|

Discussion Materials – January 28, 2010 Exhibit (c)(6) * * * * * * * * * * |

|

1 Table of Contents I. Sale Process Update & Bid Summary 2 II. Received Bid Letters 14 Page |

|

I. Sale Process Update & Bid Summary |

|

3 Summary (a) One of the bids includes two separately contacted parties. Total Contacted Initial Teaser & Draft CA Offering Memo/ Targeted Contact NDA Sent Received CA Signed Bid Letter Sent Bids Received (a) Strategic Contacts 30 30 10 1 - - - Financial Contacts 53 53 40 32 30 30 5 Totals 83 83 50 33 30 30 5 Active Initial Teaser & Draft CA Offering Memo/ Targeted Contact NDA Sent Received CA Signed Bid Letter Sent Bids Received Strategic Contacts - - - - - - - Financial Contacts 6 6 6 6 6 6 5 Totals 6 6 6 6 6 6 5 Passed Initial Teaser & Draft CA Offering Memo/ Targeted Contact NDA Sent Received CA Signed Bid Letter Sent Bids Received Strategic Contacts 30 30 10 1 - - - Financial Contacts 47 47 34 26 24 24 - Totals 77 77 44 27 24 24 - |

|

4 Passed After Initial Contact Strategic Contacts Alsea Focus Brands American Blue Ribbon Holdings Galardi Group AmRest Holdings Garden Fresh Restaurant Apple-American Group Jack in the Box AutoGrill Group Jacmar Companies Brinker International M.H. Alshaya Co. Carrols Restaurant Group Mansour Group Collins Food Group Subway Restaurant Compass Group Taco Bueno Restaurant Darden Restaurants WKS Restaurant Financial Contacts Berkshire Partners New Mountain Capital Friedman Fleischer & Lowe Olympus Partners Goldner Hawn Pacific Equity Partners Gotham Equity Partners PCG Capital GS Capital Towerbrook J.H. Whitney & Co. Weston Presidio Kinderhook Industries |

|

5 Received CA, Did Not Receive OM Strategic Contacts Amer Group Quiznos Americana Group Shakey's USA Berjaya Sodexo China Resource Enterprise Wendy's/Arby's Group Gala Corporation Zensho Financial Contacts Alpine Investors Mistral Equity Black Canyon Capital Palladium Equity Partners CIC Partners Sun Capital Partners Hancock Park Associates Tavistock Group Jacobson Partners TSG Consumer Partners |

|

6 Received OM, Did Not Bid Strategic Contacts None Financial Contacts Acon Investments Goode Partners Altpoint Capital HIG Capital American Securities Karp Reilly Angelo Gordon LNK Partners Brentwood Associates Mainsail Partners Bruckmann, Rosser, Sherrill & Co Milestone Partners Bunker Hill Capital ONCAP Management Partners Castle Harlan Quad-C Management Centre Partners Riverside Company Charlesbank Capital Partners Roark Capital Group Consumer Capital Partners Sentinel Capital Partners Fairmont Capital TPG Growth |

|

7 Submitted First Round Bid Strategic Contacts None Financial Contacts Catterton Partners Golden Gate Capital Kayne Anderson Capital Advisors Meruelo Group/Levine Leichtman Capital Partners Mill Road Capital |

|

8 Commentary Many potential acquirers are avoiding restaurant investments or acquisitions, given the uncertainty of the current economic and consumer environment Potential strategic buyers showed little interest in acquiring Rubio’s as their focus is inward rather than outward Maintaining cash in order to navigate the ongoing storm Fixing their own concepts Interested in divesting non-core brands Lack of synergy For internationals, would only enter US organically or for national brand at attractive valuation For the few strategics considering acquisitions, they are generally focused on distressed or value-oriented situations Financial buyers expressed similar concern about the environment in addition to other obstacles regarding the industry, concept, business model, company profile or their own portfolio Uncertain of the future restaurant landscape Limited experience in the restaurant space, not the right time to enter Mexican fast-casual is intensely competitive/overstored Invested in a similar concept, don’t want overexposure in the category California concentration of the restaurants Lack of concept portability Preference for franchised business models Staying away from take private situations Too small or large an investment for investment fund Valuation, would not compete above previously rejected offer of $8.00 |

|

9 Commentary Despite the aforementioned obstacles, potential acquirers were drawn to Rubio’s for a variety of reasons Positioning in the rapidly growing fast-casual segment Differentiation of the concept Continued improvement of the concept under the current management team Stable financial results in an extremely challenging consumer environment Opportunity for growth These qualities compelled 5 potential acquirers to submit an initial indication of interest Catterton Partners Golden Gate Capital Kayne Anderson Meruelo Group/Levine Leitchman Mill Road |

