Table of Contents

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to§240.14a-12 |

TEAM HEALTH HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

April 9, 2014

Dear Fellow Shareholders:

Please join us for Team Health Holdings, Inc. Annual Meeting of Shareholders on Monday, May 19, 2014, at 1:30 p.m. (Eastern Daylight Time) at the Doubletree Metropolitan Hotel, 569 Lexington Avenue, New York, New York 10022.

In accordance with the Securities and Exchange Commission rule allowing companies to furnish proxy materials to their shareholders over the Internet, we sent shareholders of record at the close of business on March 25, 2014 a Notice of Internet Availability of Proxy Materials on or about April 9, 2014. The notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as in the attached Proxy Statement.

Attached to this letter are a Notice of Annual Meeting of Shareholders and Proxy Statement, which describe the business to be conducted at the meeting. We also will report on matters of current interest to our shareholders.

Your vote is important to us. Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting in person, it is important that your shares be represented and voted at the meeting. You may vote your shares by proxy on the Internet, by telephone or by completing, signing and promptly returning a proxy card or you may vote in person at the Annual Meeting.

Thank you for your continued support of Team Health Holdings, Inc.

Sincerely,

H. Lynn Massingale, M.D.

Executive Chairman

Greg Roth

Chief Executive Officer

Table of Contents

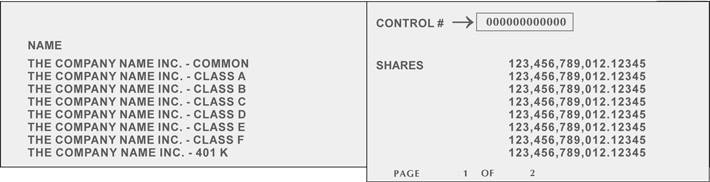

PROXY VOTING METHODS

If at the close of business on March 25, 2014, you were a shareholder of record or held shares through a broker or bank, you may vote your shares by proxy through the Internet, by telephone or by mail, or you may vote in person at the Annual Meeting. For shares held through a broker, bank or other nominee, you may vote by submitting voting instructions to your broker, bank or other nominee. To reduce our administrative and postage costs, we ask that you vote through the Internet or by telephone, both of which are available 24 hours a day. You may revoke your proxies at the times and in the manners described on page 4 of the Proxy Statement.

If you are a shareholder of record or hold shares through a broker or bank and are voting by proxy, your vote must be received by 11:59 p.m. (Eastern Daylight Time) on May 18, 2014 to be counted.

To vote by proxy if you are a shareholder of record:

BY INTERNET

| • | Go to the website www.proxyvote.com and follow the instructions, 24 hours a day, seven days a week. |

| • | You will need the 12-digit number included on your Notice of Internet Availability of Proxy Materials or proxy card to obtain your records and to create an electronic voting instruction form. |

BY TELEPHONE

| • | From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week. |

| • | You will need the 12-digit number included on your Notice of Internet Availability of Proxy Materials or proxy card in order to vote by telephone. |

BY MAIL

| • | Request a proxy card from us by following the instructions on your Notice of Internet Availability of Proxy Materials. |

| • | When you receive the proxy card, mark your selections on the proxy card. |

| • | Date and sign your name exactly as it appears on your proxy card. |

| • | Mail the proxy card in the enclosed postage-paid envelope that will be provided to you. |

YOUR VOTE IS IMPORTANT TO US. THANK YOU FOR VOTING.

If you hold your shares in street name, you may also submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your broker, bank, or other nominee on how to submit voting instructions.

Table of Contents

TEAM HEALTH HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TIME | 1:30 p.m. (Eastern Daylight Time) on Monday, May 19, 2014 |

PLACE | Doubletree Metropolitan Hotel, 569 Lexington Avenue, New York, New York 10022 |

ITEMS OF BUSINESS | 1. | To elect the three Class II director nominees listed herein. |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014. |

| 3. | To approve, in a non-binding advisory vote, the compensation paid to the named executive officers. |

| 4. | To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

RECORD DATE | You may vote at the Annual Meeting if you were a shareholder of record at the close of business on March 25, 2014. |

VOTING BY PROXY | To ensure your shares are voted, you may vote your shares over the Internet, by telephone or by requesting a paper proxy card to complete, sign and return by mail. Internet and telephone voting procedures are described on the preceding page, in the General Information section beginning on page 1 of the Proxy Statement and on the proxy card. |

By Order of the Board of Directors,

Heidi Solomon Allen

Corporate Secretary

This Notice of Annual Meeting and Proxy Statement are being distributed

or made available, as the case may be,

on or about April 9, 2014.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting to be held on Monday, May 19, 2014: Our Proxy statement

and annual report on Form 10-K are available online at

https://www.proxyvote.com.

Table of Contents

| 1 | ||||

| 5 | ||||

| 5 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

Proposal No. 2—Ratification of Independent Registered Public Accounting Firm | 18 | |||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 45 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 49 |

Table of Contents

TEAM HEALTH HOLDINGS, INC.

265 Brookview Centre Way, Suite 400

Knoxville, Tennessee 37919

Telephone: (865) 693-1000

PROXY STATEMENT

Annual Meeting of Shareholders

May 19, 2014

1:30 p.m. (Eastern Daylight Time)

Why am I being provided with these materials?

We have made these proxy materials available to you on or about April 9, 2014, on the Internet or, upon your request, have delivered printed versions of these materials to you by mail in connection with the solicitation by the Board of Directors (the “Board”) of Team Health Holdings, Inc. (the “Company”) of proxies to be voted at our Annual Meeting of Shareholders to be held on May 19, 2014 (“Annual Meeting”), and at any postponements or adjournments of the Annual Meeting. Directors, officers and other Company employees also may solicit proxies by telephone or otherwise. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses. You are invited to attend the Annual Meeting and vote your shares in person.

What am I voting on?

There are three proposals scheduled to be voted on at the Annual Meeting:

| • | Proposal No. 1: Election of the three Class II director nominees listed in this Proxy Statement. |

| • | Proposal No. 2: Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014. |

| • | Proposal No. 3: Approval, in a non-binding advisory vote, of the compensation paid to the named executive officers. |

Who is entitled to vote?

Shareholders as of the close of business on March 25, 2014 (the “Record Date”) may vote at the Annual Meeting. As of that date, there were 70,139,635 shares of common stock outstanding. You have one vote for each share of common stock held by you as of the Record Date, including shares:

| • | Held directly in your name as “shareholder of record” (also referred to as “registered shareholder”); |

| • | Held for you in an account with a broker, bank or other nominee (shares held in “street name”)—Street name holders generally cannot vote their shares directly and instead must instruct the brokerage firm, bank or nominee how to vote their shares; and |

| • | Held for you by us as restricted shares (whether vested or non-vested) under any of our stock incentive plans. |

What constitutes a quorum?

