Investor Presentation

(Based upon Fourth Quarter 2007 results)

February 19, 2008

Future operating results

Subscriber growth, retention and usage levels

Fax and voice service growth

New products, services and features

Corporate spending

Liquidity

Network capacity, coverage and security

Regulatory developments

Taxes

Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, particularly those contained in the slides entitled “2008 Outlook – Fax

Services”, “2008 Outlook – Voice Services”, and “2008 Guidance.” These forward-looking statements are based on

management’s current expectations or beliefs as of February 19, 2008 and are subject to numerous assumptions, risks

and uncertainties that could cause actual results to differ materially from those described in the forward-looking

statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-

looking statements. Readers should carefully review the risk factors described in this presentation. Such statements

address the following subjects:

Safe Harbor for Forward-Looking Statements

All information in this presentation speaks as of February 19, 2008 and any

distribution of this presentation after that date is not intended and will not be

construed as updating or confirming such information.

2

Risk Factors

Inability to sustain growth in our customer base, revenue or profitability

Competition in price, quality, features and geographic coverage

Higher than expected tax rates or exposure to additional tax liability

Inability to obtain telephone numbers in sufficient quantities on acceptable terms in desired locations

Enactment of burdensome telecommunications or Internet regulations including increased taxes or fees

Reduced use of fax services due to increased use of email, scanning or widespread adoption of digital signatures

Inadequate intellectual property protection or violations of third party intellectual property rights

System failures or breach of system or network security and resulting harm to our reputation

Inability to adapt to technological change, or third party development of new technologies superior to ours

Economic downturns in industries which rely heavily on fax transmissions or general economic downturns

Loss of services of executive officers and other key employees

Inability to maintain existing or enter into new supplier and marketing relationships on acceptable terms

Other factors set forth in our Annual Report on Form 10-K filed on 03/12/2007 and the other reports filed by us from time to

time with the Securities and Exchange Commission

The following factors, among others, could cause our business, prospects, financial condition, operating results and cash flows to

be materially adversely affected:

3

All brand names and logos are trademarks of j2 Global Communications, Inc. or its affiliates in the U.S. and/or internationally.

Messaging/Communications as a Service

4

Core j2 Global Assets

11.9 million Subscribed Telephone Numbers (DIDs)

1,064K Paid DIDs

Global Advanced Messaging Network

Over 3,000 cities in 42 countries on 5 continents

17.2MM + unique DIDs worldwide in inventory

Intellectual Property

56 issued patents and licensing programs designed to monetize the portfolio

Protection of brands and marks

Programs designed to effectively collect evidence to prosecute junk faxers

Expertise

Effective customer acquisition strategies and Web marketing

Breadth, depth and management of a complex network & architecture

Successful acquisition and integration of 16 businesses in 7 countries

Strong Financial Position

12 consecutive years of Revenue growth

6 consecutive years of positive and growing Operating Earnings

$84MM of Free Cash Flow (FY 2007)

$230MM of cash & investments to fund growth/ no debt (as of 12/31/07)

5

Individuals

Targeted marketing (search, online media and radio)

Sold through: eFax.com, eVoice.com, Onebox.com, fax.com, j2.com, and other brand

websites

Use of proprietary Life Cycle Management

Advertising, Up-selling, and Calling-Party-Pays revenue supports the Free base

Small to Mid-Sized Businesses (SMBs)

Sold through: eFaxCorporate.com and Onebox Receptionist and eVoice Receptionist websites

Supported by Chat and Telesales groups in U.S. and Europe (in multiple languages)

Self-service Web-based broadcast fax engine at jblast.com

Outsourced email, spam & virus protection and archiving

Use of proprietary Life Cycle Management (i.e. feature up-sell)

Enterprise (SMEs)/Large Enterprise/Government

Direct sales force in U.S. and Europe

Marketed through Web and traditional direct selling methods

Designed for > 150 DID accounts

Subscriber Acquisition

6

Seven Drivers for Paid DID Additions

Subscribers coming directly to the Company’s Websites/Cross Sell/Telesales

Brand awareness driven by demand-generation programs and “word of mouth”

Search engine discovery

Accounts for 40% to 50% of monthly paid DID signups

Free-to-Paid subscriber upgrades

Life Cycle Management

eFax Corporate SMB sales

Hybrid Website and human interaction (i.e. Telesales)

Direct SME/Enterprise/Government

Through the outside Corporate Sales team

Direct domestic marketing spend for paid subscribers

Targeted marketing program across various media

International marketing programs

Cross sell

Offer additional services to existing customers

Paid Subscription Drivers

7

(1) Excludes SFAS 123(R) non-cash compensation expense. See slide 23 and 24 for a reconciliation to the nearest GAAP financial measure.

