UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: January 31

Registrant is making a filing for 7 of its series: Allspring Government Money Market Fund, Allspring Heritage Money Market Fund, Allspring Money Market Fund, Allspring Municipal Cash Management Money Market Fund, Allspring National Tax-Free Money Market Fund, Allspring 100% Treasury Money Market Fund and Allspring Treasury Plus Money Market Fund

Date of reporting period: July 31, 2023

ITEM 1. REPORT TO STOCKHOLDERS

Allspring Funds

President

Allspring Funds

Notice to Shareholders |

Beginning in July 2024, the Fund will be required by the Securities and Exchange Commission to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance information and fund statistics. If you wish to receive this new tailored shareholder report electronically, please follow the instructions on the back cover of this report. |

Other information that is currently included in the shareholder report, such as the Fund’s financial statements, will be available online and upon request, free of charge, in paper or electronic format. |

Investment objective | The Fund seeks current income, while preserving capital and liquidity. |

Manager | Allspring Funds Management, LLC |

Subadviser | Allspring Global Investments, LLC |

Portfolio managers | Michael C. Bird, CFA, Jeffrey L. Weaver, CFA, Laurie White |

Average annual total returns (%) as of July 31, 2023 | ||||||

Expense ratios1 (%) | ||||||

Inception date | 1 year | 5 year | 10 year | Gross | Net2 | |

Class A (WFGXX) | 11-8-1999 | 3.55 | 1.24 | 0.72 | 0.59 | 0.58 |

Administrator Class (WGAXX) | 7-31-2003 | 3.82 | 1.40 | 0.84 | 0.34 | 0.34 |

Institutional Class (GVIXX) | 7-28-2003 | 3.96 | 1.48 | 0.92 | 0.22 | 0.20 |

Select Class (WFFXX)3 | 6-30-2015 | 4.03 | 1.53 | 0.96 | 0.18 | 0.14 |

Service Class (NWGXX) | 11-16-1987 | 3.65 | 1.30 | 0.76 | 0.51 | 0.50 |

Sweep Class 4 | 7-31-2020 | 3.65 | 1.19 | 0.43 | 0.52 | 0.50 |

1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the Financial Highlights of this report. |

2 | The manager has contractually committed through May 31, 2024 (May 31, 2025 for Class A), to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.58% for Class A, 0.34% for Administrator Class, 0.20% for Institutional Class, 0.14% for Select Class, 0.50% for Service Class and 0.50% for Sweep Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. The manager and/or its affiliates may also voluntarily waive all or a portion of any fees to which they are entitled and/or reimburse certain expenses as they may determine from time to time. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

3 | Historical performance shown for the Select Class shares prior to their inception reflects the performance of the Institutional Class shares, and includes the higher expenses applicable to the Institutional Class shares. If these expenses had not been included, returns for the Select Class shares would be higher. |

4 | Historical performance shown for the Sweep Class shares prior to their inception reflects the performance of the Service Class shares, and includes the higher expenses applicable to the Sweep Class shares. |

Yield summary (%) as of July 31, 2023 | ||||||

Class A | Administrator Class | Institutional Class | Select Class | Service Class | Sweep Class | |

7-day current yield1 | 4.75 | 5.00 | 5.13 | 5.19 | 4.83 | 4.83 |

7-day compound yield | 4.87 | 5.13 | 5.26 | 5.33 | 4.95 | 4.95 |

30-day simple yield | 4.64 | 4.88 | 5.02 | 5.08 | 4.72 | 4.72 |

30-day compound yield | 4.74 | 5.00 | 5.13 | 5.20 | 4.82 | 4.82 |

1 | The manager has contractually committed through May 31, 2024 (May 31, 2025 for Class A), to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses and may also voluntarily waive or reimburse additional fees and expenses which may be discontinued or modified at any time without notice. Without these reductions, the Fund’s 7-day current yield would have been 4.75%, 5.00%, 5.12%, 5.16%, 4.83% and 4.82% for Class A, Administrator Class, Institutional Class, Select Class, Service Class and Sweep Class, respectively. |

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

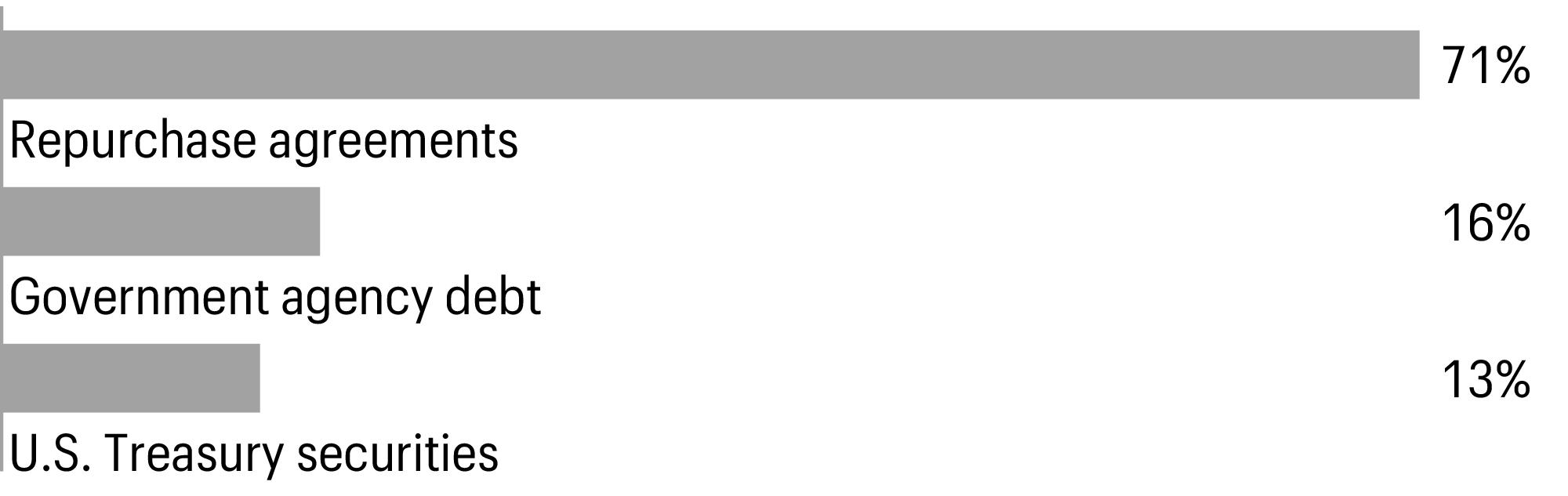

Portfolio composition as of July 31, 20231 |

1 | Figures represent the percentage of the Fund’s total investments. Allocations are subject to change and may have changed since the date specified. |

Effective maturity distribution as of July 31, 20231 |

1 | Figures represent the percentage of the Fund’s total investments. Allocations are subject to change and may have changed since the date specified. |

Weighted average maturity as of July 31, 20231 |

23 days |

1 | Weighted Average Maturity (WAM): WAM is an average of the effective maturities of all securities held in the portfolio, weighted by each security’s percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. WAM calculations allow for the maturities of certain securities with demand features or periodic interest rate resets to be shortened. WAM is a way to measure a fund’s sensitivity to potential interest rate changes. WAM is subject to change and may have changed since the date specified. |

Weighted average life as of July 31, 20231 |

68 days |

1 | Weighted Average Life (WAL): WAL is an average of the final maturities of all securities held in the portfolio, weighted by their percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. In contrast to WAM, the calculation of WAL allows for the maturities of certain securities with demand features to be shortened, but not the periodic interest rate resets. WAL is a way to measure a fund’s potential sensitivity to credit spread changes. WAL is subject to change and may have changed since the date specified. |

Beginning account value 2-1-2023 | Ending account value 7-31-2023 | Expenses paid during the period1 | Annualized net expense ratio | |

Class A | ||||

Actual | $1,000.00 | $1,021.60 | $3.01 | 0.60 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,021.82 | $3.01 | 0.60 % |

Administrator Class | ||||

Actual | $1,000.00 | $1,022.90 | $1.66 | 0.33 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,023.16 | $1.66 | 0.33 % |

Institutional Class | ||||

Actual | $1,000.00 | $1,023.60 | $1.00 | 0.20 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,023.80 | $1.00 | 0.20 % |

Select Class | ||||

Actual | $1,000.00 | $1,023.90 | $0.70 | 0.14 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,024.10 | $0.70 | 0.14 % |

Service Class | ||||

Actual | $1,000.00 | $1,022.10 | $2.51 | 0.50 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,022.32 | $2.51 | 0.50 % |

Sweep Class | ||||

Actual | $1,000.00 | $1,022.10 | $2.51 | 0.50 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,022.32 | $2.51 | 0.50 % |

1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by 181 divided by 365 (to reflect the one-half-year period). |

Interest rate | Maturity date | Principal | Value | |||

Government agency debt: 15.80% | ||||||

FFCB (U.S. SOFR+0.12%)± | 3.94 % | 12-8-2023 | $ | 100,000,000 | $100,010,759 | |

FFCB (U.S. SOFR+0.11%)± | 4.41 | 4-15-2024 | 220,000,000 | 219,991,272 | ||

FFCB (U.S. SOFR+0.11%)± | 4.41 | 1-17-2025 | 30,700,000 | 30,673,888 | ||

FFCB (U.S. SOFR+0.13%)± | 4.43 | 7-9-2024 | 160,000,000 | 159,998,665 | ||

FFCB (U.S. SOFR+0.14%)± | 4.45 | 9-5-2024 | 150,000,000 | 150,000,000 | ||

FFCB (U.S. SOFR+0.13%)± | 4.96 | 4-10-2025 | 300,000,000 | 299,951,355 | ||

FFCB (U.S. Federal Funds Effective Rate+0.15%)± | 4.98 | 2-3-2025 | 40,000,000 | 39,997,100 | ||

FFCB☼ | 5.06 | 8-25-2023 | 50,000,000 | 49,833,667 | ||

FFCB Series 0000 (U.S. SOFR+0.10%)± | 5.15 | 8-8-2024 | 75,000,000 | 75,000,834 | ||

FFCB (U.S. SOFR+0.15%)± | 5.20 | 10-8-2024 | 400,000,000 | 399,976,927 | ||

FFCB (U.S. Federal Funds Effective Rate+0.18%)± | 5.25 | 5-23-2025 | 112,500,000 | 112,490,239 | ||

FFCB (U.S. Treasury 3 Month Bill Money Market Yield -0.04%)± | 5.26 | 3-28-2024 | 100,000,000 | 100,000,000 | ||

FFCB (U.S. Federal Funds Effective Rate+0.18%)± | 5.26 | 6-2-2025 | 185,000,000 | 184,946,825 | ||

FFCB (U.S. SOFR+0.04%)± | 5.34 | 9-20-2023 | 75,000,000 | 75,000,000 | ||

FFCB (U.S. SOFR+0.04%)± | 5.34 | 12-15-2023 | 250,000,000 | 249,990,588 | ||

FFCB (U.S. SOFR+0.05%)± | 5.35 | 8-22-2023 | 110,000,000 | 110,001,118 | ||

FFCB (U.S. SOFR+0.05%)± | 5.35 | 9-29-2023 | 65,000,000 | 65,000,000 | ||

FFCB (U.S. SOFR+0.05%)± | 5.35 | 11-9-2023 | 50,000,000 | 50,000,000 | ||

FFCB (U.S. Treasury 3 Month Bill Money Market Yield -0.02%)± | 5.35 | 1-29-2024 | 50,000,000 | 50,007,495 | ||

FFCB (U.S. SOFR+0.05%)± | 5.35 | 4-12-2024 | 170,000,000 | 170,000,000 | ||

FFCB☼ | 5.36 | 1-5-2024 | 25,000,000 | 24,423,243 | ||

FFCB (U.S. SOFR+0.06%)± | 5.36 | 5-13-2024 | 98,250,000 | 98,253,880 | ||

FFCB (U.S. SOFR+0.04%)± | 5.41 | 2-2-2024 | 130,000,000 | 130,000,000 | ||

FFCB (U.S. SOFR+0.04%)± | 5.41 | 2-5-2024 | 120,000,000 | 120,000,000 | ||

FFCB (U.S. SOFR+0.04%)± | 5.41 | 2-9-2024 | 125,000,000 | 125,000,000 | ||

FFCB (U.S. SOFR+0.04%)± | 5.41 | 3-4-2024 | 90,000,000 | 90,000,000 | ||

FFCB (U.S. SOFR+0.05%)± | 5.42 | 10-16-2023 | 90,000,000 | 90,000,000 | ||

FFCB Series 0000 (U.S. SOFR+0.05%)± | 5.42 | 2-15-2024 | 190,000,000 | 190,000,000 | ||

