UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ___)

Filed by the Registrant x | Filed by a Party other than the Registrant o |

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Section 240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| £ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| (5) | Total fee paid: |

| £ | Fee paid previously with preliminary materials: |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| | |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| | |

| (3) | Filing Party: |

| | |

| | |

| (4) | Date Filed: |

| | |

NOTICE OF ANNUAL MEETING OF THE SHAREOWNERS

| Date: | May 13, 2014 |

| |

| Time: | 10:00 a.m. |

| |

| Place: | Quinnipiac University |

| School of Law Center – Grand Courtroom |

| 275 Mount Carmel Avenue |

| Hamden, Connecticut 06518 |

Matters to be voted on:

| 2. | Ratification of the selection of PricewaterhouseCoopers LLP as UIL Holdings Corporation’s independent registered public accounting firm for 2014. |

| 3. | Non-binding advisory vote to approve the compensation of named executive officers. |

| 4. | Proposal to amend the Certificate of Incorporation of UIL Holdings Corporation to provide for election of directors by majority vote. |

| 5. | Any other matters properly brought before the shareowners at the annual meeting or any adjournment of the annual meeting. |

You are cordially invited to be present at the meeting and to vote. Only shareowners of record at the close of business on March 10, 2014 are entitled to receive notice of and to vote at the meeting or any adjournment thereof.

Under New York Stock Exchange rules, if your shares are held in a brokerage account and you have not provided directions to your broker, your broker will NOT be able to vote your shares with respect to the election of directors, the advisory proposal on executive compensation or the proposal to amend the certificate of incorporation

Whether or not you plan to attend the Annual Meeting of the Shareowners, we urge you to vote your shares over the Internet or via the toll-free telephone number, as we describe in the accompanying materials and in the Notice of Internet Availability of Proxy Materials. If you received a paper proxy card, you may vote by mail by completing, signing and dating the proxy card and returning it in the pre-addressed, postage-prepaid envelope accompanying the proxy card. No postage is necessary if mailed in the United States. Voting over the Internet, via the toll-free telephone number, or by mailing a proxy card will not limit your right to vote in person or to attend the Annual Meeting.

April 3, 2014

By Order of the Board of Directors,

SIGRID KUN

Assistant General Counsel and Corporate Secretary

YOUR VOTE IS IMPORTANT In order to save UIL Holdings Corporation the expense of further solicitation to ensure that a quorum is present at the Annual Meeting, please vote your shares promptly ‑ regardless of the number of shares you own, and regardless of whether you plan to attend the meeting. |

Directions to Quinnipiac University appear at the end of the accompanying proxy statement.

[THIS PAGE INTENTIONALLY LEFT BLANK]

PROXY STATEMENT

ANNUAL MEETING OF SHAREOWNERS

May 13, 2014

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of UIL Holdings Corporation for use at the 2014 Annual Meeting of Shareowners. This proxy statement contains important information for you to consider when deciding how to vote. Please read this information carefully.

Place, Date and Time of Annual Meeting

The Annual Meeting will be held on Tuesday, May 13, 2014 at 10:00 a.m., at Quinnipiac University, School of Law Center – Grand Courtroom, 275 Mount Carmel Avenue, Hamden, Connecticut 06518.

Availability of Proxy Materials

Under rules adopted by the U.S. Securities and Exchange Commission, or SEC, we have elected to furnish the proxy statement and Annual Report to most of our shareowners via the Internet instead of mailing printed materials to each shareowner. We believe this is in the best interests of our shareowners because we can provide them with the information they need in a timely manner, while reducing the environmental impact and lowering the cost of printing and delivery.

On or about April 3, 2014, pursuant to SEC rules, we began mailing a Notice of Internet Availability of Proxy Materials, or Notice of Internet Availability, to certain shareowners that held our common stock as of the close of business on March 10, 2014, the record date. Those shareowners who receive the Notice of Internet Availability will not automatically receive a paper copy of our proxy statement, the proxy card, our 2013 Annual Report and the Shareowner Letter. The Notice of Internet Availability contains instructions on how to access our proxy materials over the Internet and request paper copies. All shareowners who do not receive a Notice of Internet Availability will receive a paper copy of the proxy materials by mail.

Shareowners who are participants in the Direct Share Purchase and Sale Program for the Common Stock of UIL Holdings Corporation, will, upon request, receive either the Proxy Materials or a Notice of Internet Availability that covers the shares held in their accounts under the plan.

Voting

If you vote using the Internet, by telephone or by mailing a proxy card, the proxies will vote your common shares as you direct. For the election of directors (Proposal 1), you can specify whether your shares should be voted for all, some or none of the listed nominees for directors. With respect to the advisory proposal on executive compensation (Proposal 2), the proposal to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm (Proposal 3), and the proposal to amend our certificate of incorporation (Proposal 4), you may vote “FOR” or “AGAINST” the proposals, or you may abstain from voting on the proposals.

If you vote using the Internet, by telephone or by mailing a proxy card but do not direct how to vote on each item, the persons named as proxies will vote as the Board recommends on each proposal, specifically: FOR the election of each director nominee; FOR the advisory proposal on executive compensation; FOR the ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm; and FOR the proposal to amend our certificate of incorporation.

Voting at the Annual Meeting

In addition to voting by the Internet, by telephone or by mailing a proxy card, you can vote your shares of common stock at the Annual Meeting of the Shareowners if our records show that you owned the shares on March 10, 2014. If shares are held in the name of a broker, trust, bank, or other nominee, you should bring with you a statement, proxy or a letter from the broker, trustee, bank or nominee confirming your beneficial ownership of the shares on March 10, 2014.

If you personally attend the Annual Meeting of the Shareowners, you will be asked to verify that you are a shareowner by presenting an attendance ticket (attached to your proxy card) or the Notice of Internet Availability,

together with a proper form of identification. Cameras, recording devices and other electronic devices including telephones or other devices with photographic capability should not be used during the meeting and are subject to confiscation. For the safety of attendees, all bags, packages, and briefcases are subject to inspection. Your compliance is appreciated.

Even if you plan to attend the annual meeting, we encourage you to vote your shares before the meeting via the Internet, by telephone or by mailing the proxy card.

Common Stock Outstanding on the Record Date; Quorum

Only holders of common stock of record at the close of business on March 10, 2014, the record date, are entitled to receive notice of and to vote at the meeting or any adjournment thereof. On the record date, there were 56,530,649 shares of our common stock outstanding and entitled to vote. You are entitled to one vote on each matter to be voted on at the Annual Meeting for each share of common stock that you held on the record date.

Under Connecticut law and our bylaws, the presence, in person or by proxy, of shareowners holding a majority of the shares of outstanding common stock will constitute a quorum for purposes of considering and acting upon the matters listed in the accompanying Notice of Annual Meeting of the Shareowners.

Revocation of Proxies

You may revoke your proxy at any time prior to its use. In order to revoke your proxy, you must send a written notice of revocation or another properly signed proxy card bearing a later date to our Corporate Secretary at the address listed on page 53 of this proxy statement. If you attend the Annual Meeting in person, you may, if you wish, vote by ballot at the Annual Meeting. If you do vote by ballot at the Annual Meeting, then any proxy you previously submitted will be cancelled.

Required Votes

In determining whether we have a quorum, we count all properly submitted proxies and ballots, including abstentions, broker non-votes and withheld votes, as present and entitled to vote. For purposes of each of the proposals being presented to shareowners, abstentions and broker non-votes will not have any effect on the results of the votes.

Election of Directors. Under Connecticut law and our bylaws, assuming that a quorum is present at the Annual Meeting, directors will be elected by a plurality of the votes properly cast. Withholding authority to vote for a director nominee will not prevent that director nominee from being elected. Under Connecticut law and our Certificate of Incorporation cumulative voting for directors is not permitted.

