UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-26669

CAN-CAL RESOURCES LTD.

(Exact name of registrant as specified in its charter)

| | |

Nevada | | 86-0865852 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

8205 Aqua Spray Ave. | | |

Las Vegas, Nevada | 89128 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (702) 243-1849

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

Preferred Stock, $0.001 par value, 5% cumulative

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

¨Yes x No

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

¨Yes x No

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨

Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of voting stock held by non-affiliates of the registrant was approximately $1,347,781 as of June 30, 2011 (computed by reference to the last sale price of a share of the registrant’s Common Stock on that date as reported by OTC Bulletin Board). The voting stock held by non-affiliates on that date consisted of 33,694,526 shares of common stock.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 39,717,911 shares of common stock, $0.001 par value, outstanding on March 27, 2011.

Documents Incorporated by Reference

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

CAN-CAL RESOURCES LTD.

FORM 10-K

TABLE OF CONTENTS

| | | |

| | Page |

| | |

PART I | | 2 |

| ITEM 1. BUSINESS (AND INFORMATION FOR ITEM 2 ON PROPERTIES) | | 2 |

| ITEM 1A. RISK FACTORS | | 3 |

| ITEM 1B. UNRESOLVED STAFF COMMENTS | | 8 |

| ITEM 2. PROPERTIES | | 8 |

| ITEM 3. LEGAL PROCEEDINGS | | 26 |

| ITEM 4. MINE SAFETY DISCLOSURES | | 26 |

| | | |

PART II | | 27 |

| ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

27 |

| ITEM 6. SELECTED FINANCIAL DATA | | 29 |

| ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS | | 30 |

| ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 34 |

| ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | 35 |

| ITEM 9. CHANGES AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

36 |

| ITEM 9A CONTROLS AND PROCEDURES | | 36 |

| ITEM 9B. OTHER INFORMATION | | 37 |

| | | |

Part III | | 38 |

| ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | | 38 |

| ITEM 11. EXECUTIVE COMPENSATION | | 40 |

| ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

41 |

| ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | |

42 |

| ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | | 42 |

| | | |

Part IV | | 44 |

| 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES | | 44 |

i

FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objections of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements or belief; and any statements of assumptions underlying any of the foregoing.

Forward-looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” or other similar words. These forward-looking statements present our estimates and assumptions only as of the date of this report. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. We do not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the dates they are made. You should, however, consult further disclosures we make in this Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The factors impacting these risks and uncertainties include, but are not limited to:

·

the unavailability of funds for capital expenditures;

·

inability to efficiently manage our operations;

·

inability to achieve future operating results;

·

inability to raise additional financing for working capital;

·

the inability of management to effectively implement our strategies and business plans;

·

our ability to recruit and hire key employees;

·

our ability to diversify our operations;

·

actions and initiatives taken by both current and potential competitors;

·

deterioration in general or regional economic, market and political conditions;

·

the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management to make estimates about matters that are inherently uncertain;

·

adverse state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations;

·

changes in U.S. GAAP or in the legal, regulatory and legislative environments in the markets in which we operate; and

·

the other risks and uncertainties detailed in this report.

1

In this form 10-K references to “Can-Cal”, “the Company”, “we,” “us,” “our” and similar terms refer to Can-Cal Resources Ltd.

AVAILABLE INFORMATION

Can-Cal files annual, quarterly, current and special reports and other information with the SEC. You can read these SEC filings and reports over the Internet at the SEC’s website at www.sec.gov or on our website at www.can-cal.com. You can also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, NE, Washington, DC 20549 on official business days between the hours of 10:00 am and 3:00 pm. Please call the SEC at (800) SEC-0330 for further information on the operations of the public reference facilities. We will provide a copy of our annual report to security holders, including audited financial statements, at no charge upon receipt to of a written request to us at Can-Cal Resources Ltd., 8205 Aqua Spray Ave., Las Vegas, Nevada 89128.

PART I

ITEM 1. BUSINESS (AND INFORMATION FOR ITEM 2 ON PROPERTIES).

Business Development

Can-Cal Resources Ltd. (“Can-Cal” or the “Company” ) is a Nevada corporation incorporated on March 22, 1995 under the name of British Pubs USA, Inc. as a wholly owned subsidiary of 305856 B.C., Ltd. d/b/a N.W. Electric Carriage Company (“NWE”), a British Columbia, Canada company (“NWE”). On April 12, 1995, NWE exchanged shares of British Pubs USA, Inc. for shares of NWE held by its existing shareholders, on a share for share basis. NWE changed its name to Can-Cal Resources Ltd. on July 2, 1996.

In January 1999, the company sold its wholly-owned Canadian subsidiary, Scotmar Industries, Inc., which was engaged in the business of buying and salvaging damaged trucks from insurance companies for resale of guaranteed truck part components. The subsidiary was sold for a profit and the proceeds used to acquire and explore mineral properties, as the Company determined that the subsidiary would lose money in the vehicle salvage business unless more capital was obtained at that time specifically for that business.

Business of Issuer

The Company is an exploration company. Since 1996, we have examined various mineral properties prospective for precious metals and minerals and acquired those deemed promising. We own, lease or have mining interest in four mineral properties in the southwestern United States (California and Arizona, as follows: Wikieup, Arizona; Cerbat, Arizona; Owl Canyon, California; and Pisgah, California).

Prior to 2003, we performed more than 1,000 “in-house” assays on mineral samples from our properties in the United States. An assay is a test performed on a sample of minerals to determine the quantity of one or more elements contained in the sample. The in-house work was conducted with our equipment by persons under Can-Cal contract who are experienced in performing assays, but who were not independent of us. We also sent samples of materials from which we obtained the most promising results to outside independent assayers to confirm in-house results.

In 2003, the Company incorporated a wholly owned subsidiary in Mexico, Sierra Madre Resources S.A. de C.V. (“SMR”), to be an operating entity for mining-related acquisitions and activities in Mexico. In February 2004, SMR acquired a 100 % interest in a gold-silver mineral concession, in Durango State, Mexico. In July 2004, SMR applied to the Mexican Government for a gold-silver concession, also in Durango State, Mexico. These were exploration stage properties, referred to in previous Company reports as “Arco Project” and “Arco 2 Project”. In November 2004, SMR applied to Mexico’s Director of Mines for three grass roots, gold-silver exploration concessions located in the State of Chihuahua, Mexico. These applications were subsequently cancelled in February 2005 due to incomplete application filings. SMR may reapply for one or more of these concessions in the future, but has currently ceased operations in Mexico.

2

The Company’s current focus has changed from Mexico to the United States with present emphasis on the Pisgah Mountain material and Wikieup material.

All the United States properties are considered “grass roots” because they are not known to contain reserves of precious metals or other minerals (a reserve is that portion of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination). None of these properties is in production.

In 2005, we sold $11,500 of volcanic cinder materials arising from the Pisgah, California property to industrial users. As of June 1, 2005, we discontinued sales of volcanic cinder materials.

Can-Cal is currently an exploration stage company. An entity remains in the exploration stage until such time as proven or probable reserves have been established for its deposits. Upon the location of commercially mineable reserves, in the event that we are successful in locating commercially mineable reserves, the Company plans to prepare for mineral extraction and enter the development stage. To date, the exploration stage of the Company’s operations consists of contracting with geologists who sample and assess the mining viability of the Company’s claims.

To the extent that financing is available, we intend to explore, develop, and, if producible and warranted, bring into production precious metals properties for either on our own account or in conjunction with joint venture partners (in those instances where we acquire less than a 100% interest in a property). However, either due to a combination of a lack of available financing, the number of properties which merit development, and/or the scope of the exploration and development work of a particular property being beyond the Company’s financial and administrative capabilities, the Company may contract out one or more of its properties to other mining companies.

Executive offices are located at 8205 Aqua Spray Ave, Las Vegas, Nevada 89128 (tel. 702.243.1849; fax 702.243.1869).

ITEM 1A. RISK FACTORS.

In the course of conducting our business operations, we are exposed to a variety of risks that are inherent to our industry specifically, and to early stage companies and for investments in securities, generally. The following discusses some of the key inherent risk factors that could affect our business and operations, as well as other risk factors which are particularly relevant to us in the current period of significant economic and market disruption. Other factors besides those discussed below or elsewhere in this report also could adversely affect our business and operations, and these risk factors should not be considered a complete list of potential risks that may affect us.

Losses to Date and General Risks Faced by the Company.

We are an exploration stage company engaged in the acquisition and exploration of precious metals mineral properties. To date, we have no producing properties. As a result, we have had minimal sources of operating revenue and we have historically operated and continue to operate at a loss. For the year ended December 31, 2011, the Company recorded net income of $574,804 due to a gain on extinguishment of debts in the amount of $1,152,039 and had an accumulated deficit of $9,680,779 at that date. Our ultimate success will depend on our ability to generate profits from our properties.

We lack material operating cash flow and rely on external funding sources. If we are unable to continue to obtain needed capital from outside sources, we will be forced to reduce, curtail or cease our operations. Furthermore the, planned exploration and development of the mineral properties in which we hold interests depends upon our ability to obtain financing through:

| | |

| - | Bank or other debt financing, |

| - | Equity financing, or |

| - | Other means. |

3

As a mineral exploration company, our ability to commence production and generate profits is dependent on our ability to discover viable and economic mineral reserves. Our ability to discover such reserves are subject to numerous factors, many of which are beyond our control and are not predictable.

Exploration for gold is speculative in nature, involves many risks and is frequently unsuccessful. Any gold exploration program entails risks relating to:

| | |

| - | The location of economic ore bodies, |

| - | Development of appropriate metallurgical processes, |

| - | Receipt of necessary governmental approvals, and |

| | Construction of mining and processing facilities at any site chosen for mining. |

The commercial viability of a mineral deposit is dependent on a number of factors including:

| | |

| - | The price of gold, |

| - | Exchange rates, |

| - | The particular attributes of the deposit, such as its size, grade and proximity to infrastructure, financing costs, taxation, royalties, land tenure, land use, water use, power use, and foreign government regulations restricting importing and exporting gold and environmental protection requirements. |

All of the mineral properties in which we have an interest or right are in the exploration stages only and are without reserves of gold or other precious metals minerals. We cannot assure that current or proposed exploration or development programs on properties in which we have an interest will result in the discovery of gold or other mineral reserves or will result in a profitable commercial mining operation.

