- ZD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Ziff Davis (ZD) 8-KRecord Free Cash Flow

Filed: 6 May 09, 12:00am

Investor Presentation

(Based upon First Quarter 2009 Results)

May 5, 2009

1

Future operating results

Global economic conditions

Subscriber growth, retention and usage levels

Fax and voice service growth

New products, services and features

Corporate spending

Liquidity

Network capacity, coverage and security

Regulatory developments

Taxes

Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, particularly those contained in the slide “2009 Guidance.” These forward-

looking statements are based on management’s current expectations or beliefs as of May 5, 2009 and are subject to

numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described

in the forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision

to these forward-looking statements. Readers should carefully review the risk factors described in this presentation.

Such statements address the following subjects:

Safe Harbor for Forward-Looking Statements

All information in this presentation speaks as of May 5, 2009 and any distribution of

this presentation after that date is not intended and will not be construed as updating

or confirming such information.

2

Risk Factors

Inability to sustain growth in our customer base, revenue or profitability, particularly in light of the uncertain U.S. or

worldwide economy and the related impact on customer acquisitions, cancelations and credit card payment declines

Competition in price, quality, features and geographic coverage

Higher than expected tax rates or exposure to additional tax liability

Inability to obtain telephone numbers in sufficient quantities on acceptable terms in desired locations

Enactment of burdensome telecommunications or Internet regulations including increased taxes or fees

Reduced use of fax services due to increased use of email, scanning or widespread adoption of digital signatures

Inadequate intellectual property protection or violations of third party intellectual property rights

System failures or breach of system or network security and resulting harm to our reputation

Inability to adapt to technological change, or third party development of new technologies superior to ours

Loss of services of executive officers and other key employees

Inability to maintain existing or enter into new supplier and marketing relationships on acceptable terms

Other factors set forth in our Annual Report on Form 10-K filed on 02/25/2009, as amended on 03/05/2009 and the other

reports filed by us from time to time with the Securities and Exchange Commission

The following factors, among others, could cause our business, prospects, financial condition, operating results and cash flows to

be materially adversely affected:

3

(1) Includes SFAS 123(R) non-cash compensation expense.

(2) Includes SFAS 123(R) non-cash compensation expense, net of tax benefit.

(3) See slide 11 for computation of free cash flow.

GAAP Results

GAAP Revenues

$60.4M

Gross Profit/Margin (1)

$49.0M

81.1%

Operating Profit/Margin (1)

$26.5M

43.8%

GAAP EPS (2)

$0.42/Share

Free Cash Flow (3)

$30.4M

Cash and Investments

$179M

$

Margin

Q1 2009

4

Operational Overview

5

Business Review

Fax

Continued success with multiple pricing programs

7 new large corporate deals including 3 upgrades

Integrated Mijanda fax customers and select brands

Acquired fax assets of CallWave

Usage and cancel rate affected by weak economy and higher unemployment

Voice

Approaching 200,000 DIDs

Strong roll out in Europe

Segmenting domestic market by three brands

Integrated Mijanda voice customers

6

Other Businesses/Operations

Successfully integrated Mailwise (hygiene provider)

Beginning to cross-sell Electric Mail services to Mailwise customers

Looking for additional M&A opportunities

Patent Licensing

Lower revenue due to acquisitions of Mijanda and Callwave fax assets

Three core patents out of reexam and related stays lifted

Advertising & Broadcast Fax

Impact of weakening economy continuing

< 2% of j2’s revenue

Operational

Gross margin improved 1 percentage point over Q1 2008

Operating margin improved more than 5 percentage points – record margin

Headcount remains stable at 400

Record free cash flow

7

2009 Guidance

Modest Increase in Revenues and Non-GAAP EPS

8

Supplemental Information

9

Metrics

10

2009

Q1

Q2

Q3

Q4

Total

Q1

Q2

Q3

Q4

Total

Q1

Fixed Subscriber Revenues

$37,757

$39,643

$41,362

$43,336

$162,098

$44,260

$46,593

$47,481

$48,125

$186,459

$48,799

Variable Subscriber Revenues

12,536

12,970

12,667

12,057

50,231

12,956

12,943

12,985

11,497

50,382

10,842

Subscriber Revenues

$50,293

$52,613

$54,029

$55,393

212,329

$57,216

$59,536

$60,466

$59,622

236,841

$59,640

Other Revenues

3,848

1,367

1,717

1,437

8,368

1,433

1,140

1,086

1,014

4,673

751

Total Revenues

$54,141

$53,980

$55,746

$56,830

220,697

$58,649

$60,676

$61,552

$60,636

241,513

$60,391

DID - Based Revenues

$48,684

$50,929

$52,204

$53,473

$205,290

$55,301

$57,551

$58,440

$57,691

$228,983

$57,449

Non-DID Revenues

5,457

3,051

3,542

3,357

15,407

3,348

3,125

3,112

2,944

12,529

2,942

Total Revenues

$54,141

$53,980

$55,746

$56,830

220,697

$58,649

$60,676

$61,552

$60,636

241,512

$60,391

Subscriber Revenues/Total Revenues

92.9%

97.5%

96.9%

97.5%

96.2%

97.6%

98.1%

98.2%

98.3%

98.1%

98.8%

DID - Based/Total Revenues

89.9%

94.3%

93.6%

94.1%

93.0%

94.3%

94.8%

94.9%

95.1%

94.8%

95.1%

%

Fixed

Subscriber Revenues

75.1%

75.3%

76.6%

78.2%

76.3%

77.4%

78.3%

78.5%

80.7%

78.7%

81.8%

%

Variable

Subscriber Revenues

24.9%

24.7%

23.4%

21.8%

23.7%

22.6%

21.7%

21.5%

19.3%

21.3%

18.2%

Paid DIDs

(1)