Ratification of Auditors. Under Connecticut law and our bylaws, assuming that a quorum is present at the Annual Meeting, the proposal to ratify the Audit Committee’s selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm will be approved if the number of votes properly cast in favor of this action exceeds the number of votes cast against it.

Non-binding Advisory Vote to Approve Executive Compensation. As required by Section 14A of the Securities Exchange Act of 1934, we are seeking a non-binding advisory vote to approve executive compensation. Under Connecticut law, assuming a quorum is present at the Annual Meeting, the proposal will be approved if the number of votes properly cast in favor of this proposal exceeds the number of votes cast against it. However, because the vote is advisory, it will be non-binding on us or the Board, and will not be construed as overruling a decision by us or the Board. The vote will not create or imply any change to our fiduciary duties or create or imply any additional fiduciary duties for us or the Board.

Amendment of Certificate of Incorporation. Under Connecticut law, assuming a quorum is present at the Annual Meeting, the proposal to adopt an amendment to our certificate of incorporation will be approved if the number of votes properly cast in favor of this proposal exceeds the number of votes cast against it.

Voting Recommendations.

The Board of Directors recommends that you vote FOR each nominee for director named, FOR the advisory proposal on executive compensation, FOR ratification of the selection of our independent registered public accounting firm for 2014 and FOR the amendment to our certificate of incorporation.

Householding Information

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, shareowners of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our proxy statement, Annual Report and Shareowner Letter, unless one or more of the shareowners at that address notifies us that they wish to continue receiving individual copies. We believe this procedure provides greater convenience to our shareowners and saves money by reducing our printing and mailing costs and fees.

If you and other shareowners of record with whom you share an address and last name currently receive multiple copies of our proxy statement, Annual Report and Shareowner Letter and would like to participate in our householding program, please contact Broadridge Financial Solutions, Inc. by calling toll-free at 800-542-1061, or by writing to Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, New York 11717. Alternatively, if you participate in householding and wish to revoke your consent and receive separate copies of our proxy statement, Annual Report and Shareowner Letter, please contact Broadridge Financial Solutions, Inc. as described above.

A number of brokerage firms have instituted householding. If you hold your shares in street name, please contact your bank, broker or other holder of record to request information.

Principal Office

The principal office of UIL Holdings Corporation is located at 157 Church Street, New Haven, CT 06510. The proxy statement, proxy card and Annual Report are being mailed to shareowners commencing on or about April 3, 2014.

Method and Cost of Solicitation

We are making this solicitation and will bear the expense of printing and mailing proxy materials to our shareowners. We will ask banks, brokers and other custodians, nominees and fiduciaries to send proxy materials to beneficial owners of shares and to secure their voting instructions, if necessary, and we will reimburse them for their reasonable expenses in so doing. Our directors, officers and employees may also solicit proxies personally or by telephone, but they will not be specifically compensated for soliciting proxies. We have retained Okapi Partners of New York, New York, at a cost of $10,000 plus expenses, to aid in the solicitation of proxies by similar methods.

PRINCIPAL SHAREOWNERS

In statements filed with the SEC, the entities identified in the table below have disclosed beneficial ownership of shares of our common stock as shown in the table. None of the entities identified in the table has acknowledged that it has acted, or is acting, as a partnership, limited partnership or syndicate, or as a group of any kind for the purpose of acquiring, holding or disposing of our common stock. There is no other person or group of persons known to us to be the beneficial owner of more than five percent of the shares of our common stock as of the close of business on March 10, 2014.

The percentage shown in the right-hand column is calculated based on the 56,530,649 shares of our common stock outstanding as of the close of business on March 10, 2014.

| Title of Class | | Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class |

| | | | | | |

| Common Stock | | BlackRock, Inc. 40 East 52nd Street New York, NY 10022 | | 5,098,158 (1) | | 9.02% |

| | | | | | |

| Common Stock | | FMR LLC 245 Summer Street Boston, MA 02109 | | 4,551,629 (2) | | 8.05% |

| | | | | | |

| Common Stock | | The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 | | 3,658,694 (3) | | 6.47% |

| | | | | | |

| Common Stock | | Deutsche Bank AG Taunusanlage 12 60325 Frankfurt am Main Federal Republic of Germany | | 3,127,921(4) | | 5.53% |

| (1) | Based upon information provided in Amendment No. 5 to Schedule 13G filed by BlackRock, Inc. with the SEC on January 17, 2014; BlackRock, Inc. has sole voting power with respect to 4,911,425 shares and sole dispositive power with respect to 5,098,158 shares. The Amendment to Schedule 13G notes that various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the reported shares. No one person’s interest in said shares exceeds five percent of our total outstanding shares of common stock. |

| (2) | Based upon information provided in Amendment No. 1 to Schedule 13G filed by FMR LLC with the SEC on February 13, 2014; FMR LLC has sole voting power with respect to 1,000 shares and sole dispositive power with respect to 4,551,629 shares. The Amendment to Schedule 13G notes that various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the reported shares. The interest of one person, Fidelity Small Cap Discovery Fund in said shares amounted to 3,000,629 shares or 5.31 % of our total outstanding shares of common stock. |

| (3) | Based upon information provided in Amendment No. 2 Schedule 13G filed by The Vanguard Group, Inc. with the SEC on February 6, 2014; The Vanguard Group, Inc. has sole voting power with respect to 174,167 shares and sole dispositive power with respect to 3,578,923 shares. |

| (4) | Based upon information provided in Schedule 13G filed by Deutsche Bank AG with the SEC on February 14, 2014; Deutsche Bank AG has sole voting power with respect to 25,555 shares and sole dispositive power with respect to 3,127,921 shares. |

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

Our Board is currently comprised of the ten directors identified in this proxy statement. The Board, upon the recommendation of our Corporate Governance and Nominating Committee, has nominated each of the directors to stand for re-election.

Unless you instruct otherwise on the proxy, shares to which the proxy relates will be voted in favor of the persons listed below for election as directors of UIL Holdings. Although we know of no reason why any of the persons listed below will be unable to serve as a director, if that should occur, your shares will be voted for any other person that our present Board of Directors names as a substitute nominee. All ten nominees listed below were elected as directors at the last annual meeting.

Our criteria for directors are discussed in our Corporate Governance Guidelines, a copy of which is available on our website at www.uil.com. Consistent with these guidelines, all of the nominees listed below have a reputation for integrity, sound judgment, respect for others, courage of their convictions, and the ability to communicate effectively. All of the nominees have also stated that they have the time and commitment to meet their responsibilities as members of the Board. As a whole, the Board reflects diversity of gender, background and experience. The Board has determined that certain areas of experience are key to the composition of the Board as a whole: leadership experience, finance experience, and energy industries experience, including electricity and gas, and utility/public policy experience.

Leadership experience: Directors must have the ability to comprehend, evaluate and prioritize significant strategies, and to exercise oversight over their implementation. Directors with experience in leadership positions, particularly as executive officers or directors of publicly held companies, will have experience with the identification of enterprise risks, development and implementation of solutions, and serving as the leaders of coordinated efforts. This experience is important to our evaluation and successful implementation of its operating strategies and its initiatives for future growth.

Finance experience: Finance experience, including experience with capital markets, accounting, audit, budgets and financial reporting, is important to all directors, and is particularly important to directors serving on the Audit Committee. Our electric and gas utility subsidiaries plan extensive capital programs over the next decade. Finance experience contributes to a director’s oversight of our internal control environment, financial accounting and reporting, capital structure and financing of cash requirements.

Energy industry experience: Our electric and gas utility subsidiaries’ core businesses are in the energy industry, which has experienced significant structural and technological changes, with the pace of such changes expected to continue or increase in the future. Experience in the energy industry contributes to a director’s evaluation of our long- and short-term objectives, assessment of future developments that may impact us strategically and operationally, and such director’s work on the Board’s committees.

