N-CSR

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09277

Viking Mutual Funds

(Exact name of registrant as specified in charter)

1 Main Street North, Minot, ND | | 58703 |

(Address of principal offices) | | (Zip code) |

Brent Wheeler and/or Kevin Flagstad, PO Box 500, Minot, ND 58702

(Name and address of agent for service)

Registrant’s telephone number, including area code: 701-852-5292

Date of fiscal year end: July 31st

Date of reporting period: July 31, 2018

Item 1. REPORTS TO STOCKHOLDERS.

Viking Mutual Funds

Kansas Municipal Fund

Maine Municipal Fund

Nebraska Municipal Fund

Oklahoma Municipal Fund

Viking Tax-Free Fund for Montana

Viking Tax-Free Fund for North Dakota

Annual Report

July 31, 2018

| |

Investment Adviser

Viking Fund Management, LLC

PO Box 500

Minot, ND 58702 | Principal Underwriter

Integrity Funds Distributor, LLC*

PO Box 500

Minot, ND 58702 |

Transfer Agent

Integrity Fund Services, LLC

PO Box 759

Minot, ND 58702 | Custodian

Wells Fargo Bank, N.A.

Trust & Custody Solutions

801 Nicollet Mall, Suite 700

Minneapolis, MN 55479 |

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115 |

|

*The Funds are distributed through Integrity Funds Distributor, LLC. Member FINRA |

|

Enclosed is the report of the operations for the Kansas Municipal Fund, Maine Municipal Fund, Nebraska Municipal Fund, and Oklahoma Municipal Fund (each a “Fund”, and collectively the “Funds”) for the year ended July 31, 2018. Each Fund’s portfolio and related financial statements are presented within for your review.

Economic Recap

The Federal Open Market Committee’s (“FOMC” or “Committee”) statement in mid-June noted that the labor market has continued to strengthen and that economic activity has been rising at a solid rate.The Committee also noted that job gains have been strong in recent months, and the unemployment rate has declined. Recent data suggest that growth of household spending has picked up, while business fixed investment has continued to grow steadily. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity and strong labor market conditions. In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-3/4 to 2 percent, its second raise of 2018. In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.

Municipal Bond Market Recap

Municipal market returns were positive in the third quarter of 2017. Municipals continue to perform well as investors looked for relative safety in higher quality assets amid increasing tensions between the United States and North Korea, along with continued gridlock in Washington. The supply/demand dynamic also remained positive for municipals. Issuance for the quarter came in at $77.9 billion nationally, a 26.3% decrease over the same quarter of 2016.

Returns were again positive for the municipal market in the fourth quarter 2017, marking four consecutive quarters of positive returns for the year. Issuance was significantly above average in the fourth quarter as issuers feared the tax bill in Congress would eliminate the tax-exempt status of private activity and advance refunding bonds. Though it didn’t go that far it did eliminate the tax exempt status of municipal advance refunding bonds. It also limits the amount of state and local taxes that households may deduct to $10,000 which could increase demand for bonds that are exempt from state tax. The robust supply was met with strong demand as investors expected the supply in early 2018 to be very light due to the large amount of issuance pulled forward into 2017. Issuance for the quarter came in at $129.2 billion nationally, a 31.1% increase over the same quarter last year.

The municipal market posted a negative first quarter of 2018, following four quarters of positive returns in 2017. Issuance was significantly below average as issuers, unsure of the potential impact from tax legislation, pulled forward a large amount of issuance in 2017 that was slated for early 2018. As a result, January’s issuance was the slowest start to a new year since 2011. Municipal yields rose with Treasury yields over the quarter due to stronger economic data, rising inflation, and the expectation of a more aggressive pace of Fed rate hikes. Interest rates spiked in January, but stabilized late in the quarter at new higher levels. Issuance for the first quarter came in at $56.3 billion nationally, a 31.0% decrease from the same quarter last year.

Municipal market returns were positive in the second quarter of 2018. As issuance continued to come in below historical averages during the quarter. April returns were negative as seasonal tax selling and higher rates pushed the municipal market lower. Rates peaked in mid-May, with the 10 year Treasury yields hitting their highest levels since 2011, before pulling back on geopolitical concerns to finish the month lower. June continued the strength from May and finished the quarter on a positive note as heavy calls and maturing bonds drove demand and resulted in net negative supply. Issuance for the quarter came in at $81.9 billion nationally, a 13.1% decrease from the same quarter last year. The second quarter strength continued into July as returns were positive for the month. However, rates were mixed, moving down slightly on the short end of the curve and up slightly on the intermediate to long end of the curve.

Fund Performance and Outlook

Over the course of the annual period, the yield curve flattened as rates on the short end of the curve (i.e. 1-8 years) increased 60 or more basis points, while rates on bonds with intermediate and longer maturities (i.e. 9-30 years) increased 20-60 basis points. Lower-rated investment grade muni bonds performed in-line to slightly better than their higher-rated counterparts.

We continue to follow a disciplined strategy of investing to maximize tax-exempt income while seeking value in the municipal market. The Portfolio Management Team (the “Team”) continues to place emphasis on preservation of capital via high quality, higher coupon, and/or lower duration bonds.The Team believes a heavy concentration in AA rated bonds and an intermediate maturity structure should provide adequate liquidity, should we experience a stressed environment. The Team has also used the recent rise in rates to sell bonds that were purchased when rates were at historic lows, in favor of bonds with similar characteristics (e.g. coupon and maturity structure) that offer higher yields.

The Kansas Municipal Fund began the period at $10.78 per share and ended the period at $10.53 per share for a total return of 0.32%* for Class A. This compares to the Barclays Capital Municipal Index’s return of 0.99%. At the end of the period the average weighted coupon and maturity of the Fund at market value was 4.88% and 9.7 years, respectively.

The Maine Municipal Fund began the period at $10.88 per share and ended the period at $10.64 per share for a total return of 0.04%* for Class A. This compares to the Barclays Capital Municipal Index’s return of 0.99%. At the end of the period the average weighted coupon and maturity of the Fund at market value was 4.74% and 9.7 years, respectively.

The Nebraska Municipal Fund began the period at $10.46 per share and ended the period at $10.25 per share for a total return of 0.34%* for Class A. This compares to the Barclays Capital Municipal Index’s return of 0.99%. At the end of the period the average weighted coupon and maturity of the Fund at market value was 4.90% and 11.7 years, respectively.

The Oklahoma Municipal Fund began the period at $11.74 per share and ended the period at $11.47 per share for a total return of -0.04%* for Class A. This compares to the Barclays Capital Municipal Index’s return of 0.99%. At the end of the period the average weighted coupon and maturity of the Fund at market value was 4.68% and 11.7 years, respectively.

Income exempt from federal income taxes and each Fund’s respective state tax with preservation of capital remains the primary objective of the Funds.

If you would like more frequent updates, please visit the Funds’ website at www.integrityvikingfunds.com for daily prices along with pertinent Fund information.

Sincerely,

The Portfolio Management Team

The views expressed are those of The Portfolio Management Team of Viking Fund Management, LLC (“Viking Fund Management”, “VFM”, or the “Adviser”). The views are subject to change at any time in response to changing circumstances in the market and are not intended to predict or guarantee the future performance of any individual security, market sector, the markets generally, or any of the funds in the Integrity Viking family of funds.

*Performance does not include applicable front-end or contingent deferred sales charges, which would have reduced the performance. For Kansas Municipal Fund, Maine Municipal Fund, Nebraska Municipal Fund, and Oklahoma Municipal Fund, the total annual fund operating expense ratio (before expense waivers and reimbursements and including acquired fund fees and expenses) as of the most recent fiscal year-end was 1.16%, 1.33%, 1.21%, and 1.19%, respectively, for Class A, and 0.92%, 1.11%, 0.97%, and 0.96%, respectively, for Class I. The net annual fund operating expense ratio (after expense waivers and reimbursements and excluding acquired fund fees and expenses) as of the most recent fiscal year-end was 0.98%, 0.98%, 0.98%, and 0.98%, respectively, for Class A and 0.73%, 0.73%, 0.73%, and 0.73%, respectively, for Class I. The Fund’s investment adviser has contractually agreed to waive fees and reimburse expenses through November 29, 2018 so that total annual fund operating expenses after fee waivers and expense reimbursements (excluding taxes, brokerage fees, commissions, extraordinary and non-recurring expenses, and acquired fund fees and expenses) do not exceed 0.98% for Class A and 0.73% for Class I of average daily net assets. This expense limitation agreement may only be terminated or modified prior to November 29, 2018 with the approval of the Fund’s Board of Trustees.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. You can obtain performance data current to the most recent month end (available within seven business days of the most recent month end) by calling 800-276-1262.

You should consider each Fund’s investment objectives, risks, charges, and expenses carefully before investing. For this and other important information, please obtain a Fund prospectus at no cost from your financial adviser and read it carefully before investing.

Bond prices and therefore the value of bond funds decline as interest rates rise. Because each Fund invests in securities of a single state, the Funds are more susceptible to factors adversely impacting the respective state than a municipal bond fund that does not concentrate its securities in a single state.

For investors subject to the alternative minimum tax, a portion of the each Fund’s dividends may be taxable. Distributions of capital gains are generally taxable.

Enclosed is the report of the operations for the Viking Tax-Free Fund for Montana and Viking Tax-Free Fund for North Dakota (each a “Fund”, and collectively the “Funds”) for the seven months ended July 31, 2018. Each Fund’s portfolio and related financial statements are presented within for your review.

Economic Recap

The Federal Open Market Committee’s (“FOMC” or “Committee”) statement in mid-June noted that the labor market has continued to strengthen and that economic activity has been rising at a solid rate.The Committee also noted that job gains have been strong in recent months, and the unemployment rate has declined. Recent data suggest that growth of household spending has picked up, while business fixed investment has continued to grow steadily. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity and strong labor market conditions. In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-3/4 to 2 percent, its second raise of 2018. In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.

