- DRRX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

DURECT (DRRX) DEF 14ADefinitive proxy

Filed: 27 Apr 23, 4:30pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

DURECT Corporation

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

|

| |

☐ | Fee paid previously with preliminary materials. | |

|

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

|

|

DURECT CORPORATION

10260 Bubb Road

Cupertino, CA 95014

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 21, 2023

On Wednesday, June 21, 2023 at 9:00 a.m. Pacific Time, DURECT Corporation (the “Company”) will hold its 2023 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will begin promptly at 9:00 a.m. local time. The Annual Meeting will be a virtual meeting of stockholders in order to facilitate greater stockholder access. Stockholders will not be able to physically attend the Annual Meeting. Stockholders will be able to attend the Annual Meeting via live audio webcast by visiting www.meetnow.global/M5TGR5V, as well as vote shares electronically and submit questions electronically during the Meeting. To attend and participate in the Annual Meeting, including voting shares at and submitting questions during the Annual Meeting, stockholders must have their 15-Digit Control Number assigned by Computershare Trust Company, N.A., the Company’s transfer agent. Instructions for how to obtain such 15-Digit Control Number are provided in the attached Proxy Statement. Stockholders may also view reference materials such as the Company’s list of stockholders as of April 25, 2023, the record date, which will be available for ten (10) days prior to the Annual Meeting. Please see the section entitled “Time and Place of the Annual Meeting” for additional details related to reviewing the Company’s list of stockholders

Only stockholders who owned common stock at the close of business on April 25, 2023 can vote or submit questions at the Annual Meeting or any adjournment that may take place. At the Annual Meeting, the stockholders are being asked to vote on:

In addition, you may be asked to consider and vote upon such other business as may properly come before the Meeting or any adjournment or postponement thereof.

You can find more information about each of these items, including the nominees for directors, in the attached Proxy Statement.

The Board of Directors recommends that you vote FOR each of the nominees to the board in proposal one, FOR each of proposals two, three and five and for every 1 YEAR for proposal four, outlined in the attached Proxy Statement.

We cordially invite all stockholders to attend the Annual Meeting virtually. However, whether or not you expect to attend the Annual Meeting, please vote your shares as soon as possible. You may vote over the internet or by using the toll-free telephone number on your proxy card or voting instruction materials, or by mailing a proxy card or voting instruction card. Please review the instructions on the Notice of Internet Availability of Proxy Materials or on your proxy card or voting instruction materials regarding your voting options. If you vote and then decide to attend the Annual Meeting to vote your shares, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement.

Following the Annual Meeting, we will also report on the Company’s business results and other matters of interest to stockholders.

|

| By Order of the Board of Directors, |

|

|

|

|

| /s/ Timothy M. Papp |

|

| Timothy M. Papp |

|

| Chief Financial Officer and Secretary |

Cupertino, California |

|

|

April 27, 2023 |

|

|

YOUR VOTE IS IMPORTANT!

Important Notice Regarding the Internet Availability of Proxy Materials for the Stockholder Meeting To Be

Held on June 21, 2023.

The Proxy Statement, a proxy card and the Company’s 2022 Annual Report are available free of charge on the internet at https://proxydocs.com/DRRX.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, WE ENCOURAGE YOU TO READ THE PROXY STATEMENT AND VOTE YOUR SHARES AS SOON AS POSSIBLE, SO THAT YOUR SHARES MAY BE REPRESENTED AT THE ANNUAL MEETING. YOU MAY VOTE OVER THE INTERNET OR BY USING THE TOLL-FREE TELEPHONE NUMBER ON YOUR PROXY CARD OR VOTING INSTRUCTION MATERIALS, OR BY MAILING A PROXY CARD OR VOTING INSTRUCTION CARD. PLEASE REVIEW THE INSTRUCTIONS ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS OR ON YOUR PROXY CARD OR VOTING INSTRUCTION MATERIALS REGARDING YOUR VOTING OPTIONS IF YOU ATTEND THE ANNUAL MEETING VIA THE INTERNET, YOU MAY VOTE IF YOU WISH TO DO SO EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY CARD OR VOTED.

DURECT CORPORATION

10260 Bubb Road

Cupertino, CA 95014

PROXY STATEMENT

FOR THE

2023 ANNUAL MEETING OF STOCKHOLDERS

JUNE 21, 2023

Information About Solicitation and Voting

The accompanying Proxy Statement is solicited on behalf of DURECT Corporation’s Board of Directors (the “Board of Directors” or the “Board”) for use at the 2023 Annual Meeting of Stockholders (the “Annual Meeting” or the “Meeting”) to be held on June 21, 2023 at 9:00 a.m. Pacific Time via live audio webcast by visiting www.meetnow.global/M5TGR5V, as well as vote shares electronically and submit questions electronically during the Annual Meeting. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

The Board has set April 25, 2023 as the record date for the Annual Meeting. Stockholders of record who owned our common stock on that date are entitled to vote at and attend the Annual Meeting, with each share entitled to one vote. Stockholders who hold shares in “street name” may vote at the Annual Meeting only if they hold a valid proxy from their broker. As of the record date, there were 24,484,867 shares of common stock outstanding and entitled to vote at the Annual Meeting.

In this Proxy Statement:

The expenses of soliciting proxies will be paid by the Company. Following the original mailing of the soliciting materials, the Company and its agents may solicit proxies by mail, electronic mail, telephone, facsimile or by other similar means. Our directors, officers and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, email, or otherwise. Following the original mailing of the soliciting materials, the Company will request brokers, custodians, nominees and other record holders to forward copies of the soliciting materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, the Company, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials and/or vote through the internet, you are responsible for any internet access charges you may incur.

We have summarized below important information with respect to the Annual Meeting.

Internet Availability of Proxy Materials

Under rules adopted by the SEC, we are furnishing proxy materials to our stockholders primarily via the internet, instead of mailing printed copies of those materials to each stockholder. On or about May 8, 2023, we will mail our stockholders on the record date a Notice Regarding the Availability of Proxy Materials (the “Notice”) containing instructions on how to access and review all of the important information contained in our proxy materials, including our Proxy Statement and our 2022 Annual Report to Stockholders. These materials are also available free of charge on the internet at https://proxydocs.com/DRRX. The Notice also provides instructions on how to vote by telephone or through the internet and includes instructions on how stockholders may obtain paper copies of our proxy materials if they so choose.

1

Time and Place of the Annual Meeting

The Annual Meeting is being held on Wednesday, June 21, 2023, at 9:00 a.m. Pacific Time. All stockholders who own shares of our stock as of April 25, 2023, the record date, may attend the Annual Meeting. The Annual Meeting will be a virtual meeting of stockholders in order to facilitate greater stockholder access. Stockholders will not be able to physically attend the Annual Meeting. Stockholders will be able to attend the Annual Meeting via live audio webcast by visiting www.meetnow.global/M5TGR5V, as well as vote shares electronically and submit questions electronically during the Meeting. To attend and participate in the Annual Meeting, including voting shares at and submitting questions during the Annual Meeting, stockholders must have their 15-Digit Control Number assigned by Computershare, the Company’s transfer agent. Instructions for how to obtain such 15-Digit Control Number are provided in the attached Proxy Statement. Stockholders of record may also view our list of stockholders as of the record date for ten (10) days prior to the Annual Meeting, for any purpose germane to the Annual Meeting between the hours of 9:00 a.m. and 5:00 p.m., local time, at our offices located at 10260 Bubb Road, Cupertino, CA 95014. If you are a stockholder of record and want to inspect the stockholder list, please send a written request to Timothy M. Papp, Chief Financial Officer, DURECT Corporation, 10260 Bubb Road, Cupertino, CA 95014, or email IR@durect.com to arrange for electronic access to the stockholder list.

