UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 09259

Morgan Stanley Total Market Index Fund

(Exact name of registrant as specified in charter)

| 522 Fifth Avenue, New York, New York | 10036 |

| (Address of principal executive offices) | (Zip code) |

Ronald E. Robison

522 Fifth Avenue, New York, New York 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-296-6990

Date of fiscal year end: July 31, 2007

Date of reporting period: July 31, 2007

Item 1 - Report to Shareholders

Welcome, Shareholder:

In this report, you’ll learn about how your investment in Morgan Stanley Total Market Index Fund performed during the annual period. We will provide an overview of the market conditions, and discuss some of the factors that affected performance during the reporting period. In addition, this report includes the Fund’s financial statements and a list of Fund investments.

| This material must be preceded or accompanied by a prospectus for the fund being offered. |

| Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objective. The Fund is subject to market risk, which is the possibility that market values of securities owned by the Fund will decline and, therefore, the value of the Fund’s shares may be less than what you paid for them. Accordingly, you can lose money investing in this Fund. Please see the prospectus for more complete information on investment risks. |

| Fund Report | |

| For the year ended July 31, 2007 | |

Total Return for the 12 Months Ended July 31, 2007

| Class A | Class B | Class C | Class D | Dow Jones Wilshire 5000 Composite Index1 | Lipper Multi-Cap Core Funds Index2 | |||||||||||||||||||||||||||

| 15.70 | % | 14.80 | % | 14.92 | % | 15.99 | % | 16.51 | % | 18.31 | % | |||||||||||||||||||||

The performance of the Fund’s four share classes varies because each has different expenses. The Fund’s total returns assume the reinvestment of all distributions but do not reflect the deduction of any applicable sales charges. Such costs would lower performance. See Performance Summary for standardized performance and benchmark information.

Market Conditions

For most of the 12-month period ended July 31, 2007, the broad stock market achieved steady gains. Concerns about potential recession and runaway inflation abated, as data showed a gradual moderation in economic growth and contained inflation. In this environment, the Federal Open Market Committee (the ‘‘Fed’’) discontinued increasing the target federal funds rate beginning in August of 2006. Investors heartily agreed with the Fed’s decision, and returned their attention to the market’s more positive dynamics, including robust global merger and acquisition activity, generally strong corporate earnings, and consumers still willing to open their wallets amid easing oil and gasoline prices. As a result, stocks rallied strongly in the second half of 2006.

In the first few months of 2007, however, sentiment was less upbeat. The housing market began to show significant signs of distress, as problems in the subprime mortgage market (which makes loans to higher risk borrowers) came to light. This news, coupled with volatility in China’s stock market, initiated a downdraft in the U.S. and most other world stock markets at the end of February and into March. Although markets recovered during the next few months, bad news about the subprime market continued to accelerate. By June, several hedge funds that invested in subprime-related securities imploded, and mortgage lenders announced bankruptcies as home foreclosures rose. Conditions worsened in July as a wider credit market c risis began to reveal itself. Illiquidity spelled the end of the cheap borrowing (for both consumers and corporations) that underpinned the market’s strong run-up over the past few years. Companies were no longer able to finance leveraged buyouts, one of the most significant drivers of recent market performance. American Express announced it would pump up its reserves in anticipation of rising credit card account delinquencies. Investor sentiment ranged from fear to panic, as the implications of the subprime contagion on the U.S. and global economies would not be fully understood for some time. As of the end of the period, the broad stock market (by most measures) had given back all of the gains made during the first seven months of 2007.

Performance Analysis

All share classes of Morgan Stanley Total Market Index Fund underperformed the Dow Jones Wilshire 5000 Composite Index and the Lipper Multi-Cap Core Funds Index for the 12 months ended July 31, 2007, assuming no deduction of applicable sales charges.

2

The financials sector was the worst performing sector during the 12-month period, although the majority of its decline occurred during the final months of the period. Not surprisingly, with their exposure to the mortgage and real estate markets, banks and real estate investment trusts (REITs) were the weakest performing groups both within the financials sector and the broad market, as measured by the Dow Jones Wilshire 5000 Composite Index. Diversified financial companies and brokerages were not spared from the turmoil either, despite having less exposure to the subprime woes.

On the positive side, the materials sector had the strongest returns during the period. High commodity prices, strong global demand and corporate takeover activity fueled investors’ preference for materials stocks. The telecommunication services sector also performed well during the period, as selected companies’ solid earnings reports demonstrated the benefits of industry consolidation. Other positive performing areas included technology stocks, which comprised six of the Fund’s top 10 positive contributors during the period. Represented among them were hardware and equipment, semiconductor, and software and services companies, each of which performed well due to company-specific reasons.

There is no guarantee that any sectors mentioned will continue to perform well or that securities in such sectors will be held by the Fund in the future.

| TOP 10 HOLDINGS | ||||||

| Exxon Mobil Corp. | 3.1 | % | ||||

| General Electric Co. | 2.4 | |||||

| Microsoft Corp. | 1.6 | |||||

| AT&T Inc. | 1.5 | |||||

| Citigroup, Inc. | 1.4 | |||||

| Bank of America Corp. | 1.3 | |||||

| Procter & Gamble Co. (The) | 1.2 | |||||

| Chevron Corp. | 1.1 | |||||

| Johnson & Johnson | 1.1 | |||||

| Cisco Systems, Inc. | 1.1 | |||||

| TOP FIVE INDUSTRIES | ||||||

| Integrated Oil | 5.1 | % | ||||

| Pharmaceuticals: Major | 4.5 | |||||

| Major Banks | 4.0 | |||||

| Industrial Conglomerates | 3.9 | |||||

| Financial Conglomerates | 3.1 | |||||

| Data as of July 31, 2007. Subject to change daily. All percentages for top 10 holdings and top five industries are as a percentage of net assets. These data are provided for informational purposes only and should not be deemed a recommendation to buy or sell the securities mentioned. Morgan Stanley is a full-service securities firm engaged in securities trading and brokerage activities, investment banking, research and analysis, financing and financial advisory services. |

3

Investment Strategy

The Dow Jones Wilshire 5000 Composite Index consists of substantially all of the stocks which are actively traded in the United States (currently, approximately 5,000). The Index consists of large capitalization, mid capitalization and small capitalization stocks. Because the Index is weighted by float-adjusted market capitalizations, currently large capitalization stocks in the Index represent approximately 85 percent of its value. The Index may include some foreign companies. The Fund will normally invest at least 80 percent of its assets in stocks included in the Index.

For More Information About Portfolio Holdings

Each Morgan Stanley fund provides a complete schedule of portfolio holdings in its semiannual and annual reports within 60 days of the end of the fund’s second and fourth fiscal quarters. The semiannual reports and the annual reports are filed electronically with the Securities and Exchange Commission (SEC) on Form N-CSRS and Form N-CSR, respectively. Morgan Stanley also delivers the semiannual and annual reports to fund shareholders and makes these reports available on its public web site, www.morganstanley.com. Each Morgan Stanley fund also files a complete schedule of portfolio holdings with the SEC for the fund’s first and third fiscal quarters on Form N-Q. Morgan Stanley does not deliver the reports for th e first and third fiscal quarters to shareholders, nor are the reports posted to the Morgan Stanley public web site. You may, however, obtain the Form N-Q filings (as well as the Form N-CSR and N-CSRS filings) by accessing the SEC’s web site, http://www.sec.gov. You may also review and copy them at the SEC’s public reference room in Washington, DC. Information on the operation of the SEC’s public reference room may be obtained by calling the SEC at (800) SEC-0330. You can also request copies of these materials, upon payment of a duplicating fee, by electronic request at the SEC’s e-mail address (publicinfo@sec.gov) or by writing the public reference section of the SEC, Washington, DC 20549-0102.

Proxy Voting Policy and Procedures and Proxy Voting Record

You may obtain a copy of the Fund’s Proxy Voting Policy and Procedures without charge, upon request, by calling toll free (800) 869-NEWS or by visiting the Mutual Fund Center on our Web site at www.morganstanley.com. It is also available on the Securities and Exchange Commission’s Web site at http://www.sec.gov.

You may obtain information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 without charge by visiting the Mutual Fund Center on our Web site at www.morganstanley.com. This information is also available on the Securities and Exchange Commission’s Web site at http://www.sec.gov.

Householding Notice

To reduce printing and mailing costs, the Fund attempts to eliminate duplicate mailings to the same address. The Fund delivers a single copy of certain shareholder documents, including shareholder reports, prospectuses and proxy materials, to investors with the same last name who reside at the same address. Your participation in this program will continue for an unlimited period of time unless you instruct us otherwise. You can request multiple copies of these documents by calling (800) 350-6414, 8:00 a.m. to 8:00 p.m., ET. Once our Customer Service Center has received your instructions, we will begin sending individual copies for each account within 30 days.

4

(This page has been left blank intentionally.)

5

| Performance Summary | |

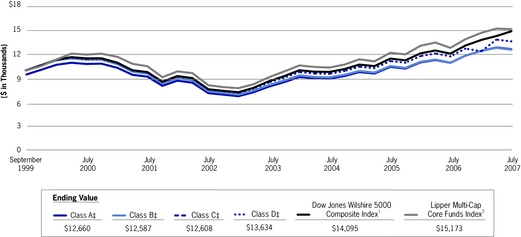

Performance of $10,000 Investment

6

Average Annual Total Returns — Period Ended July 31, 2007

| Class A Shares* (since 09/28/99) | Class B Shares** (since 09/28/99) | Class C Shares† (since 09/28/99) | Class D Shares†† (since 09/28/99) | |||||||||||||||||||||||

| Symbol | TMIAX | TMIBX | TMICX | TMIDX | ||||||||||||||||||||||

| 1 Year | 15.70% | 3 | 14.80% | 3 | 14.92% | 3 | 15.99 % | 3 | ||||||||||||||||||

| 9.63 | 4 | 9.80 | 4 | 13.92 | 4 | — | ||||||||||||||||||||

| 5 Years | 12.15 | 3 | 11.32 | 3 | 11.33 | 3 | 12.45 | 3 | ||||||||||||||||||

| 10.94 | 4 | 11.06 | 4 | 11.33 | 4 | — | ||||||||||||||||||||

| Since Inception | 3.77 | 3 | 2.98 | 3 | 3.00 | 3 | 4.03 | 3 | ||||||||||||||||||

| 3.06 | 4 | 2.98 | 4 | 3.00 | 4 | — | ||||||||||||||||||||

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. For most recent month-end performance figures, please visit www.morganstanley.com or speak with your Financial Advisor. Investment returns and principal value will fluctuate and fund shares, when redeemed, may be worth more or less than their original cost. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance for Class A, Class B, Class C, and Class D shares will vary due to differences in sales charges and expenses.

