0001081400allspring:C000020145Memberallspring:FR42226A107CTIMember2024-09-300001081400allspring:C000130040Memberallspring:FR03820C105CTIMember2024-09-300001081400allspring:C000053345Memberallspring:FR88162G103CTIMember2024-09-300001081400allspring:ALLSPRINGIndexBloombergUSUniversalBondIndex15801AdditionalIndexMember2024-07-310001081400allspring:C000089465Member2023-03-310001081400allspring:ALLSPRINGIndexRussellMidcapGrowthIndex25224BroadBasedIndexMember2022-04-300001081400allspring:ALLSPRINGIndexIndexAssetAllocationBlendedIndex15922BroadBasedIndexMember2019-04-300001081400allspring:C000219846Member2018-08-310001081400allspring:ALLSPRINGIndexRussell3000Index16049AdditionalIndexMember2020-12-310001081400allspring:C000053347Member2020-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Allspring Funds Trust

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: September 30

Registrant is making a filing for 10 of its series: Allspring Common Stock Fund, Allspring Diversified Capital Builder Fund, Allspring Diversified Income Builder Fund, Allspring Global Investment Grade Credit Fund, Allspring Income Plus Fund, Allspring Index Asset Allocation Fund, Allspring Mid Cap Growth Fund, Allspring Opportunity Fund, Allspring SMID Cap Growth Fund and Allspring Special Mid Cap Value Fund

Date of reporting period: September 30, 2024

ITEM 1. REPORT TO STOCKHOLDERS

Annual Shareholder Report

This annual shareholder report contains important information about Common Stock Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Institutional Class | $94 | 0.85% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

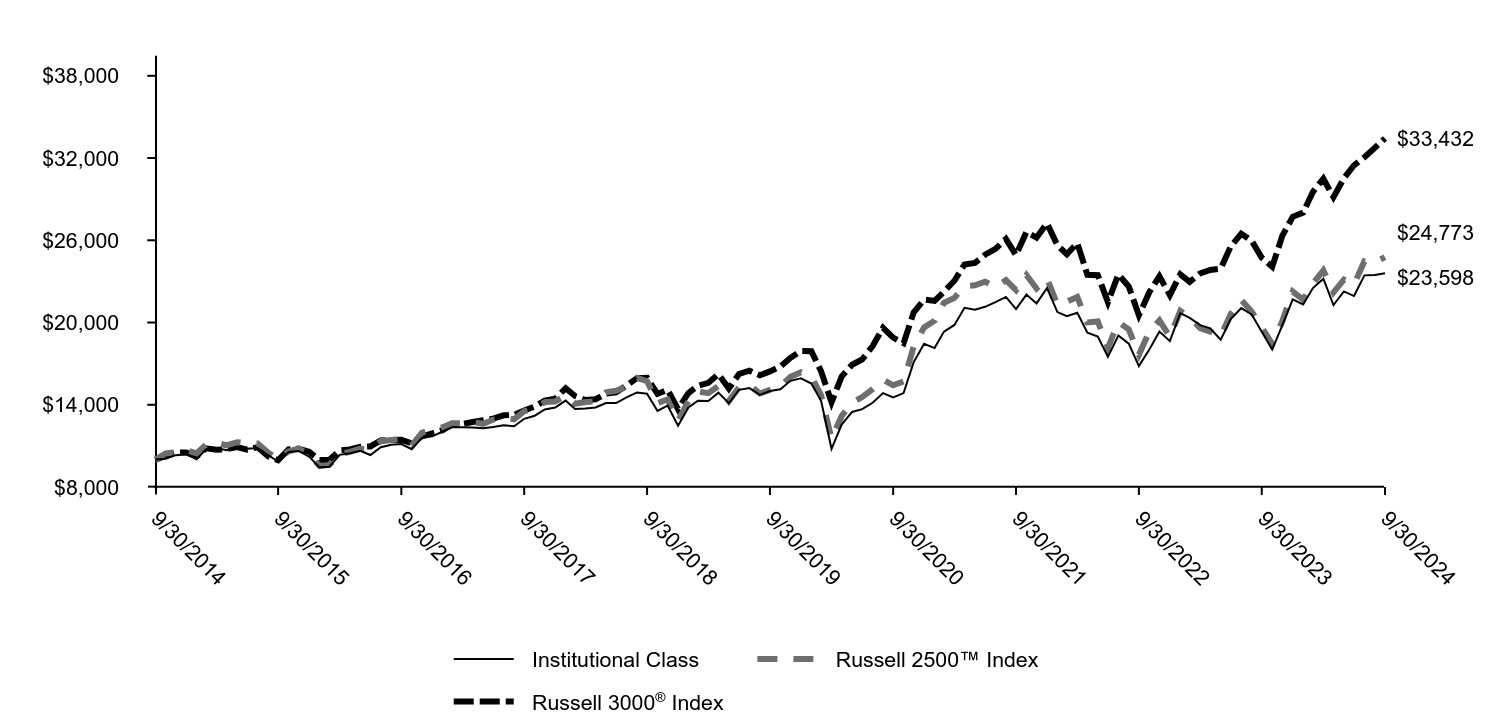

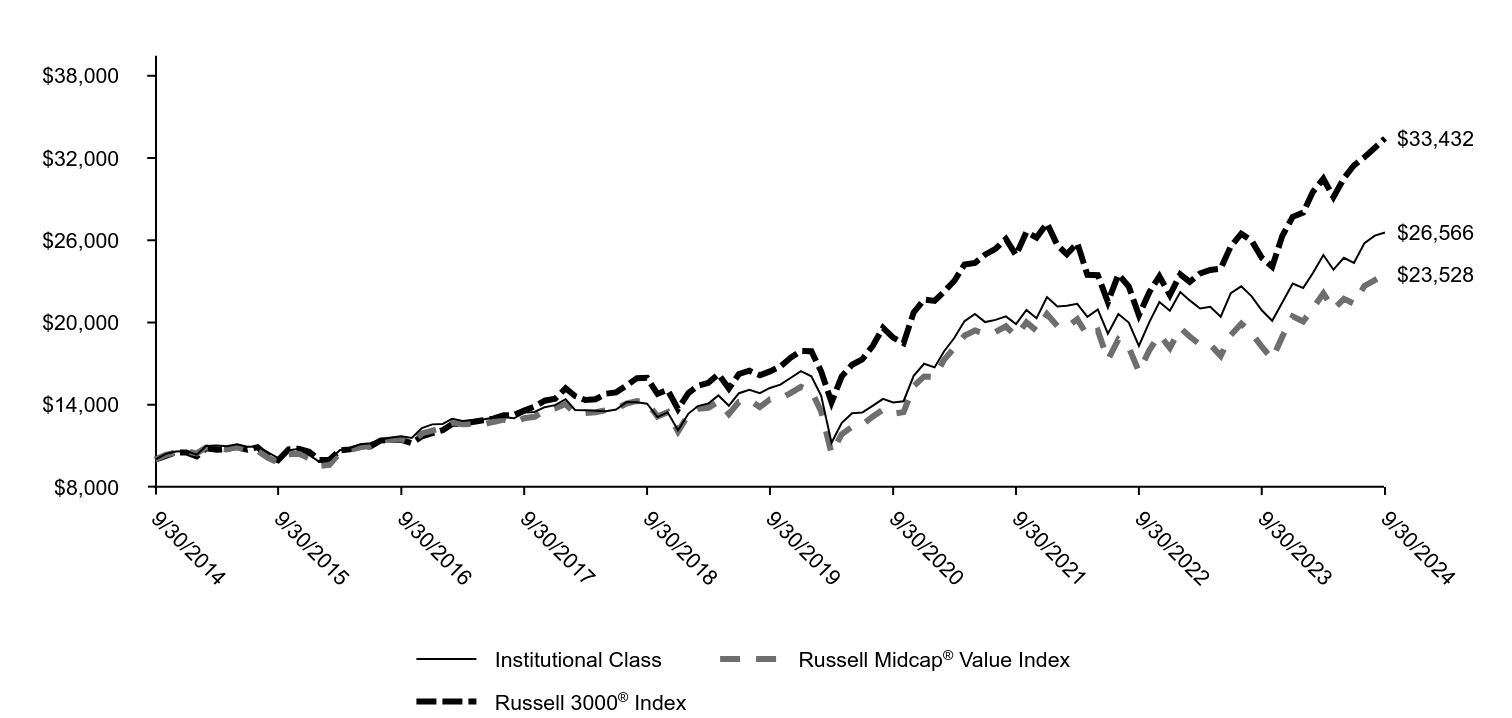

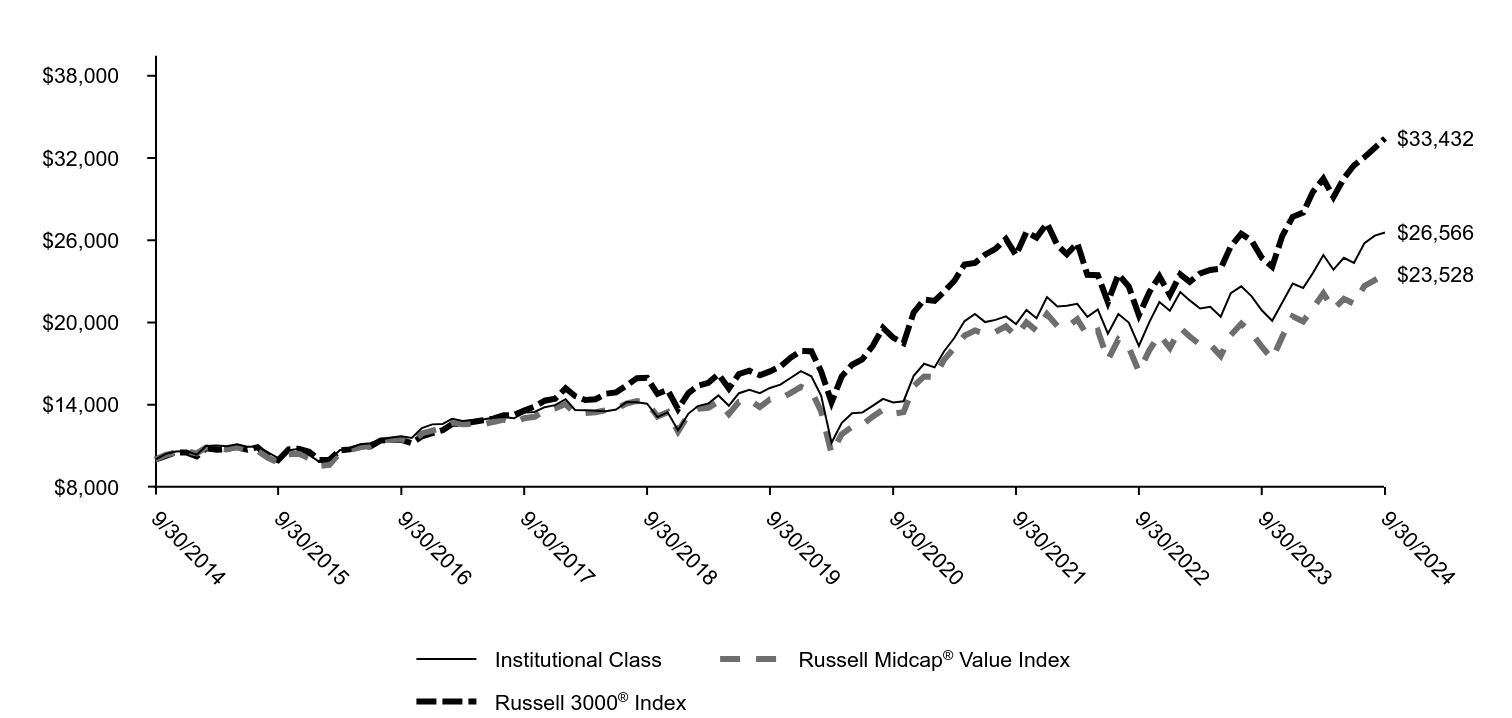

How did the Fund perform last year and what affected its performance?

Over the 12-month period that ended September 30, 2024, the equity markets soared to all-time highs, fueled by positive earnings surprises, robust economic growth, a decline in both inflation and interest rates, and a fervor around artificial intelligence (AI). Driven by semiconductor chip designer NVIDIA Corp., the AI theme significantly boosted the mega-cap growth sector to unprecedented heights. By contrast, small- and mid-cap stocks substantially underperformed large caps, partly due to their inferior balance sheet profiles. However, with the Federal Reserve pivoting to a more accommodative stance, future rate cuts could lower borrowing costs and be a catalyst for smaller-cap companies.

Key detractors during the period included Atkore Inc., which endured a cyclical downturn, citing weaker customer spending, and Leslie’s Inc., which toiled with a decline in chlorine prices, a CEO change, and softness in new pool and renovation construction. Going forward, we remain optimistic about the Fund’s prospects given the attractive private market valuations of many of our holdings.

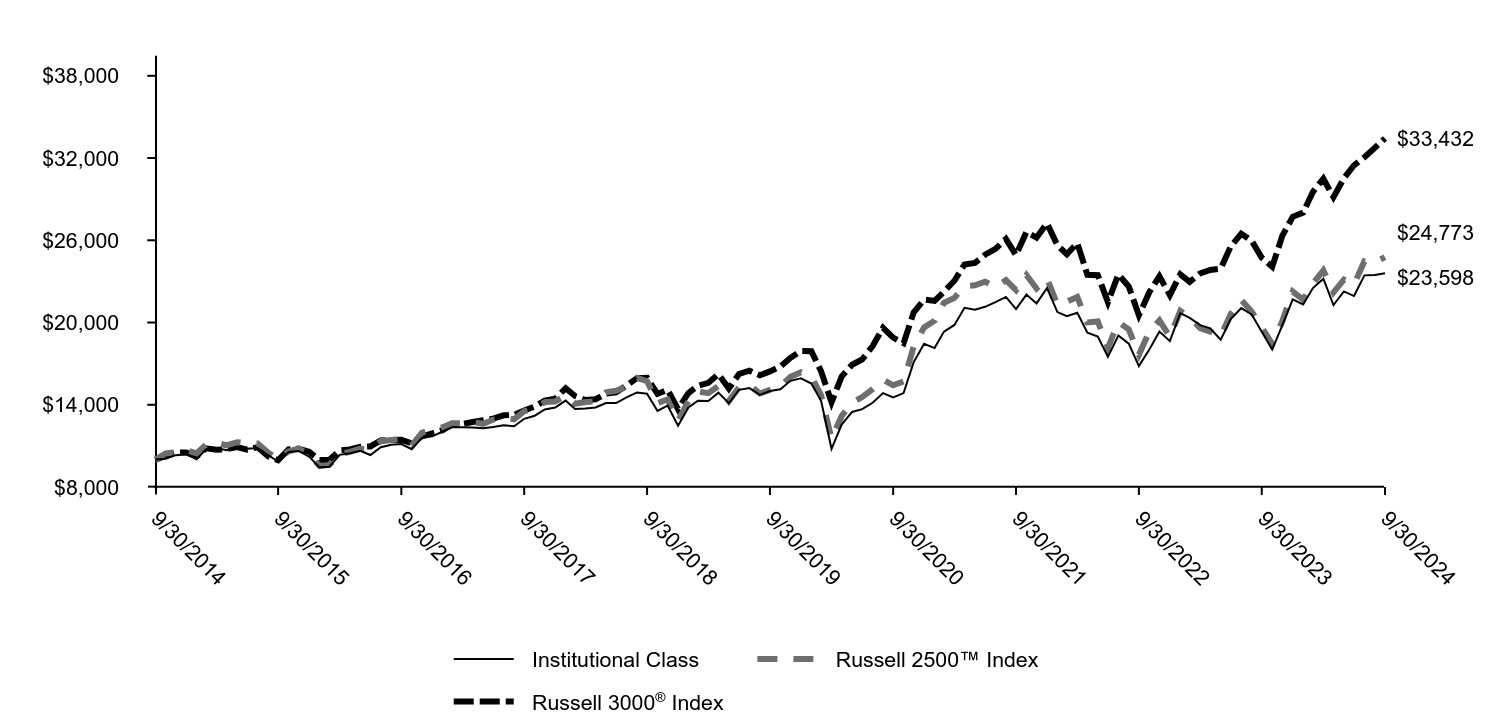

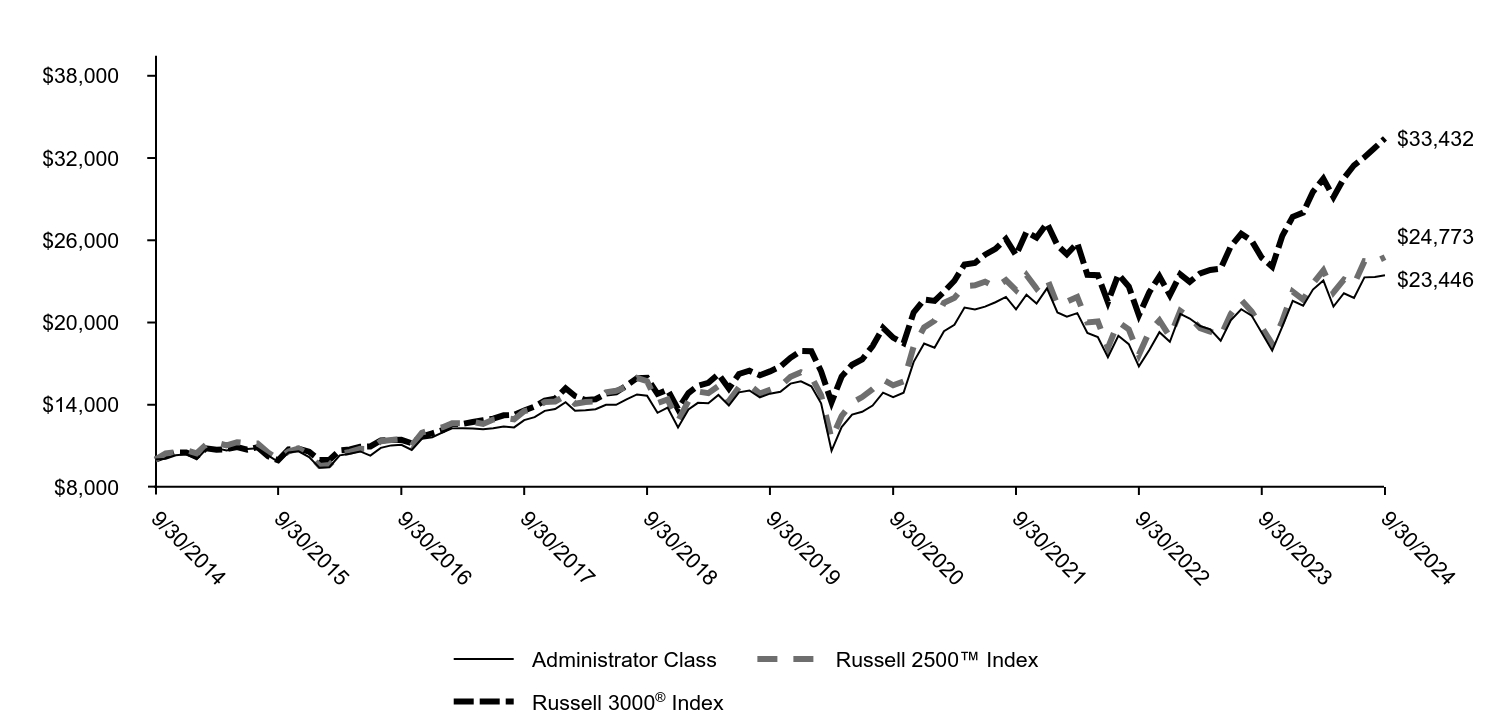

Total return based on a $10,000 investment

| Institutional Class | Russell 2500™ Index | Russell 3000® Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,063 | $10,443 | $10,275 |

| 11/30/2014 | $10,325 | $10,533 | $10,524 |

| 12/31/2014 | $10,392 | $10,677 | $10,524 |

| 1/31/2015 | $10,027 | $10,458 | $10,231 |

| 2/28/2015 | $10,761 | $11,081 | $10,824 |

| 3/31/2015 | $10,837 | $11,229 | $10,713 |

| 4/30/2015 | $10,677 | $11,032 | $10,762 |

| 5/31/2015 | $10,864 | $11,268 | $10,911 |

| 6/30/2015 | $10,797 | $11,190 | $10,728 |

| 7/31/2015 | $10,850 | $11,169 | $10,908 |

| 8/31/2015 | $10,334 | $10,508 | $10,249 |

| 9/30/2015 | $9,862 | $10,038 | $9,951 |

| 10/31/2015 | $10,548 | $10,599 | $10,736 |

| 11/30/2015 | $10,632 | $10,807 | $10,796 |

| 12/31/2015 | $10,220 | $10,367 | $10,574 |

| 1/31/2016 | $9,433 | $9,540 | $9,978 |

| 2/29/2016 | $9,478 | $9,607 | $9,975 |

| 3/31/2016 | $10,345 | $10,408 | $10,677 |

| 4/30/2016 | $10,466 | $10,561 | $10,743 |

| 5/31/2016 | $10,636 | $10,784 | $10,935 |

| 6/30/2016 | $10,335 | $10,779 | $10,958 |

| 7/31/2016 | $10,902 | $11,342 | $11,393 |

| 8/31/2016 | $11,087 | $11,432 | $11,422 |

| 9/30/2016 | $11,133 | $11,487 | $11,440 |

| 10/31/2016 | $10,756 | $11,021 | $11,192 |

| 11/30/2016 | $11,584 | $11,958 | $11,693 |

| 12/31/2016 | $11,697 | $12,190 | $11,921 |

| 1/31/2017 | $12,050 | $12,360 | $12,145 |

| 2/28/2017 | $12,351 | $12,657 | $12,597 |

| 3/31/2017 | $12,367 | $12,648 | $12,606 |

| 4/30/2017 | $12,341 | $12,746 | $12,739 |

| 5/31/2017 | $12,294 | $12,603 | $12,870 |

| 6/30/2017 | $12,382 | $12,918 | $12,986 |

| 7/31/2017 | $12,497 | $13,052 | $13,231 |

| 8/31/2017 | $12,434 | $12,944 | $13,256 |

| 9/30/2017 | $12,975 | $13,531 | $13,579 |

| 10/31/2017 | $13,198 | $13,740 | $13,876 |

| 11/30/2017 | $13,661 | $14,192 | $14,297 |

| 12/31/2017 | $13,800 | $14,240 | $14,440 |

| 1/31/2018 | $14,306 | $14,674 | $15,201 |

| 2/28/2018 | $13,684 | $14,070 | $14,641 |

| 3/31/2018 | $13,725 | $14,206 | $14,347 |

| 4/30/2018 | $13,800 | $14,239 | $14,402 |

| 5/31/2018 | $14,128 | $14,909 | $14,808 |

| 6/30/2018 | $14,128 | $15,017 | $14,905 |

| 7/31/2018 | $14,536 | $15,307 | $15,400 |

| 8/31/2018 | $14,899 | $15,964 | $15,940 |

| 9/30/2018 | $14,807 | $15,722 | $15,967 |

| 10/31/2018 | $13,552 | $14,126 | $14,791 |

| 11/30/2018 | $13,938 | $14,392 | $15,087 |

| 12/31/2018 | $12,473 | $12,815 | $13,683 |

| 1/31/2019 | $13,797 | $14,291 | $14,858 |

| 2/28/2019 | $14,301 | $14,966 | $15,380 |

| 3/31/2019 | $14,274 | $14,842 | $15,605 |

| 4/30/2019 | $14,886 | $15,363 | $16,228 |

| 5/31/2019 | $14,106 | $14,270 | $15,178 |

| 6/30/2019 | $15,088 | $15,282 | $16,244 |

| 7/31/2019 | $15,215 | $15,441 | $16,485 |

| 8/31/2019 | $14,725 | $14,823 | $16,149 |

| 9/30/2019 | $15,000 | $15,086 | $16,433 |

| 10/31/2019 | $15,135 | $15,375 | $16,786 |

| 11/30/2019 | $15,746 | $16,035 | $17,424 |

| 12/31/2019 | $15,924 | $16,374 | $17,928 |

| 1/31/2020 | $15,551 | $16,041 | $17,908 |

| 2/29/2020 | $14,288 | $14,696 | $16,442 |

| 3/31/2020 | $10,786 | $11,507 | $14,181 |

| 4/30/2020 | $12,552 | $13,182 | $16,059 |

| 5/31/2020 | $13,473 | $14,155 | $16,918 |

| 6/30/2020 | $13,679 | $14,564 | $17,304 |

| 7/31/2020 | $14,143 | $15,144 | $18,287 |

| 8/31/2020 | $14,851 | $15,830 | $19,612 |

| 9/30/2020 | $14,531 | $15,421 | $18,898 |

| 10/31/2020 | $14,851 | $15,700 | $18,490 |

| 11/30/2020 | $17,104 | $18,258 | $20,739 |

| 12/31/2020 | $18,444 | $19,647 | $21,672 |

| 1/31/2021 | $18,133 | $20,129 | $21,576 |

| 2/28/2021 | $19,337 | $21,442 | $22,250 |

| 3/31/2021 | $19,823 | $21,795 | $23,048 |

| 4/30/2021 | $21,075 | $22,665 | $24,236 |

| 5/31/2021 | $20,940 | $22,712 | $24,346 |

| 6/30/2021 | $21,147 | $22,981 | $24,947 |

| 7/31/2021 | $21,482 | $22,578 | $25,369 |

| 8/31/2021 | $21,865 | $23,091 | $26,092 |

| 9/30/2021 | $20,972 | $22,364 | $24,921 |

| 10/31/2021 | $22,040 | $23,461 | $26,607 |

| 11/30/2021 | $21,394 | $22,482 | $26,202 |

| 12/31/2021 | $22,516 | $23,220 | $27,234 |

| 1/31/2022 | $20,763 | $21,287 | $25,631 |

| 2/28/2022 | $20,462 | $21,527 | $24,986 |

| 3/31/2022 | $20,716 | $21,869 | $25,796 |

| 4/30/2022 | $19,265 | $20,006 | $23,481 |

| 5/31/2022 | $18,982 | $20,073 | $23,450 |

| 6/30/2022 | $17,502 | $18,155 | $21,488 |

| 7/31/2022 | $19,057 | $20,034 | $23,504 |

| 8/31/2022 | $18,454 | $19,501 | $22,627 |

| 9/30/2022 | $16,824 | $17,644 | $20,528 |

| 10/31/2022 | $18,030 | $19,337 | $22,212 |

| 11/30/2022 | $19,340 | $20,153 | $23,371 |

| 12/31/2022 | $18,642 | $18,954 | $22,003 |

| 1/31/2023 | $20,681 | $20,850 | $23,518 |

| 2/28/2023 | $20,343 | $20,360 | $22,968 |

| 3/31/2023 | $19,809 | $19,597 | $23,583 |

| 4/30/2023 | $19,580 | $19,341 | $23,834 |

| 5/31/2023 | $18,740 | $19,002 | $23,927 |

| 6/30/2023 | $20,245 | $20,621 | $25,560 |

| 7/31/2023 | $21,052 | $21,646 | $26,477 |

| 8/31/2023 | $20,583 | $20,796 | $25,966 |

| 9/30/2023 | $19,329 | $19,635 | $24,729 |

| 10/31/2023 | $18,031 | $18,442 | $24,073 |

| 11/30/2023 | $19,798 | $20,102 | $26,318 |

| 12/31/2023 | $21,682 | $22,257 | $27,714 |

| 1/31/2024 | $21,321 | $21,675 | $28,021 |

| 2/29/2024 | $22,516 | $22,854 | $29,538 |

| 3/31/2024 | $23,192 | $23,797 | $30,491 |

| 4/30/2024 | $21,276 | $22,203 | $29,149 |

| 5/31/2024 | $22,268 | $23,126 | $30,526 |

| 6/30/2024 | $21,930 | $22,780 | $31,471 |

| 7/31/2024 | $23,440 | $24,472 | $32,056 |

| 8/31/2024 | $23,463 | $24,409 | $32,754 |

| 9/30/2024 | $23,598 | $24,773 | $33,432 |

Annual Shareholder Report | September 30, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 22.09 | 9.49 | 8.97 |

| Russell 2500™ Index (Strategy) | 26.17 | 10.43 | 9.50 |

Russell 3000® Index (Regulatory) | 35.19 | 15.26 | 12.83 |

| Total net assets | $799,373,723 |

| # of portfolio holdings | 78 |

| Portfolio turnover rate | 46% |

| Total advisory fees paid | $6,047,377 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Industrials | 20.0 |

| Information technology | 17.3 |

| Financials | 16.1 |

| Health care | 12.8 |

| Materials | 10.2 |

| Consumer discretionary | 9.8 |

| Real estate | 9.3 |

| Consumer staples | 2.6 |

| Domestic Equity | 1.5 |

| Communication services | 0.4 |

TOP TEN HOLDINGS (% OF NET ASSETS)

| Regal Rexnord Corp. | 2.2 |

| Teledyne Technologies, Inc. | 2.1 |

| Marvell Technology, Inc. | 2.0 |

| Carlisle Cos., Inc. | 2.0 |

| Melrose Industries PLC | 1.9 |

| SBA Communications Corp., Class A | 1.9 |

| HealthEquity, Inc. | 1.9 |

| Westlake Corp. | 1.9 |

| Sun Communities, Inc. | 1.8 |

| Bio-Rad Laboratories, Inc., Class A | 1.8 |

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

This annual shareholder report contains important information about Common Stock Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Class R6 | $92 | 0.83% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

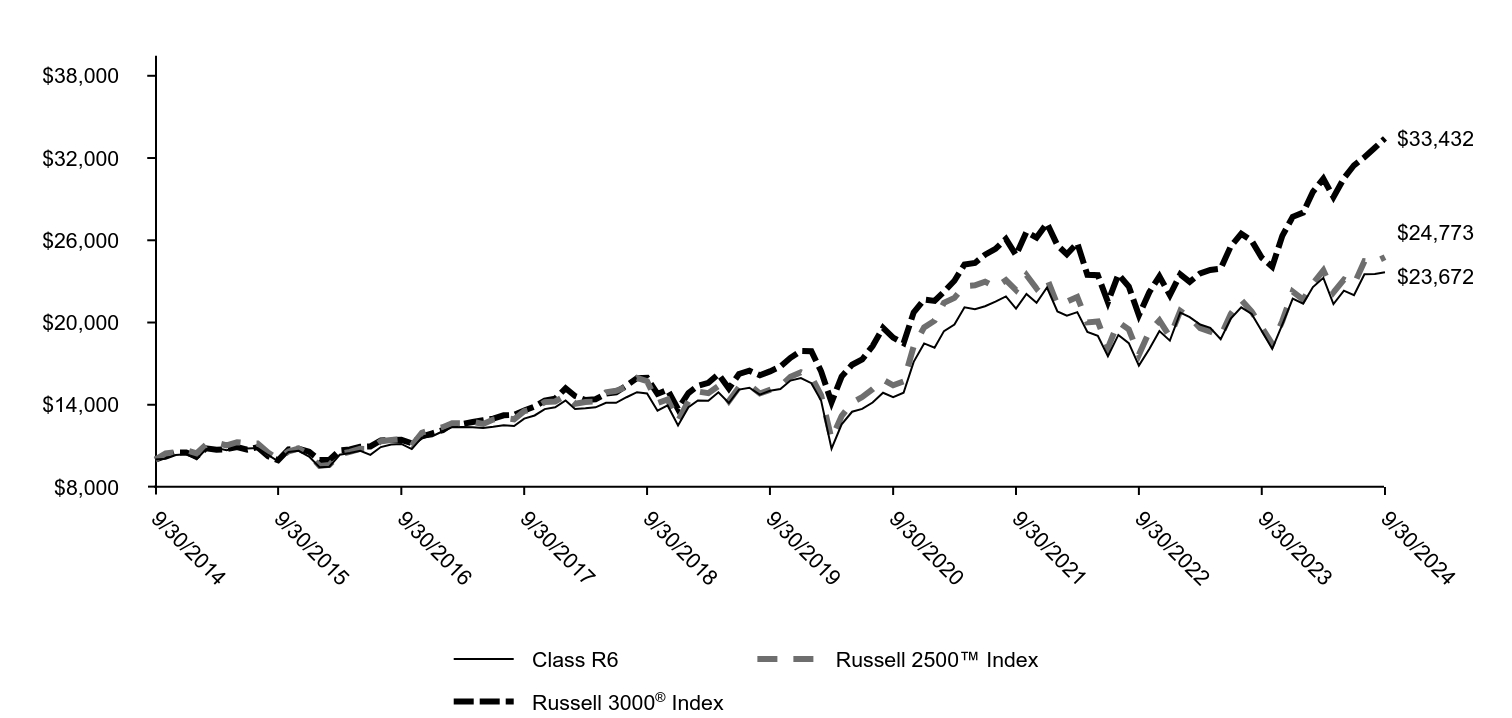

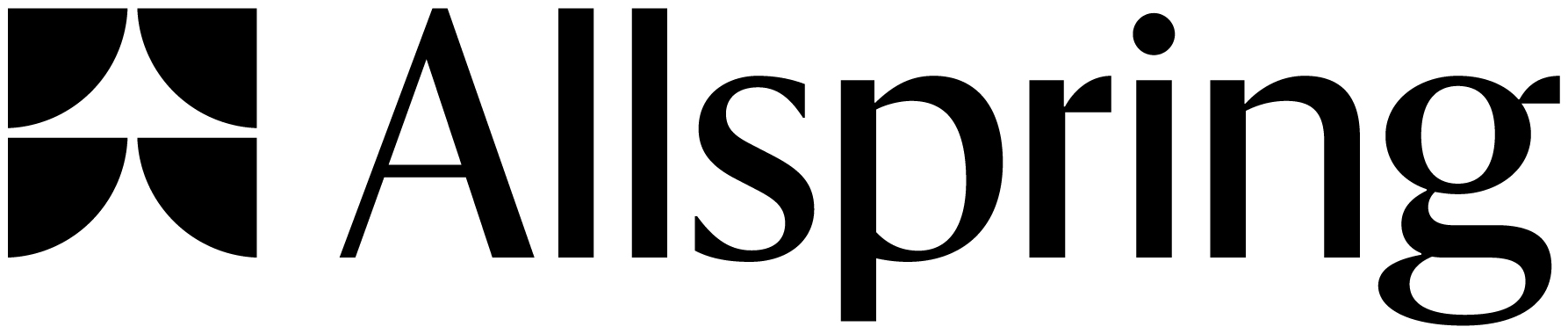

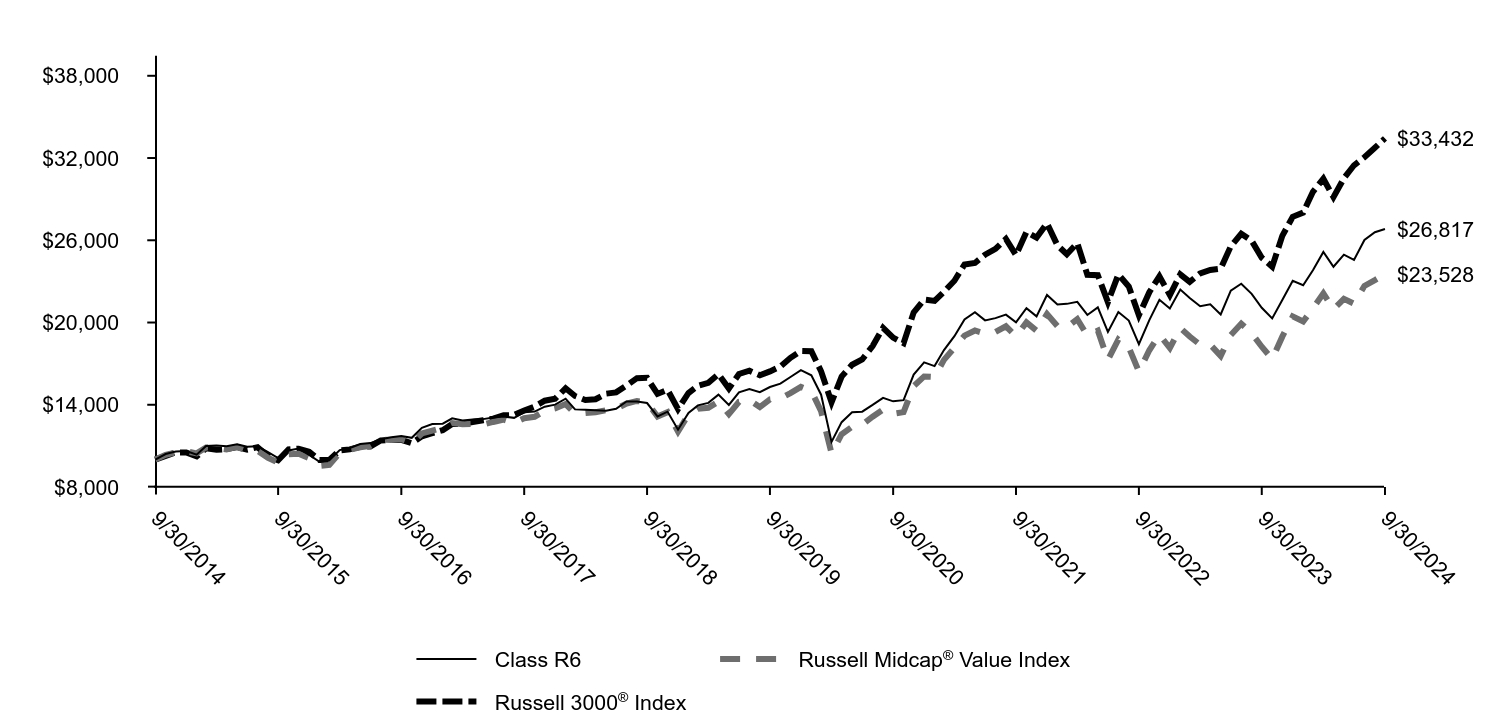

How did the Fund perform last year and what affected its performance?

Over the 12-month period that ended September 30, 2024, the equity markets soared to all-time highs, fueled by positive earnings surprises, robust economic growth, a decline in both inflation and interest rates, and a fervor around artificial intelligence (AI). Driven by semiconductor chip designer NVIDIA Corp., the AI theme significantly boosted the mega-cap growth sector to unprecedented heights. By contrast, small- and mid-cap stocks substantially underperformed large caps, partly due to their inferior balance sheet profiles. However, with the Federal Reserve pivoting to a more accommodative stance, future rate cuts could lower borrowing costs and be a catalyst for smaller-cap companies.

Key detractors during the period included Atkore Inc., which endured a cyclical downturn, citing weaker customer spending, and Leslie’s Inc., which toiled with a decline in chlorine prices, a CEO change, and softness in new pool and renovation construction. Going forward, we remain optimistic about the Fund’s prospects given the attractive private market valuations of many of our holdings.

