Filed by: UIL Holdings Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: UIL Holdings Corporation

Commission File No.: 001-15052

The following communication was made available to employees of UIL Holdings Corporation on March 26, 2015

QUIKFAX

| | |

| SOURCE: Jim Torgerson – President and CEO | | Please Post |

March 25, 2015

UIL proposed Merger with Iberdrola USA

Frequently Asked Questions Released

As promised and in order to provide employees as much information as possible, attached are frequently asked questions (FAQ’s) that were a result of the employee meetings held on March 5, 2015. The list includes a number of questions that were posed during the event or that came through email. These FAQ’s also reflect concerns that were raised to supervisors and other company representatives since the announcement of this transaction on February 25, 2015.

It is important to note, that decisions related to the future operations or strategic activities of the combined company cannot and have not been made to date. This is not a lack of transparency but is very routine when considering any merger and acquisition deal. There are laws that preclude the companies (Iberdrola USA and UIL) from discussing certain information prematurely. However, once we have the necessary federal and state approvals, much more of the detailed work will begin in earnest.

Obviously, we must and will continue to follow all applicable laws but we also understand the importance of communicating to employees. Our objective will remain focused on providing employees with as much information as we can in a timely manner.

I would encourage all employees to continue doing your daily work. Your commitment to our company, the service we deliver to our customers and the value we provide to our shareowners is paramount and shall remain so.

Thank you for your time and the important work you do for our company.

An important message from Corporate Communications. Please post/distribute this notice. #15-0XX

1

UIL Proposed Merger with IUSA

March 25, 2015

FAQs

General statement: From now until closing, UIL will continue to operate in the normal course and employees should continue to focus on doing the best job they can for our customers.

GENERAL:

| Q: | Why does the company keep saying that UIL is “combining” with Iberdrola USA, rather than Iberdrola USA acquiring UIL? |

