October 28, 2009

| | |

| United States Securities and Exchange Commission | | VIA EDGAR |

| 100 F Street, N.E. | | |

| Washington, DC 20549 | | |

Attention: Kevin W. Vaughn

| | |

| RE: | | First Community Bank Corporation of America |

| | Form 10-K for Fiscal Year Ended December 31, 2008 |

| | Filed March 27, 2009 |

| | File No. 000-50357 |

Ladies and Gentlemen:

We are in receipt of the comments of the Securities and Exchange Commission (the “Commission”) to the above-mentioned filing of First Community Bank Corporation of America (the “Company”) by letter dated October 15, 2009 and have set forth our response below:

Item 8. Financial Statements and Supplementary Data

Note 8. Income Taxes, page F-27

| 1. | We note your response and proposed disclosure to prior comments 6 and 7 in our comment letter dated September 23, 2009 related to your deferred tax assets. However, it does not appear you have provided sufficient positive objective evidence to support your conclusion that no allowance was necessary. We re-emphasize paragraphs 23 and 24 of SFAS 109 (FASB ASC 740-10-30-21 & 22), and note the difficulty in arriving at a conclusion that no valuation allowance is required when there is negative evidence, such as a three-year cumulative net loss status. Based on the assertion in your response to prior comment 7 that you expect to record a net loss for the third quarter of 2009 of $2.3 million, it appears that you will be in a three-year cumulative net loss status as of September 30, 2009. Further, in your response to prior comment 6, you state the magnitude of your loan loss provision charges are due to an unusual and infrequent downturn in the economy, which would appear to qualify as additional negative evidence such as “unsettled circumstance that could adversely affect future operations and profit levels,” as outlined in paragraph 23.c of SFAS 109. Please address the following: |

| | a. | Please provide us with additional information (for each period ended December 31, 2008, March 31, 2009, June 30, 2009, and September 30, 2009), including but not limited to, financial projections used, a discussion of the significant assumptions used in those projections, and any other positive objective evidence, to support your conclusion that a deferred tax asset valuation allowance was not needed at those dates. |

Kevin W. Vaughn

United States Securities and Exchange Commission

October 28, 2009

Page 2 of 4

| | c. | You state in your response that “The Company forecasts taxable income sufficient to realize the tax benefit of existing deductible temporary differences and carry-forwards that primarily compose the deferred tax asset by 2013.” Tell us how you determined a projection extending up to a four-year timeline is appropriate in light of the volatility in your recent earnings as well as the volatility in the credit markets. |

Answer to items a. and c. (b. explained separately)

We believe the Company will be able to realize the deferred tax asset of $5,214,000 at September 30, 2009 and that no allowance is necessary at this time. The Company has $1,876,000 recoverable from federal income taxes paid in 2007. The Company expects to realize this in 2010 from NOL carry backs. The remaining $3,388,000 is expected to be realized by 2012 from projected future earnings. If pending legislation currently in congress passes and permits 2009 loss to be carried back 5 years there would be an additional $3.7 million available for carry back. These potential recoveries are not included in our estimates.

First Community Bank Corporation of America has a history of profitable performance prior to the current economic recession with strong core earnings and a conservative credit underwriting culture. The Company has consistently had and expects to continue to have positive earnings before loan losses. The company expects to continue with strong earnings going forward as we work through the current credit issues. The deferred tax asset valuation has been reviewed by our external auditors, Hacker, Johnson & Smith PA, prior to the release of the 2008 10K and all subsequent 10Q’s. The Office of Thrift Supervision completed their audit of the bank after the 2nd Quarter, 2009 10Q was released and affirmed the deferred tax asset.

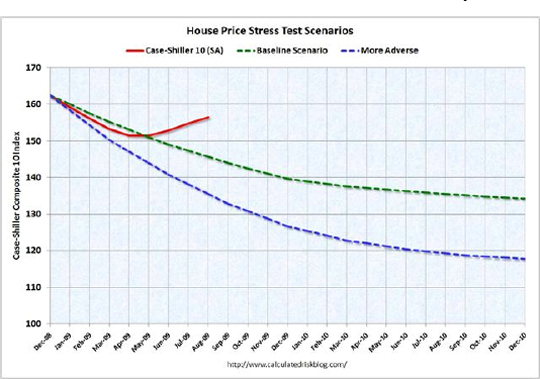

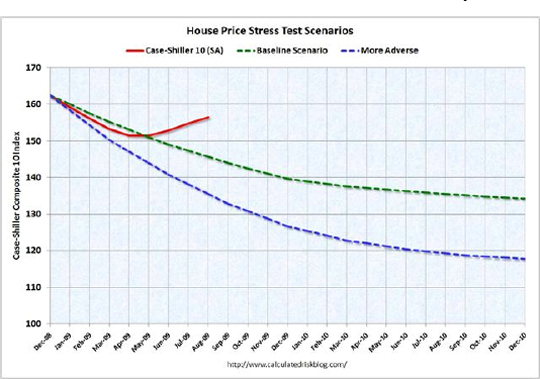

We believe the stabilization of collateral values will result in a reduction in future loan losses and improved future operating results for the Company. There is strong evidence that Florida is experiencing a significant stabilization in collateral valuation as both the number of real estate sales and sale prices have increased in the last couple of months.

Welcome reversal

Tampa Bay area homes depreciated at the start of 2009, but that downward trend appears to be reversing. Here’s a comparison of monthly home price changes between Case-Shiller and Florida Realtors:

| | | | |

| January to February | | March to April | | May to June |

| Case-Shiller: – 2.7 percent | | Case-Shiller: – 0.7 percent | | Case-Shiller: + 0.04 percent |

| Realtors: + 7 percent | | Realtors: – 0.04 percent | | Realtors: – 1.2 percent |

| February to March | | April to May | | June to July |

| Case-Shiller: – 2.7 percent | | Case-Shiller: 0.0 percent | | Case-Shiller: + 1.4 percent |

| Realtors: + 2.9 percent | | Realtors: + 4.4 percent | | Realtors: + 2.7 percent |

Sources: S&P Case-Shiller home price index, Florida Association of Realtors

Kevin W. Vaughn

United States Securities and Exchange Commission

October 28, 2009

Page 3 of 4

The bank has seen increased number of buyers looking at properties owned by the bank. The company sees the current credit losses as a direct impact of the recession which leading indicators have confirmed has ended. There is no doubt that there are still credit losses and workouts that will be experienced through the short term but the company does not consider such as “unsettled circumstances” that would adversely affect future operations.

| | b. | Further, identify the changes in your projections for future periods that were prepared as of those dates. Discuss the extent to which your projections were negatively adjusted to incorporate new information, and identify how you considered that history as negative evidence in your conclusion that no allowance was necessary. |

For the year 2009, First Community Bank of America forecasted earnings before tax and before provision for loan losses of $2,699,000 and assumed that these earnings would cover the provision for loan losses resulting in a net income of $0. During December 2008 the Bank had built its reserve for loan losses to 2.00% in anticipation of future losses. During December the Bank had aggressively charged off any known credit problems. Consequently, the Bank could only identify loans totaling $632,000 as potential charge-offs. The actual and identified charge-off projections are listed on the schedule below showing the change in visibility during the year:

Kevin W. Vaughn

United States Securities and Exchange Commission

October 28, 2009

Page 4 of 4

| | | | | | | | | | |

Date of Projections | | Actual

Y-T-D

2009 C/O’s | | (in Thousands)

Identified

Potential

2009 C/O’s | | Total

Identified

2009 C/O’s | | Identified

Potential

2010 C/O’s | | Estimated

2010

Charge-offs |

12/31/2008 | | 0 | | 632 | | 632 | | 0 | | |

1/31/2009 | | 839 | | 1,399 | | 2,238 | | 0 | | |

6/30/2009 | | 1,204 | | 5,438 | | 6,642 | | 0 | | |

9/30/2009 | | 5,731 | | 6,879 | | 12,610 | | 405 | | 3,500 |

It wasn’t until the 2nd Quarter of that 2009 that estimated total charge-offs exceeded the projected $2,699,000 in base earnings.

In conjunction with the OTS audit, First Community Bank Corporation has produced a projection through 2013 of asset quality, the balance sheet, earnings and capital. The projections were driven by asset quality and related loan losses. The cumulative charge-offs in the projections exceed those from a Stress Scenario calculated on the Bank equivalent to the tests conducted by the Treasury Department on the largest banks in the country. First Community Bank of America’s earnings is projected to be $987,000 in 2010, $2,749,000 in 2011, $4,834,000 in 2012 and $5,946,000 in 2013. The company feels that these projections are realistic as it recovers from credit losses and the related drag on the margin from non performing assets and related operating expenses. We continue to believe it is more likely than not that the projected income is more than enough to realize the benefit from deferred tax asset and that no allowance is currently required.

We will continue to monitor and update this projection quarterly.

Please do not hesitate to contact the undersigned with any questions or further comments.

Very truly yours,

|

/s/ Stan B. McClelland |

| Stan B. McClelland |

| Chief Financial Officer |