UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF THE SHAREOWNERS

| | |

Date: | | May 15, 2012 |

| |

Time: | | 10:00 a.m. |

| |

Place: | | Quinnipiac University School of Law Center – Grand Courtroom 275 Mount Carmel Avenue Hamden, Connecticut 06518 |

Matters to be voted on:

| 2. | Ratification of the selection of PricewaterhouseCoopers LLP as UIL Holdings Corporation’s independent registered public accounting firm for 2012. |

| 3. | Non-binding advisory vote on the compensation of named executive officers. |

| 4. | Any other matters properly brought before the shareowners at the annual meeting or any adjournment of the annual meeting. |

UIL Holdings Corporation is pleased to utilize the U.S. Securities and Exchange Commission rules that allow companies to furnish their proxy materials over the Internet. As a result, we are mailing to most of our shareowners a Notice of Internet Availability of Proxy Materials (the “Notice”). Those shareowners will receive the Notice instead of a paper copy of our proxy statement, proxy card, the 2011 Annual Report on Form 10-K and the Shareowner Letter. The Notice contains instructions on how to access those documents over the Internet and request a paper copy of our proxy materials. All shareowners who do not receive a Notice will receive a paper copy of the proxy materials by mail. We believe that this process allows us to provide shareowners with the information they need in a timely manner while reducing the environmental impact, and lowering the costs, of printing and distributing our proxy materials.

You can vote your shares of common stock at the Annual Meeting of the Shareowners if our records show that you owned the shares on March 12, 2012. If shares are held in the name of a broker, trust, bank, or other nominee, you should bring with you a statement, proxy or a letter from the broker, trustee, bank or nominee confirming your beneficial ownership of the shares as of March 12, 2012. Please remember that brokers may no longer vote your shares on the election of directors in the absence of your specific instructions as to how to vote, so we encourage you to provide instructions to your broker regarding the voting of your shares.

If you plan on personally attending the Annual Meeting of the Shareowners, you will be asked to verify that you are a shareowner by presenting an attendance ticket (attached to your proxy card) or the Notice, together with a proper form of identification. Cameras, recording devices and other electronic devices including telephones or other devices with photographic capability should not be used during the meeting and are subject to confiscation. For the safety of attendees, all bags, packages, and briefcases are subject to inspection. Your compliance is appreciated.

Whether you plan to attend the Annual Meeting of the Shareowners or not, please vote as soon as possible. You may vote your shares via a toll-free telephone number or over the Internet. If you received a proxy card, please complete, sign, date and promptly return that enclosed proxy card in the postage prepaid envelope provided.

April 5, 2012

|

| By Order of the Board of Directors, |

| SIGRID KUN |

Assistant General Counsel and Corporate Secretary |

YOUR VOTE IS IMPORTANT

In order to save UIL Holdings Corporation the expense of further solicitation to ensure that a

quorum is present at the annual meeting, please return your proxy card promptly - regardless of the

number of shares you own, and regardless of whether you plan to attend the meeting.

Directions to Quinnipiac University appear at the end of the accompanying Proxy Statement.

PROXY STATEMENT

UIL Holdings Corporation (“UIL Holdings” or the “Company”) is mailing either (1) a Notice of its Annual Meeting of the Shareowners, this proxy statement, the accompanying proxy card and the Shareowner Letter, or (2) a Notice of Internet Availability of Proxy Materials (the “Notice”), on or about April 5, 2012, to all of its shareowners who, according to its records, held common stock as of the close of business on March 12, 2012, in connection with the solicitation of proxies for use at the 2012 Annual Meeting of the Shareowners (the “Annual Meeting”). The Annual Meeting will be held on Tuesday, May 15, 2012 at 10:00 a.m. at Quinnipiac University, School of Law Center – Grand Courtroom, 275 Mount Carmel Avenue, Hamden, Connecticut 06518, for the purposes listed in the accompanying Notice of Annual Meeting of the Shareowners.

UIL Holdings is making this solicitation, and it will bear the expense of printing and mailing proxy materials to shareowners. UIL Holdings will ask banks, brokers and other custodians, nominees and fiduciaries to send proxy materials to beneficial owners of shares and to secure their voting instructions, if necessary, and UIL Holdings will reimburse them for their reasonable expenses in so doing. Directors, officers and employees of UIL Holdings may also solicit proxies personally or by telephone, but they will not be specifically compensated for soliciting proxies. UIL Holdings has retained Okapi Partners of New York, New York, at a cost to UIL Holdings of $10,000 plus expenses, to aid in the solicitation of proxies by similar methods.

SHAREOWNERS ENTITLED TO VOTE

At the close of business on March 12, 2012, the record date for the Annual Meeting, 50,646,448 shares of UIL Holdings common stock were outstanding. Owners of all outstanding shares of common stock will be entitled to vote at the meeting, each share being entitled to one vote, on each matter coming before the meeting as listed in the accompanying Notice of Annual Meeting of the Shareowners. In accordance with UIL Holdings’ bylaws, the President will appoint inspectors of proxies and tellers to count all votes on each matter coming before the meeting.

Shareowners who are participants in Investors Choice, a Dividend Reinvestment & Direct Stock Purchase and Sale Plan (the “Plan”) for the shares of UIL Holdings common stock, will, upon request, receive a Notice and proxy card that cover the shares held in their accounts under the Plan.

If you properly return a proxy card, in accordance with the instructions listed on the Notice or proxy card, then the shares covered by that proxy card:

| | • | | will be voted or not voted, in accordance with the instructions you give on the proxy form, to elect as Directors for the ensuing year the nine persons named in this proxy statement, or any other person(s) that the present Board of Directors name(s) as a substitute nominee if one or more of the nine persons named is unable to serve; |

| | • | | will be voted for or against, or not voted, in accordance with the instructions you give on the proxy card, with respect to the proposal to ratify the retention of PricewaterhouseCoopers LLP as UIL Holdings’ independent registered public accounting firm for fiscal year 2012; |

| | • | | will be voted for or against, or not voted, in accordance with the instructions you give on the proxy card, with respect to the proposal to approve, by non-binding advisory vote, the compensation of the named executive officers; and |

| | • | | will be voted in the discretion of the person(s) designated as proxies on the proxy card with respect to other matters, if any, which come before the meeting. UIL Holdings is not aware of any other matters to be presented at the meeting. |

You may revoke your proxy at any time prior to its use. In order to revoke your proxy, you must send a written notice of revocation or another properly signed proxy card bearing a later date to UIL Holdings’ Corporate Secretary. If you attend the Annual Meeting in person, you may, if you wish, vote by ballot at the Annual Meeting. If you do vote by ballot at the Annual Meeting, then any proxy you previously submitted will be cancelled.

1

Under Connecticut law and UIL Holdings’ bylaws, shareowners holding a majority of the shares of outstanding common stock will constitute a quorum for purposes of considering and acting upon the matters listed in the accompanying Notice of Annual Meeting of the Shareowners.

Under Connecticut law and UIL Holdings’ bylaws, assuming that a quorum is present at the meeting, directors will be elected by a plurality of the votes cast at the meeting. Withholding authority to vote for a director nominee will not prevent that director nominee from being elected. Cumulative voting for directors is not permitted under Connecticut law unless a corporation’s certificate of incorporation provides for cumulative voting rights. UIL Holdings’ certificate of incorporation does not provide for cumulative voting rights.

Under Connecticut law and UIL Holdings’ bylaws, assuming that a quorum is present at the meeting, the proposal to ratify the Audit Committee’s selection of PricewaterhouseCoopers LLP as UIL Holdings’ independent registered public accounting firm will be approved if the votes cast in favor of this action exceed the votes cast against it. Proxies marked to abstain from voting with respect to this action will not have the legal effect of voting against it.