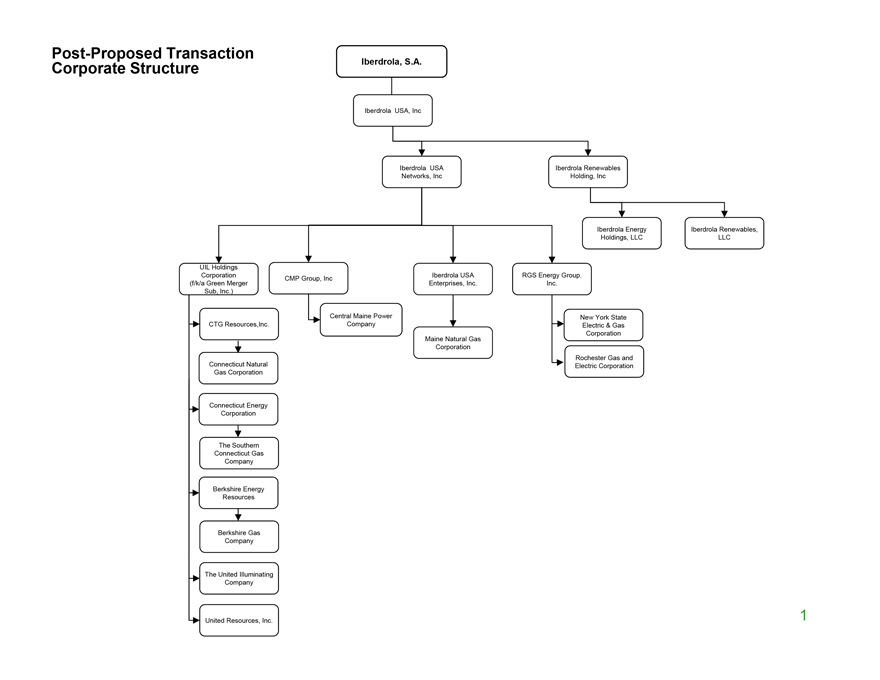

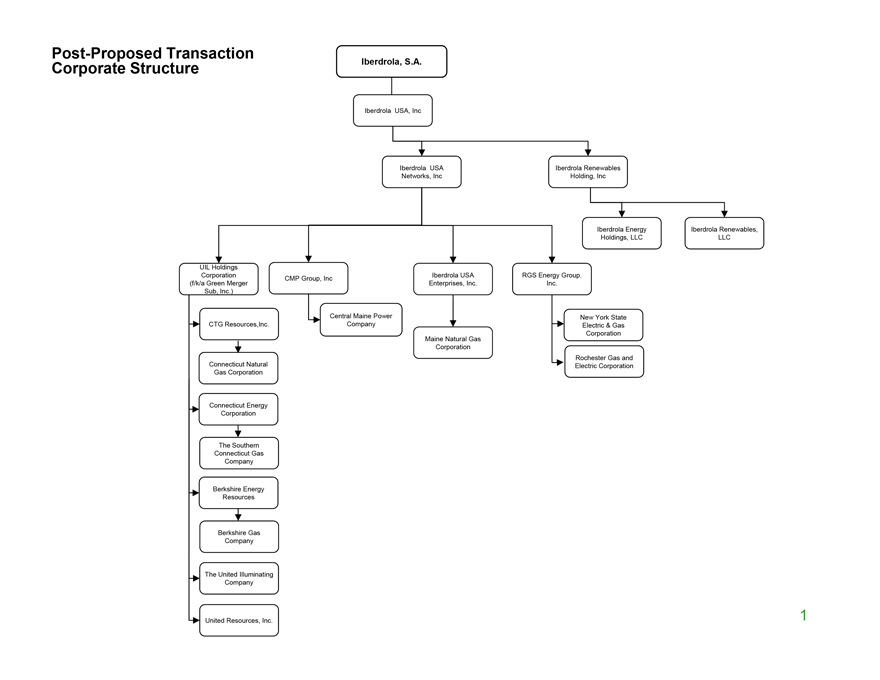

| A: | UIL is merging with a subsidiary of Iberdrola USA that was specifically established to accomplish this transaction. The merger subsidiary will be the surviving entity of the merger and will be renamed UIL Holdings Corporation. Iberdrola USA may then transfer its interests in the new UIL Holdings Corporation to Iberdrola USA Networks, Inc. (Networks), Iberdrola USA’s wholly-owned utility holding company. Networks currently owns four regulated utilities: Central Maine Power Company, Maine Natural Gas Company, New York State Electric & Gas Corporation, and Rochester Gas and Electric Corporation. If the assignment to Networks does not occur, UIL Holdings, as a wholly-owned subsidiary of Iberdrola USA, Inc., will sit alongside Iberdrola USA’s other utility companies, its gas trading and storage business and its renewables operations under Iberdrola USA. See the proposed corporate structure attached to the end of these FAQs. |

| Q: | When will all of this take place? |

| A: | We expect the transaction to close by the end of the year after receiving the various necessary approvals from regulators and shareholders, and satisfaction of other customary closing conditions. |

| Q: | How does the pending merger affect the business of UIL as it is done today? |

| A: | It is business as usual for UIL’s ongoing operations. During the pendency of the merger, UIL and its operating companies will continue to operate their respective businesses in the same manner as they currently operate them. |

| Q: | How will the regulatory standards for each company continue to apply? |

| A: | Each regulated entity will need to continue to adhere to all local regulatory standards and guidelines as each operating company continues to be regulated in its home state. |

| Q: | What has changed with the Iberdrola group since owning the gas companies? |

| A: | The Iberdrola group, through Iberdrola USA, has successfully operated utilities serving millions of customers in Maine and New York. The Iberdrola group (including Iberdrola USA) has also become a major force in renewable generation. Since 2010, UIL has successfully managed the gas companies we purchased from Iberdrola USA. The Iberdrola group has seen the success that UIL has had in managing and growing the gas companies, and is interested in continuing to build on that success. |

| Q: | How will the newly listed public company be structured? How long will the integration of UIL and Iberdrola USA take? |

| A: | Following the merger, UIL will be a direct wholly-owned subsidiary of Iberdrola USA. If Iberdrola USA assigns its interests in the new UIL to Networks following consummation of the transaction, then the new UIL will be an indirect subsidiary of Iberdrola USA and a direct subsidiary of Iberdrola USA’s utility holding company, Iberdrola USA Networks, Inc. Iberdrola USA may be renamed and will become a publicly traded company. Jim will be the CEO of the newly public company after the |

An important message from Corporate Communications. Please post/distribute this notice. #15-0XX

| | closing of the merger. Transition teams will be set up in accordance with the Merger Agreement to ensure Day 1 readiness post-closing. It is too early to say what will happen post-closing in terms of overall company structure, organizational design and business processes. |

| Q: | How will this affect mutual aid? |

| A: | As Jim stated in the February 25, 2015 press release, “[t]he combined company will be able to draw upon even more resources to react and respond to needs in any part of the system, especially in weather emergencies.” The mutual aid process will still be followed in terms of responding to severe weather events. |

| Q: | How can we help to make the transition a success? |

| A: | The transaction is expected to close by the end of 2015, after shareholder and regulatory approvals have all been obtained. Until then, we will operate as separate companies and you should continue to conduct yourselves as though UIL and Iberdrola USA were separate and unrelated. We expect everyone to continue the great work we’ve started at UIL. That means we need to stay 100% focused on safety, reliability and everything we do to keep the lights on and the gas flowing. Our customers count on us every day and our commitment to high quality service must remain unwavering. Simply put, keep a positive attitude that is focused on serving our customers. |

