UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

| SciQuest, Inc. |

| (Name of registrant as specified in its charter) |

|

|

| (Name of person(s) filing proxy statement, if other than the registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

SciQuest, Inc.

6501 Weston Parkway, Suite 200

Cary, North Carolina 27513

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders,

We invite you to attend SciQuest’s 2012 Annual Meeting of Stockholders at the Company’s headquarters, 6501 Weston Parkway, Suite 200, Cary, NC 27513, on Wednesday, April 25, 2012, at 2:00 p.m. local time. At the meeting, we will:

| | 1. | elect two directors for three-year terms expiring in 2015; |

| | 2. | vote on an advisory resolution regarding the compensation of the named executive officers as disclosed in this proxy statement; |

| | 3. | vote on amendments to the SciQuest, Inc. 2004 Stock Incentive Plan; and |

| | 4. | transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

You can vote at the annual meeting and any adjournment of the meeting if you were a stockholder of record on March 1, 2012. A list of stockholders entitled to vote at the annual meeting will be available for review by our stockholders at our corporate headquarters located at 6501 Weston Parkway, Suite 200, Cary, North Carolina, during ordinary business hours for the 10-day period before the meeting.

A copy of our Annual Report to Stockholders for the year ended December 31, 2011 is enclosed with this Notice. The following proxy statement and enclosed proxy card are being sent to stockholders on and after March 13, 2012.

|

| By order of the Board of Directors, |

|

|

|

Rudy C. Howard |

Secretary and Chief Financial Officer |

Cary, North Carolina

March 13, 2012

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY

MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON APRIL 25, 2012.

Stockholders may access, view and download the 2012 proxy statement and our 2011 Annual Report over the Internet on our website located at www.envisionreports.com/SQI.

SciQuest, Inc.

6501 Weston Parkway, Suite 200

Cary, North Carolina 27513

2012 ANNUAL MEETING OF STOCKHOLDERS

April 25, 2012

PROXY STATEMENT

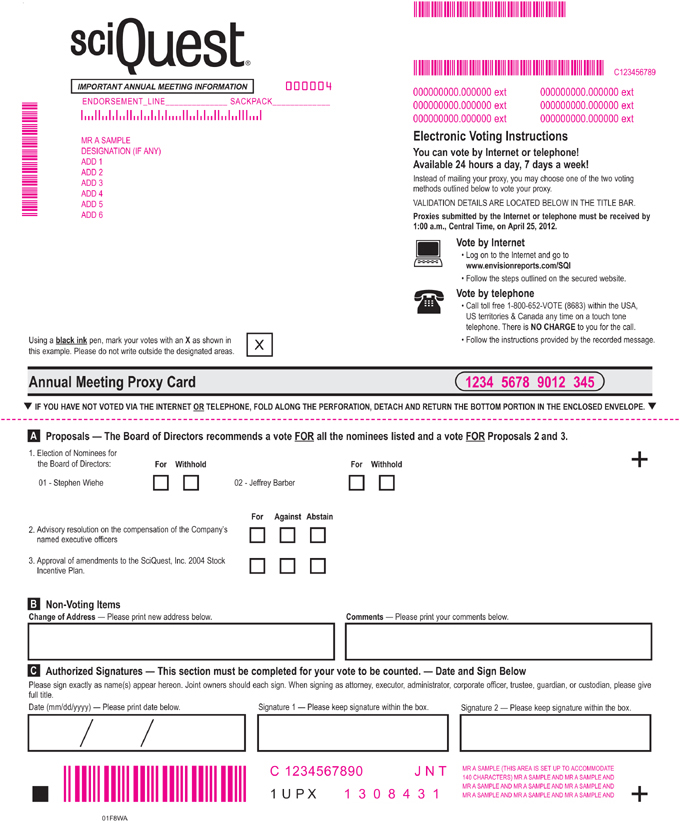

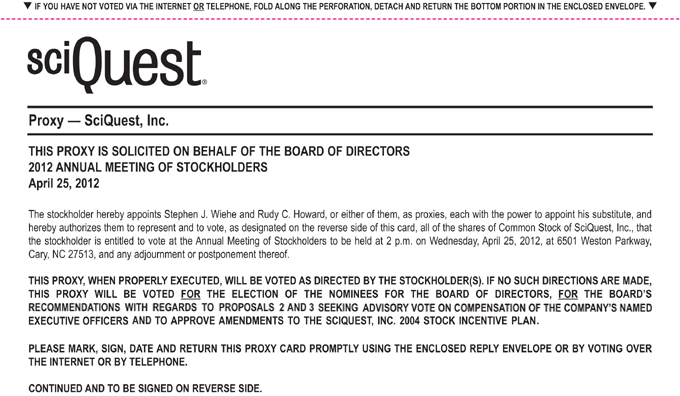

This proxy statement and enclosed proxy card are being furnished to you in connection with the solicitation of proxies by our Board of Directors for use at the annual meeting. In this proxy statement, “we,” “us,” “our” and “SciQuest” refer to SciQuest, Inc. and “you” and “your” refer to SciQuest stockholders.

Questions and Answers About the Proxy Materials and Our 2012 Annual Meeting of Stockholders

| Q: | Why am I receiving these materials? |

| A: | Our Board of Directors is providing these proxy materials to you in connection with its solicitation of proxies for use at the SciQuest 2012 Annual Meeting of Stockholders, which will take place on April 25, 2012, at the Company’s headquarters, 6501 Weston Parkway, Suite 200, Cary, NC 27513, at 2:00 p.m. local time. You are invited to attend the annual meeting and are requested to vote on the proposals described in this proxy statement. |

| Q: | What information is contained in these materials? |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of our directors and named executive officers and certain other required information. Our Annual Report to Stockholders for the year ended December 31, 2011, which includes our audited consolidated financial statements for the years ended December 31, 2011, 2010 and 2009, is included in these proxy materials. Your proxy, which you may use to vote, is also enclosed. |

| Q: | Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability of Proxy Materials or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice of Internet Availability of Proxy Materials. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of the annual meeting.

| Q: | What proposals will be voted upon at the annual meeting? |

| A: | There are three proposals scheduled to be voted on at the annual meeting: |

| | • | | election of two directors for three-year terms expiring in 2015; |

| | • | | an advisory resolution regarding the compensation of the named executive officers as disclosed in this proxy statement; and |

| | • | | approval of amendments to the SciQuest, Inc. 2004 Stock Incentive Plan. |

In addition, such other business as may properly come before the annual meeting will be considered. We are not currently aware of any other matters to be considered at the meeting.

| Q: | How does SciQuest’s Board of Directors recommend that I vote? |

| A: | Your Board of Directors recommends that you vote your shares “FOR” each of the nominees to the Board of Directors, “FOR” the advisory resolution supporting the compensation of the named executive officers as disclosed in this proxy statement and “FOR” the approval of amendments to the SciQuest, Inc. 2004 Stock Incentive Plan. |

| A: | You may vote at the annual meeting or by proxy if you were a stockholder of record at the close of business on March 1, 2012. Each stockholder is entitled to one vote per share on each matter presented. As of March 1, 2012, there were 22,148,648 shares of our common stock outstanding. |

| Q: | How do I vote before the annual meeting? |

| A: | We offer the convenience of voting by mail-in proxy, telephone or the Internet as described in more detail below. See the enclosed proxy for voting instructions. If you properly sign and return the proxy in the form we have provided or properly vote by telephone or the Internet, your shares will be voted at the annual meeting and at any adjournment of that meeting. |

| Q: | What if I return my proxy but do not provide voting instructions? |

| A: | If you specify a choice, your proxy will be voted as specified. If you return a signed proxy but do not specify a choice, your shares will be voted “FOR” the election of all nominees named in this proxy statement, “FOR” the advisory resolution supporting the compensation of the named executive officers as disclosed in this proxy statement and “FOR” the approval of amendments to the SciQuest, Inc. 2004 Stock Incentive Plan. In all cases, your proxy will be voted in the discretion of the individuals named as proxies on the proxy card with respect to any other matters that may come before the annual meeting. |