|

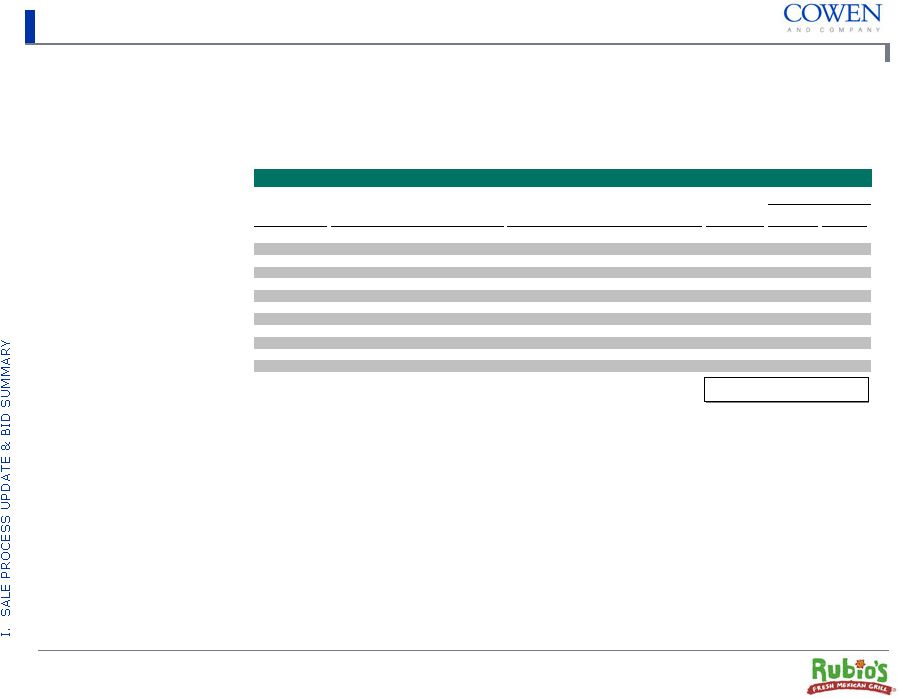

10 Summary of Received Bids Overview of Initial Indications of Interest Note: EBITDA and cash based on 2009 year end estimates from projection model. (a) Public Comparable EBITDA excludes impairment and loss on disposal. (b) Private Company EBITDA excludes impairment and loss on disposal, pre-opening, stock-based compensation and public company costs. Meruelo/ Bidder Mill Road Kayne Anderson Catterton Partners Levine Leichtman Golden Gate Price Range Low $9.50 $9.25 $8.83 $8.50 $8.00 High 9.50 10.00 9.42 8.50 8.25 Implied Public Comparable EBITDA Multiple (a) Low 7.7x 7.5x 7.1x 6.8x 6.3x High 7.7x 8.2x 7.7x 6.8x 6.5x Implied Private Company EBITDA Multiple (b) Low 6.5x 6.3x 5.9x 5.7x 5.3x High 6.5x 6.9x 6.4x 5.7x 5.5x Implied Premium Current Price: $7.30 (1/22/10) Low 30.1% 26.7% 21.0% 16.4% 9.6% High 30.1% 37.0% 29.0% 16.4% 13.0% Unaffected Price: $6.00 (10/14/09) Low 58.3% 54.2% 47.2% 41.7% 33.3% High 58.3% 66.7% 57.0% 41.7% 37.5% Form of Consideration Cash Cash Cash Cash Cash Plan to Utilize Debt Yes Yes Yes Yes Unclear Financing Contingency No Likely Likely No No Executive in Residence - - - Alex Meruelo - Comparable/Cited Investments Cossette, Galaxy Nutritional Foods None Baja Fresh, PF Chang's, Cheddars, Caribou Coffee, La Madeline, Culinary Concepts, Outback Steakhouse La Pizza Loca, Quiznos, Cici's Pizza, Wetzel's Pretzels Romano's Macaroni Grill, Express, Eddie Bauer, J. Jill, Eye Care Centers of America, Orchard Brands, Apogee Retail Other Advisors Accounting NA NA NA NA PriceWaterhouse Coopers Legal NA NA NA NA Kirkland and Ellis Timing 10 days within being selected (+legal) 60 days within being selected "in a timely fashion" 45-60 days of exclusivity "in a timely manner" Necessary Approvals None Investment Committee None None Investment Committee Held Additional Discussions with Cowen Yes Yes Yes Yes Yes Current Rubio's Ownership 4.9% - - 11.6% - Additional Diligence List Provided Yes No No No No Additional Comment Founder was PNRA BOD member; No intro necessary |