FFCB (U.S. SOFR+0.05%)± | 5.42 | 2-20-2024 | 90,000,000 | 90,000,000 | ||

FFCB (U.S. SOFR+0.05%)± | 5.42 | 3-1-2024 | 115,000,000 | 115,000,000 | ||

FFCB Series 0001 (U.S. SOFR+0.05%)± | 5.42 | 3-11-2024 | 95,000,000 | 95,000,000 | ||

FFCB (U.S. SOFR+0.05%)± | 5.42 | 4-4-2024 | 245,000,000 | 245,000,000 | ||

FFCB (U.S. SOFR+0.05%)± | 5.42 | 4-26-2024 | 110,000,000 | 110,000,000 | ||

FFCB (U.S. SOFR+0.05%)± | 5.42 | 5-9-2024 | 130,000,000 | 130,000,000 | ||

FFCB (U.S. SOFR+0.16%)± | 5.46 | 7-21-2025 | 72,000,000 | 72,000,000 | ||

FFCB (U.S. SOFR+0.16%)±%% | 5.46 | 8-4-2025 | 105,000,000 | 105,000,000 | ||

FFCB (U.S. SOFR+0.17%)± | 5.47 | 1-23-2025 | 70,000,000 | 70,000,000 | ||

FFCB (U.S. SOFR+0.17%)± | 5.47 | 6-2-2025 | 200,000,000 | 200,000,000 | ||

FFCB (U.S. SOFR+0.19%)± | 5.49 | 6-20-2025 | 100,000,000 | 100,000,000 | ||

FFCB (U.S. Federal Funds Effective Rate+0.13%)± | 5.54 | 3-12-2025 | 350,000,000 | 349,978,825 | ||

FFCB (U.S. SOFR+0.16%)± | 5.54 | 4-10-2025 | 60,000,000 | 60,000,000 | ||

FFCB (U.S. SOFR+0.16%)± | 5.54 | 5-15-2025 | 122,500,000 | 122,498,608 | ||

FFCB Series 1 (U.S. SOFR+0.17%)± | 5.54 | 7-28-2025 | 250,000,000 | 250,000,000 | ||

FFCB Series 1 (U.S. SOFR+0.20%)± | 5.57 | 6-2-2025 | 60,000,000 | 60,000,000 | ||

FFCB (U.S. SOFR+0.19%)± | 5.57 | 6-30-2025 | 150,000,000 | 150,000,000 | ||

FFCB (U.S. SOFR+0.21%)± | 5.59 | 12-12-2024 | 100,000,000 | 100,000,000 | ||

FFCB (U.S. Federal Funds Effective Rate+0.18%)± | 5.59 | 7-7-2025 | 200,000,000 | 200,000,000 | ||

FFCB (U.S. Federal Funds Effective Rate+0.20%)± | 5.60 | 2-7-2025 | 400,000,000 | 400,000,000 | ||

FFCB (U.S. Treasury 3 Month Bill Money Market Yield+0.22%)± | 5.64 | 1-27-2025 | 250,000,000 | 249,982,122 | ||

FHLB (U.S. SOFR+0.07%)± | 4.38 | 11-27-2023 | 500,000,000 | 500,000,000 | ||

FHLB☼ | 4.99 | 8-23-2023 | 105,000,000 | 104,684,300 | ||

FHLB☼ | 5.00 | 2-15-2024 | 50,000,000 | 48,644,250 | ||

FHLB☼ | 5.01 | 8-28-2023 | 100,000,000 | 99,629,500 | ||

FHLB☼ | 5.02 | 8-25-2023 | 150,000,000 | 149,505,000 | ||

FHLB☼ | 5.02 | 9-22-2023 | 100,000,000 | 99,285,000 | ||

Interest rate | Maturity date | Principal | Value | |||

Government agency debt (continued) | ||||||

FHLB☼ | 5.03 % | 8-30-2023 | $ | 25,000,000 | $24,900,031 | |

FHLB☼ | 5.03 | 9-5-2023 | 75,000,000 | 74,637,969 | ||

FHLB☼ | 5.09 | 9-28-2023 | 50,000,000 | 49,595,611 | ||

FHLB | 5.23 | 5-17-2024 | 500,000,000 | 500,000,000 | ||

FHLB | 5.27 | 4-29-2024 | 1,000,000,000 | 1,000,000,000 | ||

FHLB☼ | 5.29 | 10-4-2023 | 250,000,000 | 247,680,000 | ||

FHLB☼ | 5.33 | 10-27-2023 | 268,500,000 | 265,086,917 | ||

FHLB | 5.34 | 4-26-2024 | 700,000,000 | 700,000,000 | ||

FHLB | 5.35 | 4-24-2024 | 200,000,000 | 200,000,000 | ||

FHLB | 5.35 | 5-30-2024 | 225,000,000 | 225,000,000 | ||

FHLB | 5.36 | 6-11-2024 | 300,000,000 | 300,000,000 | ||

FHLB☼ | 5.37 | 11-22-2023 | 50,000,000 | 49,168,194 | ||

FHLB | 5.37 | 5-21-2024 | 200,000,000 | 200,000,000 | ||

FHLB Series 0000 (U.S. SOFR+0.09%)± | 5.39 | 9-14-2023 | 264,000,000 | 264,000,000 | ||

FHLB☼ | 5.39 | 1-24-2024 | 50,000,000 | 48,699,556 | ||

FHLB☼ | 5.40 | 1-26-2024 | 273,000,000 | 265,805,388 | ||

FHLB Series 0001 (U.S. SOFR+0.11%)± | 5.41 | 8-18-2023 | 200,000,000 | 200,000,000 | ||

FHLB | 5.41 | 6-7-2024 | 200,000,000 | 200,000,000 | ||

FHLB | 5.42 | 5-30-2024 | 225,000,000 | 225,000,000 | ||

FHLB (U.S. SOFR+0.06%)± | 5.43 | 8-1-2023 | 500,000,000 | 500,000,000 | ||

FHLB (U.S. SOFR+0.07%)± | 5.44 | 10-30-2023 | 500,000,000 | 500,000,000 | ||

FHLB (U.S. SOFR+0.08%)± | 5.46 | 10-23-2023 | 300,000,000 | 300,000,000 | ||

FHLB (U.S. SOFR+0.08%)± | 5.46 | 11-29-2023 | 300,000,000 | 300,000,000 | ||

FHLB | 5.47 | 6-18-2024 | 100,000,000 | 100,000,000 | ||

FHLB Series 0000 (U.S. SOFR+0.11%)± | 5.49 | 8-18-2023 | 300,000,000 | 300,000,000 | ||

FHLB (U.S. SOFR+0.12%)± | 5.50 | 9-6-2023 | 100,000,000 | 100,000,000 | ||

FHLB (U.S. SOFR+0.12%)± | 5.50 | 3-14-2024 | 128,000,000 | 128,000,000 | ||

FHLB (U.S. SOFR+0.12%)± | 5.50 | 11-18-2024 | 250,000,000 | 250,000,000 | ||

FHLB (U.S. SOFR+0.13%)± | 5.51 | 2-10-2025 | 450,000,000 | 450,000,000 | ||

FHLB (U.S. SOFR+0.16%)± | 5.54 | 7-3-2025 | 325,000,000 | 325,000,000 | ||

FHLB (U.S. SOFR+0.16%)± | 5.54 | 7-25-2025 | 200,000,000 | 200,000,000 | ||

FHLB | 5.55 | 4-5-2024 | 100,000,000 | 100,000,000 | ||

FHLB | 5.62 | 7-23-2024 | 250,000,000 | 250,000,000 | ||

FHLMC | 0.25 | 8-24-2023 | 22,122,000 | 22,055,390 | ||

FHLMC | 0.25 | 9-8-2023 | 55,115,000 | 54,836,039 | ||

FHLMC | 5.41 | 6-14-2024 | 450,000,000 | 450,000,000 | ||

FHLMC | 5.50 | 6-18-2024 | 200,000,000 | 200,000,000 | ||

FNMA | 5.42 | 3-28-2024 | 100,000,000 | 100,000,000 | ||

U.S. International Development Finance Corp. Series 3 (U.S. Treasury 3 Month Bill+0.00%)§± | 1.12 | 9-2-2031 | 10,237,689 | 10,237,689 | ||

U.S. International Development Finance Corp. Series FLR2 (U.S. Treasury 3 Month Bill+0.00%)§± | 1.13 | 11-20-2037 | 10,771,145 | 10,771,145 | ||

U.S. International Development Finance Corp. Series 6 (U.S. Treasury 3 Month Bill+0.00%)§± | 1.32 | 7-7-2040 | 4,309,241 | 4,309,241 | ||

U.S. International Development Finance Corp. Series 9000031202-IG (U.S. Treasury 3 Month Bill+0.00%)§± | 1.85 | 1-20-2035 | 8,651,610 | 8,651,610 | ||

U.S. International Development Finance Corp. Series 9000031200-IG (U.S. Treasury 3 Month Bill+0.00%)§± | 1.85 | 4-20-2035 | 4,418,000 | 4,418,000 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 1.89 | 11-15-2023 | 2,500,000 | 2,500,000 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 2.02 | 1-20-2035 | 3,495,600 | 3,495,600 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 2.02 | 4-20-2035 | 4,418,000 | 4,418,000 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 2.12 | 6-20-2027 | 5,333,334 | 5,333,334 | ||

Interest rate | Maturity date | Principal | Value | |||

Government agency debt (continued) | ||||||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 2.28 % | 9-20-2027 | $ | 15,178,571 | $15,178,571 | |

U.S. International Development Finance Corp. Series 2 (U.S. Treasury 3 Month Bill+0.00%)§± | 2.28 | 9-20-2038 | 3,294,146 | 3,294,146 | ||

U.S. International Development Finance Corp. Series 271 (U.S. Treasury 3 Month Bill+0.00%)§± | 2.31 | 7-7-2040 | 17,588,740 | 17,588,740 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.40 | 1-20-2027 | 39,666,667 | 39,666,667 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.40 | 1-20-2035 | 22,109,670 | 22,109,670 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.40 | 4-20-2035 | 23,327,040 | 23,327,040 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.40 | 7-7-2040 | 29,988,801 | 29,988,802 | ||

U.S. International Development Finance Corp. Series 277- 2012-197-IG (U.S. Treasury 3 Month Bill+0.00%)§± | 5.45 | 7-9-2026 | 28,180,500 | 28,180,500 | ||

U.S. International Development Finance Corp. Series 699- 2014-878-IG (U.S. Treasury 3 Month Bill+0.00%)§± | 5.50 | 11-15-2025 | 3,473,684 | 3,473,684 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.50 | 1-15-2030 | 9,811,321 | 9,811,321 | ||

U.S. International Development Finance Corp. Series 278- 2009-362-IG (U.S. Treasury 3 Month Bill+0.00%)§± | 5.50 | 5-15-2030 | 16,626,000 | 16,626,000 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.50 | 10-15-2032 | 15,274,360 | 15,274,360 | ||

U.S. International Development Finance Corp. Series IV (U.S. Treasury 3 Month Bill+0.00%)§± | 5.50 | 11-15-2033 | 16,957,266 | 16,957,266 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.50 | 6-15-2034 | 13,044,099 | 13,044,099 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.52 | 9-2-2031 | 33,163,862 | 33,163,862 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.52 | 9-30-2031 | 35,239,840 | 35,239,840 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.52 | 12-20-2031 | 51,395,349 | 51,395,349 | ||

U.S. International Development Finance Corp. Series 1 (U.S. Treasury 3 Month Bill+0.00%)§± | 5.55 | 3-15-2030 | 17,357,143 | 17,357,143 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.55 | 9-2-2031 | 16,259,859 | 16,259,859 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.55 | 9-30-2031 | 27,286,880 | 27,286,880 | ||

U.S. International Development Finance Corp. Series 9000031202 (U.S. Treasury 3 Month Bill+0.00%)§± | 5.55 | 1-20-2035 | 7,865,100 | 7,865,100 | ||

U.S. International Development Finance Corp. (U.S. Treasury 3 Month Bill+0.00%)§± | 5.55 | 11-20-2037 | 14,606,370 | 14,606,370 | ||