The holders of a majority of the voting power of the issued and outstanding shares of stock entitled to vote must be present in person or represented by proxy to constitute a quorum for the Annual Meeting. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker

1

Table of Contents

non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, as described below under “How are votes counted?”, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”).

What is a “broker non-vote”?

A broker non-vote occurs when shares held by a broker are not voted with respect to a proposal because (1) the broker has not received voting instructions from the shareholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at his/her discretion. Under current New York Stock Exchange interpretations that govern broker non-votes, Proposal Nos. 1 and 3 are considered non-discretionary matters and a broker will lack the authority to vote shares at his/her discretion on such proposals. Proposal No. 2 is considered a discretionary matter and a broker will be permitted to exercise his/her discretion.

How many votes are required to approve each proposal?

With respect to the election of the three Class II director nominees (Proposal No. 1), all elections of directors will be determined by a plurality of the votes cast in respect of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. A plurality vote requirement means that the three director nominees with the greatest number of votes cast, even if less than a majority, will be elected. There is no cumulative voting.

With respect to the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014 (Proposal No. 2), approval of the proposal requires a vote of the holders of a majority of the voting power of the shares of stock present in person or represented by proxy and entitled to vote on the proposal.

For any other proposal being considered at the Annual Meeting, approval of the proposal requires a vote of the holders of a majority of the voting power of the shares of stock present in person or represented by proxy and entitled to vote on the proposal. While the vote on executive compensation (Proposal 3) is advisory in nature and non-binding, the Board will review the voting results and expects to take them into consideration when making future decisions regarding executive compensation.

How are votes counted?

With respect to the election of directors (Proposal No. 1), you may vote “FOR” or “WITHOLD” with respect to each nominee. Votes that are withheld will be excluded entirely from the vote with respect to the nominee from which they are withheld and will have the same effect as an abstention. Votes that are withheld will not have any effect on the outcome of the election of directors. Broker non-votes will have no effect on the outcome of Proposal No. 1

You may vote “FOR”, “AGAINST” or “ABSTAIN” with respect to the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014 (Proposal No. 2) and the advisory vote on the compensation paid to our named executive officers (Proposal No. 3). For proposal No. 2 and No. 3, abstentions will have the effect of a vote “against” the proposal.

If you just sign and submit your proxy card without voting instructions, your shares will be voted “FOR” each director nominee listed herein and “FOR” the other proposals, as recommended by the Board and in accordance with the discretion of the holders of the proxy with respect to any other matters that may be voted upon.

2

Table of Contents

Who will count the vote?

Representatives of Broadridge will tabulate the votes, and representatives of Broadridge will act as inspectors of election.

How does the Board recommend that I vote?

Our Board recommends that you vote your shares:

| • | “FOR” each of the nominees to the Board set forth in this Proxy Statement. |

| • | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014. |

| • | “FOR” the approval, on a non-binding, advisory basis, of the compensation paid to our named executive officers. |

How do I vote my shares without attending the Annual Meeting?

If you are a shareholder of record, you may vote by granting a proxy. Specifically, you may vote:

| • | By Internet—If you have Internet access, you may submit your proxy by going to www.proxyvote.com and by following the instructions on how to complete an electronic proxy card. You will need the 12- digit number included on your Notice or your proxy card in order to vote by Internet. |

| • | By Telephone—If you have access to a touch-tone telephone, you may submit your proxy by dialing1-800-690-6903 and by following the recorded instructions. You will need the 12-digit number included on your Notice or your proxy card in order to vote by telephone. |

| • | By Mail—You may vote by mail by requesting a proxy card from us, indicating your vote by completing, signing and dating the card where indicated and by mailing or otherwise returning the card in the envelope that will be provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

If you hold your shares in street name, you may also submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your bank, broker, or other nominee on how to submit voting instructions.

Internet and telephone voting facilities will close at 11:59 p.m. (Eastern Daylight Time) on May 18, 2014 for the voting of shares held by shareholders of record or held in street name.

Mailed proxy cards with respect to shares held of record or in street name must be received no later than May 16, 2014.

How do I vote my shares in person at the Annual Meeting?

First, you must satisfy the requirements for admission to the Annual Meeting (see below). Then, if you are a shareholder of record and prefer to vote your shares at the Annual Meeting, you must bring proof of identification along with your Notice or proof of ownership. You may vote shares held in street name at the Annual Meeting only if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by Internet, telephone or mail so that your vote will be counted even if you later decide not to attend the Annual Meeting.

3

Table of Contents

What does it mean if I receive more than one Notice on or about the same time?

It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please sign and return each proxy card or, if you vote by Internet or telephone, vote once for each Notice you receive.

May I change my vote or revoke my proxy?

Yes. Whether you have voted by Internet, telephone or mail, if you are a shareholder of record, you may change your vote and revoke your proxy by:

| • | Sending a written statement to that effect to our Corporate Secretary or to any corporate officer of the Company, provided such statement is received no later than May 16, 2014; |

| • | Voting again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m. (Eastern Daylight Time) on May 18, 2014; |

| • | Submitting a properly signed proxy card with a later date that is received no later than May 16, 2014; or |

| • | Attending the Annual Meeting, revoking your proxy and voting in person. |

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy in person at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Do I need a ticket to be admitted to the Annual Meeting?

You will need yourproof of identification along with either your Notice or proof of stock ownershipto enter the Annual Meeting. If your shares are held beneficially in the name of a bank, broker or other holder of record and you wish to be admitted to attend the Annual Meeting, you must present proof of your ownership of Team Health Holdings, Inc. stock, such as a bank or brokerage account statement.

Do I also need to present identification to be admitted to the Annual Meeting?

Yes, all shareholders must present a form of personal identification in order to be admitted to the Annual Meeting.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

Could other matters be decided at the Annual Meeting?

At the date this Proxy Statement went to press, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement.

If other matters are properly presented at the Annual Meeting for consideration and you are a shareholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

4

Table of Contents

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Our Certificate of Incorporation provides for a classified Board of Directors divided into three classes: H. Lynn Massingale, M.D. and Joseph L. Herring constitute a class with a term that expires at the Annual Meeting of Shareholders in 2016 (the “Class I Directors”); Greg Roth, James L. Bierman and Mary R. Grealy constitute a class with a term that expires at the Annual Meeting of Shareholders in 2014 (the “Class II Directors”); and Glenn A. Davenport, Vicky B. Gregg and Neil M. Kurtz, M.D. constitute a class with a term that expires at the Annual Meeting of Shareholders in 2015 (the “Class III Directors”).

Upon the recommendation of the Nominating Committee, the full Board of Directors has considered and nominated the following slate of Class II nominees for a three-year term expiring in 2017: Greg Roth, James L. Bierman and Mary R. Grealy. Action will be taken at the Annual Meeting for the election of these three Class II nominees. On January 9, 2014, we announced that Greg Roth will be transitioning out of his role as our Chief Executive Officer. Mr. Roth will resign as a member of our Board of Directors at the time of his termination of employment with our Company in accordance with the terms of the Transition Services Agreement that we entered into with him.

