_____________________FAUQUIER BANKSHARES, INC. December 20, 2017NASDAQ: FBSS

2 The Fauquier Bank’s Guiding Principles FAUQUIER BANKSHARES, INC. MissionThe Fauquier Bank seeks Excellence through an Engaged and Empowered Team, building valued Relationshipswith our Customers and Community.Values Excellence Engagement Empowerment Teamwork Relationships

3 Summary Statistics FAUQUIER BANKSHARES, INC. Founded 1902Headquarters Warrenton, VirginiaTotal Assets $632 millionTotal Loans, net $485 millionShares Outstanding 3,762,677Insider Ownership 3.97%Institutional Ownership 17.26% Shareholders 331All data provided as of September 30, 2017, unless otherwise noted.

The Fauquier Bank seeks Excellence…..Quarter ended, September 30, 2017 highlights:Net income of $1.28 million, a 29% increaseNet loan growth of $22.02 millionNet interest margin of 3.75%, a 15 basis point increaseReturn on average assets increased to 0.80%Return on average equity increased to 8.96%Noninterest expenses declined 3%Efficiency ratio declined to 72.62%Continued regulatory capital strength 4 FAUQUIER BANKSHARES, INC. Aligning Values with Results and Strategic Initiatives

…..through an Engaged and Empowered Team, Progress on our strategic initiatives: 5 FAUQUIER BANKSHARES, INC. Aligning Values with Results and Strategic Initiatives

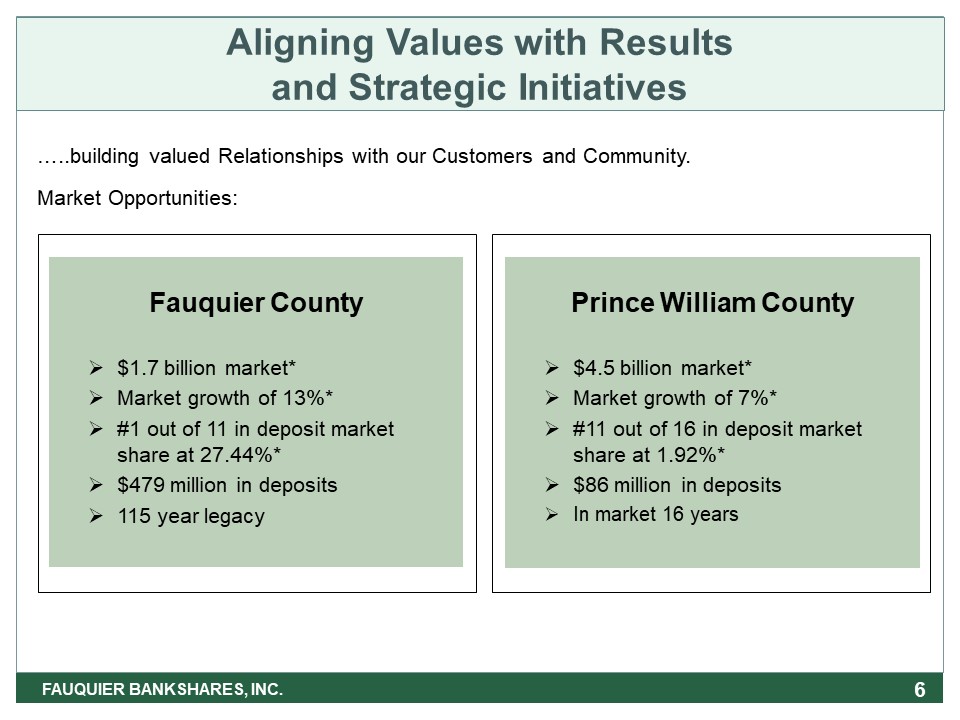

…..building valued Relationships with our Customers and Community.Market Opportunities: 6 Fauquier County$1.7 billion market*Market growth of 13%*#1 out of 11 in deposit market share at 27.44%*$479 million in deposits115 year legacy Prince William County$4.5 billion market*Market growth of 7%*#11 out of 16 in deposit market share at 1.92%*$86 million in depositsIn market 16 years FAUQUIER BANKSHARES, INC. Aligning Values with Results and Strategic Initiatives

7 Northern Virginia Marketplace FAUQUIER BANKSHARES, INC. Strong population, economic and employment growthExceptional higher educationDiverse industry employment, mostly “clean” industriesHigh median household incomeVirginia – Consistently ranked among the top “Best States for Business” Forbes (#6 in 2016)