The audit report on the financial statements at December 31, 2011 has a “going concern” qualification, which means we may not be able to continue operations unless we obtain additional funding and are successful with our strategic plan.

We have experienced losses since inception. The extended period over which losses have been experienced is principally attributable to the fact that a lot of money has been spent on exploring grass roots mineral properties to determine if precious metals might be present in economic quantities. In order to fund future activities the Company must identify and verify the presence of precious metals in economic quantities, which is currently ongoing “In House” in addition to independent third party testing. If economic results are identified, the Company then would either seek to raise capital itself, to put the Pisgah property and the Wikieup into production, or sell the properties to another company, or place the properties into a joint venture with another company.

Attaining these objectives will require capital, which the Company will have to obtain principally by selling stock or other equity in the company. However, we have currently have no definitive arrangements in place to raise the necessary capital to continue operations for any extended period of time, and have generally relied upon relatively small, and intermittent infusions to sustain operations.

As an exploration company, we are subject to the risks of the minerals business.

The exploration for minerals is highly speculative and involves risks different from and in some instances greater than risks encountered by companies in other industries. Without extensive technical and economic feasibility studies, no one can know if any property can be mined at a profit. Most exploration programs do not result in the discovery of mineralization that leads to commercially viable mining activities and most exploration programs never recover the funds invested in them. Furthermore, even with promising reserve reports and feasibility studies, profits cannot be assured.

4

The British Columbia Securities Commission has required us to obtain a report by an independent consultant qualified under the standards of the BCSC.

The British Columbia Securities Commission (“BCSC”) previously required the Company to obtain a report by an independent consultant qualified under the standards of the BCSC. Under British Columbia securities laws, all disclosure of scientific or technical information, including disclosure of a mineral resource or mineral reserve must be based on information prepared by or under the supervision of an independent third party who is “qualified” under the terms of that law. The Company was therefore required under order to supply such verification by a “qualified” third party consultant, and its stock was prohibited from trading in British Columbia until the BCSC accepted such verification. The BCSC also requested documentation regarding all subscribers to the Company stock who were at such time residing in British Columbia. The Company subsequently retained a “qualified” third party consultant who prepared and filed the necessary reports with the BCSC. If the BCSC continues with additional investigatory proceedings, it will require the Company to expend additional funds on legal and accounting fees, which will have a negative impact on our resources available for exploration and general operating activities.

We have not systematically drilled and sampled any of our properties to confirm the presence of any concentrations of precious metals, and drilling and sampling results to date have been inconclusive.

There is substantial risk that such testing on the United States properties would show limited concentrations of precious metals, and such testing may show a lack of precious metals in the properties. Any positive test results will only confirm the presence of precious metals in the samples, and it cannot be assumed that precious metals-bearing materials exist outside of the samples tested.

Policy Changes.

Changes in regulatory or political policy could adversely affect our exploration and future production activities. Any changes in government policy, in the United States or other countries where properties are or may be held, could result in changes to laws affecting ownership of assets, land tenure, mining policies, taxation, environmental regulations, and labor relations.

Environmental costs.

Compliance with environmental regulations could adversely affect our exploration and future production activities. There can be no assurance that future changes to environmental legislation and related regulations, if any, will not adversely affect our operations.

Future reserve estimates.

All of the mineral properties in which we have an interest or right are in the exploration stages only and are without reserves of gold or other minerals. Even if and when we can prove such reserves, reserve estimates may not be accurate. There is a degree of uncertainty attributable to any calculation of reserves or resources. Until reserves or resources are actually mined and processed, the quantity of reserves or resources must be considered as estimates only. In addition, the quantity of reserves or resources may vary depending on metal prices. Any material change in the quantity of reserves, resource grade or stripping ratio may affect the economic viability of our properties. In addition, there can be no assurance that mineral recoveries in small-scale laboratory tests will be duplicated in large tests under on-site conditions or during production.

5

Risks Related to Our Securities

Because our common stock is deemed a low-priced “Penny” stock, an investment in our common stock should be considered high risk and subject to marketability restrictions.

Since our common stock is a penny stock, as defined in Rule 3a51-1 under the Securities Exchange Act, it will be more difficult for investors to liquidate their investment even if and when a market develops for the common stock. Until the trading price of the common stock rises above $5.00 per share, if ever, trading in the common stock is subject to the penny stock rules of the Securities Exchange Act specified in rules 15g-1 through 15g-10. Those rules require broker-dealers, before effecting transactions in any penny stock, to:

·

Deliver to the customer, and obtain a written receipt for, a disclosure document;

·

Disclose certain price information about the stock;

·

Disclose the amount of compensation received by the broker-dealer or any associated person of the broker-dealer;

·

Send monthly statements to customers with market and price information about the penny stock; and

·

In some circumstances, approve the purchaser’s account under certain standards and deliver written statements to the customer with information specified in the rules.

Consequently, the penny stock rules may restrict the ability or willingness of broker-dealers to sell the common stock and may affect the ability of holders to sell their common stock in the secondary market and the price at which such holders can sell any such securities. These additional procedures could also limit our ability to raise additional capital in the future.

If we fail to remain current on our reporting requirements, our common stock could be removed from the OTC Bulletin Board, which would limit the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

Companies trading on the OTC Bulletin Board, such as us, must be reporting issuers under Section 12 of the Securities Exchange Act of 1934, as amended, and must be current in their reports under Section 13, in order to maintain price quotation privileges on the OTC Bulletin Board. More specifically, FINRA has enacted Rule 6530, which determines eligibility of issuers quoted on the OTC Bulletin Board by requiring an issuer to be current in its filings with the Commission. Pursuant to Rule 6530(e), if we file our reports late with the Commission three times in a two-year period or our securities are removed from the OTC Bulletin Board for failure to timely file twice in a two-year period then we will be ineligible for quotation on the OTC Bulletin Board. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

6

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company, and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

We have a limited number of personnel that are required to perform various roles and duties as well as be responsible for monitoring and ensuring compliance with our internal control procedures. As a result, our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

7

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

ITEM 2. PROPERTIES.

GENERAL

We own or have interests in four United States properties. They are:

·

Pisgah, San Bernadino County, California

·

Owl Canyon, California

·

Cerbat, Arizona

·

Wikieup, Arizona

A summary of important features about each of these properties is set forth in Exhibit 99.1 to our Form 10-KSB/A filed on March 11, 2009, and investors should take care to review this summary.

On September 26, 2006, the Company signed a letter of intent with E.R.S. Ltd., an Israeli owned Cyprus corporation with offices located in Tel Aviv. The letter of intent was to expand testing by E.R.S. on material from Can-Cal’s Pisgah property. The Company and E.R.S. did not enter into a definitive agreement in 2007.

In May and June 2006, Can-Cal acquired an additional 66 20-acre lode claims for the filing cost of $1,200. This increased the Company’s property holding to 1,900 acres or 2.97 square miles of 95 lode claims.

In April, June, July and September 2006, the Company conducted further surface sampling and rock wall sampling on its Wikieup, Arizona property. These samples were shipped to ALS Chemex, an internationally recognized assayer for fire assays (process of testing the original head ore material at high temperatures to determine the recoverability of precious metals) and I.C.P. tests. The preliminary assay results were encouraging and the Company will continue with further surface sampling from various areas of the approximate six square miles of claimed land.

On August 28, 2006, Can-Cal acquired an additional 1,800 acres from the Rose Trust in exchange for 1,000,000 restricted shares of its common stock. This increased the Company’s property holding on its Wikieup, Arizona property to 3,700 acres or approximately six square miles of 185 lode claims. The area is accessed by gravel road just off highway 93 approximately eight miles from the town of Wikieup, Arizona.

Adits (A type of entranche to underground mine shafts), tunnels and open pit locations following what may be a trend (direction that an ore body may follow) or vein structure (faults and cracks caused by shifts in the earth that had filled in with silica fluids and other magma volcanics which solidified leaving minerals behind) over a large region have been found on the property. The legacy of previous mining activity including; abandoned equipment, stone built homes, a cement water reservoir and numerous tailings piles, or piles of dirt left over from previous mining operations, can be seen from various locations.

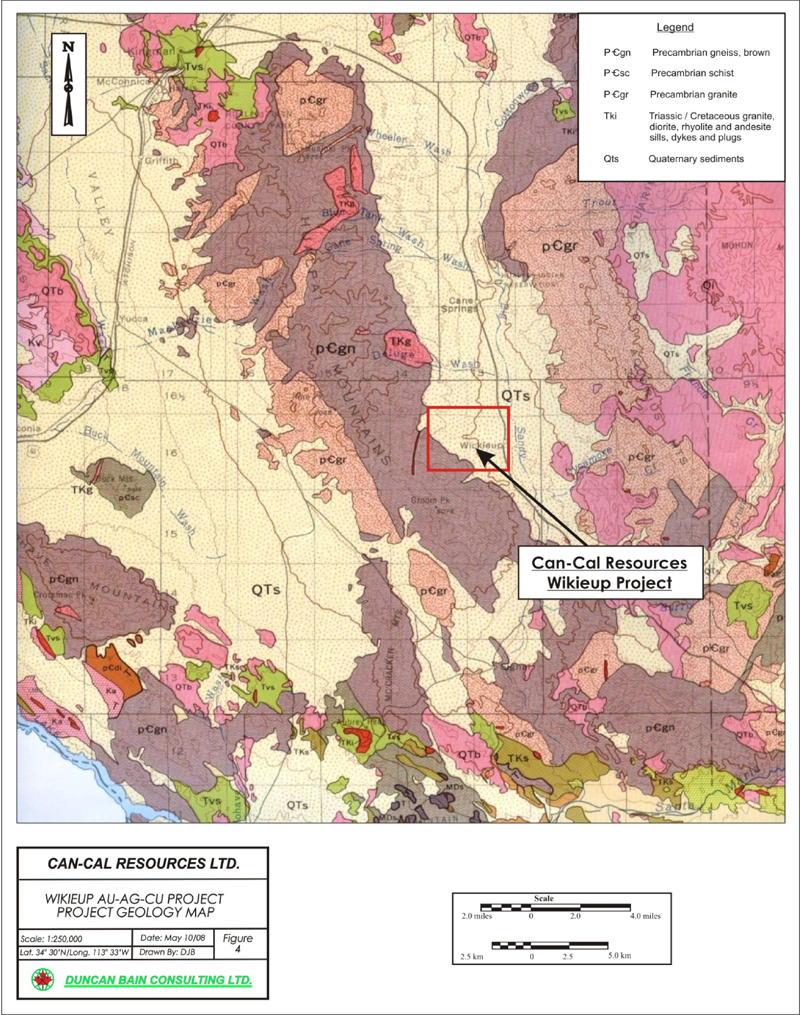

The geology of the Wikieup area claims is comprised of Precambrian ganoids and gneiss. Outcrop is extensive on the property and rock units include diorite, gabbro and granitic dikes. The Company is continuing the surface sampling program and has hired an independent geologist, working together with students from the University of Nevada Las Vegas (UNLV) for continued exploration.

