UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the 2007 Annual Report for the year ended April 29, 2007

Commission File Number: 333-10100

ALIMENTATION COUCHE-TARD INC.

1600 St-Martin Boulevard East

Tower B, Suite 200

Laval, Quebec, Canada

H7G 4S7

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40 F.

Form 20-F |_| Form 40-F |X|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes |_| No |X|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes |_| No |X|

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g-3 under the Securities Exchange Act of 1934.

Yes |_| No |X|

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

SIGNATURES:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ALIMENTATION COUCHE-TARD INC. |

| | |

| July 19, 2007 | |

| | Per: /s/ Sylvain Aubry |

| | Sylvain Aubry |

| | Corporate Secretary |

| | |

ANNUAL REPORT 2007 |

| How |

can we |

help |

|

you |

today? |

| |

| |

| |

|

HIGHLIGHTS

$12 billion in revenues (US$)

More than 45,000 motivated people

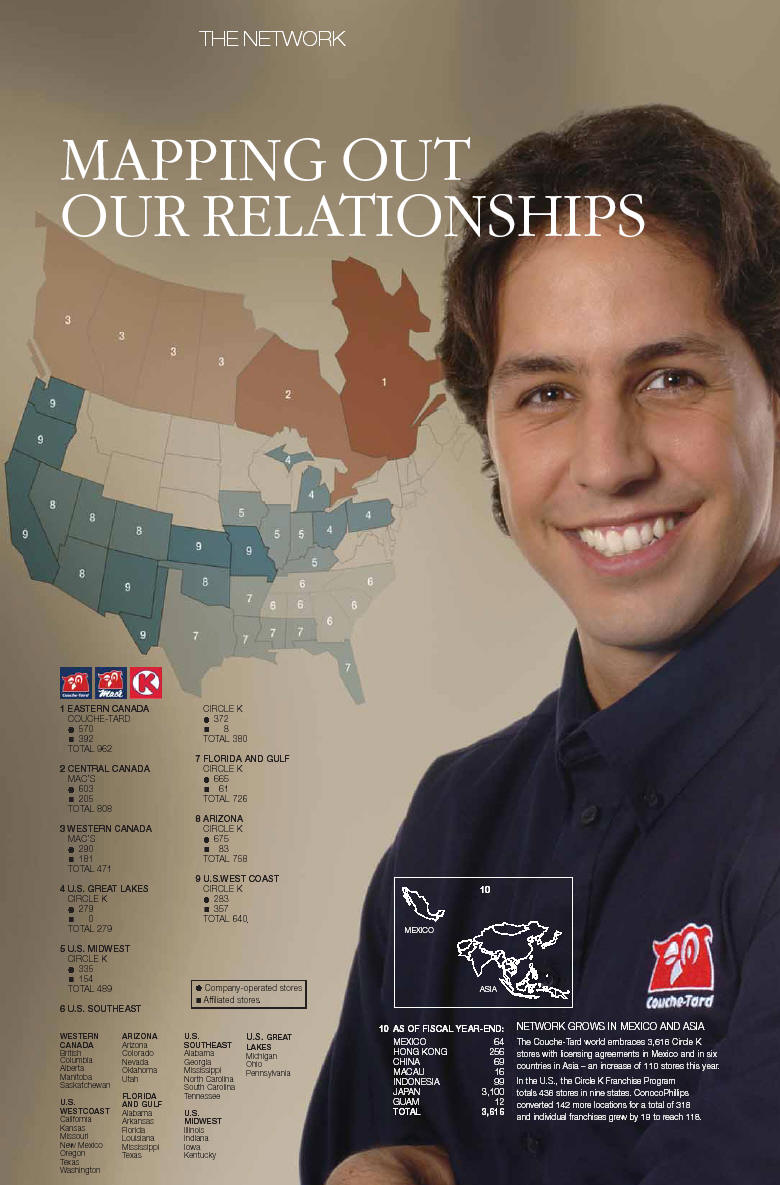

5,513 stores within the network

3 powerful brands

Increase of 19% in revenues

Implementation of IMPACT program at 413 stores

Increase of 506 company-operated stores

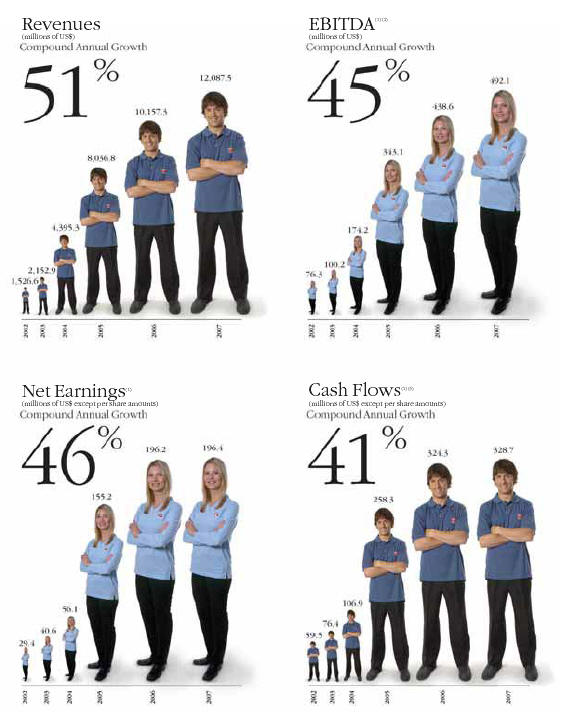

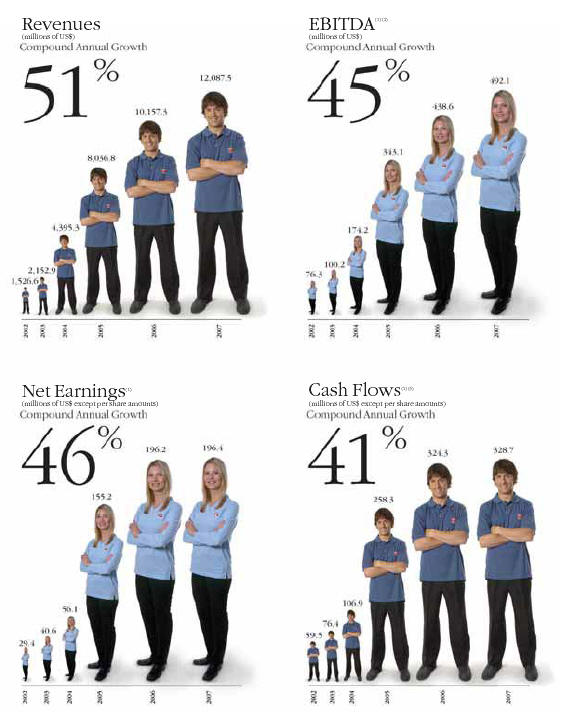

| Financial highlights | | | | |

| | (in millions of US dollars, except per share amounts) | | | | | | | |

| | | | | | | | | |

| | | 2007 | 2006 (1) | 2005 | 2004 (2) | 2003 (2) | 2002 (2) | |

| | | $ | $ | $ | $ | $ | $ | |

| | | | | | | | | |

| | Consolidated Results | | | | | | | |

| | Revenues | 12,087.4 | 10,157.3 | 8,036.8 | 4,395.3 | 2,152.9 | 1,526.6 | |

| | EBITDA(3) | 492.1 | 438.6 | 343.1 | 174.2 | 100.2 | 76.3 | |

| | Net earnings | 196.4 | 196.2 | 155.2 | 56.1 | 40.6 | 29.4 | |

| | Cash flows(4) | 328.7 | 324.3 | 258.3 | 106.9 | 76.4 | 59.5 | |

| | Per Share | | | | | | | |

| | Net Earnings | | | | | | | |

| | Basic | 0.97 | 0.97 | 0.77 | 0.31 | 0.24 | 0.19 | |

| | Diluted | 0.94 | 0.94 | 0.75 | 0.30 | 0.23 | 0.19 | |

| | Cash flows(4) | 1.63 | 1.61 | 1.28 | 0.60 | 0.45 | 0.39 | |

| | Book value | 5.67 | 4.78 | 3.63 | 2.71 | 1.74 | 1.40 | |

| | Financial Position | | | | | | | |

| | Total assets | 3,043.2 | 2,369.2 | 1,995.7 | 1,650.8 | 739.7 | 499.5 | |

| | Property and equipment | 1,671.6 | 1,014.1 | 812.0 | 663.3 | 298.5 | 195.7 | |

| | Interest-bearing debt | 870.0 | 524.1 | 530.9 | 536.8 | 204.6 | 115.7 | |

| | Shareholders’ equity | 1,145.4 | 966.0 | 733.2 | 535.0 | 293.9 | 231.3 | |

