Strength. Expertise. Partnership

Wells Fargo Advantage Funds® skillfully guides institutions, financial advisors, and individuals through the investment terrain to help them reach their financial objectives. Everything we do on behalf of our investors is built on the standards of integrity and service established by our parent company, Wells Fargo & Company; the expertise of our independent investment teams and rigorous on going investment review; and the collaborative level of superior service that is our trademark.

Investment Professionals

Offering investment professionals, both retailand institutional, a broad range of investment strategies and vehicles, the tools to meet the needs of clients, and the insight to help navigate the markets.

Institutional Cash Management

Delivering institutional investors a comprehensive roster of Rule 2a-7 money market funds to meet varying liquidity management needs.

Individual Investors

Providing individual investors with a broad lineup of mutual funds, college savings vehicles, and retirement solutions, as well as tools and resources to help investors make informed decisions.

This Web site is accompanied by current prospectuses for Wells Fargo Advantage Funds®, an EdVestSM program description (PDF), and a tomorrow's scholar® program description (PDF).

For 529 plans, an investor's or a designated beneficiary's home state may offer state tax or other benefits that are only available for investments in that state's qualified tuition program. Please consider this before investing.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

|

© 2011 Wells Fargo Funds Management, LLC. All rights reserved. EdVest and tomorrow's scholar are state-sponsored 529 college savings plans administered by the Wisconsin Office of the State Treasurer. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds, and the EdVest and tomorrow's scholar plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

This Web site is for information purposes only and is not intended as a solicitation to sell or buy any security. Wells Fargo Advantage Funds are offered by prospectus and only to residents of the United States. Wells Fargo does not control or endorse and is not responsible for third-party Web sites to which this site links.

Wells Fargo Advantage Funds 1-800-359-3379

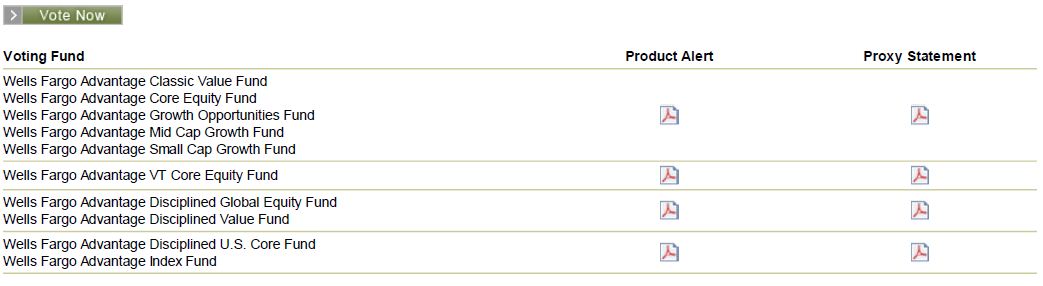

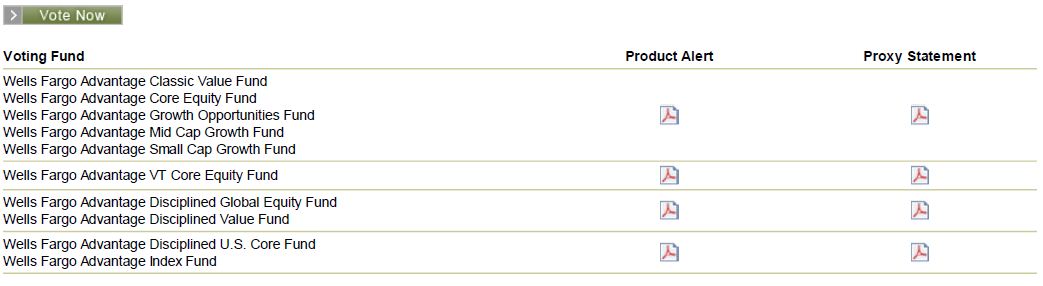

Proxy Center

Information for upcoming Wells Fargo Advantage Funds® special shareholder meetings and proxies can be found here.

Refer to your prospectus/proxy statement or proxy card for details on your voting options. If you have questions about voting your proxy, please call 1-866-828-6931 for assistance.

You will need the control number found on your proxy card when placing your vote:

- Online – You can vote online below or at the website listed on the proxy ballot. To vote online, shareholders will need the control number printed on the ballot.

