- UTHR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

United Therapeutics (UTHR) DEF 14ADefinitive proxy

Filed: 29 Apr 24, 7:00am

Filed by the Registrant x | |

Filed by a Party other than the Registrant o | |

Check the appropriate box: | |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a‑12 |

United Therapeutics Corporation | ||

(Name of Registrant as Specified In Its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box): | ||

x | No fee required. | |

o | Fee paid previously with preliminary materials. | |

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. | |

About United Therapeutics Our company was founded over 27 years ago with the challenge of finding a way to cure or treat a rare, life-threatening illness suffered by our CEO's daughter. That mission continues today, has grown to encompass a variety of rare diseases, and drives everything that we do. Early on, we developed a roadmap to success based on five strategic objectives: | ||||||

•Develop the best medicines possible from our intellectual property •Conduct the most insightful clinical trials of our medicines •Achieve superior communication and awareness of our products among physicians •Grow our business to be in the top quintile of our peers •Achieve our goals by doing the right thing and using the highest ethical standards | ||||||

Our Commitment to Corporate Social Responsibility | AWARDS AND RECOGNITION | |||||

| PATIENT-CENTRIC APPROACH The parents of a child with pulmonary arterial hypertension founded United Therapeutics, so we take our commitment to patients personally. Through our relentless pursuit of life-changing therapies, medical devices, and transplantation technologies, and our patient support and assistance programs, we are striving to improve the lives of patients with pulmonary hypertension and other life-threatening diseases. | |||||

Newsweek Magazine's America's Most Responsible Companies 2024 | ||||||

| ||||||

| ENVIRONMENTAL STEWARDSHIP We take sustainability seriously, and we believe that reducing our carbon footprint is a responsibility shared by all. Through our focus on constructing site net zero energy and LEED-certified buildings, we are taking a leadership role in driving the use of sustainable technologies forward. | |||||

Great Places to Work Certified by Fortune Magazine | ||||||

| ||||||

| OUR PEOPLE We could not have achieved the best year in our company's history without attracting, supporting, and retaining our diverse, hard-working, team-playing employees we call "Unitherians". We have a company-wide minimum living salary, on-site subsidized child care, and a suite of health and wellness benefits to take care of our Unitherians holistically. Our Board and management teams lead our diversity, equity, and inclusion efforts and initiatives. | |||||

Proxy materials or a Notice of Internet Availability are being distributed to shareholders on or about April 29, 2024. | ||||||

2024 Proxy Statement | 1 |

| DATE AND TIME |  | LOCATION |  | WHO CAN VOTE | ||

Wednesday, June 26, 2024 10:30 a.m. Eastern Time | virtualshareholdermeeting.com/ UTHR2024 | Shareholders as of April 29, 2024 (the Record Date) are entitled to notice of, and to vote at, our 2024 Annual Meeting of Shareholders | |||||

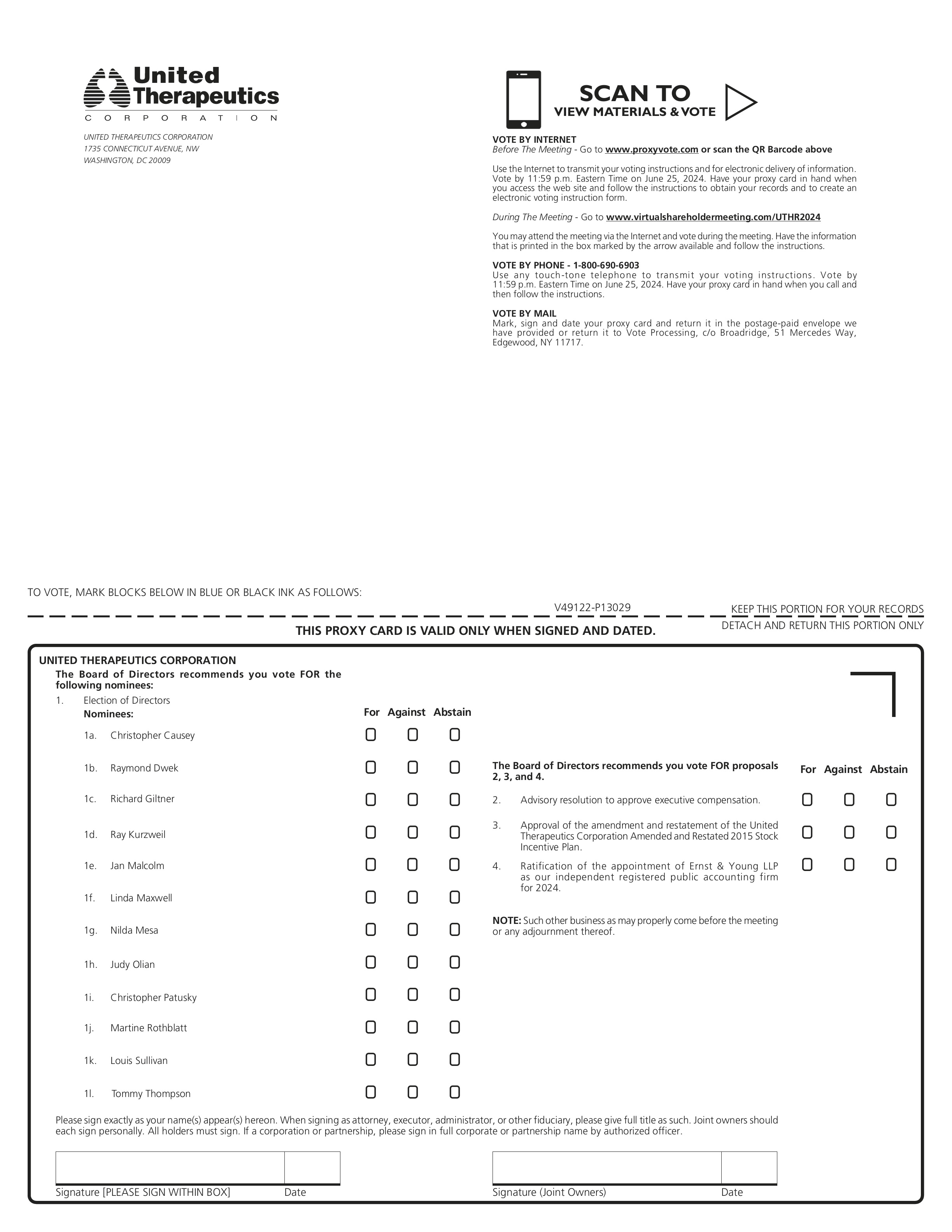

Company Proposals | Board Vote Recommendation | For Further Details | |

1 | Election of the twelve directors named in this Proxy Statement | “FOR” each director nominee | Page 18 |

2 | Advisory resolution to approve executive compensation | “FOR” | Page 41 |

3 | Approval of the amendment and restatement of the United Therapeutics Corporation Amended and Restated 2015 Stock Incentive Plan | “FOR” | Page 76 |

4 | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2024 | “FOR” | Page 86 |

| INTERNET |  | TELEPHONE |  | MAIL | ||

Before the meeting, go to proxyvote.com During the meeting, go to virtualshareholdermeeting.com/UTHR2024 | (800) 690-6903 | Mark, sign, date, and promptly mail the enclosed proxy card in the postage-paid envelope | |||||

Important Notice Regarding the Availability of Proxy Materials for United Therapeutics Corporation’s 2024 Annual Meeting of Shareholders to Be Held on Wednesday, June 26, 2024: United Therapeutics Corporation’s Proxy Statement and Annual Report on Form 10-K are available at: ir.unither.com/annual-and-proxy |

2 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 3 |

2023 Shareholder Outreach | |

Pension Benefits in 2023 | |

4 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 5 |

PH Portfolio | NB Product | ||||||||

|  |  |  |  | |||||

6 | United Therapeutics, a public benefit corporation |

n | Remodulin | n | Tyvaso DPI | n | Nebulized Tyvaso | n | Orenitram |

2024 Proxy Statement | 7 |

8 | United Therapeutics, a public benefit corporation |

ü | CONTINUED STRONG REVENUE PERFORMANCE |

ü | INDUSTRY-LEADING PROFITABILITY |

ü | CONTINUED INNOVATION AND R&D PROGRESS |

ü | STRONG BALANCE SHEET POISED FOR FUTURE INVESTMENT |

2024 Proxy Statement | 9 |

| Our Patients |

| Our People |

10 | United Therapeutics, a public benefit corporation |

| Our Presence |

| Our Principles |

All Unitherians | Management | |||

2024 Proxy Statement | 11 |

What is a Public Benefit Corporation? A Delaware PBC is a for-profit corporation. There are two primary differences between a PBC and a traditional Delaware for-profit corporation: •A corporation organized as a Delaware PBC identifies in its certificate of incorporation one or more specific public benefits that it will seek to promote in addition to shareholders' financial interests. The public benefits are actions or goals that are intended to have positive effects on a category of persons, entities, interests, or communities. •In making decisions, directors of a PBC have an obligation to balance the financial interests of shareholders, the interests of stakeholders materially affected by the PBC’s conduct, and pursuit of the corporation’s public benefit purpose. A Delaware PBC must also provide its shareholders with a statement, at least every other year, as to the PBC’s assessment of the success of its efforts to promote its public benefit purpose and the best interests of those materially affected by the PBC's conduct. We plan to continue to provide this update annually with our Corporate Responsibility and Public Benefit Report. |

12 | United Therapeutics, a public benefit corporation |

1 | Election of Directors |

Our Board recommends a vote FOR each director nominee. | See page 18 |

2 | Advisory Resolution to Approve Executive Compensation |

Our Board recommends a vote FOR this proposal. | See page 41 |

3 | Approval of the Amendment and Restatement of The United Therapeutics Corporation Amended and Restated 2015 Stock Incentive Plan (the Plan) |

Our Board recommends a vote FOR this proposal. | See page 76 |

4 | Ratification of the Appointment of Ernst & Young LLP as United Therapeutics Corporation’s Independent Registered Public Accounting Firm for 2024 |

Our Board recommends a vote FOR this proposal. | See page 86 |

2024 Proxy Statement | 13 |

Director Since | Committee Membership | |||||||||

Name and Primary Occupation | Age | AC | CC | NGC | ||||||

|  | Christopher Causey, M.B.A. | IND | 61 | 2003 | • |  | |||

Former Consultant and Healthcare Executive | ||||||||||

| Raymond Dwek, C.B.E., F.R.S. | IND | 82 | 2002 | • | |||||

Emeritus Director of the Glycobiology Institute, University of Oxford | ||||||||||

| Richard Giltner | IND | 60 | 2009 |  | • | ||||

Former Portfolio Manager, Lyxor Asset Management | ||||||||||

| Katherine Klein, Ph.D.* | IND | 67 | 2014 | ||||||

Professor of Management, The Wharton School Former Vice Dean, Wharton Social Impact Initiative | ||||||||||

| Ray Kurzweil | IND | 76 | 2002 | ||||||

Principal Researcher and AI Visionary, Google | ||||||||||

| Linda Maxwell, M.D., M.B.A. | IND | 50 | 2020 | • | |||||

Surgeon Operating Partner, DCVC | ||||||||||

| Nilda Mesa, J.D. | IND | 64 | 2018 | • | • | ||||

Adjunct Professor, Columbia University Former Director, NYC Mayor’s Office of Sustainability | ||||||||||

| Judy Olian, Ph.D. | IND | 72 | 2015 | • | |||||

President, Quinnipiac University Former Dean, UCLA Anderson School of Management | ||||||||||

| Christopher Patusky, J.D., M.G.A. | IND | 60 | 2002 |  | • | ||||

Founder, Patusky Associates, LLC Vice Chair and Lead Independent Director, United Therapeutics | ||||||||||

| Martine Rothblatt, Ph.D., J.D., M.B.A. | 69 | 1996 | |||||||

Founder, Chairperson, and Chief Executive Officer, United Therapeutics | ||||||||||

| Louis Sullivan, M.D. | IND | 90 | 2002 | • | • | ||||

President Emeritus, Morehouse School of Medicine Former Secretary, U.S. Department of Health and Human Services | ||||||||||

| Governor Tommy Thompson, J.D. | IND | 82 | 2010 | • | |||||

Former Governor of Wisconsin Former Secretary, U.S. Department of Health and Human Services | ||||||||||

AC – Audit Committee | • | Member | ||

CC – Compensation Committee |  | Chair | ||

NGC – Nominating and Governance Committee | ||||

IND | Independent | |||

* Professor Klein's term will expire at the 2024 Annual Meeting. She is not standing for re-election. | ||||