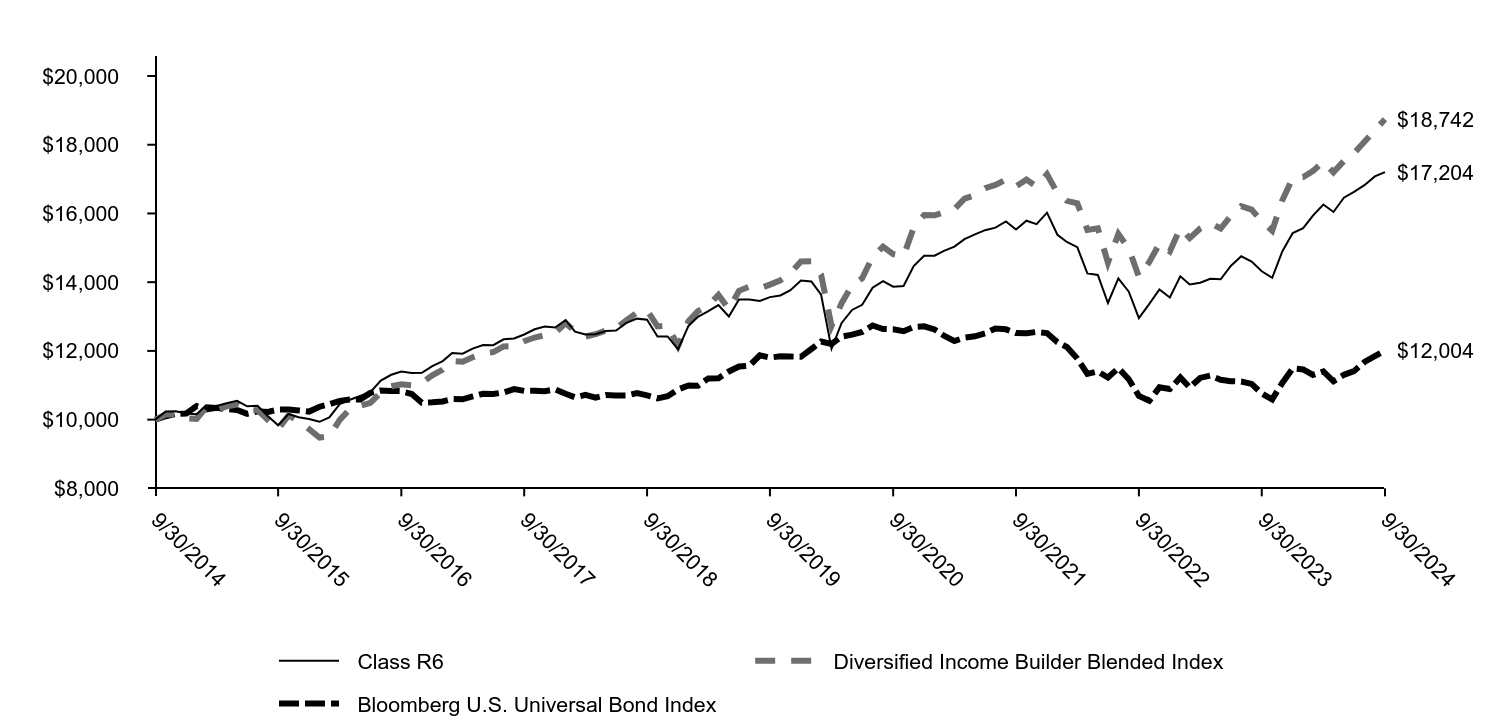

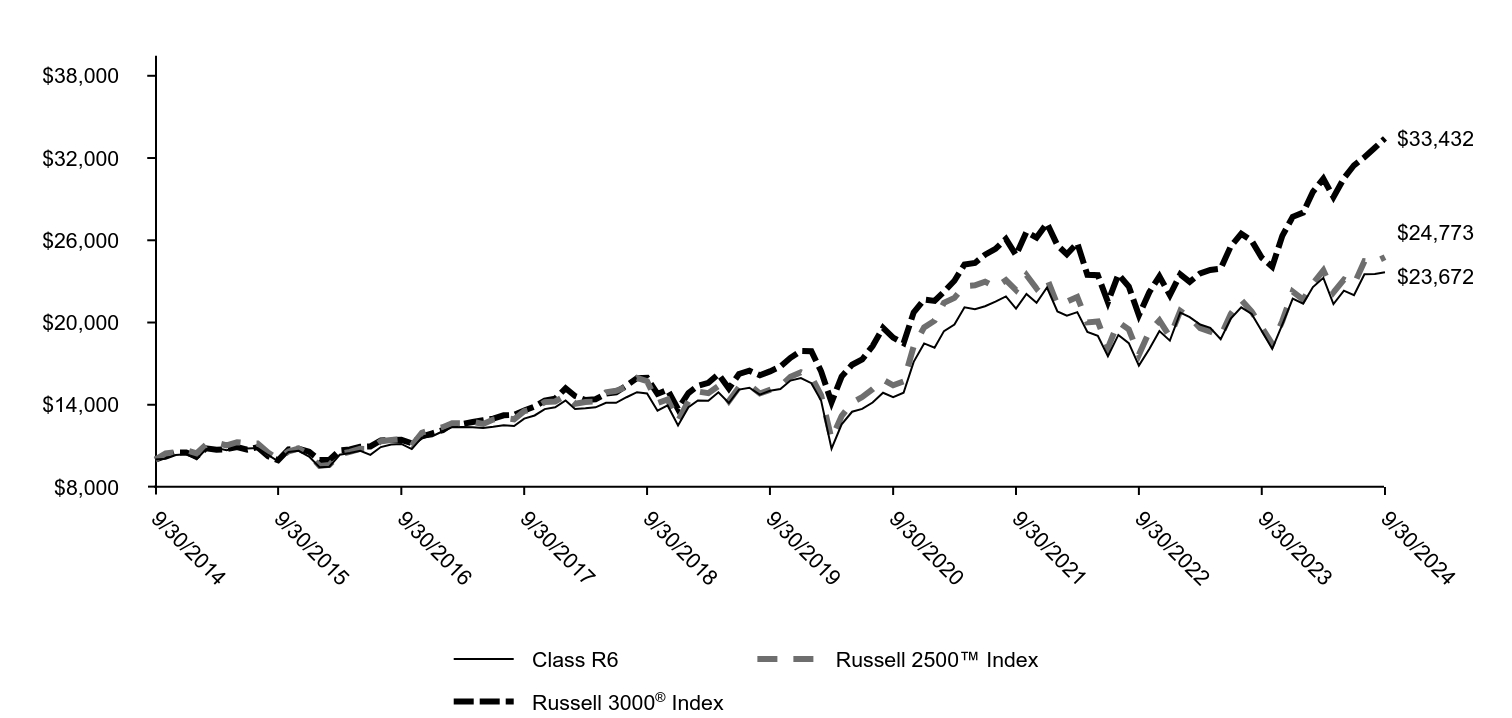

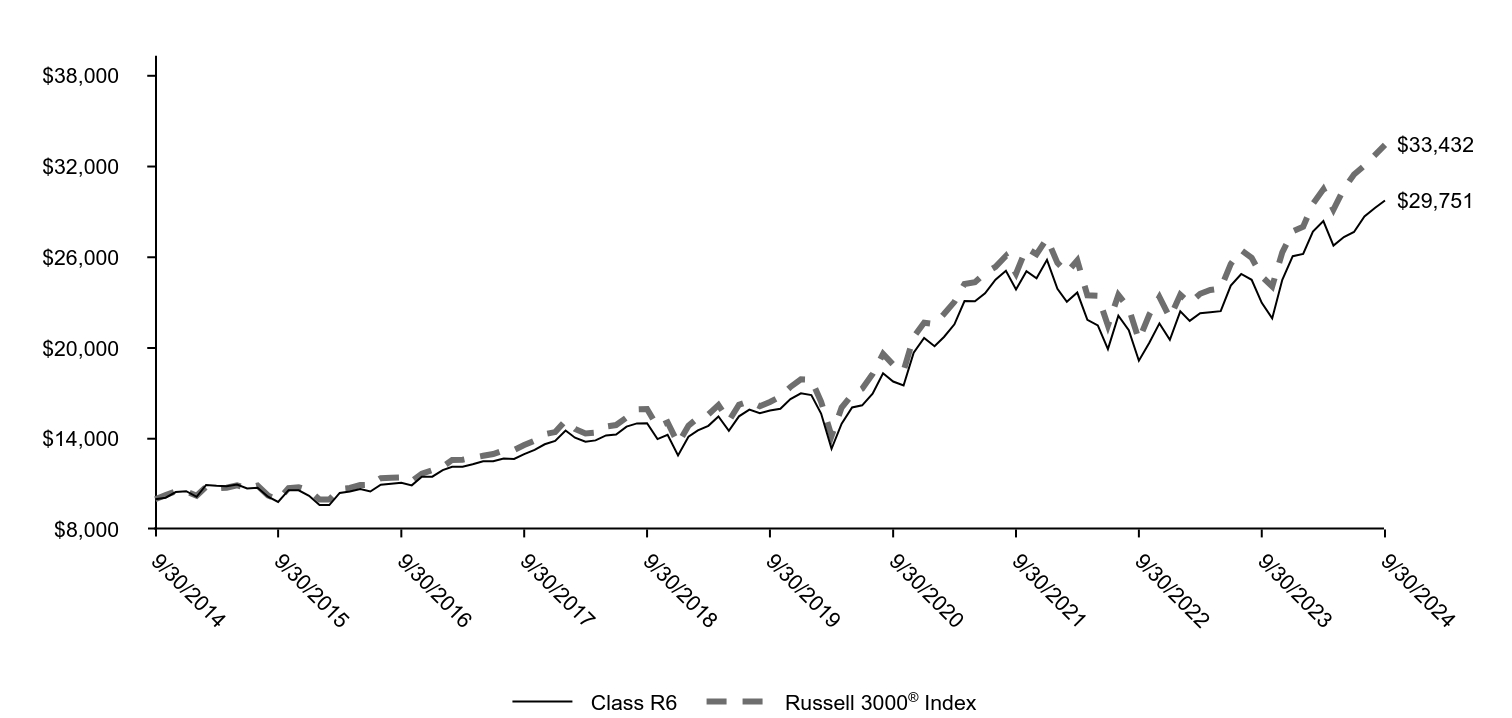

Total return based on a $10,000 investment

| Class R6 | Russell 2500™ Index | Russell 3000® Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,063 | $10,443 | $10,275 |

| 11/30/2014 | $10,328 | $10,533 | $10,524 |

| 12/31/2014 | $10,395 | $10,677 | $10,524 |

| 1/31/2015 | $10,031 | $10,458 | $10,231 |

| 2/28/2015 | $10,764 | $11,081 | $10,824 |

| 3/31/2015 | $10,840 | $11,229 | $10,713 |

| 4/30/2015 | $10,684 | $11,032 | $10,762 |

| 5/31/2015 | $10,871 | $11,268 | $10,911 |

| 6/30/2015 | $10,804 | $11,190 | $10,728 |

| 7/31/2015 | $10,853 | $11,169 | $10,908 |

| 8/31/2015 | $10,338 | $10,508 | $10,249 |

| 9/30/2015 | $9,871 | $10,038 | $9,951 |

| 10/31/2015 | $10,555 | $10,599 | $10,736 |

| 11/30/2015 | $10,636 | $10,807 | $10,796 |

| 12/31/2015 | $10,224 | $10,367 | $10,574 |

| 1/31/2016 | $9,437 | $9,540 | $9,978 |

| 2/29/2016 | $9,482 | $9,607 | $9,975 |

| 3/31/2016 | $10,354 | $10,408 | $10,677 |

| 4/30/2016 | $10,474 | $10,561 | $10,743 |

| 5/31/2016 | $10,644 | $10,784 | $10,935 |

| 6/30/2016 | $10,349 | $10,779 | $10,958 |

| 7/31/2016 | $10,915 | $11,342 | $11,393 |

| 8/31/2016 | $11,100 | $11,432 | $11,422 |

| 9/30/2016 | $11,145 | $11,487 | $11,440 |

| 10/31/2016 | $10,765 | $11,021 | $11,192 |

| 11/30/2016 | $11,596 | $11,958 | $11,693 |

| 12/31/2016 | $11,704 | $12,190 | $11,921 |

| 1/31/2017 | $12,067 | $12,360 | $12,145 |

| 2/28/2017 | $12,368 | $12,657 | $12,597 |

| 3/31/2017 | $12,378 | $12,648 | $12,606 |

| 4/30/2017 | $12,357 | $12,746 | $12,739 |

| 5/31/2017 | $12,306 | $12,603 | $12,870 |

| 6/30/2017 | $12,394 | $12,918 | $12,986 |

| 7/31/2017 | $12,513 | $13,052 | $13,231 |

| 8/31/2017 | $12,451 | $12,944 | $13,256 |

| 9/30/2017 | $12,991 | $13,531 | $13,579 |

| 10/31/2017 | $13,219 | $13,740 | $13,876 |

| 11/30/2017 | $13,681 | $14,192 | $14,297 |

| 12/31/2017 | $13,814 | $14,240 | $14,440 |

| 1/31/2018 | $14,319 | $14,674 | $15,201 |

| 2/28/2018 | $13,699 | $14,070 | $14,641 |

| 3/31/2018 | $13,739 | $14,206 | $14,347 |

| 4/30/2018 | $13,814 | $14,239 | $14,402 |

| 5/31/2018 | $14,141 | $14,909 | $14,808 |

| 6/30/2018 | $14,141 | $15,017 | $14,905 |

| 7/31/2018 | $14,549 | $15,307 | $15,400 |

| 8/31/2018 | $14,917 | $15,964 | $15,940 |

| 9/30/2018 | $14,825 | $15,722 | $15,967 |

| 10/31/2018 | $13,567 | $14,126 | $14,791 |

| 11/30/2018 | $13,952 | $14,392 | $15,087 |

| 12/31/2018 | $12,490 | $12,815 | $13,683 |

| 1/31/2019 | $13,818 | $14,291 | $14,858 |

| 2/28/2019 | $14,314 | $14,966 | $15,380 |

| 3/31/2019 | $14,288 | $14,842 | $15,605 |

| 4/30/2019 | $14,905 | $15,363 | $16,228 |

| 5/31/2019 | $14,127 | $14,270 | $15,178 |

| 6/30/2019 | $15,106 | $15,282 | $16,244 |

| 7/31/2019 | $15,240 | $15,441 | $16,485 |

| 8/31/2019 | $14,744 | $14,823 | $16,149 |

| 9/30/2019 | $15,019 | $15,086 | $16,433 |

| 10/31/2019 | $15,153 | $15,375 | $16,786 |

| 11/30/2019 | $15,763 | $16,035 | $17,424 |

| 12/31/2019 | $15,951 | $16,374 | $17,928 |

| 1/31/2020 | $15,572 | $16,041 | $17,908 |

| 2/29/2020 | $14,311 | $14,696 | $16,442 |

| 3/31/2020 | $10,801 | $11,507 | $14,181 |

| 4/30/2020 | $12,571 | $13,182 | $16,059 |

| 5/31/2020 | $13,490 | $14,155 | $16,918 |

| 6/30/2020 | $13,695 | $14,564 | $17,304 |

| 7/31/2020 | $14,166 | $15,144 | $18,287 |

| 8/31/2020 | $14,873 | $15,830 | $19,612 |

| 9/30/2020 | $14,554 | $15,421 | $18,898 |

| 10/31/2020 | $14,873 | $15,700 | $18,490 |

| 11/30/2020 | $17,129 | $18,258 | $20,739 |

| 12/31/2020 | $18,473 | $19,647 | $21,672 |

| 1/31/2021 | $18,163 | $20,129 | $21,576 |

| 2/28/2021 | $19,372 | $21,442 | $22,250 |

| 3/31/2021 | $19,849 | $21,795 | $23,048 |

| 4/30/2021 | $21,106 | $22,665 | $24,236 |

| 5/31/2021 | $20,971 | $22,712 | $24,346 |

| 6/30/2021 | $21,186 | $22,981 | $24,947 |

| 7/31/2021 | $21,520 | $22,578 | $25,369 |

| 8/31/2021 | $21,902 | $23,091 | $26,092 |

| 9/30/2021 | $21,011 | $22,364 | $24,921 |

| 10/31/2021 | $22,085 | $23,461 | $26,607 |

| 11/30/2021 | $21,441 | $22,482 | $26,202 |

| 12/31/2021 | $22,552 | $23,220 | $27,234 |

| 1/31/2022 | $20,804 | $21,287 | $25,631 |

| 2/28/2022 | $20,503 | $21,527 | $24,986 |

| 3/31/2022 | $20,757 | $21,869 | $25,796 |

| 4/30/2022 | $19,310 | $20,006 | $23,481 |

| 5/31/2022 | $19,028 | $20,073 | $23,450 |

| 6/30/2022 | $17,543 | $18,155 | $21,488 |

| 7/31/2022 | $19,094 | $20,034 | $23,504 |

| 8/31/2022 | $18,492 | $19,501 | $22,627 |

| 9/30/2022 | $16,857 | $17,644 | $20,528 |

| 10/31/2022 | $18,070 | $19,337 | $22,212 |

| 11/30/2022 | $19,376 | $20,153 | $23,371 |

| 12/31/2022 | $18,680 | $18,954 | $22,003 |

| 1/31/2023 | $20,722 | $20,850 | $23,518 |

| 2/28/2023 | $20,396 | $20,360 | $22,968 |

| 3/31/2023 | $19,853 | $19,597 | $23,583 |

| 4/30/2023 | $19,614 | $19,341 | $23,834 |

| 5/31/2023 | $18,777 | $19,002 | $23,927 |

| 6/30/2023 | $20,288 | $20,621 | $25,560 |

| 7/31/2023 | $21,103 | $21,646 | $26,477 |

| 8/31/2023 | $20,625 | $20,796 | $25,966 |

| 9/30/2023 | $19,386 | $19,635 | $24,729 |

| 10/31/2023 | $18,082 | $18,442 | $24,073 |

| 11/30/2023 | $19,853 | $20,102 | $26,318 |

| 12/31/2023 | $21,741 | $22,257 | $27,714 |

| 1/31/2024 | $21,381 | $21,675 | $28,021 |

| 2/29/2024 | $22,583 | $22,854 | $29,538 |

| 3/31/2024 | $23,257 | $23,797 | $30,491 |

| 4/30/2024 | $21,348 | $22,203 | $29,149 |

| 5/31/2024 | $22,325 | $23,126 | $30,526 |

| 6/30/2024 | $21,999 | $22,780 | $31,471 |

| 7/31/2024 | $23,515 | $24,472 | $32,056 |

| 8/31/2024 | $23,537 | $24,409 | $32,754 |

| 9/30/2024 | $23,672 | $24,773 | $33,432 |

Annual Shareholder Report | September 30, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class R6 | 22.11 | 9.53 | 9.00 |

| Russell 2500™ Index (Strategy) | 26.17 | 10.43 | 9.50 |

Russell 3000® Index (Regulatory) | 35.19 | 15.26 | 12.83 |

| Total net assets | $799,373,723 |

| # of portfolio holdings | 78 |

| Portfolio turnover rate | 46% |

| Total advisory fees paid | $6,047,377 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Industrials | 20.0 |

| Information technology | 17.3 |

| Financials | 16.1 |

| Health care | 12.8 |

| Materials | 10.2 |

| Consumer discretionary | 9.8 |

| Real estate | 9.3 |

| Consumer staples | 2.6 |

| Domestic Equity | 1.5 |

| Communication services | 0.4 |

TOP TEN HOLDINGS (% OF NET ASSETS)

| Regal Rexnord Corp. | 2.2 |

| Teledyne Technologies, Inc. | 2.1 |

| Marvell Technology, Inc. | 2.0 |

| Carlisle Cos., Inc. | 2.0 |

| Melrose Industries PLC | 1.9 |

| SBA Communications Corp., Class A | 1.9 |

| HealthEquity, Inc. | 1.9 |

| Westlake Corp. | 1.9 |

| Sun Communities, Inc. | 1.8 |

| Bio-Rad Laboratories, Inc., Class A | 1.8 |

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

This annual shareholder report contains important information about Common Stock Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Class C | $214 | 1.94% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

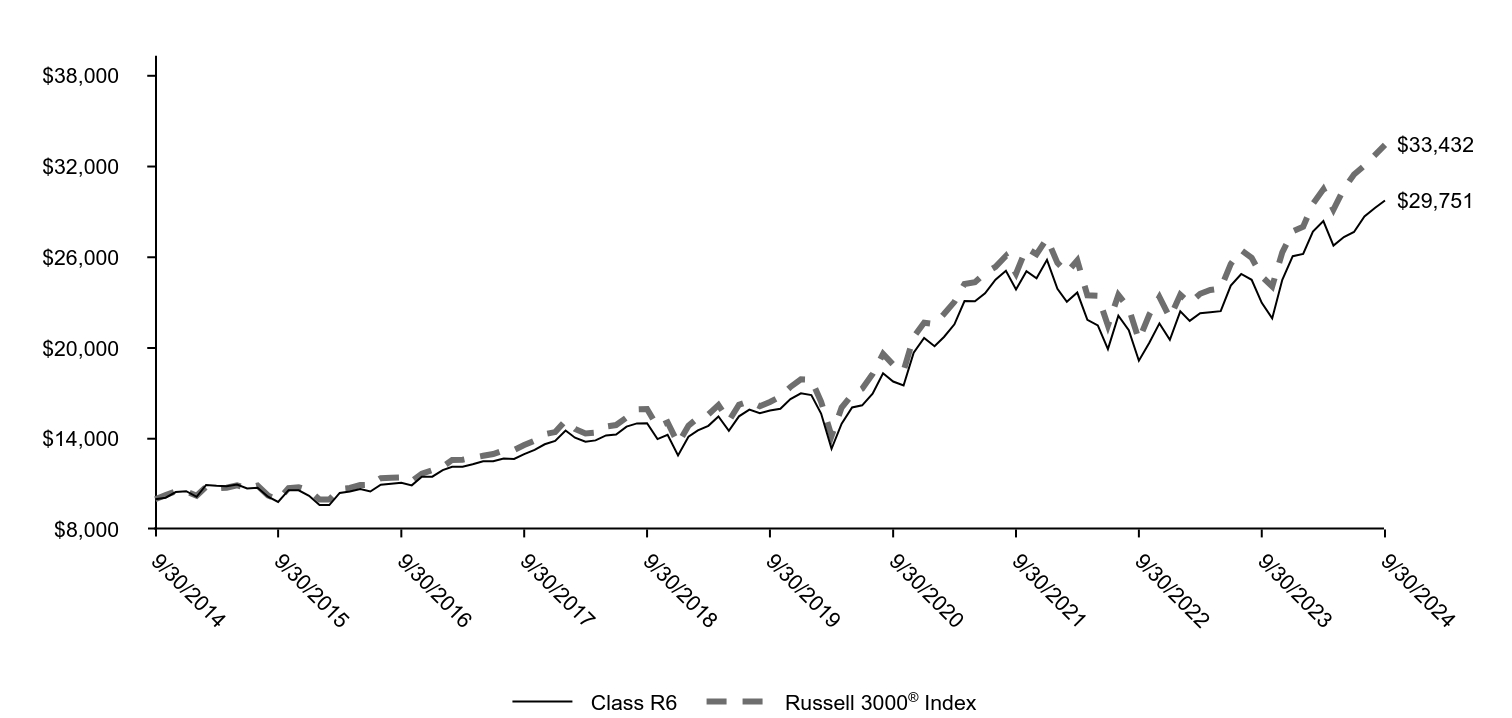

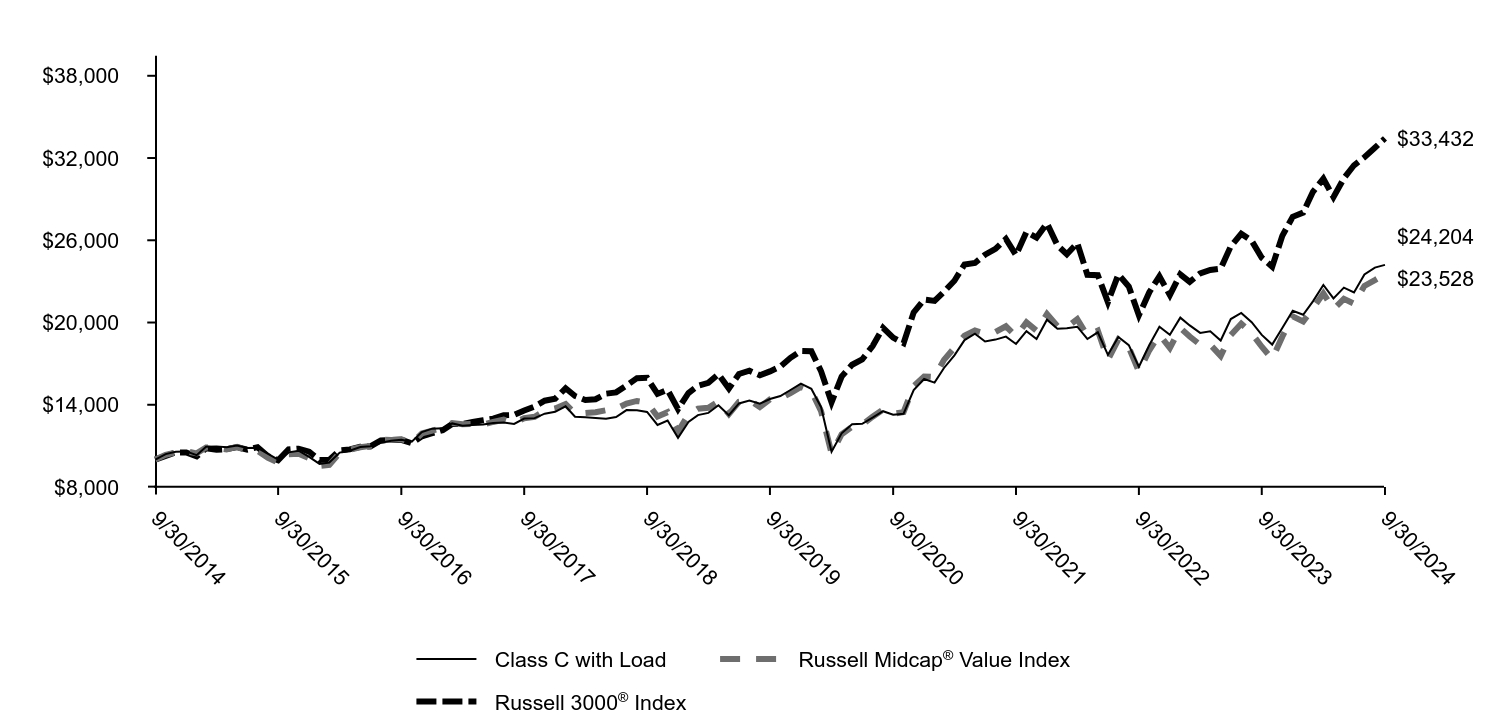

How did the Fund perform last year and what affected its performance?

Over the 12-month period that ended September 30, 2024, the equity markets soared to all-time highs, fueled by positive earnings surprises, robust economic growth, a decline in both inflation and interest rates, and a fervor around artificial intelligence (AI). Driven by semiconductor chip designer NVIDIA Corp., the AI theme significantly boosted the mega-cap growth sector to unprecedented heights. By contrast, small- and mid-cap stocks substantially underperformed large caps, partly due to their inferior balance sheet profiles. However, with the Federal Reserve pivoting to a more accommodative stance, future rate cuts could lower borrowing costs and be a catalyst for smaller-cap companies.

Key detractors during the period included Atkore Inc., which endured a cyclical downturn, citing weaker customer spending, and Leslie’s Inc., which toiled with a decline in chlorine prices, a CEO change, and softness in new pool and renovation construction. Going forward, we remain optimistic about the Fund’s prospects given the attractive private market valuations of many of our holdings.