Householding Information

We have adopted a procedure approved by the U.S. Securities and Exchange Commission (the “SEC”) called “householding.” Under this procedure, shareowners of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our proxy statement, Annual Report on Form 10-K and Shareowner Letter, unless one or more of the shareowners at that address notifies us that they wish to continue receiving individual copies. We believe this procedure provides greater convenience to our shareowners and saves money by reducing our printing and mailing costs and fees.

If you and other shareowners of record with whom you share an address and last name currently receive multiple copies of our proxy statement, Annual Report on Form 10-K and Shareowner Letter and would like to participate in our householding program, please contact Broadridge by calling toll-free at 800-542-1061, or by writing to Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, New York 11717. Alternatively, if you participate in householding and wish to revoke your consent and receive separate copies of our proxy statement, Annual Report on Form 10-K and Shareowner Letter, please contact Broadridge Financial Solutions, Inc. as described above.

A number of brokerage firms have instituted householding. If you hold your shares in street name, please contact your bank, broker or other holder of record to request information.

PRINCIPAL SHAREOWNERS

In statements filed with the SEC, the entities identified in the table below have disclosed beneficial ownership of shares of UIL Holdings common stock as shown in the table. None of the entities identified in the table has acknowledged that it has acted, or is acting, as a partnership, limited partnership or syndicate, or as a group of any kind for the purpose of acquiring, holding or disposing of UIL Holdings common stock.There is no other person or group of persons known to UIL Holdings to be the beneficial owner of more than five percent of the shares of UIL Holdings common stock as of the close of business on March 12, 2012.

2

The percentage shown in the right-hand column is calculated based on the 50,646,448 shares of UIL Holdings common stock outstanding as of the close of business on March 12, 2012.

| | | | | | |

Title of Class | | Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial

Ownership | | Percent of Class |

Common Stock | | BlackRock, Inc. 40 East 52nd Street New York, NY 10022 | | 4,562,782(1) | | 9.01% |

Common Stock | | Deutsche Bank AG Theodor-Heuss-Allee 70 60468 Frankfurt am Main Federal Republic of Germany | | 4,160,287(2) | | 8.21% |

Common Stock | | The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 | | 2,745,226(3) | | 5.42% |

| (1) | Based upon information provided in Amendment No. 3 to Schedule 13G filed by BlackRock, Inc. with the SEC on February 9, 2012. BlackRock, Inc. has sole voting power and sole dispositive power with respect to 4,562,782 shares. The Amendment to Schedule 13G notes that various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the reported shares. No one person’s interest in said shares exceeds five percent of the Company’s total outstanding shares of common stock. |

| (2) | Based upon information provided in Amendment No. 1 to Schedule 13G filed by Deutsche Bank AG with the SEC on February 10, 2012, Deutsche Bank AG has sole voting power with respect to 293,582 shares and sole dispositive power with respect to 4,160,287 shares. |

| (3) | Based upon information provided in the Schedule 13G filed by The Vanguard Group, Inc. with the SEC on February 9, 2012. The Vanguard Group, Inc. has sole voting power with respect to 77,577 shares and sole dispositive power with respect to 2,667,649 shares. |

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Unless you instruct otherwise on the proxy card, shares to which the signed and returned form relates will be voted in favor of the persons listed below for election as directors of UIL Holdings. Although UIL Holdings knows of no reason why any of the persons listed below will be unable to serve as a director, if that should occur, your shares will be voted for any other person that the present Board of Directors of UIL Holdings (the “Board of Directors” or the “Board”) names as a substitute nominee. All of the nominees listed below were elected as Directors at the 2011 Annual Meeting of the Shareowners. The Board has set the number of directors who constitute the entire Board at nine.

UIL Holdings’ criteria for directors are discussed in its Corporate Governance Guidelines, a copy of which is provided on pages 11 to 16 of this proxy statement. Consistent with these guidelines, all of the nominees listed below have a reputation for integrity, sound judgment, respect for others, courage of their convictions, and the ability to communicate effectively. All of the nominees have also stated that they have the time and commitment to meet their responsibilities as members of the Board. As a whole, the Board reflects diversity of gender, background and experience. The Board has determined that certain areas of experience are key to the composition of the Board as a whole: leadership experience, finance experience, and energy industries experience, including electricity and gas, and utility/public policy experience. Biographical information is provided for each nominee. The stated age of each director nominee will be his or her age at May 15, 2012. Experience in these key areas is summarized for each nominee below.

Leadership experience: Directors must have the ability to comprehend, evaluate and prioritize significant strategies, and to exercise oversight over their implementation. Directors with experience in leadership positions, particularly as executive officers or directors of publicly held companies, will have experience with the identification of enterprise risks, development and implementation of solutions, and serving as the leaders of coordinated efforts. This experience is important to UIL Holdings’ evaluation and successful implementation of its operating strategies and its initiatives for future growth.

3

Finance experience: Finance experience, including experience with capital markets, accounting, audit, budgets and financial reporting, is important to all directors, and is particularly important to directors serving on the Audit Committee. UIL Holdings’ electric and gas utility subsidiaries plan extensive capital programs over the next decade. Finance experience contributes to a director’s oversight of UIL Holdings’ internal control environment, financial accounting and reporting, capital structure and financing of cash requirements.

Energy industry experience: UIL Holdings’ electric and gas utility subsidiaries’ core businesses are in the energy industry, which has experienced significant structural and technological changes, with the pace of such changes expected to continue or increase in the future. Experience in the energy industry contributes to a director’s evaluation of UIL Holdings’ long- and short-term objectives, assessment of future developments that may impact UIL Holdings strategically and operationally, and such director’s work on the Board’s committees.

Utility/public policy experience: UIL Holdings’ utility subsidiaries deliver electricity and gas to residents and businesses located in each utility’s franchise area, and are subject to state regulation of electric and gas distribution rates and federal regulation of electric transmission, as applicable. UIL Holdings’ subsidiaries also engage in other cost of service-based activities, including cost of service generation investments. A director’s experience with governmental entities, including regulatory agencies, as well as the overall ratemaking process and a utility’s public service obligations to provide reliable service, can assist the director in monitoring the achievement of UIL Holdings’ objectives and the director’s understanding of the environments in which UIL Holdings does its business, the operational and financial considerations relevant to ratemaking, and UIL Holdings’ ability to earn a fair return on invested capital.

Thelma R. Albright, 65, Former President, Carter Products Division, Carter-Wallace, Inc., Cranbury, New Jersey. Director of UIL Holdings since 1995.

Carter-Wallace, Inc. is a consumer and healthcare products manufacturer. Currently, director, UIL Holdings Corporation and Church and Dwight, Inc. Former director of Imagistics, Inc. Ms. Albright holds a bachelor’s of arts degree from Marian University, and an MBA from the University of Central Missouri.

Director Qualifications in Key Areas:

| • | | Leadership experience – former president of a division of an international consumer products company; current and former director of publicly held companies and current Chair of the Executive Compensation Committee of a publicly held company; former chair of UIL Holdings’ Compensation and Executive Development Committee. |

| • | | Finance experience – managed finance, sales, marketing and research and development for a consumer products division of a publicly held company. Prior and current service on UIL Holdings’ Audit Committee and Retirement Benefits Plans Investment Committee; |

Arnold L. Chase, 60, Member of the Board of Directors and President, Gemini Networks, Inc. and Executive Vice President, Chase Enterprises, Hartford, Connecticut. Director of UIL Holdings since 1999. Current Retirement Benefits Plans Investment Committee Chair.