8

In the United States, one property is owned (patented mining claims on a volcanic cinders property at Pisgah, California), one is leased with an option to purchase (the Cerbat property in Mohave County, Arizona), and two properties are groups of unpatented mining claims located on federal public land and managed by the United States Bureau of Land Management (the “BLM”): the Owl Canyon property (23 miles northeast of Baker, California); and the Wikieup property (in Mohave County, Arizona).

In the United States, unpatented claims are “located” or “staked” by individuals or companies on federal public land. Each placer claim covers 160 acres and each lode claim covers 20 acres. The Company is obligated to pay a maintenance fee of $140 per claim per year to the BLM and file an Affidavit of Assessment Work with the County showing labor and improvements of at least $100 for each claim yearly.

If the statutes and regulations for the location and maintenance of a mining claim in the United States are complied with, the locator obtains a valid possessory right, or claim, to the contained minerals. Failure to pay such fees or make the required filings may render the mining claim void or voidable. We believe we have valid claims, but, because mining claims are self-initiated and self-maintained, it is impossible to ascertain their validity solely from public real estate records. If the government challenges the validity of an unpatented mining claim, we would have the burden of proving the present economic feasibility of mining minerals located on the claims.

PISGAH, CALIFORNIA PROPERTY

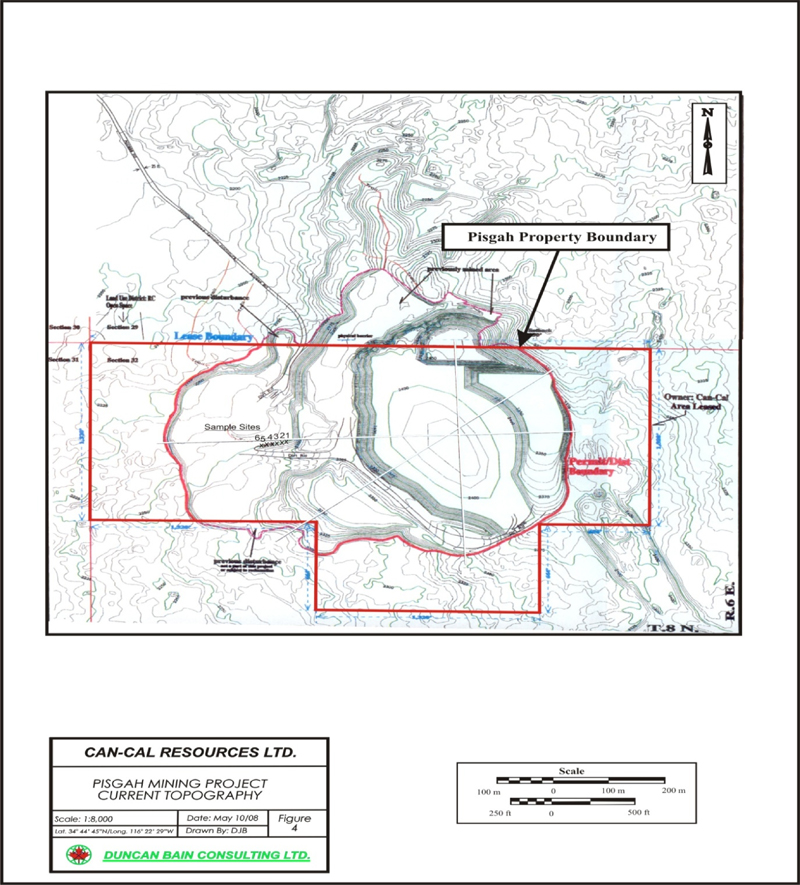

GENERAL TESTING. In 1997 we acquired fee title to a “volcanic cinders” property at Pisgah, San Bernardino County, California, for $567,000. The cinders material resulted from a geologically recent volcanic eruption.

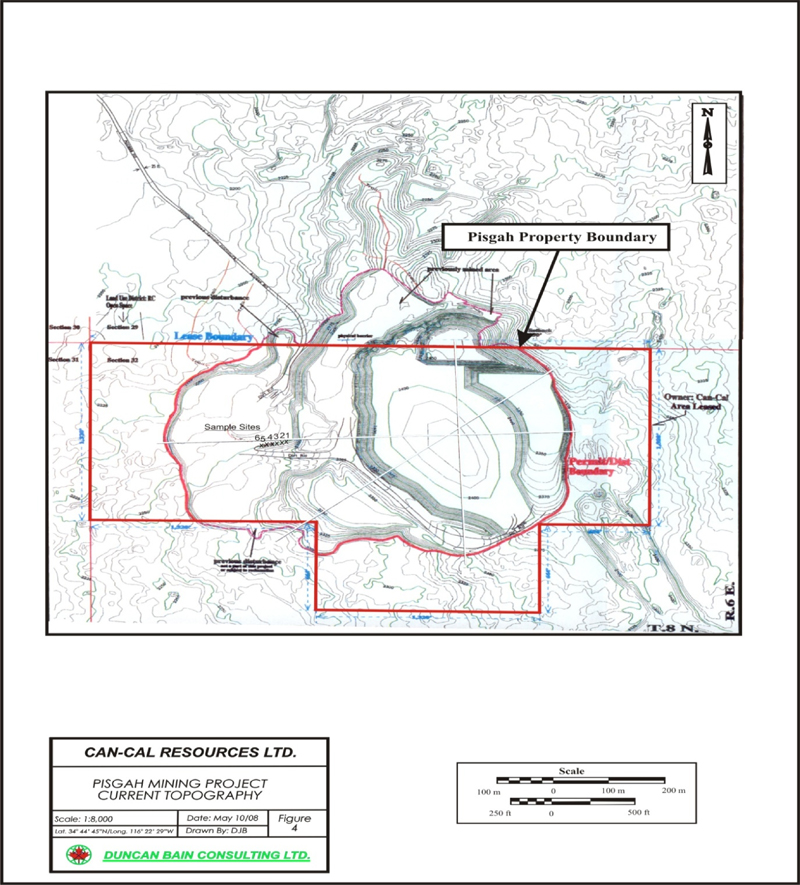

The property is privately owned and is comprised of approximately 120 acres located 10 miles southwest of Ludlow, California, with a very large hill of volcanic cinders, accessible by paved road from Interstate 40. An independent survey service hired by the Company reported that there are approximately 13,500,000 tons of volcanic cinders above the surface. Approximately 3,500,000 tons of the cinders have been screened and stockpiled, the result of prior operations by Burlington Northern Railroad Co. It processed the cinders from the hill for railroad track ballast, taking all cinders above about one inch diameter and leaving the rest on the ground surface within one-quarter mile of the hill. The remaining material in the hill and the material left over from Burlington’s operations can easily be removed by front end loaders and loaded into dump trucks for hauling. The Cinder and Cinder #2 patented mining claims contain morphologically young alkali basalt and hawaiite lava flows and cinder (rock types created by volcanic activity). The cinder and spatter cone is about 100 meters high and has a basal diameter (circumference area at the base of the volcanic material) of about 500 meters, and was formed by the splattering of lava into a cone shape during volcanic activity. The volcanic cone and crater consists of unsorted basalis tephra (volcanic material), ranging from finest ash, through scoriascious cinders and blocks, or slag like structures born from igneous rock, to dense and broken bombs up to two meters in dimension.

The Company owns equipment which was acquired with the property, and is located on the property: a ball mill used for crushing cinders, truck loading pads, two buildings, large storage tanks, conveyors to load trucks, material silos and screening equipment.

The Pisgah property consists of patented claims we own; no fees have to be paid to the BLM or work performed on the claims to retain title to the property.

From the year 2000 through 2002, the Company ran numerous tests on the volcanic cinders property to determine if the material contains precious metals. Although the program indicated precious metals might exist in material taken from the Pisgah property, overall the program results were inconclusive.

9

Pisgah Property - Mining Lease

To generate working capital, as of May 1, 1998, we signed a Mining Lease Agreement for the Pisgah property with Twin Mountain Rock Venture, a California general partnership (“Twin Mountain,”). The Agreement is for an initial term of 10 years, with an option to renew for an additional ten-year term. Twin Mountain has the right to take 600,000 tons of volcanic cinders during the initial term, and 600,000 more tons during the additional term, for processing and sale as decorative rock. The material would be removed from the original cinder deposit, not the stockpiled material. Twin Mountain has not removed any material to date.

The agreement provides that Twin Mountain will pay minimum annual rental payments of $22,500 for the initial term and $27,500 per year for the additional term. Twin Mountain is also obligated to pay us a monthly production royalty for all material removed from the premises: The greater of 5% of gross sales f.o.b. Pisgah, or $0.80 per ton for material used for block material; plus 10% of gross sales f.o.b. Pisgah for all other material. Twin Mountain will be credited against these payments for minimum royalty payments previously made.

Twin Mountain is current in payments, which are pledged to service company debt. Twin Mountain has not yet removed any material from the property and has not indicated when it would do so. Twin Mountain does not have the right to remove or extract any precious metals from the property; it does have the right to remove cinder material, which could contain precious metals (and Twin Mountain would have title to the removed cinder material), but it cannot process the materials for precious metals either on or off site.

Mining and reclamation permits, and an air quality permit have been issued by the California regulatory agencies in the names of both Twin Mountain and the Company. We posted a cash bond in the amount of $1,379 (1% of the total bond amount) and Twin Mountain has posted the remainder of the $137,886 bond. If Twin Mountain defaults, we would be responsible for reclamation of the property, but reclamation costs incurred in that event would be paid in whole or part by the bond posted by us and Twin Mountain. Reclamation costs are not presently determinable.

