Filed by Iberdrola, S.A.

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: UIL Holdings Corporation

(Commission File No. 001-15052)

The following slide is from a presentation by Iberdrola, S.A. announcing its nine months ended September 30, 2015 financial results on October 21, 2015.

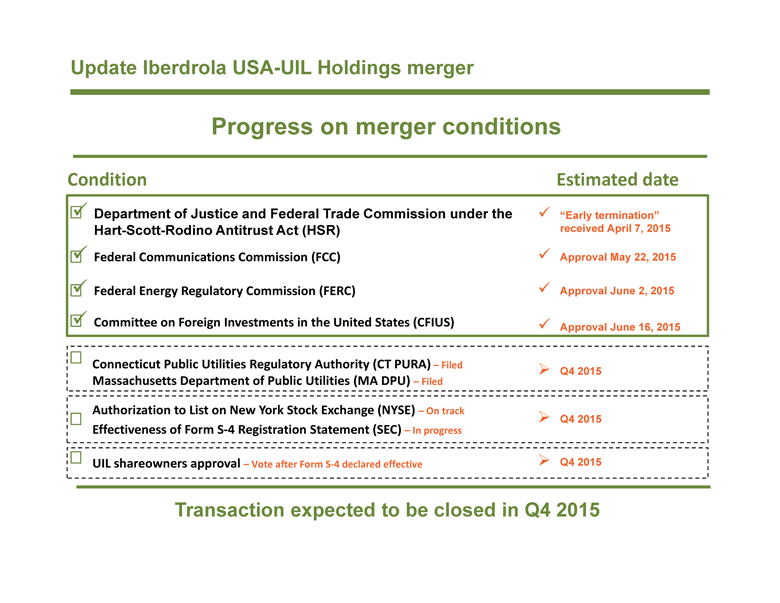

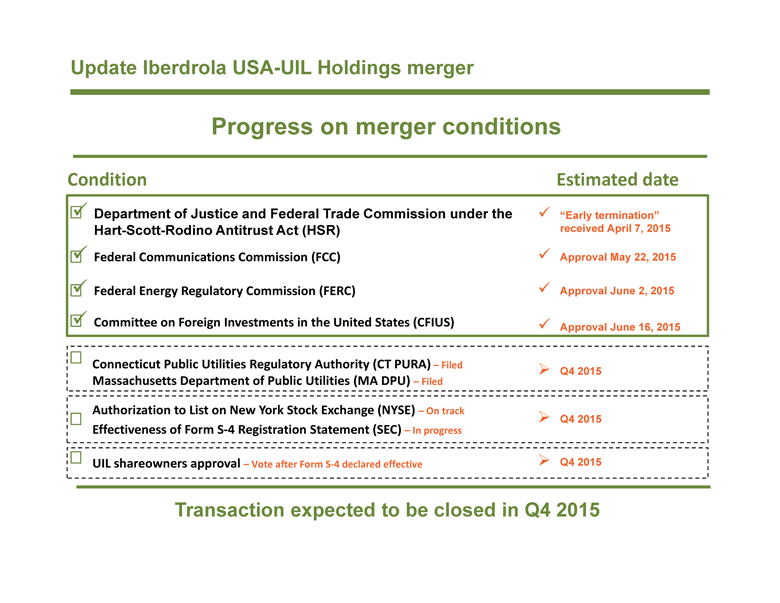

Update Iberdrola USA-UIL Holdings merger

Progress on merger conditions

Condition Estimated date

Department of Justice and Federal Trade Commission under the “Early termination” Hart-Scott-Rodino Antitrust Act (HSR) received April 7, 2015

Federal Communications Commission (FCC) Approval May 22, 2015 Federal Energy Regulatory Commission (FERC) Approval June 2, 2015 Committee on Foreign Investments in the United States (CFIUS) Approval June 16, 2015

Connecticut Public Utilities Regulatory Authority (CT PURA) – Filed

Q4 2015

Massachusetts Department of Public Utilities (MA DPU) – Filed

Authorization to List on New York Stock Exchange (NYSE) –On track

Q4 2015

Effectiveness of Form S-4 Registration Statement (SEC) – In progress

UIL shareowners approval – Vote after Form S-4 declared effective Q4 2015

Transaction expected to be closed in Q4 2015

Additional Information and Where to Find It

Iberdrola USA, Inc. initially filed with the United States Securities and Exchange Commission (“SEC”) on July 17, 2015, a registration statement on Form S-4 containing a proxy statement which will be included as a prospectus, and other documents in connection with the proposed merger. The UIL Holdings Corporation (“UIL”) proxy statement/prospectus will be sent to the shareowners of UIL. Each of Iberdrola USA, Inc. and UIL will be filing other documents regarding the proposed transaction with the SEC.SHAREOWNERS OF UIL ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, AND ANY OTHER FILINGS THAT MAY BE MADE WITH THE SEC IN CONNECTION WITH THE MERGER WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The registration statement and proxy statement/prospectus and other documents which will be filed by Iberdrola USA, Inc. with the SEC, when filed, will be available free of charge at the SEC’s website at www.sec.gov, on Iberdrola USA, Inc.’s website at http://www.iberdrolausa.com or by contacting Iberdrola’s Investor Relations Department. You may also read and copy any reports, statements and other information filed by Iberdrola USA, Inc. and UIL with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at (800) 732-0330 or visit the SEC’s website for further information on its public reference room. Certain executive officers and directors of UIL have interests in the proposed transaction that may differ from interests of shareowners generally, including benefits conferred under retention, severance and change in control arrangements and continuation of director and officer insurance and indemnification. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this communication regarding matters that are not historical facts, are forward-looking statements (as defined in the Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future. Such forward-looking statements are based on our expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. In addition, risks and uncertainties related to the proposed merger with UIL include, but are not limited to, the expected timing and likelihood of completion of the pending merger, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending merger that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed merger in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed merger, and the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Iberdrola USA to retain and hire key personnel and maintain relationships with its suppliers, and on its operating results and businesses generally. New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks, as well as other risks associated with the merger, will be more fully discussed in the joint proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that will be filed with the SEC in connection with the merger. Forward-looking statements included in this communication speak only as of the date of this communication. Iberdrola USA does not undertake any obligation to update its forward-looking statements to reflect events or circumstances after the date of this communication.