- By phone – 1-866-828-6931

- By mail – Sign and date the proxy card that was sent to you – return in the prepaid postage envelope provided.

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

|

Why is voting important?

- A majority response is required for each fund, so we are legally obligated to solicit by proxy for shareholder votes.

- Our proxy vendor, The Altman Group, will contact shareholders until a majority response is received on each fund.

Vote your proxy online now

You will need the control number found on your proxy card when placing your vote.

Additional information and where to find it: This is not an offer to sell, nor a solicitation of an offer to buy, shares of any investment company, nor is it a solicitation of any proxy.

In connection with the proposed transactions, the acquirer has filed a prospectus/proxy statement with the Securities and Exchange Commission (SEC). All shareholders are advised to read this prospectus/proxy statement in its entirety when it becomes available, because it will contain important information regarding the acquirer, target, transaction, fees, expenses, risk considerations, persons soliciting proxies in connection with the transaction, and the interests of these persons in the transaction and related matters. The target intends to mail the prospectus/proxy statement to its shareholders once such prospectus/proxy statement is declared effective by the SEC. Shareholders may obtain a free copy of the prospectus/proxy statement when available and other documents filed by the acquirer with the SEC at the SEC's website,sec.gov. Free copies of the prospectus/proxy statement, once available, may be obtained by directing a request via mail, phone, or website to the acquirer, Wells Fargo Advantage Funds, P.O. Box 8266, Boston, MA 02266-8266, 1-800-222-8222, wellsfargo.com/advantagefunds. In addition to the prospectus/proxy statement, the target and the acquirer file annual and semiannual reports and other information with the SEC. You may read and copy any reports, statements, or other information filed by the target or the acquirer at the SEC's public reference rooms at 100 F Street, N.E., Washington, D.C., 20549-0213. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. Filings made with the SEC by either the target or the acquirer are also available to the public from commercial document-retrieval services and at the website maintained by the SEC at sec.gov.

Participants in the solicitation: The acquirer and the target, as well as their respective directors, executive officers, and certain members of their management and other employees, may be soliciting proxies from shareholders in favor of the transaction and other related matters. Information concerning persons who may be considered participants in the solicitation of the target's shareholders under the rules of the SEC are set forth in the prospectus/proxy statement filed with the SEC.

This Web site is accompanied by current prospectuses for Wells Fargo Advantage Funds®, an EdVestSM program description (PDF), and a tomorrow's scholar® program description (PDF).

For 529 plans, an investor's or a designated beneficiary's home state may offer state tax or other benefits that are only available for investments in that state's qualified tuition program. Please consider this before investing.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

|

© 2011 Wells Fargo Funds Management, LLC. All rights reserved. EdVest and tomorrow's scholar are state-sponsored 529 college savings plans administered by the Wisconsin Office of theState Treasurer. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds, and the EdVest and tomorrow's scholar plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services forthe Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

This Web site is for information purposes only and is not intended as a solicitation to sell or buy any security. Wells Fargo Advantage Funds are offered by prospectus and only to residents of the United States. Wells Fargo does not control or endorse and is not responsible for third-party Web sites to which this site links.

Wells Fargo Advantage Funds 1-800-359-3379

This Web site is accompanied by current prospectuses for Wells Fargo Advantage Funds®, an EdVestSM program description (PDF), and a tomorrow's scholar® program description (PDF).

For 529 plans, an investor's or a designated beneficiary's home state may offer state tax or other benefits that are only available for investments in that state's qualified tuition program. Please consider this before investing.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

|

© 2011 Wells Fargo Funds Management, LLC. All rights reserved. EdVest and tomorrow's scholar are state-sponsored 529 college savings plans administered by the Wisconsin Office of the State Treasurer. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds, and the EdVest and tomorrow's scholar plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services forthe Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

This Web site is for information purposes only and is not intended as a solicitation to sell or buy any security. Wells Fargo Advantage Funds are offered by prospectus and only to residents of the United States. Wells Fargo does not control or endorse and is not responsible for third-party Web sites to which this site links.