Municipal Bond Market Recap

The municipal market posted a negative first quarter of 2018, following four quarters of positive returns in 2017. Issuance was significantly below average as issuers, unsure of the potential impact from tax legislation, pulled forward a large amount of issuance in 2017 that was slated for early 2018. As a result, January’s issuance was the slowest start to a new year since 2011. Municipal yields rose with Treasury yields over the quarter due to stronger economic data, rising inflation, and the expectation of a more aggressive pace of Fed rate hikes. Interest rates spiked in January, but stabilized late in the quarter at new higher levels. Issuance for the first quarter came in at $56.3 billion nationally, a 31.0% decrease from the same quarter last year. State issuance in Montana was down 14.3% in the first quarter of 2018 vs 2017, while North Dakota issuance decreased 47.5%.

Municipal market returns were positive in the second quarter of 2018. As issuance continued to come in below historical averages during the quarter. April returns were negative as seasonal tax selling and higher rates pushed the municipal market lower. Rates peaked in mid-May, with the 10 year Treasury yields hitting their highest levels since 2011, before pulling back on geopolitical concerns to finish the month lower. June continued the strength from May and finished the quarter on a positive note as heavy calls and maturing bonds drove demand and resulted in net negative supply. Issuance for the quarter came in at $81.9 billion nationally, a 13.1% decrease from the same quarter last year. State issuance in Montana was down 75.6% in the second quarter of 2018 vs 2017, while North Dakota issuance increased 27.2%. The second quarter strength continued into July as returns were positive for the month. However, rates were mixed, moving down slightly on the short end of the curve and up slightly on the intermediate to long end of the curve.

Fund Performance and Outlook

In the first seven months of 2018, the yield curve steepened as rates on the very short end of the curve (i.e. 1-2 years) increased only modestly, while rates on bonds with intermediate and longer maturities (i.e. 7-30 years) increased 40-50 basis points. Lower-rated investment grade muni bonds performed in-line with their higher-rated counterparts.

Over the course of the year, the Portfolio Management Team (the “Team”) continued to maintain a shorter maturity structure than in past years and also made a concerted effort to purchase bonds with higher coupons when possible.

Tax-Free Fund for MT and Tax-Free Fund for ND provided a total return for Class A shares of -0.74%* and -0.40%*, respectively (at net asset value with distributions reinvested) and a total return for Class I shares of -0.59%* and -0.25%*, respectively (at net asset value with distributions reinvested) for the seven month period ended July 31, 2018 compared to the Funds’ benchmark, the Barclays Capital Municipal Bond Index which returned -.01% and the Morningstar Muni Single State Intermediate Category which returned -0.38%.

Despite the continued relative scarcity of Montana and North Dakota municipal bonds throughout the period, each Fund was able to obtain an adequate supply of investment grade bonds of various maturities. Each Fund may also invest in non-rated bonds should we deem they are of investment grade equivalent.Although we refrain from making large bets on the direction of rates, we have taken the opportunity to shorten the Funds’ maturity structures over the last few years in anticipation of an eventual rise in rates.A shorter maturity structure should provide a somewhat greater degree of stability of each Fund’s share price should muni prices become volatile.The highest level of current income that is exempt from federal and each Fund’s state income taxes and is consistent with preservation of capital remains the investment objective of each Fund.

The current 3.8% Medicare surtax on investment income established by the Patient Protection and Affordable Care Act (municipals are exempt) combined with the higher marginal tax rates at the federal and state levels boost the appeal of tax-exempt income. The federal marginal tax rate for taxpayers with adjusted gross incomes of $500,000 ($600,000 for married filing jointly) is 37.0%. The after-tax yield of a 10-year U.S. Treasury Note yielding 2.96% falls to approximately 1.75% at the 37.0% federal tax rate plus the 3.8% Medicare surtax.

Finally, we recommend that shareholders view their investment as long-term. As difficult as they may be, periods of panic (and euphoria) tend to be transitory in nature and it’s the long-term investors that may be rewarded with the long-term benefits of tax-free income and relatively low volatility that muni bonds have provided for decades.

If you would like more frequent updates, please visit the Funds’ website at www.integrityvikingfunds.com for daily prices along with pertinent Fund information.

Sincerely,

The Portfolio Management Team

The views expressed are those of The Portfolio Management Team of Viking Fund Management, LLC (“Viking Fund Management”, “VFM”, or the “Adviser”). The views are subject to change at any time in response to changing circumstances in the market and are not intended to predict or guarantee the future performance of any individual security, market sector, the markets generally, or any of the funds in the Integrity Viking family of funds.

*Performance does not include applicable front-end or contingent deferred sales charges, which would have reduced the performance. For Viking Tax-Free Fund for Montana and Viking Tax-Free Fund for North Dakota, the total annual fund operating expense ratio (before expense waivers and reimbursements and including acquired fund fees and expenses) as of the most recent fiscal year-end was 1.17% and 1.31%, respectively, for Class A, and 0.91% and 1.06%, respectively, for Class I. The net annual fund operating expense ratio (after expense waivers and reimbursements and excluding acquired fund fees and expenses) as of the most recent fiscal year-end was 0.98% and 0.98%, respectively, for Class A and 0.73% and 0.73%, respectively, for Class A. The Fund’s investment adviser has contractually agreed to waive fees and reimburse expenses through April 29, 2019 so that total annual fund operating expenses after fee waivers and expense reimbursements (excluding taxes, brokerage fees, commissions, extraordinary and non-recurring expenses, and acquired fund fees and expenses) do not exceed 0.98% for Class A and 0.73% for Class I of average daily net assets. This expense limitation agreement may only be terminated or modified prior to April 29, 2019 with the approval of the Fund’s Board of Trustees.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. You can obtain performance data current to the most recent month end (available within seven business days of the most recent month end) by calling 800-276-1262.

You should consider each Fund’s investment objectives, risks, charges, and expenses carefully before investing. For this and other important information, please obtain a Fund prospectus at no cost from your financial adviser and read it carefully before investing.

Bond prices and therefore the value of bond funds decline as interest rates rise. Because each Fund invests in securities of a single state, the Funds are more susceptible to factors adversely impacting the respective state than a municipal bond fund that does not concentrate its securities in a single state.

For investors subject to the alternative minimum tax, a portion of the each Fund’s dividends may be taxable. Distributions of capital gains are generally taxable.

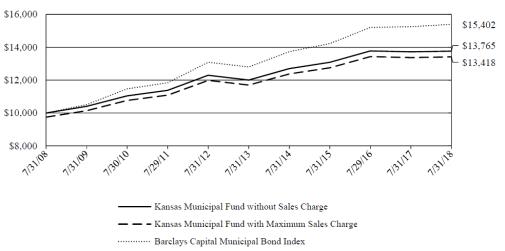

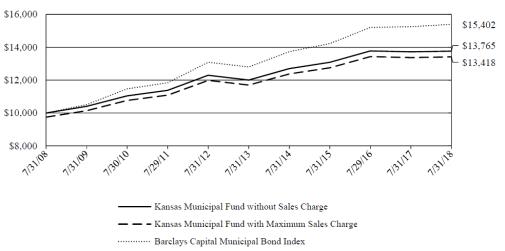

KANSAS MUNICIPAL FUND

Comparison of change in value of a $10,000 investment

Average Annual Total Returns for the periods ended July 31, 2018

| 1 year | 3 year | 5 year | 10 year | Since Inception* |

Class A Without sales charge | 0.32% | 1.70% | 2.78% | 3.25% | 4.01% |

Class A With sales charge (2.50%) | -2.22% | 0.84% | 2.26% | 2.98% | 3.91% |

Class I Without sales charge | N/A | N/A | N/A | N/A | 0.41% |

* November 15, 1990 for Class A; November 1, 2017 for Class I |

The total annual fund operating expense ratio for class A and I (before expense waivers and reimbursements and including acquired fund fees and expenses) as of the most recent fiscal year-end was 1.16% and 0.92%, respectively. The net annual fund operating expense ratio (after expense waivers and reimbursements and excluding acquired fund fees and expenses) as of the most recent fiscal year-end was 0.98% and 0.73%, respectively. The Fund’s investment adviser has contractually agreed to waive fees and reimburse expenses through November 29, 2018 so that total annual fund operating expenses after fee waivers and expense reimbursements (excluding taxes, brokerage fees, commissions, extraordinary and non-recurring expenses, and acquired fund fees and expenses) do not exceed 0.98% and 0.73%, respectively, of average daily net assets. This expense limitation agreement may only be terminated or modified prior to November 29, 2018 with the approval of the Fund’s Board of Trustees.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. You can obtain performance data current to the most recent month end (available within seven business days of the most recent month end) by calling 800-276-1262.

The table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and redemptions of Fund shares.

The graph comparing the Fund’s performance to a benchmark index provides you with a general sense of how the Fund performed. To put this information in context, it may be helpful to understand the special differences between the two. The Fund’s total return for the period shown appears with and without sales charges and includes Fund expenses and management fees. A securities index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged; there are no expenses that affect the results. In addition, few investors could purchase all of the securities to match the index. If they could, transaction costs and other expenses would be incurred. All Fund and benchmark returns include reinvested dividends. The results prior to August 1, 2009 were achieved while the Fund was managed by a different investment adviser. The current investment adviser may produce different investment results than those achieved by the previous investment adviser.

