October 13, 2009

VIA EDGAR

Mara L. Ransom

Branch Chief

United States Securities and Exchange Commission

100 F Street, N.E., Stop 3561

Washington, DC 20549

Re: UIL Holdings Corporation

Form 10-K for the fiscal year ended December 31, 2008

Filed February 18, 2009

File No. 1-15052

Dear Ms. Ransom:

We are in receipt of your letter dated September 29, 2009, which contained comments regarding our recent filings on Forms 10-K and 10-Q and the Definitive Proxy Statement on Schedule 14A. Listed below are specific responses to each of your numbered comments.

Annual Report on Form 10-K for the fiscal year ended December 31, 2008

Item 9A. Controls and Procedures, page 105

| 1. | We note your disclosure indicates that your management “recognized that any disclosure controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives...” Please revise your disclosure to state clearly, if true, that your disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives and that your principal executive officer and principal financial officer concluded that your disclosure controls and procedures are effective at that reasonable assurance level. In the alternative, please remove the reference to the level of assurance of your disclosure controls and procedures. Please refer to Section II.F.4 of Management’s Reports on Internal Control Over Financial Reporting and Certification of Disclosure in Exchange Act Periodic Reports, SEC Release No. 33-8238. This comment also applies to the same disclosure that appears in your quarterly reports on Form 10-Q. |

Response: UIL Holdings Corporation will revise future disclosure with respect to “Conclusion Regarding the Effectiveness of Disclosure Controls and Procedures” in Item 9A in its annual reports on Form 10-K and in Item 4 in its quarterly reports on Form 10-Q to read substantially as follows (added text has been underlined):

Conclusion Regarding the Effectiveness of Disclosure Controls and Procedures

UIL Holdings maintains disclosure controls and procedures that are designed to ensure that information required to be disclosed in its periodic reports to the Securities and Exchange Commission (SEC) is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to UIL Holdings’ management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure based on the definition of “disclosure controls and procedures” in Rule 13a-15(e) and Rule 15d-15(e) under the Securities Exchange Act of 1934. Management designed its disclosure controls and procedures to provide reasonable assurance of achieving the desired control objectives.

UIL Holdings carried out an evaluation, under the supervision and with the participation of its management, including its Chief Executive Officer and its Chief Financial Officer, of the effectiveness of the design and operation of UIL Holdings’ disclosure controls and procedures as of December 31, 2008. As of December 31, 2008, UIL Holdings’ Chief Executive Officer and its Chief Financial Officer concluded that its disclosure controls and procedures were effective and provided reasonable assurance that the disclosure controls and procedures accomplished their objectives.

Definitive Proxy Statement on Schedule 14A

Transactions with Related Parties, page 7

| 2. | Please describe the registrant’s policies for review, approval or ratification of any transaction required to be reported under Item 404(a) of Regulation S-K. See Item 404(b) of Regulation S-K. |

Response: UIL Holdings Corporation will augment future disclosure with respect to policies described in Item 404(b) of Regulation S-K to read substantially as follows:

UIL Holdings’ Code of Business Conduct for the Board of Directors (the “Director Code”) provides guidance to each director on areas of ethical risk, to help directors recognize and deal with potential conflicts of interest and other ethical issues to help foster a culture of honesty and accountability. Specifically, the Director Code provides that directors must avoid conflicts of interest with UIL Holdings and requires that any situation that involves, or may reasonably be expected to involve, a conflict of interest must be disclosed immediately to the Non-Executive Chair of the Board. The Director Code provides that directors should seek to identify potential conflicts of interest at an early stage. Directors are encouraged to bring questions about particular circumstances that may implicate one or more of the provisions of the Director Code to the attention of the Chair of the Audit Committee or the Chair of the Corporate Governance and Nominating Committee, who may consult with counsel as appropriate. The Director Code also applies to officers of UIL Holdings who are members of the Board of Directors.

UIL Holdings’ Code of Ethics for the Chief Executive Officer, Presidents, and Senior Financial Officers (the “Officer Code”) establishes policies and procedures that (1) encourage and reward professional integrity in all aspects of the financial organization (2) prohibit and eliminate the appearance or occurrence of conflicts between what is in the best interest of UIL and what could result in material personal gain for a member of the organization (3) provide a mechanism for members of the financial organization to inform senior management of deviations in practice from policies and procedures governing honest and ethical behavior and (4) demonstrate their personal support for such policies and procedures through periodic communication reinforcing these ethical standards throughout the financial organization.

Executive officers of UIL Holdings are also subject to the company’s general employee Code of Business Conduct (the “Employee Code”), which governs potential conflicts of interest and requires the disclosure of all facts in any situation where a conflict of interest may arise. Copies of the Director Code, Officer Code and the Employee Code are accessible on the UIL Holdings website at www.uil.com.

UIL Holdings discourages such transactions and has historically limited the approval of such transactions to specific and rare instances with the full disclosure to, and approval of, the disinterested members of the Board. Additionally, UIL Holdings requires each director and officer to complete an annual questionnaire which solicits, among other items, specific information about (1) each Board members’ individual affiliations with entities with which UIL Holdings and its executives transact business or have an affiliation (2) any transaction or series of similar transactions involving UIL Holdings and/or its subsidiaries to which they or any member of their immediate family have a direct or indirect material interest and (3) each Board members’ involvement in legal proceedings affecting UIL Holdings. UIL Holdings management reviews these questionnaires annually during the preparation of disclosures to be included in the Proxy Statement.

Executive Compensation, page 16

Short-term Incentive Compensation, page 18

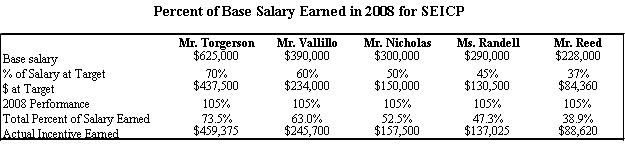

| 3. | We note the disclosure you provide in the table entitled “Percent of Base Salary Earned in 2008 for SEICP Goal Components.” Please revise to explain how you arrived at the percentages that have been disclosed in the table. For example, we note that you indicate that Mr. Torgerson earned 69% of his salary based upon achievements of the financial goals above the target threshold, however, it is unclear how you arrived at this percentage. It appears that this percentage constitutes an amalgamation of the percentages achieved relating to the EPS, Cash Flow and Capex goals discussed above, however, you should explain how each of these percentages were arrived at in computing the total percentage. In doing so, please also disclose the threshold amounts that must be achieved before payments will be made, as we note your indication earlier on the same page that no payment is made unless this amount is achieved, however, currently only your target amounts appear to be disclosed. |

Response: UIL Holdings Corporation will augment future disclosure with respect to SEICP Goal Components by enhancing the tables and calculation methodology on pages 18 and 19 to read substantially as follows:

Target annual short-term incentives, expressed as a percentage of base salary as of April 1, 2008, and based on position, were set by the CEDC in its March 2008 meeting for each NEO. Specifically, the 2008 SEICP goals, targets, thresholds, results, weights, percent of targets achieved, and weighted results (“goal weight” times “percent of target achieved”) for all of the NEOs were as follows:

| Goals | EPS | Cash Flow | Capex | SAIDI | SAIFI | LTA | MVA |

| Goal Maximum | $2.11 | $134.1 | $192.9 | 56 minutes | .63 | 6 | 31 |

| Goal Target | $1.96 | $125.1M | $179.4M | 61 minutes | .70 | 10 | 40 |

| Goal Threshold | $1.73 | $101.8M | $169.8 | 73 minutes | .80 | 12 | 45 |

| Goal Result | $1.94 | $139.8 | $195.3 | 74 minutes | .76 | 15 | 43 |

| Goal Weights | 40% | 20% | 20% | 5% | 5% | 5% | 5% |

| Percent of Target Achieved | 95% | 150% | 150% | 0% | 70% | 0% | 70% |

| Weighted Result | 38% | 30% | 30% | 0% | 3.5% | 0% | 3.5% |

EPS refers to UIL consolidated earnings per share, adjusted from the reported amount for certain Board of Director related items; Cash Flow is UIL consolidated cash flow; Capex is UIL capital expenditures (the purpose of this goal is to ensure that the Company executes its capital plan for the year); SAIDI and SAIFI refer to service reliability, specifically the duration and frequency of outages; LTA and MVA are safety metrics measuring the number of lost time accidents and motor vehicle accidents.

Based on 2008 performance of all the goals, the overall percent of target achieved under the SEICP was 105%, which means that the cumulative final results were 5% above the targets set by the CEDC. Correspondingly, as shown below, the amount of short-term incentive received by the NEOs is 5% above the amount set by the CEDC to be received had performance been achieved at target.

Each NEO’s target award expressed as a percentage of his or her base salary, the incentive payable at target and the actual goals performance appears in the table below. The actual awards earned for 2008, which were paid in March 2009, are also shown below, (as well as in the “Non-Equity Incentive Plan Compensation” column (g) of the “Summary Compensation Table.”) These percentages are calculated as follows, using

Mr. Torgerson as an example:

The sum of weighted goals results (38% + 30% + 30% + 3.5% + 3.5% = 105%) multiplied by his target incentive percentage of 70% (1.05 x .7) equals 73.5%. This percentage is applied to his base salary resulting in an earned incentive of $459,375.

This same methodology is used for all of the NEOs.

Based on the results of these goals and the different weightings given to the goals, the actual percentages of base salary earned by the NEOs for 2008, based on performance achieved, are as follows:

Long-Term Incentive Compensation, page 20

| 4. | Please include tabular disclosure for the 2008-2010 performance goals associated with your long-term incentive plan. To the extent you believe disclosure of these goals is not required because it could result in competitive harm, provide us on a supplemental basis a detailed explanation for this conclusion. See instruction 4 to Item 402(b) of Regulation S-K and Question 118.04 of our Regulation S-K Compliance and Disclosure Interpretations located on our website, www.sec.gov. If disclosure would cause competitive harm, please discuss further how difficult it will be for the named executive officer or how likely it will be for you to achieve the goals or other factors. |

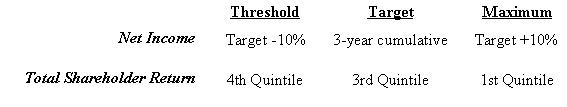

Response: UIL Holdings Corporation will augment future disclosure with respect to long-term incentive compensation goal components by inserting the following explanation and tabular representation of the plan’s goals:

Long-Term Incentive Compensation

The performance goals for the 2008 – 2010 performance cycle are based upon attainment of specific levels of cumulative Net Income (67%) and relative Total Shareholder Return (33% weight) as approved by the CEDC in March 2008, with vesting of 50%, 100% or 150% of the target amount of performance shares if the “threshold,” “target” or “maximum” level of performance is achieved, respectively.

Total Shareholder Return is determined as follows:

UIL Volume Weighted Average Closing Price for the last quarter of 2010, minus UIL Volume Weighted Average Closing Price for the first quarter of 2008 plus Dividends per share for 2008 through 2010 all divided by the Volume Weighted Average UIL Closing Price for the first quarter of 2008. The quotient obtained by this calculation is compared to the Total Shareholder Return of all the companies reported by the Edison Electric Institute (EEI) to establish the Corporation’s relative performance, measured on a Quintile scale.

As requested in the subject letter dated September 29, 2009, it is hereby acknowledged that: (i) UIL Holdings Corporation is responsible for the adequacy and accuracy of the disclosure in its filings, (ii) staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings, and (iii) UIL Holdings Corporation may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you have any further questions regarding our responses to your comments, please call me at 203-2399, or call our legal counsel, Mark Kaduboski of Wiggin and Dana LLP, at 203-363-7627.

| | Sincerely, |

| | |

| | /s/ Richard J. Nicholas |

cc: James P. Torgerson (UIL Holdings Corporation)

Linda L. Randell (UIL Holdings Corporation)

Mark S. Kaduboski (Wiggin and Dana LLP)

H. Christopher Owings (Securities and Exchange Commission)