14 | United Therapeutics, a public benefit corporation |

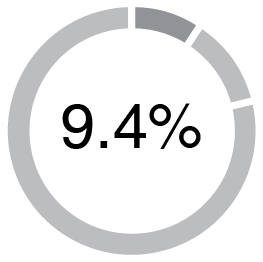

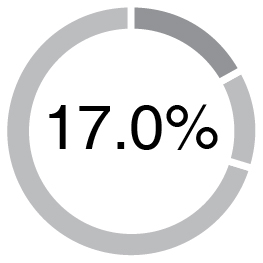

Independence | Diversity |

| Public Company Board Experience (non-UT) | |

| 6/12 | |

| Executive Management Experience | |

| 9/12 | |

| Financial Acumen | |

| 11/12 | |

| Legal | |

| 4/12 | |

| Government / Regulatory Experience | |

| 6/12 |

| International | |

| 7/12 | |

| Science / Medicine | |

| 6/12 | |

| Healthcare Industry Experience | |

| 8/12 | |

| Environmental, Social, and Governance | |

| 10/12 |

ü | MAJORITY VOTING |

ü | BOARD DESTAGGERING |

ü | DIVERSITY AND REFRESHMENT |

ü | PROXY ACCESS |

ü | SHAREHOLDER FEEDBACK |

ü | ENHANCED DISCLOSURE |

2024 Proxy Statement | 15 |

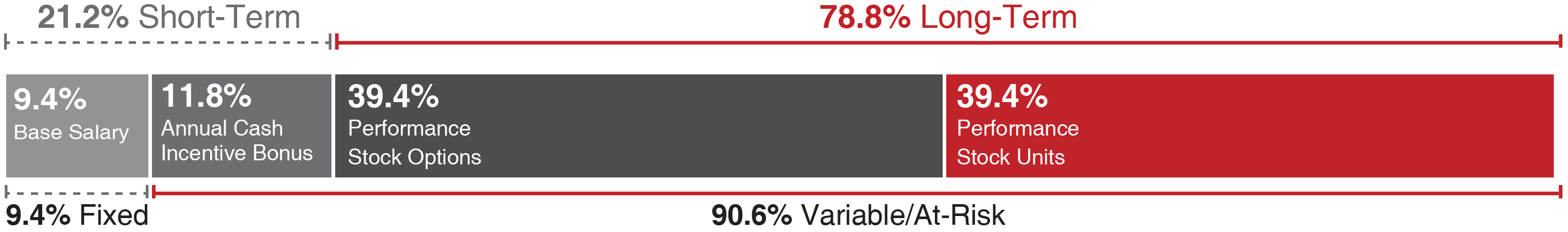

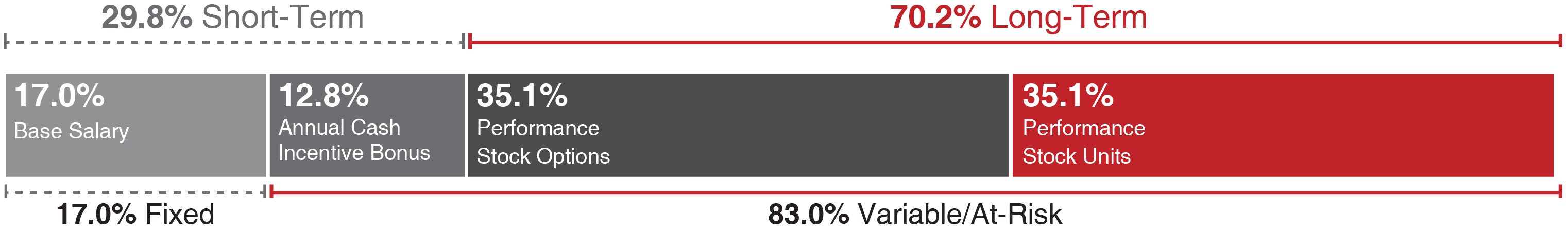

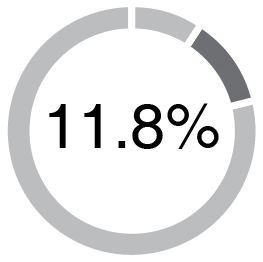

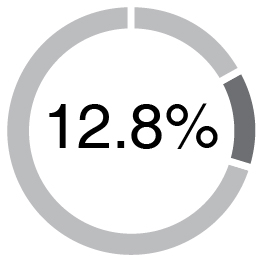

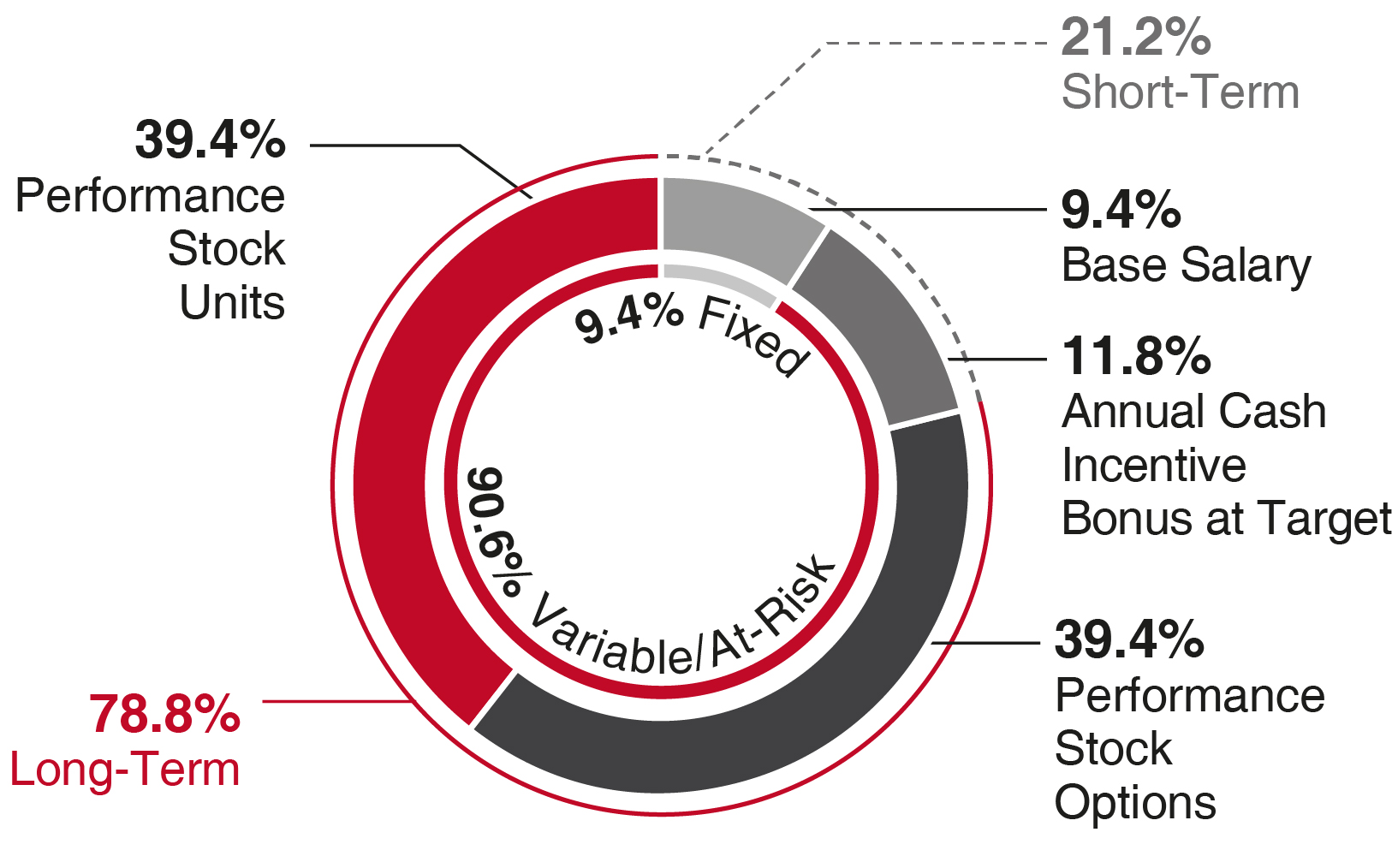

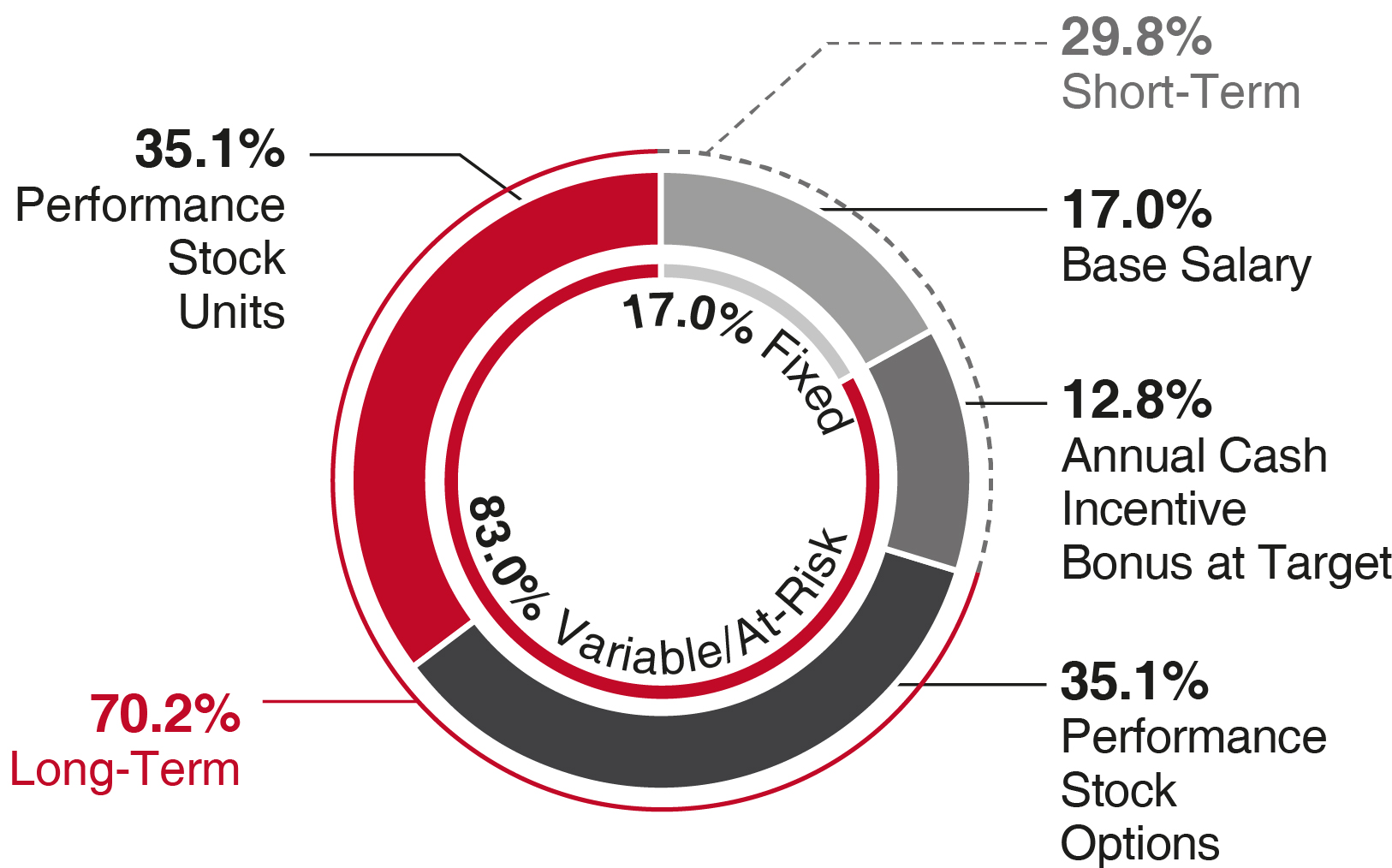

2023 CEO and Other NEOs Pay Mix | |

CEO |  |

Other NEOs |  |

16 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 17 |

1 | Election of Directors |

18 | United Therapeutics, a public benefit corporation |

Succession Planning |

Identification of Candidates |

Qualifications Sought |

Meeting with Candidates |

Decision and Nomination |

Election |

2024 Proxy Statement | 19 |

Re-Nomination Process Our Nominating and Governance Committee appreciates the importance of critically evaluating individual directors and their contributions to our Board in connection with re-nomination decisions. In considering whether to recommend re-nomination of a director for election at our Annual Meeting, our Nominating and Governance Committee conducts a detailed review, considering factors such as: •The extent to which the director’s judgment, skills, qualifications, and experience (including those gained due to tenure on our Board) continue to contribute to our Board’s success •Attendance and participation at, and preparation for, Board and committee meetings •Independence •Shareholder feedback, including the support received by those director nominees elected at our most recent Annual Meeting •Outside board and other affiliations, including any actual or perceived conflicts of interest •The extent to which the director continues to contribute to our Board’s diversity |

|  |  |  |  |  |  |  |  |  |  |  | |

Knowledge, Skills and Experience | ||||||||||||

Public Board Experience* | l | l | l | l | l | l | ||||||

Executive Management Experience | l | l | l | l | l | l | l | l | l | |||

Financial Acumen | l | l | l | l | l | l | l | l | l | l | l | |

Legal | l | l | l | l | ||||||||

Government / Regulatory Experience | l | l | l | l | l | l | ||||||

International | l | l | l | l | l | l | l | |||||

Science / Medicine | l | l | l | l | l | l | ||||||

Healthcare Industry Experience | l | l | l | l | l | l | l | l | ||||

Environmental, Social, and Governance | l | l | l | l | l | l | l | l | l | l | ||

