UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09277

Viking Mutual Funds

(Exact name of registrant as specified in charter)

| 1 Main Street North, Minot, ND | | 58703 |

| (Address of principal offices) | | (Zip code) |

Brent Wheeler and/or Kevin Flagstad, PO Box 500, Minot, ND 58702

(Name and address of agent for service)

Registrant’s telephone number, including area code: 701-852-5292

Date of fiscal year end: July 31

Date of reporting period: July 31, 2024

This N-CSR filing is amended to include the Report of Independent Registered Public Accountants.

Item 1. Reports to Stockholders

Kansas Municipal Fund Class A / KSMUX |

This shareholder report contains important information about the Kansas Municipal Fund. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class A | $98 | 0.98% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class A shares returned 2.09%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted with and without sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

August 1, 2014 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | 10 Years |

| Class A without sales charge | 2.09 | -0.15 | 1.29 |

| Class A with sales charge | -0.46 | -0.66 | 1.03 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.47 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $59 |

| Number of Holdings | 88 |

| Total Advisory Fee | $182K |

| Annual Portfolio Turnover | 29% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 51.7 | | A | 15.56 | |

| Health Care | 11.4 | | AA | 59.09 | |

| Utilities | 9.1 | | AAA | 14.57 | |

| Pre-Refunded | 8.9 | | BBB | 6.24 | |

| Other Revenue | 7.3 | | NR | 4.54 | |

| Education | 6.6 | | | | |

| Housing | 2.1 | | | | |

| Cash Equivalents and Other | 1.6 | | | | |

| Transportation | 1.3 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Kansas Municipal Fund Class I / KSITX |

This shareholder report contains important information about the Kansas Municipal Fund. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class I | $73 | 0.73% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class I shares returned 2.45%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

November 1, 2017 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | Inception^ |

| Class I | 2.45 | 0.12 | 0.98 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.01 |

^Inception Date of 11/1/2017 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $59 |

| Number of Holdings | 88 |

| Total Advisory Fee Paid | $182K |

| Annual Portfolio Turnover | 29% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 51.7 | | A | 15.56 | |

| Health Care | 11.4 | | AA | 59.09 | |

| Utilities | 9.1 | | AAA | 14.57 | |

| Pre-Refunded | 8.9 | | BBB | 6.24 | |

| Other Revenue | 7.3 | | NR | 4.54 | |

| Education | 6.6 | | | | |

| Housing | 2.1 | | | | |

| Cash Equivalents and Other | 1.6 | | | | |

| Transportation | 1.3 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Maine Municipal Fund Class A / MEMUX |

This shareholder report contains important information about the Maine Municipal Fund. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class A | $98 | 0.98% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class A shares returned 3.05%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted with and without sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

August 1, 2014 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | 10 Years |

| Class A without sales charge | 3.05 | -0.55 | 0.77 |

| Class A with sales charge | 0.51 | -1.06 | 0.52 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.47 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $9 |

| Number of Holdings | 24 |

| Total Advisory Fee | $0 |

| Annual Portfolio Turnover | 69% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 27.7 | | A | 9.09 | |

| Housing | 23.7 | | AA | 90.91 | |

| Other Revenue | 21.5 | | | | |

| Health Care | 15.6 | | | | |

| Transportation | 7.1 | | | | |

| Cash Equivalents and Other | 4.4 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Maine Municipal Fund Class I / MEIMX |

This shareholder report contains important information about the Maine Municipal Fund. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class I | $73 | 0.73% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class I shares returned 3.30%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

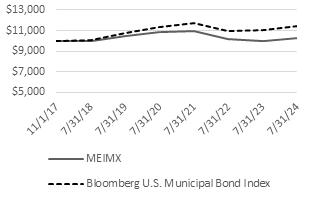

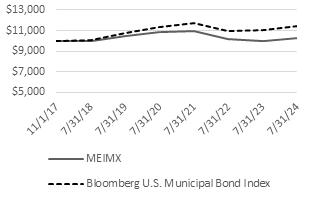

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

November 1, 2017 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | Inception^ |

| Class I | 3.30 | -0.31 | 0.45 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.01 |

| ^Inception Date of 11/1/2017 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $9 |

| Number of Holdings | 24 |

| Total Advisory Fee | $0 |

| Annual Portfolio Turnover | 69% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 27.7 | | A | 9.09 | |

| Housing | 23.7 | | AA | 90.91 | |

| Other Revenue | 21.5 | | | | |

| Health Care | 15.6 | | | | |

| Transportation | 7.1 | | | | |

| Cash Equivalents and Other | 4.4 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Nebraska Municipal Fund Class A / NEMUX |

This shareholder report contains important information about the Nebraska Municipal Fund. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class A | $98 | 0.98% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class A shares returned 1.87%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted with and without sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

August 1, 2014 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | 10 Years |

| Class A without sales charge | 1.87 | -0.44 | 1.19 |

| Class A with sales charge | -0.64 | -0.94 | 0.93 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.47 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $33 |

| Number of Holdings | 51 |

| Total Advisory Fee | $83K |

| Annual Portfolio Turnover | 79% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 58.0 | | A | 11.49 | |

| Education | 15.7 | | AA | 58.06 | |

| Utilities | 11.3 | | AAA | 8.25 | |

| Pre-Refunded | 7.0 | | BBB | 3.13 | |

| Health Care | 3.1 | | NR | 19.07 | |

| Other Revenue | 3.0 | | | | |

| Housing | 1.2 | | | | |

| Cash Equivalents and Other | 0.7 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Nebraska Municipal Fund Class I / NEITX |

This shareholder report contains important information about the Nebraska Municipal Fund. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class I | $73 | 0.73% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class I shares returned 2.02%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

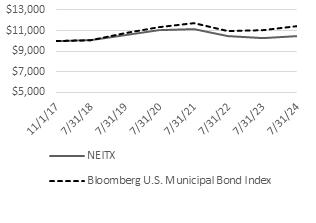

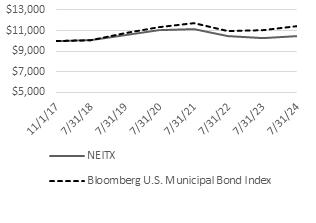

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

November 1, 2017 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | Inception^ |

| Class I | 2.02 | -0.19 | 0.74 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.01 |

| ^Inception Date of 11/1/2017 | | |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $33 |

| Number of Holdings | 51 |

| Total Advisory Fee | $83K |

| Annual Portfolio Turnover | 79% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 58.0 | | A | 11.49 | |

| Education | 15.7 | | AA | 58.06 | |

| Utilities | 11.3 | | AAA | 8.25 | |

| Pre-Refunded | 7.0 | | BBB | 3.13 | |

| Health Care | 3.1 | | NR | 19.07 | |

| Other Revenue | 3.0 | | | | |

| Housing | 1.2 | | | | |

| Cash Equivalents and Other | 0.7 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Oklahoma Municipal Fund Class A / OKMUX |