930,273

972,599

1,017,985

1,063,698

1,098,650

1,162,872

1,198,950

1,236,079

1,273,876

Average Monthly Revenue/DID

$17.16

$17.26

$16.80

$16.44

$16.30

$16.29

$15.87

$15.28

$14.85

Cancel Rate

(2)

3.0%

2.8%

3.0%

2.7%

2.8%

2.9%

3.0%

3.1%

3.5%

Free DIDs

10,355,815

10,671,519

10,706,503

10,874,104

10,098,143

10,233,875

10,357,506

10,362,771

10,137,651

Average Monthly Revenue/DID

$0.05

$0.05

$0.06

$0.07

$0.08

$0.07

$0.07

$0.06

$0.05

Total DID Inventory (MM)

16.9

17.0

17.1

17.2

17.4

17.5

17.3

19.8

19.4

Cities Covered

2,884

2,933

2,950

3,024

3,084

3,126

3,137

3,135

3,207

Countries Covered

40

42

42

42

44

45

46

46

46

Cash & Investment

(millions)

$210.3

$233.1

$239.8

$229.8

$181.3

$149.9

$151.8

$161.9

$179.3

Free Cash Flow

(3)

(millions)

$26.1

$20.6

$15.7

$21.4

$83.9

$26.9

$23.0

$14.7

$23.5

$88.2

$30.4

(1)

Paid DIDs reflect reserves for anticipated product migration and/or price increase.

(2)

Cancel Rate is defined as individual customer DIDs with greater than 4 months of continuous service (continuous service includes customer DIDs which are administratively cancelled and reactivated within calendar month),

and DIDs related to enterprise customers beginning with their first day of service. Calculated monthly and expressed here as an average over the three months of the quarter.

(3)

Free cash flow is net cash provided by operating activities, less purchases of property and equipment. See slide 11 for computation of free cash flow.

Note also that Q3 and Q4 2008 Free Cash Flow have been updated in the above schedule for an immaterial correction.

Quarterly revenues for Q1 2007 and Q1 2008 have been reclassed between fixed, variable and other revenue and between DID based and non-DID based revenue.

This reclass is related to revised revenue classification for a j2 subsidiary, it does not impact total revenues for the quarter.

2008

2007

(1)

Net cash provided by operating activities, less purchases of property & equipment. Free cash flow amounts are not meant as a

substitute for GAAP, but are solely for informational purposes.

(2)

Free cash flow schedule has been revised for an immaterial correction to Q3 and Q4 2008 free cash flow.

Computation of Free Cash Flow

($ in millions)

11

Q2 '07

Q3 '07

Q4 '07

Q1 '08

Q2 '08

Q3 '08

Q4 '08

Q1 '09

Net cash from operating activities

$23.113

$18.656

$25.779

$27.411

$23.840

$15.676

$23.789

$31.152

Purch. of property & equipment

(2.506)

(2.940)

(4.340)

(0.469)

(0.796)

(0.937)

(0.305)

(0.721)

Free Cash Flow

(1) (2)

$20.607

$15.716

$21.439

$26.942

$23.044

$14.739

$23.484

$30.431

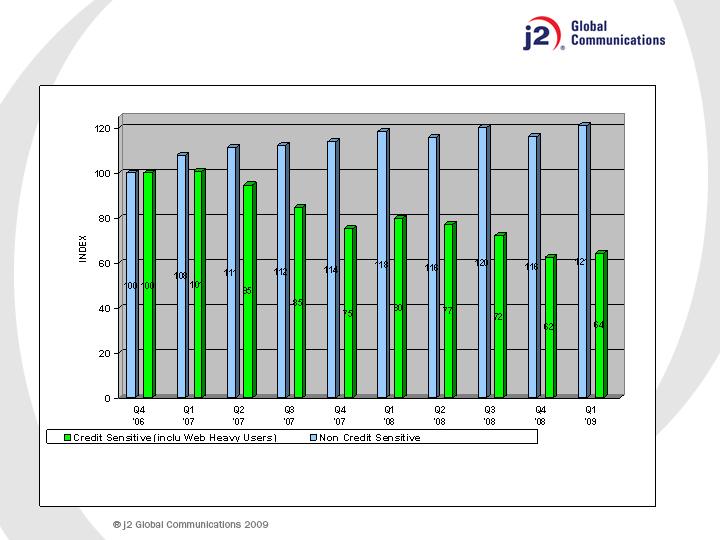

Usage of Corporate and Web High Volume Users

12