SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under § 240.14a-12 |

First Community Bank Corporation of America

(Name of Registrant as Specified in Its Charter

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | $125 per Exchange Act Rules O-11(c)(1)(iii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

| ¨ | Fee computed on table below per Exchange Act Rules 14-a6(i)(4) and O-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule O-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously by written preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form Schedule or Registration Statement No.: |

First Community Bank Corporation of America

*

Proxy Statement

FIRST COMMUNITY BANK CORPORATION

OF AMERICA

March 19, 2004

To our Shareholders:

The 2004 Annual Meeting of Shareholders of First Community Bank Corporation of America is being held at our headquarters located at 9001 Belcher Road, Pinellas Park, Florida 33782, on Monday, April 19, 2004 at 5:00 p.m. local time.

The Notice of the Annual Meeting of Shareholders and Proxy Statement attached to this letter describe the formal business that will be transacted at the Annual Meeting and provide material information concerning that business. The directors and officers of First Community Bank Corporation of America, as well as a representative of the accounting firm Hacker, Johnson & Smith, P.A., will be present at the Annual Meeting to respond to your questions. During the informal portion of the Annual Meeting, we plan to highlight some of our achievements in 2003, as well as share our goals and objectives for 2004.

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and signing the enclosed proxy card. Should you attend the Annual Meeting and prefer to vote in person, you will be given that opportunity.

On behalf of the Board of Directors and all the employees of First Community Bank Corporation of America, we look forward to seeing you at the Annual Meeting.

|

| Sincerely, |

|

| |

|

Kenneth P. Cherven President and Chief Executive Officer |

First Community Bank Corporation of America

*

Proxy Statement

FIRST COMMUNITY BANK CORPORATION

OF AMERICA

NOTICE OF THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 19, 2004

The 2004 Annual Meeting of Shareholders (“Annual Meeting”) of First Community Bank Corporation of America (“First Community”) will be held at our headquarters located at 9001 Belcher Road, Pinellas Park, Florida 33782 on April 19, 2004, beginning at 5:00 p.m., local time. At the Annual Meeting, the holders of First Community’s outstanding common stock will act on the following items:

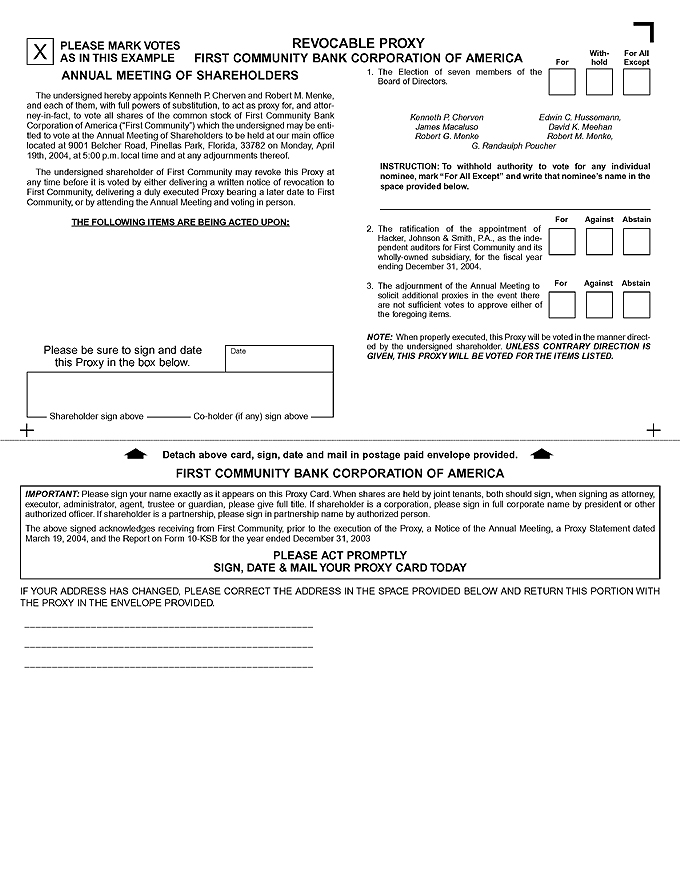

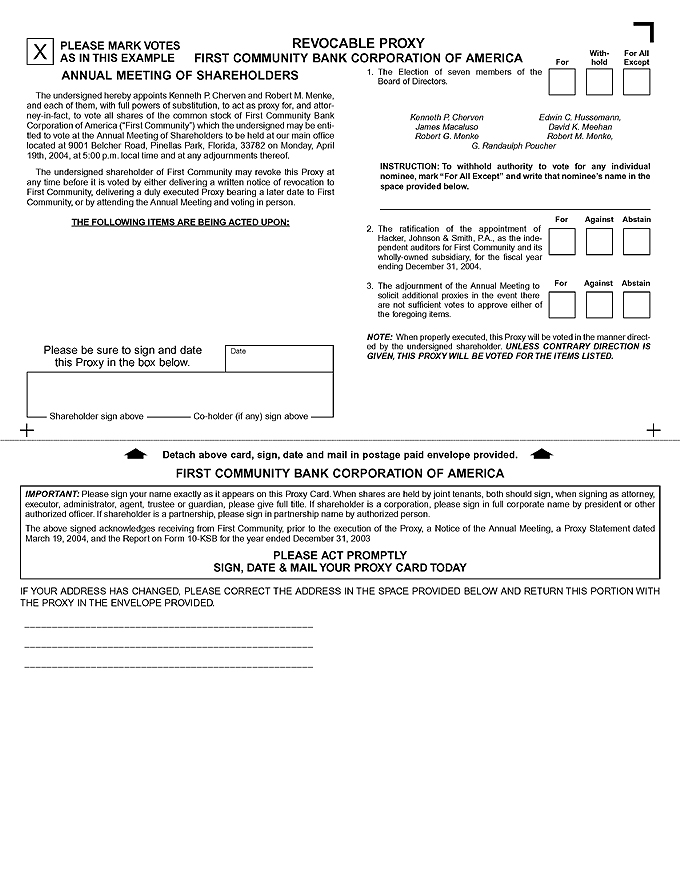

| | 1. | The election of seven members of the Board of Directors, each for one-year terms; |

