UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934 (RULE 14a-101)

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| x | | Soliciting Material Pursuant to § 240.14a-12 |

SciQuest, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transactions computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Rule 01-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

This Schedule 14A filing consists of the following communications relating to the proposed acquisition of SciQuest, Inc. (“SciQuest” or the “Company”) by AKKR Green Parent, LLC, a Delaware limited liability company (“Parent”), and AKKR Green Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (“Merger Sub”), pursuant to the terms of an Agreement and Plan of Merger, dated May 30, 2016, by and among the Company, Parent and Merger Sub:

| | • | | Email to employees with employee Frequently Asked Questions as an attachment; |

| | • | | Email to customers and partners with customers and partners Frequently Asked Questions as an attachment; |

| | • | | Email to partners with customers and partners Frequently Asked Questions as an attachment; |

| | • | | Frequently Asked Questions for Investors; and |

| | • | | Presentation used at an all hands meeting with employees. |

Each item listed above was first used or made available on May 31, 2016.

The following email was sent to the Company’s employees on May 31, 2016:

All,

Today marks the beginning of a new, exciting chapter for SciQuest. SciQuest, Inc. entered into a definitive agreement to be acquired by Accel-KKR (AKKR), a technology focused private equity firm with offices in Menlo Park, California, Atlanta and London. Following completion of the acquisition, SciQuest will no longer be a publicly traded company.

Starting with what may be your first concern, retaining talent remains a top priority. There are no plans to change the current course and speed of the business as the result of this transaction, including headcount. It is a testament to your work in building SciQuest that a firm like AKKR, which is a long-standing shareholder, is interested in acquiring the company. A big part of the reason AKKR wants to buy the business is their excitement about our vision and plans. It is therefore important to continue to move forward aggressively to achieve our Q2 numbers and all of the milestones in our ambitious release schedules for the rest of the year and beyond. We expect to close the transaction in Q3, 2016.

As a private company, we believe we will have greater flexibility to invest in new initiatives and deliver even more value to our customers. AKKR is familiar with our products and understands the compelling value proposition that they provide. I am excited to work with AKKR to help further accelerate our growth. We are playing in a big, important, and exciting market, and the folks at AKKR are going to help us seize upon our opportunity.

I know you have questions, and I hope the attached FAQ helps. I encourage you to ask the questions that are on your mind and remind leaders to answer in an open and transparent manner. I look forward to keeping the conversation going during this afternoon’s company meeting. So get your questions ready, or, even better, send them to me in advance!

Steve

Additional Information

This communication may be deemed to be a solicitation of proxies in respect of the proposed acquisition of SciQuest. In connection with the proposed acquisition, SciQuest intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”). Investors and stockholders of SciQuest are urged to read the proxy statement (including any amendments or supplements) and other relevant materials filed with the SEC when they become available because they will contain important information about SciQuest and the proposed acquisition. The definitive proxy statement and a proxy card will be mailed to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Investors and stockholders may obtain a free copy

of the proxy statement when it becomes available, and other documents filed by SciQuest, at the SEC’s website, www.sec.gov. In addition, these documents (when they are available) may also be obtained by investors and stockholders free of charge at SciQuest’s website, www.sciquest.com, or from SciQuest upon written request to its Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560.

Participants in the Solicitation

SciQuest and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from stockholders of SciQuest in connection with the proposed acquisition. Information about SciQuest’s directors and executive officers may be found in SciQuest’s proxy statement on Schedule 14A relating to its 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2016, and SciQuest’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on February 22, 2016. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed acquisition will be included in the proxy statement related to the proposed acquisition to be filed with the SEC.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions of SciQuest’s management and on information currently available to SciQuest’s management and that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements include information concerning SciQuest’s possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities, the successful closing of this transaction, effects of the transaction, operations as a private company and the location of its headquarters and the effects of competition. Forward-looking statements consist of all statements that are not historical facts and can be identified by terms such as “accelerates,” “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including, without limitation, (1) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (2) the possibility that the consummation of the proposed acquisition described in this communication does not occur or is delayed, either due to the failure of closing conditions, including approval of SciQuest’s stockholders, the failure to obtain required regulatory approvals or other reasons; (3) the risk that the proposed acquisition disrupts current plans and operations or increases operating costs and the potential difficulties in customer loss and employee retention as a result of the announcement and consummation of such acquisition; (4) the outcome of any legal proceedings that may be instituted against the SciQuest, the potential acquiror or others following announcement of the merger agreement and transactions contemplated therein; and (5) those risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of SciQuest’s most recently filed Annual Report on Form 10-K and SciQuest’s subsequently filed Quarterly Reports on Form 10-Q. SciQuest urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as otherwise required by the federal securities laws, SciQuest disclaims any obligation or undertaking to publicly release or otherwise provide any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in SciQuest’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

The following frequently asked questions were attached to the email to the Company’s employees on May 31, 2016:

Who is Accel-KKR (AKKR)?

AKKR is a technology-focused private equity firm with $4 billion in capital under management. The firm invests primarily in software and IT-enabled businesses well positioned for top-line and bottom-line growth. At the core of AKKR’s investment strategy is a commitment to developing strong partnerships with the management teams of its portfolio companies and a focus on building value through significant resources available through the AKKR network. The company has offices in Menlo Park, CA (headquarters), Atlanta, GA, and London, UK.

What other companies has AKKR invested in?

AKKR focuses on middle market companies, providing capital for buyouts and growth investments across a range of opportunities including recapitalizations, divisional carve-outs and going private transactions. A link to their portfolio of companies can be found here.

What are the terms of the transaction?

AKKR and SciQuest have entered into a definitive agreement under which AKKR will acquire SciQuest for $17.75 per share. The all-cash offer represents a 34% premium over the Company’s closing pricing on May 27, 2016, and the total transaction value is approximately $509 million. AKKR will acquire 100% of the outstanding shares of SciQuest common stock.

When will the transaction close?

The transaction is subject to customary closing conditions, including approval of SciQuest’s stockholders and required regulatory approvals. The transaction is expected to close in the third quarter of 2016. Upon closing, SciQuest will become a privately held company with its headquarters remaining in Morrisville, NC.