In addition to our historic exploration activities, we are currently under taking alternative revenue producing opportunities at our Pisgah property. On January 23, 2012 we entered into a mineral lease agreement with a partner who will purchase up to 100,000 tons of resources derived from the property to produce commercial products for resale. The agreement is for an initial period of ten (10) years, with an additional five (5) year extension at the option of the lessee. We will receive fees for the removal of minerals at diminishing prices in $0.50 increments between $12 per ton and $10 per ton for each 20,000 tons of material removed.

Pisgah Property - Debt Transactions

We owed a second private lender (First Colony Merchant) a total of $852,767 including accrued interest, on three notes payable secured by a deed of trust and assignment of rents (payments under the Twin Mountain lease) on the Pisgah property, which were cancelled during 2011 in accordance with the statute of limitations. The resulting gain on extinguishment of debt of $852,767 was recognized within the statement of operations during the year ended December 31, 2011. For additional consideration for part of the amounts loaned, the Company granted the lender a five-year option to purchase 300,000 restricted shares of common stock, at the lower of $0.65 per share or 50% of the lowest trading price during the month before exercise, payable in cash. The option was exercised in 2000 at $0.52 per share. In addition, in fiscal year 2000, as further consideration, we issued 45,000 restricted shares of common stock to a corporate affiliate of the lender as a loan placement fee.