Purpose of the Proxy Materials

You are receiving proxy materials from us because you owned shares of our common stock on April 25, 2023, the record date. This Proxy Statement describes issues on which we would like you, as a stockholder, to vote. It also gives you information on these issues so that you can make an informed decision.

If you are a stockholder of record and submit a signed proxy card, you are appointing James E. Brown and Timothy M. Papp as your representatives at the Annual Meeting. James E. Brown and Timothy M. Papp will vote your shares at the Annual Meeting as you have instructed them. This way, your shares will be voted whether or not you attend the Annual Meeting. Alternatively, you may vote your shares on the internet or by telephone by following the instructions on your Notice or proxy card.

If your shares are held in a brokerage account, by a trustee or by another nominee, you are considered the beneficial owner of shares held in street name, and the proxy materials were forwarded to you by your broker, trustee or nominee. As the beneficial owner, you have the right to direct your broker, trustee or nominee on how to vote and are also invited to attend the Annual Meeting.

Even if you plan to attend the Annual Meeting it is a good idea to vote in advance of the Annual Meeting, indicate your preferences on the paper proxy card you requested (as described below), and then date, sign and return your proxy card, or vote your shares by telephone or via the internet, just in case your plans change and you are unable to attend the Annual Meeting.

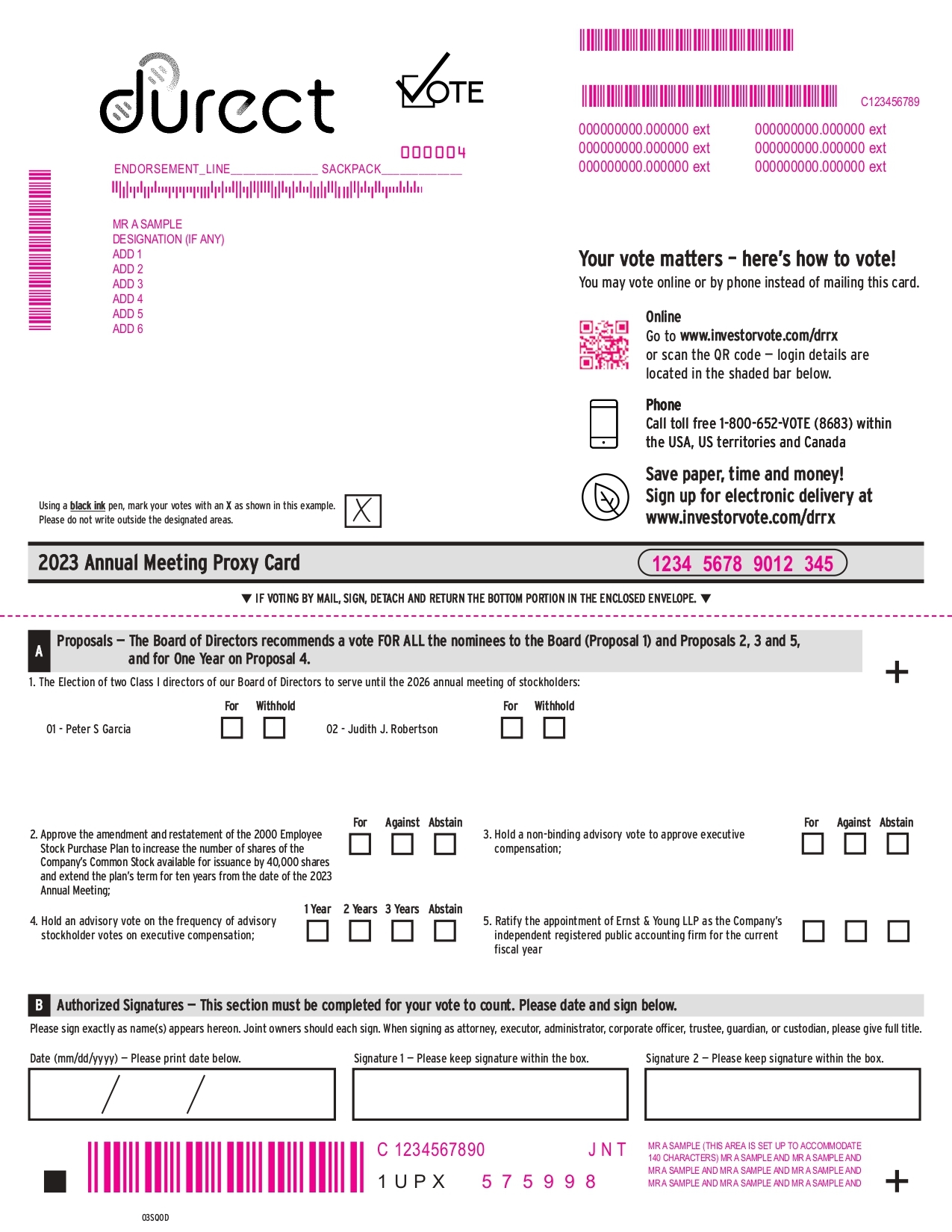

Proposals to be Voted on at This Year’s Annual Meeting

You are being asked to vote on:

2

The Board of Directors recommends a vote FOR each of the nominees to the Board (Proposal 1), FOR each of Proposals 2, 3 and 5 and for every 1 YEAR (Proposal 4).

Instructions for how to Obtain the 15-Digit Control Number and Vote

Stockholders of record

As a stockholder of record (i.e., you hold your shares through our transfer agent, Computershare), you may vote the shares held in your name.

If you do not wish to participate in the Annual Meeting via webcast, you may vote as follows:

Votes submitted by telephone or through the internet before the Annual Meeting must be received by 11:59 p.m. Eastern Time, on June 20, 2023. If you vote by mail, your proxy card must be received by June 20, 2023. Submitting your proxy, whether by telephone, through the internet or by mail if you request or received a paper proxy card, will not affect your right to vote in person should you decide to virtually attend the Annual Meeting.

If you wish to vote electronically while attending the Annual Meeting via webcast, you may vote while the polls remain open, at www.meetnow.global/M5TGR5V. You will need the 15-Digit Control Number assigned by Computershare that is included on your Notice or proxy card in order to be able to attend and vote electronically during the Annual Meeting.

Even if you plan to attend the Annual Meeting via webcast, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

Beneficial owner of shares held in street name

As a beneficial owner of shares, you have the right to direct your bank, broker, trustee or other nominee how to vote your shares.

If you do not wish to participate in the Annual Meeting via webcast, you may vote by providing voting instructions to your bank, broker, trustee or other nominee. Subject to and in accordance with the instructions provided by your bank, broker, trustee or other nominee, you may vote in one of the following manners: over the internet, by telephone or by mail.

Beneficial owners of shares may also vote electronically while attending the Annual Meeting via webcast, while the polls remain open, at www.meetnow.global/M5TGR5V. Since a beneficial owner is not the stockholder of record, you may not attend and vote your shares at the Annual Meeting unless you (i) obtain a “legal proxy” from the bank, broker, trustee or other nominee that holds your shares giving you the right to vote the shares at the Annual Meeting and (ii) register with Computershare by submitting such legal proxy to Computershare as directed below and receiving a 15-Digit Control Number assigned by Computershare. Such legal proxy must reflect your holdings of our common stock along with your name and email address. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time on June 11, 2023. You will receive a confirmation of your registration by email after Computershare receives your registration materials.

Requests for registration should be directed to Computershare as follows:

3

Your bank, broker, trustee or other nominee will also send you separate instructions describing additional procedures, if any, for voting your shares electronically during the Annual Meeting.

Even if you plan to attend the Annual Meeting via webcast, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

Voting Procedure

You may vote by internet.

If you are a stockholder of record, you may submit your proxy by internet by following the instructions on the Notice or your proxy card and by following the voting instructions on the website.