U.S. International Development Finance Corp. Series 3 (U.S. Treasury 3 Month Bill+0.00%)§± | 5.58 | 12-15-2026 | 2,100,000 | 2,100,000 | ||

Total government agency debt (Cost $18,020,150,443) | 18,020,150,443 | |||||

Interest rate | Maturity date | Principal | Value | |||

Municipal obligations: 0.05% | ||||||

Colorado: 0.05% | ||||||

Variable rate demand notes ø: 0.05% | ||||||

Colorado HFA Series C2 Class II (Housing revenue, GNMA Insured, FHLB SPA) | 4.70 % | 5-1-2052 | $ | 29,370,000 | $29,370,000 | |

Colorado HFA Series D2 Class I (Housing revenue, GNMA Insured, FHLB SPA) | 4.59 | 5-1-2042 | 26,625,000 | 26,625,000 | ||

Total municipal obligations (Cost $55,995,000) | 55,995,000 | |||||

Other instruments: 0.37% | ||||||

17th Street Rentals LLC §øø | 4.71 | 6-1-2025 | 18,200,000 | 18,200,000 | ||

2020 Sheu Family Exempt Trust §øø | 4.75 | 7-1-2041 | 9,175,000 | 9,175,000 | ||

Brandon Place Partners Ltd. Series 2018§øø | 5.46 | 12-1-2058 | 15,335,000 | 15,335,000 | ||

CLC Irrevocable Life Insurance Trust Series 2020§øø | 4.75 | 10-1-2045 | 6,610,000 | 6,610,000 | ||

Columbus Hotel Investment One LLC Series 2018§øø | 4.75 | 10-1-2048 | 6,535,000 | 6,535,000 | ||

Conger Investments LLC Series 2021§øø | 4.75 | 6-1-2051 | 6,465,000 | 6,465,000 | ||

Fortis Family Insurance LLC Series A§øø | 4.70 | 8-1-2070 | 10,345,000 | 10,345,000 | ||

Gillean Family Trust Series 2019§øø | 4.75 | 12-1-2039 | 6,140,000 | 6,140,000 | ||

Hacienda Senior Villas LP A California LP Series C§øø | 5.46 | 12-1-2058 | 20,575,000 | 20,575,000 | ||

Ken-Vin Life Co. LLC Series 2019§øø | 5.45 | 12-1-2059 | 19,645,000 | 19,645,000 | ||

L Ward Huntley Irrevocable Life Insurance Trust u/a Series 2021§øø | 4.70 | 4-1-2071 | 21,350,000 | 21,350,000 | ||

La Mesa Senior Living LP §øø | 1.25 | 8-1-2057 | 48,125,000 | 48,125,000 | ||

LaVonne V Johnson Irrevocable Life Insurance Trust Series 2021§øø | 4.75 | 6-1-2041 | 34,790,000 | 34,790,000 | ||

Legado Encino LLC Series A§øø | 4.90 | 12-1-2059 | 19,500,000 | 19,500,000 | ||

Mitchell Irrevocable Life Insurance Trust §øø | 6.49 | 9-1-2059 | 18,495,000 | 18,495,000 | ||

Morris Family Insurance Trust §øø | 4.70 | 10-1-2059 | 3,350,000 | 3,350,000 | ||

Plaza Patria Court Ltd. a California LP Series B§øø | 5.46 | 12-1-2058 | 17,325,000 | 17,325,000 | ||

Renaissance 88 Co. LP §øø | 5.46 | 3-1-2062 | 19,000,000 | 19,000,000 | ||

Rock Hill SI LLC Series 2021§øø | 4.71 | 6-1-2061 | 35,700,000 | 35,700,000 | ||

Rohnert Park 668 LP Series A§øø | 6.51 | 6-1-2058 | 20,920,000 | 20,920,000 | ||

Schulder Family Trust §øø | 4.75 | 3-1-2041 | 9,990,000 | 9,990,000 | ||

Solis Seattle LLC §øø | 4.71 | 2-1-2061 | 20,000,000 | 20,000,000 | ||

Southside Brookshore Associates LP Series A§øø | 4.71 | 9-1-2059 | 7,640,000 | 7,640,000 | ||

Vickie Bice Life Insurance Trust Series 2021§øø | 4.75 | 8-1-2046 | 6,550,000 | 6,550,000 | ||

VPM Linden Manor LP Series A§øø | 4.71 | 9-1-2060 | 15,200,000 | 15,200,000 | ||

Total other instruments (Cost $416,960,000) | 416,960,000 | |||||

Repurchase agreements^^: 72.96% | ||||||

Bank of America NA, dated 7-31-2023, maturity value $1,068,657,307(01) | 5.30 | 8-1-2023 | 1,068,500,000 | 1,068,500,000 | ||

Bank of America NA, dated 7-31-2023, maturity value $500,073,611(02) | 5.30 | 8-1-2023 | 500,000,000 | 500,000,000 | ||

Bank of America NA, dated 7-27-2023, maturity value $1,008,306,667(03) | 5.34 | 9-21-2023 | 1,000,000,000 | 1,000,000,000 | ||

Bank of Montreal, dated 7-31-2023, maturity value $250,036,806(04) | 5.30 | 8-1-2023 | 250,000,000 | 250,000,000 | ||

Barclays Bank PLC, dated 7-31-2023, maturity value $1,400,206,111(05) | 5.30 | 8-1-2023 | 1,400,000,000 | 1,400,000,000 | ||

Barclays Bank PLC, dated 7-31-2023, maturity value $5,514,911,798(06) | 5.30 | 8-1-2023 | 5,514,100,000 | 5,514,100,000 | ||

Barclays Bank PLC, dated 7-31-2023, maturity value $560,082,600(07) | 5.31 | 8-1-2023 | 560,000,000 | 560,000,000 | ||

BNP FICC, dated 7-31-2023, maturity value $2,000,294,444(08) | 5.30 | 8-1-2023 | 2,000,000,000 | 2,000,000,000 | ||

BNP Paribas Securities Corp., dated 7-31-2023, maturity value $2,400,353,333(09) | 5.30 | 8-1-2023 | 2,400,000,000 | 2,400,000,000 | ||

Interest rate | Maturity date | Principal | Value | |||

Repurchase agreements (continued) | ||||||

BNYM FICC, dated 7-31-2023, maturity value $5,000,736,111(10) | 5.30 % | 8-1-2023 | $ | 5,000,000,000 | $5,000,000,000 | |

Citibank NA, dated 7-31-2023, maturity value $250,036,806(11) | 5.30 | 8-1-2023 | 250,000,000 | 250,000,000 | ||

Citibank NA, dated 7-27-2023, maturity value $250,257,639(12) | 5.30 | 8-3-2023 | 250,000,000 | 250,000,000 | ||

Citigroup Global Markets Holdings, Inc., dated 7-27-2023, maturity value $1,401,030,556(13) | 5.30 | 8-1-2023 | 1,400,000,000 | 1,400,000,000 | ||

Citigroup Global Markets Holdings, Inc., dated 7-27-2023, maturity value $500,441,667(14) | 5.30 | 8-2-2023 | 500,000,000 | 500,000,000 | ||

Credit Agricole Corporate & Investment Bank, dated 7-31-2023, maturity value $1,000,146,944(15) | 5.29 | 8-1-2023 | 1,000,000,000 | 1,000,000,000 | ||

Credit Agricole Corporate & Investment Bank, dated 7-31-2023, maturity value $200,029,444(16) | 5.30 | 8-1-2023 | 200,000,000 | 200,000,000 | ||

Daiwa Capital Markets America, Inc., dated 7-31-2023, maturity value $1,500,220,833(17) | 5.30 | 8-1-2023 | 1,500,000,000 | 1,500,000,000 | ||

Federal Reserve Bank of New York, dated 7-31-2023, maturity value $24,303,577,500(18) | 5.30 | 8-1-2023 | 24,300,000,000 | 24,300,000,000 | ||

Fixed Income Clearing Corp., dated 7-31-2023, maturity value $100,014,639(19) | 5.27 | 8-1-2023 | 100,000,000 | 100,000,000 | ||

Goldman Sachs & Co. LLC, dated 7-31-2023, maturity value $534,544,542(20) | 3.00 | 8-1-2023 | 534,500,000 | 534,500,000 | ||

Goldman Sachs & Co. LLC, dated 7-31-2023, maturity value $100,014,250(21) | 5.13 | 8-1-2023 | 100,000,000 | 100,000,000 | ||

ING Financial Markets LLC, dated 7-31-2023, maturity value $350,051,528(22) | 5.30 | 8-1-2023 | 350,000,000 | 350,000,000 | ||

ING Financial Markets LLC, dated 7-31-2023, maturity value $500,077,556(23) | 5.30 | 8-1-2023 | 500,003,944 | 500,003,944 | ||

ING Financial Markets LLC, dated 7-27-2023, maturity value $1,159,552,667(24) | 5.34 | 9-21-2023 | 1,150,000,000 | 1,150,000,000 | ||

JP Morgan Securities LLC, dated 7-31-2023, maturity value $1,200,176,667(25) | 5.30 | 8-1-2023 | 1,200,000,000 | 1,200,000,000 | ||

JP Morgan Securities LLC, dated 7-31-2023, maturity value $4,500,662,500(26) | 5.30 | 8-1-2023 | 4,500,000,000 | 4,500,000,000 | ||

Mitsubishi Bank, dated 7-31-2023, maturity value $500,073,611(27) | 5.30 | 8-1-2023 | 500,000,000 | 500,000,000 | ||

Mitsubishi Bank, dated 7-27-2023, maturity value $1,251,104,167(28) | 5.30 | 8-2-2023 | 1,250,000,000 | 1,250,000,000 | ||

Mizuho FICC, dated 7-31-2023, maturity value $1,900,279,722(29) | 5.30 | 8-1-2023 | 1,900,000,000 | 1,900,000,000 | ||

MUFG Securities Canada Ltd., dated 7-31-2023, maturity value $1,500,220,833(30) | 5.30 | 8-1-2023 | 1,500,000,000 | 1,500,000,000 | ||

MUFG Securities Canada Ltd., dated 7-31-2023, maturity value $875,128,819(31) | 5.30 | 8-1-2023 | 875,000,000 | 875,000,000 | ||

MUFG Securities Canada Ltd., dated 7-27-2023, maturity value $1,512,483,333(32) | 5.35 | 9-21-2023 | 1,500,000,000 | 1,500,000,000 | ||

NatWest Group PLC, dated 7-27-2023, maturity value $1,501,548,750(33) | 5.31 | 8-3-2023 | 1,500,000,000 | 1,500,000,000 | ||

Nomura Securities Co. Ltd., dated 7-31-2023, maturity value $3,500,515,278(34) | 5.30 | 8-1-2023 | 3,500,000,000 | 3,500,000,000 | ||

RBC Dominion, dated 7-31-2023, maturity value $1,250,184,028(35) | 5.30 | 8-1-2023 | 1,250,000,000 | 1,250,000,000 | ||

Royal Bank of Canada, dated 7-27-2023, maturity value $2,002,065,000(36) | 5.31 | 8-3-2023 | 2,000,000,000 | 2,000,000,000 | ||

Royal Bank of Canada, dated 7-27-2023, maturity value $2,016,582,222 (37) | 5.33 | 9-21-2023 | 2,000,000,000 | 2,000,000,000 | ||

Interest rate | Maturity date | Principal | Value | |||

Repurchase agreements (continued) | ||||||

Societe Generale, dated 7-26-2023, maturity value $800,821,333(38) | 5.28 % | 8-2-2023 | $ | 800,000,000 | $800,000,000 | |

Societe Generale, dated 7-27-2023, maturity value $800,590,000(39) | 5.31 | 8-1-2023 | 800,000,000 | 800,000,000 | ||

Societe Generale, dated 7-28-2023, maturity value $800,826,000(40) | 5.31 | 8-4-2023 | 800,000,000 | 800,000,000 | ||

Societe Generale, dated 7-24-2023, maturity value $400,826,000(41) | 5.31 | 8-7-2023 | 400,000,000 | 400,000,000 | ||

Societe Generale, dated 7-25-2023, maturity value $801,652,000(42) | 5.31 | 8-8-2023 | 800,000,000 | 800,000,000 | ||

Standard Chartered Bank PLC, dated 7-31-2023, maturity value $1,250,184,028(43) | 5.30 | 8-1-2023 | 1,250,000,000 | 1,250,000,000 | ||