| | Ratios | | | | | | | |

| | Interest-bearing net debt/ | | | | | | | |

| | total capitalization | 0.39:1 | 0.15:1 | 0.28:1 | 0.42:1 | 0.37:1 | 0.31:1 | |

| | Interest-bearing net debt/ | | | | | | | |

| | EBITDA (3) | 1.48:1 | 0.39:1 | 0.81:1 | 2.20:1 | 1.71:1 | 1.32:1 | |

| | | | | | | | | |

| | | | | | | | | |

| | (1) 53 weeks. | |

| | (2) Restated. | |

| | (3) EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) is presented for information purposes only and represents a performance measure used especially in financial circles. It does not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other public companies. | |

| | (4) These cash flows and cash flows per share are presented for information purposes only and represent performance measures used especially in financial circles. They represent cash flows from net earnings, plus depreciation and amortization, write-off of financing costs, loss on disposal of assets and future income taxes. They do not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other public companies. | |

Alimentation Couche-Tard 2

| | (1) Restated figures for 2002, 2003 and 2004. | |

| | (2) EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) is presented for information purposes only and represents a performance measure used especially in financial circles. It does not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other public companies. | |

| | (3) These cash flows and cash flows per share are presented for information purposes only and represent performance measures used especially in financial circles. They represent cash flows from net earnings, plus depreciation and amortization, write-off of financing costs, loss on disposal of assets and future income taxes. They do not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other public companies. | |

Stock performance

Couche-Tard’s stock performance has outpaced the TSX index and consistently delivered outstanding shareholder value. During the fiscal year, the dividend was increased from 2.5¢ to 3¢ CA.

| |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | | |

| | RETURN ON INVESTMENT | APRIL 02 | APRIL 03 | APRIL 04 | APRIL 05 | APRIL 06 | APRIL 07 | |

| | ATD.A Class A Multiple Voting Shares | $100.00 | $68.29 | $119.32 | $187.80 | $264.88 | $235.12 | |

| | ATD.B Class B Subordinate Voting Shares | $100.00 | $82.81 | $151.07 | $213.91 | $323.77 | $303.41 | |

| | S&P/TSX (Composite Index) | $100.00 | $85.48 | $113.61 | $122.78 | $159.96 | $178.67 | |