|

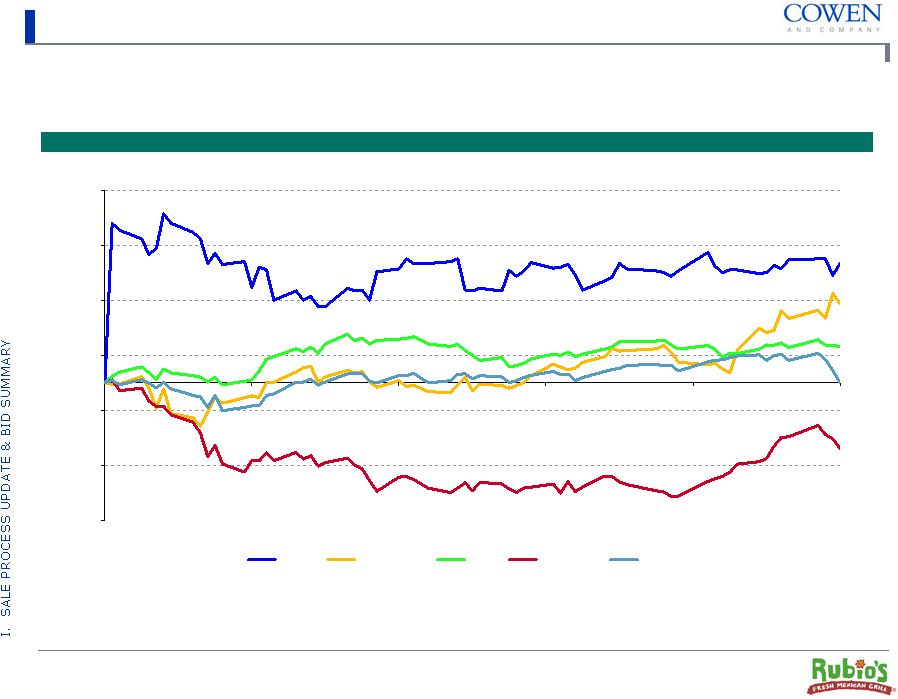

11 Relative Stock Price Change Stock Price Change Relative to Comparable Companies 2 Since 10/14/2009 (25.0%) (15.0%) (5.0%) 5.0% 15.0% 25.0% 35.0% 10/14/09 11/03/09 11/23/09 12/13/09 01/02/10 01/22/10 RUBO Fast Casual QSR Micro Cap S&P 500 |

|

12 Comparable Restaurant Analysis is } Market Statistics Select Comparable Company Analysis (US$ in millions, except per share data) (a) Enterprise Value = Market Value of Equity + Net Debt + Minority Interest. (b) From Wall Street research. (c) Rubio’s LTM EBITDA based on 2009 EBITDA per projection model. Price FD Enterprise Enterprise Value (a) / LTM PE Ratios (b) 5-Year PE % of SGR (b) Company Name 1/22/2010 Mkt Cap Value (a) Rev EBITDA 2009E 2010E SGR (b) 2009E 2010E Micro-Cap Restaurants Ark Restaurants $13.65 $47.6 $49.8 0.4x 6.5x 15.3x NA NA NM NM Benihana 4.56 70.2 116.2 0.4x 4.7x NA NA 14.0% NM NM Caribou Coffee 7.32 150.3 131.4 0.5x 6.0x 28.2x 20.9x NA NM NM Cosi 0.67 27.4 22.8 0.2x NM NM NM NA NM NM Famous Dave's 6.22 57.6 70.4 0.5x 4.8x 9.7x 8.8x 15.0% 64.8% 58.4% J. Alexander's 3.40 20.2 40.7 0.3x NM NA NA NA NM NM Jamba Juice 1.78 93.8 64.7 0.2x NM NM NM NA NM NM Kona Grill 3.37 30.9 29.4 0.4x NM NM NM 23.0% NM NM McCormick & Schmick's 7.99 118.4 134.8 0.4x 5.9x NM 22.8x 15.0% NM 152.2% Mexican Restaurants Inc 2.30 7.6 12.5 0.2x 3.0x NA NA NA NM NM Morton's 3.74 68.7 144.1 0.5x NM NM 18.7x 13.0% NM 143.8% Pizza Inn 1.61 12.9 13.5 0.3x 5.2x NA NA NA NM NM Ruth's Chris 3.03 73.2 219.1 0.6x 6.3x 8.2x 8.7x 12.0% 68.2% 72.1% Mean 0.4x 5.3x 15.3x 16.0x 15.3% 66.5% 106.6% Median 0.4x 5.5x 12.5x 18.7x 14.5% 66.5% 108.0% Rubio's Restaurants (c) $7.30 $74.8 $67.4 0.4x 5.7x NM NM 20.0% NM NM Rubio's Restaurants (private) (c) $7.30 $74.8 $67.4 0.4x 4.8x NM NM 20.0% NM NM |