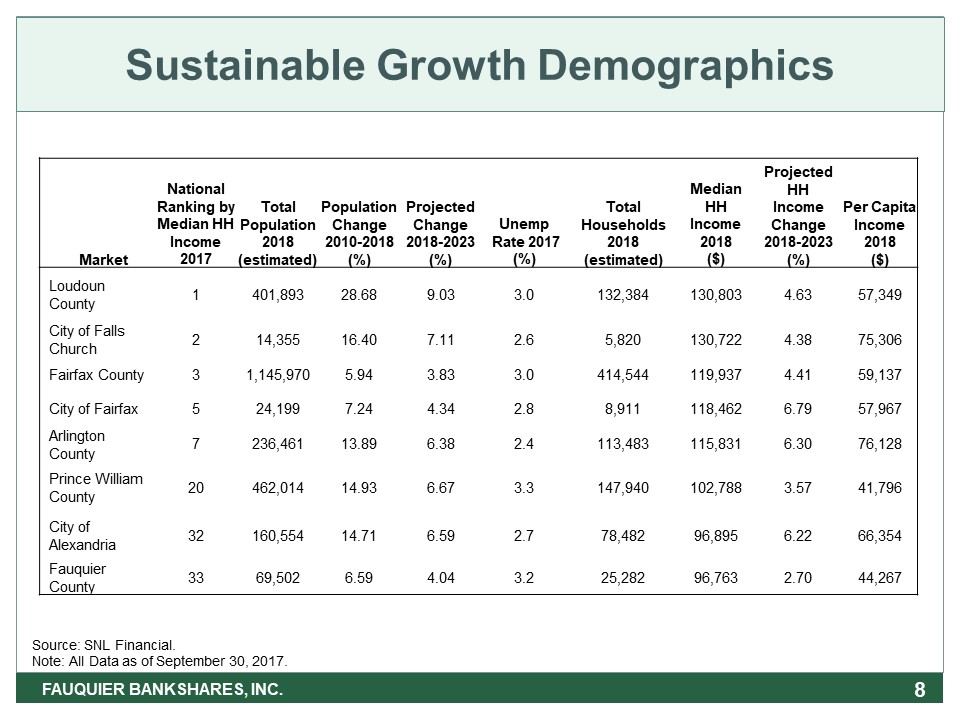

8 Sustainable Growth Demographics FAUQUIER BANKSHARES, INC. Market National Ranking by Median HH Income 2017 TotalPopulation2018(estimated) PopulationChange2010-2018(%) ProjectedChange2018-2023(%) Unemp Rate 2017(%) TotalHouseholds2018(estimated) MedianHH Income2018($) Projected HHIncome Change2018-2023 (%) Per Capita Income2018($) Loudoun County 1 401,893 28.68 9.03 3.0 132,384 130,803 4.63 57,349 City of Falls Church 2 14,355 16.40 7.11 2.6 5,820 130,722 4.38 75,306 Fairfax County 3 1,145,970 5.94 3.83 3.0 414,544 119,937 4.41 59,137 City of Fairfax 5 24,199 7.24 4.34 2.8 8,911 118,462 6.79 57,967 Arlington County 7 236,461 13.89 6.38 2.4 113,483 115,831 6.30 76,128 Prince William County 20 462,014 14.93 6.67 3.3 147,940 102,788 3.57 41,796 City of Alexandria 32 160,554 14.71 6.59 2.7 78,482 96,895 6.22 66,354 Fauquier County 33 69,502 6.59 4.04 3.2 25,282 96,763 2.70 44,267 Source: SNL Financial. Note: All Data as of September 30, 2017.

9 Financial Trends FAUQUIER BANKSHARES, INC. Dollars in-thousands 2017 Q3 2017 Q2 2017 Q1 2016 Q4 2016 Q3 Return on Average Assets 0.80% 0.63% 0.50% 0.51% 0.44% Return on Average Equity 8.96% 7.10% 5.68% 5.91% 5.11% Efficiency Ratio 72.62% 76.81% 83.95% 83.01% 79.03% Asset 631,717 646,265 630,032 624,445 623,877 Loans, net 485,326 463,309 451,166 458,608 452,874 Deposits 556,209 571,902 551,103 546,157 545,402 Net Income 1,281 990 768 808 698

Return on Average Assets (ROA) 10 FAUQUIER BANKSHARES, INC. * Peer Group consists of 16 comparable Bank Holding Companies and Commercial Banks located in Virginia, Maryland and West Virginia. Averages of reported data used. (Source: SNL)

Return on Average Equity (ROE) 11 FAUQUIER BANKSHARES, INC. FAUQUIER BANKSHARES, INC. * Peer Group consists of 16 comparable Bank Holding Companies and Commercial Banks located in Virginia, Maryland and West Virginia. Averages of reported data used. (Source: SNL)

12 Source: Fauquier Bankshares Total Assets FAUQUIER BANKSHARES, INC.

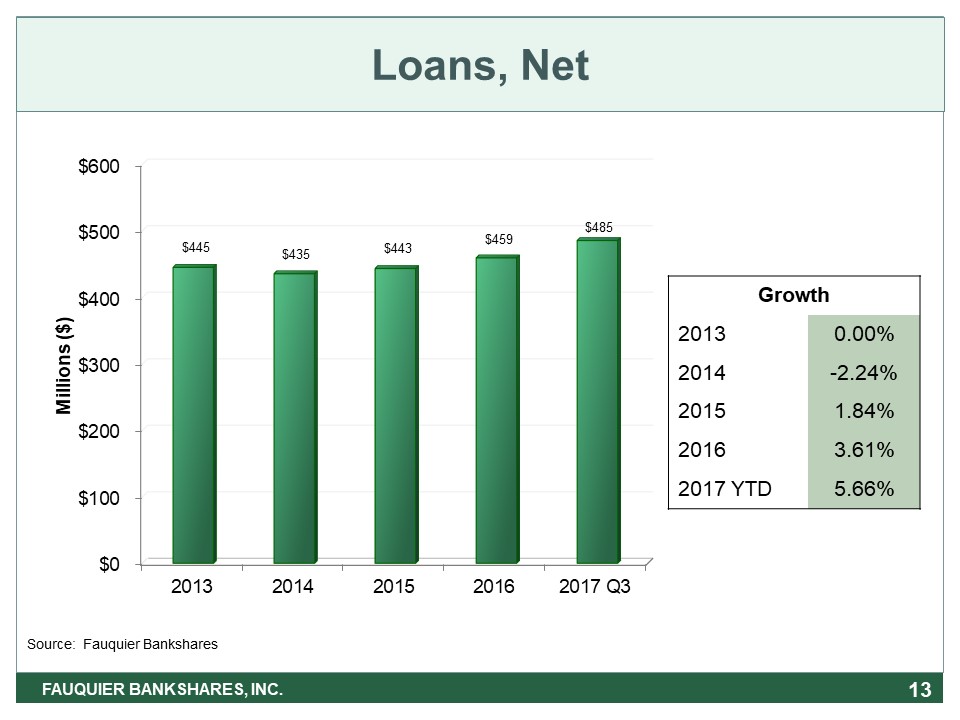

13 Source: Fauquier Bankshares Loans, Net FAUQUIER BANKSHARES, INC. Growth 2013 0.00% 2014 -2.24% 2015 1.84% 2016 3.61% 2017 YTD 5.66%

14 Source: Fauquier Bankshares*Includes $12MM in U.S. Government Guaranteed Student Loans Loan Portfolio FAUQUIER BANKSHARES, INC.

Nonperforming Loans to Total Loans 15 FAUQUIER BANKSHARES, INC. * Peer Group consists of 16 comparable Bank Holding Companies and Commercial Banks located in Virginia, Maryland and West Virginia. Averages of reported data used. (Source: SNL)

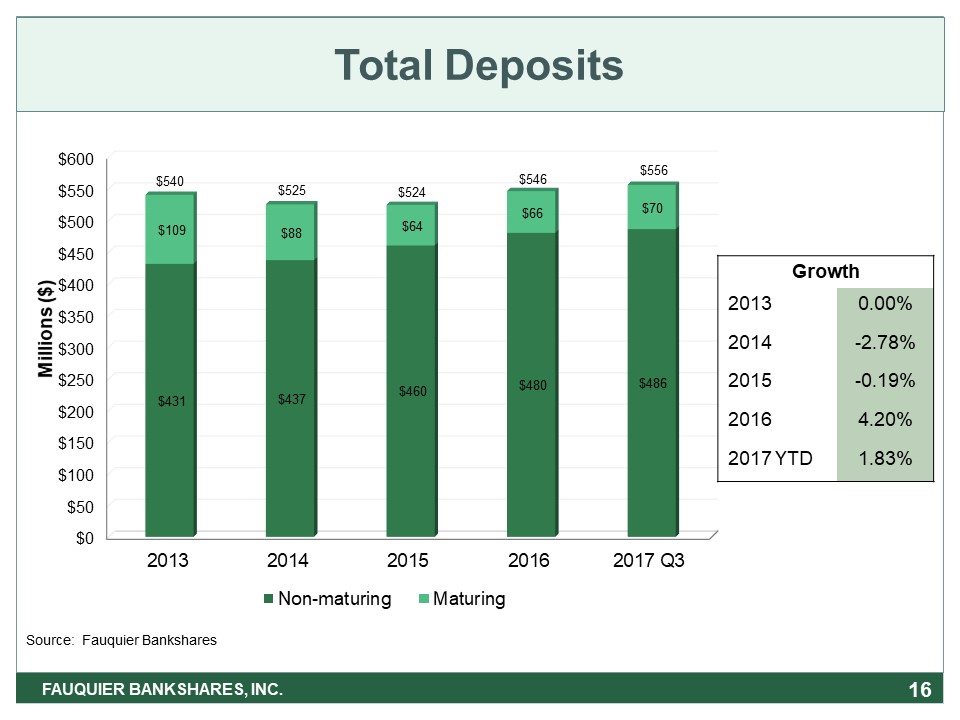

Source: Fauquier Bankshares 16 Total Deposits FAUQUIER BANKSHARES, INC. $540 $525 $524 $556 $546 Growth 2013 0.00% 2014 -2.78% 2015 -0.19% 2016 4.20% 2017 YTD 1.83%

17 Source: Fauquier Bankshares Deposit Portfolio FAUQUIER BANKSHARES, INC. * Includes large-dollar investments of local depositories in insured CDs and MMAs through exchange with other FDIC insured institutions.

Source: Fauquier Bankshares 18 Core Deposit PortfolioAverage Daily Balances FAUQUIER BANKSHARES, INC. Growth 2013 0.00% 2014 5.56% 2015 5.17% 2016 6.66% 2017 YTD 2.81%

19 Deposit Market Share FAUQUIER BANKSHARES, INC. Financial Institution Current Number ofBranches Total Deposits 2017($000) Total Deposits 2016($000) Year to Year Deposit Change 2017(%) MarketShare 2017 MarketShare2016 BB&T Corp. 20 1,414,503 1,357,592 4.19 18.96% 19.54% Wells Fargo Co. 12 1,094,033 1,019,422 7.32 14.66% 14.67% Bank of America 10 860,221 766,724 12.19 11.53% 11.03% SunTrust Bank 11 806,699 767,892 5.05 10.81% 11.05% Fauquier Bankshares 11 572,199 540,897 5.79 7.67% 7.78% United Bank 7 511,357 222,063 130.28 6.85% 3.20% Capital One Financial Corp. 10 469,872 446,903 5.14 6.30% 6.43% TD Bank 4 365,347 392,338 (6.88) 4.90% 5.65% PNC Financial Services Group 10 291,434 252,322 15.50 3.91% 3.63% Union Bank & Trust 2 231,021 113,175 104.13 3.10% 1.63% Other 10 Institutions 23 844,407 1,068,794 (20.99) 11.31% 15.39% Total 120 7,461,093 6,948,122 7.38 100% 100% Market consists of Fauquier County, Prince William County, and Manassas City. Source: FDIC – Deposit Market Share Report Data as of June 30, 2017.

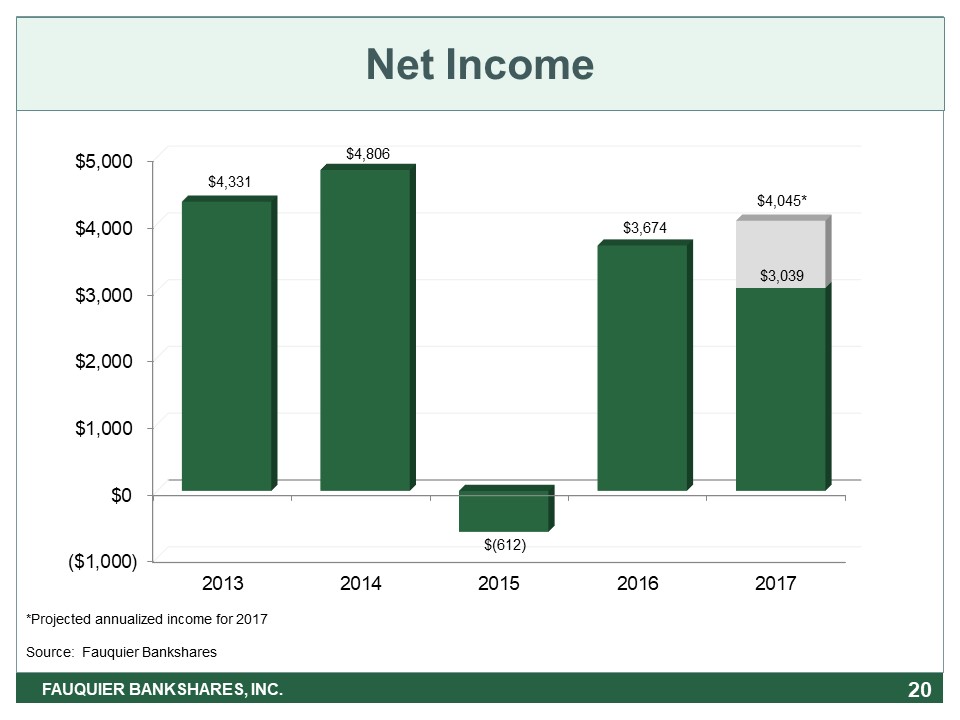

20 *Projected annualized income for 2017Source: Fauquier Bankshares FAUQUIER BANKSHARES, INC. Net Income

Net Interest Margin 21 FAUQUIER BANKSHARES, INC. * Peer Group consists of 16 comparable Bank Holding Companies and Commercial Banks located in Virginia, Maryland and West Virginia. Averages of reported data used. (Source: SNL)

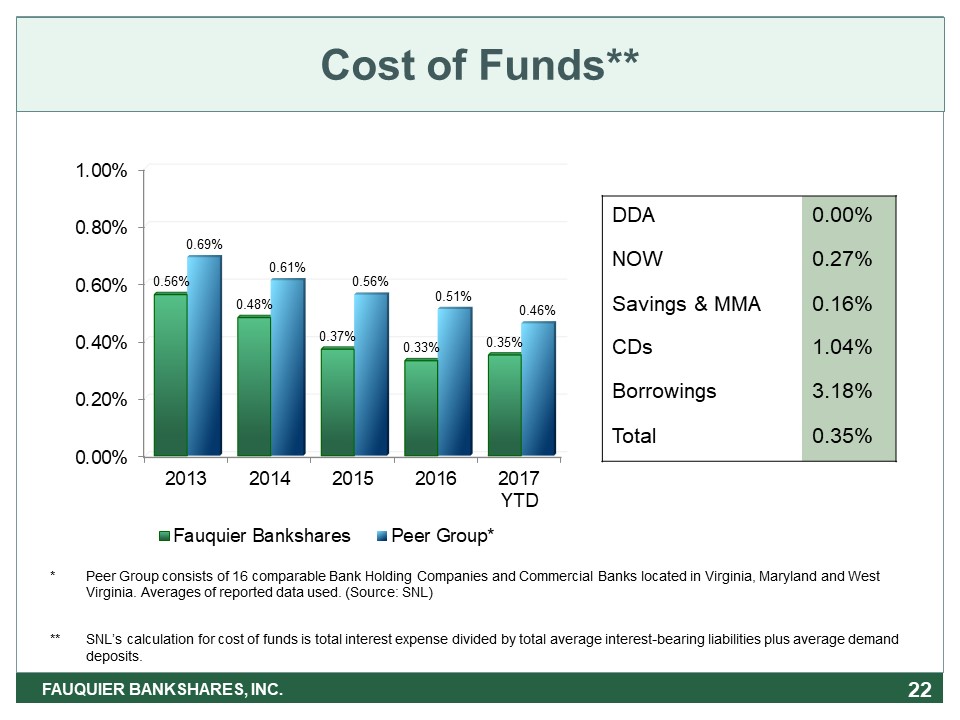

Cost of Funds** 22 FAUQUIER BANKSHARES, INC. DDA 0.00% NOW 0.27% Savings & MMA 0.16% CDs 1.04% Borrowings 3.18% Total 0.35% * Peer Group consists of 16 comparable Bank Holding Companies and Commercial Banks located in Virginia, Maryland and West Virginia. Averages of reported data used. (Source: SNL)** SNL’s calculation for cost of funds is total interest expense divided by total average interest-bearing liabilities plus average demand deposits.

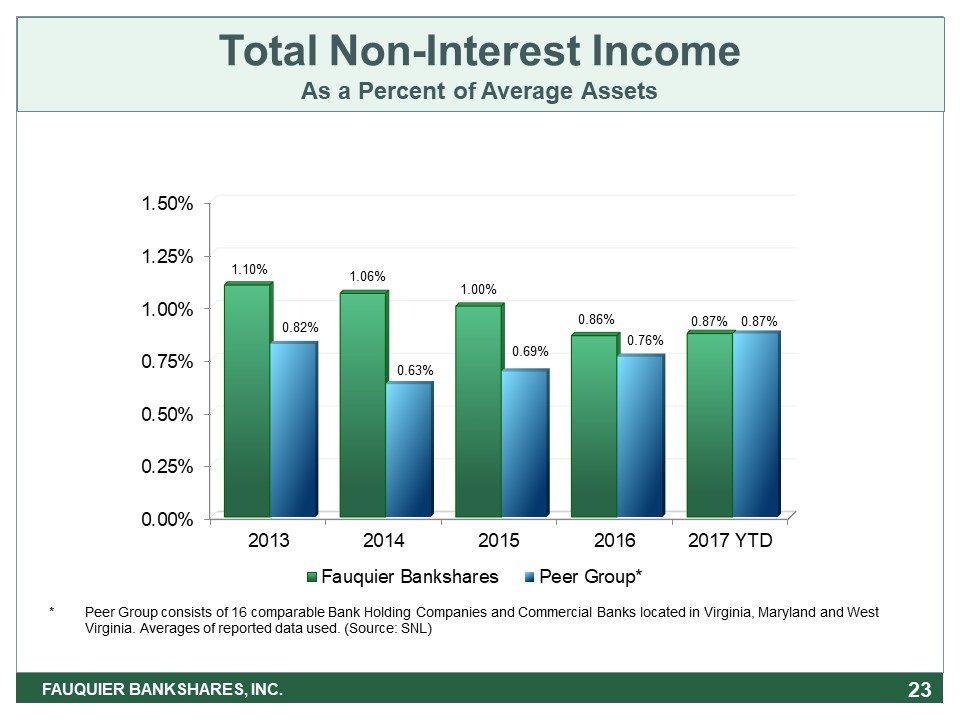

Total Non-Interest IncomeAs a Percent of Average Assets 23 FAUQUIER BANKSHARES, INC. * Peer Group consists of 16 comparable Bank Holding Companies and Commercial Banks located in Virginia, Maryland and West Virginia. Averages of reported data used. (Source: SNL)

Total Non-Interest ExpenseAs a Percent of Average Assets 24 FAUQUIER BANKSHARES, INC. * Peer Group consists of 16 comparable Bank Holding Companies and Commercial Banks located in Virginia, Maryland and West Virginia. Averages of reported data used. (Source: SNL)

Efficiency Ratio*** 25 *** Efficiency ratio is computed by dividing non-interest expense by adjusted operating income on a taxable equivalent basis. Includes gains and losses on the sale of securities and OREO. FAUQUIER BANKSHARES, INC. * Peer Group consists of 16 comparable Bank Holding Companies and Commercial Banks located in Virginia, Maryland and West Virginia. Averages of reported data used. (Source: SNL)

Assets Under Management(At Market Value) 26 FAUQUIER BANKSHARES, INC. Source: Wealth Management Services Statement of Condition and Yahoo Finance

27 Capital Ratios FAUQUIER BANKSHARES, INC. December 31, 2015(consolidated) December 31, 2016(consolidated) September 30, 2017**** Well Capitalized Threshold Leverage Ratio 9.13% 9.23% 9.51% 5.00% Common Equity Tier 1 Capital Ratio 11.64% 12.22% 12.07% 6.50% Tier 1 Capital Ratio 11.64% 12.22% 12.07% 8.00% Total Capital Ratio 12.53% 13.17% 12.96% 10.00% Tangible Equity to Total Assets 8.75% 8.72% 9.05% N/A Source: Fauquier Bankshares **** Bank only, except for tangible equity to total assets, which is consolidated.

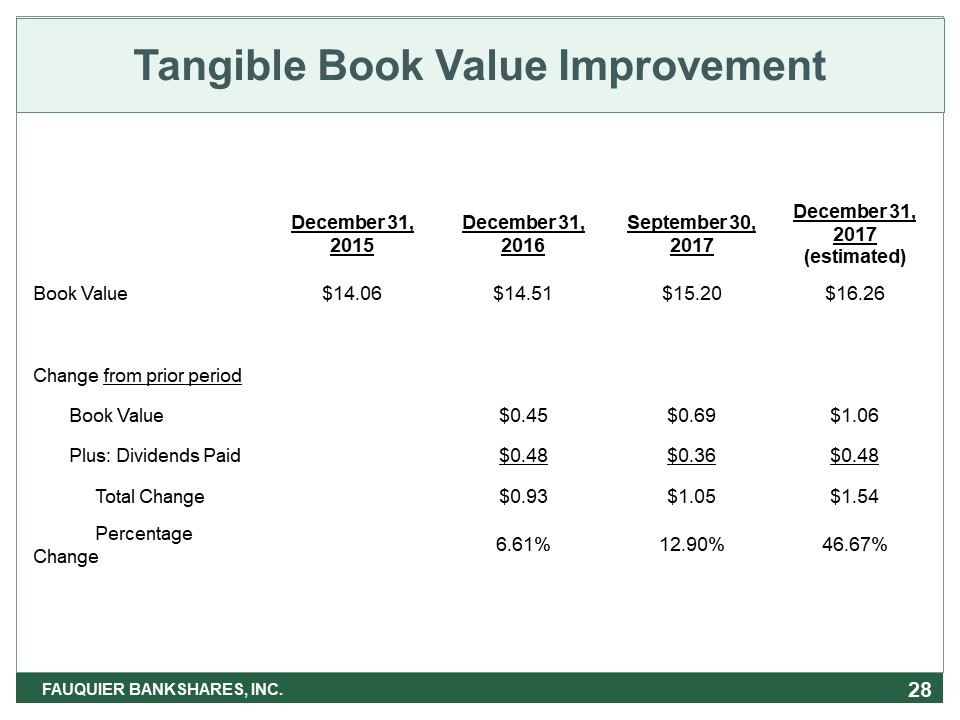

28 Tangible Book Value Improvement FAUQUIER BANKSHARES, INC. December 31, 2015 December 31, 2016 September 30, 2017 December 31, 2017 (estimated) Book Value $14.06 $14.51 $15.20 $16.26 Change from prior period Book Value $0.45 $0.69 $1.06 Plus: Dividends Paid $0.48 $0.36 $0.48 Total Change $0.93 $1.05 $1.54 Percentage Change 6.61% 12.90% 46.67%

29 Shareholders FAUQUIER BANKSHARES, INC.

30 Outlook FAUQUIER BANKSHARES, INC.

31 Profitability Targets FAUQUIER BANKSHARES, INC. 2017 2018 Percentage Change 2019 Percentage Change Return on Assets 0.63% 0.67% 11.67% 0.72% 7.46% Return on Equity 7.25% 7.50% 12.78% 8.50% 13.33% Efficiency 77.00% 75.00% 5.66% 72.50% 3.33%

Safe Harbor Statement This presentation may include forward-looking statements. These statements represent the Company's beliefs regarding future events that, by their nature, are uncertain and outside of the Company’s control. The Company’s actual results and financial condition may differ, possibly materially, from what is indicated in these forward-looking statements. Additional information concerning the Company and its business, including additional factors that could materially affect the Company’s financial results, is included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 under “Management’s Discussion and Analysis of Financial Condition and Results of Operation.” 32 FAUQUIER BANKSHARES, INC.

Investor Relations ContactsMarc J. BoganPresident & Chief Executive Officer marc.bogan@tfb.bankChristine E. HeadlyExecutive Vice President& Chief Financial Officerchris.headly@tfb.bankwww.tfb.bank MAIN OFFICE THE PLAINS VIEW TREE BEALETON GAINESVILLE SUDLEY ROAD NEW BALTIMORE CATLETT BRISTOW HAYMARKET CENTREVILLE ROAD Contact Information 33 FAUQUIER BANKSHARES, INC.