| * | The maximum front-end sales charge for Class A is 5.25%. |

| ** | The maximum contingent deferred sales charge (CDSC) for Class B is 5.0%. The CDSC declines to 0% after six years. |

| † | The maximum contingent deferred sales charge for Class C is 1.0% for shares redeemed within one year of purchase. |

| †† | Class D has no sales charge. |

| (1) | The Dow Jones Wilshire 5000 Composite Index measures the performance of U.S. headquartered equity securities and is the best measure of the entire U.S. stock market. Over 5,000 capitalization weighted security returns are used to adjust the Index. The Index is weighted by float-adjusted market capitalization. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index. |

| (2) | The Lipper Multi-Cap Core Funds Index is an equally weighted performance index of the largest qualifying funds (based on net assets) in the Lipper Multi-Cap Core Funds classification. The Index, which is adjusted for capital gains distributions and income dividends, is unmanaged and should not be considered an investment. There are currently 30 funds represented in this Index. The Fund is in the Lipper Multi-Cap Core Funds classification as of the date of this report. |

| (3) | Figure shown assumes reinvestment of all distributions and does not reflect the deduction of any sales charges. |

| (4) | Figure shown assumes reinvestment of all distributions and the deduction of the maximum applicable sales charge. See the Fund’s current prospectus for complete details on fees and sales charges. |

| ‡ | Ending value assuming a complete redemption on July 31, 2007. |

7

| Expense Example | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs, including advisory fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 02/01/07 – 07/31/07.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | ||||||||||||

| 02/01/07 | 07/31/07 | 02/01/07 – 07/31/07 | ||||||||||||

| Class A | ||||||||||||||

| Actual (1.60% return) | $ | 1,000.00 | $ | 1,016.00 | $ | 3.20 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.62 | $ | 3.21 | ||||||||

| Class B | ||||||||||||||

| Actual (1.23% return) | $ | 1,000.00 | $ | 1,012.30 | $ | 6.99 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,017.85 | $ | 7.00 | ||||||||

| Class C | ||||||||||||||

| Actual (1.31% return) | $ | 1,000.00 | $ | 1,013.10 | $ | 6.39 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,018.45 | $ | 6.41 | ||||||||

| Class D | ||||||||||||||

| Actual (1.74% return) | $ | 1,000.00 | $ | 1,017.40 | $ | 2.00 | ||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,022.81 | $ | 2.01 | ||||||||

| * | Expenses are equal to the Fund’s annualized expense ratios of 0.64%, 1.40%, 1.28% and 0.40% for Class A, Class B, Class C and Class D shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). If the Fund had borne all of its expenses, the annualized expense ratios would have been 0.70%, 1.46%, 1.34% and 0.46%, for Class A, Class B, Class C and Class D shares, respectively. |

8

Nature, Extent and Quality of Services

The Board reviewed and considered the nature and extent of the investment advisory services provided by the Investment Adviser under the Advisory Agreement, including portfolio management, investment research and equity and fixed income securities trading. The Board also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Fund’s Administrator under the Administration Agreement, including accounting, clerical, bookkeeping, compliance, business management and planning, and the provision of supplies, office space and utilities at the Investment Adviser’s expense. (The Investment Adviser and the Administrator together are referred to as the ‘‘Adviser&r squo;’ and the Advisory and Administration Agreements together are referred to as the ‘‘Management Agreement.’’) The Board also compared the nature of the services provided by the Adviser with similar services provided by non-affiliated advisers as reported to the Board by Lipper Inc. (‘‘Lipper’’).

The Board reviewed and considered the qualifications of the portfolio managers, the senior administrative managers and other key personnel of the Adviser who provide the advisory and administrative services to the Fund. The Board determined that the Adviser’s portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services in an efficient and professional manner. The Board concluded that the nature and extent of the advisory and administrative services provided were necessary and appropriate for the conduct of the business and investment activities of the Fund. The Board also concluded that the overall quality of the advisory and administrative services was sati sfactory.

Performance Relative to Comparable Funds Managed by Other Advisers

On a regular basis, the Board reviews the performance of all funds in the Morgan Stanley Fund Complex, including the Fund, compared to their peers, paying specific attention to the underperforming funds. In addition, the Board specifically reviewed the Fund’s performance for the one-, three- and five-year periods ended November 30, 2006, as shown in a report provided by Lipper (the ‘‘Lipper Report’’), compared to the performance of comparable funds selected by Lipper, (the ‘‘performance peer group’’). The Board discussed with the Adviser the performance goals and the actual results achieved in managing the Fund. The Board concluded that the Fund’s performance was com petitive with that of its performance peer group.

Fees Relative to Other Proprietary Funds Managed by the Adviser with Comparable Investment Strategies

The Board noted that the Adviser did not manage any other proprietary funds with investment strategies comparable to those of the Fund.

Fees and Expenses Relative to Comparable Funds Managed by Other Advisers

The Board reviewed the advisory and administrative fee (together, the ‘‘management fee’’) rate and total expense ratio of the Fund as compared to the average management fee rate and average total expense ratio for funds, selected by Lipper (the ‘‘expense peer group’’), managed by other advisers with investment strategies comparable to those of the Fund, as shown in the Lipper Report. The Board concluded that the Fund’s management fee rate and total expense ratio were competitive with those of its expense peer group.

9

Breakpoints and Economies of Scale

The Board reviewed the structure of the Fund’s management fee schedule under the Management Agreement and noted that it includes a breakpoint. The Board also reviewed the level of the Fund’s management fee and noted that the fee, as a percentage of the Fund’s net assets, would decrease as net assets increase because the management fee includes a breakpoint. The Board concluded that the Fund’s management fee would reflect economies of scale as assets increase.

Profitability of the Adviser and Affiliates

The Board considered information concerning the costs incurred and profits realized by the Adviser and affiliates during the last year from their relationship with the Fund and during the last two years from their relationship with the Morgan Stanley Fund Complex and reviewed with the Adviser the cost allocation methodology used to determine the profitability of the Adviser and affiliates. Based on its review of the information it received, the Board concluded that the profits earned by the Adviser and affiliates were not excessive in light of the advisory, administrative and other services provided to the Fund.

Fall-Out Benefits

The Board considered so-called ‘‘fall-out benefits’’ derived by the Adviser and affiliates from their relationship with the Fund and the Morgan Stanley Fund Complex, such as sales charges on sales of Class A shares and ‘‘float’’ benefits derived from handling of checks for purchases and sales of Fund shares, through a broker-dealer affiliate of the Adviser and ‘‘soft dollar’’ benefits (discussed in the next section). The Board also considered that a broker-dealer affiliate of the Adviser receives from the Fund 12b-1 fees for distribution and shareholder services. The Board concluded that the float benefits were relatively small and the sales charges and 1 2b-1 fees were competitive with those of other broker-dealers.

Soft Dollar Benefits

The Board considered whether the Adviser realizes any benefits as a result of brokerage transactions executed through ‘‘soft dollar’’ arrangements. Under such arrangements, brokerage commissions paid by the Fund and/or other funds managed by the Adviser would be used to pay for research that a securities broker obtains from third parties, or to pay for both research and execution services from securities brokers who effect transactions for the Fund. The Adviser informed the Board that the Fund’s commissions are used to pay for execution services only.

Adviser Financially Sound and Financially Capable of Meeting the Fund’s Needs

The Board considered whether the Adviser is financially sound and has the resources necessary to perform its obligations under the Management Agreement. The Board concluded that the Adviser has the financial resources necessary to fulfill its obligations under the Management Agreement.

Historical Relationship Between the Fund and the Adviser

The Board also reviewed and considered the historical relationship between the Fund and the Adviser, including the organizational structure of the Adviser, the policies and procedures formulated and adopted by the Adviser for managing the Fund’s operations and the Board’s confidence in the competence and integrity of the senior managers and key personnel of the Adviser. The Board concluded that it is beneficial for the Fund to continue its relationship with the Adviser.

10

Other Factors and Current Trends

The Board considered the controls and procedures adopted and implemented by the Adviser and monitored by the Fund’s Chief Compliance Officer and concluded that the conduct of business by the Adviser indicates a good faith effort on its part to adhere to high ethical standards in the conduct of the Fund’s business.

General Conclusion

On April 25, 2007, after considering and weighing all of the above factors, the Board concluded that it would be in the best interest of the Fund and its shareholders to approve renewal of the Management Agreement for another year until April 30, 2008. On June 20, 2007, the Board again considered and weighed all of the above factors and concluded that it would be in the best interest of the Fund and its shareholders to approve renewal of the Management Agreement to continue until June 30, 2008.

