19

2Q ’09 Earnings

Revenue decoupling

ØAnnual true-up

» If revenues < approved, rates will be adjusted to collect additional revenues

» If revenues > approved, excess will be returned to customers

ØDecoupling established for two-year pilot period

Other

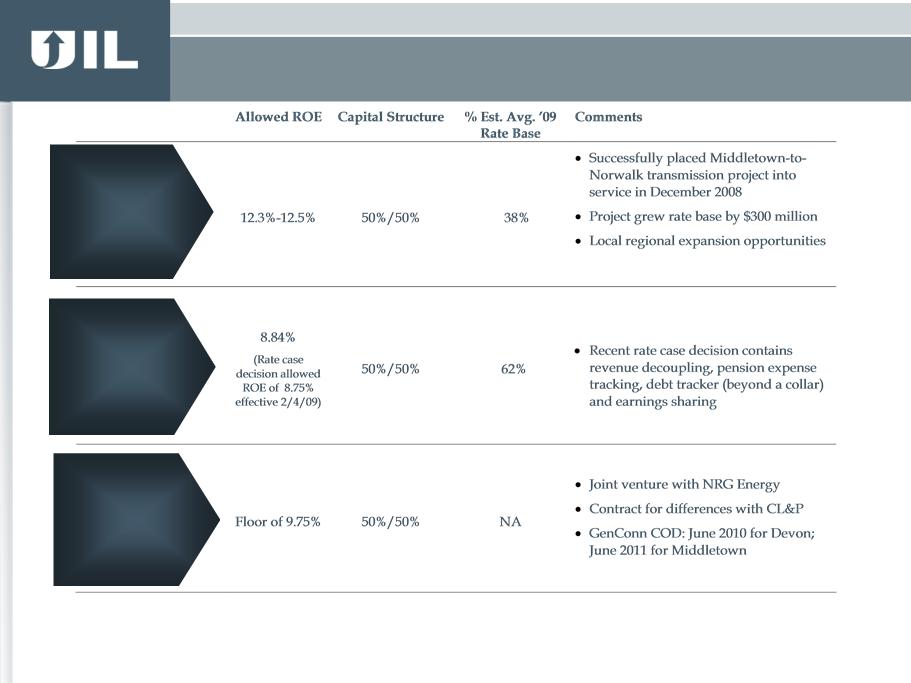

Ø50/50 Debt-to-Equity Capitalization with 8.75% ROE

ØApproved 90% of proposed distribution capital program expenditures

ØTransferred approximately $7 million of uncollectibles and other expense

to Generation Services Charge

Pension

ØEstablished a regulatory asset for a portion of 2009 increased pension and

postretirement expense

» Future recovery of $10.2 million

ØPension tracker

» 2010 expense true-up based on year-end valuation, which takes into account

changes, if any, in asset values and the discount rate

Cost of debt tracking

mechanism

ØAnnual true-up

» If embedded debt cost after issuances, differs from allowed embedded cost of debt

of 6.42% for 2009, 6.76% for 2010

4 True up if min. 25 basis points and results in +/- $1.5 million interest expense or greater.

$1.5 million deadband à true up covers amounts beyond +/- $1.5 million.

Overview of Recent Distribution Rate Decision