3 Alimentation Couche-Tard

CHAIRMAN'S MESSAGE

OPPORTUNITY

KEEPS KNOCKING

THE FOCUS IS ON GROWTH We enjoyed another solid performance in fiscal 2007 – our 15th year of uninterrupted growth. The dramatic growth in Shareholders’ Equity – close to 400% since 2003 – was slowed somewhat, with net earnings hit by reduced motor-fuel sale margins and increased credit card fees. These are addressed by my partner and our Chief Financial Officer, Richard Fortin, later in the report. Net of these items and Bill 15, the bottom line grew 18%. This was due primarily to continued improvement in in-store merchandising and cost containment, two solid sources of sustainable growth. A slowdown in net earnings growth, though, should prompt investors to scrutinize the fundamental strengths of the Company and its long term prospects. I have no hesitation in saying these have never looked better. We continue to grow the store network efficiently by following a very disciplined and profitable approach; the opportunities for high quality acquisitions increase each year and we have dedicated teams in the market place seeking them out; we remain lean and focused on cost containment and we have what I believe is the most important asset of all – an organizational structure that empowers and liberates the creativity of motivated people. Here are some of the highlights of another strong year. WHERE WE SPENT MONEY It was a big year for expanding the network. We invested roughly US$1B in acquisitions, and property and equipment. We took over 421 first class locations and added 85 new corporate stores, raising our total store network to 5,513. In the process we again added many more excellent people to the team. | Besides acquiring and building, we invested US$373.4 million in renovating, in property and equipment. We completed 413 more IMPACT make-overs which means we have now upgraded more than half of the total company-operated stores. Réal and I – partner and Chief Operating Officer Réal Plourde – are constantly amazed by the return on these investments. An IMPACT renovation is extensive and responds to local preferences. It results in bright, attractive interiors and easy access to product. Costs are usually around US$200,000 and lead to double digit revenue increases and a 0.5-1% margin improvement – usually visible within six months. One result of our network growth last year was to put us “over the top” in the US Midwest Division. Our organization is mapped out to permit a high level of personal involvement at each management layer. It tops out at about 600 stores per Division, beyond which we believe the vice-president is going to spend more time re-acting than acting. When this happened to Midwest, we responded by creating our ninth Division, Great Lakes, and placing it in the capable hands of Paul Rodriguez. I found this to be a significant moment. Midwest is where we began our journey in the United States with the purchase of the Bigfoot chain in 2001. It was Brian Hannasch’s territory and he stayed on with us. In fact, his success in growing the Division encouraged us to make the big Circle K acquisition two years later. Subsequently, Michel Bernard and now Darrell Davis have also shared in building this Division from 172 to over 600 stores. Réal and I appreciate the grace which Darrell has shown after losing half his store network to the new Great Lakes Division. He is totally focused on rebuilding! | PROFITING FROM OUR INVESTMENTS Couche-Tard is now the main consolidator in the North American c-store market and our methodology doesn’t vary. We adhere to a very disciplined program to buy strategically and well, to integrate new assets effectively and to rapidly pay down any debt encountered in the process. The formula is quite simple: We will not go below an average 25% return on capital invested within five years; We prefer to keep and motivate the people wherever possible; We invest in upgrading the acquired assets; Our regional teams are skilled at swiftly applying and teaching shared processes and benchmarking.

Right now, good opportunities are plentiful and I expect this to continue for several years. This is due to the same economic pressures that reduced profits last year, particularly the tightening motor-fuel margins. Faced with declining margins and increasing competition, owners of small and medium size chains face a Darwinian choice: acquire and evolve or look for a buyer. Organizationally we are well positioned. Until quite recently, Réal, Richard and I would chase down opportunities ourselves and I loved that part of the job. But we all move on. Today’s process reflects both our scale and administrative scope. Under the guidance of Mike Guinard, our VP Real Estate Development, regional teams in every Division are mandated to seek out growth opportunities, whether by acquisition or by new-to-industry construction. Each team follows a strategy dictated by its marketplace. Recommendations pass first through the Division VPs, then the appropriate Senior VP before coming to me and my partners. It’s an excellent system with the right decisions being made at the right place along the way. |

Alimentation Couche-Tard 4

| “I have been reminded of the power of people – our people – many times this past 12 months.” |

