UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the Annual General Meeting of Shareholders 2010

Commission File Number: 333-10100

ALIMENTATION COUCHE-TARD INC.

4204 Industriel Blvd

Laval, Quebec, Canada

H7L 0E3

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40 F.

Form 20-F |_| Form 40-F |X|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes |_| No |_ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes |_| No |_ |

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g-3 under the Securities Exchange Act of 1934.

Yes |_| No |_ |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

SIGNATURES:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ALIMENTATION COUCHE-TARD INC. |

| | |

| July 14, 2010 | |

| | Per:/s/ Sylvain Aubry |

| | Sylvain Aubry |

| | Senior Director, Legal Affairs and Corporate Secretary |

| | |

ALIMENTATION COUCHE-TARD INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN THAT the annual general meeting (the "Meeting") of shareholders of Alimentation Couche-Tard Inc. (the “Company”) will be held at the Laval room 1, at the Congress Centre of the Hotel Sheraton Laval, located at 2440 Des Laurentides Highway, in the City of Laval, Province of Quebec, onTuesday August 31, 2010, at 11:00 a.m. (local time), for the following purposes:

| 1) | to receive the consolidated financial statements of the Company for the fiscal year ended April 25, 2010, together with the auditors’ report thereon; |

| | |

| 2) | to elect the directors of the Company for the ensuing year; |

| | |

| 3) | to appoint the auditors of the Company and authorize the board of directors to set their remuneration; and |

| | |

| 4) | to transact such other business as may properly come before the Meeting or any adjournment thereof. |

The Management Proxy Circular, a form of proxy for the Meeting and a registration form for the Company’s shareholder supplemental list are enclosed with this notice.

If you are unable to attend the Meeting, please exercise your right to vote by signing and returning the enclosed form of proxy in the enclosed stamped envelope. Proxies may also be deposited with the Secretary of the Meeting, immediately prior to the commencement of the Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

(s)Sylvain Aubry

Sylvain Aubry

Senior Director, Legal Affairs

and Corporate Secretary

Laval, Quebec, July 13, 2010

ALIMENTATION COUCHE-TARD INC.

MANAGEMENT PROXY CIRCULAR

This proxy circular (the "Circular") is furnished in connection with the solicitation of proxies by the management of Alimentation Couche-Tard Inc. (the "Company")for use at the annual general meeting of shareholders of the Company (and at any adjournment thereof) (the "Meeting") to be held on Tuesday, August 31, 2010, at 11:00 a.m. (local time), at the place and for the purposes set forth in the accompanying notice of the Meeting (the "Notice"). Unless otherwise indicated, the information contained herein is given as of June 30, 2010.

SOLICITATION OFPROXIES

The proxies must be deposited at the office of the transfer agent of the Company, Computershare Trust Company of Canada, 100 University Ave., 9th Floor, North Tower, Toronto, Ontario, Canada, M5J 2Y1, before the time fixed for the Meeting. A shareholder executing the enclosed proxy has the power to revoke it at any time prior to its use, in any manner permitted by law, including by instrument in writing executed by the shareholder or by his attorney authorized in writing or, in the case of a corporation, by an officer or attorney authorized in writing. This instrument must be deposited either at the office of the transfer agent of the Company at any time up to forty-eight hours preceding the day of the Meeting at which the proxy is to be used, or with the Secretary of the Meeting on the day of the Meeting.

A shareholder has the right to appoint some other person (who need not be a shareholder of the Company) to represent him in attendance and to act on his behalf at the Meeting other than the individuals designated by the management of the Company and named in the enclosed form of proxy. Such right may be exercised by inserting in the space provided on such form of proxy the name of the other person the shareholder wishes to appoint or by completing another proper form of proxy.

This solicitation of proxies by the management of the Company is being carried out by mail. The Company may also, upon request, reimburse brokers and other persons holding shares as nominees for their reasonable costs incurred in sending proxy material to beneficial owners of shares of the Company. The costs of solicitation will be borne by the Company as per the regulation.

INSTRUCTIONS FORNON-REGISTEREDSHAREHOLDERS

Non-registered shareholders may vote shares that are held by their nominees in two ways. Applicable securities laws and regulations require nominees of non-registered shareholders to seek their voting instructions in advance of the Meeting. Non-registered shareholders will receive from their nominees a request for voting instructions for the number of shares held on their behalf. The nominee’s voting instructions will contain instructions relating to signature and return of the document and these instructions should be carefully read and followed by non-registered shareholders to ensure that their shares are accordingly voted at the Meeting. Non-registered shareholders who would like their shares to be voted on their behalf must therefore follow the voting instructions provided by their nominees.

Non-registered shareholders who wish to vote their shares in person at the Meeting must insert their own name in the space provided on the request for voting instructions in order to appoint themselves as proxy holders and follow the signature and return instructions provided by their nominees. Non-registered shareholders should not complete the remainder of the form sent to them by their nominees as their votes will be taken and counted at the Meeting.

VOTINGSHARES

The voting shares of the Company are its Class A Multiple Voting Shares (the “Multiple Voting Shares”) and its Class B Subordinate Voting Shares (the “Subordinate Voting Shares”). As at June 30, 2010, 53,706,712 Multiple Voting Shares and 131,711,661 Subordinate Voting Shares of the Company were issued and outstanding. Each Multiple Voting Share carries 10 votes and each Subordinate Voting Share carries one vote with respect to all matters coming before the Meeting. Therefore, the total aggregate voting rights for the Multiple Voting Shares are 80.31% and 19.69% for the Subordinate Voting Shares.

Conversion Rights

Each Multiple Voting Share is convertible at any time at the holder's option into one fully paid and non-assessable Subordinate Voting Share. Upon the earliest to occur of: (i) the day upon which all of the Majority Holders (defined in the Articles of the Company as being Messrs. Alain Bouchard, Richard Fortin, Réal Plourde and Jacques D'Amours) will have reached the age of 65, or (ii) the day when the Majority Holders hold, directly or indirectly, collectively less than 50% of the voting rights attaching to all outstanding voting shares of the Company, each Subordinate Voting Share shall be automatically converted into one fully paid and non-assessable Multiple Voting Share.

Take-Over Bid Protection

In the event that an offer as defined in the Articles of the Company (an "Offer") is made to holders of Multiple Voting Shares, each Subordinate Voting Share shall become convertible at the holder's option into one Multiple Voting Share, for the sole purpose of allowing the holder to accept the Offer. The term "Offer" is defined in the Articles of the Company as an offer in respect of the Multiple Voting Shares which, if addressed to holders resident in Québec, would constitute a take-over bid, a securities exchange bid or an issuer bid under theSecurities Act (Québec) (as presently in force or as it may be subsequently amended or readopted), except that an Offer shall not include: (a) an offer which is made at the same time for the same price and on the same terms to all holders of Subordinate Voting Shares; and (b) an offer which, by reason of an exemption or exemptions obtained under theSecurities Act (Québec), does not have to be made to all holders of Multiple Voting Shares; provided that, if the offer is made by a person other than a Majority Holder or by a Majority Holder to a person other than a Majority Holder, in reliance on the block purchase exemption set forth in section 123 of theSecurities Act (Québec), the offer price does not exceed 115% of the lower of the average market price of the Multiple Voting Shares and the average market price of the Subordinate Voting Shares as established with the formula provided by theRegulation Respecting Securities (Québec). The conversion right attached to the Subordinate Voting Shares is subject to the condition that if, on the expiry date of an Offer, any of the Subordinate Voting Shares converted into Multiple Voting Shares are not taken up and paid for, such Subordinate Voting Shares shall be deemed never to have been so converted and to have always remained Subordinate Voting Shares. The Articles of the Company contain provisions concerning the conversion procedure to be followed in the event of an Offer.

Holders of Multiple Voting Shares and holders of Subordinate Voting Shares listed as shareholders at the close of business on July 9, 2010 (“Record Date”) will be entitled to vote at the Meeting in respect of all matters which may properly come before the Meeting.In orderto be entitled to vote, a holder of Multiple Voting Shares or of Subordinate Voting Shares who has acquired his shares after this date must, at least ten (10) days before the Meeting, request that the Company enter his name on the list of shareholders entitled to vote. If two or more persons are joint holders of shares, those among such holders attending the Meeting may, in the absence of the others, vote such shares. However, if two or more joint holders are present in person or represented by proxy at the Meeting and wish to vote thereat, they may do so only as one and the same person. If more than one joint holder are present or represented by proxy, the vote must be made jointly and in unison.

-2-

Following a review of the agreement amongst shareholders of the Company intervened in December 1987, binding namely Développements Orano Inc. (“Orano”), having as majority shareholder Mr. Alain Bouchard and the other shareholders being Messrs. Jacques D’Amours, Richard Fortin and Réal Plourde, and Metro Inc (“Metro”) and in continuance with their former relationship, they concluded a revised shareholders’ agreement on March 8, 2005 with respect to their participation in the Company. Following a corporate reorganisation of Orano occurred on October 14, 2008, the shares held by Orano, which shareholders were Messrs. Bouchard, D’Amours, Fortin and Plourde, in the Company are now held by Orano and holding companies controlled respectively by Messrs. D’Amours, Fortin and Plourde (the “Holdings”). Following such reorganisation, Metro, Orano and the Holdings have entered into an amended shareholders agreement with respect to their participation in the Company. The rights and obligations of the parties under that amended agreement remain mainly the same as the ones in the 2005 agreement which are mainly as follows:

| (i) | Metro holds a pre-emptive right to participate in new issues of shares to maintain its then existing equity ownership percentage of the Company; |

| | |

| (ii) | Metro holds the right to nominate one person for election to the board of directors of the Company as long as it holds at least 5% of all the outstanding shares of the Company on a fully diluted basis; the representative currently designated by Metro on the board of directors of the Company is Mr. Jean Élie who is not a Metro employee and not related in anyway except for this nomination; |

| | |

| (iii) | Metro, Orano and the Holdings have undertaken not to sale or transfer directly or indirectly the shares of the Company held by them without the other party’s prior written consent; |

| | |

| (iv) | Metro, Orano and the Holdings hold a reciprocal right of first opportunity on the sale or transfer of shares held by them, subject to certain conditions; and |

| | |

| (v) | Metro, Orano and the Holdings hold a reciprocal right of first refusal on the sale and transfer of the shares of the Company held by them, subject to certain exceptions for transfers to permitted assignees (including to any of Messrs. Alain Bouchard, Richard Fortin, Réal Plourde and Jacques D'Amours). |

This agreement provides that it will terminate if either Metro or Orano and the Holdings (the latter considered as a whole) holds less than 5% of the issued and outstanding shares of the share-capital of the Company on a fully diluted basis.

Following the corporate reorganisation of Orano, the latter and the Holdings as well as Messrs. Bouchard, D’Amours, Fortin and Plourde (the “Persons”) have signed a voting agreement whereby the Persons and their respective Holding undertake to exercise their respective direct and indirect voting rights in the Company in favour of each Person’s election, subject that such Persons hold, directly or indirectly, a minimum of 1,500,000 shares of the Company. Should one of the Persons fall under such minimum share holding, the agreement will cease to apply to such Person even if eventually the minimum holding is reached. However, the agreement will continue to apply to the other parties to the agreement.

PRINCIPALHOLDERS OFSECURITIES

To the knowledge of the officers and directors of the Company, the only persons who beneficially own or exercise control or direction over shares carrying more than 10% of the votes attached to each class of voting shares outstanding of the Company are:

-3-

| | | Number of | | | | Number of | | |

| Name | | Multiple Voting | | Percentage of | | Subordinate | | Percentage of |

| | | Shares | | Multiple Voting | | Voting Shares | | Subordinate |

| | | beneficially | | Shares | | beneficially | | Voting Shares |

| | | owned, controlled | | outstanding | | owned, controlled | | outstanding |

| | | or directed | | | | or directed | | |

| | | | | | | | | |

| Alain Bouchard | | 19,225,474(1) | | 35.8 % | | 1,413,968(2) | | 1.1 % |

| Jacques D’Amours | | 10,786,436(3) | | 20.1 % | | 283,200 | | 0.2 % |

| Richard Fortin | | 5,464,710(4) | | 10.2 % | | 532,200 | | 0.4 % |

| Réal Plourde | | 2,223,548(5) | | 4.1 % | | 1,223,600 | | 0.9 % |

| Metro Inc. | | 15,018,680 | | 28.0 % | | 5,723,668 | | 4.3 % |

| Fidelity(7) | | - | | - | | 13,267,300 | | 10.1 % |

| | (1) | Of this number, 17,137,752 shares are held through Développements Orano Inc. (“Orano”), a company controlled by Alain Bouchard, President and Chief Executive Officer of the Company(6). |

| | (2) | Of this number, 1,245,000 shares are held through Orano(6). |

| | (3) | Of this number, 7,954,626 shares are held through 9201-9686 Québec Inc.(6), a company controlled by Jacques D’Amours, Vice-President, Administration of the Company. |

| | (4) | Of this number, 4,176,798 shares are held through 9201-9702 Québec Inc.(6), a company controlled by Richard Fortin, Chairman of the Board of the Company. |

| | (5) | Of this number, 1,534,746 shares are held through 9203-1848 Québec Inc.(6), a company controlled by Réal Plourde, Executive Vice- President of the Company. |

| | (6) | These companies and their respective controlling shareholders are part to a voting agreement conferring them voting control over more than 10% of the outstanding votes of the Company. Therefore, together they own a total of 37,700,168 Multiple Voting Shares and 3,452,968 Subordinate Voting Shares conferring them 56.78% of the voting rights of the shares outstanding. |

| | (7) | Comprised of the affiliated Fidelity companies: Fidelity Management & Research Company, Pyramis Global Advisors, LLC, Pyramis Global Advisors Trust Company and FIL Limited. |

MANAGEMENT’SREPORT ANDFINANCIALSTATEMENTS

The consolidated financial statements of the Company for the financial year ended April 25, 2010 and the report of the auditors thereon will be submitted at the Annual General Meeting of Shareholders, but no vote thereon is required or expected. These consolidated financial statements are reproduced in the Company’s 2010 Annual Report which was sent to shareholders who requested it with this Notice of Annual General Meeting of Shareholders and Management Proxy Circular. The Company’s 2010 Annual Report is available on SEDAR (www.sedar.com) as well as on the Company’s website (www.couche-tard.com/corporate).

ELECTION OFDIRECTORS

The Board of Directors must be composed of a minimum of three directors and of a maximum of 20 directors. Pursuant to a resolution of the Board of Directors, 10 persons are to be elected as directors for the current fiscal year, each to hold office until the next annual meeting of shareholders or until such person’s successor is elected or appointed. Management proposes the election, at the Meeting, of the following 10 nominees, who are all currently members of the Board of Directors.

Management does not contemplate that any of the nominees will be unable to serve as a director but, if that should occur for any reason prior to the Meeting, the persons named in the enclosed form of proxy reserve the right to vote for another nominee in their discretion unless the shareholder has specified in the proxy that his shares are to be withheld from voting in the election of directors.

Unless otherwise specified by the shareholders, the shares represented by any proxy enclosed herewith will be voted FOR the election of the 10 persons hereinafter named, each of whom will be nominated for election as a director.

-4-

| | | | Number of | Number of | |

| | | | Multiple Voting | Subordinate | |

| | | | Shares | Voting Shares | |

| | | | beneficially | beneficially | |

| | | | owned or over | owned or over | |

| | | | which control | which control | Number of |

| Name and Municipality of | | Director | or direction is | or direction is | deferred share |

| Residence | Principal Occupation | Since | exercised(1) | exercised(1) | units(2) |

| | | | | | |

| Alain Bouchard(3) | President and Chief | 1988 | 19,225,474(4) | 1,413,968(5)(11) | - |

| Lorraine, Québec | Executive Officer of the | | | | |

| | Company | | | | |

| | | | | | |

| Jacques D’Amours(3) | Vice-President, | 1988 | 10,786,436(7) | 283,200(11) | - |

| Lorraine, Québec | Administration of the | | | | |

| | Company(6) | | | | |

| | | | | | |

| Roger Desrosiers, FCA(13) | Corporate Director | 2003 | - | 10,000 | 6,849 |

| Montréal, Québec | | | | | |

| Chairman of the Audit | | | | | |

| Committee | | | | | |

| | | | | | |

| Jean Élie(13) | Corporate Director | 1999 | - | 21,900 | 6,350 |

| Montréal, Québec | | | | | |

| | | | | | |

| Richard Fortin(3) | Chairman of the Board of | 1988 | 5,464,710(8) | 532,200(11) | - |

| Longueuil, Québec | the Company | | | | |

| | | | | | |

| Mélanie Kau(12) | President, Mobilia | 2006 | - | - | 9,911 |

| Montréal, Québec | Interiors Inc. | | | | |

| | | | | | |

| Roger Longpré(12)(13) | President, Mergerac Inc. | 2001 | - | 16,000 | 10,055 |

| Brossard, Québec | (consulting firm in mergers | | | | |

| Chairman of the Human | and acquisitions) | | | | |

| Resources and Corporate | | | | | |

| Governance Committee | | | | | |

| | | | | | |

| Réal Plourde(3) | Executive Vice-President | 1988 | 2,223,548(9) | 1,223,600(11) | - |

| Montréal, Québec | of the Company | | | | |

| | | | | | |

| Jean-Pierre Sauriol(12) | President and Chief | 2003 | - | 4,000 | 15,536 |

| Laval, Québec | Executive Officer, Dessau | | | | |

| | inc. (engineering- | | | | |

| | construction company) | | | | |

| | | | | | |

| Jean Turmel(14) | President, Perseus | 2002 | - | 38,000 | 17,940 |

| Montréal, Québec | Capital Inc. (Fund | | | | |

| | management corporation) | | | | |

| | (1) | The information as to the shares beneficially owned, controlled or directed, not being within the knowledge of the Company, has been furnished by the respective candidates individually. |

| | (2) | For more details see section “Deferred Share Unit Plan”. |

| | (3) | Member of the Executive Committee. |

| | (4) | Of this number, 17,137,752 shares are held through Orano.(10) |

| | (5) | Of this number, 1,245,000 shares are held through Orano.(10) |

| | (6) | Mr. D’Amours is on a sabbatical leave since March 2005. |

| | (7) | Of this number, 7,954,626 shares are held through 9201-9686 Québec Inc.(10) |

| | (8) | Of this number, 4,176,798 shares are held through 9201-9702 Québec Inc.(10) |

| | (9) | Of this number, 1,534,746 shares are held through 9203-1848 Québec Inc.(10) |

| | (10) | These companies and their respective controlling shareholder are part to a voting agreement conferring them voting control over 56.78% of the outstanding votes of the Company. |

| | (11) | Messrs. Alain Bouchard, Richard Fortin, Réal Plourde and Jacques D’Amours also hold options granting them the right to purchase 2,500,000, 1,170,000, 1,170,000 and 50,000 Subordinate Voting Shares, respectively. |

| | (12) | Member of the Human Resources and Corporate Governance Committee. |

| | (13) | Member of the Audit Committee. |

| | (14) | Lead director. |

-5-

To the knowledge of the Company and based on information provided to it by the nominees, none of these nominees is, as of July 13, 2010, or was, within 10 years before that date, a director or executive officer of a company (including the Company) which, while the nominee held that position or in the year following the date on which the nominee ceased to hold that position, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, was subject to proceedings instituted by its creditors or instituted proceedings against its creditors, made an arrangement or compromise with its creditors or took steps to make an arrangement or compromise with its creditors, or had a receiver, receiver manager or trustee appointed to hold its assets, with the exception of Roger Desrosiers who was, until June 10, 2009, director and President of the Board of Directors of Aqua-Biokem BSL Inc. and ABK-Gaspésie Inc., following his appointment by Desjardins Capital de risque, their respective majority controlling shareholder, which has requested and obtained on June 16, 2009 the appointment of a receiver to hold their respective assets pursuant to section 47.1 of theBankruptcy and Insolvency Act. Since then, all the assets of these companies have been liquidated.

COMPENSATION OFDIRECTORS

Deferred Share Unit Plan

In order to further align the interest of its directors with those of its shareholders, the Board of Directors of the Company has implemented on July 13, 2004, a Director Compensation Policy, which provides namely:

any director that is an employee of the Company or one of its subsidiaries does not receive any director compensation;

the Company will no longer grant any stock options to independent directors, but instead will grant deferred share units (“DSU”) in accordance with the Company’s Deferred Share Unit Plan (the “DSU Plan”);

at least 50% of the annual retainer fee will be paid in DSU and the director may elect to be paid in either cash or DSU for the remaining 50%;

independent directors may elect to have up to 100% of their other compensation, including attendance fees, paid in DSU; and

independent directors must hold at least 5,000 shares or DSU within three years after the latest of July 13, 2004 or their election to the Board.

Under the DSU Plan, directors are credited on the basis of the amounts payable to such director divided by the value of a unit. The value of a unit corresponds to the weighted average trading price of the Subordinated Voting Shares on the Toronto Stock Exchange over the five trading days immediately preceding the credited date. The units take the form of a credit to the account of the director. Upon a director ceasing to act as member of the Board of Directors of the Company, the director has the right to receive payment of the DSU credited to his account in either (i) in cash, base on the market value of a Subordinated Voting Shares on the date of payment, or (ii) in Subordinated Voting Shares to be acquired on the open market by the Company, equal to the number of DSU acquired by the director. The payment date of the DSU is determined by the director, subject to the Human Resources and Corporate Governance Committee approval but no later the first calendar year following the calendar year during which the director has cease to act as member of the Board. Units are not transferable other than through a will or other testamentary instrument or in accordance with succession laws.

DUS entitle holders thereof to dividends which are paid in the form of additional units at the same rate applicable to dividends paid from time to time on Subordinated Voting Shares.

The following table set forth the details of the total annual compensation and attendance fees paid in kind or not, to the directors for the fiscal year ended April 25, 2010.

-6-

Name

| Compensation ($)(1)

| Share-based awards

| Value of

Retirement

Plan

($) | Total

Compensation

Paid

($) | Compensation

Breakdown |

|

Basic

Annual

Compensation

(2)(3)

($) | Compensation

Chairman of

Committee(2)

($) | Compensation

Committee

Member(2)

($) | Attendance

Fees(4)

($) | Total

Compensation

($) | Allotment

based on

DSU Plan

(1)(2)(3)

($) | Dividends

paid in

form of

DSU

($) | By

Cash

($) | BY

DSU

($) |

| Richard Fortin | 202,500(5) | - | - | - | 202,500 | - | - | - | 202,500 | 202,500 | - |

| RogerDesrosiers(6) | 13,500 | 6,075 | - | 9,450 | 29,025 | 13,500 | 932 | - | 43,457 | 29,025 | 14,432 |

| Jean Élie | 13,500 | - | 2,025(7) | 12,600 | 28,125 | 13,500 | 855 | - | 42,480 | 27,112 | 15,368 |

| Mélanie Kau | 13,500 | - | 2,025 | 9,450 | 24,975(8) | 13,500 | 1,284 | - | 39,759 | - | 39,759 |

| Roger Longpré(9) | 13,500(10) | 3,375 | 2,025 | 16,650 | 35,550 | 13,500 | 1,337 | - | 50,387 | 22,050 | 28,337 |

| Jean-PierreSauriol | 13,500 | - | 2,025 | 9,450 | 24,975 (11) | 13,500 | 2,096 | - | 40,571 | - | 40,571 |

| Jean Turmel | 30,375(12) | - | - | 5,400 | 35,775(13) | 13,500 | 2,387 | - | 51,662 | - | 51,662 |

| Total | 300,375 | 9,450 | 8,100 | 63,000 | 380,925 | 81,000 | 8,891 | - | 470,816 | 280,687 | 190,129 |

| | (1) | In support to the Company’s Management decision with regards to reducing their respective base salary by 10% for fiscal year 2010, the directors have accepted as well to reduce their total annual compensation by 10% for fiscal year 2010. |

| | (2) | The payment of the annual compensation is spread over four instalments which three of them have been paid during fiscal year ending April 25, 2010. |

| | (3) | In line with the Director Compensation Policy of the Company, half of the Directors’ basic annual compensation is paid in DSU according to the DSU Plan. |

| | (4) | An amount of $1,350 is paid for each Board of directors meeting and Human Resources and Corporate Governance Committee meeting, and $1,800 for each Audit committee meeting. |

| | (5) | Based on an annual compensation of $202,500, his mandate as Chairman of the Board does not qualify him under the DSU plan. |

| | (6) | President of Audit Committee. |

| | (7) | Mr. Élie requested to receive half of this amount in DSU. |

| | (8) | Ms. Kau requested to receive the total of this sum in DSU. |

| | (9) | President of Human Resources and Corporate Governance Committee. |

| | (10) | Mr. Longpré requested to receive the total of this amount in DSU. |

| | (11) | Mr. Sauriol requested to receive the total of this sum in DSU. |

| | (12) | This amount includes a sum of $16,875 in his capacity as lead director. |

| | (13) | Mr. Turmel requested to receive the total of this sum in DSU. |

Outstanding share-based awards and option-based awards

The following table set forth for each independent director details pertaining to all outstanding stock options at the end of the fiscal year ended April 25, 2010.

| | Option-based Awards | Share-based Awards |

Name

| Number of

securities

underlying

unexercised

options(1) | Option exercice

price ($)(1)(2)

| Option expiration

date(3)

| Value of

unexercised in-

the-money

options ($)(4)

| Number of shares

or units of shares

that have not

vested

| Market or payout

value of share-

based awards

that have not

vested ($) |

| Roger Longpré | 40,000 | 7.3575 | March 19, 2012 | 439,300 | - | - |

| Jean Turmel | 20,000 | 6.24 | March 18, 2013 | 242,000 | - | - |

| | (1) | Stock options were granted prior to the change of the Company’s policy with respect to grants to independent directors as indicated above. Take note that on March 18, 2005, there was a share split on all of the Company’s issued and outstanding shares on a two for one basis and therefore, the outstanding stock options were adjusted accordingly as to the number and the exercise price. |

| | (2) | The exercise price of a stock option corresponds to the weighted average trading price of the Subordinated Voting Shares on the Toronto Stock Exchange over the five trading days immediately preceding the grant date. |

| | (3) | The stock options expire at the tenth anniversary from grant date. |

| | (4) | Value of unexercised in-the-money options at financial year-end is the difference between the closing price of the Subordinate Voting Shares on the Toronto Stock Exchange at fiscal year-end ($18.34) and the exercise price.This gain has not been, and may never be, realized. The options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the aforesaid shares on the date of exercise. |

-7-

Incentive plan awards – value vested or earned during the fiscal year

The following table sets forth, for each independent director, the aggregate dollar value that would have been realized if the DSU had been cashed on the grant date that occurred in fiscal 2010.

Name

| Option-based awards – Value

vested during the fiscal

year($) | Share-based awards – Value

vested during the fiscal

year($)(1) | Non-equity incentive plan

compensation – Value

earned during the year($) |

| Roger Desrosiers | - | 14,432 | - |

| Jean Élie | - | 15,368 | - |

| Mélanie Kau | - | 39,759 | - |

| Roger Longpré | - | 28,337 | - |

| Jean-Pierre Sauriol | - | 40,571 | - |

| Jean Turmel | - | 51,662 | - |

| (1) | The PSU are only payable upon a director ceasing to act as member of the Board of Directors of the Company. The director has the right to receive payment of the DSU credited to his account in either (i) in cash, base on the market value of a Subordinated Voting Shares on the date of payment, or (ii) in Subordinated Voting Shares to be acquired on the open market by the Company, equal to the number of DSU acquired by the director. For more information, refer to section “Director Compensation – Deferred Stock Unit Plan” of this circular. |

EXECUTIVECOMPENSATIONCompensation discussion and analysis

The Company is committed to a competitive compensation policy that drives short- and long-term business performance. To that effect, the Board of Directors has created a Human Resources and Corporate Governance Committee to assist the Board of Directors in fulfilling its responsibilities relating to matters of human resources and corporate governance, namely compensation, establishing succession plan and development of senior management including Named Executive Officers (as defined under section “Summary Compensation Table”). This Committee has the responsibility for evaluating and making recommendations to the Board regarding the compensation of the Named Executive Officers and the equity-based and incentive compensation plans, policies and programs of the Company.

The Company’s compensation policy focuses on financial performance, both at the corporate and divisional levels, while providing its executive officers the necessary incentives to further the development of the Company, in line with its strategy and values. In determining compensation for Named Executive Officers, the Human Resources and Corporate Governance Committee reviews a survey of compensation practices of a peer group of listed Canadian and U.S. companies of similar size in the retail and manufacturing (food) industries, to benchmark compensation against the median (50thpercentile) of the peer group. The peer group is comprised of the following companies:

| Canada | | United States |

| • Canadian Tire Corporation Limited | • Rona Inc. | • Caseys General Stores Inc. |

| • The Jean Coutu Group (PJC) Inc. | • Saputo Inc. | • The Pantry Inc. |

| • Maple Leaf Foods, Inc. | • Sears Canada Inc. | • Smithfield Foods |

| • Loblaw Companies Limited | • Shoppers Drug Mart | • Susser Holdings |

| • Metro Inc. | • Tim Hortons | • Delek Holdings |

The compensation of the Named Executive Officers is comprised of the following components:

| Compensation Components | Description | Objectives |

| | | |

| Base salary | • Annual base cash compensation. | • Attract, retain and motivate. |

| | | • Recognize level of responsibility

and individual performance over

time. |

-8-

| Compensation Components | Description | Objectives |

| Annual incentive plan (“AIP”) | • | Bonus plan ranging from 50% to 100% of base salary which payment is determined by Company financial objectives (75%) and personal objectives (25%). | • | Motivate to achieve strategic objectives and business priorities of the Company. |

| • | Make Named Executive Officers accountable for the achievement of financial objectives. |

| | • | If the Company’s financial objectives are met at less than 90%, no bonus is paid on the Company financial objectives component. | | |

| • | If the financial objectives of the Company are attained at 90%, bonus shall be 10% on the Company financial objectives component and scaled-up by 10% for each additional percentage up to a maximum of 100%. | | |

| • | Should the Company financial objectives be surpassed by 130%, the maximum bonus paid on the Company financial objectives component may reach 250% of the base salary. | | |

| Long-term incentive plan | • | Stock option plan. | • | Motivate to achieve objectives that are aligned with the Company’s strategic objectives and align interests of Named Executive Officers with those of the shareholders. |

| (“LTIP”) | • | Grants vary according to position held and individual contribution (for more details with respect to this plan, refer to section “Long- term incentive plan – stock option plan” of this Circular.) |

| | • | Phantom stock unit plan. | • | Motivate to achieve objectives that are aligned with the Company’s strategic objectives and align interests of Named Executive Officers with those of the shareholders. |

| | • | Grants vary according to position held and individual contribution (for more details with respect to this plan, refer to section “Long- term incentive plan – phantom stock unit plan” of this Circular.) |

| Retirement plan | • | Defined benefit plan to provide retirement income in the form of a lifetime annuity. | • | Attract, maintain and offer competitive benefits. |

| | • | Retirement supplemental plan based on the base salary and part of the AIP paid in some cases. | | |

| Other benefits | • | Company vehicle, health program and financial planning. | • | Attract, maintain and offer competitive benefits. |

In order to achieve the objectives described in the above table, the various compensation components are established as follows:

- Base salary -is targeted at the market median, with adjustments above and below median to reflect specific circumstances such as experience and individual performance;

-9-

Annual incentive plan -targets are set at the median of the market for performance that meets objectives, with the possibility of exceeding target incentive payments (up to 250 % of the base salary) when results exceed objectives and (down to zero (0)) incentive payments when results are below target;

Long-term incentive plan –stock options formed part up to recently of the total compensation envelope established at the median of the market. Options are granted for a term of ten years and the terms during which such options may be exercised are determined at the time of each grant. The conditions of vesting and exercise of the options are established when such options are granted and the option price, as established, shall not be less than the weighted average closing price for a board lot of the Subordinate Voting Shares traded on the Toronto Stock Exchange for the five days preceding the date of grant. In fiscal year 2010, upon the Human Resources and Corporate Governance Committee’ s recommendation, the Board of Directors approved the implementation of a phantom stock unit (“PSU”) plan for the executive officers. The compensation program under the PSU plan sets forth annual grants in accordance with to predetermined grant levels ranging from 20% to 90% of the base salary considering the position held by the executive officer. The PSU vest three years less a day from the grant date and are payable in cash upon vesting. The PSU payment is subject to two objectives, one time Company employment related (35%) and the other the Company’s performance compared to its competitors (65%). The performance objectives are determined upon the PSU grant and are related to the Company’s operating performances over a three consecutive year period from the grant date and compared to certain of its competitors over the same period. The PSU grant price and payment price, as established, shall not be less than the weighted average closing price for a board lot of the Subordinate Voting Shares traded on the Toronto Stock Exchange for the five days preceding the date of grant or date of payment, as applicable.

Although stock options do not form part of the total compensation envelope, discretionary grants may occur, from time to time, to executive officers following extraordinary accomplishments as it was the case previously; and

Pension and benefits -are set at market competitive levels.