|

13 Restaurant M&A Transactions (a) Represents total consideration including the assumption of liabilities and residual cash (enterprise value) when available. Selected M&A Transactions 2005-2009 YTD (US$ in millions, except per share data) Enterprise Value/ Date Enterprise LTM LTM Ann. Target Acquirer Value (a) Revenue EBITDA 08/18/08 Romano's Macaroni Grill Golden Gate Capital 109.9 $ 0.2x 2.9x 06/18/08 Café Enterprises (Fatz Café) Milestone Partners 60.0 0.7x 6.3x 04/28/08 Max & Erma's Restaurants G&R Acquisition 58.7 0.3x 8.9x 01/29/08 Great American Cookie Company NexCen Brands 93.4 3.6x 7.6x 11/06/07 Cameron Mitchell Restaurants Ruth's Chris Steak House 92.0 0.9x 7.0x 08/07/07 Pretzel Time and Pretzelmaker NexCen Brands 28.7 4.3x 7.1x 07/05/07 Champps Entertainment F&H Acquisition Corp. (Fox & Hound) 70.9 0.3x 5.8x 06/11/07 Back Yard Burgers BBAC (Cherokee Advisors) 38.3 0.8x 7.8x 02/27/07 Bugaboo Creek Trimaran Capital (Charlie Brown's Acq. Corp. 24.0 0.2x 3.6x 10/11/06 Baja Fresh Caliber Capital Group 31.0 NA 6.2x 05/30/06 Catalina Restaurant Group Zensho Co. 105.0 0.4x 6.4x 12/29/05 Shari's Circle Peak Capital 80.0 0.5x 5.7x Mean 1.1x 6.3x Median 0.5x 6.4x Small Cap restaurant companies have generally sold in a range of 5.0x to 8.0x |

MILL ROAD CAPITAL

January 22, 2010

Rubio’s Restaurants, Inc.

c/o Cowen and Company, LLC

Attention: Owen L. Hart

555 California Street, Fifth Floor

San Francisco, CA 94104

Re: Indication of Interest

To Whom It May Concern:

As you are aware, Mill Road Capital, L.P. (“Mill Road”) has followed Rubio’s Restaurants, Inc. (“Rubio’s” or the “Company”) for many years and has been consistently impressed with the Company and its management team. We currently own approximately 4.9% of the Company’s common stock and continue to believe strongly in the long term potential of the Rubio’s concept. Accordingly, Mill Road is pleased to submit this non-binding indication of interest (the “Offer”) in accordance with the guidelines provided in your letter dated December 17, 2009.

The details of our Offer are as follows:

| | • | | Purchase Price. Mill Road proposes to acquire 100% of the shares outstanding of the Company for $9.50 per share (the “Purchase Price”). |

| | • | | Form of Consideration. The Purchase Price would be payable in cash upon the closing of the proposed transaction. |

| | • | | Financing. Mill Road and its affiliates would provide all of the equity necessary for the proposed transaction. Mill Road has a longstanding relationship with a leading middle market lender and has conducted extensive discussions about the Offer with that lender. As a result of these discussions, we are highly confident in our ability to arrange appropriate debt financing to complement our equity investment in the proposed transaction. Accordingly, we intend to sign a transaction agreement with no financing contingencies. |

| | • | | Due Diligence. In April 2008, Mill Road signed a confidentiality agreement with the Company and completed all of the due diligence that was necessary at the time to make an offer to acquire the Company. Since then, we have become one of the Company’s largest shareholders, met frequently with management and followed all publicly reported developments in the Company. Based on our extensive restaurant experience and uniquely comprehensive knowledge of the Company, we believe that only very limited confirmatory business due diligence would be required. We would also require standard legal and accounting due diligence. See Exhibit A for a list of requested business diligence information. |

382 Greenwich Avenue, Suite One • Greenwich, CT 06830 • (203) 987-3500

| | • | | Required Approvals. We do not require any outside approvals to consummate a transaction. |

| | • | | Timing. Based on the work that we have performed to date and the limited and confirmatory nature of the information that we require, Mill Road is highly confident that we need no more than 10 days to finalize our business due diligence and that legal and accounting due diligence would be completed very shortly thereafter. Mill Road has a thorough understanding of the Company, does not require an introductory presentation from the management team, and is prepared to immediately commence confirmatory final due diligence. |

| | • | | Advisors. Mill Road will not be engaging a financial advisor in connection with this transaction. We plan to engage our customary legal and accounting advisors. |

| | • | | Contacts. Please direct any questions regarding our Offer to Scott Scharfman, Managing Director. His phone number is (203) 987-3504, email issscharfman@millroadcapital.com and fax is (203) 621-3280. |

Mill Road Capital is a Greenwich, Connecticut based investment firm. We invest on behalf of a prominent and highly respected group of limited partners including state pension funds, foundations, endowments and insurance companies. The investment professionals of Mill Road are largely former Blackstone Group professionals who have successfully completed several dozen control transactions with a cumulative transaction value of several billion dollars. No firm has more recent experience in micro cap going-private transactions than Mill Road. In December 2009, we successfully executed a $140 million take-private of Cossette Inc. (Former ticker symbol: KOS) the largest domestic advertising and marketing firm in Canada. Earlier in the year, Mill Road executed a successful tender offer to take private Galaxy Nutritional Foods, Inc. (Former ticker symbol: GXYF) the largest marketer of cheese alternative products in North America.

Mill Road professionals also have significant experience in the restaurant industry, which will enable us to complete the proposed transaction expeditiously. Thomas Lynch, our founder, has been an advisor to, and is a former Board Member of, Panera Bread Company, one of the most successful restaurant chains in the United States.