Unless otherwise instructed, the persons named in the form of proxy card (the “proxyholders”) attached to this proxy statement intend to vote the proxies held by them for the election of Greg Roth, James L. Bierman and Mary R. Grealy If any of these nominees ceases to be a candidate for election by the time of the Annual Meeting (a contingency which the Board does not expect to occur), such proxies may be voted by the proxyholders in accordance with the recommendation of the Board.

Nominees for Election to the Board of Directors in 2014

The following information describes the offices held, other business directorships and the class and term of each director nominee. Beneficial ownership of equity securities of the director nominees is shown under “Ownership of Securities” below.

Class II – Nominees for Term Expiring in 2017

Name | Age | Principal Occupation and Other Information | ||||

Greg Roth | 57 | A member of our Board and Chief Executive Officer since May 2008. He also served as President of the Company from November 2004 when he joined the Company until April 2013. Prior to joining the Company, Mr. Roth had been employed by HCA—Hospital Corporation of America, a provider of healthcare services, since January 1995. Beginning in July 1998, Mr. Roth served as President of HCA, Ambulatory Surgery Division. Prior to his appointment as President, Mr. Roth served in the capacity of Senior Vice President of Operations, Western Region from May 1997 to July 1998 and the Division’s Chief Financial Officer from January 1995 to May 1997. Prior to these positions, Mr. Roth held various positions in the healthcare industry. On January 9, 2014, the Company announced that Mr. Roth will transition out of his role as Chief Executive Officer of the Company in accordance with the terms of a Transition Services Agreement with the Company. | ||||

5

Table of Contents

Name | Age | Principal Occupation and Other Information | ||||

James L. Bierman | 61 | A member of our Board since August 2010. Mr. Bierman is President and Chief Operating Officer since August 2013 of Owens & Minor, Inc., a FORTUNE 500 company and a leading distributor of medical and surgical supplies. Previously, Mr. Bierman served as Executive Vice President and Chief Operating Officer from March 2012 to August 2013, as Executive Vice President and Chief Financial Officer from April 2011 to March 2012, and as Senior Vice President and Chief Financial Officer from June 2007 to April 2011, at Owens & Minor, Inc. From 2001 to 2004, Mr. Bierman served as Executive Vice President and Chief Financial Officer at Quintiles Transnational Corp. Mr. Bierman is a former director of Quintiles Transnational Corp. and of Pharma Services Holding, Inc., (a parent company). Prior to joining Quintiles Transnational Corp., Mr. Bierman was a partner of Arthur Andersen LLP from 1988 to 1998. Mr. Bierman earned his MBA at Cornell University’s Johnson Graduate School of Management and his undergraduate degree at Dickinson College. | ||||

Mary R. Grealy | 65 | A member of our Board since October 2012. Ms. Grealy has served as President of the Healthcare Leadership Council, a coalition of chief executives of the nation’s leading healthcare companies and organizations, since 1999. As a widely recognized expert in the field of health legislation and a member of the not-for-profit board of Duquesne University and a member of the American Health Lawyers Association, Ms. Grealy frequently serves as a public speaker around the country. Ms. Grealy has strong credentials within the hospital community, bringing 33 years of consulting and advising experience to the board as part of leading trade associations, testifying before Congress, and lobbying at various levels of government. Ms. Grealy formerly served as the Chief Washington Counsel for the American Hospital Association and as Chief Operating Officer and Executive Counsel for the Federation of American Hospitals. Ms. Grealy began her career in the healthcare industry as a Legislative Assistant to U.S. House of Representatives’ Ways and Means Subcommittee on Health, during the Carter Administration. Ms. Grealy is a graduate of Duquesne University School of Law in Pittsburgh and earned her undergraduate degree at Michigan State University. | ||||

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

6

Table of Contents

Continuing Members of the Board of Directors

The following information describes the offices held, other business directorships and the class and term of each director whose term continues beyond the Annual Meeting and who is not subject to election this year. Beneficial ownership of equity securities for these directors is also shown under “Ownership of Securities” below.

Class I – Directors Whose Term Expires in 2016

Name | Age | Principal Occupation and Other Information | ||||

H. Lynn Massingale, M.D. | 61 | A member of our Board since November 2005 and Executive Chairman since May 2008. Prior to May 2008, Dr. Massingale had been the Chief Executive Officer and director of Team Health, Inc. since 1994 and also held the title of President until October 2004. Dr. Massingale previously served as President and Chief Executive Officer of Southeastern Emergency Physicians, a provider of emergency physician services to hospitals in the Southeast and the predecessor of Team Health, Inc., which Dr. Massingale co-founded in 1979. Dr. Massingale served as the director of Emergency Services for the state of Tennessee from 1989 to 1993. Dr. Massingale is a graduate of the University of Tennessee Medical Center for Health Services. | ||||

Joseph L. Herring | 58 | A member of our Board of Directors since November 2013. Mr. Herring has served as Chief Executive Officer of Covance Inc., a drug development services company, since 2005 and as Chairman of the Board of Covance since 2006. Mr. Herring previously served in several executive roles with Covance, including president and chief operating officer, president of early development services and corporate vice president and general manager for the company’s North American preclinical operations. Prior to joining Covance, Mr. Herring held a variety of senior leadership positions with Caremark International and American Hospital Supply Corporation. Mr. Herring currently serves on the nonprofit boards for University Medical Center of Princeton and the Association of Clinical Research Organizations, of which he formerly served as chairman. Mr. Herring previously served on the board of First Circle Medical, Inc. Mr. Herring earned his Bachelor of Science degree in marketing from Louisiana State University. | ||||

Class III – Directors Whose Term Expires in 2015

Name | Age | Principal Occupation and Other Information | ||||

Glenn A. Davenport | 60 | A member of our Board of Directors since December 2001. Mr. Davenport is currently President of G. A. Foods, a company specializing in nutritious meals for the senior, child nutrition, military and emergency response markets. From March 2007 to February 2009, Mr. Davenport was President of Horizon Software International, LLC, a company specializing in food service technology. Mr. Davenport served as Chairman and Chief Executive Officer of Morrison Management Specialists until August 2006. Prior thereto, he served in various management capacities with Morrison Restaurants, Inc. since 1973. Mr. Davenport serves as a director of Cracker Barrel Old Country Stores. | ||||

7

Table of Contents

Name | Age | Principal Occupation and Other Information | ||||

Vicky B. Gregg | 59 | A member of our Board of Directors since January 2013. Ms. Gregg served as the Chief Executive Officer and as a Director of BlueCross BlueShield of Tennessee (BCBST), a not-for-profit organization that, together with its subsidiaries, provides a comprehensive range of group and individual health insurance plans, products and services, from February 2003 until December 2012. Before becoming Chief Executive Officer of BCBST, Ms. Gregg served as BCBST’s President and Chief Operating Officer, overseeing all aspects of the company’s day-to-day operations, and prior to that occupied several senior leadership positions at BCBST. Prior to joining BCBST, Ms. Gregg served as a Market Vice President of Humana in Kentucky and Ohio. Ms. Gregg has served as a Director of First Horizon National Corporation since January 2011, serves on the boards of a number of other non-profit and trade organizations, and in the past has also served on several appointed commissions, including the Tennessee Governor’s Roundtable. Ms. Gregg attended the University of Tennessee at Chattanooga and the Erlanger School of Nursing. | ||||