This shareholder report contains important information about the Oklahoma Municipal Fund. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class A | $98 | 0.98% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class A shares returned 2.33%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

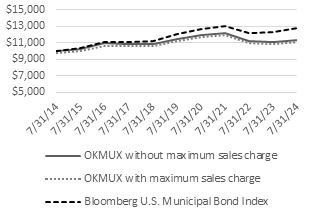

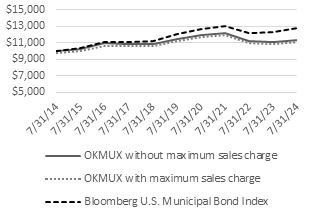

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted with and without sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

August 1, 2014 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | 10 Years |

| Class A without sales charge | 2.33 | -0.28 | 1.28 |

| Class A with sales charge | -0.20 | -0.77 | 1.02 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.47 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $45 |

| Number of Holdings | 66 |

| Total Advisory Fee | $146K |

| Annual Portfolio Turnover | 69% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| Other Revenue | 69.4 | | A | 32.32 | |

| Education | 6.4 | | AA | 36.91 | |

| Transportation | 4.8 | | AAA | 6.67 | |

| Cash Equivalents and Other | 4.6 | | BBB | 15.85 | |

| Housing | 4.5 | | NR | 8.25 | |

| General Obligation | 3.9 | | | | |

| Health Care | 3.4 | | | | |

| Utilities | 3.0 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Oklahoma Municipal Fund Class I / OKMIX |

This shareholder report contains important information about the Oklahoma Municipal Fund. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class I | $73 | 0.73% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class I shares returned 2.59%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

November 1, 2017 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | Inception^ |

| Class I | 2.59 | -0.03 | 0.90 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.01 |

| ^Inception Date of 11/1/2017 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $45 |

| Number of Holdings | 66 |

| Total Advisory Fee | $146K |

| Annual Portfolio Turnover | 69% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| Other Revenue | 69.4 | | A | 32.32 | |

| Education | 6.4 | | AA | 36.91 | |

| Transportation | 4.8 | | AAA | 6.67 | |

| Cash Equivalents and Other | 4.6 | | BBB | 15.85 | |

| Housing | 4.5 | | NR | 8.25 | |

| General Obligation | 3.9 | | | | |

| Health Care | 3.4 | | | | |

| Utilities | 3.0 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Viking Tax-Free Fund for

Montana Class A / VMTTX |

This shareholder report contains important information about the Viking Tax-Free Fund for Montana. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class A | $98 | 0.98% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class A shares returned 1.98%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted with and without sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

August 1, 2014 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | 10 Years |

| Class A without sales charge | 1.98 | -0.02 | 1.37 |

| Class A with sales charge | -0.61 | -0.52 | 1.11 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.47 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $61 |

| Number of Holdings | 106 |

| Total Advisory Fee | $202K |

| Annual Portfolio Turnover | 32% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 49.9 | | A | 26.72 | |

| Housing | 13.7 | | AA | 58.89 | |

| Other Revenue | 12.6 | | AAA | 1.95 | |

| Health Care | 12.5 | | BBB | 0.86 | |

| Utilities | 4.5 | | NR | 11.58 | |

| Cash Equivalents and Other | 2.3 | | | | |

| Pre-Refunded | 1.9 | | | | |

| Transportation | 1.9 | | | | |

| Education | 0.7 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Viking Tax-Free Fund for Montana Class I / VMTIX |

This shareholder report contains important information about the Viking Tax-Free Fund for Montana. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class I | $73 | 0.73% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class I shares returned 2.23%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

August 1, 2016 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | Inception^ |

| Class I | 2.23 | 0.23 | 0.89 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 1.79 |

| ^Inception Date of 8/1/2016 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $61 |

| Number of Holdings | 106 |

| Total Advisory Fee | $202K |

| Annual Portfolio Turnover | 32% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 49.9 | | A | 26.72 | |

| Housing | 13.7 | | AA | 58.89 | |

| Other Revenue | 12.6 | | AAA | 1.95 | |

| Health Care | 12.5 | | BBB | 0.86 | |

| Utilities | 4.5 | | NR | 11.58 | |

| Cash Equivalents and Other | 2.3 | | | | |

| Pre-Refunded | 1.9 | | | | |

| Transportation | 1.9 | | | | |

| Education | 0.7 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Viking Tax-Free Fund for North Dakota Class A / VNDFX |

This shareholder report contains important information about the Viking Tax-Free Fund for North Dakota. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class A | $98 | 0.98% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class A shares returned 1.35%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

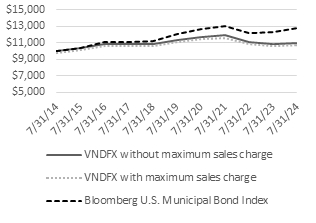

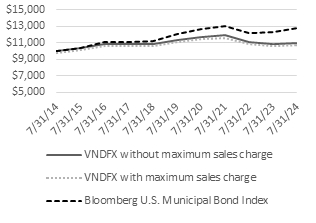

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted with and without sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

August 1, 2014 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | 10 Years |

| Class A without sales charge | 1.35 | -0.64 | 1.00 |

| Class A with sales charge | -1.14 | -1.13 | 0.74 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 2.47 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $21 |

| Number of Holdings | 45 |

| Total Advisory Fee | $40K |

| Annual Portfolio Turnover | 56% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 42.4 | | A | 22.29 | |

| Health Care | 17.1 | | AA | 51.74 | |

| Education | 12.9 | | BBB | 7.64 | |

| Housing | 12.4 | | NR | 18.33 | |

| Other Revenue | 9.4 | | | | |

| Utilities | 5.8 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Viking Tax-Free Fund for North Dakota Class I / VNDIX |

This shareholder report contains important information about the Viking Tax-Free Fund for North Dakota. Period covered: August 1, 2023 through July 31, 2024 |

ANNUAL SHAREHOLDER REPORT Viking Mutual Funds July 31, 2024 | You can find additional information about the Fund at www.integrityvikingfunds.com/documents or by calling us at (800) 276-1262. |

What were the Fund costs for the past year?