Page 2 of 4

We believe Rubio’s has a great future ahead of it, and we would appreciate the opportunity to further discuss our Offer. We are highly confident that with the support of the Board we can announce a fully negotiated and financed offer prior to the end of February 2010.

| | |

Best Regards, Mill Road Capital, L.P. |

| |

| By: | | Mill Road Capital GP LLC Its General Partner |

| | |

| |

| By: | | /s/ Scott Scharfman |

| | Scott Scharfman Managing Director |

Page 3 of 4

Exhibit A – Business Due Diligence Request List

Note: This list is largely the same as we submitted in 2008 and is designed to allow us to update our prior analyses.

Company Information

| | • | | Detailed monthly income statements, cash flows, and balance sheets for 2007, 2008, 2009 and YTD 2010 both at the consolidated and area levels |

| | • | | 2010 budget and build up and drivers to the five year financial projections |

| | • | | Annual sales, GM%, EBITDAR, rent expense and capital expenditures by restaurant for 2007, 2008, 2009 and YTD 2010 |

| | • | | Transaction count, customer count and average guest check information for each restaurant by period for 2007, 2008, 2009 and YTD 2010 |

| | • | | Data on menu price and major item changes since 2006 |

| | • | | Opening cost detail for all stores in 2008, 2009 and YTD 2010 |

| | • | | Detailed prototype unit economics |

| | • | | Expansion / Renovation / Re-imaging plans with projected and actual ROI |

| | • | | Annual purchases of major food groups with units (e.g. lbs) and unit costs (e.g. $/lb) since 2006 |

| | • | | Forward contract(s) detail, both historically and going forward |

| | • | | Applicable minimum wage information and planned changes |

| | • | | Seat count and square feet of each store (including breakout between serving and kitchen) |

| | • | | List of commitments for future restaurants |

| | • | | Breakdown of $0.9mm of public company savings |

Advertising and Promotion

| | • | | Complete list of promotional programs over past three years with a description of the program, data on volume and sales results, cost and redemption rates |

| | • | | Advertising spend by market by media over past three years, effectiveness metrics |

Other

| | • | | Board presentations for the last three years |

| | • | | Customer research studies and output of any surveys, feedback, etc. |

| | • | | Industry studies and company rankings (food quality, service, etc.) |

| | • | | Analysis of competition |

| | • | | Major contracts and agreements |

| | • | | Documents related to outstanding litigation |

Page 4 of 4

[logo]

Kayne Anderson

Private Advisors, L.P.

| | |

Cowen and Company, LLC | | CONFIDENTIAL |

Attention: Owen L Hart 555 California Street, Fifth Floor San Francisco, CA 94104 | | January 22, 2010 |

Re: Indication of Interest for Rubio’s Restaurants, Inc.

Dear Mr. Hart:

An affiliate of Kayne Anderson Private Advisors, L.P. (“KAPA”) is pleased to indicate its interest in a take-private of Rubio’s Restaurants, Inc. (“Rubio’s” or the “Company”). Based on the projected financials provided in the Confidential Information Memorandum, KAPA would envision a valuation range of $9.25 to $10.00 per share for the Company. Consideration would be entirely in cash, and sources of funding would include senior debt, mezzanine debt and equity.

Upon execution of a term sheet describing the principal terms of the transaction, we would expect to close the investment within 60 days. This letter constitutes an indication of interest only, subject to definitive documentation, and is therefore not a binding offer.

As background, Kayne Anderson was founded in 1984 with a broad mandate in investment management. Since its inception Kayne Anderson and its affiliates have grown assets under management to approximately $7.7 billion. Kayne Anderson invests in a broad array of public and privately negotiated opportunities. Our investment track record and experience give us a high degree of confidence that a transaction with Rubio’s may be consummated in an expeditious manner.

We are looking forward to working closely with you and Company management. If you have any additional questions please feel free to call me at (310) 282-2803, Doyl Burkett at (310) 282-2805 or Seema Shah at (310) 282-2832 to discuss this further.

Sincerely,

Taylor Beaupain

Kayne Anderson Private Advisors, L.P.

1800 Avenue of the Stars • Second Floor • Los Angeles, California 90067

599 West Putnam Avenue

Greenwich, CT 06830

January 25, 2009

PRIVATE AND CONFIDENTIAL

Owen Hart

Managing Director

Cowen & Company

555 California Street

San Francisco, CA 94104

Dear Owen:

Catterton Partners Management Company, L.L.C. (“Catterton”) is pleased to submit this preliminary, non-binding indication of interest to acquire Rubio’s Restaurants, Inc. (“Rubio’s” or the “Company”). We are highly impressed by the Company’s brand positioning and quality offering and are excited about the opportunity for its continued growth and unit expansion.