Gemini Networks, Inc. and Chase Enterprises are privately owned investment holding companies. Also, director, UIL Holdings Corporation, Connecticut Public Broadcasting, Inc. and Talcott Mountain Science Center. Also, member of the Hartford Carousel Committee. Mr. Chase holds a bachelor’s of science in business administration degree from Babson College.

Director Qualifications in Key Areas:

| • | | Leadership experience – current principal of two investment holdings companies; former managing director of a telecommunications company; current Chair of UIL Holdings’ Retirement Benefits Plans Investment Committee; former President, New England Weather Service; current and former director of publicly held companies. |

| • | | Finance experience – current Chair of UIL Holdings’ Retirement Benefits Plans Investment Committee; prior service on the audit committee of a publicly held bank corporation. |

4

| • | | Utility/public policy experience – Current President of a telecommunications company; former President and managerial positions with communication companies. |

Betsy Henley-Cohn, 59, Chairperson of the Board of Directors and Chief Executive Officer, Joseph Cohn & Son, Inc., North Haven, Connecticut. Director of UIL Holdings since 1989.

Joseph Cohn & Son, Inc. is a construction sub-contracting business operating in New England. Also, director, UIL Holdings Corporation. Former Chairwoman and CEO of BIW Limited, a water utility holding company whose utility assets are now primarily a part of the South Central Connecticut Regional Water Authority. Former director of Society for Savings, First Bank, The Aristotle Corporation and Citizens Bank of Connecticut. Ms. Henley-Cohn holds a bachelor’s degree from Hampshire College and has an MBA from Simmons College.

Director Qualifications in Key Areas:

| • | | Leadership experience – Chairwoman of a construction sub-contracting company; former Chairwoman of a publicly held water utility holding company; former director of several publicly held companies; former Chair of UIL Holdings’ Corporate Governance and Nominating Committee. |

| • | | Finance experience – former chair of the audit committees of publicly held companies; prior and current service on UIL Holdings’ Audit Committee and Retirement Benefits Plans Investment Committee |

| • | | Utility/public policy experience – former Chairwoman of regulated water utility; experience in ratemaking proceedings. |

Suedeen G. Kelly, 60, Partner, Patton Boggs L.L.P., Washington, D.C. Director of UIL Holdings since 2011.

Co-chair of the public policy and regulatory department at law firm. Currently, director of Chesapeake Midstream Partners and Tendril. Also, director, UIL Holdings Corporation. Former Commissioner of the Federal Energy Regulatory Commission. Former professor of law, University of New Mexico School of Law. Former Chairwoman, New Mexico Public Service Commission. Ms. Kelly holds a bachelor’s degree from the University of Rochester and has a J.D., cum laude, from the Cornell Law School.

Director Qualifications in Key Areas:

| • | | Leadership experience – current co-chair of law firm department; former Commissioner of federal agency; former Chairwoman, state public service commission; current director and chair of compensation committee of publicly held gas gathering company. |

| • | | Finance experience – review and decision-making on federal agency cases involving electric and natural gas wholesale markets and interstate transmission; author of publications on electricity rates; current service on UIL Holdings’ Retirement Benefits Plans Investment Committee. |

| • | | Utility/public policy experience – former Commissioner of federal energy agency; former Chairwoman of state public service commission; former professor of energy law and public utility regulation; author of publications on energy law and policy. |

John L. Lahey, 65, President, Quinnipiac University, Hamden, Connecticut. Director of UIL Holdings since 1994. Non-Executive Chair of UIL Holdings since 2010. Current Executive Committee Chair.

Quinnipiac University is a private, coeducational university with 5,900 undergraduate and 2,000 graduate students. Also, Trustee Yale New Haven Hospital. Director, UIL Holdings Corporation, The NYC Saint Patrick’s Day Parade, Inc., Standard Security Life Insurance Company of New York and the Independence Holding Company. Former director of The Aristotle Corporation. Dr. Lahey holds bachelor’s and master’s degrees from the University of Dayton, a master’s degree from Columbia University, and a Ph.D. from the University of Miami.

Director Qualifications in Key Areas:

| • | | Leadership and finance experience – Current President of a university; current trustee of a health care system; current director of an insurance company; former Chair of UIL Holdings’ Compensation and Executive Development Committee; current chair of UIL Holdings’ Executive Committee. |

| • | | Utility/public policy experience – Experience with Connecticut governmental entities through his work as a university President. |

5

Daniel J. Miglio, 71, Former Chairman, President and Chief Executive Officer of Southern New England Telecommunications Corporation (SNET) and The Southern New England Telephone Company, New Haven, Connecticut. Director of UIL Holdings since 1999. Current Corporate Governance and Nominating Committee Chair.

SNET and The Southern New England Telephone Company were previously independent telecommunications companies and are now part of AT&T. Currently, director, UIL Holdings Corporation and Yale-New Haven Health Services Corporation. Mr. Miglio holds a bachelor’s of science degree in economics from the Wharton School at the University of Pennsylvania.

Director Qualifications in Key Areas:

| • | | Leadership experience – former Chairman and CEO of a publicly held company; former chair of a national industry association; current Chair of UIL Holdings’ Corporate Governance and Nominating Committee; former Chair of UIL Holdings’ Compensation and Executive Development Committee. |

| • | | Finance experience – former CFO of a publicly held company; former Chair of UIL Holdings’ Audit Committee and service on audit committees of other publicly held and not-for-profit corporations. |

| • | | Utility/public policy experience – former President, officer responsible for regulatory and government relations and operations manager of a regulated public utility. |

William F. Murdy, 70, Chairman of the Board of Directors of Comfort Systems USA, Houston, Texas. Director of UIL Holdings since 2001. Current Compensation and Executive Development Committee Chair.

Comfort Systems USA is a national heating, ventilation, air conditioning and related services company serving the commercial and industrial markets. Also, director, UIL Holdings Corporation, Kaiser Aluminum, Paramount Construction, the Thayer Hotel, and Compact Power Equipment Company. Also, advisory director of private equity firms CapStreets and Chicago Growth Partners. Member, National Board and Executive Committee of Business Executives for National Security, Chairman of Warrior Gateway, the Board of Trustees Emeritus of the Association of Graduates of West Point, and the Corporate Council of the Vietnam Veterans Memorial. Mr. Murdy holds a bachelor’s of science degree from West Point and an MBA from Harvard.

Director Qualifications in Key Areas:

| • | | Leadership and finance experience – Current Chairman and former CEO of a publicly held company; current director of other publicly held companies; former CEO of five large companies; former managing partner of a venture capital firm; former officer in the United States Army; current Chair of UIL Holdings’ Compensation and Executive Development Committee. |

| • | | Finance experience – current member of UIL Holdings’ Audit Committee. |

| • | | Energy experience – current Chairman and former CEO of a national heating, ventilation, and air conditioning company; former director of a public oil and gas exploration and production company; former officer of a gas company. |

Donald R. Shassian, 56, Executive Vice President and Chief Financial Officer of Frontier Communications, Stamford, Connecticut. Director of UIL Holdings since 2008. Current Audit Committee Chair.

Frontier Communications is a full-service communications provider of voice, high-speed internet, satellite video, wireless internet data access, data security solutions, bundled offerings, specialized bundles for small business and home offices, and advanced business communications for medium and large businesses in 27 states. Also, Director, UIL Holdings Corporation. Certified Public Accountant. Former senior vice president and chief financial officer of Southern New England Telecommunications Corporation. Former partner-in-charge of the Arthur Andersen telecommunications industry practice in North America. Mr. Shassian holds a bachelor’s degree in business administration from Bucknell University.

