As filed with the Securities and Exchange Commission on April 1, 2008

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | |

| | Pre-Effective Amendment No. | | ¨ |

| | Post-Effective Amendment No. | | ¨ |

(Check appropriate box or boxes)

Exact Name of Registrant as Specified in Charter:

WELLS FARGO FUNDS TRUST

Area Code and Telephone Number: (800) 552-9612

Address of Principal Executive Offices, including Zip Code:

525 Market Street

San Francisco, California 94163

Name and Address of Agent for Service:

C. David Messman

c/o Wells Fargo Funds Management, LLC

525 Market Street, 12th Floor

San Francisco, California 94105

With copies to:

Marco E. Adelfio, Esq.

Morrison & Foerster LLP

2000 Pennsylvania Ave., N.W.

Suite 5500

Washington, D.C. 20006

It is proposed that this filing will become effective on May 6, 2008 pursuant to Rule 488.

No filing fee is required under the Securities Act of 1933 because an indefinite number of shares of beneficial interest in the Registrant has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Important Proxy Information

Please take a moment to read.

The enclosed document is a proxy statement with proposals concerning certain Wells Fargo Advantage Funds®. As a shareholder of one or more of the Funds, you are being asked to approve a reorganization of your target Wells Fargo Advantage Fund into an acquiring Wells Fargo Advantage Fund. The following information highlights the principal aspects of the proposal, which is subject to a vote by the target Funds’ shareholders. We encourage you to fully read the enclosed proxy statement.

What am I being asked to vote on?

You are being asked to approve the reorganization of your target Wells Fargo Advantage Fund into an acquiring Wells Fargo Advantage Fund. The Wells Fargo Advantage Funds Board of Trustees (the Board) believes that these reorganizations will benefit shareholders, and it unanimously approved them.

In each reorganization, the target Fund will transfer all of its assets and liabilities to a corresponding acquiring Fund in exchange for shares of the same or a comparable class of the acquiring Fund. The reorganization is expected to be a tax-free exchange. Immediately after the closing of the reorganization, you will hold the shares of an acquiring Fund with a total dollar value equal to the total dollar value of the shares of the target Fund that you held before the closing. The target Funds and the acquiring Funds are listed in the table below:

| | |

WELLS FARGO ADVANTAGE FUNDS

TARGET FUND | | WELLS FARGO ADVANTAGE FUNDS

ACQUIRING FUND |

Balanced Fund | | Asset Allocation Fund |

Corporate Bond Fund | | Income Plus Fund |

High Yield Bond Fund | | High Income Fund |

Intermediate Government Income Fund | | Government Securities Fund |

National Limited-Term Tax-Free Fund | | Short-Term Municipal Bond Fund |

National Tax-Free Fund | | Municipal Bond Fund |

Overseas Fund | | International Equity Fund |

Value Fund | | C&B Large Cap Value Fund |

Why has the Board recommended that I vote in favor of the reorganization?

Among the factors the Board considered in recommending these reorganizations were the following:

| | • | | The combined Funds will have potentially greater investment opportunities and market presence. |

| | • | | The reorganizations will eliminate duplicative expenses and can reduce associated operational costs. |

| | • | | The combined Funds are expected to have enhanced viability due to a larger asset base. A larger asset base can lead to lower expense ratios. |

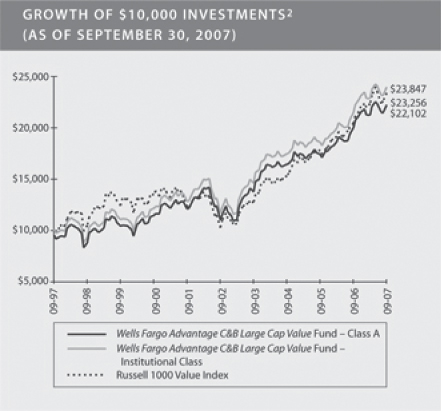

| | • | | The acquiring Funds have better comparative total return than their corresponding target Funds over most measurement periods, and, in the view of Wells Fargo Funds Management, LLC, the Funds’ advisor, they have the potential for better performance opportunities going forward. |

| | • | | The investment objectives and principal investment strategies of the target and acquiring Funds are relatively compatible. |

| | • | | Shareholders will not bear the expenses incurred by each Fund in connection with the reorganizations. |

| | • | | The reorganizations are expected to be tax-free for federal income tax purposes. |

Whom should I call with questions about the voting process?

If you have any questions about the proxy materials or the proposal, please call your investment professional, trust officer, or Wells Fargo Advantage Funds at 1-800-222-8222. If you have any questions about voting your proxy, you may call our proxy solicitor, The Altman Group, at 1-866-406-2287.

IMPORTANT NOTICE: PLEASE COMPLETE THE ENCLOSED PROXY BALLOT AND RETURN IT AS SOON AS POSSIBLE. FOR YOUR CONVENIENCE YOU MAY VOTE BY MAIL, BY CALLING THE TOLL- FREE TELEPHONE NUMBER PRINTED ON YOUR PROXY BALLOT, OR VIA THE INTERNET ACCORDING TO THE ENCLOSED VOTING INSTRUCTIONS.

WELLS FARGO FUNDS TRUST

525 MARKET STREET

SAN FRANCISCO, CALIFORNIA 94105

[May 6, 2008]

Dear Valued Shareholder:

I am pleased to invite you to a special meeting of shareholders of Wells Fargo Funds Trust’s Balanced Fund, Corporate Bond Fund, High Yield Bond Fund, Intermediate Government Income Fund, National Limited-Term Tax-Free Fund, National Tax-Free Fund, Overseas Fund and Value Fund, to be held at 525 Market Street, 12th Floor, San Francisco, California 94105 on June 30, 2008, at 3:00 p.m. (Pacific Time).

We are seeking your approval of a proposed reorganization of eight funds of Wells Fargo Funds Trust into eight other funds of Wells Fargo Funds Trust (the “Reorganization”). We refer to Wells Fargo Funds Trust as Wells Fargo Advantage Funds®. We refer to the eight funds that are proposed to be reorganized as the Target Funds, and we refer to the eight Funds into which the Target Funds will be reorganized as the Acquiring Funds. We refer to all of them together as the Funds.

The Reorganization arises out of a review by Wells Fargo Funds Management, LLC (“Funds Management”), investment adviser to the Funds, of the continued viability of various Funds of Wells Fargo Advantage Funds, and an evaluation of whether combining Funds with similar investment objectives, principal investments, principal investment strategies or portfolio securities would better serve shareholders. In each reorganization, a Target Fund will transfer all of its assets and liabilities to a corresponding Acquiring Fund in exchange for shares of the same or a comparable class (“Class”) of the corresponding Acquiring Fund in an expected tax-free exchange. The shares of each Acquiring Fund, in turn, will be distributed to the shareholders of each Target Fund in liquidation of the Target Funds. Immediately after the closing of the Reorganization (the “Closing”), each shareholder of each Target Fund will hold the shares of an Acquiring Fund with a total dollar value equal to the total dollar value of the shares of the Target Fund that the shareholder held before the Closing. The following table lists the Target Funds and the corresponding Acquiring Funds that are part of the Reorganization.

| | |

TARGET FUNDS | | ACQUIRING FUNDS |

Balanced Fund | | Asset Allocation Fund |

Corporate Bond Fund | | Income Plus Fund |

High Yield Bond Fund | | High Income Fund |

Intermediate Government Income Fund | | Government Securities Fund |

National Limited-Term Tax-Free Fund | | Short-Term Municipal Bond Fund |

National Tax-Free Fund | | Municipal Bond Fund |

Overseas Fund | | International Equity Fund |

Value Fund | | C&B Large Cap Value Fund |

Some of the potential benefits of the proposed Reorganization are:

| | * | The combined Funds will have potentially greater investment opportunities and market presence. |

| | * | The Reorganization will eliminate duplicative expenses and can reduce associated operational costs. |

1

| | * | The combined Funds should have enhanced viability due to a larger asset base. A larger asset base also can lead to lower expense ratios. |

| | * | The Acquiring Funds have better or comparable comparative total return or yield performance than the Target Funds over most measurement periods and, in Funds Management’s view, better performance opportunities going forward. |

| | * | The expected tax-free nature of the Reorganization for U.S. federal income tax purposes. |

Funds Management has agreed to pay all expenses of each reorganization, so Fund shareholders will not bear these costs.

The overall responsibility for oversight of the Target Funds and Acquiring Funds rests with the Wells Fargo Advantage Funds’ Board of Trustees (the “Board”). The Board has unanimously approved each reorganization and believes that it is in the best interests of each Target Fund’s shareholders.

The Board of Trustees of Wells Fargo Advantage Funds unanimously recommends that you vote your proxy to approve the Reorganization.

Please read the enclosed proxy materials and consider the information provided. We encourage you to complete and mail your proxy ballot promptly. No postage is necessary if you mail it in the United States. Alternatively, you may vote by calling the toll-free number printed on your proxy ballot, or via the Internet according to the enclosed voting instructions. If you have any questions about the proxy materials, or the Reorganization, please call your trust officer, investment professional, or Wells Fargo Advantage Funds’ Investor Services at 1-800-222-8222. If you have any questions about voting your proxy you may call our proxy solicitor, The Altman Group, at 1-866-406-2287. Thank you for your participation in this important initiative. Your vote is important to us, no matter how many shares you own.

Very truly yours,

Karla M. Rabusch

President

Wells Fargo Funds Trust

2

BALANCED FUND

CORPORATE BOND FUND

HIGH YIELD BOND FUND

INTERMEDIATE GOVERNMENT INCOME FUND

NATIONAL LIMITED-TERM TAX-FREE FUND

NATIONAL TAX-FREE FUND

OVERSEAS FUND

VALUE FUND

OF

WELLS FARGO FUNDS TRUST

525 MARKET STREET

SAN FRANCISCO, CALIFORNIA 94105

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

SCHEDULED FOR JUNE 30, 2008

This is the formal notice and agenda for the special shareholder meeting (the “Meeting”) of the shareholders of each of the Wells Fargo Advantage Funds listed above (the “Funds”). The Meeting will be held at 525 Market Street, 12th Floor, San Francisco, California 94105 on June 30, 2008, at 3:00 p.m. (Pacific Time). At the Meeting, shareholders will be asked to consider and act upon the proposal set forth below and transact such other business as may properly come before the Meeting. The table below lists the proposal on which shareholders will be asked to vote and identifies shareholders entitled to vote on the proposal.

| | |

PROPOSAL | | SHAREHOLDERS ENTITLED TO VOTE |

| Approval of an Agreement and Plan of Reorganization (the “Reorganization Plan”), under which substantially all of the assets of each Target Fund will be transferred to an Acquiring Fund as listed below in exchange for shares of the same or a comparable Class of the corresponding Acquiring Fund having equal value, which will be distributed proportionately to the shareholders of the Target Fund. | | Shareholders of each Target Fund with respect to the applicable reorganization shown below. |

| |

Target Fund | | Corresponding Acquiring Fund |

Balanced Fund | | Asset Allocation Fund |

Corporate Bond Fund | | Income Plus Fund |

High Yield Bond Fund | | High Income Fund |

Intermediate Government Income Fund | | Government Securities Fund |

National Limited-Term Tax-Free Fund | | Short-Term Municipal Bond Fund |

National Tax-Free Fund | | Municipal Bond Fund |

Overseas Fund | | International Equity Fund |

Value Fund | | C&B Large Cap Value Fund |

Shareholders of all Funds may consider and vote upon such other business as may properly come before the Meeting or any adjournment(s).

THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS

THAT YOU VOTE IN FAVOR OF THE PROPOSAL.

Shareholders of record of each Target Fund as of the close of business on April 18, 2008 are entitled to vote at the Meeting or any adjournment(s) thereof. Whether or not you expect to attend the Meeting, please complete and return the enclosed proxy ballot.

1

Please read the enclosed proxy materials and consider the information provided. We encourage you to complete and mail your proxy ballot promptly. No postage is necessary if you mail it in the United States. Alternatively, you may vote by calling the toll-free number printed on your proxy ballot, or via the Internet according to the enclosed voting instructions. If you have any questions about the proxy materials, or the Proposal, please call your trust officer, investment professional, or Wells Fargo Advantage Funds’ Investor Services at 1-800-222-8222. If you have any questions about voting your proxy you may call our proxy solicitor, The Altman Group, at 1-866-406-2287.

|

By Order of the Board of Trustees of Wells Fargo Funds Trust |

|

C. David Messman |

Secretary |

[May 6, 2008]

YOUR VOTE IS VERY IMPORTANT TO US REGARDLESS OF THE NUMBER OF SHARES THAT YOU ARE ENTITLED TO VOTE.

2

WELLS FARGO FUNDS TRUST

525 Market Street

San Francisco, California 94105

1-800-222-8222

COMBINED PROSPECTUS/PROXY STATEMENT

[May 6, 2008]

WHAT IS THIS DOCUMENT AND WHY ARE WE SENDING IT TO YOU?

This document is a combined prospectus and proxy statement, and we refer to it as the Prospectus/Proxy Statement. It contains the information that shareholders of the Target Funds listed in the Notice of Special Meeting of Shareholders should know before voting on the proposed Reorganization, and should be retained for future reference. It is the proxy statement of the Target Funds and also a prospectus for the Acquiring Funds.

HOW WILL THE REORGANIZATION WORK?

The Board has approved the reorganization of each Target Fund, which we refer to as the Reorganization. The Reorganization will involve three steps:

| | * | the transfer of substantially all of the assets and liabilities of the Target Fund to its corresponding Acquiring Fund in exchange for shares of the corresponding Acquiring Fund having equivalent value to the net assets transferred; |

| | * | the pro rata distribution of the same or a comparable Class of shares of the Acquiring Fund to the shareholders of record of the Target Fund as of the effective date of the Reorganization in full redemption of all shares of the Target Fund; and |

| | * | the liquidation and termination of the Target Funds. |

As a result of the Reorganization, shareholders of each Target Fund will hold shares, generally of the same or a comparable Class of the corresponding Acquiring Fund, as described in this Prospectus/Proxy Statement. The total value of the Acquiring Fund shares that you receive in the Reorganization will be the same as the total value of the shares of the Target Fund that you held immediately before the Reorganization. If one of the Target Funds does not approve the Reorganization, that Fund will not participate in the Reorganization. In such a case, the Target Fund will continue its operations beyond the date of the Reorganization and the Wells Fargo Advantage Funds’ Board of Trustees will consider what further action is appropriate, including liquidating and terminating the Target Fund as a series of Wells Fargo Advantage Funds, or considering a different reorganization.

These securities have not been approved or disapproved by the U.S. Securities and Exchange Commission (the “SEC”), nor has the SEC passed upon the accuracy or adequacy of this Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

IS ADDITIONAL INFORMATION ABOUT THE FUNDS AND REORGANIZATION PLAN AVAILABLE?

Yes, additional information about the Funds is available in the:

| | • | | Prospectuses for the Target Funds; |

| | • | | Statements of Additional Information, or SAIs, for the Target Funds and the Acquiring Funds; and |

| | • | | Annual and Semi-Annual Reports to shareholders of the Target Funds and, as applicable, Acquiring Funds. |

1

All of these documents are on file with the SEC.

The prospectuses, SAIs, and Annual and Semi-Annual Reports of the Target Funds are incorporated by reference and are legally deemed to be part of this Prospectus/Proxy Statement. The SAI to this Prospectus/Proxy Statement, dated the same date as this Prospectus/Proxy Statement, also is incorporated by reference and is legally deemed to be part of this document. The prospectuses and the most recent Annual Report to shareholders of the Target Funds, containing audited financial statements for the most recent fiscal year, and the most recent Semi-Annual Report to shareholders of the Target Funds have been previously mailed to shareholders. The SAIs of the Acquiring Fund also are incorporated by reference and are legally deemed to be part of this Prospectus/Proxy Statement.

There also is a Reorganization Plan between the Target Funds and the Acquiring Funds that describes the technical details of how the Reorganization will be accomplished. The Reorganization Plan has been filed with the SEC as Exhibit G to this Prospectus/Proxy Statement.

Copies of these documents are available upon request without charge by writing to, calling or visiting our web site:

Wells Fargo Advantage Funds

P.O. Box 8266

Boston, MA 02266-8266

1-800-222-8222

www.wellsfargo.com/advantagefunds

You also may view or obtain these documents from the SEC:

| | |

| In Person: | | At the SEC’s Public Reference Room in Washington, D.C., and regional offices in New York City, at 233 Broadway, and in Chicago, at 175 West Jackson Boulevard, Suite 900 (duplicating fee required) |

| By Phone: | | 1-800-SEC-0330 (duplicating fee required) |

| By Mail: | | Public Reference Section Securities and Exchange Commission 100 F Street, N.E. Washington, DC 20549-0213 (duplicating fee required) |

| By Email: | | publicinfo@sec.gov (duplicating fee required) |

| By Internet: | | www.sec.gov (Information about the Target Funds and Acquiring Funds may be found under Wells Fargo Funds Trust) |

OTHER IMPORTANT THINGS TO NOTE:

| | * | An investment in the Wells Fargo Advantage Funds is not a deposit of Wells Fargo Bank, N.A. (“Wells Fargo Bank”) or any other bank and is not insured or guaranteed by the FDIC or any other government agency. |

| | * | You may lose money by investing in the Funds. |

2

TABLE OF CONTENTS

3

PROPOSAL: APPROVAL OF THE REORGANIZATION PLAN

The Board of Wells Fargo Advantage Funds called this special shareholder meeting to allow shareholders of each Target Fund to consider and vote on the reorganization of each Target Fund into a corresponding Acquiring Fund, as shown in the table below.

| | |

TARGET FUND | | ACQUIRING FUND |

| Balanced Fund | | Asset Allocation Fund |

Investor Class | | Class A |

| |

Corporate Bond Fund Investor Class Advisor Class Institutional Class | | Income Plus Fund Investor Class (new class)* Class A Institutional Class (new class)* |

| |

High Yield Bond Fund Class A Class B Class C | | High Income Fund Class A (formerly Advisor Class)* Class B (new class)* Class C (new class)* |

| |

Intermediate Government Income Fund Class A Class B Class C Administrator Class | | Government Securities Fund Class A (formerly Advisor Class)* Class B (new class)* Class C Administrator Class |

| |

National Limited-Term Tax-Free Fund Class A Class B Class C Administrator Class | | Short-Term Municipal Bond Fund Class A (new class)* Class A (new class)* Class C Class A (new class)* |

| |

National Tax-Free Fund Class A Class B Class C Administrator Class | | Municipal Bond Fund Class A Class B Class C Administrator Class |

| |

Overseas Fund Investor Class Institutional Class | | International Equity Fund Investor Class (new class)* Institutional Class |

| |

Value Fund Class A Class B Class C Investor Class Administrator Class | | C&B Large Cap Value Fund Class A Class B Class C Investor Class (formerly Class D)* Administrator Class |

| * | See “Overview” below for a discussion regarding new share classes and share class modifications. |

Overview

On November 7, 2007, the Board unanimously voted to approve the Reorganization, subject to approval by shareholders of each Target Fund. In the Reorganization, each Target Fund will transfer its assets to its corresponding Acquiring Fund, which will acquire substantially all the assets and assume substantially all the liabilities of the Target Fund. Upon the transfer of assets and assumption of liabilities, the Acquiring Fund will issue shares to the corresponding Target Fund, which shares will be distributed to shareholders in liquidation of the Target Fund. Any shares you own of a Target Fund at the time of the Reorganization will be cancelled and

4

you will receive shares in the same or a comparable Class of the corresponding Acquiring Fund having a value equal to the value of your shares of the Target Fund. The Reorganization is expected to be treated as a tax-free “reorganization” for U.S. federal income tax purposes, as discussed below under “Material U.S. Federal Income Tax Consequences of the Reorganization.” If approved by shareholders, the Reorganization is expected to occur in the third quarter of 2008.

Also on November 7, 2007, the Board unanimously voted to approve the creation of new share classes for certain of the Acquiring Funds in connection with the Reorganization as noted in the chart above. The new classes are expected to commence operations prior to or upon the closing of the Reorganization. In addition, the Board approved share class modifications whereby certain Acquiring Fund share classes will be renamed and modified to assume the features and attributes associated with a different share class as noted in the chart above. The share class modifications are expected to occur on or about June 20, 2008. Since the new share classes and share class modifications will be in effect at the time of the closing of the Reorganization, the new classes and share class modifications are described in this Prospectus/Proxy Statement as if they have already occurred.

Reasons for the Reorganization

The Reorganization arises out of Fund Management’s review of the continued viability of various funds of Wells Fargo Advantage Funds, and evaluation of whether combining Funds with similar investment objectives, principal investments, principal investment strategies or portfolio securities would better serve shareholders. The Board concluded that participation in the Reorganization is in the best interests of each Target Fund and its shareholders. In reaching that conclusion, the Board considered, among other things:

| | 1. | The enhanced viability of the combined Funds due to larger asset size; |

| | 2. | The viability of the Target Funds absent approval of the Reorganization; |

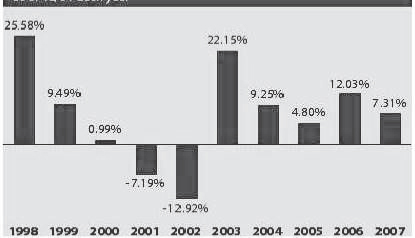

| | 3. | The comparative performance of the Acquiring Funds into which the Target Funds will be reorganized; |

| | 4. | The anticipated effect of the Reorganization on per-share expense ratios, both before and after waivers, of the Target Funds; |

| | 5. | The expected treatment of the Reorganization as a tax-free “reorganization” for U.S. federal income tax purposes; |

| | 6. | The relative compatibility of the investment objectives and principal investment strategies of the Acquiring Funds with those of the Target Funds; |

| | 7. | The anticipated benefits of economies of scale for the Target Funds and enabling greater diversification of investments. |

| | 8. | The potential elimination of duplicative costs and spreading of certain costs across a larger asset base due to combining Funds with compatible investment objectives, principal investments and principal investment strategies; and |

| | 9. | The undertaking by Funds Management to pay all expenses in connection with the Reorganization so that shareholders of the Target Funds and Acquiring Funds will not bear these expenses. |

The Board also concluded that the economic interests of the shareholders of the Target Funds and the Acquiring Funds would not be diluted as a result of the Reorganization because the number of Acquiring Fund shares to be issued to Target Fund shareholders will be calculated based on the respective net asset value of the Funds. For a more complete discussion of the factors considered by Wells Fargo Advantage Funds’ Board in approving the Reorganization, see the section entitled “Board Consideration of the Reorganization” in this Prospectus/Proxy Statement.

5

SUMMARY

The following summary highlights differences between each Target Fund and its corresponding Acquiring Fund. This summary is not complete and does not contain all of the information that you should consider before voting on the Reorganization. For more complete information, please read this Prospectus/Proxy Statement.

Comparison of Current Fees and Pro Forma Fees

The following table shows current annual fund operating expense ratios for each Target Fund and Acquiring Fund, both before (total) and after (net) any contractual expense waivers and reimbursements, and the pro forma annual operating expense ratios for each Acquiring Fund, reflecting the anticipated effects, if any, of the Reorganization on both total and net operating expenses ratios. All expense ratios are shown as a percentage of each Fund’s daily net assets and are as of the Fund’s fiscal year end dates noted below:

| | |

Fund | | Date |

Asset Allocation Fund, Balanced Fund, C&B Large Cap Value Fund, International Equity Fund, Overseas Fund | | September 30, 2007 |

| |

Corporate Bond Fund, Government Securities Fund, High Income Fund, High Yield Bond Fund, Income Plus Fund, Intermediate Government Income Fund | | May 31, 2007 |

| |

Municipal Bond Fund, National Limited-Term Tax-Free Fund, National Tax-Free Fund, Short-Term Municipal Bond Fund | | June 30, 2007 |

| |

Value Fund | | July 31, 2007 |

Two levels of expense ratios are included in the table:

| a) | Total Annual Fund Operating Expense Ratio — the total operating expenses of a fund, including acquired fund fees, if any, representing what a shareholder could potentially pay if no waivers or expense reimbursements were in place. |

| b) | Net Annual Fund Operating Expense Ratio — the expense level a shareholder can expect to actually pay, including acquired fund fees, if any, taking into account any fee waivers or expense reimbursements to which a fund’s adviser has contractually committed. |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Target Fund/Share

Class(es) | | Current | | | Acquiring Fund/Share Class(es) | | Current | | | Pro Forma | |

| | Total

Annual

Fund

Operating

Expenses* | | | Net Annual

Fund

Operating

Expenses** | | | | Total

Annual

Fund

Operating

Expenses* | | | Net Annual

Fund

Operating

Expenses** | | | Total

Annual

Fund

Operating

Expenses* | | | Net Annual

Fund

Operating

Expenses** | |

Balanced Fund | | | Asset Allocation Fund | | | | | | | |

Investor Class | | 1.57 | % | | 1.25 | % | | Class A | | 1.26 | % | | 1.15 | % | | 1.25 | % | | 1.15 | % |

| | | | | | | |

Corporate Bond Fund | | | | | | | | Income Plus Fund | | | | | | | | | | | | |

Investor Class | | 1.31 | % | | 0.98 | % | | Investor Class (new) | | 1.37 | % | | 0.95 | % | | 1.37 | % | | 0.95 | % |

Advisor Class | | 1.13 | % | | 0.95 | % | | Class A | | 1.35 | % | | 1.01 | % | | 1.24 | % | | 0.91 | % |

Institutional Class | | 0.68 | % | | 0.61 | % | | Institutional Class (new) | | 0.79 | % | | 0.62 | % | | 0.79 | % | | 0.62 | % |

| | | |

High Yield Bond Fund | | | High Income Fund | | | | | | | |

Class A | | 1.28 | % | | 1.16 | % | | Class A (formerly Advisor Class) | | 1.18 | % | | 0.91 | % | | 1.18 | % | | 0.91 | % |

Class B | | 2.03 | % | | 1.91 | % | | Class B (new) | | 1.93 | % | | 1.66 | % | | 1.93 | % | | 1.66 | % |

Class C | | 2.03 | % | | 1.91 | % | | Class C (new) | | 1.93 | % | | 1.66 | % | | 1.93 | % | | 1.66 | % |

6

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Target Fund/Share

Class(es) | | Current | | | Acquiring Fund/Share Class(es) | | Current | | | Pro Forma | |

| | Total

Annual

Fund

Operating

Expenses* | | | Net Annual

Fund

Operating

Expenses** | | | | Total

Annual

Fund

Operating

Expenses* | | | Net Annual

Fund

Operating

Expenses** | | | Total

Annual

Fund

Operating

Expenses* | | | Net Annual

Fund

Operating

Expenses** | |

Intermediate Government Income Fund | | | Government Securities Fund | | | | | | | |

Class A | | 1.09 | % | | 0.95 | % | | Class A (formerly Advisor Class) | | 1.06 | % | | 0.90 | % | | 1.04 | % | | 0.90 | % |

Class B | | 1.84 | % | | 1.70 | % | | Class B (new) | | 1.81 | % | | 1.65 | % | | 1.79 | % | | 1.65 | % |

Class C | | 1.84 | % | | 1.70 | % | | Class C | | 1.81 | % | | 1.79 | % | | 1.79 | % | | 1.65 | % |

Administrator Class | | 0.91 | % | | 0.70 | % | | Administrator Class | | 0.88 | % | | 0.70 | % | | 0.86 | % | | 0.70 | % |

| | | |

National Limited-Term Tax-Free Fund | | | Short-Term Municipal Bond Fund | | | | | | | |

Class A | | 1.12 | % | | 0.81 | % | | Class A (new) | | 1.02 | % | | 0.61 | % | | 1.01 | % | | 0.61 | % |

Class B | | 1.87 | % | | 1.56 | % | | Class A (new) | | 1.02 | % | | 0.61 | % | | 1.01 | % | | 0.61 | % |

Class C | | 1.87 | % | | 1.56 | % | | Class C | | 1.77 | % | | 1.56 | % | | 1.76 | % | | 1.36 | % |

Administrator Class | | 0.94 | % | | 0.61 | % | | Class A (new) | | 1.02 | % | | 0.61 | % | | 1.01 | % | | 0.61 | % |

| | | |

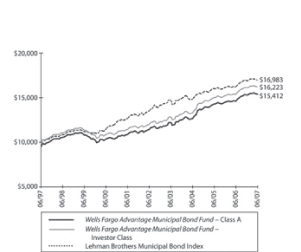

National Tax-Free Fund | | | Municipal Bond Fund | | | | | | | |

Class A | | 1.07 | % | | 0.86 | % | | Class A | | 1.08 | % | | 0.76 | % | | 1.07 | % | | 0.76 | % |

Class B | | 1.82 | % | | 1.61 | % | | Class B | | 1.83 | % | | 1.51 | % | | 1.82 | % | | 1.51 | % |

Class C | | 1.82 | % | | 1.61 | % | | Class C | | 1.83 | % | | 1.51 | % | | 1.82 | % | | 1.51 | % |

Administrator Class | | 0.89 | % | | 0.61 | % | | Administrator Class | | 0.90 | % | | 0.61 | % | | 0.89 | % | | 0.61 | % |

| | | |

Overseas Fund | | | International Equity Fund | | | | | | | |

Investor Class | | 1.91 | % | | 1.46 | % | | Investor Class (new) | | 1.82 | % | | 1.46 | % | | 1.82 | % | | 1.46 | % |

Institutional Class | | 1.34 | % | | 0.95 | % | | Institutional Class | | 1.25 | % | | 1.05 | % | | 1.25 | % | | 0.99 | % |

| | | |

Value Fund | | | C&B Large Cap Value Fund | | | | | | | |

Class A | | 1.71 | % | | 1.21 | % | | Class A | | 1.31 | % | | 1.20 | % | | 1.31 | % | | 1.15 | % |

Class B | | 2.47 | % | | 1.96 | % | | Class B | | 2.06 | % | | 1.95 | % | | 2.06 | % | | 1.90 | % |

Class C | | 2.47 | % | | 1.96 | % | | Class C | | 2.06 | % | | 1.95 | % | | 2.06 | % | | 1.90 | % |

Investor Class | | 1.87 | % | | 1.21 | % | | Investor Class (formerly Class D) | | 1.43 | % | | 1.20 | % | | 1.43 | % | | 1.20 | % |

Administrator Class | | 1.52 | % | | 0.96 | % | | Administrator Class | | 1.13 | % | | 0.95 | % | | 1.13 | % | | 0.95 | % |

| * | Includes for each Fund, except the C&B Large Cap Value Fund, the pro-rata portion of the net operating expenses of any money market fund or other fund held by the Fund. For the C&B Large Cap Value Fund, includes the gross expenses allocated from the master portfolio in which the Fund invests. |

| ** | Funds Management has committed to waive fees and/or reimburse expenses for a specified period to the extent necessary to maintain the Fund’s net annual operating expense ratio as described in Exhibit A. |

In every case except for the Corporate Bond Fund — Investor Class, Advisor Class and Institutional Class into Income Plus Fund — Investor Class, Class A and Institutional Class, and Overseas Fund — Institutional Class into the International Equity Fund — Institutional Class, the Acquiring Fund will have the same or lower total and net annual fund operating expenses than the corresponding Class of the Target Fund. Please see Exhibit A for a breakdown of the specific fees charged to each Target Fund and Acquiring Fund, and more information about expenses.

Funds Management has contractually agreed to maintain the shown pro forma Net Annual Fund Operating Expense Ratio for each of the Acquiring Funds through their next annual registration update occurring after January 31, 2009. These contractual net expense ratios for the Acquiring Funds renew automatically upon expiration of the contractual commitment period, and can only be increased upon approval by the Funds’ Board.

For further discussion regarding the Board of Trustees consideration of the total and net operating expense ratios of the Funds in approving the Reorganization, see the section entitled “Board Consideration of the Reorganization” in this Prospectus/Proxy Statement.

7

Comparison of Investment Objectives, Principal Investments and Principal Investment Strategies

Each Target Fund and its corresponding Acquiring Fund pursue similar investment objectives and hold substantially similar securities, except for the limited differences noted below. As a result, the Reorganization is not expected to cause significant portfolio turnover or transaction expenses from the sale of Target Fund portfolio securities that are incompatible with the investment objective of the Acquiring Fund.

All of the Target Funds and the Acquiring Funds have investment objectives that are classified as non-fundamental, which means that the Board can change them without shareholder approval. Also, the Target Funds and Acquiring Funds have substantially identical “fundamental” investment policies that can only be changed with shareholder approval, except that the National Limited-Term Tax-Free Fund and the National Tax-Free Fund each have a fundamental investment policy to invest at least 80% of their net assets plus investment borrowings, under normal circumstances, in investments the income from which is exempt from federal income tax (including federal alternative minimum tax). In comparison, their two Acquiring Funds, the Short-Term Municipal Bond Fund and the Municipal Bond Fund, respectively, each have a fundamental investment policy to invest at least 80% of their net assets plus investment borrowings, under normal circumstances, in investments the income from which is exempt from federal income tax, but not necessarily the federal alternative minimum tax. In addition, the Asset Allocation Fund has a fundamental investment policy reserving the Fund’s right to concentrate in any industry in which the S&P 500 Index becomes concentrated to the same degree during the same period, and reserving the right to concentrate in obligations of domestic banks (to the extent permitted by the SEC or its staff and as such term is interpreted by the SEC or its staff, whereby the Balanced Fund does not have similar policies). Thus, the Reorganization will not result in a change in the Target Funds’ shareholders’ right to vote to approve changes to the investment objectives or fundamental investment policies of the Fund(s) in which they own shares, except as described above.

Unlike other Acquiring Funds involved in the Reorganization, the C&B Large Cap Value Fund is a gateway feeder fund that does not invest directly in portfolio securities. Rather, the Fund invests in a corresponding portfolio of Wells Fargo Master Trust that has the same investment objective and strategies as the Fund. The C&B Large Cap Value Fund may invest in additional master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. References to the investment activities of the C&B Large Cap Value Fund are intended to refer to the investment activities of the master portfolio in which it invests.

The following charts compare the investment objectives, principal investments and principal investment strategies, of each Target Fund and its corresponding Acquiring Fund, and describe the key differences between the Funds. The charts are presented in summary form and, therefore, do not contain all of the information that you should consider before voting on the Reorganization. A more detailed comparison of the Funds’ investment objectives, principal investments and principal investment strategies, as well as the identity of each Fund’s investment sub-adviser and portfolio managers can be found at Exhibit B. You also can find additional information about a specific Fund’s investment objective, principal investments and principal investment strategies in its SAI, which is incorporated by reference herein. For more complete information, please read this entire document.

8

| | | | |

| | | BALANCED (TARGET FUND) | | ASSET ALLOCATION (ACQUIRING FUND) |

| Investment Objective | | Seeks total return, consisting of capital appreciation and current income. | | Seeks long-term total return, consisting of capital appreciation and current income. |

| | |

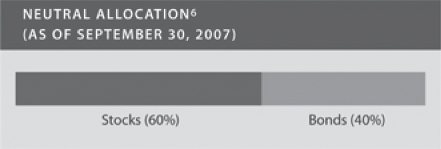

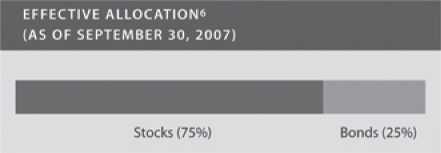

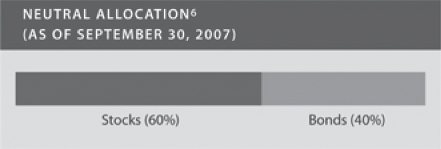

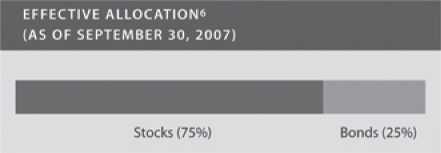

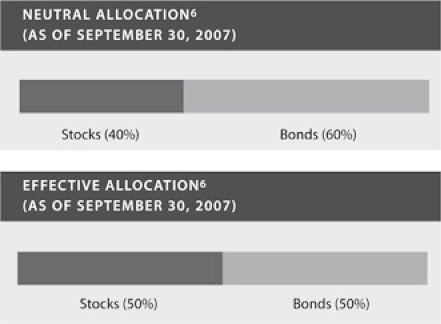

| Principal Investments | | The Fund’s target asset allocations are as follows: - 60% of its total assets in equity securities; - 40% of its total assets in fixed income securities; and - up to 10% of its total assets in below investment-grade fixed income securities. | | The Fund’s “neutral” target allocation is as follows: - 60% of its total assets in equity securities; and - 40% of its total assets in fixed income securities. |

| | |

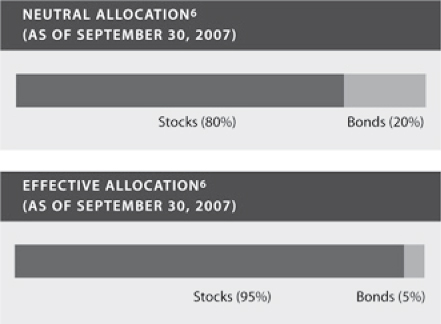

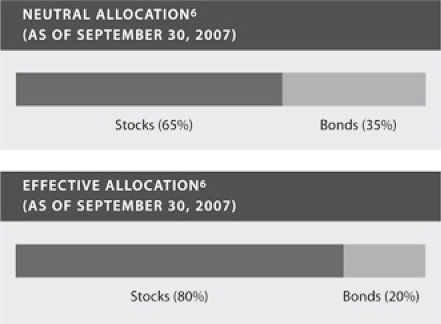

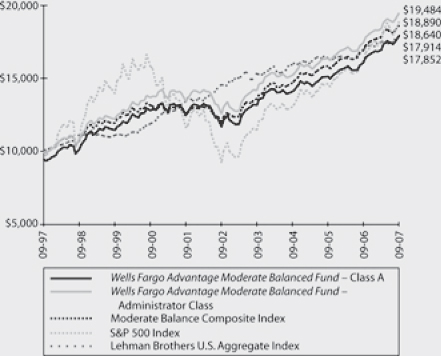

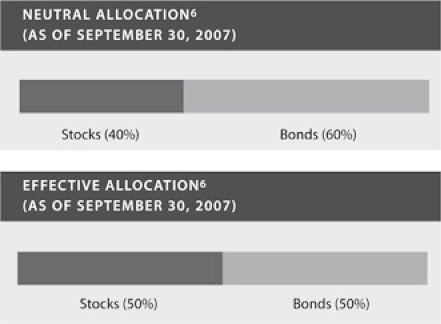

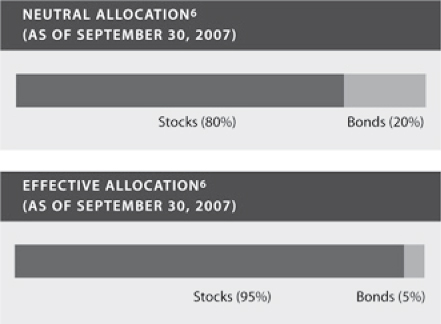

| Principal Investment Strategies | | The Fund invests in both equity and fixed income securities. The equity portion of the Fund’s portfolio consists primarily of securities, including common and preferred stocks and convertible securities, of large-capitalization, dividend-paying, U.S. companies that offer the potential for capital growth, and attempt to balance an investment’s prospects for growth and income with its potential risks. The fixed income portion of the Fund’s portfolio consists primarily of investment-grade bonds of intermediate duration, including U.S. Government obligations, corporate securities and mortgage-backed securities. | | The Fund invests in equity and fixed income securities with an emphasis on equity securities. The Fund does not select individual securities for investment, rather it buys substantially all of the securities of various indexes to replicate such indexes. The Fund invests the equity portion of its assets in common stock to replicate the S&P 500 Index, and invests the fixed income portion of its assets in U.S. Treasury Bonds to replicate the Lehman Brothers 20+ Treasury Index. The Fund seeks to maintain a 95% or better performance correlation with the respective indexes, before fees and expenses, regardless of market conditions. |

| |

| Comparison Summary | | • Both Funds have similar investment objectives, principal investments and strategies, except that: - While each Fund invests 60% of its total assets in equity securities, the equity portion of the Target Fund invests in securities of dividend-paying, large-capitalization companies with an emphasis on value, whereas the equity portion of the Acquiring Fund invests in common stocks to replicate the S&P 500 Index and utilizes an asset allocation model that may recommend a change in the target allocation of the equity portion of the portfolio ranging between 35 and 85 percent of the Fund’s total assets. - While each Fund also invests 40% of its assets in fixed income securities, the fixed income portion of the Target Fund may include investing up to 10% of its total assets in below investment-grade fixed income securities, whereas the fixed income portion of the Acquiring Fund seeks to replicate the Lehman Brothers 20+ Treasury Index by investing in U.S. Treasury Bonds with remaining maturities of 20 years or more, and utilizes an asset allocation model that may recommend a change in the target allocation of the fixed income portion of the portfolio ranging between 15 and 65 percent of the Fund’s total assets. |

9

| | | | |

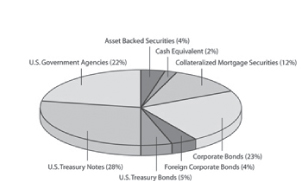

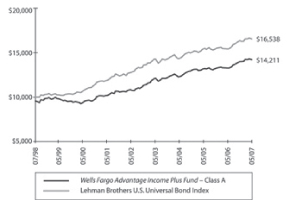

| | | CORPORATE BOND (TARGET FUND) | | INCOME PLUS (ACQUIRINGFUND) |

| Investment Objective | | Seeks current income while maintaining prospects for capital appreciation. | | Seeks to maximize income while maintaining prospects for capital appreciation. |

| | |

| Principal Investments | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in corporate debt securities; - up to 35% of its total assets in U.S. dollar-denominated debt securities of foreign issuers; and - up to 25% of its total assets in below investment-grade debt securities. | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in income-producing securities; - up to 35% of its total assets in debt securities that are below investment-grade; and - up to 25% of its total assets in debt securities of foreign issuers. |

| | |

| Principal Investment Strategies | | The Fund invests principally in corporate debt securities. The Fund may invest in investment-grade and below investment-grade debt securities (often called “high-yield” securities or “junk bonds”), as well as in debt securities of both domestic and foreign issuers. As part of the Fund’s below investment-grade debt securities investment strategy, the Fund will generally invest in securities that are rated BB through C by Standard & Poor’s, or an equivalent quality rating from another Nationally Recognized Statistical Ratings Organization, or are deemed by the Fund to be of comparable quality. The Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. Additionally, the Fund may invest in stripped securities. The Fund may also actively trade portfolio securities. | | The Fund invests principally in debt securities, including corporate, mortgage- and asset-backed securities, bank loans and U.S. Government obligations. These securities may have fixed, floating or variable rates and may include debt securities of both domestic and foreign issuers. The Fund invests in both investment-grade and below investment-grade debt securities. Below investment-grade debt securities (often called “high yield” securities or “junk bonds”) offer the potential for higher returns, as they generally carry a higher yield to compensate for the higher risk associated with their investment. As part of the Fund’s below investment-grade debt securities investment strategy, the Fund will generally invest in securities that are rated at least Caa by Moody’s or CCC by Standard & Poor’s, or an equivalent quality rating from another Nationally Recognized Statistical Ratings Organization, or are deemed by the Fund to be of comparable quality. The Fund expects to maintain an average credit quality for this portion of its portfolio equivalent to B or higher. The Fund may also use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. The Fund may actively trade portfolio securities. |

| |

| Comparison Summary | | • The Target Fund invests at least 80% of its net assets in corporate debt securities, whereas the Acquiring Fund invests at least 80% of its net assets in income-producing securities, including corporate, mortgage- and asset-backed securities, bank loans and U.S. Government obligations. • In other respects, both Funds have similar investment objectives, principal investments and strategies, except that: - The Target Fund invests up to 35% of its total assets in U.S. dollar-denominated debt securities of foreign issuers, whereas the Acquiring Fund invests up to 25% of its total assets in debt securities of foreign issuers that do not need to be U.S. dollar-denominated. - The Target Fund invests up to 25% of its total assets in below investment-grade debt securities, whereas the Acquiring Fund may invest a higher percentage, up to 35% of its total assets, in below investment-grade debt securities. In addition, the Target Fund will generally invest in securities that are rated BB through C by Standard & Poor’s, whereas the Acquiring Fund will generally invest in securities rated at least CCC by S&P. - The Target Fund may invest in stripped securities. |

10

| | | | |

| | | HIGH YIELD BOND (TARGET FUND) | | HIGH INCOME (ACQUIRINGFUND) |

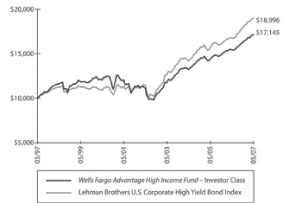

| Investment Objective | | Seeks total return, consisting of a high level of current income and capital appreciation. | | Seeks total return, consisting of a high level of current income and capital appreciation. |

| | |

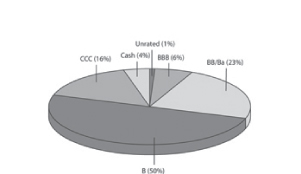

| Principal Investments | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in corporate debt securities that are below investment-grade; and - up to 20% of its net assets in preferred and convertible securities. | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in corporate debt securities that are below investment-grade; - up to 30% of its total assets in U.S. dollar-denominated debt securities of foreign issuers; - up to 20% of its total assets in equities and convertible debt securities; and - up to 10% of its total assets in debt securities that are in default at the time of purchase. |

| | |

| Principal Investment Strategies | | The Fund invests principally in below investment-grade debt securities (often called “high yield” securities or “junk bonds”) of corporate issuers. These include traditional corporate bonds as well as bank loans. These securities may have fixed, floating or variable rates. The Fund will generally invest in below investment-grade debt securities that are rated at least Caa by Moody’s or CCC by Standard & Poor’s, or an equivalent quality rating from another Nationally Recognized Statistical Ratings Organization, or are deemed by the Fund to be of comparable quality. The average credit quality of the Fund’s portfolio is expected to be equivalent to B or higher. The Fund may also use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. The Fund’s portfolio is not managed to a specific maturity or duration. | | The Fund invests principally in below investment-grade debt securities (often called “high-yield” securities or “junk bonds”) of corporate issuers. These include traditional corporate bonds as well as bank loans. These securities may have fixed, floating or variable rates. As part of the Fund’s below investment-grade debt securities investment strategy, the Fund will generally invest in securities that are rated BB through CCC by S&P, or an equivalent quality rating from another Nationally Recognized Statistical Ratings Organization, or are deemed by the Fund to be of comparable quality. The Fund may also use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. Additionally, the Fund may invest in stripped securities. |

| |

| Comparison Summary | | • Both Funds have the same investment objective. • While both Funds invest 80% of their net assets in corporate debt securities that are below investment-grade, the Target Fund expects its portfolio’s average credit quality to be equivalent to B or higher. • The Target Fund invests up to 20% of its net assets in preferred and convertible securities, whereas the Acquiring Fund invests up to 20% of its total assets in equities and convertible debt securities. • The Acquiring Fund also invests up to 10% of its total assets in debt securities that are in default at the time of purchase, and up to 30% of its total assets in U.S. dollar-denominated debt securities of foreign issuers, whereas the Target Fund does not have a principal investment strategy of investing in such securities. • The Acquiring Fund may also invest in stripped securities. |

11

| | | | |

| | | INTERMEDIATE GOVERNMENT INCOME

(TARGET FUND) | | GOVERNMENT SECURITIES (ACQUIRINGFUND) |

| Investment Objective | | Seeks to provide current income consistent with safety of principal. | | Seeks current income. |

| | |

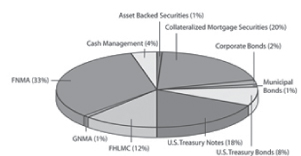

| Principal Investments | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in U.S. Government obligations, including repurchase agreements collateralized by U.S. Government obligations; and - up to 20% of its net assets in non-government mortgage- and asset-backed securities. | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in U.S. Government obligations and repurchase agreements collateralized by U.S. Government obligations; and - up to 20% of its net assets in non-government investment-grade debt securities. |

| | |

| Principal Investment Strategies | | The Fund invests principally in fixed and variable rate U.S. Government obligations, including debt securities issued or guaranteed by the U.S. Treasury, U.S. Government agencies or government-sponsored entities. The Fund will purchase only securities that are rated, at the time of purchase, within the two highest rating categories assigned by a Nationally Recognized Statistical Ratings Organization, or are deemed by the Fund to be of comparable quality. As part of the Fund’s investment strategy, the Fund may invest in stripped securities or enter into mortgage dollar rolls or reverse repurchase agreements. The Fund may also use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. Under normal circumstances, the Fund expects its dollar-weighted average effective duration will be within the range of 3- and 5-year U.S. Treasury notes. As a result, the dollar-weighted average effective maturity of the Fund generally ranges from 3 to 10 years. The Fund may actively trade portfolio securities. | | The Fund invests principally in U.S. Government obligations, including debt securities issued or guaranteed by the U.S. Treasury, U.S. Government agencies or government-sponsored entities. These securities may have fixed, floating or variable rates and also include mortgage-backed securities. As part of the Fund’s mortgage-backed securities investment strategy, the Fund may enter into dollar rolls or invest in stripped securities. The Fund may also use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. The Fund may actively trade portfolio securities. |

| |

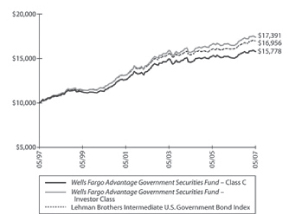

| Comparison Summary | | • Both Funds have substantially similar investment objectives, principal investments and strategies, except that: - the Target Fund purchases only securities rated within the two highest rating categories (or of comparable quality), whereas, the Acquiring Fund does not have a similar policy; and - the Target Fund expects its portfolio’s dollar-weighted average effective duration to be within the range of 3- and 5-year U.S. Treasury notes and its portfolio’s dollar-weighted average effective maturity to be within the range of 3- and 10-years, whereas the Acquiring Fund does not have similar policies. |

12

| | | | |

| | | NATIONAL LIMITED-TERM TAX-FREE (TARGET FUND) | | SHORT-TERM MUNICIPAL BOND (ACQUIRINGFUND) |

| Investment Objective | | Seeks current income exempt from federal income taxes, consistent with capital preservation. | | Seeks current income exempt from federal income tax consistent with capital preservation. |

| | |

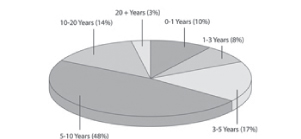

| Principal Investments | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in municipal securities that pay interest exempt from federal income tax, including federal AMT; - up to 20% of its net assets in securities that pay interest subject to federal income tax, including federal AMT; and - up to 10% of its total assets in below investment-grade municipal securities. | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in municipal securities that pay interest exempt from federal income tax, but not necessarily the federal AMT; - up to 20% of its net assets in securities that pay interest subject to federal AMT; and - up to 15% of its total assets in below investment-grade municipal securities. |

| | |

| Principal Investment Strategies | | The Fund invests principally in municipal securities of states, territories and possessions of the United States that pay interest exempt from federal income tax, including federal alternative minimum tax. Some of the securities may be below investment grade or may be unrated and deemed by the Fund to be of comparable quality. The Fund may also invest a portion of its net assets in securities that pay interest subject to federal AMT. The Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. Under normal circumstances, the Fund expects its dollar-weighted average effective maturity will be between 1 and 5 years. | | The Fund invests principally in short-term municipal securities of states, territories and possessions of the United States that pay interest exempt from federal income tax, but not necessarily the federal alternative minimum tax. Some of the securities may be below investment grade or may be unrated and deemed by the Fund to be of comparable quality. The Fund may also invest a portion of its total assets in securities that pay interest subject to federal AMT. The Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. Under normal circumstances, the Fund expects its dollar-weighted average effective maturity will be 3 years or less. The Fund may actively trade portfolio securities. |

| |

| Comparison Summary | | • Both Funds have substantially similar investment objectives, principal investments and strategies, except that: - The Target Fund invests at least 80% of its net assets in municipal securities that pay interest exempt from federal income tax, including federal AMT, whereas the Acquiring Fund invests at least 80% of its net assets in municipal securities that pay interest exempt from federal income tax, but not necessarily the federal AMT, although the Acquiring Fund does have an additional policy limiting its investments in securities that pay interest subject to federal AMT to 20% of its net assets. - While both Funds may invest in below investment-grade municipal securities, the Target Fund may invest up to 10% of its total assets in such securities, whereas the Acquiring Fund may invest up to 15% of its total assets in such securities. - The Target Fund expects its dollar-weighted average effective maturity to be between 1 and 5 years, whereas the Acquiring Fund expects its dollar-weighted average effective maturity to be 3 years or less. |

13

| | | | |

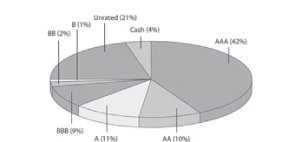

| | | NATIONAL TAX-FREE (TARGET FUND) | | MUNICIPAL BOND (ACQUIRINGFUND) |

| Investment Objective | | Seeks current income exempt from federal income tax. | | Seeks current income exempt from federal income tax. |

| | |

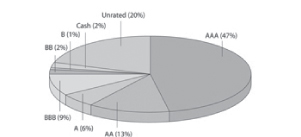

| Principal Investments | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in municipal securities that pay interest exempt from federal income tax, including federal AMT; - up to 20% of its net assets in securities that pay interest subject to federal income tax, including federal AMT; and - up to 10% of its total assets in below investment-grade municipal securities. | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in municipal securities that pay interest exempt from federal income tax, but not necessarily the federal AMT; - up to 20% of its net assets in securities that pay interest subject to federal AMT; and - up to 20% of its total assets in below investment-grade municipal securities. |

| | |

| Principal Investment Strategies | | The Fund invests principally in municipal securities of states, territories and possessions of the United States that pay interest exempt from federal income tax, including federal alternative minimum tax. Some of the securities may be below investment grade or may be unrated and deemed by the Fund to be of comparable quality. The Fund may also invest a portion of its net assets in securities that pay interest subject to federal AMT. The Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. Under normal circumstances, the Fund expects its dollar-weighted average effective maturity will be greater than 5 years and less than 20 years. | | The Fund invests principally in municipal securities of states, territories and possessions of the United States that pay interest exempt from federal income tax, but not necessarily federal alternative minimum tax. Some of the securities may be below investment grade or may be unrated and deemed by us to be of comparable quality. The Fund may also invest a portion of the Fund’s total assets in securities that pay interest subject to federal AMT. The Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. Under normal circumstances, the Fund expects its dollar-weighted average effective maturity will be greater than 5 years and less than 20 years. |

| |

| Comparison Summary | | • Both Funds have substantially similar investment objectives, principal investments and strategies, except that: - The Target Fund invests at least 80% of its net assets in municipal securities that pay interest exempt from federal income tax, including federal AMT, whereas the Acquiring Fund invests at least 80% of its net assets in municipal securities that pay interest exempt from federal income tax, but not necessarily the federal AMT, although the Acquiring Fund does have an additional policy limiting its investments in securities that pay interest subject to federal AMT to 20% of its net assets. - While both Funds invest in below investment-grade municipal securities, the Target Fund invests up to 10% of its total assets in such securities, whereas the Acquiring Fund invests up to 20% of its total assets in such securities. |

14

| | | | |

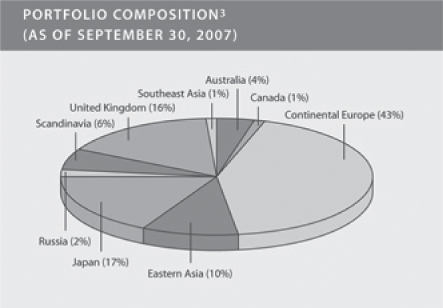

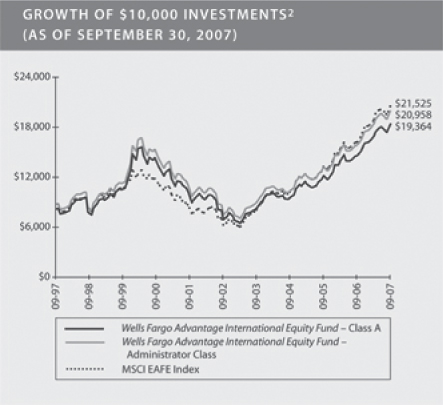

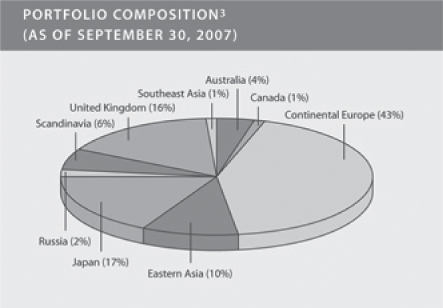

| | | OVERSEAS (TARGET FUND) | | INTERNATIONAL EQUITY (ACQUIRINGFUND) |

| Investment Objective | | Seeks long-term capital appreciation. | | Seeks long-term capital appreciation. |

| | |

| Principal Investments | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in equity securities of foreign issuers; and - up to 20% of its total assets in emerging market equity securities. | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in equity securities of foreign issuers; and - up to 20% of its total assets in emerging market equity securities. |

| | |

| Principal Investment Strategies | | The Fund invests principally in equity securities of foreign issuers. The Fund invests primarily in developed countries, but may invest in emerging markets. Furthermore, the Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. The Fund invests in companies with strong growth potential that offer good value relative to similar investments. The Fund reserves the right to hedge its foreign currency exposure by purchasing or selling currency futures and foreign currency forward contracts. However, under normal circumstances, the Fund will not engage in extensive foreign currency hedging. | | The Fund invests principally in the equity securities of foreign issuers through the use of three different styles of international equity management: an international growth style, sub-advised by Artisan Partners Limited Partnership; an international value style, sub-advised by LSV Asset Management; and an international blend style, sub-advised by New Star Institutional Managers Limited. The Fund invests primarily in developed countries, but may invest in emerging markets. Furthermore, the Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. The Fund reserves the right to hedge its foreign currency exposure by purchasing or selling currency futures and foreign currency forward contracts. However, under normal circumstances, the Fund will not engage in extensive foreign currency hedging. |

| |

| Comparison Summary | | • Both Funds have the same investment objectives and principal investments, and also have similar principal investment strategies, except that the Acquiring Fund uses a multi-style investment strategy consisting of an international growth style, an international value style, and an international blend style. |

15

| | | | |

| | | VALUE (TARGET FUND) | | C&B LARGE CAP VALUE (ACQUIRINGFUND) |

| Investment Objective | | Seeks maximum long-term, after-tax total return, consistent with minimizing risk to principal. | | Seeks maximum long-term total return (current income and capital appreciation), consistent with minimizing risk to principal. |

| | |

| Principal Investments | | Under normal circumstances, the Fund invests: - at least 80% of its total assets in equity securities of large-capitalization companies. | | Under normal circumstances, the Fund invests: - at least 80% of its net assets in equity securities of large-capitalization companies. |

| | |

| Principal Investment Strategies | | The Fund invests principally in equity securities of large-capitalization companies, which the Fund defines as companies with market capitalizations of $3 billion or more. The Fund attempts to minimize adverse federal income tax consequences for the Fund’s shareholders by managing the amount of realized gains, through reduced portfolio turnover. The Fund cannot predict the impact of this strategy on the realization of gains or losses but intends to balance these tax considerations with the pursuit of its objective. The Fund manages a relatively focused portfolio of 30 to 50 companies that enables it to provide adequate diversification, while allowing the composition and performance of its portfolio to behave differently than the market. Furthermore, the Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. | | The Fund is a gateway fund that invests substantially all of its assets in the C&B Large Cap Value Portfolio, a master portfolio with a substantially identical investment objective and substantially similar investment strategies. The Fund may invest in additional master portfolios, in other Wells Fargo Advantage Funds, or directly in a portfolio of securities. The Fund invests principally in equity securities of large-capitalization companies, which it defines as companies with market capitalizations of $3 billion or more. The Fund manages a relatively focused portfolio of 30 to 50 companies that enables it to provide adequate diversification while allowing the composition and performance of its portfolio to behave differently than the market. Furthermore, the Fund may use futures, options or swap agreements, as well as other derivatives, to manage risk or to enhance return. |

| |

| Comparison Summary | | • Both Funds have substantially similar investment objectives, principal investments and strategies, except that the Target Fund seeks to minimize adverse federal income tax consequences through reduced portfolio turnover. • The Acquiring Fund is a gateway fund that invests substantially all of its assets in a master portfolio, whereas the Target Fund is a stand-alone fund that invests directly in a portfolio of securities. |

16

Common and Specific Risk Considerations

Because of the similarities in investment objectives and policies, the Target Funds and the Acquiring Funds, for the most part, are subject to substantially similar investment risks. The following discussion describes the principal risks that may affect the Funds’ portfolios as a whole. The discussion that follows after that compares the principal risks associated with each Target Fund and its corresponding Acquiring Fund (in bold print). Additional information regarding which of the principal risks described below are applicable to each Fund may be found in Exhibit C, as well as in the prospectus for each Target Fund. Each Fund invests directly in a portfolio of securities, except for the C&B Large Cap Value Fund which invests substantially all of its assets in a master portfolio. An investment in a Fund is not a bank deposit, and it is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

Active Trading Risk Frequent trading will result in a higher-than-average portfolio turnover ratio and increased trading expenses, and may generate higher short-term capital gains.

Counter-Party Risk When a Fund enters into a repurchase agreement, an agreement where it buys a security in which the seller agrees to repurchase the security at an agreed upon price and time, the Fund is exposed to the risk that the other party will not fulfill its contract obligation. Similarly, the Fund is exposed to the same risk if it engages in a reverse repurchase agreement where a broker-dealer agrees to buy securities and the Fund agrees to repurchase them at a later date.

Currency Hedging Risk An investment transacted in a foreign currency may lose value due to fluctuations in the rate of exchange. To manage currency exposure, a Fund may purchase currency futures or enter into forward currency contracts to “lock in” the U.S. dollar price of the security. A forward currency contract involves an agreement to purchase or sell a specified currency at a specified future price set at the time of the contract. Similar to a forward currency contract, currency futures contracts are standardized for the convenience of market participants and quoted on an exchange. To reduce the risk of one party to the contract defaulting, the accrued profit or loss from a futures contract is calculated and paid on a daily basis rather than on the maturity of the contract.

Debt Securities Risk Debt securities, such as notes and bonds, are subject to credit risk and interest rate risk. Credit risk is the possibility that an issuer of an instrument will be unable to make interest payments or repay principal when due. Changes in the financial strength of an issuer or changes in the credit rating of a security may affect its value. Interest rate risk is the risk that interest rates may increase, which tends to reduce the resale value of certain debt securities, including U.S. Government obligations. Debt securities with longer maturities are generally more sensitive to interest rate changes than those with shorter maturities. Changes in market interest rates do not affect the rate payable on an existing debt security, unless the instrument has adjustable or variable rate features, which can reduce its exposure to interest rate risk. Changes in market interest rates may also extend or shorten the duration of certain types of instruments, such as asset-backed securities, thereby affecting their value and the return on your investment.

Derivatives Risk The term “derivatives” covers a broad range of investments, including futures, options and swap agreements. In general, a derivative refers to any financial instrument whose value is derived, at least in part, from the price of another security or a specified index, asset or rate. For example, a swap agreement is a commitment to make or receive payments based on agreed upon terms, and whose value and payments are derived by changes in the value of an underlying financial instrument. The use of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. The use of derivatives can lead to losses because of adverse movements in the price or value of the underlying asset, index or rate, which may be magnified by certain features of the derivatives. These risks are heightened when the portfolio manager uses derivatives to enhance a Fund’s return or as a substitute for a position or security, rather than solely to hedge (or offset) the risk of a position or security held by the Fund. The success of management’s derivatives strategies will depend on its ability to assess and predict the impact of market or economic

17

developments on the underlying asset, index or rate and the derivative itself, without the benefit of observing the performance of the derivative under all possible market conditions.

Emerging Markets Risk Emerging markets securities typically present even greater exposure to the risks described under “Foreign Investment Risk” and may be particularly sensitive to certain economic changes. For example, emerging market countries are more often dependent on international trade and are therefore often vulnerable to recessions in other countries. Emerging markets may be under-capitalized and have less developed legal and financial systems than markets in the developed world. Additionally, emerging markets may have volatile currencies and may be more sensitive than more mature markets to a variety of economic factors. Emerging market securities also may be less liquid than securities of more developed countries and could be difficult to sell, particularly during a market downturn.

Foreign Investment Risk Foreign investments, including American Depositary Receipts (ADRs) and similar investments, are subject to more risks than U.S. domestic investments. These additional risks may potentially include lower liquidity, greater price volatility and risks related to adverse political, regulatory, market or economic developments. Foreign companies also may be subject to significantly higher levels of taxation than U.S. companies, including potentially confiscatory levels of taxation, thereby reducing the earnings potential of such foreign companies. In addition, amounts realized on sales or distributions of foreign securities may be subject to high and potentially confiscatory levels of foreign taxation and withholding when compared to comparable transactions in U.S. securities. Investments in foreign securities involve exposure to fluctuations in foreign currency exchange rates. Such fluctuations may reduce the value of the investment. Foreign investments are also subject to risks including potentially higher withholding and other taxes, trade settlement, custodial, and other operational risks and less stringent investor protection and disclosure standards in certain foreign markets. In addition, foreign markets can and often do perform differently from U.S. markets.

Growth Style Investment Risk Growth stocks can perform differently from the market as a whole and from other types of stocks. Growth stocks may be designated as such and purchased based on the premise that the market will eventually reward a given company’s long-term earnings growth with a higher stock price when that company’s earnings grow faster than both inflation and the economy in general. Thus a growth style investment strategy attempts to identify companies whose earnings may or are growing at a rate faster than inflation and the economy. While growth stocks may react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks by rising in price in certain environments, growth stocks also tend to be sensitive to changes in the earnings of their underlying companies and more volatile than other types of stocks, particularly over the short term. Furthermore, growth stocks may be more expensive relative to their current earnings or assets compared to the values of other stocks, and if earnings growth expectations moderate, their valuations may return to more typical norms, causing their stock prices to fall. Finally, during periods of adverse economic and market conditions, the stock prices of growth stocks may fall despite favorable earnings trends.

High Yield Securities Risk High yield securities (sometimes referred to as “junk bonds”) are debt securities that are rated below investment-grade, are unrated and deemed by us to be below investment-grade, or are in default at the time of purchase. These securities have a much greater risk of default (or in the case of bonds currently in default, of not returning principal) and may be more volatile than higher-rated securities of similar maturity. The value of these securities can be affected by overall economic conditions, interest rates, and the creditworthiness of the individual issuers. Additionally, these securities may be less liquid and more difficult to value than higher-rated securities.

Index Tracking Risk The ability to track an index may be affected by, among other things, transaction costs and shareholder purchases and redemptions.

Issuer Risk The value of a security may decline for a number of reasons, which directly relate to the issuer, such as management performance, financial leverage, and reduced demand for the issuer’s goods and services.

18

Leverage Risk Certain transactions may give rise to a form of leverage. Such transactions may include, among others, reverse repurchase agreements, loans of portfolios securities, and the use of when-issued, delayed delivery or forward commitment transactions. The use of derivatives may also create a leveraging risk. The use of leverage may cause a Fund to liquidate portfolio positions when it may not be advantageous to do so. Leveraging, including borrowing, may cause a Fund to be more volatile than if the Fund had not been leveraged. This is because leverage tends to increase a Fund’s exposure to market risk, interest rate risk or other risks by, in effect, increasing assets available for investment.

Liquidity Risk A security may not be sold at the time desired or without adversely affecting the price.

Management Risk We cannot guarantee that a Fund will meet its investment objective. We do not guarantee the performance of a Fund, nor can we assure you that the market value of your investment will not decline. We will not “make good” on any investment loss you may suffer, nor can anyone we contract with to provide services, such as selling agents or investment advisers, offer or promise to make good on any such losses.

Market Risk The market price of securities owned by a Fund may go up or down, sometimes rapidly or unpredictably. Securities may decline in value due to factors affecting securities markets generally or particular industries represented in the securities markets. The value of a security may decline due to general market conditions which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. They may also decline due to factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. During a general downturn in the securities markets, multiple asset classes may decline in value simultaneously. Equity securities generally have greater price volatility than debt securities.

Mortgage- and Asset-Backed Securities Risk Mortgage- and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables held in trust. In addition, mortgage dollar rolls are transactions in which a Fund sells mortgage-backed securities to a dealer and simultaneously agrees to purchase similar securities in the future at a predetermined price. Mortgage- and asset-backed securities, including mortgage dollar roll transactions, are subject to certain additional risks. Rising interest rates tend to extend the duration of these securities, making them more sensitive to changes in interest rates. As a result, in a period of rising interest rates, these securities may exhibit additional volatility. This is known as extension risk. In addition, these securities are subject to prepayment risk. When interest rates decline, borrowers may pay off their debts sooner than expected. This can reduce the returns of a Fund because the Fund will have to reinvest that money at the lower prevailing interest rates. This is known as contraction risk. These securities also are subject to risk of default on the underlying mortgage or assets, particularly during periods of economic downturn.

Multi-Style Management Risk Because certain portions of a Fund’s assets are managed by different portfolio managers using different styles, a Fund could experience overlapping security transactions. Certain portfolio managers may be purchasing securities at the same time other portfolio managers may be selling those same securities. This may lead to higher transaction expenses and may generate higher short-term capital gains compared to a Fund using a single investment management style.

Municipal Securities Risk Municipal securities rely on the creditworthiness or revenue production of their issuers or auxiliary credit enhancement features. Municipal securities may be difficult to obtain because of limited supply, which may increase the cost of such securities and effectively reduce a portfolio’s yield. Typically, less information is available about a municipal issuer than is available for other types of securities issuers. Certain Funds may invest 25% or more of their total assets in municipal securities that are related in such a way that political, economic or business developments affecting one obligation would affect the others. For example, a Fund may own different obligations that pay interest based on the revenue of similar projects. Although a Fund strives to invest in municipal securities and other securities with interest that is exempt from

19