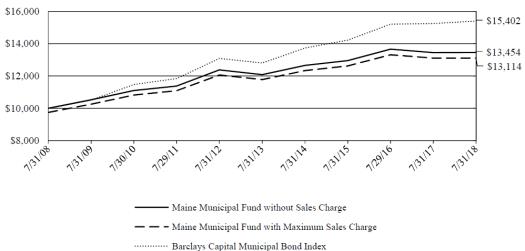

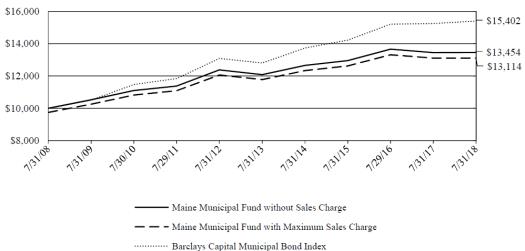

MAINE MUNICIPAL FUND

Comparison of change in value of a $10,000 investment

Average Annual Total Returns for the periods ended July 31, 2018

| 1 year | 3 year | 5 year | 10 year | Since Inception* |

Class A Without sales charge | 0.04% | 1.27% | 2.17% | 3.01% | 4.12% |

Class A With sales charge (2.50%) | -2.47% | 0.42% | 1.65% | 2.75% | 4.02% |

Class I Without sales charge | N/A | N/A | N/A | N/A | 0.16% |

* December 5, 1991 for Class A; November 1, 2017 for Class I |

The total annual fund operating expense ratio for class A and I (before expense waivers and reimbursements and including acquired fund fees and expenses) as of the most recent fiscal year-end was 1.33% and 1.11%, respectively. The net annual fund operating expense ratio (after expense waivers and reimbursements and excluding acquired fund fees and expenses) as of the most recent fiscal year-end was 0.98% and 0.73%, respectively. The Fund’s investment adviser has contractually agreed to waive fees and reimburse expenses through November 29, 2018 so that total annual fund operating expenses after fee waivers and expense reimbursements (excluding taxes, brokerage fees, commissions, extraordinary and non-recurring expenses, and acquired fund fees and expenses) do not exceed 0.98% and 0.73%, respectively, of average daily net assets. This expense limitation agreement may only be terminated or modified prior to November 29, 2018 with the approval of the Fund’s Board of Trustees.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. You can obtain performance data current to the most recent month end (available within seven business days of the most recent month end) by calling 800-276-1262.

The table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and redemptions of Fund shares.

The graph comparing the Fund’s performance to a benchmark index provides you with a general sense of how the Fund performed. To put this information in context, it may be helpful to understand the special differences between the two. The Fund’s total return for the period shown appears with and without sales charges and includes Fund expenses and management fees. A securities index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged; there are no expenses that affect the results. In addition, few investors could purchase all of the securities to match the index. If they could, transaction costs and other expenses would be incurred. All Fund and benchmark returns include reinvested dividends. The results prior to August 1, 2009 were achieved while the Fund was managed by a different investment adviser. The current investment adviser may produce different investment results than those achieved by the previous investment adviser.

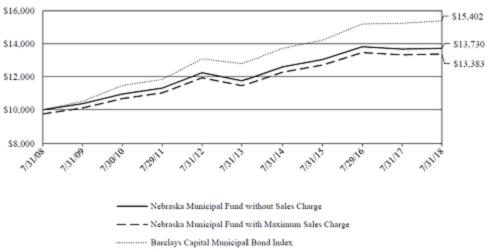

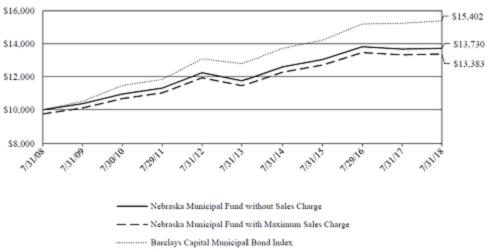

NEBRASKA MUNICIPAL FUND

Comparison of change in value of a $10,000 investment

Average Annual Total Returns for the periods ended July 31, 2018

| 1 year | 3 year | 5 year | 10 year | Since Inception* |

Class A Without sales charge | 0.34% | 1.71% | 3.14% | 3.22% | 3.53% |

Class A With sales charge (2.50%) | -2.19% | 0.85% | 2.61% | 2.96% | 3.43% |

Class I Without sales charge | N/A | N/A | N/A | N/A | 0.43% |

* November 17, 1993 for Class A; November 1, 2017 for Class I |

The total annual fund operating expense ratio for class A and I (before expense waivers and reimbursements and including acquired fund fees and expenses) as of the most recent fiscal year-end was 1.21% and 0.97%, respectively. The net annual fund operating expense ratio (after expense waivers and reimbursements and excluding acquired fund fees and expenses) as of the most recent fiscal year-end was 0.98% and 0.73%, respectively. The Fund’s investment adviser has contractually agreed to waive fees and reimburse expenses through November 29, 2018 so that total annual fund operating expenses after fee waivers and expense reimbursements (excluding taxes, brokerage fees, commissions, extraordinary and non-recurring expenses, and acquired fund fees and expenses) do not exceed 0.98% and 0.73%, respectively, of average daily net assets. This expense limitation agreement may only be terminated or modified prior to November 29, 2018 with the approval of the Fund’s Board of Trustees.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. You can obtain performance data current to the most recent month end (available within seven business days of the most recent month end) by calling 800-276-1262.

The table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and redemptions of Fund shares.

The graph comparing the Fund’s performance to a benchmark index provides you with a general sense of how the Fund performed. To put this information in context, it may be helpful to understand the special differences between the two. The Fund’s total return for the period shown appears with and without sales charges and includes Fund expenses and management fees. A securities index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged; there are no expenses that affect the results. In addition, few investors could purchase all of the securities to match the index. If they could, transaction costs and other expenses would be incurred. All Fund and benchmark returns include reinvested dividends. The results prior to August 1, 2009 were achieved while the Fund was managed by a different investment adviser. The current investment adviser may produce different investment results than those achieved by the previous investment adviser.

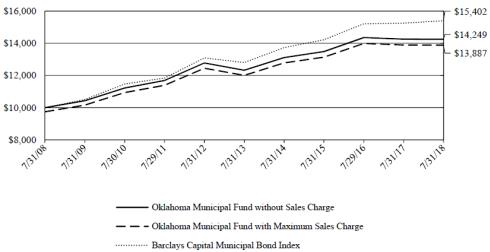

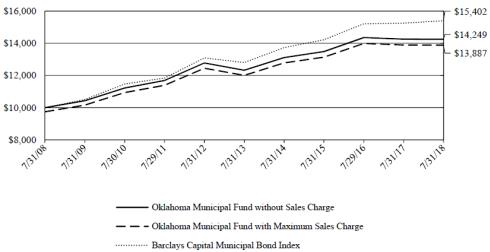

OKLAHOMA MUNICIPAL FUND

Comparison of change in value of a $10,000 investment

Average Annual Total Returns for the periods ended July 31, 2018

| 1 year | 3 year | 5 year | 10 year | Since Inception* |

Class A Without sales charge | -0.04% | 1.86% | 2.94% | 3.60% | 3.75% |

Class A With sales charge (2.50%) | -2.53% | 1.00% | 2.42% | 3.34% | 3.63% |

Class I Without sales charge | N/A | N/A | N/A | N/A | 0.14% |

* September 25, 1996 for Class A; November 1, 2017 for Class I |

The total annual fund operating expense ratio for class A and I (before expense waivers and reimbursements and including acquired fund fees and expenses) as of the most recent fiscal year-end was 1.19% and 0.96%, respectively. The net annual fund operating expense ratio (after expense waivers and reimbursements and excluding acquired fund fees and expenses) as of the most recent fiscal year-end was 0.98%. and 0.73%, respectively The Fund’s investment adviser has contractually agreed to waive fees and reimburse expenses through November 29, 2018 so that total annual fund operating expenses after fee waivers and expense reimbursements (excluding taxes, brokerage fees, commissions, extraordinary and non-recurring expenses, and acquired fund fees and expenses) do not exceed 0.98% and 0.73%, respectively, of average daily net assets. This expense limitation agreement may only be terminated or modified prior to November 29, 2018 with the approval of the Fund’s Board of Trustees.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. You can obtain performance data current to the most recent month end (available within seven business days of the most recent month end) by calling 800-276-1262.

The table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and redemptions of Fund shares.

The graph comparing the Fund’s performance to a benchmark index provides you with a general sense of how the Fund performed. To put this information in context, it may be helpful to understand the special differences between the two. The Fund’s total return for the period shown appears with and without sales charges and includes Fund expenses and management fees. A securities index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged; there are no expenses that affect the results. In addition, few investors could purchase all of the securities to match the index. If they could, transaction costs and other expenses would be incurred. All Fund and benchmark returns include reinvested dividends. The results prior to August 1, 2009 were achieved while the Fund was managed by a different investment adviser. The current investment adviser may produce different investment results than those achieved by the previous investment adviser.

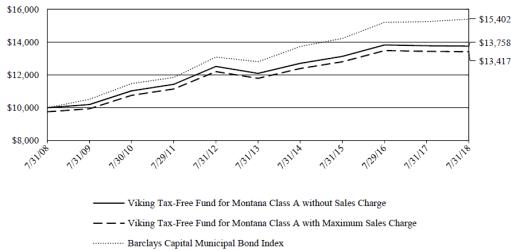

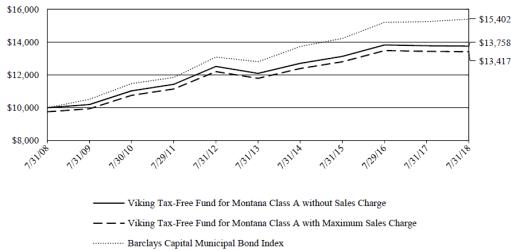

VIKING TAX-FREE FUND FOR MONTANA

Comparison of change in value of a $10,000 investment

Average Annual Total Returns for the periods ended July 31, 2018

| 1 year | 3 year | 5 year | 10 year | Since Inception* |

Class A Without sales charge | -0.16% | 1.57% | 2.61% | 3.24% | 3.71% |

Class A With sales charge (2.50%) | -2.66% | 0.72% | 2.10% | 2.98% | 3.57% |

Class I Without sales charge | 0.09% | N/A | N/A | N/A | -0.01% |

* August 3, 1999 for Class A; August 1, 2016 for Class I |

The total annual fund operating expense ratio for Class A and I (before expense waivers and reimbursements and including acquired fund fees and expenses) as of the most recent fiscal year-end was 1.17% and 0.91%, respectively. The net annual fund operating expense ratio (after expense waivers and reimbursements and excluding acquired fund fees and expenses) as of the most recent fiscal year-end was 0.98% and 0.73%, respectively. The Fund’s investment adviser has contractually agreed to waive fees and reimburse expenses through April 29, 2019 so that total annual fund operating expenses after fee waivers and expense reimbursements (excluding taxes, brokerage fees, commissions, extraordinary and non-recurring expenses, and acquired fund fees and expenses) do not exceed 0.98% and 0.73%, respectively, of average daily net assets. This expense limitation agreement may only be terminated or modified prior to April 29, 2019 with the approval of the Fund’s Board of Trustees.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. You can obtain performance data current to the most recent month end (available within seven business days of the most recent month end) by calling 800-276-1262.