Wells Fargo Advantage Funds 1-800-359-3379

Individual Investor

Individual Investor

Wells Fargo Advantage Index Fund – WFIRX

Investor Class

CUSIP | 949915730 |

Share Price 06-09-11 | 45.35 |

Daily Change | 0.34 |

YTD Return | 3.19% |

Morningstar Category | Large Blend |

Inception Date | 02-14-1985 |

Fund Number | 3278 |

Net Fund Assets as of 05-31-2011 | $2,331,600,743.96 |

Overall Morningstar Rating™ (out of 1668 funds) as of 05-31-2011 | *** |

Fund Notes

- Important Proxy Vote in effect for this fund. Shareholders please visit theProxy Center to learn more.

Fund Management

ADVISER | Wells Fargo Funds Management, LLC

SUB-ADVISER | Wells Capital Management Incorporated ("Wells Capital Management")

PORTFOLIO MANAGER

Amit Chandra, Ph.D., CFA

Mr. Chandra has been with WellsCap's Global Strategic Products team ("GSP") since its inception in 2000. He has contributed to the development and implementation of the stock selection models that are core to GSP's investment process, and he has been actively engaged in the development and management of the various GSP investment strategies. Mr. Chandra has also played a prominent role in building out the GSP team. Prior to joining GSP, Mr. Chandra was director of quantitative researchand global asset allocation at Aeltus Investment Management. He earned a bachelor's degree in electrical engineering and quantum physics from the Indian Institute of Technology, Kanpur (1985),and a Ph.D. in management science and finance from Pennsylvania State University (1989). Mr.Chandra has earned the right to use the Chartered Financial Analyst® (CFA®) designation and is amember of the Boston Security Analysts Society, the American Finance Association, and the Chicago Quantitative Alliance. He is also a former professor at Seton Hall University.

OBJECTIVE | The Index Fund seeks to replicate the total rate of return of the S&P 500 Index, before fees and expenses.

PRINCIPAL STRATEGIES | We invest in substantially all of the common stocks comprising the S&P500 Index and attempt to achieve at least a 95% correlation between the performance of the S&P 500 Index and the Fund's investment results, before fees and expenses. This correlation is sought regardless of market conditions. If we are unable to achieve this correlation, then we will closely monitor the performance and composition of the S&P 500 Index and adjust the Fund’s securities holdings as necessary to seek the correlation.

A precise duplication of the performance of the S&P 500 Index would mean that the NAV of Fund shares, including dividends and capital gains, would increase or decrease in exact proportion to changes in the S&P 500 Index. Such a 100% correlation is not feasible. Our ability to track the performance of the S&P 500 Index may be affected by, among other things, transaction costs and shareholder purchases and redemptions. We continuously monitor the performance and composition of the S&P 500 Index and adjust the Fund’s portfolio as necessary to reflect any changes to the S&P500 Index and to maintain a 95% or better performance correlation before fees and expenses.

RISKS | Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. The use of derivatives may reduce returns and/or increase volatility. Consult the fund's prospectus for additional information on these and other risks.

This Web site is accompanied by current prospectuses for Wells Fargo Advantage Funds®, an EdVestSM program description (PDF), and a tomorrow's scholar® program description (PDF).

For 529 plans, an investor's or a designated beneficiary's home state may offer state tax or other benefits that are only available for investments in that state's qualified tuition program. Please consider this before investing.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

|

© 2011 Wells Fargo Funds Management, LLC. All rights reserved. EdVest and tomorrow's scholar are state-sponsored 529 college savings plans administered by the Wisconsin Office of the State Treasurer. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds, and the EdVest and tomorrow's scholar plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services forthe Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

This Web site is for information purposes only and is not intended as a solicitation to sell or buy any security. Wells Fargo Advantage Funds are offered by prospectus and only to residents of the United States. Wells Fargo does not control or endorse and is not responsible for third-party Web sites to which this site links.

Wells Fargo Advantage Funds 1-800-359-3379

Investment Professional

Investment Professional

This Web site is accompanied by current prospectuses for Wells Fargo Advantage Funds®, an EdVestSM program description (PDF), and a tomorrow's scholar® program description (PDF).