(Based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000

investment | Costs paid as a percentage of a

$10,000 investment |

| Class I | $73 | 0.73% |

| How did the Fund perform last year? |

| | • | For the twelve month period ended July 31, 2024, the Fund’s Class I shares returned 1.61%. |

| | • | In comparison, the Bloomberg U.S. Municipal Bond Index (the Benchmark) returned 3.74% for the same period. |

| | | |

| What affected the Fund’s performance? |

| | • | An underweight to lower rated bonds (e.g. BBB) which generally outperformed across most maturities over the period, detracted from relative performance. |

| | • | An overweight to bonds maturing in roughly 13-20 years, contributed positively to relative performance. |

| | • | An underweight to higher rated bonds (e.g. AAA) maturing in greater than 25 years, contributed positively to relative performance. |

How did the Fund perform over the past 10 years?*

The chart below reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE

August 1, 2016 through July 31, 2024

AVERAGE ANNUAL TOTAL RETURN (%)

For the Periods Ended July 31, 2024

| | 1 Year | 5 Years | Inception^ |

| Class I | 1.61 | -0.41 | 0.40 |

| Bloomberg U.S. Muni Bond Index | 3.74 | 1.19 | 1.79 |

| ^Inception Date of 8/1/2016 |

* The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

What are some key Fund statistics?

(as of July 31, 2024)

| Total Net Assets (Millions) | $21 |

| Number of Holdings | 45 |

| Total Advisory Fee | $40K |

| Annual Portfolio Turnover | 56% |

What did the Fund invest in?

(as of July 31, 2024)

| Sectors | % Net

Assets | | Credit Rating

Breakdown* | % Net

Assets | |

| General Obligation | 42.4 | | A | 22.29 | |

| Health Care | 17.1 | | AA | 51.74 | |

| Education | 12.9 | | BBB | 7.64 | |

| Housing | 12.4 | | NR | 18.33 | |

| Other Revenue | 9.4 | | | | |

| Utilities | 5.8 | | | | |

Additional Fund Statistics Information

* The ratings agencies that provided the ratings are Standard & Poor’s and Moody’s. When ratings vary, the higher rating is used. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). “NR” is used to classify securities for which a rating is not available. Ratings apply to the holdings in the Fund portfolio and not to the Fund or its shares. Ratings are subject to change.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website, including…

• Prospectus • Financial information • Portfolio Holdings • Proxy voting information

Website address: www.integrityvikingfunds.com/documents

Item 2. Code of Ethics

As of the end of the period covered by this report, Viking Mutual Funds (herein referred to as the “Registrant”) has adopted a code of ethics as defined in Item 2 of Form N-CSR that applies to the Registrant’s principal executive officer and principal financial officer (herein referred to as the “Code”). There were no amendments to the Code during the period covered by this report. The Registrant did not grant any waivers, including implicit waivers, from any provisions of the Code during the period of this report. The Code is available on the Registrant’s website at http://www.integrityvikingfunds.com. A copy of the Code is also available, without charge, upon request by calling 800-601-5593. The Code is filed herewith pursuant to Item 19(a)(1) as EX-99.CODE ETH.

Item 3. Audit Committee Financial Expert

The Board of Trustees has determined that Jerry Stai is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Stai is “independent” for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services

| | (a) | Audit Fees: The aggregate fees billed for each of the last two fiscal years for professional services rendered by Cohen & Company, Ltd. (“Cohen”), the principal accountant for the audit of the Registrant’s annual financial statements, for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $51,137 for the year ended July 31, 2024 and $48,297 for the year ended July 31, 2023. |

| | | |

| | (b) | Audit-Related Fees: The aggregate fees billed in each of the last two fiscal years for assurance and related services by Cohen that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item were $0 for the year ended July 31, 2024 and $0 for the year ended July 31, 2023. |

| | | |

| | (c) | Tax Fees: The aggregate fees billed in each of the last two fiscal years for professional services rendered by Cohen for tax compliance, tax advice, and tax planning were $15,275 for the year ended July 31, 2024 and $15,275 for the year ended July 31, 2023. Such services included review of excise distribution calculations (if applicable), preparation of the Trust’s federal, state, and excise tax returns, tax services related to mergers, and routine counseling. |

| | | |

| | (d) | All Other Fees: The aggregate fees billed in each of the last two fiscal years for products and services provided by Cohen, other than the services reported in paragraphs (a) through (c) of this Item: None. |

| | | |

| | (e) | (1) | Audit Committee Pre-Approval Policies and Procedures |

| | | | |

| | | | | The Registrant’s audit committee has adopted policies and procedures that require the audit committee to pre-approve all audit and non-audit services provided to the Registrant by the principal accountant. |

| | | | |

| | | (2) | Percentage of services referred to in 4(b) through 4(d) that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X |

| | | | |

| | | | | 0% of the services described in paragraphs (b) through (d) of Item 4 were pre-approved by the audit committee. |

| | | |

| | (f) | Not applicable. All services performed on the engagement to audit the Registrant’s financial statements for the most recent fiscal year-end were performed by Cohen’s full-time permanent employees. |

| | | |

| | (g) | Non-Audit Fees: None. |

| | | |

| | (h) | Principal Accountant’s Independence: The Registrant’s auditor did not provide any non-audit services to the Registrant’s investment adviser or any entity controlling, controlled by, or controlled with the Registrant’s investment adviser that provides ongoing services to the Registrant. |

| | | |

| | (i) | Not applicable. |

| | | |

| | (j) | Not applicable. |

Item 5. Audit Committee of Listed Registrants

The independent board members are acting as the Registrant’s Audit Committee as specified in Section 3(a)(58)(B) of the Exchange Act (15 U.S.C. 78c)(a)(58)(A)). The Audit Committee consists of the following Board members: Jerry M. Stai, R. James Maxson, and Wade A. Dokken.

Item 6. Investments

Report of Independent Registered Public Accounting Firm

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Viking Mutual Funds

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Viking Mutual Funds comprising Kansas Municipal Fund, Maine Municipal Fund, Nebraska Municipal Fund, Oklahoma Municipal Fund, Viking Tax-Free Fund for Montana, and Viking Tax-Free Fund for North Dakota (the “Funds”) as of July 31, 2024, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of July 31, 2024, the results of their operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of July 31, 2024, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Viking Fund Management since 2009.

COHEN & COMPANY, LTD.

Cleveland, Ohio

September 27, 2024

Kansas Municipal Fund

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| MUNICIPAL BONDS (98.4%) | | | | | | |

| | | | | | | |

| Education (6.6%) | | | | | | |

| Kansas Development Finance Authority 3.000% 10/01/2044 Callable @ 100.000 10/01/2027 | | | 500,000 | | | $ | 398,485 | |

| Kansas Development Finance Authority 3.000% 06/01/2031 Callable @ 100.000 06/01/2028 | | | 500,000 | | | | 471,875 | |

| Kansas Development Finance Authority 4.000% 07/01/2033 Callable @ 100.000 07/01/2031 | | | 1,000,000 | | | | 1,011,120 | |

| Kansas Development Finance Authority 4.000% 07/01/2036 Callable @ 100.000 07/01/2031 | | | 2,000,000 | | | | 2,011,240 | |

| | | | | | | | 3,892,720 | |

| General Obligation (51.7%) | | | | | | | | |

| Atchison County Unified School District No 409 5.000% 09/01/2042 Callable @ 100.000 09/01/2031 | | | 610,000 | | | | 658,763 | |

| City of Bel Aire KS 4.000% 11/01/2036 Callable @ 100.000 11/01/2031 | | | 285,000 | | | | 297,055 | |

| City of Bonner Springs KS 3.000% 09/01/2044 Callable @ 100.000 09/01/2028 | | | 1,060,000 | | | | 866,603 | |

| City of Burlingame KS 3.000% 09/01/2045 Callable @ 100.000 09/01/2027 | | | 365,000 | | | | 281,207 | |

| Butler County Unified School District No 205 Bluestem 5.250% 09/01/2042 Callable @ 100.000 09/01/2032 | | | 1,520,000 | | | | 1,687,063 | |

| Cowley County Unified School District No 465 Winfield 5.000% 09/01/2038 Callable @ 100.000 09/01/2033 | | | 200,000 | | | | 222,544 | |

| Cowley County Unified School District No 465 Winfield 5.000% 09/01/2048 Callable @ 100.000 09/01/2033 | | | 500,000 | | | | 545,535 | |

| Douglas County Unified School District No 348 Baldwin City 4.000% 09/01/2030 Callable @ 100.000 09/01/2025 | | | 250,000 | | | | 253,385 | |

| Douglas County Unified School District No 348 Baldwin City 5.000% 09/01/2044 Callable @ 100.000 09/01/2031 | | | 400,000 | | | | 424,088 | |

| Douglas County Unified School District No 491 Eudora 5.000% 09/01/2042 Callable @ 100.000 09/01/2032 | | | 1,000,000 | | | | 1,081,660 | |

| City of Edgerton KS 4.000% 08/01/2037 Callable @ 100.000 08/01/2031 | | | 300,000 | | | | 313,599 | |

| City of Emporia KS 4.000% 09/01/2038 Callable @ 100.000 09/01/2032 | | | 500,000 | | | | 522,195 | |

| City of Garden City KS 5.000% 11/01/2029 | | | 500,000 | | | | 550,835 | |

| Gove County Unified School District No 293 Quinter 4.000% 09/01/2041 Callable @ 100.000 09/01/2030 | | | 655,000 | | | | 661,858 | |

| Gove County Unified School District No 293 Quinter 4.000% 09/01/2043 Callable @ 100.000 09/01/2030 | | | 250,000 | | | | 250,605 | |

| Harvey County Unified School District 440 Halstead Bentley 5.000% 09/01/2049 Callable @ 100.000 09/01/2031 | | | 1,000,000 | | | | 1,061,650 | |

| Harvey County Unified School District No 460 Hesston 5.000% 09/01/2031 | | | 410,000 | | | | 457,810 | |

| City of Haysville KS 4.250% 10/01/2025 Callable @ 100.000 10/01/2024 | | | 500,000 | | | | 500,265 | |

| Jefferson County Unified School District No 343 Perry 5.500% 09/01/2038 Callable @ 100.000 09/01/2030 | | | 265,000 | | | | 291,402 | |

| Jefferson County Unified School District No 343 Perry 5.500% 09/01/2043 Callable @ 100.000 09/01/2030 | | | 1,000,000 | | | | 1,080,010 | |

| Jefferson County Unified School District No 343 Perry 5.500% 09/01/2048 Callable @ 100.000 09/01/2030 | | | 1,000,000 | | | | 1,087,890 | |

| Johnson & Miami Counties Unified School District No 230 Spring Hills 5.000% 09/01/2039 Callable @ 100.000 09/01/2027 | | | 2,000,000 | | | | 2,122,920 | |

| Leavenworth County Unified School District No 453 4.000% 09/01/2037 Callable @ 100.000 09/01/2026 | | | 650,000 | | | | 658,210 | |

| Leavenworth County Unified School District No 458 5.000% 09/01/2049 Callable @ 100.000 09/01/2031 | | | 1,000,000 | | | | 1,059,750 | |

| County of Linn KS 3.000% 07/01/2036 Callable @ 100.000 07/01/2029 | | | 855,000 | | | | 758,317 | |

| City of Manhattan KS 4.000% 11/01/2044 Callable @ 100.000 11/01/2034 | | | 880,000 | | | | 873,602 | |

| Miami County Unified School District No 368 Paola 5.000% 09/01/2027 | | | 10,000 | | | | 9,935 | |

| City of Olathe KS 3.000% 10/01/2033 Callable @ 100.000 10/01/2029 | | | 855,000 | | | | 859,258 | |

| City of Overland Park KS 5.000% 09/01/2032 | | | 1,000,000 | | | | 1,158,720 | |

| City of Prairie Village KS 4.000% 09/01/2040 Callable @ 100.000 09/01/2027 | | | 795,000 | | | | 797,091 | |

| City of Prairie Village KS 3.000% 09/01/2049 Callable @ 100.000 09/01/2027 | | | 1,500,000 | | | | 1,263,465 | |

| Pratt County Unified School District No 382 Pratt 5.000% 09/01/2038 Callable @ 100.000 09/01/2033 | | | 500,000 | | | | 562,565 | |

| Pratt County Unified School District No 382 Pratt 5.000% 09/01/2042 Callable @ 100.000 09/01/2033 | | | 1,035,000 | | | | 1,136,627 | |

| Riley County Unified School District No 383 Manhattan Ogden 4.000% 09/01/2039 Callable @ 100.000 09/01/2027 | | | 1,000,000 | | | | 1,010,770 | |

| Salina Airport Authority 4.000% 09/01/2040 Callable @ 100.000 09/01/2032 | | | 500,000 | | | | 505,550 | |

| Salina Airport Authority 4.000% 09/01/2043 Callable @ 100.000 09/01/2032 | | | 265,000 | | | | 265,641 | |

| County of Scott KS 5.000% 04/01/2032 Callable @ 100.000 04/01/2026 | | | 500,000 | | | | 518,105 | |

| #Sedgwick County Unified School District No 262 Valley Center 4.500% 09/01/2044 Callable @ 100.000 09/01/2031 | | | 650,000 | | | | 658,073 | |

| Shawnee County Unified School District No 372 Silver Lake 5.500% 09/01/2043 Callable @ 100.000 09/01/2030 | | | 650,000 | | | | 705,296 | |

| Shawnee County Unified School District No 372 Silver Lake 5.500% 09/01/2048 Callable @ 100.000 09/01/2030 | | | 780,000 | | | | 839,795 | |

| City of South Hutchinson KS 4.000% 10/01/2038 Callable @ 100.000 10/01/2025 | | | 355,000 | | | | 357,712 | |

| City of Wichita KS 4.750% 09/01/2027 | | | 180,000 | | | | 178,826 | |

| *Wyandotte County Unified School District No 500 Kansas City 5.000% 09/01/2026 | | | 1,000,000 | | | | 1,040,370 | |

| | | | | | | | 30,436,620 | |

| Health Care (11.4%) | | | | | | | | |

| Ashland Public Building Commission 5.000% 09/01/2030 | | | 1,020,000 | | | | 1,020,571 | |

| Ashland Public Building Commission 5.000% 09/01/2035 | | | 500,000 | | | | 500,085 | |

| Ashland Public Building Commission 5.000% 09/01/2032 Callable @ 100.000 09/01/2024 | | | 550,000 | | | | 550,627 | |

| City of Colby KS 5.500% 07/01/2026 Callable @ 100.000 01/01/2026 | | | 750,000 | | | | 751,883 | |

| City of Lawrence KS 5.000% 07/01/2043 Callable @ 100.000 07/01/2028 | | | 1,500,000 | | | | 1,542,540 | |

| University of Kansas Hospital Authority 4.000% 09/01/2040 Callable @ 100.000 09/01/2025 | | | 500,000 | | | | 486,745 | |

| University of Kansas Hospital Authority 5.000% 09/01/2035 Callable @ 100.000 09/01/2025 | | | 500,000 | | | | 504,630 | |

| University of Kansas Hospital Authority 4.000% 09/01/2048 Callable @ 100.000 03/01/2029 | | | 1,000,000 | | | | 953,180 | |

| University of Kansas Hospital Authority 3.000% 03/01/2041 Callable @ 100.000 03/01/2030 | | | 500,000 | | | | 409,480 | |

| | | | | | | | 6,719,741 | |

| Housing (2.1%) | | | | | | | | |

| County of Shawnee KS 4.700% 07/01/2044 Callable @ 100.000 07/01/2033 | | | 700,000 | | | | 704,354 | |

| County of Shawnee KS 5.000% 07/01/2049 Callable @ 100.000 07/01/2033 | | | 500,000 | | | | 510,495 | |

| | | | | | | | 1,214,849 | |

| Other Revenue (7.3%) | | | | | | | | |

| Bourbon County Unified School District No 234 Fort Scott 4.000% 09/01/2035 Callable @ 100.000 09/01/2033 | | | 355,000 | | | | 364,152 | |

| *Dickson County Public Building Commission 4.000% 08/01/2038 Callable @ 100.000 08/01/2028 | | | 750,000 | | | | 757,733 | |

| Hoisington Public Building Commission 3.000% 11/01/2045 Callable @ 100.000 11/01/2029 | | | 500,000 | | | | 379,935 | |

| City of Manhattan KS 5.000% 12/01/2026 | | | 150,000 | | | | 150,250 | |

| City of Manhattan KS 4.500% 12/01/2025 | | | 225,000 | | | | 225,785 | |

| *City of Manhattan KS 5.000% 12/01/2032 | | | 1,000,000 | | | | 1,001,010 | |

| County of Shawnee KS 5.000% 09/01/2033 Callable @ 100.000 09/01/2032 | | | 230,000 | | | | 257,839 | |

| County of Shawnee KS 5.500% 09/01/2034 Callable @ 100.000 09/01/2032 | | | 210,000 | | | | 245,389 | |

| Washington County Public Building Commission 4.000% 09/01/2028 | | | 100,000 | | | | 99,671 | |

| City of Wichita KS 4.000% 09/01/2038 Callable @ 100.000 09/01/2027 | | | 815,000 | | | | 803,158 | |

| | | | | | | | 4,284,922 | |

| Pre-Refunded (8.9%) | | | | | | | | |

| Bourbon County Unified School District No 234 Fort Scott 5.000% 09/01/2027 Callable @ 100.000 09/01/2024 | | | 250,000 | | | | 250,415 | |

| Bourbon County Unified School District No 234 Fort Scott 5.000% 09/01/2028 Callable @ 100.000 09/01/2024 | | | 250,000 | | | | 250,453 | |

| Bourbon County Unified School District No 234 Fort Scott 5.000% 09/01/2029 Callable @ 100.000 09/01/2024 | | | 250,000 | | | | 250,405 | |

| Bourbon County Unified School District No 234 Fort Scott 5.000% 09/01/2030 Callable @ 100.000 09/01/2024 | | | 250,000 | | | | 250,405 | |

| Bourbon County Unified School District No 234 Fort Scott 5.000% 09/01/2031 Callable @ 100.000 09/01/2024 | | | 500,000 | | | | 500,810 | |

| *Franklin County Unified School District No 290 Ottawa 5.000% 09/01/2040 Callable @ 100.000 09/01/2025 | | | 3,000,000 | | | | 3,048,330 | |

| Sedgwick County Unified School District No 262 Valley Center 5.000% 09/01/2035 Callable @ 100.000 09/01/2024 | | | 405,000 | | | | 405,785 | |

| Seward County Unified School District No 480 Liberal 5.000% 09/01/2029 Callable @ 100.000 09/01/2025 | | | 250,000 | | | | 255,153 | |

| | | | | | | | 5,211,756 | |

| Transportation (1.3%) | | | | | | | | |

| State of Kansas Department of Transportation 5.000% 09/01/2033 Callable @ 100.000 09/01/2025 | | | 500,000 | | | | 506,915 | |

| State of Kansas Department of Transportation 5.000% 09/01/2035 Callable @ 100.000 09/01/2025 | | | 250,000 | | | | 253,270 | |

| | | | | | | | 760,185 | |

| Utilities (9.1%) | | | | | | | | |

| Kansas Municipal Energy Agency 5.000% 04/01/2030 Callable @ 100.000 04/01/2026 | | | 250,000 | | | | 257,770 | |

| Kansas Municipal Energy Agency 5.000% 04/01/2032 Callable @ 100.000 04/01/2026 | | | 500,000 | | | | 515,790 | |

| Kansas Municipal Energy Agency 5.000% 04/01/2033 Callable @ 100.000 04/01/2026 | | | 745,000 | | | | 770,039 | |

| Kansas Municipal Energy Agency 5.000% 04/01/2038 Callable @ 100.000 04/01/2026 | | | 1,000,000 | | | | 1,029,980 | |

| Kansas Municipal Energy Agency 5.000% 04/01/2035 Callable @ 100.000 04/01/2026 | | | 300,000 | | | | 310,248 | |

| Kansas Power Pool 4.000% 12/01/2031 Callable @ 100.000 12/01/2025 | | | 500,000 | | | | 505,750 | |

| Kansas Power Pool 4.000% 12/01/2041 Callable @ 100.000 12/01/2029 | | | 500,000 | | | | 502,840 | |

| City of Olathe KS Stormwater Revenue 4.000% 10/01/2044 Callable @ 100.000 10/01/2032 | | | 445,000 | | | | 446,878 | |

| Wyandotte County Kansas City Unified Government Utility System Revenue 5.000% 09/01/2035 Callable @ 100.000 09/01/2025 | | | 500,000 | | | | 507,920 | |

| Wyandotte County Kansas City Unified Government Utility System Revenue 5.000% 09/01/2028 Callable @ 100.000 09/01/2026 | | | 500,000 | | | | 523,465 | |

| | | | | | | | 5,370,680 | |

| | | | | | | | | |

| TOTAL MUNICIPAL BONDS (COST: $58,501,555) | | | | | | $ | 57,891,473 | |

| OTHER ASSETS LESS LIABILITIES (1.6%) | | | | | | $ | 940,889 | |

| NET ASSETS (100.0%) | | | | | | $ | 58,832,362 | |

| * | Indicates bonds are segregated by the custodian to cover when-issued or delayed delivery purchases. |

| # | When-issued purchase as of July 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Maine Municipal Fund

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| MUNICIPAL BONDS (95.6%) | | | | | | |

| | | | | | | |

| General Obligation (27.7%) | | | | | | |

| City of Bath ME 4.000% 05/01/2044 Callable @ 100.000 05/01/2034 | | | 400,000 | | | $ | 396,868 | |

| Town of Brunswick ME 2.500% 11/01/2041 Callable @ 100.000 11/01/2030 | | | 500,000 | | | | 390,365 | |

| Town of Gorham ME 4.000% 09/01/2040 Callable @ 100.000 09/01/2033 | | | 365,000 | | | | 371,716 | |

| City of Lewiston ME 4.000% 03/15/2037 Callable @ 100.000 03/15/2031 | | | 310,000 | | | | 320,493 | |

| Regional School Unit No 26 3.000% 09/01/2044 Callable @ 100.000 09/01/2029 | | | 475,000 | | | | 386,674 | |

| Maine School Administrative District No 51 4.000% 10/15/2029 Callable @ 100.000 10/15/2024 | | | 100,000 | | | | 100,306 | |

| Maine School Administrative District No 28 4.000% 05/01/2036 Callable @ 100.000 05/01/2028 | | | 400,000 | | | | 402,332 | |

| | | | | | | | 2,368,754 | |

| Health Care (15.6%) | | | | | | | | |

| Maine Health & Higher Educational Facilities Authority 4.500% 07/01/2031 | | | 5,000 | | | | 5,007 | |

| *Maine Health & Higher Educational Facilities Authority 4.000% 07/01/2045 Callable @ 100.000 07/01/2030 | | | 250,000 | | | | 246,325 | |

| Maine Health & Higher Educational Facilities Authority 5.250% 07/01/2048 Callable @ 100.000 07/01/2033 | | | 1,000,000 | | | | 1,081,370 | |

| | | | | | | | 1,332,702 | |

| Housing (23.7%) | | | | | | | | |

| Maine State Housing Authority 4.950% 11/15/2048 Callable @ 100.000 05/15/2033 | | | 1,000,000 | | | | 1,019,500 | |

| Maine State Housing Authority 4.450% 11/15/2044 Callable @ 100.000 05/15/2033 | | | 500,000 | | | | 500,105 | |

| Maine State Housing Authority 3.350% 11/15/2044 Callable @ 100.000 05/15/2028 | | | 155,000 | | | | 132,809 | |

| *Maine State Housing Authority 2.250% 11/15/2045 Callable @ 100.000 05/15/2029 | | | 250,000 | | | | 168,798 | |

| *Maine State Housing Authority 4.950% 11/15/2047 Callable @ 100.000 11/15/2031 | | | 200,000 | | | | 207,062 | |

| | | | | | | | 2,028,274 | |

| Other Revenue (21.5%) | | | | | | | | |

| City of Augusta ME 5.000% 10/01/2043 Callable @ 100.000 10/01/2033 | | | 955,000 | | | | 1,036,146 | |

| Maine Governmental Facilities Authority 5.000% 10/01/2025 | | | 155,000 | | | | 158,202 | |

| Maine Health & Higher Educational Facilities Authority 5.000% 07/01/2043 Callable @ 100.000 07/01/2033 | | | 275,000 | | | | 292,171 | |

| Maine Municipal Bond Bank 4.000% 11/01/2038 | | | 125,000 | | | | 125,128 | |

| Maine Municipal Bond Bank 5.000% 11/01/2025 | | | 125,000 | | | | 125,125 | |

| Maine Municipal Bond Bank 5.000% 11/01/2027 Callable @ 100.000 11/01/2024 | | | 100,000 | | | | 100,284 | |

| | | | | | | | 1,837,056 | |

| Transportation (7.1%) | | | | | | | | |

| *Maine Turnpike Authority 4.000% 07/01/2032 | | | 250,000 | | | | 250,113 | |

| Maine Turnpike Authority 5.000% 07/01/2025 | | | 105,000 | | | | 106,834 | |

| *City of Portland ME General Airport Revenue 4.000% 01/01/2040 Callable @ 100.000 01/01/2030 | | | 250,000 | | | | 246,097 | |

| | | | | | | | 603,044 | |

| | | | | | | | | |

| TOTAL MUNICIPAL BONDS (COST: $8,334,007) | | | | | | $ | 8,169,830 | |

| OTHER ASSETS LESS LIABILITIES (4.4%) | | | | | | $ | 373,905 | |

| NET ASSETS (100.0%) | | | | | | $ | 8,543,735 | |

| * | Indicates bonds are segregated by the custodian to cover when-issued or delayed delivery purchases. |

The accompanying notes are an integral part of these financial statements.

Nebraska Municipal Fund

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| MUNICIPAL BONDS (99.3%) | | | | | | |

| | | | | | | |

| Education (15.7%) | | | | | | |

| Nebraska State Colleges 5.000% 07/01/2043 Callable @ 100.000 07/01/2033 | | | 1,250,000 | | | $ | 1,372,988 | |

| Nebraska State Colleges 5.000% 07/01/2048 Callable @ 100.000 07/01/2033 | | | 1,000,000 | | | | 1,086,190 | |

| Southeast Community College Area 5.000% 12/15/2043 Callable @ 100.000 12/15/2031 | | | 1,165,000 | | | | 1,232,686 | |

| Southeast Community College Area 5.000% 12/15/2048 Callable @ 100.000 12/15/2031 | | | 1,000,000 | | | | 1,048,360 | |

| Southeast Community College 3.000% 03/15/2045 Callable @ 100.000 07/02/2025 | | | 500,000 | | | | 366,910 | |

| | | | | | | | 5,107,134 | |

| General Obligation (58.0%) | | | | | | | | |

| City of Aurora NE 5.000% 12/15/2028 Callable @ 100.000 05/15/2026 | | | 800,000 | | | | 813,208 | |

| County of Butler NE 5.000% 12/01/2043 Callable @ 100.000 12/01/2028 | | | 600,000 | | | | 618,162 | |

| Cuming County School District No 20 4.000% 12/15/2044 Callable @ 100.000 05/29/2029 | | | 1,500,000 | | | | 1,485,750 | |

| Broken Bow Public Schools 4.000% 12/15/2044 Callable @ 100.000 03/18/2029 | | | 500,000 | | | | 483,140 | |

| City of David City NE 4.050% 12/15/2027 Callable @ 100.000 07/12/2025 | | | 500,000 | | | | 500,500 | |

| City of David City NE 4.350% 06/15/2026 Callable @ 100.000 09/15/2024 | | | 500,000 | | | | 500,360 | |

| Fremont School District 5.000% 12/15/2043 Callable @ 100.000 12/15/2033 | | | 675,000 | | | | 738,963 | |

| Fremont School District 5.250% 12/15/2044 Callable @ 100.000 12/15/2033 | | | 210,000 | | | | 235,595 | |

| Fremont School District 5.250% 12/15/2045 Callable @ 100.000 12/15/2033 | | | 300,000 | | | | 335,241 | |

| Fremont School District 5.250% 12/15/2046 Callable @ 100.000 12/15/2033 | | | 395,000 | | | | 439,706 | |

| Fremont School District 5.000% 12/15/2048 Callable @ 100.000 12/15/2033 | | | 740,000 | | | | 801,620 | |

| Elkhorn School District 4.000% 12/15/2045 Callable @ 100.000 12/15/2034 | | | 1,500,000 | | | | 1,478,460 | |

| Douglas County School District No 59/NE 3.500% 06/15/2043 | | | 500,000 | | | | 438,515 | |

| Westside Community Schools 5.000% 12/01/2041 Callable @ 100.000 12/01/2031 | | | 500,000 | | | | 548,790 | |

| Westside Community Schools 4.375% 12/01/2043 Callable @ 100.000 12/01/2031 | | | 350,000 | | | | 362,604 | |

| City of Henderson NE 4.600% 12/15/2034 Callable @ 100.000 12/15/2026 | | | 210,000 | | | | 209,840 | |

| City of Henderson NE 4.850% 12/15/2036 Callable @ 100.000 12/15/2026 | | | 460,000 | | | | 460,828 | |

| City of Henderson NE 5.100% 12/15/2038 Callable @ 100.000 12/15/2026 | | | 500,000 | | | | 502,075 | |

| City of Kearney NE - 144A 4.000% 05/15/2042 Callable @ 100.000 05/16/2027 | | | 720,000 | | | | 701,388 | |

| City of La Vista NE 5.000% 09/15/2043 Callable @ 100.000 03/15/2028 | | | 500,000 | | | | 522,580 | |

| City of McCook NE 5.000% 09/15/2038 Callable @ 100.000 03/15/2028 | | | 550,000 | | | | 582,015 | |

| City of Nebraska City NE 4.150% 07/15/2033 Callable @ 100.000 07/15/2028 | | | 100,000 | | | | 98,692 | |

| City of Nebraska City NE 5.000% 07/15/2038 Callable @ 100.000 07/15/2028 | | | 540,000 | | | | 556,627 | |

| City of Nebraska City NE 3.750% 01/15/2030 Callable @ 100.000 02/22/2029 | | | 150,000 | | | | 147,478 | |

| City of Nebraska City NE 3.800% 01/15/2033 Callable @ 100.000 02/22/2029 | | | 200,000 | | | | 194,804 | |

| City of Nebraska City NE 4.000% 01/15/2036 Callable @ 100.000 02/22/2029 | | | 265,000 | | | | 259,202 | |

| City of Nebraska City NE 4.350% 01/15/2039 Callable @ 100.000 02/22/2029 | | | 205,000 | | | | 203,116 | |

| City of Omaha NE 3.750% 01/15/2038 Callable @ 100.000 01/15/2027 | | | 500,000 | | | | 504,175 | |

| Otoe County School District No 501/NE 4.500% 12/15/2043 Callable @ 100.000 11/01/2028 | | | 1,000,000 | | | | 1,030,810 | |

| Otoe County School District No 501/NE 4.750% 12/15/2047 Callable @ 100.000 11/01/2028 | | | 1,000,000 | | | | 1,029,460 | |

| Otoe County School District No 501/NE 4.125% 12/15/2047 Callable @ 100.000 06/26/2029 | | | 500,000 | | | | 494,615 | |

| City of Wahoo NE 4.750% 12/15/2033 Callable @ 100.000 08/15/2026 | | | 320,000 | | | | 323,885 | |

| City of Wayne NE 4.250% 12/15/2026 Callable @ 100.000 12/15/2024 | | | 750,000 | | | | 750,930 | |

| #York County School District No 96 4.000% 12/15/2044 Callable @ 100.000 08/07/2029 | | | 625,000 | | | | 626,512 | |

| | | | | | | | 18,979,646 | |

| Health Care (3.1%) | | | | | | | | |

| Madison County Hospital Authority No 1 5.000% 07/01/2032 Callable @ 100.000 07/01/2025 | | | 335,000 | | | | 340,551 | |

| Madison County Hospital Authority No 1 5.000% 07/01/2033 Callable @ 100.000 07/01/2025 | | | 450,000 | | | | 457,722 | |

| Madison County Hospital Authority No 1 5.000% 07/01/2034 Callable @ 100.000 07/01/2025 | | | 215,000 | | | | 218,900 | |

| | | | | | | | 1,017,173 | |

| Housing (1.2%) | | | | | | | | |

| Nebraska Investment Finance Authority 3.850% 03/01/2038 Callable @ 100.000 09/01/2024 | | | 395,000 | | | | 385,781 | |

| | | | | | | | 385,781 | |

| | | | | | | | | |

| Other Revenue (3.0%) | | | | | | | | |

| City of Columbus NE Sales Tax Revenue 4.000% 06/15/2039 Callable @ 100.000 06/14/2029 | | | 1,000,000 | | | | 993,310 | |

| | | | | | | | 993,310 | |

| Pre-Refunded (7.0%) | | | | | | | | |

| Gretna Public Schools 5.000% 12/15/2035 Callable @ 100.000 12/15/2025 | | | 250,000 | | | | 256,440 | |

| *University of Nebraska 5.000% 07/01/2035 Callable @ 100.000 07/01/2025 | | | 1,500,000 | | | | 1,528,125 | |

| University of Nebraska 5.000% 05/15/2035 Callable @ 100.000 05/15/2025 | | | 500,000 | | | | 508,030 | |

| | | | | | | | 2,292,595 | |

| Utilities (11.3%) | | | | | | | | |

| Custer Public Power District 4.125% 06/01/2039 Callable @ 100.000 06/01/2029 | | | 1,000,000 | | | | 991,160 | |

| City of David City NE Electric Utility Revenue 4.400% 12/15/2029 Callable @ 100.000 09/15/2026 | | | 135,000 | | | | 135,670 | |

| City of David City NE Electric Utility Revenue 4.550% 12/15/2034 Callable @ 100.000 09/15/2026 | | | 530,000 | | | | 535,257 | |

| *Nebraska Public Power District 5.000% 01/01/2036 Callable @ 100.000 01/01/2026 | | | 2,000,000 | | | | 2,038,240 | |

| | | | | | | | 3,700,327 | |

| | | | | | | | | |

| TOTAL MUNICIPAL BONDS (COST: $32,113,280) | | | | | | $ | 32,475,966 | |

| OTHER ASSETS LESS LIABILITIES (0.7%) | | | | | | $ | 239,194 | |

| NET ASSETS (100.0%) | | | | | | $ | 32,715,160 | |

| * | Indicates bonds are segregated by the custodian to cover when-issued or delayed delivery purchases. |

| # | When-issued purchase as of July 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Oklahoma Municipal Fund

| | | Principal | | | Fair | |

| | | Amount | | | Value | |

| MUNICIPAL BONDS (95.4%) | | | | | | |

| | | | | | | |

| Education (6.4%) | | | | | | |

| Oklahoma Development Finance Authority 5.000% 06/01/2039 | | | 19,000 | | | $ | 19,140 | |

| Oklahoma State University 4.000% 09/01/2043 Callable @ 100.000 09/01/2034 | | | 500,000 | | | | 502,285 | |

| Oklahoma State University 5.000% 09/01/2044 Callable @ 100.000 09/01/2034 | | | 590,000 | | | | 653,295 | |

| University of Oklahoma/The 5.000% 07/01/2036 Callable @ 100.000 07/01/2025 | | | 500,000 | | | | 504,635 | |

| University of Oklahoma/The 4.000% 07/01/2040 Callable @ 100.000 07/01/2025 | | | 500,000 | | | | 495,180 | |

| University of Oklahoma/The 5.000% 07/01/2038 Callable @ 100.000 07/01/2025 | | | 500,000 | | | | 504,145 | |

| University of Oklahoma/The 5.000% 07/01/2038 Callable @ 100.000 07/01/2033 | | | 200,000 | | | | 224,196 | |

| | | | | | | | 2,902,876 | |

| General Obligation (3.9%) | | | | | | | | |

| City of Broken Arrow OK 4.000% 12/01/2037 Callable @ 100.000 12/01/2028 | | | 605,000 | | | | 613,791 | |

| City of Broken Arrow OK 4.000% 12/01/2038 Callable @ 100.000 12/01/2028 | | | 610,000 | | | | 617,235 | |

| City of Catoosa OK 4.000% 06/01/2040 Callable @ 100.000 06/01/2032 | | | 500,000 | | | | 504,775 | |

| | | | | | | | 1,735,801 | |

| Health Care (3.4%) | | | | | | | | |

| Oklahoma County Finance Authority 4.000% 04/01/2041 Callable @ 100.000 04/01/2031 | | | 250,000 | | | | 252,955 | |

| Oklahoma Development Finance Authority 5.000% 08/15/2029 Callable @ 100.000 08/15/2025 | | | 250,000 | | | | 252,685 | |