2

| Q: | Can I change my mind after I vote? |

| A: | You may revoke your proxy at any time before it is exercised by delivering written notice of revocation to the Secretary of SciQuest or by attending and voting at the annual meeting. |

| Q: | How can I vote my shares in person at the annual meeting? |

| A: | Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. If you choose to vote in person, please bring the enclosed proxy card and proof of identification. Even if you plan to attend the annual meeting in person, we recommend that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the annual meeting. Shares held in “street name” through a brokerage account or by a bank or other nominee may be voted in person by you if you obtain a signed proxy from the record holder giving you the right to vote the shares. |

| Q: | What is the quorum requirement for the annual meeting? |

| A: | The presence in person or by proxy of the holders of a majority of the shares entitled to vote at the annual meeting is necessary to constitute a quorum. If a registered stockholder indicates on his or her proxy card that the stockholder wishes to abstain from voting, or a beneficial owner instructs its bank, broker or other nominee that the stockholder wishes to abstain from voting, these shares are considered present and entitled to vote at the annual meeting. These shares will count toward determining whether or not a quorum is present. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | A plurality of the shares voting is required to elect directors. This means that the nominees who receive the most votes will be elected. In counting votes on the election of directors, only votes “for” or “withheld” affect the outcome. Broker non-votes (which are explained below) will be counted as not voted and will be deducted from the total shares of which a plurality is required. |

Approval of the amendments to the SciQuest, Inc. 2004 Stock Incentive Plan requires the affirmative vote of a majority of the shares present or represented at the annual meeting and entitled to vote upon the proposal. In counting votes on this matter, abstentions will be counted as votes “against” the matter and broker non-votes, if any, will not be counted as votes cast and therefore will have no effect.

The advisory resolution regarding the compensation of the named executive officers is non-binding on us and our Board of Directors. Our Board of Directors and the Compensation Committee will review the voting results, and to the extent there are a significant number of negative votes on this resolution, we would expect to initiate procedures to better understand the concerns that influenced the resolution. Our Board of Directors and the Compensation Committee will consider constructive feedback obtained through this process in making future decisions about named executive officer compensation programs. In counting votes on the advisory resolution, abstentions will be counted as votes “against” the matter and broker non-votes, if any, will not be counted as votes cast and therefore will have no effect.

3

| Q: | What are broker non-votes and what effect do they have on the proposals? |

| A: | Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because (a) the broker has not received voting instructions from the beneficial owner and (b) the broker lacks discretionary voting power to vote those shares. |

If you do not vote your proxy and your shares are held in street name, your brokerage firm may either vote your shares on routine matters or leave your shares unvoted. On non-routine matters, if the brokerage firm has not received voting instructions from you, the brokerage firm cannot vote your shares on that proposal, which is considered a “broker non-vote.” Broker non-votes will be counted for purposes of establishing a quorum to conduct business at the annual meeting. All of the proposals in this proxy statement are non-routine. The New York Stock Exchange has eliminated broker discretionary voting for the election of directors. Therefore, your broker is not able to vote uninstructed shares on your behalf in any director election. These rules apply to us even though our common stock is traded on The Nasdaq Global Market (“Nasdaq”). Brokers who do not receive instructions may not vote for the election of directors or for any other proposal in this proxy statement. Therefore, we encourage you to sign and return your proxy, with voting instructions, before the annual meeting so that your shares will be represented and voted at the meeting even if you cannot attend in person.

| Q: | What does it mean if I receive more than one proxy or voting instruction card? |

| A: | It means that your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. |

| Q: | Where can I find the voting results of the annual meeting? |

| A: | We will announce preliminary voting results at the annual meeting and publish final results in a current report on Form 8-K shortly after the meeting. |

4

PROPOSAL 1—ELECTION OF DIRECTORS

Our Board of Directors currently consists of five directors and is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our directors are divided among the three classes as follows:

| | • | | The Class II directors are Jeffrey T. Barber and Stephen J. Wiehe and their terms will expire at the annual meeting of stockholders to be held in 2012; |

| | • | | The Class III director is Noel J. Fenton and his term will expire at the annual meeting of stockholders to be held in 2013; and |

| | • | | The Class I directors are Timothy J. Buckley and Daniel F. Gillis and their terms will expire at the annual meeting of stockholders to be held in 2014. |

We seek to achieve an appropriate level of diversity in our Board membership and to assemble a broad range of skills, expertise, knowledge and contacts to benefit our business. The Nominating and Corporate Governance Committee and the Board of Directors annually assess the current make-up of the Board, considering diversity across many dimensions, including gender, race, age, industry experience, functional areas, geographic scope, public and private company experience, academic background and director experience in the context of an assessment of our current and expected needs. The Nominating and Corporate Governance Committee reviews director candidates based on our needs as identified through this assessment and other factors, including their relative skills and characteristics, their exemplification of the highest standards of personal and professional integrity, their independence under Nasdaq listing standards, their potential contribution to the composition and culture of the Board of Directors and their ability and willingness to actively participate in Board and committee meetings and to otherwise devote sufficient time to their duties as a director. In particular, the Board of Directors and the Nominating and Corporate Governance Committee believe that sound governance of our company in an increasingly complex marketplace requires a wide range of viewpoints, backgrounds, skills and experiences. Although the Board of Directors does not have a formal policy regarding Board diversity, it believes that having such diversity among its members enhances the ability to make fully informed, comprehensive decisions. We believe that our Board of Directors collectively possesses these types of experience. Below is a summary of each director’s most relevant experience.

As recommended by the Nominating and Corporate Governance Committee, our Board of Directors has nominated Jeffrey T. Barber and Stephen J. Wiehe for election as Class II directors for terms expiring at the 2015 annual meeting of stockholders. Each proposed nominee is willing to serve as a director if elected. However, if a nominee is unable to serve or is otherwise unavailable for election, which is not contemplated, our incumbent Board of Directors may or may not select a substitute nominee. If a substitute nominee is selected, your shares will be voted for the substitute nominee (unless you give other instructions). If a substitute nominee is not selected, your shares will be voted for the remaining nominees. Proxies will not be voted for more than four nominees.

Biographical information for each nominee and each current director who will continue to serve after the annual meeting is presented below. There is no family relationship between any director, executive officer or person nominated to become a director or executive officer.

Nominees for Terms Expiring in 2015 (Class II)

Jeffrey T. Barber, 59, has been a member of our Board of Directors since March 2010. Mr. Barber has served as a Managing Director of Fennebresque & Co., an investment banking firm, since October 2009. From 1988 until June 2008, Mr. Barber was an audit partner of PricewaterhouseCoopers LLP, where he also served as the managing partner of its Raleigh, North Carolina office for a period of 14 years. Mr. Barber has served as a member of the board of directors of Ply Gem Holdings, Inc., building products provider, since January 2010. Mr. Barber also serves as chairman of Ply Gem Holdings’ audit committee. Mr. Barber has a B.S. in accounting from the University of

5

Kentucky. Mr. Barber is a financial expert as contemplated by the rules of the SEC implementing Section 407 of the Sarbanes-Oxley Act of 2002. As an audit partner with PricewaterhouseCoopers, Mr. Barber worked with numerous software and other technology companies. Mr. Barber’s accounting and financial expertise, qualifying him as a financial expert, and general business acumen results in unique and valuable contributions to our Board of Directors with respect to financial matters.