10

Location and Access

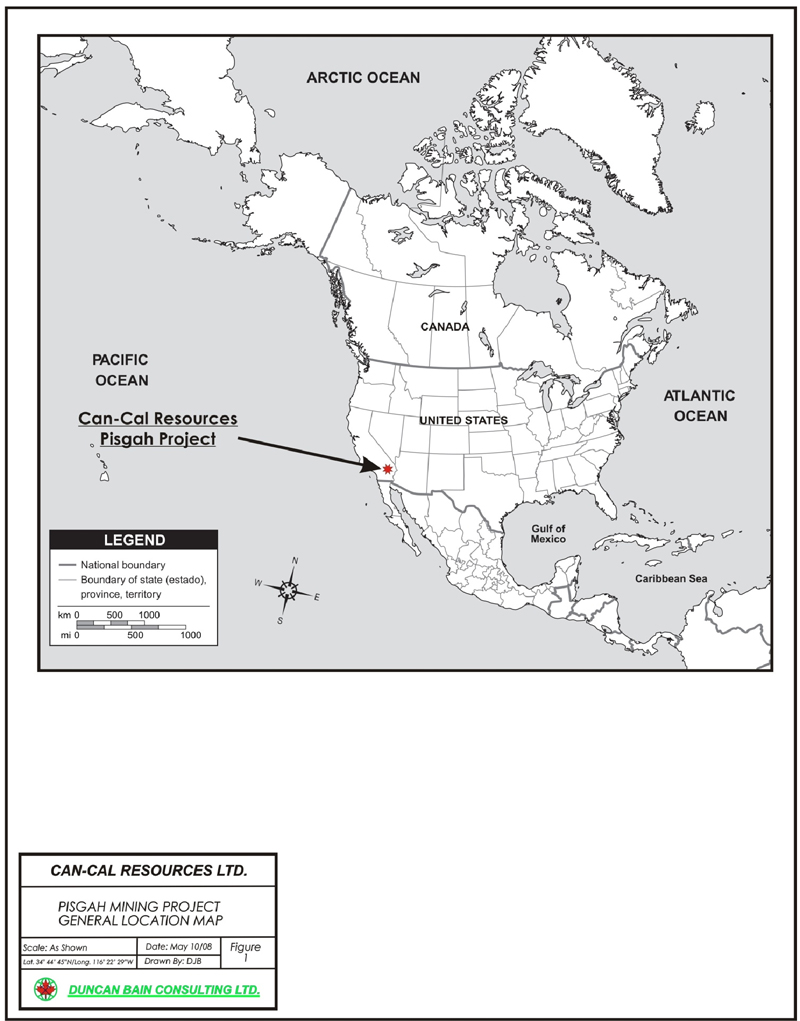

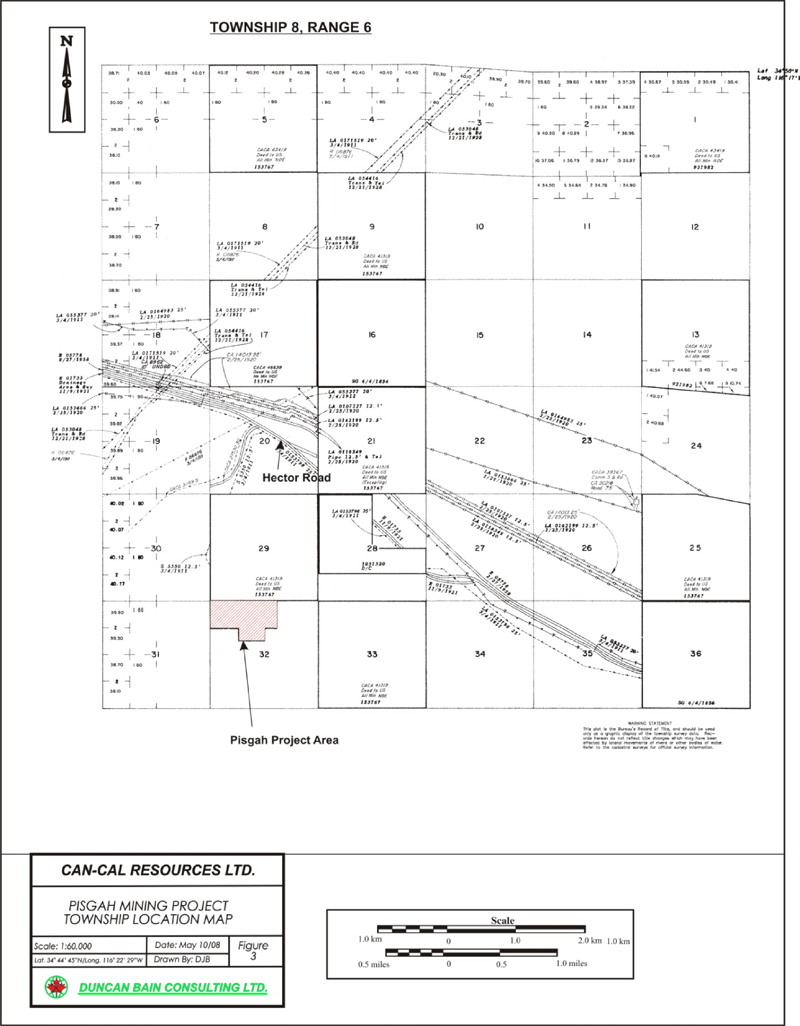

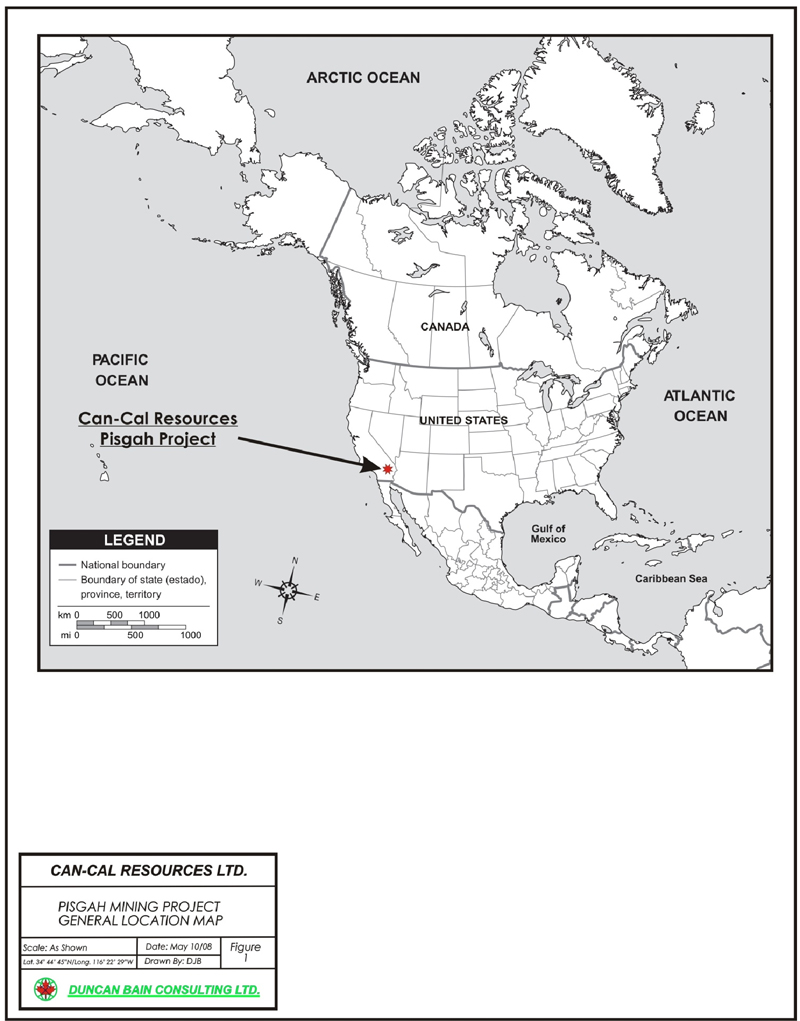

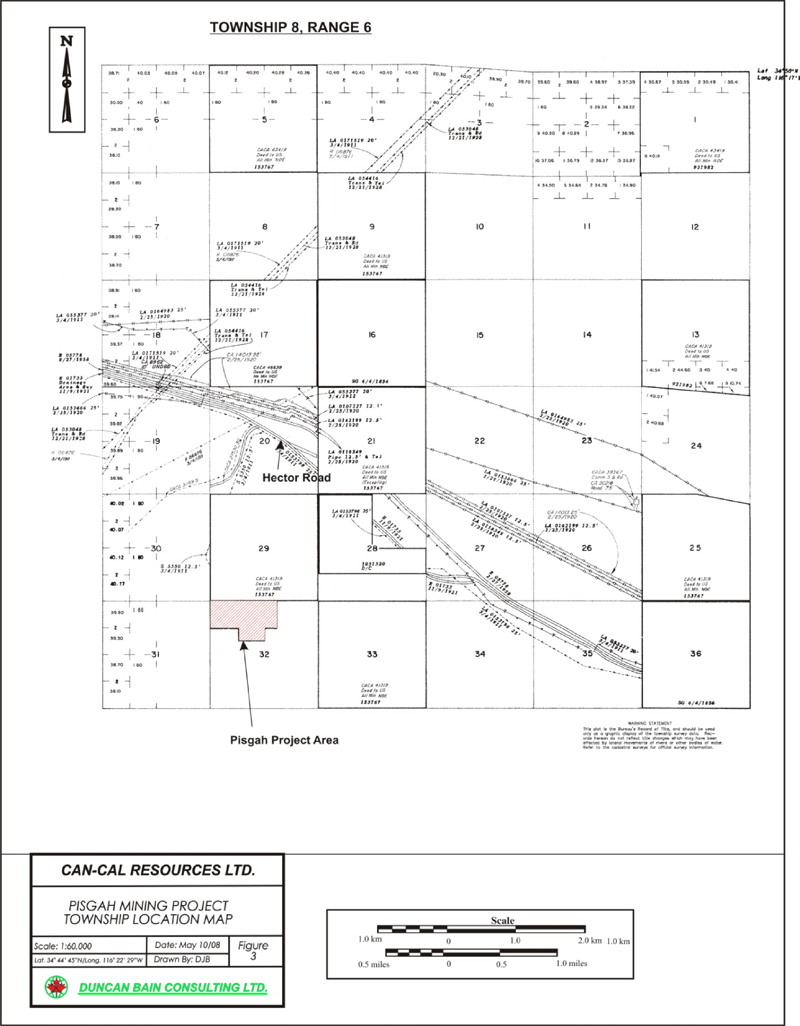

The Pisgah Project is located in San Bernardino County, 72 kilometers (45 miles) east of the city of Barstow, California, and 307 kilometers (192 miles) south-southeast of Las Vegas, Nevada, United States. Barstow lies near the southwest border of California, east of the junction of Interstate 15, Interstate 40 and U.S. Route 66. The Project is centered at Latitude 34o 44’ 47” North, Longitude 116o 22’ 29” West (See Figures 1, 2 and 3), or UTM (metric) co-ordinates 55700 E/384500 N in Zone 11, datum point NAD 27. It lies within the NW ¼ of Section 32, Township 8 North, Range 6 East from San Bernardino Meridian and has an area of 48.4 hectares (120.2 acres).

Access to the Pisgah Project is by the paved 2-lane paved road. From the junction of Interstate 15 and Interstate 40 just east of Barstow, California travel east along Interstate 40 for 52 kilometers (32.5 miles). Take the Hector Rd. Exit and turn right onto Hector Rd. From here turn left onto Historic Route 66 for 7.4 kilometers (4.6 miles), and then turn right (south) onto the Pisgah Crater road. Follow this road for 3.2 kilometers (2.0 miles) to the Pisgah Crater workings.

11

Pisgah Project

General Location Map

12

Pisgah Project

Regional Location Map

13

Pisgah Project

Township Location Map

14

Pisgah Project

Topography Map

15

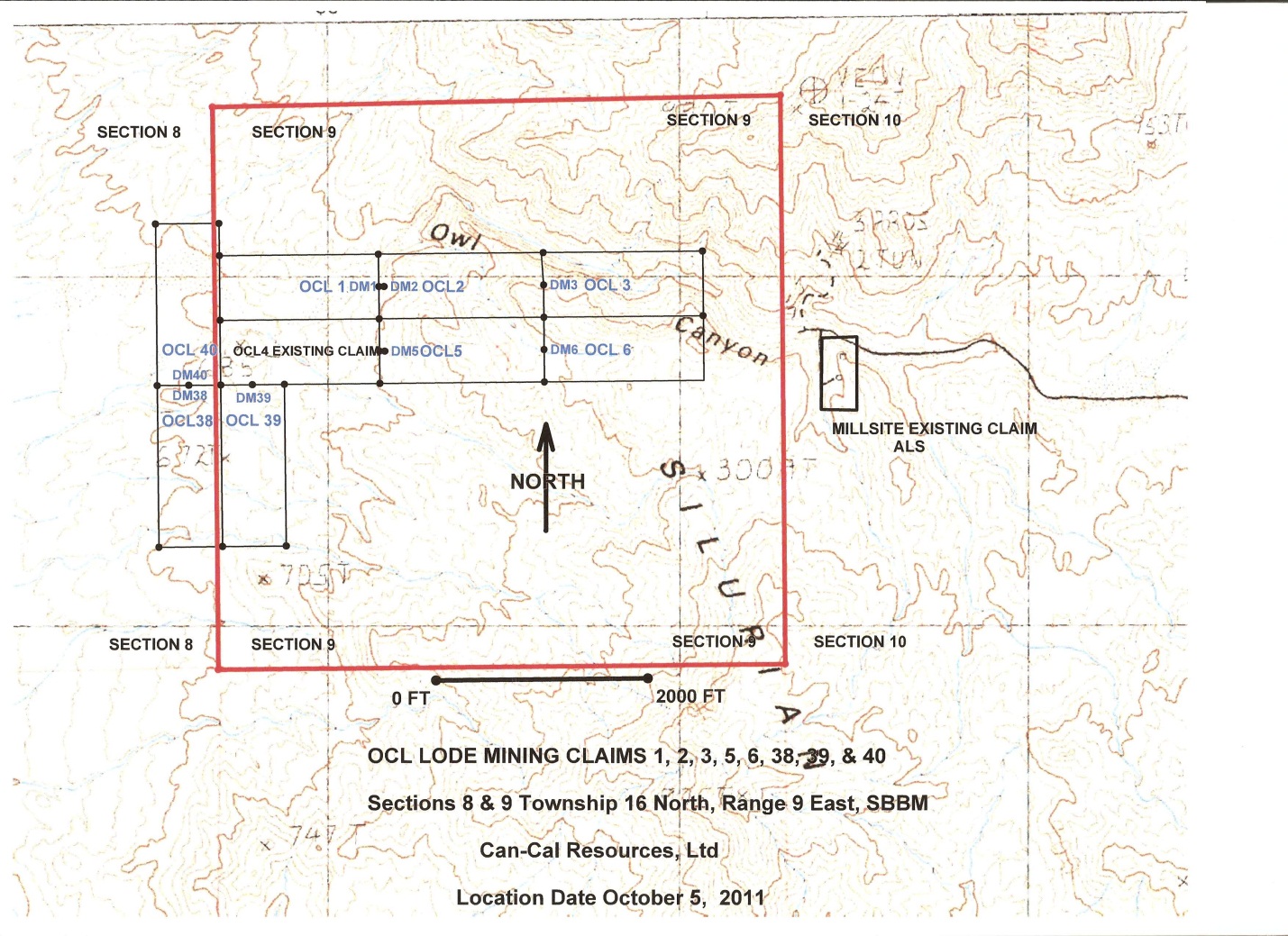

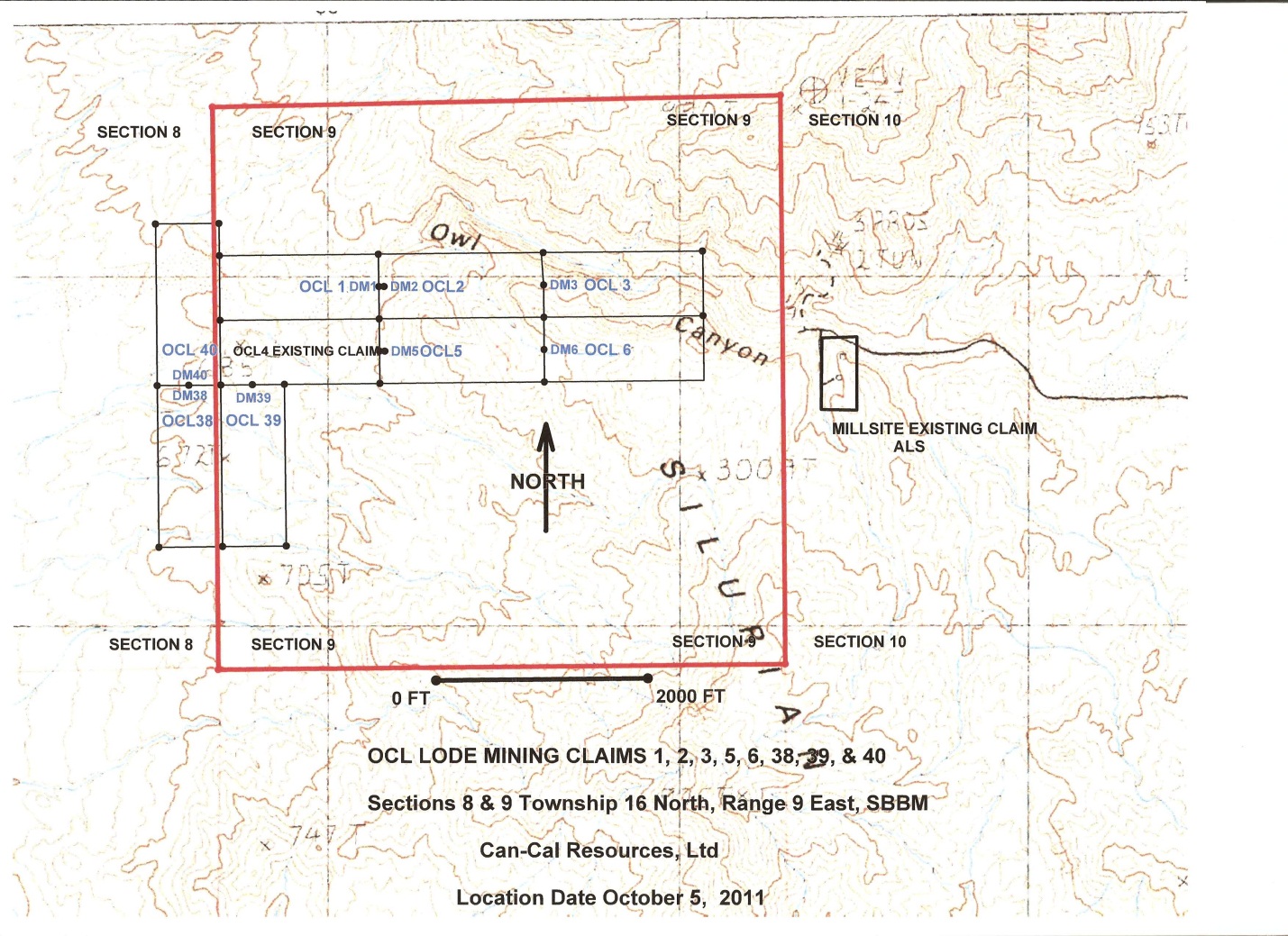

OWL CANYON - S & S JOINT VENTURE

In 1996, the Company entered into a Joint Venture Agreement with the Schwarz family covering approximately 425 acres of unpatented placer and lode mining claims in the Silurian Hills of California, known as Owl Canyon (the “S&S Joint Venture”). The S & S Joint Venture has since reduced its holdings to 160 acres of lode claims and a five-acre mill site claim. These claims are prospective for precious metals and some base metals. The property is located approximately 23 miles northeast of Baker, California, accessible by 23 miles of paved and dirt road. The Company and the Schwarz family each have a 50% interest in the venture which is operated by a management committee, comprised of G. Michael Hogan, a director of the company, and Ms. Robin Schwarz.

