SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2007

Commission File Number 000- 50357

FIRST COMMUNITY BANK CORPORATION OF AMERICA

A Florida Corporation

IRS Employer Identification No. 65-0623023

9001 Belcher Road

Pinellas Park, Florida 33782

(727) 520-0987

Securities Registered Pursuant to Section 12(b)

of the Securities Exchange Act of 1934: NONE

Securities Registered Pursuant to Section 12(g) of the Securities Exchange

Act of 1934: Common Stock, $0.05 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ¨ No x

Note – Checking the box above will not review any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant, based upon the closing price of $10.15, as quoted on the NASDAQ Capital Market, on March 3, 2008 was approximately $22,738,832. For the purposes of this response, directors and officers of the Registrant’s common stock are considered the affiliates of the Registrant at that date.

The number of shares outstanding of the Registrant’s common stock, as of March 3, 2008: 4,111,121 shares of $.05 par value common stock.

Portions of the Proxy Statement of the Registrant for the Annual Meeting of Shareholders to be held on May 12, 2008, are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

PART I

| Item 1. | Description of Business. |

Forward Looking Statements

This document contains forward-looking statements as defined by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements involve substantial risks and uncertainties. When used in this document, or in the documents incorporated by reference, the words “anticipate”, “believe”, “estimate”, “may”, “intend” and “expect” and similar expressions are some of the forward-looking statements used in these documents. Actual results, performance, or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. Factors which may cause results to change materially include competition, inflation, general economic conditions, changes in interest rates, and changes in the value of collateral securing loans First Community Bank has made, among other things. First Community Bank Corporation of America is referred to herein as “First Community. “We” and “our” refers to First Community and its wholly-owned subsidiaries First Community Bank of America and First Community Lender Services, Inc.

General

First Community is a Florida-based unitary savings and loan holding company with one bank subsidiary, First Community Bank of America (“First Community Bank”) and one non-bank subsidiary First Community Lenders Services, Inc.

First Community Bank

First Community owns all of the outstanding common stock of First Community Bank and First Community Lender Services, Inc. Our primary business activity, however, is the operation of our wholly-owned subsidiary First Community Bank, which was established in February 1985. First Community Bank has nine branch locations in Pinellas, Hillsborough, Pasco and Charlotte Counties. It is a federally-chartered stock savings bank that provides a variety of banking services to small and middle market businesses and individuals through its three banking offices located in Pinellas County, two banking offices located in Hillsborough County, one banking office in Pasco County, and three banking offices located in Charlotte County, Florida. During 2008, we anticipate opening one additional office in Pasco County.

As of December 31, 2007, First Community Bank had assets of approximately $436 million, net loans of $383 million and deposits of $335 million. Due to its strong focus on commercial lending, approximately 52% of First Community Bank’s total loans are commercial and 9% of its total deposits are comprised of non-interest bearing checking accounts.

First Community Lender Services, Inc.

First Community Lender Services, Inc. was incorporated in 2001 as a wholly-owned subsidiary of First Community. First Community Lender Services was originally established to network with title insurance vendors. In November 2004, 1031 Exchange services were added. A 1031 Exchange allows customers to sell investment property/properties and defer any capital gains taxes by purchasing a “like-kind” replacement property/properties within a certain time frame under Section 1031 of the Internal Revenue Code. First Community Lender Services, Inc. had nominal operations in 2007.

Strategy

We have experienced tremendous success in growing our Company, and attribute this success to two key business values: Safety and soundness first, coupled with a relentless commitment to serve our customers.

We believe that building relationships is a crucial factor in differentiating between the national and regional financial institutions and First Community. Even though, typically, the national and regional financial institutions have more products and more locations, they lose that personal service touch that we offer. The most frequent customer complaints we hear about the national and regional institutions are the lack of personalized service and the turnover in personnel, which limits the customer’s ability to develop a relationship with his or her banker. Customers are willing to make a change in order to have that personalized service, and we believe a significant opportunity exists to attract and retain these customers who are dissatisfied with their current banking relationship.

We believe we are unique in the sense that we offer a Regional President and local Regional Board of Directors in each of the counties we serve, all under the same charter. Each Region is operated as a community bank, emphasizing local leadership and local decision-making with Regional Presidents making most major decisions. Our Regional Presidents have

1

loan approval authority, and deposit and loan pricing authority enabling them to provide quicker service and to respond appropriately to their respective markets. Each county’s Regional Board and Regional President are drawn mainly from members of the local business community. We place emphasis on relationship banking so that each customer can identify and establish a comfort level with our bank officers and staff. While a significant portion of our lending effort is concentrated on commercial and professional businesses, we also focus on cross-marketing our deposit products to these borrowers. Many of our retail customers are the principals and employees of our small-and medium-sized business customers.

Market Focus

Our marketing efforts are focused on attracting small and medium-sized businesses and individuals, including service companies, light manufacturing companies, commercial real estate developers, entrepreneurs and professionals, such as engineers, physicians, attorneys, certified public accountants, and architects.

We have been successful in penetrating this market through our ability to deliver:

| | • | | Tailored and flexible loan products; |

| | • | | Comprehensive online banking and cash management services; and |

| | • | | Competitive investment SWEEP products. |

We distinguish ourselves from our competitors by providing a high level of personal service to customers who want quick, local decision making, and who appreciate and are looking for a long-term banking relationship. We believe banking is a business that requires public trust. Our senior management team has over 100 years of combined experience endeavoring to build a reputation worthy of our customers’ trust.

Future Growth

In the next few years, we plan to have sufficient capital on hand to take advantage of growth opportunities either through the acquisition of small banks in identified strategic markets, or through the acquisition of branch sites that may come available in markets we are trying to penetrate. Currently, we have no specific acquisition candidates targeted.During 2008, we anticipate opening one new office in our Pasco County Region. The acquisition or formation of banks, the purchase of branch facilities, and the establishment of new branch facilities are subject to regulatory approvals and other requirements. See the “Supervision and Regulation” section for more details regarding the requirements surrounding the acquisition or formation of banks.

Products and Services

General. Through First Community Bank we offer a broad array of traditional banking products and services to our customers, including the products and services described below. These services are offered at each of our banking locations, as well as through our online banking program atwww.efirstcommbank.com.

Deposits.We offer a full range of interest bearing and non-interest bearing accounts, including commercial and retail checking accounts, money market accounts, sweep accounts, cash management accounts, individual retirement accounts, savings accounts, and other time deposits, ranging from daily money market accounts to longer term certificates of deposit. We have tailored the rates and terms of our accounts and time deposits to compete with the rates and terms in our principal markets. We seek deposits from residents, businesses, professionals and employees of businesses in our primary markets. The FDIC insures all of our accounts up to the maximum amount permitted by law. In addition, we receive service charges that are competitive with other financial institutions in our principal markets, covering such matters as maintenance fees on checking accounts, per item processing fees on checking accounts, returned check charges and other similar fees.

Loan Activities. We rely on deposits, borrowings and other sources of funds to originate loans. We offer a full range of short- and medium-term commercial, consumer and real estate loans. We generally seek to allocate our loan portfolio as follows: 60% to real estate loans; 20% to consumer loans; and 20% to commercial and industrial loans. Our loan approval process provides for various levels of officer lending authority. When a loan amount exceeds officer lending authority levels, it is reviewed by the loan committee of our Board of Directors, which has ultimate lending authority. The loan committee meets as needed.