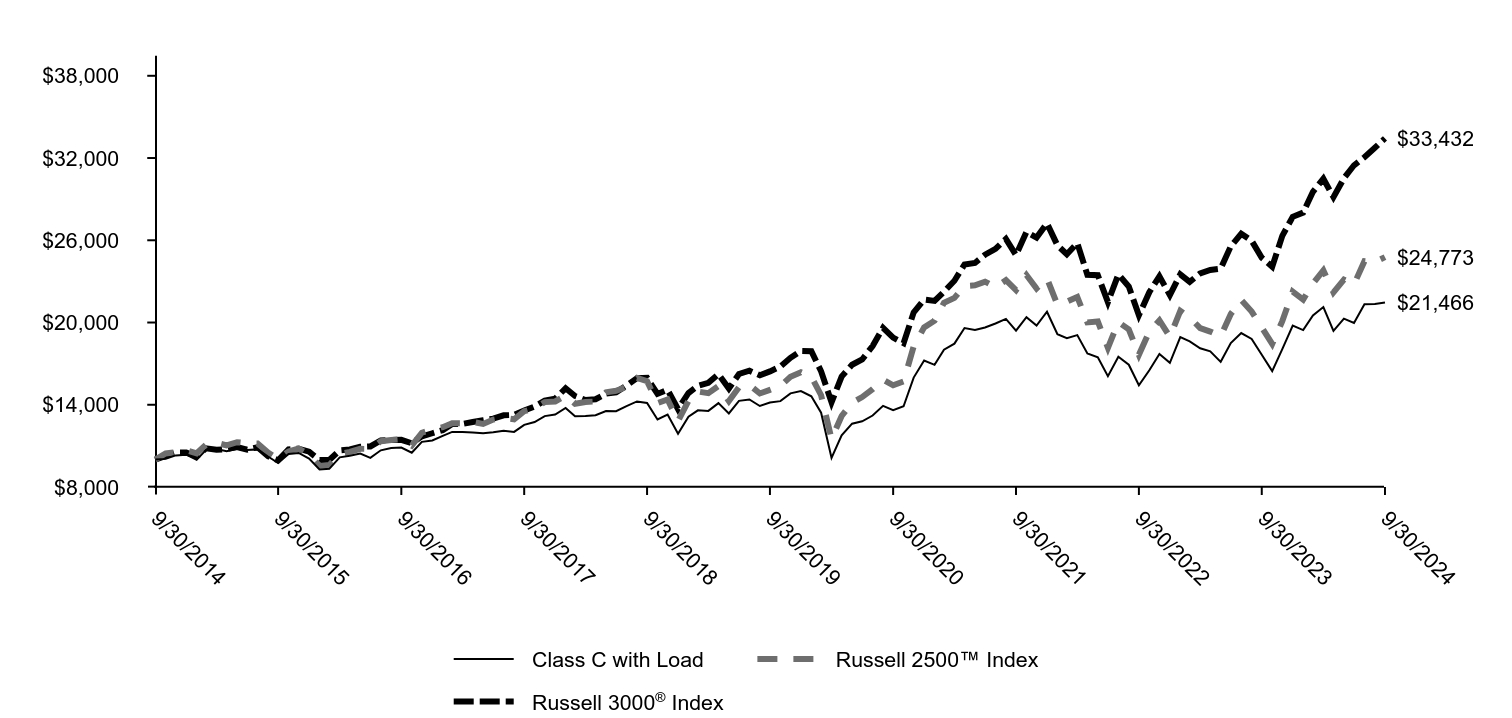

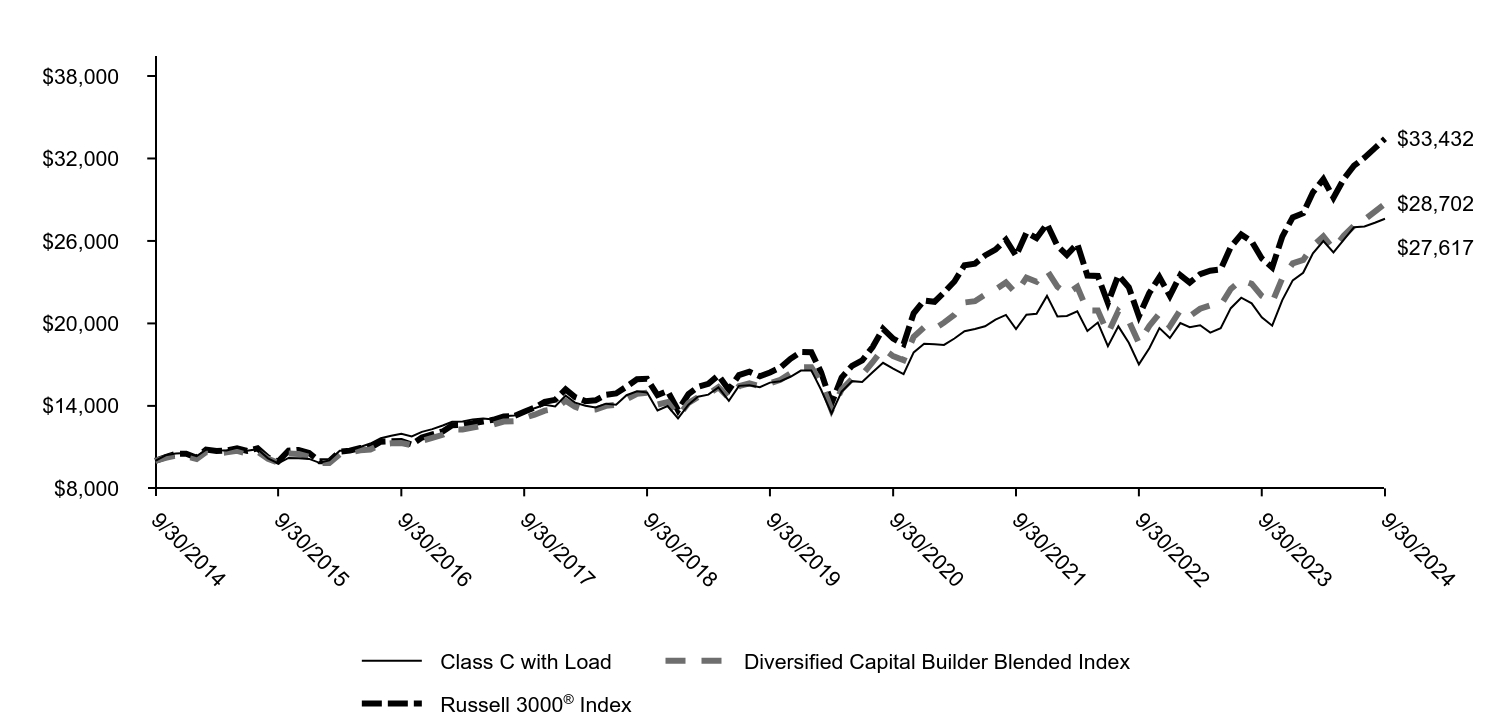

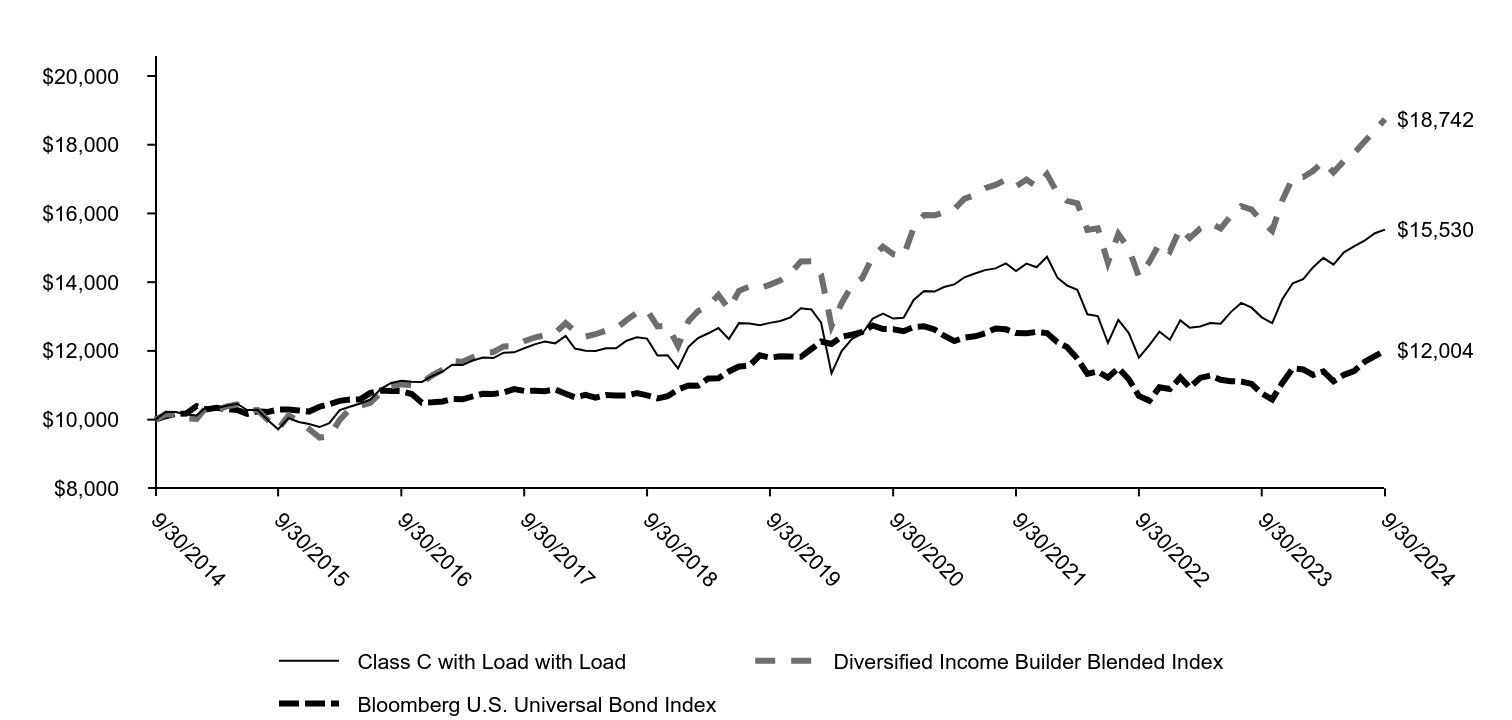

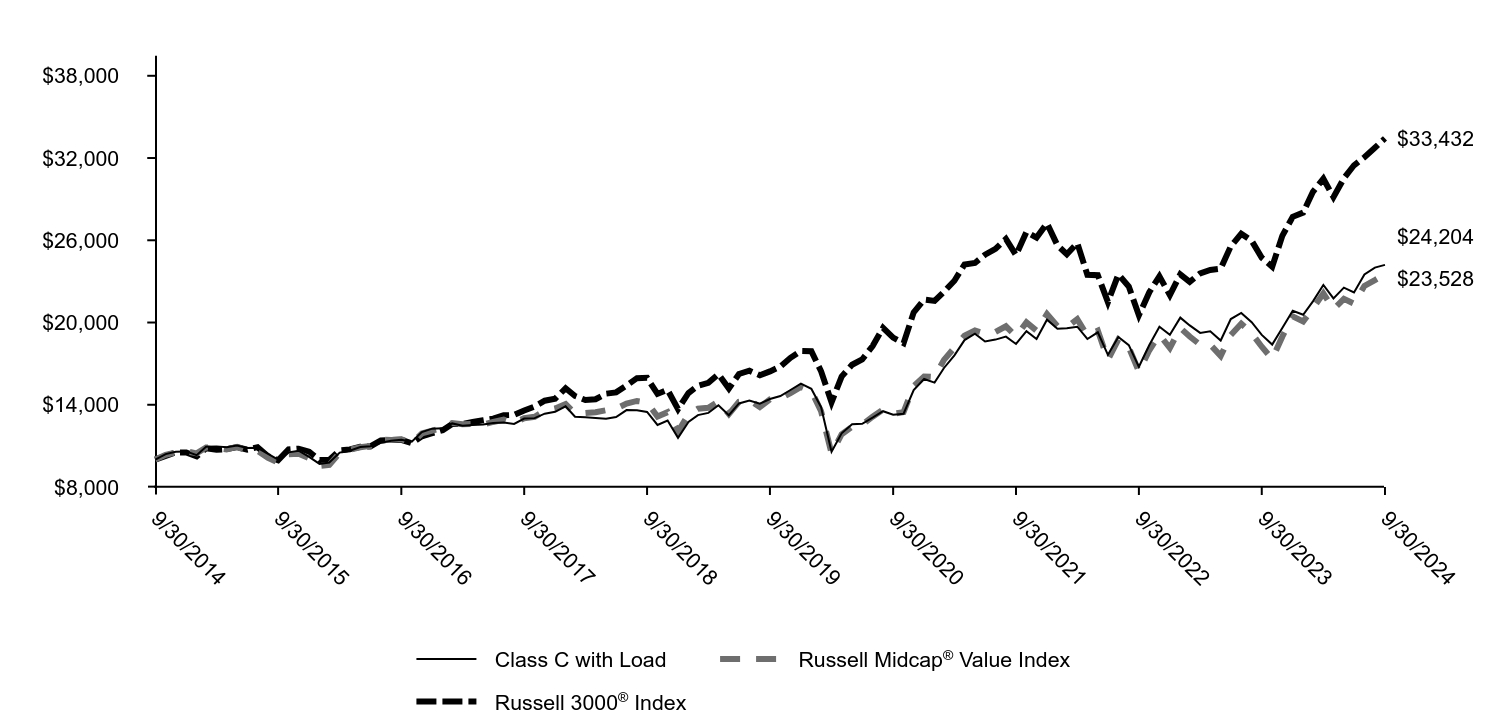

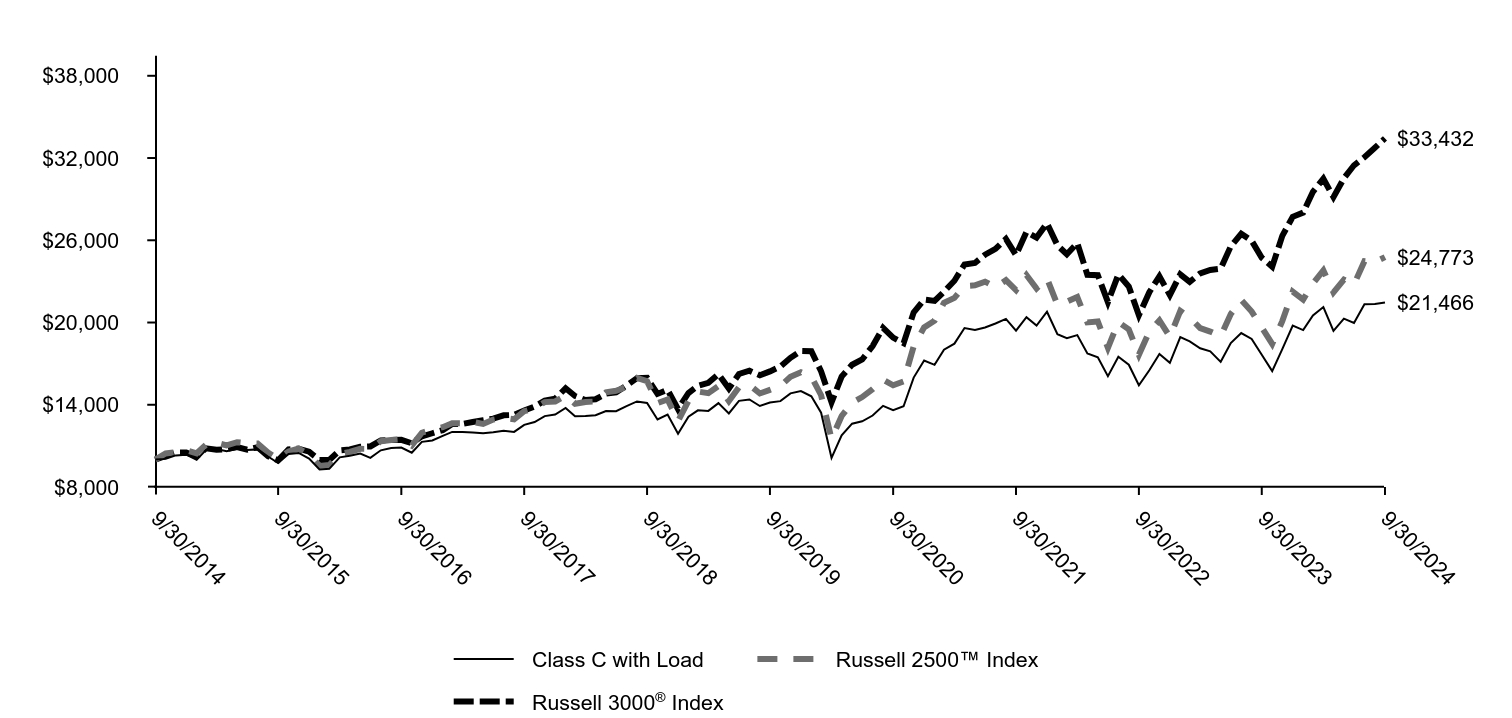

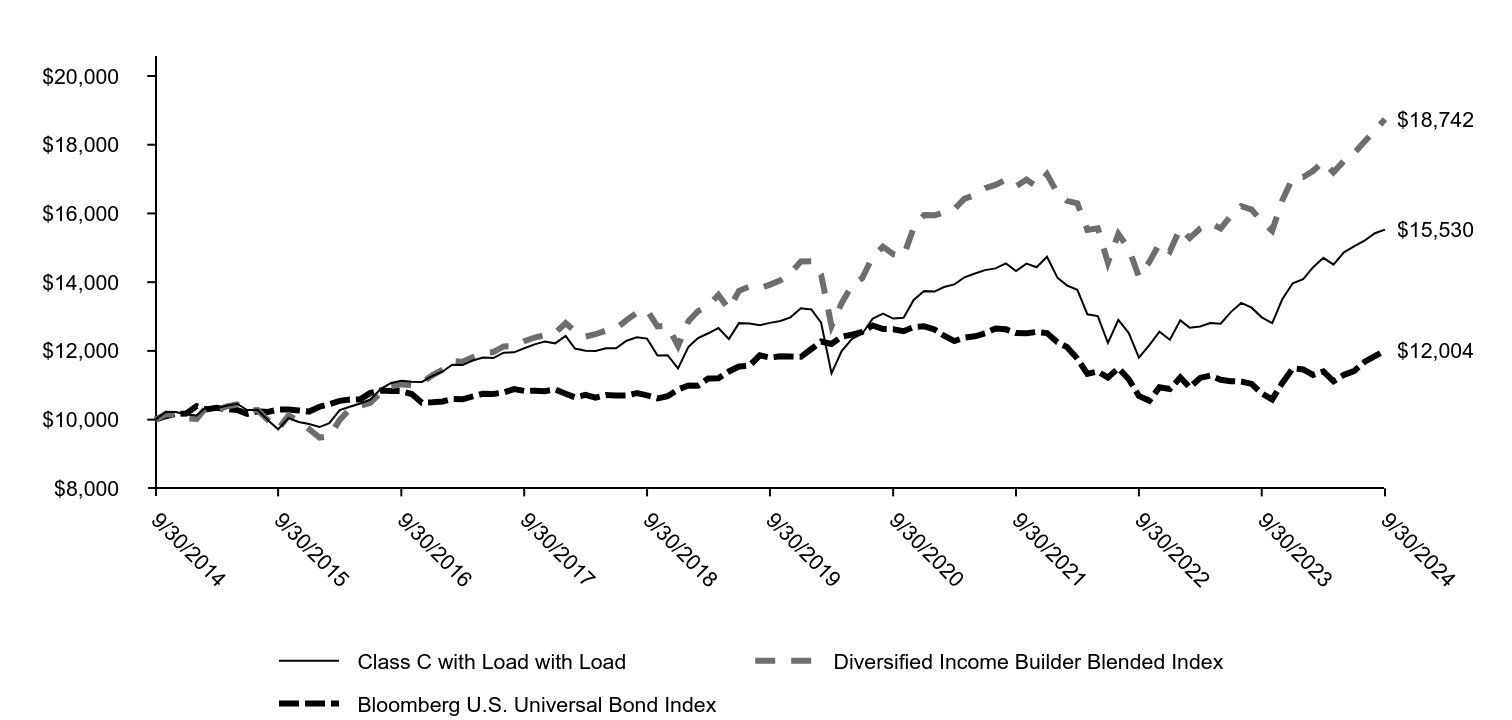

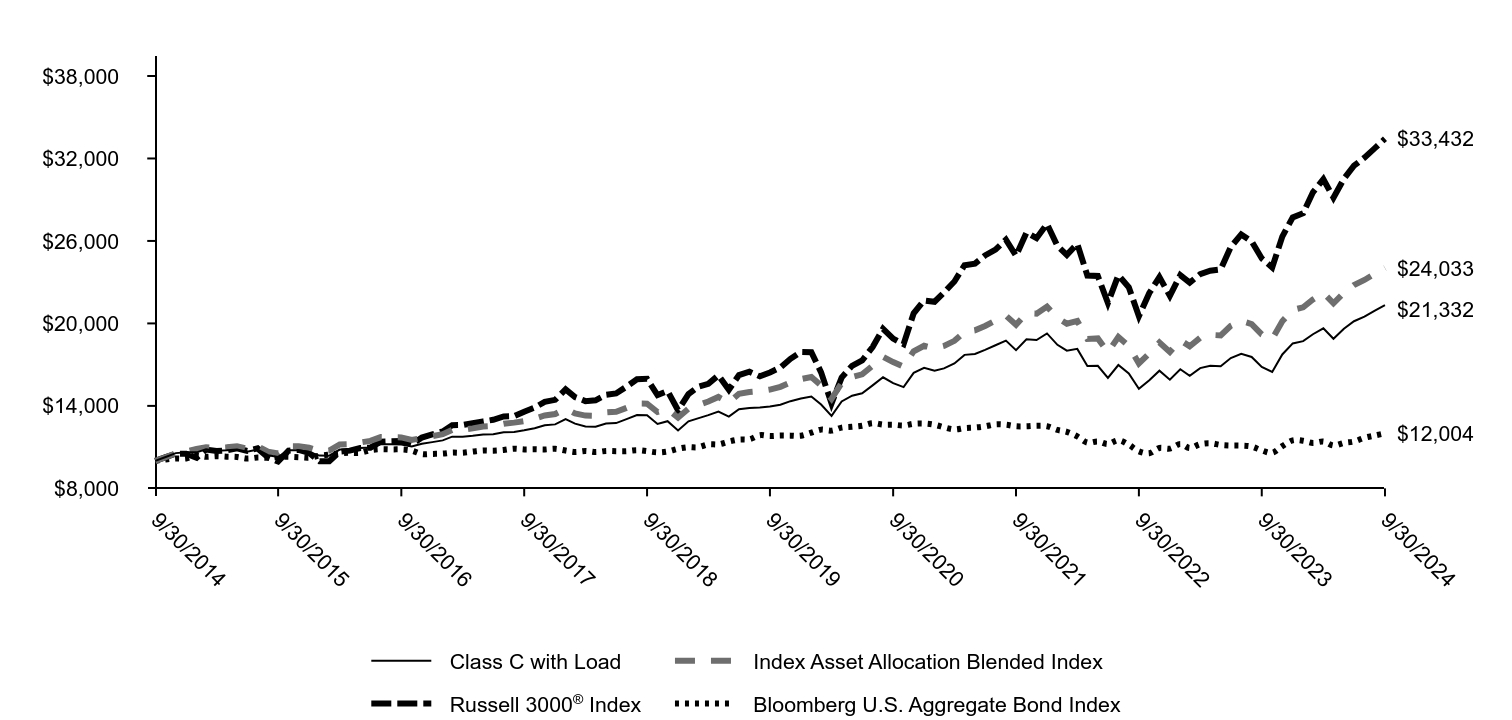

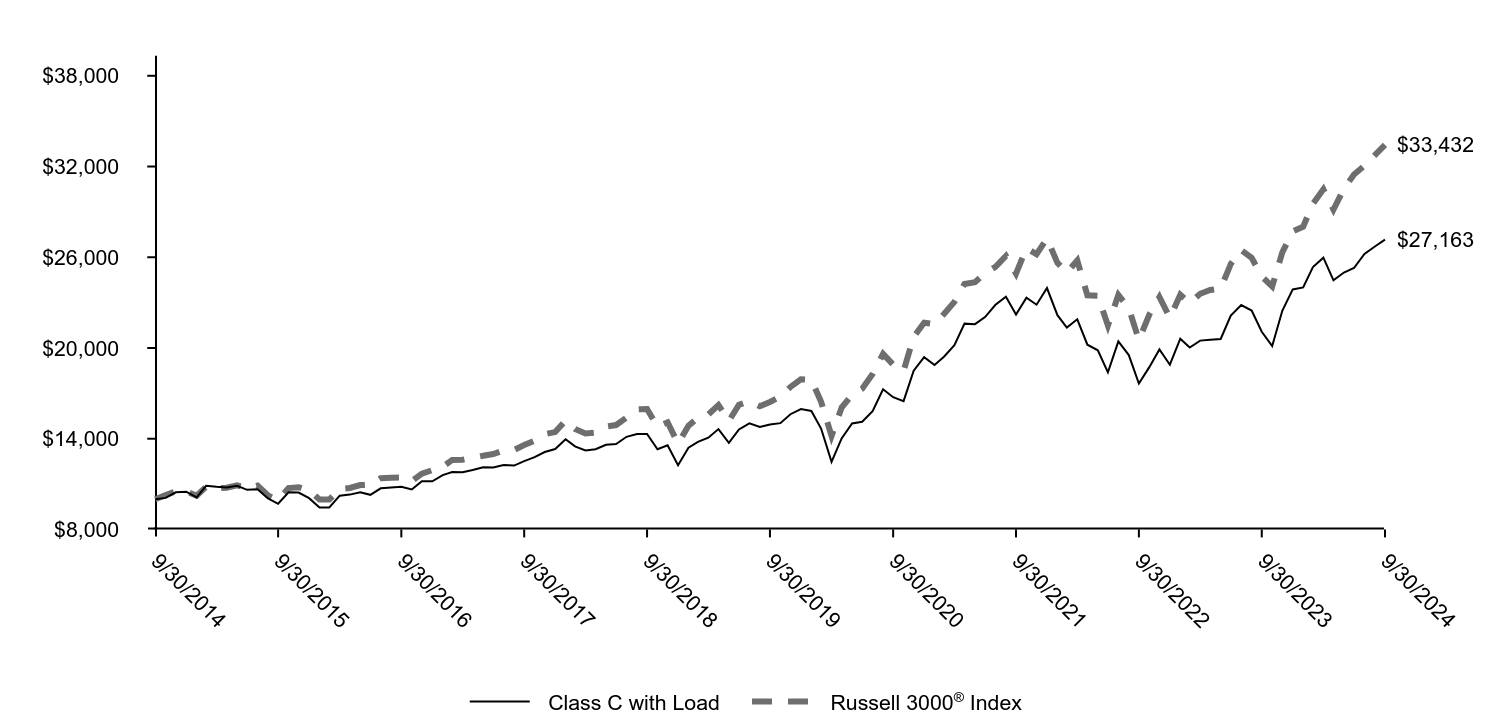

Total return based on a $10,000 investment

| Class C with Load | Russell 2500™ Index | Russell 3000® Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,052 | $10,443 | $10,275 |

| 11/30/2014 | $10,304 | $10,533 | $10,524 |

| 12/31/2014 | $10,360 | $10,677 | $10,524 |

| 1/31/2015 | $9,987 | $10,458 | $10,231 |

| 2/28/2015 | $10,706 | $11,081 | $10,824 |

| 3/31/2015 | $10,772 | $11,229 | $10,713 |

| 4/30/2015 | $10,607 | $11,032 | $10,762 |

| 5/31/2015 | $10,782 | $11,268 | $10,911 |

| 6/30/2015 | $10,700 | $11,190 | $10,728 |

| 7/31/2015 | $10,744 | $11,169 | $10,908 |

| 8/31/2015 | $10,223 | $10,508 | $10,249 |

| 9/30/2015 | $9,751 | $10,038 | $9,951 |

| 10/31/2015 | $10,415 | $10,599 | $10,736 |

| 11/30/2015 | $10,486 | $10,807 | $10,796 |

| 12/31/2015 | $10,070 | $10,367 | $10,574 |

| 1/31/2016 | $9,285 | $9,540 | $9,978 |

| 2/29/2016 | $9,324 | $9,607 | $9,975 |

| 3/31/2016 | $10,166 | $10,408 | $10,677 |

| 4/30/2016 | $10,275 | $10,561 | $10,743 |

| 5/31/2016 | $10,434 | $10,784 | $10,935 |

| 6/30/2016 | $10,128 | $10,779 | $10,958 |

| 7/31/2016 | $10,677 | $11,342 | $11,393 |

| 8/31/2016 | $10,843 | $11,432 | $11,422 |

| 9/30/2016 | $10,874 | $11,487 | $11,440 |

| 10/31/2016 | $10,498 | $11,021 | $11,192 |

| 11/30/2016 | $11,296 | $11,958 | $11,693 |

| 12/31/2016 | $11,394 | $12,190 | $11,921 |

| 1/31/2017 | $11,728 | $12,360 | $12,145 |

| 2/28/2017 | $12,016 | $12,657 | $12,597 |

| 3/31/2017 | $12,016 | $12,648 | $12,606 |

| 4/30/2017 | $11,982 | $12,746 | $12,739 |

| 5/31/2017 | $11,922 | $12,603 | $12,870 |

| 6/30/2017 | $11,996 | $12,918 | $12,986 |

| 7/31/2017 | $12,096 | $13,052 | $13,231 |

| 8/31/2017 | $12,022 | $12,944 | $13,256 |

| 9/30/2017 | $12,537 | $13,531 | $13,579 |

| 10/31/2017 | $12,738 | $13,740 | $13,876 |

| 11/30/2017 | $13,172 | $14,192 | $14,297 |

| 12/31/2017 | $13,290 | $14,240 | $14,440 |

| 1/31/2018 | $13,766 | $14,674 | $15,201 |

| 2/28/2018 | $13,159 | $14,070 | $14,641 |

| 3/31/2018 | $13,182 | $14,206 | $14,347 |

| 4/30/2018 | $13,236 | $14,239 | $14,402 |

| 5/31/2018 | $13,543 | $14,909 | $14,808 |

| 6/30/2018 | $13,528 | $15,017 | $14,905 |

| 7/31/2018 | $13,904 | $15,307 | $15,400 |

| 8/31/2018 | $14,242 | $15,964 | $15,940 |

| 9/30/2018 | $14,135 | $15,722 | $15,967 |

| 10/31/2018 | $12,929 | $14,126 | $14,791 |

| 11/30/2018 | $13,282 | $14,392 | $15,087 |

| 12/31/2018 | $11,879 | $12,815 | $13,683 |

| 1/31/2019 | $13,130 | $14,291 | $14,858 |

| 2/28/2019 | $13,591 | $14,966 | $15,380 |

| 3/31/2019 | $13,553 | $14,842 | $15,605 |

| 4/30/2019 | $14,120 | $15,363 | $16,228 |

| 5/31/2019 | $13,370 | $14,270 | $15,178 |

| 6/30/2019 | $14,284 | $15,282 | $16,244 |

| 7/31/2019 | $14,390 | $15,441 | $16,485 |

| 8/31/2019 | $13,909 | $14,823 | $16,149 |

| 9/30/2019 | $14,159 | $15,086 | $16,433 |

| 10/31/2019 | $14,265 | $15,375 | $16,786 |

| 11/30/2019 | $14,832 | $16,035 | $17,424 |

| 12/31/2019 | $14,994 | $16,374 | $17,928 |

| 1/31/2020 | $14,621 | $16,041 | $17,908 |

| 2/29/2020 | $13,423 | $14,696 | $16,442 |

| 3/31/2020 | $10,120 | $11,507 | $14,181 |

| 4/30/2020 | $11,772 | $13,182 | $16,059 |

| 5/31/2020 | $12,621 | $14,155 | $16,918 |

| 6/30/2020 | $12,795 | $14,564 | $17,304 |

| 7/31/2020 | $13,214 | $15,144 | $18,287 |

| 8/31/2020 | $13,923 | $15,830 | $19,612 |

| 9/30/2020 | $13,609 | $15,421 | $18,898 |

| 10/31/2020 | $13,889 | $15,700 | $18,490 |

| 11/30/2020 | $15,982 | $18,258 | $20,739 |

| 12/31/2020 | $17,226 | $19,647 | $21,672 |

| 1/31/2021 | $16,912 | $20,129 | $21,576 |

| 2/28/2021 | $18,018 | $21,442 | $22,250 |

| 3/31/2021 | $18,458 | $21,795 | $23,048 |

| 4/30/2021 | $19,601 | $22,665 | $24,236 |

| 5/31/2021 | $19,463 | $22,712 | $24,346 |

| 6/30/2021 | $19,639 | $22,981 | $24,947 |

| 7/31/2021 | $19,928 | $22,578 | $25,369 |

| 8/31/2021 | $20,267 | $23,091 | $26,092 |

| 9/30/2021 | $19,412 | $22,364 | $24,921 |

| 10/31/2021 | $20,393 | $23,461 | $26,607 |

| 11/30/2021 | $19,777 | $22,482 | $26,202 |

| 12/31/2021 | $20,788 | $23,220 | $27,234 |

| 1/31/2022 | $19,152 | $21,287 | $25,631 |

| 2/28/2022 | $18,863 | $21,527 | $24,986 |

| 3/31/2022 | $19,084 | $21,869 | $25,796 |

| 4/30/2022 | $17,738 | $20,006 | $23,481 |

| 5/31/2022 | $17,465 | $20,073 | $23,450 |

| 6/30/2022 | $16,085 | $18,155 | $21,488 |

| 7/31/2022 | $17,500 | $20,034 | $23,504 |

| 8/31/2022 | $16,920 | $19,501 | $22,627 |

| 9/30/2022 | $15,421 | $17,644 | $20,528 |

| 10/31/2022 | $16,517 | $19,337 | $22,212 |

| 11/30/2022 | $17,709 | $20,153 | $23,371 |

| 12/31/2022 | $17,064 | $18,954 | $22,003 |

| 1/31/2023 | $18,930 | $20,850 | $23,518 |

| 2/28/2023 | $18,619 | $20,360 | $22,968 |

| 3/31/2023 | $18,120 | $19,597 | $23,583 |

| 4/30/2023 | $17,897 | $19,341 | $23,834 |

| 5/31/2023 | $17,131 | $19,002 | $23,927 |

| 6/30/2023 | $18,497 | $20,621 | $25,560 |

| 7/31/2023 | $19,230 | $21,646 | $26,477 |

| 8/31/2023 | $18,797 | $20,796 | $25,966 |

| 9/30/2023 | $17,653 | $19,635 | $24,729 |

| 10/31/2023 | $16,453 | $18,442 | $24,073 |

| 11/30/2023 | $18,064 | $20,102 | $26,318 |

| 12/31/2023 | $19,771 | $22,257 | $27,714 |

| 1/31/2024 | $19,448 | $21,675 | $28,021 |

| 2/29/2024 | $20,520 | $22,854 | $29,538 |

| 3/31/2024 | $21,131 | $23,797 | $30,491 |

| 4/30/2024 | $19,391 | $22,203 | $29,149 |

| 5/31/2024 | $20,278 | $23,126 | $30,526 |

| 6/30/2024 | $19,967 | $22,780 | $31,471 |

| 7/31/2024 | $21,339 | $24,472 | $32,056 |

| 8/31/2024 | $21,350 | $24,409 | $32,754 |

| 9/30/2024 | $21,466 | $24,773 | $33,432 |

Annual Shareholder Report | September 30, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class C | 20.72 | 8.36 | 7.94 |

| Class C with Load | 19.72 | 8.36 | 7.94 |

| Russell 2500™ Index (Strategy) | 26.17 | 10.43 | 9.50 |

Russell 3000® Index (Regulatory) | 35.19 | 15.26 | 12.83 |

| Total net assets | $799,373,723 |

| # of portfolio holdings | 78 |

| Portfolio turnover rate | 46% |

| Total advisory fees paid | $6,047,377 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Industrials | 20.0 |

| Information technology | 17.3 |

| Financials | 16.1 |

| Health care | 12.8 |

| Materials | 10.2 |

| Consumer discretionary | 9.8 |

| Real estate | 9.3 |

| Consumer staples | 2.6 |

| Domestic Equity | 1.5 |

| Communication services | 0.4 |

TOP TEN HOLDINGS (% OF NET ASSETS)

| Regal Rexnord Corp. | 2.2 |

| Teledyne Technologies, Inc. | 2.1 |

| Marvell Technology, Inc. | 2.0 |

| Carlisle Cos., Inc. | 2.0 |

| Melrose Industries PLC | 1.9 |

| SBA Communications Corp., Class A | 1.9 |

| HealthEquity, Inc. | 1.9 |

| Westlake Corp. | 1.9 |

| Sun Communities, Inc. | 1.8 |

| Bio-Rad Laboratories, Inc., Class A | 1.8 |

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

This annual shareholder report contains important information about Common Stock Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Class A | $134 | 1.21% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

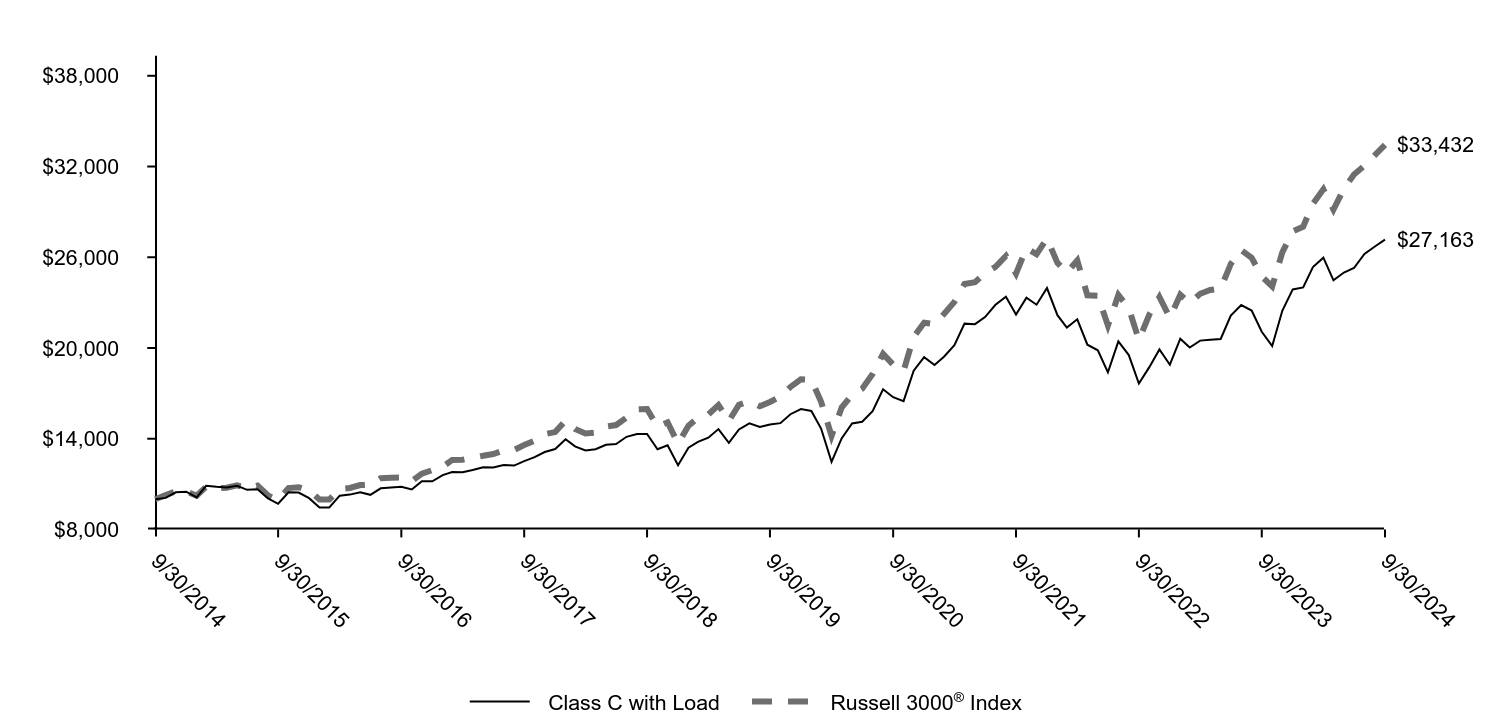

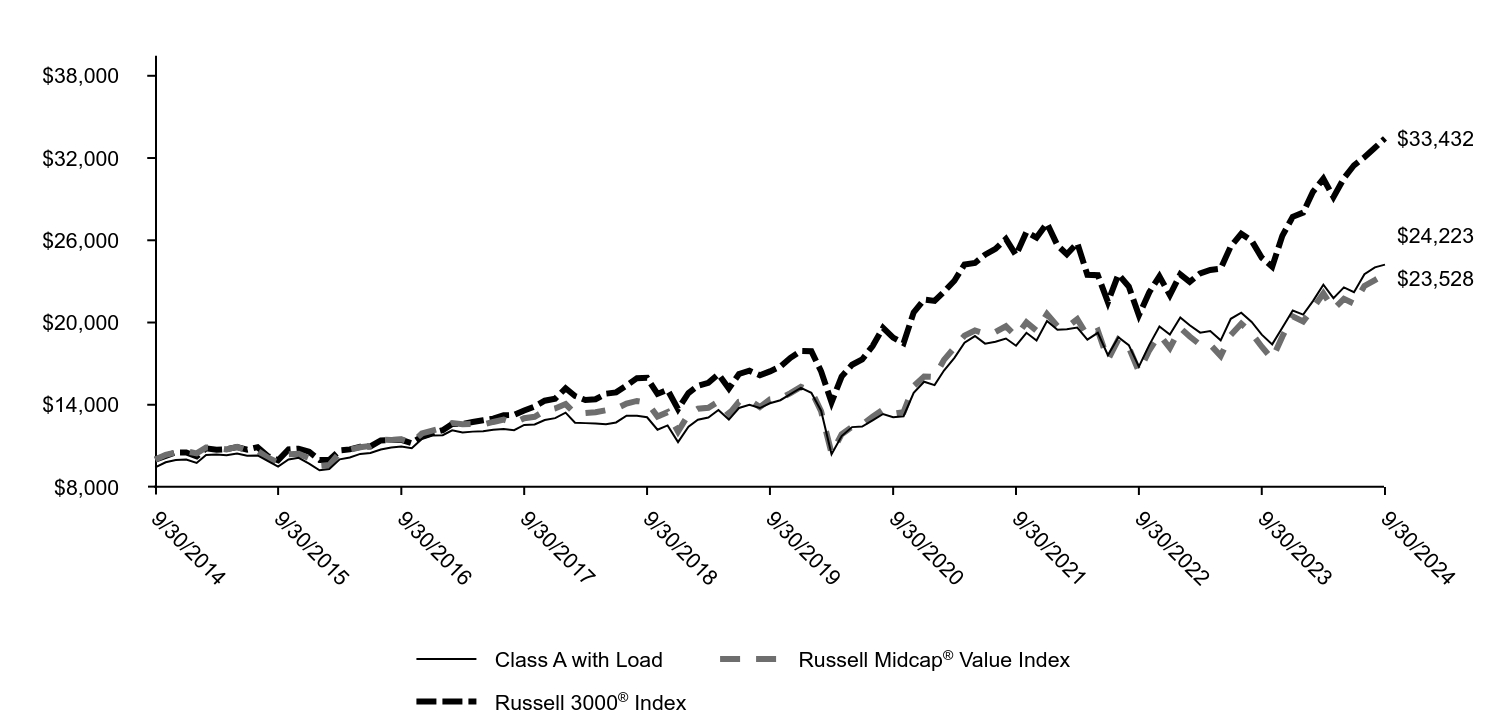

How did the Fund perform last year and what affected its performance?

Over the 12-month period that ended September 30, 2024, the equity markets soared to all-time highs, fueled by positive earnings surprises, robust economic growth, a decline in both inflation and interest rates, and a fervor around artificial intelligence (AI). Driven by semiconductor chip designer NVIDIA Corp., the AI theme significantly boosted the mega-cap growth sector to unprecedented heights. By contrast, small- and mid-cap stocks substantially underperformed large caps, partly due to their inferior balance sheet profiles. However, with the Federal Reserve pivoting to a more accommodative stance, future rate cuts could lower borrowing costs and be a catalyst for smaller-cap companies.

Key detractors during the period included Atkore Inc., which endured a cyclical downturn, citing weaker customer spending, and Leslie’s Inc., which toiled with a decline in chlorine prices, a CEO change, and softness in new pool and renovation construction. Going forward, we remain optimistic about the Fund’s prospects given the attractive private market valuations of many of our holdings.