Holding costs are approximately $160 per year for county and BLM filing fees for each of the eight lode claims, in accordance with filings under provisions of the “Small Miner Waiver”. Work must be performed on the property each year to keep title to the claims.

Pursuant to the Joint Venture Agreement, we are funding the venture’s operations. Any income from the venture will first be paid to the Company to repay funds advanced to the venture or spent on its account, with any additional income divided 50% to the Company and 50% to the Schwarz family.

As the acquisition price of its 50% interest in the S & S Joint Venture, in 1996 the Company issued 500,000 restricted shares of common stock to the Schwarz family.

Prior to 2003, the Company conducted extensive preliminary testing and assaying on the Owl Canyon property. Results indicate precious metals are present in material located on the Owl Canyon property, and further exploration is warranted. Upon conclusion of the trenching program conducted by Geochemist, Bruce Ballantyne, the assay results confirmed that the “Papa Hill” section of Owl Canyon should be a designated drill target in the future.

Geology of Owl Canyon

Mineralization on the property migrates along north/south oriented faulting and at the contact point between metamorphic and dolomite rocks. Metalliferous deposits, or deposits filled with fine metal particles, along these fractures are prevalent near the central area of Owl Canyon. Along the southern side of the property, fault contact areas exhibit localized zone alteration from migrating hydrothermal fluids, or areas altered from hot lava and hydrothermal fluids due to volcanic activity, producing a mineralized vein ranging in width from approximately 18 to 36 inches.

We have performed external and in-house fire assays on material from the Owl Canyon property, sending both trench and rock samples to independent laboratories. Approximately 15 tons of material was removed to a depth of 3 to 4 feet to expose a continuation of one of the veins. An independent laboratory analyzed samples from this material.

A detailed structural and geologic mapping survey has been completed on the property, indicating some zones in certain areas are suitable exploration targets. Currently, work on this property has been suspended. This property is without known reserves and future work would be exploratory in nature. There was no significant activity on this property in 2011.

16

Location

The Silurian Hills are located in the Silurian Hills 15-minute quadrangle. The property is located in the northeastern corner of the 7.5 minute series topographic map entitled North of Bank Quadrangle California - San Bernardino County in Section 9, Township 16N, Range 9E. It is centered along the topographic feature known as Owl Canyon.

The area lies within the California Desert Conservation Area administered by the Bureau of Land Management. This agency identified the Silurian Hills as having high mineral potential for silver (1980) which led the County of San Bernardino to zone the area for mining and mineral exploration.

Access

From Interstate 15 at Baker, California, access is via California State Highway 127 for a distance of nine miles north of the service center town of Baker. At the Powerline Road junction turn right and travel on a USGS class 3 road generally under the Power Transmission Line for a further 9 miles. At this point turn to the left and head north to the Silurian Hills until metal gates are reached after 5 miles of slow, track-road, travel. This is the eastern boundary of the Owl Canyon Mineral Property.

Topography

Relief at the Owl Canyon Mineral Property area ranges from 650 meters to about 775 meters (elevation 2,000 to 3,000 feet above sea level). Locally, topographic relief is on the order of 1,000 feet in less than one half a mile along the Owl Canyon topographic feature.

17

Owl Canyon Project

Township Location Map

18

CERBAT PROPERTY

On March 12, 1998, we signed a Lease and Purchase Option Agreement covering six patented mining claims in the Cerbat Mountains, Hualapai Mining District, and Mohave County, Arizona. The patented claims cover approximately 120 acres. We paid $10,000 as the initial lease payment and are obligated to pay $1,500 per quarter as minimum advance royalties. The Company has the option to purchase the property for $250,000, less payments already made. In the event of production before purchase, we will pay the lessor a production royalty of 5% of the gross returns received from the sale or other disposition of metals produced. Except for limited testing and evaluation work performed in mid- 2002, no work has been performed on this property since 1999. Access is north 15 miles from Kingman, Arizona on Highway 93, east from the historical market to Mill Ranch, then left three miles to a locked gate.

The country rock is pre-Cambrian granite, gneiss and schist complex. It is intruded by dikes of minette, granite porphyry, diabase, rhyolite, basalt and other rocks, some of which are associated with workable veins and are too greatly serieitized (altered small particles within the material) for determination. The complex is also flanked on the west by masses of the tertiary volcanic rocks, principally rhyolite. The mineralized body contains principally gold, silver and lead. They occur in fissure veins, which generally have a north-easterly trend and a steep north-easterly or south-westerly dip. Those situated north of Cerbat wash are chiefly gold bearing while those to the south principally contain silver and lead. The gangue (material that is considered to have base metals that are not precious or worth recovering for market value) is mainly quartz and the values usually favor the hanging wall. The Company has been informed by the owner that the property contains several mine shafts of up to several hundred feet in depth and tailings piles containing thousands of tons of tailings. The property has not produced since the late 1800’s.

The buildings on the property are practically valueless, owing to being in disuse for so many years.

We conducted (in late June and July 2002) a limited number of preliminary tests and assays on material taken from mine dumps (material left on the property from mining by others many years ago). It was anticipated that this material could be economically processed. However, the dump material tonnage will not support a small-scale operation without being supplemented with additional underground ore. We are considering selling or farming out the property, as there have been expressions of interest in the property from time to time. We have had no significant activity on Cerbat as of the date of this annual report.

Location and Access

The Cerbat Group of claims is located in the Hualapai Mining District about 15 miles north from Kingman which is the nearest railroad and supply point. The state highway from Kingman to Boulder Dam and Las Vegas passes within 4 miles of the property and a good County road connects the highway with the mining site. The County road passes through the Rolling Wave and Red Dog claims making transportation available to the lower workings. An old road connects the New Discovery shaft with the Cerbat workings near the crest of the hill. This group of claims is favorably situated for trucking and transportation purposes.

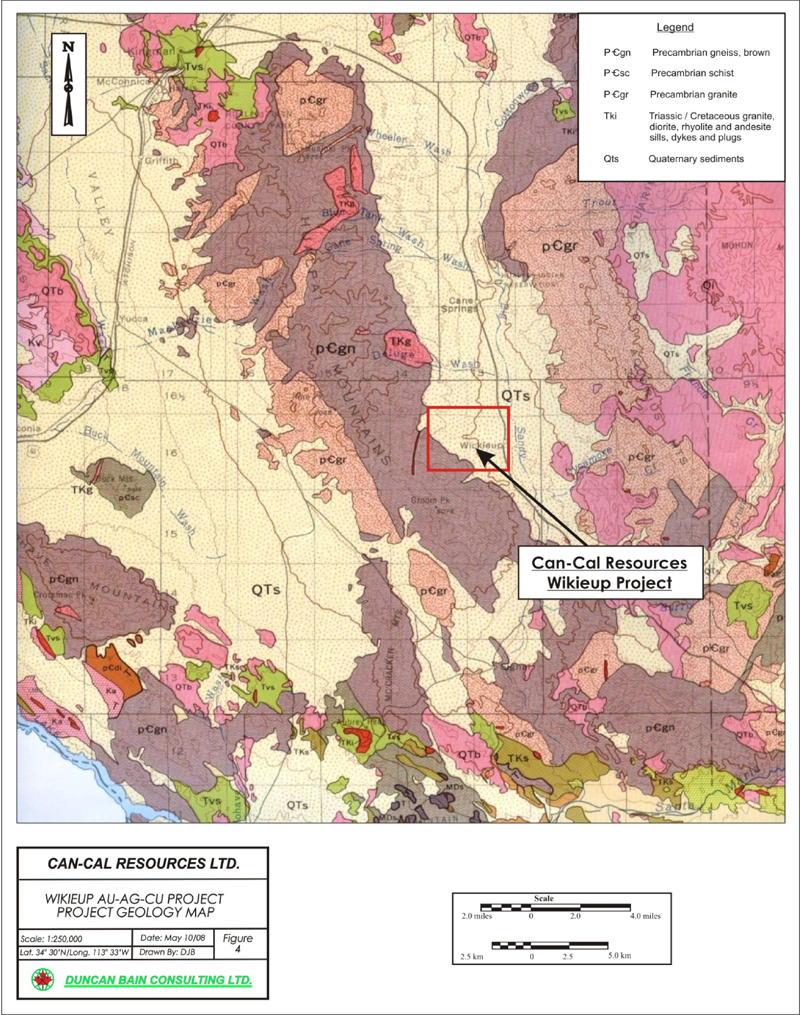

WIKIEUP PROPERTY

The Wikieup property consists of 2,400 acres or approximately 3.8 square miles of 120 lode claims. The lode claims are accessed via gravel road approximately eight miles just off Highway 93 at the town of Wikieup, Arizona.

Holding costs are approximately $155 per year for county and BLM filing fees, and work must be performed on the property each year to keep title to the claims.

19

The geology of the area is comprised of Precambrian ganoids and gneiss. Outcrop is extensive on the property and rock units include diorite, gabbro and granitic dikes. The Company has kept the claims in good standing by submission of the required rental fees. During the past nine months, the Company has conducted surface sampling of the rock units on the property for “In House” and independent third party companies’ analytical evaluation and assay tests. We are currently holding the property for further exploration. At the present time the property is without known reserves.

During 2011, we began the process of conducting a comprehensive research and development program to ascertain the potential for any rare earth elements on the Wikieup property with the assistance of an independent geologist working together with students from the University of Nevada Las Vegas’ geology department (UNLV). The study is expected to be completed during 2012.