Gender | ||||||||||||

Male | l | l | l | l | l | l | l | |||||

Female | l | l | l | l | l | |||||||

Race / Ethnicity | ||||||||||||

African American or Black | l | l | ||||||||||

Alaskan Native or American Indian | ||||||||||||

Asian | ||||||||||||

Hispanic or Latinx | l | |||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||

White | l | l | l | l | l | l | l | l | l | l | l | |

LGBTQ+ | l | l |

20 | United Therapeutics, a public benefit corporation |

| Public Company Board Experience (non-UT) |  | International | |||

| 6/12 |  | 7/12 | |||

| Executive Management Experience |  | Science / Medicine | |||

| 9/12 |  | 6/12 | |||

| Financial Acumen |  | Healthcare Industry Experience | |||

| 11/12 |  | 8/12 | |||

| Legal |  | Environmental, Social, and Governance | |||

| 4/12 |  | 10/12 | |||

| Government / Regulatory Experience | |||||

| 6/12 |

Board Skill | Why This Skill is Important to Our Board | |

Public Company Board Experience | Public companies face heightened public scrutiny and legal, regulatory, and accounting requirements unlike those faced by private companies. | |

Executive Management Experience | Management of large organizations such as United Therapeutics can be extremely complex and challenging, and experience with executive management can help provide the context needed for overseeing our executive officers. | |

Financial Acumen | It is extremely important that we manage our company in a fiscally conservative manner, and present our financial results in a clear, accurate, and reliable manner, navigating the complexity of evolving accounting standards and regulatory requirements. | |

Legal | In our business we encounter extremely complex legal issues and challenges, including threatened and actual litigation, and compliance with a myriad of laws and regulations. | |

Government / Regulatory Experience | There are fewer industries more heavily regulated than the biopharmaceutical and medical device industries. Regulatory expertise helps ensure appropriate oversight of our compliance and regulatory functions, which are critical to our success. | |

International | While most of our operations are U.S.-based, we conduct clinical trials and commercial distribution of our products worldwide. | |

Science / Medicine | Our success is heavily dependent on our ability to successfully conduct insightful research and development efforts often involving cutting-edge technologies, and to manufacture our products using highly complex technologies. | |

Healthcare Industry Experience | The healthcare sector presents unique challenges, and given our patient-centric mission experience in the healthcare field is extremely valuable. | |

Environmental, Social, and Governance | We believe that ESG issues present important challenges, as well as the opportunity to build sustainable value for shareholders and other key stakeholders. We are committed to fulfilling our PBC purpose, while also delivering excellent financial performance for our shareholders. |

Board Diversity Matrix (as of April 29, 2024) | |||||

Total Number of Directors | 12 | ||||

Part I: Gender Identity | Male | Female | Non-Binary | Did Not Disclose | |

Directors | 7 | 5 | 0 | 0 | |

Part II: Demographic Background | |||||

African American or Black | 1 | 1 | 0 | 0 | |

Alaskan Native or American Indian | 0 | 0 | 0 | 0 | |

Asian | 0 | 0 | 0 | 0 | |

Hispanic or Latinx | 0 | 1 | 0 | 0 | |

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | |

White | 6 | 5 | 0 | 0 | |

Two or More Races or Ethnicities | 0 | 2 | 0 | 0 | |

LGBTQ+ | 1 | ||||

Did Not Disclose Demographic Background | 0 | ||||

2024 Proxy Statement | 21 |

22 | United Therapeutics, a public benefit corporation |

| Christopher Causey, M.B.A. | |

Age: 61 Director Since: 2003 | Committees: Nominating and Governance (Chair) Audit | |

| Raymond Dwek, C.B.E., F.R.S. | |

Age: 82 Director Since: 2002 | Committees: Compensation | |

2024 Proxy Statement | 23 |

| Richard Giltner | |

Age: 60 Director Since: 2009 | Committees: Audit (Chair) Nominating and Governance | |

| Ray Kurzweil | |

Age: 76 Director Since: 2002 | Committees: None | |

24 | United Therapeutics, a public benefit corporation |

| Jan Malcolm | |

Age: 67 Director Since: N/A | Committees: None | |

2024 Proxy Statement | 25 |

| Linda Maxwell, M.D., M.B.A. | |

Age: 50 Director Since: 2020 | Committees: Audit | |

26 | United Therapeutics, a public benefit corporation |

| Nilda Mesa, J.D. | |

Age: 64 Director Since: 2018 | Committees: Compensation Nominating and Governance | |

2024 Proxy Statement | 27 |

| Judy Olian, Ph.D. | |

Age: 72 Director Since: 2015 | Committees: Audit | |

28 | United Therapeutics, a public benefit corporation |

| Christopher Patusky, J.D., M.G.A. | |

Age: 60 Director Since: 2002 Vice Chair of the Board Lead Independent Director | Committees: Compensation (Chair) Nominating and Governance | |

| Martine Rothblatt, Ph.D., J.D., M.B.A. | |

Age: 69 Director Since: 1996 Chairperson of the Board Chief Executive Officer | Committees: None | |

2024 Proxy Statement | 29 |

| Louis Sullivan, M.D. | |

Age: 90 Director Since: 2002 | Committees: Compensation Nominating and Governance | |

| Tommy Thompson, J.D. | |

Age: 82 Director Since: 2010 | Committees: Audit | |

30 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 31 |

Audit Committee | ||

Members: | Meetings in 2023: 5 | |

Richard Giltner (Chair), Christopher Causey, Linda Maxwell, Judy Olian, Tommy Thompson Primary Responsibilities •Representing and assisting our Board in its oversight responsibilities regarding our accounting and financial reporting processes, the audits of our financial statements, and system of internal controls over financial reporting, including the integrity of our financial statements, and the qualifications and independence of Ernst & Young LLP, our independent registered public accounting firm •Retaining and terminating our independent auditors •Approving in advance all audit and non-audit services to be performed by our independent auditors •Approving related party transactions •General oversight of risks related to our financial statements, internal controls, financial reporting processes, information technology, cybersecurity, and compliance with federal securities laws For additional information regarding the processes and procedures used by our Audit Committee, see the section entitled Report of our Audit Committee below. | ||

Compensation Committee | ||

Members: | Meetings in 2023: 5 | |

Christopher Patusky (Chair), Raymond Dwek, Nilda Mesa, Louis Sullivan Our Compensation Committee oversees our compensation plans and policies, reviews and approves compensation for our executive officers, oversees the administration of our equity incentive and share tracking awards plans and our Supplemental Executive Retirement Plan, and reviews and approves grants of equity awards to our executive officers and the methodology and formulae for granting stock options and restricted stock units to other employees. Our Compensation Committee may delegate its responsibilities to subcommittees of the Compensation Committee if it determines such delegation would be appropriate. Primary Responsibilities •Creating a system for awarding long-term and short-term performance-oriented incentive compensation to attract and retain senior management, and reviewing our compensation plans to confirm that they are appropriate, competitive, and properly reflect our goals and objectives while managing risk •Assisting our Board in discharging its responsibilities regarding compensation of our executive officers •Establishing and overseeing the administration of our clawback policy, in consultation with our Audit Committee •Evaluating our CEO and setting our CEO's compensation •Overseeing human capital management and diversity, equity, and inclusion matters For additional information regarding the processes and procedures used by our Compensation Committee, see the section entitled Compensation Discussion and Analysis below. | ||

32 | United Therapeutics, a public benefit corporation |

Nominating and Governance Committee | ||

Members: | Meetings in 2023: 6 | |

Christopher Causey (Chair), Christopher Patusky, Richard Giltner, Nilda Mesa, Louis Sullivan Primary Responsibilities In addition to the responsibilities described in the section entitled How We Select Our Director Nominees above, our Nominating and Governance Committee’s primary responsibilities include: •Proposing nominees for election to our Board •Proposing nominees to fill vacancies on our Board and newly created directorships •Reviewing candidates for election to our Board recommended to us by our shareholders •Recommending committee membership and committee chairs •Reviewing executive management succession plans •Overseeing the performance and the process for conducting evaluations of the Board and its committees •Evaluating and overseeing issues and developments with respect to corporate governance, and making recommendations to our Board regarding corporate governance •Overseeing our compliance program and our enterprise risk management program •Overseeing our ESG disclosure program, and PBC oversight and reporting •Overseeing company policies and practices regarding political contributions •Overseeing compliance with stock ownership guidelines | ||

2024 Proxy Statement | 33 |

34 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 35 |

Investor Relations and Senior Management We provide investors with many opportunities to provide feedback to our Board and senior management. We participate in investor conferences throughout the year and regularly meet with our shareholders. | Board Involvement Directors regularly and actively engage with our shareholders. For several years, our Compensation Committee Chair has actively sought to engage with our top 25+ shareholders at least once, and usually twice, per year. Our Nominating and Governance Committee Chair also engages with our shareholders on other governance topics. | |

|  | |

2023 Engagement We offered to meet with shareholders before our 2023 Annual Meeting, reaching out to 37 of our largest shareholders that collectively held approximately 70% of our outstanding shares. Calls were held with five shareholders (holding approximately 10% of our outstanding shares) where we engaged in dialogue about governance topics, ESG topics along with corporate strategy. We also sought to engage with our shareholders following the 2023 Annual Meeting, again offering to meet with shareholders that collectively held approximately 70% of our outstanding shares (32 of our largest shareholders), and held a discussion with four shareholders (holding approximately 30% of our outstanding shares) that accepted our offer. Those conversations focused on our most recent Corporate Responsibility and PBC Report and other governance topics. | ||

| ||

Outcomes from Shareholder Engagement Each year, we consider shareholder feedback carefully, and have modified our governance practices, executive compensation program, and disclosures in light of this feedback. Some of the actions we have taken in response to shareholder feedback over the past several years include: Governance •Adoption of majority voting (2015) •Adoption of proxy access (2015) •Board declassification (2020) •Stricter overboarding limits for directors (2020) •Restrictions on certain advance notice bylaws absent shareholder approval (2023) ESG •Commenced ESG disclosure program, resulting in the creation of our corporate responsibility website and our first annual corporate responsibility report (2020) •Launched effort to become the first-ever public biopharmaceutical company organized as a public benefit corporation (2021) Executive Compensation •Renegotiated our Chief Executive Officer’s employment agreement to eliminate her entitlement to an annual stock option grant based on a market capitalization formula, and to eliminate an excise tax gross-up provision (2015) •Shifted to 100% performance-based equity compensation program for our NEOs (2017) •Reduced annualized total direct compensation for our CEO to approximately the 50th percentile of our peer group (2019) •Reduced compensation for our CEO by 89% in 2020, compared to 2019 (2020); by 92% in 2021, compared to 2019 (2021); and by 88% in 2022, compared to 2019 (2022) •Addressed 2020 Say-on-Pay voting result through responsive changes and disclosures (2021) •Changed design of CEO long-term incentive compensation for 2023 in response to shareholder feedback (2023) Enhanced Disclosure •Complete revamp of our proxy statement, to enhance readability (2020) •Added significant additional disclosure concerning our executive compensation decisions, and how they tie into our business strategy (2020 and 2021) •Enhanced disclosure concerning Board skills and diversity (2021 and 2022) | ||

36 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 37 |

Annual Cash | Value of Equity Based Awards(3) | |||||

Initial | Annual | |||||

Board Membership | $60,000 | $400,000 | $400,000 | |||

Lead Independent Director(1) | $35,000 | $— | $— | |||

Committee Chair(2): | ||||||

Audit Committee | $25,000 | $— | $— | |||

Compensation Committee | $25,000 | $— | $— | |||

Nominating and Governance Committee | $25,000 | $— | $— | |||

Committee Membership(2): | ||||||

Audit Committee | $15,000 | $— | $— | |||

Compensation Committee | $15,000 | $— | $— | |||

Nominating and Governance Committee | $15,000 | $— | $— | |||

38 | United Therapeutics, a public benefit corporation |

Name | Fees Earned or Paid in Cash(1) | Restricted Stock Units(2) | Stock Options(2) | Total | |||

