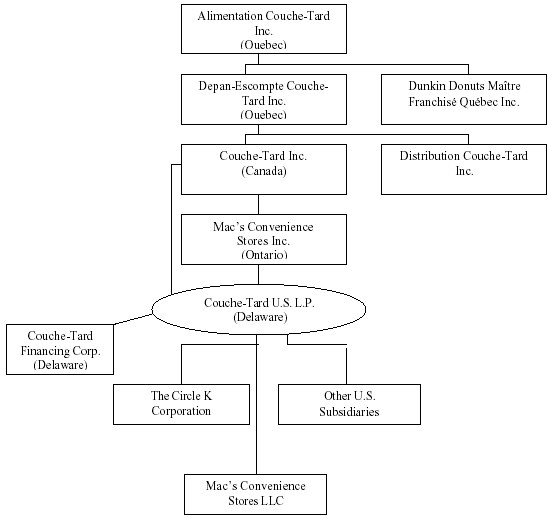

The following chart illustrates the corporate organization of the Company and its principal subsidiaries, all of which are 100% owned.

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

We are the leader in the Canadian convenience store industry. We are the fourth largest convenience store operator in North America and the second largest independent (not integrated with a petroleum company) convenience store operator in North America. As at April 25, 2004, our network consisted of 4,881 convenience stores, 3,079 of which include motor fuel dispensing, located in eight large geographic markets, including three in Canada and five in the United States, which cover 23 American states.

We sell food and beverage items, motor fuel and other products and services targeted to meet our customers’ demand for convenience and quality in a clean and welcoming environment. We believe that our business model has differentiated Couche-Tard from its competition through its decentralized management structure, commitment to operational expertise, focus on in-store merchandise, particularly the higher growth and higher margin foodservice category, and continued investment in store modernization and technology.

The convenience store industry is fragmented, with the top 10 operators representing only approximately 24% of the estimated total of 132,400 stores in the United States. Industry consolidation by highly leveraged operators in the 1990’s, combined with competition and fluctuations in motor fuel margins, has led to numerous corporate restructurings and rationalizations in recent years. As a result, we believe the opportunity exists for well-capitalized, established industry participants to grow through mergers and acquisitions.

History

Alain Bouchard, the Chairman, President and Chief Executive Officer of Alimentation Couche-Tard Inc., started the chain with one store in 1980. In 1986, with a network of 34 stores, a predecessor of Couche-Tard completed an initial public offering and listed its shares on the Montreal Exchange. In 1994, the predecessor company was privatized by its majority shareholder, Actidev Inc., a publicly held company. Later that year, Actidev Inc. changed its corporate name to “Alimentation Couche-Tard Inc.”

After establishing a leading position in Quebec, Couche-Tard expanded through internal growth and acquisitions in Ontario and Western Canada in 1997, followed by several acquisitions in the United States beginning in 2001. In May 1997, Couche-Tard acquired 245Provi-Soir stores in Quebec and 50Wink’s stores in Ontario and Western Canada from Provigo Inc. In April 1999, Couche-Tard acquired 980 stores in Ontario and Western Canada operating under theMac’s,Mike’s Mart andBecker’s banners through the acquisition of Silcorp Limited, a publicly-held company.

Fiscal 2002 - 2004 Highlights

Fiscal 2002:

In June 2001, Couche-Tard acquired the assets of Johnson Oil Company, Inc. (“Johnson Oil”) in Indiana, Illinois and Kentucky for a total cost of $119.3 million. The acquired network from Johnson Oil included 172 corporate stores, 35 dealer locations and 18 commission retailer sites under theBigfoot banner, all with gasoline sales. This acquisition generated $562 million in sales in fiscal 2002.

In July 2001, the Multiple Voting Shares and the Subordinate Voting Shares of the Company were split on a two-for-one basis.

In August 2001, the Company acquired all of the shares of R-Con Centres Inc., the holder ofMac’s master franchise for Manitoba, where that banner encompasses 31 stores including eight with gasoline dispensing.

In December 2001, the Company completed a public offering of 4,000,000 Subordinate Voting Shares at a price of $25.40 per Subordinate Voting Share, for net proceeds to the Company of $97,536,000 (before deducting the expenses of the issue).

6

Also in December 2001, the Company acquired from BP Amoco Oil Company, a six-store convenience chain based in Lafayette, Indiana.

In February 2002, the building of Couche-Tard’s $13.5 million Laval distribution centre was completed. Such distribution centre provides integrated, high quality services to the Quebec network.

In April 2002, the Company acquired a network of 12 stores from Bruce Miller Oil Company (10 locations were owned by Bruce Miller Oil Company and two are affiliated stores) located in South-eastern Indiana and the Cincinnati Metro Area in Ohio.

Fiscal 2003:

In July 2002, the Company acquired from Handy Andy Food Stores, Inc. its network of 16 convenience stores in the Indianapolis area (Indiana), 15 of which stores sell gasoline under theMarathon andCitgo brands.

Also in July 2002, the Multiple Voting Shares and the Subordinate Voting Shares of the Company were split on a two-for-one basis.

In August 2002, the Company acquired the assets of Dairy Mart Convenience Stores, Inc. (Hudson, Ohio) (“Dairy Mart”), a leading regional convenience retailing chain with stores located in Ohio, Kentucky, Pennsylvania, Michigan and Indiana. Through Mac’s Convenience Stores Inc. (“Mac’s US”), Couche-Tard became the owner of 287 Dairy Mart stores, for a total cost of US$79.5 million. This transaction included a one-year management contract (the “Management Contract”) for the network’s remaining 153 stores, some of which could be acquired by Mac’s US during the next few months, while others could be closed or sold on behalf of Dairy Mart.

In December 2002, the Company acquired the Tabatout network which accounts for 30 points of sale in Québec and is part of the non-traditional store market.

In March 2003, the Company acquired 92 Dairy Mart stores which had been subject to the Management Contract since the acquisition of Dairy Mart in August 2002. This transaction had the effect of terminating the Management Contract.

Fiscal 2004:

In August 2003, the Company and Allied Domecq Quick Service Restaurants entered into an agreement whereby the Company acquired the master franchisee rights for theDunkin’ Donuts banner in Québec. Thus, the 94 Dunkin’ Donuts stores already established in Québec became franchisees of the Company which is now responsible for the implementation of all aspects of the Dunkin’ Donuts system in Québec.

On September 4, 2003, Couche-Tard acquired certain assets of Clark Retail Enterprises, Inc. for total cash consideration of $41.0 million. In this transaction, Couche-Tard acquired 43 convenience stores, 33 of which are located in Illinois, with the remainder in Indiana, Iowa, Michigan and Ohio. All of the stores sell motor fuel. Couche-Tard acquired the buildings and land at 31 of these sites, with the remaining 12 being leased. On October 30, 2003, Couche-Tard completed a sale-leaseback transaction with respect to 19 of the Clark stores and received proceeds of approximately US$15 million.

On December 17, 2003, Couche-Tard acquired The Circle K Corporation (“Circle K”) from ConocoPhillips for a net cash purchase price of US$803.9 million, subject to post-closing adjustments. The Acquisition was financed through the proceeds from the issuance of US$350 million 7 1/2% Senior Subordinated Notes due 2013, borrowings under our senior credit facility and net proceeds of $220.5 million from the issuance of Class B subordinate voting shares. (See “Material Contracts.”)

In connection with the Acquisition:

| • | Couche-Tard acquired all the outstanding capital stock of Circle K; |

7

| • | we entered into a five-year motor fuel supply agreement with ConocoPhillips; |

| | |

| • | we entered into several other related agreements with ConocoPhillips, including several trademark licensing agreements and a reseller agreement; |

| | |

| • | we entered into an environmental liabilities agreement with ConocoPhillips; and |

| | |

| • | we agreed to undertake certain capital improvements at the Circle K stores in connection with the proposed settlement of litigation brought against Circle K under the Americans with Disabilities Act. |

As at April 25, 2004 the Company had achieved excellent progress in the Circle K integration plan with some US$10 million in synergies achieved within the first 130 days, by implementing Couche-Tard’s decentralized business model at Circle K and renegotiating several merchandise supply agreements.

In March and April 2004, the Company entered into sale-leaseback agreements for 322 Circle K properties acquired on December 17, 2003. The net proceeds from this transaction of US$252.9 million were used to reimburse part of the long-term debt borrowed in connection with the Acquisition.

