41

2011 Fall EEI

41

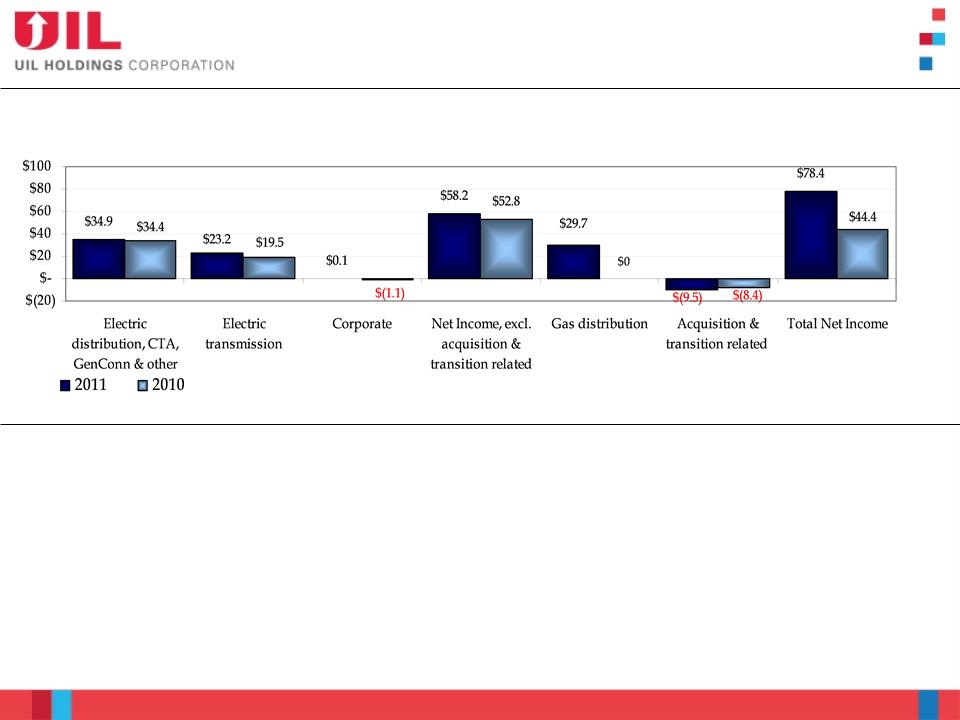

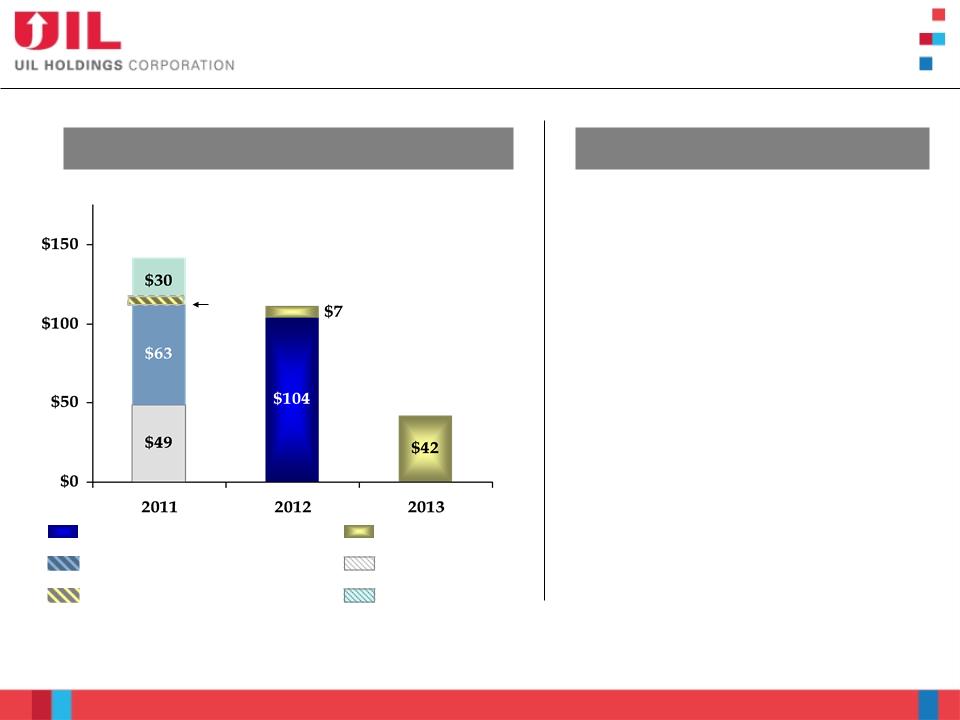

3Q & YTD 2011 Financial Results - Details

q Electric distribution, CTA, GenConn & Other

ú 1% increase in net income YTD, 3Q was lower primarily due to mark to market & effective tax

rate adjustments, offset by GenConn earnings

▪ The mark to market & effective tax rate adjustments reduced net income by $2.3M & $3.4M for the

3Q & first nine months of ’11, respectively

▪ GenConn contributed to UIL pre-tax income of $3.5M & $8.2M for the 3Q & first nine months of ’11,

respectively

ú Average D & CTA ROE as of 9/30/11: 9.63%

q Electric transmission

ú 19% increase in net income for the quarter & YTD

▪ Increase attributable to an increase in the allowance for funds used during construction due to

increased CWIP

q Gas Distribution

ú YTD income of $29.7M , 3Q loss of $6.2M due to seasonality of earnings

ú YTD - colder than normal winter season in New England in ’11

ú Recovered approximately $2.2M pre-tax of carrying charges in the 3Q ’11 on interim rate

decrease amounts over-credited to customers during stay of rate case decisions

▪ Recovery of carrying charges will continue until the outstanding surcharge balance is exhausted

ú Preliminary average ROE as of 9/30/11: SCG 8.30-8.40%, CNG 8.90-9.00%

q Corporate

ú YTD after-tax costs of $9.4M, a decrease of $0.1M compared to ’10

ú After-tax costs of $2.3M in the 3Q, a decrease of $2M compared to 3Q ’10

ú The decrease for the quarter & YTD was primarily attributable to the absence in ’11 of after-tax

acquistion related costs that occurred in the 3Q ’10, partially offset by the interest expense related

to the October ‘10 issuance of $450M of public debt

ú Interest expense on the $450M of public debt was $3.2M & $9.5M for the 3Q and first nine

months of ’11, respectively