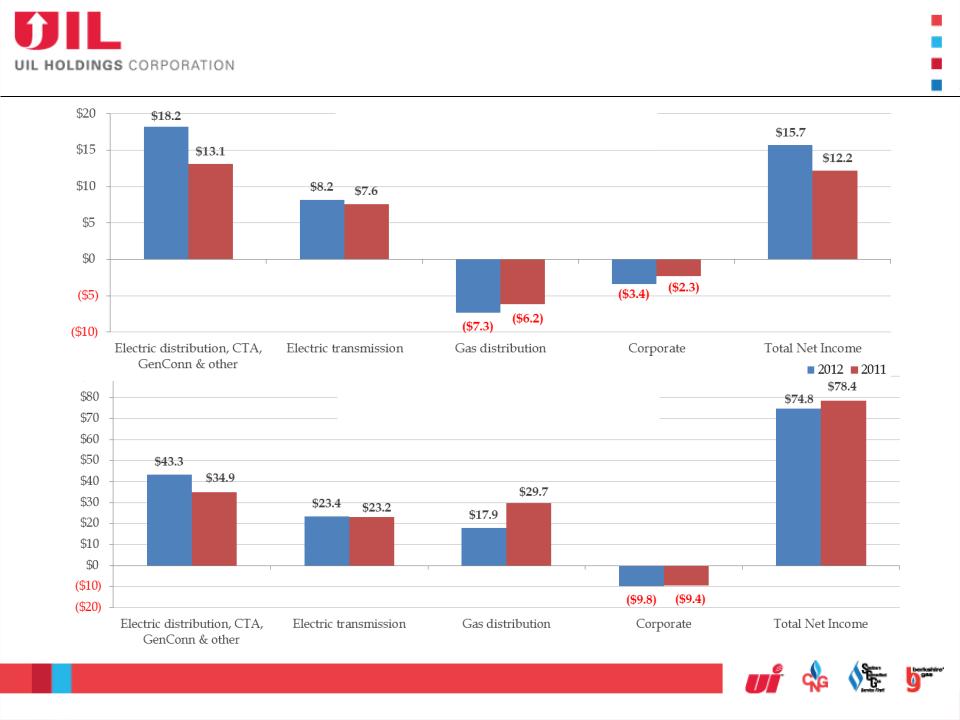

3Q & YTD 2012 Financial Results - Details

8

Electric distribution, CTA, GenConn & Other

q 39% increase in net income for the 3Q ’12, compared to 3Q ‘11; 24% increase in net

income YTD ’12, compared to YTD ‘11

§ The increase for the 3Q ’12 was due to reduced O&M expenses and to a settlement agreement

relating to power procurement incentives

ú On 10/31/12, PURA approved a settlement agreement relating to procurement incentives resulting in

increased pre-tax earnings for the quarter of $2.7 million

§ YTD ‘12 increase was attributable to increased income from UI’s equity investment in

GenConn and reduced O&M expenses and the result of the power procurement incentive

settlement agreement

ú GenConn contributed pre-tax earnings of $3.4M and $11.8M for 3Q ‘12 and first nine months ‘12,

respectively

q Average D & CTA ROE as of 9/30/12: 8.72%

Electric transmission

q 8% increase in net income for the 3Q ’12, compared to 3Q ‘11; slight increase in net

income YTD ’12, compared to YTD ‘11

§ The increase for the 3Q ‘12 and YTD ‘12 was primarily attributable to income earned on an

increase in rate base and an increased investment in NEEWS, partially offset by a decrease in

allowance for funds used during construction

q Weighted-average T ROE as of 9/30/12: 12.3%

q 3Q ‘12 consolidated earnings of $15.7M or $0.31 per diluted share, compared to

3Q ‘11 earnings of $12.2M or $0.24 per diluted share - an increase of $3.5M or 29%

q YTD ‘12 consolidated earnings of $74.8M or $1.46 per diluted share, compared to YTD ‘11 earnings

of $78.4M or $1.54 per diluted share - a decrease of $3.6M or 5%