Filed Pursuant to Rule 424(b)(5)

Registration No. 333-193777

Prospectus supplement to Prospectus dated March 20, 2014

3,000,000 shares

Common Stock

We are offering 3,000,000 shares of our common stock.

Our common stock is listed on the NASDAQ Global Market under the symbol “SQI.” The last reported sale price of our common stock on the Nasdaq Global Market on March 25, 2014 was $27.95 per share.

| | | | | | | | |

| | | Per share | | | Total | |

| | |

Public offering price | | $ | 26.75 | | | $ | 80,250,000 | |

| | |

Underwriting discounts and commissions(1) | | $ | 1.3375 | | | $ | 4,012,500 | |

| | |

Proceeds to SciQuest, Inc., before expenses | | $ | 25.4125 | | | $ | 76,237,500 | |

We have granted the underwriters a 30-day option to purchase up to an additional 450,000 shares of common stock from us.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-12.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about April 1, 2014

Joint Book-Running Managers

Co-Managers

| | | | | | | | |

| Canaccord Genuity JMP Securities | | Pacific Crest Securities | | Raymond James | | William Blair |

| | |

| |

| Barrington Research | | Sidoti & Company, LLC |

March 26, 2014

Table of contents

Prospectus Supplement

Prospectus

S-i

About this prospectus supplement

This prospectus supplement is part of a registration statement that we filed with the Securities and Exchange Commission, or the “SEC”, using a “shelf” registration process. This document is in two parts, the first part is this prospectus supplement, which describes the specific terms of this offering of common stock by us and also adds to and updates the information contained in the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, dated March 20, 2014, which gives more information about us and the types of offerings that we may undertake, some of which does not apply to this offering. If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement.

We and the underwriters have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or any relevant free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein or therein and in any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus and any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier statement.

You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein or therein, and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus supplement and accompanying prospectus entitled “Where you can find more information” and “Incorporation of information filed with the SEC.”

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus or any free writing prospectus.

S-ii

Special note regarding forward-looking statements

This prospectus, as supplemented, contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “accelerates,” “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We discuss these risks in greater detail in the “Risk Factors” section of this prospectus, as supplemented, and in our most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q, which are incorporated herein by reference, and elsewhere in this prospectus, as supplemented. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this prospectus. You should read this prospectus and any supplements and the documents that we have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

S-1

Summary

This summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before investing in our securities. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the information referred to under the heading “Risk factors” in this prospectus supplement beginning on page S-12 and “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 incorporated by reference in this prospectus supplement and accompanying prospectus, as well as the financial statements and other information in our filings with the SEC which have been incorporated by reference in this prospectus supplement and accompanying prospectus, when making an investment decision. Unless the context otherwise requires, we use the terms “SciQuest,” “we,” “us,” “the Company” and “our” in this prospectus to refer to SciQuest, Inc. and its subsidiaries.

Overview

We provide leading cloud-based business automation solutions for spend management that include:

| • | | procurement solutions that automate the source-to-settle process; |

| • | | spend analysis solutions that cleanse and classify spend data to drive and measure cost savings; |

| • | | supplier management solutions that facilitate our customers’ interactions with their suppliers; |

| • | | contract lifecycle management solutions that automate the contract lifecycle from contract creation through maintenance; and |

| • | | accounts payable solutions that automate the invoice processing and vendor payment processes. |

Our solutions are designed to meet customer needs to reduce costs, simplify and improve visibility into key business processes, further strategic initiatives, enhance control over spending decisions and improve compliance and risk management. By simplifying and streamlining cumbersome, tedious, and often manual, processes and creating a comprehensive view of spending and compliance across the organization, organizations can identify and capitalize on opportunities to reduce costs by gaining control over suppliers, contracts, purchases and payments.

Our spend management solutions provide a significant return on investment for our customers by facilitating the reduction of spending on goods and services, enhancing visibility and control over spending decisions and practices as well as optimizing the efficiency of key business processes. As a result of these benefits, our customers have the tools to focus on strategic initiatives that result in even greater value to their organizations.

Our procurement, supplier management and accounts payable solutions utilize our managed SciQuest Supplier Network, which facilitates our customers doing business with many thousands of unique suppliers and spending billions of dollars annually. Unlike many other providers, we do not charge suppliers any fees for the use of our network in part because we believe many suppliers ultimately will pass on such costs to the customer. Our approach encourages suppliers to participate in the network and facilitates customers consolidating more of their spending through our solutions.

We deliver our cloud-based solutions using a Software-as-a-Service, or “SaaS,” model, which enables us to offer greater functionality, faster innovation, easier integration and improved reliability with less cost and risk to the organization than traditional on-premise solutions. Customers pay us subscription fees and implementation

S-2

service fees for the use of our solutions under either multi-year contracts that are generally three to five years in length or one-year contracts with annual renewal provisions. Subscription payments are typically payable annually in advance. A portion of the implementation service fees are typically payable in advance with the remainder payable as the services are performed, usually within the first three to eight months of contract execution.

As of December 31, 2013, we served 534 customers, excluding customers that spend less than $10,000 per year with us. For the fiscal year ended December 31, 2013, revenues increased 36% to $90.2 million from $66.5 million for the fiscal year ended December 31, 2012. For the fiscal year ended December 31, 2012, revenues increased 25% to $66.5 million from $53.4 million for the fiscal year ended December 31, 2011. No customer accounted for more than 10% of our revenues during 2011, 2012 or 2013. Our high customer retention, combined with our long-term contracts, increases the visibility and predictability of our revenues compared with traditional perpetual license-based software businesses. Through 2013, we have achieved 34 consecutive quarters of revenue growth.

Company background

In 2001, we began developing and marketing our procurement solutions. We initially acquired a critical mass of customers in the higher education and life sciences vertical markets and selectively expanded to serve the healthcare and state and local government markets. In 2010, we completed an initial public offering of our common stock. In 2011, we acquired all of the capital stock of AECsoft USA, Inc., or “AECsoft”, a leading provider of supplier management and sourcing solutions. In 2012, we acquired substantially all of the assets of Upside Software, Inc., or “Upside”, a leading provider of contract lifecycle management solutions, and substantially all of the assets of Spend Radar LLC, or “Spend Radar”, a leading provider of spend analysis solutions. In 2013, we acquired all of the capital stock of CombineNet, Inc., or “CombineNet”, a leading provider of advanced sourcing software to organizations with large and potentially complex strategic sourcing needs.

Due to our historical focus on vertical markets, we have had a relatively high concentration of higher education, life sciences, healthcare and state and local government customers. But a majority of our customers now span the general commercial market as a result of our acquisitions as well as our own marketing efforts. Our customers currently include approximately 30% of the Forbes Global 100 companies and 25% of the Fortune 500. We currently market our solutions across the entire addressable market for spend management solutions.

Our Solutions

Our solutions are designed to meet customer needs to reduce costs, simplify and improve visibility into key business processes, further strategic initiatives, enhance control over spending decisions and improve compliance and risk management. By simplifying and streamlining cumbersome, and often manual, processes and creating a comprehensive view of spending and compliance across the organization, organizations can identify and capitalize on opportunities to reduce costs by gaining control over suppliers, contracts, purchases and payments.

Our solutions provide a significant return on investment for our customers through the following key benefits:

| • | | Enhanced visibility and control. SciQuest solutions provide greater visibility into, and control over, the management of suppliers, contracts, purchases and payments to help customers identify savings opportunities and manage risk. |

S-3

| • | | Achieve savings objectives. SciQuest solutions ultimately help customers reduce their spend through organization-wide transparency, automation, compliance and analysis. |

| • | | Optimize processes and gain efficiencies. SciQuest solutions deliver sustainable value through process transformation that reduces complexity, eliminates waste and errors and promotes ease of use. |

Business strengths and success factors

We believe that there are a number of characteristics that have facilitated, and are expected to continue to facilitate, our growth, including:

| • | | Large and growing addressable market. According to Gartner, the global procurement software market, which is a subset of the spend management market, is forecast to grow at an average annual growth rate of 10.8% to $4.4 billion in 2017. We believe that this large and growing market presents a significant opportunity to continue to accelerate our revenue growth. |

| • | | Leading provider of spend management software with a broad, differentiated cloud-based platform. We believe that we are uniquely positioned as a full suite provider of cloud based spend management solutions that can also provide best-in-class point solutions as needed by organizations. |

| • | | Unique global supplier network that encourages supplier participation and collaboration between buyers and suppliers. Through the SciQuest Supplier Network, we have built a critical mass of suppliers that enables efficient and automated transaction interactions for our customers. Unlike many other providers, we charge our customers for each of their suppliers who they choose to integrate into our supplier network rather than charging suppliers any fees for the use of our network. |

| • | | Focus on customer value. Delivering value to our customers is at the core of our business philosophy. We focus extensively on ensuring that customers achieve a demonstrated return on investment from our solutions, and we proactively engage with our customers to continually improve our software and services. |

| • | | High visibility business model. Our customers pay us subscription fees and implementation service fees for the use of our solutions under either multi-year contracts that are generally three to five years in length or one-year contracts with annual renewal provisions. In each case, we typically receive cash payments annually in advance. |

| • | | Maximize long-term customer revenue. A key aspect of our SaaS business model is to maximize the recurring revenue stream from each customer through price increases upon renewal and the sale of new products, which result in increased annual subscription fees and additional implementation service fees. In 2011, 2012 and 2013, approximately 26%, 36% and 41%, respectively, of new sales consisted of sales of additional products with services to existing customers. |

Our growth strategy

We seek to become the leading provider of business automation solutions for spend management. Our key strategic initiatives include:

| • | | Commercial market expansion. We believe the general commercial market represents a significant market opportunity for our solutions. We intend to pursue this opportunity through focused sales and marketing efforts to expand our reach and brand awareness into key segments of the commercial market. |

S-4

| • | | Capitalize on cross-selling opportunities into our installed customer base. Our existing customer base provides us with a significant opportunity to sell additional products, including new products that we develop or acquire. As of December 31, 2013, our solutions were being used by 534 customers, excluding customers that spend less than $10,000 per year with us, and most of these customers do not currently utilize all, or even a majority, of our solutions. |

| • | | Selectively pursuing acquisitions. We expect to pursue acquisitions of businesses, technologies and solutions that complement our existing offerings in an effort to accelerate our growth, enhance the capabilities of our existing solutions and/or broaden our solution offerings. |

| • | | Invest in new and current products. We have invested, and will continue to invest, significantly in the development of new products to expand our market presence and the features and functionality of our existing products to enhance their marketability through both acquisitions and internal development. |

| • | | Invest in direct and indirect sales channels. We believe that our current markets, particularly given our expansion into the general commercial market, offer significant growth opportunities. We have invested, and will continue to invest, in our direct and indirect sales channels in order to capitalize on these growth opportunities. |

| • | | Invest in international expansion to acquire new customers. We believe that the market outside the United States offers us significant growth potential. We intend to accelerate our international expansion through our direct sales force and by establishing additional third-party sales relationships in an effort to leverage our leadership position and reputation as a leading provider of spend management solutions to organizations with global operations. |

Our products and services

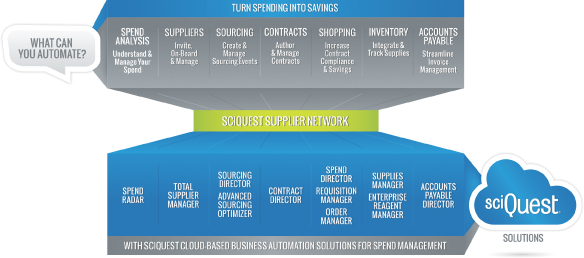

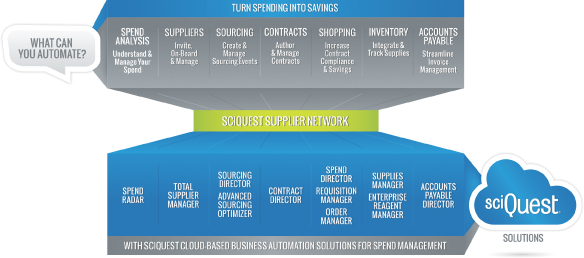

The following diagram provides an overview of our solutions:

Our solutions are priced based primarily on the products purchased and the size of the organization. Sales vary between multi-product sales and single-product sales. Our total subscription fees over a three to five year term

S-5

of the subscription agreement for sales of single products typically range from $60,000 to $500,000 ($20,000 to $100,000 per year) while a multi-product sale range can typically range from $450,000 to $1.5 million ($150,000 to $300,000 per year). Our typical one-time implementation service fees are generally equivalent to one year of license fees. Generally, customers are not charged based on the number of users or transaction volume, which encourages organizations to maximize the number of employees using our solutions, resulting in enhanced efficiencies and customer satisfaction.

Our corporate information

We were originally incorporated in November 1995. Our principal executive offices are located at 6501 Weston Parkway, Suite 200, Cary, North Carolina 27513, and our telephone number is (919) 659-2100. Our website address is www.sciquest.com. The information contained in, or that can be accessed through, our website is not incorporated by reference into this prospectus supplement or accompanying prospectus and is not part of this prospectus supplement or accompanying prospectus.

S-6

The offering

Common stock outstanding before this offering | 23,974,119 shares |

Common stock offered by us | 3,000,000 shares |

Underwriters’ option to purchase additional shares | 450,000 shares |

Common stock outstanding after this offering | 26,974,119 shares (27,424,119 shares if the underwriters exercise their option in full) |

Use of proceeds | We estimate that the net proceeds to us from the sale of shares of common stock offered by us will be approximately $76.1 million, or approximately $87.5 million if the underwriters exercise in full their option to purchase additional shares from us. This estimate is based upon the public offering price of $26.75 per share, less underwriting discounts and commissions and estimated offering expenses payable by us. |

| | We intend to use the net proceeds for working capital and general corporate purposes. We may also use a portion of the proceeds to expand our business through acquisitions of complementary businesses, products or technologies. We have no agreements or commitments with respect to any acquisitions at this time. |

| | Pending the uses described above, we intend to invest the net proceeds of this offering in short- to medium-term, investment-grade, interest-bearing securities, certificates of deposit, or direct or guaranteed obligations of the U.S. government. |

Symbol on the NASDAQ Global Market | “SQI” |

The number of shares of our common stock outstanding after this offering is based on 23,974,119 shares of our common stock outstanding as of February 28, 2014 and excludes:

| • | | an aggregate of 899,651 shares issuable upon the exercise of then outstanding options at a weighted average exercise price of $11.52 per share; and |

| • | | an aggregate of 3,603,021 shares reserved for issuance under our 2013 Stock Incentive Plan. |

Unless otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase up to 450,000 additional securities.

S-7

Summary financial data

The following tables summarize the financial data for our business. You should read this summary financial data in conjunction with “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, all included in our Annual Report on Form 10-K for the year ended December 31, 2013 and incorporated by reference into this prospectus.

The selected financial data under the heading “Statements of Operations Data” for each of the three years ended December 31, 2011, 2012 and 2013, under the heading “Non-GAAP Operating Data” relating to Non-GAAP Net Income and Adjusted Free Cash Flow for each of the three years ended December 31, 2011, 2012 and 2013 and under the heading “Balance Sheet Data” as of December 31, 2012 and 2013 have been derived from our audited financial statements, which are provided under “Part II, Item 8, Financial Statements and Supplementary Data” of our Annual Report on Form 10-K for the year ended December 31, 2013 and incorporated by reference into this prospectus.

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2011 | | | 2012 | | | 2013 | |

| | | (In thousands, except per share data) | |

| | |

Statements of Operations Data: | | | | | | | | |

Revenues | | $ | 53,438 | | | $ | 66,465 | | | $ | 90,231 | |

Cost of revenues(1)(2) | | | 13,340 | | | | 20,270 | | | | 27,411 | |

| | | | |

Gross profit | | | 40,098 | | | | 46,195 | | | | 62,820 | |

| | | | |

| | |

Operating expenses:(1) | | | | | | | | |

Research and development | | | 11,233 | | | | 17,188 | | | | 28,267 | |

Sales and marketing | | | 14,282 | | | | 17,907 | | | | 24,261 | |

General and administrative | | | 8,403 | | | | 10,918 | | | | 13,033 | |

Amortization of intangible assets | | | 864 | | | | 1,268 | | | | 2,382 | |

| | | | |

Total operating expenses | | | 34,782 | | | | 47,281 | | | | 67,943 | |

| | | | |

Income (loss) from operations | | | 5,316 | | | | (1,086 | ) | | | (5,123 | ) |

Interest and other income (expense), net | | | 298 | | | | 13 | | | | 13 | |

| | | | |

Income (loss) before income taxes | | | 5,614 | | | | (1,073 | ) | | | (5,110 | ) |

Income tax benefit (expense) | | | (2,780 | ) | | | (103 | ) | | | 376 | |

| | | | |

Net income (loss) | | $ | 2,834 | | | $ | (1,176 | ) | | $ | (4,734 | ) |

| | | | |

| | |

Net income (loss) per share: | | | | | | | | |

Basic | | $ | 0.13 | | | $ | (0.05 | ) | | $ | (0.20 | ) |

Diluted | | $ | 0.13 | | | $ | (0.05 | ) | | $ | (0.20 | ) |

| | |

Weighted average shares outstanding used in computing per share amounts: | | | | | | | | |

Basic | | | 21,673 | | | | 22,285 | | | | 23,044 | |

Diluted | | | 22,241 | | | | 22,285 | | | | 23,044 | |

| |

S-8

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2011 | | | 2012 | | | 2013 | |

| | | (In thousands) | |

| | | |

Non-GAAP Operating Data: | | | | | | | | | | | | |

Non-GAAP Net Income(3) | | $ | 6,416 | | | $ | 5,460 | | | $ | 8,845 | |

Adjusted Free Cash Flow(4) | | $ | 14,256 | | | $ | 15,748 | | | $ | 14,468 | |

| |

| | | | | | | | | | | | |

| | | December 31, | |

| | | 2011 | | | 2012 | | | 2013 | |

| | | (In thousands) | |

| | |

Balance Sheet Data: | | | | | | | | |

Cash and cash equivalents | | $ | 14,958 | | | $ | 15,606 | | | $ | 19,117 | |

Short-term investments | | | 44,685 | | | | 29,740 | | | | 15,105 | |

Working capital excluding deferred revenues | | | 65,427 | | | | 49,138 | | | | 36,261 | |

Total assets | | | 116,368 | | | | 140,324 | | | | 173,445 | |

Deferred revenues | | | 49,614 | | | | 62,461 | | | | 70,760 | |

Total stockholders’ equity (deficit) | | | 60,707 | | | | 67,228 | | | | 88,179 | |

| |

| (1) | | Amounts include stock-based compensation expense, as follows: |

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2011 | | | 2012 | | | 2013 | |

| | | (In thousands) | |

Cost of revenues | | $ | 313 | | | $ | 300 | | | $ | 499 | |

Research and development | | | 1,014 | | | | 1,217 | | | | 1,714 | |

Sales and marketing | | | 1,142 | | | | 1,510 | | | | 1,992 | |

General and administrative | | | 1,480 | | | | 2,170 | | | | 2,727 | |

| | | | |

| | $ | 3,949 | | | $ | 5,197 | | | $ | 6,932 | |

| |

| (2) | | Cost of revenues includes amortization of capitalized software development costs of: |

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2011 | | | 2012 | | | 2013 | |

| | | (In thousands) | |

Amortization of capitalized software development costs | | $ | 390 | | | $ | 928 | | | $ | 1,842 | |

Amortization of acquired software | | | 168 | | | | 553 | | | | 1,580 | |

| | | | |

| | $ | 558 | | | $ | 1,481 | | | $ | 3,422 | |

| |

| (3) | | Non-GAAP Net Income, a non-GAAP operating measure, consists of net income (loss) plus our non-cash, stock-based compensation expense, amortization of intangible assets, amortization of acquired software, purchase accounting deferred revenue adjustments in 2012 and 2013 and acquisition related costs incurred in 2011, 2012 and 2013, less the acquisition related escrow distribution received in 2011. Non-GAAP Net Income is determined on a tax-effected basis. For 2011, 2012 and 2013, due to the impact that non-taxable expenses, i.e. stock-based compensation, had on our effective tax rate, we determined the tax effect of Non-GAAP Net Income by arriving at Non-GAAP Income before taxes, multiplying this by our statutory rate of 38.9% and the difference between our statutory tax expense and our book tax expense is the tax effect of adjustments to arrive at Non-GAAP Net Income. We use Non-GAAP Net Income as a measure of operating performance because it assists us in comparing performance on a consistent basis, as it removes from our operating results the impact of our capital structure, acquisition related costs, the one-time costs associated with non-recurring events and such non-cash items such as stock-based compensation expense and amortization of intangible assets, which can vary depending upon accounting methods. We believe Non-GAAP Net Income is useful to an investor in evaluating our operating performance because it is widely used by investors, securities analysts and other interested parties in our industry to measure a company’s operating performance without regard to non-cash items such as stock-based compensation expense and amortization of intangible assets, which can vary depending upon accounting methods, and to present a meaningful measure of corporate performance exclusive of our capital structure and the method by which assets were acquired. |

S-9

Our use of Non-GAAP Net Income has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| | • | | Non-GAAP Net Income does not reflect changes in, or cash requirements for, our working capital needs; |

| | • | | Non-GAAP Net Income does not consider the potentially dilutive impact of equity-based compensation; |

| | • | | Non-GAAP Net Income does not reflect acquisition related costs, one-time cash bonuses associated with the initial public offering paid to our management or cash payments in connection with a settlement of a lawsuit, all of which reduced the cash available to us; |

| | • | | we must make certain assumptions in order to determine the tax effect adjustments for Non-GAAP Net Income, which assumptions may not prove to be accurate; and |

| | • | | other companies, including companies in our industry, may calculate Non-GAAP Net Income differently, which reduces its usefulness as a comparative measure. |

Because of these limitations, you should consider Non-GAAP Net Income alongside other financial performance measures, including various cash flow metrics, net income (loss) and our other GAAP results. Our management reviews Non-GAAP Net Income along with these other measures in order to fully evaluate our financial performance.

The following table provides a reconciliation of net income (loss) to Non-GAAP Net Income:

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2011 | | | 2012 | | | 2013 | |

| | | (In thousands) | |

Net income (loss) | | $ | 2,834 | | | $ | (1,176 | ) | | $ | (4,734 | ) |

Stock-based compensation | | | 3,949 | | | | 5,197 | | | | 6,932 | |

Amortization of intangible assets | | | 864 | | | | 1,268 | | | | 2,382 | |

Amortization of acquired software | | | 168 | | | | 553 | | | | 1,580 | |

Purchase accounting deferred revenue adjustment | | | — | | | | 1,490 | | | | 3,323 | |

Distribution of acquisition escrow | | | (223 | ) | | | — | | | | — | |

Acquisition related costs | | | 134 | | | | 1,506 | | | | 5,377 | |

Tax effect of adjustments(a) | | | (1,310 | ) | | | (3,378 | ) | | | (6,015 | ) |

| | | | |

Non-GAAP Net Income | | $ | 6,416 | | | $ | 5,460 | | | $ | 8,845 | |

| |

| | (a) | | For the years ended December 31, 2011, 2012 and 2013, due to the impact that non-taxable expenses, i.e. stock-based compensation, had on our effective tax rate, we determined the tax effect of Non-GAAP Net Income by arriving at Non-GAAP Income before taxes, multiplying this by our statutory rate of 38.9%, and the difference between our statutory tax expense and our book tax expense is the tax effect of adjustments to arrive at Non-GAAP Net Income. |

| (4) | | Free Cash Flow consists of net cash provided by operating activities, less purchases of property and equipment and less capitalization of software development costs. Adjusted Free Cash Flow consists of Free Cash Flow plus acquisition related costs in 2011, 2012 and 2013, less the acquisition related escrow distribution received in 2011. We use Adjusted Free Cash Flow as a measure of liquidity because it assists us in assessing our ability to fund our growth through our generation of cash. We believe Adjusted Free Cash Flow is useful to an investor in evaluating our liquidity because Adjusted Free Cash Flow and similar measures are widely used by investors, securities analysts and other interested parties in our industry to measure a company’s liquidity without regard to revenue and expense recognition, which can vary depending upon accounting methods. |

Our use of Adjusted Free Cash Flow has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| | • | | Adjusted Free Cash Flow does not reflect the cash requirements necessary to service principal payments on our indebtedness; |

| | • | | Adjusted Free Cash Flow does not reflect one-time litigation expense payments or one-time management bonuses associated with the initial public offering, which reduced the cash available to us; |

| | • | | Adjusted Free Cash Flow does not include acquisition related costs; and |

| | • | | Adjusted Free Cash Flow removes the impact of accrual basis accounting on asset accounts and non-debt liability accounts; and other companies, including companies in our industry, may calculate Adjusted Free Cash Flow differently, which reduces its usefulness as a comparative measure. |

Because of these limitations, you should consider Adjusted Free Cash Flow alongside other liquidity measures, including various cash flow metrics, net income and our other GAAP results. Our management reviews Adjusted Free Cash Flow along with these other measures in order to fully evaluate our liquidity.

S-10

The following table provides a reconciliation of net cash provided by operating activities to Adjusted Free Cash Flow:

| | | | | | | | | | | | |

| | | Year ended December 31, | |

| | | 2011 | | | 2012 | | | 2013 | |

| | | (In thousands) | |

Net cash provided by operating activities | | $ | 17,407 | | | $ | 20,380 | | | $ | 18,018 | |

Purchase of property and equipment | | | (2,058 | ) | | | (1,825 | ) | | | (2,873 | ) |

Capitalization of software development costs | | | (1,004 | ) | | | (3,113 | ) | | | (3,654 | ) |

| | | | |

Free Cash Flow | | | 14,345 | | | | 15,442 | | | | 11,491 | |

Distribution of acquisition escrow | | | (223 | ) | | | — | | | | — | |

Acquisition related costs | | | 134 | | | | 306 | | | | 2,977 | |

| | | | |

Adjusted Free Cash Flow | | $ | 14,256 | | | $ | 15,748 | | | $ | 14,468 | |

| |

S-11

Risk factors

We operate in a business environment that involves numerous known and unknown risks and uncertainties that could have a materially adverse impact on our operations. The risks described below highlight some of the factors that have affected, and in the future could affect, our operations. You should carefully consider these risks. These risks are not the only ones we may face. Additional risks and uncertainties of which we are unaware or that we currently deem immaterial also may become important factors that affect us. If any of the events or circumstances described in the followings risks occurs, our business, financial condition, results of operations, cash flows, or any combination of the foregoing, could be materially and adversely affected.

Our risks are described in detail below; however, the more significant risks we face include the following:

| • | | if we are unable to attract new customers, or if our existing customers do not purchase additional products or services, the growth of our business and cash flows will be adversely affected; |

| • | | our failure to sustain our historical renewal rates, pricing and terms of our customer contracts would adversely affect our operating results; |

| • | | we expect to continue to develop and acquire new product and service offerings with no guarantee that we will be able to market those acquired products and services successfully or to develop or integrate any new products effectively or efficiently; |

| • | | if we do not successfully maintain the SciQuest brand, our revenues and earnings could be materially adversely affected; |

| • | | our growth could strain our personnel resources and infrastructure, and if we are unable to implement appropriate controls and procedures to manage our growth, we will not be able to implement our business plan successfully; |

| • | | the failure to integrate successfully businesses that we have acquired or may acquire could adversely affect our business; |

| • | | continued economic weakness and uncertainty, which may result in a significant reduction in spending by our customers and potential customers, could adversely affect our business, lengthen our sales cycles and make it difficult for us to forecast operating results accurately; |

| • | | product development delays could damage our reputation and sales efforts; |

| • | | if we are unable to adapt our products and services to rapid technological change, our revenues and profits could be materially and adversely affected; and |

| • | | we have been, and may continue to be, subject to claims that we or our technologies infringe upon the intellectual property or other proprietary rights of a third party. Any such claims may require us to incur significant costs, to enter into royalty or licensing agreements or to develop or license substitute technology, which may harm our business. |

Risks related to our business and industry

If we are unable to attract new customers, or if our existing customers do not purchase additional products or services, the growth of our business and cash flows will be adversely affected.

To increase our revenues and cash flows, we must regularly add new customers and sell additional products and services to our existing customers. If we are unable to hire or retain quality sales personnel, unable to sell our products and services to companies that have been referred to us, unable to generate sufficient sales leads

S-12

through our marketing programs, or if our existing or new customers do not perceive our solutions to be of sufficiently high value and quality, we may not be able to increase sales and our operating results would be adversely affected. In addition, our revenue growth is partially dependent on the continued sale of our products across the entire addressable market for spend management solutions without regard to our historical vertical markets. If we are unsuccessful in our efforts to sell our products and services outside of our historical vertical markets, our revenue growth, cash flows and profitability may be materially and adversely affected. If we fail to sell new products and services to existing or new customers, our operating results will suffer, and our revenue growth, cash flows and profitability may be materially and adversely affected.

Our failure to sustain our historical renewal rates, pricing and terms of our customer contracts would adversely affect our operating results.

We derive, and expect to continue to derive, substantially all of our license revenues from recurring subscription fees for our spend management solutions. Should our current customers lose confidence in the value or effectiveness of our solutions, the demand for our products and services will likely decline, which could materially and adversely affect our renewal rates, pricing and contract terms. Our subscription agreements with customers are typically for either a term ranging from three to five years in length or a one-year term with automatic renewal provisions. Our value proposition and high customer satisfaction rates have led to strong recurring revenue retention rates of approximately 100%, 106% and 100% for 2011, 2012 and 2013, respectively. We calculate recurring revenue retention rates for a particular period by comparing the subscription revenue for all customers at the end of the prior period to the subscription revenue for those same customers at the end of the current period. If our customers choose not to renew their subscription agreements with us at similar rates and on similar or more favorable terms, our business, operating results and financial condition may be materially and adversely affected.

We expect to continue to develop and acquire new product and service offerings with no guarantee that we will be able to market those acquired products and services successfully or to develop or integrate any new products effectively or efficiently.

Expanding our product and service offerings is an important component of our business strategy. Any new offerings that are not favorably received by prospective customers could damage our reputation or brand name. As part of this strategy, we added our advanced sourcing product in 2013, while in 2012 we added our spend analysis, contract lifecycle management and accounts payable solutions. Expansion of our offerings will require us to devote a significant amount of time and money and may strain our management, financial and operating resources. We cannot be assured that our development or acquisition efforts will result in commercially viable products or services. In addition, we may bear development and acquisition costs in current periods that do not generate revenues until future periods, if at all. To the extent that we incur expenses that do not result in increased current or future revenues, our earnings may be materially and adversely affected.

If we do not successfully maintain the SciQuest brand, our revenues and earnings could be materially adversely affected.

We believe that developing, maintaining and enhancing the SciQuest brand in a cost-effective manner is critical in expanding our customer base, particularly in the general commercial market. Some of our competitors have well-established brands. Although we believe that the SciQuest brand is well established in certain markets where we have a significant operating history, our brand may not be as well established throughout our entire addressable market. Promotion of our brand will depend largely on continuing our sales and marketing efforts and providing high-quality products and services to our customers. We cannot be assured that these efforts will be successful in marketing the SciQuest brand. If we are unable to successfully promote our brand, or if we incur substantial expenses in attempting to do so, our revenues and earnings could be materially and adversely affected.

S-13

Our growth could strain our personnel resources and infrastructure, and if we are unable to implement appropriate controls and procedures to manage our growth, we will not be able to implement our business plan successfully.

We have experienced a period of significant growth in our operations and personnel, which places a significant strain on our management, administrative, operational and financial infrastructure. Our business strategy includes preparing for significant future growth and expanding our management, administrative, operational and financial infrastructure to facilitate this growth. Our success will depend in part upon the ability of our senior management to prepare for and manage this growth effectively. To do so, we must continue to hire, train and manage new employees, including managers, as needed. If our new hires perform poorly, or if we are unsuccessful in hiring, training, managing and integrating these new employees, or if we are not successful in retaining our existing employees, our business would be materially harmed. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. There is no assurance that we will do so effectively. The additional headcount and operating systems that we may add will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. If we fail to successfully manage our growth, we will be unable to execute our business plan.

The failure to successfully integrate businesses that we have acquired or may acquire could adversely affect our business.

An element of our strategy is to broaden the scope and content of our products and services through the acquisition of existing products, technologies, services and businesses. Acquisitions entail numerous risks, including:

| • | | the integration of new operations, products, services and personnel; |

| • | | the diversion of resources from our existing businesses, sites and technologies; |

| • | | the inability to generate revenues from new products and services sufficient to offset associated acquisition costs; |

| • | | the maintenance of uniform standards, controls, procedures and policies; |

| • | | the acquired business requiring greater resources than anticipated; |

| • | | accounting effects that may adversely affect our financial results; |

| • | | the impairment of employee and customer relations as a result of any integration of new management personnel; |

| • | | dilution to existing stockholders from the issuance of equity securities; and |

| • | | liabilities or other problems associated with an acquired business. |

In 2013, we acquired all of the capital stock of CombineNet, a leading provider of advanced sourcing software to large companies with complex procurement needs. The integration of this company into our business has represented, and continues to represent in some respects, a significant undertaking for our management team. Even to the extent that we have successfully completed this integration, conditions could still arise that require additional resources or endanger the expected benefits of this acquisition. Our failure to successfully manage the risks associated with this acquisition could adversely affect our business and operating results.

We may also have difficulty in effectively assimilating and integrating future acquired businesses, or any future joint ventures, acquisitions or alliances, into our operations, and such integration may require a significant amount of time and effort by our management team. To the extent we do not successfully avoid or overcome

S-14

the risks or problems related to any acquisitions, our business, results of operations and financial condition could be adversely affected. Future acquisitions also could impact our financial position and capital needs and could cause substantial fluctuations in our quarterly and yearly results of operations. Acquisitions could include significant goodwill and intangible assets, which may result in future impairment charges that would reduce our stated earnings.

Continued economic weakness and uncertainty, which may result in a significant reduction in spending by our customers and potential customers, could adversely affect our business, lengthen our sales cycles and make it difficult for us to forecast operating results accurately.

Our revenues depend significantly on economic conditions in our addressable market as well as the economy as a whole. We have experienced, and may experience in the future, reduced spending by our customers and potential customers due to the continuing economic weakness affecting the U.S. and global economy, and other macroeconomic factors affecting spending behavior. Many of our customers and potential customers have been facing significant budgetary constraints that have limited spending on technology solutions. Continued spending constraints may result in slower growth, or reductions, in revenues and profits in the future. In addition, economic conditions or uncertainty may cause customers and potential customers to reduce or delay technology purchases, including purchases of our solutions. Our sales cycle may lengthen if purchasing decisions are delayed as a result of uncertain budget availability or if contract negotiations become more protracted or difficult as customers institute additional internal approvals for information technology purchases. These economic conditions could result in reductions in sales of our products and services, longer sales cycles, difficulties in collecting accounts receivable or delayed payments, slower adoption of new technologies and increased price competition. Any of these events or any significant reduction in spending by our customers and potential customers would likely harm our business, financial condition, operating results and cash flows.

Product development delays could damage our reputation and sales efforts.

Developing new products and updated versions of our existing products for release at regular intervals is important to our business efforts. At times, we may experience delays in our development process that result in new releases being delayed or lacking expected features or functionality. New product or version releases that are delayed or do not meet expectations may result in customer dissatisfaction, which in turn could damage significantly our reputation and sales efforts. Such damage to our reputation and sales efforts could negatively impact our operating results.

If we are unable to adapt our products and services to rapid technological change, our revenues and profits could be materially and adversely affected.

Rapid changes in technology, products and services, customer requirements and operating standards occur frequently. These changes could render our proprietary technology and systems obsolete. Any technological changes that reduce or eliminate the need for spend management solutions could harm our business. We must continually improve the performance, features and reliability of our products and services, particularly in response to our competition.

Our success will depend, in part, on our ability to:

| • | | enhance our existing products and services; |

| • | | develop new products, services and technologies that address the increasingly sophisticated and varied needs of our customers and potential customers; and |

| • | | respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis. |

S-15

We cannot be certain of our success in accomplishing the foregoing. If we are unable, for technical, legal, financial or other reasons, to adapt to changing market conditions or buyer requirements, our market share, business and operating results could be materially and adversely affected.

We have been, and may continue to be, subject to claims that we or our technologies infringe upon the intellectual property or other proprietary rights of a third party. Any such claims may require us to incur significant costs, to enter into royalty or licensing agreements or to develop or license substitute technology, which may harm our business.

The spend management market is characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets and by litigation based on allegations of infringement or other violations of intellectual property rights. As we seek to extend our solutions, we could be constrained by the intellectual property rights of others. We have been, and may in the future be, subject to claims that our technologies infringe upon the intellectual property or other proprietary rights of a third party. While we believe that our products do not infringe upon the proprietary rights of third parties, we cannot guarantee that third parties will not assert infringement claims against us in the future, particularly with respect to technology that we acquire through acquisitions of other companies.

We might not prevail in any intellectual property infringement litigation, given the complex technical issues and inherent uncertainties in such litigation. Defending such claims, regardless of their merit, could be time-consuming and distracting to management, result in costly litigation or settlement, cause development delays, or require us to enter into royalty or licensing agreements. We generally provide in our customer agreements that we will indemnify our customers against third-party infringement claims relating to our technology provided to the customer, which could obligate us to fund significant additional amounts. If our products are found to have violated any third-party proprietary rights, we could be required to withdraw those products from the market, re-develop those products or seek to obtain licenses from third parties, which might not be available on reasonable terms or at all. Any efforts to re-develop our products, obtain licenses from third parties on favorable terms or license a substitute technology might not be successful and, in any case, might substantially increase our costs and harm our business, financial condition and operating results. Withdrawal of any of our products from the market could have a material adverse effect on our business, financial condition and operating results.

A failure to protect the integrity and security of our customers’ information could expose us to litigation, materially damage our reputation and harm our business, and the costs of preventing such a failure could adversely affect our results of operations.

Our business involves the collection and use of confidential information of our customers and their trading partners. We cannot be assured that our efforts to protect this confidential information will be successful. If any compromise of this information security were to occur, we could be subject to legal claims and government action, experience an adverse effect on our reputation and need to incur significant additional costs to protect against similar information security breaches in the future, each of which could adversely affect our financial condition, results of operations and growth prospects. In addition, because of the critical nature of data security, any perceived breach of our security measures could cause existing or potential customers not to use our solutions and could harm our reputation.

We may experience service failures or interruptions due to defects in the hardware, software, infrastructure, third-party components or processes that comprise our solutions, any of which could adversely affect our business.

Technology solutions as complex as ours may contain undetected defects in the hardware, software, infrastructure, third-party components or processes that are part of the solutions we provide. If these defects

S-16

lead to service failures, we could experience delays or lost revenues during the period required to correct the cause of the defects. Furthermore, from time to time, we have experienced immaterial service disruptions in the ordinary course of business. We cannot be certain that defects will not be found in new or upgraded products or that service disruptions will not occur in the future, resulting in loss of, or delay in, market acceptance, which could have an adverse effect on our business, results of operations and financial condition.

Because customers use our spend management solutions for critical business processes, any defect in our solutions, any disruption to our solutions or any error in execution could cause customers to not renew their contracts with us, prevent potential customers from purchasing our solutions and harm our reputation. Although most of our contracts with our customers limit our liability to our customers for these defects, disruptions or errors, we nonetheless could be subject to litigation for actual or alleged losses to our customers’ businesses, which may require us to spend significant time and money in litigation or arbitration or to pay significant settlements or damages. We do not currently maintain any warranty reserves. Defending a lawsuit, regardless of its merit, could be costly and divert management’s attention and could cause our business to suffer.

The insurers under our liability insurance policy could deny coverage of a future claim for actual or alleged losses to our customers’ businesses that results from an error or defect in our technology or a resulting disruption in our solutions, or our liability insurance might not be adequate to cover all of the damages and other costs of such a claim. Moreover, we cannot be assured that our current liability insurance coverage will continue to be available to us on acceptable terms or at all. The successful assertion against us of one or more large claims that exceeds our insurance coverage, or the occurrence of changes in our liability insurance policy, including an increase in premiums or imposition of large deductible or co-insurance requirements, could have an adverse effect on our business, financial condition and operating results. Even if we succeed in litigation with respect to a claim, we are likely to incur substantial costs and our management’s attention will be diverted from our operations.

The market for cloud-based spend management solutions is at a relatively early stage of development. If the market for our solutions develops more slowly than we expect, our revenues may decline or fail to grow and we may incur operating losses.

We derive, and expect in the near-term to continue to derive, substantially all of our revenues from our spend management solutions. Our current expectations with respect to growth may not prove to be correct. The market for our solutions is at a relatively early stage of development, making our business and future prospects difficult to evaluate. Should our prospective customers fail to recognize, or our current customers lose confidence in, the value or effectiveness of our solutions, the demand for our products and services will likely decline. Any significant price compression as a result of newly introduced solutions or consolidation among our competitors could have a material adverse effect on our business. A number of factors could affect our customers’ assessment of the value or effectiveness of our solutions, including the following:

| • | | their comfort with current purchasing and spend management procedures; |

| • | | the costs and resources required to adopt new business procedures; |

| • | | reductions in capital expenditures or technology spending budgets; |

| • | | the price, performance and availability of competing solutions or delivery platforms; |

| • | | security and privacy concerns; or |

| • | | general reticence about technology or the Internet. |

We are subject to a lengthy sales cycle and delays or failures to complete sales may harm our business and result in slower growth.

Our sales cycle may take several months to over a year. We may also experience unexpected delays that may lengthen the sales cycle for particular customers or potential customers. Such delays also make it more difficult

S-17

to predict sales cycles and the timing of future revenues. During this sales cycle, we may expend substantial resources with no assurance that a sale will ultimately result. The length of a customer’s sales cycle depends on a number of factors, many of which we may not be able to control, including the following:

| • | | potential customers’ internal approval processes; |

| • | | budgetary constraints for technology spending; |

| • | | customers’ concerns about implementing new procurement methods and strategies; and |

| • | | seasonal and other timing effects. |

Any lengthening of the sales cycle or unexpected delays with respect to particular customers or potential customers could delay our revenue recognition and cash generation and could cause us to expend more resources than anticipated. If we are unsuccessful in closing sales or if we experience delays, it could have a material adverse effect on our operating results.

Our future profitability and cash flows are dependent upon our ability to control expenses.

Our operating plan to maintain profitability is based upon estimates of our future expenses. For instance, we expect our operating expenses to increase in 2014 as compared to 2013 in order to support anticipated revenue growth, as well as the full year impact of the 2013 acquisition of CombineNet. If our future expenses are greater than anticipated, our ability to maintain profitability may be negatively impacted. Greater than anticipated expenses may negatively impact our cash flows, which could cause us to expend our capital faster than anticipated. Also, a large percentage of our expenses are relatively fixed, which may make it difficult to reduce expenses significantly in the future.

To the extent that future sales opportunities trend towards individual product sales rather than multi-product sales, the average sales price per customer of our solutions would likely decrease, which could have an adverse effect on our ability to increase future revenue and profitability.

Our solutions consist of individual products that can be deployed together as an integrated software suite or separately as individual solutions. We price our solutions in part based on the number of products purchased. Accordingly, multi-product sales of an integrated software suite will likely result in significantly higher subscription and service fees than sales of individual products even though the sales cycle will often be similar in terms of length and effort. Most of our customers do not currently utilize all, or even a majority, of our solutions, and we anticipate that many of the cross-selling opportunities into our installed customer base will be individual product sales as opposed to multi-product sales. To the extent that future sales opportunities trend towards individual product sales rather than multi-product sales, then the average sales price per customer of our solutions will likely decrease. Decreases in our average sales price per customer will require us to convert a greater number of sales opportunities, at potentially greater expense, in order to meet our revenue objectives. Thus, an increase in the number of individual product sales as compared to multi-product sales could have an adverse effect on our ability to increase future revenue and profitability.

Our future revenue growth could be impaired if our investment in direct and indirect sales channels for our products is unsuccessful.

We have invested significant time and resources in developing our direct sales force and our indirect sales channels. Sales through our direct sales force represent the primary source of our revenues. We supplement our direct sales force with indirect sales channels for our products through relationships with suppliers, ERP providers, technology providers, consultants and purchasing consortia. We cannot be assured that our direct or indirect sales channels will be successful or that we will be able to develop additional indirect sales channels to support our direct sales channel. If our direct sales efforts, and to a lesser extent our indirect sales efforts, are not effective, our ability to achieve revenue growth may be impaired. As we develop additional indirect sales

S-18

channels, we may experience conflicts with our direct sales force to the extent that these sales channels target the same customer bases. Successful management of these potential conflicts will be necessary in order to maximize our revenue growth.

If we are unable to facilitate the use of our implementation services by our customers in an optimal manner, the effectiveness of our customers’ use of our solutions would be negatively impacted, resulting in harm to our reputation, business and financial performance.

The use of our solutions typically includes implementation services to facilitate the optimal use of our solutions. Successful implementation projects can be critical to maintaining our high customer satisfaction rates and can also lower support costs. These activities require substantial involvement and cooperation from both our customers and their suppliers. For example, we typically work closely with customer personnel to improve the customer’s business processes, enable the customer’s suppliers on the SciQuest Supplier Network and support organizational activities to assist our customer’s transition to our spend management solutions. In addition, our implementation services often include extensive end-user training in order to facilitate product adoption and maximize the benefits for the organization. If we do not receive sufficient support from either the customer or its suppliers, then the optimal use of our services by the customer may be adversely impacted, resulting in lower customer satisfaction and negatively affecting our renewal rates, business, reputation and financial performance.

If we are not able to successfully create internal efficiencies for our customers and their suppliers, our operating costs and relationships with our customers and their suppliers will be adversely affected.

A key component of our products and services is the efficiencies created for our customers and their suppliers. In order to create these efficiencies, it is typically necessary for our solutions to work together with our customer’s internal systems such as inventory, customer service, technical service, ERP systems and financial systems. If these systems do not create the anticipated efficiencies, relationships with our customers will be adversely affected, which could have a material adverse affect on our financial condition and results of operations.

Our failure to raise additional capital or generate cash flows necessary to expand our operations and invest in new technologies could reduce our ability to compete successfully and adversely affect our results of operations.

To date, we have funded our business through our cash flows from operations and the proceeds of our initial public offering in September 2010 and our follow-on public offering in April 2011. We also established a $30 million credit facility in November 2012. In February 2014, we filed a shelf registration statement on Form S-3 covering 8,000,000 shares of common stock, some of which are being offered in this offering and other shares may be offered and sold in one or more additional public offerings in the future. There can be no assurance as to whether all or any portion of the shares covered by this registration statement will be offered or sold in the future. However, we may need to raise additional funds to achieve our future strategic objectives, including the execution of our strategy to pursue acquisitions. We may not be able to obtain additional debt or equity financing on favorable terms, if at all. Decreases in our stock price could adversely affect our ability to raise capital or complete acquisitions. If we raise additional equity financing, our security holders may experience significant dilution of their ownership interests and the value of shares of our common stock could decline. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness, force us to maintain specified liquidity or other ratios or restrict our ability to pay dividends or make acquisitions. If we need additional capital and cannot raise it on acceptable terms, we may not be able to, among other things:

| • | | develop and enhance our solutions; |

S-19

| • | | continue to expand our technology development, sales and/or marketing organizations; |

| • | | hire, train and retain employees; or |

| • | | respond to competitive pressures or unanticipated working capital requirements. |

Our inability to do any of the foregoing could reduce our ability to compete successfully and adversely affect our results of operations.

The market for spend management solutions is highly competitive, which makes achieving market share and profitability more difficult.

The market for spend management solutions is rapidly evolving and intensely competitive. We experience competition from multiple sources, which makes it difficult for us to develop a comprehensive business strategy that addresses all of these competitive factors. We face competition primarily from relatively small specialty software vendors, large ERP vendors and internally developed and maintained solutions. Competition is likely to intensify as this market matures.

As competitive conditions intensify, competitors may:

| • | | devote greater resources to marketing and promotional campaigns; |

| • | | reduce prices of their competing products and services; |

| • | | devote substantially more resources to product development; |

| • | | secure exclusive arrangements with indirect sales channels that impede our sales; |

| • | | develop more extensive client bases and broader client relationships than we have; and |

| • | | enter into strategic or commercial relationships with larger, more established and well-financed companies. |

In addition, some of our competitors may have longer operating histories and greater name recognition than us. New technologies and the expansion of existing technologies may increase competitive pressures. As a result of increased competition, we may experience reduced operating margins, as well as loss of market share and brand recognition. We may not be able to compete successfully against current and future competitors. These competitive pressures could have a material adverse effect on our revenue growth and results of operations.

We continue to have revenue concentration in certain vertical markets, which could make us vulnerable to adverse trends or events affecting those markets.

Due to our historical focus on vertical markets, our revenues continue to be concentrated in the higher education and to a lesser extent in the life sciences markets, state and local government and healthcare markets. Many of our customers and potential customers in the higher education and healthcare markets have been facing significant budgetary constraints that have limited spending on technology solutions. Continued spending constraints in these markets may result in slower growth, or reductions, in our revenues and profits in the future. In addition, the number of potential customers in these markets is relatively finite, which could limit our future growth prospects. Furthermore, many of our sales opportunities are generated by referrals from existing customers due to the collaborative nature of these markets, and therefore, our failure to provide a beneficial solution to our existing customers could adversely impact our reputation in these markets and our ability to generate new referral customers. The life sciences industry has been experiencing a period of consolidation, during which many of the large domestic and international pharmaceutical companies have been acquiring mid-sized pharmaceutical companies. The potential consolidation of our life sciences customers may diminish our negotiating leverage and exert downward pressure on our prices or cause us to lose the business of valuable customers who are consolidated with other pharmaceutical companies that are not our customers. Healthcare costs have risen significantly over the past decade and numerous initiatives and reforms initiated by legislators, regulators and third-party payors to curb these costs have resulted in a consolidation trend in the healthcare industry, including hospitals. This consolidation may reduce competition, exert downward pressure on the prices of our products and adversely impact our growth in this market.

S-20

If any of the circumstances described above result in decreased revenues or profitability from our existing customers in these markets or reduce our ability to generate new customers in these markets, this could have a material and adverse effect on our overall revenues and profits.

Our international sales efforts will require financial resources and management attention and could have a negative effect on our earnings.

We are investing resources and capital to expand our sales internationally. This will require financial resources and management attention and may subject us to new or increased levels of regulatory, economic, tax and political risks, all of which could have a negative effect on our earnings. We cannot be assured that we will be successful in creating international demand for our products and services. In addition, our international business may be subject to a variety of risks, including, among other things, increased costs associated with maintaining international marketing efforts, applicable government regulation, conflicting and changing tax laws, economic and political conditions and potential instability in various parts of the world, fluctuations in foreign currency, increased financial accounting and reporting burdens and complexities, difficulties in collecting international accounts receivable and the enforcement of intellectual property rights. If we continue to expand our business globally, our success will depend, in large part, on our ability to anticipate and effectively manage these and other risks associated with our international operations. Our failure to manage any of these risks successfully could adversely affect our operating results as a result of increased operating costs.

Mergers or other strategic transactions involving our competitors could weaken our competitive position, limit our growth prospects or reduce our revenues.

We believe that our industry is highly fragmented and that there is likely to be consolidation, which could lead to increased price competition and other forms of competition. Increased competition may cause pricing pressure and loss of market share, either of which could have a material adverse effect on our business, limit our growth prospects or reduce our revenues. Our competitors may establish or strengthen cooperative relationships with strategic partners or other parties. Established companies may not only develop their own products but may also merge with or acquire our current competitors. It is also possible that new competitors or alliances among competitors may emerge and rapidly acquire significant market share. Any of these circumstances could materially and adversely affect our business and operating results.

Interruptions or delays from third-party data centers could impair the delivery of our solutions, which could cause our business to suffer.

We use third-party data centers to conduct our operations, including our primary operating centers located in Durham, North Carolina, Houston, Texas and Pittsburgh, Pennsylvania and a redundant disaster recovery platform located in Scottsdale, Arizona. Generally, our solutions reside on hardware that we own and operate in these and other locations. Our operations depend on the protection of the equipment and information we store in these third-party data centers against damage or service interruptions that may be caused by fire, flood, severe storm, power loss, telecommunications failures, unauthorized intrusion, computer viruses and disabling devices, natural disasters, war, criminal acts, military action, terrorist attacks and other similar events beyond our control. A prolonged service disruption affecting the availability of our solutions for any of the foregoing reasons could damage our reputation with current and potential customers, expose us to liability and cause us to lose recurring revenue customers or otherwise adversely affect our business. We may also incur significant costs for using alternative equipment or taking other actions in preparation for, or in reaction to, events that damage the data centers we use.

Our cloud-based spend solutions are accessed by a large number of customers at the same time. As we continue to expand the number of our customers and products and services available to our customers, we may not be

S-21

able to scale our technology to accommodate the increased capacity requirements, which may result in interruptions or delays in service. In addition, the failure of our third-party data centers to meet our capacity requirements could result in interruptions or delays in our solutions or impede our ability to scale our operations. In the event that our data center arrangements are terminated, or there is a lapse of service or damage to such facilities, we could experience interruptions in our solutions as well as delays and additional expenses in arranging new facilities and services.

If we are unable to protect our intellectual property rights, our business could be materially and adversely affected.