Standard Chartered Bank PLC, dated 7-31-2023, maturity value $2,093,499,073(44) | 5.30 | 8-1-2023 | 2,093,190,909 | 2,093,190,909 | ||

Sumitomo Mitsui Banking Corp., dated 7-19-2023, maturity value $102,518,883(45) | 5.25 | 8-2-2023 | 102,310,000 | 102,310,000 | ||

Sumitomo Mitsui Banking Corp., dated 8-2-2023, maturity value $101,104,548%%(46) | 5.37 | 8-16-2023 | 101,020,000 | 101,020,000 | ||

Sumitomo Mitsui Banking Corp., dated 5-31-2023, maturity value $470,735,525(47) | 5.43 | 8-28-2023 | 464,500,000 | 464,500,000 | ||

TD Securities USA LLC, dated 7-31-2023, maturity value $300,044,166(48) | 5.30 | 8-1-2023 | 300,000,000 | 300,000,000 | ||

Total repurchase agreements (Cost $83,213,124,853) | 83,213,124,853 | |||||

U.S. Treasury securities: 13.24% | ||||||

U.S. Treasury Bills☼ | 5.28 | 12-28-2023 | 400,000,000 | 391,378,073 | ||

U.S. Treasury Bills☼ | 5.31 | 11-9-2023 | 150,000,000 | 147,816,667 | ||

U.S. Treasury Bills☼ | 5.34 | 12-7-2023 | 300,000,000 | 294,378,667 | ||

U.S. Treasury Bills☼ | 5.25 | 12-21-2023 | 600,000,000 | 587,752,500 | ||

U.S. Treasury Bills☼ | 5.34 | 1-4-2024 | 150,000,000 | 146,575,800 | ||

U.S. Treasury Bills☼ | 5.36 | 1-11-2024 | 150,000,000 | 146,412,302 | ||

U.S. Treasury Bills☼ | 5.23 | 9-19-2023 | 250,000,000 | 248,243,826 | ||

U.S. Treasury Bills☼ | 5.18 | 9-26-2023 | 865,000,000 | 857,962,744 | ||

U.S. Treasury Bills☼ | 5.19 | 9-26-2023 | 290,000,000 | 287,638,433 | ||

U.S. Treasury Bills☼ | 5.20 | 9-26-2023 | 130,000,000 | 128,938,333 | ||

U.S. Treasury Bills☼ | 5.21 | 9-26-2023 | 140,000,000 | 138,854,489 | ||

U.S. Treasury Bills☼ | 5.40 | 10-3-2023 | 500,000,000 | 495,341,916 | ||

U.S. Treasury Bills☼ | 5.29 | 10-10-2023 | 150,000,000 | 148,478,667 | ||

U.S. Treasury Bills☼ | 5.28 | 10-24-2023 | 480,000,000 | 474,170,750 | ||

U.S. Treasury Bills☼ | 5.30 | 10-31-2023 | 500,000,000 | 493,394,221 | ||

U.S. Treasury Bills☼ | 5.33 | 11-7-2023 | 230,000,000 | 226,713,652 | ||

U.S. Treasury Bills☼ | 5.33 | 11-7-2023 | 270,000,000 | 266,136,840 | ||

U.S. Treasury Bills☼ | 5.33 | 11-14-2023 | 500,000,000 | 492,334,709 | ||

U.S. Treasury Bills☼ | 5.35 | 9-7-2023 | 2,150,000,000 | 2,138,345,324 | ||

U.S. Treasury Bills☼ | 5.34 | 1-25-2024 | 300,000,000 | 292,226,013 | ||

U.S. Treasury Bills☼ | 5.35 | 10-26-2023 | 300,000,000 | 296,217,792 | ||

U.S. Treasury Bills☼ | 5.33 | 1-18-2024 | 150,000,000 | 146,273,458 | ||

U.S. Treasury Bills☼ | 5.23 | 9-26-2023 | 1,550,000,000 | 1,537,265,717 | ||

U.S. Treasury Bills☼ | 5.34 | 11-21-2023 | 650,000,000 | 639,347,438 | ||

U.S. Treasury Bills%%☼ | 5.34 | 11-28-2023 | 550,000,000 | 540,377,486 | ||

U.S. Treasury Bills☼ | 5.18 | 11-2-2023 | 400,000,000 | 394,660,828 | ||

U.S. Treasury Floating Rate Notes (U.S. Treasury 3 Month Bill Money Market Yield -0.08%)± | 5.28 | 4-30-2024 | 700,000,000 | 699,666,151 | ||

U.S. Treasury Floating Rate Notes (U.S. Treasury 3 Month Bill Money Market Yield+0.14%)± | 4.48 | 10-31-2024 | 400,000,000 | 399,512,641 | ||

U.S. Treasury Floating Rate Notes (U.S. Treasury 3 Month Bill Money Market Yield+0.20%)±## | 5.55 | 1-31-2025 | 1,150,000,000 | 1,150,333,662 | ||

Interest rate | Maturity date | Principal | Value | |||

U.S. Treasury securities (continued) | ||||||

U.S. Treasury Floating Rate Notes (U.S. Treasury 3 Month Bill Money Market Yield+0.17%)± | 5.53 % | 4-30-2025 | $ | 680,000,000 | $680,056,092 | |

U.S. Treasury Notes (U.S. Treasury 3 Month Bill Money Market Yield+0.04%)± | 5.40 | 10-31-2023 | 215,000,000 | 215,000,000 | ||

Total U.S. Treasury securities (Cost $15,101,805,191) | 15,101,805,191 | |||||

Total investments in securities (Cost $116,808,035,487) | 102.42 % | 116,808,035,487 | ||||

Other assets and liabilities, net | (2.42 ) | (2,756,526,140 ) | ||||

Total net assets | 100.00 % | $114,051,509,347 | ||||

± | Variable rate investment. The rate shown is the rate in effect at period end. |

☼ | Zero coupon security. The rate represents the current yield to maturity. |

%% | The security is purchased on a when-issued basis. |

§ | The security is subject to a demand feature which reduces the effective maturity. |

ø | Variable rate demand notes are subject to a demand feature which reduces the effective maturity. The maturity date shown represents the final maturity date of the security. The interest rate is determined and reset by the issuer daily, weekly, or monthly depending upon the terms of the security. The rate shown is the rate in effect at period end. |

øø | The interest rate is determined and reset by the issuer periodically depending upon the terms of the security. The rate shown is the rate in effect at period end. |

^^ | Collateralized by: |

(01) U.S. government securities, 2.50% to 4.50%, 12-1-2040 to 8-1-2051, fair value including accrued interest is $1,100,555,000. | |

(02) U.S. government securities, 2.00% to 6.00%, 9-20-2037 to 7-20-2053, fair value including accrued interest is $515,000,000. | |

(03) U.S. government securities, 1.50% to 6.50%, 3-1-2037 to 8-1-2053, fair value including accrued interest is $1,030,000,000. | |

(04) U.S. government securities, 2.00% to 7.00%, 8-15-2023 to 8-15-2064, fair value including accrued interest is $257,500,000. | |

(05) U.S. government securities, 1.88% to 5.50%, 4-12-2024 to 6-20-2053, fair value including accrued interest is $1,441,264,836. | |

(06) U.S. government securities, 0.13% to 5.54%, 1-15-2024 to 2-15-2048, fair value including accrued interest is $5,624,382,135. | |

(07) U.S. government securities, 0.00% to 5.11%, 3-4-2024 to 3-15-2031, fair value including accrued interest is $571,200,340. | |

(08) U.S. government securities, 0.00% to 4.25%, 9-14-2024 to 11-15-2052, fair value including accrued interest is $2,040,000,075. | |

(09) U.S. government securities, 0.00% to 7.00%, 8-15-2023 to 8-15-2063, fair value including accrued interest is $2,459,286,268. | |

(10) U.S. government securities, 0.25% to 4.50%, 4-15-2024 to 11-15-2053, fair value including accrued interest is $5,100,000,010. | |

(11) U.S. government securities, 0.00% to 7.13%, 9-15-2023 to 9-15-2065, fair value including accrued interest is $257,462,693. | |

(12) U.S. government securities, 0.00% to 8.38%, 3-8-2024 to 10-20-2067, fair value including accrued interest is $257,354,309. | |

(13) U.S. government securities, 1.13% to 6.50%, 12-31-2025 to 8-1-2023, fair value including accrued interest is $1,439,500,073. | |

(14) U.S. government securities, 2.50% to 4.25%, 8-15-2023 to 5-15-2033, fair value including accrued interest is $510,000,024. | |

(15) U.S. government securities, 0.25% to 4.25%, 4-15-2024 to 11-30-2029, fair value including accrued interest is $1,020,000,074. | |

(16) U.S. government securities, 3.75% to 3.75%, 5-31-2030 to 5-31-2030, fair value including accrued interest is $204,000,095. | |

(17) U.S. government securities, 0.00% to 7.00%, 8-3-2023 to 8-1-2053, fair value including accrued interest is $1,544,231,702. | |

(18) U.S. government securities, 0.13% to 4.50%, 8-15-2023 to 5-15-2039, fair value including accrued interest is $24,303,577,513. | |

(19) U.S. government securities, 0.38% to 3.88%, 12-31-2025 to 1-15-2026, fair value including accrued interest is $102,000,049. | |

(20) U.S. government securities, 0.00% to 6.38%, 8-29-2023 to 5-15-2052, fair value including accrued interest is $545,190,023. | |

(21) U.S. government securities, 0.25% to 0.25%, 9-30-2023 to 9-30-2023, fair value including accrued interest is $102,000,035. | |

(22) U.S. government securities, 1.50% to 6.00%, 11-1-2028 to 3-1-2057, fair value including accrued interest is $360,500,001. | |

(23) U.S. government securities, 1.25% to 4.50%, 1-15-2025 to 8-15-2031, fair value including accrued interest is $510,004,023. | |

(24) U.S. government securities, 0.75% to 8.00%, 8-15-2023 to 7-1-2060, fair value including accrued interest is $1,184,402,982. | |

(25) U.S. government securities, 0.00% to 7.50%, 4-1-2025 to 8-15-2063, fair value including accrued interest is $1,233,708,944. | |

(26) U.S. government securities, 0.00% to 6.00%, 9-28-2023 to 7-15-2028, fair value including accrued interest is $4,590,000,001. | |

(27) U.S. government securities, 0.75% to 7.00%, 9-30-2023 to 4-20-2063, fair value including accrued interest is $514,512,569. | |

(28) U.S. government securities, 0.00% to 7.50%, 8-29-2023 to 8-1-2053, fair value including accrued interest is $1,285,742,447. | |

(29) U.S. government securities, 0.00% to 6.00%, 8-10-2023 to 5-15-2053, fair value including accrued interest is $1,938,000,031. | |

(30) U.S. government securities, 0.13% to 6.54%, 3-8-2024 to 1-20-2072, fair value including accrued interest is $1,544,039,995. | |

(31) U.S. government securities, 0.13% to 4.00%, 5-15-2024 to 7-15-2032, fair value including accrued interest is $892,500,000. | |

(32) U.S. government securities, 0.00% to 6.50%, 10-12-2023 to 1-20-2072, fair value including accrued interest is $1,544,611,369. | |

(33) U.S. government securities, 0.13% to 5.48%, 8-31-2023 to 5-15-2033, fair value including accrued interest is $1,530,000,003. | |

(34) U.S. government securities, 0.00% to 8.88%, 8-15-2023 to 9-15-2065, fair value including accrued interest is $3,570,297,880. | |

(35) U.S. government securities, 0.00% to 6.00%, 8-31-2023 to 7-20-2053, fair value including accrued interest is $1,278,363,292. | |

(36) U.S. government securities, 0.00% to 6.50%, 8-15-2023 to 6-1-2053, fair value including accrued interest is $2,040,321,948. | |

(37) U.S. government securities, 0.25% to 5.50%, 11-30-2023 to 6-1-2053, fair value including accrued interest is $2,044,723,777. | |

(38) U.S. government securities, 0.63% to 4.13%, 4-30-2024 to 8-15-2030, fair value including accrued interest is $816,000,034. | |

(39) U.S. government securities, 1.38% to 4.25%, 9-30-2024 to 5-15-2032, fair value including accrued interest is $816,000,065. | |

(40) U.S. government securities, 1.25% to 4.13%, 11-30-2023 to 2-15-2032, fair value including accrued interest is $816,000,052. | |