11

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007

July 31, 2007

| NUMBER OF SHARES | VALUE | |||||||||

| Common Stocks (97.9%) | ||||||||||

| Advertising/Marketing Services (0.3%) | ||||||||||

| 791 | Aquantive Inc. | $ | 52,325 | |||||||

| 365 | Arbitron Inc.* | 18,177 | ||||||||

| 547 | Catalina Marketing Corp. | 16,514 | ||||||||

| 4,218 | Gemstar-TV Guide International, Inc.* | 24,211 | ||||||||

| 622 | Getty Images, Inc.* | 27,946 | ||||||||

| 1,016 | Harris Interactive Inc.* | 4,552 | ||||||||

| 860 | Harte-Hanks Inc. | 20,253 | ||||||||

| 965 | infoUSA, Inc. | 9,891 | ||||||||

| 4,404 | Interpublic Group of Companies, Inc. (The)* | 46,198 | ||||||||

| 879 | Lamar Advertising Co. (Class A)* | 52,327 | ||||||||

| 636 | Nautilus Group, Inc. | 6,258 | ||||||||

| 3,344 | Omnicom Group, Inc. | 173,453 | ||||||||

| 614 | R.H. Donnelley Corp.* | 38,393 | ||||||||

| 693 | Valassis Communications, Inc.* | 8,226 | ||||||||

| 1,398 | ValueClick, Inc.* | 29,889 | ||||||||

| 528,613 | ||||||||||

| Aerospace & Defense (1.6%) | ||||||||||

| 620 | AAR Corp.* | 18,495 | ||||||||

| 1,237 | Aeroflex Inc.* | 17,355 | ||||||||

| 441 | Alliant Techsystems, Inc.* | 43,708 | ||||||||

| 6,967 | Boeing Co. (The) | 720,597 | ||||||||

| 481 | Cubic Corp. | 13,242 | ||||||||

| 710 | Curtiss-Wright Corp. | 30,935 | ||||||||

| 483 | DRS Technologies, Inc. | 25,290 | ||||||||

| 385 | EDO Corp. | 12,724 | ||||||||

| 308 | ESCO Technologies Inc.* | 11,171 | ||||||||

| 409 | Esterline Corp.* | 18,933 | ||||||||

| 931 | FLIR Systems, Inc.* | 40,638 | ||||||||

| 804 | GenCorp Inc.* | 9,503 | ||||||||

| 3,245 | General Dynamics Corp. | 254,927 | ||||||||

| 1,201 | Goodrich Corp. | 75,555 | ||||||||

| 1,169 | L-3 Communications Holdings, Inc. | 114,048 | ||||||||

| 3,355 | Lockheed Martin Corp. | 330,400 | ||||||||

| 573 | Moog Inc. (Class A)* | 24,536 | ||||||||

| 3,080 | Northrop Grumman Corp. | 234,388 | ||||||||

| 874 | Orbital Sciences Corp. (c)* | 18,520 | ||||||||

| 1,323 | Precision Castparts Corp. | $ | 181,330 | |||||||

| 4,318 | Raytheon Co. | 239,044 | ||||||||

| 1,644 | Rockwell Collins, Inc. | 112,943 | ||||||||

| 97 | Sequa Corp. (Class A)* | 16,015 | ||||||||

| 490 | Teledyne Technologies Inc.* | 21,741 | ||||||||

| 309 | Triumph Group, Inc.* | 23,549 | ||||||||

| 2,609,587 | ||||||||||

| Agricultural Commodities/ Milling (0.2%) | ||||||||||

| 5,786 | Archer-Daniels-Midland Co. | 194,410 | ||||||||

| 1,167 | Bunge Ltd. | 105,742 | ||||||||

| 987 | Corn Products International, Inc. | 44,040 | ||||||||

| 344,192 | ||||||||||

| Air Freight/Couriers (0.6%) | ||||||||||

| 1,736 | C.H. Robinson Worldwide, Inc. | 84,456 | ||||||||

| 628 | Con-way Inc. | 31,017 | ||||||||

| 405 | EGL, Inc.* | 19,104 | ||||||||

| 2,071 | Expeditors International of Washington, Inc. | 92,532 | ||||||||

| 2,737 | FedEx Corp. | 303,095 | ||||||||

| 383 | Forward Air Corp. | 13,049 | ||||||||

| 613 | Pacer International, Inc. | 13,492 | ||||||||

| 5,983 | United Parcel Service, Inc. (Class B) | 453,033 | ||||||||

| 600 | UTI Worldwide Inc. (British Virgin Islands) | 15,078 | ||||||||

| 1,024,856 | ||||||||||

| Airlines (0.2%) | ||||||||||

| 1,447 | AirTran Holdings, Inc.* | 14,238 | ||||||||

| 520 | Alaska Air Group, Inc.* | 12,132 | ||||||||

| 1,710 | AMR Corp.* | 42,203 | ||||||||

| 995 | Continental Airlines, Inc. (Class B)* | 31,352 | ||||||||

| 625 | ExpressJet Holdings, Inc.* | 3,269 | ||||||||

| 678 | Frontier Airlines Holdings | 3,593 | ||||||||

| 2,132 | JetBlue Airways Corp.* | 21,000 | ||||||||

| 615 | Mesa Air Group, Inc.* | 4,090 | ||||||||

| 787 | SkyWest, Inc. | 17,558 | ||||||||

| 7,490 | Southwest Airlines Co. | 117,293 | ||||||||

| 950 | UAL Corp. | 41,933 | ||||||||

| 477 | US Airways Group Inc.* | 14,792 | ||||||||

| 323,453 | ||||||||||

See Notes to Financial Statements

12

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| Alternative Power Generation (0.0%) | ||||||||||

| 1,401 | Covanta Holding Corp. | $ | 31,775 | |||||||

| 1,140 | Plug Power, Inc.* | 3,386 | ||||||||

| 35,161 | ||||||||||

| Aluminum (0.2%) | ||||||||||

| 8,429 | Alcoa, Inc. | 321,988 | ||||||||

| Apparel/Footwear (0.5%) | ||||||||||

| 733 | Brown Shoe Co., Inc. | 15,349 | ||||||||

| 3,695 | Coach, Inc.* | 167,975 | ||||||||

| 269 | Columbia Sportswear Co.* | 16,866 | ||||||||

| 510 | Guess ? Inc.* | 24,220 | ||||||||

| 1,023 | Hanesbrands, Inc. | 31,723 | ||||||||

| 1,303 | Jones Apparel Group, Inc. | 32,523 | ||||||||

| 290 | Kellwood Co. | 7,436 | ||||||||

| 158 | Kenneth Cole Productions, Inc. (Class A) | 3,342 | ||||||||

| 337 | K-Swiss, Inc. (Class A) | 7,505 | ||||||||

| 1,053 | Liz Claiborne, Inc. | 37,002 | ||||||||

| 3,401 | Nike, Inc. (Class B) | 191,986 | ||||||||

| 314 | Oxford Industries, Inc. | 12,686 | ||||||||

| 592 | Phillips-Van Heusen Corp. | 30,820 | ||||||||

| 653 | Polo Ralph Lauren Corp. | 58,346 | ||||||||

| 1,543 | Quiksilver, Inc. | 19,797 | ||||||||

| 720 | Stride Rite Corp. | 14,666 | ||||||||

| 726 | Timberland Co. (Class A)* | 17,257 | ||||||||

| 817 | V.F. Corp. | 70,090 | ||||||||

| 893 | Wolverine World Wide, Inc. | 24,165 | ||||||||

| 783,754 | ||||||||||

| Apparel/Footwear Retail (0.6%) | ||||||||||

| 873 | Abercrombie & Fitch Co. (Class A) | 61,023 | ||||||||

| 749 | Aeropostale* | 28,522 | ||||||||

| 1,983 | American Eagle Outfitters, Inc.* | 48,108 | ||||||||

| 755 | AnnTaylor Stores Corp.* | 23,722 | ||||||||

| 295 | bebe stores, inc. | 4,092 | ||||||||

| 213 | Buckle (The), Inc. | 7,444 | ||||||||

| 594 | Cato Corp. (The) (Class A) | 12,284 | ||||||||

| 1,567 | Charming Shoppes, Inc.* | 15,482 | ||||||||

| 1,998 | Chico’s FAS, Inc.* | 38,681 | ||||||||

| 320 | Children’s Place Retail Stores, Inc. (The)* | 10,915 | ||||||||

| 443 | Christopher & Banks Corp. | 6,610 | ||||||||

| 595 | Dress Barn, Inc.* | $ | 10,823 | |||||||

| 716 | Finish Line, Inc. (Class A) | 4,840 | ||||||||

| 1,790 | Foot Locker, Inc. | 33,222 | ||||||||

| 5,873 | Gap, Inc. (The) | 101,016 | ||||||||

| 575 | Gymboree Corp. (The)* | 24,754 | ||||||||

| 896 | Hot Topic, Inc.* | 8,064 | ||||||||

| 3,250 | Limited Brands, Inc. | 78,488 | ||||||||

| 593 | Men’s Wearhouse, Inc. (The)* | 29,294 | ||||||||

| 2,259 | Nordstrom, Inc. | 107,483 | ||||||||

| 1,050 | Pacific Sunwear of California, Inc.* | 18,921 | ||||||||

| 925 | Payless ShoeSource, Inc.* | 24,624 | ||||||||

| 1,529 | Ross Stores, Inc. | 44,234 | ||||||||

| 484 | Stage Stores, Inc. | 8,635 | ||||||||

| 437 | Stein Mart, Inc. | 4,702 | ||||||||

| 421 | Talbot’s, Inc. (The) | 9,679 | ||||||||

| 4,425 | TJX Companies, Inc. (The) | 122,794 | ||||||||

| 558 | Tween Brands Inc.* | 21,349 | ||||||||

| 1,436 | Urban Outfitters, Inc.* | 28,806 | ||||||||

| 938,611 | ||||||||||

| Auto Parts: O.E.M. (0.3%) | ||||||||||

| 676 | American Axle & Manufacturing Holdings, Inc. | 16,359 | ||||||||

| 760 | ArvinMeritor, Inc. | 15,071 | ||||||||

| 652 | BorgWarner, Inc. | 56,365 | ||||||||

| 1,449 | Eaton Corp. | 140,814 | ||||||||

| 2,135 | Gentex Corp. | 42,145 | ||||||||

| 1,923 | Johnson Controls, Inc. | 217,587 | ||||||||

| 934 | Lear Corp. | 31,364 | ||||||||

| 531 | Modine Manufacturing Co. | 13,594 | ||||||||

| 125 | Proliance International Inc.* | 286 | ||||||||

| 226 | Sauer-Danfoss, Inc. | 6,159 | ||||||||

| 356 | Superior Industries International, Inc. | 6,586 | ||||||||

| 1,979 | Visteon Corp.* | 12,705 | ||||||||

| 559,035 | ||||||||||

| Automotive Aftermarket (0.1%) | ||||||||||

| 464 | Barnes Group, Inc. | 14,477 | ||||||||

| 679 | CLARCOR Inc. | 23,622 | ||||||||

| 2,203 | Goodyear Tire & Rubber Co. (The)* | 63,270 | ||||||||

| 101,369 | ||||||||||

See Notes to Financial Statements

13

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| Beverages: Alcoholic (0.3%) | ||||||||||

| 7,085 | Anheuser-Busch Companies, Inc. | $ | 345,535 | |||||||

| 702 | Brown-Forman Corp. (Class B) | 46,641 | ||||||||

| 1,978 | Constellation Brands Inc. (Class A)* | 43,378 | ||||||||

| 658 | Molson Coors Brewing Co. (Class B) | 58,523 | ||||||||

| 494,077 | ||||||||||

| Beverages: Non-Alcoholic (1.4%) | ||||||||||

| 21,145 | Coca-Cola Co. (The) | 1,101,866 | ||||||||

| 2,482 | Coca-Cola Enterprises Inc. | 56,242 | ||||||||

| 500 | Hansen Natural Corp. | 20,275 | ||||||||

| 1,389 | Pepsi Bottling Group, Inc. (The) | 46,476 | ||||||||

| 937 | PepsiAmericas, Inc. | 25,927 | ||||||||

| 16,055 | PepsiCo, Inc. | 1,053,529 | ||||||||

| 2,304,315 | ||||||||||

| Biotechnology (1.6%) | ||||||||||

| 618 | Adolor Corp.* | 2,225 | ||||||||

| 890 | Affymetrix, Inc.* | 21,698 | ||||||||

| 426 | Alexion Pharmaceuticals, Inc.* | 24,776 | ||||||||

| 1,236 | Alkermes, Inc.* | 17,601 | ||||||||

| 11,396 | Amgen Inc.* | 612,421 | ||||||||

| 1,091 | Amylin Pharmaceuticals, Inc.* | 50,742 | ||||||||

| 721 | Antigenics Inc.* | 2,149 | ||||||||

| 837 | ARIAD Pharmaceuticals, Inc.* | 3,674 | ||||||||

| 3,306 | Biogen Idec Inc.* | 186,921 | ||||||||

| 1,340 | BioMarin Pharmaceutical, Inc.* | 24,200 | ||||||||

| 1,529 | Bruker BioSciences Corp.* | 11,972 | ||||||||

| 3,326 | Celgene Corp.* | 201,423 | ||||||||

| 717 | Cell Genesys, Inc.* | 2,466 | ||||||||

| 664 | Cephalon, Inc.* | 49,893 | ||||||||

| 864 | Charles River Laboratories International, Inc.* | 44,220 | ||||||||

| 563 | Ciphergen Biosystem, Inc.* | 546 | ||||||||

| 728 | Cubist Pharmaceuticals, Inc.* | 16,788 | ||||||||

| 689 | CV Therapeutics, Inc.* | 6,828 | ||||||||

| 809 | Dendreon Corp.* | 6,156 | ||||||||

| 773 | Discovery Laboratories, Inc.* | 1,639 | ||||||||

| 807 | Enzo Biochem, Inc.* | $ | 10,313 | |||||||

| 1,051 | Enzon Pharmaceuticals, Inc.* | 7,567 | ||||||||

| 1,339 | Exelixis, Inc.* | 12,975 | ||||||||

| 4,481 | Genentech, Inc.* | 333,297 | ||||||||

| 624 | Gen-Probe Inc.* | 39,318 | ||||||||

| 2,469 | Genzyme Corp.* | 155,720 | ||||||||

| 647 | Geron Corp.* | 4,076 | ||||||||

| 8,944 | Gilead Sciences, Inc.* | 332,985 | ||||||||

| 2,017 | Human Genome Sciences, Inc.* | 15,652 | ||||||||

| 920 | ImClone Systems, Inc.* | 30,268 | ||||||||

| 924 | Immunomedics, Inc.* | 2,661 | ||||||||

| 1,354 | Incyte Corp.* | 7,203 | ||||||||

| 713 | InterMune Inc.* | 15,223 | ||||||||

| 610 | Invitrogen Corp.* | 43,798 | ||||||||

| 1,222 | Lexicon Pharmaceuticals Inc.* | 3,947 | ||||||||

| 532 | Martek Biosciences Corp.* | 13,630 | ||||||||

| 677 | Maxygen Inc.* | 5,518 | ||||||||

| 1,463 | Medarex, Inc.* | 20,716 | ||||||||

| 686 | Medicines Company (The)* | 10,914 | ||||||||

| 1,124 | MGI Pharma, Inc.* | 28,134 | ||||||||

| 3,589 | Millennium Pharmaceuticals, Inc.* | 36,213 | ||||||||

| 617 | Millipore Corp.* | 48,502 | ||||||||

| 527 | Myriad Genetics, Inc.* | 19,699 | ||||||||

| 849 | Nabi Biopharmaceuticals* | 3,617 | ||||||||

| 533 | Neurocrine Biosciences, Inc.* | 5,421 | ||||||||

| 812 | NPS Pharmaceuticals, Inc.* | 3,500 | ||||||||

| 569 | Onyx Pharmaceuticals, Inc.* | 15,824 | ||||||||

| 755 | OSI Pharmaceuticals Inc.* | 24,341 | ||||||||

| 1,403 | PDL BioPharrma Inc. | 32,956 | ||||||||

| 968 | Regeneron Pharmaceuticals, Inc.* | 14,414 | ||||||||

| 814 | SciClone Pharmaceuticals, Inc.* | 1,823 | ||||||||

| 690 | SuperGen, Inc.* | 4,147 | ||||||||

| 396 | Tanox, Inc.* | 7,722 | ||||||||

| 486 | Techne Corp.* | 27,342 | ||||||||

| 700 | Telik, Inc.* | 1,911 | ||||||||

| 456 | Trimeris, Inc.* | 2,886 | ||||||||

| 834 | Verenium Corp. | 5,204 | ||||||||

| 1,071 | Vertex Pharmaceuticals Inc.* | 34,593 | ||||||||

| 1,445 | XOMA Ltd.* | 2,977 | ||||||||

| 660 | ZymoGenetics, Inc.* | 7,630 | ||||||||

| 2,682,975 | ||||||||||

See Notes to Financial Statements

14

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| Broadcasting (0.2%) | ||||||||||

| 1,952 | Citadel Broadcasting Corp. | $ | 9,799 | |||||||

| 4,516 | Clear Channel Communications, Inc. | 166,640 | ||||||||

| 450 | Cox Radio, Inc. (Class A)* | 5,827 | ||||||||

| 996 | Cumulus Media, Inc. (Class A)* | 10,518 | ||||||||

| 521 | Emmis Communications Corp. (Class A)* | 3,829 | ||||||||

| 644 | Entercom Communications Corp.* | 14,542 | ||||||||

| 854 | Entravision Communications Corp. (Class A)* | 7,993 | ||||||||

| 168 | Fisher Communications, Inc.* | 7,683 | ||||||||

| 805 | Gray Television, Inc. | 6,480 | ||||||||

| 502 | Hearst-Argyle Television, Inc. | 10,542 | ||||||||

| 567 | Lin TV Corp. (Class A)* | 8,584 | ||||||||

| 1,395 | Radio One, Inc. (Class A)* | 8,537 | ||||||||

| 350 | Salem Communications Corp.* | 2,972 | ||||||||

| 1,141 | Sinclair Broadcast Group, Inc. (Class A)* | 14,879 | ||||||||

| 13,086 | Sirius Satellite Radio Inc.* | 39,389 | ||||||||

| 671 | Spanish Broadcasting System, Inc. (Class A)* | 2,134 | ||||||||

| 1,299 | Westwood One, Inc. | 6,833 | ||||||||

| 2,704 | XM Satellite Radio Holdings Inc. (Class A)* | 30,961 | ||||||||

| 358,142 | ||||||||||

| Building Products (0.2%) | ||||||||||

| 1,638 | American Standard Companies, Inc. | 88,534 | ||||||||

| 577 | Griffon Corp.* | 10,138 | ||||||||

| 731 | Lennox International Inc. | 27,997 | ||||||||

| 3,839 | Masco Corp. | 104,459 | ||||||||

| 448 | Simpson Manufacturing Co., Inc. | 15,156 | ||||||||

| 345 | Watsco, Inc. | 17,219 | ||||||||

| 263,503 | ||||||||||

| Cable/Satellite TV (0.8%) | ||||||||||

| 1,894 | Cablevision Systems New York Group (Class A)* | 67,407 | ||||||||

| 5,608 | Charter Communications, Inc. (Class A)* | 22,768 | ||||||||

| 29,226 | Comcast Corp. (Class A)* | $ | 767,767 | |||||||

| 8,148 | DIRECTV Group, Inc. (The)* | 182,597 | ||||||||

| 2,177 | EchoStar Communications Corp. (Class A)* | 92,065 | ||||||||

| 4,441 | Liberty Global Inc. (Class A)* | 186,211 | ||||||||

| 961 | Mediacom Communications Corp.* | 8,707 | ||||||||

| 1,327,522 | ||||||||||

| Casino/Gaming (0.4%) | ||||||||||

| 434 | Ameristar Casinos, Inc. | 13,749 | ||||||||

| 575 | Bally Technologies Inc.* | 14,145 | ||||||||

| 676 | Boyd Gaming Corp. | 29,812 | ||||||||

| 258 | Churchill Downs Inc. | 11,992 | ||||||||

| 1,826 | Harrah’s Entertainment, Inc. | 154,644 | ||||||||

| 3,249 | International Game Technology | 114,755 | ||||||||

| 272 | Isle of Capri Casinos, Inc.* | 5,832 | ||||||||

| 992 | Las Vegas Sands Corp.* | 86,552 | ||||||||

| 1,228 | MGM Mirage* | 89,779 | ||||||||

| 512 | Multimedia Games, Inc.* | 5,366 | ||||||||

| 841 | Penn National Gaming, Inc.* | 48,358 | ||||||||

| 455 | Shuffle Master, Inc.* | 6,611 | ||||||||

| 512 | Station Casinos, Inc. | 44,303 | ||||||||

| 717 | Wynn Resorts, Ltd.* | 69,234 | ||||||||

| 695,132 | ||||||||||

| Catalog/Specialty Distribution (0.1%) | ||||||||||

| 852 | Insight Enterprises, Inc.* | 19,221 | ||||||||

| 6,769 | Liberty Media Corp – Interactive (Series A)* | 141,811 | ||||||||

| 701 | Valuevision Media Inc. (Class A)* | 6,386 | ||||||||

| 167,418 | ||||||||||

| Chemicals: Agricultural (0.3%) | ||||||||||

| 5,230 | Monsanto Co. | 337,074 | ||||||||

| 657 | Scotts Miracle-Gro Company (The) (Class A) | 26,930 | ||||||||

| 1,613 | The Mosaic Company* | 60,584 | ||||||||

| 424,588 | ||||||||||

| Chemicals: Major Diversified (0.6%) | ||||||||||

| 747 | Cabot Corp. | 30,164 | ||||||||

| 9,328 | Dow Chemical Co. (The) | 405,581 | ||||||||

| 8,891 | E.I. du Pont de Nemours & Co. | 415,476 | ||||||||

See Notes to Financial Statements

15

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| 789 | Eastman Chemical Co. | $ | 54,299 | |||||||

| 1,505 | Hercules Inc. | 31,244 | ||||||||

| 1,474 | Rohm & Haas Co. | 83,310 | ||||||||

| 1,020,074 | ||||||||||

| Chemicals: Specialty (0.6%) | ||||||||||

| 2,017 | Air Products & Chemicals, Inc. | 174,208 | ||||||||

| 875 | Airgas, Inc. | 40,862 | ||||||||

| 930 | Albemarle Corp. | 37,414 | ||||||||

| 439 | Arch Chemicals, Inc. | 15,532 | ||||||||

| 682 | Ashland Inc. | 41,643 | ||||||||

| 324 | Cambrex Corp. | 4,426 | ||||||||

| 3,217 | Chemtura Corp. | 33,553 | ||||||||

| 538 | Cytec Industries, Inc. | 36,041 | ||||||||

| 505 | FMC Corp. | 45,011 | ||||||||

| 689 | Georgia Gulf Corp. | 11,155 | ||||||||

| 114 | Kronos Worldwide, Inc. | 2,666 | ||||||||

| 737 | Lubrizol Corp. (The) | 46,180 | ||||||||

| 2,304 | Lyondell Chemical Co. | 103,450 | ||||||||

| 133 | NL Industries, Inc. | 1,311 | ||||||||

| 554 | OM Group, Inc.* | 26,836 | ||||||||

| 1,634 | Polyone Corp.* | 12,288 | ||||||||

| 3,137 | Praxair, Inc. | 240,357 | ||||||||

| 576 | Schulman (A.), Inc. | 13,375 | ||||||||

| 671 | Sensient Technologies Corp. | 17,043 | ||||||||

| 1,249 | Sigma-Aldrich Corp. | 56,605 | ||||||||

| 288 | Tronox Inc. (Class B) | 3,542 | ||||||||

| 214 | Valhi, Inc. | 3,512 | ||||||||

| 967,010 | ||||||||||

| Coal (0.2%) | ||||||||||

| 1,338 | Arch Coal, Inc. | 39,993 | ||||||||

| 1,825 | CONSOL Energy, Inc. | 76,011 | ||||||||

| 200 | Foundation Coal Holdings, Inc. | 6,970 | ||||||||

| 1,061 | Massey Energy Co. | 22,652 | ||||||||

| 2,533 | Peabody Energy Corp. | 107,045 | ||||||||

| 252,671 | ||||||||||

| Commercial Printing/Forms (0.1%) | ||||||||||

| 659 | Bowne & Co., Inc. | 11,427 | ||||||||

| 671 | Deluxe Corp. | 25,337 | ||||||||

| 2,240 | Donnelley (R.R.) & Sons Co. | 94,662 | ||||||||

| 552 | Standard Register Co. | 7,419 | ||||||||

| 138,845 | ||||||||||

| Computer Communications (1.4%) | ||||||||||

| 4,882 | 3Com Corp.* | $ | 19,528 | |||||||

| 1,325 | Adaptec, Inc.* | 4,637 | ||||||||

| 4,708 | Avaya Inc.* | 77,870 | ||||||||

| 597 | Avocent Corp.* | 16,328 | ||||||||

| 4,867 | Brocade Communications Systems, Inc. | 34,264 | ||||||||

| 59,444 | Cisco Systems, Inc.* | 1,718,526 | ||||||||

| 528 | Echelon Corp.* | 10,417 | ||||||||

| 1,137 | Emulex Corp.* | 22,513 | ||||||||

| 2,762 | Extreme Networks, Inc.* | 11,214 | ||||||||

| 526 | F5 Networks, Inc.* | 45,599 | ||||||||

| 851 | FalconStor Software, Inc.* | 8,842 | ||||||||

| 3,935 | Finisar Corp.* | 14,284 | ||||||||

| 1,763 | Foundry Networks, Inc.* | 31,011 | ||||||||

| 539 | Ixia* | 5,045 | ||||||||

| 5,614 | Juniper Networks, Inc.* | 168,195 | ||||||||

| 1,890 | MRV Communications, Inc.* | 5,009 | ||||||||

| 552 | NETGEAR, Inc.* | 15,268 | ||||||||

| 1,974 | QLogic Corp.* | 26,234 | ||||||||

| 2,234,784 | ||||||||||

| Computer Peripherals (0.5%) | ||||||||||

| 608 | Avid Technology, Inc.* | 19,517 | ||||||||

| 759 | Dot Hill Systems Corp.* | 2,877 | ||||||||

| 718 | Electronics for Imaging, Inc.* | 18,855 | ||||||||

| 22,866 | EMC Corp.* | 423,250 | ||||||||

| 453 | Imation Corp. | 14,170 | ||||||||

| 999 | Lexmark International, Inc. (Class A)* | 39,500 | ||||||||

| 3,720 | Network Appliance, Inc.* | 105,425 | ||||||||

| 3,104 | Quantum Corp. – DLT & Storage Systems* | 8,784 | ||||||||

| 5,086 | Seagate Technology (Cayman Islands)* | 119,572 | ||||||||

| 6,106 | Seagate Technology (Escrow)* (a) | 0 | ||||||||

| 417 | Sonic Solutions* | 4,662 | ||||||||

| 2,285 | Western Digital Corp.* | 48,785 | ||||||||

| 942 | Zebra Technologies Corp. (Class A)* | 34,129 | ||||||||

| 839,526 | ||||||||||

See Notes to Financial Statements

16

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| Computer Processing Hardware (1.9%) | ||||||||||

| 8,201 | Apple Inc.* | $ | 1,080,564 | |||||||

| 338 | Cray Inc.* | 2,450 | ||||||||

| 19,407 | Dell Inc.* | 542,814 | ||||||||

| 26,960 | Hewlett-Packard Co. | 1,240,969 | ||||||||

| 1,762 | NCR Corp.* | 92,012 | ||||||||

| 1,188 | Palm, Inc.* | 17,725 | ||||||||

| 33,805 | Sun Microsystems, Inc.* | 172,406 | ||||||||

| 3,148,940 | ||||||||||

| Construction Materials (0.2%) | ||||||||||

| 553 | AMCOL International Corp. | 15,832 | ||||||||

| 685 | Eagle Materials Inc. | 29,955 | ||||||||

| 646 | Florida Rock Industries, Inc. | 41,027 | ||||||||

| 499 | Martin Marietta Materials, Inc. | 68,363 | ||||||||

| 412 | Texas Industries, Inc. | 32,470 | ||||||||

| 392 | Trex Co., Inc.* | 6,546 | ||||||||

| 472 | USG Corp.* | 19,593 | ||||||||

| 843 | Vulcan Materials Co. | 80,692 | ||||||||

| 294,478 | ||||||||||

| Consumer Sundries (0.0%) | ||||||||||

| 658 | American Greetings Corp. (Class A) | 16,272 | ||||||||

| 597 | Blyth Industries, Inc. | 13,325 | ||||||||

| 351 | Central Garden & Pet Co.* | 4,416 | ||||||||

| 702 | Central Garden & Pet Co. (Class A) | 8,592 | ||||||||

| 507 | Oakley, Inc. | 14,297 | ||||||||

| 56,902 | ||||||||||

| Containers/Packaging (0.4%) | ||||||||||

| 882 | Aptargroup, Inc. | 32,105 | ||||||||

| 1,043 | Ball Corp. | 53,475 | ||||||||

| 1,247 | Bemis Company, Inc. | 36,749 | ||||||||

| 543 | Caraustar Industries, Inc.* | 2,617 | ||||||||

| 1,968 | Crown Holdings, Inc.* | 48,334 | ||||||||

| 480 | Greif, Inc. | 26,400 | ||||||||

| 644 | Myers Industries, Inc. | 13,775 | ||||||||

| 1,751 | Owens-Illinois, Inc.* | 70,005 | ||||||||

| 1,051 | Packaging Corp. of America | 26,822 | ||||||||

| 1,526 | Pactiv Corp.* | 48,237 | ||||||||

| 681 | Rock-Tenn Co. (Class A) | 20,920 | ||||||||

| 1,629 | Sealed Air Corp. | 44,390 | ||||||||

| 370 | Silgan Holdings, Inc. | 19,099 | ||||||||

| 2,934 | Smurfit-Stone Container Corp.* | $ | 34,592 | |||||||

| 1,114 | Sonoco Products Co. | 40,850 | ||||||||

| 1,095 | Temple-Inland Inc. | 63,652 | ||||||||

| 582,022 | ||||||||||

| Contract Drilling (0.7%) | ||||||||||

| 673 | Diamond Offshore Drilling, Inc. | 69,440 | ||||||||

| 1,490 | ENSCO International Inc. | 90,994 | ||||||||

| 2,319 | GlobalSantaFe Corp. | 166,295 | ||||||||

| 2,538 | Grey Wolf, Inc.* | 18,807 | ||||||||

| 1,238 | Helmerich & Payne, Inc. | 40,074 | ||||||||

| 2,986 | Nabors Industries, Ltd. (Bermuda)* | 87,311 | ||||||||

| 1,292 | Noble Corp. (Cayman Islands) | 132,378 | ||||||||

| 1,844 | Patterson-UTI Energy, Inc.* | 42,228 | ||||||||

| 1,622 | Pride International, Inc.* | 56,851 | ||||||||

| 1,244 | Rowan Companies, Inc. | 52,484 | ||||||||

| 3,148 | Transocean Inc. (Cayman Islands)* | 338,253 | ||||||||

| 1,095,115 | ||||||||||

| Data Processing Services (0.9%) | ||||||||||

| 1,023 | Acxiom Corp. | 25,739 | ||||||||

| 1,071 | Affiliated Computer Services, Inc. (Class A)* | 57,470 | ||||||||

| 671 | Alliance Data Systems Corp.* | 51,533 | ||||||||

| 5,573 | Automatic Data Processing, Inc. | 258,699 | ||||||||

| 1,573 | BISYS Group, Inc. (The)* | 18,829 | ||||||||

| 1,424 | Broadridge Financial Solutions Inc. | 25,048 | ||||||||

| 1,624 | Ceridian Corp.* | 55,054 | ||||||||

| 877 | CheckFree Corp.* | 32,309 | ||||||||

| 1,789 | Computer Sciences Corp.* | 99,612 | ||||||||

| 1,697 | Convergys Corp.* | 32,328 | ||||||||

| 737 | CSG Systems International, Inc.* | 18,440 | ||||||||

| 630 | DST Systems, Inc.* | 47,798 | ||||||||

| 563 | eFunds Corp.* | 20,127 | ||||||||

| 524 | Euronet Worldwide, Inc.* | 13,315 | ||||||||

| 1,674 | Fidelity National Information Services, Inc. | 83,081 | ||||||||

| 7,385 | First Data Corp. | 234,769 | ||||||||

| 1,698 | Fiserv, Inc.* | 83,915 | ||||||||

| 959 | Global Payments Inc. | 35,867 | ||||||||

See Notes to Financial Statements

17

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| 643 | Hewitt Associates, Inc.* | $ | 19,239 | |||||||

| 500 | NeuStar, Inc. (Class A)* | 14,420 | ||||||||

| 3,254 | Paychex, Inc. | 134,651 | ||||||||

| 672 | Total System Services, Inc. | 18,903 | ||||||||

| 742 | Tyler Technologies, Inc.* | 8,926 | ||||||||

| 7,385 | Western Union Co. | 147,331 | ||||||||

| 1,537,403 | ||||||||||

| Department Stores (0.4%) | ||||||||||

| 908 | Dillard’s, Inc. (Class A) | 27,140 | ||||||||

| 2,958 | Kohl’s Corp.* | 179,846 | ||||||||

| 5,376 | Macy’s, Inc. | 193,912 | ||||||||

| 1,983 | Penney (J.C.) Co., Inc. | 134,923 | ||||||||

| 1,655 | Saks, Inc.* | 30,634 | ||||||||

| 566,455 | ||||||||||

| Discount Stores (1.3%) | ||||||||||

| 736 | 99 Cents Only Stores* | 8,957 | ||||||||

| 1,617 | Big Lots, Inc.* | 41,816 | ||||||||

| 949 | BJ’s Wholesale Club, Inc.* | 32,228 | ||||||||

| 4,563 | Costco Wholesale Corp. | 272,867 | ||||||||

| 1,274 | Dollar Tree Stores, Inc.* | 48,743 | ||||||||

| 1,520 | Family Dollar Stores, Inc. | 45,022 | ||||||||

| 628 | Fred’s, Inc. | 7,454 | ||||||||

| 921 | Sears Holdings Corp.* | 125,984 | ||||||||

| 7,627 | Target Corp. | 461,967 | ||||||||

| 24,962 | Wal-Mart Stores, Inc. | 1,147,004 | ||||||||

| 2,192,042 | ||||||||||

| Drugstore Chains (0.6%) | ||||||||||

| 15,086 | CVS Caremark Corp. | 530,876 | ||||||||

| 364 | Longs Drug Stores Corp. | 17,603 | ||||||||

| 6,011 | Rite Aid Corp.* | 33,121 | ||||||||

| 951 | Sally Beauty Holdings, Inc. | 7,637 | ||||||||

| 9,781 | Walgreen Co. | 432,125 | ||||||||

| 1,021,362 | ||||||||||

| Electric Utilities (3.0%) | ||||||||||

| 6,340 | AES Corp. (The)* | 124,581 | ||||||||

| 1,607 | Allegheny Energy, Inc.* | 83,934 | ||||||||

| 425 | Allete Inc. | 18,632 | ||||||||

| 1,196 | Alliant Energy, Inc. | 44,192 | ||||||||

| 2,045 | Ameren Corp. | 98,119 | ||||||||

| 3,805 | American Electric Power Co., Inc. | 165,479 | ||||||||

| 3,556 | Aquila, Inc.* | 13,442 | ||||||||

| 746 | Avista Corp. | 14,786 | ||||||||

| 533 | Black Hills Corp. | $ | 19,881 | |||||||

| 2,946 | CenterPoint Energy, Inc. | 48,550 | ||||||||

| 308 | CH Energy Group, Inc. | 13,660 | ||||||||

| 762 | Cleco Corp. | 18,097 | ||||||||

| 2,472 | CMS Energy Corp. | 39,948 | ||||||||

| 2,343 | Consolidated Edison, Inc. | 102,342 | ||||||||

| 1,811 | Constellation Energy Group, Inc. | 151,762 | ||||||||

| 3,357 | Dominion Resources, Inc. | 282,727 | ||||||||

| 1,303 | DPL, Inc. | 34,634 | ||||||||

| 1,788 | DTE Energy Co. | 82,927 | ||||||||

| 11,642 | Duke Energy Corp. | 198,263 | ||||||||

| 2,879 | Edison International | 152,270 | ||||||||

| 772 | El Paso Electric Co.* | 17,964 | ||||||||

| 445 | Empire District Electric Co. (The) | 9,652 | ||||||||

| 1,677 | Energy East Corp. | 42,445 | ||||||||

| 1,998 | Entergy Corp. | 199,720 | ||||||||

| 6,480 | Exelon Corp. | 454,572 | ||||||||

| 3,182 | FirstEnergy Corp. | 193,306 | ||||||||

| 3,675 | FPL Group, Inc. | 212,158 | ||||||||

| 993 | Great Plains Energy Inc. | 27,566 | ||||||||

| 1,103 | Hawaiian Electric Industries, Inc. | 25,159 | ||||||||

| 519 | IDACORP, Inc. | 16,068 | ||||||||

| 939 | Integrys Energy Group, Inc. | 46,471 | ||||||||

| 350 | MGE Energy Inc. | 10,504 | ||||||||

| 2,885 | Mirant Corp.* | 109,140 | ||||||||

| 1,631 | Northeast Utilities | 44,592 | ||||||||

| 1,860 | NRG Energy, Inc.* | 71,703 | ||||||||

| 1,217 | NSTAR | 38,275 | ||||||||

| 943 | OGE Energy Corp. | 31,260 | ||||||||

| 422 | Otter Tail Power Co. | 12,432 | ||||||||

| 1,921 | Pepco Holdings, Inc. | 52,001 | ||||||||

| 3,336 | PG&E Corp. | 142,814 | ||||||||

| 1,039 | Pinnacle West Capital Corp. | 38,942 | ||||||||

| 930 | PNM Resources Inc. | 24,022 | ||||||||

| 3,674 | PPL Corp. | 173,192 | ||||||||

| 2,405 | Progress Energy, Inc. | 105,002 | ||||||||

| 2,377 | Public Service Enterprise Group | 204,779 | ||||||||

| 1,476 | Puget Energy, Inc. | 34,169 | ||||||||

| 3,255 | Reliant Energy, Inc.* | 83,588 | ||||||||

| 1,137 | SCANA Corp. | 42,501 | ||||||||

| 1,533 | Sierra Pacific Resources* | 24,359 | ||||||||

| 7,180 | Southern Co. (The) | 241,535 | ||||||||

See Notes to Financial Statements

18

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| 2,298 | TECO Energy, Inc. | $ | 37,090 | |||||||

| 4,414 | TXU Corp. | 288,014 | ||||||||

| 380 | UIL Holdings Corp. | 11,240 | ||||||||

| 425 | UniSource Energy Corp. | 12,933 | ||||||||

| 1,177 | Westar Energy, Inc. | 27,095 | ||||||||

| 1,164 | Wisconsin Energy Corp. | 49,971 | ||||||||

| 4,089 | Xcel Energy, Inc. | 83,007 | ||||||||

| 4,947,467 | ||||||||||

| Electrical Products (0.5%) | ||||||||||

| 650 | Acuity Brands, Inc. | 38,415 | ||||||||

| 527 | Baldor Electric Co. | 24,052 | ||||||||

| 563 | Belden CDT Inc. | 30,841 | ||||||||

| 499 | C&D Technologies, Inc. | 2,405 | ||||||||

| 1,901 | Cooper Industries Ltd. (Class A) (Bermuda) | 100,601 | ||||||||

| 7,939 | Emerson Electric Co. | 373,689 | ||||||||

| 638 | Energizer Holdings, Inc.* | 64,374 | ||||||||

| 507 | Energy Conversion Devices, Inc.* | 15,134 | ||||||||

| 273 | Franklin Electric Co., Inc. | 12,716 | ||||||||

| 399 | Genlyte Group Inc. (The)* | 27,758 | ||||||||

| 366 | Greatbatch, Inc. | 11,357 | ||||||||

| 671 | Hubbell, Inc. (Class B)* | 38,683 | ||||||||

| 426 | Littelfuse, Inc.* | 13,883 | ||||||||

| 1,383 | Molex Inc. | 39,194 | ||||||||

| 1,848 | Power-One, Inc.* | 7,318 | ||||||||

| 736 | Thomas & Betts Corp.* | 45,485 | ||||||||

| 845,905 | ||||||||||

| Electronic Components (0.5%) | ||||||||||

| 1,892 | Amphenol Corporation (Class A) | 64,820 | ||||||||

| 878 | AVX Corp. | 14,039 | ||||||||

| 728 | Benchmark Electronics, Inc.* | 16,162 | ||||||||

| 1,039 | Cree, Inc.* | 26,619 | ||||||||

| 675 | CTS Corp. | 8,599 | ||||||||

| 428 | Hutchinson Technology Inc.* | 8,586 | ||||||||

| 1,787 | Jabil Circuit, Inc. | 40,261 | ||||||||

| 1,536 | Kemet Corp.* | 10,813 | ||||||||

| 1,307 | Kopin Corp.* | 4,980 | ||||||||

| 1,537 | MEMC Electronic Materials, Inc.* | 94,249 | ||||||||

| 696 | Methode Electronics, Inc. | 11,254 | ||||||||

| 682 | OmniVision Technologies, Inc.* | 11,710 | ||||||||

| 386 | Park Electrochemical Corp. | $ | 11,445 | |||||||

| 572 | Plexus Corp.* | 13,871 | ||||||||

| 1,876 | SanDisk Corp.* | 100,610 | ||||||||

| 7,066 | Sanmina-SCI Corp.* | 19,432 | ||||||||

| 11,300 | Solectron Corp.* | 42,488 | ||||||||

| 126 | Superconductor Technologies Inc.* | 190 | ||||||||

| 607 | Technitrol, Inc. | 15,782 | ||||||||

| 733 | TTM Technologies, Inc.* | 9,558 | ||||||||

| 4,890 | Tyco Electronics Ltd. | 175,160 | ||||||||

| 307 | Vicor Corp. | 3,859 | ||||||||

| 2,215 | Vishay Intertechnology, Inc.* | 34,355 | ||||||||

| 738,842 | ||||||||||

| Electronic Distributors (0.2%) | ||||||||||

| 519 | Anixter International, Inc. | 42,895 | ||||||||

| 1,216 | Arrow Electronics, Inc.* | 46,476 | ||||||||

| 1,471 | Avnet, Inc.* | 55,721 | ||||||||

| 674 | CDW Corp. | 56,731 | ||||||||

| 1,646 | Ingram Micro Inc. (Class A)* | 33,002 | ||||||||

| 2,178 | Safeguard Scientifics, Inc.* | 5,009 | ||||||||

| 478 | ScanSource, Inc.* | 12,825 | ||||||||

| 800 | Tech Data Corp.* | 29,976 | ||||||||

| 282,635 | ||||||||||

| Electronic Equipment/ Instruments (0.4%) | ||||||||||

| 4,252 | Agilent Technologies, Inc.* | 162,214 | ||||||||

| 640 | Checkpoint Systems, Inc.* | 14,765 | ||||||||

| 588 | Coherent, Inc.* | 17,023 | ||||||||

| 760 | Diebold, Inc. | 38,509 | ||||||||

| 243 | Dionex Corp.* | 16,526 | ||||||||

| 267 | DTS, Inc.* | 5,596 | ||||||||

| 682 | Intermec Inc. | 17,480 | ||||||||

| 400 | Itron, Inc.* | 31,772 | ||||||||

| 2,304 | JDS Uniphase Corp.* | 33,016 | ||||||||

| 413 | Mercury Computer Systems, Inc.* | 4,514 | ||||||||

| 707 | National Instruments Corp. | 22,871 | ||||||||

| 605 | Newport Corp.* | 7,907 | ||||||||

| 1,587 | Rockwell Automation, Inc. | 111,074 | ||||||||

| 525 | SeaChange International, Inc.* | 3,665 | ||||||||

| 1,134 | Tektronix, Inc. | 37,252 | ||||||||

See Notes to Financial Statements

19

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| 377 | Varian, Inc.* | $ | 22,673 | |||||||

| 8,877 | Xerox Corp.* | 154,992 | ||||||||

| 701,849 | ||||||||||

| Electronic Production Equipment (0.6%) | ||||||||||

| 630 | Advanced Energy Industries, Inc.* | 11,157 | ||||||||

| 1,452 | Amkor Technology, Inc.* | 17,947 | ||||||||

| 15,335 | Applied Materials, Inc. | 337,983 | ||||||||

| 716 | Asyst Technologies, Inc.* | 4,783 | ||||||||

| 560 | ATMI, Inc.* | 16,229 | ||||||||

| 1,781 | Axcelis Technologies, Inc.* | 9,885 | ||||||||

| 1,240 | Brooks Automation Inc.* | 21,787 | ||||||||

| 2,861 | Cadence Design Systems, Inc.* | 61,225 | ||||||||

| 685 | Cognex Corp. | 14,406 | ||||||||

| 414 | Cohu, Inc. | 8,276 | ||||||||

| 1,182 | Credence Systems Corp.* | 4,196 | ||||||||

| 499 | Cymer, Inc.* | 21,332 | ||||||||

| 544 | Electro Scientific Industries, Inc.* | 11,941 | ||||||||

| 1,637 | Entegris Inc.* | 17,647 | ||||||||

| 427 | FEI Co.* | 12,246 | ||||||||

| 477 | FormFactor Inc.* | 18,312 | ||||||||

| 1,935 | KLA-Tencor Corp. | 109,889 | ||||||||

| 927 | Kulicke & Soffa Industries, Inc.* | 8,677 | ||||||||

| 1,387 | Lam Research Corp.* | 80,224 | ||||||||

| 917 | LTX Corp.* | 4,209 | ||||||||

| 828 | Mattson Technology, Inc.* | 8,247 | ||||||||

| 1,407 | Mentor Graphics Corp.* | 16,898 | ||||||||

| 588 | MKS Instruments, Inc.* | 13,348 | ||||||||

| 1,316 | Novellus Systems, Inc.* | 37,532 | ||||||||

| 316 | Photon Dynamics, Inc.* | 3,400 | ||||||||

| 525 | Photronics, Inc.* | 7,361 | ||||||||

| 1,704 | Synopsys, Inc.* | 41,680 | ||||||||

| 2,345 | Teradyne, Inc.* | 36,793 | ||||||||

| 686 | Tessera Technologies, Inc.* | 28,215 | ||||||||

| 446 | Ultratech Stepper, Inc.* | 5,593 | ||||||||

| 1,093 | Varian Semiconductor Equipment Associates, Inc.* | 51,371 | ||||||||

| 319 | Veeco Instruments, Inc.* | 5,838 | ||||||||

| 1,048,627 | ||||||||||

| Electronics/Appliance Stores (0.2%) | ||||||||||

| 3,839 | Best Buy Co., Inc. | $ | 171,181 | |||||||

| 683 | Blockbuster, Inc. (Class A) | 2,930 | ||||||||

| 1,980 | Circuit City Stores – Circuit City Group | 23,562 | ||||||||

| 658 | Movie Gallery, Inc. | 368 | ||||||||

| 1,723 | RadioShack Corp. | 43,299 | ||||||||

| 241,340 | ||||||||||

| Electronics/Appliances (0.2%) | ||||||||||

| 2,926 | Eastman Kodak Co. | 73,881 | ||||||||

| 640 | Harman International Industries, Inc. | 74,240 | ||||||||

| 551 | Helen of Troy Ltd.* (Bermuda) | 12,238 | ||||||||

| 758 | Whirlpool Corp. | 77,399 | ||||||||

| 237,758 | ||||||||||

| Engineering & Construction (0.3%) | ||||||||||

| 486 | Dycom Industries, Inc.* | 13,584 | ||||||||

| 968 | EMCOR Group, Inc.* | 34,751 | ||||||||

| 814 | Fluor Corp. | 94,025 | ||||||||

| 600 | Foster Wheeler Ltd.* (Bermuda) | 67,434 | ||||||||

| 531 | Granite Construction Inc. | 34,510 | ||||||||

| 516 | Insituform Technologies, Inc. (Class A)* | 8,524 | ||||||||

| 1,180 | Jacobs Engineering Group, Inc.* | 72,723 | ||||||||

| 1,028 | McDermott International, Inc. (Panama)* | 85,262 | ||||||||

| 1,439 | Quanta Services, Inc.* | 40,911 | ||||||||

| 987 | Shaw Group Inc. (The)* | 52,528 | ||||||||

| 636 | URS Corp.* | 31,329 | ||||||||

| 535,581 | ||||||||||

| Environmental Services (0.2%) | ||||||||||

| 2,852 | Allied Waste Industries, Inc.* | 36,705 | ||||||||

| 1,425 | Newpark Resources, Inc.* | 9,020 | ||||||||

| 1,844 | Republic Services, Inc. | 58,916 | ||||||||

| 993 | Tetra Tech, Inc.* | 20,883 | ||||||||

| 947 | Waste Connections, Inc.* | 29,357 | ||||||||

| 5,333 | Waste Management, Inc. | 202,814 | ||||||||

| 357,695 | ||||||||||

See Notes to Financial Statements

20

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| Finance/Rental/Leasing (1.4%) | ||||||||||

| 144 | Amerco* | $ | 9,194 | |||||||

| 1,420 | AmeriCredit Corp.* | 28,883 | ||||||||

| 1,080 | Avis Budget Group, Inc. | 27,724 | ||||||||

| 4,536 | Capital One Financial Corp. | 320,967 | ||||||||

| 1,323 | CapitalSource, Inc. | 25,137 | ||||||||

| 504 | Cash American International, Inc. | 18,456 | ||||||||

| 756 | Centerline Holding Co. | 9,435 | ||||||||

| 1,938 | CIT Group, Inc. | 79,807 | ||||||||

| 299 | CompuCredit Corp.* | 7,849 | ||||||||

| 5,874 | Countrywide Financial Corp. | 165,471 | ||||||||

| 6,267 | Discover Financial Services | 144,454 | ||||||||

| 281 | Dollar Thrifty Automotive Group, Inc.* | 10,375 | ||||||||

| 1,578 | Doral Financial Corp. (Puerto Rico) | 1,815 | ||||||||

| 9,354 | Fannie Mae | 559,743 | ||||||||

| 543 | Financial Federal Corp. | 15,394 | ||||||||

| 6,675 | Freddie Mac | 382,277 | ||||||||

| 909 | Fremont General Corp. | 5,245 | ||||||||

| 601 | GATX Corp. | 27,261 | ||||||||

| 124 | Great Lakes Bancorp Inc.* | 1,529 | ||||||||

| 751 | IndyMac Bancorp, Inc. | 16,522 | ||||||||

| 456 | Mastercard Inc. Class A* | 73,325 | ||||||||

| 477 | Ocwen Financial Corp.* | 5,171 | ||||||||

| 700 | PHH Corp. | 20,398 | ||||||||

| 792 | Rent-A-Center, Inc.* | 15,373 | ||||||||

| 671 | Ryder System, Inc. | 36,482 | ||||||||

| 3,991 | SLM Corp. | 196,237 | ||||||||

| 71 | Student Loan Corp. (The) | 13,205 | ||||||||

| 897 | United Rentals, Inc.* | 28,830 | ||||||||

| 2,246,559 | ||||||||||

| Financial Conglomerates (3.1%) | ||||||||||

| 10,672 | American Express Co. | 624,739 | ||||||||

| 48,047 | Citigroup, Inc. | 2,237,549 | ||||||||

| 1,678 | Conseco Inc.* | 30,523 | ||||||||

| 33,581 | JPMorgan Chase & Co. | 1,477,900 | ||||||||

| 1,789 | Leucadia National Corp.* | 67,266 | ||||||||

| 468 | National Financial Partners Corp. | 21,696 | ||||||||

| 2,688 | Principal Financial Group, Inc. | 151,576 | ||||||||

| 4,775 | Prudential Financial, Inc. | 423,208 | ||||||||

| 25 | Wesco Financial Corp. | 9,911 | ||||||||

| 5,044,368 | ||||||||||

| Financial Publishing/Services (0.4%) | ||||||||||

| 365 | Advent Software, Inc.* | $ | 13,881 | |||||||

| 662 | Dun & Bradstreet Corp.* | 64,717 | ||||||||

| 1,343 | Equifax, Inc. | 54,338 | ||||||||

| 553 | FactSet Research Systems Inc. | 36,492 | ||||||||

| 632 | Interactive Data Corp.* | 17,285 | ||||||||

| 3,457 | McGraw-Hill Companies, Inc. (The) | 209,149 | ||||||||

| 2,364 | Moody’s Corp. | 127,183 | ||||||||

| 1,578 | SEI Investments Co. | 43,016 | ||||||||

| 21 | Value Line, Inc. | 1,144 | ||||||||

| 567,205 | ||||||||||

| Food Distributors (0.1%) | ||||||||||

| 583 | Performance Food Group Co.* | 16,709 | ||||||||

| 5,994 | SYSCO Corp. | 191,089 | ||||||||

| 539 | United Natural Foods, Inc.* | 14,677 | ||||||||

| 222,475 | ||||||||||

| Food Retail (0.3%) | ||||||||||

| 721 | Casey’s General Stores, Inc. | 17,975 | ||||||||

| 6,556 | Kroger Co. (The) | 170,194 | ||||||||

| 624 | Ruddick Corp. | 17,347 | ||||||||

| 4,314 | Safeway Inc. | 137,487 | ||||||||

| 2,065 | SUPERVALU, Inc. | 86,049 | ||||||||

| 137 | Weis Markets, Inc. | 5,384 | ||||||||

| 1,330 | Whole Foods Market, Inc. | 49,263 | ||||||||

| 584 | Wild Oats Markets, Inc.* | 9,402 | ||||||||

| 493,101 | ||||||||||

| Food: Major Diversified (0.8%) | ||||||||||

| 2,442 | Campbell Soup Co. | 89,939 | ||||||||

| 5,014 | ConAgra Foods Inc. | 127,105 | ||||||||

| 2,659 | Del Monte Foods Co.* | 30,844 | ||||||||

| 3,434 | General Mills, Inc. | 190,999 | ||||||||

| 3,080 | Heinz (H.J.) Co. | 134,781 | ||||||||

| 2,403 | Kellogg Co. | 124,499 | ||||||||

| 16,457 | Kraft Foods Inc. (Class A) | 538,967 | ||||||||

| 7,346 | Sara Lee Corp. | 116,434 | ||||||||

| 525 | TreeHouse Foods, Inc.* | 11,765 | ||||||||

| 1,365,333 | ||||||||||

| Food: Meat/Fish/Dairy (0.1%) | ||||||||||

| 1,336 | Dean Foods Co. | 38,437 | ||||||||

| 830 | Hormel Foods Corp. | 28,569 | ||||||||

See Notes to Financial Statements

21

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| 537 | Pilgrim’s Pride Corp. (Class B) | $ | 18,086 | |||||||

