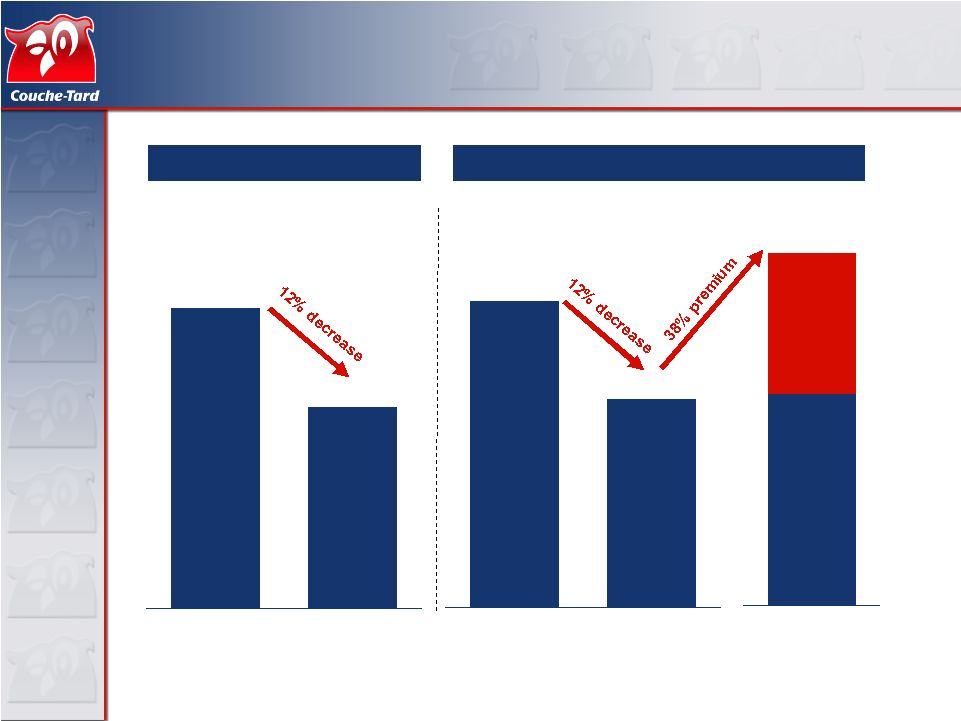

1 Important Information This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. A tender offer (the “Tender Offer”) to purchase (1) all issued and outstanding shares of common stock, no par value, of Casey’s General Stores, Inc. (“Casey’s”), and (2) the associated rights to purchase shares of Series A Serial Preferred Stock, no par value, of Casey’s issued pursuant to the Rights Agreement, dated as of April 16, 2010, between Casey’s and Computershare Trust Company, N.A., as Rights Agent, at a price of $38.50 per share, net to the seller in cash, without interest and subject to any required withholding of taxes, is being made pursuant to a tender offer statement on Schedule TO (including the Offer to Purchase, Letter of Transmittal and other related tender offer materials, together with any amendments and supplements thereto) that was filed by Alimentation Couche-Tard Inc. (“Couche-Tard”) and ACT Acquisition Sub, Inc. (“ACT Acquisition Sub”) with the Securities and Exchange Commission (“SEC”) on June 2, 2010. These materials, as they may be amended from time to time, contain important information, including the terms and conditions of the Tender Offer, that should be read carefully before any decision is made with respect to the Tender Offer. Investors and security holders of Casey’s can obtain free copies of these documents and other documents filed with the SEC by Couche-Tard through the web site maintained by the SEC at http://www.sec.gov or by directing a request to the Corporate Secretary of Alimentation Couche-Tard Inc., 4204 Industriel Blvd., Laval, Québec, Canada H7L 0E3. Free copies of any such documents can also be obtained by directing a request to Couche- Tard’s information agent, Innisfree M&A Incorporated, at (877) 717-3930. Couche-Tard and ACT Acquisition Sub filed a definitive proxy statement on Schedule 14A with the SEC on August 19, 2010 in connection with the solicitation of proxies for the 2010 annual meeting of shareholders of Casey’s. The definitive proxy statement was mailed to the shareholders of Casey’s on or about August 19, 2010. Investors and security holders of Casey’s are urged to read the definitive proxy statement and other documents filed with the SEC carefully in their entirety as they become available because they will contain important information. Investors and security holders of Casey’s can obtain free copies of these documents and other documents filed with the SEC by Couche-Tard through the web site maintained by the SEC at http://www.sec.gov or by directing a request to the Corporate Secretary of Alimentation Couche-Tard Inc., 4204 Industriel Blvd., Laval, Québec, Canada H7L 0E3. Free copies of any such documents can also be obtained by directing a request to Couche-Tard’s information agent, Innisfree M&A Incorporated, at (877) 717-3930. Free copies of the definitive proxy statement and any additional proxy solicitation materials of Couche-Tard and ACT Acquisition Sub can also be obtained through the web site maintained at http://www.ReadOurMaterials.com/Couche-Tard. Certain Information Regarding Participants Couche-Tard and ACT Acquisition Sub, its indirect wholly owned subsidiary, and certain of their respective directors and executive officers, and Couche-Tard’s nominees for election to the board of directors of Casey’s at the 2010 annual meeting of shareholders of Casey’s, may be deemed to be participants in the proposed transaction under the rules of the SEC. As of the date of this presentation, Couche-Tard is the beneficial owner of 362 shares of common stock of Casey’s (which includes 100 shares of common stock of Casey’s owned by ACT Acquisition Sub). Security holders may obtain information regarding the names, affiliations and interests of Couche-Tard’s directors and executive officers in Couche-Tard’s Annual Report on Form 40-F for the fiscal year ended April 25, 2010, which was filed with the SEC on July 19, 2010, and its proxy circular for the 2010 annual general meeting, which was furnished to the SEC on a Form 6-K on July 19, 2010. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is included in the definitive proxy statement filed with the SEC on August 19, 2010. Forward-looking Statements The statements set forth in this communication, which describes Couche-Tard’s objectives, projections, estimates, expectations or forecasts, may constitute forward-looking statements. Positive or negative verbs such as “plan”, “evaluate”, “estimate”, “believe” and other related expressions are used to identify such statements. Couche-Tard would like to point out that, by their very nature, forward-looking statements involve risks and uncertainties such that its results, or the measures it adopts, could differ materially from those indicated or underlying these statements, or could have an impact on the degree of realization of a particular projection. Major factors that may lead to a material difference between Couche-Tard’s actual results and the projections or expectations set forth in the forward-looking statements include the possibility that Couche-Tard will not be able to complete the tender offer as expected; Couche-Tard’s ability to achieve the synergies and value creation contemplated by the proposed transaction; Couche-Tard’s ability to promptly and effectively integrate the businesses of Casey’s; expected trends and projections with respect to particular products, services, reportable segment and income and expense line items; the adequacy of Couche-Tard’s liquidity and capital resources and expectations regarding Couche-Tard’s financial condition and liquidity as well as future cash flows and earnings; anticipated capital expenditures; the successful execution of growth strategies and the anticipated growth and expansion of Couche-Tard’s business; Couche-Tard’s intent, beliefs or current expectations, primarily with respect to future operating performance; expectations regarding sales growth, gross margins, capital expenditures and effective tax rates; expectations regarding the outcome of various pending legal proceedings; seasonality and natural disasters; and such other risks as described in detail from time to time in the reports filed by Couche-Tard with securities authorities in Canada and the United States. Unless otherwise required by applicable securities laws, Couche-Tard disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking information in this communication is based on information available as of the date of the communication. |