BUSINESS

Business Strengths

Leading Market Position. We have a network of more than 4,800 convenience stores which makes us the second largest independent operator and the fourth largest overall operator of convenience stores in North America, including independent chains and chains operated by integrated oil companies. We believe our well-recognized banners, includingCouche-Tard,Circle K and Mac’s, have an established reputation for convenience and excellence in product selection and value that helps to differentiate our stores from those of our competitors. We believe that the geographic diversity of our network throughout the United States and Canada reduces our exposure to adverse local and/or regional market conditions, including fluctuations in motor fuel prices. With more than $9 billion in revenues in fiscal 2004 and over 20 years of convenience store operations, we believe our size and experience have enabled us to develop operating efficiencies that provide us with a competitive advantage, particularly with respect to merchandising and purchasing.

Well-Located and Modernized Store Base. We believe that we have high-quality stores in strategic locations. We believe that focusing on developing networks of stores in the geographic areas in which we operate enables us to study those markets and refine our location strategy. We selectively choose our store sites to maximize our store traffic and visibility and we effectively manage the closure of under-performing stores. Due to current land prices and the unavailability of suitable properties in our primary markets, we believe it would be difficult for our competitors and new entrants to replicate our store base.

We have made substantial investments in our Couche-Tard stores through our Store 2000 Concept. Couche-Tard has implemented the Store 2000 Concept in over 1,000 of its company-operated stores, which represent approximately 29% of such stores. Currently, all of Couche-Tard’s company-operated stores (excluding Circle K) use scanning technology, which is significantly higher than the industry average of approximately 76% of convenience stores. We intend to complete the installation of such technology at all Circle K company-operated stores over the next 24 months.

Differentiated Business Model. We believe that our business model has positively differentiated Couche-Tard from its competitors. The principal elements of this business model are as follows:

| | Decentralized Management Structure. We believe that our culture is entrepreneurial and that Couche-Tard’s management structure is one of our most important business strengths. Couche-Tard manages its operations and workforce in a decentralized manner in order to expedite decision making, to address local demand for specific products and services, and to minimize corporate overhead costs. Each store is operated as a distinct business unit and store managers are responsible for meeting financial and operational |

8

| | targets. We support our store managers with a strong, experienced management team and capital resources, which we believe provide our managers with a significant competitive advantage compared to smaller operators. In addition, we implement a rigorous performance measurement or “benchmarking” process to ensure that best practices are deployed across our network and to allow us to provide timely and effective feedback to our managers at all levels. |

| | |

| | Commitment to Operational Expertise. We have developed substantial operational expertise that enables us to efficiently match our product assortment with our customers’ preferences. We employ this expertise throughout our product delivery chain, from the selection of store locations to the development of store designs, the supply and distribution of products, the merchandising and marketing, and ultimately to the sale of products to our customers. This delivery chain is supported by our experienced and well-trained store and management personnel who are focused on optimizing store performance and maximizing our customers’ satisfaction. In addition, each stage of our operations is supported by the use of technology that enables us to perform an in-depth analysis of our inventory purchases and sales. We use this information to continue to refine our purchasing operations and to work with our suppliers to tailor our merchandising and customize our shelf space to increase sales volume. As a result, we believe we are able to secure more favourable purchasing terms from our suppliers. |

| | |

| | Focus on In-store Merchandise. We have been able to focus on growing and developing our in-store merchandise sales, which generate higher margins than motor fuel sales because, unlike many of our competitors, a major oil company does not own us. In particular, Couche-Tard has focused on growing its higher margin foodservice business, including its Quick Service Restaurants (“QSRs”), to further improve profit margins and differentiate its stores from those of its competitors. |

Experienced and Incentivized Management Team with a Proven Track Record. Our senior executive management team has worked together for more than 20 years and has developed extensive expertise in operating convenience stores. As of April 25, 2004, our senior executive management team collectively owned approximately 20% of Alimentation Couche-Tard Inc.’s stock and controlled approximately 54% of the voting rights of all outstanding shares. Furthermore, our nine operational vice-presidents have an average of approximately 17 years of industry experience. Many of our management personnel at all levels have progressed into management positions after working with us for many years at different levels of the organization, while others have joined us in connection with acquisitions and have brought us additional expertise. Since 1997, Couche-Tard has completed many acquisitions, and management’s ability to integrate stores into our existing network has been an important factor in our success. In addition, our management has transitioned Couche-Tard from a local Quebec company to a leading convenience store operator in Canada and the United States.

Business Strategy

We plan to continue growing our business and improving our financial performance by implementing our business strategy, the key elements of which include:

Drive Internal Sales Growth and Profitability. We use our branding strategy, innovative store concepts and foodservice offerings to enhance customer loyalty and return shopping, and to grow same-store sales by promoting the consumption of high-margin products and tailoring our product and service offerings to meet local tastes.

| | In-Store Branding. We use in-store branding strategies, including proprietary and national brands, to differentiate our fresh food offerings from other convenience stores, build customer loyalty and promote return shopping. At the core of this offering is a quality assortment of freshly brewed coffee, frozen/iced beverages, fresh sandwiches and other fresh food items that are marketed under our proprietary brands. OurLa Maisonnee andHandful branded fresh sandwiches and breakfast selections, andSunshine Joe Coffee Co., Sloche, Froster, Thirst Buster andThe Frozen Zone brands of beverages are examples of successful proprietary branded items that we have added to our growing selection of fresh products. In addition, we continue to build on existing partnerships with recognized coffee franchises and national brand names such asVan Houtte, Millstone andSeattle’s Best. |

9

| | Store 2000 Concept. We plan to continue to use Couche-Tard’s successful Store 2000 Concept to grow same-store sales and drive purchases of higher margin products and services. We believe that the implementation of our Store 2000 Concept has favourably impacted the revenues and profit margins of reconfigured stores. We intend to introduce our Store 2000 Concept to the Circle K stores over the next few years. |

| | |

| | Quick Service Restaurants. Since 1998, Couche-Tard has implemented QSRs as a key element of its Store 2000 Concept. These QSRs are designed to increase customer traffic and profit margins by attracting customers through recognized brands and encouraging them to spend more time in the store. Couche-Tard operates these QSRs within |

| | |

| | the Couche-Tard stores as a franchisee and is responsible for their daily operations. We intend to continue to implement this strategy in our Couche-Tard stores and selectively introduce it to our Circle K stores. |

Invest in Store Modernization and Information Systems. We intend to continue investing in the modernization of our store base and the enhancement of our technology and information systems at all levels throughout our store network and in our distribution centre. We analyze our investment opportunities based on their potential growth, profitability and rate of return on capital. We believe that our access to both internal and external sources of capital allows us to make investments that provide us with a competitive advantage in a highly-fragmented industry.

We have made significant investments in technology because we believe that the information generated from such systems is critical to the operation of our business. By analyzing the data generated by our point-of-sale (“POS”) systems, we are better able to adjust our product and service mix to meet local demands, eliminate slow-moving inventory items, and optimize our purchasing activities.

Leverage Supplier Relationships. We seek to develop and maintain strong relationships with our merchandise and motor fuel suppliers. As the largest convenience store operator in Canada and fourth largest overall convenience store operator in North America, we represent an attractive distribution channel to suppliers due to our scale, broad geographic presence and our proven ability to grow merchandise and motor fuel sales. We use the inventory information from our POS systems to work with our suppliers to provide mutually agreeable merchandising and exclusivity arrangements, which we believe allows us to secure more favourable purchasing terms. Moreover, we believe the consolidation of Couche-Tard and Circle K will lead to additional volume purchasing benefits.

Selectively Expand our Store Network. We plan to continue to expand our store network through new store development and selective acquisitions. In particular, we intend to focus our resources on identifying “fill-in” opportunities comprised of individual stores or small chains within our existing markets that will complement our current operations. These “fill-in” acquisitions allow us to focus our management efforts on the regions in which we operate and to realize regional economies of scale. When we make an acquisition, we apply our business model to the acquired stores and typically integrate such stores into our operational and information systems.

Industry

The convenience store industry is undergoing significant structural changes, including increased competition from new market entrants such as drug stores, warehouse clubs, large supermarkets and other mass retailers (commonly known as hypermarkets) which have added convenience store staple products such as bread, milk and packaged beverages to their product mix. In addition, an increasing number of hypermarkets are selling motor fuel at low prices in an attempt to establish themselves as a one-stop shopping location and to increase customer trip frequency and traffic at their stores. See “ - Competition”.

In response to heightened competition in the industry, convenience stores are extending their range of traditional products and services to include calling cards, financial services, photo developing, QSRs and other products and services. In addition to being conveniently located and open for extended hours, convenience stores now cater to customers with busy schedules who expect to find a wide assortment of items in stock and to have many available payment options. Convenience stores are also catering to time-pressed consumers looking for “grab-and-go” items by offering fresh food and baked goods prepared on-site. As a result, those convenience store operators with superior

10

merchandising, distribution expertise and capital can overcome the challenges resulting from rising operating costs and increased customer demands.