Utility/public policy experience: Our utility subsidiaries deliver electricity and gas to residents and businesses located in each utility’s franchise area, and are subject to state regulation of electric and gas distribution rates and federal regulation of electric transmission, as applicable. Our subsidiaries also engage in other cost of service-based activities, including cost of service generation investments. A director’s experience with governmental entities, including regulatory agencies, as well as the overall ratemaking process and a utility’s public service obligations to provide reliable service, can assist the director in monitoring the achievement of our objectives and the director’s understanding of the environments in which we do our business, the operational and financial considerations relevant to ratemaking, and our ability to earn a fair return on invested capital.

Set forth on the following pages is each nominee’s name, age at May 13, 2014, date first elected as a director of UIL Holdings, and a brief summary of the nominee’s business experience, including the nominee’s particular experience, qualifications, attributes or skills that led the Board to conclude that the nominee should continue to serve as a director. Each nominee has indicated he or she will stand for election and will serve as a director if elected.

Thelma R. Albright, 67, Former President, Carter Products Division, Carter-Wallace, Inc., Cranbury, New Jersey. Director of UIL Holdings since 1995.

Carter-Wallace, Inc. is a consumer and healthcare products manufacturer. Currently, Director, UIL Holdings Corporation and Church and Dwight, Inc., and member of its Compensation and Organization Committee. Former Director of Imagistics, Inc. Ms. Albright holds a bachelor of arts degree from Marian University, and an MBA from the University of Central Missouri.

Director Qualifications in Key Areas:

| · | Leadership experience – former President of a division of an international consumer products company; current and former Director of publicly held companies and current Chair of the Compensation and Organization Committee of a publicly held company; former Chair of UIL Holdings’ Compensation and Executive Development Committee. |

| · | Finance experience – managed finance, sales, marketing and research and development for a consumer products division of a publicly held company. Prior and current service on UIL Holdings’ Audit Committee and Retirement Benefits Plans Investment Committee. |

Arnold L. Chase, 62, Member of the Board of Directors and President, Gemini Networks, Inc. and Executive Vice President, Chase Enterprises, Hartford, Connecticut. Director of UIL Holdings since 1999. Current Retirement Benefits Plans Investment Committee Chair.

Gemini Networks, Inc. and Chase Enterprises are privately owned investment holding companies. Currently, Director, UIL Holdings Corporation, Trustee, Connecticut Public Broadcasting, Inc. and Talcott Mountain Science Center. Also, member of the Hartford Carousel Committee. Mr. Chase holds a bachelor of science degree in business administration from Babson College.

Director Qualifications in Key Areas:

| · | Leadership experience – current Principal of two investment holding companies; former Managing Director of a telecommunications company; current Chair of UIL Holdings’ Retirement Benefits Plans Investment Committee; former President, New England Weather Service; current and former Director of publicly held companies. |

| · | Finance experience – current Chair of UIL Holdings’ Retirement Benefits Plans Investment Committee; prior service on the audit committee of a publicly held bank corporation. |

| · | Utility/public policy experience – current President of a telecommunications company; former President and managerial positions with communication companies. |

Betsy Henley-Cohn, 61, Managing Partner of Cohn Realty and Investments, North Haven, Connecticut. Director of UIL Holdings since 1989.

Cohn Realty and Investments is a holder of various real estate and business interests. Currently, Director, UIL Holdings Corporation. Former Chairperson of the Board and Chief Executive Officer of Joseph Cohn & Son, Inc., a construction sub-contracting business operating in New England. Former Chairwoman and CEO of BIW Limited, a water utility holding company whose utility assets were purchased by South Central Connecticut Regional Water Authority and Connecticut Water Authority. Former Director of Society for Savings, First Bank, Citizens Bank of Connecticut and The Aristotle Corporation. Ms. Henley-Cohn holds a bachelor’s degree from Hampshire College and has an MBA from Simmons College.

Director Qualifications in Key Areas:

| · | Leadership experience – Chairwoman of a construction sub-contracting company; former Chairwoman of a publicly held water utility holding company; former Director of several publicly held companies; former Chair of UIL Holdings’ Corporate Governance and Nominating Committee. |

| · | Finance experience – former Chair of the audit committees of publicly held companies; prior and/or current service on UIL Holdings’ Audit Committee and Retirement Benefits Plans Investment Committee. |

| · | Utility/public policy experience – former Chairwoman of a regulated water utility; experience in ratemaking proceedings. |

Suedeen G. Kelly, 62, Partner, Akin Gump, Strauss, Hauer & Feld, Washington, D.C. Director of UIL Holdings since 2011.

Co-chair of the energy regulatory, markets and enforcement department at law firm. Currently, Director of UIL Holdings Corporation and Access Midstream Partners GP, L.L.C. Former Partner, Patton Boggs, LLP. Former Commissioner of the Federal Energy Regulatory Commission. Former professor of law, University of New Mexico School of Law. Former Chairwoman, New Mexico Public Service Commission. Former Director of Tendril. Ms. Kelly holds a bachelor’s degree from the University of Rochester and has a J.D., cum laude, from the Cornell Law School.

Director Qualifications in Key Areas:

| · | Leadership experience – current co-chair of law firm department; former Commissioner of federal agency; former Chairwoman, state public service commission; current Director and Chair of compensation committee of publicly held gas gathering company; former managing partner of law firm. |

| · | Finance experience – review and decision-making on federal and state agency cases involving electric and natural gas wholesale markets and interstate transmission; author of publications on electricity rates; current service on UIL Holdings’ Retirement Benefits Plans Investment Committee, current service on Access Midstream Partners Audit Committee. |

| · | Utility/public policy experience – former Commissioner of federal energy agency; former Chairwoman of state public service commission; former professor of energy law and public utility regulation; author of publications on energy law and policy, current practicing energy lawyer. |

John L. Lahey, 67, President, Quinnipiac University, Hamden, Connecticut. Director of UIL Holdings since 1994. Non-Executive Chair of UIL Holdings since 2010. Current Executive Committee Chair.

Quinnipiac University is a private, coeducational university with 6,500 undergraduate and 2,500 graduate students. Currently, Trustee, Yale-New Haven Hospital, Director, UIL Holdings Corporation, Yale New Haven Health System, The NYC Saint Patrick’s Day Parade, Inc., Standard Security Life Insurance Company of New York, Independence Holding Company and Alliance for Cancer Gene Therapy. Former Director of The Aristotle Corporation. Dr. Lahey holds bachelor’s and master’s degrees from the University of Dayton, a master’s degree from Columbia University, and a Ph.D. from the University of Miami.

Director Qualifications in Key Areas:

| · | Leadership and finance experience – current President of a university; current trustee of a health care system; current Director of an insurance company; former Chair of UIL Holdings’ Compensation and Executive Development Committee; current Chair of UIL Holdings’ Executive Committee. |

| · | Utility/public policy experience – Experience with Connecticut governmental entities through his work as a university President. |

Daniel J. Miglio, 73, Former Chairman, President and Chief Executive Officer of Southern New England Telecommunications Corporation (SNET) and The Southern New England Telephone Company, New Haven, Connecticut. Director of UIL Holdings since 1999. Current Corporate Governance and Nominating Committee Chair.

SNET and The Southern New England Telephone Company were previously independent telecommunications companies and are now part of AT&T. Currently, Director, UIL Holdings Corporation and Yale New Haven Health System. Mr. Miglio holds a bachelor of science degree in economics from the Wharton School at the University of Pennsylvania.

Director Qualifications in Key Areas:

| · | Leadership experience – former Chairman and CEO of a publicly held company; former chair of a national industry association; current Chair of UIL Holdings’ Corporate Governance and Nominating Committee; former Chair of UIL Holdings’ Compensation and Executive Development Committee. |

| · | Finance experience – former CFO of a publicly held company; former Chair of UIL Holdings’ Audit Committee and service on audit committees of other publicly held and not-for-profit corporations. |

| · | Utility/public policy experience – former President, officer responsible for regulatory and government relations and operations manager of a regulated public utility. |

William F. Murdy, 72, Chairman of the Board of Directors of Comfort Systems USA, Houston, Texas. Director of UIL Holdings since 2001. Current Compensation and Executive Development Committee Chair.

Comfort Systems USA is a national heating, ventilation, air conditioning and related services company serving the commercial and industrial markets. Currently, Director, UIL Holdings Corporation, Kaiser Aluminum Corporation (Chairman, Compensation Committee), Thayer Leader Development Group and Climatec. Member of the Board of Trustees (Emeritus) of the West Point Association of Graduates. Mr. Murdy holds a bachelor of science degree from West Point and an MBA from Harvard.

Director Qualifications in Key Areas:

| · | Leadership and finance experience – current Chairman and former CEO of a publicly held company; current Director of other publicly held companies; former CEO of five large companies; former managing partner of a venture capital firm; former officer in the United States Army; current Chair of UIL Holdings’ Compensation and Executive Development Committee. |

| · | Finance experience – current member of UIL Holdings’ Audit Committee. |

| · | Energy experience – current Chairman and former CEO of a national heating, ventilation, and air conditioning company; former Director of a public oil and gas exploration and production company; former officer of a gas company. |

William B. Plummer, 54, Executive Vice President and Chief Financial Officer of United Rentals, Inc., Greenwich, CT. Director of UIL Holdings since 2013.

United Rentals, Inc. is an equipment rental company serving 836 rental locations in the United States and Canada. Currently, Director, UIL Holdings Corporation and John Wiley & Sons, Inc. Chartered Financial Analyst. Former Executive Vice President and Chief Financial Officer of Dow Jones & Company, Inc. Former Vice President and Treasurer of Alcoa Inc. Also, various executive positions at Mead Corporation, General Electric and General Electric Capital Corporation. Former Director of Alcoa Foundation and Integris Metals Inc. Mr. Plummer holds bachelor and master of science degrees in aeronautics and astronautics from the Massachusetts Institute of Technology and an MBA from Stanford University.

Director Qualifications in Key Areas:

| · | Leadership and finance experience – current Executive Vice President and Chief Financial Officer of a publicly held company; current and former director of other publicly held companies. |

| · | Finance experience – Chartered Financial Analyst; current Chief Financial Officer; former Treasurer of publicly held company. |

Donald R. Shassian, 58, Executive Vice President and Chief Financial Officer of CBS Outdoor Americas Inc., New York, New York. Director of UIL Holdings since 2008. Current Audit Committee Chair.

CBS Outdoor Americas Inc. is one of the largest lessors of advertising space on out-of-home advertising structures and sites across the United States, Canada and Latin America. Currently, Director, UIL Holdings Corporation. Certified Public Accountant. Former Executive Vice President and Chief Financial Officer of Frontier Communications, Inc. Former Senior Vice President and Chief Financial Officer of Southern New England Telecommunications Corporation. Former partner-in-charge of the Arthur Andersen telecommunications industry practice in North America. Mr. Shassian holds a bachelor’s degree in business administration from Bucknell University.

Director Qualifications in Key Areas:

| · | Leadership and finance experience –former executive positions at publicly held telecommunications companies; former audit and advisory partner at an accounting firm with specialization in the telecommunications industry; current Chair of UIL Holdings’ Audit Committee and member of the Retirement Benefits Plans Investment Committee; Certified Public Accountant. |

| · | Utility/public policy experience – executive positions at rate regulated companies; experience with ratemaking proceedings. |

James P. Torgerson, 61, President and Chief Executive Officer, UIL Holdings Corporation and Chairman President and Chief Executive Officer, The United Illuminating Company, New Haven, Connecticut. Director of UIL Holdings since 2006.

Former President and Chief Executive Officer, Midwest Independent Transmission System Operator, Inc. Currently, Director, UIL Holdings Corporation and Trustee, Yale-New Haven Hospital System. Also Chairman of each of Connecticut Natural Gas Corporation, The Southern Connecticut Gas Company and The Berkshire Gas Company, subsidiaries of UIL Holdings Corporation; Chairman, Regional Economic Xcelleration; Chairman, Connecticut Institute for the 21st Century; Chairman, Connecticut Business and Industry Association; Board member, Edison Electric Institute and American Gas Association; Trustee, Catholic Cemetery Association, Archdiocese of Hartford; and member of the Fairfield Business Council. Mr. Torgerson holds a bachelor’s of business administration degree in accounting from Cleveland State University.

Director Qualifications in Key Areas:

| · | Leadership, energy industry and utility/public policy experience – current CEO of UIL Holdings; former CEO of independent transmission system operator; experience in operations and ratemaking at regulated electric and gas utilities. |

| · | Finance experience – former chief financial officer of regulated utilities and independent transmission system operator. |

VOTE REQUIRED FOR APPROVAL

Under Connecticut law and our bylaws, assuming that a quorum is present at the Annual Meeting, directors will be elected by a plurality of the votes cast at the meeting. Withholding authority to vote for a director nominee will not prevent that director nominee from being elected. Cumulative voting for directors is not permitted.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREOWNERS VOTE “FOR” THE ELECTION OF THE NOMINEES FOR DIRECTOR NAMED ABOVE. |

INFORMATION REGARDING THE BOARD OF DIRECTORS

During 2013, the Board held 10 meetings. Each director attended at least 90% of the aggregate number of meetings of the Board of Directors and its committees held during 2013. The Board expects that directors will attend the annual meetings of the shareowners. All the members of the Board of Directors attended the 2013 Annual Meeting of the Shareowners held on May 14, 2013.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines. The Board recognizes that guidelines will not anticipate every situation. Therefore these Guidelines are intended to provide a framework, to be applied and interpreted in accordance with applicable laws and regulations and to reflect good corporate governance. The Board’s Corporate Governance and Nominating Committee reviews these Guidelines annually, or more frequently as appropriate, and recommends changes or updates to the Board. Our Corporate Governance Guidelines, our Code of Business Conduct for the Board, our Code of Business Conduct for officers and employees and our Code of Ethics for the Chief Executive Officer, Presidents, and Senior Financial Officers are available on our website, www.uil.com. We will send copies of any of these documents to any shareowner who requests the documents from our Corporate Secretary.

Board Leadership Structure

Our bylaws allow flexibility to separate or consolidate the positions of Chairman of the Board and Chief Executive Officer, or CEO, as the Board may determine to be appropriate at a given time to support the effective governance and functioning of the Board and UIL Holdings. We have had a Non-executive Chair of the Board since October 2006. The Board has determined that this is the appropriate leadership structure for us at this time. Dr. Lahey has served as the Non-executive Chair since May 2010 and has presided over the executive sessions of the Board. The Non-executive Chair and the CEO have complementary roles. The Non-executive Chair leads the Board, and works to assure that the Board meets its responsibilities, particularly in effective oversight, including oversight of senior management’s assessment and management of our enterprise risk. The responsibilities adopted by the Board as they relate to the Non-executive Chair are included in our Corporate Governance Guidelines, a copy of which is available on our website at www.uil.com. The CEO manages our day-to-day business and is the primary point of communication with shareowners and professionals active in the financial markets, such as Wall Street analysts.

Director Diversity

The Board recognizes the benefit of having directors who reflect differing individual attributes to contribute to the Board’s discussion, evaluation and decision-making. The Board does not have a specific policy regarding diversity. However, in evaluating directors and director nominees, the Corporate Governance and Nominating Committee considers diversity in the context of a breadth of experience, thought and expertise, as well as gender and racial diversity.