Catterton Partners was founded in 1990, and is one of the largest private equity firms in the U.S. focused exclusively on providing equity capital to growing consumer-focused enterprises. We are currently investing out of our sixth buyout fund, which gives us over $2.0 billion in capital under management. Catterton has a disciplined and proactive approach to investing in four key consumer industry “verticals”: Restaurants and Retail; Consumer Services and Branded Consumer Products; Food and Beverage; and Marketing Services. In our twenty-year history, and through our consumer-focused investment strategy, Catterton has acquired and/or capitalized over sixty consumer companies. We have considerable experience in seeking out and effectively utilizing consumer and market research to better understand the customer base of each of our portfolio companies, the markets in which our companies participate and the optimal positioning of our companies within those markets. In addition, Catterton has deep knowledge in the retail/restaurant space, including current and past investments in Baja Fresh, PF Chang’s, Cheddars Restaurants, First Watch Restaurants, Build-A-Bear Workshop, Caribou Coffee, La Madeline, Culinary Concepts by Jean-Georges (an international, upscale, multi-concept restaurant and licensing business), Restoration Hardware, Outback Steakhouse, Tabi (a Canadian-based woman’s apparel retailer), and Watch World. For more information about Catterton Partners please visit our website atwww.cpequity.com.

Catterton devotes a great deal of time to assessing and analyzing current consumer trends and performing extensive proprietary research on the mind and habits of the consumer. Today’s consumer is more time pressed than ever and is extremely conscious of all of their economic decisions, not the least of which is food eaten or prepared away from home—and they have clearly exhibited a desire to “trade-down” to faster service and lower price points in the category. This has led consumers to seek out culinary experiences that provide them with the high-quality they became accustomed to prior to the recession, but at more attainable price points. Rubio’s

Rubio’s Restaurants, Inc.

Indication of Interest

Page 2 of 3

food quality and fast casual offering, along with its focus on one of the fastest growing ethnic food categories, fit squarely within some of the most prevalent consumer trends currently impacting the restaurant space.

As a result of all of these factors, we believe that Rubio’s is uniquely positioned for future growth. As such, we are very excited about the opportunities for the Company and are prepared to submit the following preliminary indication of interest:

| | 1. | Valuation / Price. Based upon the financial and other information available to us to date, Catterton would expect to acquire the Company (the “Transaction”) at a valuation based on a total enterprise value of $84 million - $91 million (the “Purchase Price”), which represents approximately 5.75x - 6.25x 2009 LTM Private Company EBITDA and an approximate 28% - 38% premium to its publicly-traded price This proposed valuation assumes the business (i) has achieved 2009 LTM Private Company EBITDA of $14.6 million based on the data outlined in the Confidential Information Memorandum; (ii) is sold on a cash-free, debt-free basis; (iii) has an adequate level of working capital required to operate the business post closing; (iv) has financial statements for the recent trailing twelve month periods at close that are in accordance with GAAP; and (v) has no material unrecorded liabilities. This offer also assumes that the adjustments to EBITDA and pro-forma assumptions are ultimately satisfactory to Catterton following the completion of our accounting and business due diligence. Further, this offer also assumes (i) the selling shareholders will be responsible for all current income taxes of the Company for all taxable periods ending on or before the closing date of the Transaction and the portion through the closing date and (ii) transaction costs associated with the sale of the business that are incurred by the Company (including costs of soliciting and obtaining stockholder approval) will be paid by the selling shareholders at or prior to closing. |

| | 2. | Financing. We propose to finance the Transaction by means of a combination of debt and equity. Catterton believes strongly in letting the business plan and strategy for each respective portfolio company determine the appropriate capital structure for that investment. As such, the exact capital structure of Rubio’s would be determined at a later date. In any event, we tend to be moderately conservative in our use of leverage (as we are focused on making our returns through growing superiorly positioned consumer businesses). The equity portion of the Purchase Price would be funded by Catterton from committed equity funds and the balance of the Purchase Price would be funded by a combination of bank debt and subordinated debt, or through affiliates of Catterton. Our relationships with the most active providers of senior and subordinated debt to the middle-market are exceptionally strong. We would anticipate being able to execute debt financing for this transaction in a timely manner. Catterton will make this investment out of our $1 billion Fund VI which has approximately one-third of its capital remaining to be deployed. |

| | 3. | Due Diligence. Catterton has extensive experience evaluating business opportunities and acquiring companies in the restaurant and retail industry. We believe that this experience enables us to rapidly and accurately assess potential transactions and complete our due diligence quickly. We have reviewed the |

Rubio’s Restaurants, Inc.

Indication of Interest

Page 3 of 3

materials provided and believe that Rubio’s is well positioned for success. We are prepared to commence a more comprehensive due diligence review immediately upon notification by you that we have been selected to continue in the next phase of the process. This diligence will include customary legal, accounting, and business due diligence. Our business due diligence will largely focus on historical and projected unit-level performance, the 2009 corporate-level financials, confirmation of the Company’s current concept unit potential, and the consumer perception of the brand. We will also want to understand the desired roles and objectives of the existing management team and their desire to continue as managers of the business.

| | 4. | Timing. Catterton has extensive resources to complete due diligence and transaction documentation, and employs a decision-making process that allows us to review and complete desirable transactions in a highly expedient manner. Based upon our experience in evaluating and executing transactions similar to that proposed in this letter, we feel that we are in a strong position to work with you to accomplish our due diligence and close a potential Transaction in a timely fashion. |

| | 5. | Required Approvals. No corporate, shareholder, or regulatory approvals are required for us to consummate the Transaction, except for perfunctory regulatory approvals (such as HSR, where approval should be a fait accompli), as applicable. |

| | 6. | Advisors. Catterton uses a number of nationally known firms to perform due diligence and transaction support, all of whom have worked with Catterton numerous times and that will work professionally and productively with all parties involved. |

| | 7. | Contacts. Please feel free to contact either Jon Owsley or Andrew Taub with any questions regarding our preliminary proposal at (203) 629-4901. |

We appreciate the opportunity to evaluate this Transaction and are very excited about the potential of the Company. We look forward to hearing back from you.

Sincerely,

| | | | |

/s/ Jonathan H. Owsley | | | | /s/ Andrew C. Taub |

Jonathan H. Owsley Partner | | | | Andrew C. Taub Partner |

January 22, 2009

Rubio’s Restaurants, Inc.

c/o Mr. Owen Hart

Cowen and Company, LLC

555 California Street, Fifth Floor

San Francisco, CA 94104

owen.hart@cowen.com

Dear Owen:

We are pleased to submit this preliminary indication of interest to acquire 100% of the outstanding capital stock of Rubio’s Restaurants, Inc. (“Rubio’s” or the “Company”) for cash consideration of $8.50 per share (the “Purchase Price”). The transaction described in this preliminary indication of interest would be consummated by a group consisting of Alex Meruelo and certain of his affiliates (the “Meruelo Parties”) and Levine Leichtman Capital Partners, Inc., or an affiliate thereof (“LLCP” and, together with the Meruelo Parties, the “Investors”). This preliminary indication of interest is based on the assumption that immediately prior to the closing of the transaction (i) there will be 10,035,077 shares of common stock of the Company outstanding and the Company will not have issued any additional stock options, restricted stock units or similar awards since the date of this letter, (ii) the Company will be debt free, (iii) there will be approximately $7.4 million of cash on the Company’s balance sheet, and (iv) the Company will have adequate working capital to operate the business going forward in the ordinary course.

The Investors (together with cash available at Rubio’s at closing) will provide all of the capital required to fund and close this transaction. There will be no third party financing required to consummate this investment and no “financing contingency.” Furthermore, there are no consents required internally for either LLCP or the Meruelo Parties to fund the transaction. We are highly confident that we can quickly close on the terms set forth herein.

Immediately following the execution of a letter of exclusivity with Rubio’s, we will commence our confirmatory business and legal due diligence investigation of the Company and all of its subsidiaries and affiliates. We believe that within 45 to 60 days from the signing of a letter of exclusivity, we will be able to complete our confirmatory due diligence and negotiate the definitive documentation required to close the transaction.

The Meruelo Parties currently own approximately 11.6% of Rubio’s common stock and represent the Company’s largest non-institutional shareholder. Alex Meruelo is the principal shareholder, Chairman and CEO of the Meruelo Group, a minority owned and operated holding company with vested interests in food services, construction and engineering, real estate and private equity. In 1986, Alex established La Pizza Loca, a quick service restaurant catering to the Hispanic community, expanding it to more than 50 franchised and company owned stores.

Real estate development soon followed and the Meruelo Group now has a diversified portfolio of commercial/retail residential and industrial properties. In 1999, Alex purchased the first of four construction companies and the Meruelo Group now has a presence throughout Southern California. Alex is a founding shareholder and director of Commercial Bank of California, and sits on the board of William Lyon Homes and ExaDigm, Inc.

Levine Leichtman Capital Partners is a Los Angeles, California-based investment firm that manages approximately S5.0 billion of institutional investment capital through private equity partnerships and leveraged loan funds. LLCP is currently making new investments through Levine Leichtman Capital Partners IV, L.P. Successful investments in the restaurant industry include Quizno’s Corporation, Cici’s Pizza and Wetzel’s Pretzels.

While a high level of interest exists in consummating the transaction described above, this letter is not a commitment, a contract, or an offer to enter into a contract and should not be deemed to obligate LLCP or the Meruelo Parties in any manner whatsoever. This preliminary indication of interest should not be relied upon for any reason whatsoever.

This preliminary indication of interest supersedes the proposal letter delivered to the Company’s Board of Directors by the Investors on October 13, 2009, in its entirety.