| Q: | Will PURA hold public hearings? |

| A: | Yes, a public hearing is a requirement in connection with the Connecticut regulatory process. |

| Q: | Does Iberdrola have unions? |

| A: | Yes. Iberdrola has unions in Spain and in the U.S. |

| Q: | Will PURA mandated programs run their full course or are they subject to cancellation? |

| A: | PURA mandated programs will continue to run their full course subject to PURA’s review and oversight. |

| Q: | What will happen to UIL values and interests? |

| A: | Iberdrola USA shares UIL’s focus on industry excellence and the safe, reliable and cost efficient delivery of energy. Both companies also have a shared commitment to industry excellence, high-quality customer service and giving back to the communities we serve. In addition, all directors of the newly listed public company will have a fiduciary responsibility to the combined company’s shareholders. |

| Q: | Are there plans to expand gas infrastructure in Maine? |

| A: | If there is an opportunity, the newly listed public company may consider it. |

HR/BENEFITS:

| Q: | Why is Jim’s presentation mainly talking about the benefits for shareowners and not the benefits for employees? What are the benefits for me? |

| A: | Jim’s presentation from March 5th was the same presentation provided to the investment community upon announcement of the transaction. A strong vital company benefits all stakeholders, including employees, most of whom are shareholders as well. |

An important message from Corporate Communications. Please post/distribute this notice. #15-0XX

| Q: | What impact will the proposed transaction have on our jobs, both for current UIL employees as well as open positions? |

| A: | The need for talented employees to deliver electric and gas services in UIL service territories will continue. All union contracts will be honored. |

| Q: | What impact will the proposed merger have on our benefits and overall compensation? |

| A: | Iberdrola USA’s total rewards package is comparable to the UIL total rewards package (compensation, benefits), including elements similar to those offered by UIL. The Merger Agreement provides that total compensation at target and benefits in the aggregate, will be maintained at comparable levels for at least twelve months from the closing date. |

| Q: | Will there be any early retirement package? |

| A: | The Merger Agreement does not address early retirement packages. |

CUSTOMER CARE:

| Q: | How will customer care center employees be affected after the union contract expires in May 2017? |

| A: | All union contracts will be honored, which would include their negotiation at expiration. |

| Q: | Please discuss projected plans for the customer care centers. Will there possibly be layoffs since there are 2 customer care call centers in Maine and New York? |

| A: | The Merger Agreement does not address the customer care centers. |

| Q: | Do you know what was done with the customer care centers of the companies Iberdrola purchased? What are the past practices? Have they outsourced? |

| A: | No, other than with respect to the customer care centers of CNG, SCG and Berkshire, which all remained open after Iberdrola purchased the gas companies from Energy East. The Merger Agreement does not address the customer care centers. |

LEGAL:

| Q: | How did this deal come about? Where there discussions back when Iberdrola sold the gas companies to UIL? |

| A: | A description of the background of the transaction will be included in the proxy statement/prospectus which will be provided to all shareowners before UIL shareowners vote on the transaction and will be publicly available. |

| Q: | What will happen to the UIL name and entity? |

| A: | The surviving merger subsidiary will be renamed UIL Holdings Corporation and will remain a holding company (holding the current UIL subsidiaries) as a subsidiary of Iberdrola, S.A., Iberdrola USA and, potentially, Iberdrola USA Networks, Inc., and become part of the Iberdrola USA group of companies. Iberdrola USA may be renamed, but the new name has not yet been determined. |

An important message from Corporate Communications. Please post/distribute this notice. #15-0XX

| Q: | What are your thoughts about class action lawsuits against the Board of Directors? |

| A: | To date, there have been five lawsuits filed by individual shareholders seeking class-action status. These types of lawsuits are commonly filed in connection with public company merger and acquisition transactions. The directors and officers of UIL believe the lawsuits are without merit. |

| Q: | What are the process steps that we will see as the acquisition moves forward and what is the timeline for those steps? |

| A: | The proposed transaction is subject to various regulatory approvals in Connecticut, Massachusetts and at the federal level, as well as UIL shareholder approval. We are actively working on the approval applications and process and expect the transaction to close by the end of 2015. |

INVESTOR RELATIONS:

| Q: | Please explain how the share transfer will work and what it will mean for UIL shareholders and the future stock price of the stock we will receive in exchange for the UIL shares. Please also explain the impact on pensions and 401ks. |

| A: | As part of the transaction, Iberdrola USA may change its name and will become a newly listed public company. At closing, the newly listed public company will be owned 81.5% by Iberdrola S.A. and 18.5% by the former UIL shareholders. The shares will not be issued in an initial public offering and the merger consideration UIL shareholders will receive is not tied by the Merger Agreement to a particular stock price. At closing, all shares held by UIL shareholders as of the closing date will be exchanged on a one-for-one basis for newly-registered shares of the newly listed public company. The new shares will be listed on the NYSE and will trade post-closing based on investors’ perception of value of the newly listed public company and its projected future prospects, among other factors. |

In addition to the one-for-one share exchange, each UIL shareholder will also receive a $10.50 one-time special cash payment per share of UIL stock owned.