Alain Bouchard

Chairman of the Board,

President and Chief Executive Officer |

| | | |

Opportunities are plentiful and we can fund another $1.5B in network expansion without issuing equity. I believe that our rate of growth will most likely continue at the same pace in Fiscal 2008. IT’S ALWAYS ABOUT PEOPLE Réal and I spent the year as always – on the road. At least half of our time is spent touring the regions and the stores, together or individually. We both really enjoy getting out and meeting the people who are pulling the wagon. I have never doubted that the single most important ingredient in our success is people. Especially the store managers, dealers and customer service employees but also the market and regional directors, the talented and motivated support teams, and the industry’s most accomplished group of leaders. I have been reminded of the power of people – our people – many times this past 12 months. It has been four years since our biggest acquisition – the 1,600 stores of Circle K – and the scorecard is pretty impressive. We are now witnessing the impact made by the exceptional group of people that came with it. Let me give you just one example. Back in 2003, we nearly gave up on the Circle K stores we had acquired in El Paso, Texas which were in very poor shape. But the store managers persuaded me to give it a trial. Last year, those stores returned operating income of approximately US$7 million and doubled projections. This not only showed the mettle of the team in El Paso, it also validated for me our whole philosophy of empowerment. Circle K had been very centrally run and it was a big test of our values when we took it over. All three brands – Couche-Tard, Mac’s and Circle K – performed with distinction in fiscal 2007 and we are focussing this annual report on our people in every region. I encourage you to read about some extraordinary accomplishments and meet some very dedicated people. | HOW YOUR COMPANY IS MANAGED This makes a good place for me to comment on how your company is managed. Although most of our investors share the long term view and have been with us for some time, some of you may still be kicking the tires. Responsibility at the top is shared by the four founders – myself, Réal, Richard and Jacques, who is currently on a sabbatical – and together we represent more than 95 years of experience in this industry. We are a lean and very cost conscious group. I get used to the comments when visitors realize my office looks out on the parking lot, but the message here is we don’t have a head office. Here at executive offices, located in Laval, Quebec, we propose management strategies to the Board of Directors and steer the direction the company takes. The premises contain some 15 people who fulfill the responsibilities of a public company such as compliance, reporting and internal controls. The operating action is all in the divisions. Each of our now nine Divisions is run by a Vice-President who is essentially a CEO of his own multi-million dollar company. There are two North American Senior Vice Presidents, East and West. Responsibility is delegated generously at the base of the pyramid where each store manager has wide discretionary powers. As Réal is fond of pointing out, there are not many other places a 25-year-old can be running a business with revenues of two to 10 million. You’ll find more details on our organization structure and meet some of the people who make it work in the next pages of this report. So we are a very disciplined, flat operator. Are we effective? Given that our per-store output is among the highest in the industry and our administrative overhead (G&A) as well as our personnel turnover are among the lowest, I would say yes. | WHAT WILL TOMORROW BRING? I believe the outlook for Alimentation Couche-Tard is better than ever. Our industry continues to grow in spectacular fashion. Sales in U.S. convenience stores last year rose another 15%, outpacing almost all competing retail channels. Nonetheless, the hits on motor-fuel margins and credit card fees dropped industry profits 23% creating a climate for acquiring further excellent assets. The number of c-stores owned by the oil majors continues to fall as these companies realize the strongest return on investment is in their core business. They are divesting themselves or seeking expert management of what we call the “back court” while keeping their brand and motor-fuel out front. This trend contributed 236 of the 421 company-operated stores we acquired in 2007. While expanding, the industry is still highly fractured with the top 10 operators accounting for only 27% of the estimated 145,000 stores. Seven- Eleven is the largest single operator at roughly 4.1% but we are closing the gap. Given the dynamics of the sector, achieving 10% of this market would seem a not unreasonable objective for a well capitalized, aggressively run participant. So let’s do this together. I urge you to visit any Couche-Tard, Mac’s or Circle K store as often as you can. Tell them you’re a shareholder and get to know the staff. They all love to meet people and you’ll be delighted to get to know them. Oh, yes. And don’t forget to buy something. On behalf of my colleagues, I wish to thank our shareholders for their continued support. I also want to thank our Board of Directors for their guidance and dedication, our business partners and our managers and employees throughout the organization.

Alain Bouchard

Chairman of the Board

President and Chief Executive Officer

|

Alimentation Couche-Tard 6

CHOOSING

THE RIGHT

PARTNER

| Successful business alliances are most frequently found between partners who have similar cultures, strategies, and outlook. It is a view strongly endorsed by COO Réal Plourde. “When we form a partnership with another organization, we’re not looking for quick fixes,” he says. “We’re looking for fundamental, long-term value and the cooperation of people who share our views and our values.” As the second largest convenience store operator on the continent – and fastest growing – Couche-Tard counts many notable companies among its business associates. Prominent among them are many of the major oil companies. With motor-fuel sales contributing 68% of U.S. network revenues (39% in Canada), the company markets well-known brands of fuel in various regions as well as its own brands. Its partners include global and national companies such as Shell, ConocoPhillips, Esso, BP, Marathon, Ultramar, Irving and Petro Canada. Many of these oil companies also operate convenience stores at selected gas stations. However, | recent trends are making partners out of former competitors as the oilcos re-focus on their core business and off-load or outsource the in-store merchandizing. Last December, the company acquired 236 outlets from U.S. Shell Oil. “Shell had decided to look for specialty operators of its convenience store network,” explains Brian Hannasch, Senior Vice–President, Western North America. “We have known Shell for years and have great respect for the brand so the partnership was a natural for us.” The fuel facilities remain Shell branded and the stores become Circle K. Add-on arrangements to offer Shell fuel at other Circle K sites will make Couche-Tard one of the largest Shell wholesalers in the U.S. “This deal reflects a belief that our capital is best employed in our core business” says Larry Burch, Vice-President, Retail for Shell Oil products in the U.S. “Partnering with one of the best and most popular convenience- store chains strengthens our offer. It will help attract new traffic and give Shell customers easier access to premium convenience items and services.” | In the Midwest, Couche-Tard is the largest branded partner of Marathon Petroleum Company LLC, one of the area’s leading fuel supplier. The partnership has grown five-fold in four years, reflecting a solid and mutually respectful relationship. “We look pretty hard at who we want to do business with,” admits Tom Kelley, Manager of Brand Marketing for the 120-year-old company Marathon. “We want a relationship with companies who have a vision for the future, a passion to compete in this business and whose values are aligned with Marathon’s. “On all fronts, Couche-Tard scores extremely high in our analysis.” Shared values also underpin a long-standing partnership with Core-Mark, a $6B distributor serving the convenience retail business. Its focus is on being a model partner with low pricing and superior service. “We have a ton of respect for Couche-Tard,’’ says Chris Walsh, Senior Vice President, Sales and Marketing. “We share the same emphasis on loyalty, integrity and bringing value to our customers.” |

Alimentation Couche-Tard 8

| | | |

Both companies have a desire to make fundamental changes in the way the industry thinks and works. Currently, the focus is on vendor consolidation and simplifying a distribution process which can result in as many as 30 suppliers to 2,000 square foot store. “We are trying to make it simpler and less costly in both time and money,” explains Walsh. “In the process, we are becoming a marketing organization as well as a vendor to many small stores.” Couche-Tard is the kind of company that will say to you: “I believe in that. Let’s try it on these 100 stores.” An entrepreneurial attitude to business is common ground for a long standing partnership with Novelty Inc. which has supplied the Company with licensed and promotional items since its first venture into the U.S. in 2001. “I’m an entrepreneur and so are the people at Couche-Tard,” explains Todd Green, CEO of the US$150 million company. “Perhaps because we have that in common we enjoy a strong relationship.” “We’ve gone into new markets together. Last year, I opened in Toronto to serve the Mac’s stores better and we’re looking at Québec. We wouldn’t have done that if it wasn’t for Couche-Tard.“ | A shared focus on innovation also drives a strong relationship with Anheuser-Busch, the industry’s leading brewer, whose products are in almost half of the Company’s stores. “We have a great working relationship with every level of Couche-Tard Management,” says Joe Vonder Haar, VP, National Retail Sales/Convenience Channel. “We are focused on growing the beer category and they really work to drive each category and share best practices. For example, ACT brought walk-in coolers to the U.S. convenience store industry. They elevate the image of beer and give the beer consumer a unique shopping experience.” |

|

|

EMPLOYEE PERSPECTIVE

“A GREAT COMPANY

TO WORK FOR.”

HIGH RETENTION RATES COME FROM STRUCTURE AND VALUES After each acquisition, Couche-Tard’s employee retention rate is in the mid to high 90s. Most newcomers love Couche-Tard’s people-first approach which is backed by a structure of empowerment. Despite a network of 5,513 stores spread across 29 states and six provinces, only five layers of management separate the President and CEO Alain Bouchard from the store manager. Here are the key layers – and a few of the remarkable people who work in them. THE STORE MANAGER The buck starts here. Each store manager (or dealer, as they are called in Central and Western Canada) enjoys wide discretion to address local demand for products, participates in key decisions such as budgeting, and is responsible for meeting financial and operational targets. That attracts a highly motivated and entrepreneurial type of individual. | “I often hear it said that working for Couche-Tard is as close as you can come to running your own business,” says Réal Plourde, Chief Operating Officer. Couche-Tard is one of the few major players in the industry which is totally focused on the convenience store business – seven of the top 10 chains are owned by oil companies as add-ons to fill-up stations. For Ron Miller of the U.S. Midwest Division, the difference was big enough to push aside his retirement.

”I was going to call it a day,” says Miller, who has been in the convenience store business since 1962. ”Then Couche-Tard took over my store and totally renovated it. It looks so fantastic, the business is so good and the folks are so great I’ve decided to stick around. Indefinitely.” THE MARKET MANAGER One level up is the Market Manager who looks after an average of 8-10 stores. | “I try to visit each of my 10 stores twice a week,” says Climmie Jackson, a market manager in Memphis, Tennessee. A former store manager herself with 10 years of service, Jackson has always been drawn by the challenges of customer satisfaction and is a dedicated coach and mentor – a typical profile.

“I try to grow my managers just the way I grew,” says Climmie Jackson. “There has been so much more opportunity since I became a part of Couche-Tard. I just love the place and love what I do.” For Nathalie Lacombe, the ability to move through the company and advance her career attracted her five years ago.

“I worked my way to Market Manager with 10 stores in Québec,” she says. “Two months ago I transferred to Mac’s in Ontario to improve my English and maybe work in the U.S. It’s a great company because of how they encourage you to grow.” |