Neil M. Kurtz, M. D. | 63 | A member of our Board of Directors since November 2013. Dr. Kurtz is President and Chief Executive Officer of Golden Living, LLC, a privately-held skilled nursing, hospice, home healthcare and institutional pharmacy company. Prior to joining Golden Living in 2008, Dr. Kurtz served as president and Chief Executive Officer of TorreyPines Therapeutics, Inc., and as president of Ingenix Pharmaceutical Services, Inc., a division of United Health Group (UHG). Dr. Kurtz co-founded Worldwide Clinical Trials, a contract research organization, where he held the positions of president and Chief Executive Officer until its acquisition by UHG in 1999. His career also includes leadership positions with Boots Pharmaceuticals, Inc., Bayer Corporation, Bristol-Myers Company and Merck, Sharp and Dohme. Dr. Kurtz currently serves on the corporate boards of Golden Gate National Senior Care Holdings and Medidata Solutions, Inc. Dr. Kurtz previously served on the corporate boards for Ingenix, Inc.; NeurogesX, Inc.; Stemedica Cell Technologies and TorreyPines Therapeutics, Inc. Dr. Kurtz earned his Bachelor of Arts degree in psychology from New York University and his medical degree from the Medical College of Wisconsin. Dr. Kurtz is board certified in psychiatry and neurology in New York, California and Georgia. | ||||

8

Table of Contents

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

Our Board manages or directs the business and affairs of the Company, as provided by Delaware law, and conducts its business through meetings of the Board and four standing committees: the Audit Committee; the Compensation Committee; the Nominating/Governance Committee and the Compliance Committee.

During fiscal 2013 there were a number of changes in our Board’s composition. In January 2013, Vicky B. Gregg was appointed to the Board as a Class III director. In March 2013, Michael Dal Bello, who was originally appointed as a director of the Company by The Blackstone Group L.P. (“Blackstone”) pursuant to the terms of the stockholders’ agreement between the Company and Ensemble Parent LLC, an affiliate of Blackstone (the “Stockholders Agreement”), resigned from the Board. In July 2013, Messrs. Earl P. Holland and Steven B. Epstein resigned from the Board. In November 2013, the Board appointed Joseph L. Herring and Neil M. Kurtz, MD to serve as Class I and Class III directors, respectively, to fill the vacancies that were on the Board. In March 2014, Neil P. Simpkins, who was originally appointed as a director of the Company by Blackstone pursuant to the terms of the Stockholders Agreement, resigned from the Board.

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and NYSE rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries.

The Board has established categorical standards of director independence to assist it in making independence determinations. These standards (which are included as an annex in our Corporate Governance Guidelines and may be found on the Corporate Governance Highlights page of the Investor Relations section on our website at www.teamhealth.com) set forth certain relationships between the Company and the directors and their immediate family members, or entities with which they are affiliated, that the Board, in its judgment, has determined to be material or immaterial in assessing a director’s independence. The Board’s policy is to review the independence of all directors at least annually.

In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the categorical independence standards, the Board will determine in its judgment whether such relationship is material.

The Nominating/Governance Committee undertook its annual review of director independence and made a recommendation to our Board regarding director independence. As a result of this review, our Board affirmatively determined that each of Messrs. Davenport, Bierman, Herring, Dr. Kurtz, and Mss. Grealy and Gregg are independent under the categorical standards for director independence set forth in the Corporate Governance Guidelines and for purposes of all applicable New York Stock Exchange standards, including with respect to committee service. Our Board has also determined that Ms. Gregg and Messrs. Herring and Bierman are “independent” for purposes of Section 10A(m)(3) of the Exchange Act.

In making its independence determinations, the Board considered and reviewed transactions and relationships known to the Board (including those identified through annual directors’ questionnaires) that exist between us and our subsidiaries and the entities with which certain of our directors are affiliated.

Our Board currently consists of an Executive Chairman position that is separate from the position of Chief Executive Officer. The Board believes that the decision of whether to combine or separate the positions of CEO and Chairman of the Board will vary from company to company and depend upon a company’s particular circumstances at a given point in time. For our company, the Board currently believes that separating the CEO and Executive Chairman positions is the appropriate leadership structure and is in the best interests of our shareholders. Accordingly, Dr. Massingale serves as Executive Chairman, while Mr. Roth serves as our Chief

9

Table of Contents

Executive Officer. Our Board believes that this structure best encourages the free and open dialogue of competing views and provides for strong checks and balances. Additionally, Dr. Massingale’s attention to Board and committee matters allows Mr. Roth to focus more specifically on overseeing the Company’s day to day operations as well as strategic opportunities and planning.

The following table summarizes the current membership of each of the Board’s Committees.

| Audit Committee (1) | Compensation Committee | Nominating/Governance Committee | Compliance Committee | |||||

James L. Bierman | X, Chair | X, Chair | ||||||

Glenn A. Davenport | X, Chair | X | ||||||

Mary R. Grealy | X, Chair | |||||||

Vicky B. Gregg | X | X | ||||||

Joseph L. Herring | X | X | ||||||

Neil M. Kurtz, M.D. | X | X | ||||||

H. Lynn Massingale, M.D. | ||||||||

Greg Roth | X |

| (1) | As of the Audit Committee report date, members of the Audit Committee were Messrs. Bierman and Davenport and Ms. Gregg. Effective February 2014 Mr. Herring replaced Mr. Davenport as a member of the Audit Committee. |

All directors are expected to make every effort to attend all meetings of the Board, meetings of the committees of which they are members and the annual meeting of shareholders. During the year ended December 31, 2013, the Board held eleven meetings, the Audit Committee held eight meetings, the Compensation Committee held eight meetings, the Nominating/Governance Committee held four meetings and the Compliance Committee held four meetings. All of our current directors, other than Mr. Herring who was appointed to the Board in November 2013, attended 93% or more of the meetings of the Board and relevant committee meetings in 2013. Mr. Herring attended one of two of the meetings of the Board held subsequent to his appointment to the Board. The meeting missed by Mr. Herring was due to a preexisting scheduling conflict that occurred prior to his appointment to the Board. All of our current directors attended the 2013 annual meeting, with the exception of Mr. Herring and Dr. Kurtz who were appointed to the Board subsequent to the meeting.

