UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the 2008 Annual Report for the year ended April 27, 2008

Commission File Number: 333-10100

ALIMENTATION COUCHE-TARD INC.

1600 St-Martin Boulevard East

Tower B, Suite 200

Laval, Quebec, Canada

H7G 4S7

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40 F. |

Form 20-F £ Form 40-F Q |

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): |

Yes £ No Q |

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): |

Yes £ No Q |

|

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g-3 under the Securities Exchange Act of 1934. |

Yes £ No Q |

|

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): |

SIGNATURES:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ALIMENTATION COUCHE-TARD INC. |

| |

July 17, 2008 | |

| Per: /s/ Sylvain Aubry |

| Sylvain Aubry |

| Senior Director, Legal Affairs and Corporate Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

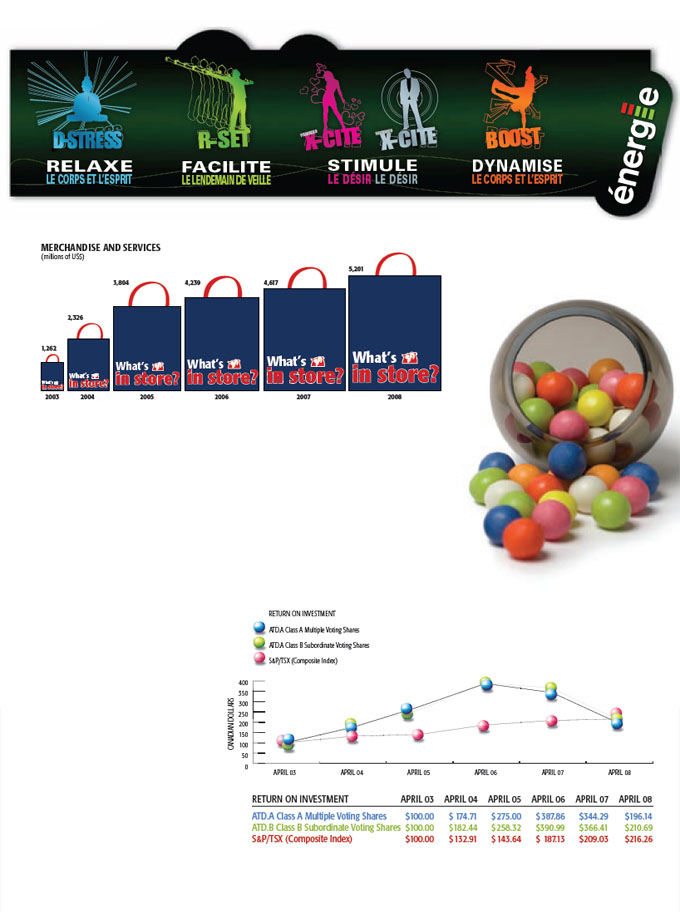

| THE YEAR IN NUMBERS

THREE GREAT BRANDS

11 DIVISIONS

422 IMPACT STORE MAKEOVERS

5,119 STORES COAST TO COAST

45,000 EMPOWERED AND MOTIVATED PEOPLE AND OVER

$15 BILLION IN REVENUES –

AN INCREASE OF 27% |

|

|

|

|

|

|

| FINANCIAL HIGHLIGHTS

(in millions of US dollars, except per share amounts) | | |

| | 2008 | 2007 | 2006(1) | 2005 | 2004(2) | 2003(2) | | |

| | $ | $ | $ | $ | $ | $ | | |

| Consolidated Results | | | | | | | | |

| Revenues | 15,370.0 | 12,087.4 | 10,157.3 | 8,036.8 | 4,395.3 | 2,152.9 | | |

| EBITDA(3) | 484.6 | 492.1 | 438.6 | 343.1 | 174.2 | 100.2 | | |

| Net earnings | 189.3 | 196.4 | 196.2 | 155.2 | 56.1 | 40.6 | | |

| Cash flows(4) | 359.2 | 328.7 | 324.3 | 258.3 | 106.9 | 76.4 | | |

| Per Share | | | | | | | | |

| Net Earnings | | | | | | | | |

| Basic | 0.94 | 0.97 | 0.97 | 0.77 | 0.31 | 0.24 | | |

| Diluted | 0.92 | 0.94 | 0.94 | 0.75 | 0.30 | 0.23 | | |

| Cash flows(4) | 1.78 | 1.63 | 1.61 | 1.28 | 0.60 | 0.45 | | |

| Book value | 6.32 | 5.67 | 4.78 | 3.63 | 2.71 | 1.74 | | |

| Financial Position | | | | | | | | |

| Total assets | 3,320.6 | 3,043.2 | 2,369.2 | 1,995.7 | 1,650.8 | 739.7 | | |

| Property and equipment | 1,748.3 | 1,671.6 | 1,014.1 | 812.0 | 663.3 | 298.5 | | |

| Interest-bearing debt | 842.2 | 870.0 | 524.1 | 530.9 | 536.8 | 204.6 | | |

| Shareholders’ equity | 1,253.7 | 1,145.4 | 966.0 | 733.2 | 535.0 | 293.9 | | |

| Ratios | | | | | | | | |

| Interest-bearing net debt/

total capitalization | 0.33:1 | 0.39:1 | 0.15:1 | 0.28:1 | 0.42:1 | 0.37:1 | | |

| Interest-bearing net debt/

EBITDA)(3) | 1.29:1 | 1.48:1 | 0.39:1 | 0.81:1 | 2.20:1 | 1.71:1 | | |

| 53 weeks. | |

| Restated. | |

| EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) is presented for information purposes only and represents a performance measure used especially in financial circles. It does not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other public companies. | |

| These cash flows and cash flows per share are presented for information purposes only and represent performance measures used especially in financial circles. They represent cash flows from net earnings, plus depreciation and amortization, write-off of financing costs, loss on disposal of assets and future income taxes. They do not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other public companies. | |

| | |

4 | COUCHE-TARD ANNUAL REPORT

(1) | Restated figures for 2003 and 2004. |

(2) | EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) is presented for information purposes only and represents a performance measure used especially in financial circles. It does not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other public companies. |

(3) | These cash flows are presented for information purposes only and represent performance measures used especially in financial circles. They represent cash flows from net earnings, plus depreciation and amortization, write-off of financing costs, loss on disposal of assets and future income taxes. They do not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other public companies. |

COUCHE-TARD ANNUAL REPORT | 5

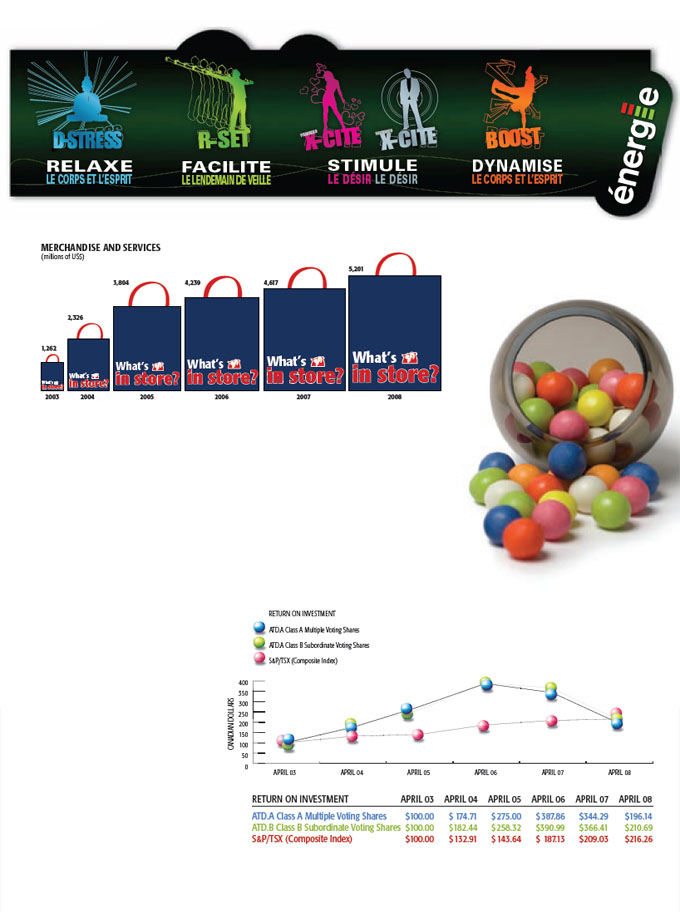

Stock

performance

Concerns over the impact of a significantly weakened economy in the U.S. have driven down the value of Couche-Tard stock over the past 24 months. Company shares placed below the S&P/TSX Composite Index for the first time since 2003.

Management remains confident that Couche-Tard is positioned for strong earnings growth as the general economy in the south and west of the U.S. recovers.

6 | COUCHE-TARD ANNUAL REPORT

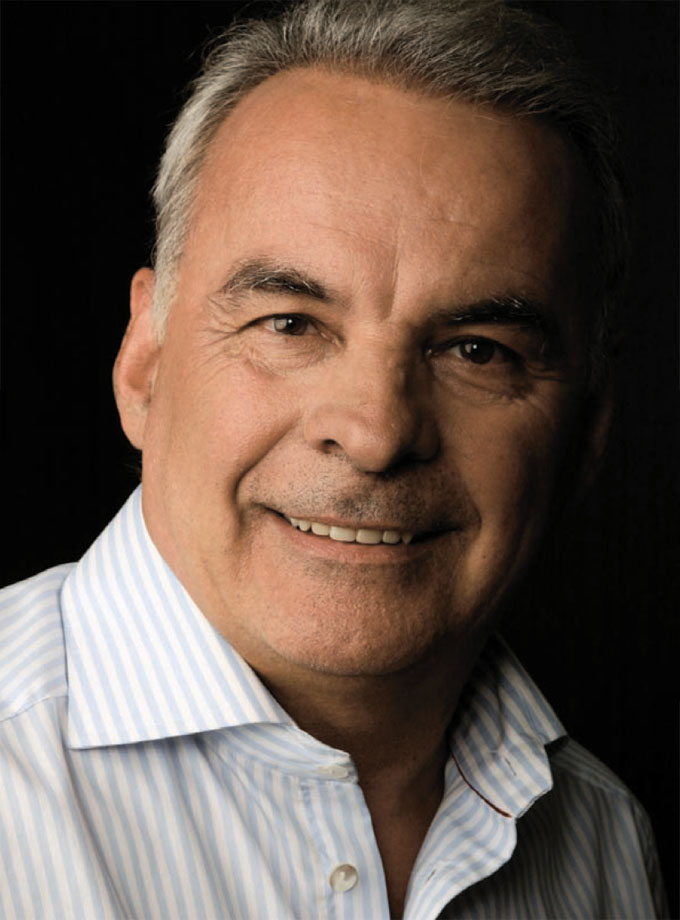

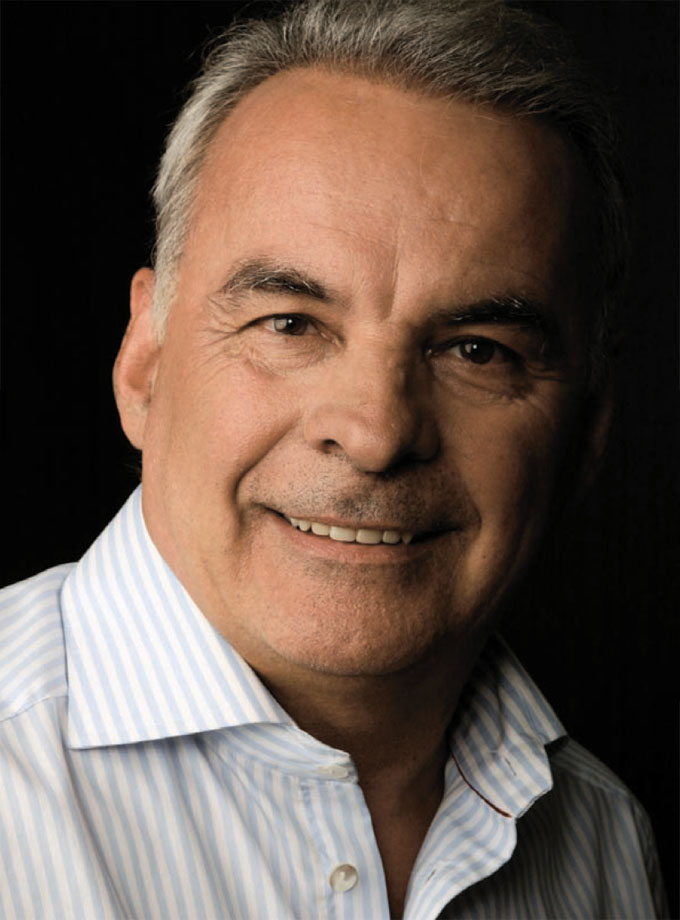

Interview with

Alain Bouchard

“EACH ONE OF OUR STORE MANAGERS RUNS HIS OWN BUSINESS. IT’S LIKE HAVING 4,068 CEOs IN THE NETWORK. IN SPORTS TERMS THAT’S WHAT I WOULD CALL BENCH STRENGTH!”

|

|

message to shareholders |

|

Bench strength |

in tough times |

| | | | |

| To paraphrase a popular prayer, this was the year when a retailer needed serenity to accept the things he could not change, the courage to change those he could and the wisdom to know the difference. Serenity proved to be in demand, because most of the year’s distress was the kind that nothing within our control would alter. Our major markets were hit by a serious economic slowdown, spectacular increases in motor fuel prices, sharply reduced discretionary spending by our customers and, in Arizona, the physical disappearance of the customers themselves due to harsh new immigration laws.

As I mentioned to Réal (Executive Vice-President and COO), it was almost as if convenience retailing had its own “perfect storm”.

Although equity growth remained positive, it slowed substantially and we experienced the first year-over-year decline in operating income and net earnings in 16 years. We ended the year with earnings per share of 94 cents (92 cents diluted) compared with 97 cents (94 cents diluted) in 2007.

Due to higher gasoline pricing and bringing on-stream the stores we acquired in 2007, we grew total sales by over 27%. But that same gasoline pricing represents the biggest single cause for reduced profitability. My colleague Richard (Executive Vice-President and CFO) discusses this elsewhere in this report. The bottom line is that no management team is content to accept the results of this year. While I believe we did change those things we could change, to the extent we outperformed our sector, the goal is clearly a return to double-digit earnings growth. | | THE TOUGH GET GOING There is another saying I like: “when the going gets tough, the tough get going”. I saw this many times over the year. Enduring success cannot be built only in the good times. If there is a silver lining to be seen in the clouds of fiscal 2008, I believe Couche-Tard showed it has what it takes to succeed in bad times and good.

When conditions turn bad, preparation is probably more reliable than prayer. Hard times are mitigated through sound strategic planning, quality processes, financial strength and excellence in execution.

Let’s look at this a bit more closely.

Shareholders are familiar with our three pillars for sustained growth, namely empowered people, geographic diversification and a focus on in-store merchandizing competence. These happen to be not only offensive, but defensive strategies: they help to make Couche-Tard “recession-resistant”.

Empowered people

Our decentralized business model places initiative in the hands of the people on site. Each store manager runs his store as a business and makes key decisions. It’s a bit like having 4,068 CEOs in the network, one for each of our corporate stores.

In sports terms, that’s having depth of talent on the bench. This permits merchandize and marketing strategies specific to each market. In a period of widely different challenges from one region to the other, this also gives us a priceless ability to implement solutions locally and swiftly – to “turn on a dime”. | |

| | | | |

| | | | “ THE GOAL IS CLEARLY

A RETURN TO DOUBLE-DIGIT

EARNINGS GROWTH.” | |

| | | | | |

| | | | | |

|

|

“OUR MEN AND WOMEN ARE THE |

ONES WHO GOT THE JOB DONE.” |

|

We work hard to attract and train the best people by setting a goal of being the best employer. In 2008, it was our 4,068 CEOs and another 45,000-plus men and women that got the job done. Geographic diversification No-one else in the convenience-store business has our diversification. Our earnings are derived primarily from operations in two countries and now 11 geographic markets. The benefits of this network mix were apparent this past year. The adverse economic impact on consumers first surfaced and spread in southern regions, most notably our Southeast, Florida / Gulf Coast, Arizona, and West Coast divisions. We have a large number of our corporate stores in these four regions. Offsetting the loss of momentum in the south, the U.S Midwest and Great Lakes regions enjoyed far healthier mini-economies and have performed strongly. So, did our stores across Canada; we have yet to feel the effects of the slowdown there, although there have been specific challenges. In-store merchandizing Our core competence is inside the store. I believe we are in the industry’s top tier for per-store profitability and per-customer revenues. We have merchandizing strategies and customer service that maximize the opportunity that accompanies each person through the door. Mostly because of this experience, we were successful in minimizing customer loss, as Richard describes elsewhere. “WE ARE IN THE TOP TIER FOR PER-STORE PROFITS AND PER-CUSTOMER REVENUES.” | | We are also the least dependent of our peers on sales of motor fuel, which annually contributes a little over 20% of gross margin. This helped to mitigate the impact of the very low fuel margins in 2008. Taken together, these factors represent a unique balance and a formidable defence against volatility in the marketplace. They help to make Couche-Tard, if not recession-proof, at least robustly recession-resistant. OUR GROWTH CONTINUES Once we were done wringing our hands over fuel prices, we went back to building the network. Two deals announced within 10 days as we transited out of fiscal 2008 will add 335 stores. We acquired another 43 stores earlier. Réal talks about this and the creation of two more business units. GOOD MORNING, VIETNAM We don’t often say very much about our franchise operations, but we have a sizeable second network outside of Canada and the U.S, operated under franchise or licence agreement. There are some 3,600 Circle K stores, mostly in Japan and also in Hong Kong, China, Indonesia, Guam, Macao and Mexico. “THERE ARE SOME 3,600 CIRCLE K STORES OFFSHORE.” This past year Rick Hamlin, who directs this part of our operations, brought in an interesting master franchise and licence agreement for development of Circle K in the Socialist Republic of Vietnam. The convenience store industry is still developing in Vietnam and foreign operators have limited access to this market. We were selected for our sophisticated operations which include management information systems and distinctive branding and design. | |

|

Expectations now are for a fairly drawn-out downturn in consumer spending but this does not in any way weaken our long-term positioning and potential. In fact, as you will be able to read in more detail, the current climate creates excellent opportunities for acquisition of quality assets to extend the network still further.

Accordingly, my colleagues and I concluded this represented an opportunity to build shareholder value through a buy-back of shares. We received approval for repurchase on the open market of up to 5% of Class A multiple voting shares and up to 5% of Class B subordinate voting shares. All shares purchased will be cancelled which will increase the proportionate holding of remaining shareholders.

At April 27, 2008, approximately 3.8% of Class A and 2.8% of Class B had been purchased in this manner. The program runs to August 7, 2008.

I would like to thank all shareholders for their continued support. The fundamentals of both the industry and the company are sound and I look forward to continued growth and a return to our previous levels of profitability as soon as conditions permit.

My colleagues and I would also like to thank the Board of Directors for their valuable guidance and conscientious stewardship. We also are grateful to our business partners, our managers, and the great people working throughout our organization.

Alain Bouchard

WHAT MAKES

US DIFFERENT?

Chairman of the Board, President and Chief Executive Officer

A dozen ways to differentiate Couche-Tard

• MOTIVATED AND EMPOWERED PEOPLE

Everyone understands and buys into our vision. Stores managers run their own operation including setting goals and budgets.

• SCALE OF OPERATION

We are close to our consumers through a network of 5,119 stores in 11 business units and are the second largest c-store chain in North America.

• GEOGRAPHIC DIVERSIFICATION

Our businesses are now in 33 U.S. States and 10 Provinces of Canada. This acts as an hedge against impact from regional market variance.

• MERCHANDISING FOCUS

We are less dependent upon gasoline sales than others. Given the mid-term outlook, we view that as a strength.

• OPERATION EXCELLENCE

Each store and region measures itself against set benchmarks. Best practices from each region are passed along and shared.

• ADVANCED TOOLS

We provide our stores with the latest technology and techniques for managing inventory and tracking sales trends.

• LEAN OVERHEAD

The head office team consists of a small group of highly skilled specialists whose primary role is to support the business units.

• FINANCIAL STRENGTH

We have a strong balance sheet. Even after credit tightened, we completed a sale leaseback of $131 million and increased our revolving credit facility by another $310 million.

• ACQUISITION STRATEGY

We observe a rigorous criteria to ensure every acquisition returns positive value in a specified term. Our model for integrating new stores is an industry standard.

• CUSTOMER ENVIRONMENT

Our IMPACT conversion program creates modern, efficient and customer friendly surroundings. Over 61.3% of the network meets this standard.

• CONSISTENT PERFORMANCE

The severe economic downturn in the southern US made fiscal 2008 the first year in 16 that we have not exceeded the previous year’s growth. We still grew, but much more slowly.

• CARING AND CONCERN

We are a caring company, with concern for both our planet and our communities. Couche-Tard in 2008 raised and donated to worthy causes over $14 million dollars.

BUYING OUR OWN SHARES

I know our recent share performance has been a disappointment to many shareholders; we are shareholders, too. But there is a case to be made here for perspective.

Share value, after all, is in the eye of the holder. The current multiples being applied are not necessarily unreasonable if your outlook is near-term. Those with a longer-term view and familiar with the company and its history may share the belief that we are undervalued at this time.

“SHARE VALUE IS IN THE

EYE OF THE HOLDER.”

“FINALLY WE HAVE OUR TOES IN BOTH OCEANS! OUR NEW STRATEGIC ALLIANCE WITH IRVING OIL BROADENS THE NETWORK COAST-TO-COAST IN BOTH CANADA AND THE U.S.”

At the end of the fiscal year, the acquisition of 83Convenient Food Mart stores took the company into Missouri for the first time. A few days later, an innovative new deal with an old partner, Irving Oil, pushes the network into four new Canadian provinces and four U.S. states.

This commercial alliance affects 252 convenience stores. Of these, 128 will carry a Couche-Tard brand in New Brunswick, Nova Scotia, Newfoundland and Labrador and Prince Edward Island. A further 124 stores will become Circle K in Maine, New Hampshire, Massachusetts and Vermont.

“Irving is a great partner,” says Mike Guinard, Vice-President, Special Projects. “We are operating all their c-stores now and this alliance will continue to grow as we expand our presence in these regions.”

The third expansion issue comes from increasing the number of stores. Including the deals mentioned here, we added 960 corporate stores in the past two years.

“That’s a big increase in capacity,” says Réal Plourde, Executive Vice-President and Chief Operating Officer. “Being able to bolt on that many stores demonstrates the flexibility of our business model. It has another benefit that might be overlooked. It increases the effectiveness of our benchmarking.”

An important expansion of the company network has been partially obscured by the economic challenges of the past year.

• We created two new business units.

• We extended our reach into eight new provinces

and states.

• We have added over 1,000 new stores to the network

in the past two years.

First of these three achievements was the formation of two new divisions which came on-stream May 1, 2008. The new Southwest division, based in Dallas, has 228 stores lifted from three neighbouring business units. The new Gulf Region has 303 stores spun off from the old Florida/Gulf and Southeast regions.

This comes only one year after creation of the Great Lakes Region and takes the total business units, or Divisions, to 11.

In each case, the changes respond to own guidelines for keeping store counts to around 500-600 for efficient management. It also allows a more precise focus on local needs and preferences, a hallmark of the Couche-Tard business model.

The second achievement significantly expands the company’s geographic scope and extends our reach from Pacific to Atlantic in both Canada and the U.S.

10 | COUCHE-TARD ANNUAL REPORT

operations report

Brian Koenig spoke from the heart when stood up at a meeting last year and thanked Couche-Tard and Circle K for the year he had just spent.

Koenig joined the Great Lakes division 12 months earlier in an acquisition. He manages 39 Circle K stores.

“I was given my division, the tools and the parameters and told to run it my way,” he says. “The spirit is tremendous and I felt part of the team right away.”

Koenig has spent 15 years in c-stores. “I’ve never been this happy, ever,” he says. “And I wanted everyone to know that.”

Réal Plourde

Executive Vice-President and Chief Operating Officer

COUCHE-TARD ANNUAL REPORT | 11

Couche-Tard’s 5,119 store network is spread among its three heavyweight brands: Couche-Tard, Mac’s and Circle K. Often overlooked are a family of smaller brands which play a prominent role in their own locales.

These are the brands of the 540-store affiliated program under namely the banners of Sept-Jour, Dairy Mart and Winks.

This affiliated program is where many newcomers gain a foothold in Canada with their first business venture.

“Joining the affiliate program gives access to the latest in industry trends, business acumen and merchandising strategies not normally available to independents,” says Rick Pasemko, Director of Franchise for Central Canada.

Benchmarking

to get better

There is a lot of work to be done before new assets can contribute to best practices. The company’s integration procedures are one of the keys to its successful growth through acquisition.

During a pre-closing period of about eight weeks to complete due diligence, teams from both acquirer and acquired pair up by discipline and complete an exhaustive review.

Immediately after the closing, senior executives and management tour all of the incoming facilities to re-assure personnel and share the Couche-Tard philosophy.

It then takes an average 12 months to get each store up to speed, measured by progress towards specific targets.

Some integrations take longer than others. The company’s biggest recent challenge came with assets which had been inconsistently managed by many third-party dealers.

Although the fundamentals such as location were excellent, the stores were in poor shape, with little stock and no labour in the deal.

“It’s taken over a year, but we’re getting there,” says Plourde.

As COO, Plourde oversees an intensive benchmarking process which is a major contributor to high levels of per store performance throughout the network.

“A centralized company has no-one to benchmark against,” he continues. “Detailed data on competitors is impossible to get. The more disparate regions we have, the more potential for valuable benchmarking.”

Comparative data is gathered on leading product categories such as milk, beer and soft drinks as well expenses and business processes. How one region takes a specific product to market or how it deals with vendors is shared among all regions. The outcome is the awareness and adoption of best practices.

In the past 12 months, the focus has been on cost containment and significant improvements have been achieved in the area of per-store IT expense.

Integration formula

a success

“A CENTRALIZED OPERATION COMPANY

HAS NO-ONE TO BENCHMARK AGAINST.”

Bright modern premises in Las Cruces, New Mexico show Circle K fuel branding and spacious interior store layout.

operations report

COUCHE-TARD ANNUAL REPORT | 13

In Erie, Colorado, Shell and Circle K are partners in the marketplace.

In Ancienne-Lorette, Quebec, it’s Irving Oil and Couche-Tard delivering the best in service to customers.

“INTEGRATION PROCEDURES

ARE A KEY TO OUR GROWTH.”

14| COUCHE-TARD ANNUAL REPORT

The company’s sources of revenue at year end were spread over 29 states and six provinces. This geographic diversification is a competitive strength which helped Couche-Tard in a challenging year. It was a year especially notable for the wide discrepancy in regional conditions around the company’s operating territories.

Canada is responsible for around 20% of the company’s revenues and has recently been benefitting from strong growth. In contrast to the economic turmoil in the U.S., growth of same-store sales have continued to strengthen north of the border.

Resource-rich western Canada has enjoyed strong growth for several years and this year the Eastern and Central Canada divisions also experienced that momentum. Both units have completed significant two-year make-overs with excellent results: Eastern Canada recorded its biggest increase in traffic and revenues in six years.

“Our team has worked hard in a competitive market and we’re very pleased with the result,” says Michel Bernard, Vice-President, Operations for Eastern Canada.

The division added six new store openings and seven Couche-Tard Menu store conversions with an extended food offer. In F2009, a commercial alliance with Irving Oil adds 128 stores with fuel in the four Atlantic provinces.

“EASTERN CANADA RECORDED ITS BIGGEST INCREASE IN TRAFFIC AND REVENUES IN SIX YEARS.”

TOBACCO CHALLENGE

Both Quebec and Ontario are adversely affected by developments in tobacco retailing. The two provinces are the primary market for sale of illegal cigarettes and, in Spring 2008, restrictive new government legislation came into effect banning the in-store display of any tobacco product.

“Of the two, the contraband issue is the one to worry about,” says Jean-Luc Meunier, Vice-President, Operations for Central Canada. “The display legislation has been in place out west for a while. It is the illegal smokes that are causing significant loss of in-store traffic and revenue.”

“IN ONTARIO 32% OF ALL TOBACCO SOLD IN 2007 WAS CONTRABAND.”

Ontario and Quebec account for over 96% of all illegal tobacco sales in Canada. The situation has reached a point in Ontario where 32% of all tobacco sold in 2007 was contraband.

In the western part of Canada, the ongoing challenge continued to be recruiting and retaining labour. The division introduced innovative incentives, bolstered training and now has a division recruiting position as well as trainers in each key market.

“Unlike many competitors, none of our stores have closed or had to reduce operating hours,” says Kim Trowbridge, Western Canada’s Vice-President Operations.

operations review

COUCHE-TARD ANNUAL REPORT | 15

MAC’S

WORLD

CHAMPION

This fall, Mac’s is looking for two straight. Jonathan Wong, Training & Development Specialist, won the retailer category in Toronto this past winter and heads to Chicago for the global competition.

This year’s challenger Jonathan Wong

Last year in Toronto, Tom Moher, Director of real Estate and Business Development for Central Canada, won the Canadian retailer category in the Global Convenience Industry Achievement Awards for young professionals aged 21-32.

He went on to win the global event in Atlanta, Georgia against competitors from Australia, New Zealand, the United Kingdom and the United Sates.

Global champion Tom Moher

sults”

Another strong contributor in 2008 is the Midwest and Great Lakes region of the U.S., a market which is now covered by two divisions. A year ago, the sprawling Midwest Region was split into two without any slowdown in same-store momentum, growing merchandise sales.

“It’s in our DNA,” says Darrell Davis, Vice-President, Operations for U.S. Midwest, the historic division where Couche-Tard first entered the U.S. market in 2001. “Our division is a melting pot of past acquisitions. We learn from each and from our sister divisions and adopt our own way of doing things.”

CHANCE TO BE FAMOUS

Meanwhile the offspring wasted no time in bulking up. The Great Lakes division added 31 new stores to reach a net 307 and completed 25 IMPACT conversions. The division exceeded its first-year business goals with a strong focus on establishing the basics of business.

“We need to establish the foundation and culture that we want to be known for, now and in the future,” says Paul Rodriguez , Vice-President, Operations for U.S. Great Lakes. “Our challenge became ‘What are we going to be famous for?”

This year’s challenger Jonathan Wong

“WHAT ARE WE GOING TO BE FAMOUS FOR? WE CAN CREATE A BEST-OF-THE-BEST.”

16| COUCHE-TARD ANNUAL REPORT

Both divisions are in a very competitive area with traditionally lower fuel margins, placing the emphasis on growing merchandise sales. Current focus is on food service sales and delivering fresh products several times a week.

The successful result of splitting up Midwest sets the bar for two other expansions in 2008 – a new Gulf Coast region and a Southwest region.

The Gulf Coast division eases a previous overload, putting half the 666 stores in the old Florida/Gulf combined region under separate management. It also clears the way for Couche-Tard’s trademark, field-level management approach.

The territory includes four quite distinct markets in Memphis, Mobile/Pensacola, Shreveport and Baton Rouge.

“By focusing specifically on these markets, we are able to understand them better and use different marketing opportunities in each community to drive growth,” says Jason Broussard, the new Vice-President, Operations for Gulf Coast.

“I SEE A LOT OF OPPORTUNITY. WE’VE BEEN A GOOD CONSOLIDATOR, MORE EFFICIENT THAN MOST, AND THIS IS A TIME TO CREATE MORE VALUE AS OTHER STORE MANAGERS AND OPERATORS PULL BACK OR GIVE UP.”

Brian Hannasch

Senior Vice-President, U.S. Operations

BEST OF BREED

The second new business unit, Southwest, also brings management closer to the community but with still another twist. This division is even more diverse, straddling four states and formed by combining stores from three different business units – Arizona, West Coast and Gulf Coast.

A first-year priority will be getting 228 stores from these different units on the same page. A comprehensive top-to-bottom communication program has been created to align everyone with the new Division’s goals and objectives.

“We have a big opportunity here” points out Lou Valdes, Southwest’s Vice-President, Operations. “By bringing together store operators already at home in these different areas, we can be really close to our customers and focus on their precise needs in each region.”

Both of the new divisions will have to contend with the difficult economic conditions faced by the four divisions they came out of. West Coast, Arizona, Florida and Southeast have all had to battle major challenges in each of their markets.

“It’s highly unusual,” says Brian Hannasch, Senior Vice-President, U.S. Operations and a 20-year veteran of C-stores. “We’ve reached a point where people are changing their behaviour. This could create a new playing field with ultimately a lot of opportunities for us”.

UNIQUE STRUCTURE

The West Coast unit is predominantly based in California, where the economy was set back by the housing downturn, energy prices and immigration issues. The division is also unique among its peers: the Circle K locations are almost equally distributed between company stores, single-site franchise stores and stores operated by ConocoPhillips.

COUCHE-TARD ANNUAL REPORT | 17

Cold drinks are the big seller in hot climates.

This Circle K store in Salinas, California gives easy access to cold beer and soft drinks as well as frozen goods.

This division made solid progress in 2008 to create synergies among the three managing groups and establish a marketing organization that serves all channels equally, ensuring a consistent customer experience.

A new challenge was posed with creation of the Southwest Division which takes away the Yuma, New Mexico and El Paso markets. This left 175 stores sharing the West Coast Division overhead where there used to be 286.

“Our goal was not to add to the burden of the remaining stores,” says U.S. West Coast’s Vice-President, Operations Tim Tourek. “Every department was challenged and we have actually achieved an overhead savings in spite of the reduced store count.”

In Arizona, Circle K is the market leader in both merchandise sales and fuel volume. With 545 locations in the state, the brand has strong recognition and high market penetration.

Arizona, like California has been hard hit from the slowdown in the U.S. and the whole region is also suffering economically from measures to stop illegal immigration from Mexico. Nowhere is the problem more severe than in Arizona.

18| COUCHE-TARD ANNUAL REPORT

LED lighting in coolers is high on the green list for most divisions. They cost much less to run and, unlike fluorescents, don’t give off heat. They are estimated to last 133 times as long.

Hispanic immigration over the years has been a key driver of economic growth for Arizona. This past January, the country’s harshest immigration laws went into effect, targeting illegal workers and triggering a mass exodus. Stores serving the Hispanic community, one-third of the total, have suffered a 6% decline in traffic .

Mac’s store in Edmonton, Canada

CUSTOMERS VANISHED

“STORES SERVING THE HISPANIC COMMUNITY LOST 6% OF THEIR TRAFFIC.”

Measured by surface area, 33% of the store network is in Canada and 67% in the USA.

“All our stores are down, but those serving the Hispanic population have lost significantly more customers,” says Geoff Haxel, Arizona’s Vice-President, Operations. “We will be working to rebuild the customer count and especially to grow the transaction size to compensate.”

If there is an epicentre to the economic earthquake of the past two years, it is Florida. The housing industry there has been devastated and, in many areas, industry jobs account for almost 20% of the workforce, twice the national average.

Convenience store markets in Florida and neighbouring states started the year with the same sales decline, but, while performance improved in the second half outside the state, Florida sales continued to fall.

The division made the best of a challenging situation, outperforming the market and growing share across the region as well as improving in-store margin.

“Our focus has been to manage the things we can and execute our plan,” says Mike Struble, Vice-President, Operations for Florida. “We stayed with our marketing plan and the share growth we won will fuel future growth and continue to solidify our position in the marketplace.”

COUCHE-TARD ANNUAL REPORT | 19

ANYONE

SEEN FRED?

SILVER LINING

The Southeast Region also lies in the “primary challenge zone” but, like Florida, managed to put a silver tinge on the clouds.

Seeing an opportunity for proprietary soft drinks, Southeast partnered with a national leader, to produce its own line of flavoured soft drinks.

“The convenience channel is 25% of soft drink sales but the least developed with private label,” says Southeast’s outgoing Vice-President, Operations Bob Campau. “Our Live Vibe drink has been an immediate hit.”

“OUR LIVE VIBE DRINK HAS BEEN A HIT.”

Circle K store manager Kathy Miller was halfway through her day in Taylorville, Illinois when she realized someone was missing.

“Has anyone seen Fred?,” she called out. You could set your clock by Fred. An elderly man living alone, he came into the store twice a day without fail. No-one had seen him for two days.

Troubled, Kathy asked police to check Fred’s home and also asked an employee to go. Fred had fallen two days earlier and could not get up.

“He’s in a nursing home now and I know the girls in the store still visit and keep in touch,” says Therese Wardell, Circle K market manager. “What a wonderful thing that Kathy knew her customers so well and did something!”

The region has also taken aim at the 20% annual growth in the energy drink market with a new brand of its own, GAzZü.

Matt McCure takes over the division leadership with the transfer of Campau to VP, Administration based in Phoenix.

20| COUCHE-TARD ANNUAL REPORT |

|

Time to get |

grow |

Compare the company’s growth with economic conditions of the last decade and the graph lines will go in opposite directions. | | FOUR COMPONENTS |

| | | Couche-Tard must meet a target of 25% return on capital employed, the first of four components of a successful acquisition program.

The second is being prepared: an opportunity is meaningless if the company is not able to act on it as a result of sound financial policy. The company keeps a low net debt to total capitalization ratio and has the capacity to fund new acquisitions up to $1.5 billion without resorting to equity.

Third is the speed and efficiency with which the company integrates the acquired assets and brings the per-store contribution to its own higher levels.

Fourth is the company’s decentralized management structure.

“Our structure makes it relatively simple to expand the network and maintain the same level of management efficiency,” says the man who started it all, President and Chief Executive Officer Alain Bouchard. “I don’t really see a limit to our growth.” |

• | In 1997, following the Canadian economic slump of 95-96, Couche-Tard acquired 295 stores in Quebec, Ontario and the west of Canada, its biggest purchase to that point. | |

| | |

• | In 1999 as the dot.com bubble was bursting, the company acquired 980 more stores in Canada. | |

| | |

• | In 2001 and 2002 as the U.S. slipped into recession, it added 546 stores in the U.S. Midwest. | |

| | |

• | In late 2003, the year unemployment reached its highest point in the past 10 years , Couche-Tard added 1,663 stores across 16 states. | |

| | |

The correlation is not hard to see: when times are hard, small or inefficient operators are motivated to sell; when times are good, asking prices frequently reflect inflated real estate values over business worth. | |

| |

“When the asking price is two million for a corner store that is returning $100,000 a year, there’s no point in going any further,” says Richard Fortin, Executive Vice President and CFO. | |

| | |

The latest bubble from 2005-2007 is now deflating rapidly, thanks to the U.S. housing collapse and a tightening of credit. Butch Seber is Vice-President, Real Estate Development and monitors all the U.S. divisions. | | |

| | |

“People are coming around,” he says. “There is a delay before they realize their price is no longer realistic but that’s happening now. Also, land and construction costs were through the roof in many areas and they’ve come back to earth as well. | | “ WHEN TIMES ARE HARD,

OPERATORS ARE MOTIVATED

TO SELL.” |

| |

“We’re going to see a lot more opportunities this coming year.” | |

1 | EASTERN CANADA |

| Couche-Tard |

|

| 556 |

|

| 330 |

| Total 886 |

2 | CENTRAL CANADA |

| Mac’s |

|

| 590 |

|

| 210 |

| Total 800 |

3 | WESTERN CANADA |

| Mac’s |

|

| 290 |

4 | U.S. GREAT LAKES |

| Circle K |

|

| 307 |

5 | U.S. MIDWEST |

| Circle K |

|

| 340 |

|

| 55 |

| Total 395 |

6 | U.S. SOUTHEAST |

| Circle K |

|

| 283 |

|

| 7 |

| Total 290 |

7 | FLORIDA |

| Circle K |

|

| 419 |

8 | GULF |

| Circle K |

|

| 303 |

|

| 1 |

| Total 304 |

9 | ARIZONA |

| Circle K |

|

| 557 |

|

| 21 |

| Total 598 |

10 | U.S. WEST COAST |

| Circle K |

|

| 175 |

|

| 300 |

| Total 475 |

11 | SOUTHWEST |

| Circle K |

|

| 228 |

|

| 127 |

| Total 355 |

| COMPANY-OPERATED STORES |

| AFFILIATED STORES |

12 | INTERNATIONAL

CHINA

GUAM

HONG KONG

INDONESIA

JAPAN

MACAU

MEXICO

TOTAL 3,599 |

EASTERN

CANADA

Québec

New Brunswick

Nova Scotia

Prince Edward

Island

Newfoundland | CENTRAL

CANADA

Ontario | WESTERN

CANADA

British

Columbia

Alberta

Manitoba

Saskatchewan | U.S. GREAT

LAKES

Michigan

Ohio

Pennsylvania

Vermont

Massachusetts

New-Hampshire

Maine | U.S.

MIDWEST

Illinois

Indiana

Iowa

Kentucky | |

| | | | | |

U.S.

SOUTHEAST

Alabama

Georgia

North Carolina

South Carolina | FLORIDA

Alabama

Florida | GULF

Tennessee

Mississippi

Louisiana

Arkansas

Panhandle

of Florida | ARIZONA

Arizona

Nevada

Utah | U.S.

WESTCOAST

California

Hawaii

Kansas

Missouri

Oregon

Washington | U.S.

SOUTHWEST

Texas

Colorado

Oklahoma

New Mexico |

22 | COUCHE-TARD ANNUAL REPORT

|

Setting the right |

direction |

| | |

| Couche-Tard is committed to good governance. Our corporate and business policies as well as financial procedures are reviewed and approved by our Board of Directors led by Alain Bouchard. | |

| | |

| | | |

BOARD OF DIRECTORS | OFFICERS | | |

|

ALAIN BOUCHARD(1)

Chairman of the Board,

President and Chief Executive Officer | ALAIN BOUCHARD

Chairman of the Board,

President and Chief Executive Officer | MATT MCCURE

Vice-President,

Operations Southeast | |

|

RICHARD FORTIN(1)

Executive Vice-President

and Chief Financial Officer | RICHARD FORTIN

Executive Vice-President

and Chief Financial Officer | JEAN-LUC MEUNIER

Vice-President,

Operations Central Canada | |

|

RÉAL PLOURDE(1)

Executive Vice-President

and Chief Operating Officer | RÉAL PLOURDE

Executive Vice-President

and Chief Operating Officer | PAUL RODRIGUEZ

Vice-President,

Operations U.S. Great Lakes | |

|

JACQUES D’AMOURS(1)

Vice-President, Administration | Jacques D’AmourS

Vice-President,

Administration | BUTCH SEBER

Vice-President,

Real Estate Development | |

|

ROGER DESROSIERS, F.C.A.(3)

Corporate Director | BRIAN HANNASCH

Senior Vice-President,

U.S. Operations

| MIKE STRUBLE

Vice-President,

Operations Florida | |

|

JEAN ÉLIE(3)

Corporate Director | ROBERT G. CAMPAU

Vice-President,

U.S. Administration | TIM TOUREK

Vice-President,

Operations U.S. Westcoast | |

|

MÉLANIE KAU (2)

President, Mobilia Interiors inc.

| RAYMOND PARÉ

Vice-President,

Corporate Finance and Treasurer | KIM J. TROWBRIDGE

Vice-President,

Operations Western Canada | |

|

ROGER LONGPRÉ(2) (3)

President

Mergerac Inc. | MICHEL BERNARD

Vice-President,

Operations Eastern Canada | LOU VALDES

Vice-President,

Operations Southwest | |

|

JEAN-PIERRE SAURIOL, Eng.(2)

President and Chief Executive Officer

Dessau Inc. | JASON BROUSSARD

Vice-President,

Operations Gulf | SYLVAIN AUBRY

Senior Director,

Legal Affairs

and Corporate Secretary | |

|

JEAN TURMEL(4)

President

Perseus Capital Inc. | DARRELL DAVIS

Vice-President,

Operations U.S. Midwest | | |

|

(1) Member of the Executive Committee

(2) Member of the Human Resources and

Corporate Governance Committee

(3) Member of the Audit Committee

(4) Lead Director | MICHAEL GUINARD

Vice-President,

Special Projects

GEOFFREY C. HAXEL

Vice-President,

Operations Arizona | | |

| | | |

Half way through the year, the extent of the U.S. economic downturn became apparent. It was clear this situation would last longer than most forecasting had anticipated.

Four of the six operating regions in the U.S. – representing 48% of the network and 78% of the U.S. store count – were increasingly affected by economic recession relating to the collapse of the housing market and sub-prime mortgage lending.

By the second half of the fiscal year, the impact on our performance was pronounced. The final quarter contained the worst comparative data in recent memory.

Although revenues for the year grew 27.2%, to $15.4 billion, it was mostly from high fuel prices and recent acquisitions. Operating income fell to $312.1 million from $358.3 million in 2007. Net earnings declined $7.1 million or $0.02 per share (diluted) to $189.3 million or 92 cents per share on a diluted basis.

Same-store merchandize sales grew 2.5% in the U.S., a slowdown of 0.8%, and by 4% in Canada, an increase of 1.4%. The consolidated gross margin for merchandize and services slipped half a point to 33.6%

Both sales volume and margins for fuel varied widely between Canada and the U.S. Same-store volume growth was excellent in Canada at 6.3% and margins grew by almost 18%. In the U.S., faced with a more challenging market, same-store volumes fell 0.2% and margins fell to 13.58 cents a gallon, almost 9% below 2007.

“FUEL MARKETS VARIED WIDELY BETWEEN CANADA AND THE U.S.”

“OUR STRONG BALANCE SHEET PLAYS A BIG ROLE AT TIMES LIKE THESE AND LEAVES US IN GOOD POSITION TO PROFIT FROM OPPORTUNITIES.”

WHAT’S A CENT WORTH?

COUCHE-TARD ANNUAL REPORT | 25

Losing or gaining one cent profit per gallon of gasoline doesn’t sound like much – unless you pump 3 billion gallons each year as Couche-Tard does.

Then it adds up. In fact, it adds up to $30 million.

Impact

at the pump

The negative impact on our operations of abrupt gas price changes is felt in three ways.

First is the time lag between the jump in our purchase price and corresponding increase at the pump. When the increases are as severe as they have been, this time lag is longer than usual and the increase is harder to recover. As a result, the gross margin is reduced, sometimes to the point where we are losing money before we are able to establish appropriate pricing at the pump.

We pumped the equivalent of 3.0 billion gallons last year in the U.S. and a one-cent margin reduction is a loss of $30 million before tax.

Second, the credit card fees relating to gas purchases are a percentage of the sale price. In other words, at 2%, a $2 dollar gallon would mean four cents in fees and a $4 gallon eight cents, a significant increase in cost which is difficult to recover and remain competitive.

Third, the exceptionally high prices have resulted in less traffic, meaning fewer store visits and reduced in-store sales.

Profits or people?

A drop-off in traffic, when consumer cash tightens up, leaves merchants with a choice of protecting profit margins or customer traffic.

“It was clear in our mind we should maintain our customer base ,” says Richard Fortin, Executive Vice-President and Chief Financial Officer. “To do that, we had to be aggressive with promotions. We have not always passed through higher costs to the consumer. But, in the long term, it costs less to keep the customer coming back.”

“WE CHOSE TO KEEP OUR CUSTOMERS COMING BACK.”

Financial muscle

As noted elsewhere, market conditions are increasingly favourable toward quality acquisition opportunities. Couche-Tard’s strong balance sheet puts it in excellent position, without resource to new share equity.

In December, we entered into a sale and leaseback transaction involving 83 properties for a total selling price of $131.4 million. This reduced our term revolving unsecured credit and contributed to strengthening our balance sheet still further. In June of 2008, we replicated our revolving credit facility already in place, adding $310 million at the same conditions.

“This shows clearly how strong our balance sheet is and also the trust our financial partners have in our capacity to generate value and to grow,” says Raymond Paré, Vice-President, Corporate Finances and Treasurer.

Richard Fortin

Executive Vice-President and Chief Financial Officer

Heating, cooling and lighting the company’s vast store network is not a small expense at over $84 million. It breaks down this way: lighting 52%, air conditioning 34% and heating 14%.

Doing the right thing for the planet is turning out to be the right thing for business. In a survey this year by Wal-Mart, the world’s biggest retailer, 66% more people than last year chose an eco-friendly product over competing products.

“The business benefits of green are more sharply defined now,” says Réal Plourde, a member of the company’s Energy Committee. “I think both employees and customers want to deal with an ecologically conscious company.”

supported by the Conference Board of Canada and has been recognized as one of 15 companies on the TSX Climate Disclosure Leadership Index. The Index exists to help investors better understand the associated long-term risks.

In 2008, the company continued to focus on reducing its environmental footprint by measuring and reducing Greenhouse Gas Emissions (GHG). It is an active participant in the Carbon Disclosure Project

Couche-Tard is concerned about climate change and is committed to meeting environmental regulations wherever it does business. It is also taking a pro-active role in seeking ways to minimize its environmental impact and adopt sustainable processes.

The energy committee is pursuing more efficient production and use of energy system-wide, including CFL light bulbs and computerized HVAC and refrigeration systems control. One third of the company’s energy is from renewable sources.

All areas of the company’s operations are actively involved.

• Plastic bags are being replaced with bags made from recycled paper.

• Branded cloth bags are being sold.

• Stores are operating recycling centres and collecting recyclable products for ongoing shipment.

• New bins are being installed in some regions to separate fibres.

• New site construction is undertaken in consultation with energy efficiency specialists.

• An accelerated campaign to increase employee awareness of recycling issues is being developed.

• Executive travel is minimized through use of video conferencing facilities.

“ONE THIRD OF THE COMPANY’S ENERGY IS FROM RENEWABLE SOURCES.”

26 | COUCHE-TARD ANNUAL REPORT

ONE

PENNY

AT A TIME

FRIENDS

IN HIGH

PLACES

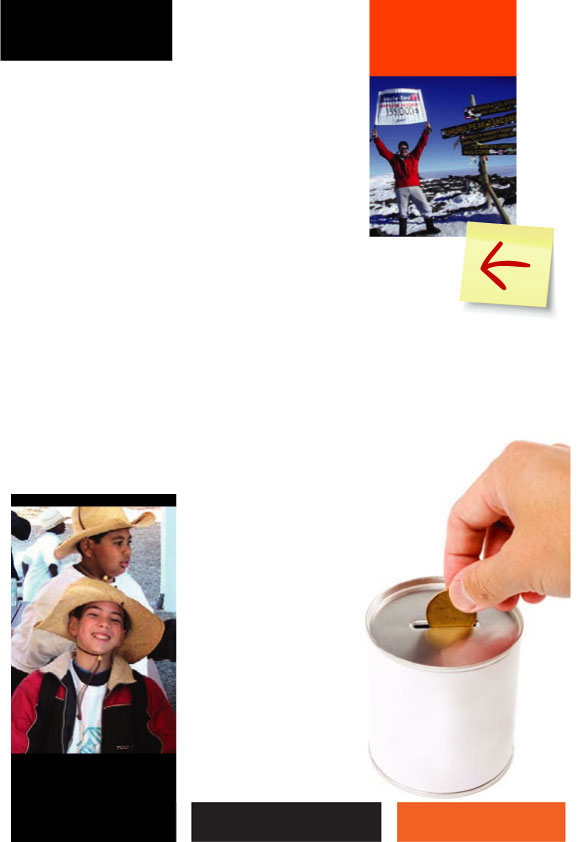

As the company’s store network grows, so does its capacity to contribute to the communities in which it does business. Each one of the 5,119 stores is a touchpoint with the community and a rallying point for local causes.

Couche-Tard does a lot more than mobilize collections. The company and its people all give generously of both time and money to help others. Some regions identify specific periods: U.S. Midwest schedules two three-week campaigns during which each of our 340 stores raises over $1,000.

That’s Michel Bernard in the photo, six days after starting his climb to the top of Mt. Kilimanjaro, the seventh highest peak in the world. Michel is Vice-President, Operations for Eastern Canada. The banner he’s holding later went up to $140,000, the amount he and his teammates and many, many friends of Couche-Tard raised for two community charities: Opération Enfant Soleil and Maison de soins palliatifs de Laval.

In some areas, donations and collections meet specific community needs. The struggling Women’s Shelter in Surrey, B.C. was a new recipient in the Western Canada region last year and received close to $20,000.

“We were looking for more community involvement and there had been a lot of publicity about spousal abuse,” says Ed Hellinger, marketing manager for Western Canada. “You feel good about helping people like this.”

In other regions, a national organization is selected as the beneficiary. The largest single recipient of this goodwill is the United Cerebral Palsy Association, which helps 1,200 families in the U.S.

Arizona’s commitment to UCP dates from 2001, a year when it donated $430,000. In fiscal 2008, the division raised $2.2 million. Florida/Gulf Coast has also given seven-figure support to UCP for many years. FishStix, a golf and fishing event for friends and partners which it started in 2005, last year raised over $500,000 for the one event.

In Central Canada , Mac’s once again raised an astonishing $7.9 million for a wide range of regional charities. Couche-Tard’s community support totalled over $14 million in 2008 and will only continue to increase as the networks grows ever larger.

Boys and Girls Club of America has been championed by the West Coast Division since 2003 and this year received $144,804 in Circle K donations.

“MAC’S RAISED AN ASTONISHING $7.9 MILLION.”

28| COUCHE-TARD ANNUAL REPORT

EXECUTIVE OFFICE

1600, Saint-Martin Boulevard East

Tower B, suite 200

Laval, Quebec H7G 4S7

Telephone: (450) 662-3272

Fax: (450) 662-6648

AUDITORS

Raymond Chabot Grant Thornton LLP

600, de la Gauchetière West

Suite 1900

Montreal, Quebec H3B 4L8

TRANSFERT AGENT

Computershare Trust Company

of Canada

1500, University Street

Suite 700

Montreal, Quebec H3A 3S8

INVESTORS RELATIONS

Richard Fortin

Executive

Vice-President

and Chief Financial Officer

For any additional information about Alimentation Couche-Tard Inc., shareholders, investors and analysts are requested to contact the Corporate Secretary by writing to the executive office address or the following e-mail address:

info@couche-tard.com

www.couche-tard.com

STOCK INFORMATION

Alimentation Couche-Tard Inc.’s shares are listed on the TSX under the ticker symbols ATD.A and ATD.B

See

what's

in store for

YOU!