Where can I find more information about the transaction itself?

SciQuest intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, SciQuest will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the transaction. INVESTORS AND SECURITY HOLDERS OF SCIQUEST ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT SCIQUEST WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SCIQUEST AND THE TRANSACTION. The definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the transaction (when they become available), and any other documents filed by SciQuest with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov) or at SciQuest’s website (http://investors.sciquest.com) or by writing to SciQuest’s Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560

Why has SciQuest entered into this agreement to be acquired?

We believe it allows us to increase our focus on long-term success that will benefit customers, employees, partners and suppliers. As a private company, we expect to continue to accelerate innovation, increase efficiency and expand our solution suite. In addition, this transaction provides SciQuest’s stockholders with a significant premium. We are playing in a big, important, and exciting market, and AKKR can help us seize upon our opportunity through their significant experience overseeing successful technology companies

Will there be a job for me in the new company or will my position be eliminated?

Retaining talent remains a top priority. There are no plans to change the current course and speed of the business as the result of this transaction, including headcount. The talent base that exists within SciQuest was a significant value driver in AKKR’s decision to acquire the company.

Will there be changes in benefit/401K programs after acquisition?

There are no expected changes to SciQuest benefit and 401K programs including 401K vesting schedules as a result of the acquisition. Providing a great benefits package is an important aspect of retaining talent and we will continue to evolve our programs to be competitive to the market.

Will my pay change (base compensation, bonus, commission, etc.)?

Compensation will remain the same subject to normal business evolutions such as internal movements, career progressions, promotions, etc.

Will I now be an employee of SciQuest, Inc. or AKKR?

There will be no change to the name of our company. You will remain an employee of SciQuest, Inc., which will be owned by AKKR.

What will happen to my ESPP shares (purchased and in progress)?

For prior ESPP programs that have already been executed, you own that stock outright as a normal stockholder. You will be able to sell your stock on the open market after a two-day employee blackout period. The current ESPP offering period ends today (May 31st), and this will be the last offering period.

What will happen to my stock options if I have them?

For options that are held until after the acquisition is closed, you will be paid the difference between $17.75 and option strike price for all vested options that have a strike price of less than $17.75. All such payments will be subject to any required tax withholdings. Unvested options and options with a strike price of at least $17.75 will be forfeited without consideration.

Will there be a new stock option plan?

It is a top priority of ours to retain talent. We will be working with AKKR to develop new incentive opportunities, and we will provide more information at a later date.

Will my role and responsibilities change?

Business will be as usual, there is no immediate or planned change to anyone’s job responsibilities.

What will the new organizational structure look like?

There will be no changes to the organizational structure of SciQuest, including the leadership team.

Will I report to a new manager or department?

AKKR intends to keep SciQuest organizationally intact, and as such, there are no planned departmental changes.

What is the culture of the new company and will it be a fit for me?

AKKR’s culture is built on a strong work ethic and drive to succeed. It is also one that values authenticity and collaboration. It will mesh well with the driven for success culture of SciQuest.

Will they keep the SciQuest offices open, or will they require me to commute or relocate?

There is no plan to close any of the SciQuest offices. SciQuest headquarters will remain in Morrisville, NC.

What should I do if someone from the press contacts me or communicates via social media?

No employees, other than approved corporate spokespeople, should make comments about the acquisition. If you are contacted by the media, investor, financial analyst or any other outside parties, please direct the inquiry to Roberta Patterson (Public Relations), 919-659-2230 rpatterson@sciquest.com or Jamie Andelman (Investor Relations), 919-659-2322 jandelman@sciquest.com.

We also ask that you refrain from commenting about the acquisition over social media.

Who should I talk to if I have additional questions?

For questions during the transition period, please speak to your manager, your division executive, and/or HR representative. We all want to share our excitement and help make this as smooth a transition as possible.

Additional Information

This communication may be deemed to be a solicitation of proxies in respect of the proposed acquisition of SciQuest. In connection with the proposed acquisition, SciQuest intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”). Investors and stockholders of SciQuest are urged to read the proxy statement (including any amendments or supplements) and other relevant materials filed with the SEC when they become available because they will contain important information about SciQuest and the proposed acquisition. The definitive proxy statement and a proxy card will be mailed to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Investors and stockholders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by SciQuest, at the SEC’s website, www.sec.gov. In addition, these documents (when they are available) may also be obtained by investors and stockholders free of charge at SciQuest’s website, www.sciquest.com, or from SciQuest upon written request to its Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560.

Participants in the Solicitation

SciQuest and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from stockholders of SciQuest in connection with the proposed acquisition. Information about SciQuest’s directors and executive officers may be found in SciQuest’s proxy statement on Schedule 14A relating to its 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2016, and SciQuest’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on February 22, 2016. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed acquisition will be included in the proxy statement related to the proposed acquisition to be filed with the SEC.

The following email was sent to the Company’s customers on May 31, 2016:

Dear [Customer]:

Today marks the beginning of a new, exciting chapter for SciQuest. We entered into a definitive agreement to be acquired byAccel-KKR, or AKKR, a technology focused private equity firm with offices in Menlo Park, California, Atlanta and London that specializes in investing in software and IT-enabled companies. Following completion of the transaction, SciQuest, Inc. will no longer be a publicly traded company. As private company, we believe we will have greater flexibility to invest in new initiatives and deliver even more value to our customers.

AKKR’s planned investment in SciQuest is a ringing endorsement of our robust product portfolio, our potential for growth and leadership in the spend management market and our deep commitment to customer success. We believe this transaction will allow us to accelerate innovation and expand our suite to ultimately deliver more value to you.

SciQuest is still SciQuest. We remain committed to meeting all of your needs, while continuing to provide the unmatched service and support that you have come to expect. Without highly satisfied customers, we cannot be successful.

Your account manager, customer success manager, support manager, and primary points of contact will remain the same. For any questions about today’s news, please review the attached FAQ. If you have any remaining questions, please contact your account manager.