PERFORMANCEGRAPH

In June 1995, the outstanding common shares of the Company were converted into Multiple Voting Shares and Subordinate Voting Shares. The Multiple Voting Shares and the Subordinate Voting Shares were traded on the Montreal Exchange until December 3, 1999 and commenced trading on the Toronto Stock Exchange on December 6, 1999.

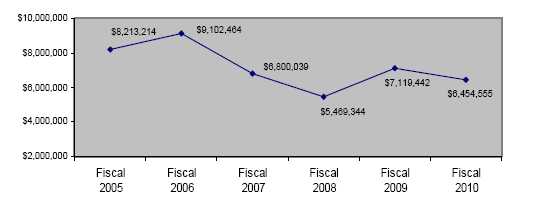

The following graph compares the cumulative total shareholder return on $100 invested at the end of April 2005 in Multiple Voting Shares and Subordinate Voting Shares of the Company with the cumulative total shareholder return on the Toronto S&P/TSX Composite Index.

-10-

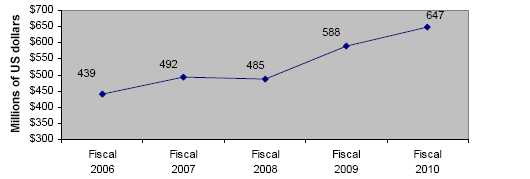

The Company determines the Named Executive Officers’ compensation according to the policy and procedures described above and not based on the total stock performance on any given stock market namely due to the fact that its stock trading price is affected by external factors beyond the Company’s control which do not necessarily reflect the Company’s performance. The following graph illustrates the Company’s performance during said period by using a performance measure used by especially in financial circles i.e. EBITDA(1), which is a key component of sustained growth.

| | (1) | Meaning Earnings Before Interest, Tax, Depreciation and Amortization. It does not have a standardized meaning prescribed by Canadian GAAP and therefore may not be comparable to similar measures presented by other publicly traded companies. |

In order to motivate the Named Executive Officers to reach targets that are aligned with the Company’s strategic objectives and the interests of those of the shareholders, the Company grants them stock options under its LTIP. Stock options granted over these fiscal years have an exercise price ranging from $13.45 to $25.71 and therefore cannot be considered as compensation since the gain has not been, and may never be, realized. The options have not been, and may never be, exercised; and actual gains, if any, on exercise will depend on the value of the aforesaid shares on the date of exercise.

The following graphs illustrate the total compensation(*) earned by the Named Executive Officers in each year of the five-year period ending on April 25, 2010. Although the comparison with the Company’s stock performance may show that there is a trend between the two components, the Named Executive Officers’ direct compensation is determined in accordance with the policies and methods indicated above.

-11-

| | * | The total compensation includes the base salary, bonus (i.e. the AIP) and value of the stock options (i.e. the LTIP) vested during the fiscal year calculated by using the Black & Scholes model which is based on various assumptions. However, the value of the stock options have has not been, and may never be, realized. The options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the aforesaid shares on the date of exercise. |

Summary Compensation Table

The following table details compensation information for the fiscal year ended April 25, 2010, for the Chief Executive Officer, the Chief Financial Officer and the three other most highly compensated executive officers of the Company (collectively, the “Named Executive Officers”).

Name and

principal

position | Fiscal

year | Salary

($) | Share-

based

awards

($) | Option-

based

awards

($)(2) | Non-equity incentive

plan compensation ($) | Pension

value

($) | All other

compensation

($)(3) | Total

compensation

($) |

Annual

incentive

plans | Long-term

incentive

plans(8) |

Alain Bouchard

President and

Chief Executive

Officer(4) | 2010

| 831,861(1)

| -

| -

| 1,345,766(1)(6)

| 121,818(1)

| -187,460(1)

| -

| 2,111,985

|

Raymond Paré

Vice-President

and Chief

Financial

Officer(4) | 2010

| 209,160(1)

| -

| 275,584(1)

| 250,207(1)(6)

| 20,419(1)

| 20,486(1)

| -

| 775,856

|

Réal Plourde

Executive Vice-

President(4)(5) | 2010

| 477,793(1)

| -

| -

| 571,560(1)(6)

| 46,645(1)

| -66,015(1)

| -

| 1,029,982

|

Brian

Hannasch

Chief Operating

Officer(4)(5) | 2010

| 307,514

| -

| 672,855(1)

| 297,776(6)

| 33,742(1)

| 146,549

| -

| 1,458,436

|

Alain Brisebois

Senior Vice-

President,

Operations | 2010

| 223,168(1)(7)

| -

| 107,371(1)

| 177,671(1)(6)

| 14,339(1)

| 32,552(1)

| -

| 555,100

|

| | (1) | In compliance with regulatory requirements, even though the amounts were paid or credited in Canadian dollars, the amount is in U.S. dollars due to the fact that the Company uses such currency in its financial statements. The conversion rate used was 0.9296, which is the average exchange rate for fiscal year 2010. |

| | (2) | The compensation value included herein represents the fair value of the stock options granted on the grant date as determined by using the Black & Scholes model which is based on various assumptions. It does not represent cash received by the Named Executive Officer. The amount is at risk and may even be equal to zero. |

| | (3) | Perquisite benefits are not in excess of $50,000 or 10% of the total base salary paid to each Named Executive Officers for the fiscal year indicated and thus are not reported. |

| | (4) | In line with proactive measures taken by the Company considering the economy, namely by freezing the wages for all the employees of the Company, the Named Executive Officers that form part of the Executives have accepted a decrease on their annual base salary of 10% for the 2010 fiscal year. |

-12-

| | (5) | Mr. Hannasch was promoted to the position of Chief Operating Officer on May 10, 2010, position held by Mr. Plourde since 1999. |

| | (6) | This amount includes a special bonus of 1.5% of the base salary which was paid by the Company to all employees. |

| | (7) | Mr. Brisebois was promoted to the position of Senior Vice-President, Operations on January 11, 2010. |

| | (8) | Represents the value for one year of the portion relating to employment (35%) of the PSU, the latter to vest in accordance with the PSU plan as described under section “Long-term plan – phantom stock unit plan”. This amount may increase or decrease since a PSU’s value equals to a Subordinate Voting Share of the Company and the latter’s value may be different from this year-end value (i.e. $18.34) upon vesting and payment. |

INCENTIVE PLAN AWARDS

Long-term incentive plan - stock option plan

The Plan provides that the number of Subordinate Voting Shares issuable pursuant to the Plan is 16,892,000, being 9.2% of the issued and outstanding Multiple Voting Shares and Subordinate Voting Shares as at fiscal year end. Pursuant to the provisions of the Plan, the Company may grant options to purchase Subordinate Voting Shares to full-time employees, officers and directors of the Company or of any of its subsidiaries. The aggregate number of Subordinate Voting Shares reserved for issuance at any time to any one optionee shall not exceed 5% of the aggregate number of Multiple Voting Shares and Subordinate Voting Shares outstanding on a non-diluted basis at such time, less the total of all shares reserved for issuance to such optionee pursuant to any other share compensation arrangement of the Company. Options may be granted for a term of up to 10 years, which is usually the case, and the terms during which such options may be exercised are determined by the Board of Directors at the time of each grant of options. The conditions of vesting and exercise of the options are established by the Board of Directors when such options are granted and usually the vesting is as follows: 20% upon grant and 20% at each anniversary grant date. The option price, as established by the Board of Directors, shall not be less than the weighted average closing price for a board lot of the Subordinate Voting Shares on the Toronto Stock Exchange for the five days preceding the date of grant.

Options granted under the Plan are personal to the optionees and cannot be assigned or transferred, except by will or by the applicable laws of succession. Upon an optionee's employment with the Company being terminated for cause or upon an optionee being removed from office as a director or becoming disqualified from being a director by law, any option or the unexercised portion thereof shall terminate forthwith. If an optionee's employment with the Company is terminated otherwise than by reason of death or termination for cause, or if any optionee ceases to be a director other than by reason of death, removal or disqualification by law, any option or the unexercised portion thereof may be exercised by the optionee for that number of shares only which he was entitled to acquire under the option at the time of such termination or cessation, provided that such option shall only be exercisable within 90 days after such termination or cessation or prior to the expiration of the term of the option, whichever occurs earlier. If an optionee dies while employed by the Company or while serving as a director, any option or the unexercised portion thereof may be exercised by the person to whom the option is transferred by will or the applicable laws of succession for that number of shares only which the optionee was entitled to acquire under the option at the time of death, provided that such option shall only be exercisable within 180 days following the date of death or prior to the expiration of the term of the option, whichever occurs earlier. The Board or Directors of the Company may, at any time, with the prior approval of the Toronto Stock Exchange, amend, suspend or terminate the Plan in whole or in part. However, the approval of the holders of a majority of the shares of the Company present and voting in person or by proxy at a meeting of shareholders of the Company may be required.

Long-term incentive plan – phantom stock unit plan

-13-

The Company implemented a PSU plan allowing the Board of Directors, through its Human Resources and Corporate Governance Committee, to grant PSUs to the executive officers and selected key employees of the Company (the “Participants”). A PSU is a nominal unit which value is based on the weighted average reported closing price for a board lot of the Company’s Subordinated Voting Shares on the Toronto Stock Exchange for the five trading days immediately preceding the grant date. The PSU provides the Participants with the opportunity to earn a cash award based on the weighted average reported closing price for a board lot of the Company’s Subordinated Voting Shares on the Toronto Stock Exchange for the five trading days immediately preceding the vesting date of the PSU. Each PSU initially granted vests no later than one day prior to the third anniversary of the grant date. The PSU payment is subject to two objectives, one time Company employment related (35%) (“Employment Portion”) and the other the Company’s performance compared to its competitors (65%) (“Performance Portion”). The performance objectives are determined by the Human Resources and Corporate Governance Committee upon the PSU grant and are related to the Company’s operating performances over a three consecutive year period from the grant date and compared to certain of its competitors’ operating performance over the same time period.

PSU granted are personal to the holder and cannot be assigned, encumbered, pledged, transferred or alienated in any way, except by will or by the applicable laws of succession. Upon a PSU holder's employment with the Company being terminated or should the PSU holder resign, all PSU are immediately forfeited and cancelled. If a PSU holder dies or if his employment with the Company is terminated due to permanent disability or if a PSU holder attains the normal retirement age of 65 (unless such age otherwise determined by the Human Resources and Corporate Governance Committee), any PSU outstanding will be subject to an early vesting on apro rata basis and shall be paid within 50 business days from the early vesting date for the one relating to the Employment Portion and within 20 business days following the approval by the Board of Directors of the Company’s annual consolidated financial statements for the third fiscal year previous to vesting date serving as reference for the Performance Portion. Upon the occurrence of transactions that would result in a change of control of the Company, all outstanding PSU shall vest as of the date of the change of control and be paid within 50 business days from such event. The PSU confers no rights as a shareholder of the Company.

Outstanding share-based awards and option-based awards

The following table provides details, for each Named Executive Officer, of stock option grants outstanding at the end of fiscal year ended April 25, 2010.

| | Option-based Awards | Share-based Awards |

Name and

principal position

| Number of

securities

underlying

unexercised

options(1) | Option exercise

price($)(1)(2)

| Option expiration

date(3)

| Value of unexercised

in-the-money

options($)(4)

| Number of

shares or units of

shares that have

not vested(6)

| Market or payout

value of share-

based awards

that have not

vested($)(7) |

Alain Bouchard

President andChief ExecutiveOfficer | 100,000 | 25.69 | Feb. 7, 2017 | - | 61,245 | 393,132 |

| 200,000 | 17.38 | May 27, 2015 | 192,000 | - | - |

| 400,000 | 10.10 | Oct. 15, 2013 | 3,296,000 | - | - |

| 1,600,000 | 7.3575 | March 19, 2012 | 17,572,000 | - | - |

| 200,000 | 3.4025 | May 8, 2011 | 2,987,500 | - | - |

| 1,000,000 | 2.3825 | July 5, 2010 | 15,957,500 | - | - |

Raymond Paré

Vice-Presidentand ChiefFinancial Officer | 25,000 | 18.56 | April 23, 2020 | - | 10,266 | 65,897 |

| 15,000 | 19.85 | Sept. 12, 2019 | - | | |

| 30,000 | 14.21 | Sept. 12, 2018 | 123,900 | | |

| 25,000 | 17.91 | Nov. 30, 2017 | 10,750 | - | - |

| 5,000 | 23.54 | May 7, 2017 | - | - | - |

| 10,000 | 25.71 | May 5, 2016 | - | - | - |

| 6,000 | 17.38 | May 27, 2015 | 5,760 | - | - |

| 800 | 11.58 | June 9, 2014 | 5,408 | | - |

Réal Plourde

Executive Vice-President(5) | 50,000 | 25.69 | Feb. 7, 2017 | - | 23,451 | 150,532 |

| 100,000 | 17.38 | May 27, 2015 | 96,000 | - | - |

| 200,000 | 10.10 | Oct. 15, 2013 | 1,648,000 | - | - |

| 700,000 | 7.3575 | March 19, 2012 | 7,687,750 | - | - |

| 120,000 | 3.4025 | May 8, 2011 | 1,792,500 | - | - |

| 250,000 | 2.3825 | July 5, 2010 | 3,989,375 | - | - |

-14-

| | Option-based Awards | Share-based Awards |

Name and

principal position

| Number of

securities

underlying

unexercised

options(1) | Option exercise

price($)(1)(2)

| Option expiration

date(3)

| Value of unexercised

in-the-money

options($)(4)

| Number of

shares or units of

shares that have

not vested(6)

| Market or payout

value of share-

based awards

that have not

vested($)(7) |

Brian Hannasch

Chief Operating

Officer(5)

| 100,000 | 18.56 | April 23, 2020 | - | 16,964 | 108,892 |

| 25,000 | 13.45 | Sept. 29, 2018 | 122,250 | - | - |

| 25,000 | 17.30 | Jan. 14, 2018 | 26,000 | - | - |

| 25,000 | 25.69 | Feb. 7, 2017 | - | - | - |

| 25,000 | 24.27 | March 10, 2016 | - | - | - |

| 25,000 | 23.19 | Dec. 15, 2015 | - | - | - |

| 100,000 | 16.995 | Dec. 15, 2014 | 134,500 | - | - |

| 80,000 | 11.13 | Nov. 18, 2013 | 576,800 | - | - |

| 30,000 | 6.995 | June 20, 2013 | 340,350 | - | - |

| 100,000 | 7.7125 | July 3, 2012 | 1,062,750 | - | - |

| 68,000 | 4.0325 | July 4, 2011 | 972,910 | - | - |

Alain Brisebois

Senior Vice-

President,

operations | 15,000 | 19.85 | Sept. 12, 2019 | - | 7,209 | 46,275 |

30,000 | 14.21 | Sept. 12, 2018 | 123,900 | - | - |

| | (1) | Take note that on July 20, 2001, July 19, 2002 and March 18, 2005, there was a share split on all of the Company’s issued and outstanding shares on a two for one basis and therefore, the outstanding stock options were adjusted accordingly as to the number and the exercise price. |

| | (2) | The option price is equal to the weighted average closing price on the Toronto Stock Exchange for a board lot of the Subordinate Voting Shares for the five days preceding the grant date. |

| | (3) | Options expire on the tenth anniversary from grant date. The options vest by trenches of 20% starting on grant date. |

| | (4) | Value of unexercised in-the-money options at financial year-end is the difference between the closing price of the Subordinate Voting Shares on the Toronto Stock Exchange at fiscal year-end ($18.34) and the exercise price.This gain has not been, and may never be, realized. The options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the aforesaid shares on the date of exercise. |

| | (5) | Mr. Hannasch was promoted to the position of Chief Operating Officer on May 10, 2010, position held by Mr. Plourde since 1999. |

| | (6) | PSU were granted during fiscal 2010 but as per the PSU plan, they will vest in fiscal 2013 since they have a three year vesting period from the grant date and therefore, no value was acquired during the fiscal year. Their cash payment is subject to namely the Company’s operating performances criteria as established upon grant. For more information, refer to “Long-term incentive plan – phantom stock units plan” under the Incentive Plan Awards Section and the “Long-term incentive plan” description under “Executive Compensation - Compensation Analysis and Discussion” of this Circular. |

| | (7) | Represents the estimated minimum payout (i.e. 35%) as of year-end considering part of the payment depends on operating performance goals of the Company (i.e. 65%). This minimum amount may increase or decrease since a PSU’s value equals to a Subordinate Voting Share of the Company and the latter’s value may be different from this year-end value (i.e. $18.34) upon vesting and payment. |

Incentive plan awards – value vested or earned during the fiscal year

The following table sets forth, for each Named Executive Officer, the aggregate dollar value that would have been realized if the options under the option-based award had been exercised on the vesting date that occurred in fiscal 2010 and the bonus earned for the 2010 fiscal year.

Name and principal position

| Option-based awards – Value

vested during the fiscal

year($)(1) | Share-based awards – Value

vested during the fiscal

year($)(4) | Non-equity incentive plan

compensation – Value

earned during the year($) |

Alain Bouchard

President and ChiefExecutive Officer | -

| -

| 1,447,683

|

Raymond Paré

Vice-President and ChiefFinancial Officer | 50,950

| -

| 269,156

|

Réal Plourde

Executive Vice-President(2) | -

| -

| 614,845

|

-15-

Name and principal position

| Option-based awards – Value

vested during the fiscal

year($)(1) | Share-based awards – Value

vested during the fiscal

year($)(4) | Non-equity incentive plan

compensation – Value

earned during the year($) |

Brian Hannasch

Chief Operating Officer(2) | 49,350

| -

| 297,776(3)

|

Alain Brisebois

Senior Vice-President,Operations | 31,200

| -

| 191,126

|

| | (1) | The option price is equal to the weighted average closing price on the Toronto Stock Exchange for a board lot of the Subordinate Voting Shares for the five days preceding the grant date. |

| | (2) | Mr. Hannasch has been promoted to the position of Chief Operating Officer on May 10, 2010, position held by Mr. Plourde since 1999. |

| | (3) | This amount is in U.S. dollars. |

| | (4) | PSU were granted during fiscal 2010 but as per the PSU plan, they will vest in fiscal 2013 since they have a three year vesting period from the grant date and therefore, no value was acquired during the fiscal year. |

PENSIONPLANBENEFITS

The Canadian Named Executive Officers participate in two non-contributory Canadian defined benefit pension plans. Messrs. Bouchard, Plourde and Paré participate in the Company’s Canadian basic pension plan (“RPP”) and Canadian enhanced supplemental retirement program (“Enhanced SERP”). The purpose of these plans is to offer the Named Executive Officers, upon retirement, income equal to 2% per year of credited service, multiplied by the final average compensation of the Named Executive Officer’s three best years (base salary plus 50% of bonus – bonus not to exceed 100% of base salary), with no offset for any payment from the Canada and Quebec pension plans. The normal retirement age is 65, with provisions for early retirement from age 55 or after 25 years of services with reduced compensation.

Mr. Brisebois participates in the RPP and the Company’s Canadian basic supplemental retirement program (“Basic SERP”). The benefit in the Basic SERP is similar to the Enhanced SERP; however it does not include any portion of the bonus as part of the final average compensation of the Named Executive Officer’s three best years. Prior to Mr. Paré’s nomination as Chief Financial Officer, he held the position of Vice-President, Finance and Treasurer and therefore was a member of the RPP and the Basic SERP.

Mr. Hannasch participates in the Company’s U.S. Non-Qualified Deferred Compensation Plan and the U.S. supplemental enhanced retirement program. In the Non-Qualified Deferred Compensation Plan, participants can contribute up to 25% of base salary and up to 100% of their pre-tax annual bonus. The Company will match 100% of the first 7% of base salary. Upon electing to defer compensation pursuant to the parameters above, the participant shall indicate if the amounts are to be deposited into his retirement account which will be remitted upon retirement and/or in-service account allowing the participant to retrieve these amounts at the earliest five years after deferral. Notwithstanding the participant’s choice, the Company’s matching portion will be deposited into the retirement account. The amounts deferred into the retirement account will namely be available upon the participant’s retirement in a lump sum or annual instalments up to five years and in a lump sum upon employment termination. As for the amounts deferred into the in-service account, they will be available in a lump sum or annual instalments up to five years. In both cases, the deferred amounts are invested into investment funds made available by the Company. As with the Canadian plan, the U.S. supplemental retirement program has no offset for any payments from Social Security benefits. However, the benefit payable is offset by an amount equal to 200% of the estimated annual benefit from the Company matching contribution into the Non-Qualified Plan. On April 30, 2010, the U.S. supplemental retirement program was amended to change the offset to 100% of the estimated annual benefit from the Company matching contribution into the Non-Qualified Plan instead of 200%. Prior to May 1, 2008, Mr. Hannasch participated in the U.S. basic supplemental retirement program.

-16-

The following table sets forth the pension benefits payable under the defined benefit plans of the Company for each Named Executive Officer calculated at the end of fiscal year 2010 by using the same actuary assumptions and methods used in the Company’s audited financial statements.

Name and

principal

position

| Number of years

credited service

| Annual benefits payable ($)(1) | Accrued

obligation

start of

fiscal year

($)(5) | Compensa

-tory

change

($)(5)(6)

| Non-

compensa-

tory change

($)(5)(7)

| Accrued

obligation

at fiscal

year-

end($)(5) |

| At year end | At age at 65 |

| RPP | SERP | RPP(2) | SERP(3) | RPP(2) | SERP(3) |

Alain Bouchard

President and Chief Executive Officer | 10.33

| 31.25

| 25,776

| 870,307

| 35,338

| 966,679

| 7,747 828

| -201,657

| 3,856,077

| 11,402,248

|

Raymond Paré

Vice-President and Chief Financial Officer | 2.42

| 2.42

| 6,029

| 4,466

| 66,727

| 67,849

| 17,246

| 22,037 | 98,984

| 138,267

|

Réal Plourde

Executive Vice- President(8) | 10.33

| 26.33

| 25,776

| 331,085

| 39,287

| 388,963

| 3,510,621

| -71,014

| 1,560,690

| 5,000,297

|

Brian Hannasch(4)

Chief Operating Officer(8) | n/a

| 8.92

| n/a

| 20,928

| n/a

| 196,903

| 56,462

| 146,549

| 212,422

| 415,433

|

Alain Brisebois

Senior Vice- President, Operations | 1.58

| 1.58

| 3,950

| 1,492

| 37,417

| 14,138

| 13,535

| 35,017

| 30,689

| 79,241

|

| | (1) | The annual benefit is the lifetime pension payable at the normal retirement age based on the final average base salary of the Named Executive Officer’s three best years as at April 30, 2010 (increased by 50% of the target bonus for service in the enchanced SERP) and based on years of credited service at year end or as of age 65. |

| | (2) | The normal form of pension is a 66% joint and survivor annuity with a 5-year guarantee. |

| | (3) | The normal form of pension of the enhanced SERP is an annuity guaranteed during the first 5 years, a 50% joint and survivor annuity for the following 5 years and there is no death protection after the first 10 years. The normal form of pension of the basic SERP is an annuity guaranteed for 5 years. |

| | (4) | The amounts indicated are in U.S. dollars. |

| | (5) | The amounts indicated include pension benefits payable under the RPP and the SERP. |

| | (6) | The compensatory change is the value of the projected pension earned for the period from May 1st, 2009 to April 30, 2010 including any differences between actual and estimated earnings and any plan changes. |

| | (7) | The non-compensatory change is the value of items other than compensatory, such as: interest on the accrued obligation at the start of the fiscal year, changes in assumptions, and other experience gains and losses for the period from May 1st, 2009 to April 30, 2010. |

| | (8) | Mr. Hannasch was promoted to the position of Chief Operating Officer on May 10, 2010, position held by Mr. Plourde since 1999. |

The following table sets forth the pension benefits payable under the defined contribution plans of the Company for each Named Executive Officer calculated at the end of fiscal year 2010 by using the same actuary assumptions and methods used in the Company’s’ audited financial statements.

Name

| Accumulated value at

start of fiscal year ($) | Compensatory ($)

| Non-compensatory ($)

| Accumulated value at

year end ($) |

| Alain Bouchard | - | - | - | - |

| Raymond Paré(1) | 36,654 | - | 5,622 | 42,276 |

| Réal Plourde | - | - | - | - |

| Brian Hannasch | 536,521 | 23,366 | 191,434 | 751,320 |

| Alain Brisebois | - | - | - | - |

| | (1) | The amounts indicated for Mr. Paré were accumulated while participating to the employees defined contribution plans of the Company prior to his nomination as Vice-President, Finance and Treasurer on November 20, 2007. |

SECURITIESAUTHORIZED FORISSUANCE UNDEREQUITYCOMPENSATIONPLANS

The following table sets forth information as at April 25, 2010 with respect to the 1999 Stock Incentive Plan (the "Plan"). The Plan was approved by the Company’s shareholders at the annual and special meeting held on September 21, 1999 and amendments to the Plan were approved by the Company’s shareholders at the annual and special meeting held on September 25, 2002.

-17-

Equity Compensation Plan Information

| Number of Subordinate

Voting Shares to be issued

upon exercise of outstanding

options | Weighted-average exercise

price of outstanding options

| Number of Subordinate

Voting Shares remaining

available for future issuance

under the Plan |

| Equity compensation planapproved by the securityholders - 1999 StockIncentive Plan | 8,697,098 | $ 9.07 | 8,194,902 |

SHARE REPURCHASE PROGRAM

The Company’s Board of Directors has approved at its meeting held on July 14, 2009, a share repurchase program authorizing the Company to repurchase up to 2,685,370 of the 53,707,412 Multiple Voting Shares (representing 5% of the multiple voting shares issued and outstanding) and up to 12,857,284 of the 128,572,846 Subordinate Voting Shares (representing 10% of the subordinated voting shares of the public float), as determined by the applicable rules as at that date, as at July 24, 2009. The share repurchase program was approved by the Toronto Stock Exchange on August 6, 2009 and is effected in accordance with applicable securities laws. The repurchases effected under the share repurchase program reduces the number of Multiple Voting Shares and of the Subordinate Voting Shares issued and outstanding and resulted in an increase on apro rata basis of the proportionate interest of the shareholders in the share capital of the Company. The Company may repurchase Multiple Voting Shares and Subordinate Voting Shares under the program on the open market through the facilities of the Toronto Stock Exchange, from time to time, over the course of twelve months commencing on August 10, 2009 and ending August 9, 2010, the whole in compliance with the approval of the Toronto Stock Exchange. As of June 30, 2010, the Company has made any repurchase under this program. All shares repurchased under the share repurchase program are cancelled upon repurchase in accordance with the incorporations law of the Company.

Security holders may obtain a copy of the notice of intention to make a normal course issuer bid as filed with the Toronto Stock Exchange, without charge, by contacting the Corporate Secretary of the Company at the head office located at 4204 Industriel Blvd., Laval, Québec, H7L 0E3.

CORPORATEGOVERNANCE

The Company complies with the guidelines adopted by the Canadian Securities Administrators and with the standards of other regulatory bodies. A description of the Company’s governance practices is attached to this proxy circular as Appendix A.

APPOINTMENT ANDREMUNERATION OFAUDITORS

At the meeting, or any adjournment thereof, Pricewaterhouse Cooper LLP will be proposed for appointment as auditors of the Company for the financial year ending April 24, 2011 and for authorizing the Company’s Board of Directors to fix their compensation.Unless otherwise specified by the shareholders, the shares represented by any proxy enclosed herewith will be voted FOR the appointment of PricewaterhouseCoopers LLP, chartered accountants, as auditors of the Company for the 2011 fiscal year, until the next annual general meeting of the shareholders and FOR authorizing the Board of Directors to set their compensation.

AUDIT ANDOTHERRELATEDFEES

PricewaterhouseCoopers LLP, chartered accountants, have served as the Company’s auditors since fiscal year 2009. For the fiscal years ended on April 25, 2010 and April 26, 2009, billed fees for audit, audit-related, tax and all other services provided to the Company by PricewaterhouseCoopers LLP were as follows:

-18-

| | 2010 | 2009 |

| | | |

| Audit Fees(1) | $ 600,000 | $600,000 |

| Audit-Related Fees(2) | $ 39,965 | $ 18,500 |

| Tax Fees(3) | $ 78,390 | $270,120 |

| All Other Fees | n/a | n/a |

| | | |

| TOTAL | $ 718,355 | $888,620 |

| | (1) | Audit services are professional services rendered for the audit of an issuer's annual financial statements and, if applicable, for the reviews of an issuer's financial statements included in the issuer's quarterly reports and services that are normally provided by the accountant in connection with an engagement to audit the financial statements of an issuer - for example: |

| | | - | attendance at audit committee meetings at which matters related to the audits or reviews are discussed; |

| | | - | consultations on specific audit or accounting matters that arise during or as a result of an audit or review; |

| | | - | preparation of a management letter; |

| | | - | time incurred in connection with the audit of the income tax accrual; and |

| | | - | services in connection with the issuer's annual and quarterly reports, prospectuses and other filings with Canadian, US or other securities commissions. |

| | | | |

| | (2) | Audit-related services (the Canadian term) are assurance and related services traditionally performed by an independent auditor: |

| | | - | employee benefit plan audits; |

| | | - | assurance engagements that are not required by statute or regulation; and |

| | | - | general advice on accounting standards. |

| | | | |

| | (3) | This category includes services of tax planning and other tax advices with respect to the Company’s international corporate structure. |

At its meeting held on March 16, 2004, the Board of Directors adopted a policy and procedures on the pre-approval of non-audit services by the Company’s auditors. This policy prohibits the Company from engaging the auditors to provide certain non-audit services to the Company and its subsidiaries, including bookkeeping or other services related to the accounting records or financial statements, financial information systems design and implementation, appraisal or valuation services, actuarial services, internal audit services, investment banking services, management functions or human resources functions, legal services and expert services unrelated to the audit. The policy allows the Company to engage the auditors to provide non-audit services, other than the prohibited services, only if the services have specifically been pre-approved by the Audit Committee.

OTHERBUSINESS

Management of the Company knows of no amendment or variation to the matters identified in the Notice, nor of any other matter to be discussed other than those identified in the Notice. However, the enclosed form of proxy confers discretionary authority upon the persons named therein to vote on any such amendments or variations or other matters.

ADDITIONALINFORMATION

Additional information relating to the Company is available as well as copies of the Company’s latest annual information form, financial statements and the management’s discussion and analysis (MD&A) filed with the Canadian and U.S. securities regulators may be obtained on SEDAR at www.sedar.com and on the Company’s Web site www.couche-tard.com/corporate.

APPROVAL BYDIRECTORS

The Board of Directors of the Company has approved the contents of this Management Proxy Circular and its sending to the shareholders of the Company.

(s)Sylvain Aubry

Sylvain Aubry

Senior Director, Legal Affairs and

Corporate Secretary

Laval, Québec, July 13, 2010

-19-

APPENDIX A

GOVERNANCEPRACTICE

BOARD OFDIRECTORS

The Board of Directors up for election is comprised of 10 directors. The Board of Directors considers six of them to be “independent” to the Company. Messrs. Alain Bouchard, Richard Fortin, Réal Plourde and Jacques D’Amours are not independent directors. Mr. Jean Élie was nominated by Metro Inc., a significant shareholder, but is not otherwise related to the Company or Metro. The Board does consider Mr. Jean Élie to be an independent director given that the Company does not have significant business dealings with Metro and that Metro does not control the Company. The five other directors, Messrs. Desrosiers, Longpré, Sauriol and Turmel and Mrs. Kau, are independent directors given that they do not have any business interests or other relationships with the Company or its principal shareholders.

The following table indicates the other issuers where directors of the Company sit as members of the board of director:

| Director | Issuer |

| | |

| Alain Bouchard | Atrium Innovations Inc. |

| | |

| Richard Fortin | Rona Inc. (also a member of the Audit Committee and the Human Resources and Compensation Committee) |

| | Transcontinental Inc. (also a member of the Audit Committee) |

| | |

| Jean Turmel | Canam Group Inc. |

| | TMX Inc. |

The Board of Directors holds regularly scheduled meetings of the Board at which non-independent directors and members of management are not in attendance. During the last fiscal year of the Company, the independent directors held four meetings.

The Chairman of the Board is not an independent director. Therefore, the Board of Directors has established procedures enabling it to function independently of management, including the appointment of an unrelated director to act as Lead Director. The Lead Director’s responsibilities include the following:

To ensure that the responsibilities of the Board of Directors are well understood by both the Board of Directors itself and management, and that the boundaries between the responsibilities of each are clearly understood and observed.

Ensure that the resources available to the Board of Directors (especially up-to-date and relevant information) are adequate and enable it to perform its work.

Adopt, together with the Chairman of the Board of Directors, procedures and meeting schedules so that the Board of Directors and its committees can effectively and efficiently accomplish their work.

Ensure that duties assigned to the competent committees are effectively carried out and that the results are communicated to the Board of Directors.