The table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and redemptions of Fund shares.

The graph comparing the Fund’s performance to a benchmark index provides you with a general sense of how the Fund performed. To put this information in context, it may be helpful to understand the special differences between the two. The Fund’s total return for the period shown appears with and without sales charges and includes Fund expenses and management fees. A securities index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged; there are no expenses that affect the results. In addition, few investors could purchase all of the securities to match the index. If they could, transaction costs and other expenses would be incurred. All Fund and benchmark returns include reinvested dividends.

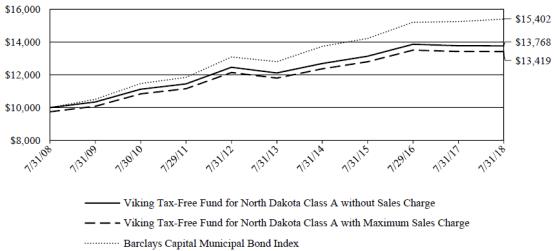

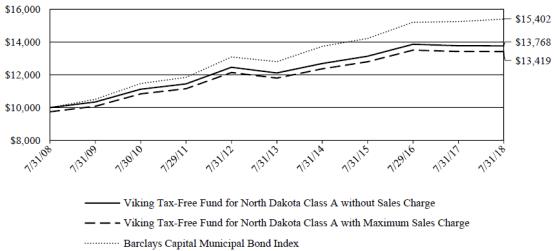

VIKING TAX-FREE FUND FOR NORTH DAKOTA

Comparison of change in value of a $10,000 investment

Average Annual Total Returns for the periods ended July 31, 2018

| 1 year | 3 year | 5 year | 10 year | Since Inception* |

Class A Without sales charge | -0.06% | 1.58% | 2.60% | 3.25% | 3.80% |

Class A With sales charge (2.50%) | -2.51% | 0.72% | 2.08% | 2.98% | 3.66% |

Class I Without sales charge | 0.09% | N/A | N/A | N/A | -0.04% |

* August 3, 1999 for Class A; August 1, 2016 for Class I |

The total annual fund operating expense ratio for class A and I (before expense waivers and reimbursements and including acquired fund fees and expenses) as of the most recent fiscal year-end was 1.31% and 1.06%, respectively. The net annual fund operating expense ratio (after expense waivers and reimbursements and excluding acquired fund fees and expenses) as of the most recent fiscal year-end was 0.98% and 0.73%, respectively. The Fund’s investment adviser has contractually agreed to waive fees and reimburse expenses through April 29, 2019 so that total annual fund operating expenses after fee waivers and expense reimbursements (excluding taxes, brokerage fees, commissions, extraordinary and non-recurring expenses, and acquired fund fees and expenses) do not exceed 0.98% and 0.73%, respectively, of average daily net assets. This expense limitation agreement may only be terminated or modified prior to April 29, 2019 with the approval of the Fund’s Board of Trustees.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. You can obtain performance data current to the most recent month end (available within seven business days of the most recent month end) by calling 800-276-1262.

The table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and redemptions of Fund shares.

The graph comparing the Fund’s performance to a benchmark index provides you with a general sense of how the Fund performed. To put this information in context, it may be helpful to understand the special differences between the two. The Fund’s total return for the period shown appears with and without sales charges and includes Fund expenses and management fees. A securities index measures the performance of a theoretical portfolio. Unlike a fund, the index is unmanaged; there are no expenses that affect the results. In addition, few investors could purchase all of the securities to match the index. If they could, transaction costs and other expenses would be incurred. All Fund and benchmark returns include reinvested dividends.

KANSAS MUNICIPAL FUND

PORTFOLIO MARKET SECTORS July 31, 2018

General Obligation | 43.7% |

Health Care | 20.6% |

Utilities | 16.1% |

Other Revenue | 12.8% |

Transportation | 2.8% |

Cash Equivalents and Other | 2.6% |

Education | 1.4% |

Housing | 0.0% |

| | 100.0% |

Market sectors are breakdowns of the Fund’s portfolio holdings into specific investment classes.

These percentages are based on net assets and are subject to change.

SCHEDULE OF INVESTMENTS July 31, 2018

| | | Principal | | Fair |

| | | Amount | | Value |

MUNICIPAL BONDS (97.4%) | | | | |

| | | | |

Education (1.4%) | | | | |

Kansas Development Finance Authority5.000% 09/01/2039 | $ | 200,000 | $ | 205,804 |

Kansas Development Finance Authority5.000% 06/01/2027 | | 250,000 | | 268,307 |

Sedgwick County Unified School District No 266 Maize5.250% 09/01/2020 | | 345,000 | | 346,080 |

Sedgwick County Unified School District No 266 Maize5.250% 09/01/2020 | | 15,000 | | 15,047 |

| | | | | 835,238 |

General Obligation (43.7%) | | | | |

Bourbon County Unified School District No 234 Fort Scott5.000% 09/01/2027 | | 250,000 | | 284,655 |

Bourbon County Unified School District No 234 Fort Scott5.000% 09/01/2028 | | 250,000 | | 281,962 |

Bourbon County Unified School District No 234 Fort Scott5.000% 09/01/2029 | | 250,000 | | 279,582 |

Bourbon County Unified School District No 234 Fort Scott5.000% 09/01/2030 | | 250,000 | | 278,427 |

Bourbon County Unified School District No 234 Fort Scott5.000% 09/01/2031 | | 500,000 | | 555,385 |

Butler County Unified School District No 402 Augusta5.250% 09/01/2021 | | 560,000 | | 561,747 |

Butler County Unified School District No 402 Augusta4.000% 09/01/2030 | | 250,000 | | 273,617 |

Butler County Unified School District No 385 Andover5.000% 09/01/2018 | | 500,000 | | 501,485 |

County of Clay KS4.000% 10/01/2036 | | 500,000 | | 514,110 |

Cowley County Unified School District No 470 Arkansas City 5.500% 09/01/2021 | | 100,000 | | 100,319 |

Cowley County Unified School District No 470 Arkansas City 4.750% 09/01/2027 | | 490,000 | | 491,490 |

Dickinson County Unified School District No 473 Chapman 5.000% 09/01/2027 | | 325,000 | | 337,451 |

Dickinson County Unified School District No 473 Chapman 4.400% 09/01/2029 | | 100,000 | | 103,188 |

Douglas County Unified School District No 348 Baldwin City 4.000% 09/01/2030 | | 250,000 | | 272,262 |

Douglas County Unified School District No 491 Eudora5.500% 09/01/2024 | | 250,000 | | 250,832 |

Douglas County Unified School District No 491 Eudora5.000% 09/01/2023 | | 375,000 | | 389,242 |

Douglas County Unified School District No 491 Eudora5.125% 09/01/2029 | | 250,000 | | 259,830 |

*Franklin County Unified School District No 290 Ottawa5.000% 09/01/2040 | | 3,000,000 | | 3,295,680 |

Harvey County Unified School District No 373 Newton4.000% 09/01/2018 | | 250,000 | | 250,607 |

Harvey County Unified School District No 373 Newton5.000% 09/01/2023 | | 200,000 | | 200,628 |

Harvey County Unified School District No 373 Newton5.000% 09/01/2025 | | 1,000,000 | | 1,003,140 |

Jackson County Unified School District No 336 Holton5.000% 09/01/2029 | | 135,000 | | 151,600 |

Jackson County Unified School District No 336 Holton5.000% 09/01/2034 | | 140,000 | | 157,214 |

Jackson County Unified School District No 336 Holton5.000% 09/01/2029 | | 115,000 | | 129,092 |

Jackson County Unified School District No 336 Holton5.000% 09/01/2034 | | 110,000 | | 123,479 |

Johnson & Miami Counties Unified School District No 230 Spring Hills 4.000% 09/01/2036 | | 500,000 | | 522,710 |

Johnson County Unified School District No 231 Gardner Edgerton 5.000% 10/01/2025 | | 250,000 | | 284,347 |

Johnson County Unified School District No 233 Olathe4.000% 09/01/2018 | | 150,000 | | 150,383 |

City of Junction City KS5.000% 09/01/2025 | | 5,000 | | 5,002 |

City of Junction City KS4.250% 09/01/2021 | | 100,000 | | 103,006 |

City of Junction City KS4.400% 09/01/2022 | | 100,000 | | 103,166 |

City of Junction City KS4.500% 09/01/2023 | | 100,000 | | 103,273 |

Leavenworth County Unified School District No 4535.250% 03/01/2024 | | 200,000 | | 208,550 |

Leavenworth County Unified School District No 4534.750% 09/01/2025 | | 300,000 | | 311,880 |

*Leavenworth County Unified School District No 4535.125% 03/01/2029 | | 1,000,000 | | 1,042,410 |

Leavenworth County Unified School District No 4585.000% 09/01/2029 | | 500,000 | | 557,640 |

Leavenworth County Unified School District No 4694.000% 09/01/2030 | | 320,000 | | 338,845 |

Leavenworth County Unified School District No 4694.000% 09/01/2032 | | 835,000 | | 865,411 |

Wichita County Unified School District 467 Leoti5.000% 10/01/2018 | | 100,000 | | 100,630 |

City of Manhattan KS5.000% 11/01/2028 | | 130,000 | | 131,108 |

Miami County Unified School District No 368 Paola5.000% 09/01/2027 | | 135,000 | | 147,859 |

Miami County Unified School District No 368 Paola5.000% 09/01/2027 | | 105,000 | | 115,034 |

Miami County Unified School District No 368 Paola5.000% 09/01/2027 | | 10,000 | | 10,875 |

Neosho County Unified School District No 4134.000% 09/01/2031 | | 250,000 | | 260,450 |

City of Newton KS5.000% 09/01/2021 | | 100,000 | | 103,798 |

City of Newton KS4.750% 09/01/2029 | | 435,000 | | 450,355 |

City of Park City KS5.100% 12/01/2020 | | 200,000 | | 209,764 |

City of Park City KS5.500% 12/01/2024 | | 100,000 | | 105,408 |

City of Park City KS6.000% 12/01/2029 | | 500,000 | | 530,330 |

City of Park City KS5.375% 12/01/2025 | | 250,000 | | 262,665 |

County of Scott KS5.000% 04/01/2032 | | 500,000 | | 568,255 |

Sedgwick County Unified School District No 261 Haysville5.000% 11/01/2021 | | 5,000 | | 5,008 |

Sedgwick County Unified School District No 262 Valley Center 5.000% 09/01/2018 | | 100,000 | | 100,321 |

Sedgwick County Unified School District No 262 Valley Center 5.000% 09/01/2028 | | 485,000 | | 486,557 |

Sedgwick County Unified School District No 262 Valley Center 5.000% 09/01/2028 | | 15,000 | | 15,039 |

Sedgwick County Unified School District No 262 Valley Center 5.000% 09/01/2024 | | 245,000 | | 245,715 |

Sedgwick County Unified School District No 262 Valley Center 5.000% 09/01/2024 | | 5,000 | | 5,015 |

Sedgwick County Unified School District No 262 Valley Center 5.000% 09/01/2035 | | 595,000 | | 689,385 |

Sedgwick County Unified School District No 262 Valley Center 5.000% 09/01/2035 | | 405,000 | | 448,930 |

Sedgwick County Unified School District No 265 Goddard4.250% 10/01/2020 | | 750,000 | | 753,990 |

Sedgwick County Unified School District No 265 Goddard4.500% 10/01/2026 | | 250,000 | | 251,370 |

Sedgwick County Unified School District No 266 Maize5.250% 09/01/2019 | | 215,000 | | 215,673 |

Sedgwick County Unified School District No 266 Maize5.250% 09/01/2019 | | 10,000 | | 10,032 |

County of Seward KS5.000% 08/01/2034 | | 260,000 | | 277,701 |

County of Seward KS5.000% 08/01/2034 | | 240,000 | | 253,754 |

Seward County Unified School District No 480 Liberal5.000% 09/01/2034 | | 500,000 | | 562,950 |

Seward County Unified School District No 480 Liberal4.250% 09/01/2039 | | 500,000 | | 546,390 |

Seward County Unified School District No 480 Liberal5.000% 09/01/2033 | | 85,000 | | 95,725 |

Seward County Unified School District No 480 Liberal5.000% 09/01/2033 | | 85,000 | | 94,742 |

Seward County Unified School District No 480 Liberal5.000% 09/01/2033 | | 330,000 | | 367,960 |

City of Wichita KS4.500% 09/01/2022 | | 150,000 | | 151,593 |

City of Wichita KS4.750% 09/01/2027 | | 180,000 | | 181,831 |

Wyandotte County Unified School District No 202 Turner5.250% 09/01/2018 | | 100,000 | | 100,350 |

Wyandotte County Unified School District No 202 Turner5.000% 09/01/2025 | | 250,000 | | 283,988 |

Wyandotte County Unified School District No 500 Kansas City 5.000% 09/01/2026 | | 1,000,000 | | 1,160,600 |

| | | | | 25,944,797 |

Health Care (20.6%) | | | | |

Ashland Public Building Commission5.000% 09/01/2030 | | 1,020,000 | | 1,075,376 |

Ashland Public Building Commission5.000% 09/01/2035 | | 500,000 | | 522,250 |

Ashland Public Building Commission5.000% 09/01/2032 | | 550,000 | | 583,253 |

Kansas Development Finance Authority5.000% 06/15/2039 | | 1,000,000 | | 1,019,950 |

Kansas Development Finance Authority5.000% 01/01/2040 | | 435,000 | | 457,433 |

Kansas Development Finance Authority5.000% 01/01/2040 | | 65,000 | | 66,912 |

Kansas Development Finance Authority5.150% 11/15/2023 | | 5,000 | | 5,210 |

Kansas Development Finance Authority5.250% 11/15/2024 | | 5,000 | | 5,215 |

Kansas Development Finance Authority5.500% 11/15/2029 | | 5,000 | | 5,232 |

Kansas Development Finance Authority5.150% 11/15/2023 | | 245,000 | | 255,635 |

Kansas Development Finance Authority5.250% 11/15/2024 | | 245,000 | | 256,846 |

Kansas Development Finance Authority5.500% 11/15/2029 | | 95,000 | | 99,082 |

Kansas Development Finance Authority5.000% 05/15/2025 | | 250,000 | | 256,293 |

Kansas Development Finance Authority5.000% 05/15/2035 | | 1,000,000 | | 1,027,080 |

Kansas Development Finance Authority5.000% 03/01/2028 | | 755,000 | | 785,940 |

Kansas Development Finance Authority4.125% 11/15/2027 | | 100,000 | | 105,220 |

City of Lawrence KS5.000% 07/01/2043 | | 1,500,000 | | 1,665,960 |

City of Manhattan KS5.000% 11/15/2023 | | 250,000 | | 277,078 |

City of Manhattan KS5.000% 11/15/2024 | | 250,000 | | 276,033 |

City of Manhattan KS5.000% 11/15/2029 | | 500,000 | | 540,350 |

City of Olathe KS5.000% 09/01/2030 | | 250,000 | | 259,138 |

City of Olathe KS4.000% 09/01/2028 | | 250,000 | | 258,080 |

City of Olathe KS4.000% 09/01/2030 | | 445,000 | | 457,286 |

University of Kansas Hospital Authority4.000% 09/01/2040 | | 500,000 | | 505,500 |

University of Kansas Hospital Authority5.000% 09/01/2035 | | 500,000 | | 552,505 |

University of Kansas Hospital Authority5.000% 03/01/2031 | | 500,000 | | 568,705 |

City of Wichita KS5.000% 11/15/2029 | | 300,000 | | 330,291 |

| | | | | 12,217,853 |

Other Revenue (12.8%) | | | | |

City of Dodge City KS5.000% 06/01/2021 | | 310,000 | | 319,052 |

City of Dodge City KS4.400% 06/01/2025 | | 350,000 | | 358,516 |

City of Dodge City KS4.500% 06/01/2028 | | 100,000 | | 102,516 |

*City of Dodge City KS5.250% 06/01/2031 | | 1,000,000 | | 1,031,260 |

Kansas Development Finance Authority4.125% 05/01/2031 | | 500,000 | | 513,830 |

Kansas Development Finance Authority5.000% 11/01/2034 | | 500,000 | | 516,525 |

Kansas Development Finance Authority5.000% 05/01/2035 | | 250,000 | | 254,718 |

City of Manhattan KS5.000% 12/01/2026 | | 470,000 | | 480,913 |

City of Manhattan KS4.500% 12/01/2025 | | 500,000 | | 524,990 |

*City of Manhattan KS5.000% 12/01/2032 | | 1,000,000 | | 1,057,300 |

County of Neosho KS4.000% 10/01/2023 | | 500,000 | | 513,010 |

Topeka Public Building Commission5.000% 06/01/2022 | | 255,000 | | 260,554 |

Washington County Public Building Commission5.000% 09/01/2032 | | 500,000 | | 560,645 |

Washington County Public Building Commission5.000% 09/01/2037 | | 400,000 | | 448,516 |

Washington County Public Building Commission4.000% 09/01/2028 | | 500,000 | | 539,860 |

Washington County Public Building Commission4.000% 09/01/2028 | | 100,000 | | 105,203 |

| | | | | 7,587,408 |

Transportation (2.8%) | | | | |

State of Kansas Department of Transportation5.000% 09/01/2033 | | 500,000 | | 574,950 |

State of Kansas Department of Transportation5.000% 09/01/2034 | | 500,000 | | 571,830 |

State of Kansas Department of Transportation5.000% 09/01/2035 | | 250,000 | | 283,678 |

Kansas Development Finance Authority4.625% 10/01/2026 | | 250,000 | | 251,265 |

| | | | | 1,681,723 |

Utilities (16.1%) | | | | |

*Kansas Municipal Energy Agency5.750% 07/01/2038 | | 1,000,000 | | 1,117,140 |

Kansas Municipal Energy Agency5.000% 04/01/2030 | | 250,000 | | 279,345 |

Kansas Municipal Energy Agency5.000% 04/01/2032 | | 500,000 | | 554,515 |

Kansas Municipal Energy Agency5.000% 04/01/2033 | | 745,000 | | 823,575 |

Kansas Municipal Energy Agency5.000% 04/01/2038 | | 1,000,000 | | 1,090,910 |

Kansas Municipal Energy Agency5.000% 04/01/2035 | | 300,000 | | 329,661 |

Kansas Power Pool4.500% 12/01/2028 | | 500,000 | | 517,980 |

Kansas Power Pool5.000% 12/01/2031 | | 750,000 | | 808,208 |

Kansas Power Pool4.000% 12/01/2031 | | 500,000 | | 526,720 |

Wyandotte County Kansas City Unified Government Utility System Revenue 5.000% 09/01/2024 | 200,000 | | 203,954 |

Wyandotte County Kansas City Unified Government Utility System Revenue 5.000% 09/01/2029 | 500,000 | | 509,885 |

Wyandotte County Kansas City Unified Government Utility System Revenue 5.000% 09/01/2036 | 250,000 | | 266,335 |

*Wyandotte County Kansas City Unified Government Utility System Revenue 5.000% 09/01/2032 | 1,250,000 | | 1,382,125 |

Wyandotte County Kansas City Unified Government Utility System Revenue 5.000% 09/01/2035 | 500,000 | | 551,840 |

Wyandotte County Kansas City Unified Government Utility System Revenue 5.000% 09/01/2028 | 500,000 | | 569,905 |

| | | | | 9,532,098 |

| | | | |

TOTAL MUNICIPAL BONDS (COST: $56,402,765) | | | $ | 57,799,117 |

| | | | |

OTHER ASSETS LESS LIABILITIES (2.6%) | | | $ | 1,517,332 |

| | | | |

NET ASSETS (100.0%) | | | $ | 59,316,449 |

|

*Indicates all or a portion of bonds are segregated by the custodian to cover when-issued or delayed-delivery purchases when they occur. As of July 31, 2018, there were no such purchases. |

|

|

The accompanying notes are an integral part of these financial statements. |

MAINE MUNICIPAL FUND

PORTFOLIO MARKET SECTORS July 31, 2018

Health Care | 27.6% |

General Obligation | 32.9% |

Education | 17.0% |

Transportation | 11.8% |

Housing | 3.4% |

Other Revenue | 3.3% |

Utilities | 2.8% |

Cash Equivalents and Other | 1.2% |

| | 100.0% |

Market sectors are breakdowns of the Fund’s portfolio holdings into specific investment classes.

These percentages are based on net assets.

SCHEDULE OF INVESTMENTS July 31, 2018

| | | Principal | | Fair |

| | | Amount | | Value |

MUNICIPAL BONDS (98.8%) | | | | |

| | | | |

Education (17.0%) | | | | |

Maine Educational Loan Authority5.875% 12/01/2039 | $ | 105,000 | $ | 107,555 |

Maine Educational Loan Authority4.450% 12/01/2025 | | 100,000 | | 104,189 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2039 | | 750,000 | | 836,415 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2034 | | 250,000 | | 279,115 |

Maine Health & Higher Educational Facilities Authority4.750% 07/01/2031 | | 250,000 | | 264,305 |

Maine Health & Higher Educational Facilities Authority4.000% 07/01/2024 | | 270,000 | | 290,458 |

*Maine Health & Higher Educational Facilities Authority5.000% 07/01/2026 | | 940,000 | | 1,088,830 |

Regional School Unit No 1 Lower Kennebec Region School Unit 5.000% 02/01/2026 | | 100,000 | | 107,482 |

| | | | | 3,078,349 |

General Obligation (32.9%) | | | | |

City of Auburn ME4.500% 09/01/2022 | | 100,000 | | 110,004 |

City of Bangor ME4.000% 09/01/2024 | | 155,000 | | 155,305 |

City of Biddeford ME4.000% 10/01/2026 | | 250,000 | | 279,755 |

Town of Gorham ME4.000% 10/01/2023 | | 100,000 | | 105,630 |

Town of Gray ME4.000% 10/15/2026 | | 280,000 | | 288,187 |

Town of Gray ME4.000% 10/15/2027 | | 280,000 | | 288,187 |

State of Maine4.000% 06/01/2020 | | 150,000 | | 158,146 |

*State of Maine5.000% 06/01/2025 | | 500,000 | | 593,285 |

Maine State Housing Authority5.000% 06/15/2024 | | 250,000 | | 263,035 |

City of Portland ME4.250% 05/01/2029 | | 150,000 | | 152,552 |

City of Portland ME4.125% 10/01/2029 | | 100,000 | | 102,166 |

City of Portland ME5.000% 08/01/2021 | | 125,000 | | 138,174 |

City of Portland ME5.000% 08/01/2022 | | 125,000 | | 138,135 |

City of Portland ME5.000% 04/01/2028 | | 250,000 | | 301,153 |

City of Saco ME4.000% 04/01/2028 | | 100,000 | | 102,988 |

City of Saco ME5.000% 10/01/2030 | | 250,000 | | 302,585 |

Town of Scarborough ME4.000% 11/01/2028 | | 100,000 | | 106,673 |

Maine School Administration District No 154.000% 11/01/2026 | | 145,000 | | 163,245 |

Maine School Administration District No 154.000% 11/01/2027 | | 145,000 | | 164,136 |

Maine School Administrative District No 514.250% 10/15/2029 | | 250,000 | | 258,022 |

Maine School Administrative District No 514.000% 10/15/2029 | | 100,000 | | 109,506 |

Maine School Administrative District No 284.000% 05/01/2036 | | 500,000 | | 522,160 |

City of Waterville ME4.000% 07/01/2025 | | 135,000 | | 143,244 |

Wells Ogunquit Community School District4.000% 11/01/2024 | | 100,000 | | 112,614 |

City of Westbrook ME5.000% 10/15/2026 | | 490,000 | | 574,500 |

Town of Yarmouth ME5.000% 11/15/2028 | | 250,000 | | 308,085 |

| | | | | 5,941,472 |

Health Care (27.6%) | | | | |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2020 | | 50,000 | | 53,246 |

Maine Health & Higher Educational Facilities Authority4.500% 07/01/2031 | | 10,000 | | 10,555 |

Maine Health & Higher Educational Facilities Authority5.250% 07/01/2023 | | 10,000 | | 10,698 |

Maine Health & Higher Educational Facilities Authority4.500% 07/01/2031 | | 190,000 | | 196,502 |

Maine Health & Higher Educational Facilities Authority5.250% 07/01/2023 | | 190,000 | | 201,962 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2020 | | 250,000 | | 265,280 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2040 | | 250,000 | | 261,720 |

*Maine Health & Higher Educational Facilities Authority5.000% 07/01/2029 | | 1,000,000 | | 1,097,750 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2030 | | 500,000 | | 552,565 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2031 | | 500,000 | | 547,700 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2023 | | 15,000 | | 17,164 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2023 | | 235,000 | | 267,632 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2022 | | 30,000 | | 30,069 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2039 | | 195,000 | | 201,133 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2026 | | 35,000 | | 36,101 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2039 | | 415,000 | | 424,416 |

Maine Health & Higher Educational Facilities Authority5.000% 07/01/2026 | | 80,000 | | 82,294 |

Maine Health & Higher Educational Facilities Authority5.125% 07/01/2039 | | 245,000 | | 252,916 |

Maine Health & Higher Educational Facilities Authority5.125% 07/01/2039 | | 470,000 | | 482,103 |

| | | | | 4,991,806 |

Housing (3.4%) | | | | |

Maine State Housing Authority4.000% 11/15/2035 | | 435,000 | | 441,734 |

Maine State Housing Authority4.000% 11/15/2030 | | 170,000 | | 173,357 |

| | | | | 615,091 |

Other Revenue (3.3%) | | | | |

Maine Governmental Facilities Authority4.000% 10/01/2024 | | 200,000 | | 210,372 |

Maine Municipal Bond Bank4.000% 11/01/2038 | | 125,000 | | 128,513 |

Maine Municipal Bond Bank5.000% 11/01/2025 | | 125,000 | | 140,119 |

Maine Municipal Bond Bank5.000% 11/01/2027 | | 100,000 | | 115,819 |

Maine Municipal Bond Bank4.900% 11/01/2024 | | 5,000 | | 5,006 |

| | | | | 599,829 |

Transportation (11.8%) | | | | |

*Maine Municipal Bond Bank5.000% 09/01/2024 | | 1,000,000 | | 1,037,100 |

Maine Municipal Bond Bank5.000% 09/01/2024 | | 210,000 | | 244,329 |

Maine Turnpike Authority4.000% 07/01/2032 | | 250,000 | | 258,163 |

City of Portland ME General Airport Revenue5.250% 01/01/2035 | | 250,000 | | 257,433 |

City of Portland ME General Airport Revenue5.000% 07/01/2022 | | 100,000 | | 110,538 |

City of Portland ME General Airport Revenue5.000% 07/01/2023 | | 100,000 | | 112,142 |

City of Portland ME General Airport Revenue5.000% 07/01/2024 | | 100,000 | | 111,315 |

| | | | | 2,131,020 |

Utilities (2.8%) | | | | |

*Kennebunk Light & Power District5.000% 08/01/2022 | | 500,000 | | 500,415 |

| | | | |

| | | | | |

TOTAL MUNICIPAL BONDS (COST: $17,523,909) | | | $ | 17,857,982 |

| | | | |

OTHER ASSETS LESS LIABILITIES (1.2%) | | | $ | 209,414 |

| | | | |

NET ASSETS (100.0%) | | | $ | 18,067,396 |

|

* Indicates all or a portion of bonds are segregated by the custodian to cover when-issued or delayed-delivery purchases when they occur. As of July 31, 2018, there were no such purchases. |

|

|

The accompanying notes are an integral part of these financial statements. |

NEBRASKA MUNICIPAL FUND

PORTFOLIO MARKET SECTORS July 31, 2018

Utilities | 31.6% |

General Obligation | 27.6% |

Education | 16.3% |

Health Care | 10.3% |

Other Revenue | 5.9% |

Transportation | 4.9% |

Cash Equivalents and Other | 1.7% |

Housing | 1.7% |

| | 100.0% |

Market sectors are breakdowns of the Fund’s portfolio holdings into specific investment classes.

These percentages are based on net assets and are subject to change.

SCHEDULE OF INVESTMENTS July 31, 2018

| | | Principal | | Fair |

| | | Amount | | Value |

MUNICIPAL BONDS (98.3%) | | | | |

| | | | |

Education (16.3%) | | | | |

County of Douglas NE5.500% 07/01/2030 | $ | 350,000 | $ | 375,606 |

*County of Douglas NE5.875% 07/01/2040 | | 1,500,000 | | 1,620,300 |

Douglas County Hospital Authority No 24.750% 09/01/2028 | | 200,000 | | 200,520 |

Nebraska Educational Health & Social Services Finance Authority 5.050% 09/01/2030 | | 250,000 | | 269,230 |

Nebraska Elementary & Secondary School Finance Authority4.750% 09/01/2028 | | 250,000 | | 250,608 |

University of Nebraska5.000% 07/01/2035 | | 1,500,000 | | 1,689,405 |

University of Nebraska5.000% 05/15/2035 | | 500,000 | | 564,210 |

University of Nebraska5.000% 05/15/2033 | | 250,000 | | 285,855 |

University of Nebraska4.000% 07/01/2024 | | 250,000 | | 254,722 |

University of Nebraska4.500% 05/15/2030 | | 250,000 | | 262,282 |

University of Nebraska5.000% 05/15/2035 | | 275,000 | | 290,922 |

University of Nebraska5.000% 07/01/2042 | | 1,000,000 | | 1,079,690 |

University of Nebraska5.000% 07/01/2038 | | 250,000 | | 274,080 |

| | | | | 7,417,430 |

General Obligation (27.6%) | | | | |

*Omaha School District5.000% 12/15/2029 | | 1,630,000 | | 1,933,865 |

Elkhorn School District4.000% 12/15/2034 | | 300,000 | | 314,133 |

Elkhorn School District4.000% 12/15/2030 | | 500,000 | | 531,475 |

Elkhorn School District4.000% 12/15/2034 | | 500,000 | | 529,390 |

Hall County Airport Authority5.000% 07/15/2030 | | 410,000 | | 436,207 |

Hall County Airport Authority5.000% 07/15/2031 | | 435,000 | | 462,205 |

Grand Island Public Schools5.000% 12/15/2033 | | 500,000 | | 559,595 |

Grand Island Public Schools5.000% 12/15/2039 | | 500,000 | | 561,175 |

City of Omaha NE5.000% 04/15/2025 | | 750,000 | | 878,595 |

City of Omaha NE5.000% 04/15/2027 | | 955,000 | | 1,122,765 |

City of Omaha NE5.000% 04/15/2028 | | 500,000 | | 583,790 |

City of Omaha NE5.000% 10/15/2025 | | 45,000 | | 46,834 |

City of Omaha NE5.000% 10/15/2025 | | 205,000 | | 213,563 |

Papillion La Vista School District5.000% 12/01/2028 | | 250,000 | | 252,800 |

Papio Missouri River Natural Resource District4.000% 12/15/2030 | | 1,000,000 | | 1,023,020 |

Platte County School District No 1 Columbus Public Schools5.000% 12/15/2039 | | 750,000 | | 835,147 |

City of Ralston NE4.500% 09/15/2031 | | 400,000 | | 360,808 |

Gretna Public Schools5.000% 12/15/2035 | | 250,000 | | 280,820 |

Scotts Bluff County School District No 325.000% 12/01/2031 | | 250,000 | | 284,682 |

City of Sidney NE4.000% 12/15/2036 | | 1,250,000 | | 1,290,787 |

| | | | | 12,501,656 |

Health Care (10.3%) | | | | |

Douglas County Hospital Authority No 25.500% 01/01/2030 | | 500,000 | | 520,670 |

Douglas County Hospital Authority No 25.000% 05/15/2027 | | 200,000 | | 230,152 |

Douglas County Hospital Authority No 35.500% 11/01/2038 | | 795,000 | | 802,696 |

Douglas County Hospital Authority No 35.500% 11/01/2038 | | 415,000 | | 419,017 |

Lincoln County Hospital Authority No 15.000% 11/01/2023 | | 250,000 | | 271,377 |

Lincoln County Hospital Authority No 15.000% 11/01/2024 | | 250,000 | | 270,745 |

Lincoln County Hospital Authority No 15.000% 11/01/2025 | | 250,000 | | 270,662 |

Lincoln County Hospital Authority No 15.000% 11/01/2032 | | 250,000 | | 261,312 |

Madison County Hospital Authority No 15.000% 07/01/2031 | | 500,000 | | 540,730 |

Madison County Hospital Authority No 15.000% 07/01/2032 | | 335,000 | | 361,227 |

Madison County Hospital Authority No 15.000% 07/01/2033 | | 450,000 | | 483,808 |

Madison County Hospital Authority No 15.000% 07/01/2034 | | 215,000 | | 230,465 |

| | | | | 4,662,861 |

Housing (1.7%) | | | | |

Hospital Authority No 1 of Lancaster County5.500% 01/01/2030 | | 250,000 | | 260,335 |

Sarpy County Hospital Authority No 15.500% 01/01/2030 | | 500,000 | | 520,670 |

| | | | | 781,005 |

Other Revenue (5.9%) | | | | |

West Haymarket Joint Public Agency5.000% 12/15/2042 | | 750,000 | | 816,757 |

Nebraska Cooperative Republican Platte Enhancement Project5.125% 12/15/2033 | | 250,000 | | 252,002 |

Nebraska Cooperative Republican Platte Enhancement Project5.000% 12/15/2038 | | 160,000 | | 161,682 |

Omaha Public Facilities Corp4.000% 11/15/2031 | | 115,000 | | 115,523 |

*City of Omaha NE5.000% 02/01/2027 | | 1,000,000 | | 1,107,530 |

Upper Republican Natural Resource District4.000% 12/15/2024 | | 200,000 | | 202,794 |

| | | | | 2,656,288 |

Transportation (4.9%) | | | | |

City of Lincoln NE5.500% 08/15/2031 | | 500,000 | | 541,400 |

Omaha Airport Authority5.000% 12/15/2027 | | 500,000 | | 578,745 |

Omaha Airport Authority5.000% 12/15/2036 | | 1,000,000 | | 1,123,830 |

| | | | | 2,243,975 |

Utilities (31.6%) | | | | |

*Central Plains Energy Project5.000% 09/01/2027 | | 2,000,000 | | 2,198,460 |

Central Plains Energy Project5.250% 09/01/2037 | | 500,000 | | 554,650 |

Central Plains Energy Project5.000% 09/01/2042 | | 500,000 | | 549,615 |

City of Columbus NE Combined Revenue4.000% 12/15/2032 | | 100,000 | | 105,616 |

City of Grand Island NE Sewer System Revenue5.000% 09/15/2026 | | 250,000 | | 281,153 |

City of Hastings NE Combined Utility Revenue4.000% 10/15/2032 | | 500,000 | | 522,610 |

*City of Lincoln NE Electric System Revenue5.000% 09/01/2037 | | 1,000,000 | | 1,091,070 |

City of Lincoln NE Solid Waste Management Revenue4.000% 08/01/2025 | | 275,000 | | 300,493 |

City of Lincoln NE Solid Waste Management Revenue4.000% 08/01/2027 | | 400,000 | | 431,940 |

City of Lincoln NE Water Revenue4.000% 08/15/2025 | | 250,000 | | 255,853 |

City of Lincoln NE Water Revenue4.500% 08/15/2034 | | 250,000 | | 255,270 |

Metropolitan Utilities District of Omaha4.000% 12/15/2026 | | 250,000 | | 267,280 |

Municipal Energy Agency of Nebraska5.125% 04/01/2024 | | 195,000 | | 199,721 |

Municipal Energy Agency of Nebraska5.000% 04/01/2030 | | 500,000 | | 543,945 |

Municipal Energy Agency of Nebraska5.000% 04/01/2032 | | 100,000 | | 108,399 |

Nebraska Public Power District5.000% 01/01/2041 | | 250,000 | | 281,000 |

*Nebraska Public Power District5.000% 01/01/2036 | | 2,355,000 | | 2,623,494 |

Nebraska Public Power District5.000% 01/01/2030 | | 500,000 | | 547,395 |

City of Omaha NE Sewer Revenue5.000% 11/15/2029 | | 250,000 | | 285,678 |

City of Omaha NE Sewer Revenue5.000% 11/15/2030 | | 250,000 | | 284,213 |

City of Omaha NE Sewer Revenue5.000% 11/15/2031 | | 500,000 | | 566,565 |

City of Omaha NE Sewer Revenue4.000% 04/01/2035 | | 250,000 | | 261,298 |

Omaha Public Power District Nebraska City Station Unit 25.000% 02/01/2032 | | 250,000 | | 280,818 |

Omaha Public Power District Nebraska City Station Unit 25.000% 02/01/2031 | | 445,000 | | 506,134 |

Omaha Public Power District Nebraska City Station Unit 24.000% 02/01/2032 | | 400,000 | | 419,688 |

Omaha Public Power District Nebraska City Station Unit 24.000% 02/01/2035 | | 365,000 | | 380,863 |

Southern Public Power District5.000% 12/15/2023 | | 250,000 | | 253,438 |

| | | | | 14,356,659 |

| | | | |

TOTAL MUNICIPAL BONDS (COST: $43,713,121) | | | $ | 44,619,874 |

| | | | |

OTHER ASSETS LESS LIABILITIES (1.7%) | | | $ | 768,186 |

| | | | |

NET ASSETS (100.0%) | | | $ | 45,388,060 |

|

*Indicates all or a portion of bonds are segregated by the custodian to cover when-issued or delayed-delivery purchases when they occur. As of July 31, 2018, there were no such purchases. |

|

|

The accompanying notes are an integral part of these financial statements. |

OKLAHOMA MUNICIPAL FUND

PORTFOLIO MARKET SECTORS July 31, 2018

Utilities | 34.6% |

Other Revenue | 29.1% |

Education | 17.7% |

Transportation | 7.0% |

Health Care | 6.7% |

General Obligation | 3.0% |

Cash Equivalents and Other | 1.9% |

Housing | 0.0% |

| | 100.0% |

Market sectors are breakdowns of the Fund’s portfolio holdings into specific investment classes.

These percentages are based on net assets and are subject to change.

SCHEDULE OF INVESTMENTS July 31, 2018

| | | Principal | | Fair |

| | | Amount | | Value |

MUNICIPAL BONDS (98.1%) | | | | |

| | | | |

Education (17.7%) | | | | |

Okarche Economic Development Authority5.000% 09/01/2023 | $ | 250,000 | $ | 276,360 |

Oklahoma Agricultural & Mechanical Colleges5.000% 07/01/2039 | | 140,000 | | 144,403 |

Oklahoma Agricultural & Mechanical Colleges4.400% 08/01/2039 | | 740,000 | | 764,627 |

*Oklahoma City Community College/OK4.375% 07/01/2030 | | 750,000 | | 772,950 |

Oklahoma Development Finance Authority4.400% 12/01/2029 | | 250,000 | | 256,470 |

Oklahoma Development Finance Authority5.000% 06/01/2039 | | 500,000 | | 550,690 |

Oklahoma Development Finance Authority5.000% 06/01/2029 | | 250,000 | | 283,475 |

Oklahoma Development Finance Authority5.000% 06/01/2034 | | 500,000 | | 558,990 |

Oklahoma Development Finance Authority5.000% 06/01/2039 | | 500,000 | | 548,730 |

Oklahoma Development Finance Authority4.000% 08/01/2030 | | 280,000 | | 294,795 |

Oklahoma Development Finance Authority4.000% 08/01/2031 | | 290,000 | | 304,512 |

Oklahoma Development Finance Authority4.000% 08/01/2032 | | 305,000 | | 319,411 |

Oklahoma Development Finance Authority4.000% 08/01/2033 | | 315,000 | | 329,005 |

University of Oklahoma/The5.000% 07/01/2037 | | 290,000 | | 315,242 |

University of Oklahoma/The5.000% 07/01/2036 | | 500,000 | | 554,230 |

University of Oklahoma/The4.000% 07/01/2040 | | 650,000 | | 670,637 |

University of Oklahoma/The5.000% 07/01/2038 | | 500,000 | | 551,570 |

| | | | | 7,496,097 |

General Obligation (3.0%) | | | | |

City of Broken Arrow OK4.125% 08/01/2031 | | 180,000 | | 187,925 |

*City of Oklahoma City OK4.000% 03/01/2024 | | 1,000,000 | | 1,088,330 |

| | | | | 1,276,255 |

Health Care (6.7%) | | | | |

Oklahoma Development Finance Authority5.000% 08/15/2025 | | 350,000 | | 410,942 |

Oklahoma Development Finance Authority5.000% 08/15/2029 | | 250,000 | | 282,987 |

Oklahoma Development Finance Authority4.000% 08/15/2038 | | 250,000 | | 254,285 |

Oklahoma Development Finance Authority5.000% 08/15/2024 | | 220,000 | | 245,487 |

Oklahoma Development Finance Authority5.000% 08/15/2025 | | 220,000 | | 248,239 |

Oklahoma Development Finance Authority5.000% 08/15/2029 | | 345,000 | | 389,329 |

Oklahoma Development Finance Authority5.000% 08/15/2033 | | 175,000 | | 194,680 |

Oklahoma Development Finance Authority5.000% 02/15/2042 | | 250,000 | | 276,135 |

Oklahoma Development Finance Authority5.000% 07/01/2035 | | 250,000 | | 267,655 |

Tulsa County Industrial Authority4.600% 02/01/2035 | | 250,000 | | 256,120 |

| | | | | 2,825,859 |

Other Revenue (29.1%) | | | | |

Caddo County Governmental Building Authority5.000% 09/01/2040 | | 1,010,000 | | 1,081,760 |

Collinsville Municipal Authority5.000% 03/01/2035 | | 275,000 | | 291,258 |

Collinsville Municipal Authority5.000% 03/01/2040 | | 250,000 | | 264,780 |

Grady County School Finance Authority5.000% 09/01/2032 | | 370,000 | | 419,010 |

City of Oklahoma City OK5.000% 03/01/2032 | | 250,000 | | 262,753 |

City of Oklahoma City OK5.000% 03/01/2034 | | 500,000 | | 520,280 |

City of Oklahoma City OK5.000% 03/01/2033 | | 250,000 | | 260,793 |

Oklahoma City Public Property Authority4.500% 10/01/2031 | | 155,000 | | 155,071 |

Oklahoma City Public Property Authority5.000% 10/01/2027 | | 350,000 | | 400,320 |

Oklahoma City Public Property Authority5.000% 10/01/2028 | | 400,000 | | 455,048 |

Oklahoma City Public Property Authority5.000% 10/01/2029 | | 625,000 | | 706,688 |

Oklahoma City Public Property Authority5.000% 10/01/2036 | | 230,000 | | 253,271 |

Oklahoma City Public Property Authority5.000% 10/01/2039 | | 835,000 | | 913,098 |

#Oklahoma Capitol Improvement Authority4.000% 07/01/2043 | | 500,000 | | 508,850 |

Oklahoma Water Resources Board5.000% 10/01/2029 | | 250,000 | | 285,963 |

Oklahoma Water Resources Board5.000% 10/01/2033 | | 500,000 | | 564,700 |

Oklahoma Water Resources Board5.000% 10/01/2029 | | 250,000 | | 292,475 |

Okmulgee County Governmental Building Authority4.250% 12/01/2035 | | 500,000 | | 517,995 |

Pawnee County Public Programs Authority4.875% 02/01/2030 | | 145,000 | | 152,176 |

*Rogers County Industrial Development Authority4.900% 04/01/2035 | | 500,000 | | 527,100 |

Sand Springs Municipal Authority4.250% 01/01/2035 | | 250,000 | | 269,085 |

Sand Springs Municipal Authority4.000% 01/01/2036 | | 500,000 | | 517,870 |

Tahlequah Public Facilities Authority4.000% 04/01/2023 | | 550,000 | | 586,020 |

Tulsa County Industrial Authority3.000% 09/01/2027 | | 245,000 | | 245,399 |

Tulsa Airports Improvement Trust5.000% 06/01/2023 | | 420,000 | | 450,836 |

Tulsa Airports Improvement Trust5.000% 06/01/2024 | | 230,000 | | 245,796 |

Tulsa Airports Improvement Trust5.250% 06/01/2025 | | 245,000 | | 262,821 |

Tulsa Airports Improvement Trust5.250% 06/01/2026 | | 360,000 | | 385,200 |

Tulsa Parking Authority4.000% 07/01/2025 | | 500,000 | | 522,980 |

| | | | | 12,319,396 |

Transportation (7.0%) | | | | |

Oklahoma Capitol Improvement Authority4.000% 10/01/2024 | | 800,000 | | 852,344 |

Oklahoma Capitol Improvement Authority4.000% 10/01/2025 | | 1,000,000 | | 1,061,570 |

Oklahoma Turnpike Authority5.000% 01/01/2028 | | 250,000 | | 267,275 |

Oklahoma Turnpike Authority4.000% 01/01/2031 | | 500,000 | | 516,985 |

Oklahoma Turnpike Authority5.000% 01/01/2030 | | 250,000 | | 269,953 |

| | | | | 2,968,127 |

Utilities (34.6%) | | | | |

Clinton Public Works Authority4.000% 12/01/2034 | | 750,000 | | 779,610 |

Clinton Public Works Authority4.000% 12/01/2039 | | 500,000 | | 513,120 |

Coweta Public Works Authority4.000% 08/01/2032 | | 1,000,000 | | 1,024,080 |

Glenpool Utility Services Authority5.100% 12/01/2035 | | 250,000 | | 266,315 |

*Grand River Dam Authority5.250% 06/01/2040 | | 2,000,000 | | 2,119,160 |

Grand River Dam Authority5.000% 06/01/2033 | | 500,000 | | 558,465 |

Holdenville Public Works Authority5.000% 11/01/2033 | | 620,000 | | 676,129 |

Miami Special Utility Authority4.000% 12/01/2036 | | 500,000 | | 518,890 |

*Midwest City Municipal Authority5.000% 03/01/2025 | | 2,000,000 | | 2,151,020 |

Oklahoma City Water Utilities Trust4.000% 07/01/2034 | | 250,000 | | 255,875 |

Oklahoma City Water Utilities Trust5.000% 07/01/2031 | | 250,000 | | 270,728 |

Oklahoma City Water Utilities Trust5.000% 07/01/2034 | | 100,000 | | 113,229 |

Oklahoma City Water Utilities Trust4.000% 07/01/2039 | | 175,000 | | 181,328 |

Oklahoma City Water Utilities Trust5.000% 07/01/2034 | | 250,000 | | 286,765 |

*Oklahoma Municipal Power Authority5.750% 01/01/2024 | | 1,180,000 | | 1,260,157 |

Oklahoma Municipal Power Authority5.000% 01/01/2038 | | 575,000 | | 640,291 |

Oklahoma Water Resources Board5.000% 04/01/2028 | | 500,000 | | 511,860 |

Oklahoma Water Resources Board5.000% 04/01/2032 | | 140,000 | | 153,352 |

Oklahoma Water Resources Board4.000% 04/01/2025 | | 150,000 | | 160,203 |

Sallisaw Municipal Authority4.450% 01/01/2028 | | 100,000 | | 102,578 |

Sapulpa Municipal Authority5.000% 04/01/2028 | | 750,000 | | 824,663 |

Seminole Utilities Authority3.150% 09/01/2025 | | 380,000 | | 384,598 |

Seminole Utilities Authority3.300% 09/01/2026 | | 315,000 | | 321,092 |

Tulsa Metropolitan Utility Authority5.000% 10/01/2025 | | 500,000 | | 596,960 |

| | | | | 14,670,468 |

| | | | |

TOTAL MUNICIPAL BONDS (COST: $40,719,608) | | | $ | 41,556,202 |

| | | | |

OTHER ASSETS LESS LIABILITIES (1.9%) | | | $ | 794,299 |

| | | | |

NET ASSETS (100.0%) | | | $ | 42,350,501 |

|

* Indicates all or a portion of bonds are segregated by the custodian to cover when-issued or delayed-delivery purchases when they occur. |

|

#When-issued purchase as of July 31, 2018. |

|

|

The accompanying notes are an integral part of these financial statements. |

VIKING TAX-FREE FUND FOR MONTANA

PORTFOLIO MARKET SECTORS July 31, 2018

General Obligation | 42.0% |

Health Care | 20.0% |

Other Revenue | 10.1% |

Education | 9.7% |