(2) Excludes SFAS 123(R) non-cash compensation expense, net of tax benefit. See slide 23 and 24 for a reconciliation to the nearest GAAP

financial measure.

(3) See slide 22 for a reconciliation to the nearest GAAP financial measure.

2007 Q4 and Annual Non-GAAP Results

9

$

Margin

$

Margin

GAAP Revenue

$56.8M

$220.7M

Gross Profit/Margin

(1)

$45.4M

79.9%

$177.4M

80.4%

Operating Profit/Margin

(1)

$23.3M

41.0%

$93.8M

42.5%

Non-GAAP EPS

(2)

$0.36

$1.45

Free Cash Flow

(3)

$21.4M

$83.9M

Cash & Investments

$229.8M

$229.8M

Q4 2007

FY 2007

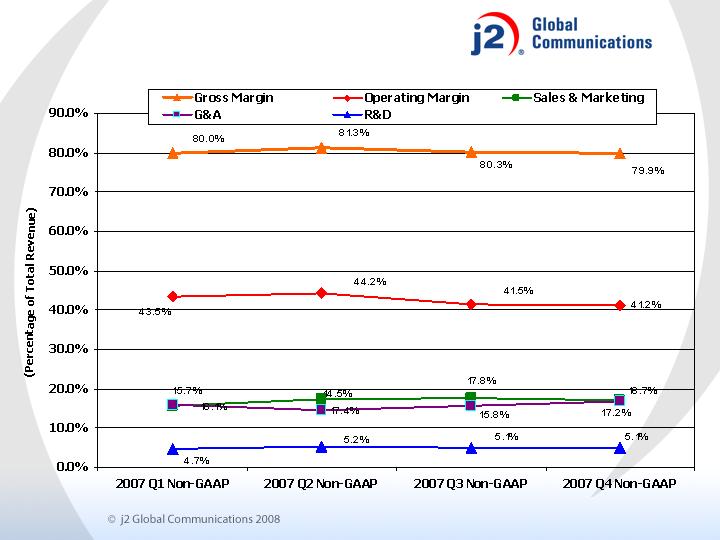

2007 excludes SFAS 123(R) non-cash compensation, net of tax benefit. See slides 23 and 24 for reconciliations to the nearest GAAP financial measures.

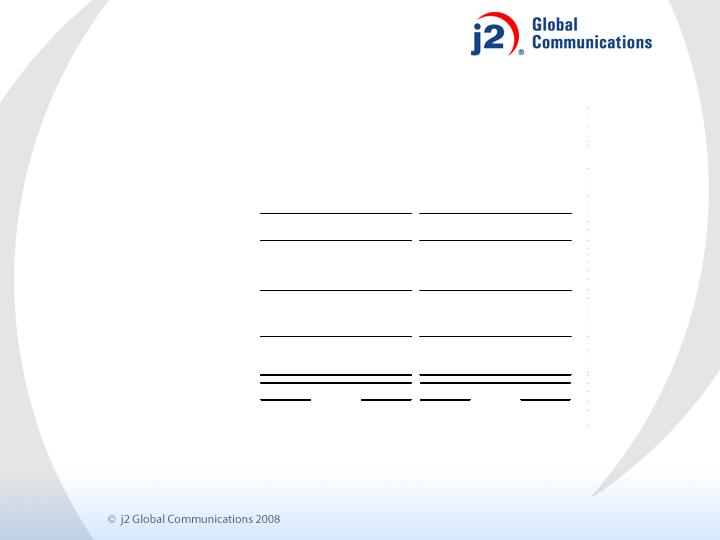

2007 Margin Trends by Quarter

10

Ending Paid DIDs (in 000s)

2007 DIDs Increased 160,000 or 18% over 2006

US DIDs Grew by 121,000 or 15% over 2006

Strong Growth in Voice services

International DIDs Increased by 49% or 38,000

Continuing Ramp Up in International Fax Services

11

2004

2005

2006

2007

US

Fax

496

666

794

870

75

9.5%

Voice

10

15

31

77

46

147.0%

Total US

506

681

826

947

121

14.7%

International

Fax

45

57

76

111

36

47.1%

Voice

3

2

3

5

3

100.6%

Total Int'l

47

59

78

116

38

48.9%

Total Ending DIDs

553

741

904

1,064

160

17.7%

'07 vs. '06

Annual Revenue Summary (in $000s)