Location and Access

The Wikieup Project is located in southern Mohave County, 88 kilometers (55 miles) south of the city of Kingman, Arizona, and 253 kilometers (158 miles) southeast of Las Vegas, Nevada, United States. Wikieup lies on Interstate 93. It occurs at Latitude 34o 44’ 47” North, Longitude 116o 22’ 29” West, the site of Wikieup, and west from there for approximately 19 kilometres (12 miles; Figures 1, 2 and 3). The Project is located 37 kilometers (23 miles) northwest of the mining camp of Bagdad, Arizona and 25 kilometers (16 miles) northwest of the mining camp of Bagdad, Arizona.

Access to the Wikieup Project is by the paved 2-lane Interstate 93 from the village of Wikieup. A few claims straddle the highway at Wikieup, but the main body of mining claims is accessed by heading west from the junction of Interstate 93 at Wikieup onto Chicken Springs Road and following various secondary and tertiary gravel and sand roads. Many of the tertiary roads require a 4-wheeldrive vehicle for access.

20

Wikieup Project

General Location Map

21

Wikieup Project

Regional Location Map

22

Wikieup Project

District Location Map

23

Wikieup Project

Geology Map

24

The evaluation and acquisition of precious metals, mining properties and mineral properties is competitive; as there are numerous companies involved in the mining and minerals business.

Exploration for and production of minerals is highly speculative and involves greater risks than exist in many other industries. Many exploration programs do not result in the discovery of mineralization and any mineralization discovered may not be of a sufficient quantity or quality to be profitably mined. Also, because of the uncertainties in determining metallurgical amenability of any minerals discovered, the mere discovery of mineralization may not warrant the mining of the minerals on the basis of available technology.

The Company’s decision as to whether any of the mineral properties it now holds, or which it may acquire in the future, contain commercially mineable deposits, and whether such properties should be brought into production, will depend upon the results of the exploration programs and independent feasibility analysis and the recommendation of engineers and geologists. The decision will involve the consideration and evaluation of a number of significant factors, including, but not limited to: 1. The ability to obtain all required permits; 2. Costs of bringing the property into production, including exploration and development or preparation of feasibility studies and construction of production facilities; 3. Availability and costs of financing; 4. Ongoing costs of production; 5. Market prices for the metals to be produced; and 6. The existence of reserves or mineralization with economic grades of metals or minerals. No assurance can be given that any of the properties the Company owns, leases or acquires contain (or will contain) commercially mineable mineral deposits, and no assurance can be given that the Company will ever generate a positive cash flow from production operations on such properties.

The Company has processed and tested mineralized materials and produced very small amounts of precious metals on a testing basis. These have come primarily from testing material from the Pisgah Mountain, Wikieup, Cerbat and the Owl Canyon properties.

The Company is not currently dependent upon one or a few major customers.

Exploration and mining operations in the United States are subject to statutory and agency requirements which address various issues, including: (i) environmental permitting and ongoing compliance, including plans of operations which are supervised by the Bureau of Land Management (“BLM”), the Environmental Protection Agency (“EPA”) and state and county regulatory authorities and agencies (e.g., state departments of environmental quality) for water and air quality, hazardous waste, etc.; (ii) mine safety and OSHA generally; and (iii) wildlife (Department of Interior for migratory fowl, if attractive standing water is involved in operations). See (b)(11) below. The Company has been added by San Bernardino County as a party to the Approved Mining/ Reclamation Plan and related permits, which have been issued for the Pisgah property. See Item 2, Description of Properties - Pisgah, California - Pisgah Property Mining Lease.

Because any exploration (and future mining) operations of the Company would be subject to the permitting requirements of one or more agencies, the commencement of any such operations could be delayed, pending agency approval (or a determination that approval is not required because of size, etc.), or the project might even be abandoned due to prohibitive costs.

The Company has historically expended a significant amount of funds on consulting, geochemical analytical testing, metallurgical processing and extracting, and precious metal assaying of material, however, the Company does not consider those activities as research and development activities. All those expenses are borne by the Company.

25

Federal, state and local provisions regulating the discharge of material into the environment, or otherwise relating to the protection of the environment, such as the Clean Air Act, Clean Water Act, the Resource Conservation and Recovery Act, and the Comprehensive Environmental Response Liability Act (“Superfund”) affect mineral operations. For exploration and mining operations, applicable environmental regulation includes a permitting process for mining operations, an abandoned mine reclamation program and a permitting program for industrial development. Other non- environmental regulations can impact exploration and mining operations and indirectly affect compliance with environmental regulations. For example, a state highway department may have to approve a new access road to make a project accessible at lower costs, but the new road itself may raise environmental issues. Compliance with these laws, and any regulations adopted there under, can make the development of mining claims prohibitively expensive, thereby frustrating the sale or lease of properties, or curtailing profits or royalties which might have been received there from. In 1997, the S & S Joint Venture spent approximately $32,000 to clean up areas of the Owl Canyon properties as requested by the BLM. The Company cannot anticipate what the further costs and/or effects of compliance with any environmental laws might be. The BLM approved the S&S Joint Venture trenching program at Owl Canyon without a requirement for bonding. The BLM approved the reclamation of this trenching program in 2000. BLM demanded further clean up of the mill site and surrounding area, and the Joint Venture complied with their request in 2000.

The Company presently has one full-time employee and relies on outside subcontractors, consultants and agents, to perform various administrative, legal and technical functions, as required.

OTHER FINANCING TRANSACTIONS

During the year ended December 31, 2011, the Company sold 5,824,584 units each consisting of one share and one warrant to purchase one share of the Company’s restricted common stock. The units were sold to various accredited Canadian investors for a total of $349,475. The warrants are exercisable at a price of $0.08 per share and expire approximately two years from the date of issuance. These securities were issued in private transactions, with respect to the Canadian residents, in reliance on the exemption from registration with the SEC provided by Regulation S and with respect to the United States investor, in reliance upon the exemption from registration provided under Section 4(2) of the 1933 Securities Act.

ITEM 3. LEGAL PROCEEDINGS.

The Company is not currently a party to, or otherwise involved in any legal proceedings.

In the ordinary course of business, we are from time to time involved in various pending or threatened legal actions. The litigation process is inherently uncertain and it is possible that the resolution of such matters might have a material adverse effect upon our financial condition and/or results of operations. However, in the opinion of our management, matters currently pending or threatened against us are not expected to have a material adverse effect on our financial position or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES.

The Company does not currently operate any mines related to its claims. As a result, mine safety disclosures are not applicable.

26

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

(a) Market Information

Our Common Stock trades sporadically on the over-the-counter bulletin board market (OTC:BB) under the symbol CCRE. Our common stock has traded infrequently on the OTC:BB, which limits our ability to locate accurate high and low bid prices for each quarter within the last two fiscal years. Therefore, the following table lists the quotations for the high and low bid prices as reported by a Quarterly Trade and Quote Summary Report of the OTC Bulletin Board for the calendar years 2011 and 2010. The quotations from the OTC Bulletin Board reflect inter-dealer prices without retail mark-up, markdown, or commissions and may not represent actual transactions.

| | | | |

| 2011 | 2010 |

| High | Low | High | Low |

1st Quarter | $0.07 | $0.02 | $0.14 | $0.04 |

2nd Quarter | $0.10 | $0.04 | $0.13 | $0.07 |

3rd Quarter | $0.10 | $0.02 | $0.09 | $0.04 |

4th Quarter | $0.05 | $0.02 | $0.12 | $0.05 |

(b) Holders of Common Stock

As of March 28, 2012, there were approximately 593 holders of record of our Common Stock and 39,717,911 shares outstanding.

(c) Dividends

In the future we intend to follow a policy of retaining earnings, if any, to finance the growth of the business and do not anticipate paying any cash dividends in the foreseeable future. The declaration and payment of future dividends on the Common Stock will be the sole discretion of board of directors and will depend on our profitability and financial condition, capital requirements, statutory and contractual restrictions, future prospects and other factors deemed relevant.

(d) Securities Authorized for Issuance under Equity Compensation Plans

STOCK OPTION PLANS

THE CAN-CAL 2003 QUALIFIED INCENTIVE STOCK OPTION PLAN: The 2003 Qualified Incentive Stock Option Plan was established by the Board of Directors in June 2003 and approved by shareholders in October 2003. A total of 1,500,000 shares of common stock are reserved for issuance under this plan, which will be used to compensate senior executives and mid-level employees in the future. An option on 500,000 shares had been granted to Mr. Ciali under this plan. These options expired unexercised in 2006. An option on 300,000 shares had been granted to Anthony F. Ciali when he was appointed an officer of the company in March 2003. These options expired unexercised in 2006.

An option on 500,000 shares has been granted to Mr. Ronald Sloan with an exercise price of $0.20 in June 2006 under this plan. These options expired unexercised in 2011. An option on 125,000 shares has been granted to Mr. James Dacyszyn with an exercise price of $0.20 in June 2006 under this plan. This option was exercisable upon issuance and expired in June 2008. An option on 125,000 shares has been granted to Mr. John Brian Wolfe with an exercise price of $0.20 in June 2006 under this plan. This option was exercisable upon issuance and expired in June 2008.

27

THE CAN-CAL 2003 NON-QUALIFIED STOCK OPTION PLAN FOR SENIOR EXECUTIVES, OUTSIDE DIRECTORS, AND CONSULTANTS: The 2003 Non-Qualified Option Plan was established by the Board of Directors in June 2003 and approved by shareholders in October 2003. A total of 1,500,000 shares of common stock are reserved for issuance under this plan. An option on 300,000 shares had been granted to Anthony F. Ciali, a former officer of the Company, when he was appointed an officer of the company in March 2003. These options expired unexercised in 2006. An option on 100,000 shares had been granted to Luis Vega when he signed a consulting agreement with the company in April 2003. Mr. Vega’s options expired unexercised in 2006.

The total number of options issued and outstanding at any time, under both the Qualified and Non-Qualified Stock Option Plans will not exceed 10% of the company’s issued and outstanding common stock, calculated on a pro forma basis.

Recent Sales of Unregistered Securities

On January 26, 2012, Can-Cal completed the sale of a Private Placement, including 100,000 Units of the Company at a price of US$0.06 per Unit, under the terms detailed, above. Each Unit consists of one share of common stock (“Common Share”) and one Common Share purchase warrant (“Warrant”) exercisable at $0.08 per share over a two year period from the date of sale. The Company received total aggregate gross proceeds of US$6,000.00 in the January 2012 sale. Finders acting in connection with the private placement are entitled to receive aggregate fees of $300 and 5,000 Common Shares.