There is no immediate impact on pension and 401ks. UIL shares held in the UIL Stock Fund under the 401k plan will be exchanged just like the shares held by all other UIL shareholders. It has not yet been determined exactly how the additional cash payment will be treated, but it will remain in the plan and will be allocated to participant accounts that are invested in the UIL Stock Fund at the time of the closing.

| Q: | How is Iberdrola USA’s credit rating going to affect UIL’s credit rating? And what does that mean for future borrowing or dividends? |

| A: | Iberdrola USA’s BBB credit rating by Standard & Poor’s is the same as UIL’s current rating of BBB. Moody’s credit rating for Iberdrola USA is Baa1, which is slightly higher than UIL’s current credit rating from Moody’s of Baa2. Standard & Poor’s and Moody’s have each affirmed their credit ratings for UIL and all of its subsidiaries after the announcement of the merger agreement. We would not expect the transaction to decrease the credit ratings for UIL and its subsidiaries or impact future borrowings. In the joint press release of Iberdrola and UIL announcing the transaction, the parties stated that the combined company will initially set its dividend at UIL’s current quarterly dividend of $1.728 per share, and will target a competitive dividend based on a 65% to 75% payout ratio long-term. Dividend payments will be determined by the Board of the newly listed public company just as the UIL Board determines quarterly dividend payments today. |

An important message from Corporate Communications. Please post/distribute this notice. #15-0XX

Important Information For Investors And Shareholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed transaction between UIL Holdings Corporation (“UIL”) and Iberdrola USA, Inc. (“Iberdrola USA”). In connection with the proposed transaction between UIL and Iberdrola USA, Iberdrola USA intends to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, containing a proxy statement of UIL, that will also constitute a prospectus of Iberdrola USA. UIL will mail the proxy statement/prospectus to UIL’s shareholders. UIL AND IBERDROLA USA URGE INVESTORS AND SHAREHOLDERS TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE, AS WELL AS OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Iberdrola USA or UIL may file with the SEC or send to shareholders in connection with the proposed transaction.

You may obtain copies of all documents filed with the SEC regarding this proposed transaction (when available), free of charge, at the SEC’s website (www.sec.gov). Copies of the documents filed with the SEC by UIL are available free of charge on UIL’s website at www.uil.com or by contacting UIL’s Investor Relations Department at 203-499-2409. Copies of the documents filed with the SEC by Iberdrola USA are available free of charge on Iberdrola USA’s website at www.iberdrolausa.com or by contacting Iberdrola’s Investor Relations department at +34917842743.

Participants in Solicitation

UIL and its directors and executive officers, and Iberdrola USA and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of UIL common stock in respect of the proposed transaction. Information about UIL’s executive officers and directors is set forth in UIL’s definitive proxy statement for its 2014 Annual Meeting of Shareholders, which was filed with the SEC on April 3, 2014. Other information regarding the interests of such individuals, as well as information regarding Iberdrola USA’s directors and executive officers, will be set forth in the proxy statement/prospectus, which will be included in Iberdrola USA’s registration on Form S-4 when it is filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this communication regarding matters that are not historical facts, are forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future. Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. In addition, risks and uncertainties related to the proposed transaction with Iberdrola USA include, but are not limited to, the expected timing and likelihood of completion of the pending transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending transaction that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger

An important message from Corporate Communications. Please post/distribute this notice. #15-0XX

agreement, the possibility that UIL’s shareowners may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of UIL’s common stock, and the risk that the proposed transaction and its announcement could have an adverse effect on the ability of UIL to retain and hire key personnel and maintain relationships with its suppliers, and on its operating results and businesses generally.

New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that will be filed with the SEC in connection with the transaction. Additional risks and uncertainties are identified and discussed in our reports filed with the SEC and available at the SEC’s website at www.sec.gov. Forward-looking statements included in this communication speak only as of the date of this communication. Neither UIL nor Iberdrola USA undertakes any obligation to update its forward-looking statements to reflect events or circumstances after the date of this communication.

An important message from Corporate Communications. Please post/distribute this notice. #15-0XX