2007 Revenues Increased $39.6M or 22% over 2006

US Revenues Increased $28.7M or 19.2% over 2006

International Revenues Increased 48% or $8.5M over 2006

Double Digit Growth Across All Sectors

12

2004

2005

2006

2007

US

Fax

$87,723

$117,576

$145,936

$171,241

$25,305

17.3%

Voice

1,394

2,418

3,266

6,618

3,352

102.6%

Total US Fax & Voice

89,117

119,994

149,202

177,859

28,657

19.2%

International

Fax

7,808

11,847

17,071

24,392

7,320

42.9%

Voice

-

728

771

1,957

1,185

153.7%

Total Int'l Fax & Voice

7,808

12,575

17,843

26,348

8,506

47.7%

Other

(1)

9,418

11,372

14,034

16,471

2,437

17.4%

Total Revenue

$106,343

$143,941

$181,079

$220,678

$39,600

21.9%

(1)

Other revenue includes Email, jBlast, Advertising and Patents

' 07 vs. '06

Accomplishments & Outlook

13

2007 Accomplishments – Fax Services

US

Fax DIDs increased to 870,000 – mostly eFax @ $16.95

Successful price increase of ~ 30% for eFax individual customers

Successfully launched fax.com/Fully integrated Send2Fax

Completed RapidFAX acquisition in December 2007

Increased Telesales staff for SMB sales

eFax Developer growth

Message center offered to corporate customers in Q4

Multi-brand approach for Fax services

International

FAX DIDs increased 47% to 111,000

Established Italian, Polish and Portuguese Web presence

Increased by 24 people presence in Europe (mostly in Ireland)

Acquired YAC

Expanded network to 42 countries

Completed multi-byte development

14

2008 Outlook – Fax Services

Global

Environment conducive to M&A

Strong cash position and cash flows

5 year low multiples for public companies

100+ candidates in fax to email delivery space

US

Double digit DID growth – Corporate faster than Individual

Stable price environment targeting multiple segments

Marketing of primary (eFax) and secondary brands

Fax indexing to create searchable faxes

Assumes light usage from credit sensitive customers

International

Increase market penetration in top European countries/Canada

Continued penetration leads to faster organic growth than US

Increase corporate European presence

Operational efficiencies due to consolidation of EU staff

Deploy multi-byte across network

15

2007 Accomplishments – Voice Services

US

Voice DIDs grew 147% to 77,000

New features introduced in Q4 2007 include click-to-call and tested

speech-to-text

Increased Telesales staff and expanded CS support

Successful cross-selling to Fax customer base

International

Began focus in late 2007

Added DIDs in 14 European countries and Hong Kong

Acquired YAC in Q3

Simplified voice service proposal in Europe

16

2008 Outlook – Voice Services

Global

Early stage and evolving space with multiple competitors worldwide

Market readiness supports high growth

Several acquisition opportunities

US

Expect organic revenue to more than double

New websites and features for eVoice and Onebox

Continue cross selling to SMB fax customer base and upsell to eVoice

Rollout speech-to-text for voicemail and launch live Onebox

Receptionist

International

Expect organic revenue/DID growth > 50%

Launch new YAC website

Launch European-centric brand and simplified Receptionist service

Consolidate and upgrade two voice platforms/facilities

17

2008 Guidance

$1.45 - $1.65

GAAP EPS

$240 - $270

2008

Revenues (MM)

2008 EPS is based on GAAP which includes SFAS 123(R) non-cash

compensation expense.

