comply with Rule 17j-1 under the 1940 Act, as it may be amended from time to time, and any broadly accepted industry practices, if requested by the Trust or the Adviser.

Section 6. Broker-Dealer Relationships. The Sub-Adviser is responsible for the purchase and sale of securities for the Funds, broker-dealer selection, and negotiation of brokerage commission rates. The Sub-Adviser's primary consideration in effecting a security transaction will be to obtain the best price and execution. In selecting a broker-dealer to execute each particular transaction for a Fund, the Sub-Adviser will take the following into consideration: the best net price available, the reliability, integrity and financial condition of the broker-dealer; the size of and difficulty in executing the order; and the value of the expected contribution of the broker-dealer to the Fund on a continuing basis. Accordingly, the price to the Fund in any transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of the portfolio execution services offered. Subject to such policies as the Trust's Board of Trustees may from time to time determine, the Sub-Adviser shall not be deemed to have acted unlawfully or to have breached any duty created by this Agreement or otherwise solely by reason of having caused a Fund to pay a broker or dealer that provides brokerage and research services to the Sub-Adviser an amount of commission for effecting a portfolio investment transaction in excess of the amount of commission another broker or dealer would have charged for effecting that transaction, if the Sub-Adviser determines in good faith that such amount of commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or the overall responsibilities of the Sub-Adviser with respect to the Fund and to other clients of the Sub-Adviser. The Sub-Adviser is further authorized to allocate the orders placed by it on behalf of the Funds to brokers and dealers who also provide research or statistical material, or other services to the Funds or to the Sub-Adviser. Such allocation shall be in such amounts and proportions as the Sub-Adviser shall determine and the Sub-Adviser will report on said allocations regularly to the Board of Trustees of the Trust indicating the brokers to whom such allocations have been made and the basis therefor.

Section 7. Expenses of the Fund. All of the ordinary business expenses incurred in the operations of the Funds and the offering of their shares shall be borne by the Funds unless specifically provided otherwise in this Agreement. These expenses borne by the Trust include, but are not limited to, brokerage commissions, taxes, legal, auditing or governmental fees, the cost of preparing share certificates, custodian, transfer agent and shareholder service agent costs, expense of issue, sale, redemption and repurchase of shares, expenses of registering and qualifying shares for sale, expenses relating to trustees and shareholder meetings, the cost of preparing and distributing reports and notices to shareholders, the fees and other expenses incurred by the Funds in connection with membership in investment company organizations and the cost of printing copies of prospectuses and statements of additional information distributed to the Funds' shareholders.

Section 8. Compensation. As compensation for the sub-advisory services provided under this Agreement, the Adviser shall pay the Sub-Adviser fees, payable monthly, the annual rates indicated on Schedule A hereto, as such Schedule may be amended or supplemented from time to time. It is understood that the Adviser shall be responsible for the Sub-Adviser's fee for its services hereunder, and the Sub-Adviser agrees that it shall have no claim against the Trust or the Funds with respect to compensation under this Agreement.

Section 9. Standard of Care. The Trust and Adviser shall expect of the Sub-Adviser, and the Sub-Adviser will give the Trust and the Adviser the benefit of, the Sub-Adviser's best judgment and efforts in rendering its services to the Trust, and as an inducement to the Sub-Adviser's undertaking these services at the compensation level specified, the Sub-Adviser shall not be liable hereunder for any mistake in judgment. In the absence of willful misfeasance, bad faith, negligence or reckless disregard of obligations or duties hereunder on the part of the Sub-Adviser or any of its officers, directors, employees or agents, the Sub-Adviser shall not be subject to liability to the Trust or to any shareholders in the Trust for any act or omission in the course of, or connected with, rendering services hereunder or for any losses that may be sustained in the purchase, holding or sale of any security.