Director Qualifications in Key Areas:

| • | | Leadership and finance experience – current and former executive positions at publicly held telecommunications companies; former audit and advisory partner at an accounting firm with specialization in the telecommunications industry; current Chair of UIL Holdings’ Audit Committee and member of the Retirement Benefits Plans Investment Committee; Certified Public Accountant. |

| • | | Utility/public policy experience – executive positions at rate regulated companies; experience with ratemaking proceedings. |

6

James P. Torgerson, 59, President and Chief Executive Officer, UIL Holdings Corporation and Chairman and Chief Executive Officer, The United Illuminating Company, New Haven, Connecticut. Director of UIL Holdings since 2006.

Former President and Chief Executive Officer, Midwest Independent Systems Operator, Inc. Current Trustee and Vice-Chairman of St. Raphael’s Healthcare System. Also, Chairman, Regional Economic Xcelleration and Connecticut Institute for the 21st Century, Vice Chairman, Connecticut Business and Industry Association, Board member, Edison Electric Institute and Trustee, Foundation for the Advancement of Catholic Schools, American Gas Association and member of the Fairfield Business Council. Mr. Torgerson holds a bachelor’s of business administration in accounting from Cleveland State University.

Director Qualifications in Key Areas:

| • | | Leadership, energy industry and utility experience – current CEO of UIL Holdings; former CEO of independent transmission system operator; experience in operations and ratemaking at regulated electric and gas utilities. |

| • | | Finance experience – former chief financial officer of regulated utilities and independent transmission system operator. |

VOTE REQUIRED FOR APPROVAL

Under Connecticut law and UIL Holdings’ bylaws, assuming that a quorum is present at the Annual Meeting, directors will be elected by a plurality of the votes cast at the meeting. Withholding authority to vote for a director nominee will not prevent that director nominee from being elected. Cumulative voting for directors is not permitted under Connecticut law unless a corporation’s certificate of incorporation provides for cumulative voting rights. UIL Holdings’ certificate of incorporation does not provide for cumulative voting. Please remember that brokers may no longer vote your shares on the election of directors in the absence of your specific instructions as to how to vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF THIS PROPOSAL CONCERNING THE ELECTION OF DIRECTORS.

INFORMATION REGARDING THE BOARD OF DIRECTORS

During 2011, the Board held 11 meetings. The average attendance record of the directors was 99% for meetings of the Board of Directors and its committees held during 2011. The Board expects that directors will attend the annual meetings of the shareowners. All the members of the Board of Directors attended the 2011 Annual Meeting of the Shareowners held on May 10, 2011.

Mr. Lahey has served as the Non-executive Chair of the Board of Directors since May 2010 and has presided over the executive sessions of the Board. The responsibilities adopted by the Board of Directors as they relate to the Non-executive Chair are included in the Corporate Governance Guidelines of UIL Holdings and described below in this proxy statement.

Board Leadership Structure

The Company’s bylaws allow flexibility to separate or consolidate the positions of Chairman of the Board and Chief Executive Officer (“CEO”), as the Board may determine to be appropriate at a given time to support the effective governance and functioning of the Board and the Company. UIL Holdings has had a Non-executive Chair of the Board since October 2006. The Board has determined that this is the appropriate leadership structure for the Company at this time. The Non-executive Chair and the CEO have complementary roles. The Non-executive Chair leads the Board, and works to assure that the Board meets its responsibilities, particularly in effective oversight, including oversight of senior management’s assessment and management of the Company’s enterprise risk. The CEO manages the day-to-day business of the Company and is the primary point of communication with shareowners and professionals active in the financial markets, such as Wall Street analysts.

Director Diversity

The Board recognizes the benefit of having directors who reflect differing individual attributes, to contribute to the Board’s discussion, evaluation and decision-making. The Board does not have a specific policy regarding diversity. However, in evaluating directors and director nominees, the Corporate Governance and Nominating Committee considers diversity in the context of a breadth of experience, thought and expertise, as well as gender and racial diversity.

7

Risk Assessment

The Board has determined that it should address enterprise risk at least quarterly, and from time to time in the evaluation of proposed Board actions. In addition, the Board has delegated to Board committees responsibility for the initial evaluation of risk in specific areas in accordance with the areas of responsibility set forth in the committees’ charters, which responsibilities are described below under “COMMITTEES OF THE BOARD OF DIRECTORS.”

Director Independence

The Board of Directors is composed at all times of at least a majority of directors who are independent. As described below, the Board has determined that seven of the Board’s nine director nominees are independent. In accordance with the New York Stock Exchange (“NYSE”) corporate governance standards, all of the members of the Audit Committee, the Compensation and Executive Development Committee and the Corporate Governance and Nominating Committee are independent directors.

The Board has adopted categorical standards to assist it in making the annual affirmative determination of each director’s independence status and these standards, “Standards for Independence of Directors,” are posted on the Company’s website,www.uil.com. A director will be considered “independent” if he or she meets the requirements of the categorical standards and the criteria for independence set forth from time to time in the listing standards of the NYSE.

The Board has evaluated the relationships between each nominee for director (and his or her immediate family members and related interests) and UIL Holdings and its subsidiaries. The Board has affirmatively determined, upon the recommendation of the Corporate Governance and Nominating Committee, that each of the following nominees is independent: Ms. Albright, Ms. Henley-Cohn, Ms. Kelly, Mr. Lahey, Mr. Miglio, Mr. Murdy and Mr. Shassian. The Board has determined that Mr. Chase and Mr. Torgerson do not meet the Company’s independence standards. Mr. Chase is not independent because he has a beneficial interest in the building known as 157 Church Street, at which a wholly-owned subsidiary of the Company is a lessee. Mr. Torgerson is not independent because he is the President and Chief Executive Officer of UIL Holdings.

COMMITTEES OF THE BOARD OF DIRECTORS

Executive Committee

Ms. Henley-Cohn, Mr. Lahey, Mr. Miglio and Mr. Torgerson serve on the Executive Committee of the Board of Directors. Mr. Lahey is the Chair of the Executive Committee. The Executive Committee is a standing committee that has and may exercise all the powers of the Board when the full Board is not in session. The Executive Committee did not hold any meetings during 2011.

Audit Committee

Ms. Albright, Ms. Henley-Cohn, Mr. Murdy and Mr. Shassian serve on the Audit Committee of the Board of Directors. Mr. Shassian is the Chair of the Audit Committee. All members of the Audit Committee are independent as defined in the listing standards of the NYSE. The Audit Committee is a standing committee whose functions include monitoring the integrity of the Company’s financial statements, financial reporting process and systems of internal controls regarding finance, accounting, and compliance with applicable laws, regulations and company policies; monitoring the independence, qualifications, and performance of the Company’s independent auditors and internal audit services and compliance; and providing an open avenue of communication among the independent auditors, financial and senior management, internal audit services and the Board. In consultation with financial and senior management, the independent auditors and internal audit services, the Audit Committee considers the integrity of UIL Holdings’ financial reporting processes and controls, discusses significant financial risk exposures and the steps management has taken to monitor, control and report such exposures, and reviews significant findings of the independent auditors and UIL Holdings’ internal audit services, together with management’s responses to these findings. The Audit Committee also performs other activities consistent with its charter, UIL Holdings’ Bylaws and governing law, such as review of contingent liabilities and risks that may be material to UIL Holdings and discussion of policies with respect to risk assessment and risk management. Each member of the Audit

8

Committee is an Audit Committee financial expert, as defined by the regulations of the SEC. The Audit Committee Charter meets the current requirements of the SEC regulations and the NYSE listing standards. The charter is posted on the Company’s website,www.uil.com and the Company will send a copy, free of charge, to any shareowner who requests it by contacting the Corporate Secretary. The Audit Committee held five meetings during 2011.