| 379 | Sanderson Farms, Inc. | 15,111 | ||||||||

| 1,111 | Smithfield Foods, Inc.* | 34,508 | ||||||||

| 2,527 | Tyson Foods, Inc. (Class A) | 53,825 | ||||||||

| 188,536 | ||||||||||

| Food: Specialty/Candy (0.3%) | ||||||||||

| 340 | American Italian Pasta Co. (Class A) | 2,771 | ||||||||

| 729 | Chiquita Brands International, Inc. | 12,801 | ||||||||

| 104 | Farmer Brothers Co. | 2,150 | ||||||||

| 1,160 | Flowers Foods Inc. | 23,780 | ||||||||

| 448 | Fresh Del Monte Produce, Inc. (Cayman Islands) | 11,491 | ||||||||

| 490 | Hain Celestial Group, Inc.* | 13,274 | ||||||||

| 1,612 | Hershey Co. (The) | 74,313 | ||||||||

| 454 | Lancaster Colony Corp. | 17,579 | ||||||||

| 567 | Lance, Inc. | 14,283 | ||||||||

| 1,236 | McCormick & Co., Inc. (Non-Voting) | 42,222 | ||||||||

| 880 | NBTY, Inc.* | 38,315 | ||||||||

| 355 | Ralcorp Holdings, Inc.* | 18,446 | ||||||||

| 683 | Smucker (J.M.) Co. | 38,118 | ||||||||

| 455 | Tootsie Roll Industries, Inc. | 11,389 | ||||||||

| 795 | Topps Co., Inc. (The) | 7,632 | ||||||||

| 2,257 | Wrigley (Wm.) Jr. Co. | 130,184 | ||||||||

| 458,748 | ||||||||||

| Forest Products (0.1%) | ||||||||||

| 1,351 | Louisiana-Pacific Corp. | 25,021 | ||||||||

| 346 | Universal Forest Products, Inc. | 13,688 | ||||||||

| 2,385 | Weyerhaeuser Co. | 169,907 | ||||||||

| 208,616 | ||||||||||

| Gas Distributors (0.7%) | ||||||||||

| 923 | AGL Resources, Inc. | 34,797 | ||||||||

| 1,109 | Atmos Energy Corp. | 31,130 | ||||||||

| 4,342 | Dynegy, Inc. (Class A)* | 38,687 | ||||||||

| 770 | Energen Corp. | 40,741 | ||||||||

| 500 | Energy Transfer Partners LP | 27,900 | ||||||||

| 1,183 | Equitable Resources, Inc. | 55,731 | ||||||||

| 1,728 | KeySpan Corp. | 71,798 | ||||||||

| 372 | Laclede Group, Inc. (The) | 10,993 | ||||||||

| 1,852 | MDU Resources Group, Inc. | 50,486 | ||||||||

| 871 | National Fuel Gas Co. | $ | 37,758 | |||||||

| 336 | New Jersey Resources Corp. | 15,792 | ||||||||

| 632 | Nicor Inc. | 24,907 | ||||||||

| 2,746 | NiSource, Inc. | 52,366 | ||||||||

| 502 | Northwest Natural Gas Co. | 20,918 | ||||||||

| 1,061 | ONEOK, Inc. | 53,846 | ||||||||

| 983 | Piedmont Natural Gas Co., Inc. | 22,796 | ||||||||

| 1,732 | Questar Corp. | 89,181 | ||||||||

| 2,229 | Sempra Energy | 117,513 | ||||||||

| 490 | South Jersey Industries, Inc. | 16,057 | ||||||||

| 1,325 | Southern Union Co.* | 40,916 | ||||||||

| 642 | Southwest Gas Corp. | 19,953 | ||||||||

| 5,820 | Spectra Energy Corp. | 148,235 | ||||||||

| 1,303 | UGI Corp. | 33,630 | ||||||||

| 1,063 | Vectren Corp. | 26,543 | ||||||||

| 698 | WGL Holdings Inc. | 20,898 | ||||||||

| 1,103,572 | ||||||||||

| Home Building (0.2%) | ||||||||||

| 573 | Beazer Homes USA Inc. | 8,016 | ||||||||

| 219 | Brookfield Homes Corp. | 4,643 | ||||||||

| 132 | Cavco Industries, Inc.* | 4,574 | ||||||||

| 1,145 | Centex Corp. | 42,720 | ||||||||

| 1,069 | Champion Enterprises, Inc.* | 12,529 | ||||||||

| 2,777 | D.R. Horton, Inc. | 45,321 | ||||||||

| 502 | Hovnanian Enterprises, Inc.* | 6,646 | ||||||||

| 881 | KB Home | 28,025 | ||||||||

| 1,368 | Lennar Corp. (Class A) | 41,943 | ||||||||

| 291 | Levitt Corp. (Class A) | 2,375 | ||||||||

| 472 | M.D.C. Holdings, Inc. | 21,712 | ||||||||

| 188 | M/I Homes, Inc. | 4,615 | ||||||||

| 360 | Meritage Homes Corp.* | 7,020 | ||||||||

| 70 | NVR, Inc.* | 40,494 | ||||||||

| 446 | Palm Harbor Homes, Inc.* | 6,092 | ||||||||

| 2,197 | Pulte Homes, Inc. | 42,490 | ||||||||

| 694 | Ryland Group, Inc. (The) | 23,076 | ||||||||

| 924 | Standard Pacific Corp. | 13,684 | ||||||||

| 1,374 | Toll Brothers, Inc.* | 30,132 | ||||||||

| 261 | TOUSA, Inc. | 746 | ||||||||

| 632 | WCI Communities, Inc.* | 5,581 | ||||||||

| 392,434 | ||||||||||

| Home Furnishings (0.2%) | ||||||||||

| 383 | Ethan Allen Interiors, Inc. | 13,083 | ||||||||

| 766 | Furniture Brands International, Inc. | 8,441 | ||||||||

See Notes to Financial Statements

22

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| 639 | Jarden Corp.* | $ | 23,087 | |||||||

| 814 | La-Z-Boy, Inc. | 8,148 | ||||||||

| 2,038 | Leggett & Platt, Inc. | 42,248 | ||||||||

| 265 | Libbey, Inc. | 5,287 | ||||||||

| 587 | Mohawk Industries, Inc.* | 52,836 | ||||||||

| 2,801 | Newell Rubbermaid, Inc. | 74,086 | ||||||||

| 919 | Select Comfort Corp.* | 14,649 | ||||||||

| 241,865 | ||||||||||

| Home Improvement Chains (0.8%) | ||||||||||

| 1,419 | Fastenal Co. | 63,954 | ||||||||

| 19,977 | Home Depot, Inc. (The) | 742,545 | ||||||||

| 14,847 | Lowe’s Companies, Inc. | 415,864 | ||||||||

| 1,096 | Sherwin-Williams Co. | 76,380 | ||||||||

| 1,298,743 | ||||||||||

| Hospital/Nursing Management (0.2%) | ||||||||||

| 475 | Amsurg Corp.* | 11,941 | ||||||||

| 1,019 | Community Health Systems Inc.* | 39,639 | ||||||||

| 2,532 | Health Management Associates, Inc. (Class A) | 20,408 | ||||||||

| 438 | Kindred Healthcare, Inc.* | 11,730 | ||||||||

| 701 | LifePoint Hospitals, Inc.* | 20,715 | ||||||||

| 824 | Manor Care, Inc. | 52,200 | ||||||||

| 600 | Psychiatric Solutions, Inc. | 20,454 | ||||||||

| 682 | Sunrise Senior Living, Inc.* | 27,116 | ||||||||

| 5,324 | Tenet Healthcare Corp.* | 27,578 | ||||||||

| 602 | Universal Health Services, Inc. (Class B) | 31,569 | ||||||||

| 263,350 | ||||||||||

| Hotels/Resorts/Cruiselines (0.5%) | ||||||||||

| 4,131 | Carnival Corp† (Panama) (Units) | 183,045 | ||||||||

| 511 | Choice Hotels International, Inc. | 18,488 | ||||||||

| 567 | Gaylord Entertainment Co.* | 28,339 | ||||||||

| 3,493 | Hilton Hotels Corp. | 154,426 | ||||||||

| 576 | Marcus Corp. (The) | 11,336 | ||||||||

| 3,492 | Marriott International, Inc. (Class A) | 145,093 | ||||||||

| 1,975 | Royal Caribbean Cruises Ltd. (Liberia) | 76,097 | ||||||||

| 2,094 | Starwood Hotels & Resorts Worldwide, Inc. | 131,838 | ||||||||

| 542 | Vail Resorts, Inc.* | $ | 29,024 | |||||||

| 1,941 | Wyndham Worldwide Corp.* | 65,315 | ||||||||

| 843,001 | ||||||||||

| Household/Personal Care (1.9%) | ||||||||||

| 951 | Alberto-Culver Co. | 22,368 | ||||||||

| 4,353 | Avon Products, Inc. | 156,752 | ||||||||

| 833 | Church & Dwight Co., Inc. | 40,867 | ||||||||

| 1,474 | Clorox Co. (The) | 89,118 | ||||||||

| 5,006 | Colgate-Palmolive Co. | 330,396 | ||||||||

| 1,253 | Estee Lauder Companies, Inc. (The) (Class A) | 56,410 | ||||||||

| 948 | International Flavors & Fragrances, Inc. | 47,504 | ||||||||

| 4,457 | Kimberly-Clark Corp. | 299,822 | ||||||||

| 861 | Nu Skin Enterprises, Inc. (Class A) | 13,363 | ||||||||

| 523 | Playtex Products, Inc.* | 9,367 | ||||||||

| 31,790 | Procter & Gamble Co. (The) | 1,966,529 | ||||||||

| 634 | Spectrum Brands, Inc.* | 2,783 | ||||||||

| 3,035,279 | ||||||||||

| Industrial Conglomerates (3.9%) | ||||||||||

| 6,691 | 3M Co. | 594,964 | ||||||||

| 2,297 | Danaher Corp. | 171,540 | ||||||||

| 100,498 | General Electric Co.** | 3,895,302 | ||||||||

| 7,319 | Honeywell International, Inc. | 420,916 | ||||||||

| 3,193 | Ingersoll-Rand Co. Ltd. (Class A) (Bermuda) | 160,672 | ||||||||

| 1,835 | ITT Corp. | 115,385 | ||||||||

| 641 | SPX Corp. | 60,171 | ||||||||

| 1,044 | Textron, Inc. | 117,857 | ||||||||

| 4,890 | Tyco International Ltd. (Bermuda) | 231,248 | ||||||||

| 9,012 | United Technologies Corp. | 657,606 | ||||||||

| 489 | Walter Industries, Inc. | 12,225 | ||||||||

| 6,437,886 | ||||||||||

| Industrial Machinery (0.5%) | ||||||||||

| 358 | Actuant Corp. (Class A) | 21,831 | ||||||||

| 652 | Flowserve Corp.* | 47,120 | ||||||||

| 719 | FuelCell Energy, Inc.* | 5,292 | ||||||||

| 767 | Graco Inc. | 31,478 | ||||||||

| 952 | IDEX Corp. | 34,472 | ||||||||

| 4,710 | Illinois Tool Works Inc. | 259,285 | ||||||||

| 534 | Kennametal Inc. | 40,936 | ||||||||

See Notes to Financial Statements

23

Morgan Stanley Total Market Index Fund

Portfolio of Investments  July 31, 2007 continued

July 31, 2007 continued

| NUMBER OF SHARES | VALUE | |||||||||

| 518 | Lincoln Electric Holdings, Inc. | $ | 37,291 | |||||||

| 758 | Mueller Water Products, Inc. (Class B Shares) | 10,006 | ||||||||

| 467 | Nordson Corp. | 21,370 | ||||||||

| 1,141 | Parker Hannifin Corp. | 112,594 | ||||||||

| 489 | Regal-Beloit Corp. | 24,802 | ||||||||

| 931 | Roper Industries, Inc. | 55,841 | ||||||||