All members of the Audit Committee are “independent,” consistent with our Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors in general and audit committees in particular. Our Board has determined that each of the members of the Audit Committee is “financially literate” within the meaning of the listing standards of the New York Stock Exchange. In addition, our Board has determined that Mr. Bierman qualifies as an audit committee financial expert as defined by applicable SEC regulations. The Board reached its conclusion as to Mr. Bierman’s qualification based on, among other things, his experience as Chief Financial Officer of Owens & Minor, Inc. and his prior experience as Chief Financial Officer of Quintiles Transnational Corp. and as a partner at Arthur Andersen LLP.

The duties and responsibilities of the Audit Committee are set forth in its charter, which may be found atwww.teamhealth.comunder Investor Relations: Corporate Governance Highlights: Committee Charters: Audit Committee, and include the following:

| • | carrying out the responsibilities and duties delegated to it by the Board, including its oversight of our financial reports and financial reporting policies, our internal controls and, in coordination with the Compliance Committee, our compliance with legal and regulatory requirements; |

10

Table of Contents

| • | selecting our independent registered public accounting firm and reviewing and at least annually evaluating its qualifications, compensation, performance and independence; |

| • | reviewing and pre-approving the audit and non-audit services and the payment of compensation to the independent registered public accounting firm; |

| • | reviewing reports and material written communications between management and the independent registered public accounting firm, including with respect to major issues as to the adequacy of the Company’s internal controls; |

| • | reviewing the work of our internal audit function; and |

| • | reviewing and discussing with management and the independent registered public accounting firm our guidelines and policies with respect to risk assessment and risk management. |

With respect to our reporting and disclosure matters, the responsibilities and duties of the Audit Committee include reviewing and discussing with management and the independent registered public accounting firm our annual audited financial statements and quarterly financial statements prior to inclusion in our Annual Report on Form 10-K or other public dissemination in accordance with applicable rules and regulations of the SEC.

On behalf of the Board, the Audit Committee plays a key role in the oversight of the Company’s risk management policies and procedures. See “Oversight of Risk Management” below.

All members of the Compensation Committee are “independent” consistent with our Corporate Governance Guidelines and the NYSE listing standards applicable to board of directors in general and Compensation Committee in particular. In addition, all members of the Compensation Committee qualify as “non-employee directors” for purposes of Rule 16b-3 of the Exchange Act, and as “outside directors” for purposes of Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”).

The duties and responsibilities of the Compensation Committee are set forth in its charter, which may be found at www.teamhealth.comunder Investor Relations: Corporate Governance Highlights: Committee Charters: Compensation Committee, and include the following:

| • | establishing and reviewing, on an annual basis, the overall compensation philosophy of the Company; |

| • | reviewing and approving corporate goals and objectives relevant to the Chief Executive Officer and other executive officers’ compensation, including annual performance objectives, if any; |

| • | evaluating the performance of the Executive Chairman and Chief Executive Officer in light of these corporate goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determining and approving the annual salary, bonus, equity-based incentives and other benefits, direct and indirect, of the Executive Chairman and Chief Executive Officer; |

| • | overseeing and approving the management continuity planning process; |

| • | reviewing and approving or making recommendations to the Board of Directors on the annual salary, bonus, equity and equity-based incentives and other benefits, direct and indirect, of the other executive officers; |

| • | considering policies and procedures pertaining to expense accounts of senior executives; |

| • | reviewing and approving, or making recommendations to the Board with respect toincentive-compensation plans and equity-based plans that are subject to the approval of the Board, and overseeing the activities of the individuals responsible for administering those plans; |

11

Table of Contents

| • | reviewing and approving equity compensation plans of the Company that are not otherwise subject to the approval of the Company’s shareholders; |

| • | reviewing and making recommendations to the Board, or approving, all equity-based awards, including pursuant to the Company’s equity-based plans; |

| • | monitoring compliance by executives with the rules and guidelines of the Company’s equity-based plans and other applicable regulations; and |

| • | reviewing and monitoring all employee benefit plans of the Company. |

With respect to our reporting and disclosure matters, the responsibilities and duties of the Compensation Committee include reviewing and recommending the Compensation Committee Report and Compensation Discussion and Analysis to the Board for inclusion in our annual proxy statement or Annual Report onForm 10-K in accordance with applicable rules and regulations of the SEC. The charter of the Compensation Committee permits the committee to delegate any or all of its authority to one or more subcommittees and to delegate to one or more officers of the Company the authority to make awards to any non-Section 16 officer of the Company under the Company’s incentive- compensation or other equity-based plan, subject to compliance with the plan and the laws of the state of the Company’s jurisdiction.

The Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, in September 2012, the Compensation Committee engaged the services of Compensation Advisory Partners LLC (“CAP”) as its independent outside compensation consultant.

All executive compensation services provided by CAP were conducted under the direction or authority of the Compensation Committee, and all work performed by CAP was pre-approved by the Compensation Committee. Neither CAP nor any of its affiliates maintains any other direct or indirect business relationships with the Company or any of its affiliates. Prior to CAP’s retention by the Committee, the Compensation Committee evaluated whether any work provided by CAP raised any conflict of interest and determined that it did not.

As requested by the Compensation Committee, in 2013, CAP’s services to the Compensation Committee included, among other things:

| • | reviewing and advising with respect to potential changes to stock incentive and annual management incentive plans; |

| • | preparing comparative analyses of executive compensation levels and design at peer group companies; |

| • | assisting the Compensation Committee in assessing the pay for performance alignment of the Company’s compensation program; and |

| • | reviewing and evaluating our overall compensation structure in light of organizational objectives. |

A CAP representative participated in five of the eight Compensation Committee meetings in 2013.

The purpose of the Compliance Committee is to assist the Board of Directors with the review and oversight of matters related to compliance with federal healthcare program laws and requirements and applicable state healthcare laws, including relevant laws, regulations and regulatory guidance. The duties and responsibilities of the Compliance Committee include the following:

| • | promoting a Company-wide culture of compliance through oversight of and coordination with management on development and implementation of a robust and effective compliance program consistent with the seven elements described in its charter; |

12

Table of Contents

| • | reporting to the Board on a periodic basis on findings, recommendations and any other matters the Compliance Committee deems appropriate or the Board requests, including reporting at least annually to the Board on its assessment of the ability of the compliance program to meet its compliance obligations; |

| • | annually reviewing and approving a work plan prepared by the Compliance Officer, which sets forth the Company’s plan for maintaining an effective compliance program; |

| • | annually overseeing an effectiveness evaluation of the compliance program, either through internal or external means, and submitting any recommended changes to the Board for its consideration; and |

| • | coordinating with the Audit Committee with respect to compliance matters relating to financial matters. |

Nominating/Governance Committee

All members of the Nominating/Governance Committee are “independent,” consistent with our Corporate Governance Guidelines and the NYSE listing standards applicable to board of directors in general and nominating committees in particular.