Christopher Causey | $100,000 | $— | $381,535 | $481,535 | |||

Raymond Dwek | $75,000 | $— | $381,535 | $456,535 | |||

Richard Giltner | $100,000 | $413,658 | $— | $513,658 | |||

Katherine Klein(3) | $60,000 | $206,829 | $190,768 | $457,597 | |||

Ray Kurzweil | $60,000 | $206,829 | $190,768 | $457,597 | |||

Linda Maxwell | $75,000 | $— | $381,535 | $456,535 | |||

Nilda Mesa | $90,000 | $206,829 | $190,768 | $487,597 | |||

Judy Olian | $75,000 | $413,658 | $— | $488,658 | |||

Christopher Patusky | $135,000 | $206,829 | $190,768 | $532,597 | |||

Louis Sullivan | $90,000 | $— | $381,535 | $471,535 | |||

Tommy Thompson | $75,000 | $— | $381,535 | $456,535 | |||

2024 Proxy Statement | 39 |

Name | Stock Options | STAP Awards | RSUs |

Christopher Causey | 28,330 | — | — |

Raymond Dwek | 19,560 | 10,000 | — |

Richard Giltner | 15,000 | 10,000 | 1,800 |

Katherine Klein | 68,240 | 29,375 | 900 |

Ray Kurzweil | 48,210 | 15,000 | 900 |

Linda Maxwell | 34,670 | — | — |

Nilda Mesa | 26,030 | — | 900 |

Judy Olian | 19,620 | — | 1,800 |

Christopher Patusky | 58,540 | — | 900 |

Louis Sullivan | 30,440 | — | — |

Tommy Thompson(1) | 56,790 | 13,000 | 880 |

40 | United Therapeutics, a public benefit corporation |

2 | Advisory Resolution to Approve Executive Compensation |

2024 Proxy Statement | 41 |

ü | INDUSTRY-LEADING PROFITABILITY |

ü | CONTINUED REVENUE GROWTH TRAJECTORY |

ü | ROBUST SUPPLY CHAIN |

ü | PIPELINE EXECUTION |

42 | United Therapeutics, a public benefit corporation |

| Martine Rothblatt, Ph.D., J.D., M.B.A. 69, Founder, Chairperson, Chief Executive Officer, and Director |

| Michael Benkowitz 52, President and Chief Operating Officer |

| James C. Edgemond 57, Chief Financial Officer and Treasurer |

| Paul A. Mahon, J.D. 60, Executive Vice President, General Counsel, and Corporate Secretary |

2024 Proxy Statement | 43 |

$2.3 billion in revenues, continuing a trend of double-digit percent revenue growth ~$2.0 million in revenue per employee, which ranked highest out of companies in our compensation peer group | We advanced our key pipeline programs during 2023, including: •TETON 1 and TETON 2 studies of nebulized Tyvaso in IPF •TETON PPF study of nebulized Tyvaso in PPF •ADVANCE OUTCOMES study of ralinepag in PAH •Phase 3 study of CLES EVLP service •ARTISAN, a phase 4 study to evaluate early and rapid treprostinil therapy in PAH | |

We reached record numbers of PH patients in the United States being treated with our treprostinil-based therapies— once again reaching more patients than ever before | ||

44 | United Therapeutics, a public benefit corporation |

Sustainable, Long-Term Shareholder Value Creation | ||||||

|  |  |  | |||

Pay-for-Performance | Shareholder Alignment | Balance Short- and Long-Term Perspectives | Market Competitiveness | |||

Objective | ||||

Compensation Element | Pay-for- Performance | Shareholder Alignment | Balance Short- and Long-Term Perspectives | Market Competitiveness |

Base Salary | ü | |||

Cash Incentive Awards | ü | ü | ü | ü |

Long-Term Incentives (Stock Options and Stock Units) | ü | ü | ü | ü |

Benefits / Perquisites | ü | |||

Supplemental Executive Retirement Plan | ü | |||

Severance / Change-of-Control Benefits | ü | ü | ||

Stock Ownership Guidelines | ü | ü | ü | |

2024 Proxy Statement | 45 |

Element / Percent of TDC | Why We Pay This Element | Key Characteristics | How We Determine Amount | ||||

|  | Base Salary | •Provides market competitive levels of fixed pay to attract and retain our NEOs | •Cash •Annual | •Market rate, internal pay equity, experience and critical skills, expertise, scope of responsibility, and sustained performance | ||

|  | ||||||

CEO | Other NEOs | ||||||

| |||||||

Cash Bonus | •Provides competitive incentives to achieve difficult, annual performance goals •Pay-for-performance •Shareholder alignment •Strategic alignment balancing a focus on patients through manufacturing and inventory performance, and advancement of clinical programs with driving revenue and profitability | •Cash •Performance-based •Annual | •50% Financial •25% Cash Profits •25% Revenues •50% Operational •25% Manufacturing •25% R&D •Payout 0-300% of target based on above target revenue and cash profit margin performance, and achieving patient growth goals | ||||

|  | ||||||

CEO | Other NEOs | ||||||

| |||||||

Equity Award | •Strategic alignment incentivizing achievement of objectives over the performance period •Pay-for-performance alignment •Shareholder alignment, focused on value creation over time •Retention element | •At-risk •Performance-based •50% of 2023 equity award delivered as performance stock options, which vest based on performance goals set at the beginning of the three- year performance period. Further, shareholder alignment is deepened since any options that vest will only have value if our stock price increases after grant •50% of 2023 equity award delivered as performance stock units, which vest based on attainment of performance goals set at the beginning of the three-year performance period •"Cliff-vest" at the end of the three-year performance period | •Market rate, internal pay equity, experience and critical skills, expertise, scope of responsibility, and sustained performance | ||||

|  | ||||||

CEO | Other NEOs | ||||||

46 | United Therapeutics, a public benefit corporation |

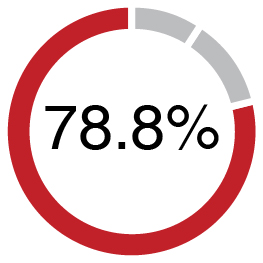

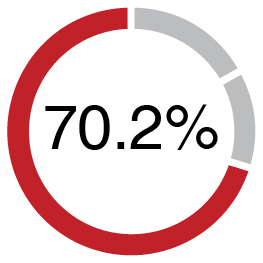

CEO Target Pay Mix | Other NEO Target Pay Mix |

|  |

NEO | 2023 Base Salary(1) | % Increase Over 2022 Base Salary | 2023 Cash Incentive Bonus Target as % of Base Salary | Change in Cash Incentive Bonus Target %(2) | 2023 Long-Term Incentive Award Target(3) | 2023 Total Target Direct Compensation | ||

Martine Rothblatt | $1,500,000 | 6.0% | 125% | —% | $12,500,000 | $15,875,000 | ||

James Edgemond | $800,000 | 6.7% | 75% | —% | $3,500,000 | $4,900,000 | ||

Michael Benkowitz | $1,130,000 | 15.3% | 85% | —% | $6,000,000 | $8,090,500 | ||

Paul Mahon | $940,000 | —% | 70% | 7.7% | $3,000,000 | $4,598,000 | ||

2024 Proxy Statement | 47 |

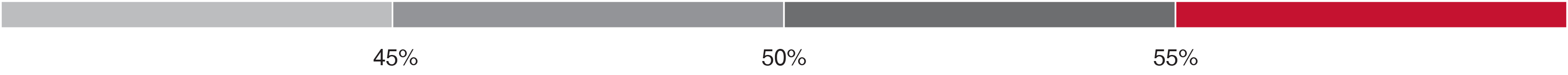

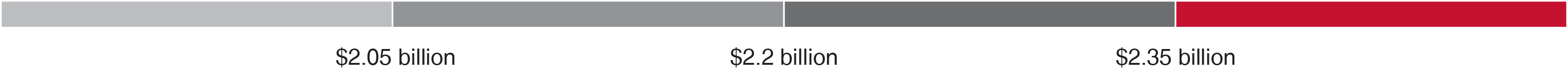

2023 Company-Wide Milestones | Weighting |

Milestone 1—Financial Performance-Cash Profits*: Achieve cash profits in the top quintile of our peer group as measured by a 50% cash profit margin | 25% |