If you hold your shares in street name, please check the Notice or the voting instructions provided by your broker, trustee or nominee for internet voting availability and instructions. Holding shares in “street name” means your shares of stock are held in an account by your stockbroker, bank or other nominee, and the stock certificates and record ownership are not in your name.

You may vote by telephone.

If you are a stockholder of record, you may submit your proxy by following the “Vote-by-Telephone” instructions on the proxy card or the Notice.

If you hold your shares in street name, please check the voting instructions provided by your broker, trustee or nominee for telephone voting availability and instructions.

You may vote by mail.

If you requested and received paper copies of our proxy materials and you are a stockholder of record, and elect to vote by mail, please indicate your preferences on the proxy card, date and sign your proxy card and return it in the postage-prepaid and addressed envelope that was enclosed with your proxy materials. If you mark your voting instructions on the proxy card, your shares will be voted as you have instructed. Note that you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote via the internet and how to request paper copies of the proxy materials.

If you hold your shares in street name, you may vote by mail by completing, signing and dating the voting instruction card provided by your broker, trustee or nominee and mailing it in the accompanying postage-prepaid and addressed envelope.

You may vote at the Annual Meeting.

If you attend the virtual Meeting, you will have the opportunity to vote at that time. If you hold your shares in street name, you must request a legal proxy from your stockbroker in order to vote at the Annual Meeting. Holding shares in “street name” means your shares of stock are held in an account by your stockbroker, bank, or other nominee, and the stock certificates and record ownership are not in your name. If your shares are held in “street name” and you wish to attend the Annual Meeting, you must notify your broker, bank or other nominee and obtain a valid legal proxy to vote your shares at the Annual Meeting and then register in advance to attend the Annual Meeting through our transfer agent, Computershare, no later than 5:00 p.m. Eastern Time on June 11, 2023.

4

The Annual Meeting webcast will begin promptly at 9:00 a.m. Pacific Time. We encourage you to access the Annual Meeting prior to the start time. Online check-in will begin at 8:30 a.m. Pacific Time, and you should allow ample time for the check-in procedures.

If you encounter any technical difficulties accessing the “virtual” Meeting during the check in or meeting time, please call the technical support number 1-888-724-2416 (toll-free within the United States, U.S. territories and Canada) or 1-781-575-2748 (outside of the United States, U.S. territories and Canada).

You may change your mind after you have returned your proxy.

If you are the stockholder of record and you change your mind after you have submitted your proxy via the internet or by telephone or returned your proxy card, you may revoke your proxy at any time before the polls close at the Annual Meeting. You may do this by:

If you hold your shares in street name, you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or, if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares, by attending the virtual Annual Meeting and voting in person.

Multiple Proxy Cards

If you received more than one proxy card, it means that you hold shares in more than one account. Please sign and return all proxy cards to ensure that all your shares are voted.

Delivery of Documents to Security Holders Sharing an Address

Only one Proxy Statement and annual report is being delivered to you if you share an address with another stockholder, unless we receive contrary instructions from you or one of the other stockholder(s). We will deliver promptly upon written or oral request a separate copy of the Proxy Statement and annual report to you if you share an address to which we delivered a single copy of the documents; this request should be directed to Timothy M. Papp, Chief Financial Officer, DURECT Corporation, 10260 Bubb Road, Cupertino, CA 95014, (408) 864-7495.

About this Proxy Statement

We are a “smaller reporting company” under the rules of the SEC and as such are not required to include certain information in this proxy statement that companies that are not “smaller reporting companies” must include. We have elected to take advantage of such lesser disclosure requirements in presenting certain information in this proxy statement.

Quorum Requirement

Shares are counted as present at the Annual Meeting if the stockholder either:

A majority of our outstanding shares as of the record date must be present at the Annual Meeting (including by proxy) in order to hold the Annual Meeting and conduct business. This is called a “quorum.”

5

Consequences of Not Returning Your Proxy; Broker Non-Votes

If your shares are held in your name, you must return your proxy (or attend the Annual Meeting in person) in order to vote on the proposals. If you are a beneficial owner of shares and your brokerage firm or other similar organization does not receive voting instructions from you, your brokerage firm may either:

If you are a beneficial owner and hold your shares in “street name” through a broker or other nominee and do not provide the organization that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. Under applicable rules, brokers have the discretion to vote on routine matters but do not have discretion to vote on non-routine matters. For example, if you do not provide voting instructions to your broker, the broker could vote your shares for the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the current fiscal year (Proposal 5) because this is deemed to be a routine matter under applicable rules, but the broker could not vote your shares for any of the other four proposals on the agenda for the Annual Meeting.

If you do not provide voting instructions to your broker and the broker has indicated that it does not have discretionary authority to vote on a particular proposal, your shares will be considered “broker non-votes” with regard to that matter. Broker non-votes will be considered as represented for purposes of determining a quorum but generally will not be considered as entitled to vote with respect to that proposal. Broker non-votes are not counted for purposes of determining the number of votes cast with respect to a particular proposal. Thus, a broker non-vote will make a quorum more readily obtainable, but the broker non-vote will not otherwise affect the outcome of the vote on a proposal that requires the affirmative vote of the holders of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote (Proposals 2 – 5) or plurality of the votes of the shares present or represented by proxy at the Annual Meeting (Proposal 1).

We encourage you to provide instructions to your brokerage firm by voting your proxy. This ensures that your shares will be voted at the Annual Meeting.

Effect of Abstentions and Withheld Votes

An abstention (Proposals 2 – 5) or withheld vote (Proposal 1) represent a stockholder’s affirmative choice to decline to vote on a proposal, as applicable. If a stockholder indicates on its proxy card that it wishes to abstain from voting its shares as to Proposals 2 – 5 or withholds its vote as to Proposal 1, or if a broker, bank or other nominee holding its customer’s shares of record causes abstentions or withheld votes to be recorded for such shares, those shares will be considered present and entitled to vote for the purposes of determining the presence of a quorum, with abstentions counting as votes AGAINST Proposals 2 – 5 and withhold votes having no effect on Proposal 1.

Required Vote

Assuming a quorum is present and as set forth in Proposal 1, each director nominee must be elected by a plurality of the votes of the shares present in person virtually or represented by proxy at the Annual Meeting and entitled to vote on the election of directors, meaning that the two nominees receiving the highest number of “FOR” votes of shares that are present and entitled to vote will be elected as Class II directors. The vote required to approve the proposed amendment to the 2000 Employee Stock Purchase Plan, including an increase to the number of shares of the Company’s Common Stock available for issuance by 40,000 shares and to re-approve its material terms, as set forth in Proposal 2, and to ratify the appointment of the independent registered public accounting firm, as set forth in Proposal 5, is the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote.

Proposals 3 and 4 are non-binding advisory votes; however, the Compensation Committee and the Board of Directors will consider the voting results on these proposals based on the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote.

6

Vote Solicitation; No Use of Outside Solicitors

DURECT Corporation is soliciting your proxy to vote your shares at the Annual Meeting. The expense of preparing, printing and mailing this Proxy Statement and the accompanying material will be borne by the Company. In addition to this solicitation by mail, our directors, officers, agents, and other employees may contact you by telephone, internet, in person or otherwise to obtain your proxy. These persons will not receive any additional compensation for assisting in the solicitation. We will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners. We will reimburse these entities and Computershare, our transfer agent, for their reasonable out-of-pocket expenses in forwarding proxy materials. We have not retained the services of a proxy solicitor.