19

Supplemental Information

20

Metrics

21

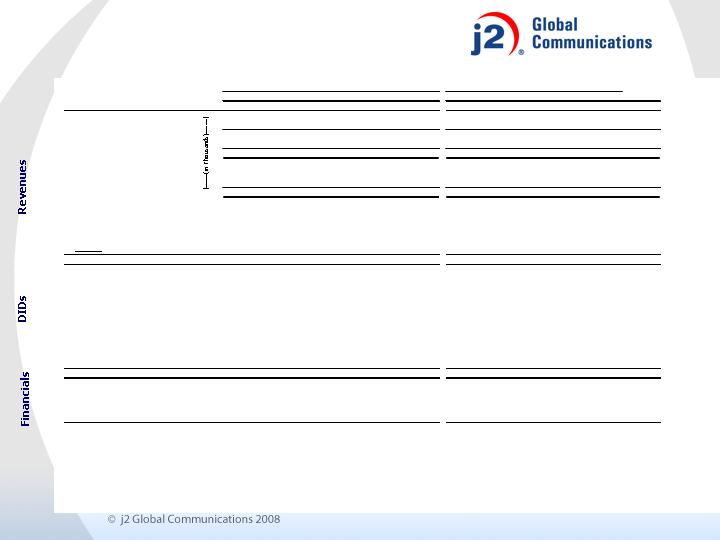

2007

Q1

Q2

Q3

Q4

Total

Q1

Q2

Q3

Q4

Total

Fixed Subscriber Revenues

$28,537

$29,855

$32,179

$36,013

$126,586

$37,765

$39,653

$41,362

$43,347

$162,127

Variable Subscriber Revenues

12,025

12,816

12,312

11,433

48,585

12,528

12,961

12,667

12,046

50,201

Subscriber Revenues

$40,562

$42,671

$44,491

$47,447

175,171

$50,293

$52,613

$54,029

$55,394

212,328

Other Revenues

1,456

1,595

1,400

1,457

5,908

3,849

1,367

1,717

1,437

8,369

Total Revenues

$42,018

$44,266

$45,891

$48,904

181,079

$54,141

$53,980

$55,746

$56,830

220,697

DID - Based Revenues

$38,718

$40,683

$42,832

$45,650

$167,882

$48,130

$50,084

$51,209

$52,353

$201,776

Non-DID Revenues

3,300

3,583

3,059

3,254

13,197

6,011

3,895

4,537

4,478

18,921

Total Revenues

$42,018

$44,266

$45,891

$48,904

181,079

$54,141

$53,980

$55,746

$56,830

220,697

Subscriber Revenues/Total Revenues

96.5%

96.4%

96.9%

97.0%

96.7%

92.9%

97.5%

96.9%

97.5%

96.2%

DID - Based/Total Revenues

92.1%

91.9%

93.3%

93.3%

92.7%

88.9%

92.8%

91.9%

92.1%

91.4%

%

Fixed

Subscriber Revenues

70.4%

70.0%

72.3%

75.9%

72.3%

75.1%

75.4%

76.6%

78.3%

76.4%

%

Variable

Subscriber Revenues

29.6%

30.0%

27.7%

24.1%

27.7%

24.9%

24.6%

23.4%

21.7%

23.6%

Paid DIDs

(1) (2) (3) (4)

788,130

836,576

887,801

906,652

930,273

972,599

1,017,985

1,063,698

Average Monthly Revenue/DID

$16.39

$16.15

$15.98

$16.45

$16.96

$16.96

$16.47

$16.08

Cancel Rate

(5)

2.5%

2.6%

2.7%

2.9%

3.0%

2.8%

3.0%

2.7%

Free DIDs

10,225,974

10,537,817

10,619,571

10,322,922

10,355,815

10,671,519

10,706,503

10,874,104

Average Monthly Revenue/DID

$0.04

$0.04

$0.05

$0.04

$0.05

$0.05

$0.06

$0.07

Total DID Inventory (MM)

15.2

15.2

16.2

16.4

16.9

17.0

17.1

17.2

Cities Covered

1,814

1,814

2,330

2,727

2,884

2,933

2,950

3,024

Countries Covered

29

32

35

37

40

42

42

42

Cash & Investment

(millions)

$162.3

$174.9

$171.0

$191.6

$210.3

$233.1

$239.8

$229.8

Free Cash Flow

(6)

(millions)

$18.5

$11.0

$12.4

$23.9

$65.8

$26.1

$20.6

$15.7

$21.4

$83.9

(1)

For Q3 2006, DIDs reflect net changes related to anticipated unprovisioned Corporate DIDs.

(2)

For Q4 2006, DIDs reflect net changes related to anticipated unprovisioned Corporate DIDs and adjustments associated with a database upgrade.

(3)

For Q3 2006, Q4 2006 and Q1 to Q3 2007, the Send2Fax DIDs reflect a reserve for the net impact of product migration and a price increase.

(4)

For Q4 2007, the RapidFax DIDs reflect a reserve for the net impact of product migration and a price increase.