For 529 plans, an investor's or a designated beneficiary's home state may offer state tax or other benefits that are only available for investments in that state's qualified tuition program. Please consider this before investing.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

|

© 2011 Wells Fargo Funds Management, LLC. All rights reserved. EdVest and tomorrow's scholar are state-sponsored 529 college savings plans administered by the Wisconsin Office of the State Treasurer. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds, and the EdVest and tomorrow's scholar plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services forthe Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

This Web site is for information purposes only and is not intended as a solicitation to sell or buy any security. Wells Fargo Advantage Funds are offered by prospectus and only to residents of the United States. Wells Fargo does not control or endorse and is not responsible for third-party Web sites to which this site links.

Wells Fargo Advantage Funds

Individual Investors · 1-800-359-3379

Investment Professionals · 1-888-877-9275

Institutional Sales Professionals · 1-866-765-0778

Investment Professional

Investment Professional

Classic Value Fund – Share Class A

All information on this page is as of 06-29-2011 unless otherwise noted.

Ticker | ETRAX |

CUSIP | 94984B660 |

NAV | $20.31 |

$ Change | $0.14 |

% Change | 0.69% |

YTD Return | 5.95% |

Inception Date | 08-31-1978 |

Net Fund Assets as of 05-31-2011 | $788,110,436.35 |

Fund Notes

Important Proxy Vote in effect for this fund. Shareholders please visit the Proxy Center to learn more.

Subject to shareholder approval, the Wells Fargo Advantage Classic Value Fund will merge into the Wells Fargo Advantage Equity Value Fund on or about the third quarter of 2011. Please refer to the Product Alert (pdf) for more information.

Class B shares are closed to new investors and additional investments from existing shareholders.

FUND FACTS

Symbols & Codes – Share Class A

Ticker Symbol ETRAX

CUSIP 94984B660

Fund Number 4319

Objective & Strategy

The Classic Value Fund seeks long-term capital appreciation.

Process

We invest principally in equity securities of large-capitalization companies, which we define as companies with market capitalizations within the range of the Russell 1000® Index. The market capitalization range of the Russell 1000® Index was $348 million to $275 billion, as of June 28, 2010, and is expected to change frequently. We may also invest in equity securities of foreign issuers including ADRs and similar investments.

We are value-oriented long-term fundamental investors who seek to own businesses whose economics we understand well. We primarily focus on companies that are structurally well positioned through a combination of favorable industry forces and company-specific competitive advantages. We use the results of our fundamental analysis to come up with a range of intrinsic values for the business underlying each equity security. Our goal is to purchase equity securities with a margin of safety, which we believe comes from both our purchase price relative to our range of value estimates and the quality of the businesses that we are purchasing. We look to sell our holdings when the valuation is no longer favorable, our assessment of the quality of the business changes or when we find more attractive opportunities.

Risk

Stock fund values fluctuate in response to the activities of individual companies and general market and economic conditions. The use of derivatives may reduce returns and/or increase volatility. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This fund is exposed to foreign investment risk. Consult the fund's prospectus for additional information on these and other risks.

Fund Management

Fund Manager

James M. Tringas, CFA, CPA

21 years of Industry Experience

Advisor

Wells Fargo Funds Management, LLC

Sub Advisor

Wells Capital Management Incorporated

Additional Information – Share Class A

Minimum Investment $1,000

Distribution Frequency Annually

Capital Gains & Dividends (2 years history)

This Web site is accompanied by current prospectuses for Wells Fargo Advantage Funds®, an EdVestSM program description (PDF), and a tomorrow's scholar® program description (PDF).

For 529 plans, an investor's or a designated beneficiary's home state may offer state tax or other benefits that are only available for investments in that state's qualified tuition program. Please consider this before investing.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund.

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

|

© 2011 Wells Fargo Funds Management, LLC. All rights reserved. EdVest and tomorrow's scholar are state-sponsored 529 college savings plans administered by the Wisconsin Office of theState Treasurer. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services, Wells Fargo Advantage Funds, and the EdVest and tomorrow's scholar plans. Other affiliates of Wells Fargo & Company provide subadvisory and other services forthe Funds. The Funds and shares in the 529 plans are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

This Web site is for information purposes only and is not intended as a solicitation to sell or buy any security. Wells Fargo Advantage Funds are offered by prospectus and only to residents of the United States. Wells Fargo does not control or endorse and is not responsible for third-party Web sites to which this site links.

Wells Fargo Advantage Funds

Individual Investors · 1-800-359-3379

Investment Professionals · 1-888-877-9275

Institutional Sales Professionals · 1-866-765-0778