Voting Procedures

Votes cast by proxy or at the Annual Meeting will be tabulated by a representative of Computershare, our transfer agent, who will act as the Inspector of Election. The Inspector of Election will also determine whether a quorum is present at the Annual Meeting. The Inspector of Election will separately tabulate affirmative, negative and withheld votes, abstentions and broker non-votes. Those shares represented by votes cast via the internet or by telephone, or represented by proxy cards received, marked, dated, and signed, and in each case, not revoked, will be voted at the Annual Meeting. If a stockholder submits proxy voting instructions with respect to any matter to be acted on, the shares will be voted in accordance with that specified choice. If you are a stockholder of record (that is, if your shares are held in your name and not in street name by a brokerage firm) and you sign, date and return a proxy card but do not give specific voting instructions, then the proxy holders will vote your shares in the manner recommended by our Board of Directors on all matters presented in this Proxy Statement, and the proxy holders may determine in their discretion any other matters properly presented for a vote at the Annual Meeting. Broker non-votes will be counted for the purpose of determining the presence or absence of a quorum, but will not be counted for the purpose of determining the number of votes cast.

We believe that the procedures to be used by the Inspector of Election to count the votes are consistent with Delaware law concerning voting of shares and determination of a quorum.

Publication of Voting Results

We will announce preliminary voting results at the Annual Meeting. We will publish the final results in a current report on Form 8-K, which we will file with the SEC within four business days of the Annual Meeting. You can get a copy on our website at www.durect.com in the Investor Relations section, by contacting Timothy M. Papp, our Chief Financial Officer, at (408) 864-7495 or the SEC at www.sec.gov.

Other Business

We do not know of any business to be considered at the Annual Meeting other than the proposals described in this Proxy Statement. However, if any other business is properly presented at the Annual Meeting, if you are a stockholder of record and submit your signed proxy card, you are giving authority to James E. Brown and Timothy M. Papp to vote on such matters at their discretion.

Stockholder Proposals for the 2024 Annual Meeting

To have your proposal included in our proxy statement for our 2024 annual meeting, you must submit your proposal in writing no later than January 9, 2024 to Timothy M. Papp, Chief Financial Officer and Secretary, DURECT Corporation, 10260 Bubb Road, Cupertino, CA 95014. Any such proposal must also comply with Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the regulations thereunder, as well as our bylaws, which may be obtained free of charge by written request to Timothy M. Papp, Chief Financial Officer and Secretary, DURECT Corporation, 10260 Bubb Road, Cupertino, CA 95014.

Pursuant to our bylaws, stockholders must provide notice of any business that they wish to submit for consideration at the 2024 annual meeting to our executive offices (Attention: Secretary) no later than April 22, 2024 and no earlier than February 22, 2024; provided, however, that if the 2024 annual meeting is moved more than 30

7

days prior to or 60 days after the anniversary of the Annual Meeting and less than 60 days’ notice is provided to stockholders, then notice of a stockholder proposal must be received within 10 days of public notice of the Annual Meeting. Additionally, to comply with universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must comply with the additional requirements of Rule 14a 19(b) under the Exchange Act.

8

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Certificate of Incorporation provides that our Board of Directors is divided into three classes, with staggered three-year terms. Our Class II directors, whose terms expire at the Annual Meeting and who are being nominated for re-election for a three-year term, are Peter S. Garcia and Judith J. Robertson. Each nominee has consented to serve an additional three-year term. If re-elected at the Annual Meeting, each of these nominees would serve until the 2026 Annual Meeting. David R. Hoffmann, our other Class II director, has decided to retire and not to be nominated for re-election.

Our Class III directors, whose terms expire at our 2024 annual meeting, are Mohammad Azab, James E. Brown and Gail M. Farfel. Our Class I directors, whose terms expire at our 2025 annual meeting, are Terrence F. Blaschke and Gail J. Maderis. You only elect one class of directors at each annual meeting. The other classes continue to serve for the remainder of their three-year terms. Peter S. Garcia and Judith J. Robertson, currently Class II directors, are nominees for re-election at the Annual Meeting.

Vote Required

If a quorum is present, the two nominees receiving the highest number of votes of shares that are present and entitled to vote will be elected as directors for the ensuing three years. Unless marked otherwise, proxies received will be voted FOR the election of Peter S. Garcia and Judith J. Robertson. If additional people are nominated for election as directors through the stockholder proposal process, which includes written notification to us within specified time frames, unless marked otherwise, the proxy holders intend to vote all proxies received by them in a way that will ensure that as many as possible of the nominees listed above are elected.

Directors

The names of our directors, their ages as of April 25, 2023 and certain other information about them are set forth below. As noted above, Mr. Hoffmann has elected not to be nominated for re-election.

Name |

| Age |

| Position |

James E. Brown, D.V.M. | 66 | President, Chief Executive Officer, Director | ||

Mohammad Azab, M.D., M. Sc., M.B.A. (1) (3) (4) | 67 | Director | ||

Terrence F. Blaschke, M.D. (3) (4) | 80 | Director, Chair of the Research and Development Committee | ||

Gail M. Farfel, Ph.D. (4) | 59 | Director | ||

Peter S. Garcia, M.B.A. (1) (2) |

| 61 |

| Director and Director Nominee |

David R. Hoffmann (1) (2) |

| 78 |

| Chair of the Audit Committee |

Gail J. Maderis, M.B.A. (1) (2) |

| 65 |

| Chair of the Board, Chair of the Compensation Committee |

Judith J. Robertson (2) (3) |

| 63 |

| Director and Director Nominee, Chair of the Nominating and Corporate Governance Committee |

James E. Brown, D.V.M. co-founded DURECT in February 1998 and has served as our President, Chief Executive Officer and on our Board of Directors since June 1998. He previously worked at ALZA Corporation as Vice President of Biopharmaceutical and Implant Research and Development from June 1995 to June 1998. Prior to that, Dr. Brown held various positions at Syntex Corporation, a pharmaceutical company, including Director of Business Development from May 1994 to May 1995, Director of Joint Ventures for Discovery Research from April 1992 to May 1995, and held a number of positions including Program Director for Syntex Research and Development from October 1985 to March 1992. Dr. Brown holds a B.A. from San Jose State University and a D.V.M. (Doctor of Veterinary Medicine) from the University of California, Davis where he also conducted post-graduate work in

9

pharmacology and toxicology. Dr. Brown’s scientific expertise and pharmaceutical industry experience as well as his valuable perspective as the Company’s Chief Executive Officer and co-founder are among the special qualifications that he brings to our Board of Directors.

Mohammad Azab, M.D., M. Sc., M.B.A. has served on our Board of Directors since January 2021. Dr. Azab served as President and Chief Medical Officer of Astex Pharmaceuticals, Inc. (“Astex”) from January 2014 to November 2020 after holding the position of Chief Medical Officer there commencing in July 2009. Upon retirement from his management role, Dr. Azab served as the chair of the board of directors for Astex, a subsidiary of Otsuka pharmaceuticals Co. Ltd, till May 2022. Previously, Dr. Azab served as President and Chief Executive Officer of Intradigm Corporation, a developer of small interfering RNA cancer therapeutics. Prior to this, Dr. Azab served as Executive Vice President of Research and Development, and Chief Medical Officer of QLT Inc., and in several drug development leadership positions at Astra Zeneca in the UK and Sanofi Pharmaceuticals in France. Dr. Azab holds his M.D. degree (M.B., B.Ch.) from Cairo University and a Master of Business Administration from the Richard Ivey School of Business, University of Western Ontario. He received post-graduate training and degrees in oncology research from the University of Paris-Sud and biostatistics from the University of Pierre et Marie Curie in Paris, France. Dr. Azab has more than 30 years of experience in clinical research, global drug development, and business management and led the global development of several drugs currently approved in oncology and other therapeutic areas. Currently, he also serves on the board of directors of Xenon Pharmaceuticals Inc., Sernova Corporation, and Lisata Therapeutics. Dr. Azab’s scientific background including his senior management experience in the pharmaceutical industry and his service as a board member on multiple publicly traded companies are among the qualifications he brings to our Board of Directors.