The duties and responsibilities of the Nominating/Governance Committee are set forth in its charter, which may be found at www.teamhealth.comunder Investor Relations: Corporate Governance Highlights: Committee Charters: Nominating/Governance Committee, and include the following:

| • | establishing the criteria for the selection of new directors; |

| • | identifying and recommending to the Board individuals to be nominated as directors; |

| • | evaluating candidates for nomination to the Board, including those recommended by shareholders; |

| • | conducting all necessary and appropriate inquiries into the backgrounds and qualifications of possible candidates; |

| • | considering questions of independence and possible conflicts of interest of members of the Board; |

| • | reviewing and recommending the composition and size of the Board; |

| • | overseeing, at least annually, the evaluation of the Board and management; and |

| • | periodically reviewing the charter, composition and performance of each committee of the Board and recommending to the Board the creation or elimination of committees. |

The Company is exposed to a number of enterprise risks including financial risks, operational risks and risks relating to regulatory and legal compliance. The Company’s Chief Financial Officer is primarily responsible for the Company’s enterprise risk management function and regularly works closely with the Company’s senior executives to identify risks material to the Company. The Chief Financial Officer reports regularly to the Chief Executive Officer and, as described below, the Audit Committee and the Board, regarding the Company’s risk management policies and procedures.

On behalf of the Board, the Audit Committee plays a key role in the oversight of the Company’s risk management policies and procedures and the Compliance Committee plays a key role in matters related to the Company’s compliance with federal and state healthcare regulatory program laws, regulations and guidance. In this regard, the Audit Committee discusses with management and the independent auditors the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the guidelines and policies to govern the process by which risk assessment and risk management are undertaken. Specifically, the Audit Committee meets with the Company’s Chief Financial Officer periodically throughout the year, as necessary to discuss the risks facing the Company, including, in particular, any new risks that may have arisen since they last met.

13

Table of Contents

The Compensation Committee is responsible for oversight of risks relating to compensation programs and reviews and discusses with management, on at least an annual basis, management’s assessment of whether risks arising from the Company’s compensation policies and practices for all employees are reasonably likely to have a material adverse effect on the Company. CAP, the Committee’s compensation consultant undertook a comprehensive review of the company’s incentives, which it reviewed and discussed with the Compensation Committee. CAP advised the Compensation Committee that based on their review they did not find there were any issues that would encourage excessive risk taking.

In addition, the Compliance Committee is responsible for oversight of matters relating to compliance with federal healthcare program laws and requirements and applicable state health care laws, including relevant laws, regulations, and regulatory guidance. The Compliance Committee relies upon the expertise and knowledge of the Company’s management, including its Chief Legal Officer and Compliance Officer. The Chairs of the Audit and Compliance Committees meet periodically throughout the year, as necessary to discuss any healthcare regulatory risks that may have a material adverse effect on the Company.

Executive sessions, which are meetings of the non-management members of the Board, are regularly scheduled throughout the year. In addition, at least once a quarter, the independent directors meet in a private session that excludes management and non-independent directors. At each of these meetings, the non-management and independent directors in attendance, as applicable, will determine which member will preside at such session based upon a scheduled rotation of such duties. The Audit, Compensation, Compliance and Nominating/Governance Committees also meet regularly in executive session.

Committee Charters and Corporate Governance Guidelines

Our commitment to good corporate governance is reflected in our Corporate Governance Guidelines, which describe the Board’s views on a wide range of governance topics. These Corporate Governance Guidelines are reviewed from time to time by the Board and, to the extent deemed appropriate in light of emerging practices, revised accordingly, upon recommendation to and approval by the full Board.

Our Corporate Governance Guidelines, which include our categorical standards of director independence, our Audit, Compensation, Compliance and Nominating/Governance Committee charters and other corporate governance information are available on the Corporate Governance Highlights page of the Investor Relations section on our website at www.teamhealth.com. Any shareholder also may request them in print, without charge, by contacting the Corporate Secretary at Team Health Holdings, Inc., 265 Brookview Centre Way, Suite 400, Knoxville, Tennessee 37919.

We maintain a Code of Conduct that is applicable to all of our directors, officers, employees and affiliated independent contractor medical professionals, including our Executive Chairman, Chief Executive Officer, President, Chief Financial Officer, Controller and other senior financial officers. The Code of Conduct sets forth our policies and expectations on a number of topics, including conflicts of interest, compliance with laws, use of our assets and business conduct and fair dealing. This Code of Conduct also satisfies the requirements for a code of ethics, as defined by Item 406 of Regulation S-K promulgated by the SEC. The Company will disclose within four business days any substantive changes in or waivers of the Code of Conduct granted to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by posting such information on our website as set forth above rather than by filing a Form 8-K.

The Code of Conduct may be found on our website at www.teamhealth.comunder Investor Relations: Corporate Governance Highlights: Code of Conduct.

14

Table of Contents

As described in our Code of Conduct, we maintain the TeamHealth Compliance Hotline by which the Company’s directors, officers, employees and affiliated independent contractor medical professionals (referenced individually as an “Associate” and collectively as “Associates”) are provided with three avenues through which they can address any ethical questions or concerns: a toll-free phone line, a fax, and a website. The TeamHealth Compliance Hotline is available 24 hours a day, 7 days a week. The hotline has a toll-free number for Associates. Associates may also access the hotline system and report integrity concerns via the Web. Associates can choose to remain anonymous in using the Hotline. In addition, we maintain a formal non-retaliation policy that prohibits action or retaliation against any Associate who makes a report in good faith even if the facts alleged are not confirmed by subsequent investigation.

The Nominating/Governance Committee weighs the characteristics, experience, independence and skills of potential candidates for election to the Board and recommends nominees for director to the Board for election. In considering candidates for the Board, the Nominating/Governance Committee also assesses the size, composition and combined expertise of the Board. As the application of these factors involves the exercise of judgment, the Nominating/Governance Committee does not have a standard set of fixed qualifications that is applicable to all director candidates, although the Nominating/Governance Committee does at a minimum assess each candidate’s strength of character, mature judgment, industry knowledge or experience, his or her ability to work collegially with the other members of the Board and his or her ability to satisfy any applicable legal requirements or listing standards. In addition, although the Board considers diversity of viewpoints, background and experiences, the Board does not have a formal diversity policy. In identifying prospective director candidates, the Nominating/ Governance Committee may seek referrals from other members of the Board, management, shareholders and other sources. The Nominating/Governance Committee also may, but need not, retain a search firm in order to assist it in identifying candidates to serve as directors of the Company. In the case of all of our new Board members including Mary R. Grealy, a Class II director nominee, a professional search firm identified them as potential director candidates. The Nominating/Governance Committee utilizes the same criteria for evaluating candidates regardless of the source of the referral. When considering director candidates, the Nominating/Governance Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance the Board’s effectiveness.

In connection with its annual recommendation of a slate of nominees, the Nominating/Governance Committee may also assess the contributions of those directors recommended for re-election in the context of the Board evaluation process and other perceived needs of the Board.