| | 2. | The ratification of the appointment of Hacker, Johnson & Smith, P.A. as the independent auditors for First Community, and its subsidiaries for the fiscal year ending December 31, 2004; and |

| | 3. | The adjournment of the Annual Meeting to solicit additional proxies in the event there are not sufficient votes to approve either of the foregoing Proposals; and |

To transact any other business that properly comes before the Annual Meeting, or at any adjournment thereof.

All holders of record of shares of First Community at the close of business on March 1, 2004, are entitled to vote at the Annual Meeting and any adjournments thereof.

|

| By Order of the Board of Directors, |

|

| |

|

Kenneth P. Cherven President and Chief Executive Officer |

Pinellas Park, Florida

March 19, 2004

FIRST COMMUNITY BANK CORPORATION

OF AMERICA

PROXY STATEMENT

We are providing these proxy materials in connection with the solicitation by the Board of Directors of First Community Bank Corporation of America (“First Community”) of proxies to be voted at our 2004 Annual Meeting of Shareholders, and at any adjournment thereof (“Annual Meeting”). Our Form 10-KSB, which includes the financial statements for the fiscal year ended December 31, 2003, accompanies this Proxy Statement, and is first being mailed to shareholders on or about March 19, 2004.

Date, Time and Location

| | Ø | Our headquarters located at 9001 Belcher Road, Pinellas Park, Florida 33782 |

Solicitation and Voting of Proxies

This Proxy Statement and the accompanying Proxy Card are being furnished to shareholders of record as of the close of business on March 1, 2004, in connection with the solicitation of proxies by the Board of Directors of First Community for the Annual Meeting.

Regardless of the number of shares of common stock that you own, it is important that your shares be represented by proxy or that you be present at the Annual Meeting. To vote by proxy, please indicate your preferences in the spaces provided on the enclosed Proxy Card and return it signed and dated, in the enclosed postage-paid envelope. Proxies obtained by the Board of Directors will be voted in accordance with the directions given therein.If you do not indicate how your shares should be voted on a matter, the shares represented by your properly completed proxy will be voted as the Board of Directors recommends.

In order for us to have a quorum present to convene the Annual Meeting, it is important that your proxy be returned promptly. Therefore, whether or not you plan to be present at the Annual Meeting, please complete, sign and date the enclosed Proxy Card and return it in the enclosed postage-paid envelope.

Revocation of Proxy

Your presence at the Annual Meeting will not automatically revoke your proxy. However, you may revoke your proxy at any time prior to its exercise by simply:

| | • | Delivering a written notice of revocation to First Community; |

First Community Bank Corporation of America

*

Proxy Statement

| | • | Delivering a duly executed proxy bearing a later date to First Community; or |

| | • | Attending the Annual Meeting and voting in person. |

Voting Procedures

Our Articles of Incorporation do not provide for cumulative voting. Under the Florida Business Corporation Act (“Act”), directors are elected by a plurality of the votes cast at a meeting at which a quorum is present. Our Bylaws provide that a majority of shares entitled to vote and represented in person or by proxy at a shareholder meeting constitutes a quorum. Therefore, each shareholder of record on the record date has the right to vote, in person or by proxy, the number of shares he or she owns for as many director nominees as there are directors to be elected. For example, if you own five shares, you may vote a maximum of five shares for each director to be elected.

Other matters are approved if affirmative votes cast for a proposal exceed the votes cast against that proposal at a meeting at which a quorum is present, unless a greater number of affirmative votes or voting by classes is required by the Act or our Articles of Incorporation. Abstentions and broker non-votes have no effect under the Act.

If your shares are held in “street name,” under certain circumstances your brokerage firm may vote your shares. Brokerage firms have authority to vote their customers’ shares on certain “routine” matters, including the election of directors. When a brokerage firm votes its customers’ shares on routine matters, these shares are also counted for purposes of establishing a quorum to conduct business at the meeting. A brokerage firm cannot vote its customer’s shares on non-routine matters. Accordingly, these shares are not counted as votes against a non-routine matter, but rather not counted at all for these matters.There are no non-routine matters being voted upon at this Annual Meeting. We, nevertheless, encourage you to provide instructions to your brokerage firm as to how your proxy should be voted. This ensures your shares will be voted at the Annual Meeting.

The Board of Directors has fixed the close of business on March 1, 2004, as the “record date” for determination of shareholders entitled to notice of, and to vote at, the Annual Meeting, and any adjournment thereof. On the record date, there were 1,993,194 shares of First Community’s common stock outstanding.