Terrence F. Blaschke, M.D. has served on our Board of Directors since December 2006. Dr. Blaschke has served on the faculty of Stanford University since 1974 and is Professor of Medicine and Molecular Pharmacology (Emeritus) at the Stanford University School of Medicine. Dr. Blaschke held the position of Vice President of Methodology and Science at Pharsight Corporation from 2000 to 2002. During the course of his career, Dr. Blaschke has served as an independent consultant working with a number of leading pharmaceutical and biotechnology companies. Dr. Blaschke was formerly a board member of Therapeutic Discovery Corporation until 1997 and Crescendo Pharmaceuticals until 2001, two publicly traded companies. He has also worked as a special government employee for the U.S. Food and Drug Administration (the “FDA”) and has served as Chair of the FDA's Generic Drugs Advisory Committee. After becoming emeritus, Dr. Blaschke joined the Bill and Melinda Gates Foundation as a Senior Program Officer from 2012 to January 2016. Dr. Blaschke holds his M.D. degree from Columbia University and a B.S. in Mathematics from the University of Denver. Dr. Blaschke’s medical and scientific expertise and pharmaceutical industry experience relating to drug development are among the qualifications he brings to our Board of Directors.

Gail M. Farfel, Ph.D. has served on our Board of Directors since April 2019. Dr. Farfel has served as the Chief Executive Officer of ProMIS Neurosciences Inc. since September 2022, a biotechnology company focused on the discovery and development of antibody therapeutics targeting misfolded proteins such as toxic oligomers, implicated in the development of neurodegenerative diseases. Prior to that, Dr. Farfel served as the Executive Vice President and Chief Development Officer of Zogenix, Inc. (“Zogenix”) from July 2015 and on the board of directors of Zogenix International Ltd., a wholly owned subsidiary of Zogenix, Inc. until the acquisition of Zogenix by UCB Pharma S.A. in March 2022, where she oversaw Nonclinical and Clinical Development and Regulatory Affairs. Before joining Zogenix, Dr. Farfel was Chief Clinical and Regulatory Officer of Marinus Pharmaceuticals Inc., a biopharma engaged in development of treatment for neurological disorders. Prior to her entry into the biotech space, Dr. Farfel served as Vice President and Therapeutic Area Head for Neuroscience at Novartis Pharmaceuticals Corporation, where she oversaw their portfolio of neurology and psychiatry products. Dr. Farfel began her career in pharmaceutical drug development at Pfizer Inc., where she worked in Clinical Development and Global Medical Affairs, directing programs through all stages of clinical development and regulatory submissions. Additionally, Dr. Farfel has served on the board of directors of AVROBIO, Inc. since October 2020. Dr. Farfel is the author of over 50 scientific articles and presentations in the areas of neuropsychopharmacology and drug effects and is a Director on the Board of the American Society for Experimental Neurotherapeutics. She holds a Ph.D. in Neuropsychopharmacology from the University of Chicago, where she is a Director on the Alumni Board. Dr. Farfel also holds a bachelor’s degree in Biochemistry from the University of Virginia. Dr. Farfel’s pharmaceutical industry experience relating to executive management, strategic planning, medical and scientific expertise and pharmaceutical industry experience as it relates to drug development and regulatory affairs are among the qualifications she brings to our Board of Directors.

Peter S. Garcia, M.B.A. has served on our Board of Directors since December 2021. Mr. Garcia has worked as a Chief Financial Officer in the life sciences industry for over 25 years and raised over $2 billion in capital during that period. He is currently the Chief Financial Officer of ALX Oncology Holdings Inc. (“ALX”) since joining them in January 2020 and led their initial public offering in July 2020 and follow on offering in December 2020. Prior to ALX,

10

he served as Vice President and Chief Financial Officer from 2013 until 2019 at PDL BioPharma, Inc. (“PDL”), an acquirer of royalties and pharmaceutical assets. Before his time at PDL, Mr. García served as Chief Financial Officer at BioTime, Inc., a clinical-stage biotechnology company now known as Lineage Cell Therapeutics. He previously served as Chief Financial Officer of Marina Biotech, Nanosys, Nuvelo, Novacept, IntraBiotics Pharmaceuticals and Dendreon, and began his life science career at Amgen where he served in a number of financial roles of increasing responsibility. Mr. García holds an M.B.A. from the University of California, Los Angeles and a B.A. in Economics and Sociology from Stanford University. Mr. Garcia’s pharmaceutical industry experience relating to finance and accounting, executive management, treasury, employee benefits and audit matters are among the qualifications he brings to our Board of Directors.

David R. Hoffmann has served on our Board of Directors since December 2002 and was appointed Chair of the Board effective January 1, 2019 and served as Chair until March 2023. Mr. Hoffman served as our lead independent director from December 2010 to December 2018. Mr. Hoffmann is retired from ALZA Corporation (now a Johnson & Johnson company) where he held the positions of Vice President and Treasurer from 1992 to until his retirement in October 2002, Vice President of Finance from 1982 to 1992, and Director of Accounting/Finance from 1976 to 1982. Mr. Hoffmann is currently Chief Executive Officer of Hoffmann Associates, a multi-group company specializing in cruise travel and financial and benefits consulting. Mr. Hoffmann holds a B.S. in Business Administration from the University of Colorado Boulder. Mr. Hoffmann has served as a member of the board of directors and Chair of the audit committee of Molecular Templates, an oncology company, since 2017. Mr. Hoffmann’s financial and accounting expertise led to his designation as our Audit Committee’s financial accounting expert. In addition, his pharmaceutical industry experience relating to executive management, treasury, employee benefits and audit matters is an additional qualification he brings to our Board of Directors.

Gail J. Maderis, M.B.A. has served on our Board of Directors since January 2021 and as Chair of our Board of Directors since March 2023. Ms. Maderis has served as Chair of the board of Antiva Biosciences, Inc. ("Antiva"), a venture funded biopharma company developing topical therapies to treat the pre-cancerous lesions caused by human papillomavirus, since April 2023. From 2015 to April 2023, Ms. Maderis served as President and Chief Executive Officer of Antiva. From 2009 to 2015, Ms. Maderis led BayBio, the industry organization representing and supporting Northern California's life science community, as its President and Chief Executive Officer. From 2003 to 2009, Ms. Maderis served as President and Chief Executive Officer of Five Prime Therapeutics, Inc., a protein discovery and development company focused on immuno-oncology. Prior to FivePrime, Ms. Maderis held senior executive positions at Genzyme Corporation, including Founder and President of Genzyme Molecular Oncology. Ms. Maderis also practiced management and strategy consulting with Bain & Co. She currently serves on the boards of directors of Antiva and Valitor, Inc., as well as on the nonprofit boards of BIO (Emerging Company and Health Sections), California Life Sciences Association, The Termeer Foundation and the University of California Berkeley Foundation Board of Trustees. Ms. Maderis previously served on the board of directors of Allarity Therapeutics, Inc. (“Allarity”) from July 2021 until January 2023 and on the board of directors of Allarity Therapeutics A/S, Allarity’s predecessor, since October 2020. She received a Bachelor of Science in business from the University of California at Berkeley and a Master of Business Administration from Harvard Business School. Ms. Maderis’ operational, industry and leadership experience in the biopharmaceutical industry as Chief Executive Officer of Five Prime Therapeutics, Inc., Founder and President of Genzyme Molecular Oncology and her current position at Antiva, and her insight into business and policy trends impacting the biopharma industry are among the qualifications she brings to our Board of Directors.