(5)

Cancel Rate is defined as individual customer DIDs with greater than 4 months of continuous service (continuous service includes customer DIDs which are administratively cancelled and reactivated within a

calendar month), and DIDs related to enterprise customers beginning with their first day of service. Calculated monthly and expressed here as an average over the three months of the quarter.

(6)

Free Cash Flow is net cash provided by operating activities, less purchases of property and equipment.��

2006

(1) Net cash provided by operating activities, less purchases of property & equipment. Free Cash Flow amounts are not meant as a substitute

for GAAP, but are solely for informational purposes.

22

Computation of Free Cash Flow

($ in millions)

Q1 '06

Q2 '06

Q3 '06

Q4 '06

Q1 '07

Q2 '07

Q3 '07

Q4 '07

Net cash from operating activities

$19.245

$14.250

$13.607

$25.903

$26.659

$23.113

$18.656

$25.779

Purch. of property & equipment

(0.757)

(3.288)

(1.181)

(1.973)

(0.529)

(2.506)

(2.940)

(4.340)

Free Cash Flow

(1)

$18.488

$10.962

$12.426

$23.930

$26.130

$20.607

$15.716

$21.439

GAAP Reconciliation

(1) Stock-based compensation is as follows: for Q4, Cost of revenues is $177K, Sales and Marketing is $342K, R&D is $228K, and G&A is $1,368K; for Q3, Cost of revenues is $169K, Sales and

Marketing is $304K, R&D is $186K, and G&A is $1,209K; for Q2, Cost of revenues is $140K, Sales and Marketing is $264K, R&D is $184K, and G&A is $1,114K; and for Q1, Cost of revenues is

$182K, Sales and Marketing is $278K, R&D is $173K, and G&A is $1,097K.

(2) Income tax expense is adjusted for the net impact of item 1 above.

23

j2 GLOBAL COMMUNICATIONS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS)

Non-GAAP

Non-GAAP

Non-GAAP

Non-GAAP

Reported

Entries

Non-GAAP

Reported

Entries

Non-GAAP

Reported

Entries

Non-GAAP

Reported

Entries

Non-GAAP

Revenues

Subscriber

55,394

$

-

$

55,394

$

54,029

$

-

$

54,029

$

52,613

$

-

$

52,613

$

50,293

$

-

$

50,293

$

Other

1,436

0

1,436

1,717

-

1,717

1,367

-

1,367

3,848

-

3,848

Total revenues

56,830

0

56,830

55,746

-

55,746

53,980

-

53,980

54,141

-

54,141

Cost of revenues

(1)

11,597

(177)

11,420

11,168

(169)

10,999

10,232

(140)

10,092

10,990

(182)

10,808

Gross profit

45,233

177

45,410

44,578

169

44,747

43,748

140

43,888

43,151

182

43,333

Operating expenses:

Sales and marketing

(1)

10,098

(342)

9,756

10,218

(304)

9,914

9,672

(264)

9,408

8,780

(278)

8,502

Research, development and engineering

(1)

3,099

(228)

2,871

3,045

(186)

2,859

2,976

(184)

2,792

2,713

(173)

2,540

General and administrative

(1)

10,866

(1,368)

9,498

10,042

(1,209)

8,833

8,950

(1,114)

7,836

9,825

(1,097)

8,728

Total operating expenses

24,063

(1,938)

22,125

23,305

(1,699)

21,606

21,598

(1,562)

20,036

21,318

(1,548)

19,770

Operating earnings

21,170

2,115

23,285

21,273

1,868

23,141

22,150

1,702

23,852

21,833

1,730

23,563

Other income and expenses:

Interest and other income, net

2,314

126

2,440

2,598

-

2,598

2,398

-

2,398

1,725

-

1,725

Total other income and expenses:

2,314

126

2,440

2,598

-

2,598

2,398

-

2,398

1,725

-

1,725

Earnings before income taxes

23,484

2,241

25,725

23,871

1,868

25,739

24,548

1,702

26,250

23,558

1,730

25,288

Income tax expense

(2)