The risk of non-payment of loans is inherent in all loans. However, we carefully evaluate all loan applicants and attempt to minimize our credit risk by using thorough loan application and approval procedures that we have established for each category of loan. In determining whether to make a loan, we consider the borrower’s credit history, analyze the borrower’s income and ability to repay the loan, and evaluate the need for collateral to secure recovery in the event of default. We have established an allowance for loan losses based upon assumptions and judgments regarding the ultimate collectability of loans in our portfolio and a percentage of the outstanding balances of specific loans when their ultimate collectability is considered questionable.

2

Our loan activities are primarily directed to individuals, businesses and professionals in our principal markets whose demand for funds generally fall within our bank’s respective legal lending limits and who are also likely deposit customers. We have the ability to make loans in excess of our individual loan limits when we are able to secure a commitment from another lending institution to purchase a participation in the loan. The following is a description of each of the major categories of loans which we make.

Commercial Loans. This category includes loans made to business entities for a variety of business purposes. We place particular emphasis on loans to small- to medium-sized professional firms, retail and wholesale businesses, and light industry and manufacturing concerns operating in our principal markets. We consider “small businesses” to include those with generally less than $10 million in sales. Our commercial loans include term loans with variable interest rates secured by equipment, inventory, receivables and real estate, as well as secured and unsecured working capital lines of credit. The risks of these types of loans depend on the general business conditions in the local economy and the borrowers’ ability to sell its products and services in order to generate sufficient business profits to repay their loans under the agreed upon terms and conditions. Personal guarantees are obtained from the principals of business borrowers, and sometimes third parties, to further support the borrowers’ ability to service the debt and reduce the risk of non-payment.

Commercial Real Estate Loans. Commercial real estate loans are offered to developers of both commercial and residential properties. Interest rates may be fixed or adjustable. We manage credit risk associated with these loans by actively monitoring such measures as advance rate, cash flow, collateral value and other appropriate credit factors. Risks associated with commercial real estate loans include the general risk of the failure of the commercial borrower, which is different for each type of business and commercial entity. We evaluate each business on an individual basis. We attempt to reduce credit risks in the commercial real estate loan portfolio by emphasizing loans on owner-occupied office and retail buildings where the loan-to-value ratio established by independent appraisals does not exceed 80%. In addition, we typically require personal guarantees of the principal owners.

Construction and Development Loans.Construction and development loans are made on both a pre-sold and speculative basis, and generally have a fixed interest rate. If the borrower has entered into an arrangement to sell the property prior to beginning construction, we consider the loan to be on a pre-sold basis. If the borrower has not entered into an agreement to sell the property prior to beginning construction, we consider the loan to be on a speculative basis. We make residential and commercial construction loans to builders and developers as well as consumers who are contracting with a builder to build their own residence. As of December 31, 2007, our construction real estate portfolio consisted of 56% residential and 44% commercial for a total of $22,214,000 in construction loans. The terms of most construction and development loans range from twelve to twenty four months. Speculative loans are based on the borrower’s financial strength and cash flow position. Loan proceeds are disbursed based on a percentage of completion basis under a set budget and only after a third party inspector inspects the project. These loans generally command higher rates and fees commensurate with the risks warranted in the construction loan field. The risk in construction lending depends upon the performance of the builder in building the project to the plans and specifications of the borrower and our ability to administer and control all phases of construction disbursements. The primary source of repayment for most construction loans is the sale of the property. If the property is to be occupied by the borrower or leased to a third party, then upon completion of construction, we typically convert the loan to a permanent loan on a monthly amortization with a longer maturity.

Residential Real Estate Loans. Adjustable or fixed-interest rate residential real estate loans are made to qualified individuals for the purchase of existing single-family residences in our principal markets. We make these loans in accordance with our appraisal policy and real estate lending policy which detail maximum loan-to-value ratios and maturities. We believe that these loan-to-value ratios are sufficient to compensate us for fluctuations in real estate market values and minimize losses that could result from a downturn in the residential real estate market. We sell mortgage loans that do not conform to our policies in the secondary markets. The risk of these loans depends on our ability to sell the loans to national investors and on the frequency of interest rate changes. Our residential real estate loans are primarily in Florida.

We limit interest rate risk and credit risk on these loans by locking in the interest rate for each loan with a secondary market investor and receiving a forward sales agreement from the secondary market investor. Loans are retained for our portfolio when there is sufficient liquidity to fund the needs of the established customers and when rates are favorable to retain the loans. The loan underwriting standards and policies are generally the same for both loans sold in the secondary market and those retained in our portfolio.

Consumer and Installment Loans. Consumer loans include lines of credit and term loans secured by second mortgages on the residences of borrowers for a variety of purposes, including home improvements, education and other

3

personal expenditures. Consumer loans also include installment loans to individuals for personal, family and household purposes, including automobile and boat loans and pre-approved lines of credit. Consumer loans generally involve more risk than mortgage loans because the collateral for a defaulted loan may not provide an adequate source of repayment of the principal. This risk is due to the potential for damage to the collateral or other loss of value, and the fact that any remaining deficiency often does not warrant further collection efforts. In addition, consumer loan performance depends on the borrower’s continued financial stability and is, therefore, more likely to be adversely affected by job loss, divorce, illness or personal bankruptcy.

In addition, we have been approved for participation in the Office of Thrift Supervision pilot program, which allows us to lend up to 25% of our capital and surplus on certain types of loans.

Other Services and Products.In addition to the deposit and loan products discussed above, we also provide:

| | |

• Cash management services | | • Sweep accounts |

| |

• Telephone banking | | • Safe deposit boxes |

| |

• Traveler’s checks | | • eStatements |

| |

• Deposit pick-up for commercial customers | | • Wire transfers and ACH services |

| |

• Online banking/bill payment services | | • 1031 Exchange Services |

| |

• Automatic drafts for various accounts | | • Debit cards |

| |

• Certificate of Deposit Account Registry Service (CDARS) | | • Direct deposit of payroll and social security checks |

| |

• VISA® and MasterCard® credit card services through our correspondent banks. | | • Health Saving Accounts (HSA) |

We offer extended banking hours (both drive-in and lobby) and an after-hours depository and are associated with a shared network of automated teller machines that customers may use throughout our market areas and other regions. We are also associated with third party Internet banking service providers that enable us to provide customers with cost effective, secure and reliable Internet banking services.

Asset and Liability Management

Our main assets are cash and cash equivalents, our loan portfolio and our investment portfolio. Our liabilities consist primarily of deposits. Our objective is to support asset growth through the growth of core deposits, which include deposits of all categories made by individuals, partnerships, corporations and other entities. Consistent with the requirements of prudent banking necessary to maintain liquidity, we seek to match maturities and rates of loans and the investment portfolio with those of deposits, although exact matching is not always possible. The largest portion of our assets is invested in real estate, commercial and consumer loans. Our investment portfolio consists primarily of marketable securities of the United States government and federal agencies, generally with varied maturities.

Our asset/liability mix is monitored on a regular basis with a quarterly report detailing interest-sensitive assets and interest-sensitive liabilities. The objective of this policy is to control interest-sensitive assets and liabilities in order to minimize the impact of substantial movements in interest rates on our earnings.

Customers

The consolidation of the Florida banking industry over the last several years has created significant opportunities for community-oriented banks such as ours to build a successful, locally managed bank. We believe that many of the larger financial institutions do not provide the high level of personalized services desired by many small and medium-sized businesses and their principals. Our marketing efforts are focused on attracting small and medium-sized businesses and individuals, including service companies, manufacturing companies, commercial real estate developers, entrepreneurs and professionals, such as engineers, physicians, CPAs, architects and attorneys.