11

Judith J. Robertson has served on our Board of Directors since April 2019. Since January 2022, Ms. Robertson has served as the Chief Commercial Officer of Opthea Limited (“Opthea”) and previously was the Chief Commercial Officer of Aerie Pharmaceuticals Inc. (“Aerie”) from December 2016 to December 2018, during which time she built the commercial organization and led the successful commercial launch of Rhopressa® (netarsudil) for glaucoma. Ms. Robertson joined Aerie from the Janssen Pharmaceutical Companies of Johnson & Johnson (“Janssen”), where she was the Vice President and Global Commercial Strategy Leader of Immunology, Ophthalmology, and Commercial Analytics from June 2013 to November 2016. Part of her duties at Janssen included evaluating all external licensing and acquisition opportunities. Prior to Janssen, she was Vice President Global Business Franchise Head of Ophthalmology at Novartis Pharma AG (“Novartis”) (f/k/a Alcon Laboratories, Inc.), Vice President Global Franchise Head of Respiratory at Novartis, Vice President of Sales & Marketing of Respiratory and Dermatology at Novartis, and President of Bristol Myers Squibb Canada Co. Ms. Robertson previously served on the board of directors of Opthea from June 2021 to January 1, 2022. Ms. Robertson holds a Master of Management from the Kellogg School of Business at Northwestern University and holds a Bachelor of Arts in social science from Ryerson University. Ms. Robertson’s pharmaceutical industry experience relating to executive leadership experience with pharmaceutical companies and her expertise with respect to sales, marketing and commercialization of pharmaceutical products are among the qualifications she brings to our Board of Directors.

There are no family relationships among any of our directors or executive officers.

The Board, Board Committees and Meetings

Corporate governance is typically defined as the system that allocates duties and authority among a company’s stockholders, board of directors and management. The stockholders elect the Board and vote on extraordinary matters; the Board is our governing body, responsible for hiring, overseeing and evaluating management, particularly the Chief Executive Officer; and management runs our day-to-day operations. The Board reviews succession planning on an annual basis and has a written succession plan. The total number of authorized directors on our Board is currently eight; Mr. Hoffmann has decided to retire and not stand for reelection such that after the Annual Meeting the size of the Board will be reduced to seven members.

“Independent” Directors Each of our directors other than Dr. Brown and Dr. Farfel, qualify as “independent directors” as defined under Nasdaq rules. Nasdaq’s definition of independent director includes a series of objective tests, such as that the director is not a Company employee and has not engaged in various types of business dealings with us or does not have a family member who is a partner with our independent registered public accounting firm. In addition, as further required by Nasdaq rules, the Board has made a subjective determination as to each independent director that no relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Board and Committee Responsibilities The primary responsibilities of the Board are providing oversight, counseling and direction to our management in the long-term interests of the Company and its stockholders. The Chief Executive Officer and management are responsible for seeking the advice and, in appropriate situations, the approval of the Board with respect to extraordinary actions to be undertaken by us.

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. The Board has delegated various responsibilities and authority to different Board committees as described in this section of the proxy statement. Committees regularly report on their activities and actions to the full Board.

Board Leadership Structure The roles of Board chair and principal executive officer are currently separated. Our Board chair is currently Gail J. Maderis, and our principal executive officer is currently James E. Brown, who serves as our President and Chief Executive Officer and as a director. By having the President and Chief Executive Officer serve on the Board, the Company believes it can better ensure that relevant information is made available directly between management and the Board. We also believe this separation of responsibilities provides an appropriate delegation of duties and responsibilities, with our Board chair concentrating on the strategic opportunities and direction of the Company with guidance from the Board, and our principal executive officer focusing on the management and coordination of the operational performance and efforts of the Company in alignment with the strategic guidance and direction offered from the Board of Directors.

Board Oversight of Risk The Board of Directors is responsible for overseeing the Company’s risks, which includes cybersecurity risks. In carrying out this responsibility, the Board evaluates the most critical risks relating to

12

our business, allocates responsibilities for the oversight of risks among the full Board and its committees, and ensures that management has established effective systems and processes for managing the Company’s risks. Additionally, because risk is inherently present in the Company’s strategic decisions, the Board analyzes risk on an ongoing basis in connection with its consideration of specific proposed actions.

While the Board is responsible for oversight, management is responsible for identifying and communicating risk to the Board. Management fulfills this obligation in a variety of ways, including its establishment of appropriate and effective internal processes for the identification of risk. Management may report its findings to the full Board or its committees. Committees of the Board play an important role in risk oversight, including the Audit Committee, which oversees our processes for assessing risks and the effectiveness of our internal controls, and the Compensation Committee, which oversees risks present in the Company’s compensation programs. Committees, to the extent that they deem appropriate or as required by their charters, report their findings and deliberations with respect to risk to the full Board.

In fulfilling its duties, the Audit Committee oversees and works in conjunction with our independent registered public accounting firm, Ernst & Young LLP. In accordance with its charter, the Audit Committee is responsible for making examinations as necessary to monitor corporate financial reporting and the internal and external audits of the Company, reporting to the Board the results of such examinations and recommending changes that may be made in the Company’s internal accounting controls. The Compensation Committee, with the assistance of its compensation consultants, periodically reviews the Company’s compensation policies and profile with management to ensure that executive compensation incentivizes its executive officers to meet the Company’s goals and strategic objectives. The Compensation Committee periodically performs an analysis of risks arising from our compensation policies and practices and has concluded that such policies and practices are not reasonably likely to expose the Company to material risk.

Board Committees and Charters The Board currently has, and appoints the members of, standing Audit, Compensation and Nominating and Corporate Governance Committees. Each of the Board committees has a written charter approved by the Board. Copies of each charter are available on our website at www.durect.com under “Investors—Corporate Governance—Documents & Charters.” The Board has also established a Research and Development Committee to assist the Board of Directors in the evaluation and oversight of the Company’s research and development programs.

Audit Committee The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Exchange Act. In accordance with its charter, the Audit Committee assists the Board in its general oversight of our financial reporting, internal controls and audit functions, and is directly responsible for the appointment, retention, compensation and oversight of the work of our independent registered public accounting firm. The Audit Committee held four meetings in 2022. The responsibilities and activities of the Audit Committee are described in greater detail in the “Audit Committee Report.” At the end of the last fiscal year, the Audit Committee was composed of the following directors: Peter S. Garcia, David R. Hoffmann, Gail J. Maderis and Judy J. Robertson. Mr. Hoffmann has served as Chair of the Audit Committee since September 2004. Mr. Hoffmann has elected to retire and not to be nominated for re-election but remains Chair of the Audit Committee until the Annual Meeting. Assuming Mr. Garcia is re-elected to the Board of Directors, it is anticipated that he will become the new Chair of the Audit Committee.

Among other matters, the Audit Committee monitors the activities and performance of our external auditors, including the audit scope, external audit fees, auditor independence matters and the extent to which the independent registered public accounting firm may be retained to perform non-audit services. Our independent registered public accounting firm, Ernst & Young LLP, provides the Audit Committee with the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and the Audit Committee discusses with the independent registered public accounting firm and management that firm’s independence.

In accordance with Audit Committee policy and the requirements of law, all services to be provided by Ernst & Young are pre-approved by the Audit Committee. Pre-approval includes audit services, audit-related services, tax services and other services. In its pre-approval and review of non-audit service fees, the Audit Committee considers, among other factors, the possible effect of the performance of such services on the auditor’s independence. To avoid certain potential conflicts of interest in maintaining auditor independence, the law prohibits a publicly traded company from obtaining certain non-audit services from its auditing firm.

As required by Nasdaq rules, the members of the Audit Committee each qualify as “independent” under special standards established for members of audit committees. The Audit Committee also includes at least one member who

13

has been determined by the Board to meet the qualifications of an “audit committee financial expert” in accordance with SEC rules. David R. Hoffmann and Peter S. Garcia have been determined by the Board of Directors to be “audit committee financial experts.” Stockholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Hoffmann’s and Mr. Garcia’s experience and understanding with respect to certain accounting and auditing matters. The designation does not impose upon Mr. Hoffmann or Mr. Garcia any duties, obligations or liability that are greater than are generally imposed on either of them as members of the Audit Committee and the Board, and their designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or the Board.

Compensation Committee The Compensation Committee reviews and approves salaries, performance-based incentives and other matters relating to executive compensation, and administers our stock option plans, including reviewing and granting stock options to executive officers. The Compensation Committee also reviews and approves various other Company compensation policies and matters. The Compensation Committee held two meetings in 2022..” At the end of the last fiscal year, the Compensation Committee was composed of Mohammad Azab, Peter S. Garcia, David R. Hoffmann and Gail J. Maderis. Ms. Maderis has served as Chair of the Committee since June 2021. As required by Nasdaq rules, the members of the Compensation Committee each qualify as “independent” under special standards established for members of compensation committees. In addition, the Compensation Committee, from time to time, retains independent compensation consultants to assist it with the benchmarking of executive and Board compensation. The Compensation Committee retained Larry Setren & Associates as an independent compensation consultant to assist it with the benchmarking of executive and Board compensation for 2022. The process by which compensation is set for executive officers is described in the Compensation Discussion and Analysis below under the heading “Setting Officer Compensation.”

Nominating and Corporate Governance Committee The Nominating and Corporate Governance Committee identifies, evaluates and recommends to the Board individuals, if any, including individuals proposed by stockholders, qualified to serve as members of the Board and the nominees for election as directors at the next annual or special meeting of stockholders at which directors are to be elected. The Nominating and Corporate Governance Committee also identifies, evaluates and recommends to the Board individuals to fill any vacancies or newly created directorships that may occur between such meetings. The Nominating and Corporate Governance Committee also is responsible for preparing and recommending to the Board adoption of corporate governance guidelines, reviewing and assessing our Code of Ethics, and overseeing and conducting an annual evaluation of the Board’s performance. The Nominating and Corporate Governance Committee held three meetings in 2022. At the end of the last fiscal year, the Nominating and Corporate Governance Committee was composed of Mohammad Azab, Terrence F. Blaschke and Judith J. Robertson. Ms. Robertson has served as Chair of the Committee since June 2022. As required by Nasdaq rules, the members of the Nominating and Corporate Governance Committee each qualify as “independent” under special standards established for members of the committee.

Research and Development Committee The Board has also established a Research and Development Committee to assist the Board of Directors in the evaluation and oversight of the Company’s research and development programs. The Research and Development Committee held four meetings in 2022. At the end of the last fiscal year, the Research and Development Committee was composed of Mohammad Azab, Terrence F. Blaschke and Gail M. Farfel. Dr. Blaschke was appointed as Chair of the Committee in June 2021.

Criteria for Board Membership In recommending candidates for appointment or re-election to the Board, the Nominating and Corporate Governance Committee considers the appropriate balance of experience, skills and characteristics required of the Board of Directors, and seeks to ensure that at least a majority of our directors are independent under Nasdaq rules, and that members of the Audit Committee meet the financial literacy and sophistication requirements under Nasdaq rules and at least one of them qualifies as an “audit committee financial expert” under SEC rules. Nominees for director are selected on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of our business environment and willingness to devote adequate time to Board duties.

Stockholder Nominees The Nominating and Corporate Governance Committee will consider written proposals from stockholders for nominees for director. Any such nominations should be submitted to the Nominating and Corporate Governance Committee, c/o Timothy M. Papp, Chief Financial Officer and Secretary, 10260 Bubb Road, Cupertino, CA 95014 and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Exchange Act (including such person’s written

14

consent to being named in the proxy statement as a nominee and to serving as a director if elected); (b) the names and addresses of the stockholders making the nomination and the number of shares of the Company’s common stock which are owned beneficially and of record by such stockholders; and (c) appropriate biographical information and a statement as to the qualification of the nominee, and should be submitted in the time frame described in our bylaws and under the caption “Stockholder Proposals for the 2024 Annual Meeting” above.

Process for Identifying and Evaluating Nominees The Nominating and Corporate Governance Committee believes that the Company is well-served by its current directors. In the ordinary course, absent special circumstances or a material change in the criteria for Board membership, the Nominating and Corporate Governance Committee will re-nominate incumbent directors who continue to be qualified for Board service and are willing to continue as directors. If an incumbent director is not standing for re-election, or if a vacancy on the Board occurs between annual stockholder meetings and the decision is not made to reduce the size of the Board, the Nominating and Corporate Governance Committee will seek out potential candidates for Board appointment who meet the criteria for selection as a nominee and have the specific qualities or skills being sought. Director candidates will be selected based on input from members of the Board, our senior management and stockholder nominations.

Consideration of Diversity and Board Diversity Matrix The Nominating and Corporate Governance Committee believes that the interests of the stockholders are best served by a board of directors whose members collectively have a diverse balance of experience, skills and characteristics as appropriate to our business because it encourages a full discussion on board topics from a variety of viewpoints and with the benefit of many different experiences. Although we do not have a policy regarding diversity, in looking for a candidate who will best meet the particular needs of the Board at the time, the Nominating and Corporate Governance Committee does consider whether the specific skills, background and work experience of a candidate would add to and complement the existing viewpoints represented by the present Board members, as well as applicable legal and listing requirements. As of the date of this filing, the Board consists of 5 men and 3 women, with one member self-designating as a Latino. The Nominating and Corporate Governance Committee believes that the current Board composition represents a diversity of experience and skills appropriate to our business, as well as gender and ethnic diversity.

The table below provides certain highlights of the composition of our Board members. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f)(1).

Board Diversity Matrix (as of April 25, 2023) |

|

|

|

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

| |||

Total Number of Directors |

|

| 8 |

|

|

|

|

|

|

|

|

| ||

Part I: Gender Identity |

| Female |

|

| Male |

| Non-Binary |

|

| Did Not Disclose Gender |

| |||

Directors |

| 3 |

|

| 5 |

|

| — |

|

|

| — |

| |

|

|

|

|

|

|

|

|

|

|

|

| |||

Part II: Demographic Background |

|

| — |

|

|

|

|

|

|

|

|

| ||

Hispanic or Latinx |

|

|

|

| 1 |

|

| — |

|

|

| — |

| |

White |

| 3 |

|

| 4 |

|

| — |

|

|

| — |

| |

Director Resignation Policy. It is the policy of the Company that any nominee for director in an uncontested election who does not receive a majority of the votes cast (i.e., receives a greater number of votes “withheld” from his or her election than votes “for” in such election) shall submit his or her offer of resignation for consideration by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee shall consider all of the relevant facts and circumstances and recommend to the Board the action to be taken with respect to such offer of resignation. The Board will then act on the Committee’s recommendation. Promptly following the Board’s decision, the Company will disclose that decision and an explanation of such decision in a filing with the SEC and a press release.

15

Attendance at Board, Committee and Annual Stockholders’ Meetings. The Board and its committees meet throughout the year on a set schedule and hold special meetings and act by written consent from time to time. The Board held five meetings during 2022, including virtual meetings, the Audit Committee held four meetings, the Research and Development Committee held four meetings, the Compensation Committee held two meetings and the Nominating and Corporate Governance Committee held three meetings. All directors are expected to attend each meeting of the Board and the committees on which they serve and are also strongly encouraged to attend our annual meeting of stockholders. During 2022, each director attended at least 75% of all Board and applicable committee meetings during the period which such director served. Our policy is to invite and encourage each member of our Board to be present at our annual meetings of stockholders. All directors attended our 2022 annual meeting of stockholders.

Communications from Stockholders to the Board. The Board recommends that stockholders initiate any communications with the Board in writing and send them c/o the Company’s Secretary, Timothy M. Papp. Stockholders can send communications by e-mail to IR@durect.com, by fax to (408) 777-3577 or by mail to Timothy M. Papp, Chief Financial Officer and Secretary, DURECT Corporation, 10260 Bubb Road, Cupertino, California 95014. This centralized process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The name of any specific intended Board recipient should be noted in the communication. The Board has instructed the Secretary to forward such correspondence only to the intended recipients; however, the Board has also instructed the Secretary, prior to forwarding any correspondence, to review such correspondence and, in his discretion, not to forward certain items if they are deemed to be of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration. In such cases, some of that correspondence may be forwarded elsewhere in the Company for review and possible response.