Compensation and Executive Development Committee

Ms. Henley-Cohn, Ms. Kelly, Mr. Miglio and Mr. Murdy serve on the Compensation and Executive Development Committee (“CEDC”) of the Board of Directors. Mr. Murdy is the Chair of the CEDC. All members of the CEDC are independent as defined in the listing standards of the NYSE. The CEDC is a standing committee whose functions include the oversight, management and administration of the executive incentive, equity and deferred compensation plans (the “Executive Plans”) of the Company and its subsidiaries; discharging the responsibilities of the Board relating to compensation of Section 16(b) executive officers, which executive officers are determined annually by the Board; discharging the responsibilities of the Board for administration and oversight of the Executive Plans; establishing competitive executive compensation policies and other supplemental compensation and benefit programs, all of which are designed to be internally equitable and externally competitive to attract and retain officers and executives of the highest quality, and to align the interests of such persons with those of the Company’s shareowners and customers; making recommendations to the Board regarding the selection of the Company’s CEO and reviewing the CEO’s nominees for other officers of the Company; evaluating the annual performance of the Company’s CEO; reviewing management development and succession matters; and administering aspects of compensation plans and stock plans and amending or recommending changes in such plans. Additionally, the CEDC is responsible for the initial evaluation of risk in connection with the areas of responsibility set forth in its charter. The CEDC charter is available on UIL Holdings’ website,www.uil.com and the Company will send a copy, free of charge, to any shareowner who requests it by contacting the Corporate Secretary. The CEDC held six meetings during 2011. Additional information about the CEDC and the Company’s compensation-setting process can be found on page 26 of this proxy statement.

Corporate Governance and Nominating Committee

Ms. Albright, Ms. Henley-Cohn, Ms. Kelly and Mr. Miglio serve on the Corporate Governance and Nominating Committee of the Board of Directors. Mr. Miglio is the Chair of the Corporate Governance and Nominating Committee. All members of the Corporate Governance and Nominating Committee are independent as defined in the listing standards of the NYSE. The Corporate Governance and Nominating Committee is a standing committee whose functions include identifying and recommending to the Board for nomination, consistent with the Company’s Corporate Governance Guidelines, individuals qualified to serve as directors of the Company, and recommending to the Board the criteria and qualifications for directors; identifying and recommending to the Board, directors qualified to serve on committees of the Board and to serve as committee chairs; recommending to the Board an appropriate Board leadership structure and identifying and recommending to the Board nominees for Chairman; developing and recommending to the Board and annually reviewing a set of corporate governance guidelines applicable to the Company; evaluating and making recommendations to the Board with respect to the compensation of directors; and overseeing the annual evaluation of Board and committee performance. Additionally, the Corporate Governance and Nominating Committee is responsible for the initial evaluation of risk in connection with the areas of responsibility set forth in its charter. The Corporate Governance and Nominating Committee’s charter is available on UIL Holdings’ website,www.uil.com and the Company will send a copy, free of charge, to any shareowner who requests it by contacting the Corporate Secretary. The Corporate Governance and Nominating Committee held five meetings during 2011.

The Corporate Governance and Nominating Committee does not set specific, minimum qualifications that nominees must meet in order for it to recommend them for election to the Board of Directors, but rather believes that each nominee should be evaluated based on his or her individual merits, taking into account the needs of UIL Holdings and the composition of the Board of Directors. Members of the Corporate Governance and Nominating Committee discuss and evaluate possible candidates in detail, and suggest individuals to explore in more depth. Outside consultants have also been employed at times to help in identifying candidates. Once a candidate is identified whom the Corporate Governance and Nominating Committee wants to seriously consider for nomination, the Chair enters into a discussion with that prospective nominee. The Corporate Governance and Nominating Committee will consider nominees recommended by shareowners. Nominees recommended by

9

shareowners will be given appropriate consideration in the same manner as other nominees. Shareowners who wish to submit the names of nominees for Director for consideration by the Corporate Governance and Nominating Committee for election at the UIL Holdings 2013 Annual Meeting of Shareowners may do so by submitting in writing, between December 1, 2012 and December 31, 2012, the names of such nominees with their qualifications and biographical information forwarded to the Committee in care of the Corporate Secretary.

Retirement Benefits Plans Investment Committee

Ms. Albright, Mr. Chase, Ms. Kelly and Mr. Shassian serve on the Retirement Benefits Plans Investment Committee of the Board of Directors. Mr. Chase is the Chair of the Retirement Benefits Plans Investment Committee. The Retirement Benefits Plans Investment Committee is responsible for carrying out the Board’s duties in connection with the investment and management of assets held on behalf of the funded employee benefits plans and any trusts established in connection with non-qualified deferred compensation plans of the Company and its affiliates. Additionally, the Retirement Benefits Plans Investment Committee is responsible for the initial evaluation of risk in connection with the areas of responsibility set forth in its charter. The Retirement Benefits Plans Investment Committee charter is available on UIL Holdings’ website,www.uil.com and the Company will send a copy, free of charge, to any shareowner who requests it by contacting the Corporate Secretary. The Retirement Benefits Plans Investment Committee, which was previously known as the Finance Committee, held five meetings during 2011.

The following table summarizes the information set forth above regarding the current composition of the committees of the Board.

| | | | | | | | | | |

Name | | Executive

Committee | | Audit

Committee | | Compensation and

Executive Development

Committee | | Corporate Governance

and Nominating

Committee | | Retirement Benefits

Plans Investment

Committee |

Thelma R. Albright | | | | X | | | | X | | X |

Arnold L. Chase | | | | | | | | | | C |

Betsy Henley-Cohn | | X | | X | | X | | X | | |

Suedeen G. Kelly | | | | | | X | | X | | X |

John L. Lahey | | C | | | | | | | | |

Daniel J. Miglio | | X | | | | X | | C | | |

William F. Murdy | | | | X | | C | | | | |

Donald R. Shassian | | | | C | | | | | | X |

James P. Torgerson | | X | | | | | | | | |

C: Chair X: Committee member

TRANSACTIONS WITH RELATED PARTIES AND CODES OF CONDUCT

The United Illuminating Company (“UI”), one of UIL Holdings’ direct subsidiaries, is a 50-50 joint-venturer in GenConn Energy LLC (“GenConn”). UI agreed to lend up to $121.5 million to GenConn under a promissory note. The principal balance of the promissory note of approximately $63 million was converted to an equity investment in July 2011. During 2011, UI recorded $1.2 million of interest income related to the promissory note, which was offset by the interest expense UI incurred to borrow the same amount from its lenders.

Under a lease agreement dated May 7, 1991, UI leased its corporate headquarters offices in New Haven from 157 Church Street, LLC, which is controlled by Arnold L. Chase, a director and shareowner of UIL Holdings, and members of his immediate family. During 2011, UI’s lease payments to 157 Church Street, LLC totaled approximately $11.4 million.

UIL Holdings made contributions of $0.5 million in 2011 to the United Illuminating Company Foundation (the “Foundation”), formed in 1990 by UIL Holdings’ electric utility subsidiary. The Foundation focuses its grants on charities that serve the same communities as those served by UIL Holdings.

UIL Holdings’ Code of Business Conduct for the Board of Directors (the “Director Code”) provides guidance to each director on areas of ethical risk, to help directors recognize and address potential conflicts of interest and other ethical issues to help foster a culture of honesty and accountability. Specifically, the Director Code provides that directors must avoid conflicts of interest with UIL Holdings and requires that any situation that involves, or may

10

reasonably be expected to involve, a conflict of interest must be disclosed promptly to the Non-executive Chair of the Board. The Director Code provides that directors should seek to identify potential conflicts of interest at an early stage. Directors are encouraged to bring questions about particular circumstances that may implicate one or more of the provisions of the Director Code to the attention of the Chair of the Audit Committee or the Chair of the Corporate Governance and Nominating Committee, who may consult with counsel as appropriate.

UIL Holdings’ Code of Ethics for the Chief Executive Officer, Presidents and Senior Financial Officers (the “Officer Code”) establishes policies and procedures that (1) encourage and reward professional integrity in all aspects of the financial organization (2) prohibit and eliminate the appearance or occurrence of conflicts between what is in the best interest of UIL Holdings and what could result in material personal gain for a member of the organization (3) provide a mechanism for members of the financial organization to inform senior management of deviations in practice from policies and procedures governing honest and ethical behavior and (4) demonstrate their personal support for such policies and procedures through periodic communication reinforcing these ethical standards throughout the financial organization.

Officers of UIL Holdings are also subject to UIL Holdings’ general employee Code of Business Conduct (the “Employee Code”), which governs potential conflicts of interest and requires the disclosure of all facts in any situation where a conflict of interest may arise. Copies of the Director Code, Officer Code and the Employee Code are accessible on the Company’s website,www.uil.com.

UIL Holdings discourages transactions involving, or that may be perceived as involving, a conflict of interest, and has historically limited the approval of such transactions to specific and rare instances with the full disclosure to, and approval of, the disinterested members of the Board. Additionally, UIL Holdings requires each director and officer to complete an annual questionnaire that solicits, among other items, specific information about (1) each Board member’s individual affiliations with entities with which UIL Holdings and its executives transact business or have an affiliation, (2) any transaction or series of similar transactions involving UIL Holdings and/or its subsidiaries to which the director or any member of the director’s immediate family has a direct or indirect material interest and (3) each Board member’s involvement in legal proceedings affecting UIL Holdings. UIL Holdings’ management reviews these questionnaires annually during the preparation of disclosures to be included in this proxy statement.

UIL HOLDINGS CORPORATION

CORPORATE GOVERNANCE GUIDELINES

The Board of Directors (the “Board”) of UIL Holdings Corporation (“UIL Holdings” or the “Company”) has adopted the following corporate governance guidelines to assist the Board in the exercise of its responsibilities to serve the best interests of the Company and its shareowners. The Board recognizes that guidelines will not anticipate every situation. Therefore these guidelines are intended to provide a framework, to be applied and interpreted in accordance with applicable laws and regulations and to reflect good corporate governance.

The Board’s Corporate Governance and Nominating Committee reviews these guidelines annually, or more frequently as appropriate, and recommends changes or updates to the Board. The Company makes available these guidelines, its Code of Business Conduct for the Board and its Code of Business Conduct for officers and employees on the Company’s website,www.uil.com. The Company will send copies of any of these documents to any shareowner who requests the documents from the Corporate Secretary.

Primary Responsibilities of the Board of Directors

In accordance with Connecticut law, all UIL Holdings corporate powers are exercised by or under the authority of, and the business and affairs of UIL Holdings are managed by or under the direction of, its Board. All directors are to exercise their responsibilities and promote the best interests of the shareowners, while also enabling UIL Holdings’ utility subsidiaries to fulfill their public service obligations. The Board exercises oversight of the Company’s business, including: review and evaluation of the Company’s financial objectives, major corporate plans and strategies; oversight of the Company’s financial and operational performance; and oversight of the Company’s legal and ethical compliance. The Board has determined that enterprise risk should be addressed by the Board at least quarterly, and in the evaluation of proposed Board actions. In addition, the Board has delegated to Board committees responsibility for the initial identification and evaluation of risk in the areas of responsibility set forth in the committees’ charters.

11

The Board selects the Company’s Chief Executive Officer (“CEO”), acts as an advisor and counselor to the CEO and, through the Non-executive Chair of the Board (“the Non-executive Chair”) and the Compensation and Executive Development Committee, evaluates the CEO’s performance. The Board selects and recommends for approval by UIL Holdings’ shareowners a suitable slate of candidates for membership on the Board.

In fulfilling his or her responsibilities, each member of the Board shall exercise his or her business judgment, in good faith, to act in a manner that the Board member believes to be in compliance with applicable laws and regulations, and in the best interest of UIL Holdings’ shareowners.

Qualifications of Directors; Composition, Size and Election of Board

All directors should have a reputation for integrity, sound judgment, respect for others, courage of their convictions, and the ability to communicate effectively. All directors should have the time and commitment to meet their responsibilities as members of the Board.

The Board as a whole should have members with broad and varied experience, skills, competencies and interests in a wide spectrum of areas to assist the Board in meeting its responsibilities. UIL Holdings has developed the following list of potential areas of experience, skills, competencies and interests to guide the evaluation of potential nominees to the Board: experience in a position of senior leadership in a publicly held corporation; financial expertise; state and federal regulation; the energy industry; energy markets; regulated utilities; government and public policy; audit and compliance; environmental regulation; risk management; and information technology. UIL Holdings also contemplates that individuals may have other specific attributes that may contribute to the Board’s effectiveness. The complement of important director attributes may change depending on developments at the Company, in the gas or electric industry, and in the national and worldwide economies. Individual directors will have different areas of expertise, and the Board also may retain independent advisors to supplement the experience, skills and competencies of the directors for specific situations.

The Board recognizes the benefit of having directors who reflect differing individual attributes, to contribute to the Board’s discussion, evaluation and decision-making. The Board does not have a specific policy regarding diversity. However, in evaluating directors and director nominees, the Corporate Governance and Nominating Committee considers diversity in the context of breadth of experience, thought and expertise, as well as gender and racial diversity.

Under the Company’s bylaws, there may not be more than 12 directors, and the Board determines the appropriate number of directorships at a given time. The entire Board is elected annually. The Corporate Governance and Nominating Committee considers candidates to recommend for nomination or re-nomination to the Board, taking into account the qualifications, attributes and expectations referenced above. In considering whether to recommend that a current director be re-nominated for continued service on the Board, the Corporate Governance and Nominating Committee considers the director’s experience, skills and competencies, the director’s contribution and effectiveness as a member of the Board, as well as the director’s enhancement of his or her effectiveness through education or other programs. The Board considers the Corporate Governance and Nominating Committee’s recommendations and determines the candidates to recommend to the shareowners for election at the annual meeting of shareowners.

The Board will not nominate a director to be a candidate for re-election after his or her seventy-second birthday. The Board will not nominate a director for election to a sixth term unless he or she is the beneficial owner, directly or indirectly, of at least 8,500 shares of UIL Holdings’ common stock. Upon any significant change in his or her primary employment, the director should submit a letter of resignation to the Non-executive Chair, in order that the Corporate Governance and Nominating Committee and the Board can determine whether the director’s continued Board membership is appropriate. If at any time a director may no longer meet the qualifications and expectations for directors, the director should notify the Non-executive Chair in order that the Corporate Governance and Nominating Committee and the Board can determine whether any action is appropriate. Prior to accepting a position to serve as a director of another publicly held corporation, a director shall advise the Non-executive Chair to enable the Corporate Governance and Nominating Committee and the Board to determine whether such service is in conflict with continued service as a director of UIL Holdings.

12

Independence of Directors

At all times a majority of directors shall be independent, as determined in accordance with applicable New York Stock Exchange (“NYSE”) listing standards, the Company’s Standards for Independence of Directors, applicable law and regulation, and such other factors as the Board may deem appropriate. Annually, the Board shall make a determination of whether each director is independent. Only directors deemed by the Board to be independent in accordance with applicable NYSE listing standards, the Company’s Standard’s for Independence of Directors, and applicable law and regulation may serve on the Audit, Compensation and Executive Development, and Corporate Governance and Nominating Committees of the Board.

Board Leadership Structure

The Company’s bylaws allow flexibility to separate or consolidate the positions of chair and CEO, as the Board may determine is appropriate at a given time to support the effective governance and functioning of the Board and the Company. The Non-executive Chair and the CEO have complementary roles. The Non-executive Chair leads the Board, and works to ensure that the Board meets its responsibilities, particularly in effective oversight of management. The CEO manages the business of the Company, including relationships with shareowners and the financial markets.

The Non-executive Chair is elected by the Board, from among the independent directors who are financially literate, to serve a one-year term. The Corporate Governance and Nominating Committee is responsible for evaluating the performance of the Non-executive Chair, and making a recommendation to the Board annually with respect to Board leadership. The Board presently expects that a director will serve as Non-executive Chair for no more than three consecutive one-year terms. However, the Board recognizes that circumstances may cause the Board to determine that having a Non-executive Chair serve for longer than three years may be in the best interest of the Company.

The Non-executive Chair is responsible for the effectiveness of the Board and the Board’s committees, and serves as an advisor to the Company’s CEO. Specific responsibilities include:

| | • | | Establishing with the CEO agendas for Board meetings and assuring that relevant materials are provided to the Board; |

| | • | | Presiding at all meetings of the Board; |

| | • | | Calling and presiding at all executive session meetings of non-management directors or independent directors, and preparing the agenda and approving materials for executive sessions; |

| | • | | Briefing directors and management, as appropriate, about the results of deliberations in executive sessions; |

| | • | | Attending meetings of committees of the Board and consulting with committee chairs, as appropriate, to stay abreast of key issues and enhance committee effectiveness; |

| | • | | Advising the CEO and acting as a liaison between the CEO and other directors; |

| | • | | Facilitating communication among directors and between directors and the Company’s management; |

| | • | | Working with directors to ensure that each director is making a significant contribution to the Board; |

| | • | | Working with the Compensation and Executive Development Committee and the CEO to ensure appropriate succession planning; |

| | • | | Conducting, with the Chair of the Compensation and Executive Development Committee, an assessment of the performance of the CEO. |

13

If the Non-executive Chair is unable to perform his or her responsibilities and so notifies the CEO or the Chair of the Corporate Governance and Nominating Committee, or if there is a vacancy in the position of Non-executive Chair, the Chair of the Corporate Governance and Nominating Committee will temporarily have the responsibilities of the Non-executive Chair, pending other action by the Board as appropriate.

Board Meetings and Operation

The Board’s meeting schedule is developed to enable the Board to meet its responsibilities. The Board has at least four regularly scheduled meetings each year. Special meetings are scheduled as appropriate. The Board expects that each director will attend all meetings of the Board. Attendance at meetings is expected to be in person, although infrequent telephonic attendance is acceptable, provided that the effectiveness of the meetings is not impaired. The Board recognizes that participation of a director may not be possible when meetings need to be scheduled on short notice, and that conflicts may arise from time to time to prevent a director from attending a regularly scheduled meeting. Nonetheless, the Board expects that directors will keep such absences to a minimum. The Board expects that all directors will attend the annual meeting of shareowners.

The Non-executive Chair presides at all meetings of the Board, and establishes with the CEO Board meeting agendas, which are distributed in advance of the meetings, if possible. Directors may suggest inclusion of additional items on the agenda. Directors may also raise at any regular Board meeting subjects for discussion that are not on the formal agenda; however, the desire for inclusion of such items should be communicated to the Non-executive Chair or Corporate Secretary in advance of the meeting, if possible. The Board expects to hold executive sessions of the non-management directors at regularly scheduled meetings and, at least once a year, an executive session of independent directors.

The Non-executive Chair, working with the CEO and the Corporate Secretary, shall ensure that the Board is provided relevant materials that are important to the Board’s exercise of its responsibilities. The Board expects that directors will receive periodic financial reports, analyst reports, and other information designed to keep them informed of significant aspects of the Company’s business performance and prospects. Each member of the Board shall be responsible for carefully reviewing all such material received.

Directors shall have access to the Company’s executive officers and other senior management. The Board expects that management will be present regularly at Board meetings to provide additional insight into the items being discussed and to provide the Board the opportunity to evaluate future management potential. The Board shall also have access to the Company’s counsel and auditors, may retain counsel or other professional advisors of its choice with respect to any issue relating to its activities, and may communicate with the Company’s management on issues, as appropriate.

Board Committees

A substantial amount of the analysis and work of the Board is done by standing Board committees. Each director is expected to participate actively in the meetings of each committee to which the director is appointed.

The Company has the following standing committees:

| • | | Compensation and Executive Development Committee |

| • | | Corporate Governance and Nominating Committee |

| • | | Retirement Benefits Plans Investment Committee |

14

Unless otherwise required by law, regulation or applicable listing standards, each standing committee shall have a minimum of three members. Each standing committee has a charter approved by the Board. Charters of the Audit, Compensation and Executive Development, Corporate Governance and Nominating, and Retirement Benefits Plans Investment Committees are posted on the UIL Holdings website,www.uil.com. Each of these committees reviews its charter annually and recommends changes as appropriate for consideration and action by the Board. Subject to the Company’s bylaws, applicable law, regulation and listing standards, the Board may increase or decrease the number of committees, or appoint ad hoc committees, with the authority specified in the Board’s resolutions creating the committees.

Selection of Committee Members and Committee Chairs: The Corporate Governance and Nominating Committee recommends to the Board the membership and chair of each committee. The Board makes all committee and chair assignments. A committee member may resign without prior notice. The Board may remove a committee member without prior notice to the member.

There are no specific rotation directives. In recommending committee assignments and chairs, the Corporate Governance and Nominating Committee considers: the subject matter expertise and experience of directors; the potential benefits of rotating committee members and chairs, thus providing directors an opportunity to participate in the work of various committees and provide broad experience to the directors and committees; and the potential benefits of directors’ expertise and knowledge of specific areas through continued service on a committee. It is the Board’s policy that the Non-executive Chair shall be the Chair of the Executive Committee, and that the CEO shall be a member of the Executive Committee if he or she is a director. The Non-executive Chair and the CEO are invited to attend meetings of other committees, as appropriate.

Committee Meetings, Agendas and Reports to the Board: The Audit, Compensation and Executive Development, Corporate Governance and Nominating, and Retirement Benefits Plans Investment Committees each have at least four regularly scheduled meetings, and schedule other meetings as necessary to enable the committees to meet the responsibilities in their charters and as otherwise requested by the Board. The Executive Committee does not have regularly scheduled meetings, but is available to meet as necessary. The chair of each committee establishes the agenda for each committee meeting with the assistance of the Company’s management as appropriate, and distributes it in advance of the meeting, if possible. Any director may suggest inclusion of additional items on the agenda. Directors may also raise at any regular committee meeting subjects for discussion that are not on the formal agenda; however, the desire for inclusion of such items should be communicated to the committee chair or the Company’s management in advance of the meeting, if possible. The Board expects that each committee will hold executive sessions of the non-management directors at regularly scheduled meetings as appropriate.

Each committee chair, working with the Company’s management, shall ensure that the committee is provided relevant materials that are important to the committee’s exercise of its responsibilities. Each member of the committee shall be responsible for carefully reviewing all such material received.

Each committee shall report at the next Board meeting on significant matters considered at each committee meeting. At least annually, each committee shall report to the Board on its identification and evaluation of risks associated with the committee’s areas of responsibility. In addition, directors are furnished copies of the minutes of all committee meetings.