Risk Assessment

The Board has determined that it should address enterprise risk at least quarterly, and from time to time in the evaluation of proposed Board actions. In addition, the Board has delegated to Board committees the responsibility for the initial evaluation of risk in specific areas in accordance with the areas of responsibility set forth in the committees’ charters, which responsibilities are described below under “COMMITTEES OF THE BOARD OF DIRECTORS.”

Director Independence

The Board of Directors is composed at all times of at least a majority of directors who are independent. As described below, the Board has determined that eight of the Board’s ten director nominees are independent. In accordance with the corporate governance standards of the New York Stock Exchange, or NYSE, all of the members of the Audit Committee, the Compensation and Executive Development Committee and the Corporate Governance and Nominating Committee are independent directors.

The Board has established guidelines, the Standards for Independence of Directors, to assist it in determining director independence, which standards conform to or are more exacting than the independence requirements of the NYSE. The Standards for Independence of Directors are posted on our website, www.uil.com. In addition to applying these guidelines, the Board considers all relevant facts and circumstances in making an independence determination, and not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation.

The Board has evaluated the relationships between each nominee for director (and his or her immediate family members and related interests) and UIL Holdings and its subsidiaries. Similarly, the Board has examined relationships and transactions between each nominee for director and (a) our senior management and (b) our independent registered public accountants. The Board has affirmatively determined, upon the recommendation of the Corporate Governance and Nominating Committee, that none of the directors, with the exception of Mr. Chase and Mr. Torgerson, have a material relationship with UIL Holdings and therefore, each of the following nominees is independent: Ms. Albright, Ms. Henley-Cohn, Ms. Kelly, Dr. Lahey, Mr. Miglio, Mr. Murdy, Mr. Plummer and Mr. Shassian. The Board has determined that Mr. Chase and Mr. Torgerson do not meet our independence standards. Mr. Chase is not independent because he has a beneficial interest in the building known as the Connecticut Financial Center, 157 Church Street, New Haven Connecticut, in which we lease office space. Mr. Torgerson is not independent because he is the President and Chief Executive Officer of UIL Holdings.

Ms. Kelly, a director, is also a practicing attorney. In November 2012, Ms. Kelly joined the law firm of Akin Gump Straus Hauer and Feld LLP, or Akin, as a partner and co-chair of the firm’s energy regulatory practice. At the time Ms. Kelly joined Akin, that firm already represented us in certain federal energy regulatory matters. We continually consider the roster of law firms that represent us in the various areas of law. Since the time that Ms. Kelly joined Akin, we have terminated Akin’s representation, and legal work previously performed by Akin has been transitioned to another firm. In 2013, we paid approximately $216,000 in legal fees to Akin stemming from engagements prior to Ms. Kelly’s arrival at Akin and none of which related to services performed for us by Ms. Kelly. The Board has considered this relationship and determined that it did not impair Ms. Kelly’s independence.

COMMITTEES OF THE BOARD OF DIRECTORS

Executive Committee

Ms. Henley-Cohn, Dr. Lahey, Mr. Miglio and Mr. Torgerson serve on the Executive Committee of the Board of Directors. Dr. Lahey is the Chair of the Executive Committee. The Executive Committee is a standing committee that has and may exercise all the powers of the Board when the full Board is not in session. The Executive Committee held one meeting during 2013.

Audit Committee

Ms. Albright, Ms. Henley-Cohn, Mr. Murdy and Mr. Shassian serve on the Audit Committee of the Board of Directors. Mr. Shassian is the Chair of the Audit Committee. All members of the Audit Committee are independent as defined in the listing standards of the NYSE. The Audit Committee is a standing committee whose functions include monitoring the integrity of our financial statements, financial reporting process and systems of internal controls regarding finance, accounting, and compliance with applicable laws, regulations and company policies; monitoring the independence, qualifications, and performance of our independent auditors and internal audit services and compliance; and providing an open avenue of communication among the independent auditors, financial and senior management, internal audit services and the Board. In consultation with financial and senior management, the independent auditors and internal audit services, the Audit Committee considers the integrity of our financial reporting processes and controls, discusses significant financial risk exposures and the steps management has taken to monitor, control and report such exposures, and reviews significant findings of the independent auditors and our internal audit services, together with management’s responses to these findings. The Audit Committee also performs other activities consistent with its charter, our bylaws and governing law, and is responsible for the initial evaluation of risk in connection with the areas of responsibility set forth in its charter. The Board has determined that each member of the Audit Committee is an Audit Committee financial expert, as defined by the regulations of the SEC. The Audit Committee Charter meets the current requirements of the SEC regulations and the NYSE listing standards. The Audit Committee charter is posted on our website, www.uil.com, and we will send a copy, free of charge, to any shareowner who requests it by contacting the Corporate Secretary at the address set forth on page 53 of this Proxy Statement. The Audit Committee held five meetings during 2013.

Compensation and Executive Development Committee

Ms. Henley-Cohn, Ms. Kelly, Mr. Miglio, Mr. Murdy and Mr. Plummer serve on the Compensation and Executive Development Committee, or CEDC, of the Board of Directors. Mr. Murdy is the Chair of the CEDC. All members of the CEDC are independent as defined in the listing standards of the NYSE. The CEDC is a standing committee whose functions include the oversight, management and administration of our executive incentive, equity and deferred compensation plans; discharging the responsibilities of the Board relating to compensation of Section 16(b) executive officers, which executive officers are determined annually by the Board; discharging the responsibilities of the Board for administration and oversight of the executive incentive, equity and deferred compensation plans; establishing competitive executive compensation policies and other supplemental compensation and benefit programs, all of which are designed to be internally equitable and externally competitive to attract and retain officers and executives of the highest quality, and to align the interests of such persons with those of our shareowners and customers; making recommendations to the Board regarding the selection of the Company’s CEO and reviewing the CEO’s nominees for other officers; evaluating the annual performance of our CEO; reviewing management development and succession matters; and administering aspects of compensation plans and stock plans and amending or recommending changes in such plans. Additionally, the CEDC is responsible for the initial evaluation of risk in connection with the areas of responsibility set forth in its charter. The CEDC charter is available on our website, www.uil.com, and we will send a copy, free of charge, to any shareowner who requests it

by contacting the Corporate Secretary. The CEDC held seven meetings during 2013. Additional information about the CEDC and our compensation-setting process can be found on pages 22 and 23 of this proxy statement.

Corporate Governance and Nominating Committee

Ms. Albright, Ms. Henley-Cohn, Ms. Kelly and Mr. Miglio serve on the Corporate Governance and Nominating Committee of the Board of Directors. Mr. Miglio is the Chair of the Corporate Governance and Nominating Committee. All members of the Corporate Governance and Nominating Committee are independent as defined in the listing standards of the NYSE. The Corporate Governance and Nominating Committee is a standing committee whose functions include identifying and recommending to the Board for nomination, consistent with our Corporate Governance Guidelines, individuals qualified to serve as our directors, and recommending to the Board the criteria and qualifications for directors; identifying and recommending to the Board, directors qualified to serve on committees of the Board and to serve as committee chairs; recommending to the Board an appropriate Board leadership structure and identifying and recommending to the Board nominees for Chairman; developing and recommending to the Board and annually reviewing a set of corporate governance guidelines applicable to us; evaluating and making recommendations to the Board with respect to the compensation of directors; and overseeing the annual evaluation of Board and committee performance. Additionally, the Corporate Governance and Nominating Committee is responsible for the initial evaluation of risk in connection with the areas of responsibility set forth in its charter. The Corporate Governance and Nominating Committee charter is available on our website, www.uil.com, and we will send a copy, free of charge, to any shareowner who requests it by contacting the Corporate Secretary. The Corporate Governance and Nominating Committee held four meetings during 2013.

The Corporate Governance and Nominating Committee does not set specific, minimum qualifications that nominees must meet in order for it to recommend them for election to the Board of Directors, but rather believes that each nominee should be evaluated based on his or her individual merits, taking into account our needs and the composition of the Board of Directors. Members of the Corporate Governance and Nominating Committee discuss and evaluate possible candidates in detail, and suggest individuals to explore in more depth. Outside consultants have also been employed at times to help in identifying candidates. Once a candidate is identified whom the Corporate Governance and Nominating Committee wants to seriously consider for nomination, the Chair enters into a discussion with that prospective nominee. The Corporate Governance and Nominating Committee will consider nominees recommended by shareowners. Nominees recommended by shareowners will be given appropriate consideration in the same manner as other nominees. Shareowners who wish to submit the names of nominees for Director for consideration by the Corporate Governance and Nominating Committee for election at our 2015 Annual Meeting of Shareowners may do so by submitting the names of such nominees, with their qualifications and biographical information, in writing, to the Committee in care of the Corporate Secretary, any time between November 4, 2014 and December 4, 2014.

Retirement Benefits Plans Investment Committee

Ms. Albright, Ms. Kelly, Mr. Chase, Mr. Plummer and Mr. Shassian serve on the Retirement Benefits Plans Investment Committee of the Board of Directors. Mr. Chase is the Chair of the Retirement Benefits Plans Investment Committee. The Retirement Benefits Plans Investment Committee is responsible for carrying out the Board’s duties in connection with the investment and management of assets held on behalf of the funded employee benefits plans and any trusts established in connection with our non-qualified deferred compensation plans. Additionally, the Retirement Benefits Plans Investment Committee is responsible for the initial evaluation of risk in connection with the areas of responsibility set forth in its charter. The Retirement Benefits Plans Investment Committee charter is available on our website, www.uil.com, and we will send a copy, free of charge, to any shareowner who requests it by contacting the Corporate Secretary. The Retirement Benefits Plans Investment Committee held four meetings during 2013.

The following table summarizes the information set forth above regarding the current composition of the committees of the Board.

Committees of the Board of Directors Table

| Name | Executive Committee | Audit Committee | Compensation and Executive Development Committee | Corporate Governance and Nominating Committee | Retirement Benefits Plans Investment Committee |

| Thelma R. Albright | | X | | X | X |

| Arnold L. Chase | | | | | C |

| Betsy Henley-Cohn | X | X | X | X | |

| Suedeen G. Kelly | | | X | X | X |

| John L. Lahey | C | | | | |

| Daniel J. Miglio | X | | X | C | |

| William F. Murdy | | X | C | | |

| William B. Plummer | | | X | | X |

| Donald R. Shassian | | C | | | X |

| James P. Torgerson | X | | | | |

C: Chair X: Committee member

TRANSACTIONS WITH RELATED PARTIES AND CODES OF CONDUCT

Under the sixth amendment, dated February 15, 2012, to a lease agreement dated May 7, 1991, we lease our corporate headquarters offices in New Haven from 157 Church Street, LLC, which is controlled by Arnold L. Chase, a director and shareowner of UIL Holdings, and members of his immediate family. During 2013, our lease payments to 157 Church Street, LLC totaled approximately $1.5 million.

The Board adopted a Related Party Transactions Policy on March 25, 2014. The Policy is administered by the Corporate Governance and Nominating Committee. The policy generally defines a “Related Party Transaction” as any transaction or series of transactions in which (i) UIL Holdings or a subsidiary is a participant, (ii) the aggregate amount involved exceeds $120,000 and (iii) any “Related Party” has a direct or indirect material interest. A “Related Party” is defined as any director or nominee for director, any executive officer, any shareowner owning more than 5% of our outstanding common stock, any immediate family member of any such person or any entity controlled by any of the above. Management submits to the Corporate Governance and Nominating Committee for consideration any proposed Related Party Transaction. The Corporate Governance and Nominating Committee recommends to the Board for approval only those transactions that are in (or not inconsistent with) our best interests. Related Party Transactions are considered in light of the requirements set forth in our Code of Business Conduct for the Board of Directors, including the provisions addressing Conflicts of Interest, and the Company’s Code of Ethics for the Chief Executive Officer, Presidents and Senior Financial Officers. Transactions involving the rendering of services by our public utility subsidiaries at rates fixed in conformity with laws or governmental authority are not subject to this policy. If management causes us to enter into a Related Party Transaction prior to approval by the Corporate Governance and Nominating Committee, the transaction will be subject to ratification by the Board. If the Board determines not to ratify the transaction, then management will use its best efforts to cancel or annul such transaction.

Our Code of Business Conduct for the Board of Directors, or the Director Code, provides guidance to each director on areas of ethical risk to help directors recognize and address potential conflicts of interest and other ethical issues in order to foster a culture of honesty and accountability. Specifically, the Director Code provides that directors must avoid conflicts of interest with UIL Holdings and requires that any situation that involves, or may reasonably be expected to involve, a conflict of interest must be disclosed promptly to the Non-executive Chair of the Board. The Director Code provides that directors should seek to identify potential conflicts of interest at an early stage. Directors are encouraged to bring questions about particular circumstances that may implicate one or more of the provisions of the Director Code to the attention of the Chair of the Audit Committee or the Chair of the Corporate Governance and Nominating Committee, who may consult with counsel as appropriate.

Our Code of Ethics for the Chief Executive Officer, Presidents and Senior Financial Officers, or the Officer Code, establishes policies and procedures that (1) encourage and reward professional integrity in all aspects of the financial organization, (2) prohibit and eliminate the appearance or occurrence of conflicts between what is in our best interest and what could result in material personal gain for a member of the organization, (3) provide a mechanism

for members of the financial organization to inform senior management of deviations in practice from policies and procedures governing honest and ethical behavior, and (4) requires the officers to demonstrate their personal support for such policies and procedures through periodic communication reinforcing these ethical standards throughout the financial organization.

Our officers are also subject to our employee Code of Business Conduct, or the Employee Code, which governs potential conflicts of interest and requires the disclosure of all facts in any situation where a conflict of interest may arise. Copies of the Related Party Transactions Policy, Director Code, Officer Code and the Employee Code are accessible on our website, www.uil.com.

We discourage transactions involving, or that may be perceived as involving, a conflict of interest, and have historically limited the approval of such transactions to specific and rare instances with the full disclosure to, and approval of, the disinterested members of the Board. Additionally, we require each director and officer to complete an annual questionnaire that solicits, among other items, specific information about (1) each Board member’s individual affiliations with entities with which we and our executives transact business or have an affiliation, (2) any transaction or series of similar transactions involving us and/or our subsidiaries to which the director or any member of the director’s immediate family has a direct or indirect material interest and (3) each Board member’s involvement in legal proceedings affecting us. Our management reviews these questionnaires annually during the preparation of disclosures to be included in this proxy statement.

COMMUNICATIONS WITH DIRECTORS

In order to provide shareowners and other interested parties with a direct and open line for communication to the independent members of the Board, the Board has adopted the following procedures for confidential communications to directors. Our shareowners and other interested persons may communicate with the Board by sending a letter to the following address:

| Linda L. Randell |

| Senior Vice President and General Counsel |

| UIL Holdings Corporation |

| 157 Church Street |

| New Haven, CT 06506 |

All communications received in accordance with these procedures will be reviewed by our General Counsel to determine whether the subject matter of the communication should be brought to the attention of the independent directors, the non-management directors, the full Board, or one or more of its committees, as well as whether any response to the communication is appropriate. Any such response will be made only in accordance with applicable law and regulations relating to the disclosure of information. The criteria utilized by the General Counsel to guide the handling of the matter will include whether the communication:

| · | relates to matters other than our business or affairs or the functioning or constitution of the Board or any of its committees; |

| · | relates to routine or insignificant matters that do not warrant the attention of the Board; |

| · | is an advertisement or other commercial solicitation or communication; and |

| · | is frivolous or offensive; or otherwise not appropriate for delivery to directors. |

Our General Counsel will retain copies of all communications received pursuant to these procedures for a period of at least one year. The Corporate Governance and Nominating Committee of the Board will review the effectiveness of these procedures from time to time and, if appropriate, recommend changes.

STOCK OWNERSHIP OF DIRECTORS AND OFFICERS

The following table shows the number of shares of our common stock beneficially owned, directly or indirectly, as of March 10, 2014, by (i) each of our directors (which includes all nominees for the Board of Directors listed above), (ii) our CEO and our Chief Financial Officer, and each of the three other most highly compensated persons who are our executive officers and (iii) the total, as a group, of all of our directors and executive officers serving as of December 31, 2013.

| | | | | | | | | Total Shares | |

| | | | | | | | | Beneficially | |

| Name of Individual or | | | | | Stock | | | Owned Directly | |

| Number of Persons in Group (2) | | Shares | | | Units | | | or Indirectly | |

| Thelma R. Albright | | | 30,480 | | | | 96,369 | | | | 126,849 | |

| Arnold L. Chase (1) | | | 1,028,827 | | | | 20,442 | | | | 1,049,269 | |

| Betsy Henley-Cohn | | | 32,466 | | | | 12,092 | | | | 44,558 | |

| Suedeen G. Kelly | | | 2,775 | | | | 7,009 | | | | 9,784 | |

| John L. Lahey | | | 20,884 | | | | 53,044 | | | | 73,928 | |

| Daniel J. Miglio | | | 32,289 | | | | 19,730 | | | | 52,019 | |

| William F. Murdy | | | 6,000 | | | | 71,326 | | | | 77,326 | |

| William B. Plummer | | | 2,286 | | | | - | | | | 2,286 | |

| Donald R. Shassian | | | 18,539 | | | | - | | | | 18,539 | |

| James P. Torgerson | | | 31,202 | | | | 203,122 | | | | 234,324 | |

| Richard J. Nicholas | | | 26,703 | | | | 56,717 | | | | 83,420 | |

| John J. Prete | | | 11,459 | | | | - | | | | 11,459 | |

| Linda L. Randell | | | 29,788 | | | | 22,531 | | | | 52,319 | |

| Steven P. Favuzza | | | 14,833 | | | | 4,221 | | | | 19,054 | |

| All Directors and executive officers as a group (18 persons) (3) | | | 1,317,606 | | | | 570,151 | | | | 1,887,757 | |

(1) The number of shares of common stock beneficially owned by Mr. Chase, as listed in the above stock ownership table, is approximately 1.9% of the 56,530,649 shares of common stock outstanding as of March 10, 2014, adjusted to reflect Mr. Chase’s right to receive shares of common stock for his stock units. Shares reported as beneficially owned by Mr. Chase include 427,377 shares directly held by Mr. Chase with respect to which he holds sole voting and investment power; 2,286 shares of restricted stock directly held by Mr. Chase acquired under our director compensation plans, with respect to which he holds sole voting power; 20,442 shares underlying currently exercisable stock units held by UIL Holdings under its non-employee directors’ plan; 44,166 shares directly held by The Sandra and Arnold Chase Family Foundation, Inc., a charitable foundation of which Mr. Chase serves as a director, president and chief executive officer, and with respect to which he may be deemed to hold shared voting and investment power; 554,500 shares directly held by RLC Investments LLC, of which Mr. Chase is a manager, and with respect to which he may be deemed to hold shared voting and investment power; and 498 shares of common stock held by Mr. Chase as custodian for his non-adult children, with respect to which he holds sole voting and investment power.

(2) The number of shares of common stock beneficially owned by each of the other persons included in the table is less than 1% of the outstanding shares of common stock as of March 10, 2014.

(3) The number of shares of common stock beneficially owned by all of the directors and executive officers as a group represents approximately 3.3% of the shares of common stock outstanding as of March 10, 2014, adjusted to reflect the additional shares which would be outstanding if all of the directors and executive officers exercised their right to receive shares of common stock for their stock units.

The number of shares listed in the above stock ownership table includes: shares held for the benefit of executive officers that are participating in the 401(k)/Employee Stock Ownership Plan; shares that may be acquired within sixty (60) days of March 10, 2014 through the exercise of previously granted stock options; and stock units that are in stock accounts under both the UIL Holdings Deferred Compensation Plan and our Non‑Employee Directors Common Stock and Deferred Compensation Plan, described below under “Director Compensation.” Stock units in these plans are payable in an equivalent number of shares of our common stock.

The numbers in the above stock ownership table are based in part on reports furnished by the directors and officers. Mr. Chase does not admit beneficial ownership of any shares other than those shown in the foregoing table, or that he has acted, or is acting, as a member of a partnership, limited partnership or syndicate, or group of any kind for the purpose of acquiring, holding or disposing of our common stock. With respect to other directors and officers, the shares reported in the above stock ownership table include, in some instances, shares held by the immediate families of a director or officer or entities controlled by a director or officer, the reporting of which is not to be construed as an admission of beneficial ownership. All directors who are serving their sixth or greater term own, directly or indirectly, at least 8,500 shares, or have stock units reflecting deferral of at least 8,500 shares, in compliance with the stock ownership guidelines contained in our Corporate Governance Standards.

Each of the persons included in the above stock ownership table has sole voting and investment power as to the shares of common stock beneficially owned, directly or indirectly, by him or her, except (a) as described above in footnote (1) regarding Mr. Chase, and (b) that voting and investment power over 3,391 shares owned by Betsy Henley-Cohn is held by a family trust.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who beneficially own more than ten percent of our common stock to file with the SEC and the NYSE, and furnish to us, initial reports of ownership and reports of changes in ownership of our common stock and other equity securities.

As a practical matter, we assist our directors and executive officers by monitoring transactions and completing and filing Section 16 reports on their behalf. Based solely on review of reports furnished to us and written representations of our directors and executive officers and persons who beneficially own more than ten percent of our common stock that no other reports were required, during the fiscal year ended December 31, 2013, each of such persons timely complied with all applicable Section 16(a) filing requirements, except that, due to an administrative oversight, a Form 4 disclosing the sale of a fractional share by Mr. Favuzza was not timely filed. The Form 4 was filed promptly upon becoming aware of the oversight.

EXECUTIVE COMPENSATION

Report of the Compensation and Executive Development Committee*

The Compensation and Executive Development Committee, or CEDC, of the Board of Directors (the Board) of UIL Holdings Corporation (UIL Holdings or the Company) has reviewed and discussed with management the following section of this proxy statement entitled “Compensation Discussion and Analysis” (CD&A) required by Item 402(b) of Regulation S-K. Based on such review and discussions, the CEDC recommended to the Board that the CD&A be included in the Company’s 2014 Proxy Statement and incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013. This report is provided by the following independent directors, who comprise the CEDC:

William F. Murdy, Chair

Betsy Henley-Cohn

Suedeen G. Kelly

Daniel J. Miglio

William B. Plummer

* The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company other than the Company’s Annual Report on Form 10-K, under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof, except to the extent this report is specifically incorporated by reference.

Compensation Discussion and Analysis

This discussion and analysis of the compensation program for our named executive officers, or NEOs, should be read in conjunction with the tables and text elsewhere in this proxy statement that describe the compensation awarded to, earned by or paid to the NEOs in 2013.

Our Compensation Discussion & Analysis, or CD&A, provides information about the compensation objectives and policies used by the CEDC to determine compensation for our Chief Executive Officer, our Chief Financial Officer, and our other three most highly compensated executive officers. It describes how the CEDC establishes target ranges for total compensation that are consistent with comparable positions in the energy services industry and that we choose to focus on the selected goals and objectives because our success in achieving or exceeding them will allow for sustained returns to our shareowners. Overall, this CD&A provides a general description of our compensation program and specific information about its various components, which are intended to describe information contained in the executive compensation tables that follow this discussion. Throughout this discussion, the following individuals are referred to collectively as the NEOs for 2013:

| · | James P. Torgerson – President and Chief Executive Officer; |

| · | Richard J. Nicholas – Executive Vice President and Chief Financial Officer; |

| · | Linda L. Randell – Senior Vice President and General Counsel; |

| · | Steven P. Favuzza – Vice President and Controller; |

| · | John J. Prete – Senior Vice President Electric Operations |

2013 Non-Binding Advisory Vote on the Compensation of NEOs

In May 2013, our shareowners approved a non-binding advisory proposal on the compensation of NEOs at our 2013 Annual Meeting with over 95% of the votes cast voting in favor of that proposal. Also in 2013, two major shareholder advisory services recommended “Yes” votes on our proposal. The CEDC reviewed the results of the shareowner vote and view the high percentage of votes in favor of the proposal as an indication that our shareowners continue to strongly support the pay-for-performance approach of our compensation program.

Executive Summary

Our compensation program is designed to support the achievement of our short-term and long-term performance objectives. The four elements of the compensation program are:

| · | Base salaries which are set competitively around the median of our Comparator Companies (as defined and described below). |

| · | Annual short-term incentives that have competitive targets and are based on financial and operational criteria critical to delivering superior results for our stakeholders - our gas and electric customers, shareowners and employees. |

| · | Long-term incentives that are based on the achievement of three year earnings goals and delivering superior returns for our shareowners. |

| · | Benefits and perquisites which may include both health and welfare benefits and qualified and non-qualified savings and pension plans. |

We enter 2014 with optimism and anticipation for continued success. We reaffirm our commitment to maintaining strong customer service and high reliability, and creating value for our customers and shareowners. During 2013, our achievements were significant:

| · | We ended calendar year 2013 with nearly 15,000 new gas heating customers. This surpassed our established goal of 12,200 set at the beginning of 2013. |

| · | We successfully executed an equity offering and maintained investment grade credit ratings. |

| · | Solid management. Prudent fiscal management along with an increase to the electric distribution rate base and additional natural gas distribution sales have strongly contributed to our financial position. At the end of 2013, the state regulatory agency overseeing utilities reconsidered an earlier ruling and allowed UI to recover $9.5 million it had previously denied. |

| · | We’ve enhanced electric system reliability and service with an infrastructure investment to help protect our substations against the major storms and unconventional flooding of recent years. |

| · | We’ve continued to demonstrate corporate responsibility in our communities through our direct work and financially. Our role as corporate citizen is just as valuable as the energy and heat we provide to our customers year-round. In 2013 alone, UIL Holdings and its employees contributed almost $370,000 to support 300 nonprofit organizations in our service territories. |

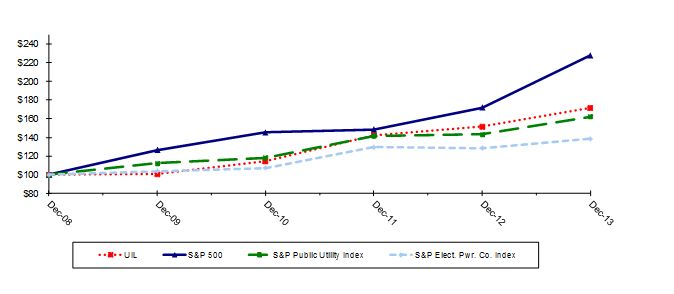

The line graph below compares the yearly change in UIL Holdings’ cumulative total shareowner return, or TSR, on its common stock with the cumulative total return on the S&P Composite-500 Stock Index, the S&P Public Utility Index and the S&P Electric Power Companies Index for the period of five fiscal years commencing 2009 and ending 2013. It reflects superior TSR performance over the last five years relative to the utility indices.

| | | Dec-08 | | | Dec-09 | | | Dec-10 | | | Dec-11 | | | Dec-12 | | | Dec-13 | |

| UIL | | | $ | 100 | | | $ | 101 | | | $ | 114 | | | $ | 142 | | | $ | 152 | | | $ | 172 | |

| S&P 500 | | | $ | 100 | | | $ | 126 | | | $ | 145 | | | $ | 148 | | | $ | 172 | | | $ | 228 | |

| S&P Public Utility Index | | | $ | 100 | | | $ | 112 | | | $ | 118 | | | $ | 142 | | | $ | 143 | | | $ | 162 | |

| S&P Elect. Pwr. Co. Index | | | $ | 100 | | | $ | 104 | | | $ | 107 | | | $ | 129 | | | $ | 128 | | | $ | 138 | |

| * | Assumes that the value of the investment in UIL Holdings’ common stock and each index was $100 on December 31, 2008 and that all dividends were reinvested. For purposes of this graph, the yearly change in cumulative shareowner return is measured by dividing (i) the sum of (A) the cumulative amount of dividends for the year, assuming dividend reinvestment, and (B) the difference in the fair market value at the end and the beginning of the year, by (ii) the fair market value at the beginning of the year. The changes displayed are not necessarily indicative of future returns measured by this or any other method. |

The CEDC appropriately rewards executives based on critical financial and operational performance of the Company, while being responsive to regulatory concerns and compensation best practices. For 2013 the key compensation decisions made by the CEDC included:

| · | Continuing to adjust our NEOs’ compensation relative to data in compensation surveys and the compensation paid to executives at the Comparator Companies. In 2011, after the acquisition of the Gas Companies, the CEDC saw market data that seemed to call for significant increases, questioned whether the market increases were a one-year phenomenon or would persist, and decided at that time to bring the NEOs’ compensation to median over the three-year period ending in 2013, instead of all at once. In light of this, NEO compensation for 2013 was determined to be set appropriately based on the CEDC’s analysis of the market data and trends; |

| · | Authorizing the payment of short-term incentive awards at 138.3% of target, based on actual 2013 performance that exceeded target; |

| · | Awarding shares equal to 115.6% of the target number of shares based on performance under the 2011-2013 long-term performance share grants against established goals; |

| · | Granting equity-based performance shares for the 2013-2015 performance period. As with previous three-year cycles, the CEDC determined that it was appropriate to measure performance for incentive payout based on Company Net Income and TSR; |

| · | Continuing use of a comparator group of energy services companies comparable in size and business mix to use as benchmarks for compensation; |

| · | Formalizing an anti-hedging policy for directors, officers and employees who receive stock-based compensation; |

| · | Amending and restating the 2008 Stock and Incentive Compensation Plan. |

Compensation Philosophy and Objectives

Our compensation philosophy is to offer our NEOs a total compensation package that is equal to or near the median (middle) of the comparable market levels for their positions and is designed to reward achievement of specific, challenging goals that we have tied to our business strategy. To that end, a significant percentage of each NEO’s compensation is “at risk” and can vary with the Company’s short- and long-term financial performance to encourage superior performance and business achievement. We achieve this through a mix of base salary, performance-based annual short-term and long-term incentives and benefits and perquisites, which are discussed more fully below.

We believe that the structure of our compensation program rewards the practice of our core values and the achievement of both short-term and long-term objectives, which in turn creates value for our shareowners. The goals we set for our NEOs reflect that belief.

We also believe that compensation should:

| · | Balance risk and reward; |