We believe joining forces with AKKR will enable us to increase our focus on our collective long-term success. Thank you for your continued business.

Sincerely,

Stephen J. Wiehe

Chairman & CEO

SciQuest, Inc.

Additional Information

This communication may be deemed to be a solicitation of proxies in respect of the proposed acquisition of SciQuest. In connection with the proposed acquisition, SciQuest intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”). Investors and stockholders of SciQuest are urged to read the proxy statement (including any amendments or supplements) and other relevant materials filed with the SEC when they become available because they will contain important information about SciQuest and the proposed acquisition. The definitive proxy statement and a proxy card will be mailed to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Investors and stockholders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by SciQuest, at the SEC’s website, www.sec.gov. In addition, these documents (when they are available) may also be obtained by investors and stockholders free of charge at SciQuest’s website, www.sciquest.com, or from SciQuest upon written request to its Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560.

Participants in the Solicitation

SciQuest and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from stockholders of SciQuest in connection with the proposed acquisition. Information about SciQuest’s directors and executive officers may be found in SciQuest’s proxy statement on Schedule 14A relating to its 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2016, and SciQuest’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on February 22, 2016. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed acquisition will be included in the proxy statement related to the proposed acquisition to be filed with the SEC.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions of SciQuest’s management and on information currently available to SciQuest’s management and that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements include information concerning SciQuest’s possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities, the successful closing of this transaction, effects of the transaction, operations as a private company and the location of its headquarters and the effects of competition. Forward-looking statements consist of all statements that are not

historical facts and can be identified by terms such as “accelerates,” “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including, without limitation, (1) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (2) the possibility that the consummation of the proposed acquisition described in this communication does not occur or is delayed, either due to the failure of closing conditions, including approval of SciQuest’s stockholders, the failure to obtain required regulatory approvals or other reasons; (3) the risk that the proposed acquisition disrupts current plans and operations or increases operating costs and the potential difficulties in customer loss and employee retention as a result of the announcement and consummation of such acquisition; (4) the outcome of any legal proceedings that may be instituted against the SciQuest, the potential acquiror or others following announcement of the merger agreement and transactions contemplated therein; and (5) those risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of SciQuest’s most recently filed Annual Report on Form 10-K and SciQuest’s subsequently filed Quarterly Reports on Form 10-Q. SciQuest urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as otherwise required by the federal securities laws, SciQuest disclaims any obligation or undertaking to publicly release or otherwise provide any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in SciQuest’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

The following frequently asked questions were attached to the email to the Company’s customers on May 31, 2016:

Who is Accel-KKR (AKKR)?

AKKR is a technology-focused private equity firm with $4 billion in capital under management. The firm invests primarily in software and IT-enabled businesses well positioned for top-line and bottom-line growth. At the core of AKKR’s investment strategy is a commitment to developing strong partnerships with the management teams of its portfolio companies and a focus on building value through significant resources available through the AKKR network. The company has offices in Menlo Park, CA (headquarters), Atlanta, GA, and London, UK.

What other companies has AKKR invested in?

AKKR focuses on middle-market software and IT-enabled companies, providing capital for buyouts and growth investments across a range of opportunities including recapitalizations, divisional carve-outs and going private transactions. A link to their portfolio of companies can be found here.

When will the transaction close?

The transaction is subject to customary closing conditions, including approval of SciQuest’s stockholders and required regulatory approvals. The transaction is expected to close in the third quarter of 2016. Upon closing, SciQuest will become a privately held company with its headquarters remaining in Morrisville, NC.

Why has SciQuest entered into this agreement to be acquired?

We believe it will allow us to increase our focus on long-term success that will benefit customers, employees, partners and suppliers. As a private company, we expect to continue to accelerate innovation, increase efficiency and expand our solution suite. In addition, this transaction provides SciQuest’s stockholders with a significant premium. We are playing in a big, important, and exciting market, and AKKR can help us seize upon our opportunity through their significant experience overseeing successful technology companies

When will the transaction close?

The deal is subject to customary closing conditions, including approval of SciQuest’s stockholders and required regulatory approvals. The transaction is expected to close in the third quarter of 2016. Upon closing, SciQuest will become a privately held company with its headquarters remaining in Morrisville, NC.

Will there be any changes in product and services? Will SciQuest continue to offer the full source-to-settle suite of offerings?

We believe this transaction allow us to increase our focus on long-term success that will benefit customers and other important constituents. As a private company, we expect to continue to accelerate innovation, increase efficiency and expand our solution suite. Our full suite software and services will continue to be available. We’re still tracking toward product delivery dates and are focused on delivering top- notch customer service.

Will my contractual agreements remain valid?

All current contracts will remain in place with no change in our business agreements.

Will there be any changes to my current SciQuest sales or support team?

Meeting the needs of our customers and partners remains one of our highest priorities. SciQuest’s customers and partners will see no operational impact, account managers and other points of contact will remain the same.

Do you expect any pricing changes once my contract is up for renewal?

This transaction does not impact our current pricing plans.

Will SciQuest continue to have three development releases a year? Will there be any date changes to upcoming releases?

This transaction does not impact our current release schedule.

How will the current product development roadmap change?

We don’t expect to make major changes in the short-term. We’re still tracking toward product delivery dates and are focused on delivering top- notch customer service.

Will SciQuest’s Next Level annual conference still take place August 21st in Nashville, TN?

SciQuest’s Next Level conference is an important tool as a forum for our customers, industry experts, and luminaries to exchange industry insights and to share upcoming product and industry developments. We are fully committed to executing on a valuable event in Nashville. For more information on Next Level and to register go to http://nextlevel.sciquest.com/.

Additional Information

This communication may be deemed to be a solicitation of proxies in respect of the proposed acquisition of SciQuest. In connection with the proposed acquisition, SciQuest intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”). Investors and stockholders of SciQuest are urged to read the proxy statement (including any amendments or supplements) and other relevant materials filed with the SEC when they become available because they will contain important information about SciQuest and the proposed acquisition. The definitive proxy statement and a proxy card will be mailed to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Investors and stockholders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by SciQuest, at the SEC’s website, www.sec.gov. In addition, these documents (when they are available) may also be obtained by investors and stockholders free of charge at SciQuest’s website, www.sciquest.com, or from SciQuest upon written request to its Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560.