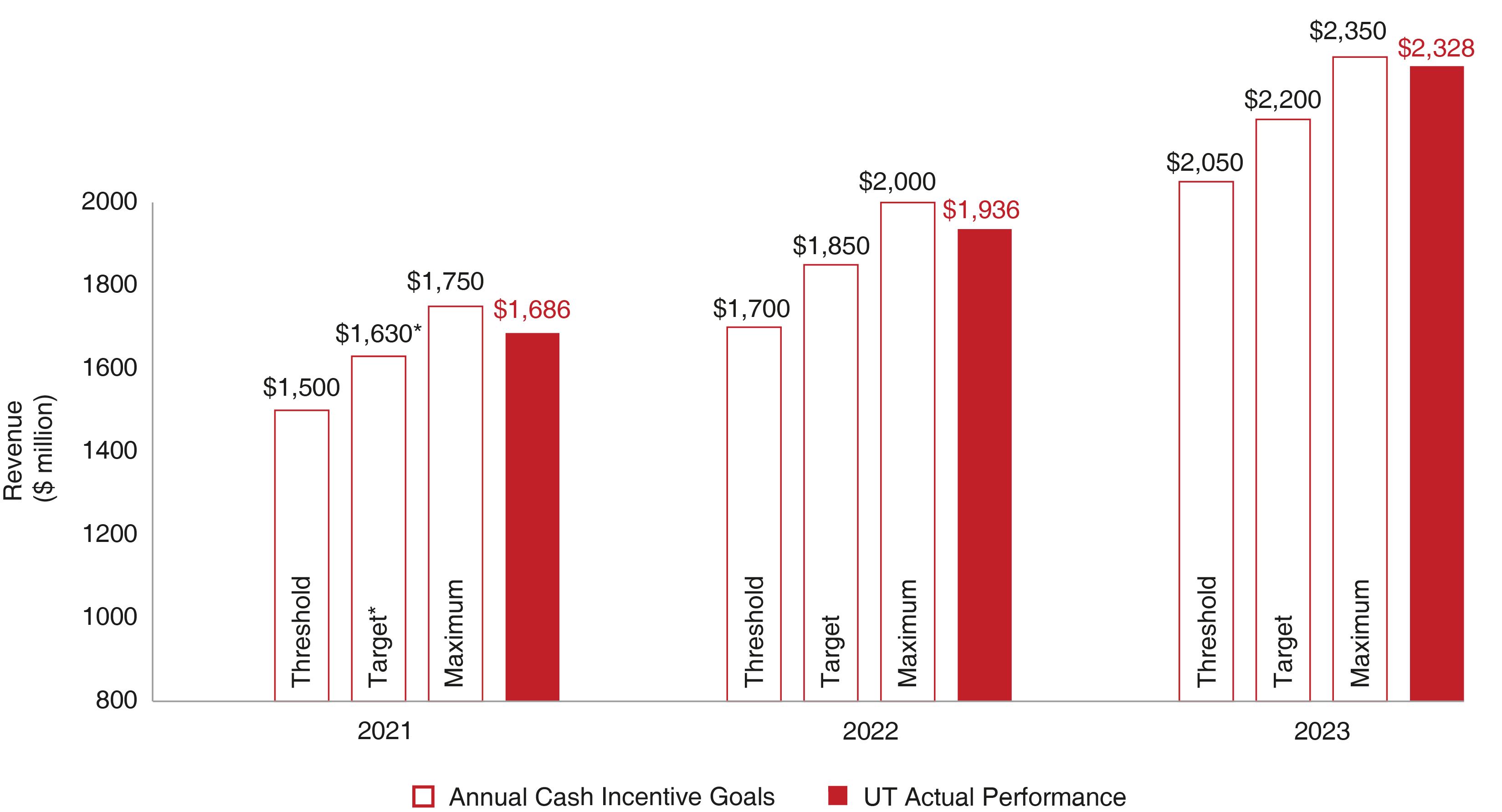

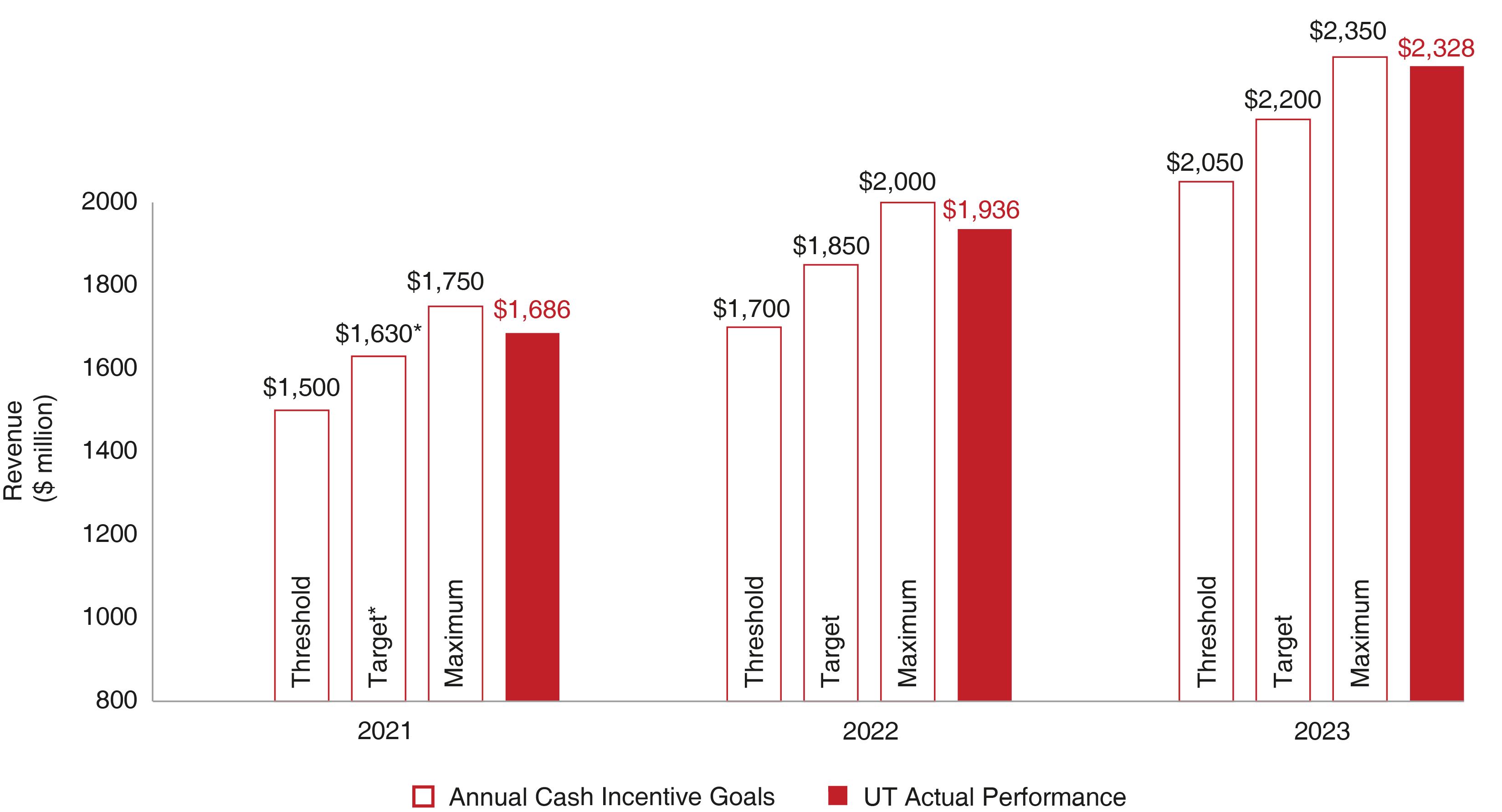

Milestone 2—Financial Performance-Revenue: Superior financial performance as evidenced by achieving the net revenues for 2023 included in our long-range business plan (a target of $2.2 billion) | 25% |

Milestone 3—Manufacturing: Adequate manufacturing capabilities, evidenced by a two-year inventory of Remodulin, Tyvaso (nebulized), and Orenitram finished drug product and passing all GMP-related FDA inspections at our facilities without any issues that prevent the use or approval of any of our drug products | 25% |

Milestone 4—Research & Development: Conduct insightful research and development programs, taking into account regulatory approvals, label extensions and the quantity and quality of trials that support our business goals | 25% |

48 | United Therapeutics, a public benefit corporation |

Below Threshold 0% credit | At Threshold 50% credit | Target 100% credit | Stretch/Maximum 125% credit* |

| |||

Below Threshold 0% credit | At Threshold 50% credit | Target 100% credit | Stretch/Maximum 125% credit* |

| |||

Award pro rata credit | 100% credit (at target) |

< 100% of Goal | 100%+ of Goal |

2024 Proxy Statement | 49 |

Range (Target to Stretch/Maximum) | ||

Cash Profit Margin Performance | 50% | 55% |

Revenue Performance | 2.2 billion | 2.35 billion |

Multiplier for each Metric* | 0% | 25% |

Range (Threshold/Target to Stretch/Maximum) | ||

Patient Goal | 14,000 | 15,000 |

Multiplier* | 0% | 100% |

50 | United Therapeutics, a public benefit corporation |

Milestone | Performance | Attainment Level % (A) | Weighting (B) | % of Award Earned (A × B) |

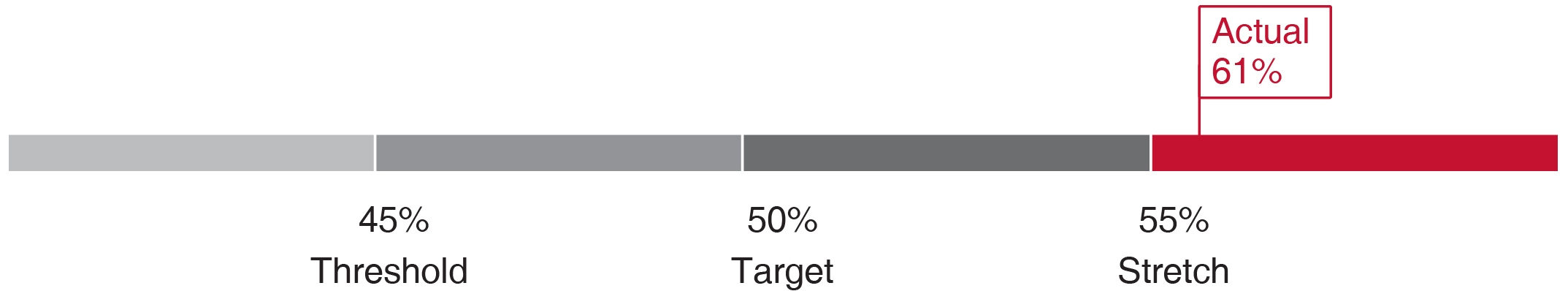

1 (Cash Profit Margin) |  | 100% | 25% | 25% |

2023 cash profit margin was 61%, representing 122% performance against the target of 50%. Because performance also exceeded the maximum 55% threshold, the full milestone achievement was awarded including a 25% financial multiplier. | ||||

2 (Revenue) |  | 100% | 25% | 25% |

2023 net revenues were $2.33 billion, exceeding our target of $2.2 billion. Because performance exceeded target, full milestone achievement was awarded and a 21% financial multiplier. | ||||

3 (Mfg) | Maintained greater than two-year inventory of all strengths of Remodulin, nebulized Tyvaso, and Orenitram and passed all FDA inspections at our facilities without any issues that prevent the use or approval of any of our drug products. Full Milestone achievement was awarded. | 100% | 25% | 25% |

4 (R&D) | Achieved 32 R&D points against a goal of 25 (details provided below). | 100% | 25% | 25% |

Total Milestone Attainment | 100% | |||

Financial Multiplier | Cash profit performance exceeded maximum at 61% (25% financial multiplier) and revenue performance exceeded target but did not achieve maximum performance (21% financial multiplier) resulting in total Financial Multiplier of 146%. | 146% | ||

Milestone Attainment x Financial Multiplier | 146% | |||

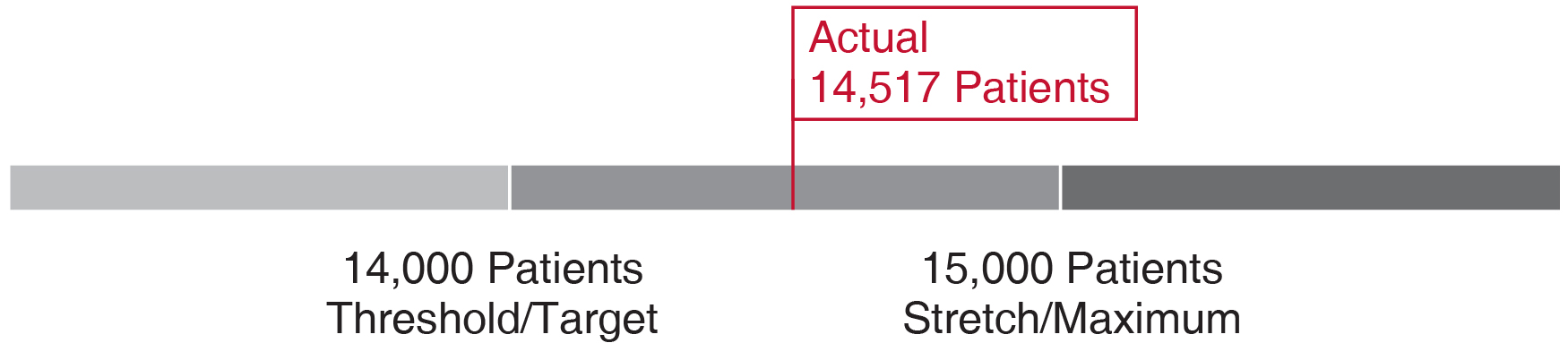

Patient Multiplier |  | |||

We completed 2023 with 14,517 patients on our therapies, exceeding our threshold/ target of 14,000 patients, resulting in a 152% Patient Multiplier to be awarded. | 152% | |||

Total | Milestone Attainment x Financial Multiplier x Patient Multiplier | 222% | ||

2024 Proxy Statement | 51 |

52 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 53 |

NEO | 2023 Base Salary (A) | 2023 Cash Incentive Award Target as % of Base Salary (B) | 2023 Milestone Attainment (C) | 2023 Financial Multiplier (D) | 2023 Patient Multiplier (E) | Total Cash Incentive Bonus Earned (A × B x C x D x E) | ||

Martine Rothblatt | $1,500,000 | 125% | 100% | 146% | 152% | $4,161,000 | ||

James Edgemond | $800,000 | 75% | 100% | 146% | 152% | $1,331,520 | ||

Michael Benkowitz | $1,130,000 | 85% | 100% | 146% | 152% | $2,131,542 | ||

Paul Mahon | $940,000 | 70% | 100% | 146% | 152% | $1,460,234 | ||

54 | United Therapeutics, a public benefit corporation |

Target Value and Target # of PSOs and PSUs Granted | ||||||||

PSOs | PSUs | |||||||

Named Executive Officer | Total Target Equity Value Awarded | PSOs Target Value ($) | # of PSOs granted at target | PSUs Target Value ($) | # of PSUs - Revenue Growth granted at target | # of PSUs - R&D Milestones granted at target | ||

Martine Rothblatt | $12,500,000 | $6,250,000 | 69,240 | $6,250,000 | 12,360 | 12,360 | ||

James Edgemond | $3,500,000 | $1,750,000 | 19,390 | $1,750,000 | 3,460 | 3,460 | ||

Michael Benkowitz | $6,000,000 | $3,000,000 | 33,240 | $3,000,000 | 5,930 | 5,930 | ||

Paul Mahon | $3,000,000 | $1,500,000 | 16,620 | $1,500,000 | 2,965 | 2,965 | ||

While compensation paid to our CEO in 2023 as reported in the Summary Compensation Table increased by more than 200% as compared to 2022, this was a by-product of our return to an annual equity award cycle. 2023 was the first year our CEO received an equity award since 2019. |

2024 Proxy Statement | 55 |

56 | United Therapeutics, a public benefit corporation |

2022 PEER GROUP |  | ADDITIONS FOR 2023 | ||

Alexion Pharmaceuticals | Incyte | Alnylam Pharmaceuticals | Novavax | |

Alkermes | Ionis Pharmaceuticals | CRISPR Therapeutics | Viatris | |

Amarin | Jazz Pharmaceuticals | Maraval Life Sciences | Vir Biotechnology | |

Amgen | Moderna | |||

BeiGene | Myriad Genetics | |||

| ||||

Biogen | Neurocrine Biosciences | DELETIONS FOR 2023 | ||

BioMarin Pharmaceutical | Opko Health | Alexion Pharmaceuticals | Myriad Genetics | |

Blueprint Medicines | PRA Health Sciences | Amarin | OPKO Health | |

Endo International | Regeneron | Blueprint Medicines | PRA Health Sciences | |

Exelixis | Seattle Genetics | |||

Gilead Sciences | Syneos Health | |||

Horizon Therapeutics | Vertex | |||

Illumina | ||||

2023 PEER GROUP | ||||

Alkermes | Endo International | Jazz Pharmaceuticals | Syneos Health | |

Alnylam Pharmaceuticals | Exelixis | Maraval Life Sciences | Vertex Pharmaceuticals | |

Amgen | Gilead Sciences | Moderna | Viatris | |

BeiGene | Horizon Therapeutics | Neurocrine Biosciences | Vir Biotechnology | |

Biogen | Illumina | Novavax | ||

BioMarin Pharmaceuticals | Incyte | Regeneron Pharmaceuticals | ||

CRISPR Therapeutics | Ionis Pharmaceuticals | Seattle Genetics | ||

2024 Proxy Statement | 57 |

United Therapeutics ($ in millions) | Percentile | Rank | ||

Revenue | $1,768.3 |  | 16th of 26 | |

Operating Income | $908.7 |  | 9th of 26 | |

Adjusted Operating Income(1) | $909.3 |  | 10th of 26 | |

Net Income | $687.4 |  | 11th of 26 | |

Return on Invested Capital | 12.3% |  | 8th of 26 | |

Return on Equity | 18.0% |  | 10th of 26 | |

Return on Assets(1) | 11.4% |  | 6th of 26 | |

Market Cap Per Employee(2) | $8.9 |  | 9th of 26 | |

Revenue Per Employee | $1.8 |  | 8th of 26 | |

58 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 59 |

Title of NEO | Ownership Target |

Chairperson and Chief Executive Officer | Lesser of 6x base salary or 100,000 shares |

President and Chief Operating Officer | Lesser of 3x base salary or 30,000 shares |

Chief Financial Officer and Treasurer | Lesser of 3x base salary or 20,000 shares |

Executive Vice President and General Counsel | Lesser of 3x base salary or 30,000 shares |

60 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 61 |

Name and Principal Position | Year | Salary(1) ($) | Restricted Stock Units(2) ($) | Stock Options(2) ($) | Non-Equity Incentive Plan Compensation(3) ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings(4) ($) | All Other Compensation(5) ($) | Total ($) | |

Martine Rothblatt Chairperson and Chief Executive Officer | 2023 | 1,476,379 | (6) | 5,376,600 | 5,926,252 | 4,161,000 | — | 17,826 | 16,958,057 |

2022 | 1,402,290 | (6) | — | — | 3,909,114 | — | 10,800 | 5,322,204 | |

2021 | 1,367,858 | (6) | — | — | 2,132,813 | — | 10,400 | 3,511,071 | |

James Edgemond Chief Financial Officer and Treasurer | 2023 | 790,385 | 1,505,100 | 1,659,590 | 1,331,520 | 741,821 | 26,068 | 6,054,484 | |

2022 | 745,192 | — | — | 1,243,181 | — | 17,411 | 2,005,784 | ||

2021 | 721,154 | — | — | 679,688 | 481,573 | 20,800 | 1,903,215 | ||

Michael Benkowitz President and Chief Operating Officer | 2023 | 1,101,154 | 2,579,550 | 2,845,012 | 2,131,542 | 1,125,721 | 23,572 | 9,806,551 | |

2022 | 973,269 | — | — | 1,841,013 | — | 14,153 | 2,828,435 | ||

2021 | 940,385 | — | — | 1,004,063 | 355,353 | 16,691 | 2,316,492 | ||

Paul Mahon Executive Vice President and General Counsel | 2023 | 940,000 | 1,289,775 | 1,422,506 | 1,460,234 | — | 41,086 | 5,153,601 | |

2022 | 934,231 | — | — | 1,350,371 | — | 24,600 | 2,309,202 | ||

2021 | 905,385 | — | — | 739,375 | — | 22,400 | 1,667,160 |

Name | Type of Equity Award | Number of Shares (at target) | Grant-Date Fair Value (at target) | Number of Shares (at maximum) | Grant-Date Fair Value (at maximum) | ||

Martine Rothblatt | Stock Options | 69,240 | $5,926,252 | 207,720 | $17,778,755 | ||

RSUs | 24,720 | $5,376,600 | 74,160 | $16,129,800 | |||

James Edgemond | Stock Options | 19,390 | $1,659,590 | 58,170 | $4,978,770 | ||

RSUs | 6,920 | $1,505,100 | 20,760 | $4,515,300 | |||

Michael Benkowitz | Stock Options | 33,240 | $2,845,012 | 99,720 | $8,535,035 | ||

RSUs | 11,860 | $2,579,550 | 35,580 | $7,738,650 | |||

Paul Mahon | Stock Options | 16,620 | $1,422,506 | 49,860 | $4,267,517 | ||

RSUs | 5,930 | $1,289,775 | 17,790 | $3,869,325 | |||

62 | United Therapeutics, a public benefit corporation |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards | Estimated Future Payouts Under Equity Incentive Plan Awards | Exercise or Base Price of Stock Option Awards ($/Sh) | Grant Date Fair Value of Stock Option Awards and RSU Awards(5) ($) | |||||||||

Name | Grant Date | Threshold(4) ($) | Target(4) ($) | Maximum(4) ($) | Threshold (#) | Target (#) | Maximum (#) | |||||

Martine Rothblatt | 3/15/2023 | (1) | 34,620 | 69,240 | 207,720 | $85.59 | 5,926,252 | |||||

3/15/2023 | (2) | 6,180 | 12,360 | 37,080 | 2,688,300 | |||||||

3/15/2023 | (3) | 6,180 | 12,360 | 37,080 | 2,688,300 | |||||||

N/A | (4) | 703,125 | 1,875,000 | 5,625,000 | ||||||||

James Edgemond | 3/15/2023 | (1) | 9,695 | 19,390 | 58,170 | $85.59 | 1,659,590 | |||||

3/15/2023 | (2) | 1,730 | 3,460 | 10,380 | 752,550 | |||||||

3/15/2023 | (3) | 1,730 | 3,460 | 10,380 | 752,550 | |||||||

N/A | (4) | 225,000 | 600,000 | 1,800,000 | ||||||||

Michael Benkowitz | 3/15/2023 | (1) | 16,620 | 33,240 | 99,720 | $85.59 | 2,845,012 | |||||

3/15/2023 | (2) | 2,965 | 5,930 | 17,790 | 1,289,775 | |||||||

3/15/2023 | (3) | 2,965 | 5,930 | 17,790 | 1,289,775 | |||||||

N/A | (4) | 360,188 | 960,500 | 2,881,500 | ||||||||

Paul Mahon | 3/15/2023 | (1) | 8,310 | 16,620 | 49,860 | $85.59 | 1,422,506 | |||||

3/15/2023 | (2) | 1,483 | 2,965 | 8,895 | 644,888 | |||||||

3/15/2023 | (3) | 1,483 | 2,965 | 8,895 | 644,888 | |||||||

N/A | (4) | 246,750 | 658,000 | 1,974,000 | ||||||||

2024 Proxy Statement | 63 |

Name | Month/Year of Agreement | Minimum Base Salary under Agreement | Base Salary as of March 5, 2023 | ||

James Edgemond | March 2015 | $400,000 | $800,000 | ||

Michael Benkowitz | June 2016 | $650,000 | $1,130,000 | ||

Paul Mahon | June 2001 | $300,000 | $940,000 | ||

64 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 65 |

Option Awards | Stock Awards | ||||||||

Name and Grant Date | Award Type | Number of Securities Underlying Unexercised Options or STAP Awards | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option or STAP Award Exercise Price ($) | Option or STAP Award Expiration Date | Equity Incentive Plan Awards: Number of Unearned and Unvested RSUs (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned and Unvested RSUs ($)(12) | ||

Exercisable (#) | Unexercisable (#) | ||||||||

Martine Rothblatt | |||||||||

12/31/2014 | Stock Option | (1) | 723,869 | — | — | 129.49 | 12/31/2024 | — | — |

03/15/2016 | Stock Option | (2) | 294,000 | — | — | 120.26 | 03/15/2026 | — | — |

03/15/2017 | Stock Option | (3) | 240,000 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (4) | 100,000 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (6) | 150,288 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (4) | 244,122 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2018 | Stock Option | (5) | 285,103 | — | — | 111.00 | 03/15/2028 | — | — |

03/15/2018 | Stock Option | (6) | 213,827 | — | — | 111.00 | 03/15/2028 | — | — |

03/15/2019 | Stock Option | (7) | 500,000 | — | — | 135.42 | 03/15/2027 | — | — |

03/15/2019 | Stock Option | (8) | 500,000 | — | — | 117.76 | 03/15/2027 | — | — |

03/15/2023 | Stock Option | (9) | — | — | 207,720 | 217.50 | 03/15/2033 | — | — |

03/15/2023 | RSU | (10) | — | — | — | — | — | 37,080 | 8,153,521 |

03/15/2023 | RSU | (11) | — | — | — | — | — | 37,080 | 8,153,521 |

James Edgemond | |||||||||

03/13/2015 | STAP Award | (2) | 25,000 | — | — | 163.30 | 03/13/2025 | — | — |

03/13/2015 | STAP Award | (2) | 15,160 | — | — | 163.30 | 03/13/2025 | — | — |

03/15/2016 | Stock Option | (2) | 49,000 | — | — | 120.26 | 03/15/2026 | — | — |

03/15/2017 | Stock Option | (3) | 45,000 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (4) | 18,750 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (6) | 32,205 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (4) | 52,312 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2018 | Stock Option | (5) | 75,349 | — | — | 111.00 | 03/15/2028 | — | — |

03/15/2018 | Stock Option | (6) | 56,512 | — | — | 111.00 | 03/15/2028 | — | — |

03/15/2019 | Stock Option | (7) | 162,500 | — | — | 135.42 | 03/15/2027 | — | — |

03/15/2019 | Stock Option | (8) | 162,500 | — | — | 117.76 | 03/15/2027 | — | — |

03/15/2023 | Stock Option | (9) | — | — | 58,170 | 217.50 | 03/15/2033 | — | — |

03/15/2023 | RSU | (10) | — | — | — | — | — | 10,380 | 2,282,458 |

03/15/2023 | RSU | (11) | — | — | — | — | — | 10,380 | 2,282,458 |

Michael Benkowitz | |||||||||

03/13/2015 | STAP Award | (2) | 32,200 | — | — | 163.30 | 03/13/2025 | — | — |

03/15/2016 | Stock Option | (2) | 39,200 | — | — | 120.26 | 03/15/2026 | — | — |

06/24/2016 | Stock Option | (2) | 52,500 | — | — | 102.11 | 06/24/2026 | — | — |

03/15/2017 | Stock Option | (3) | 63,000 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (4) | 26,250 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (6) | 42,940 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (4) | 69,750 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2018 | Stock Option | (5) | 85,531 | — | — | 111.00 | 03/15/2028 | — | — |

03/15/2018 | Stock Option | (6) | 64,148 | — | — | 111.00 | 03/15/2028 | — | — |

03/15/2019 | Stock Option | (7) | 187,500 | — | — | 135.42 | 03/15/2027 | — | — |

03/15/2019 | Stock Option | (8) | 187,500 | — | — | 117.76 | 03/15/2027 | — | — |

03/15/2023 | Stock Option | (9) | — | — | 99,720 | 217.50 | 03/15/2033 | — | — |

03/15/2023 | RSU | (10) | — | — | — | — | — | 17,790 | 3,911,843 |

03/15/2023 | RSU | (11) | — | — | — | — | — | 17,790 | 3,911,843 |

66 | United Therapeutics, a public benefit corporation |

Option Awards | Stock Awards | ||||||||

Name and Grant Date | Award Type | Number of Securities Underlying Unexercised Options or STAP Awards | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option or STAP Award Exercise Price ($) | Option or STAP Award Expiration Date | Equity Incentive Plan Awards: Number of Unearned and Unvested RSUs (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned and Unvested RSUs ($)(12) | ||

Exercisable (#) | Unexercisable (#) | ||||||||

Paul Mahon | |||||||||

03/13/2015 | STAP Award | (2) | 116,250 | — | — | 163.30 | 03/13/2025 | — | — |

03/15/2017 | Stock Option | (3) | 75,000 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (4) | 31,250 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (6) | 42,940 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2017 | Stock Option | (4) | 69,750 | — | — | 146.03 | 03/15/2027 | — | — |

03/15/2019 | Stock Option | (7) | 150,000 | — | — | 135.42 | 03/15/2027 | — | — |

03/15/2019 | Stock Option | (8) | 90,000 | — | — | 117.76 | 03/15/2027 | — | — |

03/15/2023 | Stock Option | (9) | — | — | 49,860 | 217.50 | 03/15/2033 | — | — |

03/15/2023 | RSU | (10) | — | — | — | — | — | 8,895 | 1,955,922 |

03/15/2023 | RSU | (11) | — | — | — | — | — | 8,895 | 1,955,922 |

2024 Proxy Statement | 67 |

Option Awards | ||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($)(1) |

Martine Rothblatt | 664,000 | 85,384,470 |

James Edgemond | — | — |

Michael Benkowitz | — | — |

Paul Mahon | 140,500 | 15,710,975 |

Name | Plan Name | Number of Years of Credited Service(1) | Actual Years of Service(2) | Present Value of Accumulated Benefit ($)(3) |

Martine Rothblatt | SERP | 15.0 | 27.5 | 14,175,604 |

James Edgemond | SERP | 11.0 | 11.0 | 5,769,435 |

Michael Benkowitz | SERP | 12.8 | 12.8 | 7,748,807 |

Paul Mahon | SERP | 15.0 | 22.6 | 11,509,531 |

68 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 69 |

Executive Benefits and Payments Upon Separation | Involuntary Termination Without Cause/Resignation for Good Reason/ Resignation While Continuing as Senior Advisor(1) | Disability | Death | Termination upon a Change in Control | Change In Control without Termination of Employment | |||||

Martine Rothblatt | ||||||||||

Salary and cash incentive | $20,136,456 | $1,500,000 | $1,500,000 | $20,136,456 | $— | |||||

Equity vesting acceleration(2) | $5,601,164 | $5,601,164 | $5,601,164 | $5,601,164 | $5,601,164 | |||||

Supplemental Executive Retirement Plan(3) | $14,175,604 | $14,175,604 | $9,833,583 | $14,175,604 | $14,175,604 | |||||

Health and other benefits(4) | $148,894 | $— | $— | $148,894 | $— | |||||

Total | $40,062,118 | $21,276,768 | $16,934,747 | $40,062,118 | $19,776,768 | |||||

James Edgemond | ||||||||||

Salary and cash incentive | $157,808 | $— | $— | $4,086,362 | $— | |||||

Equity vesting acceleration(2) | $— | $1,567,981 | $1,567,981 | $1,567,981 | $1,567,981 | |||||

Supplemental Executive Retirement Plan | $— | $5,908,678 | $4,053,625 | $5,878,653 | $5,878,653 | |||||

Health and other benefits(5) | $— | $— | $— | $71,596 | $— | |||||

Total | $157,808 | $7,476,659 | $5,621,606 | $11,604,592 | $7,446,634 | |||||

Michael Benkowitz | ||||||||||

Salary and cash incentive | $547,973 | $— | $— | $5,942,026 | $— | |||||

Equity vesting acceleration(2) | $— | $2,687,339 | $2,687,339 | $2,687,339 | $2,687,339 | |||||

Supplemental Executive Retirement Plan | $— | $5,305,985 | $3,347,371 | $7,217,880 | $7,217,880 | |||||

Health and other benefits(5) | $— | $— | $— | $71,596 | $— | |||||

Total | $547,973 | $7,993,324 | $6,034,710 | $15,918,841 | $9,905,219 | |||||

Paul Mahon | ||||||||||

Salary and cash incentive | $4,580,742 | $— | $— | $4,580,742 | $— | |||||

Equity vesting acceleration(2) | $1,343,670 | $1,343,670 | $1,343,670 | $1,343,670 | $1,343,670 | |||||

Supplemental Executive Retirement Plan(3) | $11,509,531 | $11,509,531 | $8,071,143 | $11,509,531 | $11,509,531 | |||||

Total | $17,433,943 | $12,853,201 | $9,414,813 | $17,433,943 | $12,853,201 | |||||

70 | United Therapeutics, a public benefit corporation |

Provision | Terms Applicable to Chairperson and CEO | Terms Applicable to Mr. Mahon |

Payments Upon Involuntary Termination without Cause, or Resignation for Good Reason, or Resignation while Continuing as Senior Advisor | •Lump sum prorated cash incentive bonus payment* •Lump sum payment equal to 3.0 times base salary + 3.0 times annual cash incentive award* •Continuation of health care benefits for 36 months, outplacement services for 12 months and the transfer of one currently leased vehicle •Immediate vesting of unvested stock options and PSUs** | •Lump sum payment equal to 2.0 times: (1) current base salary; plus (2) annual cash incentive award* •Immediate vesting of unvested stock options and PSUs** |

Payments Upon Disability | •Continued payment of current base salary through the end of the calendar year following such disability •Acceleration of SERP benefits •Immediate vesting of unvested stock options and PSUs** | •Immediate vesting of unvested stock options and PSUs** •Acceleration of SERP benefits |

Payments Upon Death | •Continued payment of current base salary through the end of the calendar year following such death to Executive’s legal representatives •Acceleration of SERP benefits •Immediate vesting of unvested stock options and PSUs** | •Immediate vesting of unvested stock options and PSUs** •Acceleration of SERP benefits |

Payments Upon Termination Following Change in Control | •Same as Payments Upon Involuntary Termination, etc., except that payment of SERP benefits occurs immediately, and is calculated as described above under Supplemental Executive Retirement Plan | •Same as Payments Upon Involuntary Termination, etc. •Acceleration of SERP benefits |

Payments Upon Change in Control without Termination | •Acceleration of SERP benefits •Immediate vesting of unvested stock options and PSUs** (if not assumed) | •Immediate vesting of unvested stock options and PSUs** (if not assumed) •Acceleration of SERP benefits |

Provision | Terms Applicable to Mr. Edgemond and Mr. Benkowitz |

Payments Upon Involuntary Termination without Cause | •Lump sum payment equal to base salary through the remainder of the agreement term |

Payments Upon Disability | •Continued payment of current base salary through date of termination •Immediate vesting of unvested stock options and PSUs* •Acceleration of SERP benefits |

Payments Upon Death | •Immediate vesting of unvested stock options and PSUs* •Acceleration of SERP benefits |

2024 Proxy Statement | 71 |

Provision | Terms Applicable to Mr. Edgemond and Mr. Benkowitz |

Payments Upon Termination Following Change in Control | •Payment of a lump sum cash amount equal to 2.0 times the sum of (x) base salary plus (y) the highest of (1) the cash incentive paid to the individual for the year immediately preceding the year in which the change in control occurs; (2) the cash incentive award payable to the individual for the year immediately preceding the year in which the termination of employment occurs; or (3) the individual’s annual target cash incentive award •Immediate vesting of unvested stock options and PSUs* •Acceleration of SERP benefits •Continuation of medical benefits for 24 months •Outplacement benefits with a value of $4,500 |

Payments Upon Change in Control without Termination | •Acceleration of SERP benefits •Immediate vesting of unvested stock options and PSUs* (if not assumed) |