Store Network

Couche-Tard is the largest Canadian convenience store operator with a network of 1,924convenience stores in Canada and has a significant presence in the United States with an additional 2,957 stores. Of the 4,881 Couche-Tard stores, 3,620 are company-operated and 1,261 are operated under our affiliate program. Motor fuel is sold at 64% of Couche-Tard’s company-operated stores.Couche-Tard’s Canadian stores are located in Quebec, Ontario, Alberta, British Columbia, Manitoba, Saskatchewan and the Northwest Territories, and its U.S. stores are located in 23 U.S. states, including Ohio, Indiana, Kentucky, Illinois, Michigan, Pennsylvania, Iowa, Arizona, Florida, California, Louisiana and Texas. The Couche-Tard stores are primarily operated under theCouche-Tard andMac’s banners in Canada and theMac’s andCircle K banners in the United States.

Couche-Tard’s stores, which are located in a variety of high-traffic areas, include freestanding stores and stores located in strip shopping centres. Couche-Tard’s stores in Canada and in the U.S. Midwest are designed to appeal to customers in their local markets, rather than conforming to a single standard format. The Circle K stores’ simple and consistent design makes them easily recognizable. The majority of the stores are open seven days a week, 24 hours a day, with peak customer traffic in the early morning and late afternoon. The size of the typical Couche-Tard store is between 2,000 and 2,500 square feet, while newly-developed stores are typically approximately 3,000 square feet, to accommodate in-store seating and, in certain cases, QSRs.

The following table sets out the number of Couche-Tard’s stores in operation by geographic location and type of store as of April 25, 2004.

Region | | Provinces/States | | Total

Number of

Stores | | Total

Company-

Operated

Stores | | Total

Affiliates | | Percentage

of Total

Stores | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | |

| Eastern Canada | | Quebec | | | | 844 | | | | | 569 | | | | | 275 | | | | | 17.2 | % | |

| Central Canada | | Ontario | | | | 793 | | | | | 614 | | | | | 179 | | | | | 16.2 | % | |

| Western Canada | | British Columbia, Alberta, Saskatchewan, Manitoba, Northwest Territories | | | | 287 | | | | | 283 | | | | | 4 | | | | | 6.1 | % | |

| U.S. Midwest | | Ohio, Indiana, Kentucky, Illinois, Michigan, Pennsylvania, Iowa | | | | 675 | | | | | 504 | | | | | 171 | | | | | 13.8 | % | |

| | | | |

|

| | | |

|

| | | |

|

| | | |

|

| | |

| U.S. West Coast | | Washington, Oregon, California | | | | 542 | | | | | 283 | | | | | 259 | | | | | 11.1 | % | |

| | | | |

|

| | | |

|

| | | |

|

| | | |

|

| | |

U.S. Arizona

Region | | Nevada, Arizona, New Mexico, Western Texas | | | | 554 | | | | | 526 | | | | | 28 | | | | | 11.4 | % | |

| | | | |

|

| | | |

|

| | | |

|

| | | |

|

| | |

| U.S. Southeast | | Tennessee, Northern Mississippi, Georgia, North Carolina, South Carolina | | | | 345 | | | | | 279 | | | | | 66 | | | | | 7.0 | % | |

| | | | |

|

| | | |

|

| | | |

|

| | | |

|

| | |

U.S. Florida and

Gulf Coast | | Florida, Alabama, Arkansas, Louisiana, Southern Mississippi, Eastern Texas | | | | 839 | | | | | 562 | | | | | 277 | | | | | 17.2 | % | |

| | | | |

|

| | | |

|

| | | |

|

| | | |

|

| | |

| Total | | | | | | 4,881 | | | | | 3,620 | | | | | 1,261 | | | | | 100 | % | |

| | | | |

|

| | | |

|

| | | |

|

| | | |

|

| | |

Couche-Tard conducts its convenience store business through two main types of arrangements, as set out below.

Company-Operated Stores. Couche-Tard has 3,620 company-operated stores in its network, 2,810 of which are employee-operated and 810 of which are dealer-operated. All of the stores in Quebec and the United States are employee-operated. For employee-operated stores, Couche-Tard is responsible for store operations, owns the equipment, systems and inventory and employs salaried and part-time staff. For dealer-operated stores, Couche-Tard owns the equipment, inventory and systems and the independent store operator employs the staff, agrees to operate according to Couche-Tard’s standards and is paid a commission based primarily on store revenues to manage the store. The dealer-operator is also fully responsible for losses related to any inventory shrinkage.

Affiliated Store Program. Couche-Tard’s affiliated store program includes franchise arrangements, license arrangements and arrangements under which the Midwest sells motor fuel to certain independent store operators (motor fuel dealers).

11

| a) | Franchised Stores. Couche-Tard has 291 franchised stores in Canada and the United States. Franchised stores are operated by independent store operators who have entered into a franchise agreement, which typically provides for an upfront franchise fee and/or royalties based primarily on sales to be paid to Couche-Tard. These stores operate under one of Couche-Tard’s banners. The franchisee is responsible for managing the store, hiring and managing the staff and maintaining inventory through supply agreements with authorized suppliers. In most cases, Couche-Tard either leases or subleases the real estate to the franchisee and, in many locations; Couche-Tard owns the in-store equipment and motor fuel equipment. |

| | |

| b) | Licensed Stores. Couche-Tard has 876 stores operated under license agreements in Canada and the United States that are owned and operated by independent store operators. The licensee typically owns or leases the real property from third parties and owns all other assets related to the business. The licensee enters into a license agreement with Couche-Tard to use one of Couche-Tard’s proprietary banners and agrees to buy merchandise from certain suppliers in order to benefit from certain vendor rebates based on Couche-Tard’s purchasing volume. Couche-Tard’s revenues from licensed stores includes license fees and a portion of the vendor rebates related to the licensee’s purchases that are paid to Couche-Tard. |

| | |

| c) | Motor Fuel Dealers. Couche-Tard’s Midwest Division has agreements to sell motor fuel directly to 94 independent operators at cost plus a mark-up. |

Internationally, Couche-Tard through Circle K has license agreements for the operation and development of stores in Japan, Hong Kong, China, Indonesia, Mexico and Taiwan. The terms of these agreements vary, as do the royalty rates which are generally below 1% of merchandise sales.

Merchandise Operations

Couche-Tard offers its customers more than 2,500 product stock keeping units (“SKUs”) that include traditional convenience store items such as packaged and frozen beverages, candy and snacks, coffee, dairy items, beer/wine and tobacco products, as well as products not traditionally offered by convenience stores such as fresh food and foodservice items. In addition, services such as automatic teller machines and lottery ticket sales are featured in many stores. Couche-Tard is continually looking for new product ideas, such as cell phones, prepaid phone cards and home office supplies, to offer to its customers to meet their convenience needs. Couche-Tard evaluates store product assortment on an ongoing basis to ensure that low turnover products are replaced by top selling items in order to maximize selling space and ensure that high demand items are available to the consumer.

Couche-Tard employs category management as a merchandising tool and assigns internal “category managers” for its top selling products in each region. These category managers are experts on the products within their responsibilities, and they use their in-depth knowledge of the product’s sales trends, regional preferences, popularity and producers in deciding which items to stock in a particular geographical region.

Based on merchandise purchase and sales information, Couche-Tard estimates category revenues as a percentage of total in-store merchandise sales for the last fiscal year as follows:

| Category | | Percentage of

Total | |

|

| |

| |

| | | | | | | |

| Tobacco Products | | | | 37.4 | | |

| Grocery | | | | 24.8 | | |

| Beer/Wine/Liquor | | | | 15.7 | | |

| Candy/Snacks | | | | 9.7 | | |

| Food Service | | | | 8.6 | | |

| Dairy Products | | | | 3.8 | | |

| | | |

|

| | |

| Total In-Store Merchandise Sales | | | | 100.0 | % | |

| | | |

|

| | |

12

In order to grow its merchandise sales and increase profits, Couche-Tard focuses primarily on developing its banners and brands, growing and refining its Store 2000 Concept and expanding its QSR business.

Branding. Couche-Tard operates its stores under a variety of banners, includingCouche-Tard,Provi-Soir,Mac’s,Mike’s Mart,Becker’s andWink’s in Canada andBigfoot,Dairy Mart,Mac’s andHandy-Andy in the U.S. Midwest. Circle K stores operate under theCircle K banner. In-store brands includeCircle K, Circle K Express, Grocery Express, Grabbers, The Frozen Zone, Circle K Strike Out Meter, Thirst Buster, Thirst Buster Nothing’s Cooler, Thirst Freezer, Thirst Freezer Dangerously Cold, Freshest Coffee Going!and Circle K Short Orders. Our main service brand isCirclek.com. Tag lines include “All you want today is at your Circle K”, “All you want today” and “Circle K, A Better Way”. The core banners for Couche-Tard are currentlyCouche-Tard,Mac’s and Circle K.

Couche-Tard’s brand strategy employs both proprietary and national brands for brewed coffee, frozen/iced beverages, fresh sandwiches and other fresh food items.La Maisonnee andHandful branded fresh sandwiches and breakfast selections andSunshine Joe Coffee Co. are examples of successful proprietary branded items that Couche-Tard has added to its growing selection of fresh products. Couche-Tard also continues to build on existing partnerships with recognized coffee franchises and brand names such asVan Houtte andSeattle’s Best Coffee names.

Store 2000 Concept. In 1998, Couche-Tard launched its Store 2000 Concept. The program has been implemented in over 1,000, or approximately 28%, of its company-operated stores. Under the Store 2000 Concept, the selection of products and services is designed to create an in-store perception of freshness to appeal to consumers and promote increased sales of higher-margin products. Each selected location is adapted to the needs of the socio-economic and cultural character of the community with the assistance of a multi-disciplinary team comprising marketing, merchandising, real estate service, interior design and operations specialists. A full-scale Store 2000 Concept implementation typically includes an expanded foodservice operation, and may include a QSR. Couche-Tard uses a scaled-down version of the concept in markets that cannot support a full-scale conversion. The cost of a full-scale Store 2000 Concept implementation is typically between $150,000 and $200,000, while a partial or scaled-down conversion may cost between $40,000 and $60,000. Management believes that there is an opportunity to increase gross margins through the expansion of this concept, particularly in certain of the Circle K stores.

Quick Service Restaurants. In order to differentiate its company-operated stores and to increase customer traffic and profit margins, Couche-Tard is focusing on the expansion of its foodservice program and has entered into franchise agreements with quick service restaurants includingSubway,Dunkin’ Donuts,M&M Meat Shops,Taco Bell, Mr. Hero, Noble Roman, A&W, Mr. Sub, Cafe Depot, Second Cup andQuiznos. These foodservice programs are a very important part of the Store 2000 Concept. Couche-Tard runs the branded foodservice operation as a franchisee and pays royalties, rather than renting out space to foodservice operators for a fixed dollar fee. While this approach prevents Couche-Tard from partnering with certain companies, it allows Couche-Tard to benefit from increased popularity of these products and Couche-Tard believes that this approach enables it to generate higher margin and returns, as well as to ensure quality of service.

Fuel Operations

Prior to Couche-Tard’s entry into the U.S. market, approximately 70% of total revenues were generated from merchandise and service revenues and 30% from motor fuel sales. The mix has been altered since the acquisition of Bigfoot, Dairy Mart and Circle K, as these companies had a greater reliance on motor fuel sales than Couche-Tard. In fiscal 2004, Couche-Tard’s motor fuel sales in Canada represented about 30% of its Canadian revenues compared to approximately 57% of revenues for its U.S. stores.

Generally, Couche-Tard’s company-operated stores sell both branded and unbranded motor fuel by purchasing the motor fuel and reselling it at a profit. In addition, Couche-Tard earns a commission for supplying unbranded motor fuel on a consignment basis to company-operated stores in respect of which it does not own the pumps or storage tanks. Couche-Tard also acts as agent in the sale of motor fuel to some of its franchise stores and receives a commission. At select locations in the United States only, Couche-Tard sells motor fuel to independent store operators for cost plus a mark-up. Except for sales made on a commission basis for which only the commission is recorded as motor fuel revenues, Couche-Tard includes the full value of such sales in its motor fuel revenues.

13

The wholesale price in Couche-Tard’s supply agreements with major oil companies is typically set by the oil company supplying the motor fuel. Generally, Couche-Tard obtains the fuel at a price referred to as the “rack to retail price” and sets the retail price.

Couche-Tard sells motor fuel either under its own brands, includingCouche-Tard andMac’s in Canada andBigfoot and Circle Kin the United States, or under the name of major oil companies such asEsso, Petro-Canada, Shell,Irving, Ultramar,BP Amoco,76 andPhillips 66, among others. In connection with the acquisition of Circle K, we entered into license agreements with ConocoPhillips which allow us to use theUnion 76, 76andUnion brand name at 849 sites and thePhillips 66, 66andPhillips brand name at 68 sites in the United States. Circle K has given notice to ConoccoPhillips of its plan to debrand the 76 and 66 locations in California and Arizona which commenced in June 2004.

Distribution and Suppliers

Merchandise Distribution and Supply Arrangements. Couche-Tard has established national and regional distribution and supply networks for its in-store merchandise in Canada and the United States. With the exception of Eastern Canada where Couche-Tard operates its own distribution centre, in-store merchandise is supplied to Couche-Tard stores either through distribution specialists or directly by manufacturers. Couche-Tard has arrangements with major tobacco manufacturers and other major suppliers such asFritoLay,Nestle,Coca-Cola andPepsi for direct distribution to its stores. Couche-Tard has also negotiated supply agreements with regional suppliers, to the extent required, to meet the needs of each market and to adapt its product mix to local consumer preferences.

In Central Canada, Couche-Tard uses Karrys Bros., Limited as a regional warehouse supplier to distribute the majority of its in-store merchandise on an exclusive basis to its company-operated stores and on a non-exclusive basis to affiliates. Couche-Tard also purchases products such as carbonated beverages and potato chips, which are not covered under the arrangement with Karrys, directly from manufacturers and producers. Similarly, Couche-Tard uses Core-Mark International Inc. as its exclusive supplier for the majority of its in-store merchandise to its Western Canada stores. Recently, Couche-Tard entered into an exclusive supply agreement with Eby-Brown Company to supply the majority of its in-store merchandise for all of its company-operated stores in the U.S. Midwest. To the extent required, the remainder of the products are purchased on a non-exclusive basis from regional manufacturers.

In Eastern Canada, Couche-Tard recently opened a distribution centre in Laval, Quebec through which most deliveries to Couche-Tard’s Quebec stores are channelled, with the remainder of supplies being delivered directly to the stores by the manufacturers. The distribution centre was established to allow Couche-Tard to provide integrated, high-quality services to the 739 Couche-Tard stores dispersed throughout the province. The distribution centre has enabled Couche-Tard to increase the frequency of its delivery of dairy products and fresh and frozen foods from once to at least twice a week.

Circle K has a distribution centre in Arizona which is managed by Core-Mark International Inc. pursuant to a contract for a fee. The distribution centre services approximately 500 Circle K stores. The distribution centre allows Circle K to utilize its buying power for warehouse-delivered items plus certain dairy, bakery, sandwich, ice cream and snack items through vendor consolidation with the Arizona distribution centre.

Two types of suppliers provide merchandise to Circle K stores. Direct store delivery suppliers generally supply items such as beer, soft drinks, snack items, newspapers, milk and bread directly to the stores, while warehouse suppliers provide cigarettes, fountain cups, groceries, health and beauty aids, and candy and snacks to the Circle K stores in all areas outside of Arizona. Circle K also uses Core-Mark as a warehouse supplier to distribute merchandise to the majority of its stores west of the Mississippi and to provide management services to the Circle K distribution centre located in Arizona. Circle K uses McLane Company, Inc. to distribute merchandise to the majority of its stores east of the Mississippi.

Core-Mark is a subsidiary of Fleming Companies Inc., which filed for Chapter 11 protection on April 1, 2003. To date, the bankruptcy has caused only minimal disruption in the services Core-Mark provides to Circle K. Nevertheless, Circle K management is monitoring the situation and has developed contingency plans to ensure an uninterrupted supply of merchandise to the stores. These plans are flexible and address the various scenarios that

14

could occur in markets served by Core-Mark. Core-Mark is expected to emerge from reorganization proceedings in the summer of 2004.

Motor Fuel Supply Arrangements. Couche-Tard purchases the motor fuel it sells under its brand name directly from oil refineries. It also purchases branded motor fuel from a number of major oil companies and sells such motor fuel under the oil company’s name. Typically, the motor fuel sold in Canada under Couche-Tard’s brand is supplied in accordance with motor fuel supply contracts. Generally, both of these types of contracts are entered into with major oil companies and are based on a scaling or commission per litre (or gallon) sold, both of which are directly correlated to the quantity of fuel sold.

Circle K has entered into a supply agreement with ConocoPhillips pursuant to which ConocoPhillips will provide, for at least the next five years, subject to cancellation at the option of Couche-Tard, a supply of gasoline and diesel for the stores covered by such supply agreement. In 2004, Circle K gave notice to terminate its supply arrangement with ConoccoPhillips for California and Arizona. Cancellation of the supply agreement for other areas is being considered in the future.

Properties

Of the 3,620 company-operated stores, 2,792 are leased and 828 are owned by Couche-Tard, while the remaining 1,259 stores are either leased or owned by affiliates and franchisees. Most of the owned properties are located in Quebec. Couche-Tard believes that none of the leases is individually material to it. Most of the leases are net leases requiring Couche-Tard to pay taxes, insurance and maintenance costs. Although the leases expire at various times, the leases for approximately 45% of these properties have terms, including renewal options, extending beyond the end of fiscal 2008. Of the leases that expire prior to the end of fiscal 2008, management anticipates that it will be able to negotiate acceptable extensions of the leases for those locations that it intends to continue operating. A number of our properties have been and will be subject to sale-leaseback transactions.

Couche-Tard leases its corporate headquarters in Laval, Quebec. Management believes that Couche-Tard’s headquarters are adequate for its present and foreseeable needs. In addition, Couche-Tard has three regional offices located in Scarborough, Ontario, Calgary, Alberta, Columbus, Indiana, Fort Mill, South Carolina, Tampa, Florida, Corona, California and Tempe, Arizona, all of which are leased. The distribution centre in Laval, Quebec is also leased. We lease a portion of Circle K’s corporate headquarters, in Tempe, Arizona, from ConocoPhillips. Pursuant to an Office Lease between ConocoPhillips and Circle K entered into at the time of closing of the Acquisition, Tosco Operating Company, Inc. leases to Circle K approximately 193,747 (currently 125,000) square feet of office space in a building located in Tempe, Arizona. Circle K has the right to reduce the area of the leased premises at any time upon 30 days’ prior notice. In June 2004, Circle K entered into a lease for 75,000 square feet of office space to house the Arizona Region and centralized administrative functions. The move is expected to be completed by October at which time the lease with ConoccoPhillips will be terminated.

Information Systems

Couche-Tard uses the information obtained from its POS systems to manage its product mix at the store level. The periodic reports generated from the data collected using POS scanners allows the store operators to identify slow-moving inventory, track customer preferences, optimize product assortment and effectively adapt the store to the needs of community. Couche-Tard uses POS technology, including scanning, in all of its company-operated stores except for Circle K stores where approximately 36% are equipped with POS technology, including scanning. Couche-Tard is also currently implementing new POS systems including the selective installation of touch screens in its Mac’s stores and pay-at-the-pump systems for motor fuel distribution at certain company-owned stores in all of its regions. This technology maximizes convenience for customers while allowing Couche-Tard to collect information on consumer habits to better implement its merchandising strategy. In fiscal 2003, Couche-Tard established a data warehouse for all of its Canadian divisions and is developing a wide area network, or WAN, which will allow it to implement a perpetual inventory and in-store assisted ordering system. The system, which is in use primarily in Quebec, is designed to optimize the store supply process.

15

Employees and Training

As of April 25, 2004, Couche-Tard had approximately 34,000 employees throughout its company-operated stores, administrative offices and distribution centre. Approximately 150 employees work in the head office in Laval, Quebec. All of Couche-Tard’s head office employees work on a full-time basis.

Couche-Tard is organized in eight operating units based on geography: Eastern Canada (Quebec), Central Canada (Ontario), Western Canada, the U.S. Midwest, the West Coast Region, the Arizona Region, the Southeast Region and the Florida and Gulf Coast Region, each managed by a Vice-President of Operations. Each Vice-President is typically responsible for up to 800 stores. Each store is operated as a separate business unit and store managers within each region are required to meet specific performance objectives. Store manager’s report to market managers who are typically responsible for eight to ten stores. Market manager’s report to regional directors who typically oversee 60 to 70 stores. Finally, regional directors are accountable to the regional vice-presidents. Couche-Tard’s decentralized structure allows most store-specific decisions to be made locally, rather than centrally, which expedites the decision-making process.

When Couche-Tard hires head office director-level employees who are new to the convenience store industry, those employees generally spend six to 12 weeks learning employee positions at the store level. Couche-Tard believes that this fosters a sense of ownership in the business and promotes entrepreneurial behaviour. Couche-Tard typically spends between 2% and 4% of total annual compensation in the network on the training of its employees.

Trade Names, Service Marks and Trademarks

Couche-Tard has registered or applied for registration of a variety of trade names, service marks and trademarks for use in its business, which Couche-Tard regards as having significant value and as being important factors in the marketing of the company and its convenience stores. Couche-Tard operates its corporate stores under a variety of banners, includingCouche-Tard,Provi-Soir,Mac’s,Mike’s Mart,Becker’s andWink’s in Canada and under theCircle K,Bigfoot,Dairy Mart,Mac’s andHandy Andy banners in the United States. The three core banners areCouche-Tard, Circle K andMac’s. Couche-Tard sells its proprietary branded food items such asLa Maisonnee andHandful fresh sandwiches and breakfast selections, as well asSloche andFroster brands of iced beverages. Circle K store brands includeCircle K,Circle K Express,Grocery Express,Grabbers,The Frozen Zone,Circle K Strike Out Meter,Thirst Buster,Thirst Buster Nothing’s Cooler,Thirst Freezer,Thirst Freezer Dangerously Cold,Freshest Coffee Going!,andCircle K Short Orders. Service brands include:QuickFlick andCirclek.com. Tag lines include “All you want today is at your Circle K”, “All you want today” and “Circle K, A Better Way”. Couche-Tard also sells motor fuel under its private labels, includingCouche-Tard,Mac’s,Bigfoot andDairy Mart. Couche-Tard is not dependent upon any single trademark or trade name, however, it considers its banners and brands to be important assets. Accordingly, Couche-Tard’s policy is to register or otherwise protect these intangible assets in all jurisdictions in which Couche-Tard operates. Couche-Tard has exclusive rights to use its trademarks, except in certain counties in Texas and Oklahoma where Circle K has granted SSP Partners, one of its franchisees, the exclusive right to use theCircle K brand.

COMPETITION

Our stores compete with a number of national, regional, local and independent retailers, including hypermarkets, grocery and supermarket chains, grocery wholesalers and buying clubs, other convenience store chains, oil company motor fuel/mini-convenience stores, food stores and fast food chains as well as variety, drug and candy stores. In terms of motor fuel sales, our stores compete with other food stores, service stations and, increasingly, supermarket chains and discount retailers. Each store’s ability to compete depends on its location, accessibility and customer service. The rapid growth in the numbers of convenience-type stores opened by oil companies and the entry of a large number of hypermarkets into the industry over the past several years has intensified competition. An increasing number of hypermarkets and other retail format such as supermarkets and drugstores have been expanding their product mix to include core convenience items and fill-in grocery. This channel blending is eroding the convenience stores’ traditional base of business, as exemplified by major drug store chains extending business hours to 24 hours a day, seven days a week and selling a product assortment similar to that of convenience stores.

16

ENVIRONMENTAL MATTERS

We are subject to various federal, state, provincial and local environmental laws and regulations, including, in the United States, the Resource Conservation and Recovery Act of 1976, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, the Superfund Amendments and Reauthorization Act of 1986 and the Clean Air Act, in each case as amended. The enforcement of these laws by regulatory agencies such as the U.S. Environmental Protection Agency (the “EPA”) and its state and provincial equivalents will continue to affect our operations by imposing increased operating and maintenance costs and capital expenditures required for compliance. In addition, certain procedures required by these laws can result in increased lead time and costs for new facilities. Violation of environmental statutes, regulations or orders could result in civil or criminal enforcement actions. We make financial expenditures in order to comply with regulations governing underground storage tanks adopted by federal, provincial, state and local regulatory agencies.

In particular, at the U.S. federal level, the Resource Conservation and Recovery Act of 1976, as amended, requires the EPA to establish a comprehensive regulatory program for the detection, prevention and cleanup of releases from leaking underground storage tanks. Regulations enacted by the EPA in 1988 established requirements for installing underground storage tank systems, upgrading underground storage tank systems, taking corrective action in response to releases, closing underground storage tank systems, keeping appropriate records, and maintaining evidence of financial responsibility for taking corrective action and compensating third parties for bodily injury and property damage resulting from releases. These regulations permit states to develop, administer and enforce their own regulatory programs, incorporating requirements which are at least as stringent as the federal standards.

Our Canadian operations are also subject to environmental regulation imposed by provincial, federal and municipal governments. This primarily relates to the motor fuel operations conducted at approximately 509 locations throughout Canada, including the remediation of such products which have spilled or leaked on or migrated from such locations and other locations used in our earlier operations and those of our predecessors. We believe that we are in material compliance with environmental laws in Canada, including such regulation, and do not anticipate that any increase in the future costs of maintaining compliance in Canada or of remediation of spills or leaks, including any capital expenditure required, will be material to us. We are currently dealing with a small number of claims by third parties or governmental agencies for remediation or damages caused by contamination alleged to be on or migrating from our current or historic operations. We do not anticipate any material expense from such claims. However, changes in applicable requirements and their enforcement or newly discovered conditions could cause us to incur material costs that could adversely affect our business and results of operations.

REGULATORY MATTERS

Many aspects of our operations are subject to regulation under federal, provincial, state and local laws. We describe below the most significant of the regulations that impact all aspects of our operations.

Safety. We are subject to comprehensive federal, provincial, state and local safety laws and regulations. These regulations address issues ranging from facility design, equipment specific requirements, training, hazardous materials, record retention, self-inspection, equipment maintenance and other worker safety issues including workplace violence. These regulatory requirements are fulfilled through a comprehensive Health, Environmental and Safety program. There are no known safety risks or liabilities that are material to our operations or financial position.

Sale of Alcoholic Beverages and Tobacco Products. In certain areas where our stores are located, provincial, state or local laws limit the sale of and/or the hours of operation for the sale of alcoholic beverages and the sale of alcoholic beverages and tobacco products to persons younger than a specified age. State and local regulatory agencies have the authority to approve, revoke, suspend or deny applications for and renewals of permits and licenses relating to the sale of alcoholic beverages, as well as issue fines to stores for the improper sale of alcoholic beverages or tobacco products. These agencies may also impose various restrictions and sanctions. In many states, retailers of alcoholic beverages have been held responsible for damages caused by intoxicated individuals who purchased alcoholic beverages from them. Retailers of alcoholic beverages may also be fined or have a store’s permit revoked for selling alcohol to a minor. While the potential exposure for damage claims, as a seller of

17

alcoholic beverages is substantial, we have adopted procedures intended to minimize such exposure. In addition, we maintain general liability insurance which may mitigate the effect of any liability.

Store Operations. Our stores are subject to regulation by federal agencies and to licensing and regulations by provincial, state and local health, sanitation, safety, fire and other departments relating to the development and operation of convenience stores, including regulations relating to zoning and building requirements and the preparation and sale of food. Difficulties in obtaining or failures to obtain the required licenses or approvals could delay or prevent the development of a new store in a particular area.

Our operations are also subject to federal, provincial and state laws governing such matters as wage rates, overtime, working conditions and citizenship requirements. At the federal level, there are proposals under consideration from time to time to increase minimum wage rates and to introduce a system of mandated health insurance, which could affect our results of operations.

RISK FACTORS

The “Business Risks” and “Other Risks” sections of our “Management’s Discussion and Analysis of Operating Results and Financial Position” on pages 50 to 54 of the Company’s 2004 Annual Report, is incorporated herein by reference, as supplemented from time to time in the “Business Risks” sections of our quarterly reports to shareholders.

DIVIDENDS

Since 1989, the Company has not declared any dividends. In addition, the Credit Agreement dated as of December 17, 2003 among Couche-Tard and the members of its lending syndicate restricts the payment of dividends, return of capital or other distributions to the shareholders of the Company, without the consent of the lenders, except, notably, for stock dividends in connection with stock subdivisions of the outstanding equity shares and normal course repurchases, in accordance with applicable rules. The Board of Directors believes that the Company has a strong potential for development and should invest large amounts to keep its network competitive. For this reason, over the near term, the Company plans to invest its liquidity in expansion and renovation projects.

CAPITAL STRUCTURE

The voting shares of the Company are its Class A Multiple Voting Shares (the “Multiple Voting Shares”) and its Class B Subordinate Voting Shares (the “Subordinate Voting Shares”). As at June 30, 2004, 28,520,561 Multiple Voting Shares and 72,109,356Subordinate Voting Shares of the Company were issued and outstanding. Each Multiple Voting Share carries 10 votes and each Subordinate Voting Share carries one vote with respect to all matters coming before the Meeting.

Conversion Rights

Each Multiple Voting Share is convertible at any time at the holder’s option into one fully paid and non-assessable Subordinate Voting Share. Upon the earliest to occur of: (i) the day upon which all of the Majority Holders (defined in the Articles of the Company as being Messrs. Alain Bouchard, Richard Fortin, Réal Plourde and Jacques D’Amours) will have reached the age of 65, or (ii) the day when the Majority Holders hold, directly or indirectly, collectively less than 50% of the voting rights attaching to all outstanding voting shares of the Company, each Subordinate Voting Share shall be automatically converted into one fully paid and non-assessable Multiple Voting Share.

Take-Over Bid Protection

In the event that an offer as defined in the Articles of the Company (an “Offer”) is made to holders of Multiple Voting Shares, each Subordinate Voting Share shall become convertible at the holder’s option into one Multiple Voting Share, for the sole purpose of allowing the holder to accept the Offer. The term “Offer” is defined in the Articles of the Company as an offer in respect of the Multiple Voting Shares which, if addressed to holders resident in Québec, would constitute a take-over bid, a securities exchange bid or an issuer bid under theSecurities Act (Québec) (as presently in force or as it may be subsequently amended or readopted), except that an Offer shall not

18

include: (a) an offer which is made at the same time for the same price and on the same terms to all holders of Subordinate Voting Shares; and (b) an offer which, by reason of an exemption or exemptions obtained under theSecurities Act (Québec), does not have to be made to all holders of Multiple Voting Shares; provided that, if the offer is made by a person other than a Majority Holder or by a Majority Holder to a person other than a Majority Holder, in reliance on the block purchase exemption set forth in section 123 of theSecurities Act (Québec), the offer price does not exceed 115% of the lower of the average market price of the Multiple Voting Shares and the average market price of the Subordinate Voting Shares as established with the formula provided by theRegulation Respecting Securities (Québec). The conversion right attached to the Subordinate Voting Shares is subject to the condition that if, on the expiry date of an Offer, any of the Subordinate Voting Shares converted into Multiple Voting Shares are not taken up and paid for, such Subordinate Voting Shares shall be deemed never to have been so converted and to have always remained Subordinate Voting Shares. The Articles of the Company contain provisions concerning the conversion procedure to be followed in the event of an Offer.

RATINGS

On November 18, 2003, Moody’s Investors Service announced that it rated the Company’s Senior Subordinated Notes at Ba3. Obligations rated Ba are in the fifth highest category and are judged to have speculative elements and are subject to substantial credit risk. The rating is based upon potential post-Circle K merger operating efficiencies from the Company’s position as one of the leading convenience store chain in North America, the Company’s pattern after prior acquisitions of reducing leverage with free cash flow and incremental equity offerings, and expected growth in higher-margin merchandise categories. Constraining the ratings are the integration risks in more than doubling the Company’s base with the Circle K acquisition, the expectation that fixed charge coverage will remain fairly low for the next several years, and increase reliance on unpredictable profits from gasoline sales. This is the first time that Moody’s has rated the Company’s securities.

On November 21, 2003, Standard and Poor’s Ratings Services Limited announced that it had assigned a “B” rating to the Company’s Senior Subordinated Notes, with a stable outlook. An obligation rated ‘B’ is more vulnerable to non-payment than obligations rated ‘BB’, but the obligor currently has the capacity to meet its financial commitment on the obligation. Adverse business, financial, or economic conditions will likely impair the obligor’s capacity or willingness to meet its financial commitment on the obligation. The rating reflects the relative large size of the Circle K acquisition, and the resulting high leverage of the mostly debt funded acquisition. These factors are partially offset by the Company’s strong performing current store base, the acquired store base that has performed reasonably well and a seasoned management team that has experience with previous, albeit smaller acquisitions. This is the first time that Standard and Poor’s has rated the Company’s securities.

A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the rating organization.

MARKET FOR SECURITIES

The Multiple Voting Shares and Subordinate Voting Shares are listed on the Toronto Stock Exchange since December 6, 1999 under the symbols ATD.A and ATD.B, respectively.

19

Price Ranges and Volume Traded

| Monthly Period | | Symbol | | High Price (1) | | Low Price (1) | | Traded Volume | |

|

| |

| |

| |

| |

| |

| April-03(2) | | | ATD.A | | | $ | 14.52 | | | | $ | 14.15 | | | | 1,100 | | |

| May-03 | | | ATD.A | | | $ | 15.50 | | | | $ | 14.00 | | | | 10,013 | | |

| June-03 | | | ATD.A | | | $ | 16.00 | | | | $ | 14.20 | | | | 28,719 | | |

| July-03 | | | ATD.A | | | $ | 17.30 | | | | $ | 14.00 | | | | 17,970 | | |

| August-03 | | | ATD.A | | | $ | 18.50 | | | | $ | 17.00 | | | | 8,058 | | |

| Sept-03 | | | ATD.A | | | $ | 26.00 | | | | $ | 17.15 | | | | 30,496 | | |

| Oct-03 | | | ATD.A | | | $ | 31.25 | | | | $ | 22.30 | | | | 28,338 | | |

| Nov-03 | | | ATD.A | | | $ | 28.50 | | | | $ | 23,50 | | | | 24,608 | | |

| Dec-03 | | | ATD.A | | | $ | 27.00 | | | | $ | 23.55 | | | | 29,192 | | |

| Jan-04 | | | ATD.A | | | $ | 26.50 | | | | $ | 24.50 | | | | 14,152 | | |

| Fed-04 | | | ATD.A | | | $ | 27.25 | | | | $ | 24.25 | | | | 16,770 | | |

| March-04 | | | ATD.A | | | $ | 29.33 | | | | $ | 23.51 | | | | 153,071 | | |

| April-04(3) | | | ATD.A | | | $ | 24.66 | | | | $ | 24.29 | | | | 36,482 | | |

| April-03(2) | | | ATD.B | | | $ | 13.33 | | | | $ | 13.17 | | | | 78,177 | | |

| May-03 | | | ATD.B | | | $ | 14.30 | | | | $ | 12.55 | | | | 1,613,209 | | |

| June-03 | | | ATD.B | | | $ | 14.15 | | | | $ | 13.10 | | | | 1,241,652 | | |

| July-03 | | | ATD.B | | | $ | 15.80 | | | | $ | 13.45 | | | | 2,608,123 | | |

| Aug-03 | | | ATD.B | | | $ | 16.50 | | | | $ | 15.02 | | | | 1,472,523 | | |

| Sept-03 | | | ATD.B | | | $ | 17.69 | | | | $ | 15.75 | | | | 1,703,570 | | |

| Oct-03 | | | ATD.B | | | $ | 23.24 | | | | $ | 16.90 | | | | 5,431,072 | | |

| Nov-03 | | | ATD.B | | | $ | 23.79 | | | | $ | 20.55 | | | | 4,125,668 | | |

| Dec-03 | | | ATD.B | | | $ | 23.98 | | | | $ | 22.01 | | | | 3,791,323 | | |

| Jan-04 | | | ATD.B | | | $ | 24.50 | | | | $ | 22.51 | | | | 2,952,099 | | |

| Feb-04 | | | ATD.B | | | $ | 26.70 | | | | $ | 21.95 | | | | 4,959,904 | | |

| March-04 | | | ATD.B | | | $ | 29.25 | | | | $ | 23.36 | | | | 13,224,890 | | |

| April-04(3) | | | ATD.B | | | $ | 24.28 | | | | $ | 23.84 | | | | 2,007,022 | | |

| (1) | All prices are in CAD$ an on a per share basis. |

| | |

| (2) | From April 28 to 30, 2003 - average prices and total volumes for partial month |

| | |

| (3) | From April 1 to 25, 2004 – average prices and volumes for partial month |

DIRECTORS AND OFFICERS

Directors

The following tables list the Company’s directors. All information is accurate as of June 30, 2004.

20

Name, municipality of

residence and office held

with the Company | | Principal occupation | | Director since | | Number of Multiple

Voting Shares

beneficially owned or

over which control or

direction is exercised

(1) | | Number of

Subordinate

Voting Shares

beneficially

owned or over

which control or

direction is

exercised (1) | |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | |

Alain Bouchard (4)

Lorraine, Québec

Chairman of the Board,

President and Chief

Executive Officer | | Chairman of the Board, President and Chief Executive Officer of the Company | | 1988 | | | 16,270,160 (2) | | | | 601,984 (3) | | |

| | Member of the Board of Directors and Human Resources Committee of Quebecor inc. (communications holding company) and Atrium Biotechnologies Inc. (development and marketing of cosmetic and nutritional ingredients); member of the Board of Directors, Audit Committee and Human Resources and Compensation Committee of RONA inc.(hardware stores retailer) | | | | | | | | | | | |

| | | | | | | | | | | | | |

Robert Brunet (6),(7)

Bolton Centre, Québec

Lead Director | | President, Socoro Inc. (management consulting firm) | | 1991 | | | — | | | | 102,000 | | |

| | | | | | | | | | | | | |

Jacques D’Amours (4)

Lorraine, Québec

Vice-President,

Administration | | Vice-President, Administration of the Company | | 1988 | | | 1,421,760 | | | | 387,600 (3) | | |

| | | | | | | | | | | | | |

Roger Desrosiers(6)

Montréal, Québec

Chairman of the Audit

Committee | | Corporate Director | | 2003 | | | — | | | | 4,000 | | |

| | Member of the Board of Directors and Chairman of the Audit Committee of Desjardins, Groupe d’ Assurances Générales and its subsidiaries, La Sécurité, Compagnie d’ Assurances, the Securities Insurance Company and Certas Inc. Also member of the Board of Directors of PG Mensys Systèmes d’ Information Inc. and M3K Inc. | | | | | | | | | | | |

| | | | | | | | | | | | | |

Jean Élie(5)

Montréal, Québec | | Corporate Director | | 1999 | | | — | | | | 17,700 | | |

| | | | | | | | | | | | | |

Richard Fortin (4)

Longueuil, Québec

Executive Vice-President and

Chief Financial Officer | | Executive Vice-President and Chief Financial Officer of the Company | | 1988 | | | 966,140 | | | | 403,600 (3) | | |

| | | | | | | | | | | | | |

| | Member of the Board of Directors and Audit Committee of Transcontinental inc. (commercial printer) | | | | | | | | | | | |

| | | | | | | | | | | | | |

Josée Goulet

Montréal, Québec | | Director of marketing services, Bell Canada (telephone company) | | 2000 | | | — | | | | — (3) | | |

21

Roger Longpré (5),(6)

Brossard, Québec

Chairman of the Human

Resources and Corporate

Governance Committee | | President, Mergerac Inc. (consultants in mergers and acquisitions) | | 2001 | | | — | | | | 8,000 (3) | | |

| | | | | | | | | | | | | |

Réal Plourde (4)

Montréal, Québec

Executive Vice-President and

Chief Operating Officer | | Executive Vice-President and Chief Operating Officer of the Company | | 1988 | | | 350,256 | | | | 646,800 (3) | | |

| | Member of the Board of Directors and Compensation Committee of Bouclair Inc. (fabric retailer). | | | | | | | | | | | |

| | | | | | | | | | | | | |

Jean-Pierre Sauriol (5)

Laval, Québec | | President and Chief Executive Officer, Dessau-Soprin inc. (engineering- construction company) | | 2003 | | | — | | | | 2,000 | | |

| | Member of the Board of Directors of Dessau-Soprin inc. and Camoplast inc. (industrial manufacturer) | | | | | | | | | | | |

| | | | | | | | | | | | | |

Jean Turmel

Montréal, Québec | | President – Financial Markets, Treasury and Investment of a Canadian chartered bank | | 2002 | | | — | | | | 8,000 (3) | | |

| | | | | | | | | | | | | |

| | Member of the Board of Directors of a Canadian chartered bank; member of the Board of Directors and Chairman of National Bank Financial Inc. and Natcan Investment Management Inc. (financial services) and also of the Montreal Exchange | | | | | | | | | | | |

Notes: |

|

1) | The information as to the shares beneficially owned, controlled or directed, not being within the knowledge of the Company, has been furnished by the respective candidates individually. |

| |

2) | Of this number, 14,973,132 shares are held through Developpements Orano Inc. |

| |

3) | Messrs. Alain Bouchard, Richard Fortin, Réal Plourde and Jacques D’ Amours also hold options granting them the right to purchase 1,600,000, 710,000, 710,000 and 4,000 Subordinate Voting Shares, respectively. Mrs. Josée Goulet, Messrs. Roger Longpré and Jean Turmel hold options granting them the right to purchase 40,000, 20,000 and 10,000 Subordinate Voting Shares, respectively. |

| |

4) | Member of the Executive Committee. |

| |

5) | Member of the Human Resources and Corporate Governance Committee. |

| |

6) | Member of the Audit Committee. |

| |

7) | Lead director. |

Alain Bouchard has been a board member since 1988. He is the founder of the companies that became Alimentation Couche-Tard Inc., which began with just one store in 1980. He is our Chairman of the Board, President and Chief Executive Officer and has more than 35 years of experience in the industry. Mr. Bouchard began his career at Perrette Dairy Ltd. in 1968 as interim store manager. He later became supervisor and district director until 1973. As district director, he supervised the opening of 80 stores and developed the Perrette network. From 1973 to 1976, while employed by Provigo Inc. (Provi-Soir division), Mr. Bouchard organized and supervised the opening of 70 Provi-Soir convenience stores. From 1976 to 1980, Mr. Bouchard operated a Provi-Soir franchise and, in 1980, he opened the first Couche-Tard convenience store. Mr. Bouchard is also a director of Quebecor Inc., a communications holding company, RONA Inc., a hardware retailer and Atrium Biotechnologies Inc. (development and marketing of cosmetic and nutritional ingredients).