Participants in the Solicitation

SciQuest and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from stockholders of SciQuest in connection with the proposed acquisition. Information about SciQuest’s directors and executive officers may be found in SciQuest’s proxy statement on Schedule 14A relating to its 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2016, and SciQuest’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on February 22, 2016. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed acquisition will be included in the proxy statement related to the proposed acquisition to be filed with the SEC.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions of SciQuest’s management and on information currently available to SciQuest’s management and that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements include information concerning SciQuest’s possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities, the successful closing of this transaction, effects of the transaction, operations as a private company and the location of its headquarters and the effects of competition. Forward-looking statements consist of all statements that are not historical facts and can be identified by terms such as “accelerates,” “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including, without limitation, (1) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (2) the possibility that the consummation of the proposed acquisition described in this communication does not occur or is delayed, either due to the failure of closing conditions, including approval of SciQuest’s stockholders, the failure to obtain required regulatory approvals or other reasons; (3) the risk that the proposed acquisition disrupts current plans and operations or increases operating costs and the potential difficulties in customer loss and employee retention as a result of the announcement and consummation of such acquisition; (4) the outcome of any legal proceedings that may be instituted against the SciQuest, the potential acquiror or others following announcement of the merger agreement and transactions contemplated therein; and (5) those risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of SciQuest’s most recently filed Annual Report on Form 10-K and SciQuest’s subsequently filed Quarterly Reports on Form 10-Q. SciQuest urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as otherwise required by the federal securities laws, SciQuest disclaims any obligation or undertaking to publicly release or otherwise provide any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in SciQuest’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

The following email was sent to the Company’s partners on May 31, 2016:

Dear [Partner]:

Today marks the beginning of a new, exciting chapter for SciQuest. We entered into a definitive agreement to be acquired by Accel-KKR or (AKKR), a technology focused private equity firm with offices in Menlo Park, California, Atlanta and London that specializes in investing in software and IT-enabled companies. Following completion of the transaction, SciQuest, Inc. will no longer be a publicly traded company. As a private company, we believe we will have greater flexibility to invest in new initiatives and deliver even more value to our customers and partners.

AKKR’s planned investment in SciQuest is a ringing endorsement of our robust product portfolio, our future potential for growth and leadership in the spend management market and our deep commitment to customer success. We believe this transaction will allow us to hone our business strategy, accelerate product development and ultimately deliver more value to you.

SciQuest is still SciQuest. We remain committed to meeting all of your needs, while continuing to provide the unmatched service and support that you and your customers have come to expect.

Your primary points of contact will remain the same. For any questions about today’s news, contact your partner manager directly.

We believe joining forces with AKKR will enable us to increase our focus on our collective long-term success. Thank you for your continued partnership.

Sincerely,

Stephen J. Wiehe

Chairman & CEO

SciQuest, Inc.

Additional Information

This communication may be deemed to be a solicitation of proxies in respect of the proposed acquisition of SciQuest. In connection with the proposed acquisition, SciQuest intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”). Investors and stockholders of SciQuest are urged to read the proxy statement (including any amendments or supplements) and other relevant materials filed with the SEC when they become available because they will contain important information about SciQuest and the proposed acquisition. The definitive proxy statement and a proxy card will be mailed to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Investors and stockholders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by SciQuest, at the SEC’s website, www.sec.gov. In addition, these documents (when they are available) may also be obtained by investors and stockholders free of charge at SciQuest’s website, www.sciquest.com, or from SciQuest upon written request to its Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560.

Participants in the Solicitation

SciQuest and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from stockholders of SciQuest in connection with the proposed acquisition. Information about SciQuest’s directors and executive officers may be found in SciQuest’s proxy statement on Schedule 14A relating to its 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2016, and SciQuest’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on February 22, 2016. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed acquisition will be included in the proxy statement related to the proposed acquisition to be filed with the SEC.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions of SciQuest’s management and on information currently available to SciQuest’s management and that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements include information concerning SciQuest’s possible or assumed future results of operations, business strategies, financing

plans, competitive position, industry environment, potential growth opportunities, potential market opportunities, the successful closing of this transaction, effects of the transaction, operations as a private company and the location of its headquarters and the effects of competition. Forward-looking statements consist of all statements that are not historical facts and can be identified by terms such as “accelerates,” “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including, without limitation, (1) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (2) the possibility that the consummation of the proposed acquisition described in this communication does not occur or is delayed, either due to the failure of closing conditions, including approval of SciQuest’s stockholders, the failure to obtain required regulatory approvals or other reasons; (3) the risk that the proposed acquisition disrupts current plans and operations or increases operating costs and the potential difficulties in customer loss and employee retention as a result of the announcement and consummation of such acquisition; (4) the outcome of any legal proceedings that may be instituted against the SciQuest, the potential acquiror or others following announcement of the merger agreement and transactions contemplated therein; and (5) those risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of SciQuest’s most recently filed Annual Report on Form 10-K and SciQuest’s subsequently filed Quarterly Reports on Form 10-Q. SciQuest urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as otherwise required by the federal securities laws, SciQuest disclaims any obligation or undertaking to publicly release or otherwise provide any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in SciQuest’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

The following frequently asked questions were attached to the email to the Company’s partners on May 31, 2016:

Who is Accel-KKR (AKKR)?

AKKR is a technology-focused private equity firm with $4 billion in capital under management. The firm invests primarily in software and IT-enabled businesses well positioned for top-line and bottom-line growth. At the core of AKKR’s investment strategy is a commitment to developing strong partnerships with the management teams of its portfolio companies and a focus on building value through significant resources available through the AKKR network. The company has offices in Menlo Park, CA (headquarters), Atlanta, GA, and London, UK.

What other companies has AKKR invested in?

AKKR focuses on middle-market software and IT-enabled companies, providing capital for buyouts and growth investments across a range of opportunities including recapitalizations, divisional carve-outs and going private transactions. A link to their portfolio of companies can be found here.

When will the transaction close?

The transaction is subject to customary closing conditions, including approval of SciQuest’s stockholders and required regulatory approvals. The transaction is expected to close in the third quarter of 2016. Upon closing, SciQuest will become a privately held company with its headquarters remaining in Morrisville, NC.

Why has SciQuest entered into this agreement to be acquired?

We believe it will allow us to increase our focus on long-term success that will benefit customers, employees, partners and suppliers. As a private company, we expect to continue to accelerate innovation, increase efficiency and expand our solution suite. In addition, this transaction provides SciQuest’s stockholders with a significant premium. We are playing in a big, important, and exciting market, and AKKR can help us seize upon our opportunity through their significant experience overseeing successful technology companies

When will the transaction close?

The deal is subject to customary closing conditions, including approval of SciQuest’s stockholders and required regulatory approvals. The transaction is expected to close in the third quarter of 2016. Upon closing, SciQuest will become a privately held company with its headquarters remaining in Morrisville, NC.

Will there be any changes in product and services? Will SciQuest continue to offer the full source-to-settle suite of offerings?

We believe this transaction allow us to increase our focus on long-term success that will benefit customers and other important constituents. As a private company, we expect to continue to accelerate innovation, increase efficiency and expand our solution suite. Our full suite software and services will continue to be available. We’re still tracking toward product delivery dates and are focused on delivering top- notch customer service.

Will my contractual agreements remain valid?

All current contracts will remain in place with no change in our business agreements.

Will there be any changes to my current SciQuest sales or support team?

Meeting the needs of our customers and partners remains one of our highest priorities. SciQuest’s customers and partners will see no operational impact, account managers and other points of contact will remain the same.

Do you expect any pricing changes once my contract is up for renewal?

This transaction does not impact our current pricing plans.

Will SciQuest continue to have three development releases a year? Will there be any date changes to upcoming releases?

This transaction does not impact our current release schedule.

How will the current product development roadmap change?

We don’t expect to make major changes in the short-term. We’re still tracking toward product delivery dates and are focused on delivering top- notch customer service.

Will SciQuest’s Next Level annual conference still take place August 21st in Nashville, TN?

SciQuest’s Next Level conference is an important tool as a forum for our customers, industry experts, and luminaries to exchange industry insights and to share upcoming product and industry developments. We are fully committed to executing on a valuable event in Nashville. For more information on Next Level and to register go to http://nextlevel.sciquest.com/.

Additional Information

This communication may be deemed to be a solicitation of proxies in respect of the proposed acquisition of SciQuest. In connection with the proposed acquisition, SciQuest intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”). Investors and stockholders of SciQuest are urged to read the proxy statement (including any amendments or supplements) and other relevant materials filed with the SEC when they become available because they will contain important information about SciQuest and the proposed acquisition. The definitive proxy statement and a proxy card will be mailed to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Investors and stockholders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by SciQuest, at the SEC’s website, www.sec.gov. In addition, these documents (when they are available) may also be obtained by investors and stockholders free of charge at SciQuest’s website, www.sciquest.com, or from SciQuest upon written request to its Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560.

Participants in the Solicitation

SciQuest and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from stockholders of SciQuest in connection with the proposed acquisition. Information about SciQuest’s directors and executive officers may be found in SciQuest’s proxy statement on Schedule 14A relating to its 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2016, and SciQuest’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on February 22, 2016. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed acquisition will be included in the proxy statement related to the proposed acquisition to be filed with the SEC.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions of SciQuest’s management and on information currently available to SciQuest’s management and that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements include information concerning SciQuest’s possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities, the successful closing of this transaction, effects of the transaction, operations as a private company and the location of its headquarters and the effects of competition. Forward-looking statements consist of all statements that are not historical facts and can be identified by terms such as “accelerates,” “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including, without limitation, (1) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (2) the possibility that the consummation of the proposed acquisition described in this communication does not occur or is delayed, either due to the failure of closing conditions, including approval of SciQuest’s stockholders, the failure to obtain required regulatory approvals or other reasons; (3) the risk that the proposed acquisition disrupts current plans and operations or increases operating costs and the potential difficulties in customer loss and employee retention as a result of the announcement and consummation of such acquisition; (4) the outcome of any legal proceedings that may be instituted against the SciQuest, the potential acquiror or others following announcement of the merger agreement and transactions contemplated therein; and (5) those risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of SciQuest’s most recently filed Annual Report on Form 10-K and SciQuest’s subsequently filed Quarterly Reports on Form 10-Q. SciQuest urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as otherwise required by the federal securities laws, SciQuest disclaims any obligation or undertaking to publicly release or otherwise provide any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in SciQuest’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

The following frequently asked questions were first used with investors on May 31, 2016:

| | • | | Offer represents compelling value — $17.75 per share (34% premium to Fri. 5/27 closing price). |

| | • | | As a private company, SciQuest believes it will be able to accelerate innovation, increase efficiency and expand our solution suite. |

| | • | | These improvements will be good for customers, employees, partners and suppliers. |

| | • | | AKKR has significant experience partnering with successful technology companies. |

| | • | | SciQuest will continue to operate as a public company until the transaction closes, which is expected in the third quarter 2016 |

| 1. | Why should stockholders support this transaction? |

| | • | | At $17.75 per share in cash, stockholders will receive compelling value for their shares — a 34% premium to the closing price on 5/27. |

| | • | | It is an all-cash offer. |

| | • | | There is no financing contingency. |

| | • | | The ~3.2x revenue multiple that the offer represents compares well to current trading multiples for SaaS companies who are expected to have revenue growth of ~10% or less in 2017 (<1.5x). |

| 2. | Do you expect the transaction to go through? Will stockholders vote for it? What percentage vote is required? What specific regulatory hurdles do you need to go through? Do you expect any regulatory holdups / complications? |

| | • | | We believe stockholders will recognize the logic and value of this transaction. |

| | • | | The deal requires the support of the majority of the shares outstanding. |