(41) U.S. government securities, 4.75% to 4.75%, 7-31-2025 to 7-31-2025, fair value including accrued interest is $408,000,049. | |

(42) U.S. government securities, 0.13% to 3.13%, 2-15-2024 to 8-31-2029, fair value including accrued interest is $816,000,042. | |

(43) U.S. government securities, 0.25% to 6.50%, 9-30-2023 to 6-20-2053, fair value including accrued interest is $1,285,083,329. | |

(44) U.S. government securities, 1.38% to 5.00%, 6-30-2027 to 5-15-2049, fair value including accrued interest is $2,135,909,091. | |

(45) U.S. government securities, 2.38% to 3.25%, 8-31-2024 to 11-15-2049, fair value including accrued interest is $104,450,200. | |

(46) U.S. government securities, 2.38% to 3.25%, 8-31-2024 to 11-15-2049, fair value including accrued interest is $103,126,639. | |

(47) U.S. government securities, 3.25% to 4.00%, 8-31-2024 to 4-20-2049, fair value including accrued interest is $478,407,286. | |

(48) U.S. government securities, 2.00% to 7.50%, 10-20-2041 to 7-20-2053, fair value including accrued interest is $309,000,000. | |

## | All or a portion of this security is segregated for when-issued securities. |

Abbreviations: | |

FFCB | Federal Farm Credit Banks |

FHLB | Federal Home Loan Bank |

FHLMC | Federal Home Loan Mortgage Corporation |

FNMA | Federal National Mortgage Association |

GNMA | Government National Mortgage Association |

HFA | Housing Finance Authority |

SOFR | Secured Overnight Financing Rate |

SPA | Standby purchase agreement |

Assets | |

Investments in unaffiliated securities, at amortized cost | $33,594,910,634 |

Investments in repurchase agreements, at amortized cost | 83,213,124,853 |

Receivable for interest | 175,205,020 |

Receivable for Fund shares sold | 2,798,380 |

Prepaid expenses and other assets | 28 |

Total assets | 116,986,038,915 |

Liabilities | |

Payable for investments purchased | 2,032,946,544 |

Payable for when-issued transactions | 645,377,486 |

Dividends payable | 233,338,652 |

Management fee payable | 9,108,117 |

Administration fees payable | 4,844,507 |

Payable for Fund shares redeemed | 4,658,016 |

Overdraft due to custodian bank | 195,227 |

Distribution fee payable | 65,374 |

Accrued expenses and other liabilities | 3,995,645 |

Total liabilities | 2,934,529,568 |

Total net assets | $114,051,509,347 |

Net assets consist of | |

Paid-in capital | $114,058,660,872 |

Total distributable loss | (7,151,525 ) |

Total net assets | $114,051,509,347 |

Computation of net asset value per share | |

Net assets–Class A | $377,539,764 |

Shares outstanding–Class A1 | 377,567,577 |

Net asset value per share–Class A | $1.00 |

Net assets–Administrator Class | $3,441,122,954 |

Shares outstanding–Administrator Class1 | 3,441,360,100 |

Net asset value per share–Administrator Class | $1.00 |

Net assets–Institutional Class | $29,879,560,586 |

Shares outstanding–Institutional Class1 | 29,881,533,466 |

Net asset value per share–Institutional Class | $1.00 |

Net assets–Select Class | $78,237,565,228 |

Shares outstanding–Select Class1 | 78,242,378,846 |

Net asset value per share–Select Class | $1.00 |

Net assets–Service Class | $1,378,308,917 |

Shares outstanding–Service Class1 | 1,378,412,769 |

Net asset value per share–Service Class | $1.00 |

Net assets–Sweep Class | $737,411,898 |

Shares outstanding–Sweep Class1 | 737,470,018 |

Net asset value per share–Sweep Class | $1.00 |

Investment income | |

Interest | $2,337,747,388 |

Expenses | |

Management fee | 60,261,349 |

Administration fees | |

Class A | 392,750 |

Administrator Class | 1,422,106 |

Institutional Class | 11,333,458 |

Select Class | 12,161,971 |

Service Class | 862,573 |

Sweep Class | 135,248 |

Shareholder servicing fees | |

Class A | 453,781 |

Administrator Class | 1,422,106 |

Service Class | 1,797,027 |

Sweep Class | 1,127,068 |

Distribution fee | |

Sweep Class | 450,827 |

Custody and accounting fees | 1,346,065 |

Professional fees | 62,727 |

Registration fees | 1,306,514 |

Shareholder report expenses | 58,759 |

Trustees’ fees and expenses | 12,009 |

Other fees and expenses | 1,016,223 |

Total expenses | 95,622,561 |

Less: Fee waivers and/or expense reimbursements | |

Fund-level | (7,002 ) |

Class A | (9,977 ) |

Institutional Class | (2,205,968 ) |

Select Class | (10,695,826 ) |

Service Class | (39,612 ) |

Sweep Class | (72,056 ) |

Net expenses | 82,592,120 |

Net investment income | 2,255,155,268 |

Net realized losses on investments | (7,390,372 ) |

Net increase in net assets resulting from operations | $2,247,764,896 |

Six months ended July 31, 2023 (unaudited) | Year ended January 31, 2023 | |||

Operations | ||||

Net investment income | $2,255,155,268 | $1,893,970,796 | ||

Net realized gains (losses) on investments | (7,390,372 ) | 149,695 | ||

Net increase in net assets resulting from operations | 2,247,764,896 | 1,894,120,491 | ||

Distributions to shareholders from | ||||

Net investment income and net realized gains | ||||

Class A | (7,856,736 ) | (5,107,291 ) | ||

Administrator Class | (65,507,224 ) | (52,936,267 ) | ||

Institutional Class | (668,476,842 ) | (548,499,498 ) | ||

Select Class | (1,461,766,222 ) | (1,244,456,867 ) | ||

Service Class | (31,771,859 ) | (25,306,204 ) | ||

Sweep Class | (19,782,205 ) | (17,779,099 ) | ||

Total distributions to shareholders | (2,255,161,088 ) | (1,894,085,226 ) | ||

Capital share transactions | Shares | Shares | ||

Proceeds from shares sold | ||||

Class A | 51,720,510 | 51,720,510 | 97,246,217 | 97,246,217 |

Administrator Class | 6,659,242,272 | 6,659,242,272 | 19,247,989,683 | 19,247,989,683 |

Institutional Class | 53,890,353,280 | 53,890,353,280 | 133,382,515,269 | 133,382,515,269 |

Select Class | 289,760,966,890 | 289,760,966,890 | 739,906,150,392 | 739,906,150,392 |

Service Class | 10,615,591,614 | 10,615,591,614 | 36,788,307,413 | 36,788,307,413 |

Sweep Class | 3,207,848,921 | 3,207,848,921 | 7,282,764,941 | 7,282,764,941 |

364,185,723,487 | 936,704,973,915 | |||

Reinvestment of distributions | ||||

Class A | 7,839,428 | 7,839,428 | 5,088,443 | 5,088,443 |

Administrator Class | 22,693,840 | 22,693,840 | 21,593,914 | 21,593,914 |

Institutional Class | 227,721,751 | 227,721,751 | 181,718,307 | 181,718,307 |

Select Class | 804,084,314 | 804,084,314 | 750,229,605 | 750,229,605 |

Service Class | 2,917,344 | 2,917,344 | 2,171,675 | 2,171,675 |

Sweep Class | 19,782,205 | 19,782,205 | 17,779,099 | 17,779,099 |

1,085,038,882 | 978,581,043 | |||

Payment for shares redeemed | ||||

Class A | (38,233,362 ) | (38,233,362 ) | (62,551,940 ) | (62,551,940 ) |

Administrator Class | (6,868,598,750 ) | (6,868,598,750 ) | (20,668,809,280 ) | (20,668,809,280 ) |

Institutional Class | (53,770,596,155 ) | (53,770,596,155 ) | (144,108,581,896 ) | (144,108,581,896 ) |

Select Class | (268,439,882,177 ) | (268,439,882,177 ) | (769,736,358,487 ) | (769,736,358,487 ) |

Service Class | (10,659,553,234 ) | (10,659,553,234 ) | (37,244,407,620 ) | (37,244,407,620 ) |

Sweep Class | (3,535,231,227 ) | (3,535,231,227 ) | (7,357,298,131 ) | (7,357,298,131 ) |

(343,312,094,905 ) | (979,178,007,354 ) | |||

Net increase (decrease) in net assets resulting from capital share transactions | 21,958,667,464 | (41,494,452,396 ) | ||

Total increase (decrease) in net assets | 21,951,271,272 | (41,494,417,131 ) | ||

Net assets | ||||

Beginning of period | 92,100,238,075 | 133,594,655,206 | ||

End of period | $114,051,509,347 | $92,100,238,075 | ||

(For a share outstanding throughout each period)

Six months ended July 31, 2023 (unaudited) | Year ended January 31 | |||||

Class A | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Net investment income | 0.02 | 0.01 | 0.00 1 | 0.00 1 | 0.02 | 0.01 |

Net realized gains (losses) on investments | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 |

Total from investment operations | 0.02 | 0.01 1 | 0.00 1 | 0.00 1 | 0.02 | 0.01 |

Distributions to shareholders from | ||||||

Net investment income | (0.02 ) | (0.01 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.01 ) |

Net realized gains | 0.00 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 |

Total distributions to shareholders | (0.02 ) | (0.01 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.01 ) |

Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Total return2 | 2.16 % | 1.50 % | 0.01 % | 0.13 % | 1.59 % | 1.38 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 0.60 % | 0.61 % | 0.60 % | 0.60 % | 0.61 % | 0.61 % |

Net expenses | 0.60 % | 0.48 %* | 0.07 %* | 0.28 %* | 0.60 % | 0.60 % |

Net investment income | 4.33 % | 1.55 % | 0.01 % | 0.13 % | 1.56 % | 1.39 % |

Supplemental data | ||||||

Net assets, end of period (000s omitted) | $377,540 | $356,236 | $316,459 | $306,864 | $366,601 | $311,616 |

* | Ratio includes class-level expenses which were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would be increased by the following amounts: |

Year ended January 31, 2023 | 0.12% |

Year ended January 31, 2022 | 0.53% |

Year ended January 31, 2021 | 0.32% |

1 | Amount is less than $0.005. |

2 | Returns for periods of less than one year are not annualized. |

(For a share outstanding throughout each period)

Six months ended July 31, 2023 (unaudited) | Year ended January 31 | |||||

Administrator Class | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Net investment income | 0.02 | 0.02 | 0.00 1 | 0.00 1 | 0.02 | 0.02 |

Net realized gains (losses) on investments | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 |

Total from investment operations | 0.02 | 0.02 | 0.00 1 | 0.00 1 | 0.02 | 0.02 |

Distributions to shareholders from | ||||||

Net investment income | (0.02 ) | (0.02 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.02 ) |

Net realized gains | 0.00 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 |

Total distributions to shareholders | (0.02 ) | (0.02 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.02 ) |

Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Total return2 | 2.29 % | 1.71 % | 0.01 % | 0.17 % | 1.85 % | 1.65 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 0.34 % | 0.34 % | 0.33 % | 0.33 % | 0.34 % | 0.34 % |

Net expenses | 0.33 % | 0.28 %* | 0.07 %* | 0.22 %* | 0.34 % | 0.34 % |

Net investment income | 4.61 % | 1.63 % | 0.01 % | 0.14 % | 0.81 % | 1.67 % |

Supplemental data | ||||||

Net assets, end of period (000s omitted) | $3,441,123 | $3,628,015 | $5,027,252 | $4,540,262 | $3,893,928 | $2,411,490 |

* | Ratio includes class-level expenses which were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would be increased by the following amounts: |

Year ended January 31, 2023 | 0.06% |

Year ended January 31, 2022 | 0.27% |

Year ended January 31, 2021 | 0.11% |

1 | Amount is less than $0.005. |

2 | Returns for periods of less than one year are not annualized. |

(For a share outstanding throughout each period)

Six months ended July 31, 2023 (unaudited) | Year ended January 31 | |||||

Institutional Class | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Net investment income | 0.02 | 0.02 | 0.00 1 | 0.00 1 | 0.02 | 0.02 |

Net realized gains (losses) on investments | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 |

Total from investment operations | 0.02 | 0.02 | 0.00 1 | 0.00 1 | 0.02 | 0.02 |

Distributions to shareholders from | ||||||

Net investment income | (0.02 ) | (0.02 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.02 ) |

Net realized gains | 0.00 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 |

Total distributions to shareholders | (0.02 ) | (0.02 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.02 ) |

Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Total return2 | 2.36 % | 1.82 % | 0.01 % | 0.22 % | 1.99 % | 1.79 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 0.22 % | 0.22 % | 0.21 % | 0.21 % | 0.22 % | 0.22 % |

Net expenses | 0.20 % | 0.17 %* | 0.07 %* | 0.18 %* | 0.20 % | 0.20 % |

Net investment income | 4.72 % | 1.66 % | 0.01 % | 0.16 % | 1.97 % | 1.79 % |

Supplemental data | ||||||

Net assets, end of period (000s omitted) | $29,879,561 | $29,533,412 | $40,078,395 | $42,883,663 | $29,289,517 | $26,000,569 |

* | Ratio includes class-level expenses which were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would be increased by the following amounts: |

Year ended January 31, 2023 | 0.03% |

Year ended January 31, 2022 | 0.13% |

Year ended January 31, 2021 | 0.02% |

1 | Amount is less than $0.005. |

2 | Returns for periods of less than one year are not annualized. |

(For a share outstanding throughout each period)

Six months ended July 31, 2023 (unaudited) | Year ended January 31 | |||||

Select Class | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Net investment income | 0.02 | 0.02 | 0.00 1 | 0.00 1 | 0.02 | 0.02 |

Net realized gains (losses) on investments | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 |

Total from investment operations | 0.02 | 0.02 | 0.00 1 | 0.00 1 | 0.02 | 0.02 |

Distributions to shareholders from | ||||||

Net investment income | (0.02 ) | (0.02 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.02 ) |

Net realized gains | 0.00 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 |

Total distributions to shareholders | (0.02 ) | (0.02 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.02 ) |

Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Total return2 | 2.39 % | 1.89 % | 0.03 % | 0.26 % | 2.05 % | 1.85 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 0.18 % | 0.18 % | 0.17 % | 0.17 % | 0.18 % | 0.18 % |

Net expenses | 0.14 % | 0.11 %* | 0.05 %* | 0.14 % | 0.14 % | 0.14 % |

Net investment income | 4.81 % | 1.73 % | 0.03 % | 0.19 % | 2.02 % | 1.82 % |

Supplemental data | ||||||

Net assets, end of period (000s omitted) | $78,237,565 | $56,118,082 | $85,197,344 | $95,165,936 | $51,954,718 | $45,335,385 |

* | Ratio includes class-level expenses which were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would be increased by the following amounts: |

Year ended January 31, 2023 | 0.03% |

Year ended January 31, 2022 | 0.09% |

1 | Amount is less than $0.005. |

2 | Returns for periods of less than one year are not annualized. |

(For a share outstanding throughout each period)

Six months ended July 31, 2023 (unaudited) | Year ended January 31 | |||||

Service Class | 2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Net investment income | 0.02 | 0.02 | 0.00 1 | 0.00 1 | 0.02 | 0.01 |

Net realized gains (losses) on investments | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 | 0.00 1 |

Total from investment operations | 0.02 | 0.02 | 0.00 1 | 0.00 1 | 0.02 | 0.01 |

Distributions to shareholders from | ||||||

Net investment income | (0.02 ) | (0.02 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.01 ) |

Net realized gains | 0.00 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 | (0.00 )1 |

Total distributions to shareholders | (0.02 ) | (0.02 ) | (0.00 )1 | (0.00 )1 | (0.02 ) | (0.01 ) |

Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

Total return2 | 2.21 % | 1.58 % | 0.01 % | 0.14 % | 1.69 % | 1.48 % |

Ratios to average net assets (annualized) | ||||||

Gross expenses | 0.51 % | 0.51 % | 0.50 % | 0.50 % | 0.51 % | 0.51 % |

Net expenses | 0.50 % | 0.40 %* | 0.07 %* | 0.25 %* | 0.50 % | 0.50 % |

Net investment income | 4.42 % | 1.47 % | 0.01 % | 0.13 % | 1.67 % | 1.45 % |

Supplemental data | ||||||

Net assets, end of period (000s omitted) | $1,378,309 | $1,419,439 | $1,873,382 | $1,862,889 | $1,994,923 | $1,856,426 |

* | Ratio includes class-level expenses which were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would be increased by the following amounts: |

Year ended January 31, 2023 | 0.10% |

Year ended January 31, 2022 | 0.43% |

Year ended January 31, 2021 | 0.25% |

1 | Amount is less than $0.005. |

2 | Returns for periods of less than one year are not annualized. |

(For a share outstanding throughout each period)

Six months ended July 31, 2023 (unaudited) | Year ended January 31 | |||

Sweep Class | 2023 | 2022 | 20211 | |

Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 |

Net investment income | 0.02 | 0.02 | 0.00 2 | 0.00 2 |

Net realized gains (losses) on investments | 0.00 2 | 0.00 2 | 0.00 2 | 0.00 2 |

Total from investment operations | 0.02 | 0.02 | 0.00 2 | 0.00 2 |

Distributions to shareholders from | ||||

Net investment income | (0.02 ) | (0.02 ) | (0.00 )2 | (0.00 )2 |

Net realized gains | 0.00 | (0.00 )2 | (0.00 )2 | (0.00 )2 |

Total distributions to shareholders | (0.02 ) | (0.02 ) | (0.00 )2 | (0.00 )2 |

Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 |

Total return3 | 2.21 % | 1.58 % | 0.01 % | 0.01 % |

Ratios to average net assets (annualized) | ||||

Gross expenses | 0.52 % | 0.52 % | 0.51 % | 0.56 % |

Net expenses | 0.50 % | 0.41 %* | 0.06 %* | 0.13 %* |

Net investment income | 4.39 % | 1.54 % | 0.01 % | 0.01 % |

Supplemental data | ||||

Net assets, end of period (000s omitted) | $737,412 | $1,045,053 | $1,101,824 | $1,465 |

* | Ratio includes class-level expenses which were voluntarily waived by the investment manager. Without this voluntary waiver, the net expense ratio would be increased by the following amounts: |

Year ended January 31, 2023 | 0.09% |

Year ended January 31, 2022 | 0.44% |

Year ended January 31, 2021 | 0.37% |

1 | For the period from July 31, 2020 (commencement of class operations) to January 31, 2021. |

2 | Amount is less than $0.005. |

3 | Returns for periods of less than one year are not annualized. |

Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

Assets | ||||

Investments in: | ||||

Government agency debt | $0 | $18,020,150,443 | $0 | $18,020,150,443 |

Municipal obligations | 0 | 55,995,000 | 0 | 55,995,000 |

Other instruments | 0 | 416,960,000 | 0 | 416,960,000 |

Repurchase agreements | 0 | 83,213,124,853 | 0 | 83,213,124,853 |

U.S. Treasury securities | 0 | 15,101,805,191 | 0 | 15,101,805,191 |

Total assets | $0 | $116,808,035,487 | $0 | $116,808,035,487 |

Average daily net assets | Management fee |

First $5 billion | 0.150 % |

Next $5 billion | 0.140 |

Next $5 billion | 0.130 |

Next $85 billion | 0.125 |

Over $100 billion | 0.120 |

Class-level administration fee | |

Class A | 0.20 % |

Administrator Class | 0.10 |

Institutional Class | 0.08 |

Select Class | 0.04 |

Service Class | 0.12 |

Sweep Class | 0.03 |

EXPENSE RATIO CAPS | |

Class A | 0.58 % |

Administrator Class | 0.34 |

Institutional Class | 0.20 |

Select Class | 0.14 |

Service Class | 0.50 |

Sweep Class | 0.50 |

Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Foundation (non-profit organization). Mr. Ebsworth is a CFA charterholder. | N/A |

Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

Isaiah Harris, Jr. (Born 1952) | Trustee, since 2009; Audit Committee Chair, since 2019 | Retired. Member of the Advisory Board of CEF of East Central Florida. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | N/A |

David F. Larcker (Born 1950) | Trustee, since 2009 | Distinguished Visiting Fellow at the Hoover Institution since 2022. James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

Olivia S. Mitchell (Born 1953) | Trustee, since 2006; Nominating and Governance Committee Chair, since 2018 | International Foundation of Employee Benefit Plans Professor since 1993, Wharton School of the University of Pennsylvania. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously taught at Cornell University from 1978 to 1993. | N/A |

Timothy J. Penny (Born 1951) | Trustee, since 1996; Chair, since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Vice Chair of the Economic Club of Minnesota, since 2007. Co-Chair of the Committee for a Responsible Federal Budget, since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, from 2007-2022. Senior Fellow of the University of Minnesota Humphrey Institute from 1995 to 2017. | N/A |

Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

James G. Polisson (Born 1959) | Trustee, since 2018 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non- profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

Pamela Wheelock (Born 1959) | Trustee, since January 2020; previously Trustee from January 2018 to July 2019 | Retired. Executive and Senior Financial leadership positions in the public, private and nonprofit sectors. Interim President and CEO, McKnight Foundation, 2020. Interim Commissioner, Minnesota Department of Human Services, 2019. Chief Operating Officer, Twin Cities Habitat for Humanity, 2017-2019. Vice President for University Services, University of Minnesota, 2012- 2016. Interim President and CEO, Blue Cross and Blue Shield of Minnesota, 2011-2012. Executive Vice-President and Chief Financial Officer, Minnesota Wild, 2002-2008. Commissioner, Minnesota Department of Finance, 1999-2002. Chair of the Board of Directors of Destination Medical Center Corporation. Board member of the Minnesota Wild Foundation. | N/A |

* | Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable. |

Name and year of birth | Position held and length of service | Principal occupations during past five years or longer |

Andrew Owen (Born 1960) | President, since 2017 | President and Chief Executive Officer of Allspring Funds Management, LLC since 2017 and Head of Global Fund Governance of Allspring Global Investments since 2022. Prior thereto, co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, from 2019 to 2022 and Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. |

Jeremy DePalma (Born 1974) | Treasurer, since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. |

Christopher Baker (Born 1976) | Chief Compliance Officer, since 2022 | Global Chief Compliance Officer for Allspring Global Investments since 2022. Prior thereto, Chief Compliance Officer for State Street Global Advisors from 2018 to 2021. Senior Compliance Officer for the State Street divisions of Alternative Investment Solutions, Sector Solutions, and Global Marketing from 2015 to 2018. From 2010 to 2015 Vice President, Global Head of Investment and Marketing Compliance for State Street Global Advisors. |

Matthew Prasse (Born 1983) | Chief Legal Officer, since 2022; Secretary, since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

P.O. Box 219967

Kansas City, MO 64121-9967

SAR0450 07-23

Allspring Heritage Money Market Fund |

Allspring Funds

President

Allspring Funds

Notice to Shareholders |

Beginning in July 2024, the Fund will be required by the Securities and Exchange Commission to send shareholders a paper copy of a new tailored shareholder report in place of the full shareholder report that you are now receiving. The tailored shareholder report will contain concise information about the Fund, including certain expense and performance information and fund statistics. If you wish to receive this new tailored shareholder report electronically, please follow the instructions on the back cover of this report. |

Other information that is currently included in the shareholder report, such as the Fund’s financial statements, will be available online and upon request, free of charge, in paper or electronic format. |

Investment objective | The Fund seeks current income, while preserving capital and liquidity. |

Manager | Allspring Funds Management, LLC |

Subadviser | Allspring Global Investments, LLC |

Portfolio managers | Michael C. Bird, CFA, Jeffrey L. Weaver, CFA, Laurie White |

Average annual total returns (%) as of July 31, 2023 | ||||||

Expense ratios1 (%) | ||||||

Inception date | 1 year | 5 year | 10 year | Gross | Net2 | |

Administrator Class (SHMXX) | 6-29-1995 | 4.12 | 1.56 | 0.99 | 0.36 | 0.33 |

Institutional Class (SHIXX) | 3-31-2000 | 4.25 | 1.65 | 1.08 | 0.24 | 0.20 |

Select Class (WFJXX) | 6-29-2007 | 4.32 | 1.71 | 1.14 | 0.20 | 0.13 |

Service Class (WHTXX) | 6-30-2010 | 4.01 | 1.49 | 0.93 | 0.53 | 0.43 |

1 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the Financial Highlights of this report. |

2 | The manager has contractually committed through May 31, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses after fee waivers at 0.33% for Administrator Class, 0.20% for Institutional Class, 0.13% for Select Class and 0.43% for Service Class. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense caps. Prior to or after the commitment expiration date, the caps may be increased or the commitment to maintain the caps may be terminated only with the approval of the Board of Trustees. The manager and/or its affiliates may also voluntarily waive all or a portion of any fees to which they are entitled and/or reimburse certain expenses as they may determine from time to time. Without these caps, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

Yield summary (%) as of July 31, 2023 | ||||

Administrator Class | Institutional Class | Select Class | Service Class | |

7-day current yield1 | 5.15 | 5.28 | 5.35 | 5.05 |

7-day compound yield | 5.28 | 5.42 | 5.49 | 5.18 |

30-day simple yield | 5.05 | 5.18 | 5.25 | 4.95 |

30-day compound yield | 5.17 | 5.31 | 5.38 | 5.06 |

1 | The manager has contractually committed through May 31, 2024, to waive fees and/or reimburse expenses to the extent necessary to cap total annual fund operating expenses and may also voluntarily waive or reimburse additional fees and expenses which may be discontinued or modified at any time without notice. Without these reductions, the Fund’s 7-day current yield would have been 5.12%, 5.24%, 5.28% and 4.95% for Administrator Class, Institutional Class, Select Class and Service Class, respectively. |

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

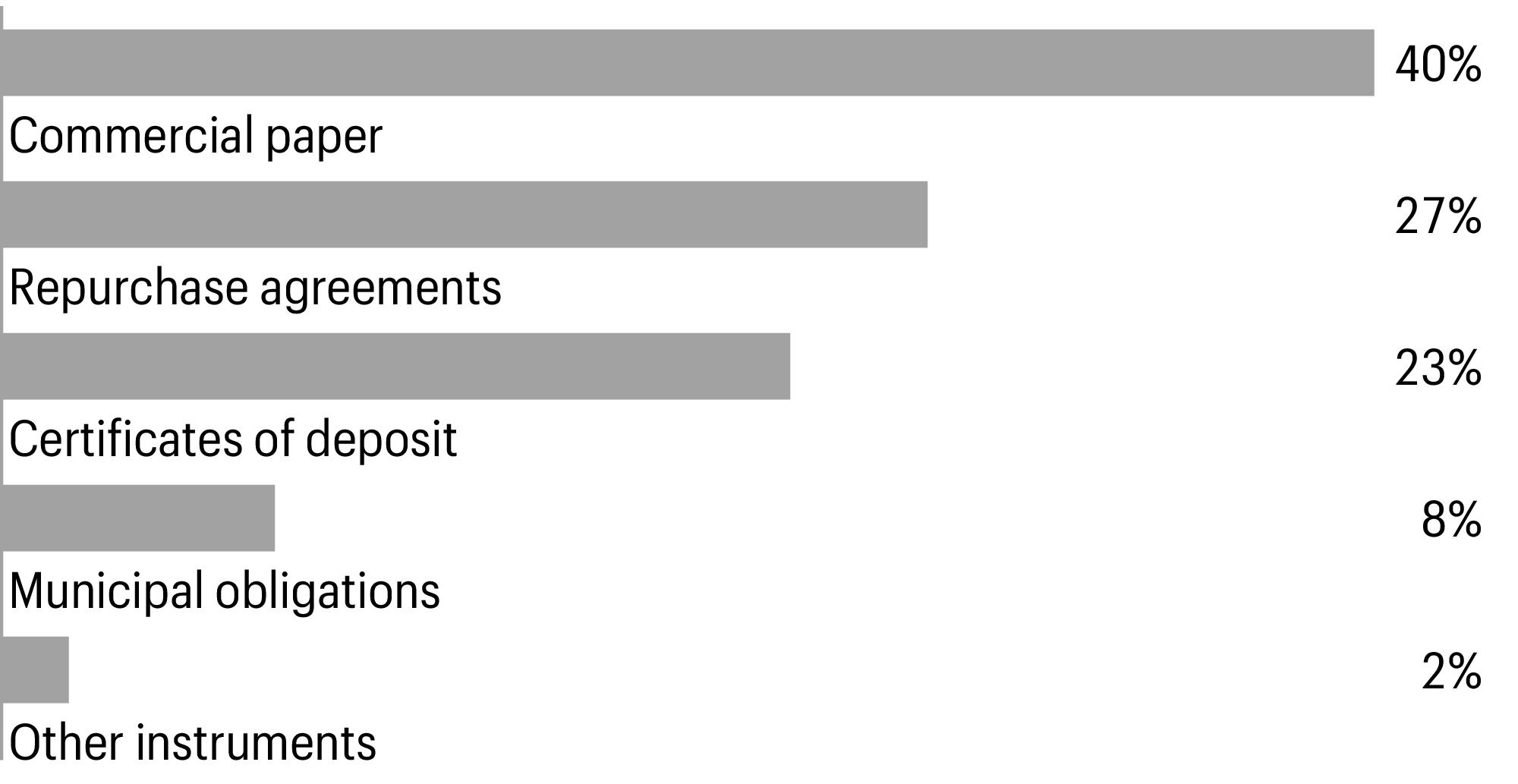

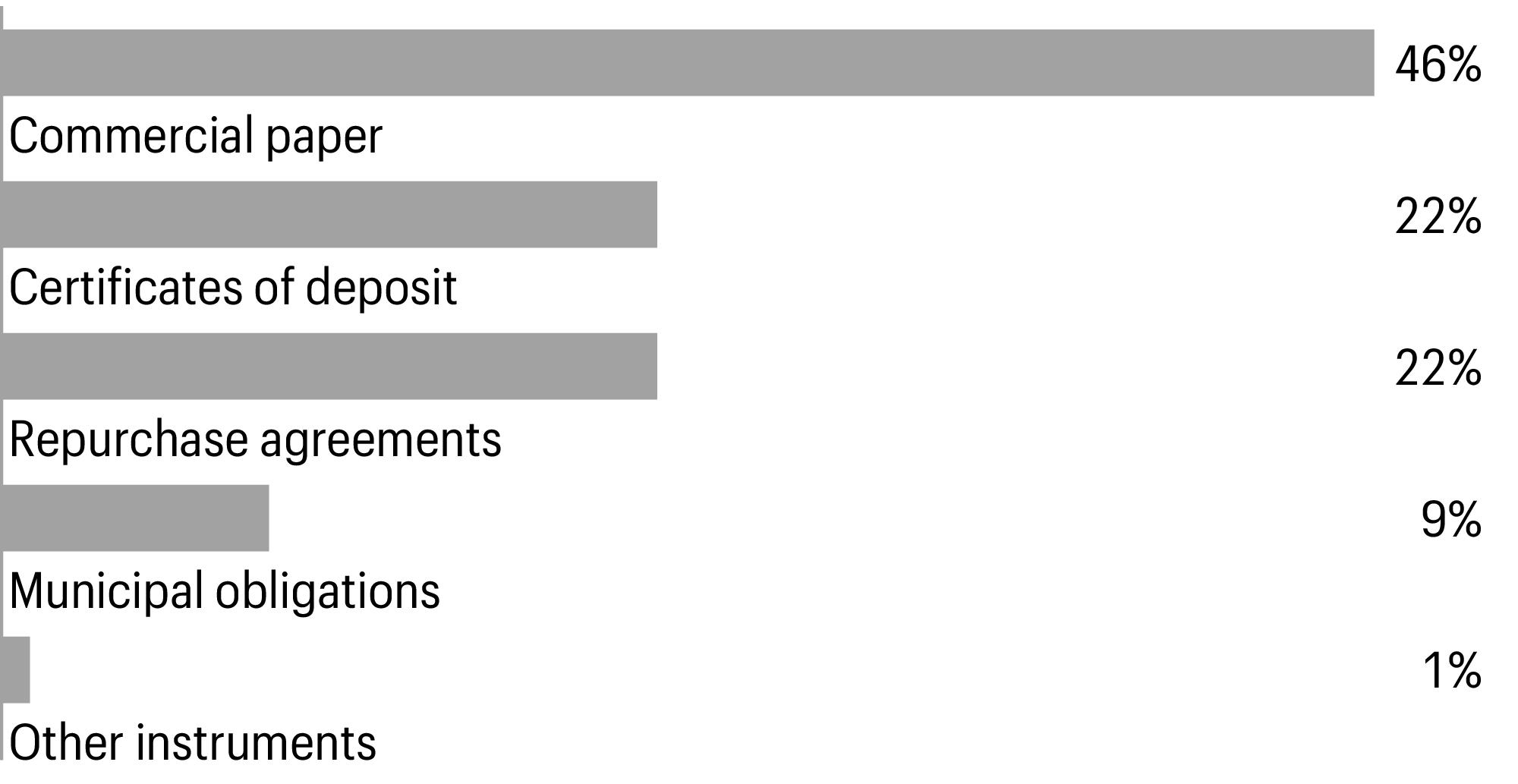

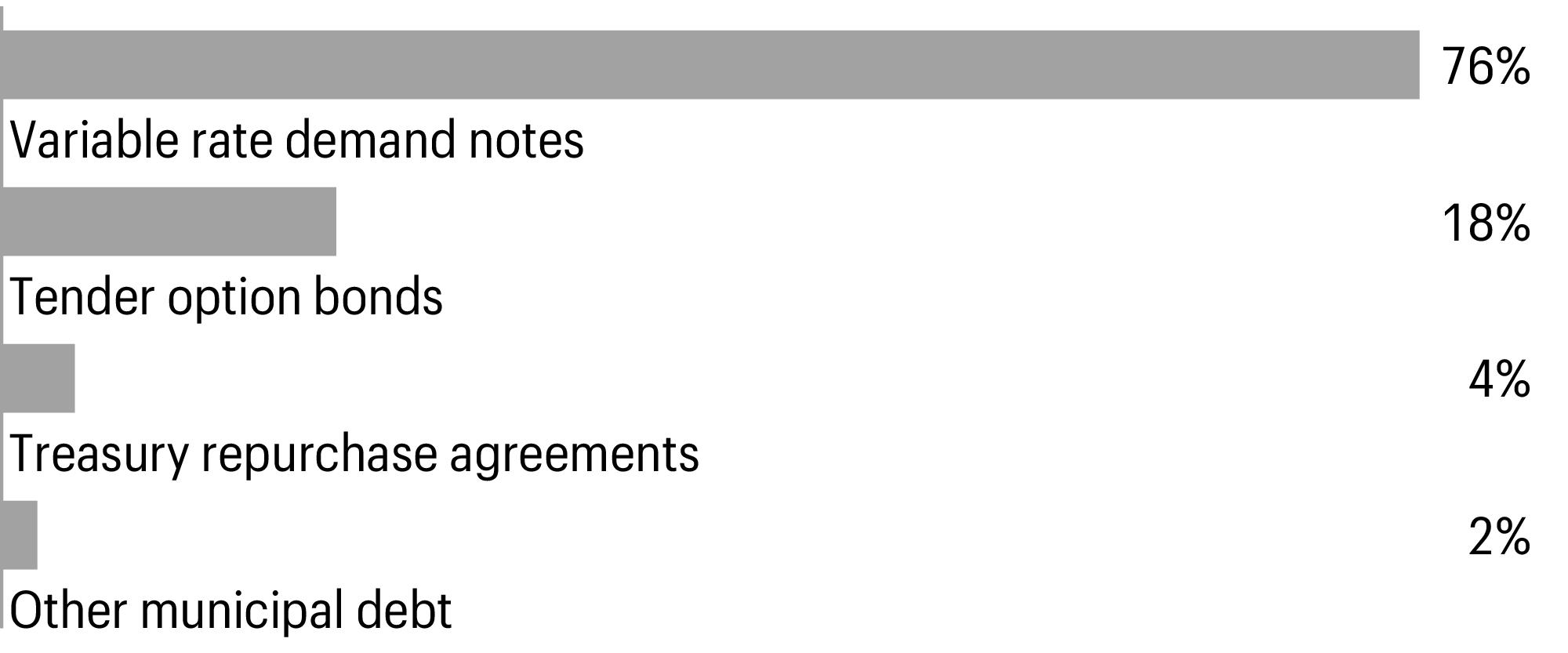

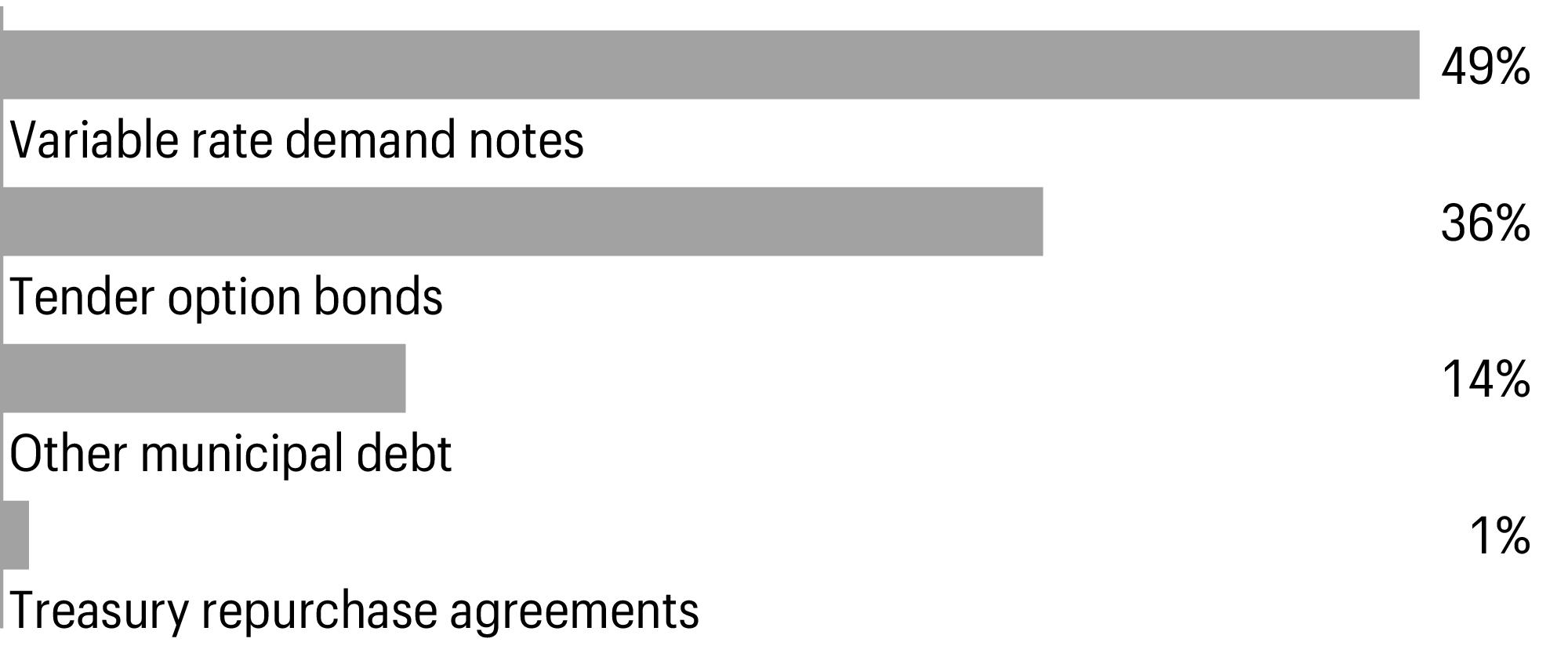

Portfolio composition as of July 31, 20231 |

1 | Figures represent the percentage of the Fund’s total investments. Allocations are subject to change and may have changed since the date specified. |

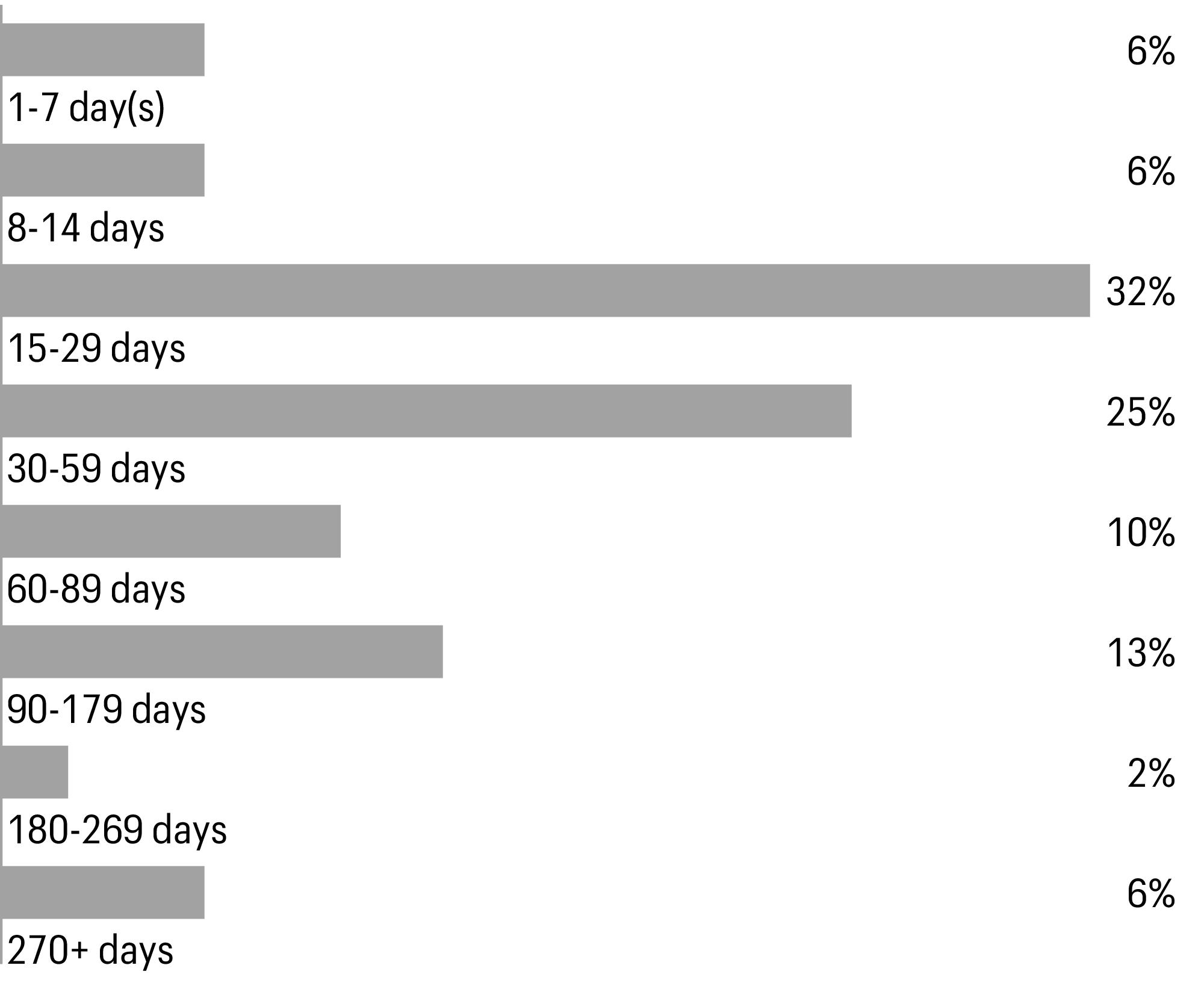

Effective maturity distribution as of July 31, 20231 |

1 | Figures represent the percentage of the Fund’s total investments. Allocations are subject to change and may have changed since the date specified. |

Weighted average maturity as of July 31, 20231 |

15 days |

1 | Weighted Average Maturity (WAM): WAM is an average of the effective maturities of all securities held in the portfolio, weighted by each security’s percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. WAM calculations allow for the maturities of certain securities with demand features or periodic interest rate resets to be shortened. WAM is a way to measure a fund’s sensitivity to potential interest rate changes. WAM is subject to change and may have changed since the date specified. |

Weighted average life as of July 31, 20231 |

45 days |

1 | Weighted Average Life (WAL): WAL is an average of the final maturities of all securities held in the portfolio, weighted by their percentage of total investments. The maturity of a portfolio security is the period remaining until the date on which the principal amount is unconditionally required to be paid, or in the case of a security called for redemption, the date on which the redemption payment is unconditionally required to be made. In contrast to WAM, the calculation of WAL allows for the maturities of certain securities with demand features to be shortened, but not the periodic interest rate resets. WAL is a way to measure a fund’s potential sensitivity to credit spread changes. WAL is subject to change and may have changed since the date specified. |

Beginning account value 2-1-2023 | Ending account value 7-31-2023 | Expenses paid during the period1 | Annualized net expense ratio | |

Administrator Class | ||||

Actual | $1,000.00 | $1,000.00 | $1.64 | 0.33 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,023.16 | $1.66 | 0.33 % |

Institutional Class | ||||

Actual | $1,000.00 | $1,024.50 | $1.00 | 0.20 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,023.80 | $1.00 | 0.20 % |

Select Class | ||||

Actual | $1,000.00 | $1,024.90 | $0.65 | 0.13 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,024.15 | $0.65 | 0.13 % |

Service Class | ||||

Actual | $1,000.00 | $1,023.40 | $2.16 | 0.43 % |

Hypothetical (5% return before expenses) | $1,000.00 | $1,022.66 | $2.16 | 0.43 % |

1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by 181 divided by 365 (to reflect the one-half-year period). |

Interest rate | Maturity date | Principal | Value | |||

Certificates of deposit: 23.82% | ||||||

ABN AMRO Bank NV## | 5.33 % | 8-3-2023 | $ | 75,000,000 | $75,000,000 | |

Banco Santander SA | 5.68 | 10-12-2023 | 10,000,000 | 10,004,556 | ||

Banco Santander SA (U.S. SOFR+0.52%)± | 5.91 | 12-11-2023 | 15,000,000 | 15,005,561 | ||

Bank of America N.A. | 5.94 | 3-4-2024 | 7,000,000 | 7,002,997 | ||

Bank of Montreal (U.S. SOFR+0.53%)± | 5.91 | 4-5-2024 | 10,000,000 | 10,002,975 | ||

Bank of Montreal (U.S. SOFR+0.75%)± | 6.13 | 8-1-2023 | 35,000,000 | 35,000,571 | ||

Bank of Montreal (U.S. SOFR+0.75%)± | 6.13 | 12-4-2023 | 25,000,000 | 25,035,444 | ||

BNP Paribas SA (U.S. SOFR+0.30%)± | 5.68 | 11-16-2023 | 50,000,000 | 50,004,769 | ||

Canadian Imperial Bank of Commerce | 5.31 | 8-1-2023 | 50,000,000 | 50,000,000 | ||

Canadian Imperial Bank of Commerce (U.S. SOFR+0.44%)± | 5.82 | 1-18-2024 | 25,000,000 | 25,018,569 | ||

Citibank NA | 5.73 | 1-4-2024 | 10,000,000 | 9,999,651 | ||

Citibank NA | 5.76 | 1-29-2024 | 10,000,000 | 9,999,225 | ||

Citibank NA (U.S. SOFR+0.55%)± | 5.93 | 3-21-2024 | 10,000,000 | 10,006,567 | ||

Credit Agricole Corporate & Investment Bank (U.S. SOFR+0.44%)± | 5.78 | 11-17-2023 | 15,000,000 | 15,008,904 | ||

Credit Agricole Corporate & Investment Bank SA | 5.31 | 8-1-2023 | 50,000,000 | 50,000,000 | ||

Credit Industriel et Commercial | 5.71 | 1-16-2024 | 15,000,000 | 15,000,466 | ||

Erste Group Bank AG | 5.33 | 8-7-2023 | 75,000,000 | 75,000,000 | ||

MUFG Bank Ltd. | 5.70 | 12-6-2023 | 10,000,000 | 9,999,522 | ||

MUFG Bank Ltd. (U.S. SOFR+0.38%)± | 5.77 | 11-13-2023 | 25,000,000 | 25,005,636 | ||

MUFG Bank Ltd. (U.S. SOFR+0.44%)± | 5.83 | 1-19-2024 | 25,000,000 | 25,002,814 | ||

Norinchukin Bank (U.S. SOFR+0.41%)±%% | 5.71 | 2-1-2024 | 25,000,000 | 24,995,624 | ||

Oversea-Chinese Banking Corp. Ltd. (U.S. SOFR+0.15%)± | 5.54 | 9-6-2023 | 15,000,000 | 14,999,504 | ||

Oversea-Chinese Banking Corp. Ltd. (U.S. SOFR+0.27%)± | 5.66 | 8-28-2023 | 25,000,000 | 25,002,821 | ||