6,628

664

7,292

5,783

584

6,367

7,470

518

7,988

7,119

464

7,583

Net earnings

16,856

$

1,577

$

18,433

$

18,088

$

1,284

$

19,372

$

17,078

$

1,184

$

18,262

$

16,439

$

1,266

$

17,705

$

Diluted net earnings per share

0.34

$

0.36

$

0.35

$

0.38

$

0.33

$

0.36

$

0.32

$

0.35

$

Diluted weighted average shares outstanding

50,268,781

50,517,395

51,075,957

51,372,910

51,007,561

51,225,457

50,680,093

50,905,135

THREE MONTHS ENDED JUNE 30, 2007

THREE MONTHS ENDED MARCH 31, 2007

THREE MONTHS ENDED SEPTEMBER 30, 2007

THREE MONTHS ENDED DECEMBER 31, 2007

GAAP Reconciliation

(1) Stock-based compensation adjustments for 2007 are: Cost of revenue is $668K, Sales and Marketing is $1,187K, R&D is $771K, and G&A is $4,788K. 2006 adjustments are as follows: Cost of revenues is $316K, Sales and Marketing is $1,038K, R&D

is $556K, and G&A is $3,782K.

(2) Income tax expense is adjusted for the net impact of items above.

24

j2 GLOBAL COMMUNICATIONS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS)

Non-GAAP

Non-GAAP

Reported

Entries

Modified

Reported

Entries

Modified

Revenues

Subscriber

212,329

$

-

$

212,329

$

175,171

$

-

$

175,171

$

Other

8,368

-

8,368

5,908

-

5,908

$

Total revenues

220,697

-

220,697

181,079

-

181,079

Cost of revenues

(1)

43,987

(668)

43,319

36,723

(316)

36,407

Gross profit

176,710

668

177,378

144,356

316

144,672

Operating expenses:

Sales and marketing

(1)

38,768

(1,187)

37,581

30,792

(1,038)

29,754

Research, development and engineering

(1)

11,833

(771)

11,062

8,773

(556)

8,217

General and administrative

(1)

39,683

(4,788)

34,895

38,754

(3,782)

34,972

Total operating expenses

90,284

(6,746)

83,538

78,319

(5,376)

72,943

Operating earnings

86,426

7,414

93,840

66,037

5,692

71,729

Other income and expenses:

Interest and other income, net

9,035

126

9,161

7,195

0

7,195

Total other income and expenses:

9,035

126

9,161

7,195

0

7,195

Earnings before income taxes

95,461

7,540

103,001

73,232

5,692

78,924

Income tax expense

(2)

Income tax expense

(2)

27,000

2,213

29,213

20,101

1,584

21,685

Net earnings

68,461

$

5,327

$

73,788

$

53,131

$

4,108

$

57,239

$

Diluted net earnings per share

1.35

$

1.45

$

1.04

$

1.12

$

Diluted weighted average shares outstanding

50,762,007

51,009,299

51,048,995

51,330,932

TWELVE MONTHS ENDED

DECEMBER 31, 2006

TWELVE MONTHS ENDED

DECEMBER 31, 2007

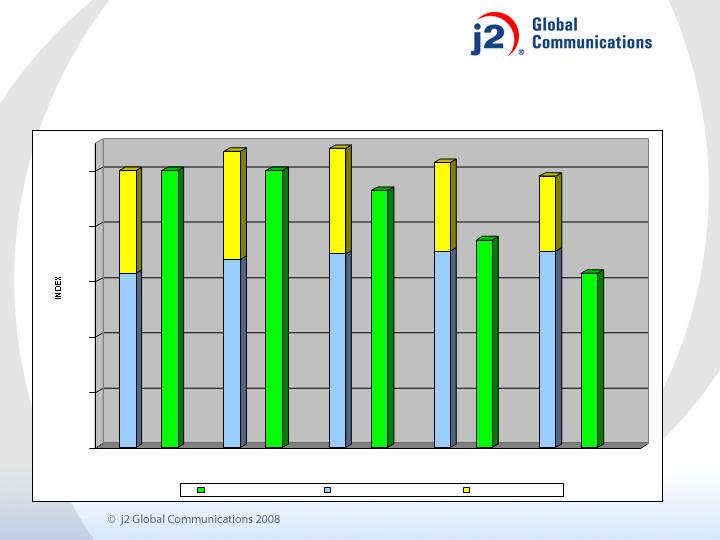

Usage Pattern of Corporate and Web High Volume

Users

25

63

37

100

68

39

100

70

38

93

71

32

75

71

27

63

0

20

40

60

80

100

Q4

'06

Q1

'07

Q2

'07

Q3

'07

Q4

'07

Web Heavy Users

Non Credit Sensitive

Credit Sensitive