When considering whether the directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Board focused primarily on the information discussed in each of the board member’s biographical information set forth above. Each of the Company’s directors possesses high ethical standards, acts with integrity and exercises careful, mature judgment. Each is committed to employing his or her skills and abilities to aid the long-term interests of the stockholders of the Company. In addition, our directors are knowledgeable and experienced in one or more business, governmental, or civic endeavors, which further qualifies them for service as members of the Board. A significant number of our directors possess experience in owning and managing public and privately held enterprises and are familiar with corporate finance and strategic business planning activities that are unique to publicly traded companies like ours. Finally, many of our directors possess substantial expertise in advising and managing companies in various segments of the healthcare industry.

| • | Dr. Massingale has significant experience in the healthcare industry, having managed the Company since 1994 and having served as director of Emergency Services for the State of Tennessee from 1989 to 1993. |

| • | Mr. Roth has significant healthcare experience, having served in executive positions in various segments of the healthcare industry, such as President, Ambulatory Surgery Division of HCA. |

15

Table of Contents

| • | Mr. Davenport is experienced in management, having served as President of Horizon Software, Chairman and Chief Executive Officer of Morrison Management Specialists and in other management capacities with Morrison Restaurants, Inc. |

| • | Mr. Bierman has both healthcare and accounting experience, serving as Senior Vice President and Chief Operating Officer for Owens & Minor and having served as Chief Financial Officer of Quintiles Transnational Corp. and as a partner at Arthur Andersen LLP. |

| • | Ms. Grealy is a widely recognized expert in the field of health legislation who also brings experience in management. She is currently the President of the Healthcare Leadership Council, a coalition of chief executives of the nation’s leading healthcare companies and organizations. A lawyer by training, she also has strong credentials with the hospital community having formerly served as Chief Washington Counsel for the American Hospital Association and as Chief Operating Officer and Executive Counsel for the Federation of American Hospitals. |

| • | Ms. Gregg has relevant technical skills and industry knowledge. She has healthcare and business leadership experience having served as Blue Cross Blue Shield of Tennessee’s Chief Executive Officer from 2003 to 2012. She has extensive knowledge of healthcare plans, having served as the chair of that industry’s leading trade organization, America’s Health Insurance Plans (AHIP), and still serves on its Foundation Board. |

| • | Mr. Herring has significant experience in the healthcare industry, currently serving as Chief Executive Officer of Covance Inc. |

| • | Dr. Kurtz has significant experience in the healthcare industry, currently serving as Chief Executive Officer and President of Golden Living, LLC. |

This process resulted in the Nominating/Governance Committee’s recommendation to the Board, and the Board’s nomination, of the three incumbent directors named in this Proxy Statement and proposed for election by you at the upcoming Annual Meeting.

The Nominating/Governance Committee will consider director candidates recommended by shareholders. Any recommendation submitted to the Corporate Secretary should be in writing and should include any supporting material the shareholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected. Shareholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Corporate Secretary, Team Health Holdings, Inc., 265 Brookview Centre Way, Suite 400, Knoxville, Tennessee 37919. All recommendations for nomination received by the Corporate Secretary that satisfy our by-law requirements relating to such director nominations will be presented to the Nominating/Governance Committee for its consideration. Shareholders must also satisfy the notification, timeliness, consent and information requirements set forth in our by-laws. These requirements are also described under the caption “Shareholder Proposals for the 2015 Annual Meeting”.

As described in the Corporate Governance Guidelines, shareholders and other interested parties who wish to communicate with a member or members of the Board, including the chairperson of the Audit, Compensation, Compliance or Nominating/Governance Committees or to the non-management or independent directors as a group, may do so by (1) addressing such communications or concerns to them c/o Corporate Secretary, Team Health Holdings, Inc., 265 Brookview Centre Way, Suite 400, Knoxville, Tennessee 37919 or (2) sending an e-mail to Corporate_Secretary@teamhealth.com. The Corporate Secretary will forward such correspondence to the appropriate party. Such communications may be done confidentially or anonymously.

16

Table of Contents

Executive Officers of the Company

Set forth below is certain information regarding each of our current executive officers, other than Dr. H. Lynn Massingale, whose biographical information is presented under “Class I—Directors Whose Term Expires in 2016” and Mr. Greg Roth, whose biographical information is presented under “Class II—Nominees for Term Expiring in 2017.”

Name | Age | Principal Occupation and Other Information | ||||

Michael D. Snow | 59 | Our President since April 2013. Throughout his career, Mr. Snow has held numerous executive-level positions in the healthcare arena. Mr. Snow served as President of HCA’s Gulf Coast Division from 1996 to 2004. From 2004 to 2007, Mr. Snow served as Executive Vice President and Chief Operating Officer of HealthSouth Corporation. From 2007 to 2008, Mr. Snow served as President and Chief Executive Officer of Surgical Care Affiliates. Mr. Snow served as President and Chief Executive Officer of Wellmont Health System from 2008 to 2009. From 2010 to 2011, Mr. Snow served as Chief Operating Officer of Amedisys, Inc. From 2011 to 2013, Mr. Snow operated Overton Advisory Group, which provided strategic and operational consulting services to various healthcare companies and investment groups. Mr. Snow earned his Bachelor of Science degree from the University of Alabama and a Master’s Degree in Business Administration from Troy State University. | ||||

David P. Jones | 46 | Our Chief Financial Officer since May 1996. In November 2010, Mr. Jones assumed the title of Executive Vice President and Chief Financial Officer. From 1994 to 1996, Mr. Jones was our Controller. Prior to that, Mr. Jones worked at Pershing, Yoakley and Associates, a regional healthcare audit and consulting firm, as a Supervisor. Before joining Pershing, Yoakley and Associates, Mr. Jones worked at KPMG Peat Marwick as an Audit Senior. Mr. Jones received a B.S. in Business Administration from the University of Tennessee. | ||||

Heidi S. Allen | 60 | Our Senior Vice President and General Counsel since June 2008. From February 2003 to June 2008, Ms. Allen was Associate General Counsel, U.S. Litigation and Investigations, for Sanofi, a major global pharmaceutical company. Admitted to and a member in good standing of the legal bars of Tennessee, South Carolina and New Jersey, Ms. Allen has more than 15 years of experience advising corporations on healthcare law, including a position as Associate General Counsel, Head of Litigation, for Blue Cross Blue Shield of New Jersey. She also served as an Assistant United States Attorney for 11 years. Ms. Allen received a B.A. from the University of Pennsylvania and a J.D. from Rutgers School of Law. | ||||

17

Table of Contents

PROPOSAL NO. 2—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Ernst & Young LLP to serve as our independent registered public accounting firm for 2014.

Although ratification is not required by our by-laws or otherwise, the Board is submitting the selection of Ernst & Young LLP to our shareholders for ratification because we value our shareholders’ views on the Company’s independent registered public accounting firm. If our shareholders fail to ratify the selection, it will be considered as notice to the Board and the Audit Committee to consider the selection of a different firm. Even if the selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our shareholders.

Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They also will have the opportunity to make a statement if they desire to do so, and they are expected to be available to respond to appropriate questions.