Alimentation Couche-Tard 10

THE REGIONAL OPERATIONS DIRECTOR Next level up is the Regional Operations Director (ROD). He is responsible for roughly 10 Market Managers and 100 stores, depending upon region and geography. Duane Sharp is an ROD in the Arizona Division, responsible for 11 market managers and 125 stores from Phoenix to Las Vegas. A passionate coach, Sharp tries to visit every store in a period of 28 days, as well as meet with his Market Managers. “I’m one of those people who are up at 2:15 a.m.,” he admits. “I enjoy helping others and my thrill is to watch people succeed. At last I feel I’m working for a company that feels the way I do about its people.” It’s a sentiment echoed by Randy Horne, an ROD in Tallahassee whose store chain was owned by a petroleum company before acquisition by Couche-Tard. “When you are owned by ‘Big Oil’, you are just a tiny sliver on the profitability pie chart,” he says. “For us that meant no capital investment and no attention.” “It is a huge difference to work for people who want to be in this business, who love and understand it, and who will invest in both the assets and the people.” | VPS ET AL Only four steps away from the store counter is where Couche-Tard’s “C” level starts. A Vice-President Operations runs each of nine geographic Divisions but, in the Couche-Tard world, these are virtually CEOs of nine autonomous businesses. “I was a Vice-President with a competitor when it was acquired by Couche-Tard,” recalls Darrell Davis, now VP of the US Midwest Division. “I was offered a lesser title and lower pay but they told me I would have more decision making power and impact at this level than I ever did as a VP at my old company. And it was true!” Managing the nine Divisions are two Senior Vice-Presidents, one for Eastern and one for Western North America and this is still only the fifth layer of management. Brian Hannasch, the Western SVP, was in charge of 180 stores in the U.S. Midwest when Couche-Tard made its first acquisition south of the border. “I admit that I thought to myself what can these Canadians show us,” remembers Hannasch, “and I gave it six months. But we soon found they really knew the business and the principals were all fully engaged. It’s a great company to work for.” |  |

Brian Hannasch

Senior Vice-President

U.S. Midwest |

11 Alimentation Couche-Tard

THE COUCHE-TARD SPIRIT

“THAT’S MY CIRCLE K!”

| When El Paso finally got its chance, it didn’t look back. Part of the team that pulled an amazing turnaround (l-r) Mike Ruiz, Victor Salas, Isela Almanzar, Grace Aguirre, K.C. Kingsbury. | TEAMWORK OVERCOMES TOUGH CHALLENGES As President and CEO Alain Bouchard and Executive Vice-President and COO Réal Plourde toured El Paso, Texas during the Circle K deal of 2003, their thoughts were on the same truth: acquiring over 1,600 stores in one deal inevitably means some pruning. “There had been no investment in El Paso for some time,” recalls Bouchard. “The assets were in poor shape. We’re buyers, not sellers, but I didn’t see how we could justify keeping these stores.”

But when they expressed these concerns, they faced some determined managers. “We’re very proud people down here,” says Victor Salas, Category Manager. “We wanted a chance to show what we could do with some support.” | The company agreed to a limited test and the response was overwhelming. “We’d heard these promises in the past but this time it was actually happening,” went on Salas. “We all pooled our best practices and worked together. There were no egos. We were just not going to let anyone down.” In the first year of Couche-Tard ownership, the region had operating loss of over US$0.3M. Last year, it posted operating income of approximately US$7M, exceeding plan by almost 100%. Fuelling has been re-branded Circle K and volume has grown 52% since 2004. Average merchandize revenue per store has increased by 23% and merchandizing margin by 40%. Fiscal 2008 will see the completion of 34 IMPACT upgrades as the turnaround continues. The stores have bright, modern interiors with new coffee bars and frosters, beer caves and a powerful new colour scheme evoking the desert environment. Pride and the new paint quickly led to a new slogan in the region: “That’s my Circle K!” “We’re seeing a big, positive change in all areas,” says Tim Tourek, Interim Vice-President of the U.S. West Coast Division. “We measure in-store customer service with a “Mystery Shopper” index and I’m proud of the 91% we have for the division. But El Paso’s way out in front. Their score is over 95% which is extremely strong by any standard.” | FROM SANDSTORM TO SNOWBANK Some 1,400 kilometres to the northeast, another Circle K team was tackling a different challenge. A deal with Shell Oil U.S. in late 2006 included 67 locations in Denver, Colorado. The deal came with a catch. Under Shell’s system of Multi-Site Operators, the sites were run by three separate businesses. That meant no management above store manager was being acquired and Circle K was starting from scratch. “We re-located an entire management team of a dozen people up there,” says Geoff Haxel, Vice-President Operations of the Arizona Division. “We were able to do this because we focus a tremendous amount on people in our organization and go through a succession planning process twice a year.” The incoming team completed an ambitious transition plan in record time.

“We transformed all 67 stores to Circle K imagery and branding in the space of four-days,” says Steve Maeda, Retail Operations Director and team leader. “We were able to create a uniform presentation which was missing among the three previous businesses.” |

Alimentation Couche-Tard 12

Denver’s population is increasing rapidly and in 2006 it moved from 11th to 8th fastest growing city in the U.S. The population is young, the economy vibrant and the lifestyle healthy. Circle K is following the market with additional offerings of waters, juices and energy drinks. Denver is also more than 1,200 metres above Phoenix, where many of the new management team are based. “These are people who are thrilled to see seven inches of rain on an annual basis.” says Haxel. “Two weeks after the deal closed on December 6, Denver was hit by 45 inches of snow – a 30-year record.” At least the transition plan had specified four-wheel drive vehicles. WORK FOR ME. PLEASE! The Company’s Western Canada region has recorded exceptional growth for several years now, a remarkable effort. “The economy out here is really overheated, thanks to the tar sands and other energy projects,” says Division Vice-President Kim Trowbridge. “It’s making it increasingly difficult to hire and retain quality folks.” The region’s business model has helped to this point. Under the Mac’s brand, store managers, who are called dealers, operate the stores as turnkey operations for a percentage of revenue. So they share in the growth. Good employees are another story. |

Joe Nemeth is Director of Operations in Northern Alberta, where the problem is most pronounced. In Fort McMurray, competing stores and fast food restaurants have signs in the window reading “Work here and get $700”. “It’s not unusual to find a restaurant closed on a Thursday night because they can’t get staff,” says Nemeth. Two years ago, Western Canada’s Division management and the dealers came up with a winning, non-cash solution to the HR challenge. The dealers pool resources and fund incentives that include a free apartment to live in, use of a car to get around and plane rides home every six months or so. Recruiting is directed out of the division as far away as Toronto. After six months, employees also become eligible for drawings of $500. “Most people working here are from somewhere else,” says Nemeth. “So these incentives really mean more than getting extra pay but then having to pay huge rents.” | | THE

OPERATIONS

TEAM |

| | |

| Michel Bernard (Couche-Tard)

Vice-President, Operations

Eastern CanadaExcellent team builder. Did a great job in the U.S. Midwest before returning to Québec 18 months ago with a new vision for Eastern Canada. |

| | |

| Jean-Luc Meunier (Mac’s)

Vice-President, Operations

Central Canada Transferred with his family out to Ontario to take over Central Canada. Has been rebuilding the network there and is now repositioning more than 600 Mac’s stores. |

| | |

| Kim J. Trowbridge (Mac’s)

Vice-President, Operations

Western Canada A source of inspiration for the Company. A brilliant marketer, he first came up with the IMPACT concept and the “chain of one”. Delivers astonishing Return on Investment levels. |

| | |

| Darrell Davis (Circle K)

Vice-President, Operations

U.S. MidwestVery focused operations manager with the best G&A average per store in the U.S. Reacted positively to splitting his Division and co-managed Paul Rodriguez off to a great start. |

| | |

| Paul Rodriguez (Circle K)

Vice-President, Operations

U.S. Great Lakes Building our newest Region in Ohio, Michigan and Pennsylvania. Acquired 20 stores before he had an office for a total of 302. Has 20 years of experience with Circle K. |

| | |

| Robert G. Campau (Circle K)

Vice-President, Operations

U.S. Southeast Skilled people manager with a special touch for acquisitions. Integrated 82 stores and 850 people from Spectrum in fiscal 2007. Established his own acquisition team. |

| | |

| Mike Struble (Circle K)

Vice-President, Operations

Florida and Gulf Mike took over from Mick Parker who left at year-end. His 30 years of experience and deep knowledge of the company make Mike an ideal choice here where we face the task of rebuilding this hurricane-hit region. |

| | |

| Geoffrey C. Haxel (Circle K)

Vice-President, Operations

Arizona Arizona is the biggest contributor to the company and Geoff grew market share yet again. Inspiring leader who pulled together a full management team for Denver without missing a beat. |

| | |

| Tim Tourek (Circle K)

Interim Vice-President, Operations

U.S. West Coast With over 15 years of experience with us, Tim’s well cut out for this job. He took over the job from Joy Powell, allowing her to refocus her career. Joy remains with us and we wish them both continued success. |

| | |

| Michael Guinard

Vice-President,

Real Estate Development Directs and coordinates the company’s fast-growing real estate portfolio. Oversees regional Directors of Real Estate who lead development teams in each of the nine Divisions. |

| | |

| Rick Hamlin (Circle K)

Senior Director,

Worldwide Franchise Added 110 new stores outside of North America in fiscal 2007. Along with his involvement in the U.S., Rick is steadily building an international market in Mexico, Japan, Indonesia, Guam and China. |

| | |

COMMUNITY AND ENVIRONMENT

CARING FOR PEOPLE

AND THE PLANET

| At Couche-Tard, we care not only for people but for our planet. This past year, we stepped up our commitment to preserving our environment and we reached new heights in caring for others. CARING FOR THE PLANET The recent past has seen increased awareness of the need for more responsible use of energy and resources. Corporations around the world are stepping up to the plate. Here in Canada, the initiative is being led by the Conference Board of Canada. Last year, we joined many other companies in the Carbon Disclosure Project 5, monitoring and reporting on our energy use as a basis for future action. We retained an expert company to complete the year-long research and filed our report with the Conference Board May 31, 2007. Part of the study seeks to establish how many tons of “greenhouse gasses” are put into the atmosphere as a result of our operations. With motor fuel sold at 62% of our locations, these sales constitute the largest single source of CO2 caused by our actions. | When you back these sales out, 85% of the remaining CO2 comes from our use of electricity, notably the operation of refrigeration and air conditioning units in the stores. How this electricity is generated varies according to region but, on a system-wide basis, roughly 30% comes from renewable sources, e.g. hydro power. We already have in place specific programs to save energy. As we continue to refine and add to the data, we will be able to make choices as to socially and economically appropriate ways to reduce these emissions. Environmental measures We have used video conferencing since 1999 to reduce executive travel;

This annual report, and the Proxy Circular, are among an increasing number of documents printed on 100% recycled paper;

We have air-blast doorways on some 500 stores which conserves the inside temperature;

We are measuring the amounts of recycled and non-recycled garbage;

We are recording the amount of coolant used in the refrigeration units.

|

| | | |

Alimentation Couche-Tard 14

|

| Dominic Gendron and Frédérique Brou provided nearby shelter during college shooting in Montréal. |

| | | | |

Energy efficiency measures We are changing the lighting in the stores to more efficient CFL bulbs;

We are extending installation of magic eye systems that turn lights on and off as needed;

We have adjusted our compressors and equipment to avoid drawing heavily on power at peak periods;

A study is being made of an Internet-based system for optimum control of lighting, heating, ventilation, air conditioning and refrigeration.

Since our network is constantly expanding, our response is targeted at improving energy effectiveness and reducing C02 emissions on a per-store basis. PROVIDING SANCTUARY One Wednesday last September, Dominic Gendron was making a regular call on one of the Couche-Tard stores he supervises in Montréal. He had just gone out to his car to get some documents when the shooting began. “We closed the store right away,” he recalls. “Then I started bringing people in and Frédérique would give them something to drink or snack on while they collected themselves.” That was the day when a 25-year-old man walked into Dawson College near the store and shot 19 people, killing one. The drama played out for several hours with students and bystanders caught in the confusion. | “It all started so quickly,” says Frédérique Brou, the store manager. “There were people running past and crying. Dominic kept going outside and bringing more people in.” The Couche-Tard team provided sanctuary for about 30 people. Gendron also persuaded a neighbouring restaurant to provide a hot meal for which he paid. “All the stores and restaurants were naturally closed and the people left,” he says. “When I thought about it later, I wish I’d persuaded some of them to stay open and shelter more people.” “I’m happy we did what we could.” HELPING OTHERS –

“A JOB WE LOVE!” The convenience store business creates natural networks for pooling the resources of others. For Couche-Tard, that network includes more than 45,000 people, their families and 5,513 stores and their customers –altogether an outreach that touches millions of people. All three brands have proud commitments to serving their communities and the Executive Office, too, has its own dedicated program of support for others. Each year, the Couche-Tard family gives and helps generate millions of dollars for worthy causes and raised over US$3.2 million this past year in donations and community sponsorships. Each Division varies in its approach and many of the relationships have been built up over years of participation and teamwork. | In Central Canada, for example, Mac’s has been supporting Big Brothers and Big Sisters for over 30 years. In Eastern Canada, the focus is also on young people with support for the Club des petits déjeuners as well as Opération Enfant Soleil. U.S. West Coast has been a booster of the Boys and Girls Club since 2001, Western Canada has been proud to help out the Kids Help Phone for many years and is also a big supporter of Minor Hockey for both boys and girls. One of the biggest and longest running partnerships is between the Florida/Gulf Coast and Arizona Divisions and the United Cerebral Palsy Association. This year, the 18th, the Division again will hand over more than $2M.

“It’s become a part of the job that we love,” says Region Operations Director Lisa Geyer, a former member of the UCP board. “I take the Market Managers to the meetings and we read to the kids. And the parents bring the kids around to the stores to thank us. That makes it pretty personal.” | THE

COUCHE-TARD TEAM PROVIDED SANCTUARY

FOR ABOUT

30 PEOPLE.

|

15 Alimentation Couche-Tard

FINANCIAL REVIEW

THE COUCHE-TARD WAY The Company performed strongly again in fiscal 2007. As presented on pages 2-3 in summary form, revenues grew 19% to reach US$12B. Earnings growth was lower than previous years for two reasons. First was a reduction of half a cent in motor-fuel gross margins, after deducting the costs related to electronic payments at our corporate stores in the U.S., a decrease which represents missing income of some US$17 million. The second was the continuing increase in credit card fees. These surged 22% in 2007 on an industry basis, becoming the second largest expense behind labour. | “We faced the possibility of spending millions of dollars and thousands of hours implementing and documenting these procedures,” says Fortin. “After listening to the experts, I thought there had to be a Couche-Tard way to do this.” The Couche-Tard way turned a necessity into a virtue. Under the management of Raymond Paré, Senior Director of Finance, the extensive tasks were parcelled out and teams trained at each of the Company’s four administrative centres in Laval, Toronto, Columbus Indiana and Phoenix Arizona. It required an intensely detailed plan, the buy-in of senior management of each division and tight scheduling and supervision. |  |

| | | Richard Fortin

Executive Vice-President

and Chief Financial Officer |

MAKING AN ASSET OUT OF A NECESSITY |

| | | |

“These are industry-wide issues for which we will all have to compensate,” says Richard Fortin, Executive Vice President and Chief Financial Officer. “In the long term view, our balance sheet is strong, the Company continues to outpace the competition and opportunities for continued growth remain plentiful.” In-store performance continues to improve, as evidenced by a 11.9% increase in gross profit margin, 74% of which comes from in-store sales. The increase primarily reflects the result of the IMPACT store renovation program which has now upgraded more than 50% of the Company-operated stores. Rigorous cost containment was also evident last year. Despite intense pressure on salaries in hot economies such as Arizona, Florida and Alberta, Selling, General & Administrative Expenses as a percentage of merchandise and services revenues increased less than 1%. An interesting example of cost management was the Company’s approach to complying with the new requirements for internal controls dictated by Canadian and American legislation. |

“There were two big benefits by doing it this way,” explains Paré. “First, while other companies dedicated teams in a centralized effort and spent huge amounts of money, our four regional teams worked as part of their regular duties and additional costs were very, very modest.” “Second, the work was done by the people who could use the knowledge and train others. That knowledge is now in the divisions where it belongs under our decentralized structure.” | TAILORING THE TASK The focus was put on processes and key controls that could have a material impact on the quality of the financial information.

The whole process was done in record time.

The success of this project is mainly due to the tremendous efforts and devotion of Couche-Tard’s people within each division.

|

Alimentation Couche-Tard 16