While a significant portion of our lending effort is concentrated on commercial and professional businesses, emphasis is also placed on generating a significant amount of consumer business. Many of our consumer customers are the principals and employees of our small and medium-sized business customers. We believe in old-fashioned “relationship banking,” where each customer can identify and establish a comfort level with our bank officers. We intend to continue to develop our consumer business with individuals who appreciate a high level of personal service, contact with their loan officer and

4

responsive decision-making. Most of our business is developed through our loan officers and members of our board of directors and by pursuing an aggressive strategy of calling on customers and potential customers throughout our principal market areas.

Information About Our Primary Markets

Pinellas, Hillsborough, Pasco and Charlotte Counties are considered to be our primary market areas. Pinellas County, located on Florida’s Gulf Coast, is a peninsula bordered by the Gulf of Mexico on the west and by Tampa Bay on the east. Pinellas County estimated its population in 2007 to be almost one million. Two of the top five beaches in the United States are located along the 588 miles of Pinellas County coastline, according to America’s Best Beaches’ List. Nicknamed the “Sunshine City,” St. Petersburg averages 361 sunny days every year, and is located in southeast Pinellas County. St. Petersburg is also home to the Tampa Bay Devil Rays. Top key business segments in Pinellas County are services industries, light manufacturing and financial services. Pinellas County has received the “Successful Community Award” for creating a special metropolitan region by improving housing, expanding recreational opportunities and protecting the environment. Hillsborough County is located midway along the west coast of Florida and is contiguous with Pinellas County. As of 2007, Hillsborough County estimated its population at 1,172,427. The City of Tampa is the largest city in Hillsborough County and is the third most populous city in Florida. It is approximately 20 miles northeast of St. Petersburg. Hillsborough’s key business segments include tourism, agriculture, construction, finance, health care, government, technology, and the port of Tampa, which is the seventh largest in the Nation. Tampa is home to both the NFL Tampa Bay Buccaneers and the NHL Tampa Bay Lightning. Pasco County, located on the Gulf of Mexico in the Tampa Bay area, is part of a nine-county region referred to as the “Nature Coast.” Pasco County estimated its population to be approximately 440,648 in 2007. Located in the rolling hills of eastern Pasco County, Dade City is the county seat. Pasco County’s economy has historically been tied to agriculture, however, over time it has shifted more to service, government and retail. Pasco County has a total of 745 square miles with more than 100 square miles of managed recreational facilities, including parks, four artificial reefs (one made up of surplus military tanks), more than 25 golf courses, and three State-designated canoe trails. Charlotte County is located between Lee County (Fort Myers) and Sarasota County in Southwest Florida on the Gulf of Mexico. Charlotte County estimated its population in 2007 at 170,461. Port Charlotte, the county’s geographical center, is approximately 100 miles south of St. Petersburg. Charlotte County features over 70 parks and recreational areas, including Charlotte Harbor, which is the 17th largest estuary in the Nation and the 2nd largest estuary in the State encompassing 270 square miles. The top two business segments of the County are service industries and construction. Charlotte County has been designated one of the top ten sailing destinations by SAIL magazine, and ranked 3rd “Best in America” place to live and golf by Golf Digest.

Competition

We are subject to intense competition from a variety of different competitors in our primary market areas in all phases of our operations. These competitors include:

| | • | | Large national and super-regional financial institutions that have well-established branches and significant market share in the communities we serve; |

| | • | | Finance companies, investment banking and brokerage firms, and insurance companies that offer bank-like products; |

| | • | | Credit unions, which can offer highly competitive rates on loans and deposits because they receive tax advantages not available to commercial banks; |

| | • | | Other community banks, including start-up banks, that can compete with us for customers who desire a high degree of personal service; |

| | • | | Technology-based financial institutions including large national and super-regional banks offering on-line deposit, bill payment, and mortgage loan application services; and |

| | • | | Both local and out-of-state trust companies and trust service offices. |

Other existing community banks with whom we compete, and many new community bank start-ups, have marketing strategies similar to ours. These other community banks may open new branches in the communities we serve and compete directly for customers who want the level of service offered by community banks. Other community banks also compete for the same management personnel in Florida.

Various legislative actions in recent years have led to increased competition among financial institutions. With the enactment of the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 and other laws and regulations affecting interstate bank expansion, it is easier for financial institutions located outside of the State of Florida to enter the Florida market, including our targeted markets. In addition, recent legislative and regulatory changes and technological advances have enabled customers to conduct banking activities without regard to geographic barriers, through computer and telephone-based banking and similar services. There can be no assurance that the United States Congress, the Florida Legislature, or the applicable bank regulatory agencies will not enact legislation or promulgate rules that may further increase competitive pressures on us.

5

Personnel

At December 31, 2007, First Community had four officers and no other employees and First Community Bank had 102 full-time employees and 7 part-time persons. First Community Lender Services, Inc. has no employees of its own and operates using employees of First Community Bank.

SUPERVISION AND REGULATION

General

First Community is a registered unitary savings and loan holding company within the meaning of the Home Owners’ Loan Act (“HOLA”). First Community and First Community Bank, operate in a highly regulated environment. Our business activities, which are governed by statute, regulation and administrative policies, are supervised by a number of federal bank regulatory agencies, including the Office of Thrift Supervision, the Federal Deposit Insurance Corporation (“FDIC”) and, to a limited extent, the Federal Reserve Board. The following is a brief summary of the more recent legislation that affects our company and our subsidiaries.

Regulation of the Holding Company

Restrictions on the Acquisition of Savings Institutions. Under the change in Bank Control Act, no person may acquire control of a federal savings bank or its parent holding company, directly or indirectly, unless the Office of Thrift Supervision has been given 60 days prior written notice and has issued a notice discussing the proposed acquisition. In addition, regulations provide that no company may acquire control of a federal savings bank without the prior approval of the Office of Thrift Supervision. Any company that acquires such control becomes a “savings and loan holding company” subject to registration, examination and regulation by the Office of Thrift Supervision. Control in this context means ownership, control of, or holding proxies representing more than 25% of the voting shares of, an insured institution, the power to control in any manner the election of a majority of the directors of such institution or the power to exercise a controlling influence over the management or policies of the institution.

The Office of Thrift Supervision also has established certain rebuttable control determinations. An acquiror must file for approval of control with the Office of Thrift Supervision, or file to rebut the presumptions before surpassing a rebuttable control level of ownership. To rebut the presumption, the acquirer must file a submission with the Office of Thrift Supervision setting forth the reasons for rebuttal. The submission must be filed when the acquirer acquires more than 25% of any class of voting stock of the savings bank and when they have any of the control factors enumerated in 12 C.F.R. Section 574.4(c) which include, but are not limited to:

| | • | | The acquirer would be one of the two largest stockholders of any class of voting stock; |

| | • | | The acquirer and/or the acquirer’s representative or nominees would constitute more than one member of the savings bank’s board of directors; and |

| | • | | The acquirer or nominee or management official of the acquirer would serve as the chairman of the board of directors, chairman of the executive committee, chief executive officer, chief operating officer, chief financial officer, or in any similar policy making authority in the savings bank. |

Transactions with Affiliates. Our authority to engage in transactions with related parties or “affiliates” or to make loans to certain insiders is limited by Sections 23A and 23B of the Federal Reserve Act (“FRA”) and Regulation “W” adopted by the Federal Reserve. Section 23A limits the aggregate amount of transactions with any individual affiliate to 10% of the capital and surplus of the savings institution and also limits the aggregate amount of transactions with all affiliates to 20% of the savings institution’s capital and surplus.

Certain transactions with affiliates are required to be secured by collateral in an amount and of a type described in the FRA and the purchase of low quality assets from affiliates is generally prohibited. Section 23B provides that certain transactions with affiliates, including loans and asset purchases, must be on terms and circumstances, including credit standards, that are substantially the same or at least as favorable to the savings institution as those prevailing at the time for comparable transactions with a non-related party or non-affiliated holding company. In the absence of comparable transactions, such transactions may only occur under terms and circumstances, including credit standards that in good faith would be offered to or would apply to non-related parties or non-affiliated companies. Notwithstanding Sections 23A and 23B, savings institutions are prohibited from lending to any affiliate that is engaged in activities that are not permissible for bank holding companies under Section 4(c) of the Bank Holding Company Act of 1956. Further, no savings institution may purchase the securities of any affiliate other than a subsidiary.

6

In addition, Sections 22(g) and 22(h) of the FRA and Regulation O (which set limits on extensions of credit to executive officers, directors and 10% stockholders, as well as companies which such persons control) apply to savings institutions. Among other things, such loans must be made on terms, including interest rates, substantially the same as loans to unaffiliated individuals and which involve no more than the normal risk of collectability. These regulations also place limits on the amount of loans we may make to such persons. These restrictions apply in addition to certain restrictions on transactions with affiliates contained in the Office of Thrift Supervision regulations.

Support of Subsidiary Depository Institutions. Under Office of Thrift Supervision policy, First Community is expected to act as a source of financial strength to and to commit resources to support First Community Bank. This support may be required at times when, in the absence of such Office of Thrift Supervision policy, First Community might not be inclined to provide such support. In addition, any capital loans by First Community to First Community Bank must be subordinate in right of payment to deposits and to certain other indebtedness of First Community Bank. In the event of bankruptcy, any commitment by a holding company to a federal bank regulatory agency to maintain the capital of a subsidiary depository institution will be assumed by the bankruptcy trustee and will be entitled to a priority of payment.

Under the Federal Deposit Insurance Act, a depository institution of a holding company can be held liable for any loss incurred by, or reasonably expected to be incurred by, the FDIC, in connection with:

| | • | | The default of a commonly controlled FDIC-insured depository institution; or |

| | • | | Any assistance provided by the FDIC to any commonly controlled FDIC-insured depository institution in danger of default. |

Default is defined generally as the appointment of a conservator or a receiver and “in danger of default” is defined generally as the existence of certain conditions indicating that a default is likely to occur in the absence of regulatory assistance.

Payment of Dividends. There are statutory and regulatory limitations on the payment of dividends by First Community Bank as proscribed by the Office of Thrift Supervision’s capital distribution regulation. Under the regulation, First Community Bank may make a capital distribution without the approval of the Office of Thrift Supervision, provided the Office of Thrift Supervision is notified 30 days before declaration of the capital distribution. First Community Bank must also meet the following requirements:

| | • | | It is not of supervisory concern, and will remain adequately or well-capitalized, as defined in the Office of Thrift Supervision prompt corrective action regulations, following the proposed distribution; and |

| | • | | The distribution does not exceed First Community Bank’s net income for the calendar year-to-date, plus retained net income for the previous two calendar years (less any dividends previously paid). |

If First Community Bank does not meet the above-stated requirements, it must obtain the prior approval of the Office of Thrift Supervision before declaring any proposed distributions. The Office of Thrift Supervision can prohibit a proposed capital distribution by a savings institution, which would otherwise be permitted by the regulation, if the Office of Thrift Supervision determines that such distribution would constitute an unsafe or unsound practice. First Community Bank has never paid a dividend; instead earnings are reinvested in First Community Bank to support our current growth rate.

Regulation of First Community Bank

Capital Requirements. Both the Office of Thrift Supervision and the FDIC have promulgated regulations setting forth capital requirements applicable to depository institutions. The Office of Thrift Supervision capital regulations require savings institutions to meet three capital standards:

| | • | | A 1.5% tangible capital ratio (defined as the ratio of tangible capital to adjusted total assets); |

| | • | | A 4% leverage (core capital) ratio (defined as the ratio of core capital to adjusted total assets); and |

| | • | | An 8% risk-based capital standard as defined below. |

First Community Bank’s tangible capital, core capital, and risk-based capital ratios at December 31, 2007, were 7.71%, 10.02%, and 11.23%, respectively.

Core capital is defined as common stockholder’s equity (including retained earnings), certain non-cumulative perpetual preferred stock and related surplus, minority interests in equity accounts of consolidated subsidiaries, certain

7

goodwill and certain mortgage servicing rights less certain intangible assets, mortgage servicing rights less certain intangible assets, mortgage servicing rights and investments in non-includable subsidiaries. Tangible capital is defined in the same manner as core capital, except that all intangible assets (excluding certain mortgage servicing rights) must be deducted. Adjusted total assets is defined as GAAP total assets, minus intangible assets (except those included in core capital). The Office of Thrift Supervision regulations also require that in calculating the leverage ratio, tangible and risk-based capital standards, savings institutions must deduct investments in and loans to subsidiaries engaged in activities not permissible for a national bank.

The Office of Thrift Supervision risk-based capital standard for savings institutions requires that total capital (comprised of core capital and supplementary capital) be at least 8% of risk-weighted assets. In determining risk-weighted assets, all assets, including certain off-balance sheet assets, are multiplied by a risk-weight of 0% to 100%, as assigned by the Office of Thrift Supervision capital regulation based on the risks Office of Thrift Supervision believes are inherent in the type of asset. Generally, zero weight is assigned to risk-free assets, such as cash and unconditionally guaranteed United States Government securities. A weight of 20% is assigned to, among other things, certain obligations of United States Government-sponsored agencies (such as the FNMA and the FHLMC) and certain high quality mortgage-related securities. A weight of 50% is assigned to qualifying mortgage loans and certain other mortgaged-related securities, repossessed assets and assets that are 90 days or more past due.

The components of core capital are equivalent to those discussed above. The components of supplementary capital include permanent capital instruments (such as cumulative perpetual preferred stock, mandatory convertible subordinated debt and perpetual subordinated debt), maturing capital instruments (such as mandatory convertible subordinated debt and intermediate-term preferred stock) and the allowance for loan and lease losses. Allowance for loan and lease losses includable in supplementary capital is limited to a maximum of 1.25% of risk-weighted assets. Overall, the amount of capital counted toward supplementary capital cannot exceed 100% of core capital.

At December 31, 2007, First Community Bank exceeded each of its capital requirements. See Note 12 to the consolidated financial statements for a summary of the regulatory capital levels and percentages.

Standards for Safety and Soundness. The FDICIA, as amended by the Reigle Community Development and Regulatory Improvement Act of 1994, requires each federal banking agency to prescribe standards relating to internal controls, information systems and audit systems, loan documentation, credit underwriting, interest rate risk exposure, asset growth, and compensation, fees and benefits and such other operational and managerial standards as the agency deems appropriate for all insured depository institutions and their holding companies. The Office of Thrift Supervision and the other federal banking agencies adopted a rule establishing deadlines for the agencies to submit and review safety and soundness compliance plans and Interagency Guidelines Establishing Standards for Safety and Soundness. The guidelines require depository institutions to maintain internal controls and information systems and internal audit systems that are appropriate for the size, nature and scope of the institution’s business.

The guidelines also establish certain basic standards for loan documentation, credit underwriting, interest rate-risk exposure, and asset growth. The guidelines further provide that savings institutions should maintain safeguards to prevent the payment of compensation, fees and benefits that are excessive or that could lead to material financial loss, and that they should take into account factors such as compensation practices at comparable institutions. The Interagency Guidelines also include asset quality and earnings standards.

If the Office of Thrift Supervision determines that a savings institution is not in compliance with the safety and soundness guidelines, it may require the institution to submit an acceptable plan to achieve compliance with the guidelines. A savings institution is required to submit an acceptable compliance plan to the Office of Thrift Supervision within 30 days after receipt of a request for such a plan. Failure to submit or implement a compliance plan may subject the institution to regulatory sanctions.

Insurance of Deposit Accounts. The FDIC currently maintains the Deposit Insurance Fund (“DIF”), which was created in 2006 in the merger of the Bank Insurance Fund and Savings Association Insurance Fund. The deposit accounts of the Bank are insured by the DIF to the maximum amount provided by law. This insurance is backed by the full faith and credit of the United States Government.

As insurer, the FDIC is authorized to conduct examinations of and to require reporting by DIF-insured institutions. It also may prohibit any DIF-insured institution from engaging in any activity the FDIC determines by regulation or order to pose a serious threat to the DIF. The FDIC also has the authority to take enforcement actions against insured institutions.

The FDIC’s regulations for risk-based deposit insurance assessments establish four Risk Categories. Risk Category I is for well-capitalized institutions that are financially sound with only a few minor weaknesses. Risk Categories II, III and

8

IV present progressively greater risks to the DIF. Effective January 1, 2007, Risk Category I institutions pay quarterly assessments for deposit insurance at annual rates of 5 to 7 basis points. The rates for Risk Categories II, III and IV are 7, 28 and 43 basis points, respectively. With advance notice to insured institutions, rates are subject to change. Within Risk Category I, the precise rate for an individual institution with less than $10 billion in assets is generally determined by a formula using CAMELS ratings, which are assigned in examinations, and financial ratios. A different method applies for larger institutions. The rate for an individual institution is applied to it is assessment base, consisting generally of its deposit liabilities subject to certain adjustments. An institution insured by the FDIC on December 31, 1996, which had previously paid assessments (or its successor) is eligible for certain credit against deposit insurance assessments.

The FDIC also collects assessments against the assessable deposits of insured institutions to service the debt on bonds issued during the 1980’s to resolve the thrift bailout. During the year ended December 31, 2007, the quarterly assessments averaged approximately .00285% of assessable deposits, and First Community Bank paid approximately $38,500 in assessments.

Business Activities.

Qualified Thrift Lender Test (“QTL”). The HOLA requires savings institutions to meet a QTL test. The QTL test, as amended by the FDICIA, requires a savings institution to maintain at least 65% of its “portfolio assets” (as defined by regulation) in qualified thrift investments, primarily residential mortgages and related investments on a monthly basis in nine out of every 12 months. The definition of portfolio assets has recently been amended to include the small business loans upon which we focus. As of December 31, 2007, we exceeded the QTL test, maintaining approximately 84.81% of our portfolio assets in qualified thrift investments.

Interstate Banking. Federally-chartered savings institutions are allowed to branch nationwide to the extent allowed by federal statute. This ability permits savings institutions with interstate networks to diversify their loan portfolios and lines of business. The Office of Thrift Supervision authority preempts any state law purporting to regulate branching by federal savings institutions. Prior approval of the Office of Thrift Supervision is required for a savings institution to branch interstate or intrastate. To obtain supervisory clearance for branching, an applicant’s regulatory capital must meet or exceed the minimum requirements established by law and by the Office of Thrift Supervision regulations. In addition, the savings institution must have a satisfactory record under the Community Reinvestment Act (“CRA”). First Community Bank does not conduct interstate branching operations and does not plan to do so in the foreseeable future.

The Reigle-Neal Interstate Banking and Branching Efficiency Act of 1994 (“Interstate Act”) eliminated many existing restrictions on interstate banking by authorizing interstate acquisitions of financial institutions by bank holding companies without geographic limitations. Under the Interstate Act, existing restrictions on interstate acquisitions of banks by bank holding companies were repealed. Bank holding companies located in Florida are able to acquire any Florida-based bank, subject to certain deposit percentage and other restrictions. The legislation also provides thatde novo branching by an out-of-state bank is permitted only if it is expressly permitted by the laws of the host state. The authority of a bank to establish and operate branches within a state is subject to applicable state branching laws. Florida law permits interstate branching through the acquisition of a bank in existence for more than three years, but prohibits de novo branching by out of state banks.

Office of Thrift Supervision Assessments. Savings institutions are required by Office of Thrift Supervision regulation to pay assessments to the Office of Thrift Supervision to fund the operations of the Office of Thrift Supervision. The general assessment, to be paid on a semiannually basis, is computed upon the savings institution’s total assets, including consolidated subsidiaries, as reported in the institution’s latest quarterly thrift financial report.

The Office of Thrift Supervision also assesses fees to savings and loan holding companies such as First Community. The semi-annual assessment for savings and loan holding companies includes a $3,000 base assessment with an additional assessment based on the savings and loan holding company’s risk or complexity, organizational form and condition.

Federal Home Loan Bank System.First Community Bank is a member of the Federal Home Loan Bank (“FHLB”) system, which consists of 12 regional FHLBs. The FHLB provides a central credit facility primarily for member institutions. As a member of the FHLB-Atlanta, First Community Bank is required to acquire and hold shares of capital stock in that FHLB in an amount at least equal to 4.5% of our advances (borrowings) from the FHLB-Atlanta plus 8% of certain assets sold to the FHLB-Atlanta. We are in compliance with this requirement. FHLB advances must be secured by specified types of collateral and may be obtained only for the purpose of providing funds for residential housing finance.

The FHLBs are required to provide funds for the resolution of insolvent savings institutions and to contribute funds for affordable housing programs. These requirements could reduce the amount of dividends that the FHLBs pay to their members and could also result in the FHLBs imposing a higher rate of interest on advances to members. For the year ended

9

December 31, 2007, dividends paid by the FHLB-Atlanta to First Community Bank amounted to approximately $101,000, at a yield of 5.94% on our investment. Should dividends be reduced, or interest on FHLB advances increased, our consolidated net interest income might also be reduced. Furthermore, there can be no assurance that the value of the FHLB-Atlanta stock we hold will not decrease as a result of any new legislation.

Federal Reserve System. Federal Reserve regulations require depository institutions to maintain non-interest-earning reserves against their transaction accounts (primarily NOW and regular checking accounts). The Federal Reserve regulations generally require that reserves of 3% must be maintained against aggregate transaction accounts of $40.6 million or less (subject to adjustment by the Federal Reserve) and an initial reserve of $1,218,000 plus 10% of accounts in excess of $40.6 million. The first $6.6 million of otherwise reversible balances (subject to adjustments by the Federal Reserve) are exempted from the reserve requirements. We are in compliance with the foregoing requirements. The balances maintained to meet the reserve requirements imposed by the Federal Reserve may be used to satisfy liquidity requirements imposed by the Office of Thrift Supervision.

Because required reserves must be maintained in the form of either vault cash, a non-interest-bearing account at a Federal Reserve or a pass-through account as defined by the Federal Reserve, the effect of this reserve requirement is to reduce our interest-earning assets. FHLB System members are also authorized to borrow from the Federal Reserve discount window, however, Federal Reserve regulations require institutions to exhaust all FHLB sources before borrowing from a Federal Reserve discount window.

Other Laws. State usury and credit laws limit the amount of interest and various other charges collected or contracted by a bank on loans. Our loans are also subject to federal laws applicable to credit transactions, such as the:

| | • | | Federal Truth-In-Lending Act, which governs disclosures of credit terms to consumer borrowers; |

| | • | | Community Reinvestment Act, which requires financial institutions to meet their obligations to provide for the total credit needs of the communities they serve, including investing their assets in loans to low- and moderate-income borrowers; |

| | • | | Home Mortgage Disclosure Act requiring financial institutions to provide information to enable public officials to determine whether a financial institution is fulfilling its obligations to meet the housing needs of the community it serves; |

| | • | | Equal Credit Opportunity Act prohibiting discrimination on the basis of race, creed or other prohibitive factors in extending credit; |

| | • | | Real Estate Settlement Procedures Act, which requires lenders to disclose certain information regarding the nature and cost of real estate settlements, and prohibits certain lending practices, as well as limits escrow account amounts in real estate transactions; |

| | • | | Fair Credit Reporting Act governing the manner in which consumer debts may be collected by collection agencies; and |

| | • | | Rules and regulations of various federal agencies charged with the responsibility of implementing such federal laws. Our operations are also subject to the: |

| | • | | Privacy provisions of the Gramm-Leach-Bliley Act of 1999, which require us to maintain privacy policies intended to safeguard consumer financial information, to disclose these policies to our customers, and to allow customers to “opt out” of having their financial service providers disclose their confidential financial information to non-affiliated third parties, subject to certain exceptions; |

| | • | | Right to Financial Privacy Act, which imposes a duty to maintain confidentiality of consumer financial records and prescribes procedures for complying with administrative subpoenas of financial records; and |

| | • | | Electronic Funds Transfer Act and Regulation E, which govern automatic deposits to, and withdrawals from, deposit accounts and customers’ rights and liabilities arising from the use of debit cards, automated teller machines and other electronic banking services. |

Financial Modernization. The Gramm-Leach-Bliley Act of 1999 sought to achieve significant modernization of the federal bank regulatory framework by allowing the consolidation of banking institutions with other types of financial services firms, subject to various restrictions and requirements. In general, the Gramm-Leach-Bliley Act repealed most of the federal statutory barriers which separated commercial banking firms from insurance and securities firms and authorized the consolidation of such firms in a “financial services holding company”. We have no immediate plans to utilize the structural options created by the Gramm-Leach-Bliley Act, but we may develop such plans in the future.

10

After the September 11, 2001 terrorist attacks in New York and Washington, D.C., the United States government acted in several ways to tighten control on activities perceived to be connected to money laundering and terrorist funding. A series of orders were issued which identified terrorists and terrorist organizations and required the blocking of property and assets of, as well as prohibiting all transactions or dealings with, such terrorists, terrorist organizations and those that assist or sponsor them. The USA Patriot Act:

| | • | | Substantially broadens existing anti-money laundering legislation and the extraterritorial jurisdiction of the United States; |

| | • | | Imposes new compliance and due diligence obligations; |

| | • | | Creates new crimes and penalties; |

| | • | | Compels the production of documents located both inside and outside the United States; including those of foreign institutions that have a correspondent relationship in the United States; and |

| | • | | Clarifies the safe harbor from civil liability to customers. |

In addition, the United States Treasury Department issued regulations in cooperation with the federal banking agencies, the Securities and Exchange Commission, the Commodity Futures Trading Commission and the Department of Justice to:

| | • | | Require customer identification and verification; |

| | • | | Expand the money-laundering program requirement to the major financial services sectors; including insurance and unregistered investment companies, such as hedge funds; and |

| | • | | Facilitate and permit the sharing of information between law enforcement and financial institutions, as well as among financial institutions themselves. |

The United States Treasury Department also has created the Treasury USA Patriot Act Task Force to work with other financial regulators, the regulated community, law enforcement and consumers to continually improve the regulations.

On July 30, 2002, President Bush signed into law the Sarbanes-Oxley Act of 2002 (“Act”). The Securities and Exchange Commission (“SEC”) has promulgated certain regulations pursuant to the Act and will continue to propose additional implementing or clarifying regulations as necessary in furtherance of the Act. The passage of the Act and the regulations implemented by the SEC subject publicly traded companies to additional and more cumbersome reporting regulations and disclosure. Compliance with the Act and corresponding regulations may increase our operating expenses. The effective date of the application of the provision of Section 404 of the Act concerning independent auditor attestation of internal control compliance reporting for non-accelerated filers such as First Community has been extended to the first fiscal year ending on or after July 15, 2008.

Investing in our common stock involves risk. In addition to the other information set forth elsewhere in this Report, the following factors relating to us and our common stock should be carefully considered in deciding whether to invest in our common stock.

Our growth strategy may not be successful

As a strategy, we have sought to increase the size of our franchise through branch expansion and rapid growth, aggressively pursuing business development opportunities. No assurance can be provided that we will continue to be successful in increasing the volume of loans and deposits at acceptable risk levels and upon acceptable terms and expanding our asset base, while managing the costs and implementation risks associated with this growth strategy. There also can be no assurance that any further expansion will be profitable or that we will continue to be able to sustain our rate of growth, either through internal growth or through other successful expansions of our banking markets, or that we will be able to maintain capital sufficient to support our continued growth.

Losses from loan defaults may exceed the allowance we establish for that purpose, which will have an adverse effect on our business

If a significant number of loans are not repaid, it would have an adverse effect on our earnings and overall financial condition. Like all financial institutions, we maintain an allowance for loan losses to provide for losses inherent in the loan portfolio. The allowance for loan losses reflects our management’s best estimate of probable losses in the loan portfolio at the relevant balance sheet date. This evaluation is primarily based upon a review of our and the banking industry’s historical loan loss experience, known risks contained in the loan portfolio, composition and growth of the loan portfolio,

11

and economic factors. However, the determination of an appropriate level of loan loss allowance is an inherently difficult process and is based on numerous assumptions. As a result, our allowance for loan losses may not be adequate to cover actual losses, and future provisions for loan losses may adversely affect our earnings.

Our loan portfolio would be impaired if real estate values in our target markets decline

A significant portion of our loan portfolio consists of mortgages secured by real estate located in our primary market areas of Hillsborough and Pinellas Counties. Real estate values and real estate markets are generally affected by, among other things, changes in national, regional or local economic conditions; fluctuations in interest rates and the availability of loans to potential purchasers; changes in the tax laws and other governmental statutes, regulations and policies; and acts of nature. Over the past year, real estate prices in each of our markets have declined and if real estate prices continue to decline in any of these markets, the value of the real estate collateral securing our loans could be reduced. Such a reduction in the value of our collateral could increase the number of non-performing loans and adversely affect our financial performance.

Weakness in the economy and in the real estate market within our geographic footprint may adversely affect us

If the strength of the local economies in which we conduct operations declines, or continues to decline, this could result in, among other things, a deterioration of credit quality or a reduced demand for credit, including a resultant effect on our loan portfolio and allowance for loan and lease losses. The vast majority of our loan portfolio is secured by real estate or other commercial assets in our Florida markets. Certain markets have been particularly adversely affected by declines in real estate value, declines in home sale volumes, and declines in new home building. In 2007, the inventory of houses for sale in some of our markets has increased to a two-year supply. These declines may also adversely affect the general economy in our markets. These factors could result in higher delinquencies and greater charge-offs in future periods, which would materially adversely affect our financial condition and results of operations.

Changes in interest rates can have an adverse effect on our profitability

Our earnings and cash flows are largely dependent upon our net interest income. Net interest income is the difference between interest income earned on interest earning assets such as loans and investment securities and interest expense paid on interest bearing liabilities such as deposits and borrowed funds. Interest rates are highly sensitive to many factors that are beyond our control, including general economic conditions, competition, and policies of various governmental and regulatory agencies and, in particular, the Board of Governors of the Federal Reserve System. Changes in monetary policy, including changes in interest rates, could influence not only the interest we receive on loans and investment securities and the amount of interest it pays on deposits and borrowings, but such changes could also affect (i) our ability to originate loans and obtain deposits, (ii) the fair value of our financial assets and liabilities, and (iii) the average duration of our assets and liabilities. If the interest rates paid on deposits and other borrowings increase at a faster rate than the interest rates received on loans and other investments, our net interest income, and therefore earnings, could be adversely affected. Earnings could also be adversely affected if the interest rates received on loans and other investments fall more quickly than the interest rates paid on deposits and other borrowings.

Since January 1, 2008, the Federal Reserve Bank has dropped the prime rate 200 basis points from 7.25% to 5.25%. Although management believes it has implemented effective asset and liability management strategies to reduce the potential effects of changes in interest rates on our results of operations, any substantial unexpected, prolonged change in market interest rates could have a material adverse effect on our financial condition and results of operations.

Our business may suffer if we lose key employees

Our success is largely dependent on the personal contacts of our officers and employees in our market areas. If we lose key employees, temporarily or permanently, our business could be negatively impacted. We could be particularly hurt if our key employees went to work for our competitors. Our future success depends on the continued contributions of our existing senior management personnel, including our Chief Executive Officer and President Kenneth P. Cherven. We have entered into an employment agreement with Chief Executive Officer and President Cherven which contains standard non-competition provisions to help alleviate some of this risk.

Our subsidiaries face strong competition, which may limit their asset growth and profitability

Our primary market area is the urban areas in Hillsborough and Pinellas Counties, and to a lesser extent Pasco and Charlotte Counties. The banking business in these areas is extremely competitive, and the level of competition facing us following our expansion plans may increase further, which may limit our asset growth and profitability. Our subsidiary bank and service company experience competition in both lending and attracting funds from other banks, savings

12

institutions, and non-bank financial institutions located within its market area, many of which are significantly larger institutions. Non-bank competitors competing for deposits and deposit type accounts include mortgage bankers and brokers, finance companies, credit unions, securities firms, money market funds, life insurance companies and the mutual funds industry. For loans, we encounter competition from other banks, savings associations, finance companies, mortgage bankers and brokers, insurance companies, small loan and credit card companies, credit unions, pension trusts and securities firms.

Our financial results could be adversely affected if adverse economic conditions in our target markets exist for a prolonged period

Our success will depend in large part on economic conditions in West Central Florida. A prolonged economic downturn or recession in these markets could increase our nonperforming assets, which would result in operating losses, impaired liquidity and the erosion of capital. A variety of factors could cause such an economic dislocation or recession, including adverse developments in the industries in these areas such as tourism, or natural disasters such as hurricanes, floods or tornadoes, or additional terrorist activities such as those our country experienced in September 2001.

First Community and its subsidiaries operate in an environment highly regulated by state and federal government; changes in banking laws and regulations could have a negative impact on our business

As a unitary holding company, First Community is regulated primarily by the OTS. Our current Subsidiaries are regulated primarily by the Office of Thrift Supervision, the Federal Deposit Insurance Corporation and the Florida Office of Finance Regulation. Federal and various state laws and regulations govern numerous aspects of our operations and the operations of our Subsidiaries, including:

| | • | | Adequate capital and financial condition; |

| | • | | Permissible types and amounts of extensions of credit and investments; |

| | • | | Permissible non-banking activities; and |

| | • | | Restrictions on dividend payments. |

Federal and state regulatory agencies have extensive discretion and power to prevent or remedy unsafe or unsound practices or violations of law by our holding company, our subsidiary bank and service company. Following such examinations, we may be required, among other things, to change its asset valuations or the amounts of required loan loss allowances or to restrict its operations, based on information available to them at the time of their respective examination.

Regulatory action could severely limit future expansion plans

To carry out some of our expansion plans, we are required to obtain permission from the Office of Thrift Supervision. Application for the acquisition of existing thrifts and banks are submitted to the federal and state bank regulatory agencies for their approval. The future climate for regulatory approval is impossible to predict. Regulatory agencies could prohibit or otherwise significantly restrict our expansion plans, as well as those of our Subsidiaries, which could limit our ability to increase revenue.

Investors may face dilution resulting from the issuance of common stock in the future

We have the power to issue common stock without shareholder approval, up to the number of authorized shares set forth in our Articles of Incorporation. Our Board of Directors may determine from time to time a need to obtain additional capital through the issuance of additional shares of common stock or other securities, subject to limitations imposed by the NASDAQ Capital Market and the Office of Thrift Supervision. There can be no assurance that such shares can be issued at prices or on terms better than or equal to the terms obtained by our current shareholders. The issuance of any additional shares of common stock by us in the future may result in a reduction of the book value or market price, if any, of the then-outstanding common stock. Issuance of additional shares of common stock will reduce the proportionate ownership and voting power of our existing shareholders.

Shares of our preferred stock may be issued in the future which could materially adversely affect the rights of the holders of our common stock

Pursuant to our Articles of Incorporation, we have the authority to issue additional series of preferred stock and to determine the designations, preferences, rights and qualifications or restrictions of those shares without any further vote or action of the shareholders. The rights of the holders of our common stock will be subject to, and may be materially adversely affected by, the rights of the holders of any preferred stock that may be issued by us in the future.

13

We may need additional capital in the future and this capital may not be available when needed or at all

We may need to incur additional debt or equity financing in the near future to fund future growth and meet our capital needs. We cannot assure you that such financing will be available to us on acceptable terms or at all. If we are unable to obtain future financing, we may not have the resources available to fund our planned growth.

Future sales of our common stock could depress the price of the common stock

Sales of a substantial number of shares of our common stock in the public market by our shareholders, or the perception that such sales are likely to occur, could cause the market price of our common stock to decline.

There are substantial regulatory limitations on ownership of our common stock and changes of control

With certain limited exceptions, federal regulations prohibit a person or company or a group of persons deemed to be “acting in concert” from, directly or indirectly, acquiring 10% or more (5% if the acquirer is a bank holding company) of any class of our voting stock or obtaining the ability to control in any manner the election of a majority of our directors or otherwise direct our management or our policies without prior notice or application to and the approval of the Office of Thrift Supervision.

Although publicly traded, our common stock has substantially less liquidity than the average trading market for a stock quoted on the NASDAQ Capital Market, and our price may fluctuate in the future

Although our common stock is listed for trading on the NASDAQ Capital Market, the trading market in our common stock has substantially less liquidity than the average trading market for companies quoted on the NASDAQ Capital Market. A public trading market having the desired characteristics of depth, liquidity and orderliness depends on the presence in the marketplace of willing buyers and sellers of our common stock at any given time. This presence depends on the individual decisions of investors and general economic and market conditions over which we have no control.

The market price of our common stock may fluctuate in the future, and these fluctuations may be unrelated to our performance. General market price declines or overall market volatility in the future could adversely affect the price of our common stock, and the current market price may not be indicative of future market prices.

| Item 1B. | Unresolved Staff Comments. |

Not applicable.

| Item 2. | Description of Property. |

We lease our corporate headquarters, which also serves as our Mid-County office. Our headquarters is located at 9001 Belcher Road, Pinellas Park, Florida 33782 and consists of a 7,200 square foot, two-story stand alone building. The facility has three drive-through lanes and an ATM machine.

In addition to our headquarters, we currently have eight branch offices: St. Petersburg, Largo, South Shore, West Shore, Dade City, Port Charlotte, Punta Gorda and Veterans. We own our West Shore, Port Charlotte, Punta Gorda and Veterans offices. Our West Shore office in Hillsborough County is a two-story, 6,200 square foot building, with four drive-through lanes and an ATM machine. The Port Charlotte office is located in a stand-alone building consisting of approximately 4,000 square feet, with one drive-through lane. We renovated a 1,509 square foot vacant commercial building for our Punta Gorda office, which has two drive-through lanes, plus a drive-up ATM. The Veterans office is a two-story, 7,400 square foot building with four drive-through lanes and an ATM machine. We lease the St. Petersburg, Largo, South Shore, and Dade City offices. The St. Petersburg office consists of a 7,400 square foot, single story facility, with three drive-through lanes and an ATM machine. The Largo office consists of a 2,000 square foot, single story, stand alone facility with one drive-through lane. Our South Shore office, located in Apollo Beach in Hillsborough County, is a 3,227 square feet facility with one drive-through lane. The Dade City office consists of 1,400 square feet and is located in a retail center. During 2008, we will open one office in Pasco County. The Zephyrhills office will be a 3,200 square foot building of “Systems Built” construction located on an out parcel of the Merchant Square Plaza on U.S. 301. It will have two drive through lanes, and a drive-up ATM.

We operate a 400 square foot loan production facility in Bradenton, Florida and a 5,749 square foot operations center in Largo, Florida. Both facilities are leased.

| Item 3. | Legal Proceedings. |

There are no pending legal proceedings to which we are a party or to which any of our properties are subject.

14

| Item 4. | Submission of Matters to a Vote of Security Holders. |

No matters were submitted to a vote of security holders, through the solicitation of proxies or otherwise, during the fourth quarter of 2007.

PART II

| Item 5. | Market for Common Equity and Related Stockholder Matters. |

On September 4, 2003, our stock began trading on The NASDAQ SmallCap Market (currently the NASDAQ Capital Market) under the symbol “FCFL.” As of March 3, 2008, there were 153 registered holders of common stock of First Community and approximately 518 street name holders. On March 15, 2005, we paid a stock dividend in common stock equal to 5% of the outstanding shares to shareholders of record as of the close of business on March 1, 2005. On January 20, 2006, a three-for-two stock split was issued to shareholders of record as of the close of business on January 10, 2006. On February 28, 2007 we paid a common stock dividend equal to 5% of our common shares outstanding to record holders as of the close of business on February 12, 2007.

On March 3, 2008, the closing sales price of our common stock was $10.15 compared to $11.00 at December 31, 2007.

| | | | | | | | | | | | |

| | | Calendar Years |

| | | 2007 | | 2006 |

| | | Low | | High | | Low | | High |

| | | (Per share) | | (Per share) |

First Quarter* | | $ | 18.05 | | $ | 22.00 | | $ | 17.00 | | $ | 28.24 |

Second Quarter* | | | 14.05 | | | 19.00 | | | 19.75 | | | 21.75 |

Third Quarter* | | | 13.57 | | | 17.24 | | | 18.77 | | | 21.75 |

Fourth Quarter* | | | 10.98 | | | 14.60 | | | 18.51 | | | 20.58 |

| * | Reflects the 5% stock dividends paid on March 15, 2005 and February 28, 2007, and three-for-stock split issued on January 20, 2006. |

Equity Compensation Plan Information

| | | | | | | |

Plan Category | | Number of Securities to be

Issued Upon Exercise of

Outstanding Options | | Weighted-Average

Exercise Price of

Outstanding Options(1)) | | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans(2)) |

Equity compensation plans approved by security holders | | 685,721 | | $ | 10.71 | | 55,790 |

Equity compensation plans not approved by security holders | | | | | | | |

| | | | | | | |

Total | | 685,721 | | $ | 10.71 | | 55,790 |

| | | | | | | |

(1) | Reflects the 5% stock dividends paid on March 15, 2005 and February 28, 2007, and the three-for-two stock split issued on January 20, 2006. |

(2) | Excludes securities reflected in first column. |

(Remainder of this page intentionally left blank)

15

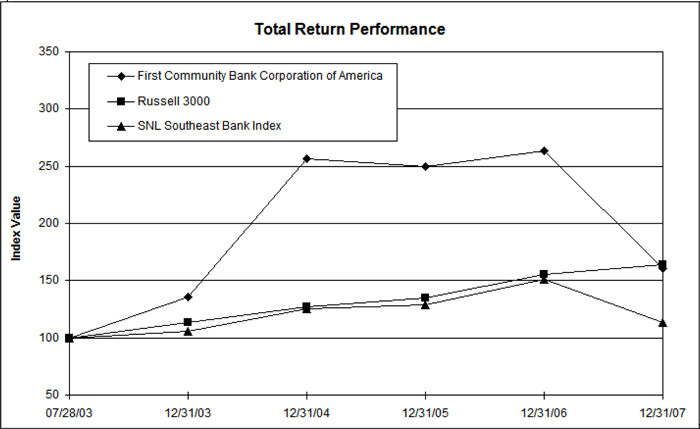

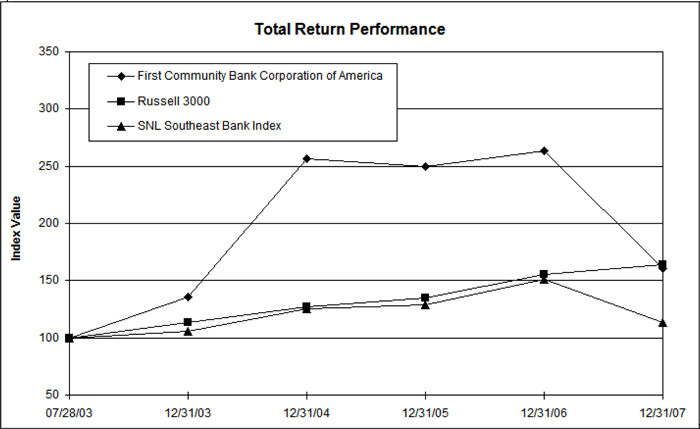

Stock Performance Graph

The following graph compares the cumulative stockholder’s return on First Community’s common stock with: (i) SNL Financial LC’s index for southeastern banks and bank holding companies; and (ii) the Russell 3000 Index, which pertains to listed companies representing 98% of the U.S. market for the period from July 28, 2003 to December 31, 2007, inclusive.

First Community Bank Corporation of America

| | | | | | | | | | |

| | | Period Ending |

Index | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 |

First Community Bank Corporation of America | | 135.40 | | 256.65 | | 249.35 | | 263.29 | | 160.98 |

Russell 3000 | | 113.22 | | 126.74 | | 134.50 | | 155.64 | | 163.64 |

SNL Southeast Bank Index | | 106.02 | | 125.72 | | 128.69 | | 150.90 | | 113.68 |

16

| Item 6. | Selected Consolidated Financial Data |