First Community Bank Corporation of America

*

Proxy Statement

2

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table contains information regarding our Directors and Executive Officers and the only persons known to us to be the beneficial owners of five percent or more of the outstanding shares of First Community as of December 31, 2003. The beneficial ownership was determined based on Securities Exchange Commission rules and regulations. In general, beneficial ownership includes shares over which a person has sole or shared voting or investment power, and shares which the person has the right to acquire within 60 days.

| | | | | | | | | | |

Name

| | Number of Common Shares

Owned(1)

| | | Options

and/or

Warrants

Held

| | Vested Options and/or Warrants(2)

| | % of Beneficial Ownership(3)

| |

Scott C. Boyle | | 12,500 | | | 37,500 | | 28,125 | | 2.00 | % |

| | | | |

Michael J. Bullerdick | | 437 | | | 12,062 | | 2,062 | | * | |

| | | | |

Kenneth P. Cherven | | 6,250 | | | 118,750 | | 48,750 | | 2.69 | |

| | | | |

Edwin C. Hussemann | | — | | | — | | — | | * | |

| | | | |

James Macaluso | | 54,375 | (4) | | 45,937 | | 45,937 | | 4.92 | |

| | | | |

David K. Meehan | | 6,250 | (5) | | — | | — | | * | |

| | | | |

Robert G. Menke | | 1,250 | | | — | | — | | * | |

| | | | |

Robert M. Menke | | 565,318 | (6) | | 231,250 | | 231,250 | | 35.81 | |

| | | | |

G. Randaulph Poucher | | 47,917 | (7) | | 42,708 | | 42,708 | | 4.45 | |

| | | | |

Ralph E. Stevens, Jr.** | | 95,374 | (8) | | 23,124 | | 23,124 | | 5.88 | |

| | | | |

John A. Stewart, Jr. | | 2,500 | | | 6,875 | | 4,375 | | * | |

| | | | |

Clifton E. Tufts | | 2,500 | | | 12,500 | | 2,500 | | * | |

| | | | |

All officers and directors as a group (12) persons. | | 796,546 | | | 530,706 | | 428,831 | | 50.59 | % |

| ** | Deceased January 5, 2004 |

| (1) | Includes shares for which the named person has sole voting and investment power, has shared voting and investment power with a spouse, or holds in an IRA or other retirement plan program, unless otherwise indicated in these footnotes, but does not include shares that may be acquired by exercising stock options. |

First Community Bank Corporation of America

*

Proxy Statement

3

| (2) | Includes shares that may be acquired by exercising vested stock options and/or vested warrants. |

| (3) | Under the rules of the Securities Exchange Commission, the determinations of “beneficial ownership” of our common stock are based upon Rule 13d-3 under the Securities Exchange Act of 1934, which provides that shares will be deemed to be “beneficially owned” where a person has, either solely or in conjunction with others, the power to vote or to direct the voting of shares and/or the power to dispose, or to direct the disposition of shares, or where a person has the right to acquire any such power within 60 days after the date such beneficial ownership is determined. Shares of our common stock that a beneficial owner has the right to acquire within 60 days under the exercise of the options or warrants are deemed to be outstanding for the purpose of computing the percentage ownership of such owner, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| (4) | Of Mr. Macaluso’s holdings, 10,625 shares and 5,312 warrants are owned by the W.J. Trust. Mr. Macaluso serves as Trustee for the Trust. |

| (5) | All of Mr. Meehan’s shares are in the name of his spouse. |

| (6) | Includes 12,500 shares controlled by Mr. Menke in Bankers Insurance Group, Inc.; 490,318 controlled by Mr. Menke in First Community Financial Corporation; The 231,250 options held by Mr. Menke are held in trust for First Community Financial Corporation. First Community Financial Corporation is wholly owned by Mr. Menke. |

| (7) | Includes 10,417 shares and 5,208 warrants held by A. Randy’s Electric, a company controlled by Mr. Poucher. |

| (8) | Mr. Stevens’ shares are held as follows: 44,562 in the name of his spouse, Carol S. Stevens; 50,812 in Mr. Stevens name individually. An additional 5,312 warrants are held by Mr. Stevens’ spouse and 5,312 warrants are held in his name. |

BOARD OF DIRECTORS AND COMMITTEE MEETINGS

First Community’s Board of Directors has four standing committees: theAudit Committee,Nominating Committee, Executive Committee, and theCorporate Governance Committee. The Board of Directors meets monthly. No director attended fewer than 75% of the Board Meetings in 2003. Directors receive no additional compensation for serving on First Community’s Board of Directors above what is received as directors at First Community Bank (“Bank”) and as Committee members of either Board. The Bank’s Board of Directors is divided into two committees:Asset/Liability and the Loan Committee. All members of the Bank’s Board of Directors serve on the Loan Committee. In 2003, no director attended fewer than 75% of the meetings of the Bank’s Board or any Committee on which he served. Directors receive no compensation for Board service, although they may be reimbursed for reasonable expenses incurred in attending meetings. Bank Board members receive $400 per meeting, with the Chairman receiving $500 per meeting. The Bank also has Regional Boards for its Pinellas County and Charlotte County markets. The Pinellas County Regional Board members receive $500 per meeting and the Charlotte County Regional Board members receive $250 per meeting, with no additional fees to their respective Chairmen.

First Community Bank Corporation of America

*

Proxy Statement

4

Board Committee meetings—$150 per meeting attended.

The composition of and number of meetings held by each committee of First Community in 2003 is reflected in the following table:

| | | | | | | | |

Board Member

| | Audit

| | Nominating

| | Executive

| | Corporate

Governance

|

Kenneth P. Cherven | | | | X | | X | | X |

| | | | |

Edwin C. Hussemann | | X | | | | | | |

| | | | |

James Macaluso | | Chair | | | | X | | X |

| | | | |

David K. Meehan | | X | | X | | | | Chair |

| | | | |

Robert G. Menke | | | | X | | | | X |

| | | | |

Robert M. Menke | | | | | | Chair | | |

| | | | |

G. Randaulph Poucher | | X | | | | X | | |

| | | | |

Ralph E. Stevens, Jr. | | X | | Chair | | X | | |

| | |

| |

| |

| |

|

Meetings in 2003 | | 4 | | 1 | | 3 | | 1 |

| | |

| |

| |

| |

|

The First Community Committees were established in 2003 following our Nasdaq SmallCap listing and have not completed a full year cycle. The Committees were previously established at the Bank level.

The Audit Committee for First Community composition was examined during the year by the Board of Directors in light of the new Nasdaq Marketplace and Securities Exchange Commission Rules requiring that all members of the Audit Committee be “independent directors.” Based upon this examination, the Board determined that not all of the members of our Audit Committee qualify as “independent directors” within the meaning of these Rules. The Audit Committee is currently taking steps to ensure that each member of the 2004 Audit Committee will qualify as an “independent director”. Further, James Macaluso, an accountant with extensive bank management and auditing experience, has the requisite financial expertise to qualify as an “audit committee financial expert” as defined by Securities Exchange Commission Rules. Accordingly, the Board has designated him to hold that position.

REPORT OF THE AUDIT COMMITTEE

The audit functions of the Audit Committee are focused on three areas:

| | • | The adequacy of First Community’s and the Bank’s internal controls and financial reporting process and the reliability of First Community’s and the Bank’s financial statements. |

First Community Bank Corporation of America

*

Proxy Statement

5

| | • | The performance of First Community’s and the Bank’s internal auditors and the independence and performance of First Community’s and the Bank’s independent auditors. |

| | • | First Community’s and the Bank’s compliance with legal and regulatory requirements. |

The Audit Committee met with management periodically to consider the adequacy of First Community’s and the Bank’s internal controls and the objectivity of their financial reporting. The Audit Committee discussed these matters with First Community’s and the Bank’s independent auditors and with appropriate company financial personnel.

The Audit Committee meets regularly with the independent auditors without the presence of management. The independent auditors have unrestricted access to the Audit Committee.

The Audit Committee also recommends to the Board the appointment of the independent auditors and reviews their performance, fees and independence from management.

The Board of Directors has determined that none of the members of the Audit Committee has a relationship to First Community and the Bank that may interfere with the members’ independence from First Community and the Bank and their management.

Management has primary responsibility for First Community’s and the Bank’s financial statements and the overall reporting process, including the system of internal controls. The independent auditors audit the annual financial statements prepared by management, express an opinion as to whether those financial statements fairly present the financial position, results of operations and cash flows of First Community and the Bank in conformity with accounting principles generally accepted in the United States of America. The independent auditors discuss any issues they believe should be brought to the Audit Committee’s attention.

This year, the Audit Committee reviewed First Community’s audited financial statements as of and for the fiscal year ended December 31, 2003, and met with both management and First Community’s and the Bank’s independent auditors to discuss those financial statements. Management has represented that the financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

The Audit Committee has received from and discussed with Hacker, Johnson & Smith, P.A., the written disclosure and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). These items relate to that firm’s independence from First Community and the Bank. The Audit Committee also discussed with Hacker, Johnson & Smith, P.A., any matters required to be discussed by Statement on Auditing Standards No. 61. (Communication with Audit Committees).

First Community Bank Corporation of America

*

Proxy Statement

6

Based on these reviews and discussions, the members of the Audit Committee (Chairman James Macaluso and Directors Edwin C. Hussemann, G. Randaulph Poucher, and David K. Meehan) recommended to the Board that First Community’s and the Bank’s audited financial statements be included in First Community’s Annual Report on Form 10-KSB for the fiscal year ended December 31, 2003.

The Nominating Committee for First Community meets as needed and is responsible for recommending the number of Directors to serve for the ensuing period, recommending the number of Directors to be elected by the shareholders, and for selecting the management nominees for election as Directors. Non-management directors are considered for nomination by the full Board. The Nominating Committee does not operate pursuant to a charter and its members are not “independent” under the listing standards contained in the Nasdaq Marketplace rules. First Community does not have any procedures or policies for considering shareholder nominations, but will consider shareholder nominations on a case-by-case basis.

The Executive Committee for First Community meets as needed and has all the authority of the Board of Directors, when the Board of Directors is not in session, except as specially limited by the Board. The Committee is responsible for reviewing executive compensation, performance incentives, stock options, and strategic business planning.

The Corporate Governance Committee for First Community meets at least annually and is responsible for overseeing NASDAQ’s Corporate Governance rules, evaluating Director performance, and overseeing the Ethics Policy and the Whistleblower Policy.

1. ELECTION OF DIRECTORS

The Board of Directors is presently comprised of seven members, all of whom have been nominated by the Board to stand for election at the Annual Meeting. Directors are each elected for a one-year term and serve until their successors are elected and installed. To the best of our knowledge, no director nominee is being proposed for election pursuant to any agreement between that person and any other person.

The seven nominees named herein have indicated that they are willing to stand for election and to serve as directors if elected. Should a director nominee become unable or unwilling to serve, proxies will be voted for the election of such other person as the Board of Directors may choose to nominate.

The affirmative vote of a plurality of the votes cast at the Annual Meeting is needed to elect a director. Abstentions and withheld votes will have the same effect as votes against a director nominee.

First Community Bank Corporation of America

*

Proxy Statement

7

Information relating to the business experience of each director nominee is set forth below:

NOMINEES FOR DIRECTORS

Kenneth P. Cherven is President, Chief Executive Officer and Director of First Community and is Chief Executive Officer and Director of First Community Bank. Mr. Cherven also serves as an Advisory Director of the Pinellas and Charlotte County Regions. Mr. Cherven has been our President and Chief Executive Officer since July 2000. Mr. Cherven has been in banking in Florida since 1981 and has served as President and Chief Executive Officer of two local and regional banks: first at Gulf Bank where he served from 1989 to 1993; and then at Premier Community Bank where he served from 1994 to 1999. Mr. Cherven has a MBA degree in Business from the University of Tampa and a Bachelor’s degree in Finance from Florida Southern College. Mr. Cherven serves as an adjunct Professor for the Florida School of Banking, and the Graduate School of Banking at Louisiana State University, where he also serves as Trustee. Mr. Cherven is Vice Chairman of the Foundation Board of St. Petersburg College, and Chairman of the Finance Committee.

Edwin C. Hussemann is a Director of First Community and First Community Bank. Mr. Hussemann has served in these positions since 1995. Mr. Hussemann is a Certified Public Accountant. For the last 27 years, Mr. Hussemann has served as Chief Financial Officer of Bankers Insurance Group, Inc., as well as at several of its subsidiaries. He is a member of the American Institute of Certified Public Accountants (AICPA) and the Florida Institute of Certified Public Accountants (FICPA).

James Macaluso is a Director with First Community and First Community Bank, commencing his positions in January, 1999. He is also an Advisory Director and Chairman of the First Community Bank Pinellas County Region. From 1991 through the present, Mr. Macaluso has been an accountant with, and owner of, Macaluso & Company, P.A., in St. Petersburg, Florida. Mr. Macaluso is a former member of the Board of Directors of Marine Bank of St. Petersburg, Florida, where he served for 12 years. At Marine Bank he also served as Chairman of the Audit Committee.

David K. Meehanis a Director of First Community and First Community Bank. He has served in these positions since 1995. He joined the organizers of Bankers Insurance Group, Inc. in 1976 as Corporate Secretary and was appointed its President in 1979. He is currently First Vice-Chairman of Bankers Insurance Group, Inc., and President of Bankers Insurance Company. He has served in that capacity since October 1997. In 1999, Mr. Meehan was appointed by Florida Governor Jeb Bush as Commissioner of the Florida Fish and Wildlife Conservation Commission. He was reappointed by the Governor in July 2002 to serve another 5-year term. Mr. Meehan has served on the Boards of Governors of the Florida Joint Underwriting Association, the Florida Property and Casualty Joint Underwriting Association, Insurance Management Solution Group, Inc. and the Florida Residential Property and Casualty Joint Underwriting Association. Mr. Meehan is also a member of the Florida State University Alumni and Advisory Board, Director of the Florida Insurance Council, National Association of Independent Insurers, past National Flood Insurance Chairman, and past Chairman and President of the Florida Association of Domestic Insurance Companies.

First Community Bank Corporation of America

*

Proxy Statement

8

Robert G. Menke is a Director of First Community and First Community Bank. He has served in these position since 2000. Mr. Menke is the son of Robert M. Menke, our Chairman. Since 2002, Mr. Menke has acted as a consultant to Bankers Insurance Group, Inc., and its affiliated companies. Prior to that, from 1999 to 2002, Mr. Menke served as Chief Executive Officer and President of P&C Companies. From 1996 to 1999, he served as Executive Vice President and Chief Operations Officer at Bankers Insurance Group, Inc. Mr. Menke has an MBA from the University of South Florida.

Robert M. Menke is a Director and Chairman of the Board of First Community and a Director of First Community Bank. He has served in these positions since 1995. Mr. Menke founded Bankers Insurance Group in 1976 and, is currently, and has been, its Chairman of the Board since inception. Mr. Menke was honored as “Insurance Man of the Year” in 1986 by the Florida Association of Domestic Insurance Companies. Mr. Menke is also a member of the Florida Insurance Council, and the National Association of Independent Insurers. He is currently a director of Bankers Security Insurance Company, Bankers Life Insurance Company and Bankers Insurance Company.

Gordon Randaulph “Randy” Poucher is a Director of First Community and First Community Bank and an Advisory Director of the Pinellas County Region. He has served in these positions since 1999. Mr. Poucher is a native of St. Petersburg, Florida. From 1975 through the present, Mr. Poucher has been the owner of A. Randy’s Electric, Inc. Mr. Poucher was a Director of the Marine Bank of St. Petersburg, Florida.

The Board of Directors Recommends that the Shareholders

Vote “For” the Election of the Seven Director Nominees.

NON-DIRECTOR

EXECUTIVE OFFICERS

First Community Executive Officers

John A. Stewart, Jr. is Senior Vice President and Chief Financial Officer for First Community. He joined First Community in 2000. Mr. Stewart has been in banking in Florida since 1975. From July 1989 to December 1999 he served as Senior Vice President and Chief Financial Officer at First Federal Savings Bank of the Glades. Prior to that he served as Vice President of Bayside Federal Savings and Loan Association. Mr. Stewart has a Bachelor’s degree in Accounting from the University of Tennessee.

First Community Bank Executive Officers

Scott C. Boyle is Regional President of Pinellas County for First Community Bank. Mr. Boyle has served in that capacity since January 1999. Mr. Boyle has been in banking in Florida since 1977. From June 1990 to January 1999, Mr. Boyle was with First Central Bank in St. Petersburg, Florida, as Senior Vice-President, Commercial Lending. Mr. Boyle has a Bachelor’s degree in Business and Finance from the University of Florida. Mr. Boyle is active in the Kiwanis Club of St. Petersburg and the St. Petersburg Chamber of Commerce.

First Community Bank Corporation of America

*

Proxy Statement

9

Michael J. Bullerdickis Regional President of Charlotte County for First Community Bank. Mr. Bullerdick has been in that position since March 2003. Mr. Bullerdick has been in banking in Florida since 1981. Prior to joining First Community Bank, Mr. Bullerdick was employed with SunTrust Bank for nine years. His last position with SunTrust Bank was Senior Vice President-Commercial Banking. From 1989 to 1993 he was employed as Head of Commercial and Residential Lending for Century Bank. Mr. Bullerdick has a Bachelor’s degree in Business Administration from Ferris State University and an MBA in Finance from the University of Sarasota. Mr. Bullerdick is active in the Police Athletic League of Sarasota, and is a graduate of Leadership Sarasota.

Clifton E. Tufts is Executive Vice President of First Community Bank. He has served in that position since February, 2003. From 1998 to 2002, he served as Senior Vice President and then Executive Vice President of Premier Community Bank of Florida. Mr. Tufts also served as Head of the Association Services Division for Premier’s holding company, P.C.B. Bancorp, Inc. P.C.B. is a four-bank holding company located in Largo, Florida. Mr. Tufts is a graduate of Stetson University and has a BBA degree in Accounting. He is a Certified Public Accountant in the State of Florida. Mr. Tufts is active in Little League and Youth Football in North Tampa, and serves as a Director for the Community Associations Institute’s Suncoast Chapter. Mr. Tufts also serves as Vice Chairman of the Banking Committee of the National CAI.

EXECUTIVE COMPENSATION

First Community has an employment agreement with its President and Chief Executive Officer, Kenneth P. Cherven. The terms and conditions of the Agreement are summarized below.

Mr. Cherven entered into a joint employment agreement dated as of June 16, 2000, with First Community and First Community Bank, pursuant to which Mr. Cherven is to serve as President and Chief Executive Officer of First Community, and as Chief Executive Officer of First Community Bank. The employment agreement has a five-year term ending on July 3, 2005. The employment agreement calls for a base salary of $140,000 in the first year of the term and is adjusted annually by the Board. The employment agreement requires that an annual bonus be paid provided that certain predetermined performance goals are met. The performance goals are mutually agreed upon at the beginning of each year. An additional bonus may be granted at the Board’s discretion. In addition, the agreement grants Mr. Cherven stock options to purchase 125,000 shares of the common stock, based on an annual vesting schedule, at an exercise price of $8.00 per share. Mr. Cherven’s employment agreement contains a non-compete provision for two years following termination of the employment agreement. The non-compete provision prevents Mr. Cherven from competing with us either directly or indirectly within 35 miles of the main office of First Community Bank. The employment agreement calls for a severance payment equal to existing compensation through the end of the term of his employment agreement should Mr. Cherven be terminated for other than Good Cause or if he resigns for Good Reason as defined in the agreement.

First Community Bank Corporation of America

*

Proxy Statement

10

SUMMARY COMPENSATION TABLE

The following Summary Compensation Table shows compensation information regarding Kenneth P. Cherven, Dale E. Bowe, Scott C. Boyle, Michael J. Bullerdick, John A. Stewart, Jr. and Clifton E. Tufts. No other executive officer received compensation at a level required to be reported herein by Securities and Exchange Commission regulations.

| | | | | | | | | | | | | |

| | | Summary Compensation Table

|

| | | Annual Compensation

| | Long-Term

Compensation

|

Name and Principal Position | | Year

| | Salary

| | Bonus(1)

| | Other Annual

Compensation(2)

| | Securities Underlying

Options/SARS

Awards(3)

|

| | | | | |

Kenneth P. Cherven

President, Chief

Executive Officer and

Director of First Community

and is Chief Executive

Officer, and Director of

First Community Bank | | 2003

2002

2001 | | $

$

$ | 160,509

151,424

145,600 | | $

$

$ | 75,000

50,000

18,000 | | $

$

| 21,589

19,212

18,108 | | —

—

125,000 |

| | | | | |

Dale E. Bowe(4)

Former Regional

President, Charlotte County | | 2003

2002

2001 | | $

$

$ | 115,839

113,568

109,200 | |

$

$ | —

10,000

7,000 | | $

$

| 6,000

6,000

6,000 | | —

—

— |

| | | | | |

Scott C. Boyle

Regional President,

Pinellas County | | 2003

2002

2001 | | $

$

$ | 120,382

113,568

109,200 | | $

$

$ | 50,000

30,000

14,000 | | $

$

| 6,565

6,508

6,188 | | —

—

37,500 |

| | | | | |

Michael J. Bullerdick

Regional President

Charlotte County | | 2003

2002

2001 | | $

| 110,000

—

— | | $

| 10,000

—

— | | $

| 6,000

—

— | | 12,500

—

— |

| | | | | |

John A. Stewart, Jr.

Senior Vice President and

Chief Financial Officer | | 2003

2002

2001 | | $

$

$ | 84,645

81,390

78,260 | | $

$

$ | 25,000

20,000

7,000 | | $

$

$ | 1,500

1,500

1,500 | | —

—

6,250 |

| | | | | |

Clifton E. Tufts

Executive Vice President | | 2003

2002

2001 | | $

| 108,000

—

— | | $

| 45,000

—

— | | $

| 5,000

—

— | | 12,500

—

— |

| (1) | Annual incentive awards paid for results achieved during the calendar year, which were paid during the year or immediately following the years indicated. |

| (2) | All additional forms of cash and non-cash compensation paid, awarded or earned, which includes automobile allowances and club membership costs. |

| (3) | Grants of stock options made under First Community Bank Corporation of America’s Long Term Incentive Plan. |

| (4) | Mr. Bowe resigned in March, 2003. |

First Community Bank Corporation of America

*

Proxy Statement

11

Option Grants In Last Fiscal Year

The following table sets forth certain information regarding stock options granted to the Named Executive Officers during the 2003 Fiscal Year. We have never granted any stock appreciation rights.

| | | | | | | | | | |

NAME

| | NUMBER OF

SECURITIES

UNDERLYING

OPTIONS

GRANTED(1)

| | PERCENT OF

TOTAL OPTIONS

GRANTED TO

EMPLOYEES 2003(2)

| | | EXERCISE

PRICE PER

SHARE ($)

| | EXPIRATION

DATE

|

Michael J. Bullerdick | | 2,500

2,500

2,500

2,500

2,500 | | 10

10

10

10

10 | %

%

%

%

% | | $

$

$

$

$ | 9.60

9.60

9.60

9.60

9.60 | | March 24, 2009

March 24, 2010

March 24, 2011

March 24, 2012

March 24, 2013 |

| | |

| |

|

| | | | | |

TOTAL | | 12,500 | | 50 | % | | | — | | — |

| | |

| |

|

| | | | | |

Clifton E. Tufts | | 2,500

2,500

2,500

2,500

2,500 | | 10

10

10

10

10 | %

%

%

%

% | | $

$

$

$

$ | 9.60

9.60

9.60

9.60

9.60 | | February 28, 2009

February 28, 2010

February 28, 2011

February 28, 2012

February 28, 2013 |

| | |

| |

|

| | | | | |

TOTAL | | 12,500 | | 50 | % | | | — | | — |

| | |

| |

|

| | | | | |

| (1) | Each option represents the right to purchase one share of Common Stock. The options shown in this table were all granted under our Long Term Incentive Plan, as amended. |

| (2) | In the 2003 Fiscal Year, we granted options to employees to purchase an aggregate of 25,000 shares of Common Stock. |

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

The following table sets forth information concerning the exercise of stock options during the 2003 Fiscal Year by each of the Named Executive Officers and the fiscal year-end value of unexercised options.

| | | | |

| | | SHARES ACQUIRED ON EXERCISE

| | VALUE REALIZED

|

Michael J. Bullerdick | | 350 | | $700.00 |

| | | | | | | | | | |

| | | NUMBER OF SECURITIES UNDERLYING

UNEXERCISED OPTIONS AT DECEMBER 31, 2003

| | VALUE OF UNEXERCISED IN-THE-MONEY OPTIONS AT DECEMBER 31, 2003(1)

|

| | | EXERCISABLE

| | UNEXERCISABLE

| | EXERCISABLE

| | UNEXERCISABLE

|

Kenneth P. Cherven | | 48,750 | | 70,000 | | $ | 360,750 | | $ | 518,000 |

| | | | |

Scott C. Boyle | | 28,125 | | 9,375 | | | 208,125 | | | 69,375 |

| | | | |

Michael J. Bullerdick | | 2,062 | | 10,000 | | | 11,948 | | | 38,000 |

| | | | |

Clifton E. Tufts | | 2,500 | | 10,000 | | | 14,500 | | | 58,000 |

| | | | |

John A. Stewart, Jr. | | 3,750 | | 2,500 | | | 27,750 | | | 18,500 |

| (1) | The fair market value of the Common Stock as of December 31, 2003 was $15.40. |

First Community Bank Corporation of America

*

Proxy Statement

12

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Certain of First Community’s directors, officers and employees have banking relations with the Bank. Loans made to Directors, executive officers and principal shareholders, defined as individuals owning 10% or more of First Community’s common stock, are governed under the provisions of Section 22(h) of the Federal Reserve Act, which requires that any loans made to those individuals must:

| | • | Be on substantially the same terms, including interest rates and collateral as those prevailing at the time for comparable transactions with non-affiliated parties; and |

| | • | Not involve more than the normal risk of repayment or present other unfavorable features. |

There is, however, an exception for loans made to employees who are affiliates that are made pursuant to a benefit or compensation package that is widely available to all Bank employees and does not give a preference to affiliates. There is also an aggregate limit of $25,000, or 5% of the amount of the Bank’s unimpaired capital and unimpaired surplus on all loans to those individuals, unless the Board of Directors has approved the amount and the individual has abstained from participating in the voting.

There is further exception for loans made to executive officers. Executive officers are those people who participate, or who have authority to participate, in major policymaking functions of First Community, regardless of their title. In 2003, the Bank had five employees who would be considered executive officers. The Bank may lend any otherwise permissible sum of money to an executive officer for:

| | • | Financing the education of the officer’s children; |

| | • | A Board of Director’s approved first mortgage on the officer’s residence; or |

| | • | A loan secured by certain low-risk collateral. |

The Bank may also lend up to the higher of $25,000, or 2.5% of its unimpaired capital and unimpaired surplus (but never more than $100,000) to an executive officer for any other purpose.

During 2003, First Community’s Directors and executive officers (or their related business interests) had loans or lines of credit with the Bank that, in the aggregate totaled $3,526,269. These loans and lines of credit were made on the same terms as extensions of credit are made to the Bank’s unaffiliated customers.

First Community Bank Corporation of America

*

Proxy Statement

13

2. RATIFICATION OF THE APPOINTMENT OF AUDITORS

FOR FISCAL YEAR ENDING DECEMBER 31, 2004

The Board of Directors intends to retain the accounting firm of Hacker, Johnson & Smith, P.A., as First Community’s and First Community Bank’s independent auditors for the fiscal year ending December 31, 2004. A representative from the firm is expected to be present at the Annual Meeting to respond to questions regarding our financial statements and the notes thereto.

Audit Fees.The aggregate fees billed for professional services by Hacker, Johnson & Smith, P.A. in connection with the audit of the annual financial statements for the year and for the reviews of the quarterly financial statements filed with the Securities and Exchange Commission, as well as tax-related services were $49,500. The Audit Committee does not believe that First Community’s payment for tax services impairs Hacker, Johnson & Smith, P.A.’s independence in conducting its audits of First Community.

All Other Fees.In addition to fees billed for audit services and reviews of financial statements for 2003 by Hacker, Johnson & Smith, P.A., First Community was billed $15,297.48 by Crowe Chizek & Company for internal review services, and loan and document reviews.

In order to be adopted, this item must be approved by the holders of a majority of the outstanding shares of First Community’s common stock present or represented by proxy and entitled to vote at the Annual Meeting. If the shareholders do not vote in favor of the appointment of Hacker, Johnson & Smith, P.A., the Board of Directors will consider the selection of other auditors.

The Board of Directors Recommends that Shareholders Vote “For”

the Ratification of the Appointment of Hacker, Johnson & Smith, P.A.

for the Fiscal Year Ending December 31, 2004.

3. ADJOURNMENT OF ANNUAL MEETING

The Board of Directors seeks your approval to adjourn the Annual Meeting in the event that there are not a sufficient number of votes to approve items 1 or 2 at the Annual Meeting. In order to permit proxies that have been timely received by the First Community to be voted for an adjournment, we are submitting this item as a separate matter for your consideration. If it is necessary to adjourn the Annual Meeting and the adjournment is for a period of less than 30 days, no notice of the time or place of the reconvened meeting will be given to shareholders, other than an announcement made at the Annual Meeting.

The Board of Directors Recommends that Shareholders Vote “For”

the Approval of the Adjournment of the Annual Meeting.

First Community Bank Corporation of America

*

Proxy Statement

14

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

To the best of First Community’s knowledge, during 2003, each of its directors, executive officers and beneficial owners of 10% of its common stock timely filed all reports required by Section 16(a) of the Securities Exchange Act of 1934.

SHAREHOLDER PROPOSALS

In order to be eligible for inclusion in the First Community proxy materials for the 2005 Annual Meeting of Shareholders, a shareholder’s proposal to take action at such meeting must be received at First Community’s main office at 9001 Belcher Road, Pinellas Park, Florida 33782, on or before November 14, 2004. To be included in the proxy materials, proposals must comply with the Securities and Exchange Commission’s proxy rules, as provided in 17 C.F.R. Section 240.14(a).

NOTICE OF BUSINESS TO BE CONDUCTED AT AN ANNUAL MEETING

AND SHAREHOLDER NOMINATIONS

The Bylaws of First Community provide an advance notice procedure for certain business, including nominations for directors, to be brought before an annual meeting. In order for a shareholder to properly bring business before an annual meeting, the shareholder must give written notice to the Corporate Secretary not less than 10 days before the time originally fixed for such meeting.

SOLICITATION

The cost of soliciting proxies on behalf of the Board of Directors for the Annual Meeting will be borne by First Community. Proxies may be solicited by directors, officers or our regular employees, in person or by telephone, e-mail or mail. We are requesting persons and entities holding shares in their names, or in the names of their nominees, to send proxy materials to, and obtain proxies from, such beneficial owners. Those persons and entities will be reimbursed for their reasonable out-of-pocket expenses.

OTHER MATTERS THAT MAY PROPERLY COME BEFORE

THE ANNUAL MEETING

The Board of Directors knows of no additional business that will be presented for consideration at the Annual Meeting. Unless you indicate otherwise, however, execution of the enclosed Proxy Card confers discretionary authority upon the designated proxy holders to vote your shares in accordance with their best judgment on any other business that may properly come before the Annual Meeting, or any adjournment thereof. If you do not wish to extend such authority, you may limit your proxy by marking the appropriate box on the Proxy Card.

First Community Bank Corporation of America

*

Proxy Statement

15

AVAILABILITY OF ADDITIONAL INFORMATION

Accompanying this Proxy Statement is First Community’s 2003 annual report on Form 10-KSB, which includes our audited financial statements. Additional copies of our Form 10-KSB are available to shareholders at no charge. Any shareholder who would like an additional copy may contactKay M. McAleer, Vice President/Corporate Secretary, First Community Bank Corporation of America, 9001 Belcher Road, Pinellas Park, Florida 33782, telephone number (727) 520-0987 x208.

First Community currently files periodic reports (including Form 10-KSBs, Form 10-QSBs, Proxy Statements) with the Securities and Exchange Commission. These periodic reports are filed electronically via EDGAR and are available for review on the Securities and Exchange Commission’s website atwww.sec.gov, or can be inspected and copied at the public reference facilities maintained by the Securities and Exchange Commission at its Public Reference Section, 450 Fifth Street, NW, Washington, DC 20549.

FIRST COMMUNITY BANK CORPORATION OF AMERICA

March 19, 2004

First Community Bank Corporation of America

*

Proxy Statement

16