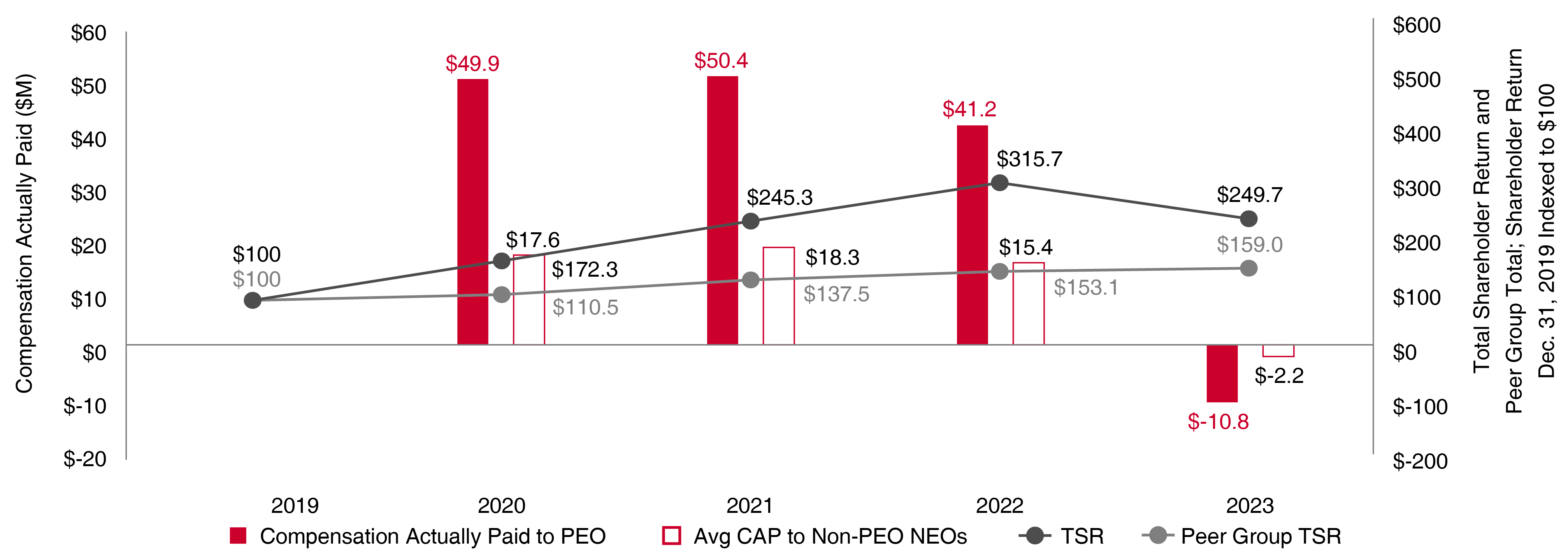

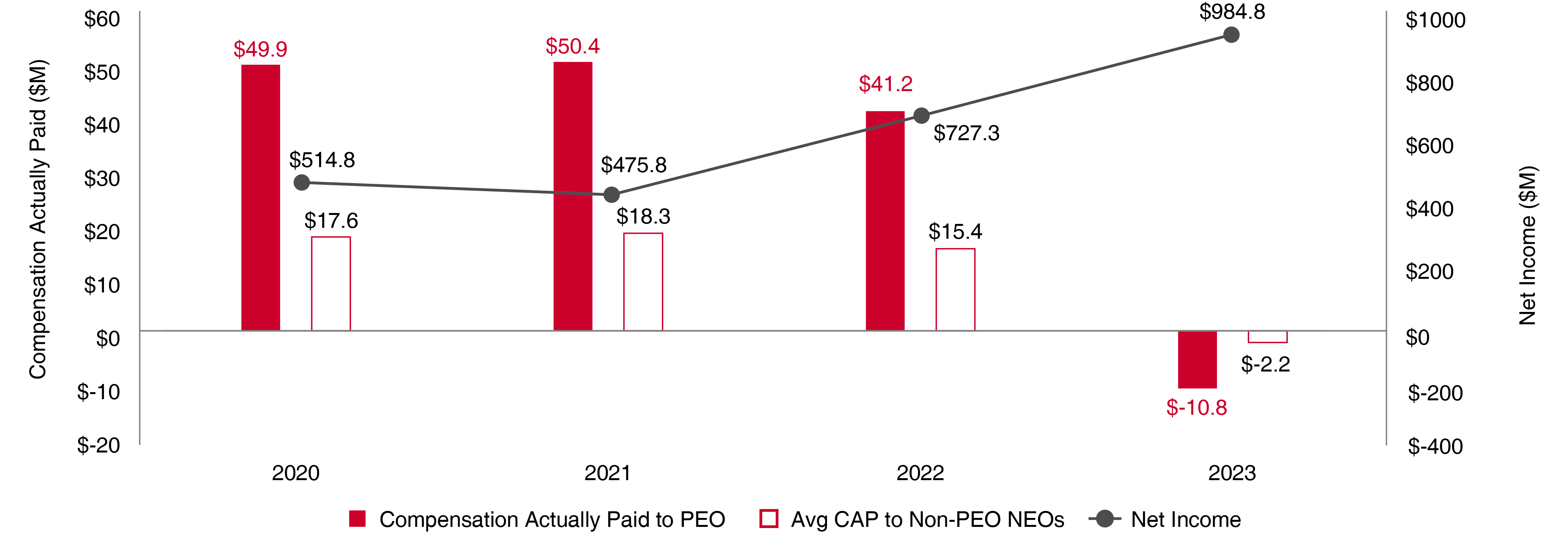

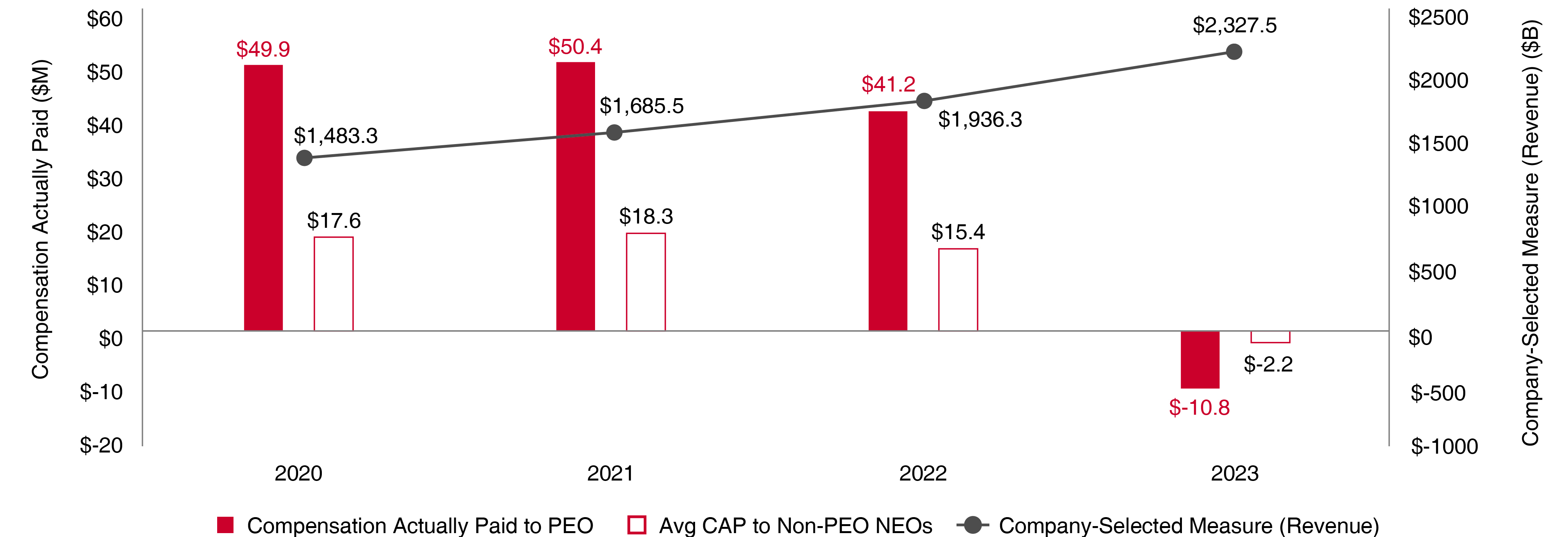

Year (a) | Summary Compensation Table Total for PEO (1) (b) | Compensation Actually Paid to PEO (2) (c) | Average Summary Compensation Table Total for Non-PEO NEOs (3) (d) | Average Compensation Actually Paid to Non-PEO NEOs (4) (e) | Value of Initial Fixed $100 Investment Based on: | Net Income ($ in millions) (7) (h) | Revenue ($ in millions) (8) (i) | |

Total Share- Holder Return (5) (f) | Peer Group Total Share- Holder Return (6) (g) | |||||||

2023 | $16,958,057 | $(10,805,540) | $7,004,879 | $(2,186,013) | $249.65 | $159.01 | $984.8 | $2,327.5 |

2022 | $5,322,204 | $41,188,180 | $2,381,140 | $15,387,032 | $315.72 | $153.08 | $727.3 | $1,936.3 |

2021 | $3,511,071 | $50,428,496 | $1,962,289 | $18,294,614 | $245.32 | $137.47 | $475.8 | $1,685.5 |

2020 | $4,811,672 | $49,919,731 | $4,145,541 | $17,608,882 | $172.33 | $110.52 | $514.8 | $1,483.3 |

72 | United Therapeutics, a public benefit corporation |

Compensation Actually Paid to PEO | 2023 | 2022 | 2021 | 2020 |

Summary Compensation Table Total | $16,958,057 | $5,322,204 | $3,511,071 | $4,811,672 |

Less value of Stock Options and RSUs reported in Summary Compensation Table | $11,302,852 | — | — | — |

Less Change in Pension Value reported in Summary Compensation Table | — | — | — | $1,575,757 |

Plus year-end fair value of outstanding and unvested equity awards granted in the year | $24,052,395 | — | — | — |

Plus fair value as of vesting date of equity awards granted and vested in the year | — | — | — | — |

Plus (less) year over year change in fair value of outstanding and unvested equity awards granted in prior years | — | $41,115,001 | $42,020,090 | $46,738,027 |

Plus (less) change in fair value from prior fiscal year end to the vesting date of equity awards granted in prior years that vested in the year | $(40,513,140) | $(5,249,025) | $4,897,335 | $(54,211) |

Less prior year-end fair value for any equity awards forfeited in the year | — | — | — | — |

Plus dividends or other earnings paid on awards in the covered fiscal year prior to vesting if not otherwise included in the Summary Compensation Table Total for the covered fiscal year | — | — | — | — |

Plus pension service cost for services rendered during the year | — | — | — | — |

Compensation Actually Paid to Martine Rothblatt, Chairperson and CEO | $(10,805,540) | $41,188,180 | $50,428,496 | $49,919,731 |

Average Compensation Actually Paid to Non-PEO NEOs | 2023 | 2022 | 2021 | 2020 |

Average Summary Compensation Table Total | $7,004,879 | $2,381,140 | $1,962,289 | $4,145,541 |

Less average value of Stock Options and RSUs reported in Summary Compensation Table | $3,767,178 | — | — | — |

Less average Change in Pension Value reported in Summary Compensation Table | $622,514 | — | $278,975 | $2,461,396 |

Plus average year-end fair value of outstanding and unvested equity awards granted in the year | $8,017,006 | — | — | — |

Plus average fair value as of vesting date of equity awards granted and vested in the year | — | — | — | — |

Plus (less) average year over year change in fair value of outstanding and unvested equity awards granted in prior years | — | $13,705,000 | $14,006,697 | $14,907,728 |

Plus (less) average change in fair value from prior fiscal year end to the vesting date of equity awards granted in prior years that vested in the year | $(13,504,380) | $(1,749,675) | $1,464,630 | $69,866 |

Less prior year-end fair value for any equity awards forfeited in the year | — | — | — | — |

Plus dividends or other earnings paid on awards in the covered fiscal year prior to vesting if not otherwise included in the Summary Compensation Table Total for the covered fiscal year | — | — | — | — |

Plus average pension service cost for services rendered during the year | $686,174 | $1,050,567 | $1,139,973 | $947,143 |

Average Compensation Actually Paid to Non-PEO NEOs | $(2,186,013) | $15,387,032 | $18,294,614 | $17,608,882 |

2024 Proxy Statement | 73 |

74 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 75 |

3 | Approval of The Amendment and Restatement of The United Therapeutics Corporation Amended and Restated 2015 Stock Incentive Plan |

76 | United Therapeutics, a public benefit corporation |

Total shares underlying all outstanding stock options | 6,466,272 | |

Weighted average exercise price of outstanding stock options | $145.13 | |

Weighted average remaining contractual life of outstanding stock options | 3.94 years | |

Total shares of common stock outstanding | 44,159,108 | |

Total shares underlying all outstanding and unvested performance shares | 349,800 | |

Total shares underlying all outstanding and unvested restricted stock (excluding performance shares) | 865,655 | |

Shares available for future awards that could be issued under Prior Plan(1) | 0 | |

Shares available for future awards that could be issued under the 2015 Stock Incentive Plan(2) | 1,720,819 | |

Shares available for future awards that could be issued under the 2019 Inducement Stock Incentive Plan(3) | 1,448 |

2024 Proxy Statement | 77 |

Options Granted(1) | Full-Value Shares Granted(1) | Total Granted = Options+ Full-Value Shares | Weighted Average Number of Common Shares Outstanding | Burn Rate | |

Fiscal 2023 | 455,996 | 370,068 | 826,064 | 46,788,051 | 1.8% |

Fiscal 2022 | 40,029 | 683,280 | 723,309 | 45,451,063 | 1.6% |

Fiscal 2021 | 43,653 | 188,378 | 232,031 | 44,860,950 | 0.5% |

Three-Year Average | 179,893 | 413,909 | 593,801 | 45,700,021 | 1.3% |

78 | United Therapeutics, a public benefit corporation |

Name and Principal Position | Stock Options | Restricted Stock Units(1) |

Martine Rothblatt | 3,015,094(2) | 170,790 |

Chairperson and Chief Executive Officer | ||

James Edgemond | 798,797 | 51,810 |

Chief Financial Officer and Treasurer | ||

Michael Benkowitz | 1,054,551(2) | 85,260 |

President and Chief Operating Officer | ||

Paul Mahon | 905,024 | 41,940 |

Executive Vice President and General Counsel | ||

All executive officers as a group (4 persons)(3) | 5,773,466 | 349,800 |

All non-executive directors as a group (11 persons) | 477,320 | 131,800 |

Each nominee for election as a director | — | — |

Each associate of the above-mentioned directors, executive officers, or nominees | — | — |

Each other person who received or is to receive 5% of such options, warrants or rights | — | — |

All employees (other than current executive officers) as a group (2,764 persons)(4) | 1,736,195 | 1,854,250 |

2024 Proxy Statement | 79 |

80 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 81 |

82 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 83 |

Plan category | Number of securities to be issued upon exercise of outstanding options and RSUs (a)(3) | Weighted average exercise price of outstanding options (b)(4) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c)(5) | |

Equity compensation plan approved by security holders(1) | 7,153,777 | $136.60 | 5,273,018 | |

Equity compensation plans not approved by security holders(2) | 24,835 | — | 24,586 | |

Total | 7,178,612 | $136.60 | 5,297,604 | |

84 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 85 |

4 | Ratification of The Appointment of Ernst & Young LLP as United Therapeutics Corporation’s Independent Registered Public Accounting Firm for 2024 |

86 | United Therapeutics, a public benefit corporation |

2023 | 2022 | |

Audit fees | $2,332,695 | $2,089,249 |

Audit-related fees | — | — |

Tax fees: | ||

Fees for tax compliance services | 370,275 | 370,136 |

Fees for tax consulting services (including tax advice and tax planning) | 6,755 | 26,480 |

Total tax fees | 377,030 | 396,616 |

All other fees | 7,632 | 9,082 |

$2,717,357 | $2,494,947 |

2024 Proxy Statement | 87 |

88 | United Therapeutics, a public benefit corporation |

Name | Number of Shares of Common Stock Beneficially Owned(1) | Percentage of Outstanding Shares(2) | Vested STAP Awards(3) |

Beneficial Owners | |||

BlackRock, Inc.(4) 50 Hudson Yards New York, NY 10001 | 5,294,844 | 11.9% | — |

The Vanguard Group(5) 100 Vanguard Boulevard Malvern, PA 19355 | 4,673,678 | 10.5% | — |

Wellington Management Group LLP(6) 280 Congress Street Boston, MA 02210 | 3,794,010 | 8.6% | — |

Avoro Capital Advisors LLC(7) 110 Greene Street, Suite 800 New York, NY 10012 | 2,858,888 | 6.4% | — |

FMR LLC(8) 245 Summer Street Boston, MA 02210 | 2,321,039 | 5.2% | — |

Executive Officers, Directors, and Nominees | |||

Martine Rothblatt(9) | 3,525,982 | 7.5% | — |

Michael Benkowitz(10) | 820,896 | 1.8% | 32,200 |

James Edgemond(11) | 655,706 | 1.5% | 40,160 |

Paul Mahon(12) | 453,650 | 1.0% | 116,250 |

Tommy Thompson(13) | 74,710 | * | — |

Katherine Klein(14) | 69,600 | * | 19,584 |

Christopher Patusky(15) | 57,364 | * | — |

Ray Kurzweil(16) | 57,110 | * | — |

Richard Giltner(17) | 30,620 | * | — |

Linda Maxwell(18) | 30,110 | * | — |

Nilda Mesa(19) | 29,123 | * | — |

Christopher Causey(20) | 27,955 | * | — |

Louis Sullivan(21) | 25,880 | * | — |

Judy Olian(22) | 21,925 | * | — |

Raymond Dwek(23) | 16,750 | * | 3,000 |

Jan Malcolm | — | * | — |

All directors, nominees, and executive officers as a group (16 persons)(24) | 5,897,381 | 11.9% | 211,194 |

2024 Proxy Statement | 89 |

90 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 91 |

92 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | 93 |

94 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | A-1 |

A-2 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | A-3 |

A-4 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | A-5 |

A-6 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | A-7 |

A-8 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | A-9 |

A-10 | United Therapeutics, a public benefit corporation |

2024 Proxy Statement | A-11 |

A-12 | United Therapeutics, a public benefit corporation |

(In millions, except percentages) | Year Ended December 31, 2023 |

Net income, as reported | $984.8 |

Adjusted for the following: | |

Interest income, net | (103.4) |

Income tax expense | 289.5 |

Depreciation & amortization expense | 53.2 |

Share-based compensation expense | 39.1 |

EBITDASO (Non-GAAP) | $1,263.2 |

Total revenues | $2,327.5 |

Net income margin | 42.3% |

EBITDASO margin | 54.3% |

2024 Proxy Statement | B-1 |