The shares represented by your proxy will be voted for the ratification of the selection of Ernst & Young LLP unless you specify otherwise.

In connection with the audit of the 2013 financial statements, we entered into an agreement with Ernst & Young LLP which set forth the terms by which Ernst & Young LLP performed audit services for the Company.

The following table presents fees for professional services rendered by Ernst & Young LLP for the audit of our financial statements for 2013 and 2012 and fees billed for other services rendered by Ernst & Young LLP for those periods:

| 2013 | 2012 | |||||||

Audit fees(1) | $ | 1,159,191 | $ | 917,027 | ||||

Audit-related fees(2) | 401,058 | 807,600 | ||||||

Tax fees(3) | 311,421 | 116,257 | ||||||

All other fees(4) | 1,995 | 1,995 | ||||||

|

|

|

| |||||

Total: | $ | 1,873,665 | $ | 1,842,879 | ||||

|

|

|

| |||||

| (1) | Includes the aggregate fees recognized in each of the last two fiscal years for professional services rendered by Ernst & Young LLP for the audit of the Company’s annual financial statements and the review of financial statements included in Forms 10-Q and Forms 10-K. The fees are for services that are normally provided by Ernst & Young LLP in connection with statutory or regulatory filings or engagements. |

| (2) | Includes fees billed for assurance and related services performed by Ernst & Young LLP that are related to the Company’s SEC filings and other research and consultation services. |

| (3) | Includes the aggregate fees recognized in each of the last two fiscal years for professional services rendered by Ernst & Young LLP for tax compliance, tax advice and tax planning. |

| (4) | Includes the aggregate fees recognized in each of the last two fiscal years for products and services provided by Ernst & Young LLP, other than those services described above. |

The Audit Committee considered whether providing the non-audit services shown in this table was compatible with maintaining Ernst & Young LLP’s independence and concluded that it was.

18

Table of Contents

Consistent with SEC policies regarding auditor independence and the Audit Committee’s charter, the Audit Committee has responsibility for engaging, setting compensation for and reviewing the performance of the independent registered public accounting firm. In exercising this responsibility, the Audit Committee pre- approves all audit and permitted non-audit services provided by any independent registered public accounting firm prior to each engagement and requires the independent registered public accounting firm and management to report actual fees incurred periodically throughout the year.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2014.

The Audit Committee operates pursuant to a charter which is reviewed annually by the Audit Committee. Additionally, a brief description of the primary responsibilities of the Audit Committee is included in this Proxy Statement under the discussion of “The Board of Directors and Certain Governance Matters—Committee Membership—Audit Committee”. Under the Audit Committee charter, our management is responsible for the preparation, presentation and integrity of our financial statements, the application of accounting and financial reporting principles and our internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America.

In the performance of its oversight function, the Audit Committee reviewed and discussed the audited financial statements of the Company with management and with the independent registered public accounting firm. The Audit Committee also discussed with the independent registered public accounting firm the matters required to be discussed by the Public Company Accounting Oversight Board’s Auditing Standard No. 16 “Communications with Audit Committees.” In addition, the Audit Committee received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and discussed with the independent registered public accounting firm their independence.

Based upon the review and discussions described in the preceding paragraph, our Audit Committee recommended to the Board that the audited financial statements of the Company be included in the Annual Report on Form 10-K for the year ended December 31, 2013 filed with the SEC.

Submitted by the Audit Committee of the Company’s Board of Directors:

James L. Bierman, Chair

Glenn A. Davenport

Vicky B. Gregg

19

Table of Contents

PROPOSAL NO. 3—NON-BINDING VOTE ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Exchange Act (which was added by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”)) and the related rules of the SEC, we are including in these proxy materials a separate resolution subject to shareholder vote to approve, in a non-binding, advisory vote, the compensation paid to our named executive officers as disclosed on pages 24 to 48. While the results of the vote are non-binding and advisory in nature, the Board intends to carefully consider the results of this vote.

The text of the resolution in respect of proposal no. 3 is as follows:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in this Proxy Statement pursuant to the rules of the SEC, including the Compensation Discussion and Analysis, compensation tables and any related narrative discussion is hereby APPROVED.”

In considering their vote, shareholders may wish to review with care the information on the Company’s compensation policies and decisions regarding the named executive officers presented in Compensation Discussion and Analysis on pages 24 to 33, as well as the discussion regarding the Compensation Committee on pages 12 to 13.

In particular, shareholders should note the following:

| • | A significant portion of named executive officers’ total compensation is tied to the achievement of Company’s financial goals and individual accomplishments that contribute to the Company’s success in the short- and long-term. |

| • | Long-term equity incentive grants, which constitute a key component of executive compensation, typically have a multi-year vesting period designed to motivate our named executive officers to make business decisions that, over the long-term, should increase the price of our stock. |

| • | Executives are subject to meaningful stock ownership guidelines (and holding requirements) that align their long-term interests with those of our shareholders and encourage a long-term focus in managing the company. |

| • | The Company does not provide any tax gross-ups of annual compensation. |

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS.

20

Table of Contents

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information about our Equity Compensation Plans as of December 31, 2013:

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||||||

Equity compensation plan approved by security | 5,062,611 | $ | 20.33 | 3,754,775 | ||||||||

Equity compensation plan not approved by security | — | — | — | |||||||||

|

|

|

|

|

| |||||||

Total | 5,062,611 | 3,754,775 | ||||||||||

|

|

|

| |||||||||

21

Table of Contents

Compensation Discussion and Analysis

This section of the Proxy Statement explains our compensation philosophy and describes how our compensation programs are designed and operate with respect to our named executive officers for whom compensation is disclosed in the tables below.

2013 Overview

In a very challenging healthcare environment, we had a very successful year in 2013, delivering financial performance with solid growth leading to record levels of net revenue, Adjusted EBITDA, and earnings per share. In addition to strong financial results, we completed several successful acquisitions, enhanced our capital structure, and made strategic organizational investments that have positioned us for continued growth in 2014. The following highlights our strong performance during 2013.

| • | Net revenue less provision increased by 15.2% to $2.38 billion; |

| • | Adjusted EBITDA increased to $251.3 million; |

| • | Fully diluted earnings per share were $1.24; |

| • | We completed nine physician practice acquisitions, which expanded our footprint in key markets and provided a strengthened platform for future growth in new geographic areas; and |

| • | We continued to advance our operational excellence strategies, which included, among others, (i) making investments in quality, patient care, safety and risk management, which helped us achieve a 94% client retention rate for emergency department (“ED”) operations in 2013, (ii) making enhancements in our physician recruiting and retention efforts, (iii) making investments in billing service centers and in leadership development of our physician and business leaders, and (iv) strong performance of our revenue cycle management and internal billing services. |

Consistent with our philosophy that compensation should reflect performance, in determining compensation for the 2013 performance year, the Compensation Committee considered our achievements described above and our named executive officers’ contributions to those achievements, in making the following compensation decisions with respect to the named executive officers: