4

EEI Nov. 2009

Progressive pure-play

electric utility

Transmission focus

(FERC Regulated)

Regulation

Ø Virtually 100% regulated

Ø Long history of National 1st quartile reliability performance

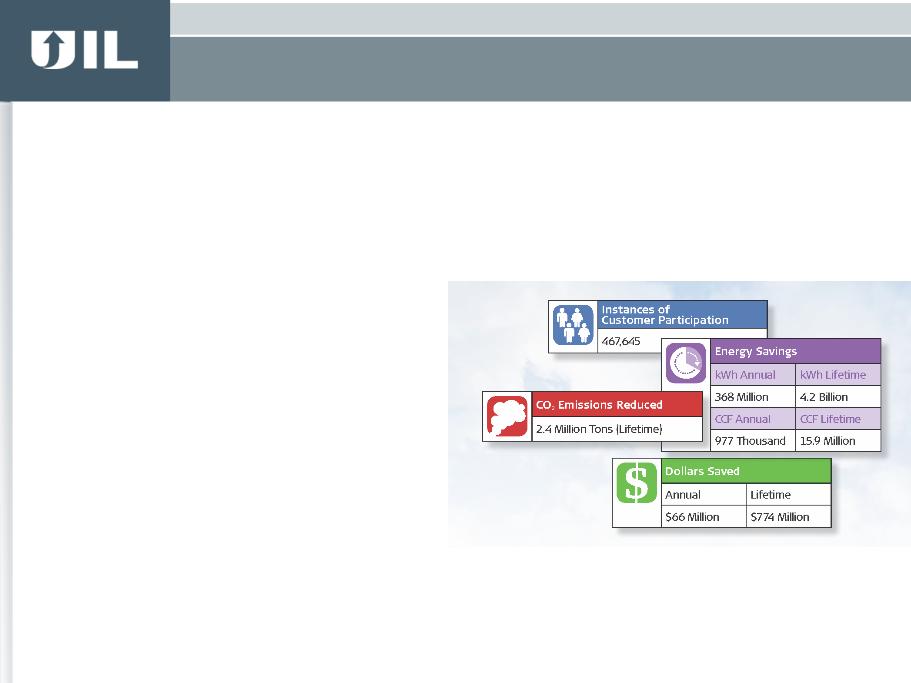

Ø 20 year leader in Conservation & Load Management programs

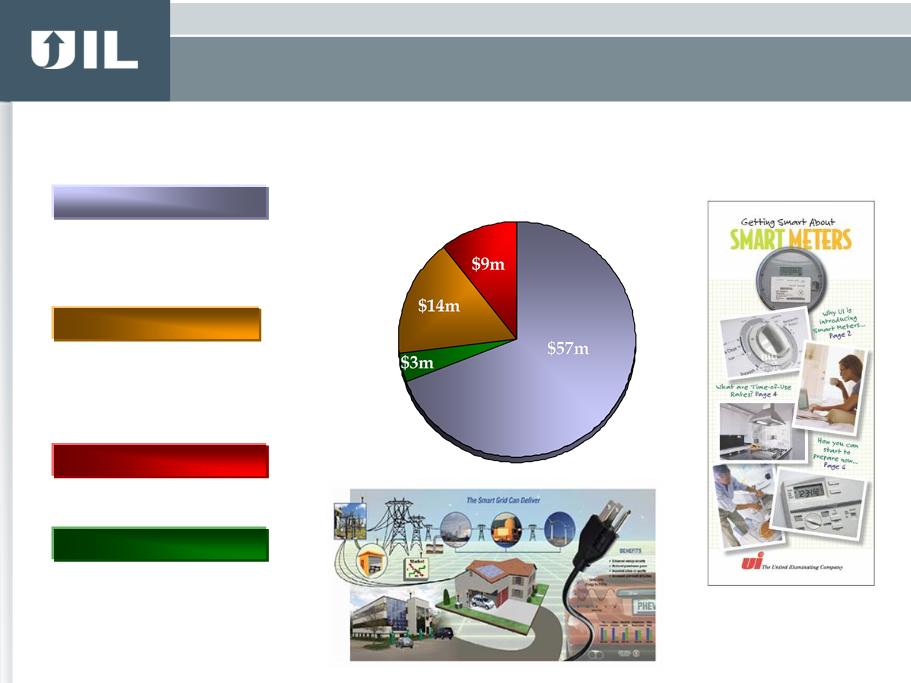

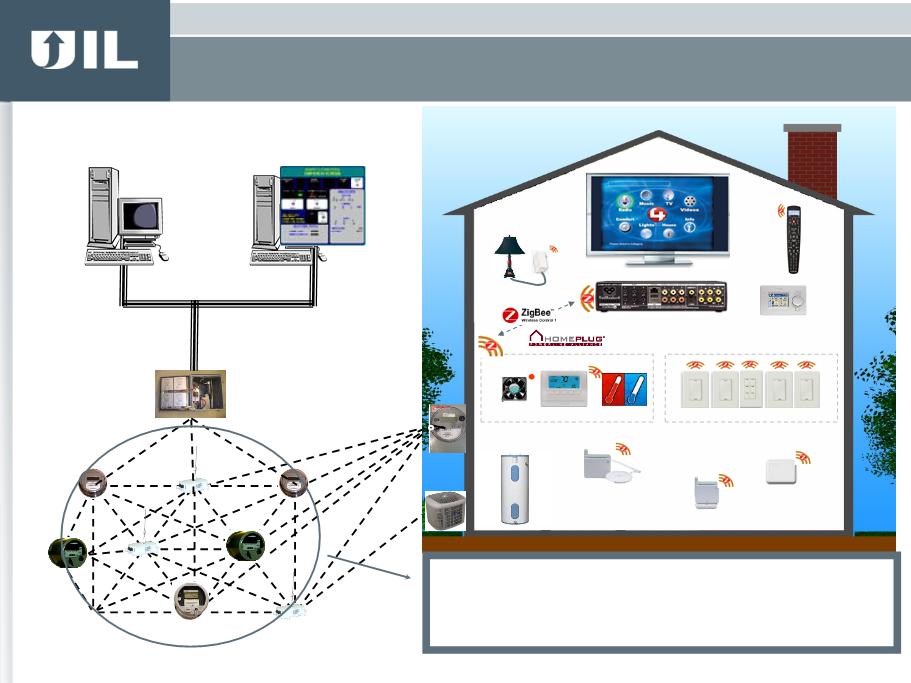

Ø Smart Grid - - ahead of the curve

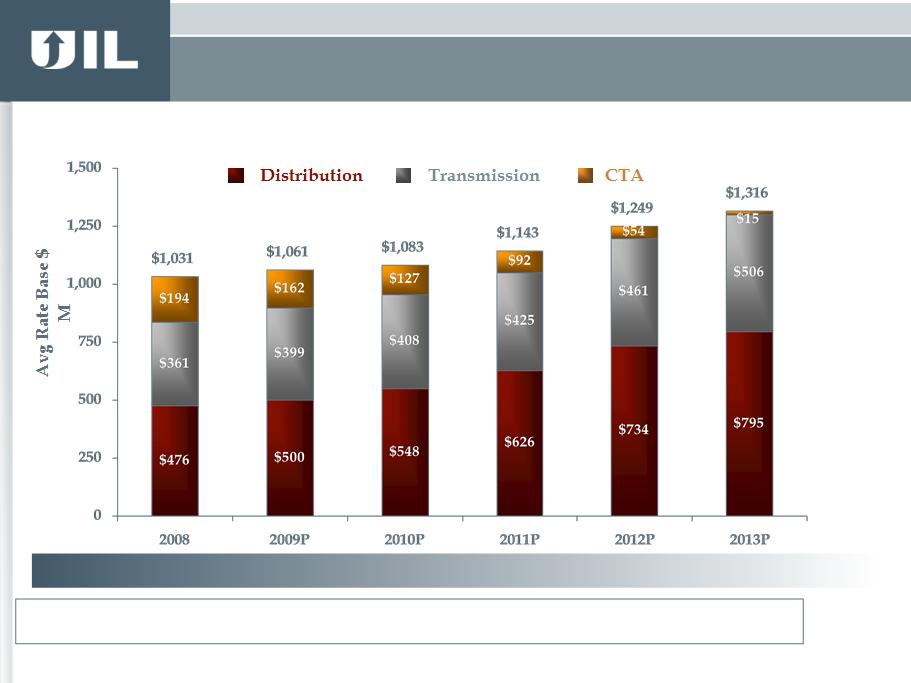

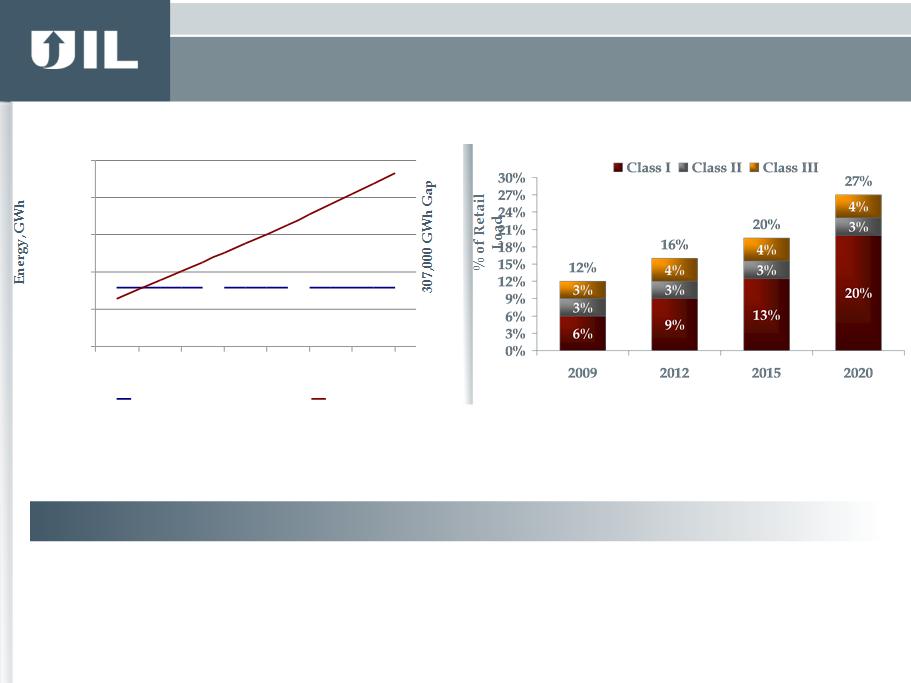

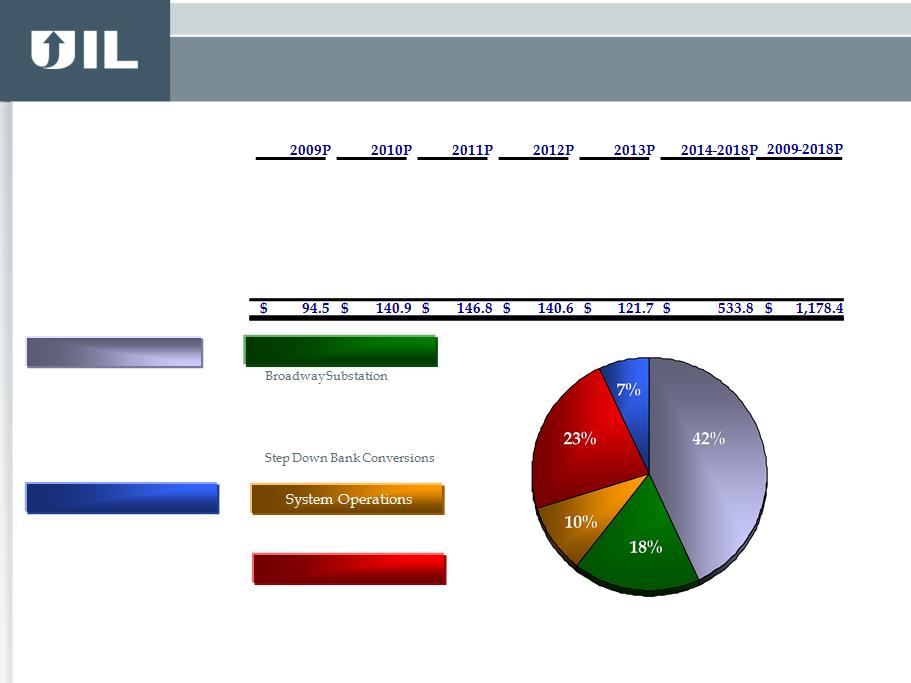

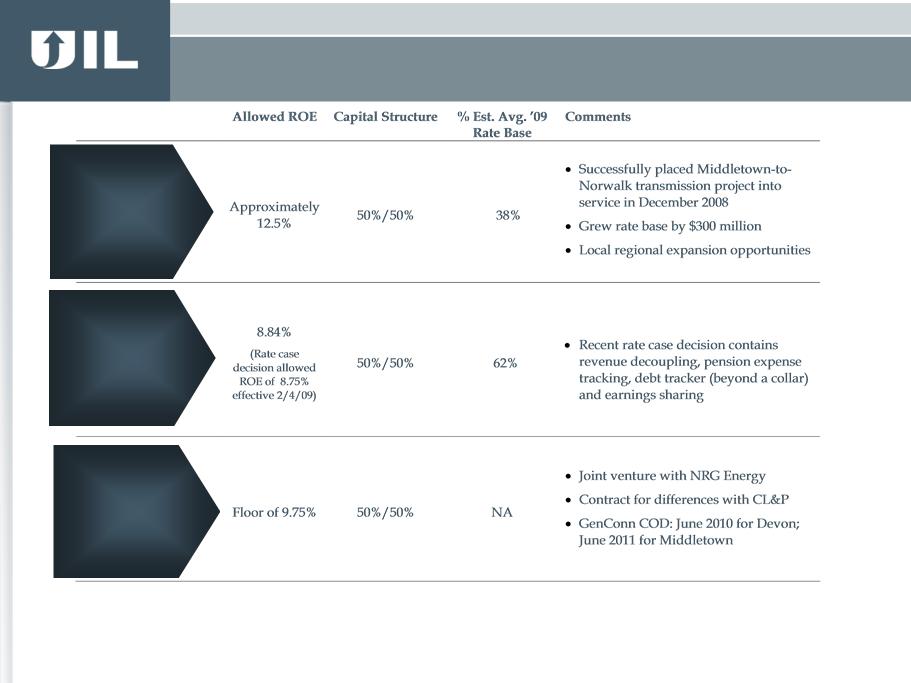

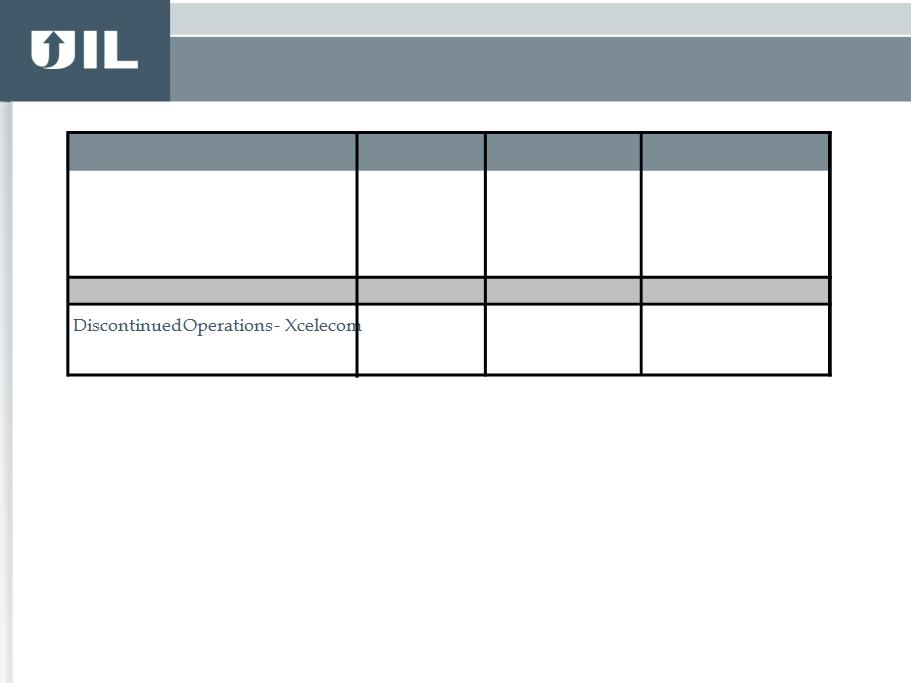

Ø Estimated 38% of 2009 total rate base

Ø 2009 composite return on equity of approximately 12.5% and capital structure of 50% equity

Ø Identified future investment opportunities

Ø Recent distribution rate case includes favorable items such as revenue decoupling mechanism,

pension tracker and cost of debt tracking mechanism

Ø Expected enhanced stability and predictability of earnings

Ø 2009 blended transmission & distribution allowed return on equity of approximately 10.2%

UIL: progressive pure-play electric utility with significant growth opportunities and an attractive dividend yield

Conservative financial

strategy

Ø Commitment to investment grade credit profile

Ø Disciplined capital investment program

Ø Consistent history of dividend payments

High probability

growth

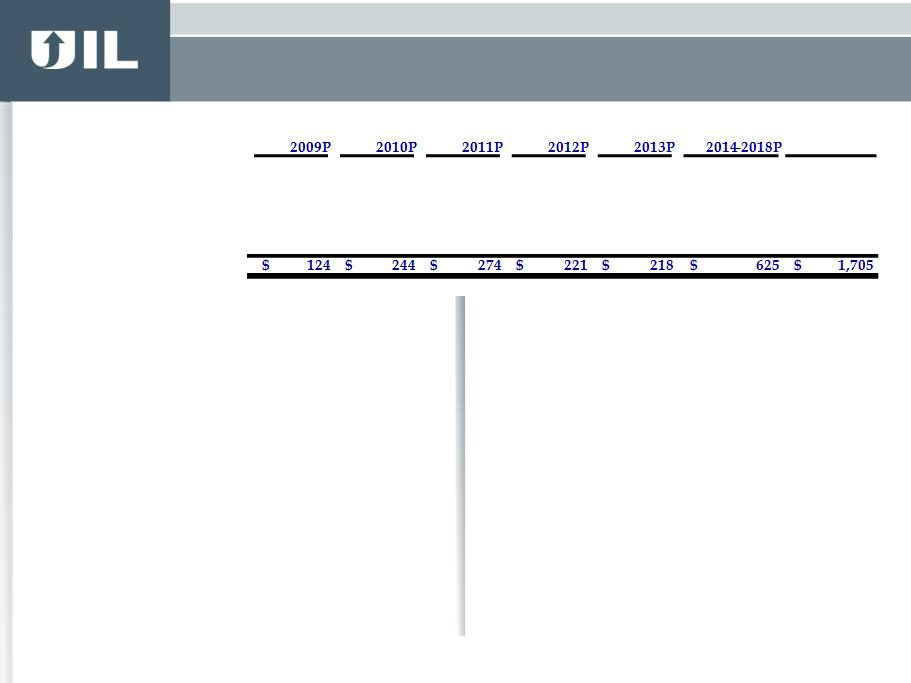

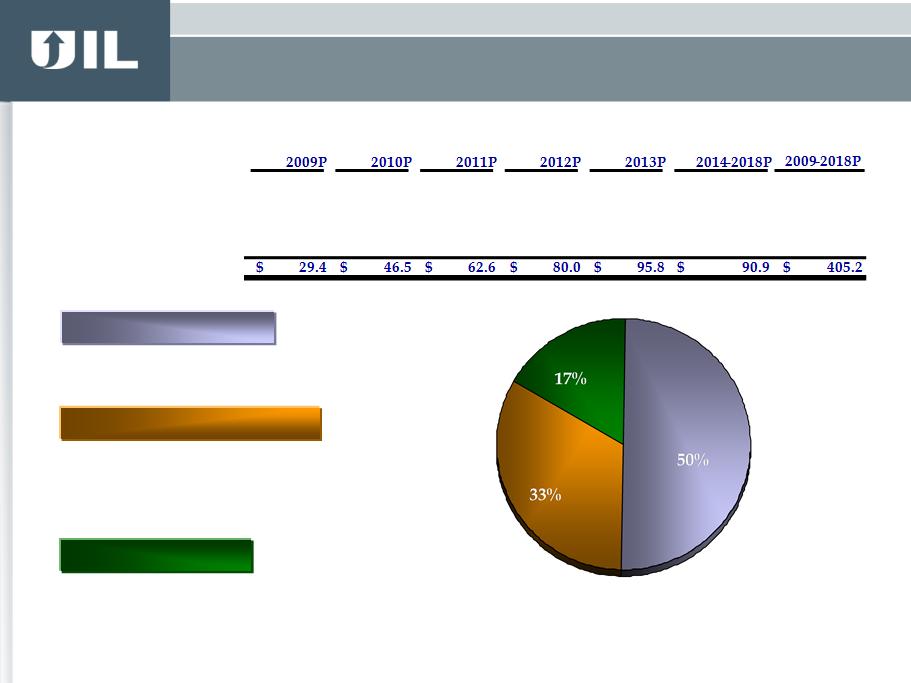

Ø $1.7 billion of projected regulated capital and equity investment for 2009-2018

Ø Base plan provides significant growth 90+% probability of occurrence

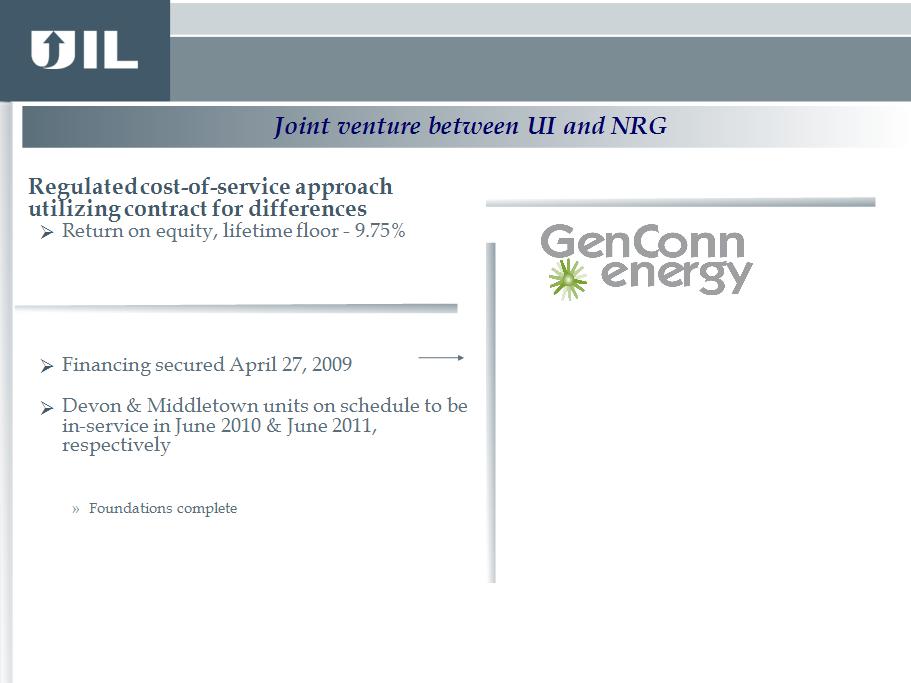

Ø GenConn: cost-of-service electric generation development underway

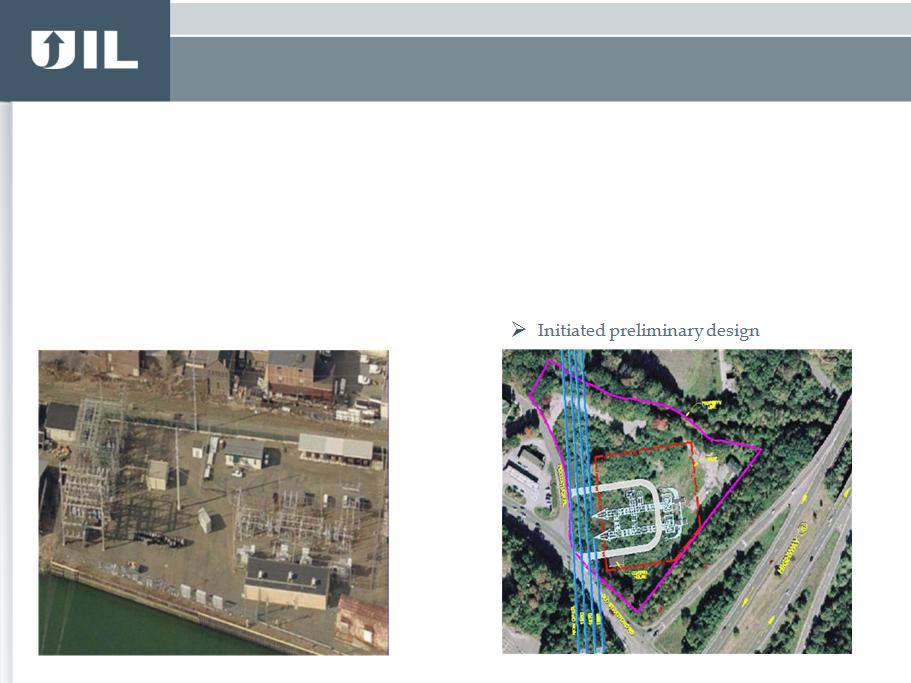

Ø Proven ability to execute on capital projects, e.g. Middletown-to-Norwalk transmission line

Investment Highlights