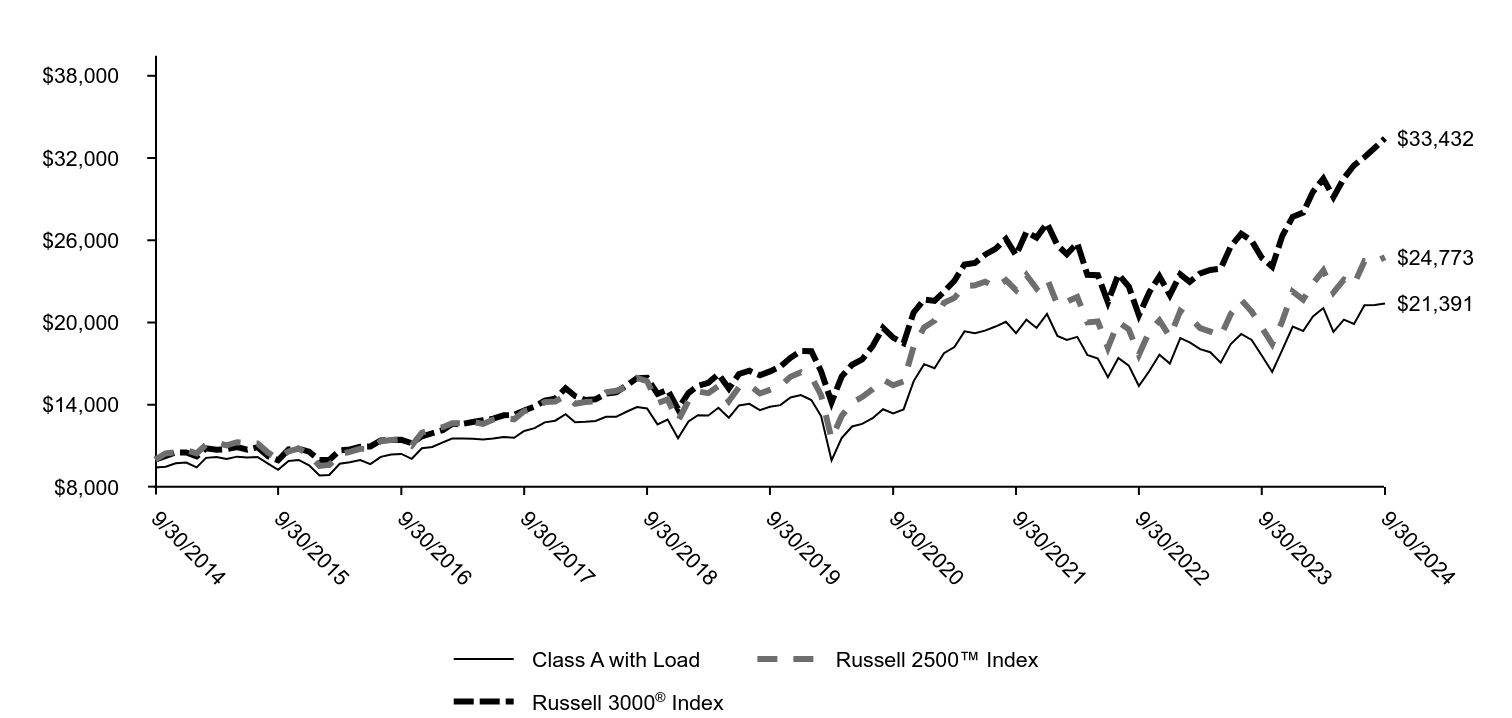

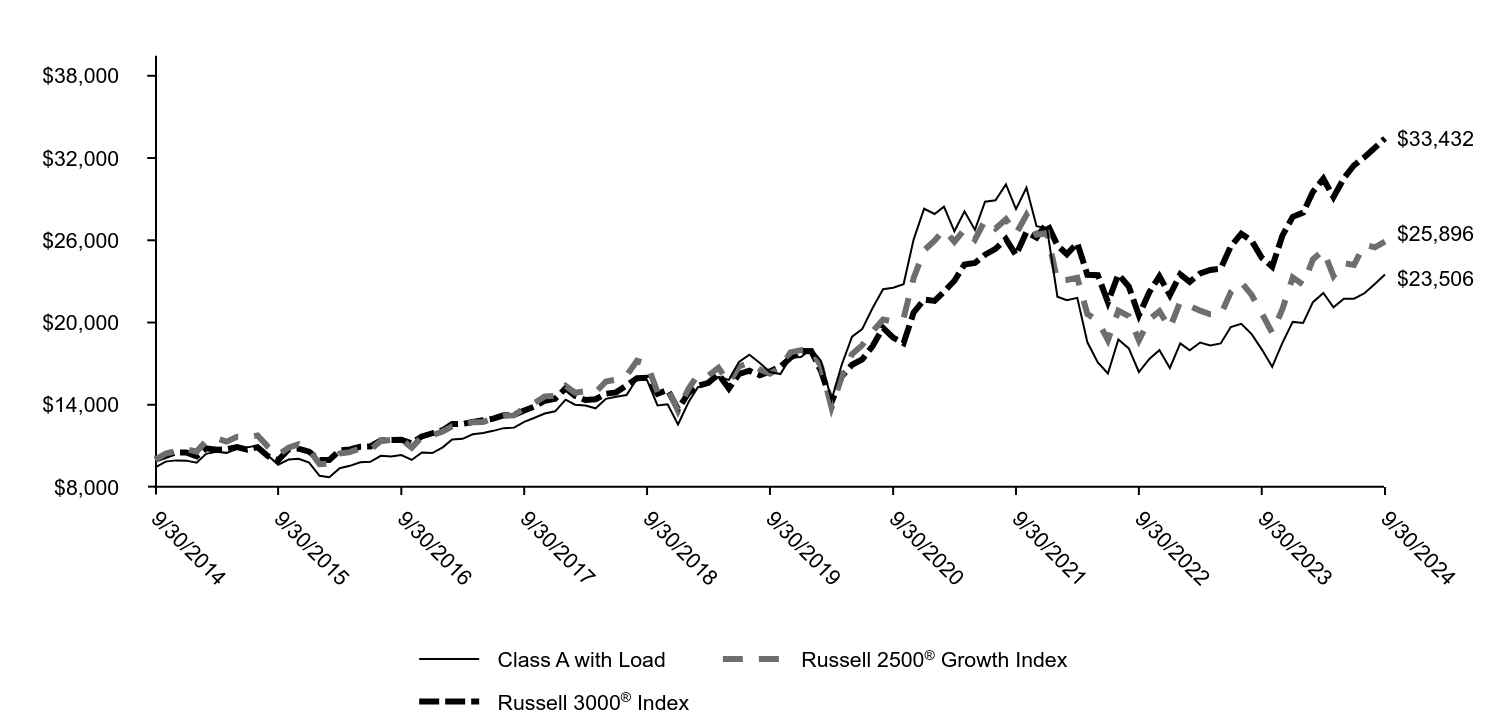

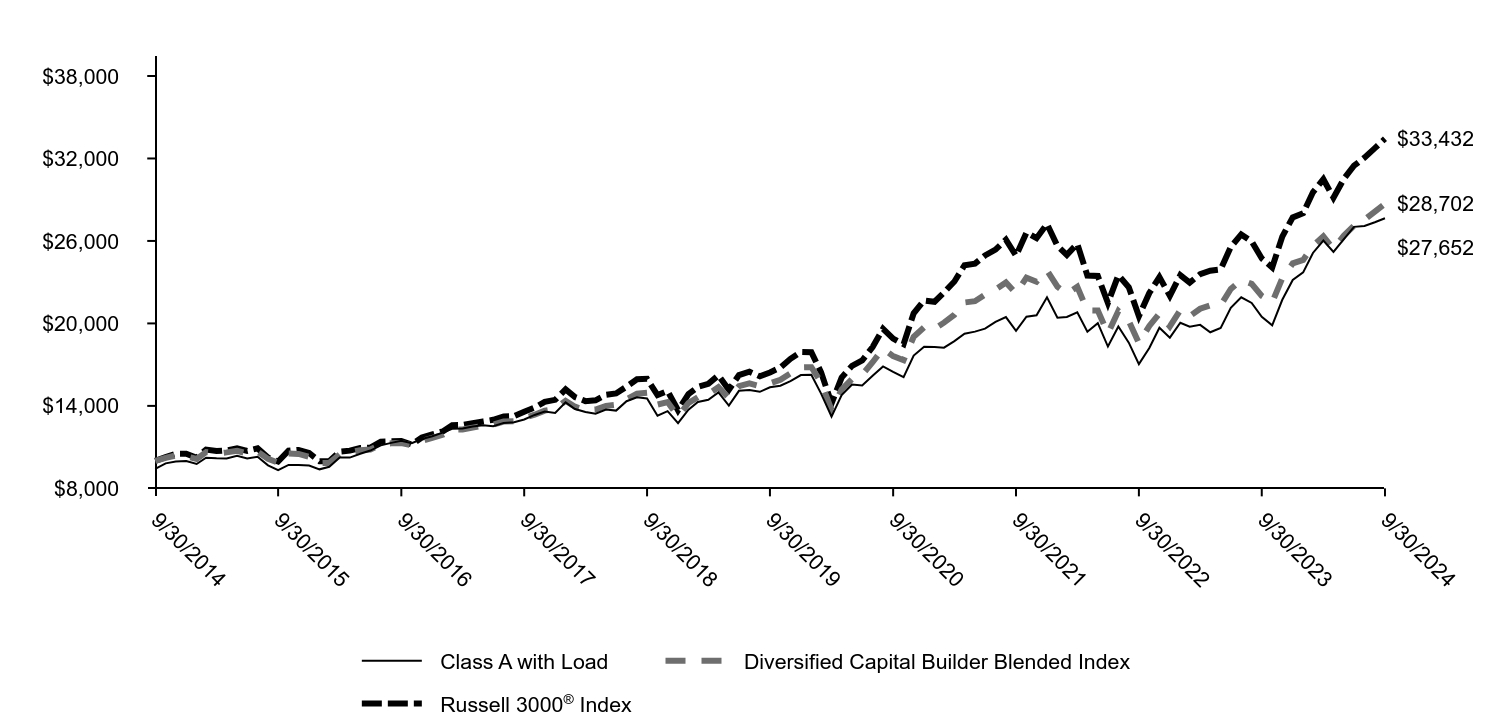

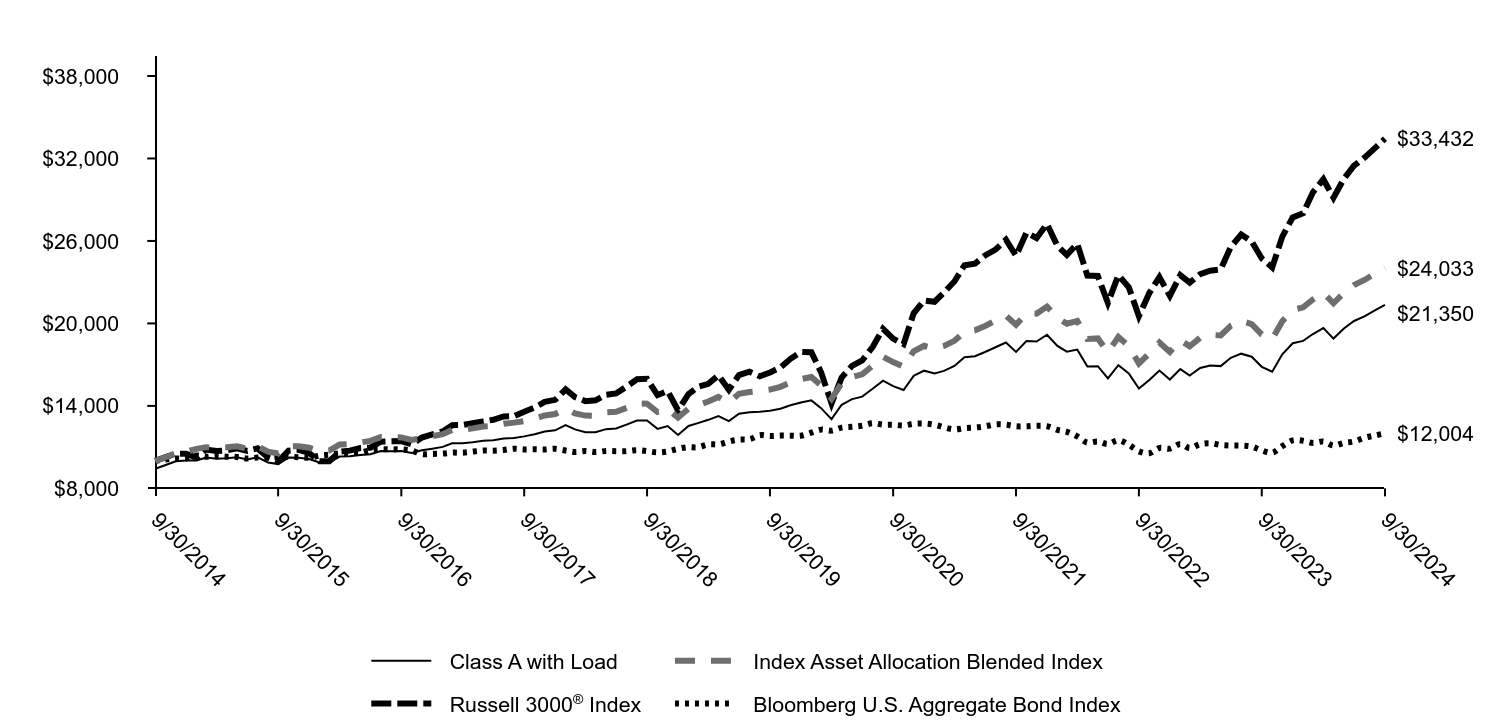

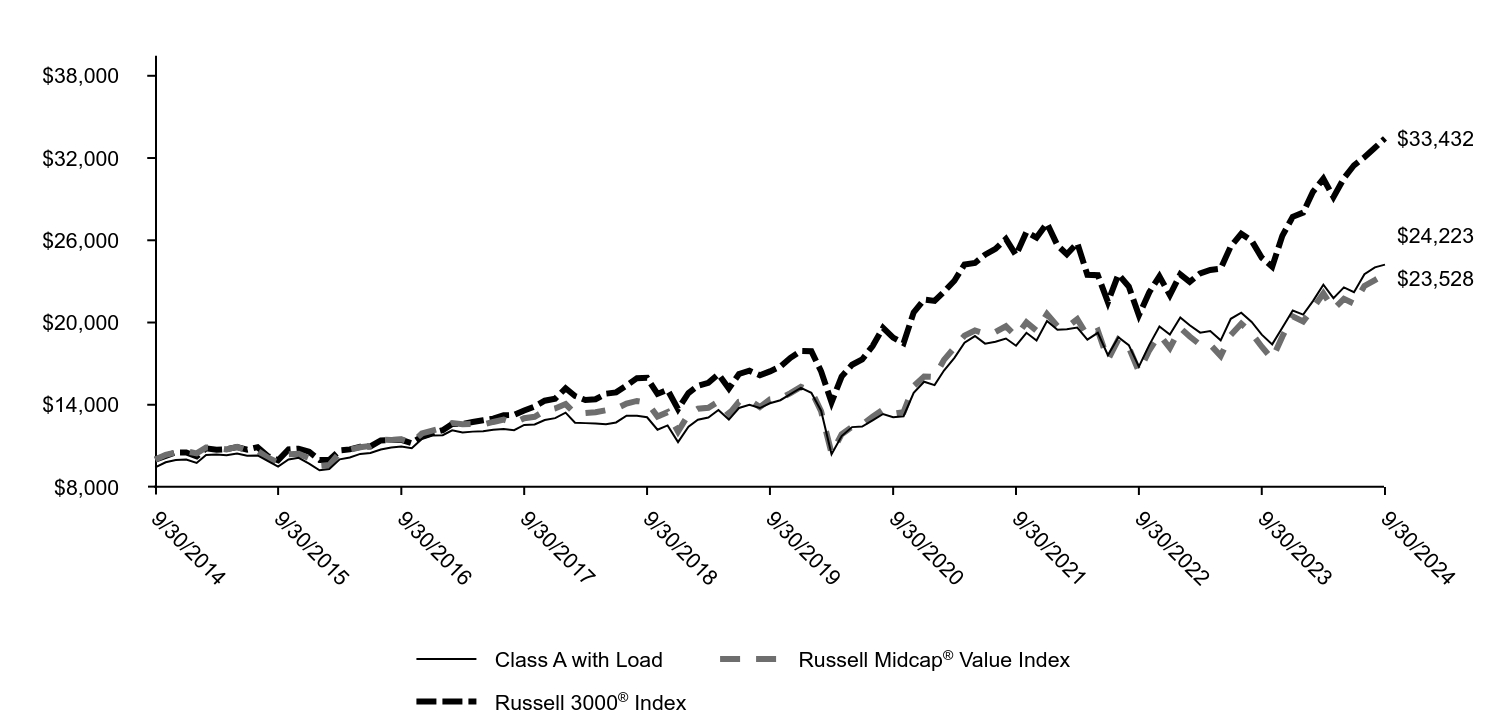

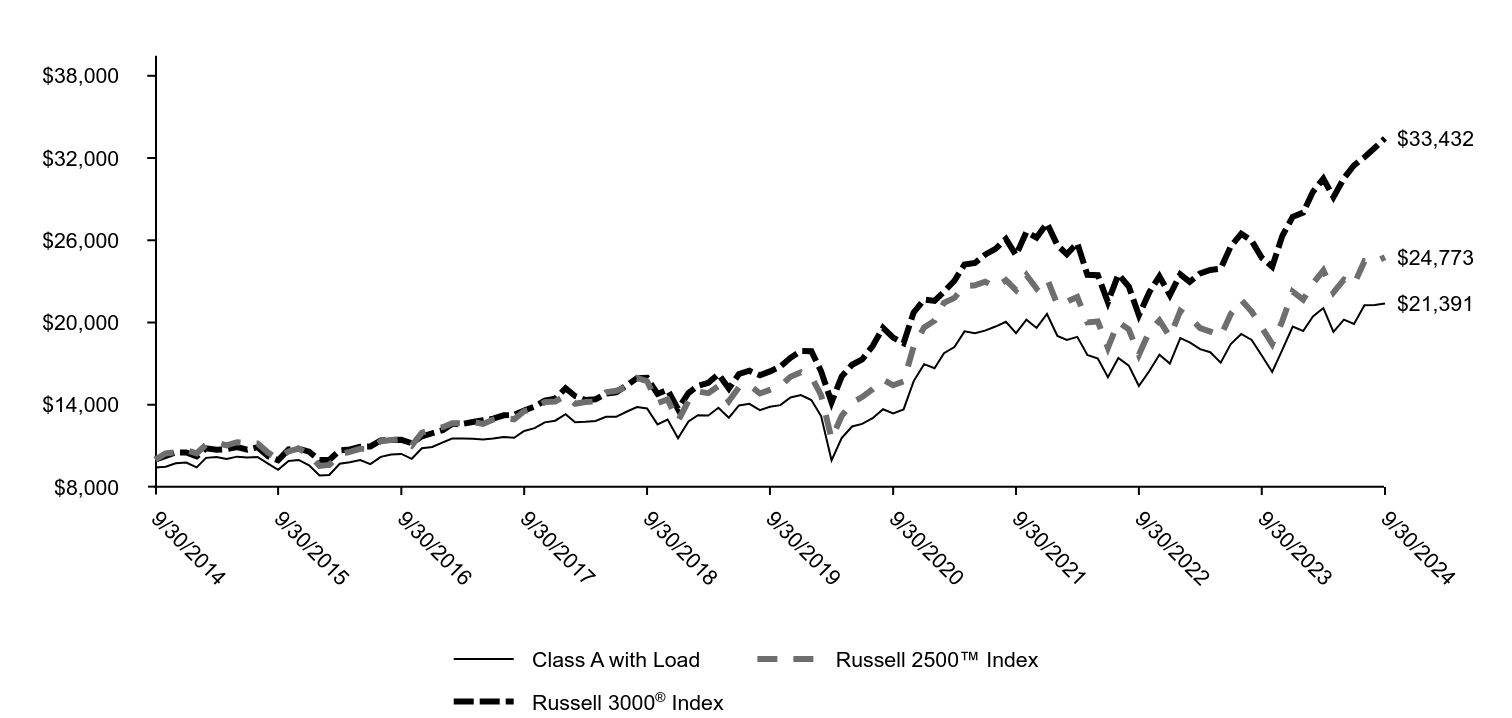

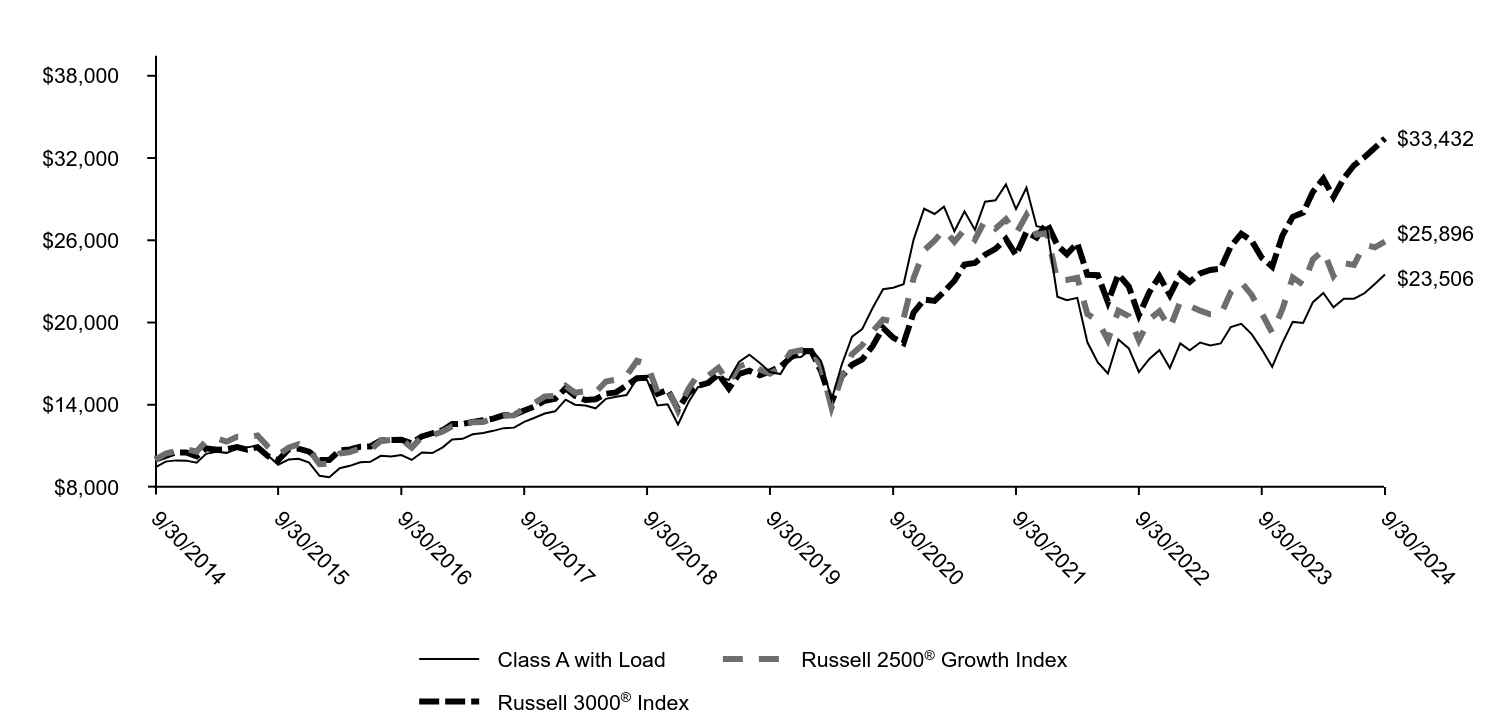

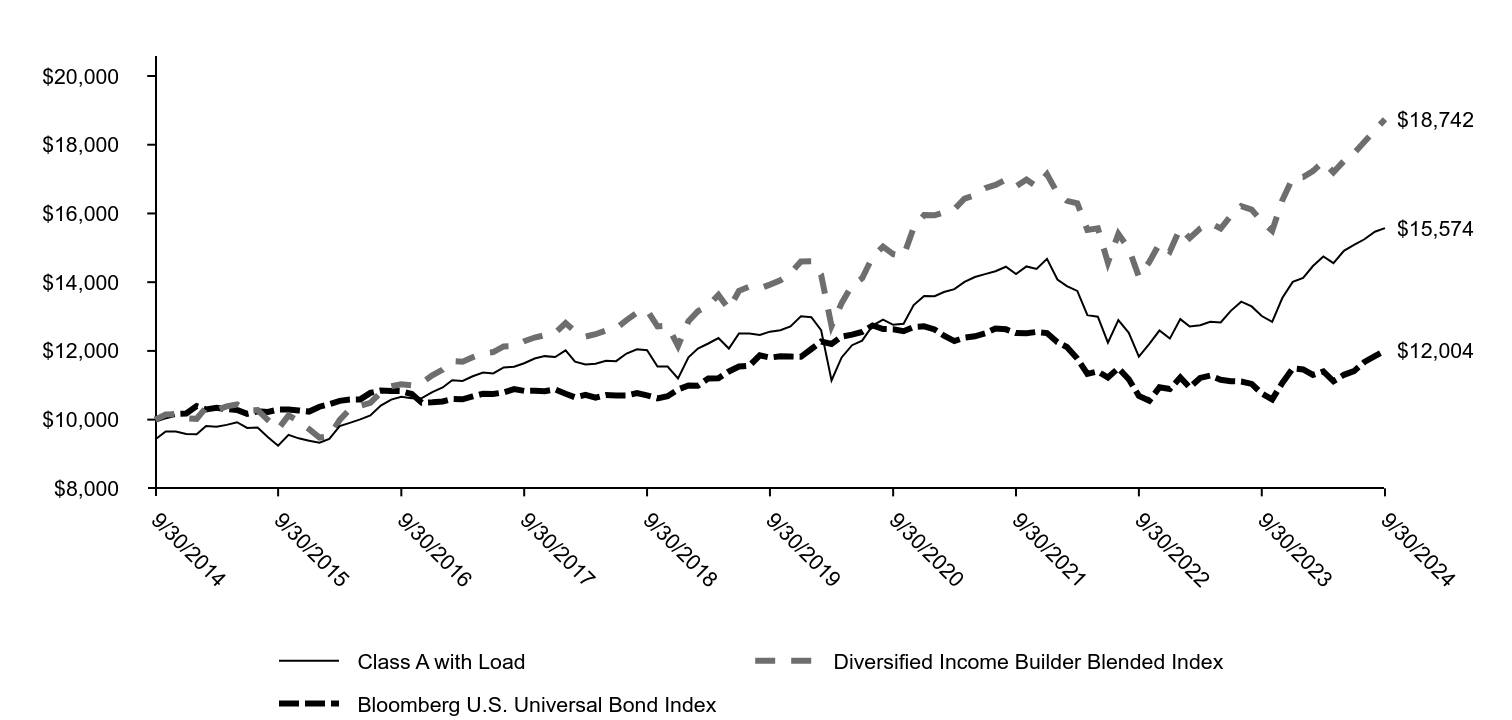

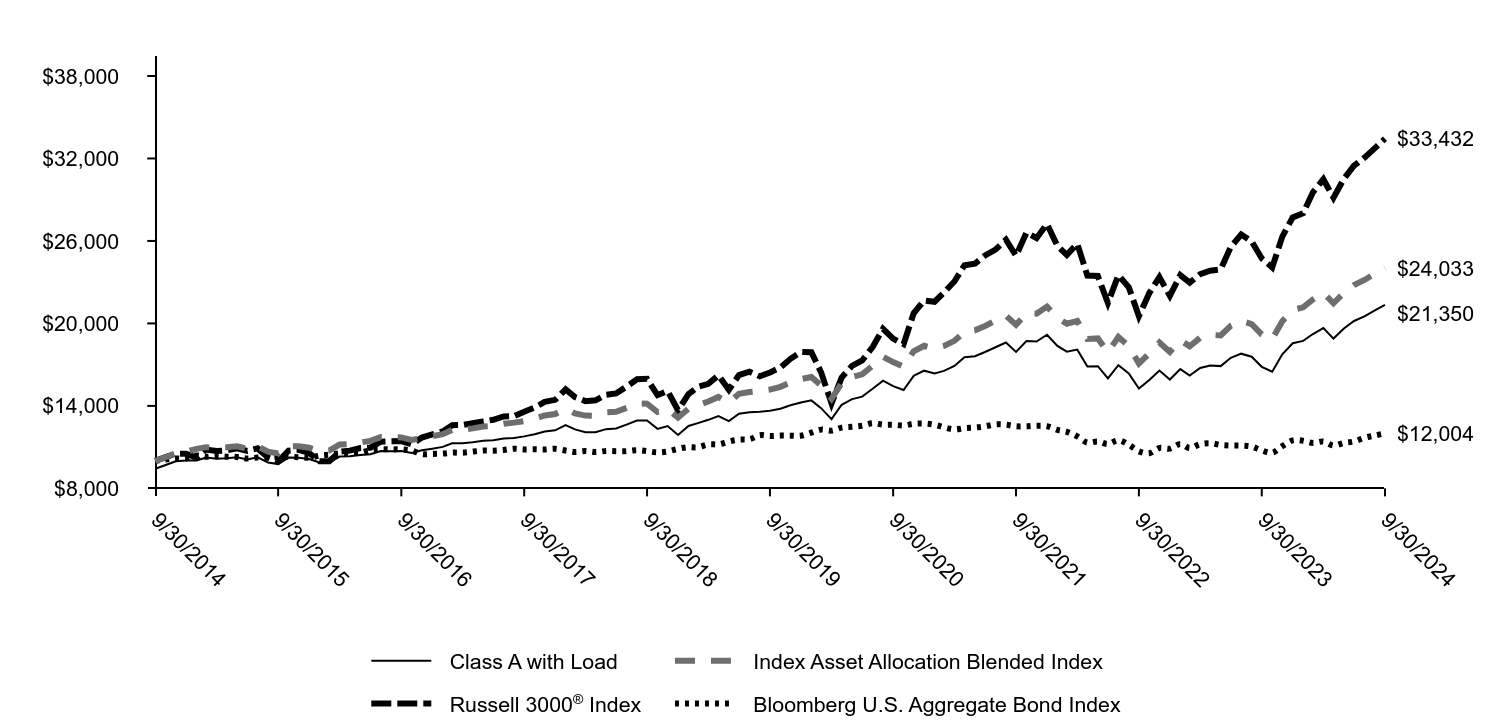

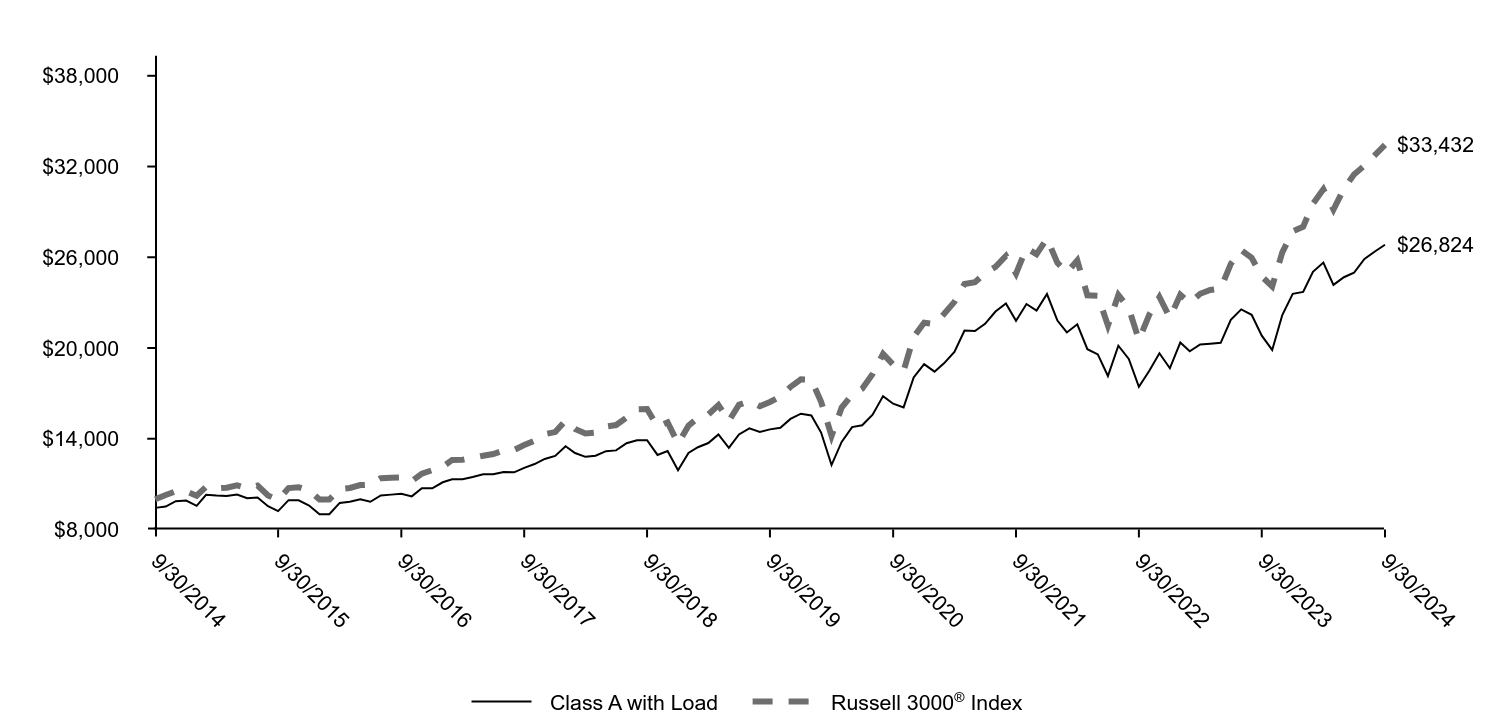

Total return based on a $10,000 investment

| Class A with Load | Russell 2500™ Index | Russell 3000® Index |

|---|

| 9/30/2014 | $9,426 | $10,000 | $10,000 |

| 10/31/2014 | $9,479 | $10,443 | $10,275 |

| 11/30/2014 | $9,726 | $10,533 | $10,524 |

| 12/31/2014 | $9,782 | $10,677 | $10,524 |

| 1/31/2015 | $9,435 | $10,458 | $10,231 |

| 2/28/2015 | $10,125 | $11,081 | $10,824 |

| 3/31/2015 | $10,193 | $11,229 | $10,713 |

| 4/30/2015 | $10,039 | $11,032 | $10,762 |

| 5/31/2015 | $10,215 | $11,268 | $10,911 |

| 6/30/2015 | $10,146 | $11,190 | $10,728 |

| 7/31/2015 | $10,193 | $11,169 | $10,908 |

| 8/31/2015 | $9,701 | $10,508 | $10,249 |

| 9/30/2015 | $9,260 | $10,038 | $9,951 |

| 10/31/2015 | $9,898 | $10,599 | $10,736 |

| 11/30/2015 | $9,971 | $10,807 | $10,796 |

| 12/31/2015 | $9,582 | $10,367 | $10,574 |

| 1/31/2016 | $8,841 | $9,540 | $9,978 |

| 2/29/2016 | $8,880 | $9,607 | $9,975 |

| 3/31/2016 | $9,694 | $10,408 | $10,677 |

| 4/30/2016 | $9,800 | $10,561 | $10,743 |

| 5/31/2016 | $9,960 | $10,784 | $10,935 |

| 6/30/2016 | $9,674 | $10,779 | $10,958 |

| 7/31/2016 | $10,202 | $11,342 | $11,393 |

| 8/31/2016 | $10,371 | $11,432 | $11,422 |

| 9/30/2016 | $10,410 | $11,487 | $11,440 |

| 10/31/2016 | $10,057 | $11,021 | $11,192 |

| 11/30/2016 | $10,827 | $11,958 | $11,693 |

| 12/31/2016 | $10,921 | $12,190 | $11,921 |

| 1/31/2017 | $11,252 | $12,360 | $12,145 |

| 2/28/2017 | $11,533 | $12,657 | $12,597 |

| 3/31/2017 | $11,538 | $12,648 | $12,606 |

| 4/30/2017 | $11,513 | $12,746 | $12,739 |

| 5/31/2017 | $11,463 | $12,603 | $12,870 |

| 6/30/2017 | $11,543 | $12,918 | $12,986 |

| 7/31/2017 | $11,649 | $13,052 | $13,231 |

| 8/31/2017 | $11,589 | $12,944 | $13,256 |

| 9/30/2017 | $12,086 | $13,531 | $13,579 |

| 10/31/2017 | $12,292 | $13,740 | $13,876 |

| 11/30/2017 | $12,714 | $14,192 | $14,297 |

| 12/31/2017 | $12,838 | $14,240 | $14,440 |

| 1/31/2018 | $13,307 | $14,674 | $15,201 |

| 2/28/2018 | $12,726 | $14,070 | $14,641 |

| 3/31/2018 | $12,760 | $14,206 | $14,347 |

| 4/30/2018 | $12,821 | $14,239 | $14,402 |

| 5/31/2018 | $13,123 | $14,909 | $14,808 |

| 6/30/2018 | $13,117 | $15,017 | $14,905 |

| 7/31/2018 | $13,491 | $15,307 | $15,400 |

| 8/31/2018 | $13,827 | $15,964 | $15,940 |

| 9/30/2018 | $13,732 | $15,722 | $15,967 |

| 10/31/2018 | $12,570 | $14,126 | $14,791 |

| 11/30/2018 | $12,922 | $14,392 | $15,087 |

| 12/31/2018 | $11,561 | $12,815 | $13,683 |

| 1/31/2019 | $12,784 | $14,291 | $14,858 |

| 2/28/2019 | $13,238 | $14,966 | $15,380 |

| 3/31/2019 | $13,212 | $14,842 | $15,605 |

| 4/30/2019 | $13,777 | $15,363 | $16,228 |

| 5/31/2019 | $13,054 | $14,270 | $15,178 |

| 6/30/2019 | $13,948 | $15,282 | $16,244 |

| 7/31/2019 | $14,066 | $15,441 | $16,485 |

| 8/31/2019 | $13,606 | $14,823 | $16,149 |

| 9/30/2019 | $13,856 | $15,086 | $16,433 |

| 10/31/2019 | $13,974 | $15,375 | $16,786 |

| 11/30/2019 | $14,533 | $16,035 | $17,424 |

| 12/31/2019 | $14,705 | $16,374 | $17,928 |

| 1/31/2020 | $14,346 | $16,041 | $17,908 |

| 2/29/2020 | $13,179 | $14,696 | $16,442 |

| 3/31/2020 | $9,948 | $11,507 | $14,181 |

| 4/30/2020 | $11,571 | $13,182 | $16,059 |

| 5/31/2020 | $12,416 | $14,155 | $16,918 |

| 6/30/2020 | $12,603 | $14,564 | $17,304 |

| 7/31/2020 | $13,022 | $15,144 | $18,287 |

| 8/31/2020 | $13,672 | $15,830 | $19,612 |

| 9/30/2020 | $13,373 | $15,421 | $18,898 |

| 10/31/2020 | $13,658 | $15,700 | $18,490 |

| 11/30/2020 | $15,729 | $18,258 | $20,739 |

| 12/31/2020 | $16,963 | $19,647 | $21,672 |

| 1/31/2021 | $16,665 | $20,129 | $21,576 |

| 2/28/2021 | $17,765 | $21,442 | $22,250 |

| 3/31/2021 | $18,205 | $21,795 | $23,048 |

| 4/30/2021 | $19,353 | $22,665 | $24,236 |

| 5/31/2021 | $19,219 | $22,712 | $24,346 |

| 6/30/2021 | $19,408 | $22,981 | $24,947 |

| 7/31/2021 | $19,707 | $22,578 | $25,369 |

| 8/31/2021 | $20,053 | $23,091 | $26,092 |

| 9/30/2021 | $19,227 | $22,364 | $24,921 |

| 10/31/2021 | $20,202 | $23,461 | $26,607 |

| 11/30/2021 | $19,605 | $22,482 | $26,202 |

| 12/31/2021 | $20,624 | $23,220 | $27,234 |

| 1/31/2022 | $19,013 | $21,287 | $25,631 |

| 2/28/2022 | $18,730 | $21,527 | $24,986 |

| 3/31/2022 | $18,956 | $21,869 | $25,796 |

| 4/30/2022 | $17,628 | $20,006 | $23,481 |

| 5/31/2022 | $17,364 | $20,073 | $23,450 |

| 6/30/2022 | $16,007 | $18,155 | $21,488 |

| 7/31/2022 | $17,411 | $20,034 | $23,504 |

| 8/31/2022 | $16,855 | $19,501 | $22,627 |

| 9/30/2022 | $15,367 | $17,644 | $20,528 |

| 10/31/2022 | $16,460 | $19,337 | $22,212 |

| 11/30/2022 | $17,647 | $20,153 | $23,371 |

| 12/31/2022 | $17,004 | $18,954 | $22,003 |

| 1/31/2023 | $18,864 | $20,850 | $23,518 |

| 2/28/2023 | $18,554 | $20,360 | $22,968 |

| 3/31/2023 | $18,056 | $19,597 | $23,583 |

| 4/30/2023 | $17,835 | $19,341 | $23,834 |

| 5/31/2023 | $17,071 | $19,002 | $23,927 |

| 6/30/2023 | $18,432 | $20,621 | $25,560 |

| 7/31/2023 | $19,163 | $21,646 | $26,477 |

| 8/31/2023 | $18,731 | $20,796 | $25,966 |

| 9/30/2023 | $17,591 | $19,635 | $24,729 |

| 10/31/2023 | $16,395 | $18,442 | $24,073 |

| 11/30/2023 | $18,001 | $20,102 | $26,318 |

| 12/31/2023 | $19,702 | $22,257 | $27,714 |

| 1/31/2024 | $19,380 | $21,675 | $28,021 |

| 2/29/2024 | $20,448 | $22,854 | $29,538 |

| 3/31/2024 | $21,057 | $23,797 | $30,491 |

| 4/30/2024 | $19,323 | $22,203 | $29,149 |

| 5/31/2024 | $20,207 | $23,126 | $30,526 |

| 6/30/2024 | $19,897 | $22,780 | $31,471 |

| 7/31/2024 | $21,264 | $24,472 | $32,056 |

| 8/31/2024 | $21,276 | $24,409 | $32,754 |

| 9/30/2024 | $21,391 | $24,773 | $33,432 |

Annual Shareholder Report | September 30, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class A | 21.60 | 9.07 | 8.54 |

| Class A with Load | 14.60 | 7.78 | 7.90 |

| Russell 2500™ Index (Strategy) | 26.17 | 10.43 | 9.50 |

Russell 3000® Index (Regulatory) | 35.19 | 15.26 | 12.83 |

| Total net assets | $799,373,723 |

| # of portfolio holdings | 78 |

| Portfolio turnover rate | 46% |

| Total advisory fees paid | $6,047,377 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Industrials | 20.0 |

| Information technology | 17.3 |

| Financials | 16.1 |

| Health care | 12.8 |

| Materials | 10.2 |

| Consumer discretionary | 9.8 |

| Real estate | 9.3 |

| Consumer staples | 2.6 |

| Domestic Equity | 1.5 |

| Communication services | 0.4 |

TOP TEN HOLDINGS (% OF NET ASSETS)

| Regal Rexnord Corp. | 2.2 |

| Teledyne Technologies, Inc. | 2.1 |

| Marvell Technology, Inc. | 2.0 |

| Carlisle Cos., Inc. | 2.0 |

| Melrose Industries PLC | 1.9 |

| SBA Communications Corp., Class A | 1.9 |

| HealthEquity, Inc. | 1.9 |

| Westlake Corp. | 1.9 |

| Sun Communities, Inc. | 1.8 |

| Bio-Rad Laboratories, Inc., Class A | 1.8 |

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

This annual shareholder report contains important information about Common Stock Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Administrator Class | $122 | 1.10% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

How did the Fund perform last year and what affected its performance?

Over the 12-month period that ended September 30, 2024, the equity markets soared to all-time highs, fueled by positive earnings surprises, robust economic growth, a decline in both inflation and interest rates, and a fervor around artificial intelligence (AI). Driven by semiconductor chip designer NVIDIA Corp., the AI theme significantly boosted the mega-cap growth sector to unprecedented heights. By contrast, small- and mid-cap stocks substantially underperformed large caps, partly due to their inferior balance sheet profiles. However, with the Federal Reserve pivoting to a more accommodative stance, future rate cuts could lower borrowing costs and be a catalyst for smaller-cap companies.

Key detractors during the period included Atkore Inc., which endured a cyclical downturn, citing weaker customer spending, and Leslie’s Inc., which toiled with a decline in chlorine prices, a CEO change, and softness in new pool and renovation construction. Going forward, we remain optimistic about the Fund’s prospects given the attractive private market valuations of many of our holdings.

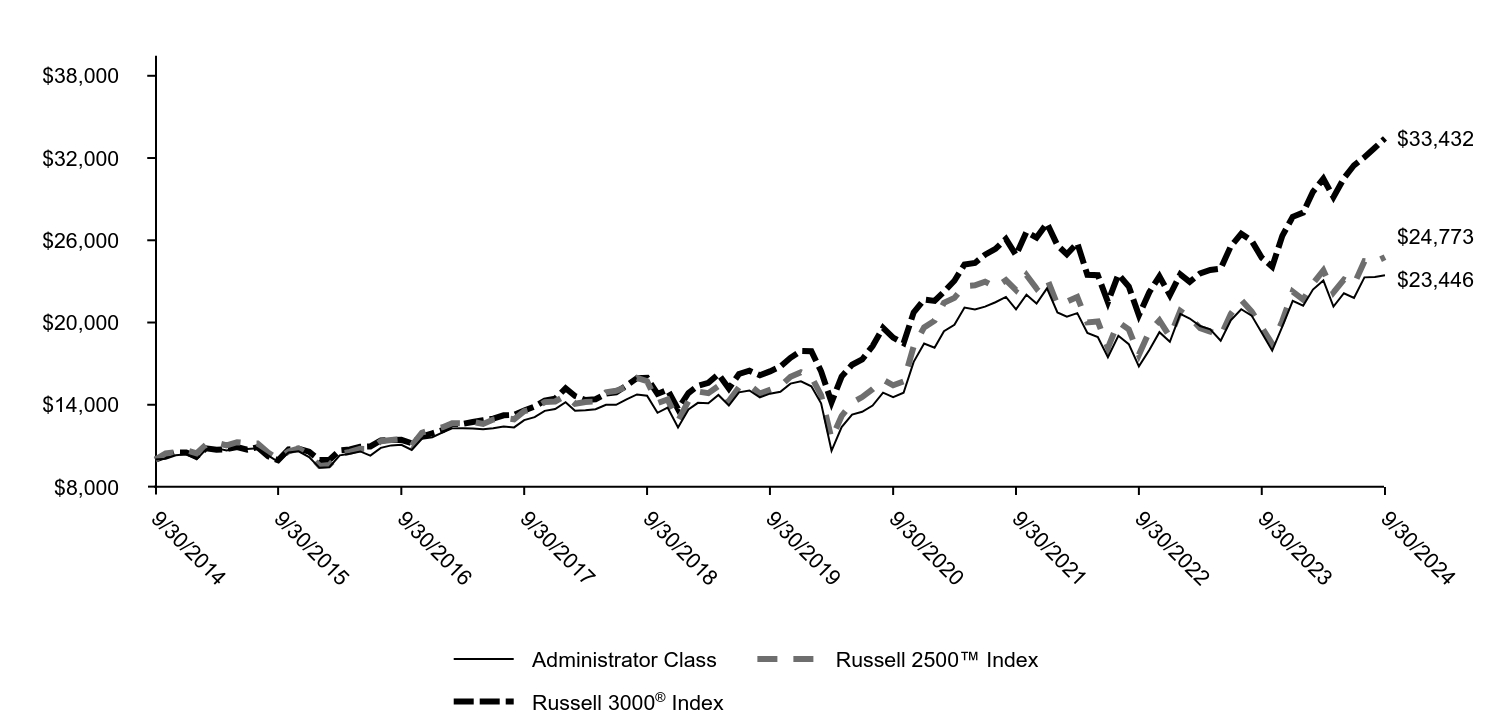

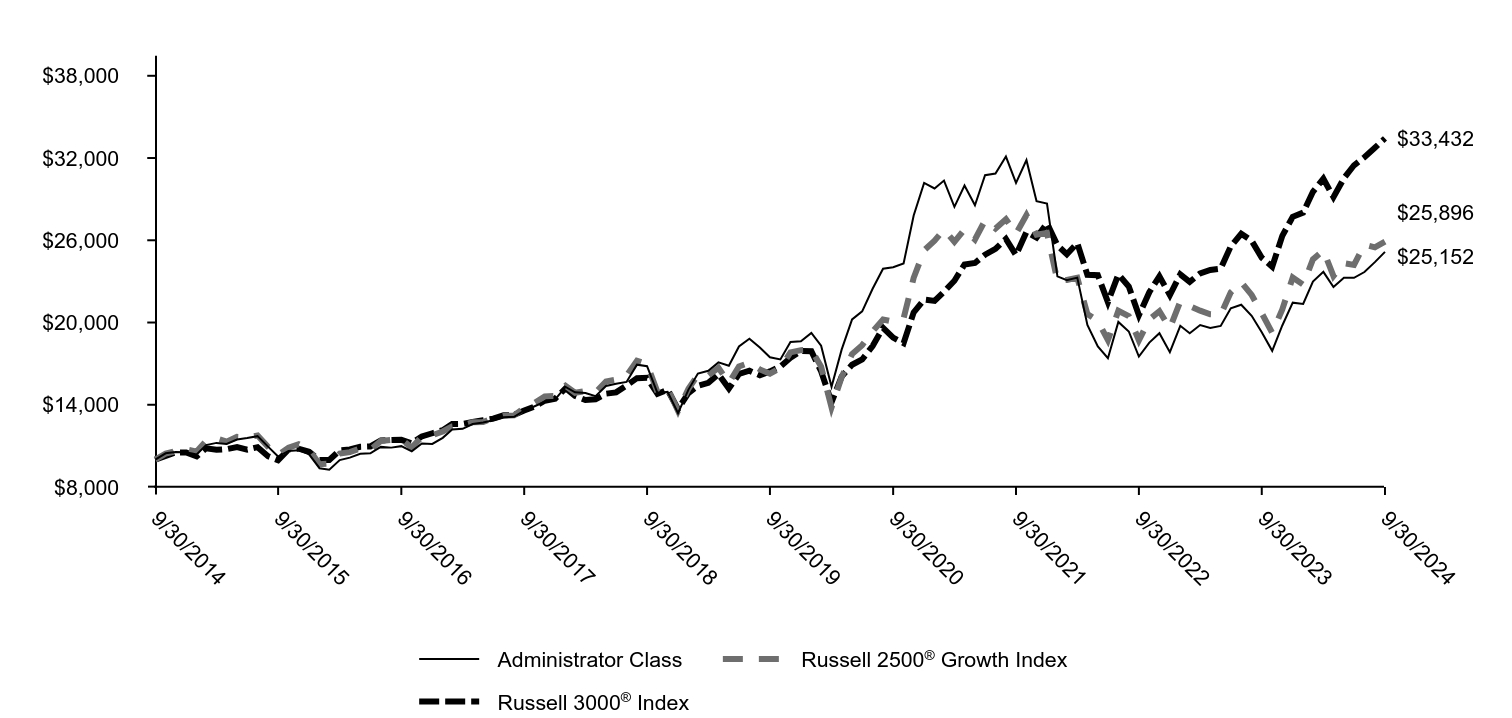

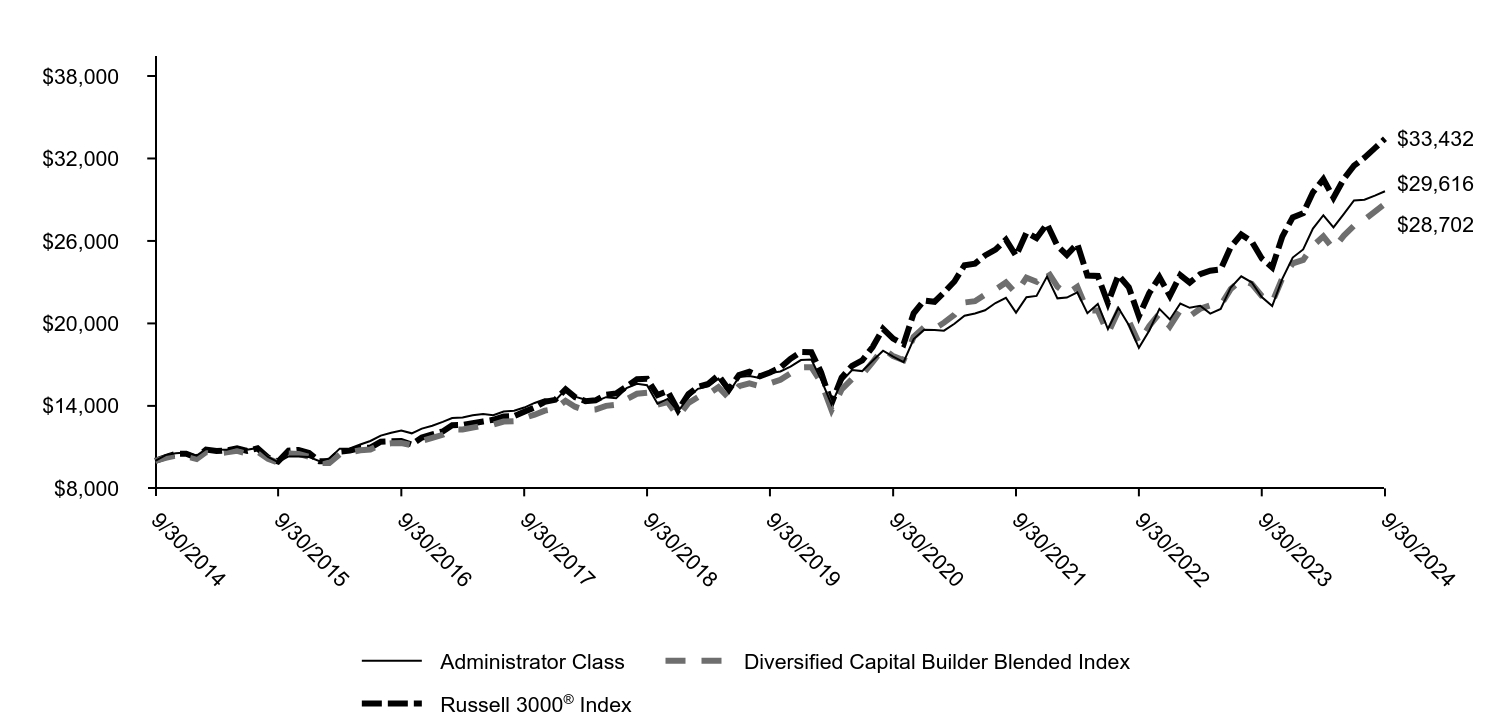

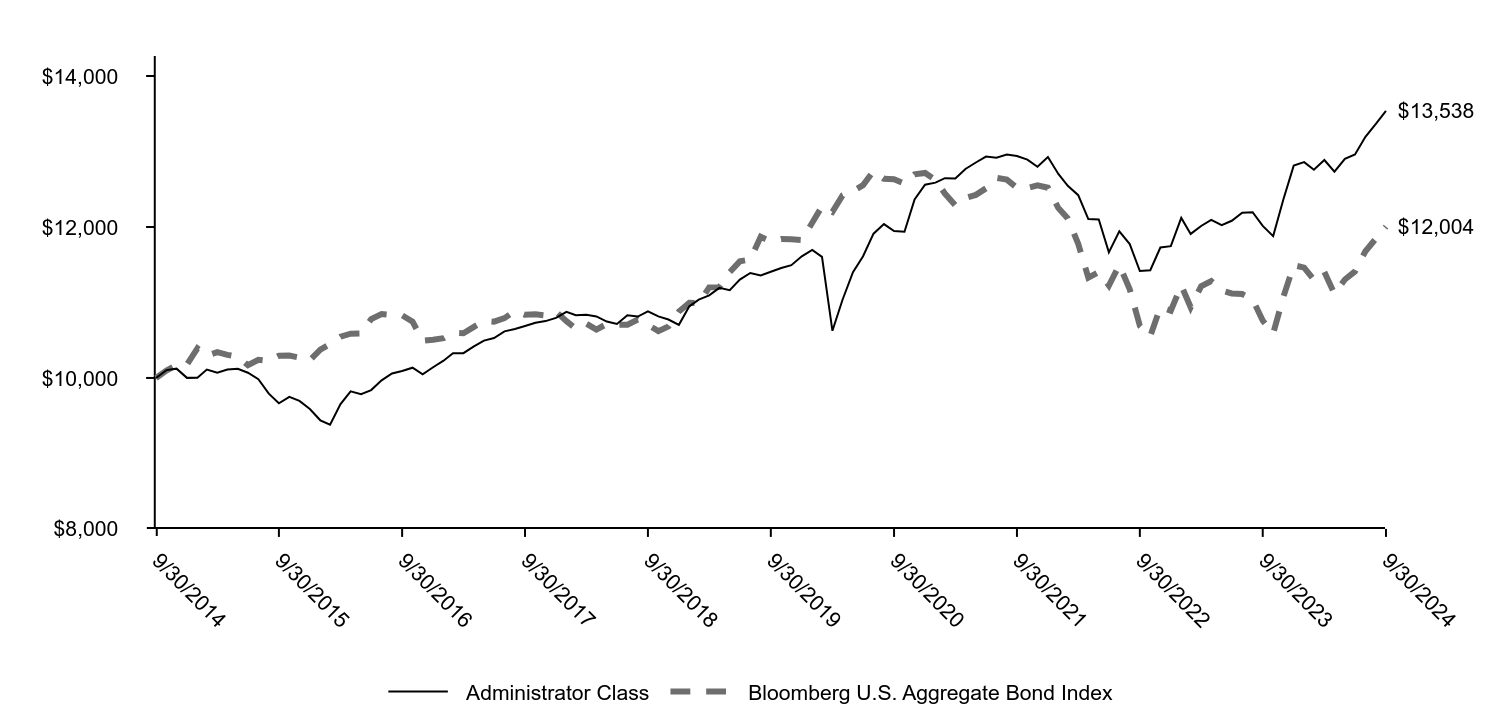

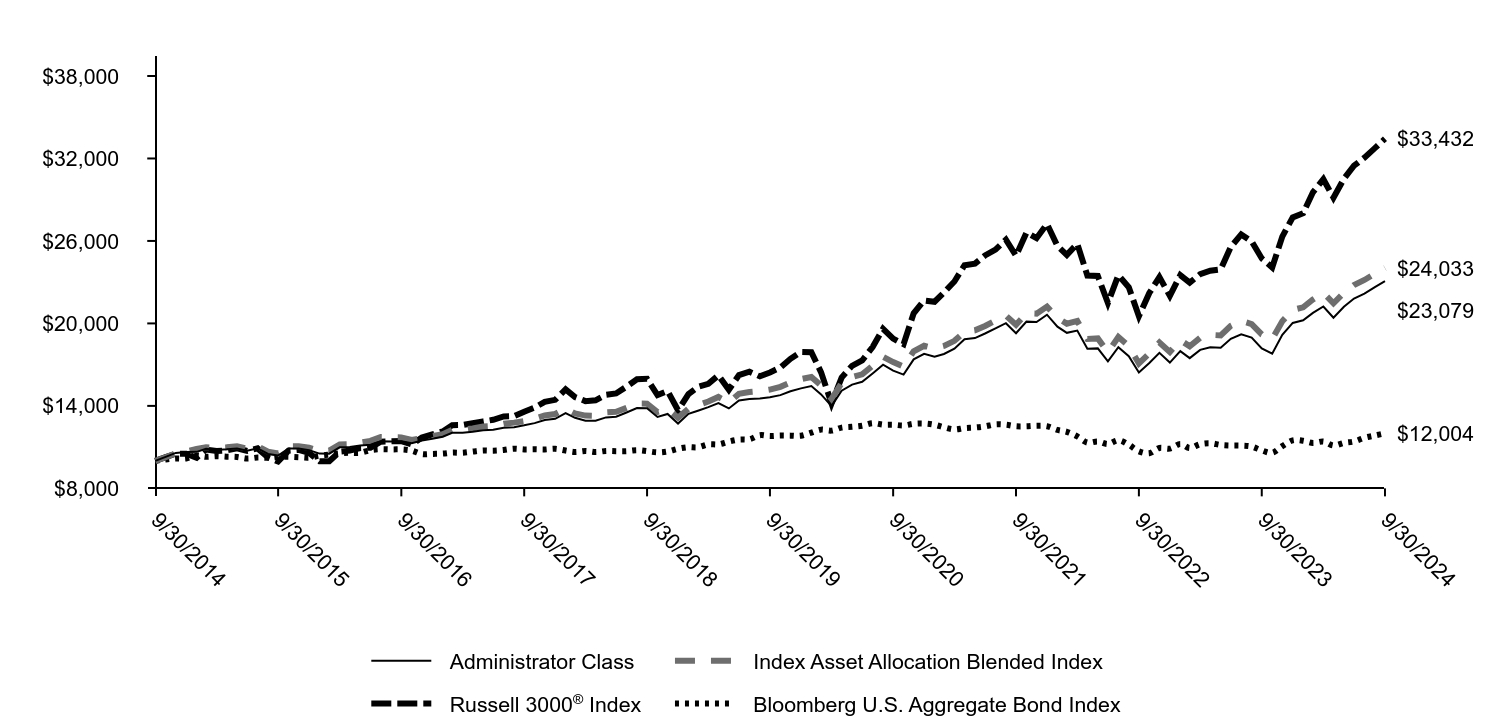

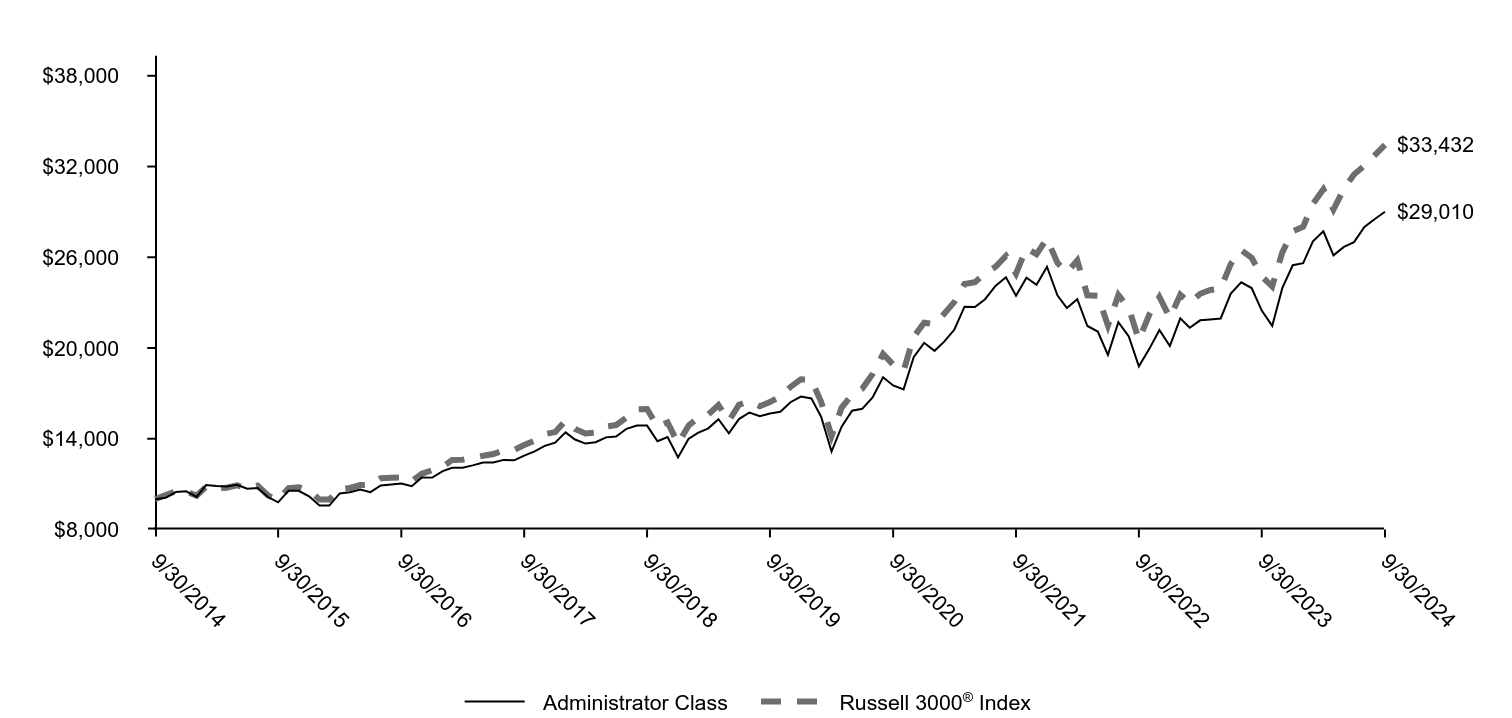

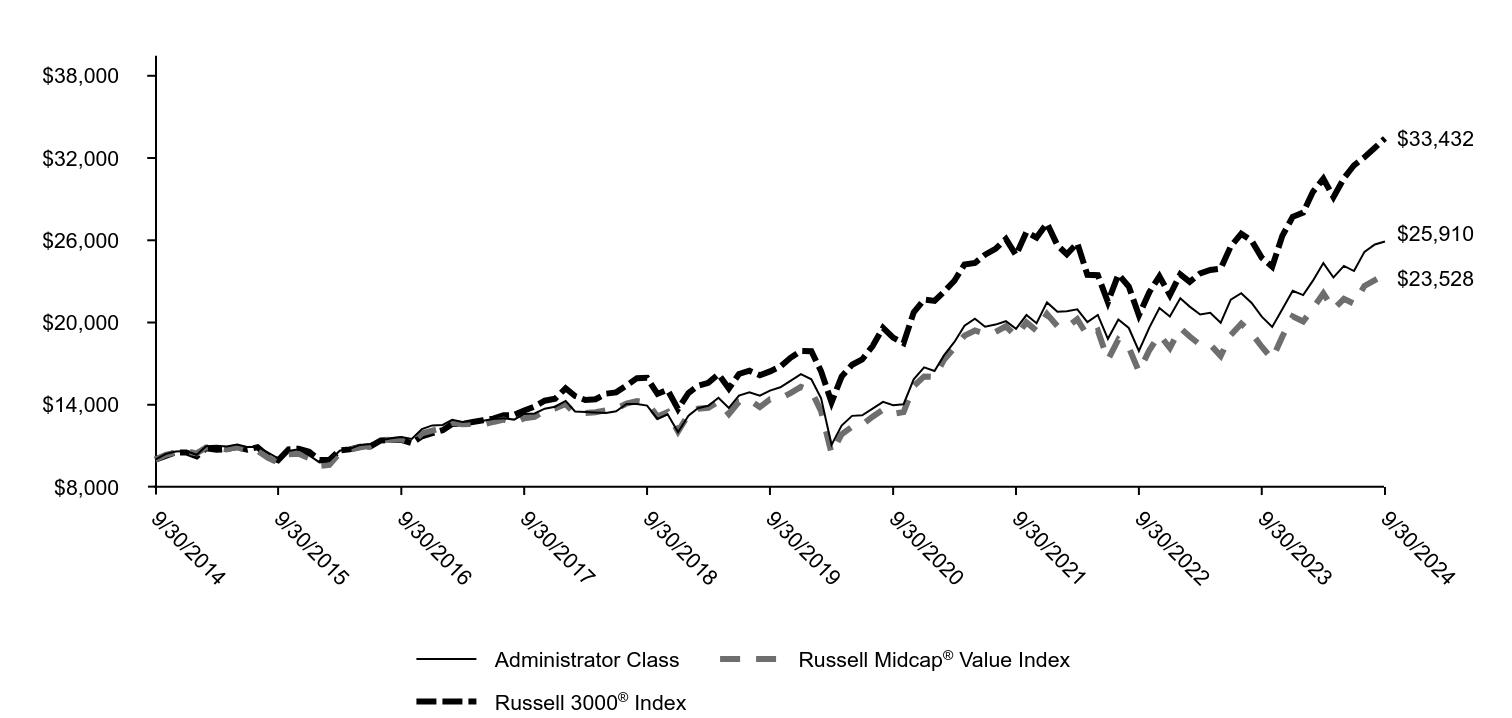

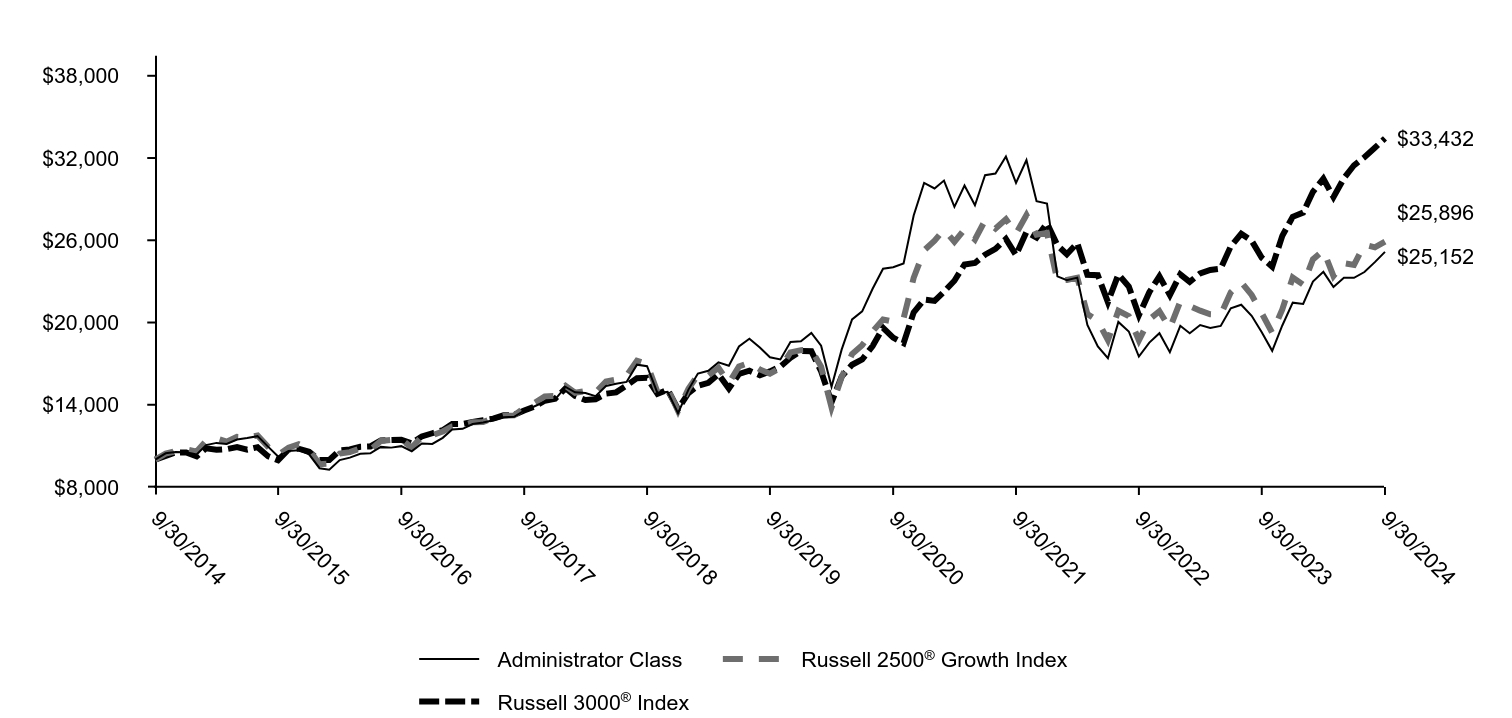

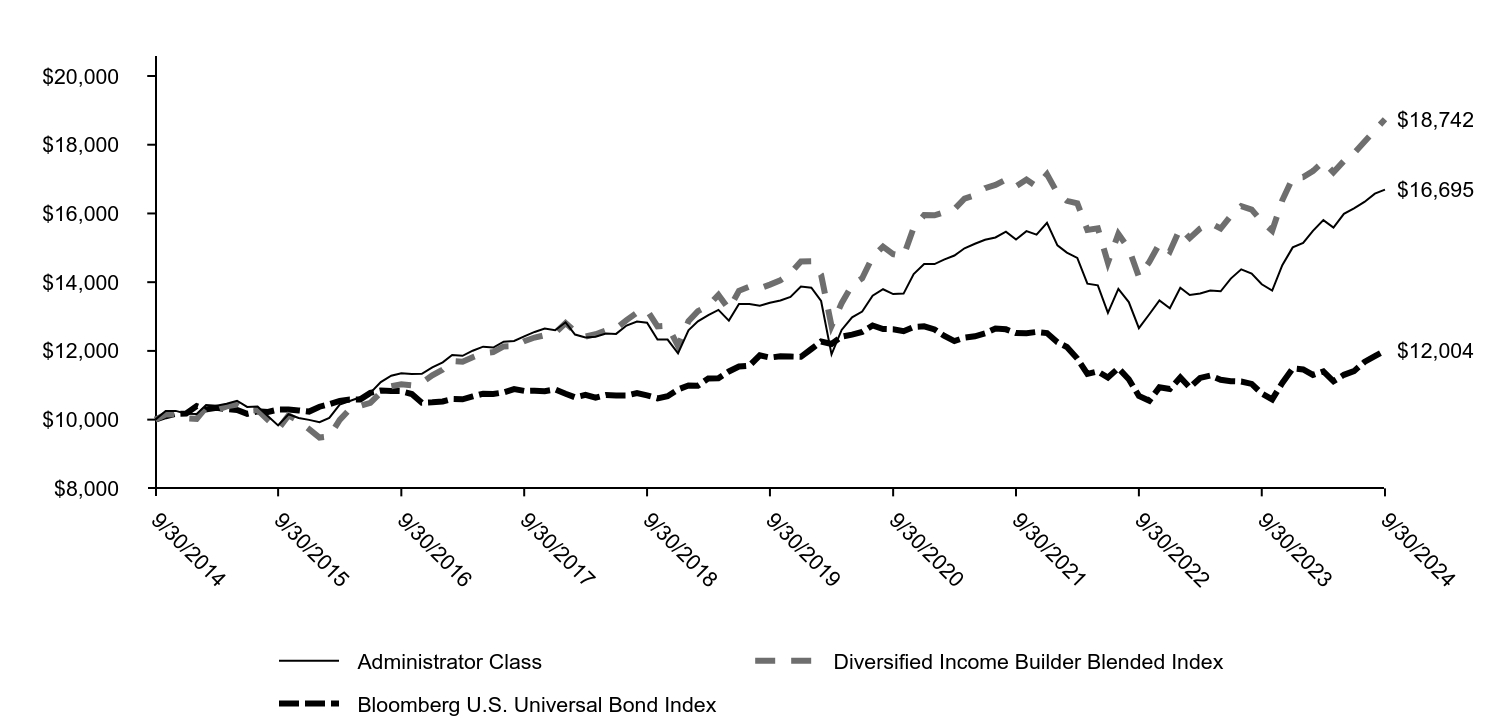

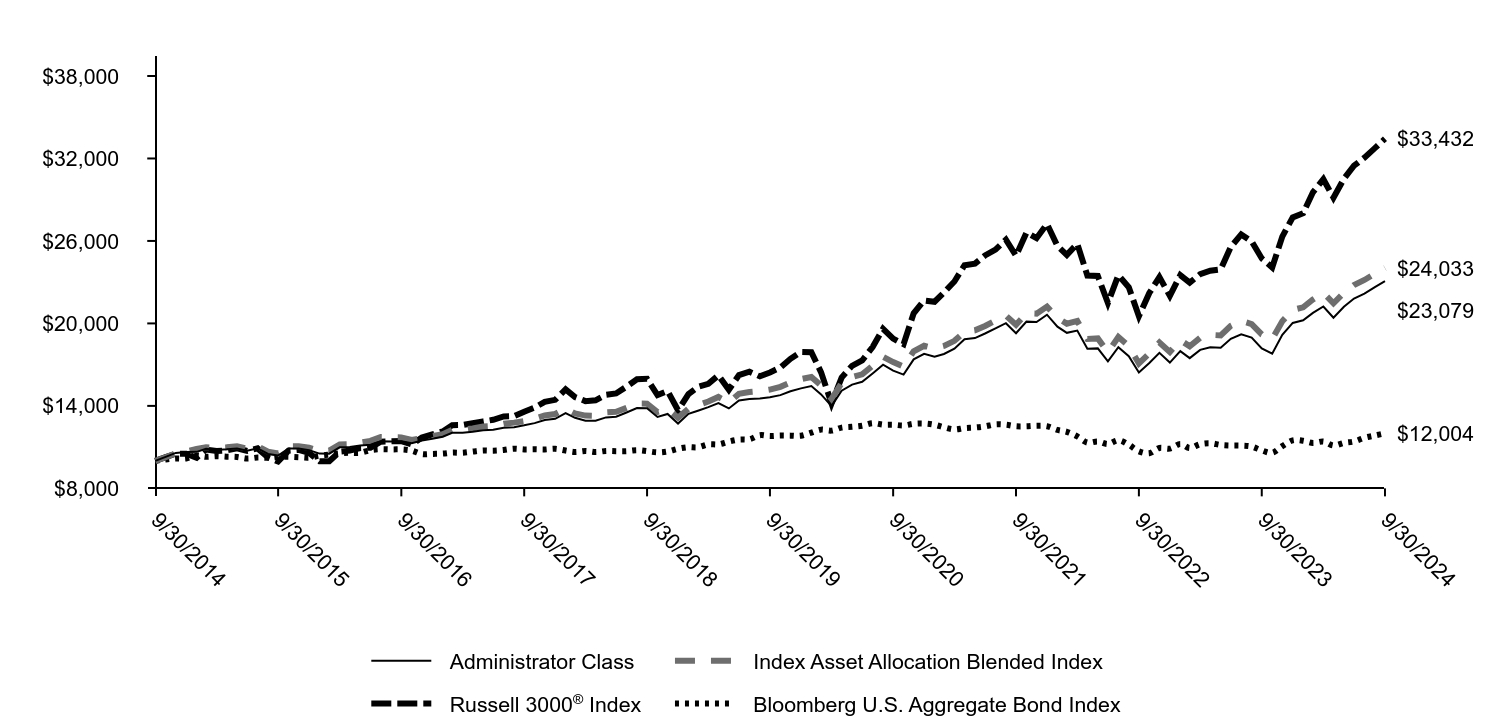

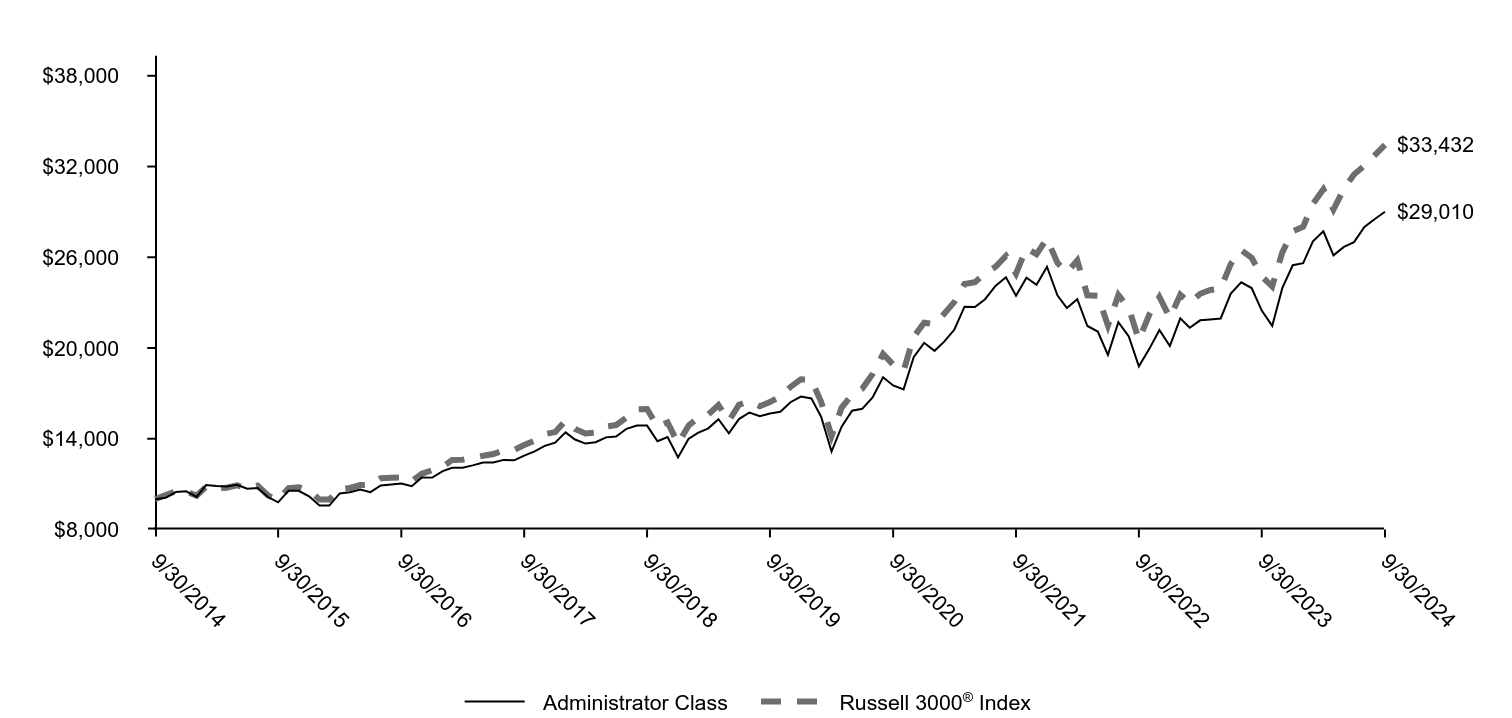

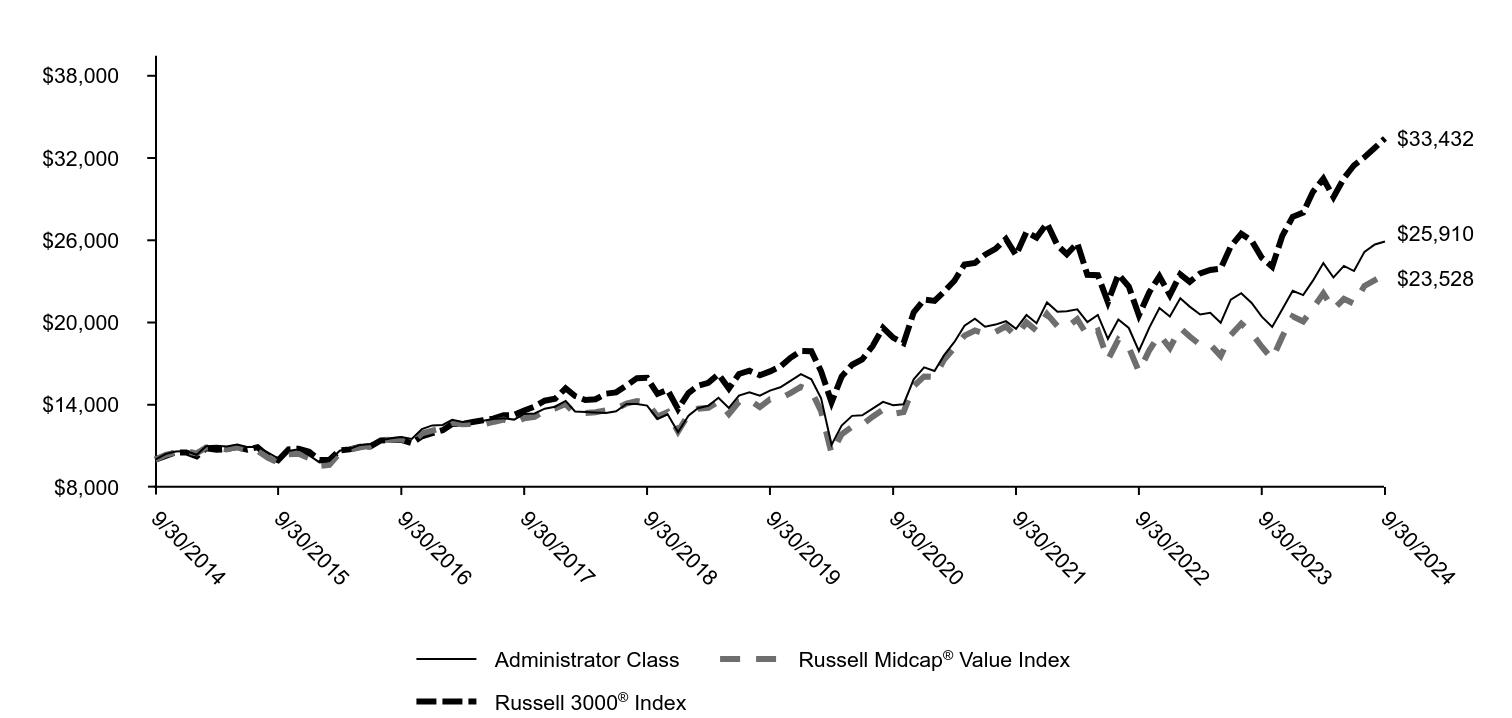

Total return based on a $10,000 investment

| Administrator Class | Russell 2500™ Index | Russell 3000® Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,060 | $10,443 | $10,275 |

| 11/30/2014 | $10,320 | $10,533 | $10,524 |

| 12/31/2014 | $10,388 | $10,677 | $10,524 |

| 1/31/2015 | $10,019 | $10,458 | $10,231 |

| 2/28/2015 | $10,748 | $11,081 | $10,824 |

| 3/31/2015 | $10,825 | $11,229 | $10,713 |

| 4/30/2015 | $10,663 | $11,032 | $10,762 |

| 5/31/2015 | $10,847 | $11,268 | $10,911 |

| 6/30/2015 | $10,775 | $11,190 | $10,728 |

| 7/31/2015 | $10,829 | $11,169 | $10,908 |

| 8/31/2015 | $10,307 | $10,508 | $10,249 |

| 9/30/2015 | $9,838 | $10,038 | $9,951 |

| 10/31/2015 | $10,519 | $10,599 | $10,736 |

| 11/30/2015 | $10,600 | $10,807 | $10,796 |

| 12/31/2015 | $10,187 | $10,367 | $10,574 |

| 1/31/2016 | $9,399 | $9,540 | $9,978 |

| 2/29/2016 | $9,445 | $9,607 | $9,975 |

| 3/31/2016 | $10,309 | $10,408 | $10,677 |

| 4/30/2016 | $10,421 | $10,561 | $10,743 |

| 5/31/2016 | $10,594 | $10,784 | $10,935 |

| 6/30/2016 | $10,294 | $10,779 | $10,958 |

| 7/31/2016 | $10,853 | $11,342 | $11,393 |

| 8/31/2016 | $11,036 | $11,432 | $11,422 |

| 9/30/2016 | $11,077 | $11,487 | $11,440 |

| 10/31/2016 | $10,701 | $11,021 | $11,192 |

| 11/30/2016 | $11,520 | $11,958 | $11,693 |

| 12/31/2016 | $11,629 | $12,190 | $11,921 |

| 1/31/2017 | $11,982 | $12,360 | $12,145 |

| 2/28/2017 | $12,277 | $12,657 | $12,597 |

| 3/31/2017 | $12,288 | $12,648 | $12,606 |

| 4/30/2017 | $12,261 | $12,746 | $12,739 |

| 5/31/2017 | $12,209 | $12,603 | $12,870 |

| 6/30/2017 | $12,293 | $12,918 | $12,986 |

| 7/31/2017 | $12,409 | $13,052 | $13,231 |

| 8/31/2017 | $12,346 | $12,944 | $13,256 |

| 9/30/2017 | $12,878 | $13,531 | $13,579 |

| 10/31/2017 | $13,100 | $13,740 | $13,876 |

| 11/30/2017 | $13,553 | $14,192 | $14,297 |

| 12/31/2017 | $13,689 | $14,240 | $14,440 |

| 1/31/2018 | $14,187 | $14,674 | $15,201 |

| 2/28/2018 | $13,572 | $14,070 | $14,641 |

| 3/31/2018 | $13,607 | $14,206 | $14,347 |

| 4/30/2018 | $13,677 | $14,239 | $14,402 |

| 5/31/2018 | $13,999 | $14,909 | $14,808 |

| 6/30/2018 | $13,994 | $15,017 | $14,905 |

| 7/31/2018 | $14,398 | $15,307 | $15,400 |

| 8/31/2018 | $14,755 | $15,964 | $15,940 |

| 9/30/2018 | $14,661 | $15,722 | $15,967 |

| 10/31/2018 | $13,414 | $14,126 | $14,791 |

| 11/30/2018 | $13,794 | $14,392 | $15,087 |

| 12/31/2018 | $12,338 | $12,815 | $13,683 |

| 1/31/2019 | $13,650 | $14,291 | $14,858 |

| 2/28/2019 | $14,138 | $14,966 | $15,380 |

| 3/31/2019 | $14,111 | $14,842 | $15,605 |

| 4/30/2019 | $14,715 | $15,363 | $16,228 |

| 5/31/2019 | $13,946 | $14,270 | $15,178 |

| 6/30/2019 | $14,908 | $15,282 | $16,244 |

| 7/31/2019 | $15,038 | $15,441 | $16,485 |

| 8/31/2019 | $14,544 | $14,823 | $16,149 |

| 9/30/2019 | $14,811 | $15,086 | $16,433 |

| 10/31/2019 | $14,942 | $15,375 | $16,786 |

| 11/30/2019 | $15,540 | $16,035 | $17,424 |

| 12/31/2019 | $15,716 | $16,374 | $17,928 |

| 1/31/2020 | $15,342 | $16,041 | $17,908 |

| 2/29/2020 | $14,102 | $14,696 | $16,442 |

| 3/31/2020 | $10,639 | $11,507 | $14,181 |

| 4/30/2020 | $12,378 | $13,182 | $16,059 |

| 5/31/2020 | $13,283 | $14,155 | $16,918 |

| 6/30/2020 | $13,486 | $14,564 | $17,304 |

| 7/31/2020 | $13,938 | $15,144 | $18,287 |

| 8/31/2020 | $14,882 | $15,830 | $19,612 |

| 9/30/2020 | $14,562 | $15,421 | $18,898 |

| 10/31/2020 | $14,874 | $15,700 | $18,490 |

| 11/30/2020 | $17,128 | $18,258 | $20,739 |

| 12/31/2020 | $18,470 | $19,647 | $21,672 |

| 1/31/2021 | $18,159 | $20,129 | $21,576 |

| 2/28/2021 | $19,361 | $21,442 | $22,250 |

| 3/31/2021 | $19,836 | $21,795 | $23,048 |

| 4/30/2021 | $21,087 | $22,665 | $24,236 |

| 5/31/2021 | $20,948 | $22,712 | $24,346 |

| 6/30/2021 | $21,161 | $22,981 | $24,947 |

| 7/31/2021 | $21,480 | $22,578 | $25,369 |

| 8/31/2021 | $21,864 | $23,091 | $26,092 |

| 9/30/2021 | $20,964 | $22,364 | $24,921 |

| 10/31/2021 | $22,028 | $23,461 | $26,607 |

| 11/30/2021 | $21,381 | $22,482 | $26,202 |

| 12/31/2021 | $22,491 | $23,220 | $27,234 |

| 1/31/2022 | $20,733 | $21,287 | $25,631 |

| 2/28/2022 | $20,432 | $21,527 | $24,986 |

| 3/31/2022 | $20,684 | $21,869 | $25,796 |

| 4/30/2022 | $19,237 | $20,006 | $23,481 |

| 5/31/2022 | $18,945 | $20,073 | $23,450 |

| 6/30/2022 | $17,468 | $18,155 | $21,488 |

| 7/31/2022 | $19,033 | $20,034 | $23,504 |

| 8/31/2022 | $18,420 | $19,501 | $22,627 |

| 9/30/2022 | $16,798 | $17,644 | $20,528 |

| 10/31/2022 | $17,993 | $19,337 | $22,212 |

| 11/30/2022 | $19,295 | $20,153 | $23,371 |

| 12/31/2022 | $18,594 | $18,954 | $22,003 |

| 1/31/2023 | $20,628 | $20,850 | $23,518 |

| 2/28/2023 | $20,289 | $20,360 | $22,968 |

| 3/31/2023 | $19,746 | $19,597 | $23,583 |

| 4/30/2023 | $19,509 | $19,341 | $23,834 |

| 5/31/2023 | $18,673 | $19,002 | $23,927 |

| 6/30/2023 | $20,165 | $20,621 | $25,560 |

| 7/31/2023 | $20,967 | $21,646 | $26,477 |

| 8/31/2023 | $20,504 | $20,796 | $25,966 |

| 9/30/2023 | $19,249 | $19,635 | $24,729 |

| 10/31/2023 | $17,949 | $18,442 | $24,073 |

| 11/30/2023 | $19,701 | $20,102 | $26,318 |

| 12/31/2023 | $21,574 | $22,257 | $27,714 |

| 1/31/2024 | $21,223 | $21,675 | $28,021 |

| 2/29/2024 | $22,404 | $22,854 | $29,538 |

| 3/31/2024 | $23,071 | $23,797 | $30,491 |

| 4/30/2024 | $21,164 | $22,203 | $29,149 |

| 5/31/2024 | $22,135 | $23,126 | $30,526 |

| 6/30/2024 | $21,796 | $22,780 | $31,471 |

| 7/31/2024 | $23,294 | $24,472 | $32,056 |

| 8/31/2024 | $23,317 | $24,409 | $32,754 |

| 9/30/2024 | $23,446 | $24,773 | $33,432 |

Annual Shareholder Report | September 30, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Administrator Class | 21.80 | 9.62 | 8.89 |

| Russell 2500™ Index (Strategy) | 26.17 | 10.43 | 9.50 |

Russell 3000® Index (Regulatory) | 35.19 | 15.26 | 12.83 |

| Total net assets | $799,373,723 |

| # of portfolio holdings | 78 |

| Portfolio turnover rate | 46% |

| Total advisory fees paid | $6,047,377 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Industrials | 20.0 |

| Information technology | 17.3 |

| Financials | 16.1 |

| Health care | 12.8 |

| Materials | 10.2 |

| Consumer discretionary | 9.8 |

| Real estate | 9.3 |

| Consumer staples | 2.6 |

| Domestic Equity | 1.5 |

| Communication services | 0.4 |

TOP TEN HOLDINGS (% OF NET ASSETS)

| Regal Rexnord Corp. | 2.2 |

| Teledyne Technologies, Inc. | 2.1 |

| Marvell Technology, Inc. | 2.0 |

| Carlisle Cos., Inc. | 2.0 |

| Melrose Industries PLC | 1.9 |

| SBA Communications Corp., Class A | 1.9 |

| HealthEquity, Inc. | 1.9 |

| Westlake Corp. | 1.9 |

| Sun Communities, Inc. | 1.8 |

| Bio-Rad Laboratories, Inc., Class A | 1.8 |

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

This annual shareholder report contains important information about SMID Cap Growth Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Class R6 | $91 | 0.79% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

How did the Fund perform last year and what affected its performance?

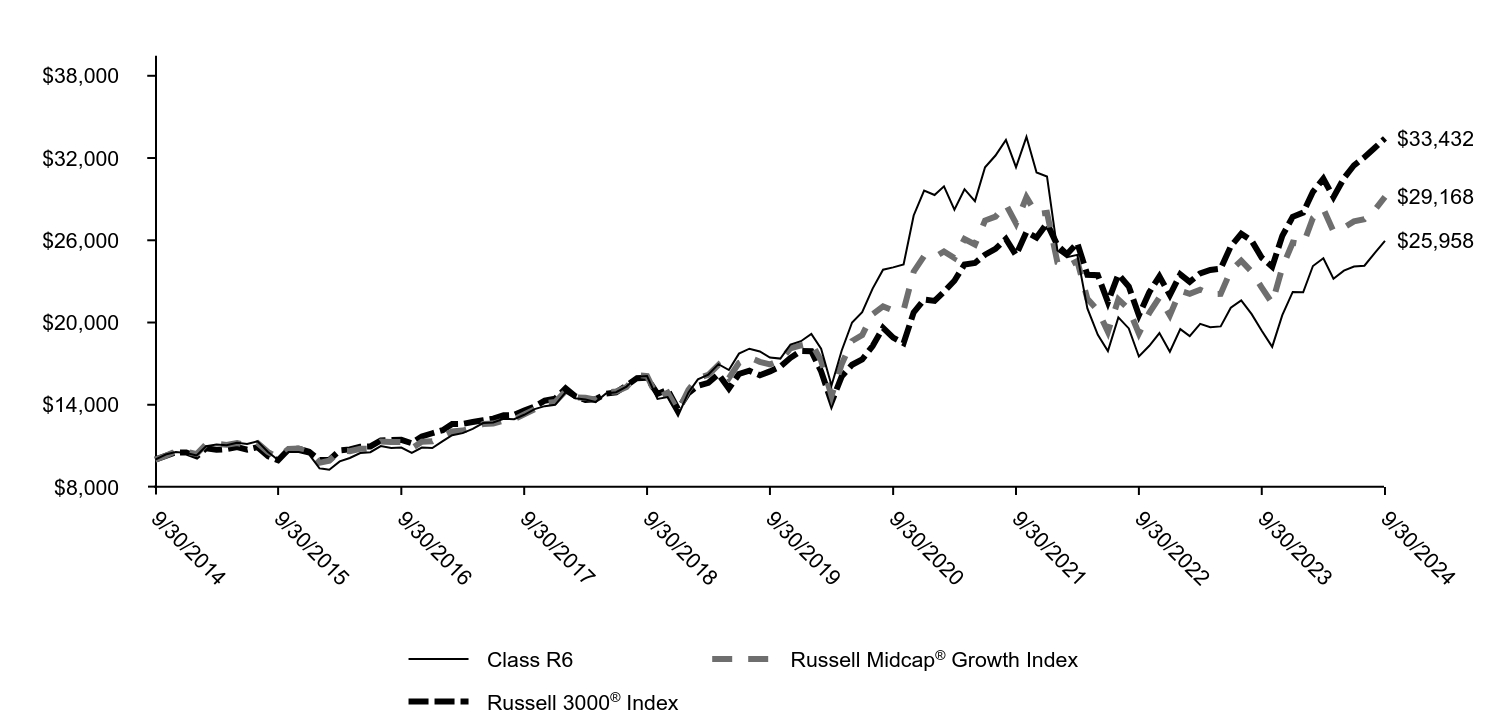

Positive earnings results fueled a bull market for U.S. equities during the 12-month period that ended September 30, 2024. Despite lingering macroeconomic concerns, the S&P 500 Index marked its fourth straight quarter of favorable year-over-year earnings growth. Companies tied to artificial intelligence (AI) saw their valuations soar, with the so called “Magnificent 7” stocks substantially outperforming the market. Late in the fiscal year, market leadership broadened as several mega-cap companies struggled to meet high expectations and the Federal Reserve reduced policy rates. As a result, small- and mid-cap stocks narrowed the performance gap relative to large caps. This aided the Fund’s performance.

The portfolio benefited from security selection within the industrials and consumer discretionary sectors. In particular, exposure to companies that are facilitating the buildout of AI contributed to performance. To the contrary, enterprise software spending slumped as information technology budgets were pointed toward AI-related projects. Portfolio holdings with software-related products detracted from returns. While we adjusted individual holdings, we have not made material changes within positioning.

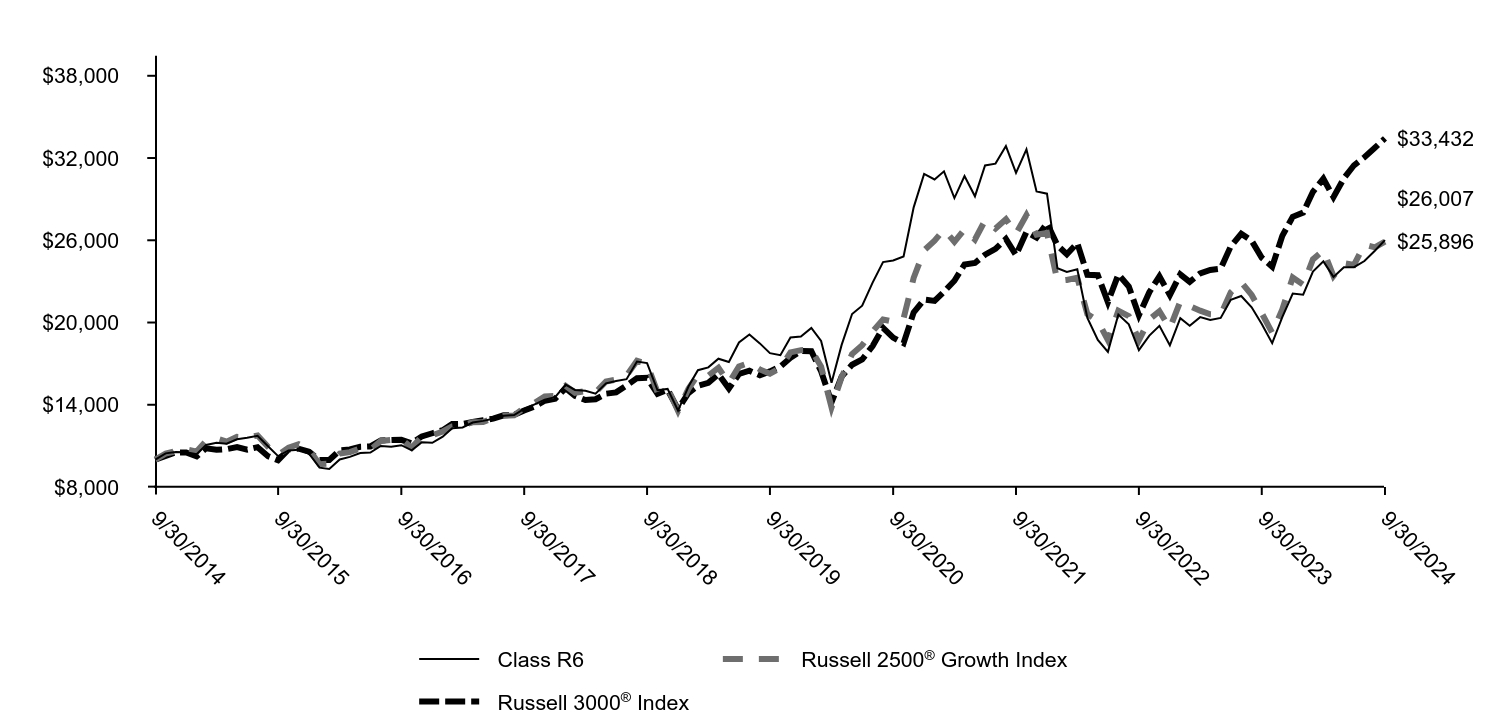

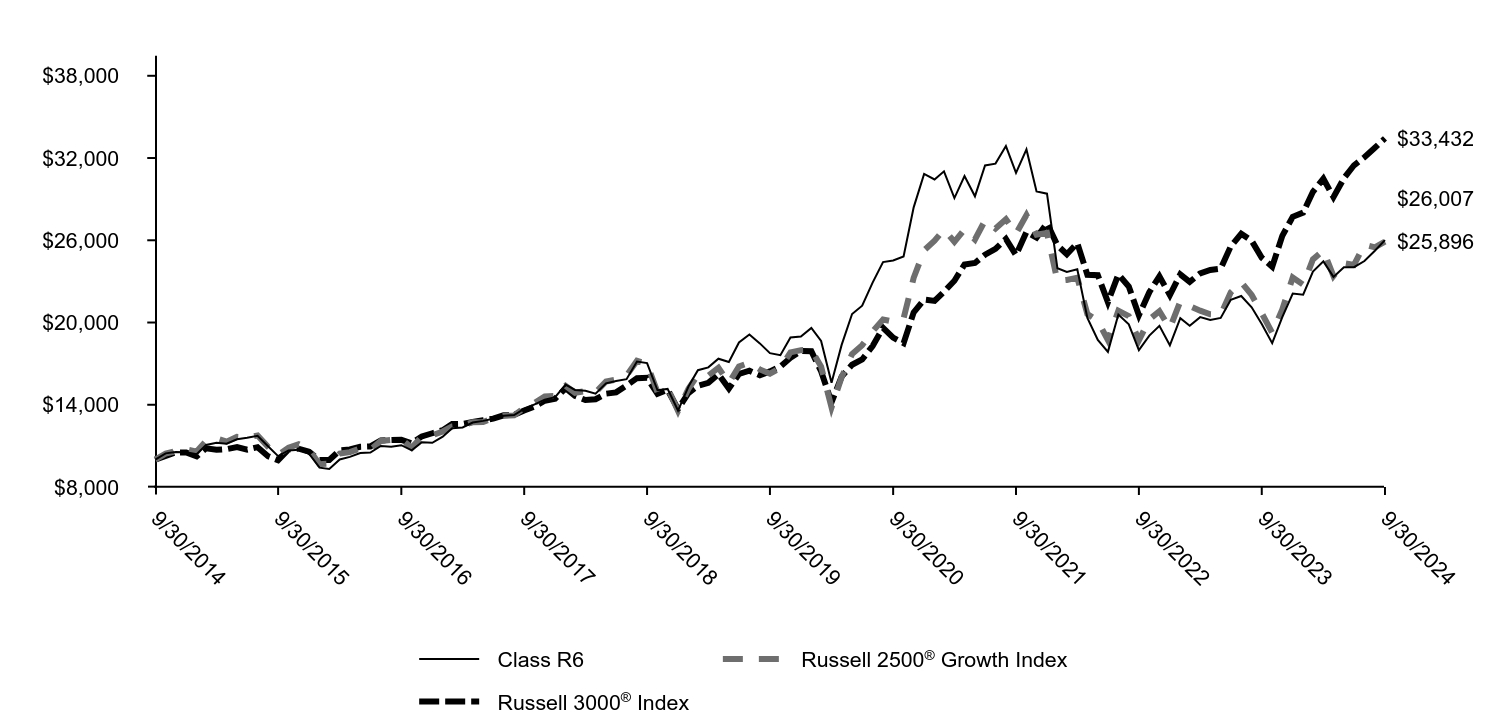

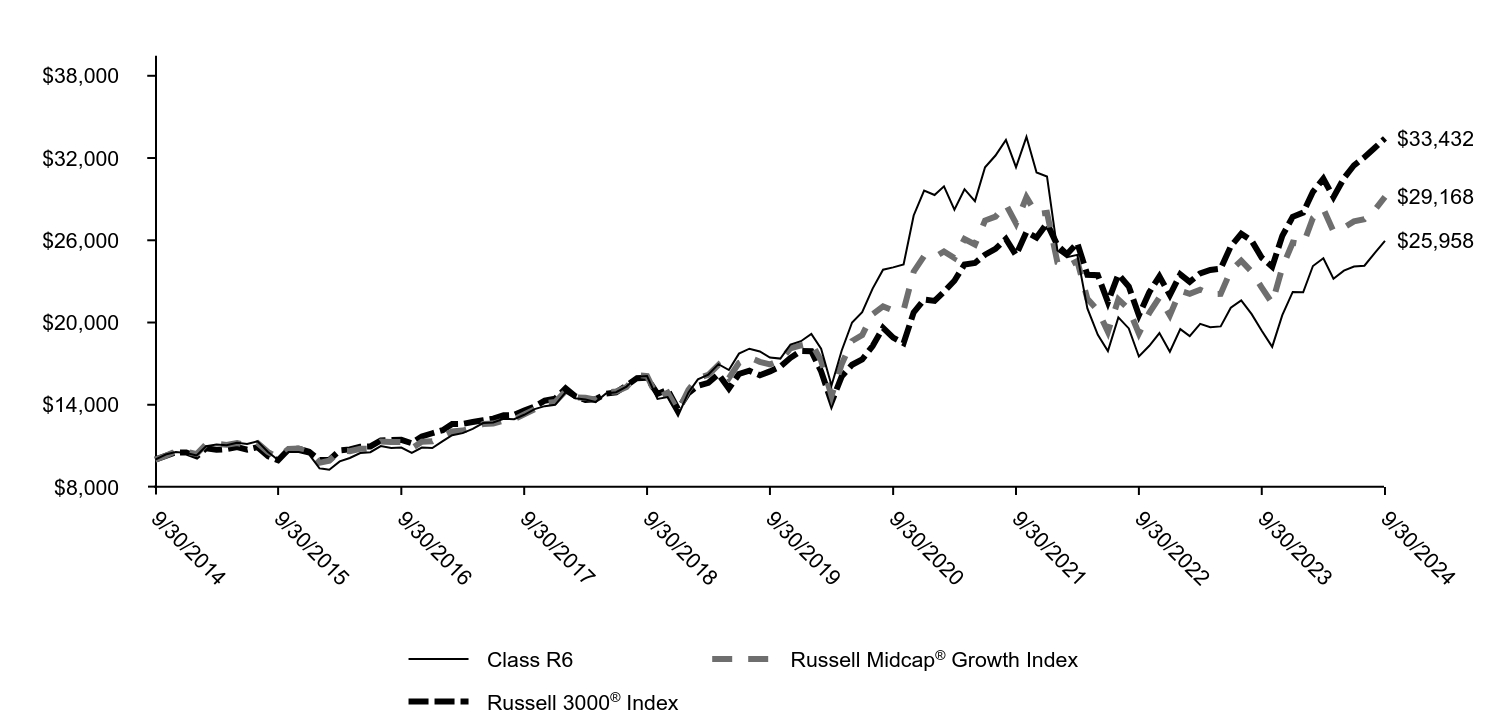

Total return based on a $10,000 investment

| Class R6 | Russell 2500® Growth Index | Russell 3000® Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,456 | $10,440 | $10,275 |

| 11/30/2014 | $10,553 | $10,614 | $10,524 |

| 12/31/2014 | $10,538 | $10,749 | $10,524 |

| 1/31/2015 | $10,384 | $10,583 | $10,231 |

| 2/28/2015 | $11,071 | $11,362 | $10,824 |

| 3/31/2015 | $11,234 | $11,548 | $10,713 |

| 4/30/2015 | $11,158 | $11,308 | $10,762 |

| 5/31/2015 | $11,484 | $11,657 | $10,911 |

| 6/30/2015 | $11,592 | $11,619 | $10,728 |

| 7/31/2015 | $11,739 | $11,757 | $10,908 |

| 8/31/2015 | $10,976 | $10,933 | $10,249 |

| 9/30/2015 | $10,253 | $10,335 | $9,951 |

| 10/31/2015 | $10,666 | $10,875 | $10,736 |

| 11/30/2015 | $10,723 | $11,122 | $10,796 |

| 12/31/2015 | $10,428 | $10,729 | $10,574 |

| 1/31/2016 | $9,409 | $9,668 | $9,978 |

| 2/29/2016 | $9,309 | $9,697 | $9,975 |

| 3/31/2016 | $10,007 | $10,443 | $10,677 |

| 4/30/2016 | $10,195 | $10,544 | $10,743 |

| 5/31/2016 | $10,473 | $10,805 | $10,935 |

| 6/30/2016 | $10,515 | $10,725 | $10,958 |

| 7/31/2016 | $10,991 | $11,363 | $11,393 |

| 8/31/2016 | $10,939 | $11,442 | $11,422 |

| 9/30/2016 | $11,050 | $11,475 | $11,440 |

| 10/31/2016 | $10,678 | $10,875 | $11,192 |

| 11/30/2016 | $11,259 | $11,668 | $11,693 |

| 12/31/2016 | $11,226 | $11,772 | $11,921 |

| 1/31/2017 | $11,673 | $12,051 | $12,145 |

| 2/28/2017 | $12,289 | $12,417 | $12,597 |

| 3/31/2017 | $12,345 | $12,508 | $12,606 |

| 4/30/2017 | $12,704 | $12,728 | $12,739 |

| 5/31/2017 | $12,824 | $12,734 | $12,870 |

| 6/30/2017 | $12,986 | $13,024 | $12,986 |

| 7/31/2017 | $13,204 | $13,198 | $13,231 |

| 8/31/2017 | $13,249 | $13,224 | $13,256 |

| 9/30/2017 | $13,700 | $13,777 | $13,579 |

| 10/31/2017 | $14,031 | $14,146 | $13,876 |

| 11/30/2017 | $14,369 | $14,612 | $14,297 |

| 12/31/2017 | $14,551 | $14,651 | $14,440 |

| 1/31/2018 | $15,472 | $15,383 | $15,201 |

| 2/28/2018 | $15,080 | $14,878 | $14,641 |

| 3/31/2018 | $15,022 | $15,000 | $14,347 |

| 4/30/2018 | $14,807 | $14,905 | $14,402 |

| 5/31/2018 | $15,563 | $15,698 | $14,808 |

| 6/30/2018 | $15,728 | $15,829 | $14,905 |

| 7/31/2018 | $15,869 | $16,126 | $15,400 |

| 8/31/2018 | $17,153 | $17,215 | $15,940 |

| 9/30/2018 | $17,042 | $16,964 | $15,967 |

| 10/31/2018 | $15,059 | $14,926 | $14,791 |

| 11/30/2018 | $15,154 | $15,208 | $15,087 |

| 12/31/2018 | $13,578 | $13,558 | $13,683 |

| 1/31/2019 | $15,327 | $15,172 | $14,858 |

| 2/28/2019 | $16,521 | $16,172 | $15,380 |

| 3/31/2019 | $16,729 | $16,132 | $15,605 |

| 4/30/2019 | $17,362 | $16,696 | $16,228 |

| 5/31/2019 | $17,116 | $15,587 | $15,178 |

| 6/30/2019 | $18,547 | $16,800 | $16,244 |

| 7/31/2019 | $19,122 | $17,062 | $16,485 |

| 8/31/2019 | $18,479 | $16,577 | $16,149 |

| 9/30/2019 | $17,768 | $16,266 | $16,433 |

| 10/31/2019 | $17,614 | $16,683 | $16,786 |

| 11/30/2019 | $18,904 | $17,819 | $17,424 |

| 12/31/2019 | $18,974 | $17,985 | $17,928 |

| 1/31/2020 | $19,601 | $18,004 | $17,908 |

| 2/29/2020 | $18,652 | $16,783 | $16,442 |

| 3/31/2020 | $15,598 | $13,809 | $14,181 |

| 4/30/2020 | $18,368 | $16,023 | $16,059 |

| 5/31/2020 | $20,621 | $17,696 | $16,918 |

| 6/30/2020 | $21,226 | $18,348 | $17,304 |

| 7/31/2020 | $22,911 | $19,352 | $18,287 |

| 8/31/2020 | $24,411 | $20,223 | $19,612 |

| 9/30/2020 | $24,531 | $20,067 | $18,898 |

| 10/31/2020 | $24,815 | $20,304 | $18,490 |

| 11/30/2020 | $28,403 | $23,262 | $20,739 |

| 12/31/2020 | $30,836 | $25,263 | $21,672 |

| 1/31/2021 | $30,436 | $25,969 | $21,576 |

| 2/28/2021 | $31,031 | $26,785 | $22,250 |

| 3/31/2021 | $29,080 | $25,891 | $23,048 |

| 4/30/2021 | $30,682 | $26,801 | $24,236 |

| 5/31/2021 | $29,206 | $26,056 | $24,346 |

| 6/30/2021 | $31,460 | $27,454 | $24,947 |

| 7/31/2021 | $31,592 | $26,860 | $25,369 |

| 8/31/2021 | $32,873 | $27,532 | $26,092 |

| 9/30/2021 | $30,911 | $26,484 | $24,921 |

| 10/31/2021 | $32,627 | $27,842 | $26,607 |

| 11/30/2021 | $29,566 | $26,408 | $26,202 |

| 12/31/2021 | $29,401 | $26,537 | $27,234 |

| 1/31/2022 | $23,958 | $23,036 | $25,631 |

| 2/28/2022 | $23,684 | $23,105 | $24,986 |

| 3/31/2022 | $23,881 | $23,272 | $25,796 |

| 4/30/2022 | $20,334 | $20,615 | $23,481 |

| 5/31/2022 | $18,728 | $20,114 | $23,450 |

| 6/30/2022 | $17,860 | $18,722 | $21,488 |

| 7/31/2022 | $20,578 | $20,858 | $23,504 |

| 8/31/2022 | $19,870 | $20,462 | $22,627 |

| 9/30/2022 | $17,989 | $18,699 | $20,528 |

| 10/31/2022 | $19,047 | $20,219 | $22,212 |

| 11/30/2022 | $19,755 | $20,821 | $23,371 |

| 12/31/2022 | $18,337 | $19,582 | $22,003 |

| 1/31/2023 | $20,316 | $21,542 | $23,518 |

| 2/28/2023 | $19,769 | $21,201 | $22,968 |

| 3/31/2023 | $20,393 | $20,863 | $23,583 |

| 4/30/2023 | $20,178 | $20,600 | $23,834 |

| 5/31/2023 | $20,332 | $20,577 | $23,927 |

| 6/30/2023 | $21,656 | $22,201 | $25,560 |

| 7/31/2023 | $21,933 | $22,943 | $26,477 |

| 8/31/2023 | $21,109 | $22,009 | $25,966 |

| 9/30/2023 | $19,893 | $20,683 | $24,729 |

| 10/31/2023 | $18,491 | $19,248 | $24,073 |

| 11/30/2023 | $20,401 | $20,954 | $26,318 |

| 12/31/2023 | $22,118 | $23,288 | $27,714 |

| 1/31/2024 | $22,034 | $22,762 | $28,021 |

| 2/29/2024 | $23,720 | $24,606 | $29,538 |

| 3/31/2024 | $24,459 | $25,270 | $30,491 |

| 4/30/2024 | $23,327 | $23,387 | $29,149 |

| 5/31/2024 | $24,028 | $24,335 | $30,526 |

| 6/30/2024 | $24,036 | $24,205 | $31,471 |

| 7/31/2024 | $24,483 | $25,679 | $32,056 |

| 8/31/2024 | $25,237 | $25,480 | $32,754 |

| 9/30/2024 | $26,007 | $25,896 | $33,432 |

Annual Shareholder Report | September 30, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Class R6 | 30.74 | 7.92 | 10.03 |

Russell 2500® Growth Index (Strategy) | 25.20 | 9.75 | 9.98 |

Russell 3000® Index (Regulatory) | 35.19 | 15.26 | 12.83 |

| Total net assets | $1,129,551,146 |

| # of portfolio holdings | 75 |

| Portfolio turnover rate | 64% |

| Total advisory fees paid | $8,525,068 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Industrials | 26.5 |

| Information technology | 23.7 |

| Health care | 21.0 |

| Consumer discretionary | 13.1 |

| Financials | 8.0 |

| Communication services | 3.5 |

| Materials | 1.6 |

| Real estate | 1.4 |

| Consumer staples | 1.2 |

TOP TEN HOLDINGS (% OF NET ASSETS)

| Natera, Inc. | 2.7 |

| Tetra Tech, Inc. | 2.3 |

| Clearwater Analytics Holdings, Inc., Class A | 2.2 |

| Casella Waste Systems, Inc., Class A | 2.2 |

| Dynatrace, Inc. | 2.1 |

| Morningstar, Inc. | 2.0 |

| EMCOR Group, Inc. | 1.9 |

| Applied Industrial Technologies, Inc. | 1.9 |

| Saia, Inc. | 1.9 |

| TKO Group Holdings, Inc., Class A | 1.9 |

This is a summary of certain changes and planned changes to the Fund since October 1, 2023.

On May 31, 2024, Robert Gruendyke was added as a portfolio manager to the Fund. On August 9, 2024, the Fund’s name was changed from the Allspring Discovery SMID Cap Growth Fund to the Allspring SMID Cap Growth Fund.

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

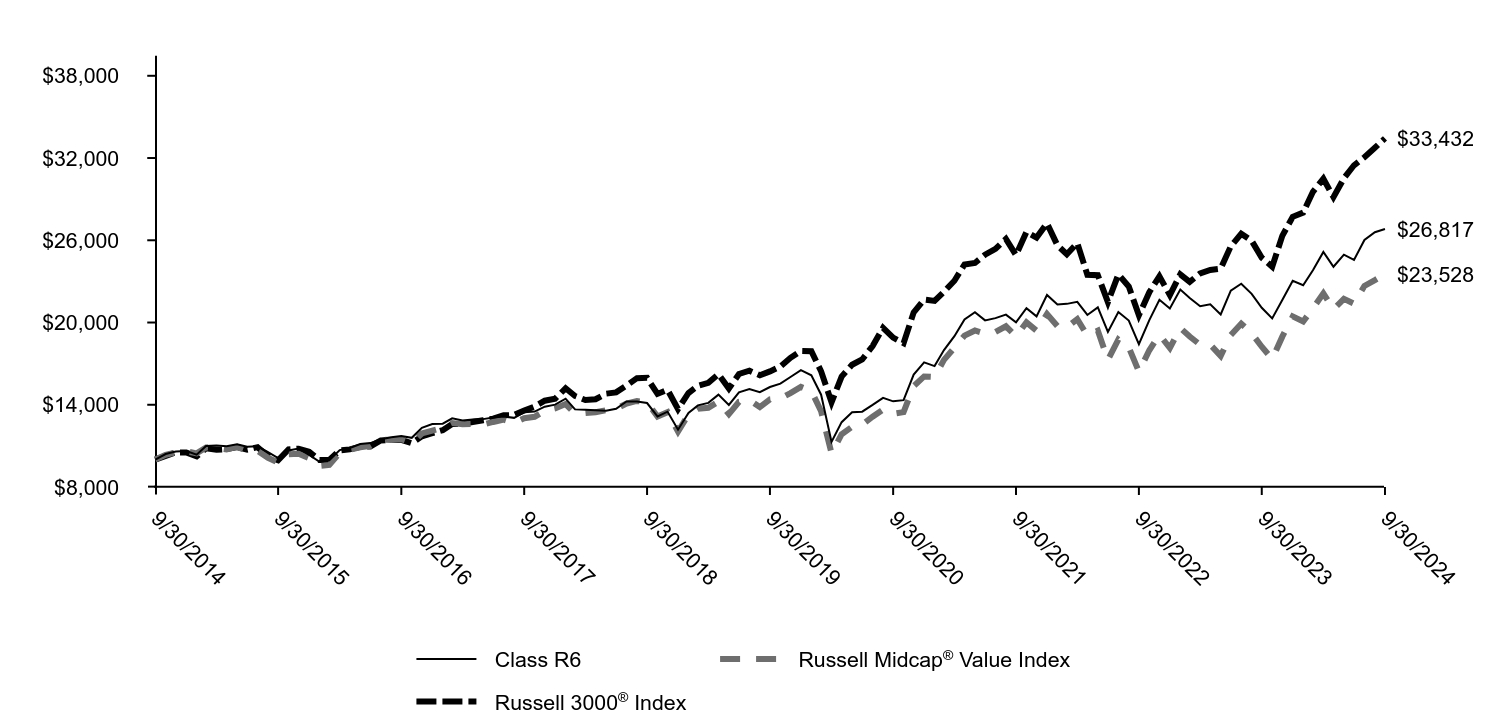

Annual Shareholder Report

This annual shareholder report contains important information about SMID Cap Growth Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

| Institutional Class | $103 | 0.89% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

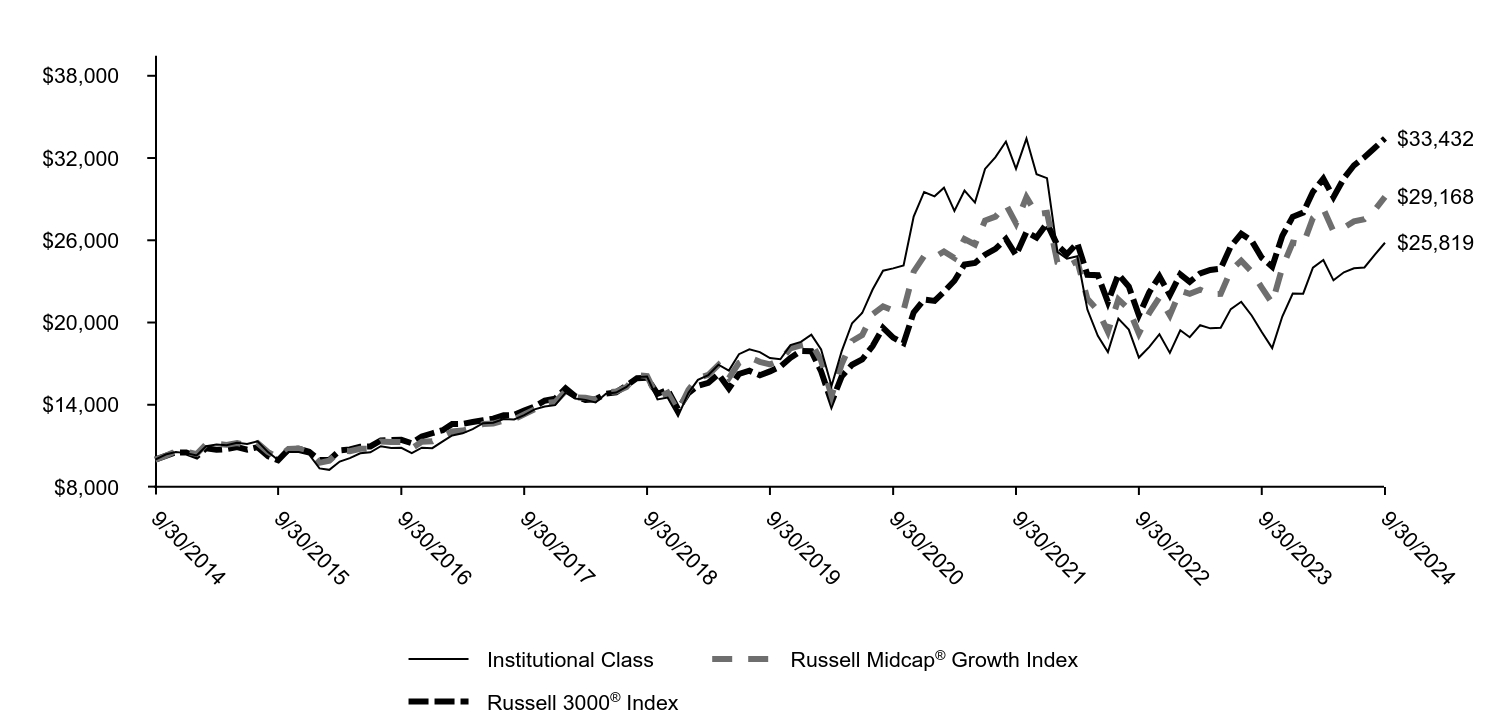

How did the Fund perform last year and what affected its performance?

Positive earnings results fueled a bull market for U.S. equities during the 12-month period that ended September 30, 2024. Despite lingering macroeconomic concerns, the S&P 500 Index marked its fourth straight quarter of favorable year-over-year earnings growth. Companies tied to artificial intelligence (AI) saw their valuations soar, with the so called “Magnificent 7” stocks substantially outperforming the market. Late in the fiscal year, market leadership broadened as several mega-cap companies struggled to meet high expectations and the Federal Reserve reduced policy rates. As a result, small- and mid-cap stocks narrowed the performance gap relative to large caps. This aided the Fund’s performance.

The portfolio benefited from security selection within the industrials and consumer discretionary sectors. In particular, exposure to companies that are facilitating the buildout of AI contributed to performance. To the contrary, enterprise software spending slumped as information technology budgets were pointed toward AI-related projects. Portfolio holdings with software-related products detracted from returns. While we adjusted individual holdings, we have not made material changes within positioning.

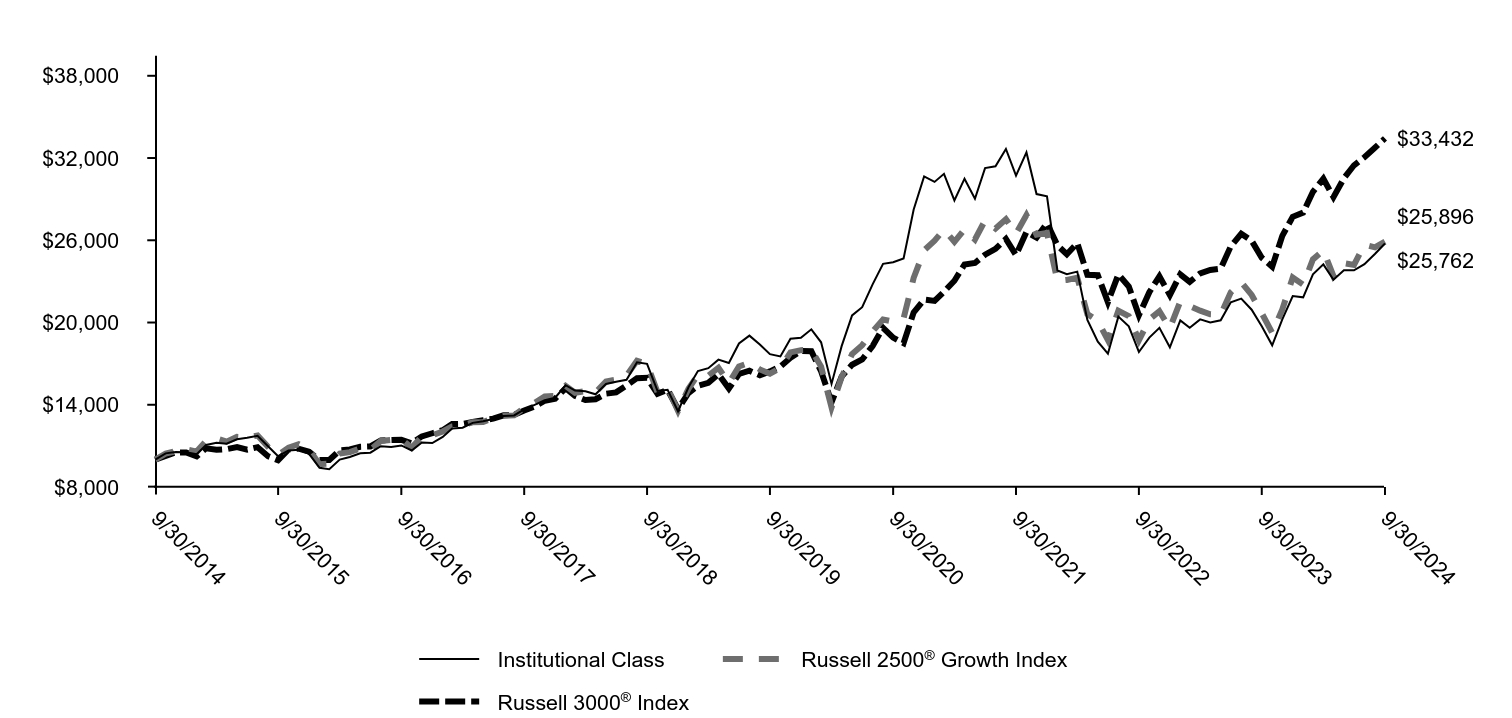

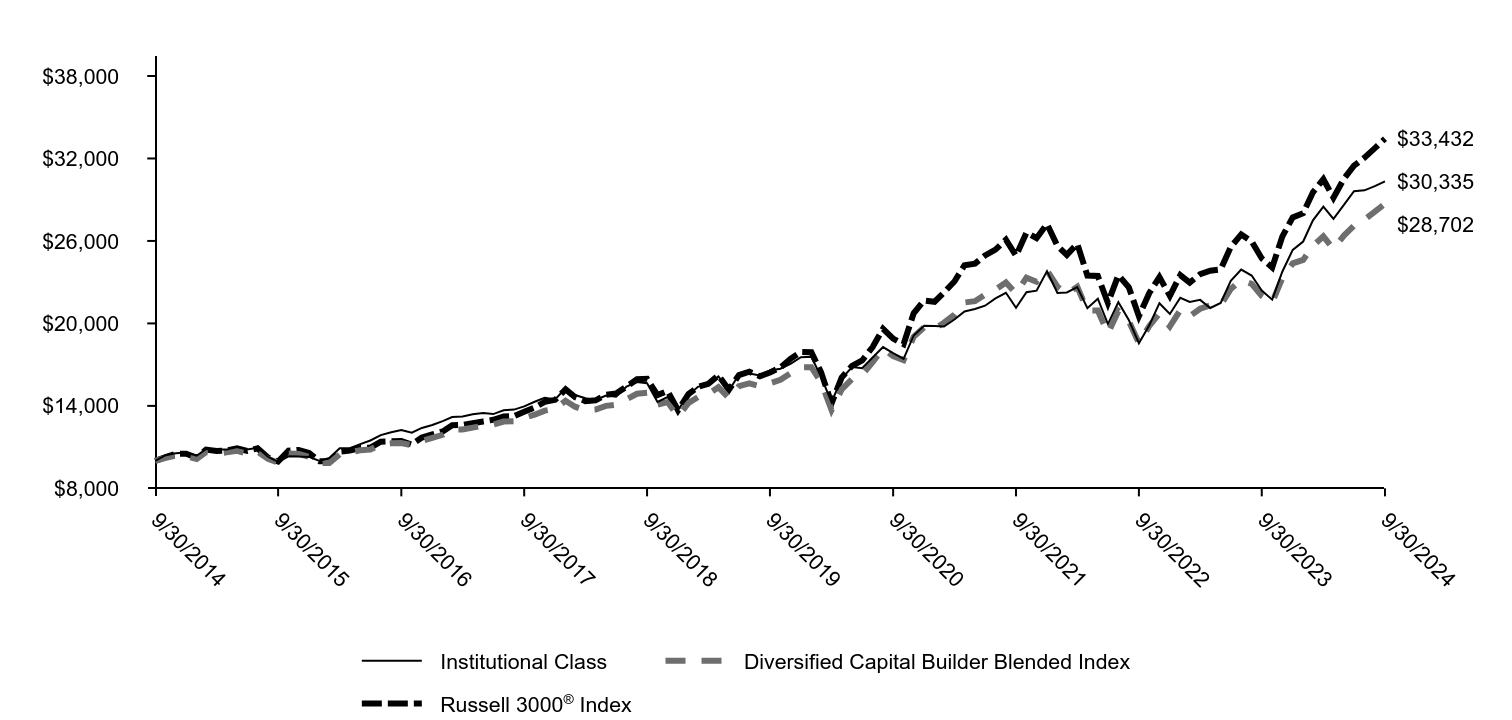

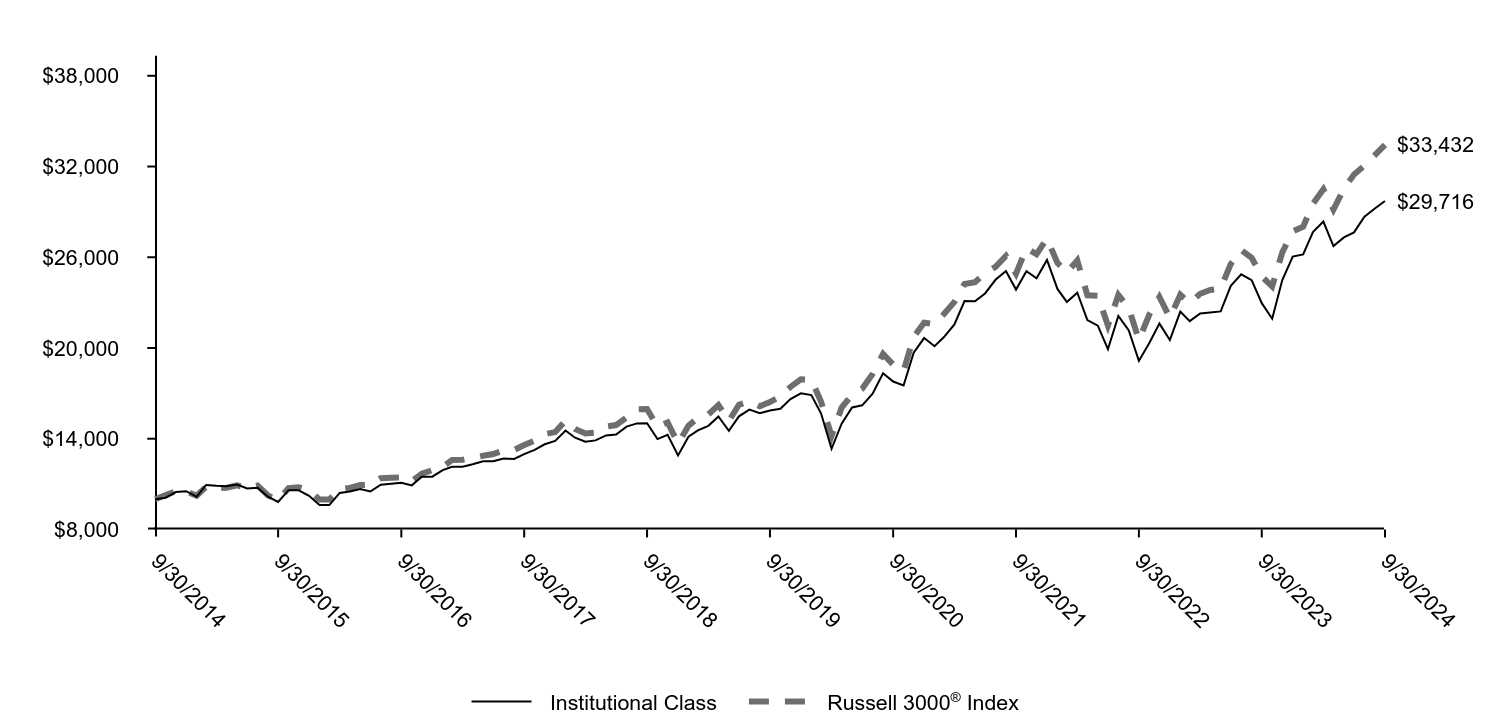

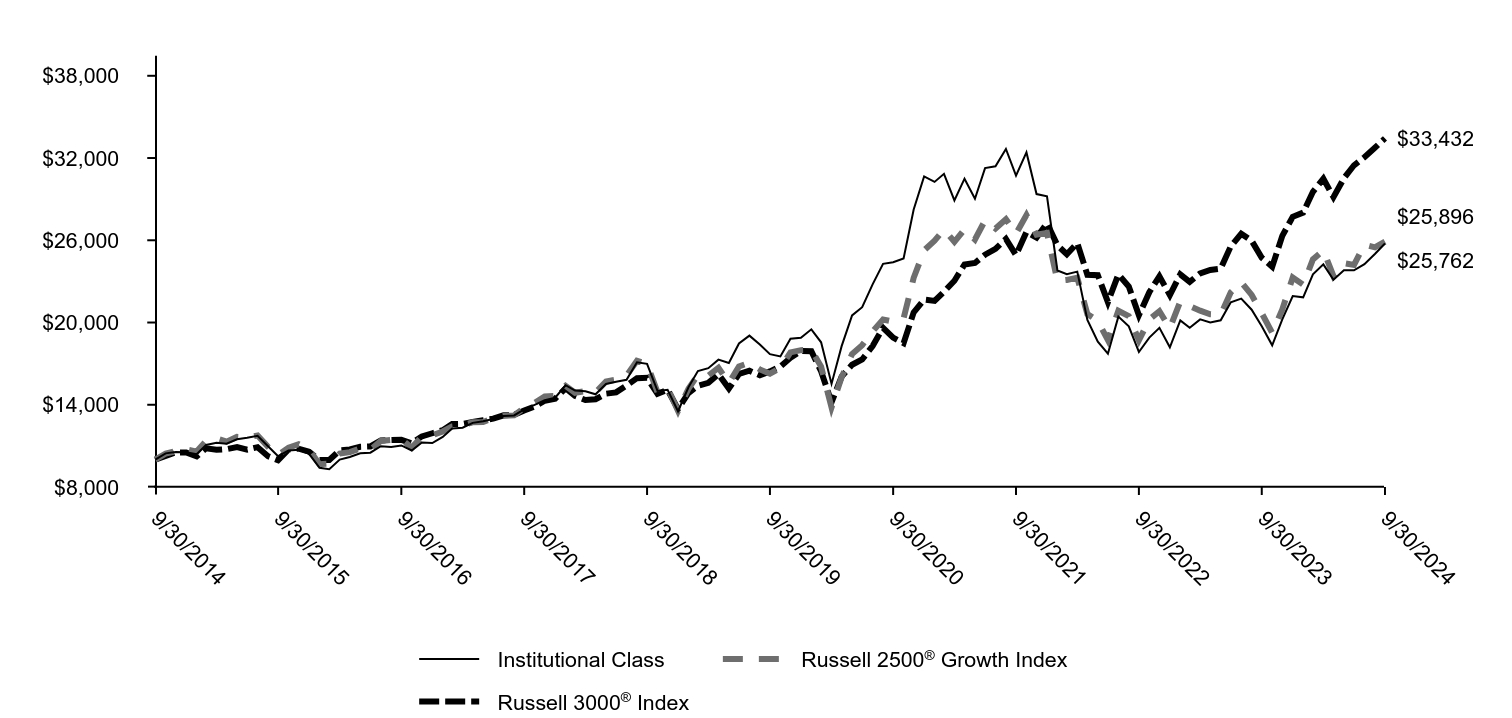

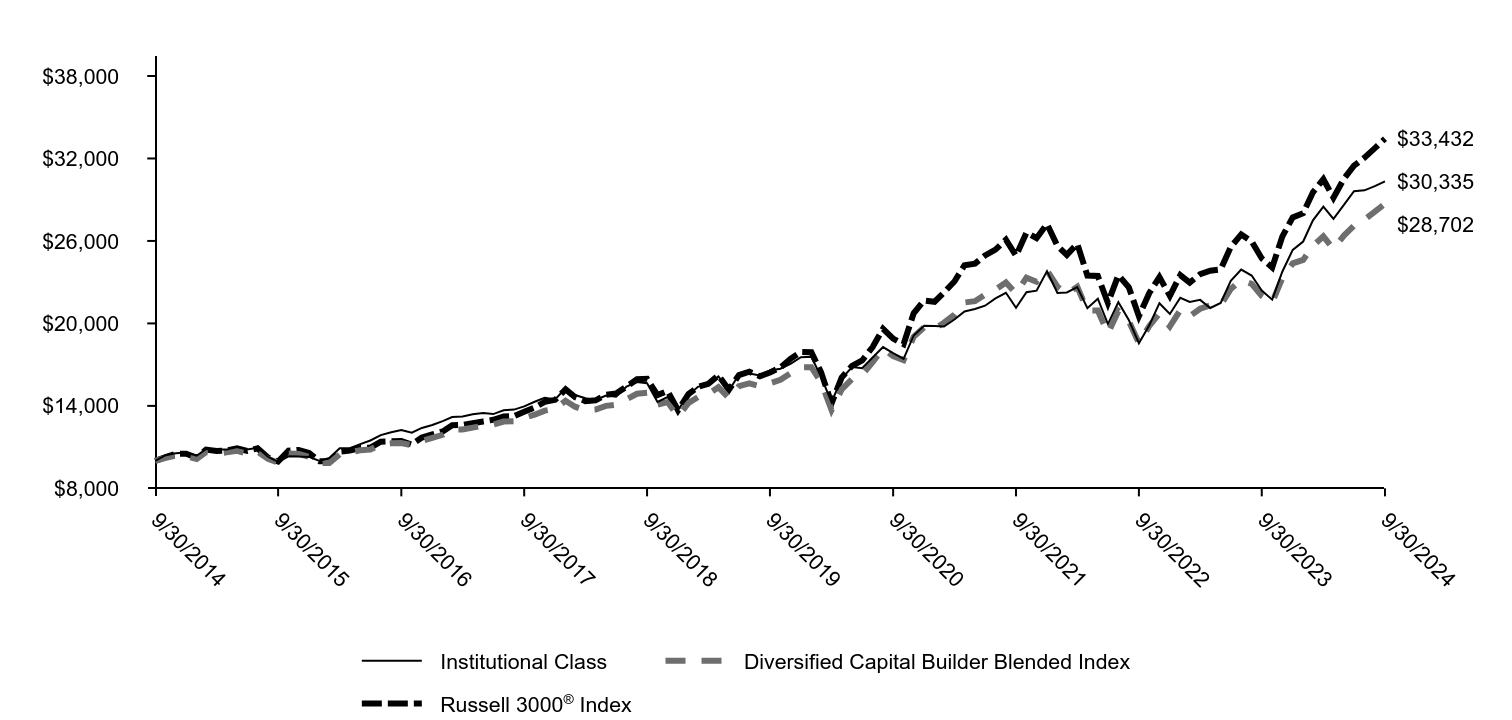

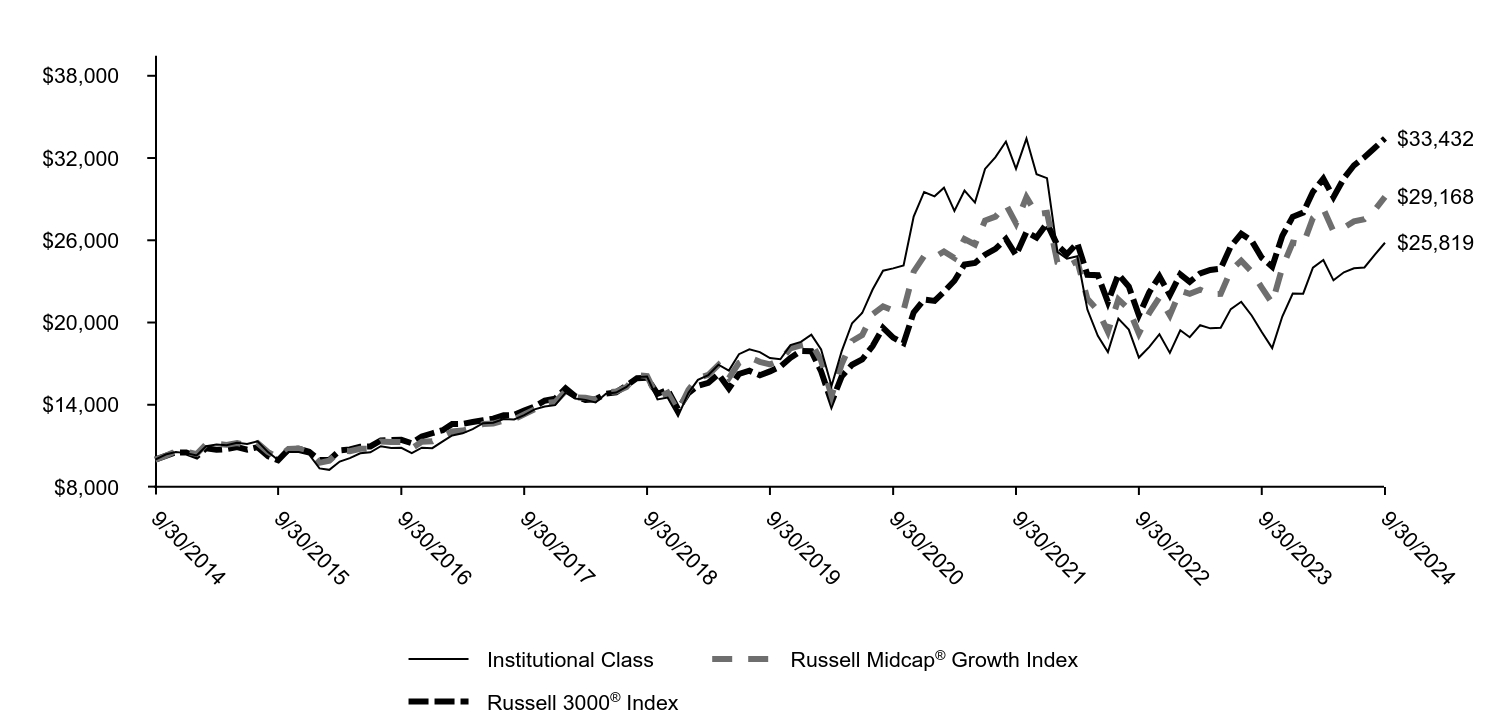

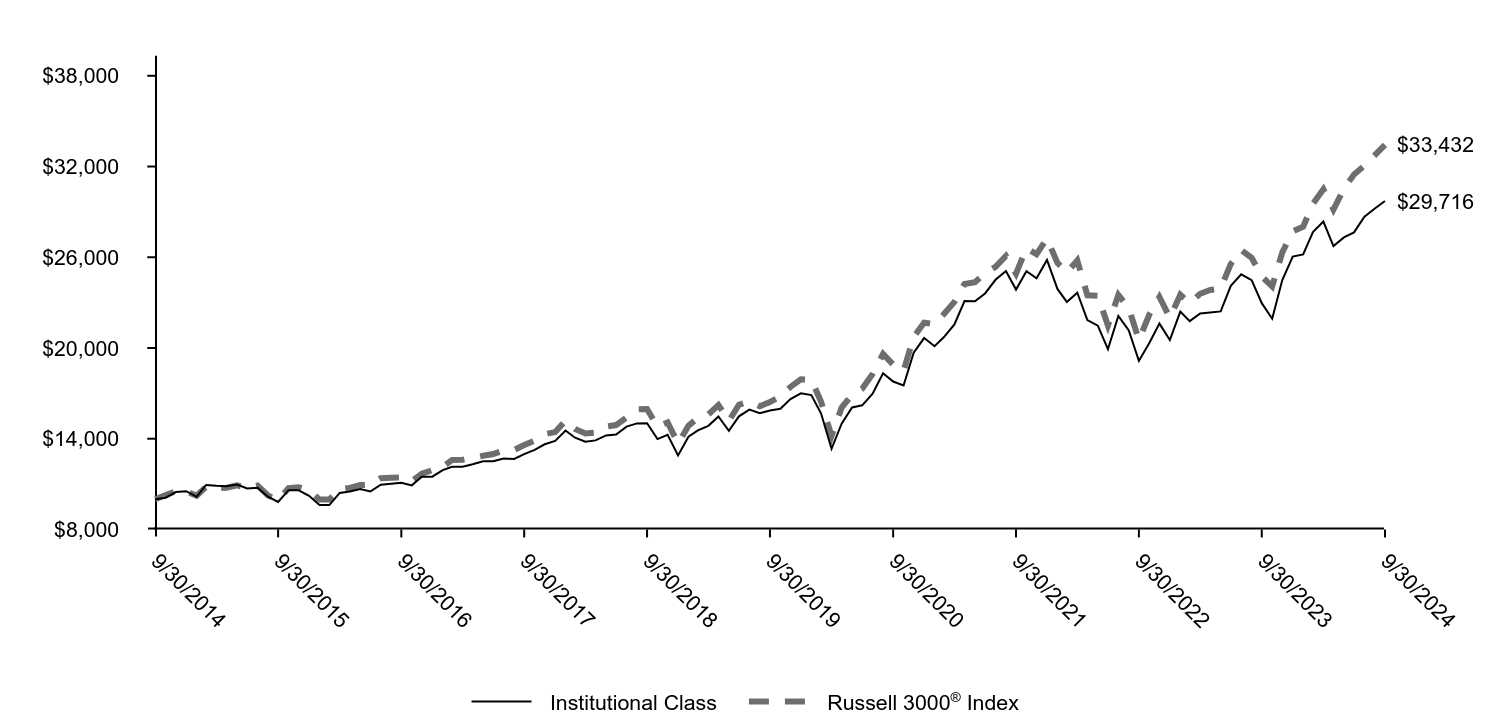

Total return based on a $10,000 investment

| Institutional Class | Russell 2500® Growth Index | Russell 3000® Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,456 | $10,440 | $10,275 |

| 11/30/2014 | $10,554 | $10,614 | $10,524 |

| 12/31/2014 | $10,538 | $10,749 | $10,524 |

| 1/31/2015 | $10,385 | $10,583 | $10,231 |

| 2/28/2015 | $11,069 | $11,362 | $10,824 |

| 3/31/2015 | $11,232 | $11,548 | $10,713 |

| 4/30/2015 | $11,156 | $11,308 | $10,762 |

| 5/31/2015 | $11,479 | $11,657 | $10,911 |

| 6/30/2015 | $11,591 | $11,619 | $10,728 |

| 7/31/2015 | $11,735 | $11,757 | $10,908 |

| 8/31/2015 | $10,973 | $10,933 | $10,249 |

| 9/30/2015 | $10,247 | $10,335 | $9,951 |

| 10/31/2015 | $10,660 | $10,875 | $10,736 |

| 11/30/2015 | $10,717 | $11,122 | $10,796 |

| 12/31/2015 | $10,422 | $10,729 | $10,574 |

| 1/31/2016 | $9,402 | $9,668 | $9,978 |

| 2/29/2016 | $9,298 | $9,697 | $9,975 |

| 3/31/2016 | $10,001 | $10,443 | $10,677 |

| 4/30/2016 | $10,185 | $10,544 | $10,743 |

| 5/31/2016 | $10,464 | $10,805 | $10,935 |

| 6/30/2016 | $10,502 | $10,725 | $10,958 |

| 7/31/2016 | $10,979 | $11,363 | $11,393 |

| 8/31/2016 | $10,927 | $11,442 | $11,422 |

| 9/30/2016 | $11,034 | $11,475 | $11,440 |

| 10/31/2016 | $10,662 | $10,875 | $11,192 |

| 11/30/2016 | $11,243 | $11,668 | $11,693 |

| 12/31/2016 | $11,207 | $11,772 | $11,921 |

| 1/31/2017 | $11,654 | $12,051 | $12,145 |

| 2/28/2017 | $12,267 | $12,417 | $12,597 |

| 3/31/2017 | $12,324 | $12,508 | $12,606 |

| 4/30/2017 | $12,680 | $12,728 | $12,739 |

| 5/31/2017 | $12,796 | $12,734 | $12,870 |

| 6/30/2017 | $12,958 | $13,024 | $12,986 |

| 7/31/2017 | $13,173 | $13,198 | $13,231 |

| 8/31/2017 | $13,219 | $13,224 | $13,256 |

| 9/30/2017 | $13,670 | $13,777 | $13,579 |

| 10/31/2017 | $13,997 | $14,146 | $13,876 |

| 11/30/2017 | $14,332 | $14,612 | $14,297 |

| 12/31/2017 | $14,511 | $14,651 | $14,440 |

| 1/31/2018 | $15,429 | $15,383 | $15,201 |

| 2/28/2018 | $15,036 | $14,878 | $14,641 |

| 3/31/2018 | $14,978 | $15,000 | $14,347 |

| 4/30/2018 | $14,763 | $14,905 | $14,402 |

| 5/31/2018 | $15,512 | $15,698 | $14,808 |

| 6/30/2018 | $15,677 | $15,829 | $14,905 |

| 7/31/2018 | $15,818 | $16,126 | $15,400 |

| 8/31/2018 | $17,097 | $17,215 | $15,940 |

| 9/30/2018 | $16,985 | $16,964 | $15,967 |

| 10/31/2018 | $15,007 | $14,926 | $14,791 |

| 11/30/2018 | $15,098 | $15,208 | $15,087 |

| 12/31/2018 | $13,527 | $13,558 | $13,683 |

| 1/31/2019 | $15,272 | $15,172 | $14,858 |

| 2/28/2019 | $16,459 | $16,172 | $15,380 |

| 3/31/2019 | $16,668 | $16,132 | $15,605 |

| 4/30/2019 | $17,293 | $16,696 | $16,228 |

| 5/31/2019 | $17,046 | $15,587 | $15,178 |

| 6/30/2019 | $18,471 | $16,800 | $16,244 |

| 7/31/2019 | $19,043 | $17,062 | $16,485 |

| 8/31/2019 | $18,398 | $16,577 | $16,149 |

| 9/30/2019 | $17,690 | $16,266 | $16,433 |

| 10/31/2019 | $17,530 | $16,683 | $16,786 |

| 11/30/2019 | $18,820 | $17,819 | $17,424 |

| 12/31/2019 | $18,884 | $17,985 | $17,928 |

| 1/31/2020 | $19,503 | $18,004 | $17,908 |

| 2/29/2020 | $18,556 | $16,783 | $16,442 |

| 3/31/2020 | $15,523 | $13,809 | $14,181 |

| 4/30/2020 | $18,277 | $16,023 | $16,059 |

| 5/31/2020 | $20,515 | $17,696 | $16,918 |

| 6/30/2020 | $21,118 | $18,348 | $17,304 |

| 7/31/2020 | $22,787 | $19,352 | $18,287 |

| 8/31/2020 | $24,281 | $20,223 | $19,612 |

| 9/30/2020 | $24,396 | $20,067 | $18,898 |

| 10/31/2020 | $24,675 | $20,304 | $18,490 |

| 11/30/2020 | $28,244 | $23,262 | $20,739 |

| 12/31/2020 | $30,659 | $25,263 | $21,672 |

| 1/31/2021 | $30,257 | $25,969 | $21,576 |

| 2/28/2021 | $30,849 | $26,785 | $22,250 |

| 3/31/2021 | $28,907 | $25,891 | $23,048 |

| 4/30/2021 | $30,492 | $26,801 | $24,236 |

| 5/31/2021 | $29,027 | $26,056 | $24,346 |

| 6/30/2021 | $31,268 | $27,454 | $24,947 |

| 7/31/2021 | $31,394 | $26,860 | $25,369 |

| 8/31/2021 | $32,664 | $27,532 | $26,092 |

| 9/30/2021 | $30,716 | $26,484 | $24,921 |

| 10/31/2021 | $32,411 | $27,842 | $26,607 |

| 11/30/2021 | $29,372 | $26,408 | $26,202 |

| 12/31/2021 | $29,205 | $26,537 | $27,234 |

| 1/31/2022 | $23,797 | $23,036 | $25,631 |

| 2/28/2022 | $23,521 | $23,105 | $24,986 |

| 3/31/2022 | $23,713 | $23,272 | $25,796 |

| 4/30/2022 | $20,191 | $20,615 | $23,481 |

| 5/31/2022 | $18,596 | $20,114 | $23,450 |

| 6/30/2022 | $17,729 | $18,722 | $21,488 |

| 7/31/2022 | $20,429 | $20,858 | $23,504 |

| 8/31/2022 | $19,723 | $20,462 | $22,627 |

| 9/30/2022 | $17,852 | $18,699 | $20,528 |

| 10/31/2022 | $18,903 | $20,219 | $22,212 |

| 11/30/2022 | $19,608 | $20,821 | $23,371 |

| 12/31/2022 | $18,194 | $19,582 | $22,003 |

| 1/31/2023 | $20,158 | $21,542 | $23,518 |

| 2/28/2023 | $19,615 | $21,201 | $22,968 |

| 3/31/2023 | $20,228 | $20,863 | $23,583 |

| 4/30/2023 | $20,011 | $20,600 | $23,834 |

| 5/31/2023 | $20,166 | $20,577 | $23,927 |

| 6/30/2023 | $21,478 | $22,201 | $25,560 |

| 7/31/2023 | $21,749 | $22,943 | $26,477 |

| 8/31/2023 | $20,934 | $22,009 | $25,966 |

| 9/30/2023 | $19,723 | $20,683 | $24,729 |

| 10/31/2023 | $18,334 | $19,248 | $24,073 |

| 11/30/2023 | $20,228 | $20,954 | $26,318 |

| 12/31/2023 | $21,928 | $23,288 | $27,714 |

| 1/31/2024 | $21,835 | $22,762 | $28,021 |

| 2/29/2024 | $23,511 | $24,606 | $29,538 |

| 3/31/2024 | $24,241 | $25,270 | $30,491 |

| 4/30/2024 | $23,115 | $23,387 | $29,149 |

| 5/31/2024 | $23,806 | $24,335 | $30,526 |

| 6/30/2024 | $23,814 | $24,205 | $31,471 |

| 7/31/2024 | $24,256 | $25,679 | $32,056 |

| 8/31/2024 | $25,002 | $25,480 | $32,754 |

| 9/30/2024 | $25,762 | $25,896 | $33,432 |

Annual Shareholder Report | September 30, 2024

AVERAGE ANNUAL TOTAL RETURNS (%)

| 1 Year | 5 Years | 10 Years |

|---|

| Institutional Class | 30.62 | 7.81 | 9.93 |

Russell 2500® Growth Index (Strategy) | 25.20 | 9.75 | 9.98 |

Russell 3000® Index (Regulatory) | 35.19 | 15.26 | 12.83 |

| Total net assets | $1,129,551,146 |

| # of portfolio holdings | 75 |

| Portfolio turnover rate | 64% |

| Total advisory fees paid | $8,525,068 |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund.

What did the Fund invest in?

(Based on long-term investments)

SECTOR ALLOCATION (% OF LONG-TERM INVESTMENTS)

| Industrials | 26.5 |

| Information technology | 23.7 |

| Health care | 21.0 |

| Consumer discretionary | 13.1 |

| Financials | 8.0 |

| Communication services | 3.5 |

| Materials | 1.6 |

| Real estate | 1.4 |

| Consumer staples | 1.2 |

TOP TEN HOLDINGS (% OF NET ASSETS)

| Natera, Inc. | 2.7 |

| Tetra Tech, Inc. | 2.3 |

| Clearwater Analytics Holdings, Inc., Class A | 2.2 |

| Casella Waste Systems, Inc., Class A | 2.2 |

| Dynatrace, Inc. | 2.1 |

| Morningstar, Inc. | 2.0 |

| EMCOR Group, Inc. | 1.9 |

| Applied Industrial Technologies, Inc. | 1.9 |

| Saia, Inc. | 1.9 |

| TKO Group Holdings, Inc., Class A | 1.9 |

This is a summary of certain changes and planned changes to the Fund since October 1, 2023.

On May 31, 2024, Robert Gruendyke was added as a portfolio manager to the Fund. On August 9, 2024, the Fund’s name was changed from the Allspring Discovery SMID Cap Growth Fund to the Allspring SMID Cap Growth Fund.

You can find additional information on the Fund's website at allspringglobal.com, including its:

- Prospectus - Financial Information - Fund holdings - Proxy voting information

Annual Shareholder Report

This annual shareholder report contains important information about SMID Cap Growth Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at allspringglobal.com. You can also request this information by contacting us at 1-800-222-8222.

This report describes changes to the Fund that occurred either during or after the reporting period.

What were the Fund costs for the past year?

The table explains the costs you would have paid within the reporting period based on a hypothetical $10,000 investment.

| CLASS NAME | COSTS OF A $10,000 INVESTMENT | COSTS PAID AS A % OF A $10,000 INVESTMENT |

|---|

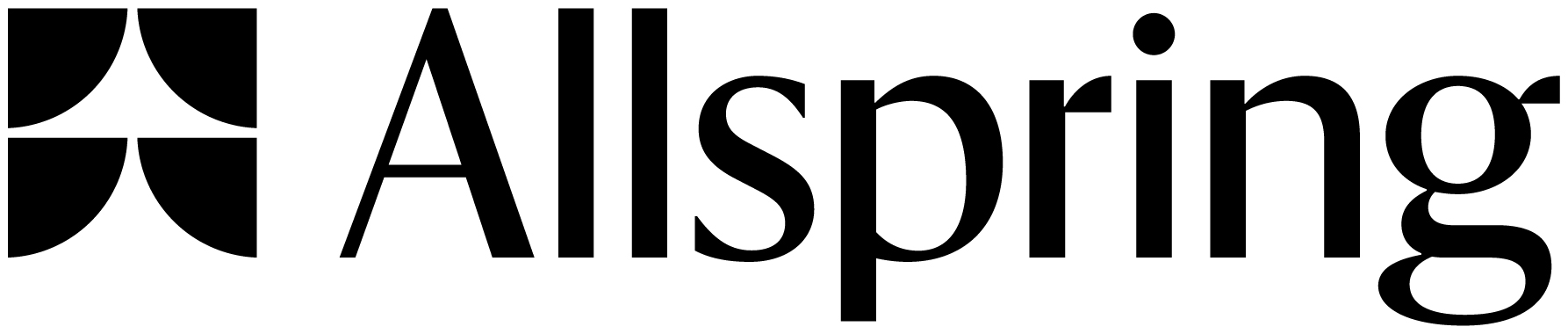

| Class C | $225 | 1.96% |

The manager has contractually committed to waive fees and/or reimburse certain expenses to the extent necessary to cap the Fund's total annual fund operating expense ratio at a specific amount. Without this cap, the costs shown above may have been higher. Please see the prospectus for the amount and the expiration date of the cap. Prior to or after the commitment expiration date, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees.

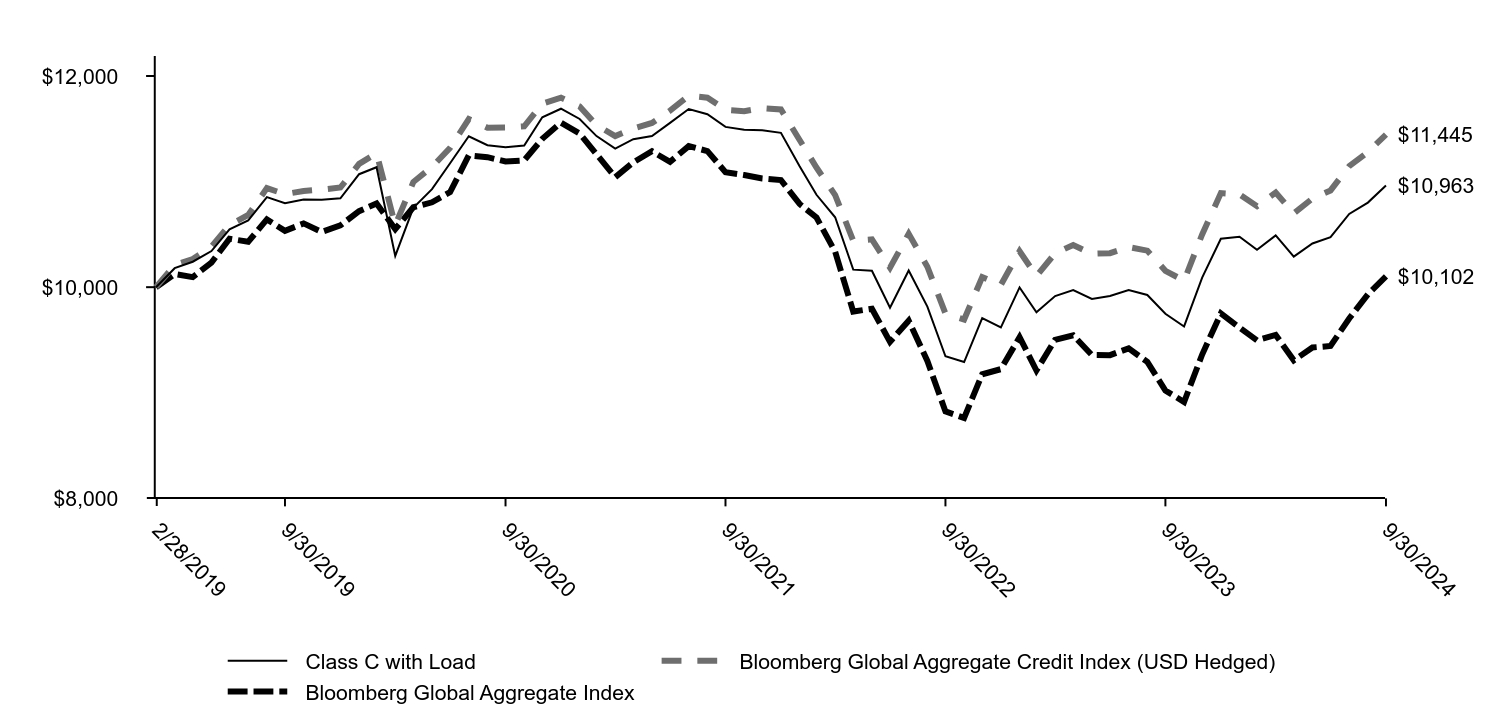

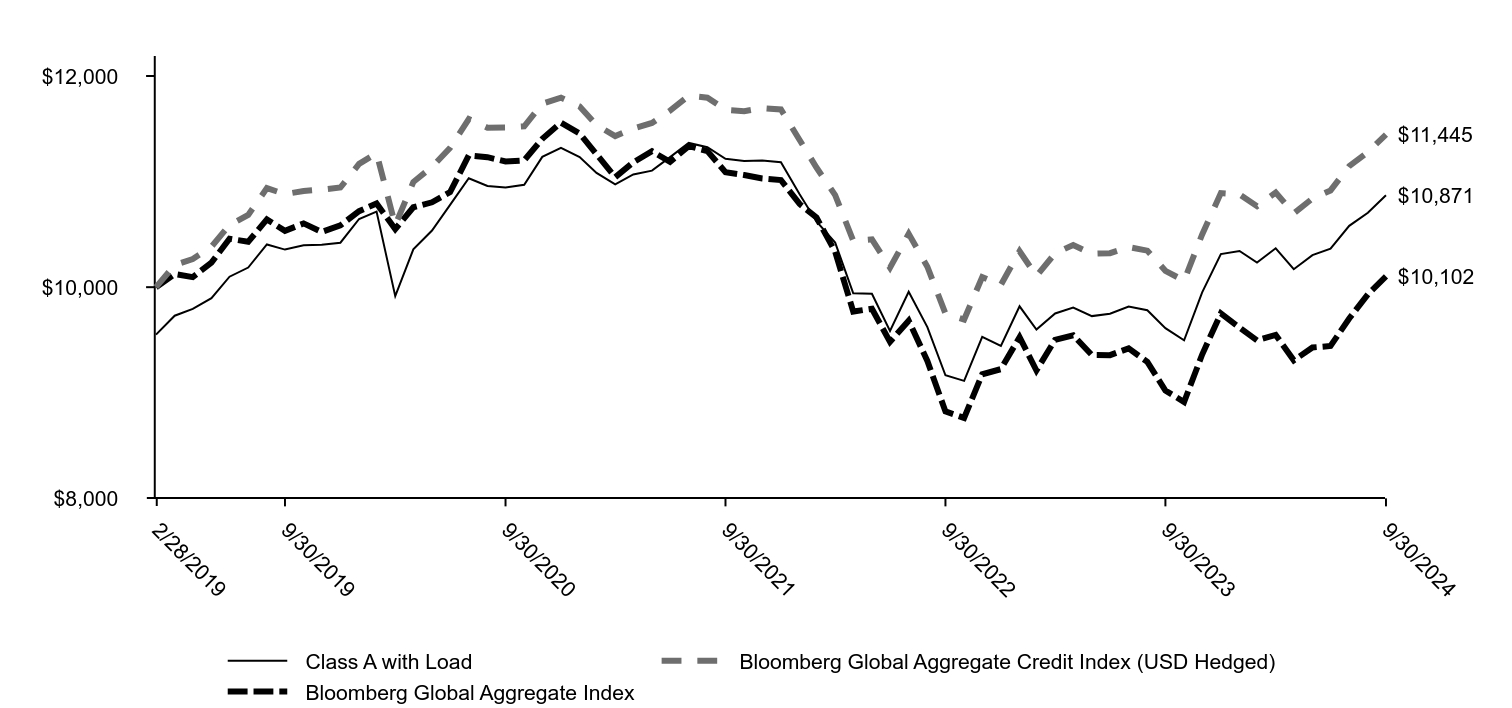

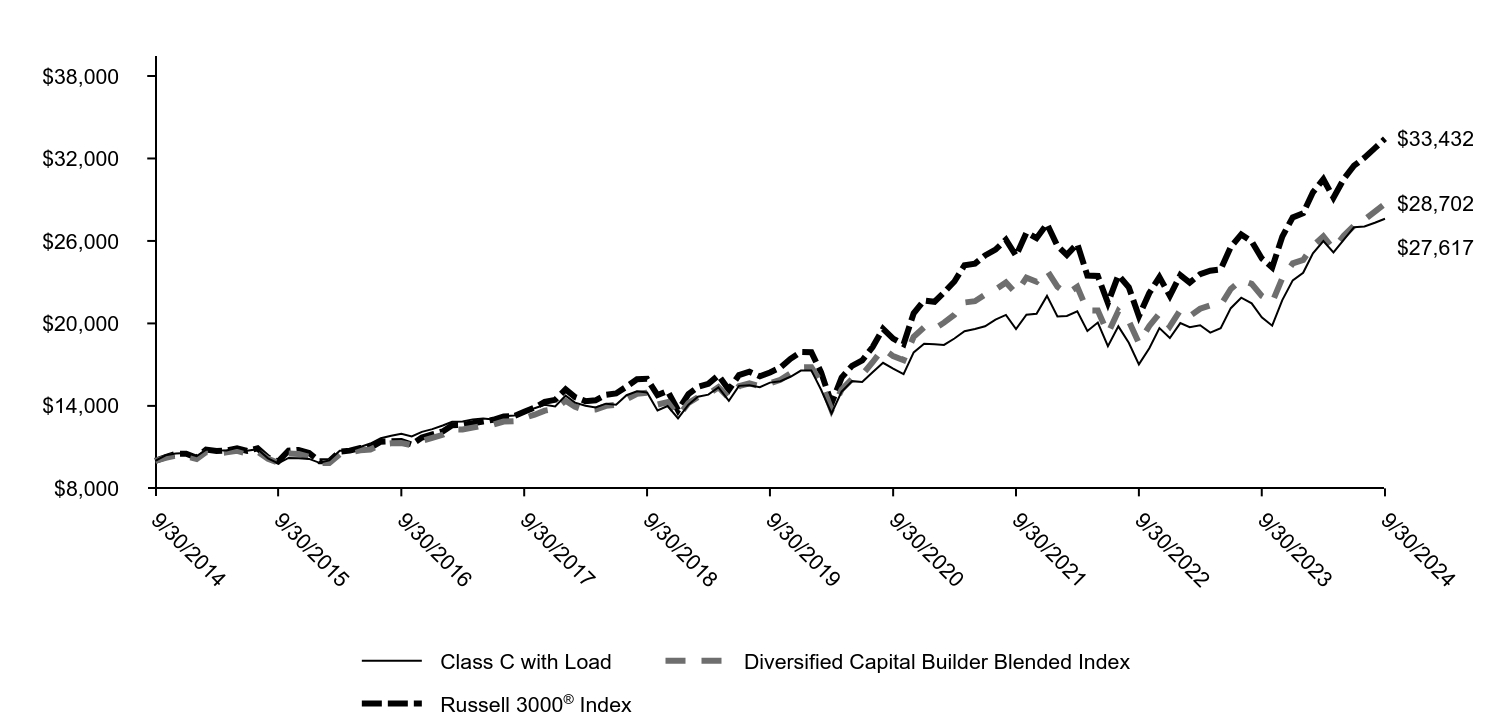

How did the Fund perform last year and what affected its performance?

Positive earnings results fueled a bull market for U.S. equities during the 12-month period that ended September 30, 2024. Despite lingering macroeconomic concerns, the S&P 500 Index marked its fourth straight quarter of favorable year-over-year earnings growth. Companies tied to artificial intelligence (AI) saw their valuations soar, with the so called “Magnificent 7” stocks substantially outperforming the market. Late in the fiscal year, market leadership broadened as several mega-cap companies struggled to meet high expectations and the Federal Reserve reduced policy rates. As a result, small- and mid-cap stocks narrowed the performance gap relative to large caps. This aided the Fund’s performance.

The portfolio benefited from security selection within the industrials and consumer discretionary sectors. In particular, exposure to companies that are facilitating the buildout of AI contributed to performance. To the contrary, enterprise software spending slumped as information technology budgets were pointed toward AI-related projects. Portfolio holdings with software-related products detracted from returns. While we adjusted individual holdings, we have not made material changes within positioning.

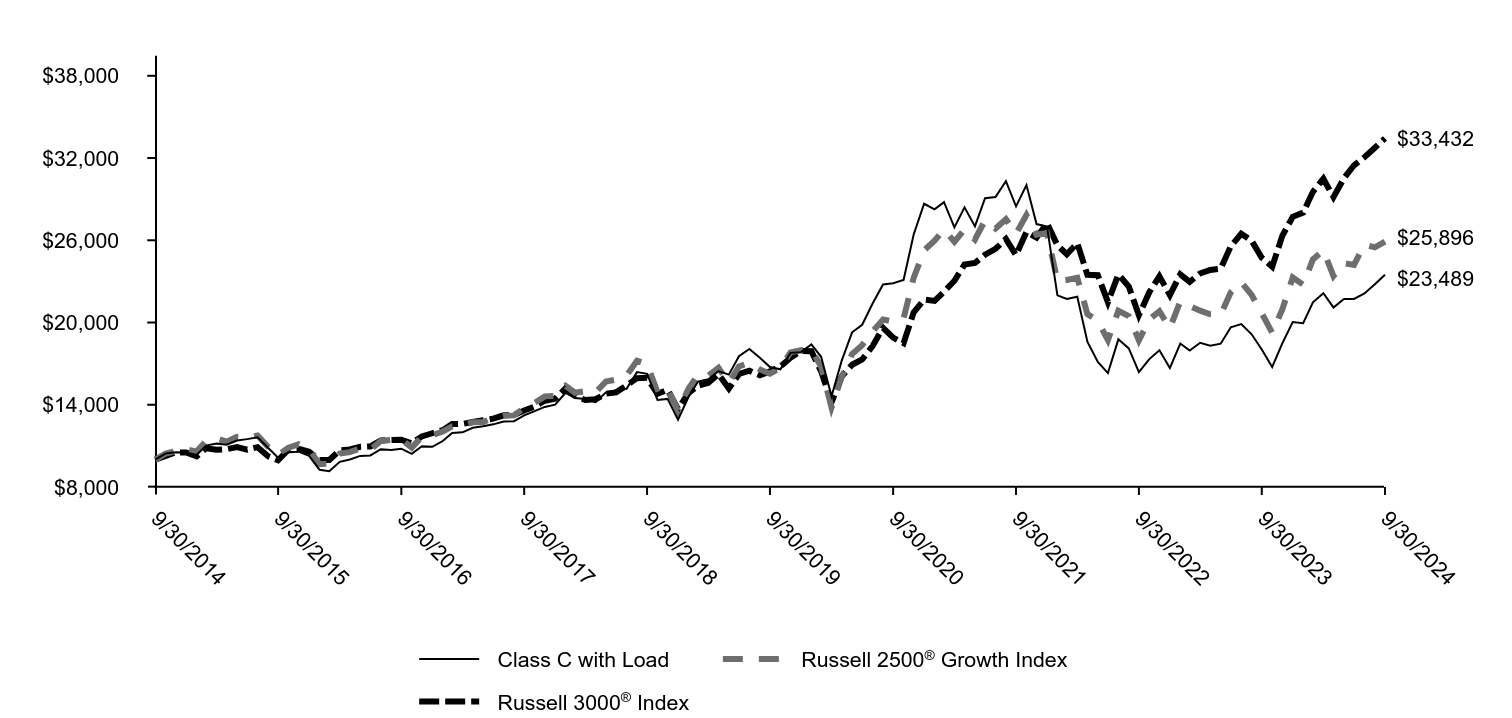

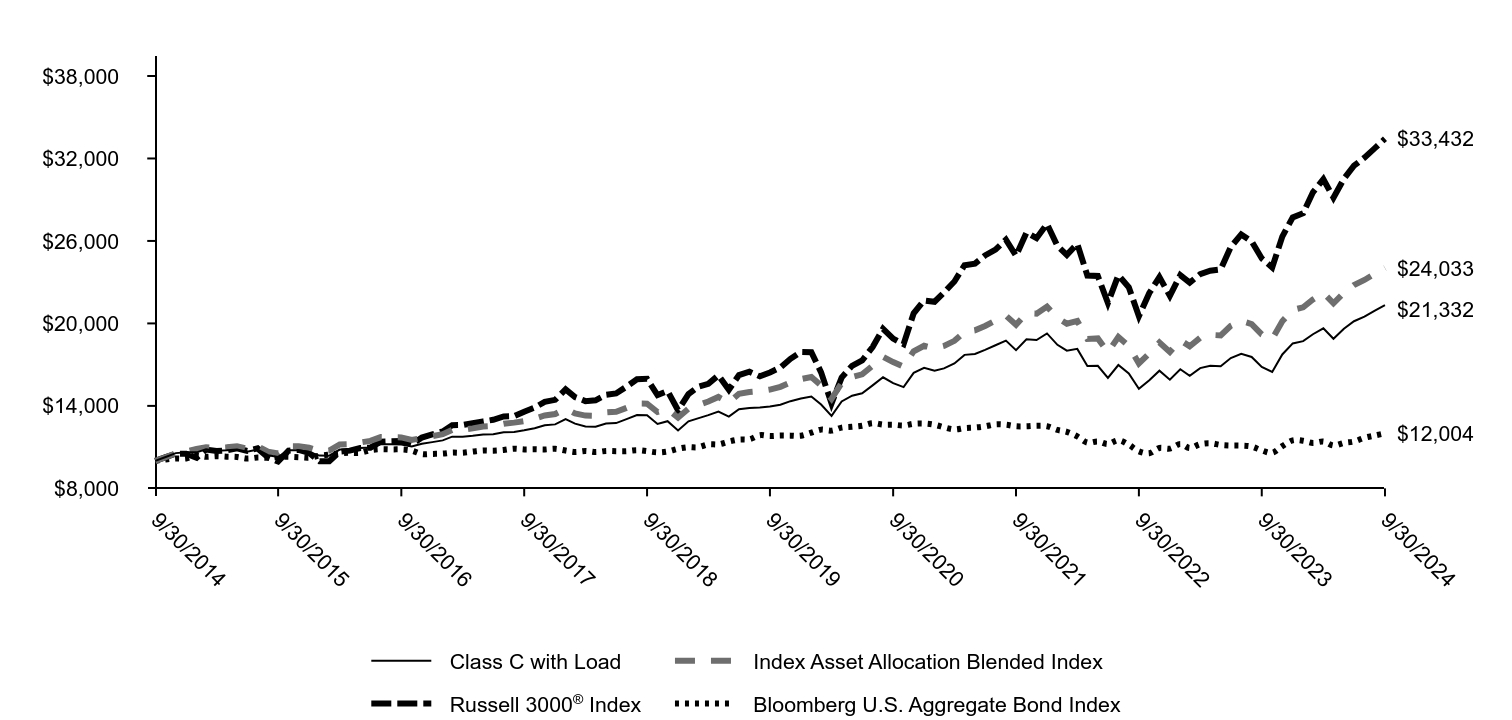

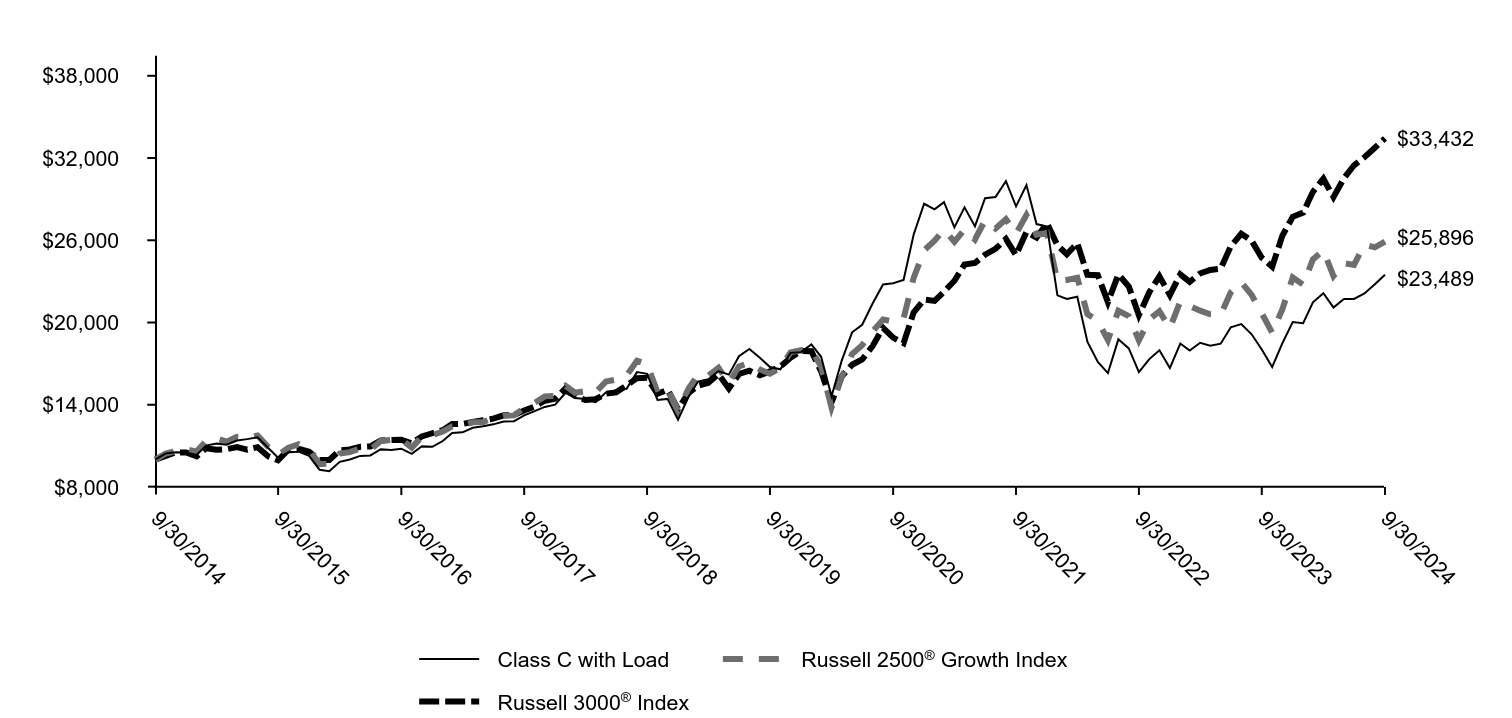

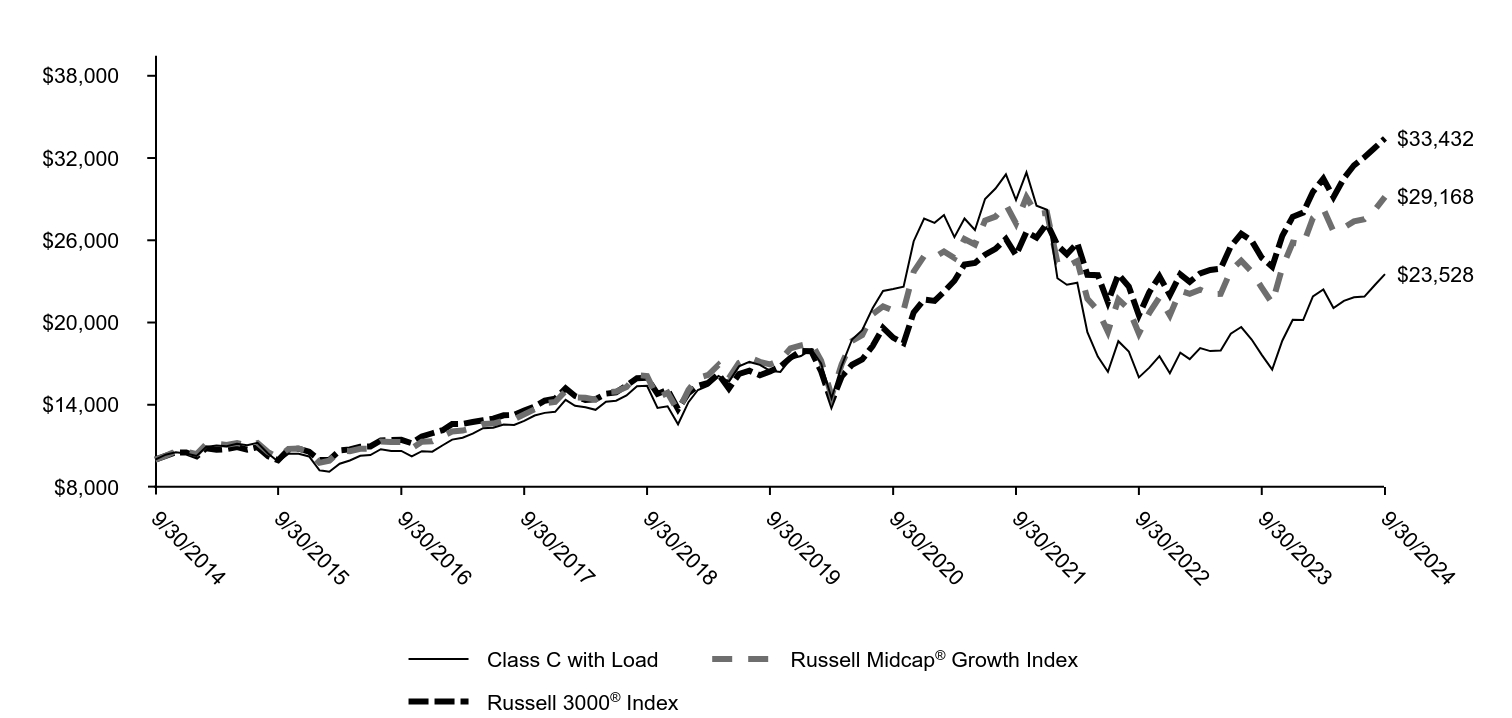

Total return based on a $10,000 investment

| Class C with Load | Russell 2500® Growth Index | Russell 3000® Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 10/31/2014 | $10,448 | $10,440 | $10,275 |

| 11/30/2014 | $10,537 | $10,614 | $10,524 |

| 12/31/2014 | $10,509 | $10,749 | $10,524 |

| 1/31/2015 | $10,344 | $10,583 | $10,231 |

| 2/28/2015 | $11,018 | $11,362 | $10,824 |

| 3/31/2015 | $11,169 | $11,548 | $10,713 |

| 4/30/2015 | $11,083 | $11,308 | $10,762 |

| 5/31/2015 | $11,392 | $11,657 | $10,911 |

| 6/30/2015 | $11,492 | $11,619 | $10,728 |

| 7/31/2015 | $11,625 | $11,757 | $10,908 |

| 8/31/2015 | $10,860 | $10,933 | $10,249 |

| 9/30/2015 | $10,135 | $10,335 | $9,951 |

| 10/31/2015 | $10,530 | $10,875 | $10,736 |

| 11/30/2015 | $10,580 | $11,122 | $10,796 |

| 12/31/2015 | $10,273 | $10,729 | $10,574 |

| 1/31/2016 | $9,262 | $9,668 | $9,978 |

| 2/29/2016 | $9,155 | $9,697 | $9,975 |

| 3/31/2016 | $9,835 | $10,443 | $10,677 |

| 4/30/2016 | $10,009 | $10,544 | $10,743 |

| 5/31/2016 | $10,269 | $10,805 | $10,935 |

| 6/30/2016 | $10,301 | $10,725 | $10,958 |

| 7/31/2016 | $10,755 | $11,363 | $11,393 |

| 8/31/2016 | $10,696 | $11,442 | $11,422 |

| 9/30/2016 | $10,795 | $11,475 | $11,440 |

| 10/31/2016 | $10,419 | $10,875 | $11,192 |

| 11/30/2016 | $10,977 | $11,668 | $11,693 |

| 12/31/2016 | $10,931 | $11,772 | $11,921 |

| 1/31/2017 | $11,356 | $12,051 | $12,145 |

| 2/28/2017 | $11,946 | $12,417 | $12,597 |

| 3/31/2017 | $11,990 | $12,508 | $12,606 |

| 4/30/2017 | $12,322 | $12,728 | $12,739 |

| 5/31/2017 | $12,427 | $12,734 | $12,870 |

| 6/30/2017 | $12,571 | $13,024 | $12,986 |

| 7/31/2017 | $12,771 | $13,198 | $13,231 |

| 8/31/2017 | $12,803 | $13,224 | $13,256 |

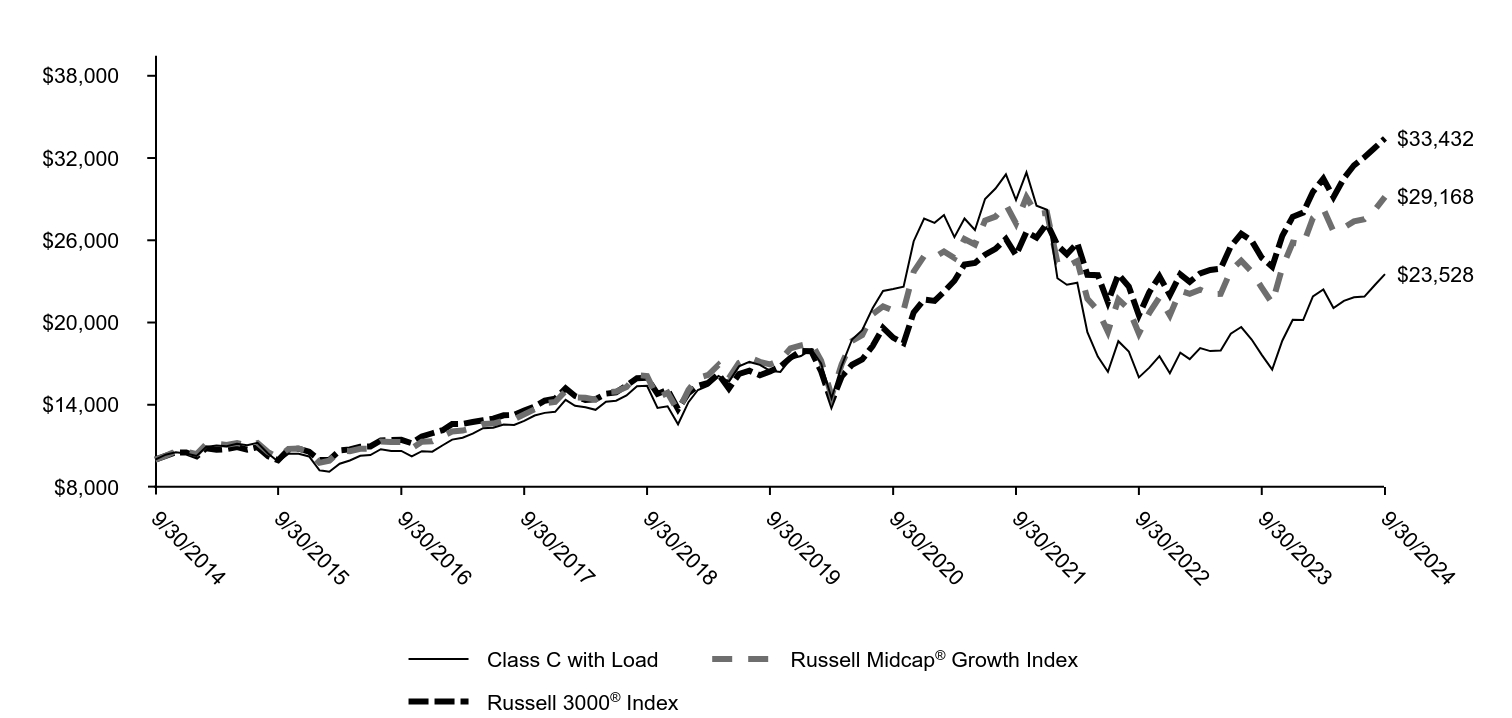

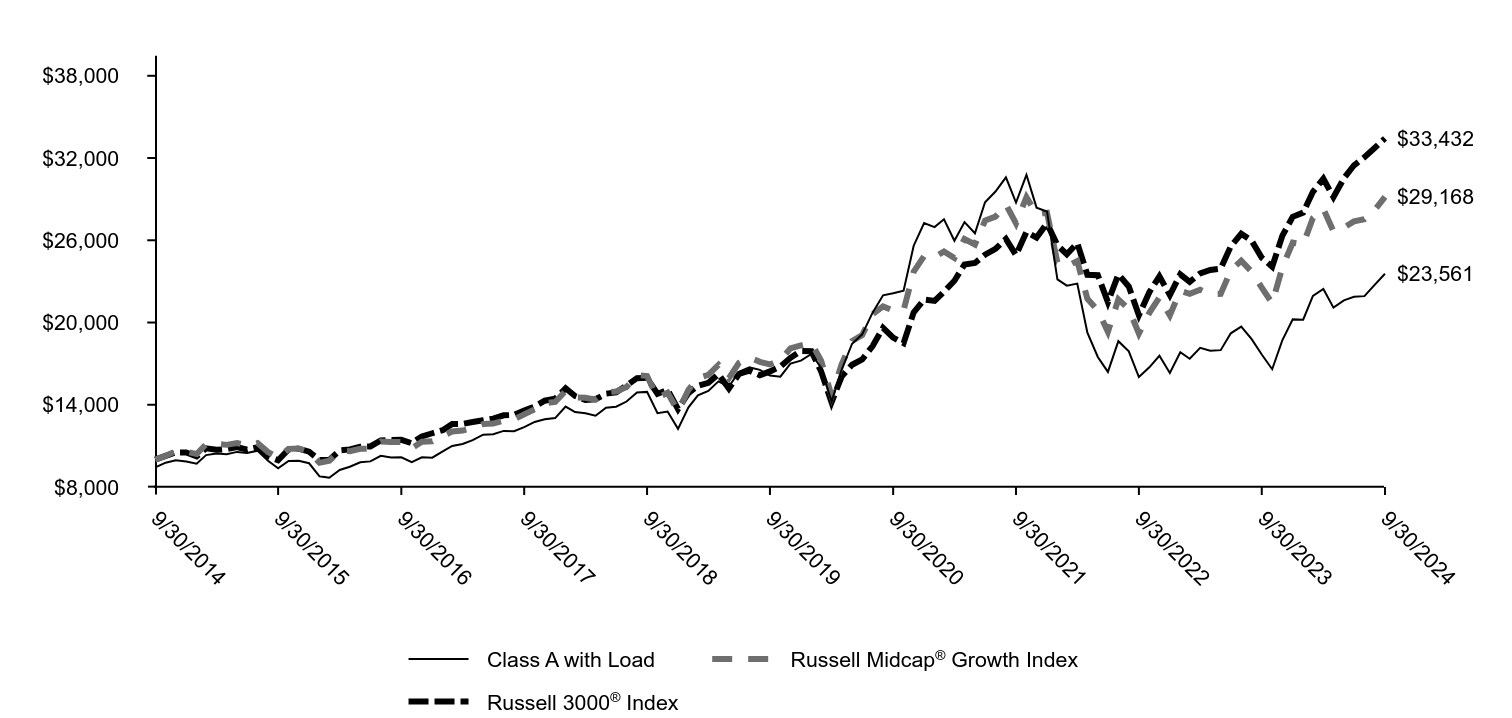

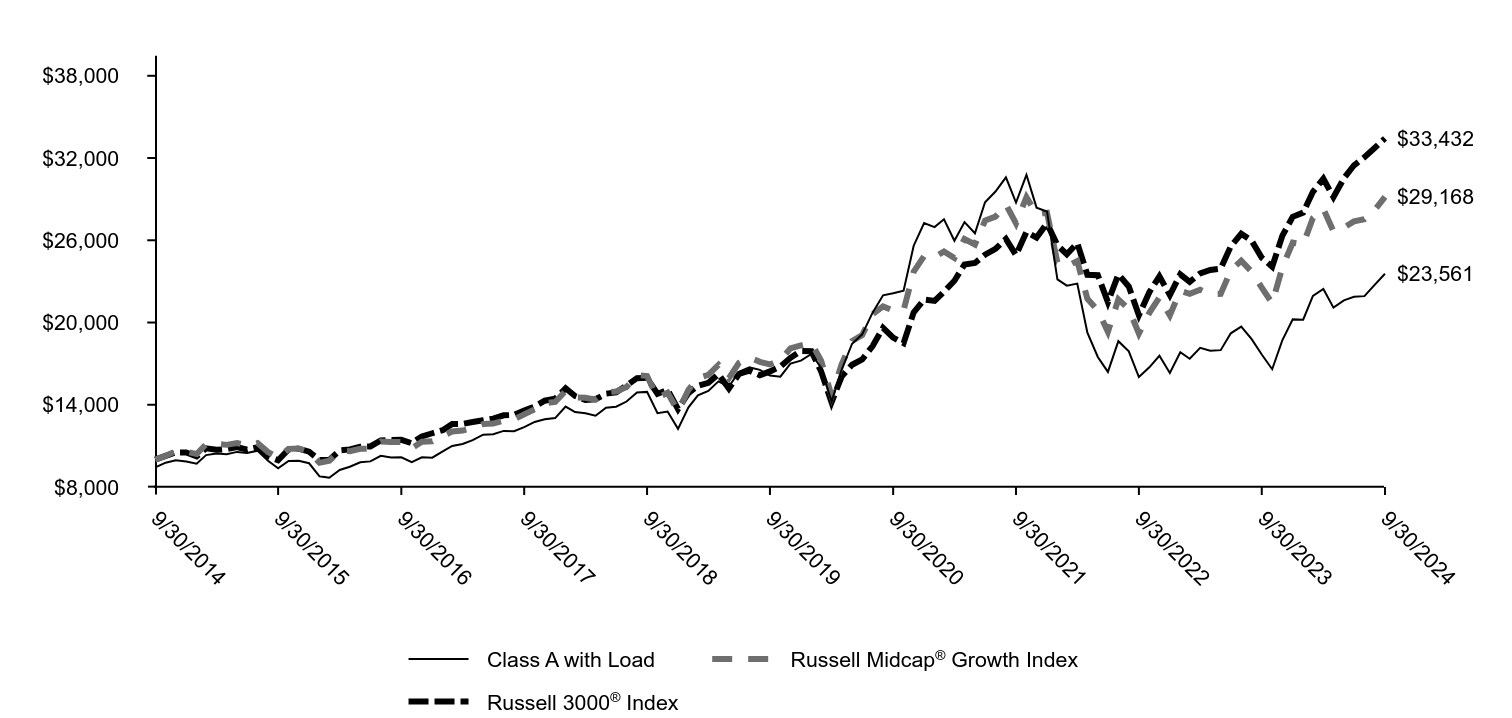

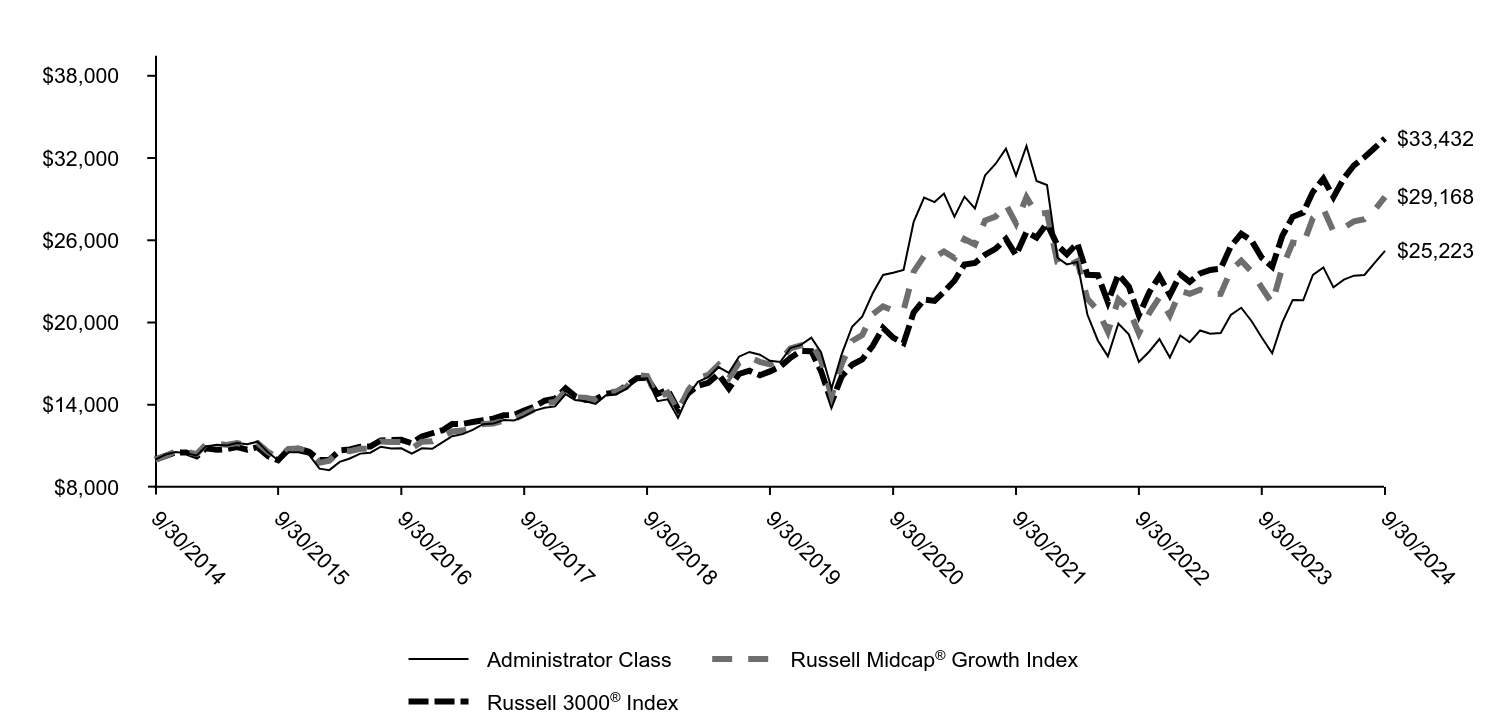

| 9/30/2017 | $13,224 | $13,777 | $13,579 |