| | • | | Transaction is subject to Hart Scott Rodino review as well as SEC approval of the proxy statement. |

| | • | | We don’t see any reason for a regulatory body to oppose this transaction. |

| 3. | How did the deal come about? How long has it been in the works? Do you expect any superior bids? |

| | • | | AKKR has been a significant shareholder in SciQuest with 4.9% ownership. |

| | • | | AKKR approached SciQuest. |

| | • | | There is a 25-day “go shop” period (ends June 24th) that allows our board to solicit and entertain other offers. |

| | • | | More details on the background to the transaction will be disclosed in the proxy statement. |

| 4. | When will the transaction close? What is the timeline? |

| | • | | We expect the transaction to close in the third quarter 2016. |

| | • | | There is a 25-day “go shop” period (ends June 24th) that allows our board to solicit and entertain other offers. |

| | • | | We will prepare and file a proxy statement promptly and will mail the proxy statement out within 2 business days after the SEC has completed its review. |

| | • | | The stockholders meeting will take place within 20 business days of the mailing of the proxy. |

| | • | | Closing will take place after all conditions in the merger agreement have been satisfied or waived. |

| 5. | What are the outs /termination rights? |

| | • | | See Section VIII of the merger agreement that was filed in a Form 8-K dated 5/31. |

| 6. | What is the breakup fee? |

| | • | | See the definition of “Termination Fee” on page 8 of the merger agreement that was filed in a Form 8-K dated 5/31. |

| 7. | Will you be holding a Q2 earnings call? |

| | • | | We will report second quarter earnings via a press release. We will determine whether or not to conduct a conference call as well. |

Additional Information

This communication may be deemed to be a solicitation of proxies in respect of the proposed acquisition of SciQuest. In connection with the proposed acquisition, SciQuest intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”). Investors and stockholders of SciQuest are urged to read the proxy statement (including any amendments or supplements) and other relevant materials filed with the SEC when they become available because they will contain important information about SciQuest and the proposed acquisition. The definitive proxy statement and a proxy card will be mailed to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Investors and stockholders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by SciQuest, at the SEC’s website, www.sec.gov. In addition, these documents (when they are available) may also be obtained by investors and stockholders free of charge at SciQuest’s website, www.sciquest.com, or from SciQuest upon written request to its Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560.

Participants in the Solicitation

SciQuest and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from stockholders of SciQuest in connection with the proposed acquisition. Information about SciQuest’s directors and executive officers may be found in SciQuest’s proxy statement on Schedule 14A relating to its 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2016, and SciQuest’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on February 22, 2016. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed acquisition will be included in the proxy statement related to the proposed acquisition to be filed with the SEC.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions of SciQuest’s management and on information currently available to SciQuest’s management and that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements include information concerning SciQuest’s possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities, the successful closing of this transaction, effects of the transaction, operations as a private company and the location of its headquarters and the effects of competition. Forward-looking statements consist of all statements that are not historical facts and can be identified by terms such as “accelerates,” “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including, without limitation, (1) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (2) the possibility that the consummation of the proposed acquisition described in this communication does not occur or is delayed, either due to the failure of

closing conditions, including approval of SciQuest’s stockholders, the failure to obtain required regulatory approvals or other reasons; (3) the risk that the proposed acquisition disrupts current plans and operations or increases operating costs and the potential difficulties in customer loss and employee retention as a result of the announcement and consummation of such acquisition; (4) the outcome of any legal proceedings that may be instituted against the SciQuest, the potential acquiror or others following announcement of the merger agreement and transactions contemplated therein; and (5) those risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of SciQuest’s most recently filed Annual Report on Form 10-K and SciQuest’s subsequently filed Quarterly Reports on Form 10-Q. SciQuest urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as otherwise required by the federal securities laws, SciQuest disclaims any obligation or undertaking to publicly release or otherwise provide any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in SciQuest’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

The following presentation was used at an all hands meeting with employees on May 31, 2016:

All HANDS May 31, 2016 Steve Wiehe, Chairman, President and CEO

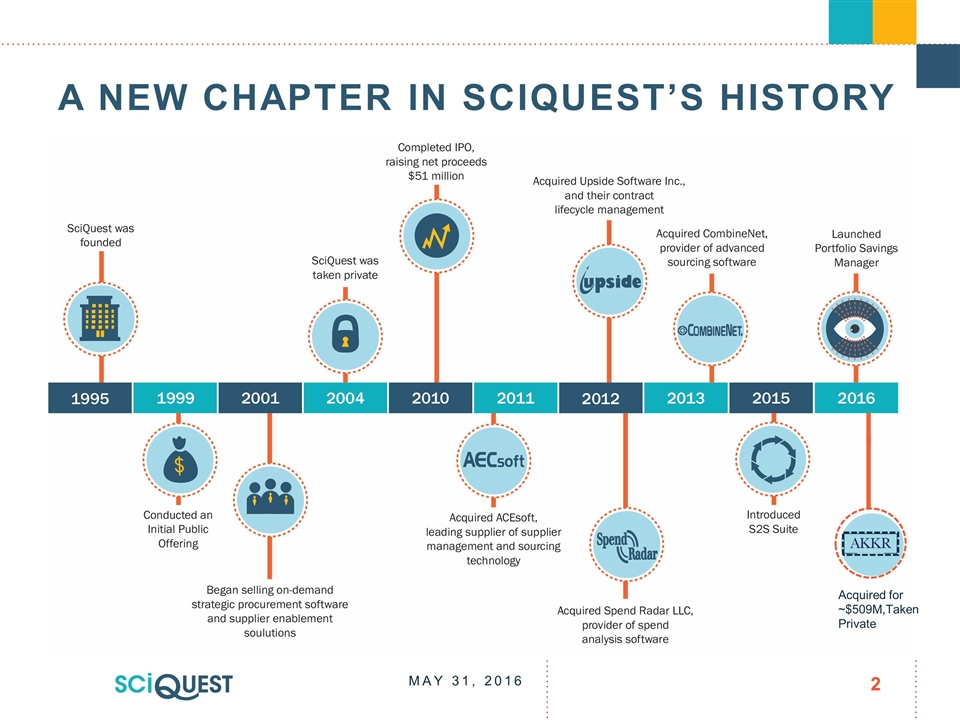

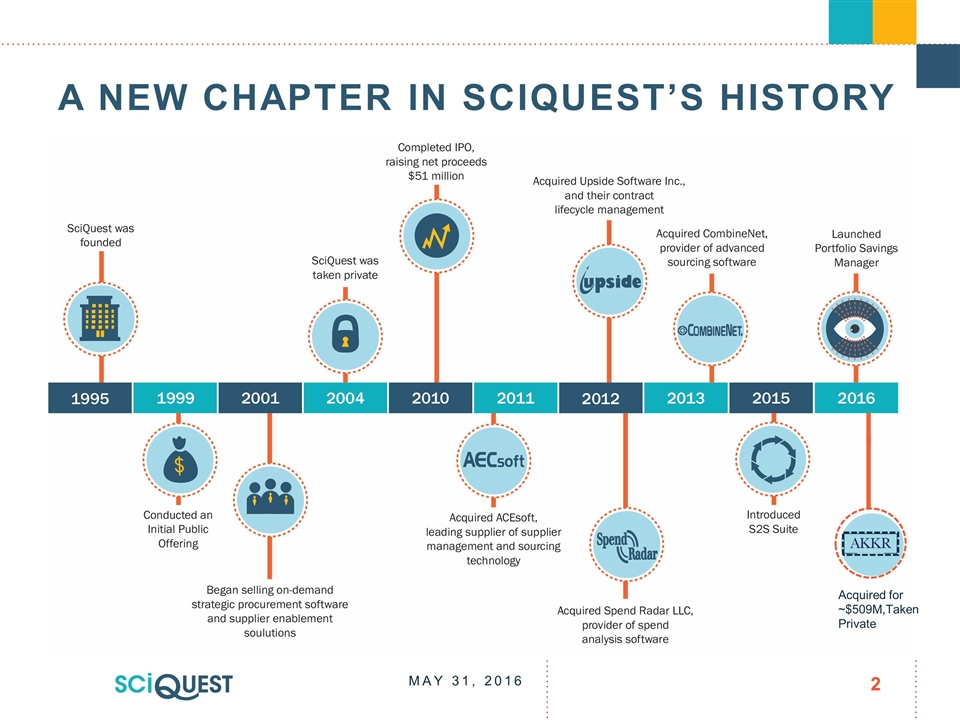

A new Chapter in Sciquest’s History May 31, 2016 Acquired for ~$509M,Taken Private

SciQuest to be Acquired by Accel-KKR for Over $500 Million AKKR, currently a large shareholder, will acquire 100% of the outstanding shares of SciQuest common stock SciQuest will go from being a publically traded company on the NASDAQ to a private company owned by AKKR Subject to customary closing conditions May 31, 2016

Transaction Terms Offer for $17.75 per share Stockholders would receive a 34% premium to the closing price on 5/27/16 It is an all-cash offer Valuation compares favorably compared to current SaaS companies with revenue growth of ~10% or less May 31, 2016

Why Accel-KKR (AKKR) May 31, 2016 AKKR is a technology-focused private equity firm with $4 billion in capital under management The firm invests primarily in software and IT-enabled businesses well positioned for top-line and bottom-line growth AKKR's investment strategy is committed to developing strong partnerships with the management teams of its portfolio companies AKKR allows its companies the opportunity to build value through significant resources available through the AKKR network

What does this mean? A Nice complement We believe SciQuest can leverage AKKR expertise and connections Eliminates costs and distractions associated with being a public company Allows focus on long-term success that will benefit customers, employees, partners and suppliers Investment allows us to enhance product development and innovation and make strategic acquisitions May 31, 2016

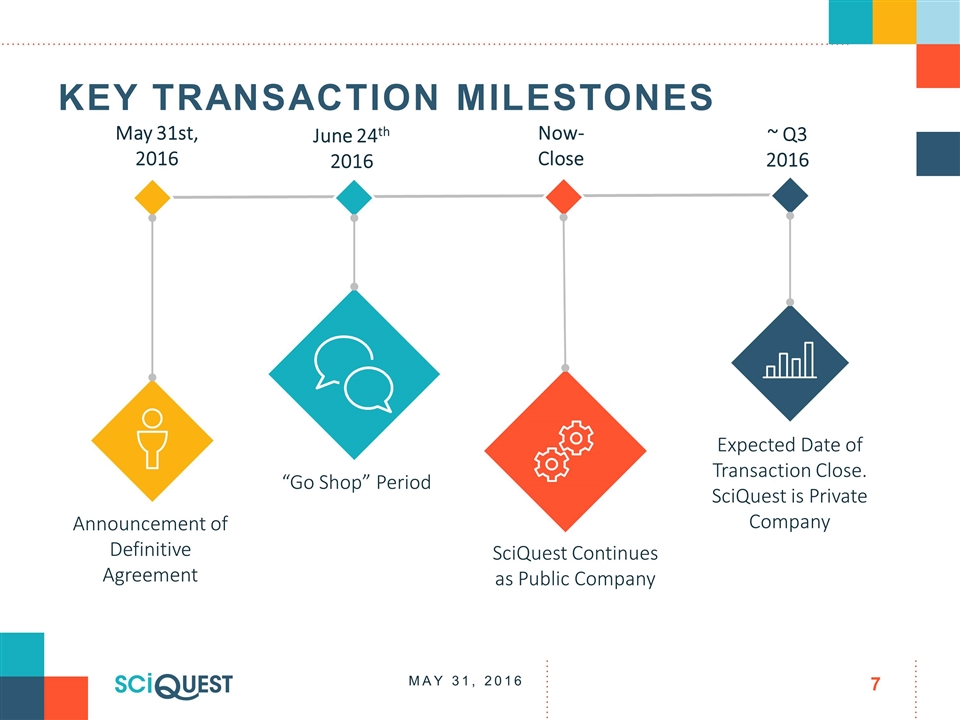

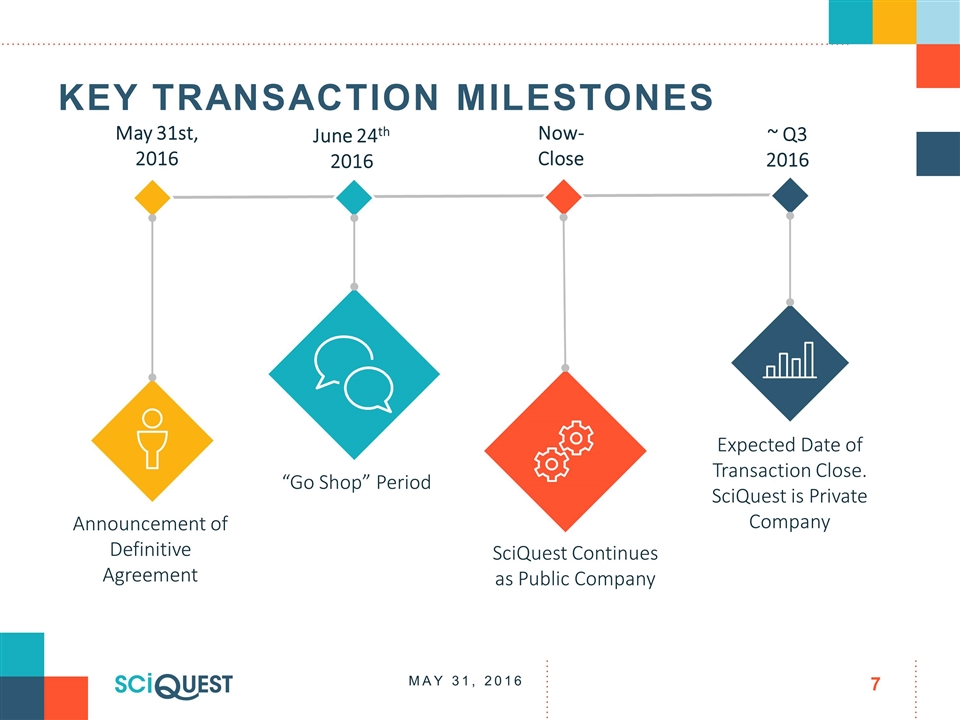

Key transaction Milestones May 31, 2016 May 31st, 2016 June 24th 2016 Now-Close ~ Q3 2016 Announcement of Definitive Agreement “Go Shop” Period SciQuest Continues as Public Company Expected Date of Transaction Close. SciQuest is Private Company

Key takeaways We believe joining forces with AKKR will help us reach and exceed our goals faster This deal validates all of your hard work AKKR only buys companies they believe in It is business as usual – keep doing what you’ve been doing Retaining and recruiting top talent remains a top priority Ask questions and share your concerns May 31, 2016

WHAT ROLE WILL AKKR HAVE IN RUNING OUR BUSINESS? QUESTIONS & Answers May 31, 2016 WHAT IF STOCKHOLDERS DON’T APPROVE? IS THERE ANYTHING THAT COULD STOP THIS DEAL? WILL I LOSE MY JOB? WILL THE LEADERSHIP TEAM STAY IN PLACE?

Next Scoop Meeting NOAH’s Event Venue 5180 Paramount Pkwy, Morrisville, NC 27560 August 4th, 2016 May 31, 2016

May 31, 2016

May 31, 2016 Additional Information This communication may be deemed to be a solicitation of proxies in respect of the proposed acquisition of SciQuest. In connection with the proposed acquisition, SciQuest intends to file a proxy statement and other relevant materials with the Securities and Exchange Commission (the “SEC”). Investors and stockholders of SciQuest are urged to read the proxy statement (including any amendments or supplements) and other relevant materials filed with the SEC when they become available because they will contain important information about SciQuest and the proposed acquisition. The definitive proxy statement and a proxy card will be mailed to each stockholder entitled to vote at the special meeting relating to the proposed acquisition. Investors and stockholders may obtain a free copy of the proxy statement when it becomes available, and other documents filed by SciQuest, at the SEC’s website, www.sec.gov. In addition, these documents (when they are available) may also be obtained by investors and stockholders free of charge at SciQuest’s website, www.sciquest.com, or from SciQuest upon written request to its Investor Relations at 3020 Carrington Mill Boulevard, Suite 100, Morrisville, NC 27560. Participants in the Solicitation SciQuest and its directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from stockholders of SciQuest in connection with the proposed acquisition. Information about SciQuest’s directors and executive officers may be found in SciQuest’s proxy statement on Schedule 14A relating to its 2016 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2016, and SciQuest’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed on February 22, 2016. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the proposed acquisition will be included in the proxy statement related to the proposed acquisition to be filed with the SEC.

May 31, 2016 Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on beliefs and assumptions of SciQuest’s management and on information currently available to SciQuest’s management and that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements include information concerning SciQuest’s possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities, the successful closing of this transaction, effects of the transaction, operations as a private company and the location of its headquarters and the effects of competition. Forward-looking statements consist of all statements that are not historical facts and can be identified by terms such as “accelerates,” “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward-looking statements, as a result of various factors including, without limitation, (1) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; (2) the possibility that the consummation of the proposed acquisition described in this communication does not occur or is delayed, either due to the failure of closing conditions, including approval of SciQuest’s stockholders, the failure to obtain required regulatory approvals or other reasons; (3) the risk that the proposed acquisition disrupts current plans and operations or increases operating costs and the potential difficulties in customer loss and employee retention as a result of the announcement and consummation of such acquisition; (4) the outcome of any legal proceedings that may be instituted against the SciQuest, the potential acquiror or others following announcement of the merger agreement and transactions contemplated therein; and (5) those risks and uncertainties described in the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of SciQuest’s most recently filed Annual Report on Form 10-K and SciQuest’s subsequently filed Quarterly Reports on Form 10-Q. SciQuest urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as otherwise required by the federal securities laws, SciQuest disclaims any obligation or undertaking to publicly release or otherwise provide any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in SciQuest’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.