Mr. Daro Blankenship

We used all methods and procedures that we considered necessary, under the circumstances, in the preparation of this report. We did not perform any field inspection of the properties, nor did we examine the mechanical operation or condition of the wells and facilities. We have not investigated possible environmental liability related to the properties; therefore, our estimates do not include any costs due to such possible liability.

Reserve estimates are strictly technical judgments. The accuracy of any reserve estimate is a function of the quality of data available and of engineering and geological interpretations. The reserve estimates presented in this report are believed reasonable; however, they are estimates only and should be accepted with the understanding that reservoir performance subsequent to the date of the estimate may justify their revision.

PRICING AND EXPENSE PARAMETERS

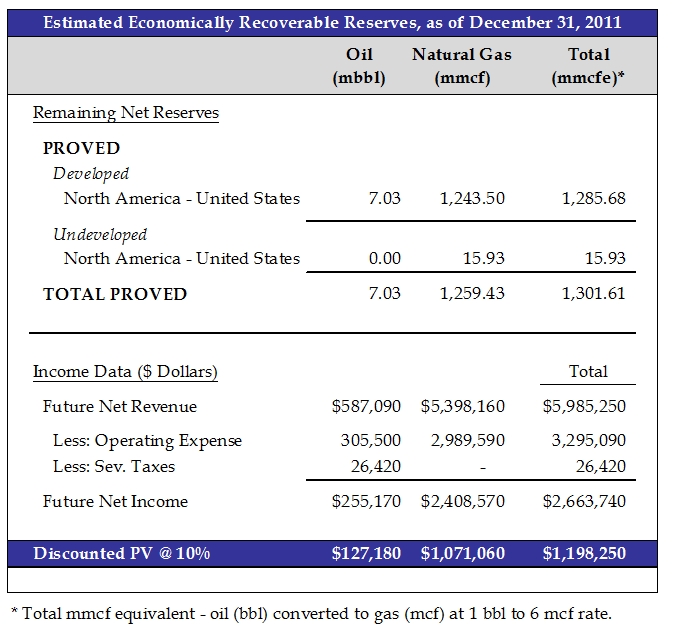

Pursuant to SEC guidelines, prices used in this report are based on the 12-month un-weighted arithmetic average of the first-day-of-the-month price for each month in the period from January 2011 through December 2011. For oil and gas prices, the SEC 2011 12-month average West Texas Intermediate crude spot price of $96.19 per barrel and Henry Hub spot price of $4.12 per MMBTU, respectively, were adjusted by lease for energy content, transportation fees and regional price differentials. All prices were held constant throughout the lives of the properties. The average adjusted product prices, weighted by production over the remaining lives of the properties, are $83.46 per barrel of oil and $4.29 per MCF of gas.

Lease operating expenses were estimated for each well based on 2011 expense data provided by the Company. A 4.5% Kentucky severance tax was applied to the Company’s oil reserves in that state. Currently, there are no severance taxes in Pennsylvania.

Future net revenue to the Vadda interest is prior to deducting state production taxes. Future net income is after deductions for state production taxes and operating expenses, but prior to consideration of any income taxes. The future net income has been discounted at an annual rate of 10 percent to determine its present worth, which is shown to indicate the effect of time on the value of money. Future net income presented in this report, whether discounted or undiscounted, should not be construed as being representative of the fair market value of the properties.

GENERAL

All data used in this assignment was provided by the Company or obtained from public sources. A field inspection of the properties was not made in connection with the preparation of this report.

The oil and gas extraction industry is highly regulated, with the federal and state governments being involved in all stages of production. State governments determine which areas are open to oil exploration and extraction, enforce environmental legislation, and issue exploration and production leases. The effects of such regulation may prevent or interfere with the Company’s ability to recover the estimated Reserves. The potential environmental liability related to ownership and/or operation of the properties has not been addressed in this report. Abandonment and clean-up costs and possible salvage value of the equipment were not considered in this report.