Code of Ethics

In September 2022, the Board approved an amended Code of Ethics applicable to all of our employees, officers and directors. The purpose of the Code of Ethics is to deter wrongdoing and, among other things, promote compliance with applicable laws, fair dealing, proper use and protection of our assets, prompt and accurate public company reporting, reporting of accounting complaints or concerns and avoidance of conflicts of interest and usurpation of corporate opportunities.

Our Code of Ethics can be found on our corporate website at www.durect.com under “Investors—Corporate Governance—Documents & Charters.” If we make any substantive amendments to the Code of Ethics or grant any waiver from a provision of the Code of Ethics to any executive officer or director, we will promptly disclose the nature of the amendment or waiver by a method selected by the Board of Directors and in conformity with applicable SEC and Nasdaq rules.

Whistleblower Policy

In December 2003, in compliance with Section 301 of the Sarbanes-Oxley Act, the Audit Committee of the Board of Directors established procedures for the receipt, retention, and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and confidential, anonymous employee submissions of concerns regarding questionable accounting or auditing matters (“Whistleblower Policy”). In September 2022, the Board approved an amended Whistleblower Policy. Our Whistleblower Policy can be found on our corporate website at www.durect.com under “Investors—Corporate Governance—Documents & Charters.”

Recommendation of the Board:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR

THE ELECTION OF ALL NOMINEES NAMED ABOVE.

16

PROPOSAL NO. 2

APPROVAL OF THE AMENDMENT AND RESTATEMENT OF THE COMPANY’S 2000 EMPLOYEE

STOCK PURCHASE PLAN, INCLUDING AN INCREASE TO THE NUMBER OF SHARES OF THE

COMPANY’S COMMON STOCK AVAILABLE FOR ISSUANCE BY 40,000 SHARES AND AN

EXTENSION OF THE PLAN’S TERM FOR 10 YEARS FROM THE DATE OF THE

2023 ANNUAL MEETING

General

At the Annual Meeting, you are being asked to approve the amendment and restatement of the Company’s 2000 Employee Stock Purchase Plan (the “ESPP”). The purpose of the ESPP is to allow the Company to provide eligible employees of the Company and its participating parents and subsidiaries with the opportunity to purchase common stock of the Company at a discount from the then current market price through payroll deductions. The ESPP, and the right of participants to make purchases thereunder, is intended to qualify under the provisions of Sections 421 and 423 of the Code. The ESPP was last approved by our stockholders in June 2020.

As of April 25, 2023, 25,455 shares remained available for future issuance under the ESPP.

The changes we propose to make to the ESPP are to:

(1) Increase the number of shares of our common stock authorized for issuance under the ESPP by 40,000 shares so that the total number of shares that will remain available for future issuance under the ESPP will be 65,455; and

(2) Extend the term of the ESPP so that the ESPP will terminate on the date that is ten (10) years following stockholder approval of the amended and restated ESPP.

If the stockholders approve the amendment and restatement of the ESPP, the amended and restated version of the ESPP will replace the prior version of the ESPP. If the stockholders do not approve the amended and restated version of the ESPP, the prior version of the ESPP will remain in effect until its expiration in June 2030, at which time the Company will no longer be able to offer an employee stock purchase plan under which eligible employees would be able to purchase Company common stock at a discount.

Summary of the ESPP

A copy of the ESPP, as amended, will be filed with the SEC contemporaneously with this Proxy Statement as Exhibit 1 and is available online at www.sec.gov or from the Company upon request by any stockholder. The following description of the ESPP is only a summary and so is qualified by reference to the complete text of the ESPP. Except as otherwise noted, this summary reflects the amendments proposed above.

Administration

The ESPP may be administered by the Board or the Compensation Committee of the Board. It is anticipated the Compensation Committee will serve as Administrator. The Compensation Committee, as Administrator, has full authority to adopt such rules and procedures as it may deem necessary for the proper plan administration and to interpret the provisions of the ESPP.

Shares Available Under the ESPP

As of April 25, 2023, 25,455 shares remained available for future issuance under the ESPP.

Subject to stockholder approval, the number of shares reserved for issuance under the ESPP will be increased by 40,000 shares to 365,000 shares so that the total number of shares that will remain available for future issuance under the ESPP will be 65,455. The number of shares reserved for issuance under the ESPP is subject to adjustment in the event of a stock split, stock dividend, combination or reclassification or similar event.

17

Offering Periods

The ESPP is currently implemented by six-month consecutive offering periods commencing on or about May 1 and November 1 of each year and ending on the following October 31 and April 30, respectively. The Administrator may alter the duration of future offering periods in advance without stockholder approval. Each participant will be granted a separate purchase right to purchase shares of our common stock for each offering period in which he or she participates. Purchase rights under the ESPP will be granted on the start date of each offering period in which the participant participates and will be automatically exercised on the last day of the offering period. Each purchase right entitles the participant to purchase the whole number of shares of our common stock obtained by dividing the participant’s payroll deductions for the offering period by the purchase price in effect for such period, up to a maximum of 200 shares of our common stock per offering period.

If, during any ongoing offering period, the fair market value of our common stock on any purchase date is less than the fair market value of our common stock on the offering date for such ongoing offering period, the ongoing offering period will end after the exercise of participants’ options, and all participants will be automatically re-enrolled in the immediately following offering period.

Eligibility

Any individual who is regularly expected to work for at least twenty (20) hours per week for more than five (5) months per calendar year in the employ of the Company or any designated parent or subsidiary is eligible to participate in one or more offering periods. An eligible employee may only join an offering period on the start date of that period. Designated parents and subsidiaries include any parent or subsidiary corporations of the Company, whether now existing or hereafter organized, which elect, with the approval of the Administrator, to extend the benefits of the ESPP to their eligible employees.

As of April 25, 2023, 3 executive officers and approximately 72 other employees were expected to be eligible to participate in the ESPP.

Purchase Provisions

Each participant in the ESPP may authorize periodic payroll deductions that may not exceed the least of (i) 20% of his or her compensation, which is defined in the ESPP to include the regular straight time gross earnings, exclusive of any payments for overtime, shift premium, bonuses, commissions, incentive compensation, incentive payments and other compensation or (ii) such lesser amount determined by the Administrator per offering period. A participant may increase his or her rate of payroll deductions once during an offering period and may reduce the rate once during an offering period.

On the last day of each offering period, the accumulated payroll deductions of each participant are automatically applied to the purchase shares of our common stock at the purchase price in effect for that period.

Purchase Price

The purchase price per share at which our common stock is purchased on the participant’s behalf for each offering period is equal to the lower of (i) 85% of the fair market value per share of our common stock on the date of commencement of the offering period or (ii) 85% of the fair market value per share of our common stock on the purchase date.

Valuation

The fair market value of our common stock on a given date is the last sale price of our common stock on the Nasdaq Capital Market as of such date. As of April 25, 2023, the fair market value of a share of the Company’s common stock as reported on the Nasdaq Capital Market was $4.24.

18

Special Limitations

The ESPP imposes certain limitations upon a participant’s right to acquire our common stock, including the following limitations:

Termination of Purchase Rights

A participant’s purchase right immediately terminates upon such participant’s loss of eligible employee status, and his or her accumulated payroll deductions for the offering period in which the purchase right terminates are refunded. A participant may withdraw from an offering period by giving advance notice prior to the end of that period and his or her accumulated payroll for the offering period in which withdrawal occurs shall be refunded.

Assignability

No purchase right will be assignable or transferable (other than by will or the laws of descent and distribution) and will be exercisable only by the participant.

Corporate Transaction