22

Richard Fortin has been a board member since 1988. He is our Executive Vice-President and Chief Financial Officer. Before joining Couche-Tard in 1984, he had more than 13 years of experience at a number of major financial institutions, and was Vice-President of Quebec for a Canadian bank wholly-owned by Societe Generale (France). Mr. Fortin holds a bachelor’s degree in Management with a major in Finance from Laval University in Quebec City. Mr. Fortin is also a director of Transcontinental Inc., a commercial printer.

Réal Plourde has been a board member since 1988. He is our Executive Vice-President and Chief Operating Officer. Mr. Plourde joined us in 1984 and has held various positions, ranging from Manager of Technical Services to Vice-President of Development, Sales and Operations. In 1988 and 1989, Mr. Plourde also acted as President of Pro Optic Inc., then a wholly-owned subsidiary of Couche-Tard and Quebec’s first optical lens manufacturer. Mr. Plourde began his career in various engineering projects in Canada and Africa. Mr. Plourde holds an Engineering Degree (Applied Sciences) from Laval University in Quebec City and an MBA from the Ecole des Hautes Etudes Commerciales in Montreal. Mr. Plourde is a member of the Quebec Engineers Association. Mr. Plourde is also a director of Bouclair Inc., a fabric retailer.

Jacques D’ Amours has been a board member since 1988. He is our Vice-President, Administration and, since joining us in 1980, has worked in a variety of roles, including Manager of Technical Services, Vice-President of Sales and Vice-President of Administration and Operations.

Robert R. Brunet has been a board member since 1991. Mr. Brunet is President of Socoro Inc., a management consulting firm. From 1988 to 1998, Mr. Brunet was Vice-President and General Manager of RNG Group Inc., a Canadian energy equipment distribution company. From 1963 to 1988, Mr. Brunet was employed by Gulf Canada Inc. and by Ultramar Canada Inc. where his last function was as Vice-President, Retail Operations.

Jean A. Élie has been a board member since 1999. From 1998 to 2002, Mr. Élie was managing director of a Canadian bank wholly-owned by Societe Generale (France). From 1987 to 1997, Mr. Élie was a director and member of the Executive Committee and Chairman of the Finance and Audit Committee of Hydro-Quebec, for which he also acted as Interim Chairman in 1996. From 1981 to 1995, he was a Vice-President and officer (director of governance and corporate services) of Burns Fry Limited (today BMO Nesbitt Burns Inc.), a Canadian investment banking and brokerage firm. Mr. Élie was also a director and member of the Executive Committee of the Investment Dealers Association of Canada. Mr. Élie holds a B.C.L. (law) from McGill University and an MBA from the University of Western Ontario and is a member of the Quebec Bar Association.

Josée Goulet has been a board member since 2000. Mrs. Goulet is Chief of Marketing Services with Bell Canada, a telephone company. Mrs. Goulet joined the Bell group of companies in 1985 and held various management positions prior to being appointed to various senior management positions since 1994. Mrs. Goulet graduated from the Ecole Polytechnique of Montreal where she obtained a bachelor’s degree in electrical engineering and holds an MBA from McGill University in Montreal.

Roger Longpré has been a board member since 2001. Mr. Longpré is President and founder of Mergerac Inc., a consulting firm in the areas of mergers and acquisitions and corporate finance. From 1986 to 1994, Mr. Longpré was a partner of Raymond Chabot Grant Thornton where he began consulting in the areas of corporate finance and mergers and acquisitions and subsequently became responsible for all of the firm’s financial consulting services. From 1980 to 1986, Mr. Longpré was Vice-President of Credit Suisse First Boston Canada, Montreal Branch. Prior to 1980, Mr. Longpré was employed in the banking industry. Mr. Longpré has a bachelor’s degree in business administration with a major in finance. He also holds an MBA degree, also with a major in finance.

Jean Turmel has been a board member since 2002. Mr. Turmel is President, Financial Markets, Treasury and Investment Bank of a Canadian chartered bank. Mr. Turmel is a director of a Canadian chartered bank and a director and chairman of National Bank Financial Inc. Mr. Turmel is also Chairman of the Board of Natcan Investment Management Inc. Prior to 1981, Mr. Turmel held various positions at McMillan Bloedel Inc., Dominion Securities Inc. and Merrill Lynch Royal Securities. Mr. Turmel holds a baccalaureate in commerce and an MBA both from Laval University in Quebec City.

Jean-Pierre Sauriol as elected to the board of directors on September 24, 2003. Mr. Sauriol is President and Chief Executive Officer of Dessau-Soprin Inc., one of Canada’s largest engineering-construction companies.

23

Mr. Sauriol was Chairman of the Association of Consulting Engineers of Canada in 1993 and of the Association of Consulting Engineers of Quebec in 1988 and 2000. Mr. Sauriol is a Fellow of the Canadian Academy of Engineering. Mr. Sauriol graduated from the Ecole Polytechnique of Montreal in 1979 and completed Harvard Business School’s Owner President Management Program in 1993.

Roger Desrosiers was elected to the board of directors on September 24, 2003. Mr. Desrosiers has been a chartered accountant since 1963. In 1973, Mr. Desrosiers founded an accounting firm that subsequently merged with Arthur Andersen in 1994. From 1994 to 2000, Mr. Desrosiers was the Managing Partner, Eastern Canada of Arthur Andersen. From 1968 to 1973, Mr. Desrosiers was assistant-treasurer, director of accounting and budget for Quebec-Telephone (now TELUS Inc.). Prior to 1968, Mr. Desrosiers practised accounting with Coopers & Lybrand. Mr. Desrosiers is a Fellow of the Quebec Order of Chartered Accountants. Mr. Desrosiers sits on the Board of Directors of various insurance companies and is a member of the Consulting Board of Telus Quebec Inc. and Telus Solutions d’ Affaires. Mr. Desrosiers holds a Masters Degree in Commercial Sciences and a License in Accounting Sciences both from Laval University in Quebec City.

One of the Company’s directors is employed by a subsidiary of a Canadian chartered bank, which is one of the Company’s lenders.

Officers

The following table lists the Company’s officers who are not also directors. All information is accurate as of June 30, 2004.

Name & municipality of

residence | | Office held with the Company | | Officer since | | Number of Subordinate

Voting Shares beneficially

owned or over which

control or direction is

exercised |

| |

| |

| |

|

| | | | | | |

MICHEL BERNARD

COLUMBUS, INDIANA | | Vice-President, Operations, U.S.Midwest | | 2003 | | | 48,100 | |

| | | | | | | | |

ROBERT G. CAMPAU | | Vice-President, Operations, U.S. Southeast Region | | 2003 | | | NIL | |

| | | | | | | | |

CAVE CREEK, ARIZONA | | | | | | | | |

| | | | | | | | |

STÉPHANE GONTHIER | | Vice-President, Operations, Central Canada | | 1998 | | | 50,750 | |

| | | | | | | | |

Ste-Rose, Quebec | | | | | | | | |

| | | | | | | | |

MICHEL GUINARD

LAVAL QUEBEC | | Vice-President, Development | | 2000 | | | 1,300 | |

| | | | | | | | |

BRIAN HANNASCH

Columbus Indiana | | Vice-President, Integration | | 2001 | | | 8,000 | |

| | | | | | | | |

GEOFFREY C. HAXEL | | Vice-President, Operations, U.S. Arizona Region | | 2003 | | | NIL | |

| | | | | | | | |

SCOTTSDALE, ARIZONA | | | | | | | | |

| | | | | | | | |

JEAN-LUC MEUNIER

ROSEMERE, QUEBEC | | Vice-President, Operations, Eastern Canada | | 2004 | | | NIL | |

| | | | | | | | |

CHARLES PARKER