Stephen J. Wiehe, 48, has served as our President, Chief Executive Officer and a member of our Board of Directors since joining SciQuest in February 2001. From 2000 until he joined SciQuest, Mr. Wiehe served as Senior Director, Strategic Investments & Mergers and Acquisitions at SAS Institute. Mr. Wiehe joined SAS as part of its acquisition of DataFlux Corporation, a provider of data quality and data warehousing solutions, where Mr. Wiehe had served as President and Chief Executive Officer since 1999. From 1998 until joining DataFlux, Mr. Wiehe served as Managing Director/Europe and Senior Executive Vice President for SunGard Treasury Systems, a division of SunGard Data Systems, Inc., a software and IT services company. He also served as President of Multinational Computer Models, Inc., a provider of Treasury management solutions used by large multinational corporations to manage their foreign exchange, debt, and investment-related financial hedging instruments, from 1991 until Multinational Computer Models was sold to SunGard Data Systems in 1998. Mr. Wiehe started his career with General Electric Company, serving in various financial positions from 1987 to 1991 and graduating from its Financial Management Program in 1989. Mr. Wiehe is a graduate of the University of Kentucky. Mr. Wiehe’s past experience as chief executive officer of two software companies, his participation in relevant industry organizations and his long service with us has resulted in significant operational experience and a deep knowledge of the software industry generally and our business in particular. These qualities and this experience provide a critical contribution to our Board of Directors.

Our Board of Directors unanimously recommends that you voteFOR each of the above-listed nominees.

Continuing Director with Term Expiring in 2013 (Class III)

Noel J. Fenton, 73, serves as our lead independent director. He has been a member of our Board of Directors since August 2004 and has served as Chairman since March 2010. Mr. Fenton also served as a member of our Board of Directors from November 1998 until February 2004. In 1986, Mr. Fenton co-founded Trinity Ventures, a venture capital firm that made an initial investment in our company in 1998, and has served as one of its directors since 1998. He also serves as a director of several private companies. Prior to co-founding Trinity Ventures, he was a co-founder of three successful technology start-ups and Chief Executive Officer of two of them. Mr. Fenton is actively involved in the World’s Presidents’ Organization and is a past Chairman of the Northern California Chapter of the Young Presidents’ Organization and a past chairman of the American Electronic Association. Mr. Fenton serves as a director of LoopNet, Inc. (NASDAQ: LOOP). Mr. Fenton holds a B.S. from Cornell University and an M.B.A. from the Stanford University Graduate School of Business. We believe Mr. Fenton’s qualifications to sit on our Board of Directors include his previous operating experience as a chief executive officer and founder of technology companies, his more than 25 years of experience as a venture capital investor, his service on the board of directors of approximately 30 companies in which his venture capital firm invested, his service as a director of public companies and, as one of our early stage investors, his extensive knowledge of our company and the electronic commerce marketplace.

Continuing Directors with Terms Expiring in 2014 (Class I)

Timothy J. Buckley, 60, has been a member of our Board of Directors since March 2010. Mr. Buckley has served as Chief Executive Officer of Xtium Inc., a provider of virtual hosting and recovery services since November 2011. From April 1999 until November 2003, Mr. Buckley served as the chief operating officer for Red Hat (NYSE: RHT), a premier open source and Linux provider. As chief operating officer, Mr. Buckley used his insight to accelerate the momentum of open source and expand Red Hat’s worldwide business operations. From December 1993 until joining Red Hat, Mr. Buckley was senior vice president of worldwide sales at Visio Corporation (NASDAQ: VSIO), a software application company that was acquired by Microsoft Corporation in 2000 in a transaction valued at $1.5 billion. He currently serves on the board of directors of several privately-held companies. Mr. Buckley graduated from Pennsylvania State University with a degree in liberal arts. Mr. Buckley’s experience as a sales executive and chief operating officer for publicly-held companies in the software industry as well as a director of several privately-held companies provides us with valuable experience and qualifies him to serve as a director.

6

Daniel F. Gillis, 65, has been a member of our Board of Directors since October 2005. From 1997 until 2001, Mr. Gillis served as Chief Executive Officer of SAGA Systems, a NYSE-traded enterprise software company. Prior to joining SAGA Systems, Mr. Gillis had served as Executive Vice President of Falcon Systems, an interactive equipment company serving the federal government market. Mr. Gillis also served as a member of the NYSE Listed Companies Advisory Board from 1999 until 2001. Mr. Gillis is a graduate of the University of Rhode Island. Mr. Gillis’ executive, managerial and sales experience, including service as chief executive officer and director of a publicly-held software company, as well as his experience with the NYSE, brings valuable contributions and experience to our Board of Directors.

CORPORATE GOVERNANCE

Board of Directors

Our stockholders elect the Board of Directors to oversee management of our company. The Board delegates authority to the Chief Executive Officer and senior management to pursue the company’s mission and oversees the Chief Executive Officer’s and senior management’s conduct of our business. In addition to its general oversight function, our Board of Directors reviews and assesses the company’s strategic and business planning, senior management’s approach to addressing significant risks and has additional responsibilities including, but not limited to, the following:

| | • | | reviewing and approving the company’s key objectives and strategic business plans and monitoring implementation of those plans and our success in meeting identified objectives; |

| | • | | reviewing the company’s financial objectives and major corporate plans, business strategies and actions; |

| | • | | providing advice and oversight regarding the selection, evaluation, development and compensation of executive management; |

| | • | | reviewing significant risks confronting our company and alternatives for their mitigation; and |

| | • | | assessing whether adequate policies and procedures are in place to safeguard the integrity of our business operations and financial reporting and to promote compliance with applicable laws and regulations, and monitoring management’s administration of those policies and procedures. |

During 2011, our Board of Directors held seven meetings. All directors attended at least 75% of the meetings of the Board and the committees on which they served. It is our policy that each director attend our annual meeting of stockholders.

We have three standing committees of the Board of Directors: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Members of each committee are appointed by the Board of Directors and the authority, duties and responsibilities of each committee are governed by written charters approved by the Board of Directors. In addition to regular meetings of the Board of Directors and committees, we have regular scheduled executive sessions for our non-management, or independent, directors. Our Board of Directors may from time to time establish other committees.

Director Independence

Our Board of Directors has determined that four of our five directors are independent directors within the meaning of the independent director guidelines of the Nasdaq Listing Rules. The independent directors are Messrs. Fenton, Gillis, Barber and Buckley.

7

Board Committees

Audit Committee

The Audit Committee oversees our corporate accounting and financial reporting processes. The Audit Committee will also:

| | • | | evaluate the qualifications, performance and independence of our independent auditor and review and approve both audit and non-audit services to be provided by the independent auditor; |

| | • | | discuss with management and our independent auditors any major issues as to the adequacy of our internal controls, any actions to be taken in light of significant or material control deficiencies and the adequacy of disclosures about changes in internal control over financial reporting; |

| | • | | establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, including the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters; |

| | • | | review our financial statements and review our critical accounting policies and estimates; and |

| | • | | prepare the Audit Committee report that SEC rules require to be included in our annual proxy statement and annual report on Form 10-K. |

The current members of the Audit Committee are Messrs. Barber, Buckley and Fenton. Mr. Barber serves as the chairman of the Audit Committee and is a financial expert as contemplated by the rules of the SEC implementing Section 407 of the Sarbanes-Oxley Act of 2002. The composition of the Audit Committee meets the requirements for independence under current Nasdaq and SEC rules and regulations. Our Board of Directors has adopted an Audit Committee charter. We believe that the Audit Committee’s charter and functioning comply with the applicable requirements of Nasdaq and SEC rules and regulations. We intend to comply with future requirements to the extent they become applicable to us.

Copies of the charter for our Audit Committee are available without charge, upon request in writing to SciQuest, Inc., 6501 Weston Parkway, Suite 200, Cary, North Carolina 27513, Attn: Secretary, or on the investor relations portion of our website, www.sciquest.com.

Compensation Committee

The Compensation Committee oversees our corporate compensation and benefit programs and has the responsibilities described in the “Compensation Discussion and Analysis” section of this proxy statement.

The members of the Compensation Committee are Messrs. Buckley and Gillis, each of whom our Board of Directors has determined is independent within the meaning of the independent director guidelines of Nasdaq. Mr. Gillis serves as the chairman of the Compensation Committee. The composition of the Compensation Committee meets the requirements for independence under current Nasdaq and SEC rules and regulations. Our Board of Directors has adopted a Compensation Committee charter. We believe that the Compensation Committee charter and the functioning of the Compensation Committee comply with the applicable requirements of Nasdaq and SEC rules and regulations. We intend to comply with future requirements to the extent they become applicable to us.

Copies of the charter for our Compensation Committee are available without charge, upon request in writing to SciQuest, Inc., 6501 Weston Parkway, Suite 200, Cary, North Carolina 27513, Attn: Secretary, or on the investor relations portion of our website, www.sciquest.com.

8

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee oversees and assists our Board of Directors in reviewing and recommending nominees for election as directors. The Nominating and Corporate Governance Committee will also:

| | • | | assess the performance of the members of our Board of Directors; |

| | • | | oversee guidelines for the composition of our Board of Directors; and |

| | • | | review and administer our corporate governance principles. |

The current members of the Nominating and Corporate Governance Committee are Messrs. Fenton and Gillis, each of whom our Board of Directors has determined is independent within the meaning of the independent director guidelines of Nasdaq. Mr. Fenton serves as the chairman of the Nominating and Corporate Governance Committee. The compensation of the Nominating and Corporate Governance Committee meets the requirements for independence under current Nasdaq and SEC rules and regulations. Our Board of Directors has adopted a Nominating and Corporate Governance Committee charter. We believe that the Nominating and Corporate Governance Committee charter and the functioning of the Nominating and Corporate Governance Committee comply with the applicable requirements of Nasdaq and SEC rules and regulations. We intend to comply with future requirements to the extent they become applicable to us.

Copies of the charter for our Nominating and Corporate Governance Committee are available without charge, upon request in writing to SciQuest, Inc., 6501 Weston Parkway, Suite 200, Cary, North Carolina 27513, Attn: Secretary, or on the investor relations portion of our website, www.sciquest.com.

Identification and Evaluation of Director Candidates

Our Board of Directors prides itself on its ability to recruit and retain directors who have a diversity of experience, who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who are effective in collectively serving the long-term interests of our stockholders.

The Nominating and Corporate Governance Committee of the Board of Directors acts as the Board’s nominating committee. All members of the Nominating and Corporate Governance Committee are independent as defined by Nasdaq rules. The Nominating and Corporate Governance Committee seeks individuals qualified to become directors and recommends candidates for all director openings to the full Board.

The Nominating and Corporate Governance Committee considers director candidates suggested by directors, senior management and stockholders and evaluates all nominees for director in the same manner. Our Board of Directors ultimately determines individuals to be nominated at each annual meeting. Stockholders must comply with the procedures described below under “Stockholder Nominations.”

Stockholder Nominations

Stockholders who wish to recommend nominees for consideration by the Nominating and Corporate Governance Committee must submit their nominations in writing to our Secretary. Submissions must include sufficient biographical information concerning the recommended individual, including age, five-year employment history with employer names and a description of the employer’s business, whether such individual can read and comprehend basic financial statements and other board memberships, if any, held by the recommended individual. The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Board of Directors and to serve if elected by the stockholders. The Nominating and Corporate Governance Committee may consider such stockholder recommendations when it evaluates and recommends nominees to the full Board of Directors for submission to the stockholders at each annual meeting. Stockholder nominations made in accordance with these procedures and requirements must be addressed to SciQuest, Inc., Attn: Secretary, at 6501 Weston Parkway, Suite 200, Cary, North Carolina 27513.

9

In addition, stockholders may nominate directors for election without consideration by the Nominating and Corporate Governance Committee. Any stockholder of record may nominate an individual by following the procedures and deadlines set forth in the “Stockholder Proposals for Inclusion in Next Year’s Proxy Statement” and “Other Stockholder Proposals for Presentation at Next Year’s Annual Meeting” sections of this proxy statement and by complying with the eligibility, advance notice and other provisions of our bylaws. Under our bylaws, a stockholder is eligible to submit a proposal if the stockholder is a holder of record and entitled to vote at the annual meeting. The stockholder also must provide us with timely notice of the proposal. To be timely, the stockholder must provide advance notice not less than 90 nor more than 120 calendar days prior to the anniversary date of the preceding year’s annual meeting.

Board Leadership Structure

Our Board of Directors does not have a formal policy with respect to whether the Chief Executive Officer should also serve as Chairman of the Board. The decision regarding leadership structure is based on an evaluation of the circumstances in existence and the specific needs of our company and the Board of Directors at the time it reviews either or both roles. The Board of Directors periodically reviews its leadership structure to ensure that it remains the optimal structure for our company and our stockholders.

Currently, Noel J. Fenton is our Chairman and Stephen J. Wiehe is our President and Chief Executive Officer. Mr. Fenton also serves as our lead independent director. In these roles, Mr. Fenton leads the Board of Directors in its role to provide general oversight of our company, ensures that the independent directors meet regularly in executive session and otherwise function effectively as a group and to provide guidance and support for the Chief Executive Officer. Further, the Chairman presides over meetings of the full Board of Directors. As Chief Executive Officer, Mr. Wiehe is responsible for developing and executing the corporate strategy, as well as for overseeing the day-to-day operations and performance of the company. We believe that separating the roles of Chairman and Chief Executive Officer represents the appropriate structure for our company at this time.

Risk Oversight by our Board of Directors

While risk management is primarily the responsibility of our management team, our Board of Directors is responsible for the overall supervision of our risk management activities. Our Board of Directors implements its risk oversight function both at the full Board level and through delegation to various committees. These committees meet regularly and report back to the full Board. The Audit Committee has primary oversight responsibility for financial reporting with respect to our major financial exposures and the steps management has taken to monitor and control such exposures. The Audit Committee also oversees our procedures for the receipt, retention and treatment of complaints relating to accounting and auditing matters and oversees management of our legal and regulatory compliance systems. The Compensation Committee oversees risks relating to our compensation plans and programs.

In 2011, the Board directed our management team to conduct a comprehensive enterprise risk management assessment, the results of which were presented to the Board. The Board has further directed our management team to periodically review and update this enterprise risk management assessment and to provide reports to the Board in that regard. In addition, the Board and its various committees receive presentations throughout the year from various department and business unit leaders that include discussion of significant risks as appropriate. The Board regularly addresses in an executive session matters of particular importance or concern, including any significant areas of risk that require Board attention.

We believe that our approach to risk oversight, as described above, optimizes our ability to assess inter-relationships among the various risks, make informed cost-benefit decisions and approach emerging risks in a proactive manner for the company. We also believe that our risk structure complements our current Board of Directors leadership structure, as it allows our independent directors, through the three fully-independent Board committees, to exercise effective oversight of the actions of management in identifying risks and implementing effective risk management policies and controls.

10

Code of Business Ethics and Conduct

Our Board of Directors has adopted a code of business ethics and conduct for all employees, officers and directors. The code of business ethics and conduct is available on our website at www.sciquest.com. We expect that any amendments to the code of business ethics and conduct, or any waiver of its requirements, will be disclosed on our website. The inclusion of our website address in this proxy statement does not include or incorporate by reference the information on our website into this proxy statement.

Attendance

Board and committee meeting attendance is central to the proper functioning of our Board and is a priority. Directors are expected to make every effort to attend all meetings of the Board of Directors, meetings of committees on which they serve and the annual meeting of stockholders.

Stockholder Communications with the Board of Directors

Stockholders and interested parties may communicate with our Board of Directors by sending correspondence to the Board, a specific Board committee or a director c/o Secretary, SciQuest, Inc., 6501 Weston Parkway, Suite 200, Cary, North Carolina 27513.

The Secretary reviews all communications to determine whether the contents include a message to a director and will provide a summary and copies of all correspondence (other than solicitations for services, products or publications) to the applicable directors at each regularly scheduled meeting. The Secretary will alert individual directors to items which warrant a prompt response from the individual director prior to the next regularly scheduled meeting. Items warranting prompt response, but not addressed to a specific director, will be routed to the applicable committee chairperson.

Director Compensation

In 2010, our Board of Directors approved the following compensation package for our non-employee directors based on the recommendation of our Chief Executive Officer and the Compensation Committee:

| | | | |

Annual retainer | | $ | 20,000 | |

In-person board of directors and committee meeting fees | | $ | 2,000 | |

Telephonic board of directors and committee meeting fees | | $ | 500 | |

Audit committee chair retainer | | $ | 10,000 | |

Compensation committee chair retainer | | $ | 5,000 | |

Nominating and corporate governance committee chair retainer | | $ | 5,000 | |

Initial grant of stock options | | | 22,500 | |

Annual grant of stock options | | | 13,750 | |

We also reimburse our non-employee directors for reasonable travel and other expenses incurred in connection with attending board of director and committee meetings.

The following table sets forth information regarding compensation earned by our non-employee directors during 2011:

Director Compensation Table for Year Ended December 31, 2011

| | | | | | | | | | | | | | | | |

| | | Fees Earned or Paid | | | | |

Name | | in Cash | | | Stock Awards | | | Option Awards(1) | | | Total | |

| | | | |

Jeffrey T. Barber | | $ | 48,000 | | | | — | | | $ | 162,140 | | | $ | 210,140 | |

Timothy J. Buckley | | $ | 40,000 | | | | — | | | $ | 162,140 | | | $ | 202,140 | |

Noel J. Fenton | | $ | 42,500 | | | | — | | | $ | 162,140 | | | $ | 204,640 | |

Daniel F. Gillis | | $ | 36,500 | | | | — | | | $ | 162,140 | | | $ | 198,640 | |

In 2012, our Board of Directors adopted a new compensation package for our non-employee directors, effective as of the annual meeting, as follows:

| | | | |

Annual Retainers: | | | | |

Cash | | $ | 30,000 | |

Restricted Stock Unit Grant | | $ | 70,000 | |

Committee Chair Fees: | | | | |

Audit committee chair | | $ | 15,000 | |

Compensation committee chair | | $ | 10,000 | |

Nominating and corporate governance committee chair retainer | | $ | 10,000 | |

Committee Membership Fees: | | | | |

Per each non-chair committee membership | | $ | 5,000 | |

Initial election restricted stock unit grant | | $ | 100,000 | |

The new compensation package was adopted in order to simplify the compensation structure and to promote long-term value as opposed to meeting attendance. The restricted stock unit grants will be based on the market value of our common stock on the date of grant. The annual restricted stock unit grants will have one-year vesting, with 50% issue upon vesting and 50% deferred until termination of Board service, although a director may elect to defer the entire issuance until termination of Board service. For the initial election restricted stock unit grants, issuance will be fully deferred until termination of Board service.

11

Compensation Committee Interlocks and Insider Participation

No current member of the Compensation Committee is a current or former executive officer or employee of our company. None of our executive officers served and currently none of them serves on the board of directors or compensation committee of any other entity with executive officers who have served on our Board of Directors or Compensation Committee.

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND OFFICERS AND DIRECTORS

The following table sets forth information regarding beneficial ownership of our common stock as of December 31, 2011 by (i) each of our named executive officers; (ii) each of our directors; (iii) all of our executive officers and directors as a group; and (iv) each person or group of affiliated persons known by us to be the beneficial owner of more than 5% of our common stock.

Beneficial ownership in this table is determined in accordance with the rules of the SEC and does not necessarily indicate beneficial ownership for any other purpose. Under these rules, the number of shares of common stock deemed outstanding includes shares issuable upon exercise of options held by the respective person or group that may be exercised within 60 days after December 31, 2011. For purposes of calculating each person’s or group’s percentage ownership, stock options exercisable within 60 days after December 31, 2010 are included for that person or group.

Percentage of beneficial ownership is based on 22,133,036 shares of common stock outstanding as of December 31, 2011.

Unless otherwise indicated and subject to applicable community property laws, to our knowledge, each stockholder named in the following table possesses sole voting and investment power over the shares listed, except for those jointly owned with that person’s spouse. Unless otherwise noted below, the address of each person listed on the table is c/o SciQuest, Inc., 6501 Weston Parkway, Suite 200, Cary, North Carolina 27513. Beneficial ownership representing less than 1% is denoted with an asterisk (*).

| | | | | | | | | | |

| | | Beneficial Ownership | |

Name | | Shares | | | Percentage | |

| | |

Named Executive Officers and Directors: | | | | | | | | |

Stephen J. Wiehe(1) | | | 825,380 | | | | 3.7 | % |

James B. Duke | | | 363,093 | | | | 1.6 | % |

Jeffrey A. Martini (2) | | | 169,029 | | | | * | |

Rudy C. Howard(3) | | | 91,106 | | | | * | |

C. Gamble Heffernan(4) | | | 52,843 | | | | * | |

Grant W. Collingsworth | | | — | | | | * | |

Noel J. Fenton(5) | | | 3,203,447 | | | | 14.5 | % |

Daniel F. Gillis(6) | | | 142,803 | | | | * | |

Jeffrey T. Barber(7) | | | 21,093 | | | | * | |

Timothy J. Buckley(8) | | | 21,093 | | | | * | |

All executive officers and directors as a group (12 people) (9) | | | 4,694,327 | | | | 21.0 | % |

5% Stockholders: | | | | | | | | |

Funds associated with Trinity Ventures(10) | | | 3,187,500 | | | | 14.4 | % |

FMR LLC(11) | | | 2,878,670 | | | | 13.0 | % |

Wasatch Advisors, Inc.(12) | | | 1,559,987 | | | | 7.0 | % |

Capital Research Global Investors(13) | | | 1,419,400 | | | | 6.4 | % |

Massachusetts Financial Services Company(14) | | | 1,403,444 | | | | 6.3 | % |

Wells Fargo & Company(15) | | | 1,356,866 | | | | 6.1 | % |

Riverbridge Partners LLC(16) | | | 1,118,145 | | | | 5.1 | % |

| (1) | Includes 7,546 shares held by Mr. Wiehe as custodian for Andrew John Wiehe and Stephanie Elizabeth Wiehe, over which Mr. Wiehe has voting and investment power. Includes 27,082 shares subject to options that are exercisable within 60 days of the date of the table. |

| (2) | Includes 17,603 shares subject to options that are exercisable within 60 days of the date of the table. |

| (3) | Consists of shares subject to options that are exercisable within 60 days of the date of the table. |

13

| (4) | Includes 42,843 shares subject to options that are exercisable within 60 days of the date of the table. |

| (5) | Includes 3,187,680 shares held by Trinity Ventures VII, L.P., Trinity VII Side-By-Side Fund, L.P., Trinity Ventures VIII, L.P., Trinity VIII Side-By-Side Fund, L.P. and Trinity VIII Entrepreneurs’ Fund, L.P. Mr. Fenton may be deemed to have shared voting and investment power over the shares held by these entities but disclaims beneficial ownership of such shares. Includes 4,364 shares held by the Fenton Family 1994 Trust. Mr. Fenton may be deemed to have shared voting and investment power over the shares held by this trust but disclaims beneficial ownership of such shares. Includes 180 shares held by TVL Management Corporation and 10,312 shares subject to options that are exercisable within 60 days of the date of the table and that are held by TVL Management Corporation. Mr. Fenton may be deemed to have shared voting and investment power over the shares held by this entity or subject to options held by this entity but disclaims beneficial ownership of such shares. |

| (6) | Includes 51,620 shares held by Gillis Company, LLC, over which Mr. Gillis has sole voting and investment power. Includes 10,312 shares subject to options that are exercisable within 60 days of the date of the table. The address for Mr. Gillis and Gillis Company, LLC is 5 Masters Court, Potomac, MD 20854. |

| (7) | Consists of shares subject to options that are exercisable within 60 days of the date of the table. |

| (8) | Consists of shares subject to options that are exercisable within 60 days of the date of the table. |

| (9) | Includes 284,252 shares subject to options that are exercisable within 60 days of the date of the table. Includes 7,546 shares held by Mr. Wiehe as custodian for Andrew John Wiehe and Stephanie Elizabeth Wiehe, over which Mr. Wiehe has voting and investment power. Includes 51,620 shares held by Gillis Company, LLC, over which Mr. Gillis has sole voting and investment power. Includes 3,187,680 shares held by Trinity Ventures VII, L.P., Trinity VII Side-By-Side Fund, L.P., Trinity Ventures VIII, L.P., Trinity VIII Side-By-Side Fund, L.P. and Trinity VIII Entrepreneurs’ Fund, L.P. Mr. Fenton may be deemed to have shared voting and investment power over the shares held by these entities but disclaims beneficial ownership of such shares. Includes 4,364 shares held by the Fenton Family 1994 Trust. Mr. Fenton may be deemed to have shared voting and investment power over the shares held by this trust but disclaims beneficial ownership of such shares. Includes 180 shares held by TVL Management Corporation and 10,312 shares subject to options that are exercisable within 60 days of the date of the table and that are held by TVL Management Corporation. Mr. Fenton may be deemed to have shared voting and investment power over the shares held by this entity or subject to options held by this entity but disclaims beneficial ownership of such shares. |

| (10) | Consists of shares held by Trinity Ventures VII, L.P., Trinity VII Side-By-Side Fund, L.P., Trinity Ventures VIII, L.P., Trinity VIII Side-By-Side Fund, L.P. and Trinity VIII Entrepreneurs’ Fund, L.P. The address for each of these Trinity funds is 3000 Sand Hill Road, Building 4, Suite 160, Menlo Park, CA 94025. |

| (11) | Consists of shares held by the following subsidiaries: Fidelity Management & Research Company and Pyramis Global Advisors Trust. The address for FMR LLC is 82 Devonshire Street, Boston, MA 02109. |

| (12) | The address for Wasatch Advisors, Inc. is 150 Social Hall Avenue, Salt Lake City, UT 84111. |

| (13) | The address for Capital Research Global Investors is 333 South Hope Street, Los Angeles, CA 90071. |

| (14) | The address for Massachusetts Financial Services Company is 500 Boylston Street, Boston, MA 02116. |

| (15) | Consists of shares held by the following subsidiaries: Wells Capital Management Incorporated, Wells Fargo Advisors Financial Network, LLC, Wells Fargo Bank, N.A. and Wells Fargo Funds Management, LLC. The address for Wells Fargo & Company is 420 Montgomery Street, San Francisco, CA 94104. |

| (16) | The address for Riverbridge Partners LLC is 801 Nicollet Mall, Suite 600, Minneapolis, MN 55402. |

14

EXECUTIVE OFFICERS

Executive Officers

In addition to Mr. Wiehe, our President and Chief Executive Officer, whose biographical information appears under “Proposal 1—Election of Directors,” set forth below are the names, ages and biographical information for each of our current executive officers.

| | | | |

Name | | Age | | Position |

| | |

Stephen J. Wiehe | | 48 | | President, Chief Executive Officer and Director |

Rudy C. Howard | | 54 | | Chief Financial Officer |

Jeffrey A. Martini | | 53 | | Senior Vice President of Worldwide Sales |

C. Gamble Heffernan | | 50 | | Senior Vice President of Marketing and Strategy |

Jennifer G. Kaelin | | 40 | | Vice President of Finance |

Peter N. Asmar | | 55 | | Vice President of Customer Operations |

Daryl L. Broddle | | 46 | | Vice President of Technology |

Grant W. Collingsworth | | 48 | | General Counsel |

Stephen J. Wiehehas served as our President, Chief Executive Officer and a member of our Board of Directors since joining SciQuest in February 2001. From 2000 until he joined SciQuest, Mr. Wiehe served as Senior Director, Strategic Investments & Mergers and Acquisitions at SAS Institute. Mr. Wiehe joined SAS as part of its acquisition of DataFlux Corporation, a provider of data quality and data warehousing solutions, where Mr. Wiehe had served as President and Chief Executive Officer since 1999. From 1998 until joining DataFlux, Mr. Wiehe served as Managing Director/Europe and Senior Executive Vice President for SunGard Treasury Systems, a division of SunGard Data Systems, Inc., a software and IT services company. He also served as President of Multinational Computer Models, Inc., a provider of Treasury management solutions used by large multinational corporations to manage their foreign exchange, debt, and investment-related financial hedging instruments, from 1991 until Multinational Computer Models was sold to SunGard Data Systems in 1998. Mr. Wiehe started his career with General Electric Company, serving in various financial positions from 1987 to 1991 and graduating from its Financial Management Program in 1989. Mr. Wiehe is a graduate of the University of Kentucky. Mr. Wiehe’s past experience as chief executive officer of two software companies, his participation in relevant industry organizations and his long service with us has resulted in significant operational experience and a deep knowledge of the software industry generally and our business in particular. These qualities and this experience provide a critical contribution to our Board of Directors.

Rudy C. Howardhas served as our Chief Financial Officer since joining SciQuest in January 2010. From November 2008 until joining SciQuest, Mr. Howard served as Senior Vice President and Chief Financial Officer of MDS Pharma Services, a pharmaceutical services company, where he was responsible for all financial management functions. From 2003 until joining MDS Pharma Services, Mr. Howard operated his own financial consulting company, Rudy C. Howard, CPA Consulting, in Wilmington, North Carolina, where his services included advising on merger and acquisition transactions, equity and debt issuances and other general management matters. From 2001 through 2003, Mr. Howard served as Chief Financial Officer for Peopleclick, Inc., an international human capital management software company. From 2000 until joining Peopleclick, Mr. Howard served as Chief Financial Officer for Marketing Services Group, Inc., a marketing and internet technology company. From 1995 until 2000, Mr. Howard served as Chief Financial Officer for PPD, Inc., a clinical research organization. Prior to joining PPD, Mr. Howard was a partner with PricewaterhouseCoopers. Mr. Howard holds a B.A. in Accounting from North Carolina State University, and he is a Certified Public Accountant.

Jeffrey A. Martinihas served as our Senior Vice President of Worldwide Sales since joining SciQuest in January 2005. From 2004 until he joined SciQuest, Mr. Martini served as Vice President of Worldwide Sales for VitualEdge Corporation, a leading provider of real-time recruiting software for the extended enterprise. Prior to joining VirtualEdge, Mr. Martini had served as Vice President of Worldwide Sales at Primavera Systems, a portfolio management vendor, since 2002. From 1987 until joining Primavera Systems, Mr. Martini held a variety of sales and sales management roles at SCT Corporation, a leading provider of enterprise software applications, including serving as Corporate Vice President of Sales. Mr. Martini’s early sales career included positions at Highline Data Systems, a provider of human resource information systems for the mid-market, in 1986, and Personnel Data Systems, a provider of human resources information systems, in 1985. Mr. Martini is a graduate of Gettysburg College.

15

Jennifer G. Kaelinhas served as our Vice President of Finance since January 2010 and from joining SciQuest in July 2005 until January 2008. From January 2008 until December 2009, Ms. Kaelin served as our Chief Financial Officer. From 2003 until she joined SciQuest, Ms. Kaelin served as Corporate Controller at Art.com, an e-tailer of posters, prints and custom framing. Prior to joining Art.com, Ms. Kaelin had served as Controller for several manufacturing sites at Moduslink, a global supply chain management company for technology-based manufacturers, since 1998. Ms. Kaelin also was a financial analyst for IBM from 1997 until 1998, and was an auditor for PricewaterhouseCoopers from 1994 until 1997. She holds a master’s degree in accounting and a bachelor’s degree in business administration from the University of North Carolina at Chapel Hill, and she is a certified public accountant.

C. Gamble Heffernanhas served as our Vice President of Marketing and Strategy since joining SciQuest in October 2008 and was designated as Senior Vice President of Marketing and Strategy in March 2012. From September 2007 until joining SciQuest, Ms. Heffernan served as Senior Vice President of Community Solutions for Misys, an application software and services provider to the financial services and healthcare industries, where she was responsible for the development and management of its community services business team. Ms. Heffernan previously served as Senior Vice President, Product Management for Healthcare for Misys from October 2005 until September 2007, where she was responsible for portfolio and market strategy. Prior to joining Misys, Ms. Heffernan had served as Vice President and General Manager of Professional Services and Consulting for Cardinal Health and the Director of the ALARIS Center for Medication Safety and Clinical Improvement since 2002. Ms. Heffernan also served as Vice President of Services Marketing at Ortho-Clinical Diagnostics, a provider of in-vitro diagnostic systems, from 2001 until 2002. From 1996 until joining Ortho-Clinical Diagnostics, she worked for GE Medical Systems, where she held various management positions including General Manager for eBusiness, General Manager for Clinical Information Systems and Senior Business Unit Manager for Neonatal.

Peter N. Asmarhas served as our Vice President of Customer Operations since July 2011. From March 2006 until July 2011, Mr. Asmar served as Chief Information Officer at The North Carolina Department of Public Instruction, the agency charged with implementing North Carolina public school laws and the State Board of Education’s policies and procedures governing pre-kindergarten through 12th grade public education. From March 1993 until June 2005, Mr. Asmar held various management positions, including Chief Operating Officer, Professional Services, with J.P. MorganChase, a financial services company. Prior to that, Mr. Asmar held senior positions at Credit Suisse First Boston, International Paper Company and United Parcel Service. Mr. Asmar holds a bachelor’s degree in economics from Brooklyn College and a master’s degree in business administration from the New York Institute of Technology.

Daryl L. Broddlehas served as our Vice President of Technology since May 2011. From September 2007 until May 2011, Mr. Broddle served as our Vice President of Product Development. From September 1999 until September 2007, Mr. Broddle served in various positions in our product development organization. Prior to joining SciQuest, Daryl served as Director of Store Systems at NationsRent. He also previously held positions in application development at Blockbuster and Wal-Mart Stores Inc. Mr. Broddle holds a bachelor’s degree in computer science from the University of Kansas.

Grant W. Collingsworth has served as our General Counsel since April 2011. From October 1996 until April 2011, Mr. Collingsworth was a partner at the law firm of Morris, Manning and Martin, LLP, where he practiced corporate and securities law. From September 1989 until September 1996, Mr. Collingsworth served as an associate at the law firm of Jenkens & Gilchrist, P.C. Mr. Collingsworth holds a bachelor’s degree in business administration from the University of Oklahoma and a juris doctor from Emory University.

16

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following is a discussion and analysis of the compensation arrangements for our named executive officers for 2011 as well as the actions taken in 2012 that affect the current and future compensation of our named executive officers. Our named executive officers as of the end of 2011 were Stephen Wiehe, our President and Chief Executive Officer, Rudy Howard, our Chief Financial Officer, Jeffrey Martini, our Senior Vice President of Worldwide Sales, Gamble Heffernan, our Vice President of Marketing and Strategy, and Grant Collingsworth, our General Counsel. Mr. Collingsworth joined our company in April 2011. In addition, James Duke served as our Chief Operating Officer through September 30, 2011 and is included as a named executive officer.

Executive Summary

We seek to closely align the interests of our named executive officers with the interests of our stockholders. Our compensation programs are designed to reward named executive officers for the achievement of short-term and long-term strategic and operational goals, while at the same time avoiding the encouragement of excessive risk-taking. Our named executive officers’ total compensation is comprised of a mix of base salary, annual cash incentive bonuses, equity incentive awards and insurance and other employee benefits and compensation.

In 2011, we achieved a number of important accomplishments in the continued growth of our business, including the following:

| | • | | Strong Revenue Growth. 2011 revenue was $53.4 million, an increase of 26% as compared to 2010. |

| | • | | Improved Profitability. 2011 income from operations was $5.3 million, a 381% increase over 2010 income from operations of $1.1 million. 2011 net income was $2.8 million, compared to a 2010 net loss of $336,000. |

| | • | | Strong Cash Flows. 2011 operating cash flow was $17.4 million, a 195% increase over 2010 operating cash flow of $5.0 million. |

| | • | | Significantly Increased Customer Count. We ended 2011 with 321 customers compared to 195 customers at the end of 2010. |

| | • | | Significant Increase in Revenue Backlog. Backlog revenue at the end of 2011 increased 35% compared to backlog revenue at the end of 2010, in each case including assumed renewals. |

| | • | | Strong Stock Performance. Our stock price increased approximately 9.7% during 2011 compared to the Nasdaq composite index decrease of 0.8%. |

| | • | | Selection by WSCA. In 2011, we were selected by the Western States Contracting Alliance as its eprocurement provider, which is an important milestone in our expansion into the state and local government market. |

Compensation Objectives

Our Compensation Committee’s primary objectives with respect to executive compensation are to:

| | • | | attract, motivate, reward and retain high quality executives necessary to formulate and execute our business strategy; |

| | • | | ensure that compensation provided to executive officers is closely aligned with our short and long-term business objectives, risk profile, financial performance and strategic goals; |

| | • | | build a strong link between an individual’s performance and his or her compensation; and |

| | • | | further align the interests of management with our stockholders by providing equity incentive compensation. |

17

Our executive compensation practices are intended to provide each executive a total annual compensation that is commensurate with the executive’s responsibilities, experience and demonstrated performance. We intend our compensation to be competitive with companies in our industry and region. Variations to this targeted compensation may occur depending on the experience level of the individual and market factors, such as the demand for executives with similar skills and experience.

Significant Compensation Practices

We review and evaluate our compensation programs, practices and policies on an ongoing basis. We modify our compensation programs to address evolving best practices. We have provided below some of the more significant practices and recent modifications.

| | • | | Performance-Based Compensation. Our philosophy is to pay for performance. In that regard, both our annual cash incentive bonuses and our equity incentive awards are based on meeting corporate and individual performance goals. No bonuses or equity incentive awards are guaranteed in any way. |

| | • | | Stock Ownership Guidelines. Our Board of Directors has approved stock ownership guidelines for our executive officers and non-employee directors align the interests of executives and directors with the interests of stockholders. These individuals are required to beneficially own a number of shares of company common stock having a value equal to the applicable guidelines established for each participant as follows: |

| | • | | Chief Executive Officer – 5x annual base salary; |

| | • | | Other Executives – 3x annual base salary; and |

| | • | | Non-Employee Directors – 3x annual cash retainer fee. |

Until the applicable guideline is achieved, a participant will be required to retain an amount equal to 50% of the net shares received as a result of the exercise of SciQuest stock options or the vesting of restricted stock or restricted stock units.

| | • | | Anti-Hedging Policy. Our executives and non-executive directors are prohibited from engaging in any transactions involving puts, calls or other derivatives on SciQuest’s securities on an exchange or in any other organized market or any other derivative or hedging transactions on SciQuest securities in which the person could profit if the value of our stock falls. |

| | • | | Clawback Policy. Our clawback policy allows us to “clawback” compensation paid to any executive who has engaged in misconduct that materially contributes to a financial restatement. |

| | • | | No Tax Gross-Ups. Neither our 2004 Stock Incentive Plan nor any agreements with our directors, executives or other employees provide for any tax gross-up payments. |

| | • | | Independent Compensation Committee. Our Compensation Committee is comprised solely of independent directors as defined by Nasdaq and our director independence standards. |

| | • | | Independent Compensation Consultant. Our Compensation Committee has retained an independent compensation consultant who performs no other consulting or other services for our company. The independent compensation consultant had no relationship with any named executive officer prior to the engagement. |

18

| | • | | NoDiscounted Stock Options or Stock Appreciation Rights. All stock options and stock appreciation rights have been granted at an exercise price equal to or greater than the fair market value of the underlying shares on the grant date. Subject to stockholder approval at the annual meeting, our Board of Directors has approved an amendment to our 2004 stock incentive plan to require all stock options and stock appreciation rights to be granted at an exercise price equal to or greater than the fair market value of the underlying shares on the grant date. |

| | • | | No Repricing Without Stockholder Approval. Subject to stockholder approval at the annual meeting, our Board of Directors has approved an amendment to our 2004 stock incentive plan to specify that outstanding stock options or other equity awards cannot be “repriced” by reducing the exercise price of such stock option or stock appreciation right or exchanging such stock option or stock appreciation right for cash or other awards without stockholder approval. |

| | • | | No Cash Buyout of Equity Awards Without Stockholder Approval.Subject to stockholder approval at the annual meeting, our Board of Directors has approved an amendment to our 2004 stock incentive plan to clarify that cash buyouts of outstanding stock options or other equity awards issued to employees without stockholder approval is prohibited. |

| | • | | Minimum Vesting Period for Equity Awards. Subject to stockholder approval at the annual meeting, our Board of Directors has approved an amendment to our 2004 stock incentive plan to require minimum four-year vesting periods for time-based equity awards to employees, minimum one-year vesting periods for time-based equity awards to directors and minimum one-year vesting periods for performance-based equity awards, which is consistent with our past practices. |

Compensation Process

General. The Compensation Committee of our Board of Directors oversees our executive compensation program. In this role, the Compensation Committee reviews and approves annually all compensation decisions relating to our named executive officers other than with respect to equity awards. The Compensation Committee receives input from our chief executive officer regarding the compensation of our other named executive officers, which is taken into account in its deliberations. Our Compensation Committee proposes grants of equity awards for our named executive officers and recommends such proposals to our Board of Directors for approval. Our Compensation Committee believes that our compensation program is aligned with our business and risk management objectives and does not believe that our compensation program is likely to have a material adverse effect on us. In January of each year, our Compensation Committee typically determines our named executive officers’ base salaries, awards annual cash incentive bonuses based on the achievement of bonus criteria in the prior year and sets bonus criteria for the upcoming year. The Compensation Committee also proposes grants of equity awards to our named executive officers, which are considered and approved by our Board of Directors in January as well.

2011 Compensation Process. In establishing executive compensation levels for 2011, the Compensation Committee developed a peer group comprised solely of U.S.-based publicly traded companies that generally have a SaaS business model and that are similar in size to our company based on revenue and market capitalization. We refer to this peer group as the 2011 Peer Group. In establishing the 2011 Peer Group, the Compensation Committee selected those companies that it believes are used by investors and securities analysts to value our company and otherwise measure our performance, excluding the companies that have only recently become publicly traded and therefore had not disclosed compensation data since their initial public offering. The 2011 Peer Group consists of athenahealth Inc., Concur Technologies Inc., Constant Contact, Inc., DealerTrack Holdings, Inc., DemandTec, Inc., Kenexa Corporation, NetSuite Inc. Omniture, Inc., RightNow Technologies, Inc., Salary.com, Inc., SuccessFactors, Inc., Taleo Corporation, The Ultimate Software Group, Inc. and Vocus, Inc.

The median revenue of the 2011 Peer Group was $194 million for the most recently completed fiscal year for which executive compensation was available and the median market capitalization of the 2011 Peer Group was $1,195 million as of January 17, 2011. The Compensation Committee recognized that most companies within the 2011 Peer Group are larger than us with respect to revenue and market capitalization and took those disparities into account when determining compensation levels, as discussed below.

The Compensation Committee based its review of executive compensation levels on benchmark data from the 2011 Peer Group for base salary, annual cash incentive bonuses and equity awards provided by Equilar, an information services firm with products focused on analyzing and benchmarking executive and director compensation. Equilar draws data from proxy statements and reports filed with the SEC.

19

Although the Compensation Committee is authorized to retain an independent compensation consultant, it believed that with its subscription to the Equilar database it could rely on our management to gather data and present information to the Compensation Committee in a more cost-efficient manner. Accordingly, in January 2011, our chief executive officer provided a report to the Compensation Committee with respect to the relevant compensation data for the 2011 Peer Group for each named executive officer together with a summary of such officer’s performance in the prior year, including his or her achievement of bonus criteria.

Our compensation program seeks to provide competitive total compensation to each of our named executive officers while taking into account the unique requirements and skills of each of our named executive officers. Our Compensation Committee compared our compensation practices and levels by each compensation component described below. The purpose of this analysis is to determine whether the compensation offered to each named executive officer, both in its totality and with respect to each of the constituent components, is competitive with the applicable market comparables that the Compensation Committee has reviewed for the corresponding period.

Because the companies in the 2011 Peer Group were generally larger than us with respect to revenues and market capitalization, the Compensation Committee generally considered 2011 compensation to be competitive for our named executive officers if total compensation approximated the 25th percentile of compensation offered by the 2011 Peer Group. Where total compensation or a specific component of compensation does not approximate this target, the Compensation Committee used the competitive data as a factor for its compensation determination but may have also taken into account factors specific to a named executive officer in making its final compensation decisions, including each named executive officer’s position and functional role, seniority, performance and overall level of responsibility.

2012 Compensation Process. Our Compensation Committee retained Aon Hewitt (“Aon”) to serve as an independent compensation consultant to assist it in designing and implementing our executive compensation program. Other than executive and Board compensation consulting, Aon has not provided any other services to our company in 2011 or 2012.

The Compensation Committee and management sought the views of Aon regarding market trends for executive compensation and analysis of specific compensation program components. Aon provided information comparing the compensation for the named executive officers to market data from a group of peer companies (as described below) as well as other broader-based survey sources.

Based on Aon’s recommendation, the Compensation Committee selected a group of peer companies for use in establishing 2012 compensation levels for the named executive officers (the “2012 Peer Group”). To develop the 2012 Peer Group, Aon considered (i) industry relevance, utilizing the Global Industry Classification Standard and software industry analyst reports, (ii) historical revenues and revenue growth, and (iii) market capitalization as a multiple of revenues. Aon provided information from this peer group for base salary and short- and long-term incentive compensation. Consistent with standard practices, due to the varying sizes of the companies included in the peer group, Aon included statistical analysis to “size-adjust” certain market compensation data to reflect our relative annual revenue. This peer group consisted of:

| | | | |

Actuate Corporation | | DemandTec, Inc. | | OPNET Technologies, Inc. |

Callidus Software, Inc. | | Guidance Software, Inc. | | Sourcefire, Inc. |

Carbonite, Inc. | | Keynote Systems, Inc. | | SPS Commerce, Inc. |

Convio, Inc. | | LogMeIn, Inc. | | Support.com, Inc. |

Cornerstone OnDemand, Inc. | | Magma Design Automation, Inc. | | Vocus, Inc. |

Our Compensation Committee compared our compensation practices and levels by each compensation component described below. The purpose of this analysis is to determine whether the compensation offered to each named executive officer, both in its totality and with respect to each of the constituent components, is competitive with the applicable market comparables that the Compensation Committee has reviewed for the corresponding period Generally, we target our compensation program to fall within a range around the median of the market compensation data for the 2012 Peer Group. Where total compensation or a specific component of compensation does not approximate this target, the Compensation Committee used the competitive data as a factor for its

20