COMMUNICATIONS WITH DIRECTORS

In order to provide shareowners and other interested parties with a direct and open line for communication to the independent members of the Board, the Board has adopted the following procedures for confidential communications to directors. UIL Holdings’ shareowners and other interested persons may communicate with the directors of the Company by sending a letter to the following address:

| | | | |

| | Linda L. Randell | | |

| | Senior Vice President, General Counsel, and Chief Compliance Officer |

| | UIL Holdings Corporation |

| | 157 Church Street |

| | New Haven, CT 06506 |

15

All communications received in accordance with these procedures will be reviewed by the Company’s General Counsel to determine whether the subject matter of the communication should be brought to the attention of the independent directors, the non-management directors, the full Board, or one or more of its committees, as well as whether any response to the communication is appropriate. Any such response will be made only in accordance with applicable law and regulations relating to the disclosure of information. The criteria utilized by the General Counsel to guide the handling of the matter will include whether the communication:

| | • | | relates to matters other than the business or affairs of UIL Holdings or the functioning or constitution of the Board or any of its committees; |

| | • | | relates to routine or insignificant matters that do not warrant the attention of the Board; |

| | • | | is an advertisement or other commercial solicitation or communication; and |

| | • | | is frivolous or offensive; or otherwise not appropriate for delivery to directors. |

The Company’s General Counsel will retain copies of all communications received pursuant to these procedures for a period of at least one year. The Corporate Governance and Nominating Committee of the Board will review the effectiveness of these procedures from time to time and, if appropriate, recommend changes.

STOCK OWNERSHIP OF DIRECTORS AND OFFICERS

The following table shows the number of shares of UIL Holdings common stock beneficially owned, directly or indirectly, as of March 12, 2012, by (i) each Director of UIL Holdings (which includes all nominees for the Board of Directors listed above), (ii) the CEO and the Chief Financial Officer of UIL Holdings, and each of the three other most highly compensated persons who are executive officers of UIL Holdings (“Named Executive Officers”) and (iii) the total, as a group, of all of the Directors and executive officers of UIL Holdings serving as of December 31, 2011.

| | | | | | | | | | | | | | | | |

Name of Individual or Number of Persons in Group (2) | | Shares | | | Stock

Options | | | Stock

Units | | | Total Shares

Beneficially

Owned Directly

or Indirectly | |

Thelma R. Albright | | | 30,480 | | | | — | | | | 80,238 | | | | 110,718 | |

Arnold L. Chase (1) | | | 1,013,758 | | | | 7,500 | | | | 18,630 | | | | 1,039,888 | |

Betsy Henley-Cohn | | | 30,687 | | | | — | | | | 11,020 | | | | 41,707 | |

Suedeen G. Kelly | | | 2,775 | | | | — | | | | 28 | | | | 2,803 | |

John L. Lahey | | | 19,491 | | | | — | | | | 41,327 | | | | 60,818 | |

Daniel J. Miglio | | | 30,220 | | | | 7,500 | | | | 17,981 | | | | 55,701 | |

William F. Murdy | | | 6,000 | | | | 7,500 | | | | 58,135 | | | | 71,635 | |

Donald R. Shassian | | | 13,470 | | | | — | | | | — | | | | 13,470 | |

James P. Torgerson | | | 8,692 | | | | — | | | | 156,525 | | | | 165,217 | |

Anthony J. Vallillo | | | 73,905 | | | | — | | | | — | | | | 73,905 | |

Richard J. Nicholas | | | 20,979 | | | | — | | | | 46,361 | | | | 67,340 | |

Linda L. Randell | | | 17,455 | | | | — | | | | 20,303 | | | | 37,758 | |

Robert M. Allessio | | | 869 | | | | — | | | | — | | | | 869 | |

All Directors and executive officers as a group (19 persons) (3) | | | 1,302,995 | | | | 22,500 | | | | 457,570 | | | | 1,783,065 | |

| (1) | The number of shares of common stock beneficially owned by Mr. Chase, as listed in the above stock ownership table, is approximately 2.1% of the 50,646,448 shares of common stock outstanding as of March 12, 2012, adjusted to reflect the additional shares which would be outstanding if Mr. Chase exercised his stock options and right to receive shares of common stock for his stock units. Shares reported as beneficially owned by Mr. Chase include 404,362 shares directly held by Mr. Chase, with respect to which he holds sole voting and investment power; 10,232 shares of restricted stock directly held by Mr. Chase acquired under the Company’s director compensation plans, with respect to which he holds sole voting power; 7,500 shares |

16

| | underlying currently exercisable options granted by UIL Holdings under its director compensation plans and directly held by Mr. Chase; 18,630 shares underlying currently exercisable stock units held by UIL Holdings under its non-employee directors’ plan; 44,166 shares directly held by The Sandra and Arnold Chase Family Foundation, Inc., a charitable foundation of which Mr. Chase serves as a director, president and chief executive officer, and with respect to which he may be deemed to hold shared voting and investment power; 554,500 shares directly held by RLC Investments LLC, of which Mr. Chase is a manager, and with respect to which he may be deemed to hold shared voting and investment power; and 498 shares of common stock held by Mr. Chase as custodian for his non-adult children, with respect to which he holds sole voting and investment power. |

| (2) | The number of shares of common stock beneficially owned by each of the other persons included in the table is less than 1.0% of the outstanding shares of common stock as of March 12, 2012. |

| (3) | The number of shares of common stock beneficially owned by all of the directors and executive officers as a group represents approximately 3.5% of the shares of common stock outstanding as of March 12, 2012, adjusted to reflect the additional shares which would be outstanding if all of the directors and executive officers exercised their stock options and right to receive shares of common stock for their stock units. |

The number of shares listed in the above stock ownership table includes: shares held for the benefit of officers that are participating in the 401(k)/Employee Stock Ownership Plan; shares that may be acquired within sixty (60) days of March 12, 2012 through the exercise of previously granted stock options; and stock units that are in stock accounts under both the UIL Holdings Deferred Compensation Plan and the Non-Employee Directors Common Stock and Deferred Compensation Plan of UIL Holdings, described below under “Director Compensation.” Stock units in these plans are payable in an equivalent number of shares of UIL Holdings common stock.

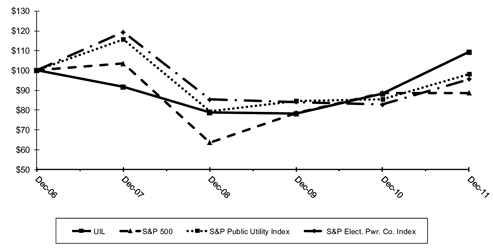

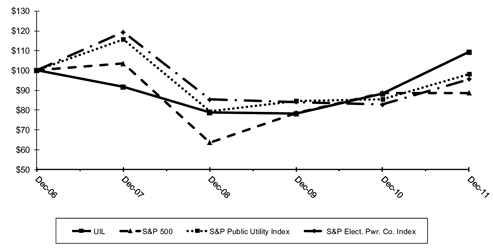

The numbers in the above stock ownership table are based in part on reports furnished by the directors and officers. Mr. Chase does not admit beneficial ownership of any shares other than those shown in the foregoing table, or that he has acted, or is acting, as a member of a partnership, limited partnership or syndicate, or group of any kind for the purpose of acquiring, holding or disposing of UIL Holdings common stock. With respect to other directors and officers, the shares reported in the above stock ownership table include, in some instances, shares held by the immediate families of a director or officer or entities controlled by a Director or officer, the reporting of which is not to be construed as an admission of beneficial ownership. All directors who are serving their sixth or greater term own, directly or indirectly, at least 8,500 shares, or have stock units reflecting deferral of at least 8,500 shares, in compliance with the stock ownership guidelines contained in the Company’s Corporate Governance Standards.