On January 27, 2012, Can-Cal completed the sale of a Private Placement, including 100,000 Units of the Company at a price of US$0.06 per Unit, under the terms detailed, above. Each Unit consists of one share of common stock (“Common Share”) and one Common Share purchase warrant (“Warrant”) exercisable at $0.08 per share over a two year period from the date of sale. The Company received total aggregate gross proceeds of US$6,000.00 in the January 2012 sale. Finders acting in connection with the private placement are entitled to receive aggregate fees of $300 and 5,000 Common Shares.

The Company plans to use the proceeds of the sale for: ( i) the completion of its work-up of two extraction processes to determine which process, if either, will be used in the Company’s efforts to potentially prove up any precious metals, platinum groups elements and/or other base metals on the Company’s Pisgah, California site and Wikieup, Arizona site; (ii) conducting a drill program to potentially prove up potential tonnages and subsequently any precious metals and/or other base metals on the Wikieup, Arizona property; (iii) the undertaking of a comprehensive research and development program to ascertain the potential for any rare earth elements on the Owl Canyon, California site; (iv) the potential engagement of a qualified and comprehensive US and Canadian investor relations and shareholder communications group, and; (v) strategic working capital reserve.

On October 24, 2011, the Company issued a total of 218,793 shares of its common stock as commissions on previous sales of securities amongst three different sales persons. The total fair value of the common stock was $12,078 based on the closing price of the Company’s common stock on the grant dates.

On October 18, 2011, the Company sold a total of 200,000 shares of its common stock and an equal number of warrants pursuant to a unit offering in exchange for total proceeds of $12,000 from two investors.

On October 14, 2011, the Company sold a total of 150,000 shares of its common stock and an equal number of warrants pursuant to a unit offering in exchange for total proceeds of $9,000 from two investors.

On September 26, 2011, the Company sold a total of 700,000 shares of common stock and an equal number of warrants pursuant to a unit offering in exchange for total proceeds of $42,000 from three investors.

28

The Company used the proceeds of the sale (i) for exploration and development of Can-Cal’s current properties, including ongoing laboratory processing and metallurgy testing in relation to precious metal extraction from Can-Cal’s Pisgah and Wikieup properties; (ii) for general working capital requirements.

The recipients of the shares were afforded an opportunity for effective access to files and records of the Company that contained the relevant information needed to make their investment decisions, including the Company’s financial statements and 1934 Act reports. The Company reasonably concluded that the recipients, immediately prior to issuing the shares, had such knowledge and experience in our financial and business matters that they were capable of evaluating the merits and risks of their respective investments.

Issuer Purchases of Equity Securities

We did not repurchase any of our equity securities during the year ended December 31, 2011.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable.

29

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of the business, financial condition and results of operation of the Company should be read in conjunction with the financial statements of the Company for the years ended December 31, 2011 and 2010 and the notes to those statements that are included elsewhere in this Annual Report on Form 10-K. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under the section titled “Risk Factors.”

Overview

Can-Cal Resources Ltd. is a publicly traded exploration stage company engaged in seeking the acquisition and exploration of metals mineral properties. As part of its growth strategy, the Company will focus its future activities in the USA, with an emphasis on the Pisgah Mountain, California property and the Wikieup, Arizona property.

At December 31, 2011, we had cash on hand of approximately $38,000 available to sustain operations. Accordingly, we are uncertain as to whether the Company may continue as a going concern. While we may seek additional investment capital, or possible funding or joint venture arrangements with other mining companies, we have no assurance that such investment capital or additional funding and joint venture arrangements will be available to the Company.

We expect in the near term to continue to rely on outside financing activities to finance our operations. We used investment proceeds realized during 2011 and 2010 for (i) completion of work-up of two potential extraction processes to determine which process we will employ to potentially prove up any precious metals, platinum groups elements and/or other base metals on the Pisgah, California property and the Wikieup, Arizona property, if any; (ii) the development of a drill program to potentially prove up any tonnages and precious metals and/or other base metals on the Wikieup, Arizona property, if any; (iii) the continued development a comprehensive research and development program to ascertain the potential for any rare earth elements on the Owl Canyon, California property; (iv) strategic working capital reserve and (v) to finance our operations.

In addition to our historic exploration activities, we are currently under taking alternative revenue producing opportunities at our Pisgah property. On January 23, 2012 we entered into a mineral lease agreement with a partner who will purchase up to 100,000 tons of resources derived from the property to produce commercial products for resale. The agreement is for an initial period of ten (10) years, with an additional five (5) year extension at the option of the lessee. We will receive fees for the removal of minerals at diminishing prices in $0.50 increments between $12 per ton and $10 per ton for each 20,000 tons of material removed.

With reference to the Wikieup Property, Can-Cal has commissioned a Geologist to perform a three-phased project to evaluate the property and its surrounding areas. The use of Satellite Imaging Interpretation software will provide regional, geological mapping. The next phase is to take surface samplings from various areas and have the samples analyzed. The results will determine the potential for any commercially viable mineral deposits as well as prospective drilling locations.

30

Results of Operations for the Years Ended December 31, 2011 and 2010:

| | | | | | |

| Years Ended December 31, | | Increase / (Decrease) |

| 2011 | | 2010 | | |

| Amount | | Amount | | $ | % |

Expenses: | | | | | | |

General & administrative | $ 311,743 | | $ 318,602 | | $ (6,859) | (2%) |

Exploration costs | 46,499 | | 12,981 | | 33,518 | 258% |

Depreciation | 8,230 | | 9,381 | | (1,151) | (12%) |

Officer salary | 120,000 | | 120,000 | | - | - |

Total operating expenses | 486,472 | | 460,964 | | 25,508 | 6% |

| | | | | | |

Net operating loss | (486,472) | | (460,964) | | 25,508 | 6% |

| | | | | | |

Other income (expense): | | | | | | |

Other income | 12,400 | | 7,098 | | 5,302 | 75% |

Gain on extinguishment of debts | 1,152,039 | | - | | 1,152,039 | 100% |

Interest income | - | | 23 | | (23) | (100%) |

Rental revenue | 39,000 | | 29,791 | | 9,209 | 31% |

Loss on disposal of fixed assets | (23,673) | | - | | 23,673 | 100% |

Interest expense | (118,490) | | (148,803) | | (30,313) | (20%) |

Total other income (expense) | 1,061,276 | | (111,891) | | 1,173,168 | 1,048% |

| | | | | | |

Net income (loss) | $ 574,804 | | $ (572,855) | | $ 1,147,659 | 200% |

Revenues:

We are an exploration stage company and had no revenue to recognize in the years ended December 31, 2011 and 2010. As such, there were no comparative revenues or cost of revenues.

General and Administrative:

General and administrative expenses were $311,743 for the year ended December 31, 2011 compared to $318,602 for the year ended December 31, 2010, a decrease of $6,859 or approximately 2%. The decrease in general and administrative expense for the year ended December 31, 2011 compared to the year ended December 31, 2010 was due to decreased professional fees provided during 2011 as we made improvements in our reporting procedures that enabled us to become more cost effective.

Exploration Costs:

For the year ended December 31, 2011, exploration costs were $46,499 compared to $12,981 for the year ended December 31, 2010, an increase of $33,518, or 258%. The increase in exploration costs for the year ended December 31, 2011 compared to the year ended December 31, 2010 is due to increased exploration activities at our Pisgah and Wikieup locations.

Depreciation:

For the year ended December 31, 2011, depreciation expense was $8,230 compared to $9,381 for the year ended December 31, 2010, a decrease of $1,151, or 12%. The decrease in depreciation expense for the year ended December 31, 2011 compared to the year ended December 31, 2010 is due to diminishing depreciation expense as assets have become fully depreciated and have not been replaced.

31

Officer Salary:

For the year ended December 31, 2011, officer salary expense was $120,000 compared to $120,000 for the year ended December 31, 2010. Officer salary expense for the year ended December 31, 2011 compared to the year ended December 31, 2010 remained constant as our CEO’s compensation is fixed at $10,000 per month. All salaries payable in 2011 and 2010 were accrued, but not paid, and remain an outstanding obligation of the Company.

Net Operating Loss:

Net operating loss for the year ended December 31, 2011 was $486,472, or ($0.01) per share, compared to a net operating loss of $460,964 for the year ended December 31, 2010, or ($0.01) per share, an increase of $25,508 or 6%. Net operating loss increased primarily due to increased exploration activities in 2011 compared to 2010.

Other Income:

Other income was $12,400 for the year ended December 31, 2011 compared to $7,098 for the year ended December 31, 2010, an increase of $5,302, or 75%. Other income increased due to the collection of proceeds of $12,400 received in settlement of misappropriated funds by our former bookkeeper compared to the collection of $3,500 during the year ended December 31, 2010, an increase of $8,900 over the comparative period. Other income in the comparative year ended December 31, 2010 also included $3,598 of other income related to the conversion of previously issued convertible debentures settled through the issuance of equity outside of the terms of the convertible debentures that was not recognized during the year ended December 31, 2011. The note holders agreed to forgive all unpaid interest as part of the conversions.

Gain on extinguishment of debts:

Gain on extinguishment of debts was $1,152,039 for the year ended December 31, 2011 compared to $-0- for the year ended December 31, 2010. The gain on extinguishment of debts in 2011 consisted of a total of $852,767 of principal and accrued interest that was written off during 2011 in accordance with the statute of limitations, along with another $17,268 of accrued interest on a debt that was previously paid in full. We also recognized a gain of $282,004 due to the forgiveness of accrued salaries previously earned by our former CEO, Ron Sloan.

Interest Income:

Interest income was $-0- for the year ended December 31, 2011 compared to $23 for the year ended December 31, 2010, a decrease of $23, or 100%. The decrease in interest income for the year ended December 31, 2011 compared to the year ended December 31, 2010 is due to the closure of interest bearing savings accounts in the latter part of 2010, as bank charges related to those accounts exceeded the benefit derived from the realized interest income.

Rental Revenue:

Rental revenue was $39,000 for the year ended December 31, 2011 compared to $29,791 for the year ended December 31, 2010, an increase of $9,209, or 31%. The increase in rental revenue for the year ended December 31, 2011 compared to the year ended December 31, 2010 is due to revenues received from special leasing projects in 2011 that were not realized in 2010. Such revenues include, but are not limited to, sub-leasing land for video shoots and television commercials.

Loss on disposal of fixed assets: