UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2009

[ ]TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number000-31503

EDEN ENERGY CORP.

(Exact name of registrant as specified in its charter)

| Nevada | N/A |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| Suite 1660 – 1055 West Hastings St, Vancouver, BC V6E 2E9 | V6E 2E9 |

| (Address of principal executive offices) | (Zip Code) |

| | |

| Registrant's telephone number, including area code: | 604.568.4700 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered |

| N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

N/A

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act

Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of

the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports) and (2) has been subject to such filing requirements for the last 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website,

if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registration statement

was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this

chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy

or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form

10-K.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer,

or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of Common Stock held by non-affiliates of the Registrant on June 30, 2009 (the last business day

of the registrant’s most recently completed second fiscal quarter) was $225,641 based on a $0.031 closing price for the Common

Stock on June 30, 2009. For purposes of this computation, all executive officers and directors have been deemed to be affiliates.

Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of

the Registrant.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

9,893,571 as of March 23, 2010

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

TABLE OF CONTENTS

3

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms "we", "us", "our" and "Eden" mean Eden Energy Corp. and/or our subsidiaries, unless otherwise indicated.

General Overview

From mid 2004 through to mid 2008 we were an exploration stage oil and gas company engaged in the exploration for petroleum and natural gas in the State of Nevada and in the Province of Alberta, Canada. Effective September 2006 we commenced with a natural gas development-drilling program in the White River Dome, Ant Hill Unit located in the Piceance Basin in Colorado. The White River Dome project became our primary focus of activity mid 2008 due to the belief it represented the combination of good commercial returns while providing a large number of low risk development locations. We commenced receiving revenues from our White River Dome project during 2008 and have moved from an exploration stage company to an operating company. We concluded all operations in Nevada in 2008 and currently in conjunction with our partners are monitoring exploration activities in Alberta, Canada.

During 2008 Eden continued with a strategy of growing its natural gas and oil reserves and production by drilling four new wells in the Ant Hill Unit. These new wells were added to production in the first quarter of 2009 bringing our total number of production wells in the area to eight. Net production from continuing operations for the year ended December 31, 2009 was approximately 257,745 Mcfe as compared to approximately 295,157 Mcfe for the year ended December 31, 2008. Revenues recognized declined due to the lower production volumes and significantly lower commodity prices received to approximately $1.05 million for the year ended December 31, 2009 as compared to approximately $2.39 million for the year ended December 31, 2008.

The past year’s decline in gas and oil prices has impaired the valuation of our Colorado assets and currently has eroded our access to reserve based financing for continued drilling in Colorado. The commencement date for our continuous drilling program in Colorado has been extended to no later than July 1, 2010. Management continues to assess its future plans in the area as a result of the deterioration of selling prices and actual field results prior to further decisions.

Management has rationalized corporate costs where possible in an attempt to better align them with expected reduced revenues. During the past year we concluded negotiated settlements with all our vendors in Colorado and recorded lien releases on the four liens that were filed against our Ant Hill property. We concluded settlement with our operating partner in Colorado and received their reimbursement of $337,643 for their portion of Ant Hill pipeline and water gathering system costs.

4

In order to proceed with our plans we entered into a loan agreement whereby under certain terms and conditions we could borrow up to a $1,000,000 from a company owned and controlled by our president. As of December 31, 2009 we had borrowed the full amount. Ongoing production related issues and the volatility of oil and gas prices for the year ahead are challenging our revenue projections and estimates of operating cash flows. Additional funds to meet loan retirement obligations and to cover future costs of company operations will be required when the loan comes due in October 2010 if not earlier. There is uncertainty that further funding can be raised when necessary. Management plans to continue to review other potential exploration projects, which may be presented to them from time to time.

Our company, Eden Energy Corp., was incorporated in the State of Nevada on January 29, 1999, under the name E-Com Technologies Corp. On June 16, 2004 we effected a 2 for 1 stock split of our common stock and our preferred stock. On August 6, 2004 we changed our name to Eden Energy Corp. and increased our authorized capital to 100,000,000 shares of common stock having a $0.001 par value and 10,000,000 shares of preferred stock having a $0.001 par value. On January 7, 2010 we effected a share consolidation of our authorized and issued and outstanding shares of common stock on a five (5) old for one (1) new basis, such, such that our authorized capital decreased from 100,000,000 shares of common stock with a par value of $0.001 to 20,000,000 shares of common stock with a par value of $0.001 and, correspondingly, our issued and outstanding shares of common stock decreased from 49,467,856 shares of common stock to 9,893,571 shares of common stock.

Due to the implementation of British Columbia Instrument 51-509 on September 30, 2008 by the British Columbia Securities Commission, we have been deemed to be a British Columbia based reporting issuer. As such, we are required to file certain information and documents atwww.sedar.com.

Our Current Business

We are primarily focused and engaged in development drilling of the White River Dome, Ant Hill Unit Project in Colorado. We expect to continue to monitor our other exploration projects pursuant to our participation agreements with our partners.

White River Dome, Ant Hill Unit Drilling and Development Project – Colorado

The White River Dome, Ant Hill Project is a natural gas development-drilling program located in the Piceance Basin of western Colorado. Through agreements entered into September 1, 2006 and August 31, 2007 we have an 85% working interest in these prospective lands, and Eden carries EnCana for 15% of the total well cost in each new well drilled on 40-acre drill site quarter/quarter section. For each well drilled, Eden earned a 100% interest in a diagonal 40-acre tract, located in the same 160-acre quarter section. EnCana retains its 100% interest in the two remaining offset locations in each 160-acre drilling block.

After the initial four locations were drilled, Eden elected to develop 4 additional 160-acre drilling blocks on acreage outside the existing PA’s under the same terms, which initiated Eden’s continuing drilling commitment. There are 34 potential 160-acre drilling blocks outside of the existing PA’s that have not been developed, resulting in 68 potential drilling locations on what is effectively 40-acre spacing. There is also the potential to develop the field on 20-acre spacing, which would provide for another 68 drilling locations.

Ant Hill Unit – Colorado

The primary targets are the Cameo Coal and Williams Fork Sandstones of the Cretaceous Mesaverde Group, found at an average depth of 8,100 feet. As of January 1, 2010 cumulative production from the field is in excess of 82.5 Bcfe from 162 wells, with current production averaging 6.5 MMcf/d from 106 active wells. Typical well life in the field is in the range of 20 – 25 years. Effective January 1, 2010 in accordance with the current SEC reserve evaluation criteria, which uses an average of 2009 monthly actual received oil and gas prices, MHA Petroleum Consultants Inc. of Lakewood, CO. assigned Eden net reserves of 2.05 Bcfe. This report included our proved developed producing reserves only. Effective January 1, 2010, in accordance with the current Canadian Oil and Gas Handbook NI 51-101 reserve evaluation criteria, which uses the Sproule December 31, 2009 oil and gas price forecast, MHA Petroleum Consultants Inc. assigned Eden net reserves of 6.6 Bcfe. Gas from the Ant Hill unit typically contains about 25% carbon dioxide, which is removed at a local natural gas treatment plant. Drilling and completion costs have historically been in the $2,000,000 range per well throughout the field, though with service costs declining due to general economic conditions, we estimate costs now to be in the $1,500,000 range. Operations in the White River Dome Field are largely prohibited in the winter months.

5

On January 30, 2009 we reported that all of the new wells had been tied in to the sales line and that we were conducting additional completion operations to get all of the wells flowing. We reported that as of January 28, 2009 we were producing approximately 1,240 mcfd gross from our White River Dome wells. We also reported the costs and time to drill and complete the wells was in line with our original estimates, while the costs and time to install pipeline and tie-in to sales were above original estimates and we were in discussions with suppliers, subcontractors, and our operating partner to resolve these outstanding issues and their related costs. We reported that until these issues were resolved, we were not in a position to advance funds to settle all 2008 drilling program related accounts or claims.

On February 16, 2009 we received an independent reserve report from MHA Petroleum Consultants Inc., of Golden, Colorado, which was effective January 1, 2009. The report assigned total proved reserves of 10.11 Bcfe net to Eden’s interest; however due to the decline in gas and oil prices used in assigning reserve values, the proved undeveloped locations (8 PUD’s) currently are uneconomical to drill and complete. Using year-end actual received gas and oil prices as mandated by the SEC, net to Eden, the report assigned our eight proved developed producing wells reserves of 2.85 Bcfe with a PV10 value of $4.74 million.

On March 12 2009 we reported we had received notice of a lien being placed against the property by one of the suppliers relating to the pipeline installation. The lien filed was in the amount of $692,118. On April 27, 2009 we received notice of another lien being placed against the property by one other supplier relating to our 2008 well program. The lien filed was in the amount of $28,956. On June 12, 2009 we received notice of a lien being placed against the property by another supplier. The lien filed was in the amount of $148,864. On June 26, 2009 we received notice of a lien being placed against the property by another supplier. The lien filed was in the amount of $4,965.

On August 12, 2009 we finalized negotiations with our operating partner whereby under certain terms and conditions they agreed to reimburse us for pipeline related costs up to a maximum of $383,947 subject to discounts, and they agreed to extend the commencement date for our Continuous Drilling Program to no later than July 1, 2010. In addition we agreed to amend numerous ambiguous terms of our D&D Agreement including to provide for Eden to pay actual water gathering and disposal costs and for EnCana to construct Well Connect Facilities.

On October 20, 2009 we finalized settlements relating to the abovementioned four creditors who filed liens against our Ant Hill Unit properties in Colorado. Pursuant to the settlement agreements, in consideration for a final payment of $340,000 to cover three of the liens and $18,000 to cover the fourth lien, the four creditors each delivered an original lien release, which was recorded by the Rio Blanco County Clerk and Recorder in Colorado.

On October 26, 2009 we reported we had settled the majority of other account claims relating to our 2008 work program in the Ant Hill Unit. With the support and consideration of our contractor and vendor partners in Colorado, we settled approximately $1,444,230 of account claims, which included the lien settlements mentioned above, for approximately $828,400. In order to fund the settlements and provide capital for ongoing operations, on October 2, 2009 we entered into a loan agreement whereby under certain terms and conditions we could borrow up to US$1,000,000 from a company owned and controlled by our President. The loan has a one year term and is secured against our company pursuant to a general security agreement. The full principal amount of $1,000,000 has been advanced to the company.

6

Pursuant to our August 12, 2009 agreement with our Ant Hill partner, once all 2008 well program accounts and lien releases were settled, they were obliged to reimburse us for additional Ant Hill pipeline and water gathering system costs up to a maximum of $383,947, subject to discounts negotiated. As of October 30, 2009 we had incurred total costs of approximately $1,843,944 to construct the pipeline.

During the 2009 vendor settlement process, we negotiated approximately $230,800 in credits and discounts from the contractors and vendors involved on the pipeline project, which when deducted from the total pipeline costs of approximately $1,843,944 incurred, left a final cost of approximately $1,613,123. On January 7, 2009 our partner reimbursed us $868,025 of these costs, which effectively left $745,098 remaining unreimbursed. Due to the financial constraints we experienced at the time, these remaining costs and the related vendor accounts went unpaid until the recent settlement process described above. Under the terms and conditions of the agreement with our Ant Hill partner, we received a final pipeline cost reimbursement of $337,643 on December 17, 2009.

At the time of the agreement with our Ant Hill partner, they also agreed to extend the commencement date for our Continuous Drilling Program to no later than July 1, 2010. In addition we agreed to amend numerous ambiguous terms of our D&D Agreement including provisions for Eden to pay actual water gathering and disposal costs and for EnCana to construct Well Connect Facilities.

Net production from continuing operations for the year ended December 31, 2009 was approximately 257,745 Mcfe as compared to approximately 295,157 Mcfe for the year ended December 31, 2008. Revenues recognized declined due to the lower production volumes and significantly lower commodity prices received to approximately $1.05 million for the year ended December 31, 2009 as compared to approximately $2.39 million for the year ended December 31, 2008.

On February 5, 2010 we received an independent reserve report from MHA Petroleum Consultants Inc., of Lakewood, Colorado, which was effective January 1, 2010. Using an average of 2009 monthly actual received oil and gas prices in accordance with SEC criteria, net to Eden, the report assigned our eight proved developed producing wells net reserves of 2.05 Bcfe with a PV10 value of $2.88 million. Our eight associated proved and undeveloped well locations were not included in the SEC report as they are uneconomical to develop using the current SEC reserve criteria. Effective January 1, 2010 and in accordance with the current Canadian Oil and Gas Handbook NI 51-101 reserve evaluation criteria, which uses the Sproule December 31, 2009 oil and gas price forecast, MHA Petroleum Consultants Inc. assigned Eden net reserves of 6.6 Bcfe with a pre tax PV 10 value of $13.81 million.

The past year’s decline in gas and oil prices has impaired the valuation of our Colorado assets and currently has eroded our access to reserve based financing for continued drilling in Colorado. Management continues to assess its future plans in the area as a result of the deterioration of selling prices and actual field results prior to further decisions. More detailed information on this project is available in our 2008-year end filing.

Noah Project - Nevada

From August 2004 to July 2008 we conducted an exploration program in Nevada, which cumulated in the drilling of the Noah Federal #1 well in the spring of 2008. On April 28, 2008 we reported the Noah Federal #1 well had been plugged and abandoned after reaching a total depth of 7,080 feet. The well encountered its targeted formation, the sub-thrust Devonian Simonson dolomite, at a depth of 5,058 feet. Based on log analysis and the lack of oil or gas shows while drilling, the well did not warrant further testing.

On July 28, 2008 we reported our joint venture partner advised us they have elected not to pursue further exploration on additional Prospect area lands beyond the earned Prospect Area 1. We reported also that after incorporating the results of the Noah well into our overall geological model of the area, we have decided not to pursue additional drilling leads and will not be renewing leases we hold in the project area. Accordingly, we recognized total impairment of $8,398,382 related to the Noah project during the year ended December 31, 2008.

7

We believe that the Noah #1 well adequately tested our best seismic feature, and the results of the well did not warrant further drilling on the prospect or the expense of maintaining the leases. Therefore and pursuant to the Participation Agreement with Cedar Strat and upon their instruction, on October 27, 2008 we assigned all of our rights, title, and interest in all of the approximate 150,000 acres of leases in Prospect Areas 2 through 4 of the Noah Prospect to Diamond Land, LLC, a Utah based Company. Pursuant to the Participation Agreement, on November 3, 2008 we assigned the appropriate overriding royalties of Prospect Area 1 to Cedar Strat and Fort Scott. On December 11, 2008 we assigned our interests in approximately 39,732 acres of Prospect Area 1 to our drilling Partner in Prospect Area 1. We retained a 0.5% overriding royalty interest in the approximate 9,808 acres of the drill site lease only of Prospect Area 1, essentially concluding our participation and interest in the Noah project. We are not carrying any value for this retained override as the fair value is not readily determinable.

Due to Diamond Land, LLC and/or Cedar Strat Corporation’s failure to file the aforementioned assignments within the BLM mandated filing period, on February 23, 2009 we agreed by Letter Agreement with Cedar Strat Corporation to extend the assignment period to March 31, 2009 whereby Cedar Strat Corporation will advise us which leases and to which entity Eden should make assignment of the lands in Prospect Area 2 through 4 of the Noah prospect. On March 31, 2009 we assigned leases as instructed by Cedar Strat to Emergent Value Group LLC. More detailed information on this project is available in our 2008-year end filing.

Cherry Creek Project - Nevada

On October 21, 2005, we entered into a separate Letter Agreement with Cedar Strat Corporation for the exploration and development of a new project called Cherry Creek. On July 28, 2008, subsequent to the Noah well drilling and after a careful review of the technical aspects of the project, we reported we decided not to pursue further activities and would not be renewing leases we hold in the project area. Accordingly, we have recognized total impairment of $876,195 related to the Cherry Creek project during the year ended December 31, 2008.

Pursuant to the Participation Agreement with Cedar Strat on October 7, 2008 we assigned our interest in all of the approximate 26,000 acres of leases in the Cherry Creek prospect to Cedar Strat Corporation thereby concluding our participation and interest in the project.

Due to Cedar Strat Corporation’s failure to file the aforementioned assignments within the BLM mandated filing period, on February 23, 2009 we agreed by Letter Agreement with Cedar Strat Corporation to extend the assignment period to March 31, 2009 whereby Cedar Strat Corporation will advise us which leases and to which entity Eden should make assignment of the lands in the Cherry Creek prospect. On March 31, 2009 we assigned leases as instructed by Cedar Strat to Lucinda Kemp. More detailed information on this project is available in our 2008-year end filing.

Chinchaga Project – Alberta

From March 13, 2006 to February 2007 in conjunction with our partners, we conducted an exploration program in Alberta, which cumulated with drilling two exploratory wells. Both wells were plugged and abandoned in early 2007 and we recognized total impairment of $1,462,214 relating to the dry wells. By drilling these wells we have earned an interest in certain lands for potential future exploration. At this time no further decisions on continuing exploration in the area have been made. More detailed information on this project is available in our 2008-year end filing.

Competition

The oil and gas industry is intensely competitive. We compete with numerous individuals and companies, including many major oil and gas companies, which have substantially greater technical, financial and operational resources and staff. Accordingly, there is a high degree of competition for desirable oil and gas leases, suitable properties for drilling operations and necessary drilling equipment, as well as for access to funds. There are other competitors that have operations in the Northern Alberta and Colorado areas and the presence of these competitors could adversely affect our ability to acquire additional leases and/or equipment as required.

8

Governmental Regulations

Our oil and gas operations are subject to various United States and Canadian federal, state/provincial and local governmental regulations. Matters subject to regulation include discharge permits for drilling operations, drilling and abandonment bonds, reports concerning operations, the spacing of wells, and pooling of properties and taxation. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. The production, handling, storage, transportation and disposal of oil and gas, by-products thereof, and other substances and materials produced or used in connection with oil and gas operations are also subject to regulation under federal, state, provincial and local laws and regulations relating primarily to the protection of human health and the environment. To date, expenditures related to complying with these laws, and for remediation of existing environmental contamination, have not been significant in relation to the results of operations of our company. The requirements imposed by such laws and regulations are frequently changed and subject to interpretation, and we are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations.

Research and Development

We have incurred $Nil in research and development expenditures over the last fiscal year.

Employees

Currently our only employees are our directors and officers. Due to the deterioration of general economic conditions, effective February 28, 2009, we concluded our contract with an investor’s relations consultant and laid off a corporate manager and oil and gas assistant. There may be further material changes in the number of employees over the next 12-month period. We do and will continue to outsource contract employment as needed. With project advancement and if we are successful in any exploration or drilling programs, we may retain additional employees.

Item 1A. Risk Factors

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

We have had negative cash flows from operations If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

To date we have had negative cash flows from operations and we have been dependent on sales of our equity securities and debt financing to meet our cash requirements and have incurred losses totaling approximately $2,834,956 for the year ended December 31, 2009, and cumulative losses of $47,815,280 to December 31, 2009. As of December 31, 2009 we had a working capital deficit of $672,995. Other than for possibly a few months where our production rates are higher and commodity prices remain firm, we do not expect positive cash flow from operations in the next twelve month period and there is no assurance that actual cash requirements will not exceed our estimates, or that our sales projections will be realized as estimated. In particular, additional capital may be required in the event that:

- drilling and completion costs for further wells increase beyond our expectations; or

- commodity prices for our production decline beyond our expectations; or

- production levels do not meet our expectations; or

- we encounter greater costs associated with general and administrative expenses or offering costs.

The occurrence of any of the aforementioned events could adversely affect our ability to meet our business plans.

9

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. Capital may not continue to be available if necessary to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because our operations have been primarily financed through the sale of equity securities, a decline in the price of our common stock could be especially detrimental to our liquidity and our continued operations. Any reduction in our ability to raise equity capital in the future would force us to reallocate funds from other planned uses and would have a significant negative effect on our business plans and operations, including our ability to develop new products and continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

We have a history of losses and fluctuating operating results. We expect to continue to incur operating losses and negative cash flow until we receive significant commercial production from our properties

From inception through to December 31, 2009, we have incurred aggregate losses of approximately $47,815,280. Our loss from operations for the twelve months ended December 31, 2009 was $3,114,623. There is no assurance that we will operate profitably or will generate positive cash flow in the future. In addition, our operating results in the future may be subject to significant fluctuations due to many factors not within our control, such as the unpredictability of when customers will purchase our production and/or services, the size of customers’ purchases, the demand for our production and/or services, and the level of competition and general economic conditions. If we cannot generate positive cash flows in the future, or raise sufficient financing to continue our normal operations, then we may be forced to scale down or even close our operations. Until such time as we generate significant revenues, we expect an increase in development costs and operating costs. Consequently, we expect to continue to incur operating losses and negative cash flow until we receive significant commercial production from our properties.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have limited history of revenues from operations and have limited significant tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and must be considered in the development stage. The success of our company is significantly dependent on a successful acquisition, drilling, completion and production program. Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves, extract the reserves economically, and/or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

10

Trading of our stock may be restricted by the SEC's "Penny Stock" regulations, which may limit a stockholder's ability to buy and sell our stock.

The U.S. Securities and Exchange Commission has adopted regulations which generally define "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors." The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of, our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder's ability to buy and sell our stock.

In addition to the "penny stock" rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Trading in our common shares on the OTC Bulletin Board is limited and sporadic making it difficult for our shareholders to sell their shares or liquidate their investments.

Our common shares are currently listed for public trading on the OTC Bulletin Board. The trading price of our common shares has been subject to wide fluctuations. Trading prices of our common shares may fluctuate in response to a number of factors, many of which will be beyond our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies with no current business operation. There can be no assurance that trading prices and price earnings ratios previously experienced by our common shares will be matched or maintained. These broad market and industry factors may adversely affect the market price of our common shares, regardless of our operating performance.

In the past, following periods of volatility in the market price of a company's securities, securities class-action litigation has often been instituted. Such litigation, if instituted, could result in substantial costs for us and a diversion of management's attention and resources.

11

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We have largely been engaged in the business of exploring and until only recently attempting to develop commercial reserves of oil and gas. Our Alberta property is in the exploration stage and without known reserves of oil and gas. Only our Colorado properties have commenced production. Accordingly, we have not generated significant revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate significant revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon attaining adequate levels of internally generated revenues through locating and developing economic reserves of oil and gas, which itself is subject to numerous risk factors as set forth herein. Since we have not generated significant revenues, we will have to raise additional monies through either securing industry reserve based debt financing, or the sale of our equity securities or debt, or combinations of the above in order to continue our business operations.

As our properties are in the exploration and early development stage there can be no assurance that we will establish commercial discoveries and/or profitable production programs on these properties.

Exploration for economic reserves of oil and gas is subject to a number of risk factors. Few properties that are explored are ultimately developed into producing oil and/or gas wells. Our Nevada properties have been impaired and our Alberta properties are in the exploration stage only and are without proven reserves of oil and gas. We may not establish commercial discoveries on these properties. Our Colorado property is in early stage development drilling and may prove uneconomic to develop.

The potential profitability of oil and gas ventures depends upon factors beyond the control of our company.

The potential profitability of oil and gas properties is dependent upon many factors beyond our control. For instance, world prices and markets for oil and gas are unpredictable, highly volatile, potentially subject to governmental fixing, pegging, controls, or any combination of these and other factors, and respond to changes in domestic, international, political, social, and economic environments. Additionally, due to worldwide economic uncertainty, the availability and cost of funds for production and other expenses have become increasingly difficult, if not impossible, to project. These changes and events may materially affect our financial performance.

Adverse weather conditions can also hinder drilling operations. A productive well may become uneconomic in the event water or other deleterious substances are encountered which impair or prevent the production of oil and/or gas from the well. In addition, production from any well may be unmarketable if it is impregnated with water or other deleterious substances. The marketability of oil and gas, which may be acquired or discovered, will be affected by numerous factors beyond our control. These factors include the proximity and capacity of oil and gas pipelines and processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental protection. These factors cannot be accurately predicted and the combination of these factors may result in our company not receiving an adequate return on invested capital.

Competition in the oil and gas industry is highly competitive and there is no assurance that we will be successful inacquiring the leases.

The oil and gas industry is intensely competitive. We compete with numerous individuals and companies, including many major oil and gas companies, which have substantially greater technical, financial and operational resources and staff. Accordingly, there is a high degree of competition for desirable oil and gas leases, suitable properties for drilling operations and necessary drilling equipment, as well as for access to funds. We cannot predict if the necessary funds can be raised or that any projected work will be completed. Our budget does not anticipate the potential acquisition of additional acreage in Nevada and/or Alberta although this may change at any time without notice. This acreage may not become available or if it is available for leasing, that we may not be successful in acquiring the leases. There are other competitors that have operations in these areas and the presence of these competitors could adversely affect our ability to acquire additional leases.

12

The marketability of natural resources will be affected by numerous factors beyond our control, which may result in us not receiving an adequate return on invested capital to be profitable or viable.

The marketability of natural resources, which may be acquired or discovered by us, will be affected by numerous factors beyond our control. These factors include market fluctuations in oil and gas pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of oil and gas and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

Oil and gas operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company.

Oil and gas operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Oil and gas operations are also subject to federal, state, and local laws and regulations, which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages, which it may elect not to insure against due to prohibitive premium costs and other reasons. To date we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Exploration and production activities are subject to certain environmental regulations, which may prevent or delay the commencement or continuance of our operations.

In general, our exploration and production activities are subject to certain federal, state and local laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Compliance with these laws and regulations has not had a material effect on our operations or financial condition to date. Specifically, we are subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of state authorities. However, such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in the industry.

We believe that our operations comply, in all material respects, with all applicable environmental regulations.

Our operating partners maintain insurance coverage customary to the industry; however, we are not fully insured against all possible environmental risks.

Exploratory and development drilling involves many risks and we may become liable for pollution or other liabilities, which may have an adverse effect on our financial position.

Drilling operations generally involve a high degree of risk. Hazards such as unusual or unexpected geological formations, power outages, labor disruptions, blow-outs, sour gas leakage, fire, inability to obtain suitable or adequate machinery, equipment or labour, and other risks are involved. We may become subject to liability for pollution or hazards against which it cannot adequately insure or which it may elect not to insure. Incurring any such liability may have a material adverse effect on our financial position and operations.

13

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States, Canada, or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

Our By-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our By-laws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of 20,000,000 shares of common stock with a par value of $0.001 and 10,000,000 shares of preferred stock with a par value of $0.001. In the event that we are required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we issue any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other shareholders. Further, any such issuance may result in a change in our control.

Our By-laws do not contain anti-takeover provisions, which could result in a change of our management and directors if there is a take-over of our company.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors.

As a result of a majority of our directors and officers are residents of other countries other than the United States, investors may find it difficult to enforce, within the United States, any judgments obtained against our company or our directors and officers.

Other than our operations office in Denver, Colorado, we do not currently maintain a permanent place of business within the United States. In addition, a majority of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons' assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Other Risks

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

14

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Executive Offices

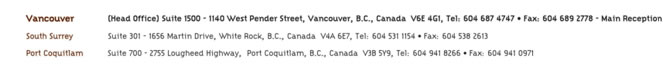

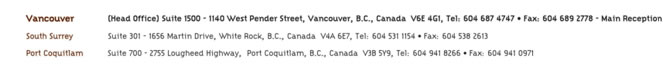

Effective December 1, 2009 our corporate head office is located at 1660, 1055 West Hastings Street, Vancouver, British Columbia V6E 2E9, Canada where we rent approximately 900 sq. ft. of office space for approximately $3000 monthly. On September 9 2009, our five year office lease which commenced September 1, 2007 was terminated by the Landlord. We are currently in negotiation with this Landlord to finalize costs and expenses as they relate to this lease.

Item 3. Legal Proceedings

On December 21, 2009 Ontrea Inc. filed an action in the courts of British Columbia, Canada against Eden Canada Holdings Ltd., a registered name of Eden Energy Corp. in Canada, claiming arrears rent and accelerated rent overdue of $109,273.25 plus damages. Eden Canada Holdings Ltd. filed its Statement of Defense on February 1, 2010 and at this time the outcome is not determinable. Other than this, we know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company.

Item 4. (Removed and Reserved)

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases ofEquity Securities

Our common shares are quoted on the Over-the-Counter Bulletin Board under the symbol “EDNE.” The following quotations, obtained from Yahoo Finance, reflect the high and low bids for our common shares based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

| National Association of Securities Dealers OTC Bulletin Board(1) |

| Quarter Ended | High | Low |

| December 31, 2009 | $0.22 | $0.03 |

| September 30, 2009 | $0.07 | $0.011 |

| June 30, 2009 | $0.055 | $0.021 |

| March 31, 2009 | $0.09 | $0.035 |

| December 31, 2008 | $0.20 | $0.05 |

| September 30, 2008 | $0.39 | $0.13 |

| June 30, 2008 | $0.94 | $0.23 |

| March 31, 2008 | $0.95 | $0.50 |

| December 31, 2007 | $1.00 | $0.53 |

15

(1) Over-the-counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission, and may not represent actual transactions.

Our shares are issued in registered form. Pacific Stock Transfer Inc., 500 E Warm Springs Road, Las Vegas, NV 89119 (Telephone: (702) 361-3033; Facsimile: (702) 433-1979) is the registrar and transfer agent for our common shares.

On March 11 , 2010, the shareholders' list showed 146 registered shareholders and 9,893,563 common shares outstanding and Nil preferred shares outstanding.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Equity Compensation Plan Information

As at December 31, 2009, we have one compensation plan in place, entitled Amended 2004 Stock Option Plan. This plan has not been approved by our security holders. On December 20, 2007, the directors of our company approved an amendment to the Amended 2004 Stock Option Plan by increasing the maximum number of options available for grant from 3,000,000 to 4,276,332. (On January 7, 2010 we effected 1:5 reverse share consolidation. The number of options available for grant post January 7, 2010 is reduced to 989,357.)

The Amended 2004 Stock Option Plan allows for the granting of share purchase options at a price of not less than fair value of the stock and for a term not to exceed five years. The total number of options granted to any person shall not exceed 5% of the issued and outstanding common stock of the Company.

The following table summarizes certain information regarding our equity compensation plans as at December 31, 2009. (The table includes share adjustment for a 1:5 reverse share consolidation effective January 7, 2010):

| Equity Compensation Plan Information |

Plan category |

Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights |

Weighted-average

exercise price of

outstanding options,

warrants and rights | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a)) |

| Equity compensation plans approved by security holders | Nil | Nil | Nil |

| Equity compensation plans not approved by security holders | 600,000 | $8.06 | 389,357 |

| | 600,000 | $8.06 | 389,357 |

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities which were not registered under the Securities Act during the year ended December 31, 2009 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended December 31, 2009.

16

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended December 31, 2009.

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our consolidated audited financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below and elsewhere in this annual report, particularly in the section entitled "Risk Factors" beginning on page 9 of this annual report.

Our consolidated audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Overview

We are a Nevada corporation incorporated on January 29, 1999. We were previously involved in the business of providing internet and programming services through our subsidiary company to clients located primarily in Canada. Our principal products and services included the development of e-commerce web sites and strategies, web design and hosting, domain name registration, Internet marketing and consulting and custom programming of web based applications. Due to the inability to run this business with a profit and the difficulty in attracting additional capital on terms favorable to existing shareholders, we ceased operation of this business and disposed of our subsidiary company on December 31, 2003 for nominal consideration. We became an exploration stage oil and gas company engaged in the exploration for petroleum and natural gas in the State of Nevada and the Province of Alberta, Canada. As of July 28, 2008 our primary focus became a development-drilling program for natural gas in the State of Colorado and due to the commencement of receiving significant revenues in 2008, as at December 31, 2008 we have moved from an exploration stage company to an operating company.

PLAN OF OPERATIONS AND CASH REQUIREMENTS

Cash Requirements

For the next twelve-month period we expect to monitor our exploration projects in Alberta as our joint venture agreements provide for. We expect to review other potential exploration projects from time to time as they are presented to us.

In Colorado, we hold 640 gross acres in our White River Dome, Ant Hill Unit development-drilling project. We have assigned our interests to our partners in the Noah and Cherry Creek projects in Nevada. In Alberta we have interests in approximately 23,000 gross acres of leases pursuant to our joint venture exploration agreements.

Our current focus of activity is our development-drilling program in Colorado and over the next twelve-month period we have not budgeted for exploration expenditures.

The declines in gas and oil prices through late 2008 and the first half of 2009 together with the ongoing deterioration of general economic conditions has led to a significant write down in the valuation of our Colorado assets and currently has eroded our access to reserve based financing for continued drilling in Colorado. Ongoing production related issues and the volatility of oil and gas prices for the twelve-month period ahead are challenging our revenue projections and estimates of operating cash flows. We expect cash flows for the next twelve-month period to be in a range of $750,000, which we anticipate will not provide adequate operating cash flow for the period. For the year ending December 31, 2009 we had received or accrued approximately $1.05 million from gas, oil, and natural gas liquid sales from our production wells. We received a final pipeline cost reimbursement of $337,643 from our operating partner in Colorado on December 17, 2009.

17

Management continues to assess future plans in the area as a result of the deterioration of selling prices and field results prior to further decisions. Management has rationalized corporate costs where possible in an attempt to better align them with expected future revenues. We anticipate we will not have adequate operating cash flow for the next twelve month period. Additional funds to meet obligations and to cover the costs of company operations will be required in future and there is uncertainty that further funding can be raised.

Our net cash provided by financing activities during the year ended December 31, 2009 was $1,058,679 as compared to $5,361,070 used during the year ended December 31, 2008.

We will require additional funds in the future to maintain operations and further funds to implement our growth strategy in our gas development operations. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares. There is still no assurance that we will be able to maintain operations at a level sufficient for an investor to obtain a return on his investment in our common stock. Further, we may continue to be unprofitable.

In order to proceed with our plans, on October 2, 2009 we entered into a loan agreement to borrow the principal sum of up to US$1,000,000 from a company owned and controlled by Donald Sharpe, our President and a Director. The Loan is to be secured against our company pursuant to a general security agreement, also dated effective October 2, 2009.

The loan available to us was to be drawn down in an initial draw of $500,000 and, upon the provision of 30 days written notice, further draws of not less than $50,000, to an aggregate maximum of $1,000,000. The initial draw was confirmed received by the company on October 7, 2009 and a subsequent draw of $500,000 was confirmed received on October 21, 2009.

The loan bears interest from the date any funds are advanced to the date of full repayment of all amounts outstanding under the Loan, at 20% per annum. Interest shall be payable quarterly, in arrears, commencing January 5, 2010, and quarterly thereafter, for the initial draw. For subsequent draws, interest shall be payable three months after such draws, in arrears, and quarterly thereafter. The undrawn amount of the Loan shall bear interest at the rate of 1% per month, which amount shall be payable quarterly, commencing three months after the date of the Loan agreement.

We are required to repay the principal amount of the Loan and all accrued and unpaid amounts and interest on the earlier to occur of October 5, 2010, subject to extension upon mutual agreement, or an “Event of Default” occurring as defined in the agreement. We may prepay the Loan in whole or in part, at any time and from time to time without notice, bonus or penalty.

Over the next twelve months we expect to expend funds as follows:

Estimated Net Expenditures During the Next Twelve Months

| | | $ | |

| General, Administrative, and Corporate Expenses | | 750,000 | |

| Interim Loan Interest Expense | | 200,000 | |

| Interim Loan Retirement | | 1,000,000 | |

| Ant Hill Unit Lease Operating Expenses | | 360,000 | |

| Total | | 2,310,000 | |

18

We have suffered recurring losses from operations. The continuation of our company is dependent upon our company attaining and maintaining profitable operations and raising additional capital as needed.

The continuation of our business is dependent upon obtaining further financing, a successful program of exploration and/or development, and, finally, achieving a profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

There are no assurances that we will be able to obtain further funds required for our continued operations. As noted herein, we are pursuing various financing alternatives to meet our immediate and long-term financial requirements. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will be unable to conduct our operations as planned, and we will not be able to meet our other obligations as they become due. In such event, we will be forced to scale down or perhaps even cease our operations.

Results of Operations – Twelve Months Ended December 31, 2009 and 2008

The following summary of our results of operations should be read in conjunction with our financial statements for the year ended December 31, 2009, which are included herein.

Our operating results for the twelve months ended December 31, 2009, for the twelve months ended December 31, 2008 and the changes between those periods for the respective items are summarized as follows:

|

Twelve Months Ended

December 31,

2009 |

Twelve Months Ended

December 31,

2008 | Change Between

Twelve Month Period

Ended

December 31, 2009 and

December 30, 2008 |

| Revenue | $ 1,050,170 | $ 2,392,435 | $ (1,342,265) |

| Debt conversion expense | Nil | 3,605,000 | (3,605,000) |

| Depletion, depreciation and amortization | 634,943 | 1,596,371 | (961,428) |

| General and administrative | 712,806 | 820,001 | (107,195) |

| Interest expense | 47,907 | 771,597 | (723,690) |

| Impairment loss on oil and gas properties | 1,721,598 | 24,794,404 | (23,072,806) |

| Management fees | 357,167 | 924,847 | (567,680) |

| Oil and gas operating expenses | 453,862 | 726,696 | (272,834) |

| Production taxes | 48,941 | 119,373 | (70,432) |

| Professional fees | 187,569 | 233,462 | (45,893) |

| Loss on disposal of equipment | (88,117) | Nil | (88,117) |

| Gain on recovery of costs previously impaired | 357,678 | Nil | 357,678 |

| Net loss | $ (2,834,824) | $ (30,996,554) | $ 28,160,730 |

Our accumulated losses increased to $47,815,280 as of December 31, 2009. Our financial statements report a net loss of $2,834,824 for the twelve month period ended December 31, 2009 compared to a net loss of $30,996,554 for the twelve month period ended December 31, 2008. Our losses have decreased primarily as a result of rationalization initiatives, a decrease in interest and other costs, and a decrease in impairment of oil and gas properties of $1,721,598 for the twelve months ended December 31, 2009 as compared to $24,794,404 for the twelve months ended December 31, 2008. The Company also recognized depletion, depreciation and amortization of its capitalized oil and gas expenditures of $634,943 during the twelve months ended December 31, 2009, compared to $1,596,371 for the twelve months ended December 31, 2008. The depletion rate for Colorado production for the twelve months ended December 31, 2009 was $1.41/mcfe.

19

Our total liabilities as of December 31, 2009 were $1,441,477 as compared to total liabilities of $2,044,722 as of December 31, 2008. The decrease was primarily due to a reduction in accounts payable of $88,927 as of December 31, 2009 as compared to $1,810,797 as of December 31, 2008 offset by an increase in loans payable of $1,045,954 as of December 31, 2009 as compared to $nil as of December 31, 2008.

During the twelve months ended December 31, 2009 we spent $445,749 on exploration, development and acquisition of our oil and gas properties as compared to $12,123,183 spent during the twelve months ended December 31, 2008. Of this amount $13,091 was attributable to acquisition costs (2008 - $220,041), and $432,658 (2008 - $11,993,142) was attributable to exploration and development costs incurred during the twelve months ended December 31, 2009.

Liquidity and Financial Condition

Working Capital

| | | At | | | At | |

| | | December 31, | | | December 31, | |

| | | 2009 | | | 2008 | |

| Current assets | $ | 520,565 | | | 1,941,490 | |

| Current liabilities | | 1,193,560 | | | 1,810,797 | |

| Working capital (deficit) | $ | (672,995 | ) | | 130,693 | |

Cash Flows

| | | Year Ended | |

| | | December 31 | |

| | | 2009 | | | 2008 | |

| Cash flows provided by (used in) operating activities | $ | 767,165 | | | (812,945 | ) |

| Cash flows provided by (used in) investing activities | | (2,181,002 | ) | | (12,768,396 | ) |

| Cash flows provided by (used in) financing activities | | 1,058,679 | | | (5,361,070 | ) |

| Effect of exchange rate changes on cash | | (132 | ) | | 22,519 | |

| Net increase (decrease) in cash during period | $ | (355,290 | ) | | (18,920,252 | ) |

Operating Activities

Net cash provided by operating activities was $767,165 in the year ended December 31, 2009 compared with net cash used in operating activities of $812,945 in the same period in 2008. The increase in cash provided by operating activities of $1,580,110 is mainly attributed to rationalization efforts decreasing expenses and a significant reduction in impairment expense being offset by a reduction in revenues.

Investing Activities

Net cash used in investing activities was $2,181,002 in the year ended December 31, 2009 compared to net cash used in investing activities of $12,768,396 in the same period in 2008. The decrease in use of cash of $10,587,394 in investing activities is mainly attributable to the decrease in oil and gas property development costs.

Financing Activities

Net cash provided by financing activities was $1,058,679 in the year ended December 31, 2009 compared to $5,361,070 used in financing activities in the same period in 2008. The difference in cash of $6,419,749 in financing activities is mainly attributed to cash provided by a $1,000,000 loan in the year ended December 31, 2009 as compared to cash used in repayment of $5,398,570 of convertible notes in the year ended December 31, 2008.

20

Oil and gas sales volume comparisons for the twelve months ended December 31, 2009 compared to the twelve months ended December 31, 2008

Net production from continuing operations for the year ended December 31, 2009 was approximately 257,745 Mcfe as compared to approximately 295,157 Mcfe for the year ended December 31, 2008. Revenues recognized declined due to the lower production volumes and significantly lower commodity prices received to approximately $1.05 million for the year ended December 31, 2009 as compared to approximately $2.39 million for the year ended December 31, 2008.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

In 2008 we commenced receiving revenues from the White River Dome project and at mid-year we concluded our Nevada exploration projects. Reflecting these operational changes, as at December 31, 2008 we moved from an exploration stage company to an operating company. However, due to early production instability with our new wells in the White River Dome field and a dramatic decline in oil and gas selling prices through 2008 and into 2009, we continue to be burdened with operating losses and a lack of substantial positive cash flow such that we anticipate an operating cash short fall sometime within approximately twelve months time. Reserve based debt financing for further development is currently unavailable to us due to the decline in oil and gas selling prices. We anticipate that additional funding will be required in the form of equity financing from the sale of our common stock. At this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or through a loan from our directors to meet our obligations within or beyond the next approximate twelve months. We currently do not have any firm arrangements in place for any future debt or equity financing. Global financial markets and economic conditions have deteriorated significantly and though we have been successful in the past raising funding, we may not be successful in future in order to maintain operations. We have reduced overhead costs where possible in attempt to match anticipated future revenues; however ongoing commitments and a certain level of fixed costs make further reductions challenging to realize. Future economic concerns and uncertainty are exacerbating the already negative environment we operate in as continued commodity pricing pressure is expected through the year ahead, which may result in further reduced revenues realized.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions.

21

The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. The most significant estimates with regard to these financial statements relate to recoverable values of oil and gas properties, stock-based compensation, the provision for income taxes, depreciation, depletion and asset retirement obligations.

Oil and Gas Properties