Section 10. Non-Exclusivity. The services of the Sub-Adviser to the Adviser and the Trust are not to be deemed to be exclusive, and the Sub-Adviser shall be free to render investment advisory and administrative or other services to others (including other investment companies) and to engage in other activities. It is understood and agreed that officers or directors of the Sub-Adviser are not prohibited from engaging in any other business activity or from rendering services to any other person, or from serving as partners, officers, directors or trustees of any other firm or trust, including other investment advisory companies.

Section 11. Records. The Sub-Adviser shall, with respect to orders the Sub-Adviser places for the purchase and sale of portfolio securities of the Funds, maintain or arrange for the maintenance of the documents and records required pursuant to Rule 31a-1 under the 1940 Act as well as trade tickets and confirmations of portfolio trades and such other records as the Adviser or the Funds' Administrator reasonably requests to be maintained. All such records shall be maintained in a form acceptable to the Funds and in compliance with the provisions of Rule 31a-1 or any successor rule. All such records will be the property of the Funds, and will be available for inspection and use by the Funds and their authorized representatives (including the Adviser). The Sub-Adviser shall promptly, upon the Trust's request, surrender to the Funds those records which are the property of the Trust or any Fund. The Sub-Adviser will promptly notify the Funds' Administrator if it experiences any difficulty in maintaining the records in an accurate and complete manner.

Section 12. Term and Approval. This Agreement shall become effective with respect to a Fund after it is approved in accordance with the express requirements of the 1940 Act, and executed by the Trust, Adviser and Sub-Adviser and shall thereafter continue from year to year, provided that the continuation of the Agreement is approved in accordance with the requirements of the 1940 Act, which currently requires that the continuation be approved at least annually:

(a) (i) by the Trust's Board of Trustees or (ii) by the vote of "a majority of the outstanding voting securities" of the Fund (as defined in Section 2(a)(42) of the 1940 Act), and

(b) by the affirmative vote of a majority of the Trust's Trustees who are not parties to this Agreement or "interested persons" (as defined in the 1940 Act) of a party to this Agreement (other than as Trustees of the Trust), by votes cast in person at a meeting specifically called for such purpose.

Section 13. Termination. As required under the 1940 Act, this Agreement may be terminated with respect to a Fund at any time, without the payment of any penalty, by vote of the Trust's Board of Trustees or by vote of a majority of a Fund's outstanding voting securities, or by the Adviser or Sub-Adviser, on sixty (60) days written notice to the other party. The notice provided for herein may be waived by the party entitled to receipt thereof. This Agreement shall automatically terminate in the event of its assignment, the term "assignment" for purposes of this paragraph having the meaning defined in Section 2(a)(4) of the 1940 Act, as it may be interpreted by the Commission or its staff in interpretive releases, or applied by the Commission staff in no-action letters, issued under the 1940 Act.

Section 14. Indemnification by the Sub-Adviser. The Trust shall not be responsible for, and the Sub-Adviser shall indemnify and hold the Trust or any Fund of the Trust harmless from and against, any and all losses, damages, costs, charges, counsel fees, payments, expenses and liability arising out of or attributable to the willful misfeasance, bad faith, negligent acts or reckless disregard of obligations or duties of the Sub-Adviser or any of its officers, directors, employees or agents.

Section 15. Indemnification by the Trust. In the absence of willful misfeasance, bad faith, negligence or reckless disregard of duties hereunder on the part of the Sub-Adviser or any of its officers, directors, employees or agents, the Trust hereby agrees to indemnify and hold harmless the Sub-Adviser against all claims, actions, suits or proceedings at law or in equity whether brought by a private party or a governmental department, commission, board, bureau, agency or instrumentality of any kind, arising from the advertising, solicitation, sale, purchase or pledge of securities, whether of the Funds or other securities, undertaken by the Funds, their officers, directors, employees or affiliates, resulting from any violations of the securities laws, rules, regulations, statutes and codes, whether federal or of any state, by the Funds, their officers, directors, employees or affiliates. Federal and state securities laws impose liabilities under certain circumstances on persons who act in good faith, and nothing herein shall constitute a waiver or limitation of any rights which a Fund may have and which may not be waived under any applicable federal and state securities laws.

Section 16. Notices. Any notices under this Agreement shall be in writing, addressed and delivered or mailed postage paid to the other party at such address as such other party may designate for the receipt of such notice. Until further notice to the other party, it is agreed that the address of the Trust shall be 525 Market Street, 12th Floor, San Francisco, California 94163, Attention Michael J. Hogan, and that of the Adviser shall be 525 Market Street, 12th Floor, San Francisco, California 94163, Attention: Michael J. Hogan, and that of the Sub-Adviser shall be 525 Market Street, 10th Floor, San Francisco, California 94163, Attention: J. Mari Casas.

Section 17. Questions of Interpretation. Any question of interpretation of any term or provision of this Agreement having a counterpart in or otherwise derived from a term or provision of the 1940 Act shall be resolved by reference to such terms or provision of the 1940 Act and to interpretations thereof, if any, by the United States Courts or in the absence of any controlling decision of any such court, by rules, regulations or orders of the Commission, or interpretations of the Commission or its staff, or Commission staff no-action letters, issued pursuant to the 1940 Act. In addition, where the effect of a requirement of the 1940 Act or the Advisers Act reflected in any provision of this Agreement is revised by rule, regulation or order of the Commission, such provision shall be deemed to incorporate the effect of such rule, regulation or order. The duties and obligations of the parties under this Agreement shall be governed by and construed in accordance with the laws of the State of Delaware.

Section 18. Amendment. This Agreement supersedes the sub-advisory agreement among Wells Fargo Funds Trust, Wells Fargo Bank, N.A. and Wells Fargo Capital Management Incorporated dated November 8, 1999, as approved by the Board of Trustees on March 26, 1999 as amended October 28, 1999, May 9, 2000 and July 25, 2000. No provision of this Agreement may be changed, waived, discharged or terminated orally, but only by an instrument in writing signed by the party against which enforcement of the change, waiver, discharge or termination is sought. If shareholder approval of an amendment is required under the 1940 Act, no such amendment shall become effective until approved by a vote of the majority of the outstanding shares of the affected Funds. Otherwise, a written amendment of this Agreement is effective upon the approval of the Board of Trustees, the Adviser and the Sub-Adviser.

Section 19. Wells Fargo Name. The Sub-Adviser and the Trust each agree that the name "Wells Fargo," which comprises a component of the Trust's name, is a property right of the parent of the Adviser. The Trust agrees and consents that: (i) it will use the words "Wells Fargo" as a component of its corporate name, the name of any series or class, or all of the above, and for no other purpose; (ii) it will not grant to any third party the right to use the name "Wells Fargo" for any purpose; (iii) the Adviser or any corporate affiliate of the Adviser may use or grant to others the right to use the words "Wells Fargo," or any combination or abbreviation thereof, as all or a portion of a corporate or business name or for any commercial purpose, other than a grant of such right to another registered investment company not advised by the Adviser or one of its affiliates; and (iv) in the event that the Adviser or an affiliate thereof is no longer acting as investment adviser to any Fund or class of a Fund, the Trust shall, upon request by the Adviser, promptly take such action as may be necessary to change its corporate name to one not containing the words "Wells Fargo" and following such change, shall not use the words "Wells Fargo," or any combination thereof, as a part of its corporate name or for any other commercial purpose, and shall use its best efforts to cause its trustees, officers and shareholders to take any and all actions that the Adviser may request to effect the foregoing and to reconvey to the Adviser any and all rights to such words.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed in duplicate by their respective officers on the day and year first written above.

WELLS FARGO FUNDS TRUST

on behalf of the Funds

By:

C. David Messman

Secretary

WELLS FARGO FUNDS MANAGEMENT, LLC

By:

Andrew Owen

Executive Vice President

WELLS CAPITAL MANAGEMENT INCORPORATED

By:

Karen Norton

Chief Operating Officer

APPENDIX A

WELLS CAPITAL MANAGEMENT INCORPORATED

INVESTMENT SUB-ADVISORY AGREEMENT

WELLS FARGO FUNDS TRUST

Asset Allocation Fund1

1On February 27-28, 2018 the Board of Trustees of Wells Fargo Funds Trust approved Wells Capital Management Incorporated as the sub-adviser to the Wells Fargo Asset Allocation Fund, effective on or about June 15, 2018.

SCHEDULE A

WELLS CAPITAL MANAGEMENT INCORPORATED

INVESTMENT SUB-ADVISORY AGREEMENT

FEE AGREEMENT

WELLS FARGO FUNDS TRUST

This fee agreement is made as of the 27th day of March, 2009, and is amended as of the 10th day of November, 2017, by and between Wells Fargo Funds Management, LLC (the "Adviser") and Wells Capital Management Incorporated (the "Sub-Adviser"); and

WHEREAS, the parties and Wells Fargo Funds Trust (the "Trust") have entered into an Investment Sub-Advisory Agreement ("Sub-Advisory Agreement") whereby the Sub-Adviser provides investment management advice to each series of the Trust as listed in Appendix A to the Sub-Advisory Agreement (each a "Fund" and collectively the "Funds").

WHEREAS, the Sub-Advisory Agreement provides that the fees to be paid to the Sub-Adviser are to be as agreed upon in writing by the parties.

NOW THEREFORE, the parties agree that the fees to be paid to the Sub-Adviser under the Sub-Advisory Agreement shall be calculated as follows on a monthly basis by applying the annual rates described in this Schedule A to Appendix A for each Fund listed in Appendix A.

The Sub-Adviser shall receive a fee as described in this Schedule A to Appendix A of the assets of the Growth Balanced Fund and Moderate Balanced Fund and from each WealthBuilder Fund for providing services with respect to which Master Trust Portfolios (or, in the case of the WealthBuilder Funds, other unaffiliated funds) these Funds will invest in and the percentage to allocate to each Master Portfolio or unaffiliated fund in reliance on Section 12(d)(1)(G) under the Act, the rules thereunder, or order issued by the Commission exempting the Fund from the provisions of Section 12(d)(1)(A) under the Act (a "Fund of Funds structure").

The net assets under management against which the foregoing fees are to be applied are the net assets as of the first business day of the month. If this fee agreement becomes effective subsequent to the first day of a month or shall terminate before the last day of a month, compensation for that part of the month this agreement is in effect shall be subject to a pro rata adjustment based on the number of days elapsed in the current month as a percentage of the total number of days in such month. If the determination of the net asset value is suspended as of the first business day of the month, the net asset value for the last day prior to such suspension shall for this purpose be deemed to be the net asset value on the first business day of the month.

Asset Allocation Fund1

First 250M - 0.10%

Over 250M - 0.05%

1On February 27-28, 2018 the Board of Trustees of Wells Fargo Funds Trust approved Wells Capital Management Incorporated as the sub-adviser to the Wells Fargo Asset Allocation Fund, effective on or about June 15, 2018.

Exhibit B

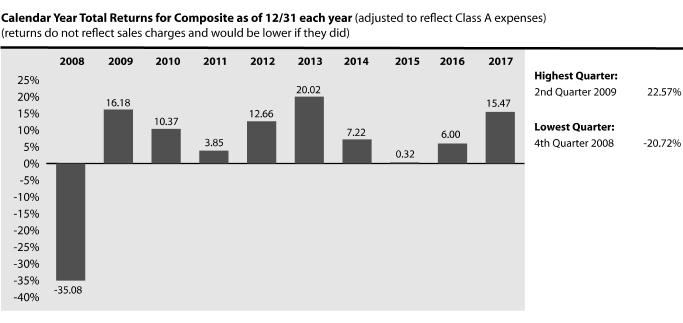

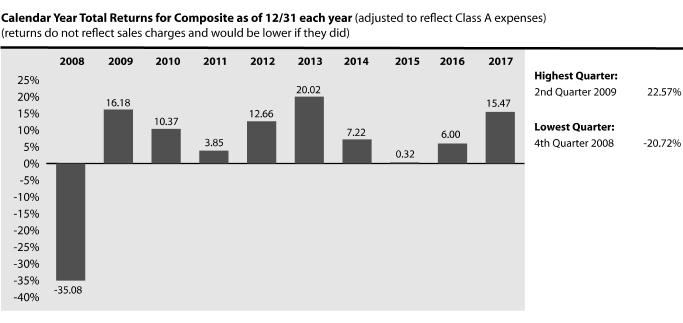

The performance information shown below represents a composite of the prior performance of all discretionary accounts managed by Wells Capital Management with substantially similar investment objectives, policies and strategies as the Fund (the "Composite"). The discretionary accounts included in the Composite are not subject to the diversification requirements, specific tax restrictions, and investment limitations imposed on the Fund by the 1940 Act and Subchapter M of the Internal Revenue Code. As a result, the investment portfolio of the Fund, if it had been in operation during the periods shown, would likely have differed to some extent from the portfolio of the accounts included in the Composite. If the accounts in the Composite had been subject to these restrictions, the performance of the Composite might have been adversely affected.

The Composite's performance information presented below includes actual brokerage commissions and execution costs paid by the discretionary accounts and has been adjusted to reflect the higher expenses of the Class A shares of the Fund, as shown in the "Total Annual Operating Expenses After Fee Waiver" row in the Fund's Annual Operating Expenses Table. The Composite's performance does not represent historical performance of the Fund and should not be interpreted as indicative of the future performance for the Fund. The performance information for the Composite should not be relied upon as a substitute for the Fund's performance information or as an indication of the future performance of the Fund because, among other things, the cash flow in and out of the Fund and the accounts comprising the Composite, and the fees and expenses and the portfolio size and positions of the accounts comprising the Composite and the Fund will vary. The Composite performance information presented below was calculated in accordance with the methodology contained in the CFA Institute's Global Investment Performance Standards, which differs from the SEC's standard methodology for calculating performance. Past performance of the Composite shown below is no guarantee of similar future performance for the Fund.

Average Annual Total Returns for the periods ended 12/31/2017 |

| Inception Date | 1 Year | | 5 Year | 10 Year | |

Composite Class A | 5/31/1989 | 8.83% | | 9.58% | 3.79% | |

Composite Class C | | 13.62% | | 8.77% | 3.63% | |

Composite Class R | | 15.19% | | 9.31% | 4.14% | |

Composite Administrator Class | | 15.68% | | 9.78% | 4.59% | |

Composite Institutional Class | | 15.85% | | 9.94% | 4.75% | |

Growth Balanced Blended Index (reflects no deduction for fees, expenses or taxes) | | 15.06% | | 10.12% | 6.68% | |

Exhibit C

Principal Holders of Fund Shares. Set forth below as of February 26, 2018, is the name, address and share ownership of each person with record ownership of 5% or more of a class of the Fund. Except as identified below, no person with record ownership of 5% or more of a class of a Fund is known by the Trust to have beneficial ownership of such shares.

Name and Address of Shareholders | Number of Shares | | Percentage of Shares of Class | |

Asset Allocation Fund

Class A | | | | |

Wells Fargo Clearing Services, LLC

Special Custody Account For The

Exclusive Benefit Of Customers

2801 Market Street

Saint Louis, MO 63103-2523 | 50,659,688.0960 | | 51.51% | |

MLPF&S For The Sole Benefit

of Its Customers

Attn: Mutual Fund Administration

4800 Deer Lake Dr E FL 3

Jacksonville, FL 32246-6484 | 11,163,946.2390 | | 11.35% | |

American Enterprise Investment Services

707 2nd Ave South

Minneapolis, MN 55402-2405 | 7,066,518.8140 | | 7.18% | |

Asset Allocation Fund

Class C | | | | |

Wells Fargo Clearing Services, LLC

Special Custody Account For The

Exclusive Benefit Of Customers

2801 Market Street