We look forward to having the opportunity to work with you and the Rubio’s team on this transaction,

Sincerely,

| | | | |

/s/ Alex Meruelo | | | | /s/ Lauren Leichtman |

Alex Meruelo Chairman and Chief Executive Officer Meruelo Group | | | | Lauren Leichtman Chief Executive Officer Levine Leichtman Capital Partners |

[logo]

GOLDEN GATE CAPITAL

January 22, 2010

Rubio’s Restaurants, Inc.

c/o Cowen and Company, LLC

Attention: Owen L. Hart

555 California Street, Fifth Floor

San Francisco, CA 94104

Re: Acquisition of Rubio’s Restaurants, Inc.

Dear Mr. Hart:

We are pleased to submit the following proposal regarding the acquisition of Rubio’s Restaurants, Inc. (“Rubio’s” or the “Company”), pursuant to which an entity controlled by investment funds managed by Golden Gate Private Equity, Inc. (“Golden Gate Capital” or “GGC”) would acquire 100% of the outstanding stock of the Company (the “Transaction”).

We believe that Golden Gate Capital would be an excellent financial and strategic partner for the Company and is well positioned to consummate the transaction described herein:

| | • | | Strong Track Record and Extensive Access to Capital: Golden Gate Capital, headquartered in San Francisco, is a private equity investment firm with over $9 billion of capital under management. GGC’s investors include leading educational endowments, non-profit foundations, investment banks, and selected entrepreneurs and managers. The firm’s charter is to partner with world-class management teams in making change-intensive and growth-oriented investments. The principals of Golden Gate Capital have a long and successful history of investing in these types of transactions. In aggregate, GGC’s professionals have participated in more than 100 investments aggregating to over $10.0 billion in enterprise value. |

| | • | | Significant Restaurant and Consumer Investment Expertise: The consumer sector is a significant focus area for our investment staff, with a specific emphasis on multi-channel retail and foodservice. In December 2008, we completed the acquisition of Romano’s Macaroni Grill from Brinker International. In addition, we have made over a dozen successful investments in multi-unit and multi-channel consumer companies including Express (the 6th largest specialty apparel retailer in the country), Eddie Bauer ($1B in annual sales across 350 stores, catalogs, and the web), J. Jill (a 220 store retailer of women’s apparel), Eye Care Centers of America (the second largest eye care retailer in the country), Orchard Brands (the largest multi-channel marketer of apparel and other products targeting the 55+ demographic), and |

One Embarcadero Center, 39th Floor, San Francisco, CA 94111

telephone 415.983.2700 fax 415.983.2701 web www.goldengatecap.com

Apogee Retail (the second largest chain of for-profit thrift stores in the country). We believe that our experience and focus gives us a strong understanding of the market and opportunities available to the Company, and that this differentiates us among potential financial sponsors.

We would be pleased to propose a Transaction on the following terms:

| 1. | Purchase Price. Based on our review of the materials provided to date as well as publicly available information, we are pleased to propose a purchase price of $8.00 -$8.25 per share for 100% of the outstanding stock of the Company. |

| 2. | Financing. Golden Gate Capital will provide 100% of the financing for the Transaction at the signing of the purchase agreement. There will be no financing conditions. We believe that our ability and willingness to provide a commitment for 100% of the purchase price significantly enhances the speed and certainty of a Transaction with Golden Gate. |

| 3. | Necessary Approvals. As a privately held investment partnership, Golden Gate Capital does not require any corporate or shareholder approvals or other extraordinary conditions to consummate the Transaction. |

| 4. | Activities prior to Closing. As you are aware, Golden Gate Capital has significant experience with transactions of this nature. Our key due diligence activities would include the following: (i) confirmatory accounting review by PriceWaterhouseCoopers; (ii) confirmatory legal due diligence by Kirkland and Ellis LLP; (iii) receipt of all necessary and material governmental and third party approvals required to consummate the Transaction (if any); (iv) negotiation of a mutually satisfactory definitive purchase agreement; and (v) completion of our business due diligence. |

| 5. | Key Contacts. Josh Olshansky (415/983-2728) and Josh Cohen (415/983-2784) of Golden Gate Capital are available to respond to any questions you might have regarding our proposal. |

| 6. | Confidentiality. Unless mutually agreed to in writing, no party hereto will make any disclosure to any third party (other than their respective officers, directors, employees, agents, potential financing sources and other representatives who have a need to know such information in furtherance of the transactions contemplated hereby) of the existence or contents of this letter, the transactions contemplated hereby, or the status of negotiations with respect thereto. |

One Embarcadero Center, 39th Floor, San Francisco, CA 94111

telephone 415.983.2700 fax 415.983.2701 web www.goldengatecap.com

We thank you for the opportunity to present our proposal. We are enthusiastic about this opportunity and are prepared to dedicate the necessary resources to expeditiously complete the proposed Transaction.

Sincerely,

Josh Olshansky

Golden Gate Capital

Office: (415) 983-2728

Fax: (415) 983-2828

jolshansky@goldengatecap.com

One Embarcadero Center, 39th Floor, San Francisco, CA 94111

telephone 415.983.2700 fax 415.983.2701 web www.goldengatecap.com